Va 1

Sec 502- FC Impact Report_FINAL TO (20)_12_10_09.doc

Loan Guaranty Service (LGY) Foreclosure Impact Survey - Veterans Recently Separated

VA 1

OMB: 2900-0754

Report to Congress

Impact of Mortgage Foreclosures on Veterans

Public Law 110-389 Section 502

Report on Impact of Mortgage Foreclosures on Veterans

Introduction

Public Law 110-389, section 502, directs the Secretary of Veterans Affairs to submit a report to Congress on the effects of mortgage foreclosures on Veterans. The law provides that the report include four specific elements, each dealing with different, albeit interrelated, factors which may be involved in either reducing or increasing the likelihood of mortgage foreclosures on veterans:

(1) A general assessment of the income of veterans who have recently separated from the Armed Forces.

(2) An assessment of the effects of any lag or delay in the adjudication by the Secretary of claims of veterans for disability compensation on the capacity of veterans to maintain adequate or suitable housing.

(3) A description of the extent to which the provisions of the Servicemembers Civil Relief Act (50 U.S.C. App. 501 et seq.) protect veterans from mortgage foreclosure, and an assessment of the adequacy of such protections.

(4) A description and assessment of the adequacy of the home loan guaranty programs of the Department of Veterans Affairs (VA), including the authorities of such programs and the assistance provided individuals in the utilization of such programs, in preventing foreclosure for veterans recently separated from the Armed Forces, and for members of the Armed Forces, who have home loans guaranteed by the Secretary.

For elements 1 and 2, this report provides details regarding the research approach, methodology, results, and an aggregate conclusion. For elements 3 and 4, this report provides descriptions of the various mortgage programs and protections afforded Veterans and an assessment of their effect on mortgage foreclosures in the Veteran population.

INCOME OF recently separated Veterans

Background

The first element of the report to Congress required by Public Law 110-389, section 502, is a general assessment of the income of Veterans who have recently separated from the Armed Forces.

Although VA does not currently monitor the income of recently separated Veterans (RSVs), we were able to consult multiple sources to obtain a general overview of RSV income levels. VA relied heavily on The Census Bureau’s American Community Survey (ACS) data for a general assessment of RSV income. As a cross-check of the data available in the ACS, VA consulted the Internal Revenue Service (IRS) and also culled information from the VA/Department of Defense Identity Repository (VADIR) and VA’s Loan Guaranty data systems. A general summation of RSV income is provided in Table 1. VA believes the independent facts that were gathered are useful in creating a general assessment of RSV income, as this data can be directly compared to that of the civilian population.

VA is also developing an informational survey of RSVs. The survey has been published in the Federal Register (74 FR 49073) for public comment. VA intends to use the survey to provide a comprehensive assessment of income for recently separated individual Veterans. The survey will provide a means of collecting data on the nature of current employment, reason(s) for any gaps in employment following separation from service, the quantitative breakdown of income sources, and how individual Veterans have fared from an income standpoint from the time of actual separation to present.

Findings

For the purpose of narrative clarity in the following findings, “civilian” is defined as an individual who never served in the Armed Forces. “Renter” is defined as an individual who occupies but does not own a home.1

In general, RSV household income ($79,627) is essentially the same as civilian household income ($79,555).2 A similar relationship exists for RSV and civilian homeowners. RSV homeowners had an average income of $94,997, where civilian homeowners’ average income was $93,540.

There is a large difference in household income when comparing homeowners to renters, in both the RSV and civilian populations. RSVs who own a home have a household income 62 percent greater than RSV renters ($94,997 vs. $58,472). An even larger gap (94 percent) exists within the civilian population, with homeowner income reported to be $93,540 and renter income reported to be $48,169.

Interestingly, when examining differences in the renter population, RSVs’ household income was 21 percent higher than that of civilians ($58,472 vs. $48,169).

|

Definition of “Recently Separated Veterans” |

Mean Household Income |

Homeowner Mean Household Income |

Renter Mean Household Income |

2008 American Community Survey: Recently Separated Veterans |

Currently separated veterans, who served on Active Duty within last 12 months at date of survey |

$79,627 |

$94,997 |

$58,472 |

2008 American Community Survey: Civilians |

N/A |

$79,555 |

$93,540 |

$48,169 |

Internal Revenue Service (2008 Income Tax Filings)3 |

Separated between May 2008 and April 2009 |

$72,991 |

Unknown4 |

Unknown |

VA Home Loan Program Participants5 |

Separated between May 2008 and April 2009 |

N/A |

$88,080 |

N/A |

Table 1: Income Data and Sources

CLAIM ADJUDICATION DELAYS AND THE ABILITY TO MAINTAIN HOUSING

The second element of the report to Congress required by Public Law 110-389, section 502, is an assessment of the effects of any lag or delay in the adjudication by the Secretary of claims of Veterans for disability compensation on the capacity of Veterans to maintain adequate or suitable housing.

