DOE Recovery Act Reporting Requirements for the Energy Efficiency and Conservation Block Grant (EECBG) Program

EECBG Reporting Program Guidance v6 0.docx

Energy Efficiency and Conservation Block Grant Program Status Report

DOE Recovery Act Reporting Requirements for the Energy Efficiency and Conservation Block Grant (EECBG) Program

OMB: 1910-5150

EECBG PROGRAM NOTICE 10-07

EFFECTIVE

DATE: TBD

SUBJECT: DOE RECOVERY ACT REPORTING REQUIREMENTS FOR THE

ENERGY EFFICIENCY AND CONSERVATION BLOCK GRANT (EECBG) PROGRAM

REFERENCES:

(1) OMB Memorandum M-09-21 Implementing Guidance for the Reports on the Use of Funds Pursuant to the American Recovery and Reinvestment Act of 2009, June 22, 2009 (Reference 1)

(2) OMB Memorandum M-10-08 Updated Guidance on the American Recovery and Reinvestment Act – Data Quality, Non-Reporting Recipients, and Reporting of Job Estimates, December 18, 2009 (Reference 2).

1.0 PURPOSE: Provides guidance to recipients of the Energy Efficiency and Conservation Block Grant (EECBG) Program on the requirements of reporting under the American Recovery and Reinvestment Act of 2009 (ARRA or Recovery Act; Pub. L. No. 111-5).

2.0 SCOPE: The provisions of this guidance apply to prime recipients (i.e. States, units of local government, and Indian tribes) named in a Notification of Grant Award as the recipients of financial assistance under the Department of Energy (DOE) Energy Efficiency and Conservation Block Grant (EECBG) Program and select sub-recipients as determined by the prime recipient. NOTE: This guidance applies solely to those performance metrics associated with Recovery Act-supported EECBG Program activities as reported to DOE via the Performance and Accountability for Grants in Energy (PAGE) system. This guidance is supplemental to the guidance issued by the Office of Management and Budget (OMB) in References 1 and 2. This guidance does not satisfy or replace the requirement to report to OMB in accordance with Section 1512 of the Recovery Act to FederalReporting.gov.

The monthly reporting requirements for EECBG recipients with formula allocations >$2M outlined by this guidance are authorized under a six-month emergency approval by OMB of an emergency Information Collection Request (ICR) that expires on TBD.

If DOE seeks renewal of this emergency monthly collection it will engage OMB 4 months after approval date to begin a dialogue on burden impact and introducing a risk-tiered model where selected recipients could return to quarterly reporting. In most cases, monthly data will be used internally for managerial purposes only, but where DOE does intend to publicize monthly data, it will clearly indicate it to be "preliminary/informal and subject to change".1

3.0 LEGAL AUTHORITY: Title V, Subtitle E of the Energy Independence and Security Act of 2007 (EISA; Pub. L. No. 110-140) establishes the EECBG Program under which DOE makes funds available to States, units of local government, and Indian tribes to develop and implement projects to improve energy efficiency and reduce energy use and fossil fuel emissions in their communities. All EECBG awards shall comply with applicable law including EISA, ARRA, and all other procedures applicable to this program.

4.0 DEFINITIONS

Non-Federal funds: Funds used in execution of a Recovery Act-supported project that do not come from DOE or any other Federal entity. These funds should be:

Cognizable and verifiably applied to the Recovery-Act project, not assumed or projected; and

Additional to Recovery Act funds (i.e., they would not have been applied to the project in the absence of Recovery Act funds).

Obligation: refers to the binding commitment of Recovery Act funds by the recipient to other entities for the execution of projects. This figure is inclusive of funds already spent (i.e. outlays) and commitments outstanding but not invoiced or otherwise liquidated. This figure should include any loans or grants disbursed by the recipient but not included by the recipient in outlays.

Prime Recipient: refers to a non-Federal organization receiving Recovery Act funding (grants, loans, or cooperative agreements) directly from the Federal Government.

Sub-Recipient: refers to a non-federal organization that receives Recovery Act funds from a prime recipient to carry out a Federal program—not a direct program beneficiary.

