Technology Innovation Program

Technology Innovation Program (TIP) Application Requirements

0693-0050-New-Chapter 7-TIPPreparationPreparationKit

Technology Innovation Program

OMB: 0693-0050

CHAPTER 7

GENERAL INSTRUCTIONS FOR SUBMITTING TIP PROPOSALS ELECTRONICALLY VIA GRANTS.GOV

1. How to Start. Go to the http://www.grants.gov website and click on “Apply for Grants” under “For Applicants” in the left column and follow the instructions. The first thing you’ll need to do is register.

2. Registration Process. Before using Grants.gov for the first time, each proposer must register to create an institutional profile http://www.grants.gov/applicants/get_registered.jsp. Once registered, the proposer can then apply for any federal government grant or cooperative agreement on the Grants.gov website, including TIP.

To avoid any potential processing backlogs due to last minute registrations, proposers are strongly encouraged to start their Grants.gov registration process at least four weeks prior to the proposal submission due date. New businesses [i.e., those applying to the Internal Revenue Service (IRS) for an Employer Identification Number (EIN) to complete the registration] should allow at least two additional weeks to obtain the number and register.

|

TIP will not make any allowances for submission delays due to incomplete Grants.gov registration. It is the proposer’s responsibility to check and verify the correctness and completeness of the proposal submission

3. Software Requirements. The downloading of a Grant Application Package and Instructions is carried out from http://www.grants.gov. If you have not already done so, follow the instructions to test for Grants.Gov compatible version of Adobe Reader as identified on the Grants.gov website http://www.grants.gov/applicants/AdobeVersioningTestOnly.jsp If your version is not compatible you will receive “ an error message “If an error message displays, the test application package was opened with an incompatible version of Adobe Reader. To download the compatible version required to complete and submit a grant application package please visit the download software page.”

In order to access, fill out, and electronically submit a proposal, you must use the compatible version of this viewer for proper operation of the intelligent logic used in the application package.

4. Once you are registered, complete the following steps:

a) Go to the “Apply for Grants” page and click on the “Download a Grant Application Package and Instructions” link.

b) Enter the CFDA Number as 11.616 for TIP. Leave the Funding Opportunity Number and the Funding Opportunity Competition ID fields blank. Click on the Download Package button.

c) Under the heading “Instructions & Application” click on “Download.”

d) On the next screen click on “Download Application Instructions” and print out the detailed instructions for the submission process. Read these instructions carefully before continuing.

e) Once you understand the instructions and have assembled your completed proposal and all appropriate documents on your computer, return to where you left off in Grants.gov and click on “Download Application Package.”

f) Follow the instructions that you have printed out to complete your electronic submission. Remember, you will need to be completely familiar with the requirements in the TIP Proposal Preparation Kit and the Federal Funding Opportunity (FFO) notice to begin the proposal preparation process. Both of these documents are available on the TIP website at http://www.nist.gov/tip/comp_09/comp09_home.html

The FFO can also be found on the Grants.gov synopsis page for 2010-TIP-01. Simply go to “Quick Links” on the http://www.grants.gov website. Then click on “Grant Search,” use the “Search by CFDA Number” feature and type in 11.616. When the synopsis page appears, either click on the oblong labeled “Full Announcement” near the top of the screen, or click on the “Link to Full Announcement” hyperlink towards the bottom of the synopsis page.4.

5. Proposal Components. Complete proposals must include the required forms and documents and the proposal must be assembled in accordance with the guidelines in Chapter 3 of the TIP Proposal Preparation Kit. None of the prescribed forms may be altered, including adding text outside the forms’ design. Structural changes to any of the prescribed forms may invalidate the proposal.

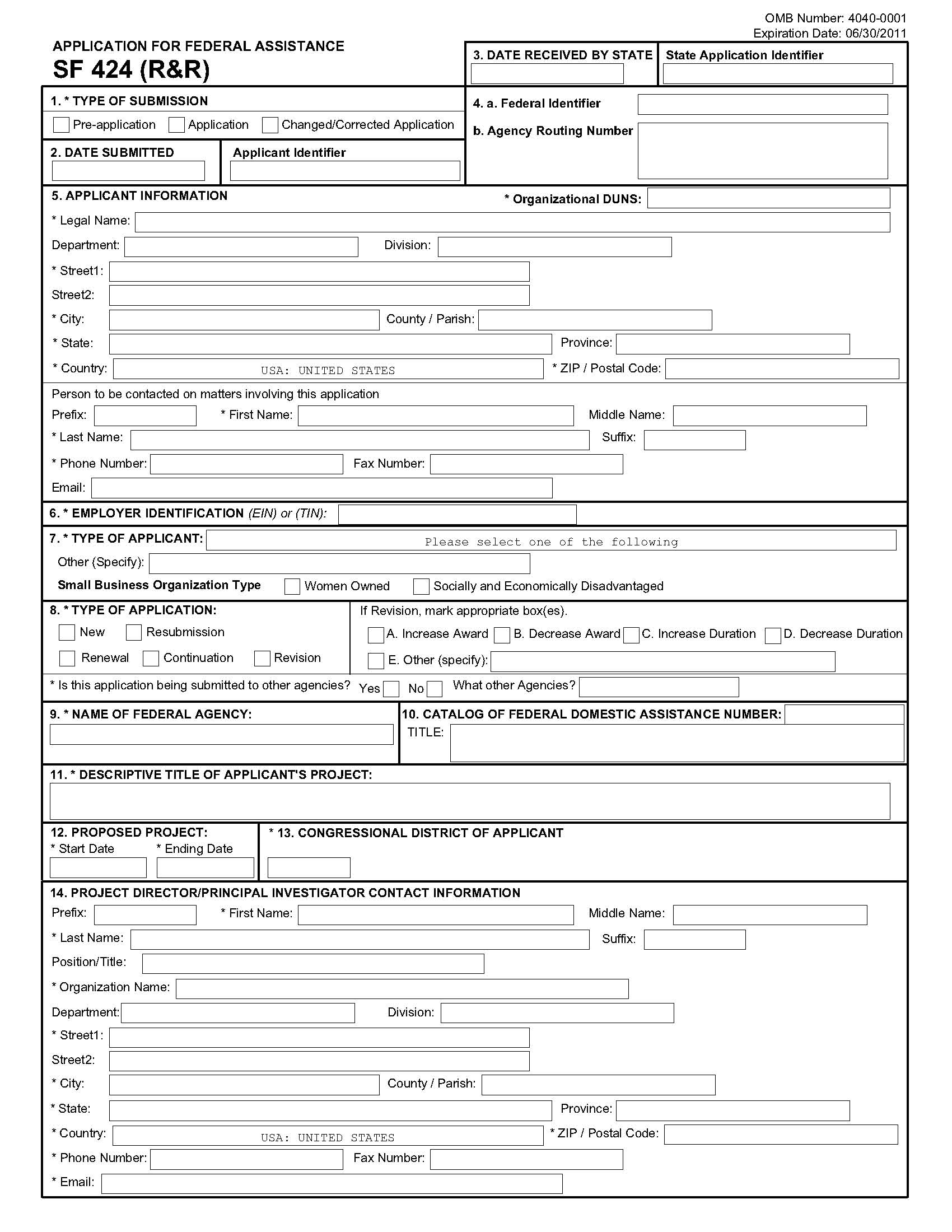

a) The SF-424 (R&R), Application for Federal Assistance, serves as the cover sheet for the proposal. No other cover sheet or letter should be used. Note that there are multiple versions of the SF-424; therefore, be sure to use the SF-424 (R&R) version. Any other SF-424 form such as the SF-424 Core Form, is not required for submitting TIP proposals.

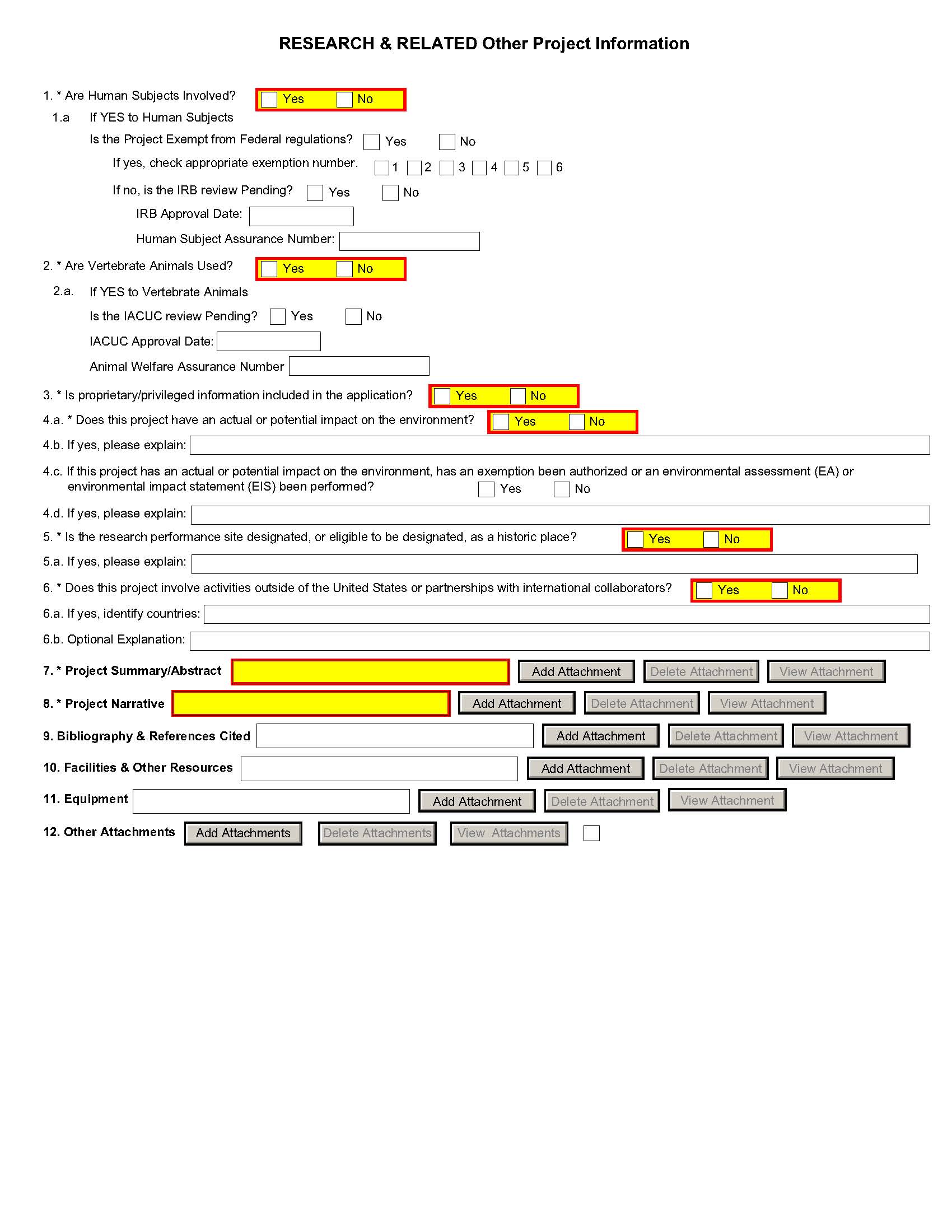

b) The next important form is the Research and Related Other Project Information. This form is the mechanism used to submit the documents of your proposal electronically via Grants.gov.