At this time, VA is unable to conclude if any relationship exists between disability claim adjudication delays and the capacity of Veterans to maintain adequate or suitable housing. VA plans to use the same survey referenced under the first element of this report to gather data from Veterans (holding a VA loan, other type of loan, or no loan at all) who applied for disability compensation benefits within the last five years. The survey should allow VA to determine if claim delays have a significant impact on a Veteran’s ability to stay current on his/her home loan or maintain rent payments. This survey will also allow us to gather data regarding the type and quality of living situation (e.g., the existence of overcrowding and other substandard living conditions) for those Veterans who are experiencing, or have experienced, delays in disability claim adjudication.

Servicemembers Civil Relief Act

The third element of the report to Congress required by Public Law 110-389, section 502, is a description of the extent to which the provisions of the Servicemembers Civil Relief Act (50 U.S.C. Appendix §§ 501-596) protect Veterans from mortgage foreclosure, and an assessment of the adequacy of such protections.

Description of General Protections

The Servicemembers Civil Relief Act (SCRA, or the Act) provides numerous protections to active duty military members and reservists, or members of the National Guard called to active duty, and, in limited situations, dependents of military members. The SCRA is intended to ease the economic and legal burdens on military personnel during their active service by postponing, suspending, or mitigating various types of obligations, including mortgage payments.

The SCRA provides for stays against enforcement of certain actions during military service and after active service under certain circumstances. It prevents accruals of penalties when an action for compliance with the terms of a contract is stayed pursuant to the Act, and allows a court to reduce a penalty or fine if military service materially affects a servicemember’s ability to perform under a legal contract. The SCRA excludes military service when computing any statute of limitation period, including for the redemption of real property. It restricts the maximum interest rate that may be charged on an obligation during military service. The Act also provides certain relief related to evictions, enforcement of installment contracts, and foreclosures of mortgages.

The SCRA provides special protection to a servicemember who is called to active duty after incurring obligations prior to that service, by virtue of a potentially reduced interest rate on a mortgage or other obligations. In a State where a non-judicial foreclosure procedure is normally utilized, the SCRA requires court approval for a foreclosure unless the servicemember agrees in writing to allow a non-judicial foreclosure. The Act also provides protection to a servicemember who obtained a mortgage after entering active duty, but who is not readily available (especially due to an overseas assignment) to defend him or herself against judicial proceedings.

Assessment of Mortgage Foreclosure Protections

Potential Interest Rate Reduction

In general, the SCRA provides that a debt incurred by a servicemember (or by a servicemember jointly with a spouse), prior to entering military service, shall not bear interest at a rate above six percent during the period of military service. This limitation applies to all consumer debts, including mortgage loans. In a case concerning a mortgage loan, the SCRA protection is in force for a period of one year after military service. However, if a mortgage lender believes that military service has not affected the servicemember’s ability to repay the mortgage, they have the right to ask a court to grant relief from the interest rate reduction.

The reduction in interest rate can be realized in three main ways. First, a benefit is realized by those servicemembers who obtained mortgage loans at rates higher than six percent. This population may be limited, however, as interest rates on mortgage loans originated for most of the past five years have been at or below six percent. It is only for older loans, or loans with higher than prevalent interest rates (i.e. subprime loans), where the SCRA interest rate limitation can serve to actually reduce mortgage payments. Secondly, servicemembers who experience a drop in income once being called to active duty may benefit from the concomitant reduction in mortgage payments. Finally, the reduction in interest rates (and therefore payments) on other consumer debt may allow a household’s resources to be reallocated to mortgage payments in order to avoid foreclosure.

