1513-XXXX Laws and Regulations

1513-XXXX Laws and Regs.doc

Application, Permit, and Report - Wine and Beer (Puerto Rico) and Application, Permit and Report - Distilled Spirits Products (Puerto Rico)

1513-XXXX Laws and Regulations

OMB: 1513-0123

1513-XXXX (TTB F 5100.21 and 5110.51)

26 U.S.C.

Sec. 5001. Imposition, rate, and attachment of tax

(a) Rate of tax

(1) General

There is hereby imposed on all distilled spirits produced in or

imported into the United States a tax at the rate of $13.50 on each

proof gallon and a proportionate tax at the like rate on all

fractional parts of a proof gallon.

(2) Products containing distilled spirits

All products of distillation, by whatever name known, which

contain distilled spirits, on which the tax imposed by law has not

been paid, and any alcoholic ingredient added to such products,

shall be considered and taxed as distilled spirits.

(3) Wines containing more than 24 percent alcohol by volume

Wines containing more than 24 percent of alcohol by volume shall be taxed as distilled spirits.

(4) Distilled spirits withdrawn free of tax

Any person who removes, sells, transports, or uses distilled

spirits, withdrawn free of tax under section 5214(a) or section

7510, in violation of laws or regulations now or hereafter in force

pertaining thereto, and all such distilled spirits shall be subject

to all provisions of law relating to distilled spirits subject to

tax, including those requiring payment of the tax thereon; and the

person so removing, selling, transporting, or using the distilled

spirits shall be required to pay such tax.

(5) Denatured distilled spirits or articles

Any person who produces, withdraws, sells, transports, or uses

denatured distilled spirits or articles in violation of laws or

regulations now or hereafter in force pertaining thereto, and all

such denatured distilled spirits or articles shall be subject to

all provisions of law pertaining to distilled spirits that are not

denatured, including those requiring the payment of tax thereon;

and the person so producing, withdrawing, selling, transporting, or

using the denatured distilled spirits or articles shall be required

to pay such tax.

(6) Fruit-flavor concentrates

If any volatile fruit-flavor concentrate (or any fruit mash or

juice from which such concentrate is produced) containing one-half

of 1 percent or more of alcohol by volume, which is manufactured

free from tax under section 5511, is sold, transported, or used by

any person in violation of the provisions of this chapter or

regulations promulgated thereunder, such person and such

concentrate, mash, or juice shall be subject to all provisions of

this chapter pertaining to distilled spirits and wines, including

those requiring the payment of tax thereon; and the person so

selling, transporting, or using such concentrate, mash, or juice

shall be required to pay such tax.

(7) Imported liqueurs and cordials

Imported liqueurs and cordials, or similar compounds,

containing distilled spirits, shall be taxed as distilled spirits.

(8) Imported distilled spirits withdrawn for beverage

purposes

There is hereby imposed on all imported distilled spirits

withdrawn from customs custody under section 5232 without payment

of the internal revenue tax, and thereafter withdrawn from bonded

premises for beverage purposes, an additional tax equal to the duty

which would have been paid had such spirits been imported for

beverage purposes, less the duty previously paid thereon.

(9) Alcoholic compounds from Puerto Rico

Except as provided in section 5314, upon bay rum, or any

article containing distilled spirits, brought from Puerto Rico into

the United States for consumption or sale there is hereby imposed a

tax on the spirits contained therein at the rate imposed on

distilled spirits produced in the United States.

(b) Time of attachment on distilled spirits

The tax shall attach to distilled spirits as soon as this substance

is in existence as such, whether it be subsequently separated as pure or impure spirits, or be immediately, or at any subsequent time,

transferred into any other substance, either in the process of original

production or by any subsequent process.

(c) Cross reference

For provisions relating to the tax on shipments to the

United States of taxable articles from Puerto Rico and the

Virgin Islands, see section 7652.

(Added Pub. L. 85-859, title II, Sec. 201, Sept. 2, 1958, 72 Stat. 1314; amended Pub. L. 86-75, Sec. 3(a)(2), (3), June 30, 1959, 73 Stat. 157; Pub. L. 86-564, title II, Sec. 202(a)(4), (5), June 30, 1960, 74 Stat. 290; Pub. L. 87-72, Sec. 3(a)(4), (5), June 30, 1961, 75 Stat. 193; Pub. L. 87-508, Sec. 3(a)(3), (4), June 28, 1962, 76 Stat. 114; Pub. L. 88-52, Sec. 3(a)(4), (5), June 29, 1963, 77 Stat. 72; Pub. L. 88-348, Sec. 2(a)(4), (5), June 30, 1964, 78 Stat. 237; Pub. L. 89-44, title V, Sec. 501(a), June 21, 1965, 79 Stat. 150; Pub. L. 96-39, title VIII, Secs. 802, 805(d), July 26, 1979, 93 Stat. 273, 278; Pub. L. 98-369, div. A, title I, Sec. 27(a)(1), July 18, 1984, 98 Stat. 507; Pub. L.

101-508, title XI, Sec. 11201(a)(1), Nov. 5, 1990, 104 Stat. 1388-415;

Pub. L. 103-465, title I, Sec. 136(a), Dec. 8, 1994, 108 Stat. 4841.)

Sec. 5041. Imposition and rate of tax

(a) Imposition

There is hereby imposed on all wines (including imitation,

substandard, or artificial wine, and compounds sold as wine) having not

in excess of 24 percent of alcohol by volume, in bond in, produced in,

or imported into, the United States, taxes at the rates shown in

subsection (b), such taxes to be determined as of the time of removal

for consumption or sale. All wines containing more than 24 percent of

alcohol by volume shall be classed as distilled spirits and taxed

accordingly. Still wines shall include those wines containing not more

than 0.392 gram of carbon dioxide per hundred milliliters of wine;

except that the Secretary may by regulations prescribe such tolerances

to this maximum limitation as may be reasonably necessary in good

commercial practice.

(b) Rates of tax

(1) On still wines containing not more than 14 percent of alcohol by volume, $1.07 per wine gallon;

(2) On still wines containing more than 14 percent and not exceeding 21 percent of alcohol by volume, $1.57 per wine gallon;

(3) On still wines containing more than 21 percent and not exceeding 24 percent of alcohol by volume, $3.15 per wine gallon;

(4) On champagne and other sparkling wines, $3.40 per wine gallon;

(5) On artificially carbonated wines, $3.30 per wine gallon; and

(6) On hard cider which is a still wine derived primarily from

apples or apple concentrate and water, containing no other fruit

product, and containing at least one-half of 1 percent and less than 7

percent alcohol by volume, 22.6 cents per wine gallon.