The SF-424 (R&R) and the Research and Related Other Project Information forms above are available as part of the Grants.gov application package. Instructions for filling out these forms are provided in the Exhibits following this chapter.

c) The next set of required forms includes a series of 1022 forms as described in Chapter 3 of the TIP Proposal Preparation Kit. These forms have been consolidated into one PDF file and are available on the TIP Web site http://www.nist.gov/tip/comp_09/comp09_forms.html. Instructions for filling out these forms are provided in the Exhibits following this chapter.

d) The remaining documents, identified as documents (k) through (t) as listed in Chapter 4, Section C “Proposal Assembly/Presentation Order”, must be consolidated into one Word or PDF file and attached to Item 8 (pg 56) within the “Research and Related Other Project Information” form.

The proposer is responsible for ensuring that the proposal, whether submitted via Grants.gov or by hardcopy, is correct and complete and that it conforms to the requirements of the TIP Federal Funding Opportunity notice and TIP Proposal Preparation Kit. Proposals that deviate substantially from these guidelines or that omit required information may be found unresponsive and may not be considered for further review or funding. Please read, understand, and follow the Application Instructions that are available once you register and open the TIP application form on Grants.gov.

6. Contact Information. For further information or questions regarding applying electronically contact Christopher Hunton at 301-975-5718 or at [email protected]. For technical questions related to the NIST 1022 and associated forms, contact Deborah Dubeau at 301-975-3462 or at [email protected].

Proposers are strongly encouraged to start early and not wait until the approaching due date before logging on and reviewing the instructions for submitting a proposal through Grants.gov. Proposers should save and print the proof of submission they receive from Grants.gov. If problems occur while using Grants.gov, the proposer is advised to (a) print any error message received, and (b) call Grants.gov directly at 1-800-518-4726 for immediate assistance. Assistance from the Grants.gov Help Desk will be available around the clock every day, with the exception of the Federal holidays. Help Desk service will resume at 7:00 a.m. Eastern Time the day after a Federal holiday. For assistance with using the Grants.gov, you may also contact [email protected].

This page intentionally left blank.

Exhibits

Instructions for Filling Out the SF-424 (R&R) Form

Instructions for Filling Out the Research & Related Other Project Information Form

Instructions for Filling Out the NIST-1022 Form, “Proposal Information Sheet”

Instructions for Filling Out the NIST-1022A Form, “Other Joint Venture Members”

Instructions for Filling Out the NIST-1022B Form, “Contractors or Subrecipient Information”

Instructions for Filling Out the NIST-1022C Form, “Budget Narrative”

Instructions for Filling Out the NIST-1022D Form, “Third Party In-Kind Contributions”

Instructions for Filling Out the NIST-1022E Form, “Estimated Multi-Year Budget – Single Company”

Instructions for Filling Out the NIST-1022F Form, “Estimated Multi-Year Budget – Joint Venture”

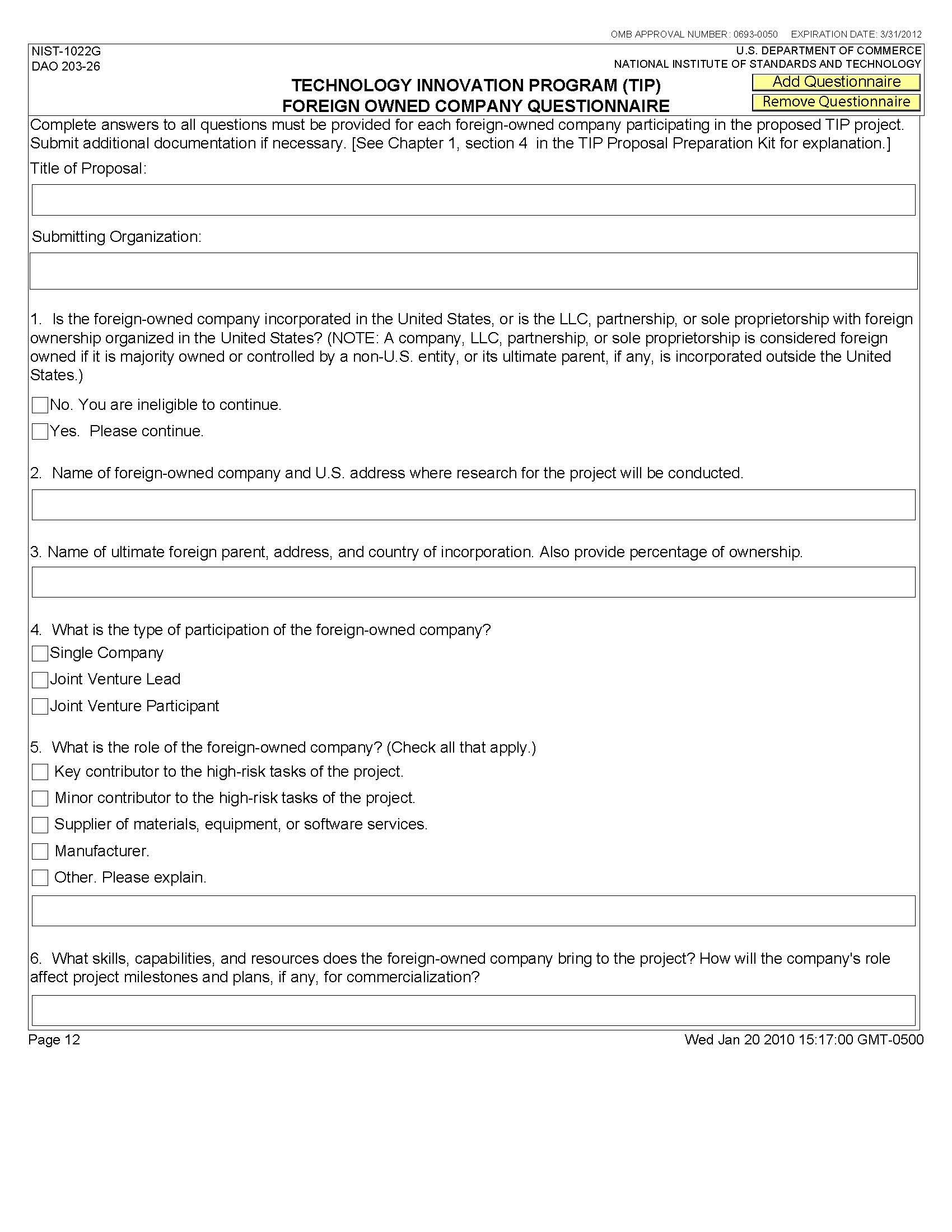

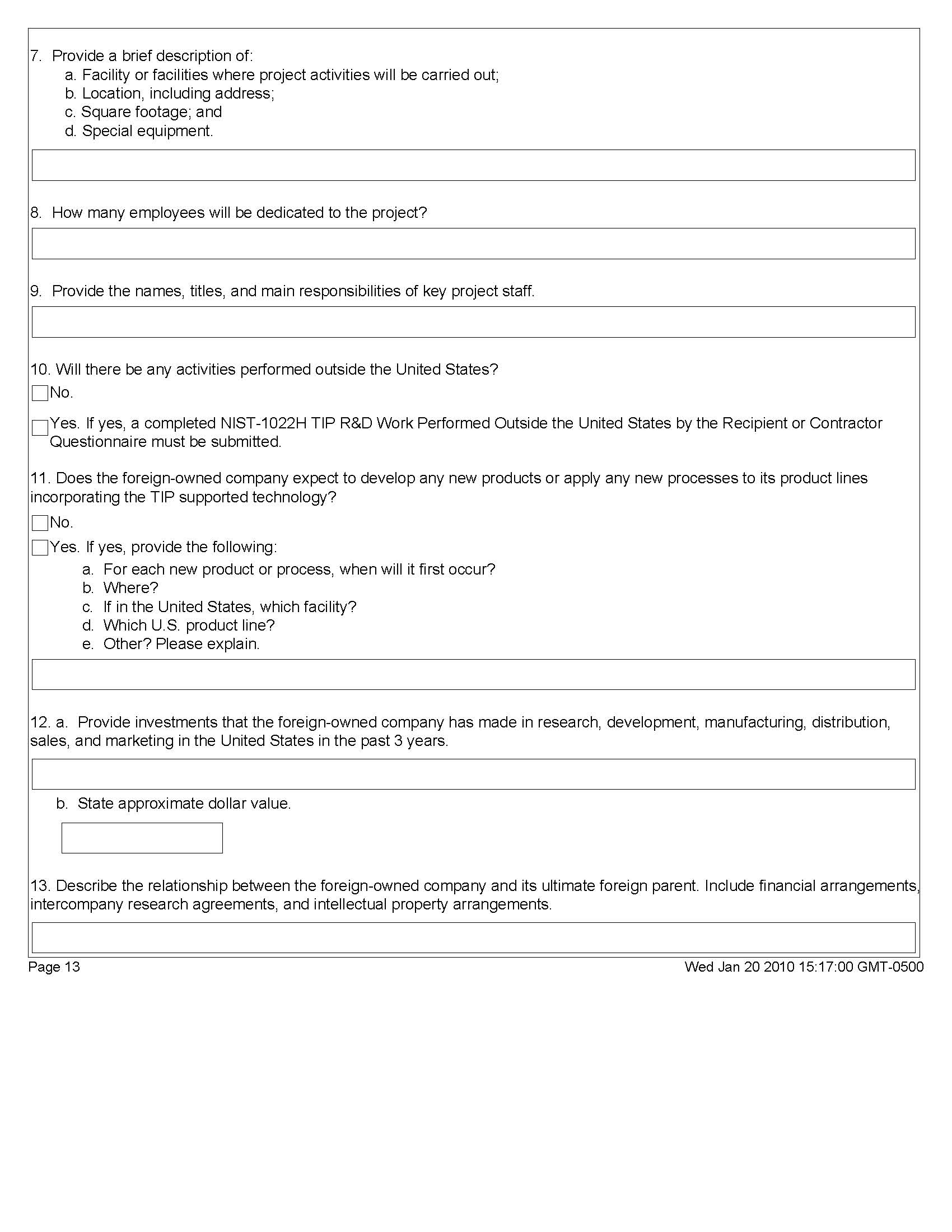

Instructions for Filling Out the NIST-1022G Form, “Foreign-Owned Company Questionnaire”