2. Stays Against Default Judgments and Proceedings

The Act protects against the issuance of default judgments and any civil action or proceeding when a servicemember cannot appear in court due to military service. See 50 U.S.C. App. § 521 and App. § 522. For protection under either section, the servicemember must apply for relief, and do so not later than 90 days after termination of military service. If the servicemember does so, and can demonstrate that he or she was materially affected by reason of military service, courts are required to vacate or set aside any judgment entered during the servicemember’s period of military service (or within 60 days after release from service), and/or to stay a civil court action for not less than 90 days. These protections could apply when a State foreclosure action requires judicial proceedings, or when a loan holder is attempting to obtain a court order, as required under the Act.

The provisions in sections 521 and 522 could provide protection for servicemembers who face judicial foreclosure actions while on active duty. However, since the protections are predicated upon the servicemember’s inability to be present to defend against actions, they could be more beneficial for servicemembers who are actually assigned overseas. Servicemembers who are still serving in the locale of their home or have been reassigned to a different part of the United States could be considered by the court as reasonably able to be present to defend against any proceedings. However, even in an instance where a civil court proceedings were not halted, or a judgment was obtained against a servicemember who was unable to adequately defend against the action due to military service, the authority for the court to set aside that judgment (upon application by the servicemember within 90 days after release from military service) affords a reasonable opportunity to correct such an action.

3. Stays Against Foreclosures

Another protection applies specifically to mortgages and trust deeds, only if they originated before the period of the servicemember’s military service. The provisions in U.S.C. App. § 533 allow, and under some circumstances require, a court to stay proceedings or adjust a debt after determining that the servicemember’s military service materially affected his/her ability to comply with the mortgage obligation. Under SCRA protections, unless the servicemember agrees to allow a foreclosure to proceed, the holder of a mortgage must obtain court approval before foreclosing, even if in a State where judicial action is not normally required for a sale, foreclosure, or seizure of property for breach of obligation.

While SCRA provides some servicemembers with a period of time to develop repayment plans or other arrangements with their mortgage holders in order to avoid foreclosure, the SCRA foreclosure protections apply only to those servicemembers who obtained mortgages prior to entering active duty. An additional item of note is that the delay in foreclosure afforded under SCRA results in additional accrued interest and other default-related charges that would need to be addressed in any subsequent repayment arrangements with the mortgage holder.

VA EFFORTS TO PREVENT FORECLOSURE

The fourth element of the report to Congress required by Public Law 110-389, section 502, is a description and assessment of the adequacy of the home loan guaranty programs of the Department of Veterans Affairs, including the authorities of such programs and the assistance provided individuals in the utilization of such programs, in preventing foreclosure for Veterans recently separated from the Armed Forces, and for members of the Armed Forces, who have home loans guaranteed by the Secretary.

Description of General Program Authorities

The Department of Veterans Affairs (VA) Home Loan Guaranty Program provides home loan guaranty benefits to a very large and diverse clientele who served or are serving in the Armed Forces of the Nation. As part of the original GI Bill, the initial program objective was to assist eligible Veterans to transition from military to civilian life. However, the Home Loan Guaranty program has evolved through legislation (authorized by Chapter 37 of Title 38, United States Code) to provide a benefit not only to men and women who served their country but also to active duty servicemembers, reservists, and certain surviving spouses. Since 1944, VA has guaranteed more than 18.7 million home loans worth $1.04 trillion. Over 90 percent of VA loans have been made without a down payment. Currently, there are approximately 1.3 million outstanding VA home loans. While the provision and oversight of loan guaranties are not the only activities under the VA Home Loan Guaranty Program, this discussion will be limited to such, as they most closely achieve the objective of preventing Veteran foreclosures.

Eligibility

Most persons who enlist after September 7, 1980, must complete 24 months of continuous active duty or the full period for which called or ordered to active duty, but not less than 90 days during a wartime period or 181 days during peacetime. The law does provide some exceptions. For example there is no length of service requirement for a person discharged because of a service-connected disability. The Veteran must have been released under conditions other than dishonorable. Active duty servicemembers, including members of the Selected Reserves or National Guard who have been mobilized, with 90 days of continuous wartime active duty or 181 days of continuous peacetime active duty are eligible to apply for VA loans. Members of the Selected Reserves and National Guard without the requisite active duty service are typically eligible after six years of Reserve or Guard service.