(c) Credit for small domestic producers

(1) Allowance of credit

Except as provided in paragraph (2), in the case of a person

who produces not more than 250,000 wine gallons of wine during the

calendar year, there shall be allowed as a credit against any tax

imposed by this title (other than chapters 2, 21, and 22) of 90

cents per wine gallon on the 1st 100,000 wine gallons of wine

(other than wine described in subsection (b)(4)) which are removed

during such year for consumption or sale and which have been

produced at qualified facilities in the United States. In the case

of wine described in subsection (b)(6), the preceding sentence

shall be applied by substituting ``5.6 cents'' for ``90 cents''.

(2) Reduction in credit

The credit allowable by paragraph (1) shall be reduced (but not

below zero) by 1 percent for each 1,000 wine gallons of wine

produced in excess of 150,000 wine gallons of wine during the

calendar year.

(3) Time for determining and allowing credit

The credit allowable by paragraph (1)--

(A) shall be determined at the same time the tax is

determined under subsection (a) of this section, and

(B) shall be allowable at the time any tax described in

paragraph (1) is payable as if the credit allowable by this

subsection constituted a reduction in the rate of such tax.

(4) Controlled groups

Rules similar to rules of section 5051(a)(2)(B) shall apply for

purposes of this subsection.

(5) Denial of deduction

Any deduction under subtitle A with respect to any tax against

which a credit is allowed under this subsection shall only be for

the amount of such tax as reduced by such credit.

(6) Credit for transferee in bond

If--

(A) wine produced by any person would be eligible for any

credit under paragraph (1) if removed by such person during the

calendar year,

(B) wine produced by such person is removed during such

calendar year by any other person (hereafter in this paragraph

referred to as the ``transferee'') to whom such wine was

transferred in bond and who is liable for the tax imposed by

this section with respect to such wine, and

(C) such producer holds title to such wine at the time of

its removal and provides to the transferee such information as

is necessary to properly determine the transferee's credit

under this paragraph,

then, the transferee (and not the producer) shall be allowed the

credit under paragraph (1) which would be allowed to the producer

if the wine removed by the transferee had been removed by the

producer on that date.

(7) Regulations

The Secretary may prescribe such regulations as may be

necessary to carry out the purposes of this subsection, including

regulations--

(A) to prevent the credit provided in this subsection from

benefiting any person who produces more than 250,000 wine

gallons of wine during a calendar year, and

(B) to assure proper reduction of such credit for persons

producing more than 150,000 wine gallons of wine during a

calendar year.

(d) Wine gallon

For the purpose of this chapter, the term ``wine gallon'' means a

United States gallon of liquid measure equivalent to the volume of 231

cubic inches. On lesser quantities the tax shall be paid proportionately (fractions of less than one-tenth gallon being converted to the nearest one-tenth gallon, and five-hundredths gallon being converted to the next full one-tenth gallon).

(e) Tolerances

Where the Secretary finds that the revenue will not be endangered

thereby, he may by regulation prescribe tolerances (but not greater than \1/2\ of 1 percent) for bottles and other containers, and, if such

tolerances are prescribed, no assessment shall be made and no tax shall

be collected for any excess in any case where the contents of a bottle

or other container are within the limit of the applicable tolerance

prescribed.

(f) Illegally produced wine

Notwithstanding subsection (a), any wine produced in the United

States at any place other than the bonded premises provided for in this

chapter shall (except as provided in section 5042 in the case of tax-

free production) be subject to tax at the rate prescribed in subsection

(b) at the time of production and whether or not removed for consumption or sale.

(Added Pub. L. 85-859, title II, Sec. 201, Sept. 2, 1958, 72 Stat. 1331; amended Pub. L. 86-75, Sec. 3(a)(5), June 30, 1959, 73 Stat. 157; Pub. L. 86-564, title II, Sec. 202(a)(7), June 30, 1960, 74 Stat. 290; Pub. L. 87-72, Sec. 3(a)(7), June 30, 1961, 75 Stat. 193; Pub. L. 87-508, Sec. 3(a)(6), June 28, 1962, 76 Stat. 114; Pub. L. 88-52, Sec. 3(a)(7), June 29, 1963, 77 Stat. 72; Pub. L. 88-348, Sec. 2(a)(7), June 30, 1964, 78 Stat. 237; Pub. L. 89-44, title V, Sec. 501(c), title VIII, Sec. 806(a), June 21, 1965, 79 Stat. 150, 162; Pub. L. 93-490,

Sec. 6(a), Oct. 26, 1974, 88 Stat. 1468; Pub. L. 94-455, title XIX,

Sec. 1906(b)(13)(A), Oct. 4, 1976, 90 Stat. 1834; Pub. L. 100-647, title VI, Sec. 6101(a), Nov. 10, 1988, 102 Stat. 3710; Pub. L. 101-508, title XI, Sec. 11201(b)(1), (2), Nov. 5, 1990, 104 Stat. 1388-415, 1388-416; Pub. L. 104-188, title I, Sec. 1702(b)(5), Aug. 20, 1996, 110 Stat. 1868; Pub. L. 105-34, title IX, Sec. 908(a), (b), Aug. 5, 1997, 111 Stat. 876; Pub. L. 105-206, title VI, Sec. 6009(a), July 22, 1998, 112 Stat. 812.)

Sec. 5051. Imposition and rate of tax

(a) Rate of tax

(1) In general

A tax is hereby imposed on all beer brewed or produced, and

removed for consumption or sale, within the United States, or

imported into the United States. Except as provided in paragraph

(2), the rate of such tax shall be $18 for every barrel containing

not more than 31 gallons and at a like rate for any other quantity

or for fractional parts of a barrel.

(2) Reduced rate for certain domestic production

(A) $7 a barrel rate

In the case of a brewer who produces not more than

2,000,000 barrels of beer during the calendar year, the per

barrel rate of the tax imposed by this section shall be $7 on

the first 60,000 barrels of beer which are removed in such year

for consumption or sale and which have been brewed or produced

by such brewer at qualified breweries in the United States.