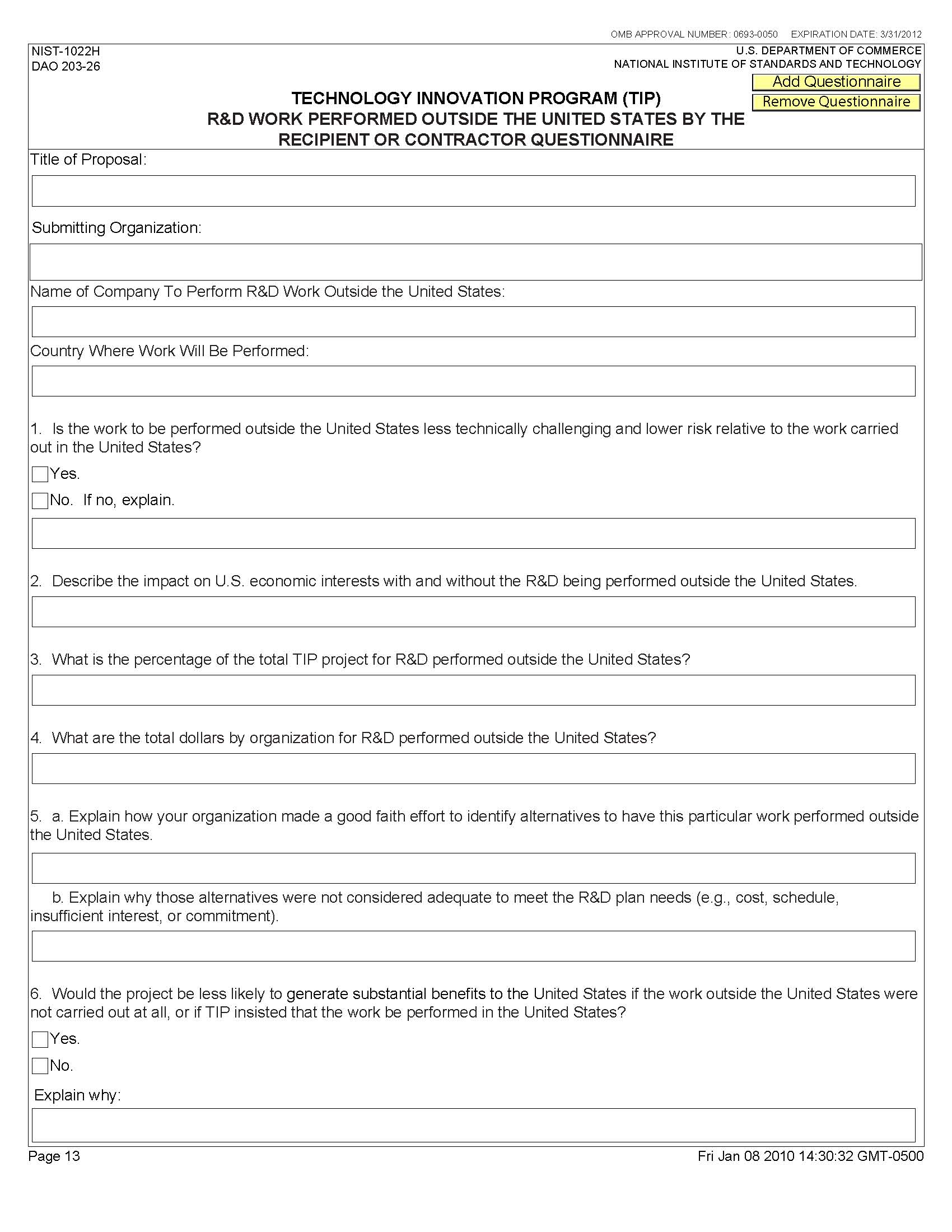

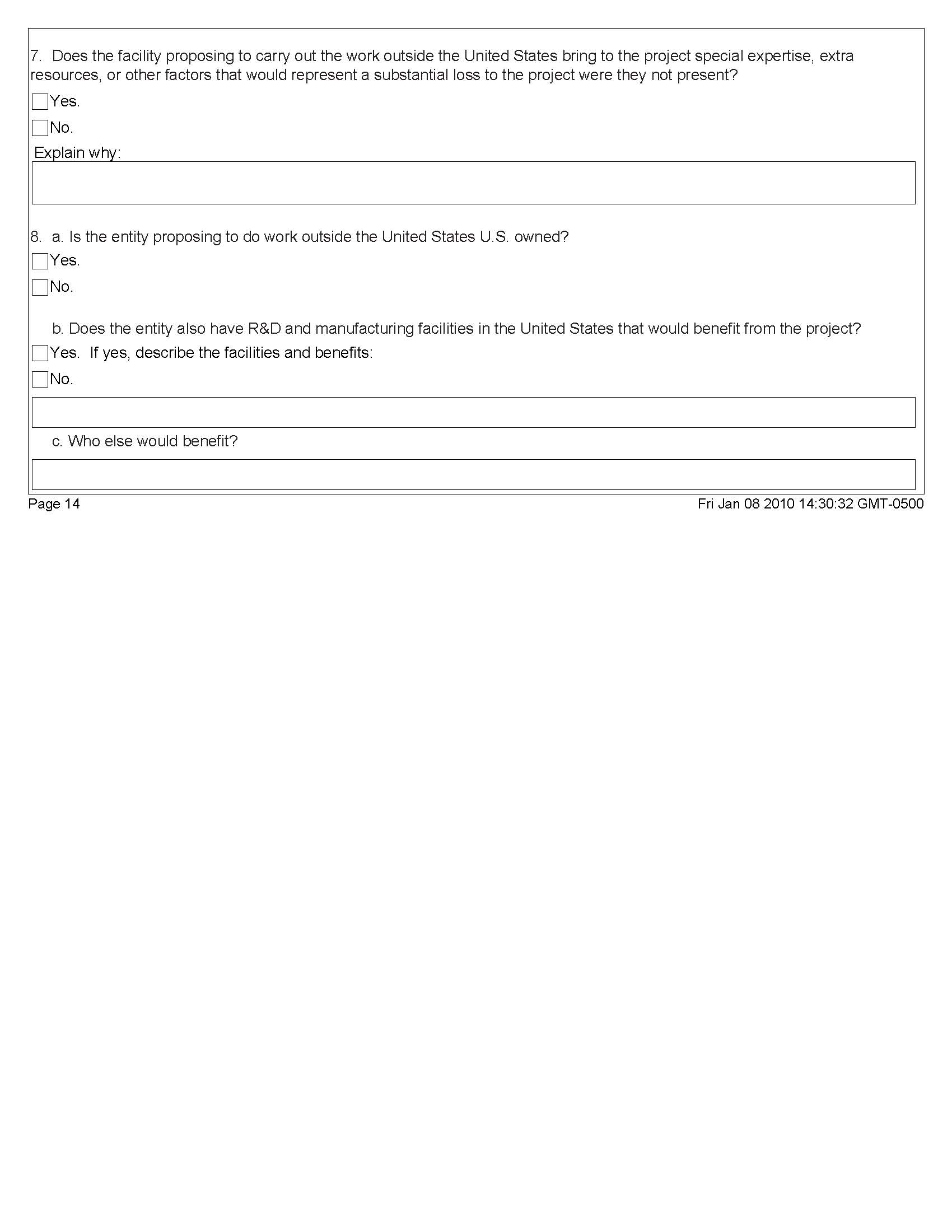

Instructions for Filling Out the NIST-1022H Form, “R&D Work Performed Outside the United States by the Recipient or Contractor Questionnaire”

Examples: Entering Multiple Sources of Funds

Instructions for Filling Out the SF-424 (R&R) Form

These instructions for the SF-424 (R&R) form have been developed for use under the Technology Innovation Program (TIP) and are only applicable for proposals submitted to TIP. Some of the items are required and some are optional. Required items are identified with an asterisk on the form and are specified in the instructions below.

1. Type of Submission (Required): Select Application.

2. Date Submitted/Applicant Identifier: Enter date of proposal submission. Applicant Identifier: Not applicable; leave blank.

3. Date Received by State & State Application Identifier: Not applicable; leave blank.

4. a. Federal Identifier: Enter the TIP competition number provided in the Federal Funding Opportunity notice that corresponds to the competition for which you are applying.

b. Agency Routing Number: Leave blank.

5. Applicant Information/Organizational DUNS (Required): Enter the organization’s 9-digit Dun and Bradstreet Data Universal Numbering System (DUNS) received from Dun and Bradstreet. Information on obtaining a DUNS number is available at http://www.nist.gov/tip/helpful.html. The applicants’ nine-digit DUNS number must be consistent with the information on the Central Contractor Registration (CCR) (www.ccr.gov) and Automated Standard Application for Payment System (ASAP). For complex organizations with multiple DUNS numbers, the DUNS number MUST be the number for the applying entity. Entities that provide incorrect/inconsistent DUNS numbers may experience significant delays in submitting their proposals through Grants.gov and receiving funds if the proposal is selected for funding. Fill in Applicant Information as requested (i.e., name, address, etc.)

6. Employer Identification (Required): Enter the nine-digit Employer or Taxpayer Identification Number (EIN or TIN) as assigned by the Internal Revenue Service. For instructions on how to obtain an EIN, see http://www.nist.gov/tip/helpful.html. The applicants nine-digit EIN or TIN must be consistent with the information on the Central Contractor Registration (CCR) (www.ccr.gov) and Automated Standard Application for Payment System (ASAP). For complex organizations with multiple EIN or TIN numbers, the EIN or TIN number MUST be the number for the applying entity. Entities that provide incorrect/inconsistent EINS or TINS may experience significant delays in submitting their proposals through Grants.gov and receiving funds if the proposal is selected for funding.

7. Type of Applicant: Click on the dropdown menu and enter the appropriate type. Large businesses are not eligible to apply.

8. Type of Application (Required): Select “New” if not previously submitted to a prior TIP competition. Select “Resubmission” if proposal was submitted to a prior TIP competition.