5.0 BACKGROUND

The EECBG Program funds provided through the Recovery Act represent an unprecedented Federal investment in energy efficiency and renewable energy activities designed and implemented by the States, Territories, units of local government, and Indian tribes. Concomitant with this investment, the President has pledged that transparency and accountability will be central aims throughout the grant process. Furthermore, DOE will effectively monitor and report the return on investment of EECBG funds in terms of jobs created and energy saved. Pursuant to these objectives, new reporting requirements have been put in place for all Federal Recovery Act programs. For all EECBG recipients, these requirements are fulfilled through reporting via two distinct but similar processes:

1. Quarterly reporting of data to OMB via FederalReporting.gov and

2. Quarterly and monthly (for recipients with formula allocations >$2M) reporting of data to DOE via PAGE

6.0 GUIDANCE

The following sections detail how EECBG recipients will:

1. Report Section 1512 data to OMB quarterly

2. Report required data to DOE quarterly and monthly via PAGE

3. Summarize the timing and process relationship between OMB and DOE reporting requirements

6.1 QUARTERLY REPORTING TO OMB VIA FEDERALREPORTING.GOV)

6.1.1 Background

Section 1512 of the Recovery Act establishes reporting requirements for all recipients. Section 1512(c) requires, in part, that recipients of Recovery Act funding submit quarterly reports that address (1) the total amount of Recovery Act funds received; (2) the amount of Recovery Act funds expended or obligated to projects or activities; (3) a detailed list of all projects or activities for which Recovery Act funds were expended or obligated; and (4) information on any subcontracts or subgrants awarded by the recipient. Section 1512(c) can be found in its entirety at http://www.gpo.gov/fdsys/pkg/PLAW-111publ5/content-detail.html.

In June 2009, the Office of Management and Budget (OMB) issued guidance on the reporting requirements for recipients of Recovery Act funds (Reference 1) and issued amendments in December 2009 (Reference 2). Both OMB guidance documents: (1) answer questions and clarify issues related to the mechanics and chronology of recipient reporting required by the Recovery Act; (2) provide clarification on what information will be required to be reported on the central reporting site at www.FederalReporting.gov and what information will be reported on www.Recovery.gov; (3) instruct recipients on steps that must be taken to meet these reporting requirements, including the incorporation of sub-recipient reporting; and (4) establish a common framework for Federal agencies and recipients to manage a data quality process associated with these reporting requirements.

6.1.2 Who is Required to Report

Prime recipients of Recovery Act funds under the EECBG Program are responsible for reporting the information required by Section 1512 of the ARRA and as provided in both OMB guidance documents. Prime recipients may delegate certain reporting requirements to sub-recipients. The OMB Guidance does not provide for such a delegation to vendors. A vendor is defined as a dealer, distributor, merchant or other seller providing goods or services that are required for the conduct of a Federal program.

Complete guidance on who is required to report under the Recovery Act is provided in section 2.2 of Reference 1. The policy regarding delegation of reporting by the prime recipient is further described in Section 2.3 of Reference 1. The responsibilities of prime recipients and sub-recipients are discussed also in section 2.3 of Reference 1.

6.1.3 Reporting Guidelines

FederalReporting.gov is the central, government-wide data collection system for recipients of Federal awards, under Section 1512 of the Recovery Act. Recipients must access FederalReporting.gov in order to fulfill their reporting obligations. Prime Recipients and selected sub-recipients are required to submit data on a quarterly basis for grants, loans, and federally awarded contracts under the Recovery Act and must report the information described in Section 1512 (c) of the Recovery Act using the reporting instructions and data elements provided online at http://www.FederalReporting.gov.

Complete guidance for Section 1512 (c) reporting and instructions is provided at DOE’s Recovery Act Recipient and Contractor Reporting website:

http://www.energy.gov/recovery/ARRA_ Reporting_Requirements.htm.

Subsets of topics at this site include the following (which are also summarized in the instructions at DOE’s Recovery Act Recipient and Contractor Reporting website):

Who is required to report (responsibilities of the prime and sub-recipients)

Reporting timeframe and registration

Overview of the Required Reporting Data Elements and Metrics

Required jobs reporting

What information must be reported

Timetable for submitting, viewing, and editing reports

Process for downloading and uploading files

Process for making corrections to reports

6.1.4 Resources to assist recipients with OMB reporting:

DOE Recovery Act website: http://www.energy.gov/recovery/ARRA_ Reporting_Requirements.htm

DOE has published a central list of codes and other reporting elements by award to assist recipients in completing their reports. That list can be found at http://www.energy.gov/recovery/documents/Federal_Reporting_Recipient_Information.xls.

DOE Recovery Act Clearinghouse: https://recoveryclearinghouse.energy.gov or 1-888-363-7289 to questions about OMB reporting requirements

A full description of these requirements is published on the Recipient Reporting Information section of the Recovery.gov Web site.