(B) Controlled groups

In the case of a controlled group, the 2,000,000 barrel

quantity specified in subparagraph (A) shall be applied to the

controlled group, and the 60,000 barrel quantity specified in

subparagraph (A) shall be apportioned among the brewers who are

component members of such group in such manner as the Secretary

or his delegate shall by regulations prescribed. For purposes

of the preceding sentence, the term ``controlled group'' has

the meaning assigned to it by subsection (a) of section 1563,

except that for such purposes the phrase ``more than 50

percent'' shall be substituted for the phrase ``at least 80

percent'' in each place it appears in such subsection. Under

regulations prescribed by the Secretary or his delegate,

principles similar to the principles of the preceding two

sentences shall be applied to a group of brewers under common

control where one or more of the brewers is not a corporation.

(C) Regulations

The Secretary may prescribe such regulations as may be

necessary to prevent the reduced rates provided in this

paragraph from benefiting any person who produces more than

2,000,000 barrels of beer during a calendar year.

(3) Tolerances

Where the Secretary or his delegate finds that the revenue will

not be endangered thereby, he may by regulations prescribe

tolerances for barrels and fractional parts of barrels, and, if

such tolerances are prescribed, no assessment shall be made and no

tax shall be collected for any excess in any case where the

contents of a barrel or a fractional part of a barrel are within

the limit of the applicable tolerance prescribed.

(b) Assessment on materials used in production in case of fraud

Nothing contained in this subpart or subchapter G shall be construed to authorize an assessment on the quantity of materials used in producing or purchased for the purpose of producing beer, nor shall the quantity of materials so used or purchased be evidence, for the purpose of taxation, of the quantity of beer produced; but the tax on all beer shall be paid as provided in section 5054, and not otherwise; except that this subsection shall not apply to cases of fraud, and nothing in this subsection shall have the effect to change the rules of law respecting evidence in any prosecution or suit.

(c) Illegally produced beer

The production of any beer at any place in the United States shall

be subject to tax at the rate prescribed in subsection (a) and such tax

shall be due and payable as provided in section 5054(a)(3) unless--

(1) such beer is produced in a brewery qualified under the

provisions of subchapter G, or

(2) such production is exempt from tax under section 5053(e)

(relating to beer for personal or family use).

(Added Pub. L. 85-859, title II, Sec. 201, Sept. 2, 1958, 72 Stat. 1333; amended Pub. L. 86-75, Sec. 3(a)(6), June 30, 1959, 73 Stat. 157; Pub. L. 86-564, title II, Sec. 202(a)(8), June 30, 1960, 74 Stat. 290; Pub. L. 87-72, Sec. 3(a)(8), June 30, 1961, 75 Stat. 193; Pub. L. 87-508, Sec. 3(a)(7), June 28, 1962, 76 Stat. 114; Pub. L. 88-52, Sec. 3(a)(8), June 29, 1963, 77 Stat. 72; Pub. L. 88-348, Sec. 2(a)(8), June 30, 1964, 78 Stat. 237; Pub. L. 89-44, title V, Sec. 501(d), June 21, 1965, 79 Stat. 150; Pub. L. 94-529, Sec. 1, Oct. 17, 1976, 90 Stat. 2485; Pub. L. 95-458, Sec. 2(b)(2)(A), Oct. 14, 1978, 92 Stat. 1256; Pub. L. 101-508, title XI, Sec. 11201(c), Nov. 5, 1990, 104 Stat. 1388-416.)

Sec. 7101. Form of bonds

Whenever, pursuant to the provisions of this title (other than

section 7485), or rules or regulations prescribed under authority of

this title, a person is required to furnish a bond or security--

(1) General rule

Such bond or security shall be in such form and with such

surety or sureties as may be prescribed by regulations issued by

the Secretary.

(2) United States bonds and notes in lieu of surety bonds

The person required to furnish such bond or security may, in

lieu thereof, deposit bonds or notes of the United States as

provided in section 9303 of title 31, United States Code.

(Aug. 16, 1954, ch. 736, 68A Stat. 847; Pub. L. 92-310, title II,

Sec. 230(b), June 6, 1972, 86 Stat. 209; Pub. L. 94-455, title XIX,

Sec. 1906(b)(13)(A), Oct. 4, 1976, 90 Stat. 1834; Pub. L. 97-258,

Sec. 3(f)(11), Sept. 13, 1982, 96 Stat. 1065.)

Sec. 7102. Single bond in lieu of multiple bonds

In any case in which two or more bonds are required or authorized,

the Secretary may provide for the acceptance of a single bond complying

with the requirements for which the several bonds are required or

authorized.

(Aug. 16, 1954, ch. 736, 68A Stat. 847; Pub. L. 94-455, title XIX,

Sec. 1906(b)(13)(A), Oct. 4, 1976, 90 Stat. 1834.)

Sec. 7652. Shipments to the United States

(a) Puerto Rico

(1) Rate of tax

Except as provided in section 5314, articles of merchandise of

Puerto Rican manufacture coming into the United States and

withdrawn for consumption or sale shall be subject to a tax equal

to the internal revenue tax imposed in the United States upon the

like articles of merchandise of domestic manufacture.

(2) Payment of tax

The Secretary shall by regulations prescribe the mode and time

for payment and collection of the tax described in paragraph (1),

including any discretionary method described in section 6302(b) and

(c). Such regulations shall authorize the payment of such tax

before shipment from Puerto Rico, and the provisions of section

7651(2)(B) shall be applicable to the payment and collection of

such tax in Puerto Rico.

(3) Deposit of internal revenue collections

All taxes collected under the internal revenue laws of the

United States on articles produced in Puerto Rico and transported

to the United States (less the estimated amount necessary for

payment of refunds and drawbacks), or consumed in the island, shall

be covered into the treasury of Puerto Rico.

(b) Virgin Islands

(1) Taxes imposed in the United States

Except as provided in section 5314, there shall be imposed in

the United States, upon articles coming into the United States from

the Virgin Islands, a tax equal to the internal revenue tax imposed

in the United States upon like articles of domestic manufacture.

(2) Exemption from tax imposed in the Virgin Islands

Such articles shipped from such islands to the United States

shall be exempt from the payment of any tax imposed by the internal

revenue laws of such islands.

(3) Disposition of internal revenue collections

The Secretary shall determine the amount of all taxes imposed

by, and collected under the internal revenue laws of the United

States on articles produced in the Virgin Islands and transported

to the United States. The amount so determined less 1 percent and

less the estimated amount of refunds or credits shall be subject to

disposition as follows:

(A) The payment of an estimated amount shall be made to the

government of the Virgin Islands before the commencement of

each fiscal year as set forth in section 4(c)(2) of the Act

entitled ``An Act to authorize appropriations for certain

insular areas of the United States, and for other purposes'',

approved August 18, 1978 (48 U.S.C. 1645), as in effect on the

date of the enactment of the Trade and Development Act of 2000.