9. Name of Federal Agency (Required): Enter NIST.

10. Catalog of Federal Domestic Assistance Number/Title: Enter 11.616 TIP.

11. Descriptive Title of Applicant’s Project (Required): Enter a brief descriptive title of the project.

12. Proposed Project Start and End Dates (Required): Self explanatory.

13. Congressional District of Applicant (Required): Self explanatory.

14. Project Director/Principal Investigator Contact Information: Self explanatory.

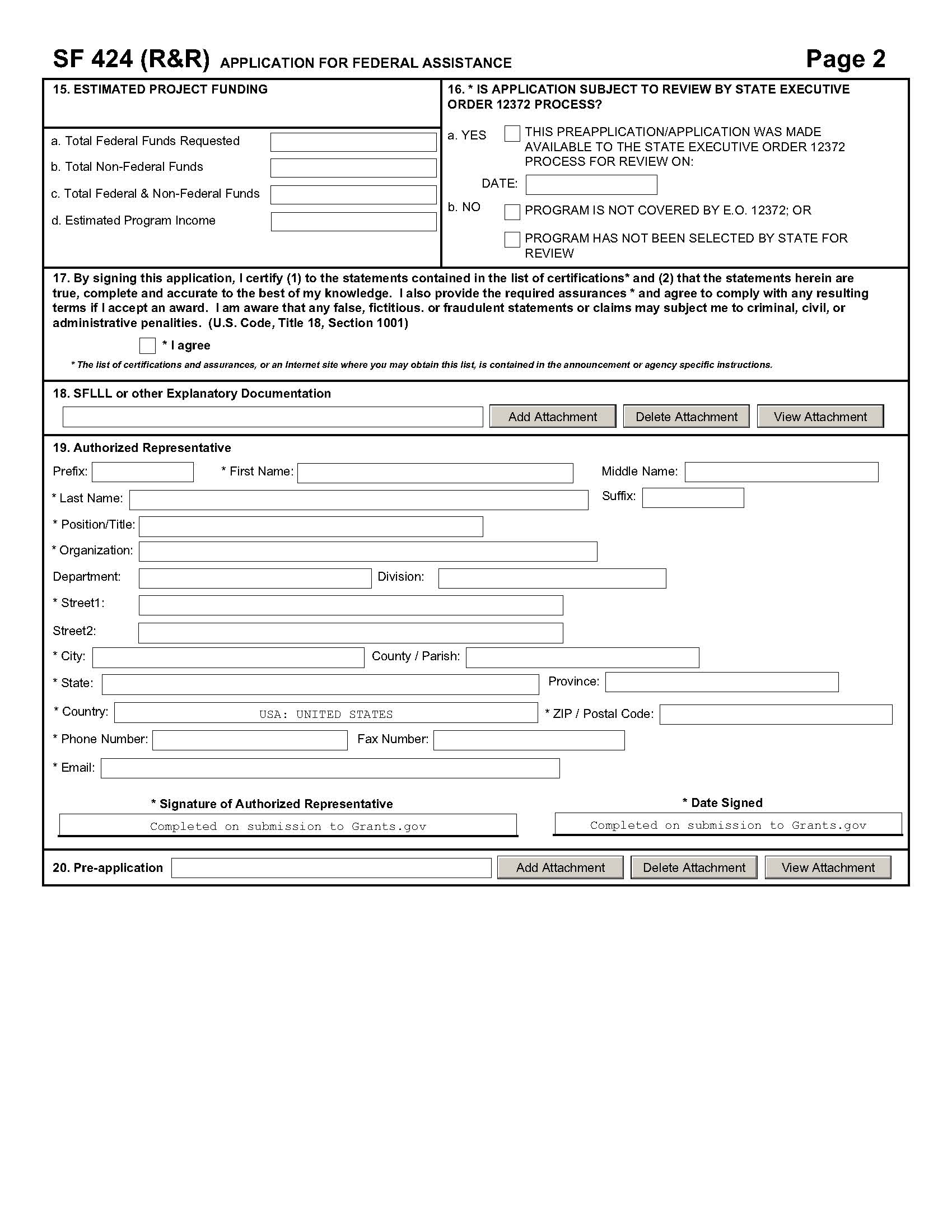

15. Estimated Project Funding (Required): a. Total Federal Funds Requested: Enter total funds requested from TIP (i.e., for Single applicant, NIST-1022E, line H, Total; for Joint Venture, NIST-1022F, line H, Total).

b. Total Non-Federal Funds:

(i.e., for Single applicant, NIST-1022E, lines I+J, Total; for Joint Venture, NIST-1022F, lines I+J, Total).

c. Total Federal & Non-Federal Funds:

(i.e., for Single applicant, NIST-1022E, line K, Total; for Joint Venture, NIST-1022F, line K, Total).

d. Estimated Program Income: Enter 0

16. Is Application Subject to Review by State Under Executive Order 12372 Process? Select “NO. Program is not covered by E.O. 12372”

17. Self explanatory.

18. SFLLL or other Explanatory Documentation. Not applicable; leave blank.

19. Authorized Representative (Required): Self explanatory.

20. Pre-Application: Not applicable; leave blank.

Instructions for Filling Out the Research & Related

Other Project Information Form

The Research & Related Other Project Information form has been adapted for use by the Technology Innovation Program (TIP) for proposals submitted to TIP. For electronic submissions of proposals, this is a mandatory, predefined form that you will use to attach the various documents that make up your proposal. For hardcopy submissions of proposals, this is also a required form. Some of the items are required and some are optional. Required items are identified with an asterisk on the form and are specified in the instructions below.

1-5a For hardcopy and electronic submissions these items are self explanatory.

6-12 For hardcopy submissions, no further entries required; leave blank.

For electronic submissions these entries are used to include the required attachments that make up your proposal. Instructions for each item are as follows:

7. Project Summary/Abstract: Use this field to attach and submit your NIST-1022 form (pdf file). Click on Add Attachment that opens the “Attach File” window. Locate and highlight your completed NIST-1022 form (pdf file) that is on your computer and click on the Open button to attach this file.

NOTE: It is important that you view the file once you have attached it and verify that the information that you have entered appears and that it is not a blank document.

8. Project Narrative: Click on Add Attachment that opens the “Attach File” window. Locate and highlight your completed Project Narrative (a single file addressing Scientific and Technological

Merit, including bibliographic references and letters of commitment) file that is on your computer and click on the Open button to attach this file.

NOTE: It is important that you view the file once you have attached it and verify that the information that you have entered appears and that it is not a blank document.

9-12 Leave blank.

Submitting to Grants.Gov

When you have completed attaching all of your forms, click on the Close Form button and return to Grant Application Package.

Click on the Check for Errors button at the top of the screen and correct any errors if indicated.

After your application package is complete, click on the Save button at the top of the screen. This will save your application (in PDF format) on your computer. NOTE: if you do not save your application at this stage you may have to reenter your data and reattach your files.

When you are ready to submit your proposal application, click on the Submit button at the top of the screen. If the Submit button is grayed out you need to click on the Check for Errors button and the Save button. Note: if your browser has a “pop-up” blocker installed, you may have to hold the Ctrl key down while clicking on the Submit button.

The next screen that appears asks you to enter your Username and password. When you enter this the next screen will ask “Do you wish to sign and submit this application?” When you are ready to do so, click on the Sign and Submit Application button.

The next screen that appears is the confirmation page. This is evidence of your electronic submission to TIP through Grants.gov. Print this page and keep it in a safe location. Click on Close to exit Grants.gov.

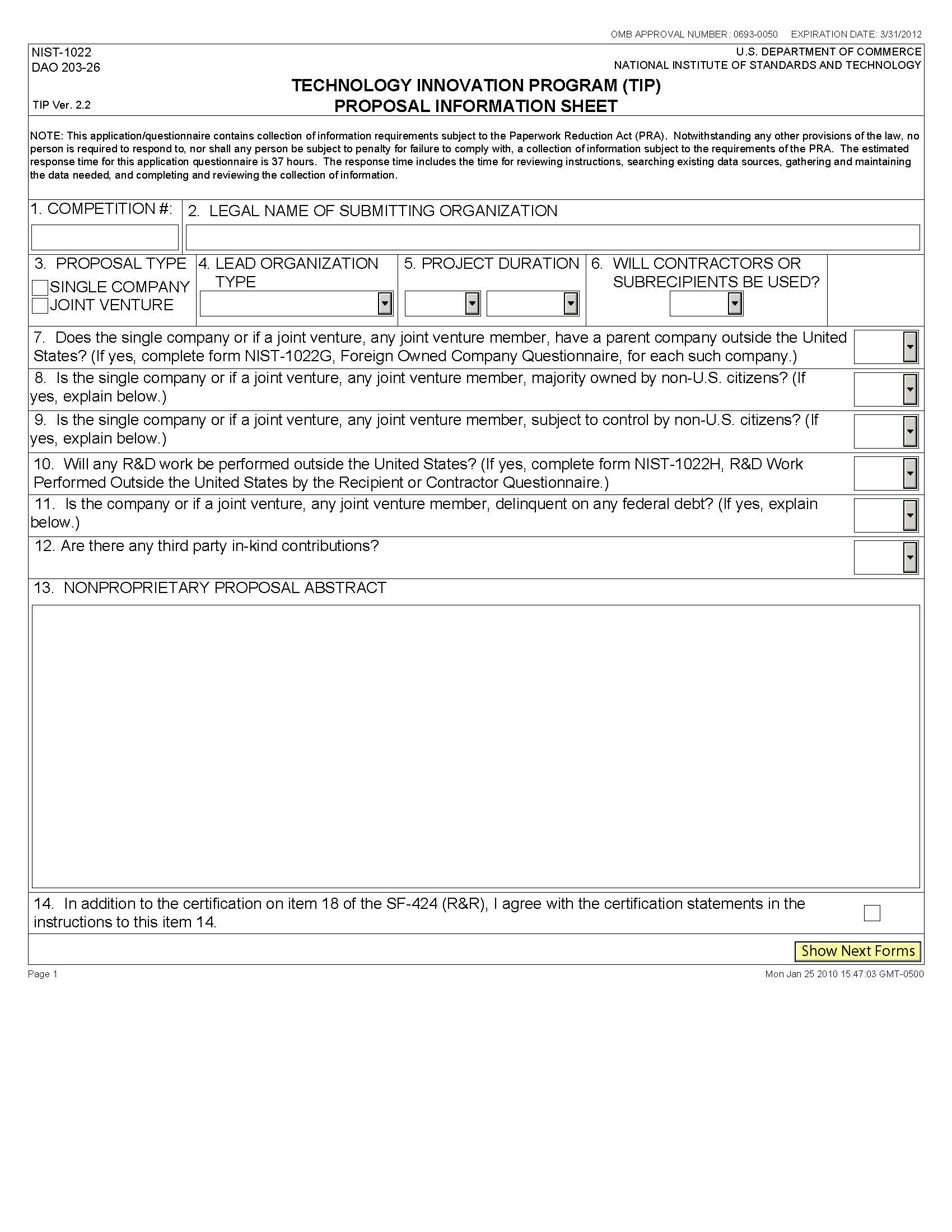

Instructions for Filling Out the NIST-1022 Form

“Proposal Information Sheet”

Notwithstanding any other provision of the law, no person is required to respond to, nor shall any person be subject to, a penalty for failure to comply with a collection of information subject to the requirements of the Paperwork Reduction Act, unless that collection of information displays a currently valid OMB Control Number. The reason for collecting this information is for NIST to be able to perform the appropriate technical and impact reviews of a TIP proposal. The information obtained will assist in determining eligibility for federal financial assistance. Responses to the collection of information are required to be considered for a TIP award.

The NIST-1022 “Family of Forms” consists of the NIST-1022 form “TIP Proposal Information Sheet,” which is considered the first page, and the NIST-1022A-H forms. The NIST-1022 “Family of Forms” is available as a dynamic, interactive set of Adobe PDF forms where answers supplied on the first page of the NIST-1022 form are used to generate the specific set of additional forms needed to meet proposal submission needs. Data entered in the “Family of Forms” propagates through the entire set of forms to minimize duplicative data entry. Due to the dynamic nature of these forms, changes in key data elements (explained below) will cause form regeneration and may result in the loss of previously entered data if the data has been entered in an ad hoc manner. We strongly encourage you to finalize all project information before data entry to avoid potential loss of data.