VA-guaranteed loans are available through thousands of private lenders, including banks, credit unions, mortgage companies, and mortgage brokers. Due to the limited availability of private sector credit on tribal lands, VA offers direct mortgages to Native American Veterans and their spouses who live on Federal Trust land. VA issues Certificates of Eligibility (COEs) to Veterans as evidence of their basic eligibility for the home loan benefit. In many cases, lenders can obtain a Veteran’s COE directly from VA’s online system. This reduces the instances where Veterans need to apply for a COE before applying for a loan.

All VA borrowers must satisfy established credit and income criteria. The law governing the program requires that the contemplated terms of a loan payment bear a proper relation to the Veteran’s present and anticipated income and expenses, and that the Veteran be a satisfactory credit risk as determined in accordance with credit underwriting standards established in VA regulations. See 38 U.S.C. 3710(b) and (g). These standards protect the Government against potential loss due to loan default, and also increase the likelihood that Veterans will not face foreclosure because they only incur obligations they are able to repay, barring unforeseen circumstances.

Available Loan Products and Effective Loan Amounts

VA guarantees fixed-rate loans, adjustable rate mortgages, and hybrid adjustable rate mortgages, with terms of 30 years or less. Loans are available to purchase single-family homes, condominium units, cooperative units, manufactured homes, and multi-family homes with four units or less. Loans are also available for new home construction. Additionally, loans are available to refinance an existing loan. Recently, the Veterans’ Benefits Improvement Act of 2008 expanded VA refinancing loans. Refinancing loans are now available for up to 100 percent of the home’s value, even if the existing loan is not a VA loan.

VA’s maximum guaranty amount varies by county based on local housing costs and is adjusted annually. This has helped Veterans in communities with high housing costs obtain no-down-payment VA loans. VA loan limits vary by county and currently range from $417,000 to $1,094,625 in the contiguous 48 states (may be higher in Alaska, Guam, Hawaii, and the U.S. Virgin Islands). Veterans and servicemembers can typically borrow up to their local VA County Loan Limit with no down payment. Veterans can borrow more than their local VA County Loan Limit, but a down payment is usually required. A list of VA County Loan Limits is available at http://www.homeloans.va.gov/loan_limits.htm.

Description of Specific Authorities for Preventing Foreclosures

Title 38, U.S.C., § 3732, describes specific authorities and requirements of the Secretary with respect to procedures upon the default of a VA-guaranteed home loan. In addition, § 3720 provides the Secretary with additional authority that may be used to prevent foreclosures.

The authorities provided in the VA Home Loan Guaranty program, and the assistance provided to individuals in the utilization of the program, have been very effective in preventing foreclosure for recently separated Veterans and active-duty servicemembers who have VA-guaranteed home loans. VA has adapted the program to align with industry innovations and best practices, and to take advantage of cutting edge technological advances in order to provide Veterans and servicemembers every available opportunity to avoid foreclosure. Additionally, to the extent possible, VA endeavors to assist those Veterans and servicemembers who are experiencing difficulty in making their mortgage payments, but who obtained non VA-guaranteed loans.

Default Reporting by Holders

Under § 3732(a)(1), a loan holder is required to report the default to VA, which serves as notice of the potential for foreclosure, and provides VA an opportunity to review loss mitigation efforts by the private loan holder. Taking advantage of newer technology, VA has developed the VA Loan Electronic Reporting Interface (VALERI) to enable electronic reporting on all VA-guaranteed loans. This allows VA to monitor the status of all loans, and to focus attention as necessary on loans becoming more seriously delinquent.

When a VA-guaranteed loan is in default, the mortgage holder is responsible for contacting the borrower, determining the reason for the default, and making arrangements for repayment of the delinquency – in other words, performing primary loan servicing. If the default is not cured by the 61st day of delinquency, the mortgage holder must report the default, along with certain other information relating to the mortgage, to VA. This requirement is found in title 38, Code of Federal Regulations, § 36.4817(c)(7). Upon receipt of such notice, VA will assign that active default to the next available loan technician in one of our national network of nine Regional Loan Centers, or in the VA Regional Office in Hawaii for those loans in the Pacific. The loan technician will monitor the actions taken by the holder to ensure the Veteran borrower receives every consideration to resolve the default. In certain circumstances, such as when the holder’s efforts appear to be inadequate, the VA loan technician may intervene and perform loss mitigation activities directly with the Veteran borrower.