The payment so made shall constitute a separate fund in the

treasury of the Virgin Islands and may be expended as the

legislature may determine.

(B) Any amounts remaining shall be deposited in the

Treasury of the United States as miscellaneous receipts.

If at the end of any fiscal year the total of the Federal

contribution made under subparagraph (A) with respect to the four

calendar quarters immediately preceding the beginning of that

fiscal year has not been obligated or expended for an approved

purpose, the balance shall continue available for expenditure

during any succeeding fiscal year, but only for emergency relief

purposes and essential public projects. The aggregate amount of

moneys available for expenditure for emergency relief purposes and

essential public projects only shall not exceed the sum of

$5,000,000 at the end of any fiscal year. Any unobligated or

unexpended balance of the Federal contribution remaining at the end

of a fiscal year which would cause the moneys available for

emergency relief purposes and essential public projects only to

exceed the sum of $5,000,000 shall thereupon be transferred and

paid over to the Treasury of the United States as miscellaneous

receipts.

(c) Articles containing distilled spirits

For purposes of subsections (a)(3) and (b)(3), any article

containing distilled spirits shall in no event be treated as produced in Puerto Rico or the Virgin Islands unless at least 92 percent of the

alcoholic content in such article is attributable to rum.

(d) Articles other than articles containing distilled spirits

For purposes of subsections (a)(3) and (b)(3)--

(1) Value added requirement for Puerto Rico

Any article, other than an article containing distilled

spirits, shall in no event be treated as produced in Puerto Rico

unless the sum of--

(A) the cost or value of the materials produced in Puerto

Rico, plus

(B) the direct costs of processing operations performed in

Puerto Rico, equals or exceeds 50 percent of the value of such

article as of the time it is brought into the United States.

(2) Prohibition of Federal excise tax subsidies

(A) In general

No amount shall be transferred under subsection (a)(3) or

(b)(3) in respect of taxes imposed on any article, other than

an article containing distilled spirits, if the Secretary

determines that a Federal excise tax subsidy was provided by

Puerto Rico or the Virgin Islands (as the case may be) with

respect to such article.

(B) Federal excise tax subsidy

For purposes of this paragraph, the term ``Federal excise

tax subsidy'' means any subsidy--

(i) of a kind different from, or

(ii) in an amount per value or volume of production

greater than, the subsidy which Puerto Rico or the Virgin

Islands offers generally to industries producing articles

not subject to Federal excise taxes.

(3) Direct costs of processing operations

For purposes of this subsection, the term ``direct cost of

processing operations'' has the same meaning as when used in

section 213 of the Caribbean Basin Economic Recovery Act.

(e) Shipments of rum to the United States

(1) Excise taxes on rum covered into treasuries of Puerto

Rico and Virgin Islands

All taxes collected under section 5001(a)(1) on rum imported

into the United States (less the estimated amount necessary for

payment of refunds and drawbacks) shall be covered into the

treasuries of Puerto Rico and the Virgin Islands.

(2) Secretary prescribes formula

The Secretary shall, from time to time, prescribe by regulation

a formula for the division of such tax collections between Puerto

Rico and the Virgin Islands and the timing and methods for

transferring such tax collections.

(3) Rum defined

For purposes of this subsection, the term ``rum'' means any

article classified under subheading 2208.40.00 of the Harmonized

Tariff Schedule of the United States (19 U.S.C. 1202).

(4) Coordination with subsections (a) and (b)

Paragraph (1) shall not apply with respect to any rum subject

to tax under subsection (a) or (b).

(f) Limitation on cover over of tax on distilled spirits

For purposes of this section, with respect to taxes imposed under

section 5001 or this section on distilled spirits, the amount covered

into the treasuries of Puerto Rico and the Virgin Islands shall not

exceed the lesser of the rate of--

(1)

$10.50 ($13.25 in the case of distilled spirits brought

into the United States after June 30, 1999, and before January 1,

2004), or

(2) the tax imposed under section 5001(a)(1), on each proof

gallon.

(g) Drawback for medicinal alcohol, etc.

In the case of medicines, medicinal preparations, food products,

flavors, flavoring extracts, or perfume containing distilled spirits,

which are unfit for beverage purposes and which are brought into the

United States from Puerto Rico or the Virgin Islands--

(1) subpart F of part II of subchapter A of chapter 51 shall be

applied as if--

(A) the use and tax determination described in section

5131(a) had occurred in the United States by a United States

person at the time the article is brought into the United

States, and

(B) the rate of tax were the rate applicable under

subsection (f) of this section, and

(2) no amount shall be covered into the treasuries of Puerto

Rico or the Virgin Islands.

(h) Manner of cover over of tax must be derived from this title

No amount shall be covered into the treasury of Puerto Rico or the

Virgin Islands with respect to taxes for which cover over is provided

under this section unless made in the manner specified in this section

without regard to--

(1) any provision of law which is not contained in this title

or in a revenue Act; and

(2) whether such provision of law is a subsequently enacted

provision or directly or indirectly seeks to waive the application

of this subsection.

(Aug. 16, 1954, ch. 736, 68A Stat. 907; Pub. L. 85-859, title II,

Sec. 204(17), (18), Sept. 2, 1958, 72 Stat. 1430; Pub. L. 89-44, title

VIII, Sec. 808(b)(3), June 21, 1965, 79 Stat. 164; Pub. L. 94-202,

Sec. 10(a), Jan. 2, 1976, 89 Stat. 1141; Pub. L. 94-455, title XIX,

Sec. 1906(a)(55), (b) (13)(A), Oct. 4, 1976, 90 Stat. 1832, 1834; Pub.

L. 98-67, title II, Sec. 221(a), Aug. 5, 1983, 97 Stat. 395; Pub. L. 98-213, Sec. 5(c), Dec. 8, 1983, 97 Stat. 1460; Pub. L. 98-369, div. B,

title VI, Secs. 2681(a), 2682(a), July 18, 1984, 98 Stat. 1172, 1174;

Pub. L. 99-514, title XVIII, Sec. 1879(i)(1), Oct. 22, 1986, 100 Stat.