This form is designed to make data submission easier and more accurate. However, there are several caveats that should be clearly understood before beginning data entry.

a. After data is entered on the NIST-1022 form, clicking the “Show Next Forms” button at the bottom of the page locks items 3 and 5 on this form and generates the forms needed to complete your proposal. If there is a change in the proposal type (item 3) or the project duration (item 5), ALL information/data previously entered on the NIST-1022A-H forms WILL BE LOST since new responses to these questions will generate new forms.

b. Deleting or adding a joint venture member after the NIST-1022C form “Budget Narrative” is generated will invalidate the information and the form will need to be started again.

c. Once the NIST-1022C form “Budget Narrative” is generated for a joint venture proposal, the number of joint venture members cannot be changed without the regeneration of the entire NIST-1022C form. In order to change the number of joint venture members from the number initially specified, click on the "Unlock Items 3 and 5" button on the first page of the NIST-1022 form. This will reset the forms and ALL information/data previously entered on the NIST-1022A- H forms WILL BE LOST and will have to be reentered. Therefore, if there is any doubt about the number of joint venture members, delay generating and completing the NIST-1022C form until this matter is resolved to avoid starting over.

d. Review all the forms and plan data entry to minimize change so time and data are not lost. It is recommended that you turn off the auto complete feature in your browser if you are using it to complete Adobe forms.

e. The single PDF file containing these forms must remain intact and the PDF format must remain unaltered. Altering the PDF form may invalidate your proposal.

Once complete, the PDF file containing the NIST-1022 “Family of Forms” must be submitted electronically by attaching its link to item 7 of the SF-424 “Research & Related Other Project Information” form. If paper copies are submitted, the entire NIST-1022 “Family of Forms” that are generated electronically by your answers on the NIST-1022 form are to be submitted. Failure to submit a complete and accurate set of forms may result in disqualification.

Instructions for each item on the NIST-1022 form follow:

1. Enter the TIP competition number provided in the Federal Funding Opportunity notice that corresponds to the competition for which you are applying.

2. Enter the legal name of the organization submitting the proposal. You cannot get past the NIST-1022 form to see the other NIST-1022 “Family of Forms” without entering a legal name in item 2. The legal name entered in this item must be the same as the legal name shown on item 5 of the SF-424 (R&R). If this is a joint venture proposal the lead company name must appear in item 2 of the NIST-1022 form. The joint venture members should be identified on the NIST-1022A form “Other Joint Venture Members.”

3. Select Proposal type by clicking the box next to Single Company or Joint Venture. Once the appropriate proposal type is clicked, the applicable Budget Narrative and Multi-Year Budget forms will be generated corresponding to the answer given, as well as the NIST-1022A form, which must be completed if Joint Venture is clicked.

4. Select lead organization type from the drop down box.

5. Enter the number of years and months for the duration of this project. The answer to this question will impact the Budget Narrative and Multi-Year Budget forms generated.

6. Select “Yes” or “No” from the drop down box as appropriate. Selecting “Yes” will generate the NIST-1022B form, which must be completed if contractors and/or subrecipients are used on the project.

7. Select “Yes” or “No” from the drop down box as appropriate. Selecting “Yes” will generate the NIST-1022G form, which must be completed.

8. Select “Yes” or “No” as appropriate. Selecting “Yes” requires an explanation in the text box that will pop up.

9. Select “Yes” or “No” as appropriate. Selecting “Yes” requires an explanation in the text box that will pop up.

10. Select “Yes” or “No” from the drop down box as appropriate. Selecting “Yes” will generate the NIST-1022H form, which must be completed.

11. Select “Yes” or “No” as appropriate. Selecting “Yes” requires an explanation in the text box. If the company is delinquent on any federal debt, including the Internal Revenue Service (IRS), provide the amount of the debt, the name of the federal agency to which the debt is owed, how old the debt is, the circumstances surrounding the establishment of the debt, and why the debt has not been paid.

12. Select “Yes” or “No” as appropriate. Note that in-kind contributions can only come from third parties. Selecting “Yes” requires an explanation in the text box. Selecting “Yes” will generate the NIST-1022D form, which must be completed.

13. Enter a nonproprietary proposal abstract of the proposed work in the text box provided. As part of the abstract, include a statement of the technical problem addressed in the proposal. The text box is limited to the visible space in the box.

14. The authorized company representative who certifies the form must have delegated fiduciary authority. By checking this box the company representative agrees to the certification on item 17 of the SF-424 (R&R) form, certifies the commitment of cost sharing, and attests to the accuracy of the proposal. The certification also signifies that the company representative has coordinated with top management within their own company and if a joint venture, with all companies/organizations identified as joint venture members about their commitment and cost sharing to the proposed project.

IMPORTANT REMINDER: When the Show Next Forms button at the bottom of this form is clicked, items 3 and 5 are “locked” and the required applicable forms are generated for completion. They can be unlocked but this will cause the loss of forms previously generated and data entered. For example, when item 3 Proposal Type is clicked as a “Single Company,” the applicable NIST-1022C form and NIST-1022E form are automatically generated. If “Joint Venture” is clicked, the NIST-1022A form, the applicable NIST-1022C form, and the NIST-1022F form are automatically generated.

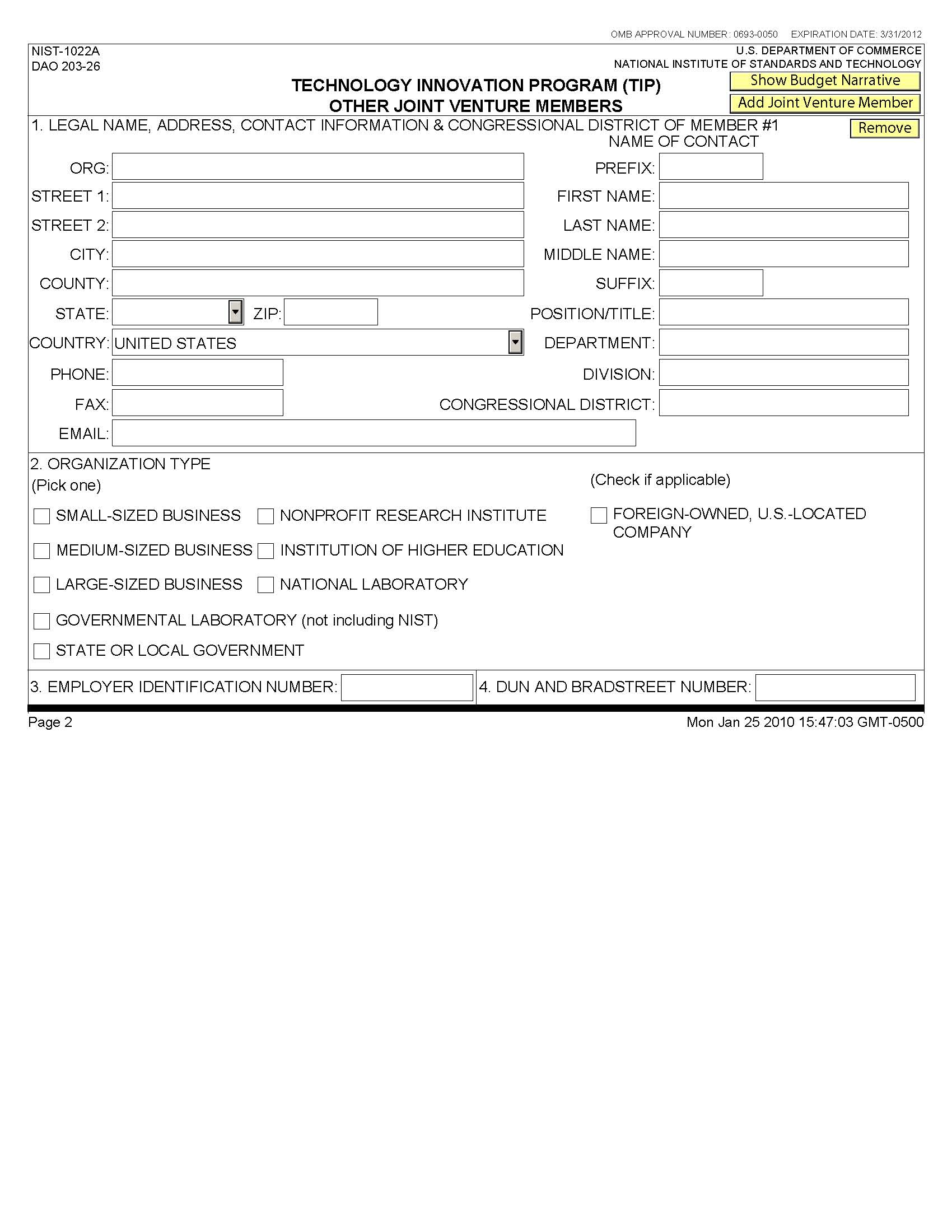

Instructions for Filling Out the NIST-1022A Form

“Other Joint Venture Members”

This form must be submitted with each joint venture proposal to identify specific information on each joint venture member (excluding the organization submitting the proposal since that information is provided on the NIST-1022 form “TIP Proposal Information Sheet.”)

Once item 3, Proposal Type, of the NIST-1022 form, is clicked as a Joint Venture, the NIST-1022A form “TIP Joint Venture Members” is automatically generated. You must then enter data for each joint venture member. To generate additional pages of the NIST-1022A form, click the "Add Joint Venture Member" button after data is entered for a joint venture member.

IMPORTANT: After completing data for all joint venture members, you MUST then click the “Show Budget Narrative” button in order to generate NIST-1022C form(s).

Reminder: Once you click on the “Show Budget Narrative" button, you cannot add or delete Joint Venture members until you purge all data by clicking on the "Unlock Items 3 and 5" button found on the NIST-1022 form. This will reset the forms and ALL information/data previously entered on the NIST-1022A through NIST-1022H forms WILL BE LOST and will have to be reentered. Therefore, if there is any doubt about the number of joint venture members, delay generating and completing the NIST-1022C form “Budget Narrative” until this matter is resolved to avoid starting over.

Review all the forms and plan data entry to minimize change so time and data are not lost. It is recommended that you turn off the auto complete feature in your browser if you are using it to complete Adobe forms.

Categories of joint venture members are not adequate identification. For example, do not list a “manufacturing company,” a “university,” or a “hospital.” You must provide the legal name and contact information of each joint venture member. Include only those organizations to be bound by the Joint Venture Agreement. Do not list contractors on this form, as information about proposed contractors should be provided on the NIST-1022B form. Additionally, do not list informal collaborators.

1. Enter the organization's legal name, address, contact information (individual in the organization to be contacted regarding technical portion of the proposal), and Congressional District (home office). DO NOT USE A POST OFFICE BOX.

2. Self-explanatory.

3. Enter the joint venture member’s employer identification number (EIN). For instructions on how to obtain an EIN, see http://www.nist.gov/tip/helpful.html.

4. Enter the joint venture member’s Dun and Bradstreet (D&B) number. For instructions on how to obtain a D&B number, see http://www.nist.gov/tip/helpful.html.