FederalReporting.gov User Guide

Additional training for OMB Recovery Act Reporting is available at: http://www.whitehouse.gov/Recovery/WebinarTrainingMaterials/

6.1.5 Reporting Timeframe and Registration

The report to FederalReporting.gov is due no later than ten calendar days after the calendar quarter in which the recipient received this grant and subsequent quarters until full expenditure of funds.

Reporting through Federalreporting.gov requires recipients to register on the system. To register as a recipient in the FederalReporting.gov, you will need:

Email Address, Award Letter, DUNS Number, CCR Number.

Recipients will be able to submit their reports 1 to 10 days after the end of every fiscal quarter starting with Q4 FY 2009. (i.e. October 1 - October 10, 2009).

Days 11 - 21 are available for prime recipients to review and edit the data loaded by the 10th.

The reporting process is discussed in full in Section 3 of Reference 1.

6.1.6 Overview of the Required Reporting Data Elements and Metrics

For reporting into FederalReporting.gov, recipients will input 31 data elements. For a complete list of all data elements, please see Required Data on page 10 of Reference 1. These elements comprise primarily organizational, financial and jobs- related information, and do not include performance metrics, which will be covered in program specific reporting. Some key data elements include:

Amount of award – which is the total dollar amount of Recovery funds received from DOE in Block 13 of the Assistance Agreement.

Award number – which is the identifying number assigned by DOE in Block 1 of the Assistance Agreement.

Total amount of Recovery Act expenditure – which is the cumulative total dollar amount of Recovery Act funds spent on the project.

Total Recovery Act infrastructure expenditure – which is the total dollar amount of Recovery Act funds spent on infrastructure project, if relevant.

Total number of sub-awards issued and total amount paid to sub-recipients during the last quarter

Basic data elements for any sub-awards over $25,000

Total number and amount of sub-awards.

Total number and amount to payments to vendors < $25,000

Basic data elements for any purchases more than $25,000

Total number and amount of payments to vendors less than $25,000.

Number and description of jobs created or retained (by both prime and sub-recipients).

Included in the description are labor categories, job titles, and general descriptions of work to be performed in newly created jobs.

Primary place of performance – which is the place where the majority of the work and activities will be performed for this project.

Top five highly compensated officers – which are the names of the individuals who received the highest amount of compensation in the previous fiscal year, if three conditions are met: $25 million, 80 percent of all revenues from federal government, no other federally-required public reporting (e.g. – SEC filings).

Please note: Submitting information to DOE does NOT fulfill the OMB reporting requirement. DOE cannot forward the information to OMB on the prime recipient’s sub-recipient’s behalf – the prime recipient or sub-recipient must submit the information directly. Significant reporting errors or omissions can be corrected from the 11th until the 21st of the month following the end of the quarter. Specific instructions for making these adjustments can be found at the www.FederalReporting.gov site.

6.2 QUARTERLY AND MONTHLY2 REPORTING TO DOE VIA PAGE

6.2.1 Who is Required to Report

Prime recipients are responsible for reporting quarterly. Additionally, prime recipients with formula allocations >$2M are responsible for reporting monthly information. Prime recipients may, at their discretion, delegate the authority for reporting to sub-recipients through creation of user accounts in PAGE. However, regardless of how prime recipients decide to manage their reporting processes, the prime recipients ultimately retain the responsibility to ensure that reports are submitted accurately and on time.

6.2.2 Reporting Timeline

6.2.2a Quarterly Reporting

Attachment 1 lists all metrics that recipients are required to report to the DOE via PAGE on a quarterly basis to DOE. The deadline for reporting these quarterly metrics will be on the 30th of the month, following the close of the quarter for which data are being reported (e.g. April 30th for data from January-March 2010).

DOE recognizes that as more accurate data becomes available, recipients may need to amend their quarterly reports after submission. Recipients will coordinate post-submission corrections of quarterly reports through their respective Project Officers.

6.2.2b Monthly Reporting

In addition to the quarterly reporting of metrics, a subset of key metrics will be reported on a monthly basis from recipients with formula allocations greater than $2 million. EECBG recipients with formula allocations less than $2 million will not be required to report any metrics monthly.

These metrics, listed in Attachment 2, are required to be reported on a more frequent basis in order to track progress and report success in key areas, to identify where additional assistance may be needed, and to maintain transparency and accountability regarding the use of Recovery Act funds. Monthly reports will be due on the 30th of the month following the month for which data is being reported.3 The first monthly reporting deadline will be March 30th, 2010, reporting data for February 2010. As all of the monthly metrics overlap with a subset of the quarterly metrics, there will be several instances when both monthly and quarterly figures are required for the same metrics in the same month. In those months where monthly and quarterly reporting dates coincide (e.g. April 2010), both data required for the month and quarter will be submitted.