Notice to Veterans of Alternatives to Foreclosure

Under 38 U.S.C. 3732(a)(4), VA is required to provide delinquent VA-guaranteed loan borrowers with information, and to the extent feasible, counseling about alternatives to foreclosure and liabilities of VA and the Veteran in the event of foreclosure. It should be noted that under the new VALERI environment, this is one of the activities that loan holders complete directly and that VA oversees. Under (38 CFR 36.4850(g)(1)(iv)(B)(4)), loan holders are required to provide the delinquency information in one of their servicing letters. VA mandates that the information provided includes a VA web site address for additional information, as well as a toll-free telephone number Veterans can use to reach VA. This reminds Veterans that although their mortgage holder is the primary servicer of the loan, they are always able to speak with a VA loan technician.

The letter to Veterans outlines various alternatives to foreclosure. These may include loss mitigation options to help retain homeownership, such as extended repayment plans, special forbearance, or loan modifications. In unfortunate instances where a home cannot be retained, there are still options that typically mitigate the losses associated with foreclosure -- a compromise sale or a deed in lieu of foreclosure.

Loan Modification Authority

In the past, it was often difficult to compel loan servicers to modify a VA-guaranteed loan as losses would likely be assumed when the market’s prevailing interest rate was higher than the loan’s original rate. In 2008, VA promulgated new regulations (38 CFR 36.4815) allowing more flexibility to modify loans and adjust interest rates. The result has been significant numbers of loans now being modified. The new regulations were based on the authority contained in 38 U.S.C. 3720(a)(2), which allows the Secretary to consent to the modification of a guaranteed loan.

Alternatives to Foreclosure

When a borrower has no realistic prospects for maintaining even reduced mortgage payments, VA encourages Veteran borrowers to pursue a private sale of the home to avoid foreclosure. Since many properties sell for less than the total amount owing on the loan, VA assists by pre-authorizing the servicer to approve a sale involving a compromise loan guaranty claim (which pays the loan holder the difference between the sale proceeds and the total debt on the loan). This authority is contained in 38 CFR 36.4822(e). If a private sale cannot be arranged, the servicer considers acceptance of a deed in lieu of foreclosure in accordance with VA regulation 38 CFR 36.4822(f). If a deed in lieu of foreclosure is not feasible, the holder will generally proceed with foreclosure.

Notice of Foreclosure Referral

Termination of the loan is solely the responsibility of the mortgage holder. VA regulations (38 CFR 36.4817(c)(23)) require the servicer to electronically submit notice of referral for foreclosure no later than the 7th calendar day of the month after referral. This allows VA time to conduct a review of the adequacy of servicing in case VA intervention is warranted based on the facts of a particular case. If the loan has not been referred for foreclosure within 210 days of the due date of the last paid installment, VA will conduct the adequacy of servicing review at that time to ensure that all loss mitigation options have been considered.

Refunding Authority

When other loss mitigation options (repayment plan, special forbearance, or modification) for defaulting Veteran borrowers are not feasible, VA has discretionary authority to "refund" (purchase) a loan from the mortgage holder by paying the unpaid principal balance plus accrued interest. The law providing this authority (38 U.S.C. 3732(a)(2)) does not vest borrowers with any right to have their loans refunded, nor does it allow borrowers to “apply” for refunding. VA can refund a loan from the holder and reviews every case prior to foreclosure to determine if refunding is a viable option. Refunding is done at VA’s discretion, and loans are refunded when VA determines it is in the best interests of the Veteran and the Government.

VA intervention through refunding is exercised in situations where the borrower has the ability to maintain the mortgage obligation, or clearly will have that ability in the near future, but the holder has determined it would not be in its best interest to continue to extend forbearance or modify the loan. When VA refunds a loan, the delinquency is capitalized and re-amortized, the interest rate is usually reduced, and often the term is extended in order to lower the monthly installment payments.

Of loans refunded by VA, 72 percent are current after more than 13 months. This compares very favorably with recent reports that over 50 percent of all types of modified loans experience a re-default in the first few months after modification.

Assessment of Adequacy of Foreclosure Prevention

The VA Home Loan Guaranty Program has a strong record of helping to protect Veterans from foreclosure. Before the mortgage industry began to widely pursue loss mitigation options, VA actively sought to contact all Veterans who were seriously delinquent on their VA-guaranteed home loans to discuss alternatives to foreclosure. VA often intervened with loan holders to help Veterans arrange repayment plans or special forbearance arrangements, and in some cases requested postponement of foreclosure sales to allow Veterans time to sell their homes and salvage their equity. With the implementation of the VALERI operating environment in early 2008, VA recognized the increased loss mitigation efforts being made by the mortgage industry by promulgating regulations with detailed guidance and authority for loan holders to initiate alternatives to foreclosure without the necessity of prior approval by VA.