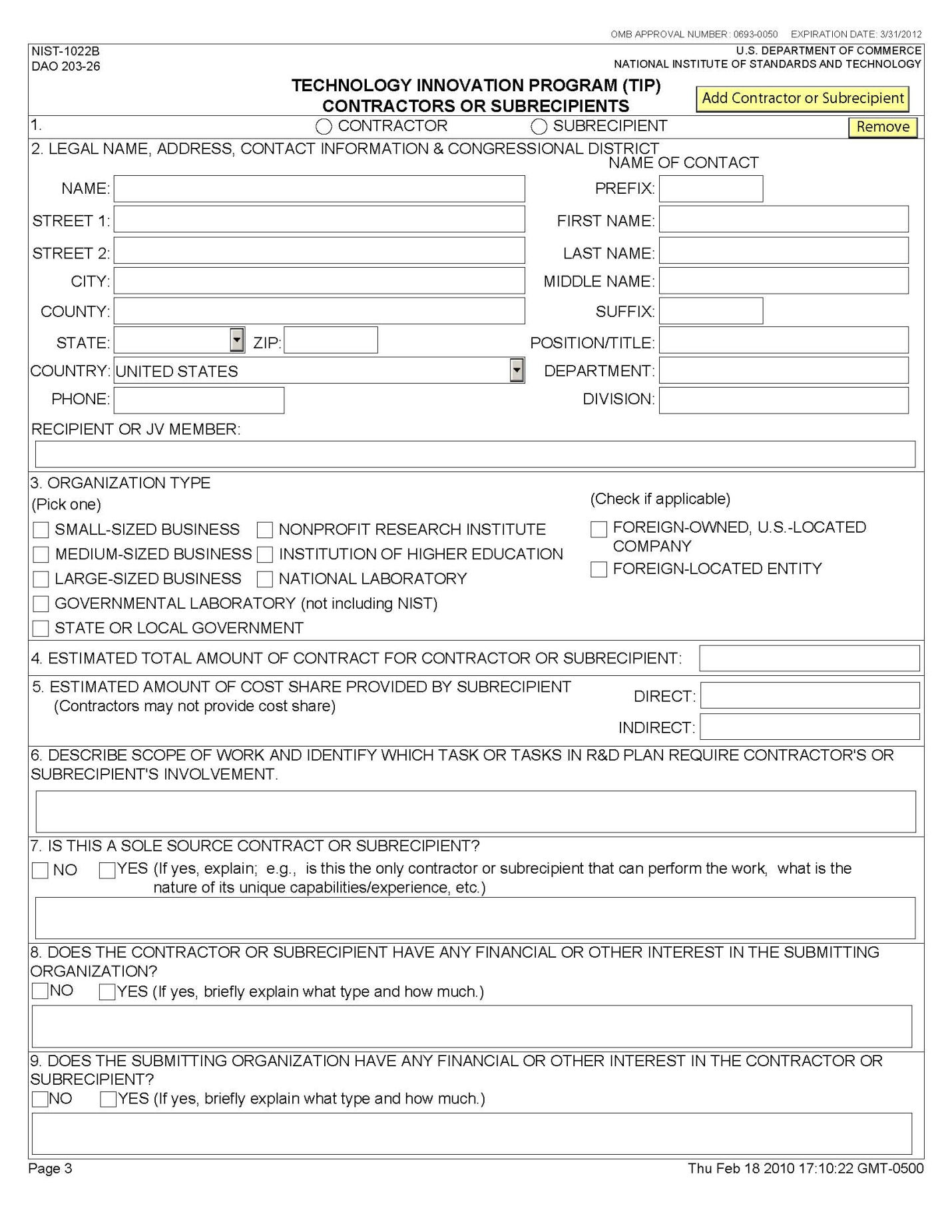

Instructions for Filling Out the NIST-1022B Form

“Contractors or Subrecipients”

A NIST-1022B form is needed for each contractor and/or each subrecipient involved in the project. Select the type of arrangement involved and fill out the required information. To generate another NIST-1022B form for another entity, click on the Add Contractor or Subrecipient button.

Self explanatory. If a contractor’s or subrecipient’s identity is undetermined, enter “Undetermined” in the NAME box. For a contractor, enter the name of the recipient or JV member that will engage the contractor. For a subrecipient, enter the name of the recipient or joint venture member that will issue the subaward to the “subrecipient.”

Click the appropriate box to identify the contractor’s or subrecipient’s type of organization. Also click the appropriate box if foreign-owned or foreign-located.

Enter the total amount of the contract or subaward. This is the amount of funds that the contractor or subrecipient will receive over the life of the TIP award.

If the subrecipient will be providing funds that go towards the recipient’s cost share requirement, enter the total amount of cost share funds to be provided over the life of the TIP award that go towards covering the recipient’s direct and/or indirect costs.

Briefly describe the scope of work and identify which task(s) in the R&D plan will be performed by the contractor or subrecipient.

Click the appropriate box to identify if the contractor or subrecipient will be selected on a sole source basis. Contractors or subrecipients should be selected on a competitive basis pursuant to the Procurement Standards in 15 CFR Part 14.

If the contractor or subrecipient is to be selected on a sole source basis, provide a brief justification for selection on a noncompetitive basis. In writing a sole source justification, be sure to refer to the Procurement Standards in 15 CFR Part 14 and address basis for selecting noncompetitively.

If the contractor or subrecipient has any financial or other interest in the submitting organization or if a joint venture, in any joint venture member, briefly explain what type and how much.

If the submitting organization or if a joint venture, any joint venture member, has any financial or other interest in the contractor or subrecipient, briefly explain what type and how much.

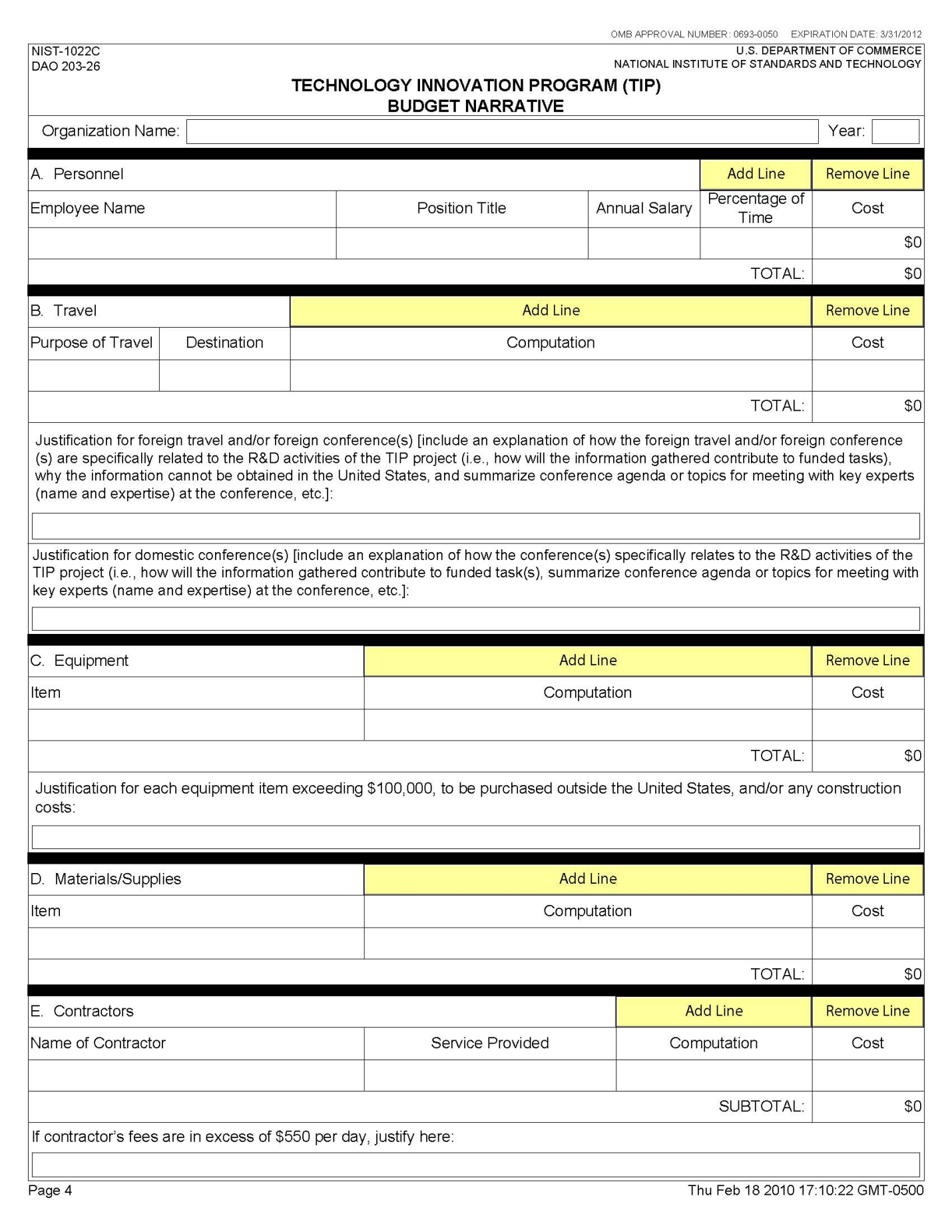

Instructions for Filling Out the NIST-1022C Form

“Budget Narrative”

The Budget Narrative is used to determine reasonableness and allowability of costs in a TIP proposal. Proposed costs must be reasonable, allocable, and allowable in accordance with applicable federal cost principles and TIP guidelines. All figures must be rounded to the nearest dollar.

A Budget Narrative is required for each year of the project and for each joint venture participant, if a joint venture. Note that the data entered in the NIST-1022C form is populated automatically into the Section 1 of the NIST-1022E form “Estimated Multi-Year Budget – Single Company” or the NIST-1022F form “Estimated Multi-Year Budget – Joint Venture.”

As previously mentioned, the program automatically generates the appropriate number of NIST-1022C forms for each organization and each year of the project specified. For each NIST-1022C form generated, enter the following budget and source of funds data for the organization and year indicated at the top of the form.

A. Personnel. List each employee’s name, if available, position title, annual salary, and percentage of time (up to a 3 digit whole number, e.g., “100” for 100%, “75” for 75%, or “5” for 5%) to be devoted to the project. The total personnel cost will be calculated automatically. Compensation paid for employees must be consistent with that paid for similar work within the proposer’s organization and similar positions in related markets. Escalation rates for the out-years should be reasonable.

If unable to identify all of the personnel to be assigned to the project, state “To be determined” or “TBD” for each such employee under “Employee Name.” Use generic position titles such as “senior chemical engineer.” Nonemployees of the organization such as consultants and temps should NOT be included in this category; they should be included in Section E “Contractors.” Employees who are considered indirect labor should not be included as direct personnel costs.

B. Travel. Provide best estimates of essential travel under project. For each trip, provide purpose of travel, destination, computation and cost. Computation must include airfare, lodging, M&IE, and number of people per trip. For example your computation might look like this:

[air$1000 + (hotel$175 + M&IE$64) x 2 days] x 2 people + car$150.

C. Equipment. Identify each item of equipment, computation (i.e., cost per item multiplied by number of items), and cost. In addition, be sure the need for the equipment is clearly stated in the technical plan. Any equipment item exceeding $100,000, purchases outside the U.S., and/or any construction costs must be clearly identified and requires a strong justification.