2907; Pub. L. 100-418, title I, Sec. 1214(p)(1), Aug. 23, 1988, 102

Stat. 1159; Pub. L. 103-66, title XIII, Sec. 13227(e), Aug. 10, 1993,

107 Stat. 494; Pub. L. 103-465, title I, Sec. 136(b), Dec. 8, 1994, 108

Stat. 4841; Pub. L. 106-170, title V, Sec. 512(a), Dec. 17, 1999, 113

Stat. 1924; Pub. L. 106-200, title VI, Sec. 602(b), (c), May 18, 2000,

114 Stat. 305, 306; Pub. L. 107-147, title VI, Sec. 609(a), Mar. 9,

2002, 116 Stat. 60.)

27 CFR

§ 26.66 Bond, TTB Form 5110.50—Distilled spirits.

(a) General. If any person intends to ship to the United States, distilled spirits products of Puerto Rican manufacture from bonded storage in Puerto Rico on computation, but before payment, of the tax imposed by 26 U.S.C. 7652(a), equal to the tax imposed in the United States by 26 U.S.C. 5001(a)(1), he shall, before making any such shipment, furnish a bond TTB Form 5110.50, for each premises from which shipment will be made, to secure payment of such tax, at the time and in the manner prescribed in this subpart, on all distilled spirits products shipped. The bond shall be executed in a penal sum not less than the amount of unpaid tax which, at any one time, is chargeable against the bond. The penal sum of such bond shall not exceed $1,000,000, but in no case shall the penal sum be less than $1,000.

(b) Blanket bond. Any person who is the proprietor of more than one premises in Puerto Rico from which shipment of spirits to the United States will be made, may, in lieu of furnishing two or more separate bonds on TTB Form 5110.50 as required by paragraph (a) of this section, furnish a blanket bond on TTB Form 5110.50. The penal sum of such blanket bond shall be equal to the sum of the penal sums of all the bonds in lieu of which it is given. Such blanket bond on TTB Form 5110.50 shall show each bonded warehouse and/or bonded processing room and/or rectifying plant to be covered by the bond, and the part of the total penal sum (computed in accordance with paragraph (a) of this section) to be allocated to each of the designated premises. If the penal sum of the bond allocated to a designated premises is in an amount less than the maximum prescribed in paragraph (a) of this section, transactions at such premises shall not exceed the quantity permissible, as reflected by the penal sum allocated in the bond to such premises. Such blanket bond shall contain the terms and conditions of the bonds in lieu of which it is given and shall be conditioned that the total amount of the bond shall be available for satisfaction of any liability incurred under the terms and conditions of such bond.

(Act of August 16, 1954, 68A Stat. 847, as amended, 907, as amended (26 U.S.C 7101, 7102, 7652))

[T.D. ATF–62, 44 FR 71710, Dec. 11, 1979]

§ 26.67 Bond, Form 2897—Wine.

Where a proprietor intends to withdraw, for purpose of shipment to the United States, wine of Puerto Rican manufacture from bonded storage in Puerto Rico on computation, but before payment, of the tax imposed by 26 U.S.C. 7652(a), equal to the tax imposed in the United States by 26 U.S.C. 5041, he shall, before making any such withdrawal, furnish a bond, Form 2897, to secure payment of such tax, at the time and in the manner prescribed in this subpart, on all wine so withdrawn. The bond shall be executed in a penal sum not less than the amount of unpaid tax which, at any one time, is chargeable against the bond: Provided, That the penal sum of such bond shall not exceed $250,000, but in no case shall the penal sum be less than $500.

(Aug. 16, 1954, Chapter 736, 68A Stat. 775, as amended, 847, as amended, 906, 907, as amended (26 U.S.C. 6302, 7101, 7102, 7651(2)(B), 7652(a)))

[T.D. 6551, 26 FR 1490, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–48, 44 FR 55852, Sept. 28, 1979]

§ 26.68 Bond, Form 2898—Beer.

Where a brewer intends to withdraw, for purpose of shipment to the United States, beer of Puerto Rican manufacture from bonded storage in Puerto Rico on computation, but before payment, of the tax imposed by 26 U.S.C. 7652(a), equal to the tax imposed in the United States by 26 U.S.C. 5051, he shall, before making any such withdrawal, furnish a bond, Form 2898, to secure payment of such tax, at the time and in the manner prescribed in this subpart, on all beer so withdrawn. The bond shall be executed in a penal sum not less than the amount of unpaid tax which, at any one time, is chargeable against the bond: Provided, That the penal sum of such bond shall not exceed $500,000, but in no case shall the penal sum be less than $1,000.

(Aug. 16, 1954, Chapter 736, 68A Stat. 775, as amended, 847, as amended, 906, 907, as amended (26 U.S.C. 6302, 7101, 7102, 7651(2)(B), 7652(a)))

[T.D. 6551, 26 FR 1490, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–48, 44 FR 55852, Sept. 28, 1979]

§ 26.68a Bond account.

Every person who files a bond under this subpart shall keep an account of the charges against and credits to the bond if the penal sum of his bond is less than the maximum prescribed in §§26.66(a), 26.67, or §26.68, or if the penal sum allocated to his premises under §26.66(b) is less than the prescribed maximum. He shall charge the bond with the amount of liability he accepts at the time he executes TTB Form 5110.51 or 2900, and shall credit the bond with the amount of the tax paid at the time he files each return, TTB Form 5110.32, 2927, or 2929, and remittance. The account shall also show the balance available under the bond at any one time.

[T.D. ATF–62, 44 FR 71710, Dec. 11, 1979. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.69 Strengthening bonds.

In all cases where the penal sum of any bond becomes insufficient, the principal shall either give a strengthening bond with the same surety to attain a sufficient penal sum, or give a new bond to cover the entire liability. Strengthening bonds will not be approved where any notation is made thereon which is intended, or which may be construed, as a release of any former bond, or as limiting the amount of any bond to less than its full penal sum. Strengthening bonds shall show the current date of execution and the effective date.

§ 26.70 New or superseding bonds.

New bonds shall be required in case of insolvency or removal of any surety, and may, at the discretion of the appropriate TTB officer, be required in any other contingency affecting the validity or impairing the efficiency of an existing bond. Executors, administrators, assignees, receivers, trustees, or other persons acting in a fiduciary capacity, continuing or liquidating the business of the principal, shall execute and file a new bond or obtain the consent of the surety or sureties on the existing bond or bonds. Where, under the provisions of §26.72, the surety on any bond given under this subpart has filed an application to be relieved of liability under said bond and the principal desires or intends to continue the operations to which such bond relates, he shall file a valid superseding bond to be effective on or before the date specified in the surety's notice. New or superseding bonds shall show the current date of execution and the effective date.

