Form RSM1 RSM/DBTS

Retirement Systems Modernization (RSM) Defined Benefits Technology Solution (DBTS)

Screens & forms.DOC

RSM/DBTS

OMB: 3206-0249

Attachment A

Sample DBTS Information Collection Screens and Paper Forms

The following screens and scanned forms are a representative sample of the information collection processes and outcomes anticipated for Wave 1. Since the DBTS is still completing its testing phases at the time of this submission, the contents of the screens and forms may change based on testing and review sessions with OPM.

Index

Privacy Act, Terms of Service, and Public Burden Statement 2

Information Collection - Confirmation of Password Reset 7

Information Collection: Confirmation of Security Change 12

Information Collection: Confirmation of Address Change 17

Information Collection: Confirmation of Preference Change 23

Information Collection: Assignment Cover Letter 27

Information Collection: Confirmation of Election 36

Information Collection: Other Qualifying Life Events 47

Qualifying Life Event Form – FEGLI Notice of Conversion Privilege 56

Qualifying Life Event Form – FERS Starting Your Beneficiary Pension Benefit – In Pay Status 60

Qualifying Life Event Form – CSRS Beneficiary Pension Election Authorization Form 64

DBTS/System-Generated Events – FERS Pension Recalculation Notice 67

DBTS/System-Generated Events – Confirmation of Coverage 68

DBTS/System-Generated Events – Notice of Time Limit to Change Your Elections 69

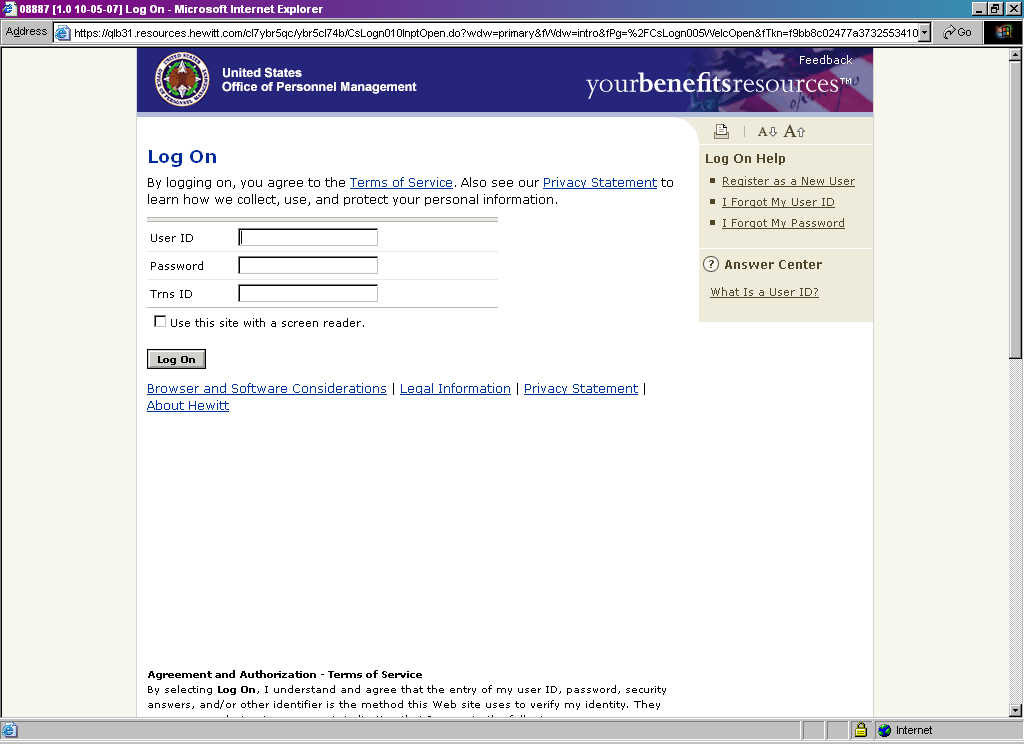

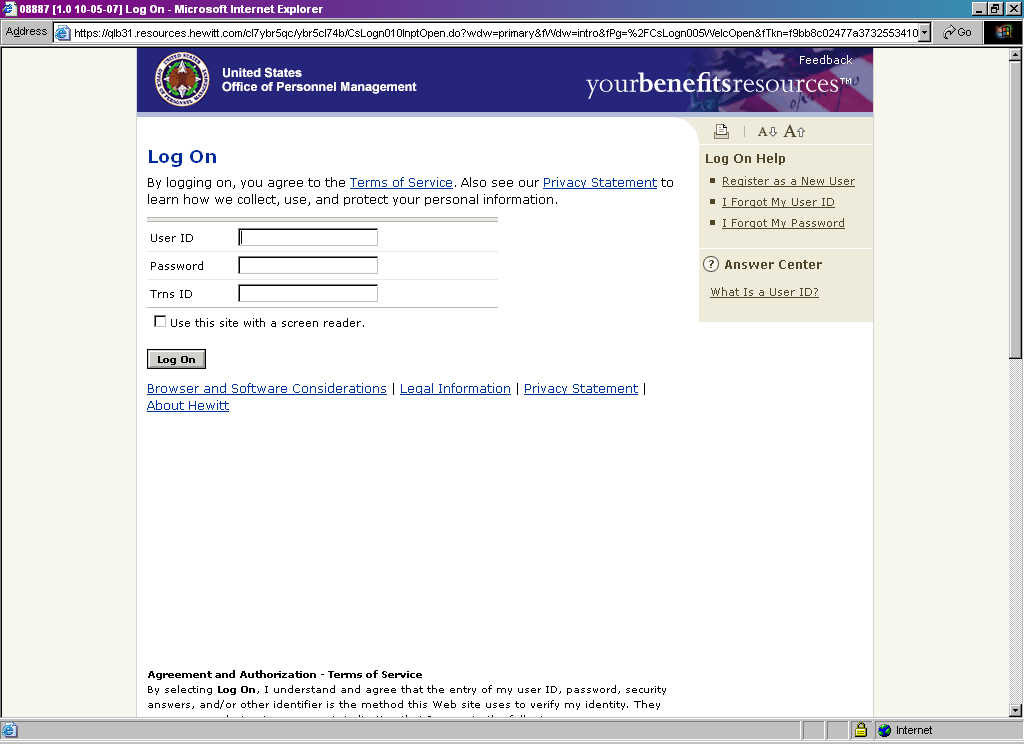

Privacy Act, Terms of Service, and Public Burden Statement

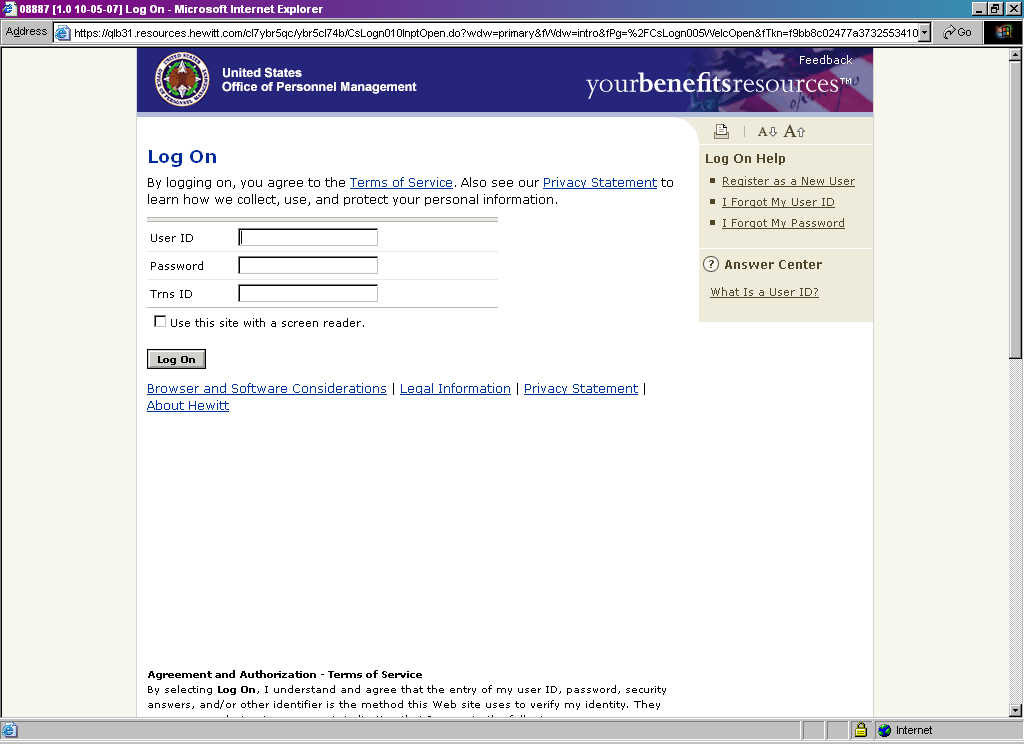

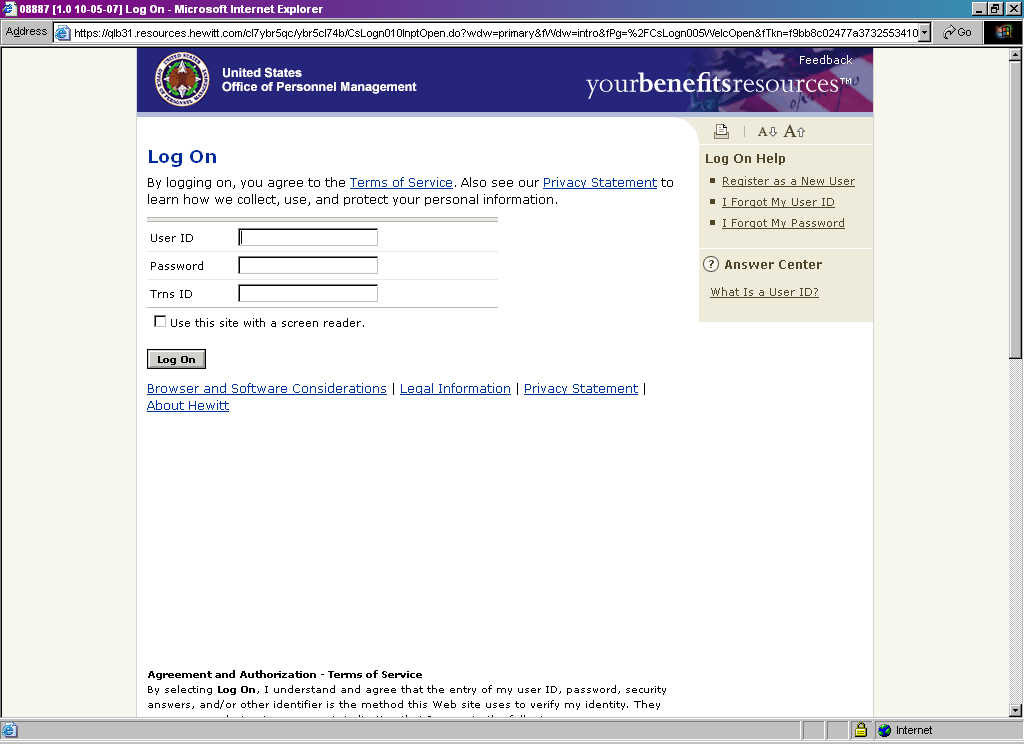

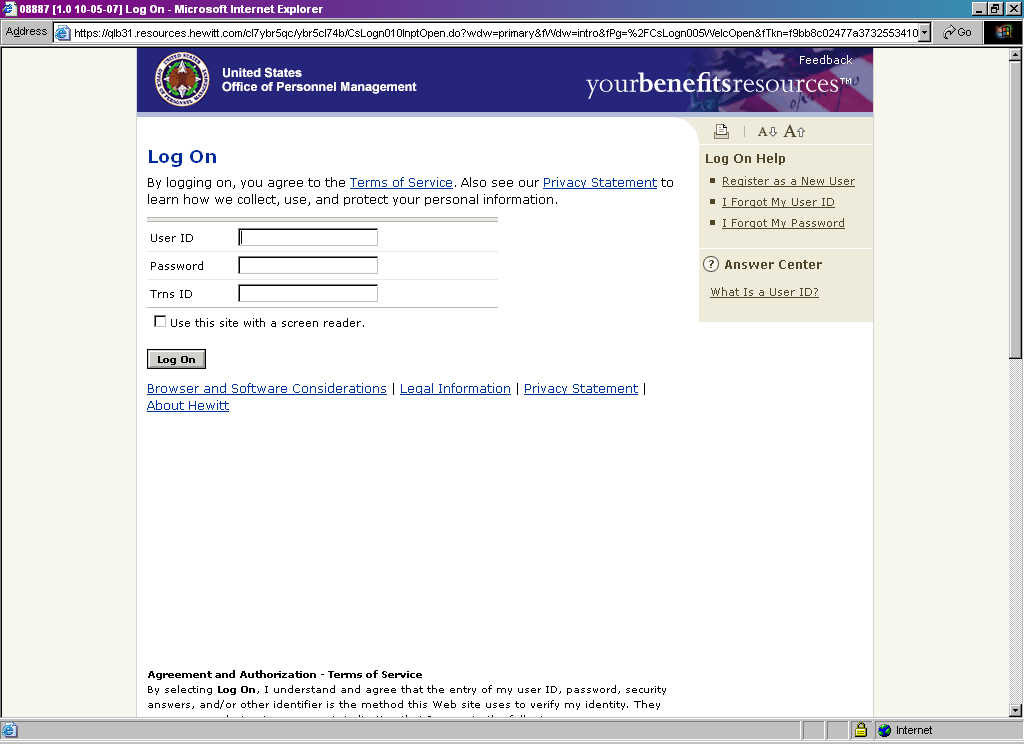

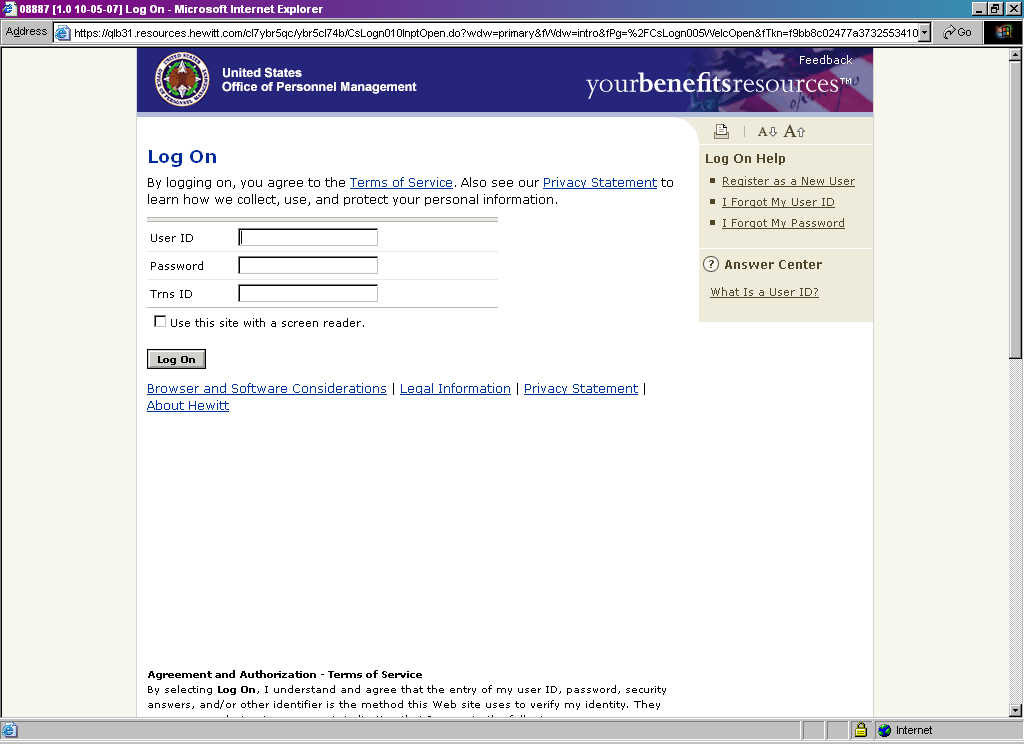

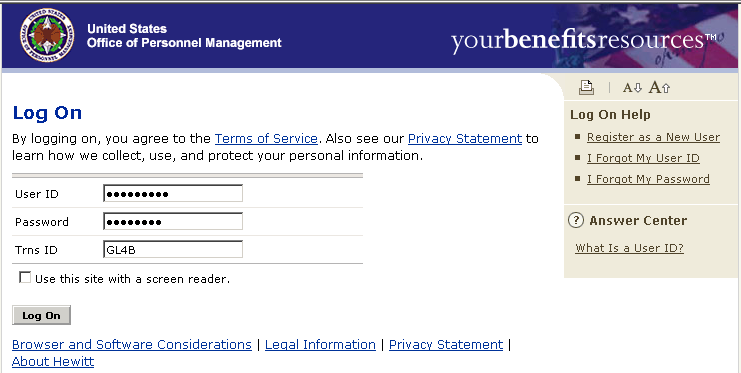

Upon loading the Your Benefits Resources (YBR) website the user will be prompted for his/her login credentials. This screen also provides links to the system Privacy Statement, Terms of Service, and Public Burden Statement, and indicates the OMB Control number.