VA Measurement of Foreclosure Prevention

In 1990, VA started tracking the actions of its employees in helping Veterans avoid foreclosure. This first measure was the Foreclosure Avoidance with VA Involvement Ratio, or FAVIR. In 1993, the measure was revised and became the Foreclosure Avoidance Through Servicing (FATS) ratio. FATS measured the extent to which VA supplemental servicing efforts directly helped Veterans avoid foreclosure by arranging repayment plans, forbearance agreements, loan modifications, compromise VA claims on short sales, and deeds in lieu of foreclosure. During fiscal year 2007, the last full fiscal year prior to the phased implementation of the VALERI environment, VA achieved a FATS ratio of 57 percent. This meant that of the cases reported to VA as seriously delinquent (typically four payments due and unpaid), 57 percent of those cases were resolved without foreclosure.

With the implementation of the VALERI environment, VA reduced its supplemental servicing efforts and focused on overseeing activities of primary loan servicers, to ensure they were providing Veterans with all reasonable assistance in avoiding foreclosure. Because VA was tracking defaults earlier, the new measure became the Default Resolution Ratio (DRR). It measures primary servicers’ efforts to help Veterans avoid foreclosure by arranging repayment plans, forbearance arrangements, loan modifications, compromise claims on short sales, and deeds in lieu of foreclosure. While some servicers were not fully transitioned to the VALERI environment at the start of fiscal year 2009, the DRR for the full year was still 66.74 percent. This meant that, even with the difficult financial conditions of the past year, of the cases considered reportable defaults in VALERI (typically three payments due and unpaid), almost 67 percent were resolved without foreclosure.

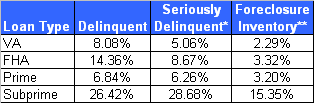

Additional measures of the adequacy of the VA home loan program in preventing foreclosures for Veterans are the delinquency and foreclosure inventory rates compiled by the Mortgage Bankers Association, as seen in Table 2. The VA rates listed here represent Veterans with VA-guaranteed loans. For the third quarter of calendar year 2009, VA had the lowest foreclosure inventory (2.29 percent) for any type of loan. The foreclosure inventory rate was 3.32 percent for Federal Housing Administration (FHA) insured loans, 3.20 percent for prime loans, and 15.35 percent for subprime loans. VA also had the lowest rate of seriously delinquent loans (5.06 percent) for any type of loan.

Table 2: Delinquency Rates, VA vs. Industry

All

data are for the third quarter of calendar year 2009.

*

Loans 90 or more days delinquent or in the process of foreclosure

**

Loans in the process of foreclosure

1 Renters are comprised of those who occupy a unit with or without cash payment of rent.

2 Data obtained from IRS, while slightly lower, are relatively consistent with these Census AHS figures for income. VA obtained a statistically significant sample of recently separated veterans from VADIR. When IRS cross-referenced these 5,000 veterans with IRS 2008 tax filings, the average income of the population was found to be $72,991.

3 VA consulted the Defense Manpower Data Center (DMDC) to obtain the population of Veterans that separated in fiscal year 2008 (approximately 245,000). VA obtained a random sample of 5,000 Veterans who recently separated from the Armed Forces from the VA/DoD Identity Repository (VADIR). 5,000 represents a statistically significant sample with 95% confidence level and a ±1.37% confidence interval. IRS used this sample to obtain 2008 reported income. (Adjusted gross Income for 4,798 of the 5,000 Veterans was available).

4 Due to privacy concerns, IRS could not break data out by sources of income (e.g., salary, income from entitlement programs, retirement pay, etc.) or provide data on the basis of ‘individual’ or ‘household’ income.

5 The sample of 5,000 Veterans was matched against VA Loan Guaranty databases to obtain income at loan origination for recently separated Veterans who had originated a VA home loan with the last two years (October 2007 to September 2009).

| File Type | application/msword |

| File Title | (1) |

| Author | lgymjamr |

| File Modified | 2010-10-05 |

| File Created | 2010-10-05 |

© 2026 OMB.report | Privacy Policy