D. Materials/Supplies. Provide a breakdown of each item/type of expendable materials/ supplies, computation (i.e., item multiplied by number of items), and cost. Office supplies, e.g., paper, pens, toner cartridges, etc., are normally included in indirect costs and should not be budgeted as direct costs. If they are not included in indirect costs, they must be used exclusively for the TIP project, and a justification and explanation must be provided.

E. Contractors. For each contractor identified on the NIST-1022B form, enter the name, if known, service to be provided, the fee computation (i.e., hourly or daily fee [8-hour day] multiplied by estimated time on the project) and cost. If contractor fees are in excess of $550 per day, provide a justification. Enter any additional contractor expenses (e.g., travel, licensing, etc.), computation and cost.

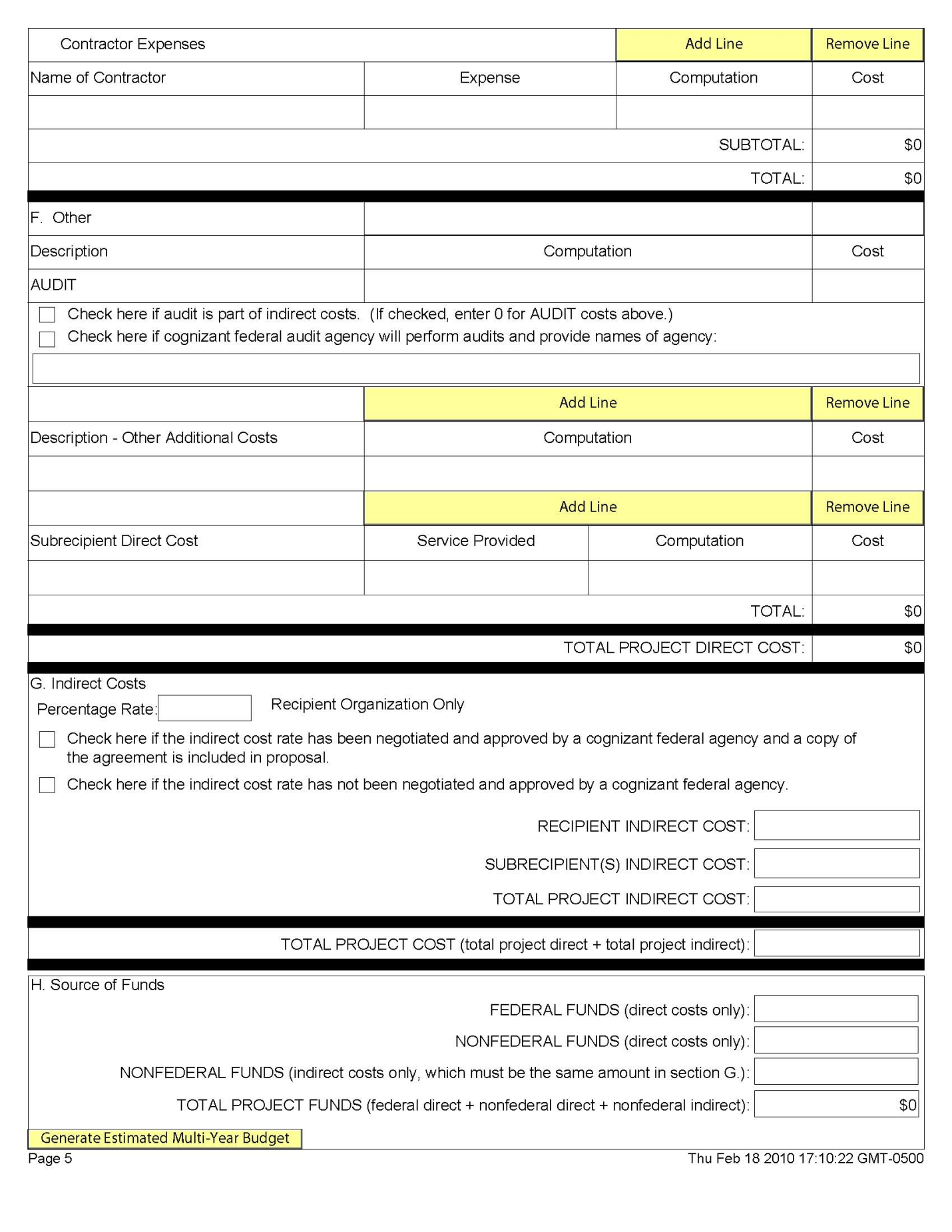

F. Other. Describe in detail any other direct costs that do not fall within the direct cost categories above, computation (i.e., cost per item multiplied by number of items), and cost. Project audit costs should be included in this category unless it is part of the indirect costs or to be performed by a cognizant federal audit agency, e.g., DCAA. If it is part of indirect costs or to be performed by a cognizant federal audit agency, indicate it as such. Other costs might include fees, licensing expenses, fringe benefits, third party in-kind contributions and subrecipient direct costs.

For third party in-kind contributions, list each contribution, the method of valuation (under computation) and cost as it appears in the related NIST-1022D form “Third Party In-Kind Contributions.”

For subrecipient direct costs, enter the name of each subrecipient, the direct cost service to be provided, computation (e.g., hourly or daily fee [8-hour day] multiplied by estimated time on the project) and the subrecipient’s annual direct cost charged to the project.

Once direct costs are entered, the program will automatically calculate the Total Project Direct Cost for this organization and this year.

G. Indirect Costs. Specify the recipient’s current indirect cost rate(s) and annual indirect cost. Also indicate if a copy of a negotiated indirect cost rate agreement by a cognizant federal agency is included in your proposal. If an indirect cost rate has not been established by a cognizant federal agency, check the appropriate box.

If a subaward is issued, enter the subrecipient’s annual indirect cost charged to the project.

Once indirect costs are entered, the program will automatically calculate the Total Project Indirect Cost for this organization and this year.

The program will then automatically calculate the Total Project Cost (Total Project Direct Cost + Total Project Indirect Cost) for this organization and this year.

H. Source of Funds. Identify the source of project cost share funds associated with this organization and this year.

Enter the total annual amount of FEDERAL funds requested from TIP to cover direct costs only. Note that FEDERAL funds cannot be used to cover indirect costs.

Enter the total annual amount of NONFEDERAL funds provided by the proposer to cover direct costs. Note that any third party in-kind contributions should be included as part of NONFEDERAL funds (direct cost only).

Enter the annual amount of NONFEDERAL funds provided by the proposer to cover indirect costs.

The total annual project funds will then be calculated as the sum of FEDERAL funds for direct costs, NONFEDERAL funds for direct costs (if any), and NONFEDERAL funds for indirect costs.

Note that proposals that fail to identify both Federal and Nonfederal funds for each year of the proposed project will be considered unresponsive and incomplete, and may not be considered for funding.

For complex projects with multiple sources of cost sharing, please refer to the examples provided in the Exhibits following this chapter.

Once budgeted costs and sources of funds are entered, the program checks to see if Total Project Cost is equal to Total Project Funds for this organization and this year. If this is not so, a warning flag appears. Adjust cost data and/or source of funds data to equate Total Project Cost to Total Project Funds.

IMPORTANT: Once all budget and source of funds data are entered click on the “Generate Estimated Multi-Year Budget” button at the bottom of the page in order to generate the multi-year NIST-1022E form for Single Company proposals or the multi-year NIST-1022F form for Joint Venture proposals.

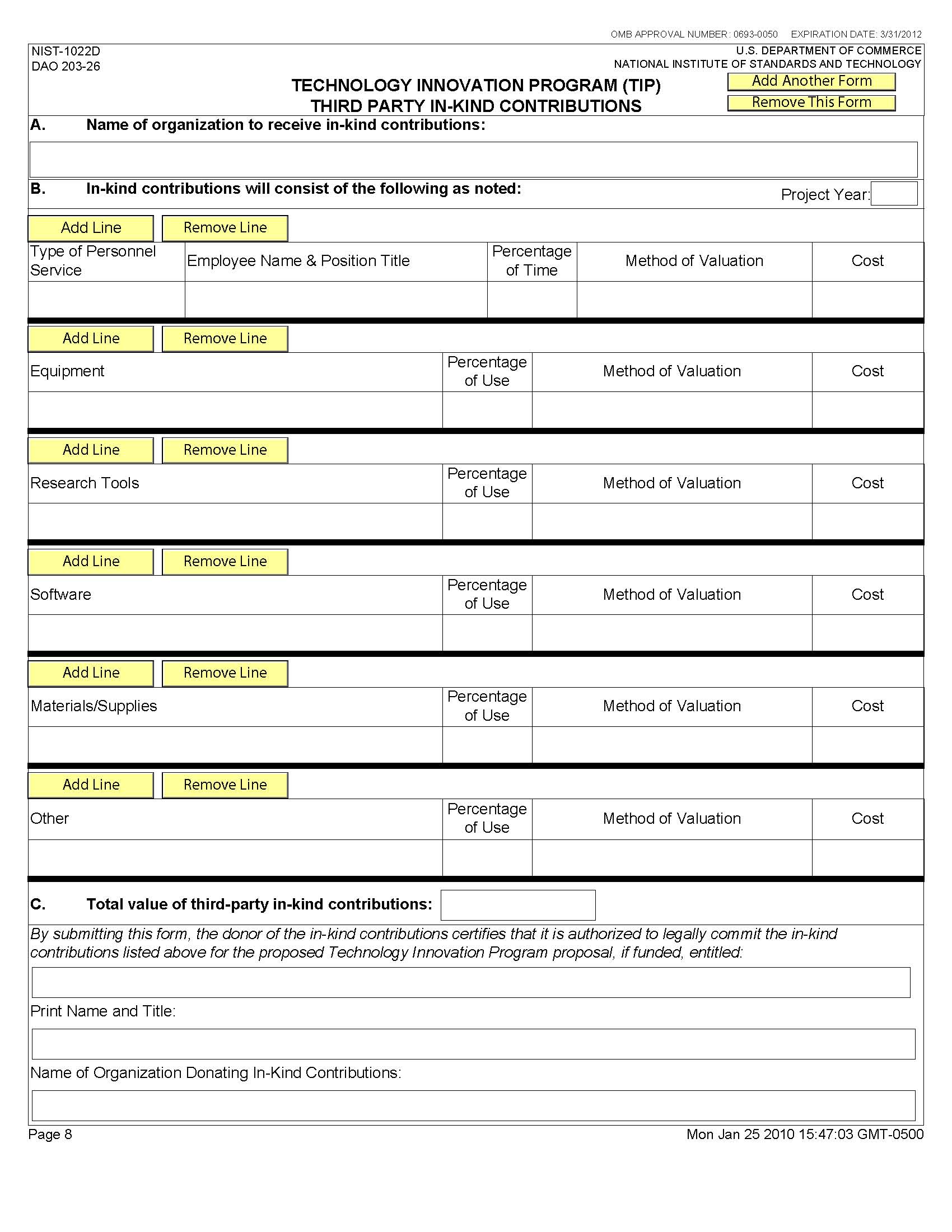

Instructions for Filling Out the NIST-1022D Form

“Third Party In-Kind Contributions”

Third party in-kind contributions include but are not limited to equipment, research tools, software, supplies, and/or services. The value of in-kind contributions shall be determined in accordance with 15 CFR §14.23 and will be prorated according to the share of total use dedicated to the TIP project. Note that in-kind contributions provided by project participants are considered to be cash contributions. Pursuant to §296.10 “Third Party In-Kind Contribution of Research Services”, NIST shall not issue a TIP award to a single recipient or joint venture whose proposed budget includes the use of third party in-kind contribution of research as cost share, and no costs shall be incurred under such a TIP project, until such time as an agreement between the recipient and the third party contributor of in-kind research has been executed by both parties and approved by NIST.