|

Public

Burden Statement

OMB

No. 3206-XXXX

P

OMB

No. 3206-XXXX

ublic

Burden Statement

ublic

Burden Statement

This page intentionally left blank

OPM.gov Privacy Policy

Terms of Service

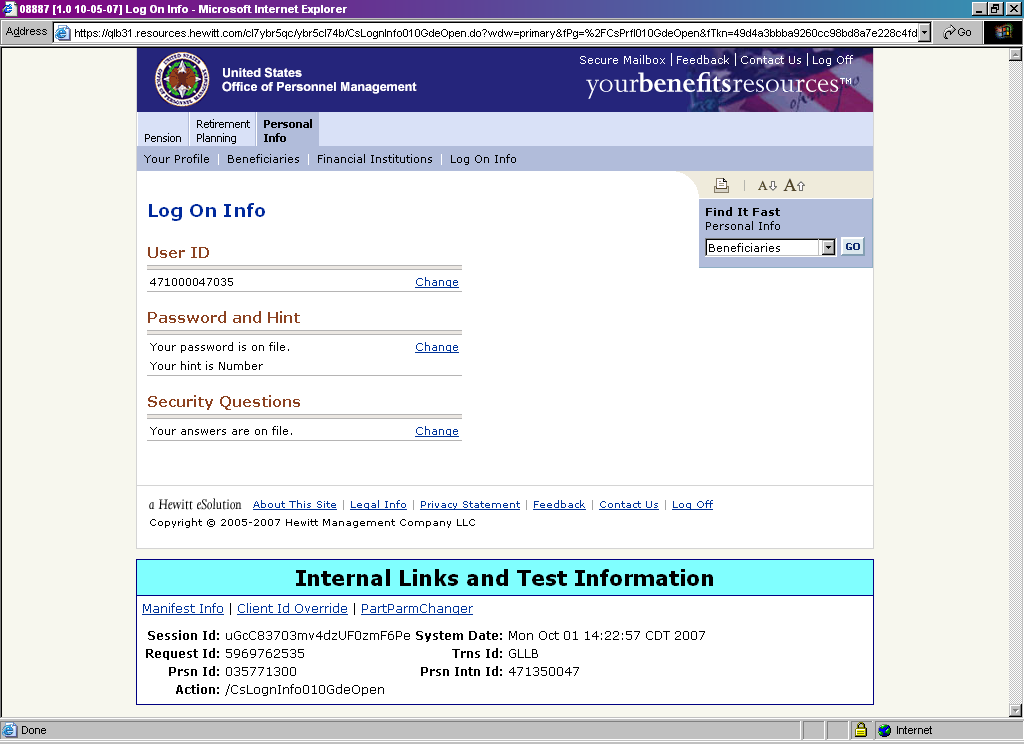

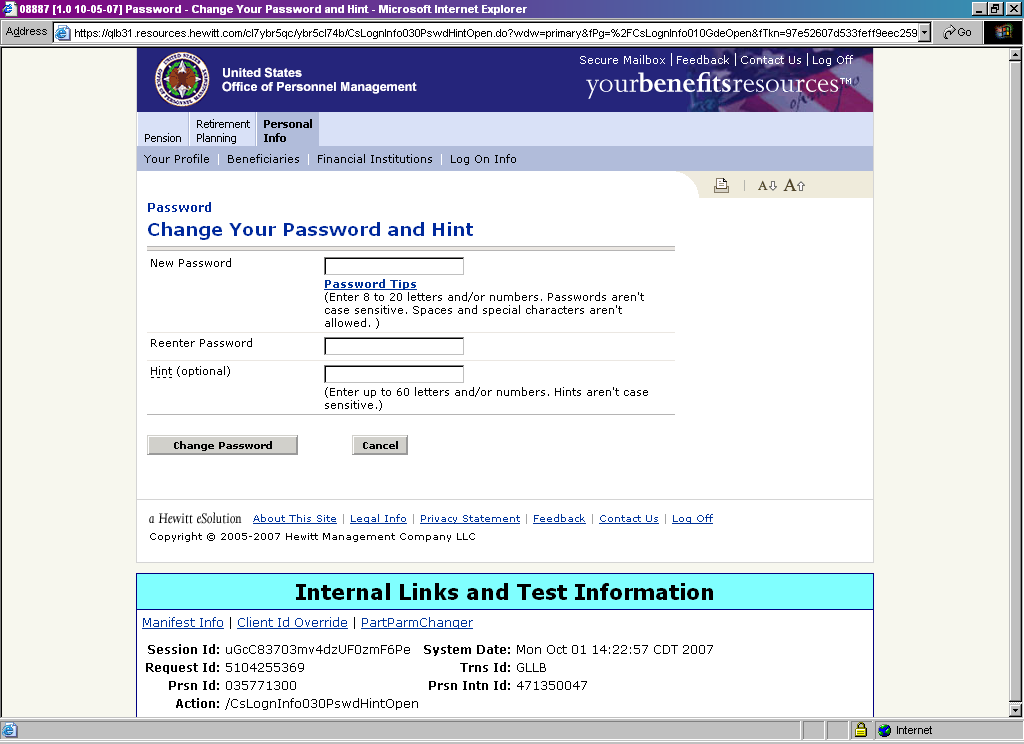

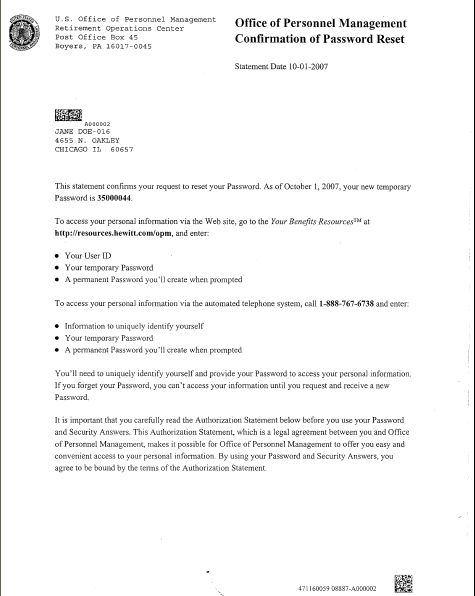

Information Collection - Confirmation of Password Reset

Description:

Sent to any YBR user new to the system needing a temporary password

for initial access.

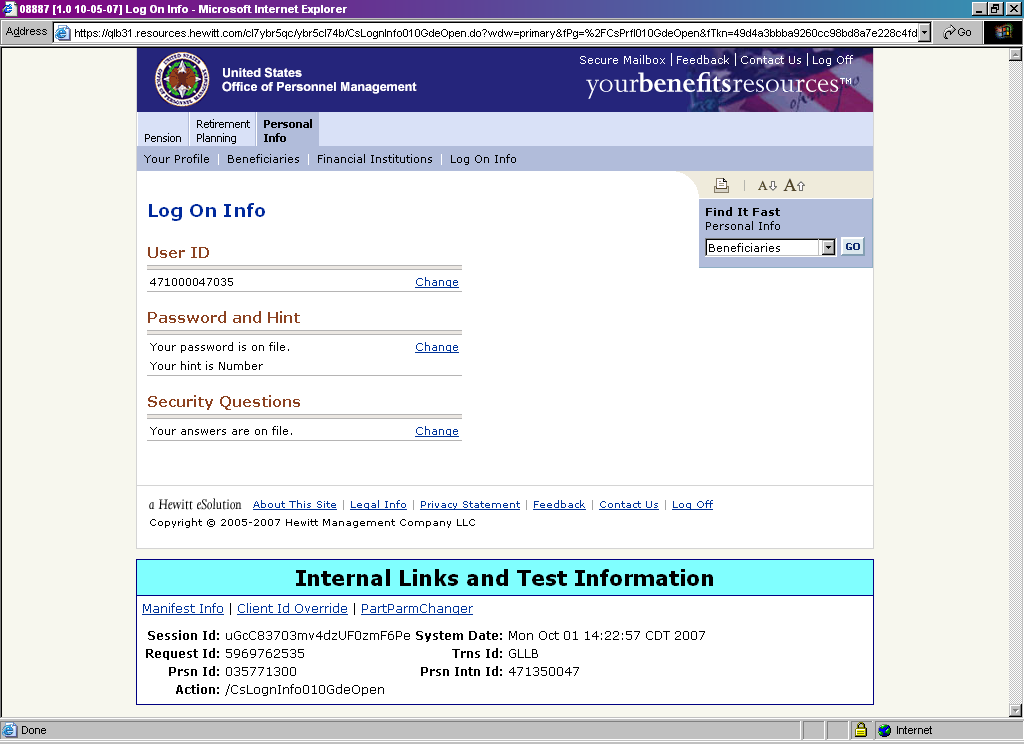

Step 1 – User logs in to the YBR tool.

Step

2

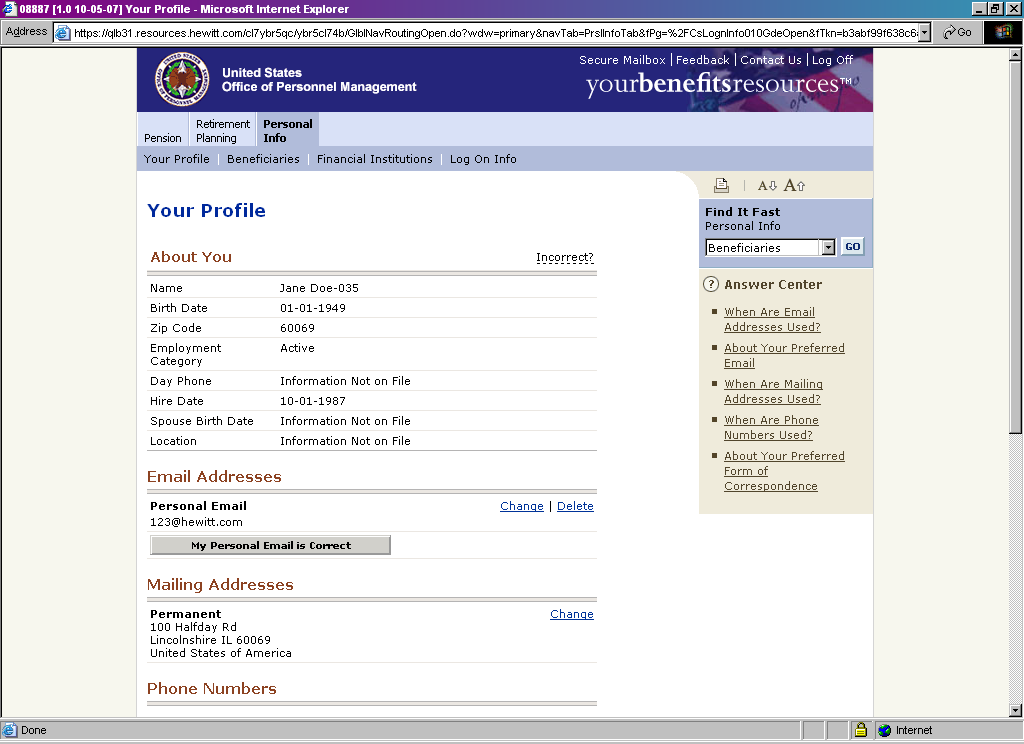

– User clicks on ‘Personal Info’ tab and then ‘log

on info’ tab

Step 3 – User clicks on ‘change’ link under ‘Password and Hint’ heading

Step 4 – User clicks enters new password, re-enters new password, and a password hint (optional)

Step 5 – Once user has entered his/her new password information, they click the ‘Change Password’ button and the following confirmation form is sent to them via mail:

Information

Collection: Confirmation of Security Change

Description: This

notice is sent to anyone who updates or changes their security

credentials on YBR to mitigate possible fraud.

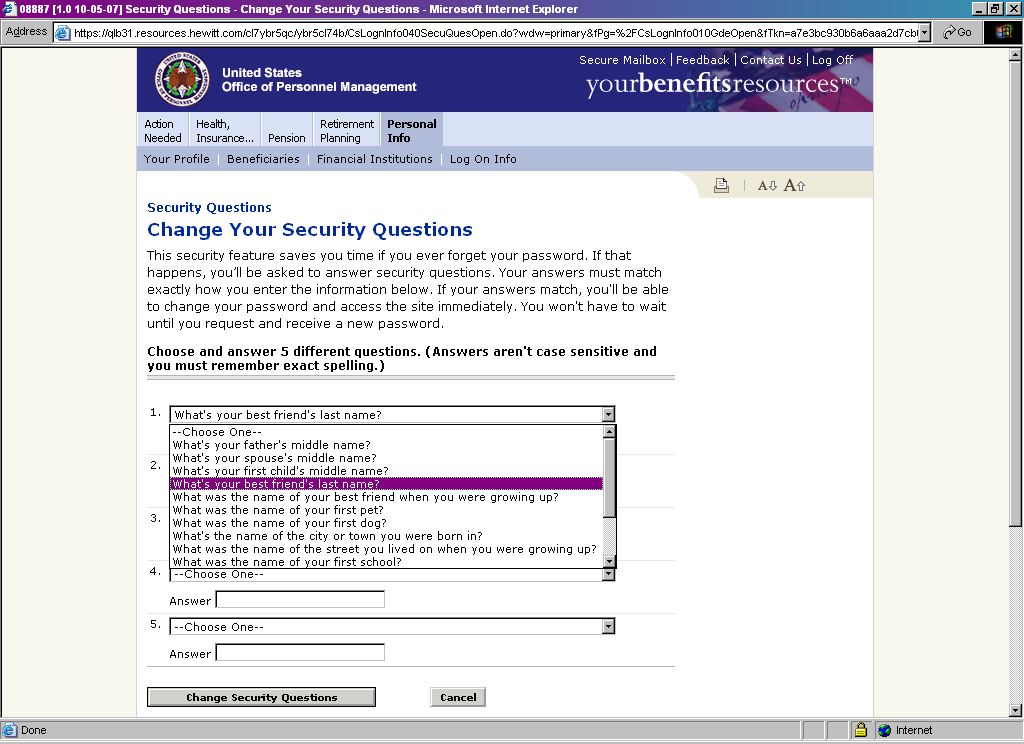

Step 1 – User logs in to the YBR tool.