[T.D. 6551, 26 FR 1590, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–251, 52 FR 19338, May 22, 1987. Further redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.70a Notice of approval of bonds.

Upon approval of an original, a strengthening, or a superseding bond, the appropriate TTB officer shall notify the Secretary, and the revenue agent at the premises, of the total penal sum of the bond or bonds, and in the case of a blanket bond, the amount of the penal sum allocated to the premises.

[T.D. 6695, 28 FR 12932, Dec. 5, 1963. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–251, 52 FR 19338, May 22, 1987]

§ 26.71 Termination of bonds.

Any bond given under the provisions of this subpart may be terminated as to future transactions—

(a) Pursuant to application of surety as provided in §26.72;

(b) On approval of a superseding bond;

(c) On notification by the principal to the appropriate TTB officer that he has discontinued transactions under the bond; or

(d) On notification by the principal to the appropriate TTB officer that he has discontinued business.

[T.D. 6695, 28 FR 12932, Dec. 5, 1963. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–251, 52 FR 19338, May 22, 1987. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.72 Application of surety for relief from bond.

A surety on any bond given under the provisions of this subpart may at any time in writing notify the principal and the appropriate TTB officer that he desires, after a date named, to be relieved of liability under said bond. Such date shall be not less than 10 days after the date the notice is received by the appropriate TTB officer. The surety shall also file with the appropriate TTB officer an acknowledgment or other proof of service on the principal. If such notice is not thereafter in writing withdrawn, the rights of the principal as supported by said bond shall be terminated on the date named in the notice, and the surety shall be relieved from liability to the extent set forth in §26.73.

(Approved by the Office of Management and Budget under control number 1512–0352)

[T.D. 6551, 26 FR 1490, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–172, 49 FR 14943, Apr. 16, 1984; T.D. ATF–251, 52 FR 19338, May 22, 1987. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.73 Relief of surety from bond.

Where the surety on a bond given under the provisions of this subpart has filed application for relief from liability, as provided in §26.72, the surety shall be relieved from liability for transactions occurring wholly subsequent to the date specified in the notice, or the effective date of a new bond, if one is given.

[T.D. 6551, 26 FR 1490, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975 and further redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.74 Release of pledged securities.

Securities of the United States pledged and deposited as provided in §26.63, shall be released only in accordance with the provisions of 31 CFR part 225. Such securities will not be released by the appropriate TTB officer until the liability under the bond for which they were pledged has been terminated. When the appropriate TTB officer is satisfied that they may be released, he shall fix the date or dates on which a part or all of such securities may be released. At any time prior to the release of such securities, the appropriate TTB officer may extend the date of release for such additional length of time as he deems necessary.

(61 Stat. 650; 6 U.S.C. 15)

[T.D. 6551, 26 FR 1590, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–251, 52 FR 19338, May 22, 1987. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.75 Form 1490, Notice of Termination of Bond.

When the appropriate TTB officer is satisfied that any bond given under the provisions of this subpart may be terminated, he shall issue Form 1490, Notice of Termination of Bond, and shall forward copies to the principal and to the surety. The appropriate TTB officer shall, prior to the termination date, notify the Secretary and the revenue agent of the proposed termination of any bond given under this part and the date of such termination.

[T.D. 6695, 28 FR 12932, Dec. 5, 1963, as amended by T.D. ATF–2, 37 FR 22736, Oct. 21, 1972. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–251, 52 FR 19338, May 22, 1987]

§ 26.76 Insular permits.

Before liquors or articles of Puerto Rican manufacture may be shipped to the United States, an insular permit, TTB Form 5110.51 (for distilled spirits) or Form 2900 (for wine or beer), to compute the taxes imposed by 26 U.S.C. 7652(a), and to withdraw the products from the bonded establishment where they may be deposited, must be obtained from the Secretary, and such products may not be shipped to the United States until a permit to ship, on Form 487B, is applied for and obtained from the Secretary.

[T.D. 6551, 26 FR 1490, Feb. 22, 1961. Redesignated at 40 FR 16835, Apr. 15, 1975]

Editorial Note: For Federal Register citations affecting §26.76, see the List of CFR Sections Affected, which appears in the Finding Aids section of the printed volume and on GPO Access.

§ 26.77 Subject to tax.

(a) Distilled spirits of Puerto Rican manufacture, and any products containing such distilled spirits, brought into the United States and withdrawn for consumption or sale are subject to a tax equal to the tax imposed in the United States by 26 U.S.C. 5001.

(b) A credit against the tax imposed on distilled spirits by 26 U.S.C. 7652 is allowable under 26 U.S.C. 5010 on each proof gallon of alcohol derived from eligible wine or from eligible flavors which do not exceed 2 1/2 percent of the finished product on a proof gallon basis. The credit is allowable at the time the tax is payable as if it constituted a reduction in the rate of tax.

(c) Where credit against the tax is desired, the person liable for the tax shall establish an effective tax rate in accordance with §26.79a. The effective tax rate established will be applied to each withdrawal or other disposition of the distilled spirits for consumption or sale within the United States.

(Approved by Office of Management and Budget under control number 1512–0203)

(Act of August 16, 1954, Pub. L. 591, 68A Stat. 907, as amended (26 U.S.C. 7652); Sec. 201, Pub. L. 85–859, 72 Stat. 1314, as amended (26 U.S.C. 5001); Sec. 6, Pub. L. 96–598, 94 Stat. 3488, as amended (26 U.S.C. 5010))

[T.D. ATF–297, 55 FR 18066, Apr. 30, 1990. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.78 Application and permit, TTB Form 5110.51.

Application for permit to compute the tax on, and to withdraw, distilled spirits shall be made on TTB Form 5110.51, in quintuplicate, by the proprietor. The proprietor shall forward all copies of the form to the Secretary. If the application is properly prepared and is otherwise in order, the Secretary or his delegate shall execute the permit, retain one copy, and forward the original and remaining copies of the form to the revenue agent at the premises where the products are located.

[T.D. ATF–62, 44 FR 71711, Dec. 11, 1979, as amended by T.D. ATF–251, 52 FR 19338, May 22, 1987]

§ 26.79 Inspection or gauge and computation of tax.