DOE recognizes that as more accurate data becomes available and that EECBG recipients with formula allocations >$2M may need to amend their monthly reports after submission. Recipients will be able to freely edit monthly reports at any time during the reporting quarter in which the monthly reports are submitted. After the close of this quarter, recipients will coordinate post-submission corrections of monthly reports through their respective Project Officers.

6.2.3 Reported Metrics

There are three categories of metrics that collected on a quarterly basis, as listed in Attachment 1. Broad descriptions of these three types of metrics are provided below. In determining these metrics, recipients should consider the impact of funds for the entire project, including non-Federal funds in addition to EECBG funds. In this manner, DOE will be able to accurately measure the full impact of Recovery Act funding.

6.2.3a Jobs

This category of metrics allows DOE to capture the depth and breadth of the impact of EECBG funds on the domestic labor market. To ensure the number of jobs is being reported consistently, EECBG Program Notice 10-08 provides detailed instruction on how to calculate and report job creation and retention. EECBG recipients will only be required to report on job creation and retention on a quarterly basis. Recipients should use the methodology in EECBG Program Notice 10-08 to calculate job creation for quarterly reporting to DOE and quarterly reporting to OMB. Through adherence to this standard methodology, consistency between the jobs figures reported to both DOE and OMB can be maintained. Examples of the types of jobs to be covered by this methodology include (but are not necessarily limited to): Crew member, Crew chief, Record keeper, Auditor, Estimator, Monitor, Program Staff and Administrative Staff.

6.2.3b Standard Programmatic Metrics

This category of metrics allows DOE to monitor progress on the scopes of work identified by recipients in each project activity. Accordingly, recipients will be required to report on that set of metrics associated with the specific activity identified on the project activity worksheet(s) submitted with the EECBG application. In accordance with Attachment 1 & 2, recipients will be required to report outlays (i.e. Recovery Act funds spent or expended by recipients and sub-recipients), obligations, and a subset of specific metrics on a monthly and quarterly basis. Recipients and sub-recipients will report all other metrics on a quarterly basis only. Recipients are only required to report on standard programmatic metrics associated with the project activities that they are implementing (e.g. If Town XX is conducting building retrofits, they will be required to report on outlays, obligations, number and square footage of buildings retrofitted). Recipients are not responsible for reporting on metrics not associated with their project activities.

6.2.3c Critical Metrics

This category of metrics allows DOE to assess the true impact of the project activities submitted by recipients and encompasses energy savings, energy cost savings, renewable energy generation, and emissions reductions. Accordingly, recipients will report on the applicable set of metrics identified Attachment 1. Under the assumption that the determination of these metrics is both accurate and relatively easy, DOE prefers that recipients utilize their own methodology for the determination and reporting of critical metrics. However, it is understood that determination of these metrics can prove difficult for some recipients. To address this eventuality, DOE has developed a tool to help recipients estimate these metrics from a simple list of user-defined inputs. Recipients are not required to utilize the tool to determine critical metrics; the tool is meant only to facilitate determination of critical metrics as necessary. This tool will be available online in .xls format in both the Reference Library section of PAGE and as a link from the Metrics Wizard functionality on PAGE. Additionally, the calculator will be available in .xls format at:

http://www.eecbg.energy.gov/Downloads/ARRA_Benefits_Reporting_Calculator.xls

Please note: This benefits (i.e. critical metrics) calculator supersedes all previous editions of benefit calculators. Only the calculator posted at the link above should be used for the purposes of reporting critical metrics to DOE for Recovery Act-supported projects.

6.2.4 Reporting tool

PAGE is the online system (www.page.energy.gov) that provides all EECBG recipients with the ability to electronically submit and manage grant performance and financial information. A host of training tools to familiarize users with PAGE are readily accessible from the front page of the site, including a weekly webinar series and a number of training videos created to guide recipients through each of the necessary reporting steps.