Step 2 – User clicks on ‘Personal Info’ tab and then ‘log on info’ tab

Step 3 – User clicks on ‘change’ link under ‘Security Questions’ heading

Step 4 – The user provides answers to 5 security questions that will be used in the event the user forgets his/her password.

Step 5 – Once user has entered his/her security question answers, they click the ‘Change Security Questions’ button and the following confirmation form is sent to them via mail:

User ID screen

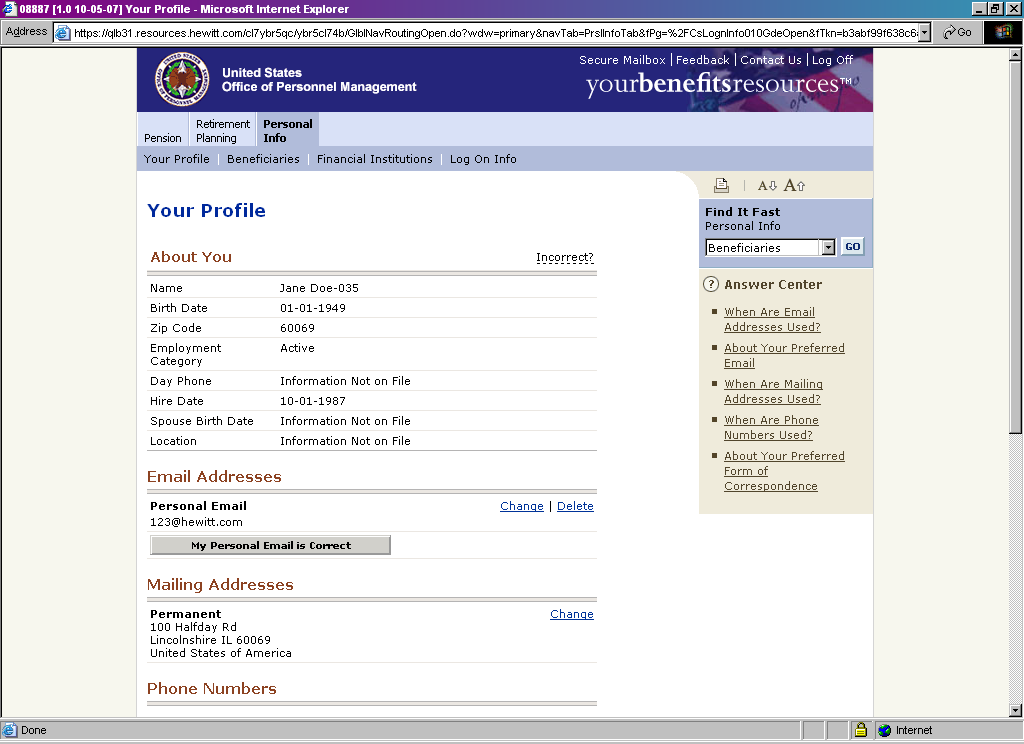

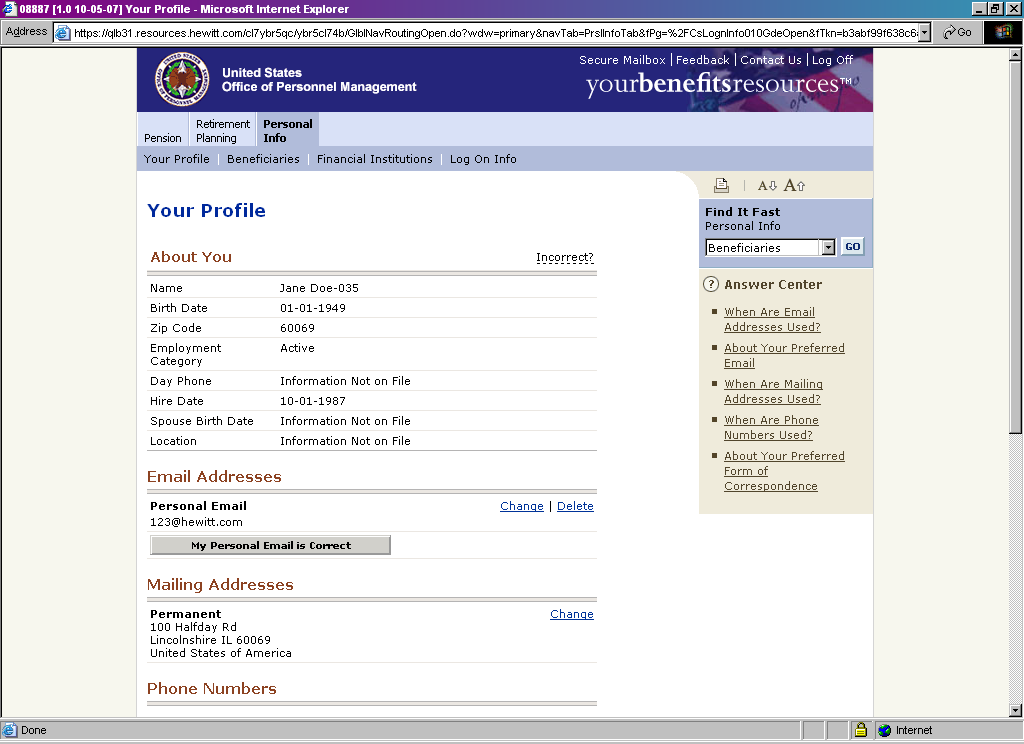

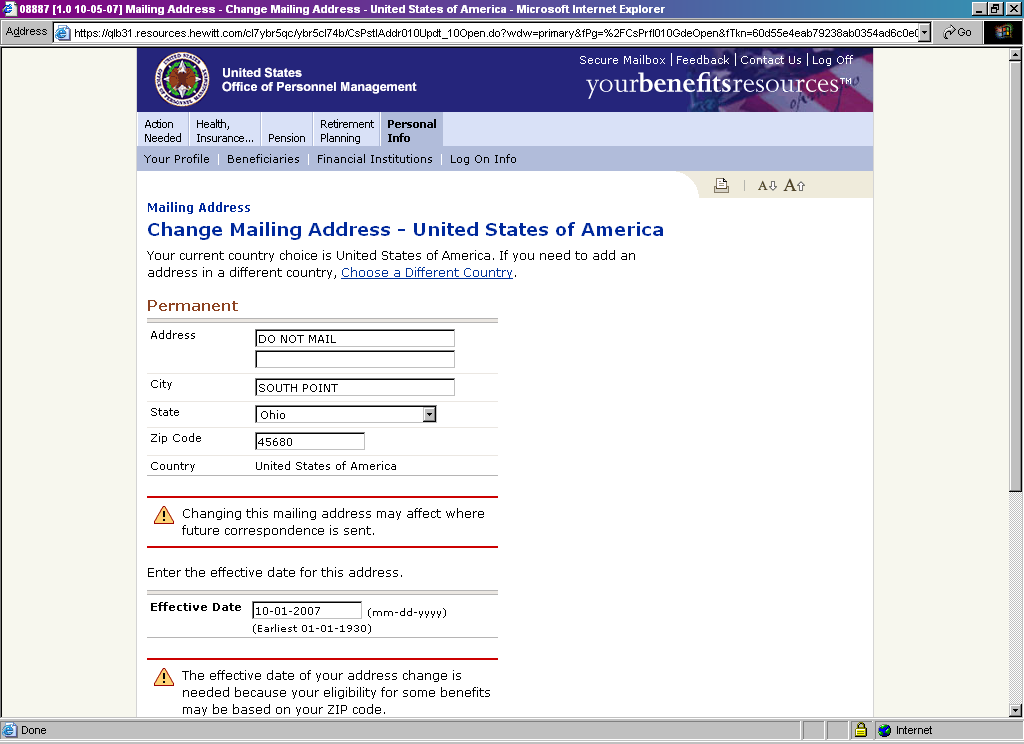

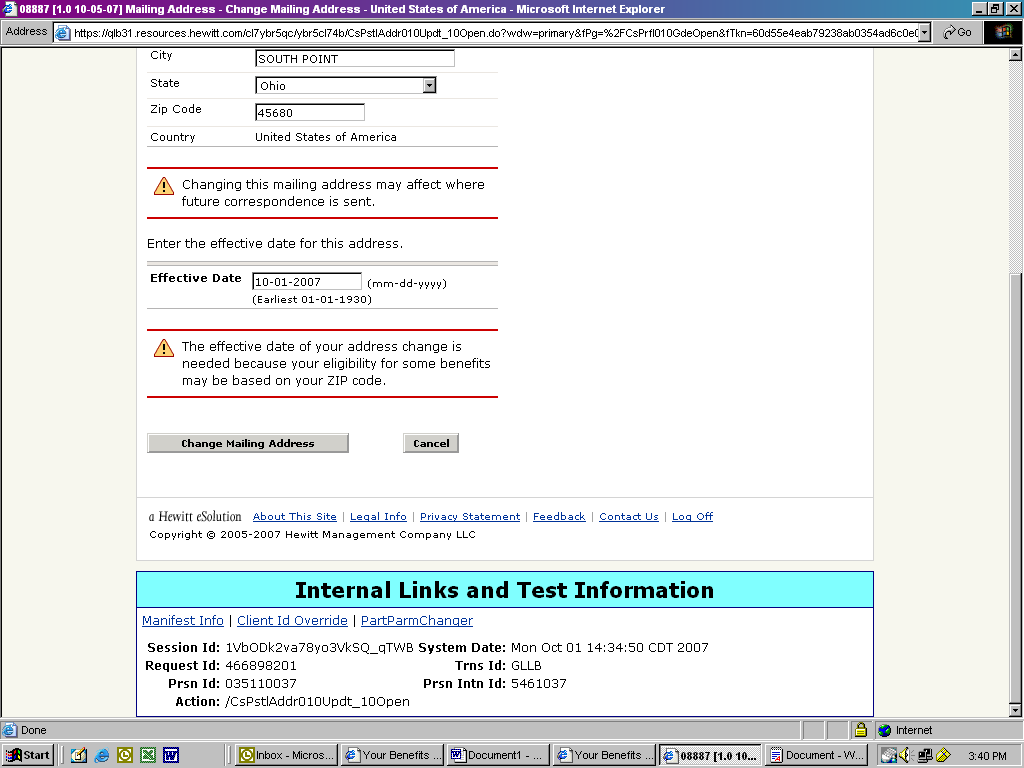

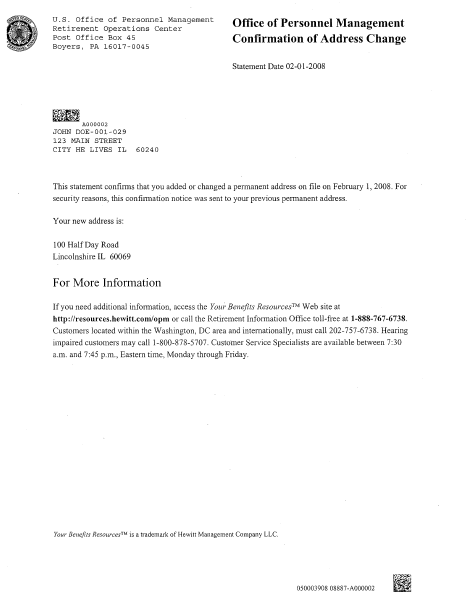

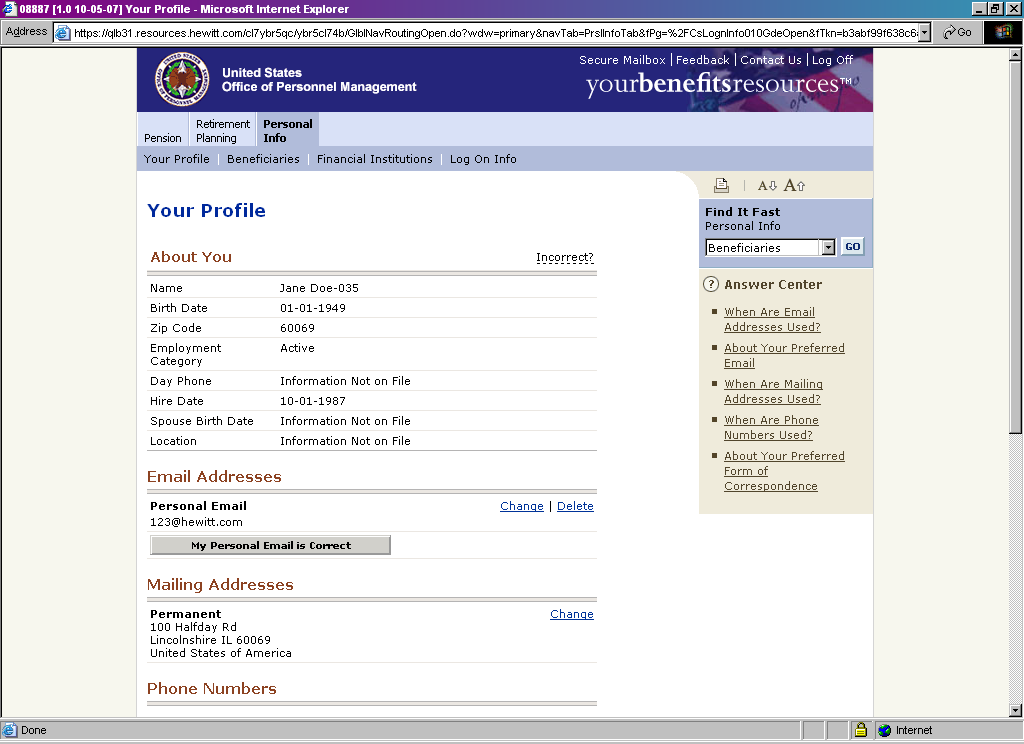

Information Collection: Confirmation of Address Change

Description: This notice is sent to any annuitant or former employee on DBTS who changes their address to mitigate possible fraud (it is sent to the former and new address).

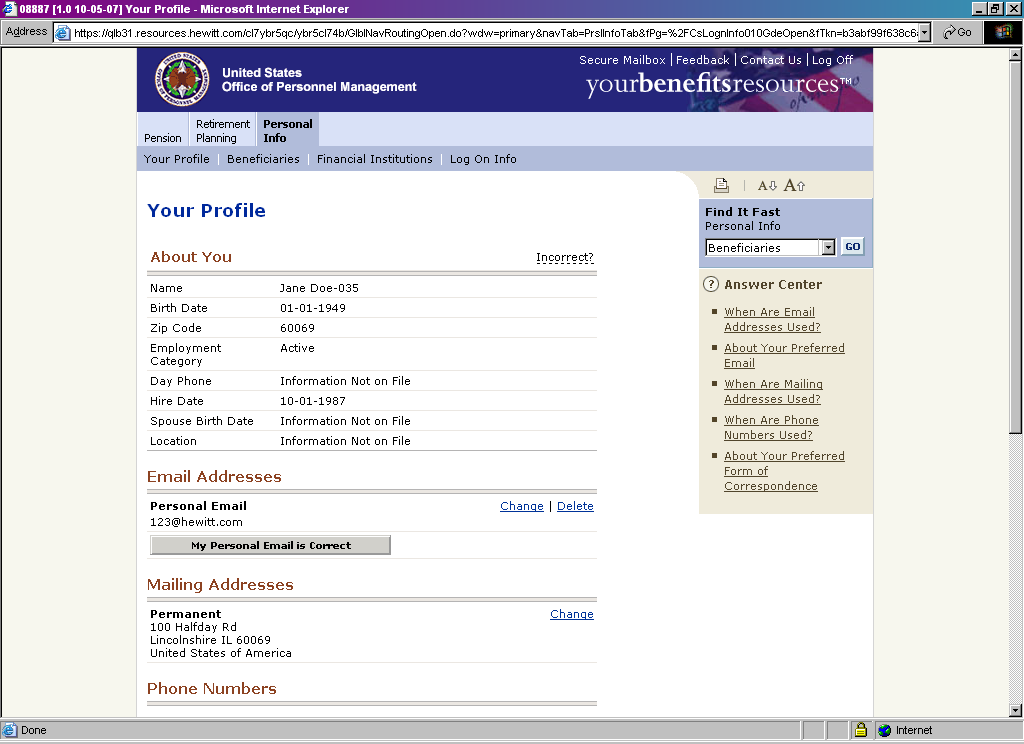

Step 1 – User logs in to the YBR tool.

Step

2

– User clicks on ‘Personal Info’ tab and then ‘Your

Profile’ tab

Step 3 – User clicks on ‘change’ link under ‘Mailing Address’ heading

Step 4 – The user provides updated mailing address information including city, state, zip code, and country (if applicable).