On receipt of permit to compute the tax on TTB Form 5110.51, the revenue agent shall:

(a) In the case of spirits in packages, prepare a gauge record as provided in §26.164a in quadruplicate, compute the tax thereon, and attach all copies of the gauge record to TTB Form 5110.51;

(b) In the instance of spirits in cases, verify by inspection the quantity of spirits described on the form; or

(c) In the case of spirits in a bulk conveyance, verify by gauge or inspection the quantity of spirits described on the form.

If the revenue agent determines any variation between his gauge and the quantity of spirits described on Form 5110.51, he shall amend and initial the data in part I of the form. The revenue agent shall deliver all copies of Form 5110.51 and any accompanying package gauge record to the proprietor. The proprietor shall then compute and enter the amount of tax on all copies of Form 5110.51.

(Approved by the Office of Management and Budget under control number 1512–0250)

[T.D. ATF–198, 50 FR 8549, Mar. 1, 1985. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

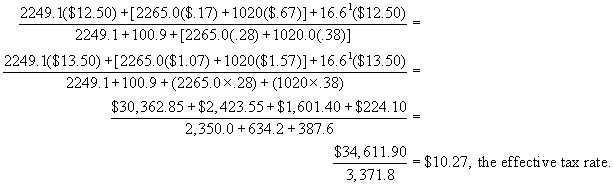

§ 26.79a Computation of effective tax rate.(a) The proprietor shall compute the effective tax rate for distilled spirits containing eligible wine or eligible flavors as the ratio of the numerator and denominator as follows: (1) the numerator will be the sum of: (i) The proof gallons of all distilled spirits used in the product (exclusive of distilled spirits derived from eligible flavors), multiplied by the tax rate prescribed by 26 U.S.C. 5001; (ii) The wine gallons of each eligible wine used in the product, multiplied by the tax rate prescribed by 26 U.S.C. 5041(b) (1), (2), or (3), as applicable; and (iii) The proof gallons of all distilled spirits derived from eligible flavors used in the product, multiplied by the tax rate prescribed by 26 U.S.C. 5001, but only to the extent that such distilled spirits exceed 2 1/2% of the denominator prescribed in paragraph (a)(2) of this section. (2) The denominator will be the sum of: (i) The proof gallons of all distilled spirits used in the product, including distilled spirits derived from eligible flavors; and (ii) The wine gallons of each eligible wine used in the product, multiplied by twice the percentage of alcohol by volume of each, divided by 100. (b) In determining the effective tax rate, quantities of distilled spirits, eligible wine, and eligible flavors will be expressed to the nearest tenth of a proof gallon. The effective tax rate may be rounded to as many decimal places as the proprietor deems appropriate, provided that, such rate is expressed no less exactly than the rate rounded to the nearest whole cent, and the effective tax rates for all products will be consistently expressed to the same number of decimal places. In such case, if the number is less than five it will be dropped; if it is five or over, a unit will be added. (c) The following is an example of the use of the formula. 1 Proof gallons by which distilled spirits derived from eligible flavors exceed 2 1/2% of the total proof gallons in the batch (100.9 − (2 1/2%) × 3.371.8 = 16.6). |

Batch Record

----------------------------------------------------

Distilled spirits 2249.1 proof gallons.

Eligible wine 2265.0 wine gallons

(14% alcohol by

volume)

Eligible wine 1020.0 wine gallons

(19% alcohol by

volume)

Eligible flavors 100.9 proof gallons

(Sec. 6, Pub. L. 96–598, 94 Stat. 3488, as amended (26 U.S.C. 5010)) [T.D. ATF–297, 55 FR 18066, Apr. 30, 1990, as amended by T.D. ATF–307, 55 FR 52741, Dec 21, 1990] |

§ 26.80 Deferred payment of tax—release of spirits.

(a) Action by proprietor. Where the proprietor has furnished bond on TTB Form 5110.50, and payment of the tax is to be deferred, he shall execute an agreement on TTB Form 5110.51 to pay the amount of tax which has been computed and entered on the form. He shall also certify, under the penalties of perjury, that he is not in default of any payment of tax chargeable against his bond, and that his bond is in the maximum penal sum, or that it is sufficient to cover the amount of tax on the distilled spirits described on the form in addition to all other amounts chargeable agains this bond. The proprietor shall deliver all copies of TTB Form 5110.51 and any package gauge record as provided in §26.164a to the revenue agent.

(b) Action by revenue agent. On receipt of TTB Form 5110.51 and any package gauge record, the revenue agent shall verify the computation of the tax entered on the TTB Form 5110.51, and if the proprietor has on file a good and sufficient bond, TTB Form 5110.50, so indicate on TTB Form 5110.51. The revenue agent shall then execute his report of release on the TTB Form 5110.51 and release the spirits for shipment to the United States. He shall distribute TTB Form 5110.51 and any package gauge record according to the instructions of TTB Form 5110.51. Where the revenue agent finds that the proprietor does not have good and sufficient bond coverage, or where the revenue agent has received information that the proprietor is in default of payment of any taxes previously charged to his bond, he shall return all copies of TTB Form 5110.51 and any package gauge record to the proprietor, giving his reasons for such action.

(Approved by the Office of Management and Budget under control number 1512–0250)

[T.D. ATF–198, 50 FR 8549, Mar. 1, 1985. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.81 Prepayment of tax and release of spirits.

(a) Action by proprietor. Where the distilled spirits are to be released after payment of the computed tax, the proprietor shall enter the amount of such computed tax on all copies of TTB Form 5110.51 and execute the statement that such tax is being prepaid. The proprietor shall then prepare TTB Form 5000.25 in duplicate, and send the original with all copies of TTB Form 5110.51 and any package gauge record as provided in §26.164a and the remittance in full for the tax, to the appropriate TTB officer.

(b) Action by appropriate TTB officer. On receipt of TTB Forms 5110.51, 5000.25 and any package gauge record, with remittance covering prepayment of tax, the appropriate TTB officer shall execute the receipt on TTB Form 5000.25 and execute the report of prepaid taxes on all copies of TTB Form 5110.51. The appropriate TTB officer shall then retain the originals of TTB Forms 5110.51 and 5000.25 and forward the remaining copies of TTB Form 5110.51 in accordance to the instructions on the form.

(c) Action by revenue agent. On receipt of TTB Form 5110.51 executed by the appropriate TTB officer to show receipt of TTB Form 5000.25 and remittance, the revenue agent shall execute the report of release on the TTB Form 5110.51 and release the spirits for shipment to the United States. The completed TTB Form 5110.51 shall be distributed according to the instructions on the form.