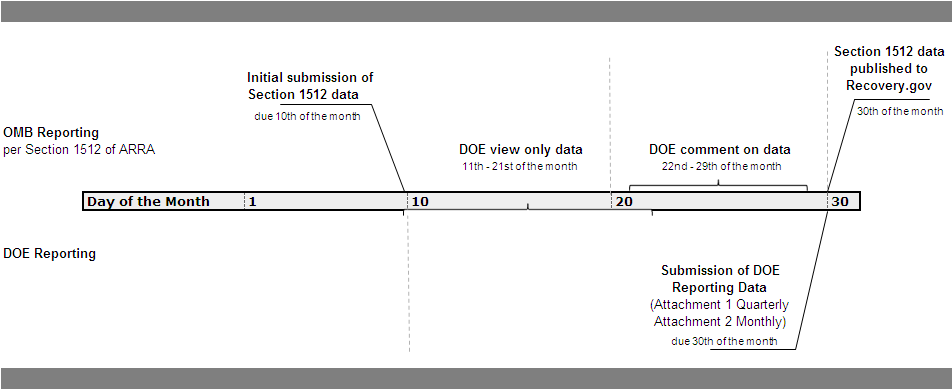

6.3 TIMELINE AND PROCESS FOR REPORTING TO OMB AND DOE

Per Reference 1, in the 1-to-10- day window following the end of the reporting quarter, prime recipients and selected sub-recipients will enter and edit OMB reporting data as necessary. During this time, DOE will be unable to review the data unless explicitly submitted for review to the agency by the recipient. Prime recipients and delegated sub-recipients that have not submitted their data reports by the end of the 10th day will be considered non-compliant with the recipient reporting requirements. During the 11-to-21- day window (following submission of OMB not later than the 10th), DOE will be able to review the submitted data but not provide official feedback to prime recipients. In this window, prime recipients and sub-recipients will still be able to freely correct their initial submissions.

During the 21-29 day window, DOE will be able to review and comment on information submitted to OMB. In this window, submitted reports will not be editable by recipients unless specifically unlocked by DOE via FederalReporting.gov. On the 30th day, a separate submission of quarterly data is required to DOE in accordance with guidance above. The respective OMB and DOE reporting timelines are illustrated below:

In one instance, both DOE and OMB are requiring submission of the same data over the quarterly reporting window. The DOE metric “Total Outlays (Recovery Act funds)” and the OMB metric “Total amount of Recovery Act expenditure” are equivalent.

Grantees should endeavor to minimize any discrepancy between the reports of this metric made to DOE and OMB. It is understood that as time passes from the close of the reporting period, grantees are able to obtain an increasingly accurate picture of grant performance during the reporting period.

If information on Total Outlays (Recovery Act funds)/Total amount of Recovery Act expenditure is updated after 21st of the month, the grantee should contact the Project Officer to coordinate correction of the report submitted to FederalReporting.gov and ensure consistency with the report to be submitted to DOE. In cases where the grantees (e.g. State agencies) have relegated the ability to report via FederalReporting.gov to a higher authority (e.g. State Recovery Act office) and receives updated information on Total Outlays or Jobs Created through Recovery Act funds, they should request that the higher authority make the necessary changes to the report in FederalReporting.gov.

In any situation, grantees should prioritize the accuracy of data submitted to DOE over the consistency of data being submitted to various sources.

7.0 CONCLUSION

Recovery Act funding is supporting initiatives by States, units of local government, and Indian tribes, and is an unprecedented opportunity to deploy energy efficiency and renewable energy projects across the country. It is a pleasure to work with you on this important challenge. I look forward to the growth of this Program and our continued partnership.

Claire Broido Johnson

Acting Program Manager

Office of Weatherization and Intergovernmental Program Energy Efficiency and Renewable Energy

Attachment 1: EECBG Quarterly Reporting Metrics (Recovery Act)

Attachment 2: EECBG Monthly Reporting Metrics (Recovery Act)

1 DOE will likewise engage OMB if seeking renewal of emergency monthly collections on the Weatherization Assistance Program (WAP) and State Energy Program (SEP) and will at four months from approval date for those collections, begin a dialogue on burden impact and introducing a risk-tiered model where selected recipients could return to quarterly reporting. Further, with the same presumption that monthly data will be used internally for managerial purposes only, DOE will clearly indicate that any publicized monthly data from WAP or SEP is "preliminary/informal and subject to change".

2 Monthly reports are only required for EECBG recipients with formula allocations greater than $2M

3 For monthly reports on January each calendar year, the deadline will be either February 28th or 29th as applicable

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | STATE ENERGY PROGRAM NOTICE |

| Author | Eric Thomas |

| File Modified | 0000-00-00 |

| File Created | 2021-02-03 |

© 2026 OMB.report | Privacy Policy