Step 4 (continued) – User completes updates, provides the effective date of the address, and clicks the ‘Change Mailing Address’ button

Step 5 – Once user has submitted his/her new address information the following confirmation form is sent to them via mail:

User ID screen

Information Collection: Confirmation of Preference Change

Description:

This notice is sent to anyone who changes the preference of how they

would like to receive forms from DBTS (electronic or US Mail).

Step 1 – User logs in to the YBR tool.

Step

2

– The user selects the ‘Personal Info’ tab. Once on

the ‘Your Profile’ screen, the user can then make address

(email or mailing) changes.

Step 3 – The user will be prompted to select his/her preferred form of correspondence and then clicks the ‘Change Preferences’ button.

Step 4 – Once user has submitted his/her preferences the following confirmation form is sent to them via mail:

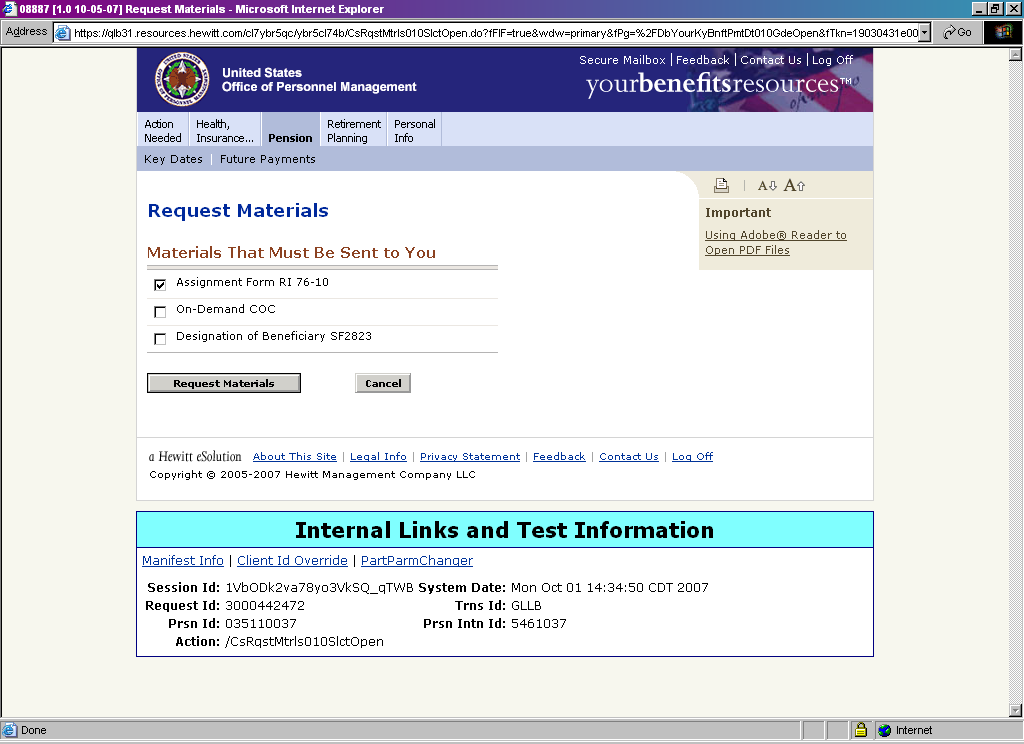

Information Collection: Assignment Cover Letter

Description:

This cover letter accompanies the Assignment Form which provides a

method to the annuitant of assigning his or her Basic Life

Insurance, Option A Standard Life Insurance, and Option B Additional

Life Insurance to another individual or a trust.