(Approved by the Office of Management and Budget under control number 1512–0210 and 1512–0497)

[T.D. ATF–277, 53 FR 45267, Nov. 9, 1988. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.95 Deferred payment of tax—release of wine.

(a) Action by proprietor. Where the proprietor has furnished bond, on Form 2897, and payment of the tax is to be deferred, he shall execute the agreement on Form 2900 to pay the amount of tax which has been computed and entered on the form. He shall also certify under the penalties of perjury that he is not in default of any payment of tax chargeable against his bond, and that his bond is in the maximum penal sum, or that it is sufficient to cover the amount of tax on the wine described on the form in addition to all other amounts chargeable against his bond. The proprietor shall deliver all copies of Form 2900 to the revenue agent.

(b) Action by revenue agent. On receipt of Form 2900, the revenue agent shall verify the computation of the tax entered on the form, and if the proprietor has on file a good and sufficient bond, Form 2897, so indicate on Form 2900. The revenue agent shall then execute his report of release on the Form 2900 and release the wine for the purpose authorized on the form. The completed form shall be distributed in the same manner as provided for TTB Form 5110.51 in §26.80(b). Where the revenue agent finds that the proprietor does not have good and sufficient bond coverage, or that the proprietor is in default of payment of any taxes previously charged to his bond, he shall return all copies of Form 2900 to the proprietor, giving his reasons for such action.

[T.D. 6695, 28 FR 12934, Dec. 5, 1963. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–62, 44 FR 71712, Dec. 11, 1979. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.96 Prepayment of tax—release of wine.

(a) Action by proprietor. Where the wine is to be withdrawn from bonded storage after payment of the computed tax, the proprietor shall enter the amount of such computed tax on all copies of TTB Form 2900 (5100.21) and execute the statement that such tax is being prepaid. The proprietor shall then prepare TTB Form 5000.25 in duplicate and send the original with all copies of TTB Form 2900 (5100.21) and the remittance in full for the tax, to the appropriate TTB officer.

(b) Action by appropriate TTB officer. On receipt of TTB Forms 2900 (5100.21) and 5000.25, and remittance covering prepayment of tax, the appropriate TTB officer shall execute the receipt on TTB Form 5000.25 and execute the report of prepaid taxes on all copies of TTB Form 2900 (5100.21). The appropriate TTB officer shall then retain the originals of TTB Forms 2900 (5100.21) and 5000.25 and forward the remaining copies of TTB Form 2900 (5100.21) in accordance with the instructions on the form.

(c) Action by revenue agent. On receipt of TTB Form 2900 (5100.21) executed by the appropriate TTB officer to show receipt of TTB Form 5000.25 and remittance, the revenue agent shall execute the report of release on the TTB Form 2900 (5100.21) and release the wine for the purpose authorized on the form. The completed TTB Form 2900 (5100.21) shall be distributed according to the instructions on the form.

(Approved by the Office of Management and Budget under control number 1512–0149 and 1513–0090)

[T.D. ATF–277, 53 FR 45267, Nov. 9, 1988]

§ 26.104 Deferred payment of tax—release of beer.

(a) Action by brewer. Where the brewer has furnished bond on Form 2898, and payment of the tax is to be deferred, he shall execute the agreement on Form 2900 to pay the amount of tax which has been computed and entered on the form. He shall also certify under the penalties of perjury that he is not in default of any payment of tax chargeable against his bond, and that his bond is in the maximum penal sum, or that it is sufficient to cover the amount of tax on the beer described on the form in addition to all other amounts chargeable against his bond. The brewer shall deliver all copies of Form 2900 to the revenue agent.

(b) Action by revenue agent. On receipt of Form 2900, the revenue agent shall verify the computation of the tax entered on the form, and if the proprietor has on file a good and sufficient bond, Form 2898, so indicate on Form 2900. The revenue agent shall then execute his report of release on the Form 2900 and release the beer for the purpose authorized on the form. The completed form shall be distributed in the same manner as provided for TTB Form 5110.51 in §26.80(b). Where the revenue agent finds that the proprietor does not have good and sufficient bond coverage, or that the proprietor is in default of payment of any taxes previously charged to his bond, he shall return all copies of Form 2900 to the proprietor, giving his reasons for such action.

[T.D. 6695, 28 FR 12934, Dec. 5 1963. Redesignated at 40 FR 16835, Apr. 15, 1975, and amended by T.D. ATF–62, 44 FR 71712, Dec. 11, 1979. Redesignated and amended by T.D. ATF–459, 66 FR 38550, 38551, July 25, 2001]

§ 26.105 Prepayment of tax—release of beer.

(a) Action by brewer. Where the beer is to be withdrawn from bonded storage after payment of the computed tax the brewer shall enter the amount of such computed tax on all copies of TTB Form 2900 (5100.21) and execute the statement that such tax is being prepaid. The brewer shall then prepare TTB Form 5000.25 in duplicate and send the original with all copies of TTB Form 2900 (5100.21) and the remittance in full for the tax, to the appropriate TTB officer.

(b) Action by appropriate TTB officer. On receipt of TTB Forms 2900 (5100.21) and 5000.25, and remittance covering prepayment of tax, the appropriate TTB officer shall execute the receipt on TTB Form 5000.25 and execute the report of prepaid taxes on all copies of TTB Form 2900 (5100.21). The appropriate TTB officer shall then retain the originals of TTB Forms 2900 (5110.21) and 5000.25 and forward the remaining copies of TTB Form 2900 (5100.21) in accordance with the instructions of the form.

(c) Action by revenue agent. On receipt of TTB Form 2900 (5100.21) executed by the appropriate TTB officer to show receipt of TTB Form 5000.25 and remittance, the revenue agent shall execute the report of release on the TTB Form 2900 (5100.21) and release the beer for the purpose authorized on the form. The completed TTB Form 2900 (5100.21) shall be distributed according to the instructions on the form.

(Approved by the Office of Management and Budget under control number 1512–0149 and 1513–0090)

[T.D. ATF–277, 53 FR 45268, Nov. 9, 1988]

| File Type | application/msword |

| File Title | 1513-XXXX (TTB F 5100 |

| Author | TTB |

| Last Modified By | TTB |

| File Modified | 2006-10-05 |

| File Created | 2006-08-24 |

© 2026 OMB.report | Privacy Policy

(Approved

by Office of Management and Budget under control number 1512–0203)

(Approved

by Office of Management and Budget under control number 1512–0203)