Step 1 – User logs in to the YBR tool.

Step 2 – The user selects the ‘Pension’ tab and will select the ‘assignment form’ to be sent to their preferred mailing address. The user selects the ‘Request Materials’ button.

Step 34 – The user will receive the following confirmation form via mail as

well as the requested Assignment Form (RI 76-10):

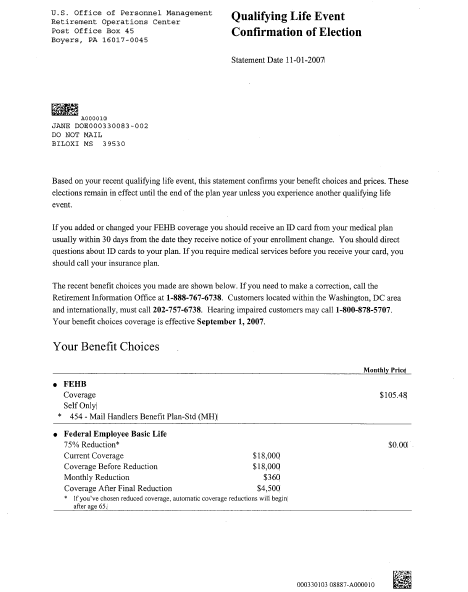

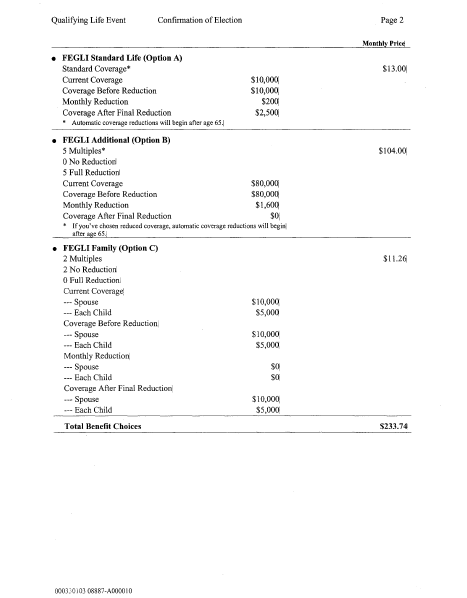

Information

Collection: Confirmation of Election

Step 1 – User logs in to the YBR tool.

Step 2 – The user selects the ‘Health, Insurance, and Other Benefits’ tab.

Step 3 – The user selects ‘change’ from the drop-down menu on the right.

Step 34 – The user selects the relevant qualifying life event from the drop down list.

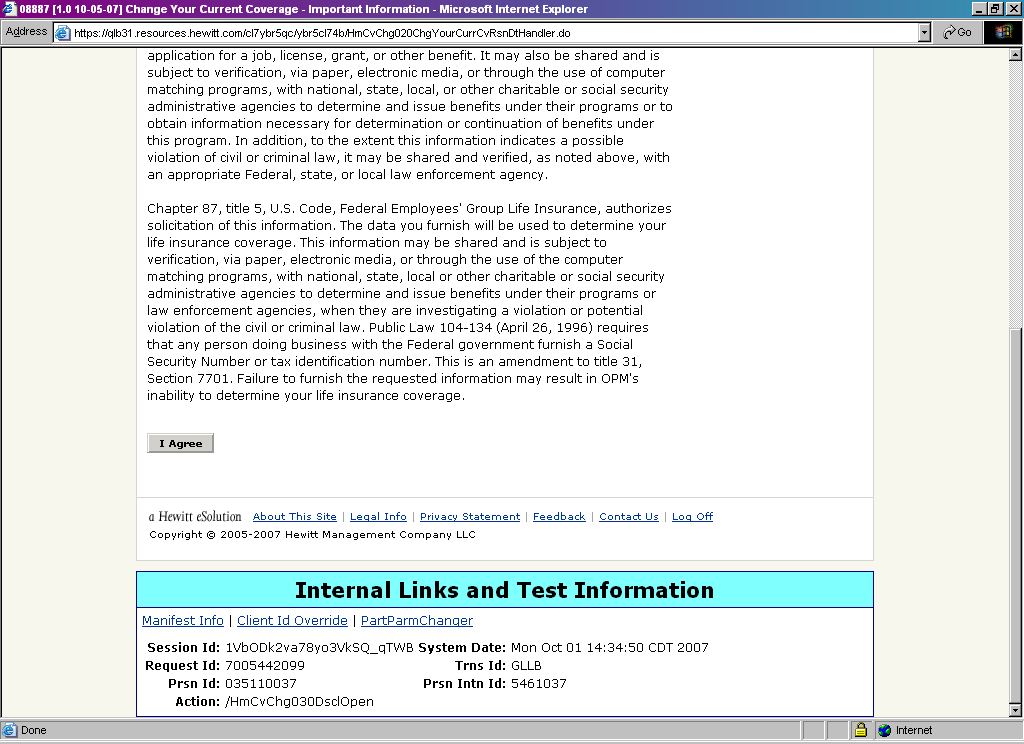

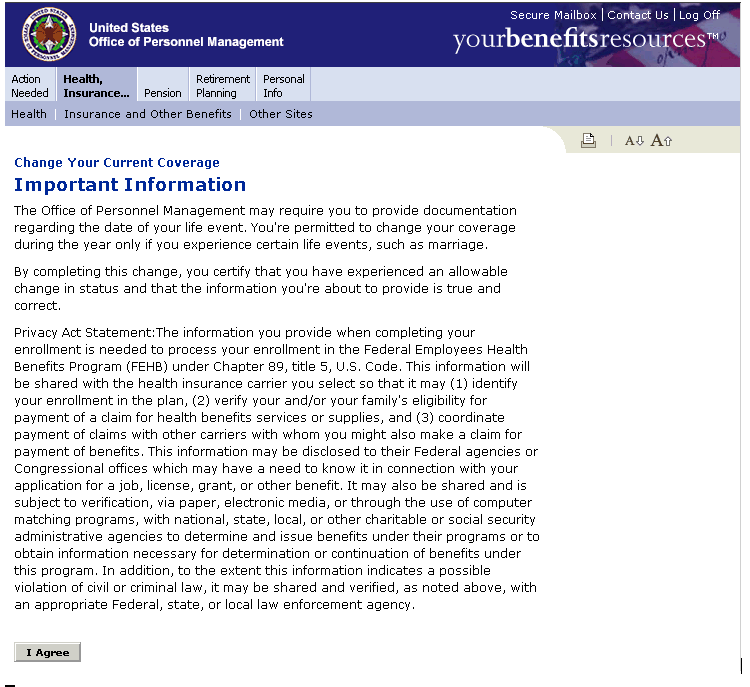

Step 54 – The user reads and agrees to the Privacy Act Statement and additional information regarding the collection of information.

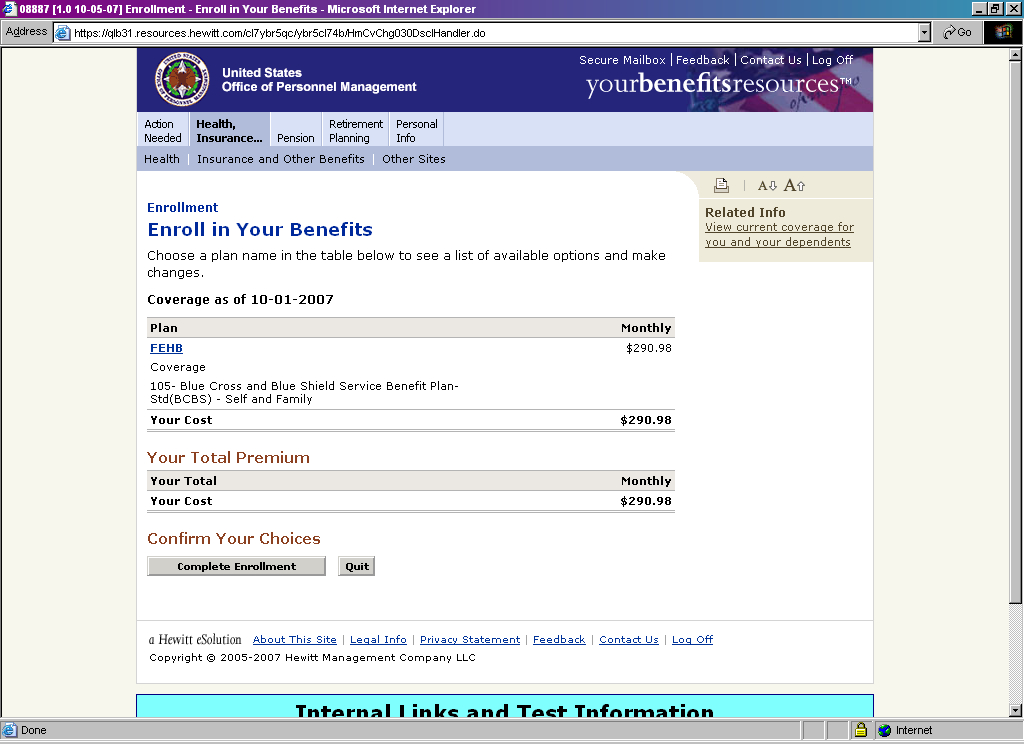

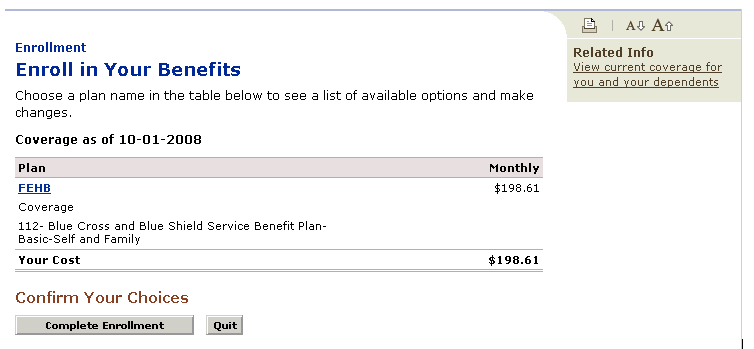

Step 56 – The user reviews their current coverage as presented by the system and clicks on their plan name link.

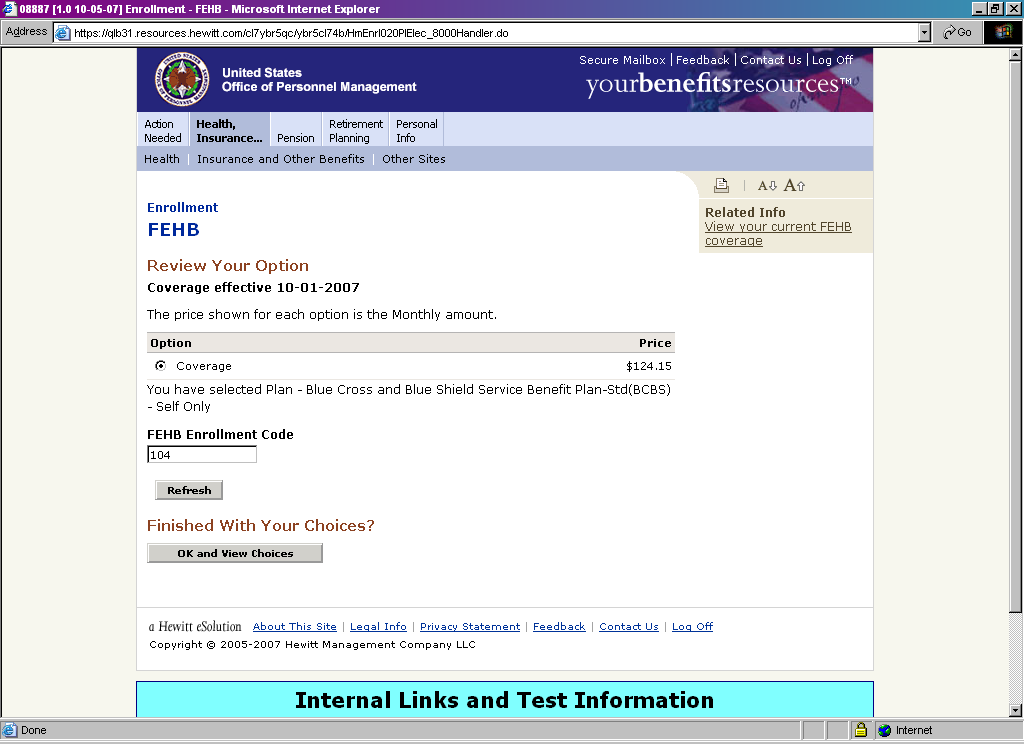

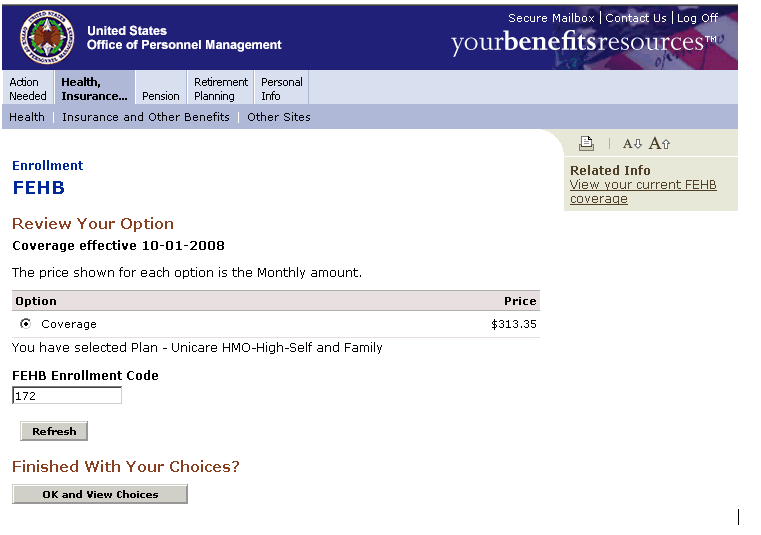

Step 76 – The user indicates their enrollment code and then selects ‘Ok and view choices’.

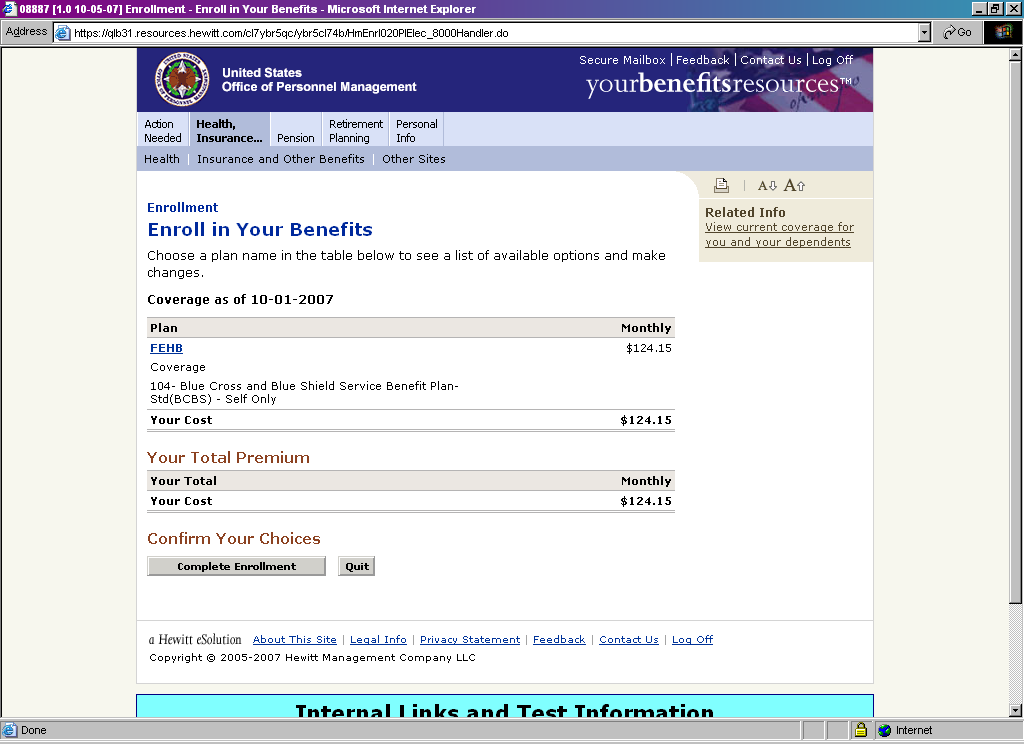

Step 87 – The user reviews their elections and clicks ‘Complete Enrollment’.

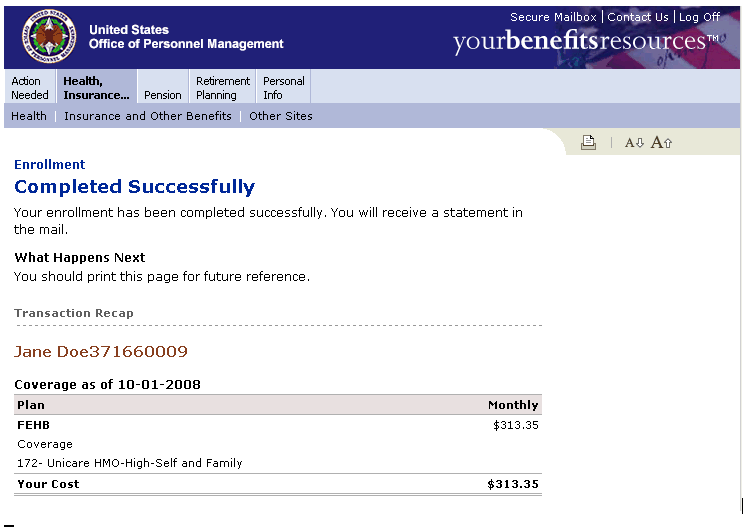

Step 98 – The user will receive the following confirmation form in the mail.

Information Collection: Other Qualifying Life Events

Description: Qualifying Life events (e.g. death of annuitant) and DBTS system updates such as pension recalculations may trigger paper forms to be sent to an annuitant, survivor, or other member of the public.

Users will log in to YBR and then follow a standard process (below) to indicate their Qualifying Life Event in the tool. The following screenshots demonstrate the information collection for changes to an FEHB enrollment; the same process also applies to other life events and generates the following forms (provided at end of section):

FEGLI Notice of Conversion Privilege Option C

FERS Starting your Beneficiary Pension Benefit – In Pay Status

CSRS Beneficiary Pension Election Authorization Form

For system-generated changes resulting from an update in the DBTS (e.g., recalculations) the following forms will be sent to the public (provided at end of section):

Confirmation of Coverage

FERS Pension Recalculation Notice

CSRS Confirmation of Beneficiary Pension Election Authorization Form

Notice of Time Limit

Step 1: Logon using user id and password

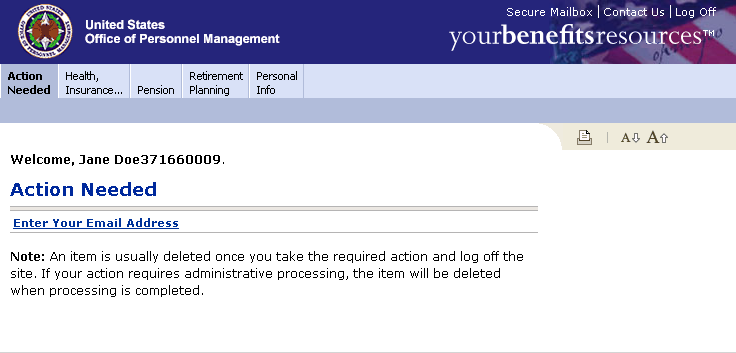

Step 2: User will receive the ‘Action needed’ page will appear on successful login

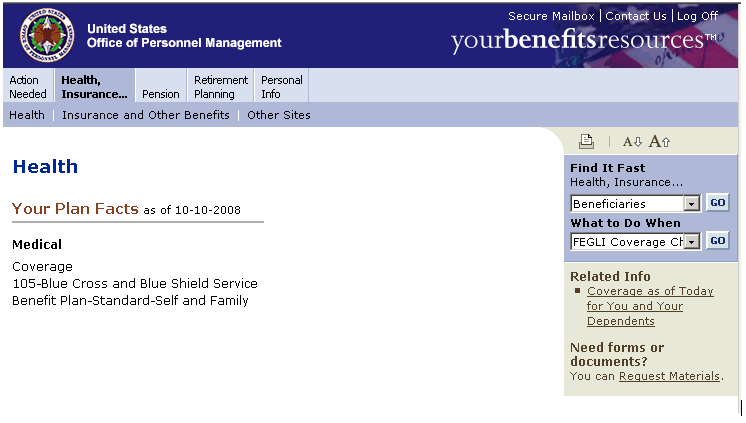

Step 3: Users will then go to main ‘Health & Insurance’ tab and choose change current coverage from Find it Fast drop down

Step 4: The user chooses the reason code for the Qualifying Life Event from the drop down and enters the date of event

Step 5: The ‘Important Information’ page containing the Privacy Act Statement will appear after selecting the reason code and life event date

Step 6: The ‘Enroll in your benefits page’ will appear showing current coverage for FEHB Plan

Step 7: After going into FEHB link the user can change the FEHB enrolment code

Step 8: Once the user has entered the information and selected ‘Complete Enrollment’ they will receive the ‘Complete Successfully’ Page

Q

ualifying

Life Event Form – FEGLI Notice of Conversion Privilege

ualifying

Life Event Form – FEGLI Notice of Conversion Privilege

Qualifying Life Event Form – FERS Starting Your Beneficiary Pension Benefit – In Pay Status

Qualifying Life Event Form – CSRS Beneficiary Pension Election Authorization Form

DBTS/System-Generated Events – CSRS Confirmation of Beneficiary Pension Election Authorization Form

DBTS/System-Generated Events – FERS Pension Recalculation Notice

DBTS/System-Generated Events – Confirmation of Coverage

DBTS/System-Generated Events – Notice of Time Limit to Change Your Elections

Description: This letter alerts retirees of the deadline they have to make changes to their annuity election options relating to survivor benefits and to make changes to their post-retirement basic life insurance reduction election.

----------------------------------------------------------------------------------------------------

Notice of Time Limit to Change Your Elections

January 6, 2008

Pat Annuitant

123 Ambitious Road

RSM, DC

Dear Mr. Annuitant:

This notice is to inform you that we have completed work on your application for retirement under the Civil Service Retirement System /Federal Employees’ Retirement System [use the one that is appropriate], and have established your monthly annuity rate. The type of annuity you elected, the gross monthly rate of annuity payable to you, and the gross monthly rate of annuity payable to your survivor upon your death are provided below. Your election for Post-Retirement Basic Life Insurance is also provided below.

In accordance with subpart B of part 850 of title 5, code of Federal Regulations, we are providing this notice to inform you that if you wish to change or revoke either your annuity election or your Post-Retirement Basic Life Insurance election, you must contact the Office of Personnel Management no later than February 11, 2008. [This is the date that is 35 days from the date of the letter in this example – we want to see the actual date the person must respond by in the letter]. After that date,

your options to make changes to your annuity election will be limited to the situations described in the Changes to Annuity Elections After Retirement information provided below;

your options to change your Post Retirement Basic Life Insurance election may also be limited as described in the Changes to Post Retirement Basic Life Insurance Reduction Election information below.

In addition, if you wish to pay a service credit deposit to obtain credit for additional Federal civilian service, you must also complete the deposit by February 11, 2008. [This is the date that is 35 days from the date of the letter in this example – we want to see the actual date the person must respond by in the letter]. After that date, you will not have another opportunity to complete the deposit.

Annuity Election:

You Elected:

A reduced annuity to provide a partial survivor annuity to your spouse, Chris.

The gross monthly annuity payable to you is: $1,500.

The gross monthly survivor annuity payable to Chris after your death is: $500

(These amounts are subject to change due to cost-of-living adjustments.)

Post Retirement Basic Life Insurance Reduction Election

You Elected:

50 Percent Reduction Option

Amount of Post-Retirement Basic Life Insurance

Before Insurance Starts to Reduce: $80,000

After Insurance is fully Reduced: $40,000

Basic Life Insurance Monthly Premium:

Until the month after your 65th birthday: $74.00

Starting the month after your 65th birthday: $48.00.

To make a change in your annuity election or Post Retirement Basic Life Insurance Election your written request must be post-marked before February 11, 2008, [This is the date that is 35 days from the date of the letter in this example – we want to see the actual date the person must respond by in the letter] and sent to:

U.S. Office of Personnel Management

Retirement Operations Center

Post Office Box 45

Boyers, PA 16017

If you have any questions about this notice, you can call the Retirement Information Office at

1 (888) 767-6738, or email us at [email protected].

Changes to Annuity Elections After Retirement

You may name a new survivor or change your election not later than 35 days after the date of this notice as described above. If the person you named to receive a survivor annuity dies or your current marriage ends in death, divorce or annulment, you should write OPM, Retirement Operations Center, Boyers, PA 16017. (Note: If your marriage to the spouse you had at retirement continues, you must have his or her consent to any election that does not provide the maximum current spouse survivor annuity.)

When this 35-day period for changing your election described above has passed, you cannot change your election except under the circumstances explained in the following paragraphs.

You may change your decision not to provide a survivor annuity for your spouse at retirement or you may increase the survivor annuity amount for your spouse at retirement if you request the change in writing no later than eighteen months after the commencing date of your annuity. Such an election would cancel any joint waivers made at retirement. You must also pay a deposit representing the difference between the reduction for the new survivor election and the original survivor election, plus a charge, with interest on both. Under CSRS, the charge is $245.00 for each thousand-dollar change in the designated survivor’s base. Under FERS, the charge for a full survivor annuity is 24.5 percent of your annual annuity, and for a partial survivor annuity, 12.25 percent.

The reduction in your annuity to provide a survivor annuity for your current spouse stops if your marriage ends because of death, divorce, or annulment. However, you may elect, within 2 years after the marriage ends by divorce or annulment, to continue the reduction to provide a former spouse survivor annuity for that person, subject to the restrictions in paragraph j. Please note that the pre-divorce or pre-annulment survivor annuity election automatically terminates upon divorce. You must make a new election within 2 years after the divorce to provide a survivor annuity for a former spouse, even if you made a survivor annuity election for him or her as a current spouse at the time of retirement. Continuing a survivor reduction, by itself, is not a former spouse survivor election. If you marry someone else before you make this election, your new spouse must consent to your election.

The reduction in your annuity to provide a survivor annuity for a former spouse ends (1) when the former spouse dies, (2) when the former spouse remarries before reaching age 55, or (3) under the terms of the court order that required you to provide the survivor annuity for the former spouse when you retired. (Modifications of the court order issued after you retire do not affect the former spouse annuity.) If you and your former spouse were married for 30 years or longer, the reduction does not end. However, if at retirement, you had elected a survivor annuity for your current spouse (or another former spouse), the reduction will be continued to provide the survivor annuity for that person. If you have not previously made an election regarding a current spouse whom you married after retirement (or if your election regarding a current spouse at retirement was based on a waiver of spousal consent), you may, within 2 years after the former spouse is no longer eligible because of remarriage before age 55 or death, elect a reduced annuity to provide a survivor annuity for that current spouse. This election is subject to the restrictions given in paragraph j.

If you were not married at retirement, you may elect, within 2 years after a post-retirement marriage, a reduced annuity to provide a maximum or less-than-maximum survivor annuity for your spouse, subject to the restrictions given in paragraph j.

If you were married at retirement, that marriage ends, and you marry again, you may elect a reduced annuity to provide a maximum or less-than-maximum survivor annuity for your new spouse, subject to the restrictions given in paragraph j. If you remarry the same person you were married to at retirement and that person had previously consented to your election of no survivor annuity, you may not elect to provide a survivor annuity for that person when you remarry.

If, at retirement, you received (by election or court order) a reduced annuity to provide a survivor annuity for a former spouse and you elected to provide an insurable interest survivor annuity for your current spouse, you may change the insurable interest election to a regular current spouse survivor annuity within 2 years after your former spouse loses entitlement (because of remarriage before age 55, death, or the terms in the court order), subject to restrictions (1) and (2) given in paragraph j.

The reduction in your annuity to provide an insurable interest survivor annuity ends if the person you named to receive the insurable interest annuity dies or when the person you named is your current spouse and you change your election as explained in paragraph h. The reduction also ends if, after you retire, you marry the insurable interest beneficiary and elect to provide a regular survivor annuity for that person. If you marry someone other than the insurable interest beneficiary after you retire and elect to provide a regular survivor annuity for your new spouse, you may elect to cancel the insurable interest reduction.

Post-retirement survivor elections are subject to the following restrictions:

They cannot be honored to the extent that they conflict with the terms of a qualifying court order that requires you to provide a survivor annuity for a former spouse.

They cannot be honored if they cause combined current and former spouse survivor annuities to exceed maximum survivor annuity; and

If, during any period after you retired, your annuity was not reduced to provide a current or former spouse survivor annuity, you must pay into the retirement fund an amount equal to the amount your annuity would have been reduced during that period, plus any applicable charges (see item c., above), plus 6% annual interest.

k. Insurable interest elections are not available after retirement.

Changes To Post Retirement Basic Life Insurance Reduction Election

You have 35 days from the date of this notice as described above to change your Post Retirement Basic Life Insurance Reduction election. Your request to make a change in your reduction must be in writing and must be post-marked before February 11, 2008. [This is the date that is 35 days from the date of the letter in this example – we want to see the actual date the person must respond by in the letter]. Your request should be sent to:

U.S. Office of Personnel Management

Retirement Operations Center

Post Office Box 45

Boyers, PA 16017

After February 11, 2008, [This is the date that is 35 days from the date of the letter in this example – we want to see the actual date the person must respond by in the letter] you or the assignee(s), if applicable, may only change to 75% Reduction and not to 50% Reduction or No Reduction. If you or the assignee(s), if applicable, change to 75% Reduction, we will compute the amount of your Basic as if you had originally elected 75% Reduction. The additional premium for the No Reduction or the 50 Percent Reduction election will stop. You will not receive a refund of premiums you already paid.

| File Type | application/msword |

| File Title | Password Reset |

| Author | Jon Judah - Booz Allen Hamilton |

| Last Modified By | OPM |

| File Modified | 2008-01-11 |

| File Created | 2008-01-11 |

© 2026 OMB.report | Privacy Policy