A. Name of organization to receive in-kind contributions. The entity identified in the TIP proposal that will be receiving the third party contributions should be identified here; not the entity that is donating the third party in-kind contributions.

B. In-Kind Contributions. The appropriate type(s) of in-kind contributions, i.e., personnel service, equipment, research tools, software, materials/supplies, or other, must be provided in the appropriate section with the requested information in each column entered. Enter the project year during which these contributions will be received. Fill out one form for each applicable Project Year for each donating organization if there is more than one.

C. Total value of third party in-kind contributions. Enter the sum of the last column (Cost) of each type of third party in-kind contribution.

By submitting this form, the donor of the in-kind contributions certifies that it is authorized to legally commit the in-kind contributions listed on the NIST-1022D form if the project is funded. The title of the TIP proposal, name and title of authorized donor organization official, name of organization donating in-kind contributions must be provided in the spaces indicated.

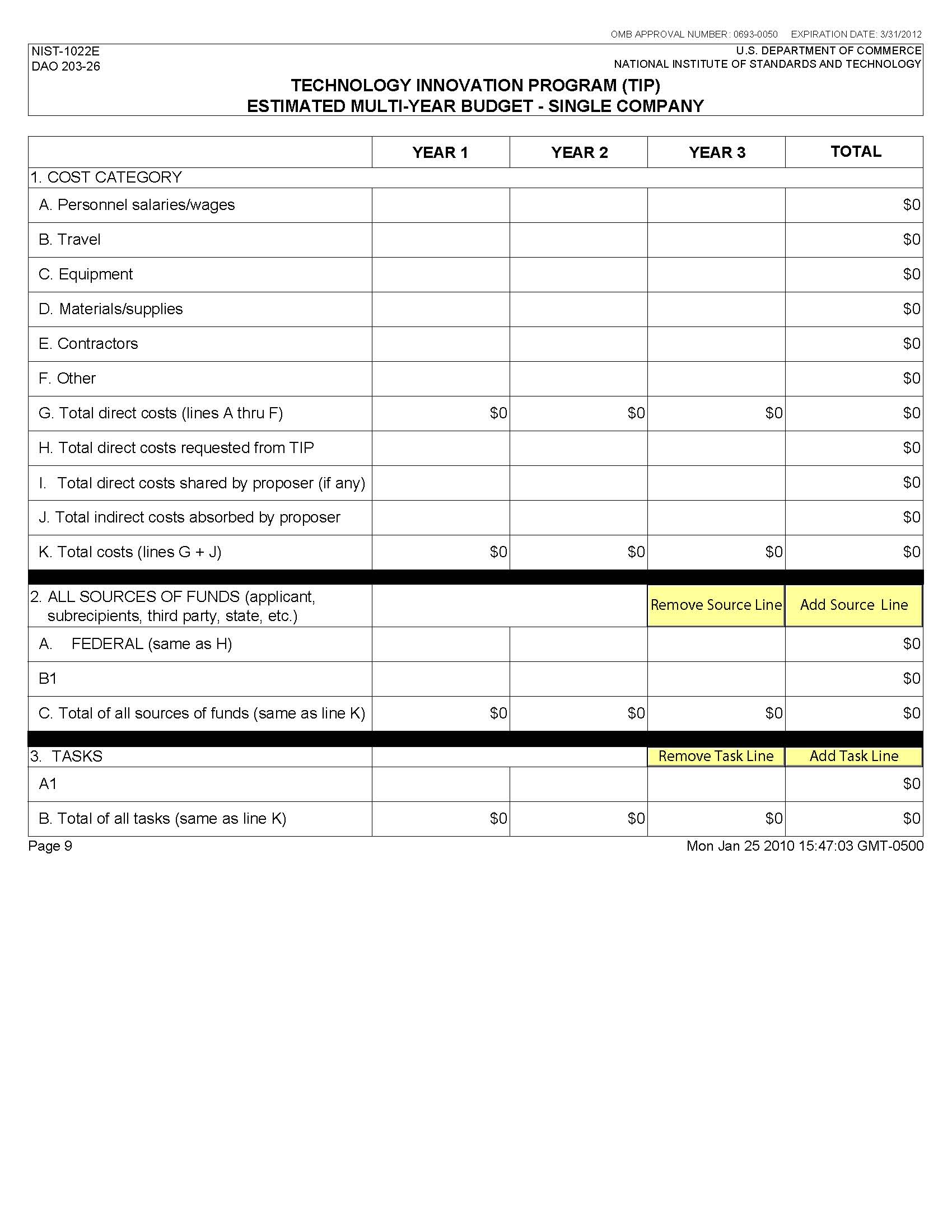

Instructions for Filling Out the NIST-1022E Form

“Estimated Multi-Year Budget – Single Company”

1. COST CATEGORY. The data for Section 1 is populated automatically from previously entered data on the NIST-1022C form “Budget Narrative.” Therefore, no data entry is required for Section 1.

2. ALL SOURCES OF FUNDS. The data for Section 2 must be entered manually and is not populated automatically. List in the leftmost column the names of all sources of funds individually. Line 2.A. is the TIP source of funding that is automatically populated from Section 1.H. of this form, therefore, no data entry is required. Click on the “Add Source Line” button and B.1. will automatically appear below 2.A. Enter the name of the of each nonfederal source of funds, e.g., submitting organization, third party in-kind contributions, state/local government, etc., followed by the source amounts under each column for the appropriate years. Click the “Add Source Line” after each source data is entered until all sources are listed. For example, if there are four nonfederal sources of funds, each source will be identified below line 2.A. as B.1, B.2., B.3., and B.4. The form will allow you to type past the end of the box in the left-most column, but only the visible data will be displayed and printed. Enter short references to sources in the visible part of this form. The last line 2.C. of each column will be computed automatically and must match the total sources in line 1.K.

Note that the appendix to this chapter provides additional information on how to enter sources of funds data for complex projects with multiple sources. Both single company and joint venture examples are included.

3. TASKS. List in the left-most column, beginning with A1, all of the proposed tasks by name, and enter the associated costs in the appropriate rows and columns. (Click the “Add Task Line” button as needed to generate new lines.) Tasks should be a high-level aggregation of subtasks that have costs that can be easily updated as a group on an annual basis. TIP does not prescribe the appropriate number of tasks. Task names and amounts must correspond with those in the Gantt chart in the R&D plan discussion in the proposal.

If Section 2 “ALL SOURCES OF FUNDS” and Section 3 “TASKS” are lengthy and result in the total lines being shifted to second page, be sure to review all totals in Lines 2.C. and 3.B. to ensure that they match the totals on line 1.K.

If changes are made to the NIST-1022C, Budget Narrative, they will not appear on the NIST-1022E form until the data is saved. To insure accurate data, manually save the file before printing or submitting to be sure the changes are reflected on the NIST-1022E form. Check the totals of lines 2.C. and 3.B. to be sure they still match totals in 1.K. after the changes apply.

Data does not update on this form automatically.

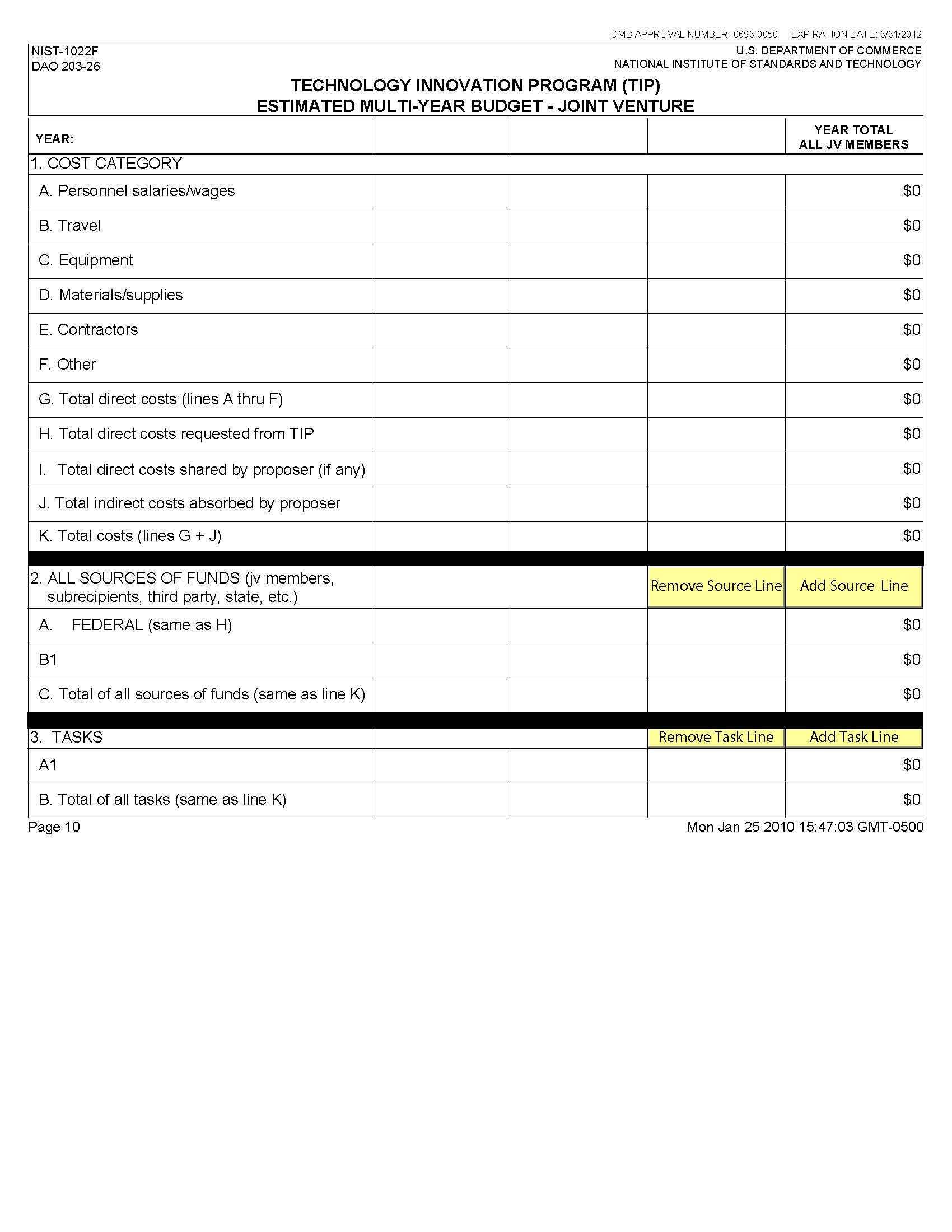

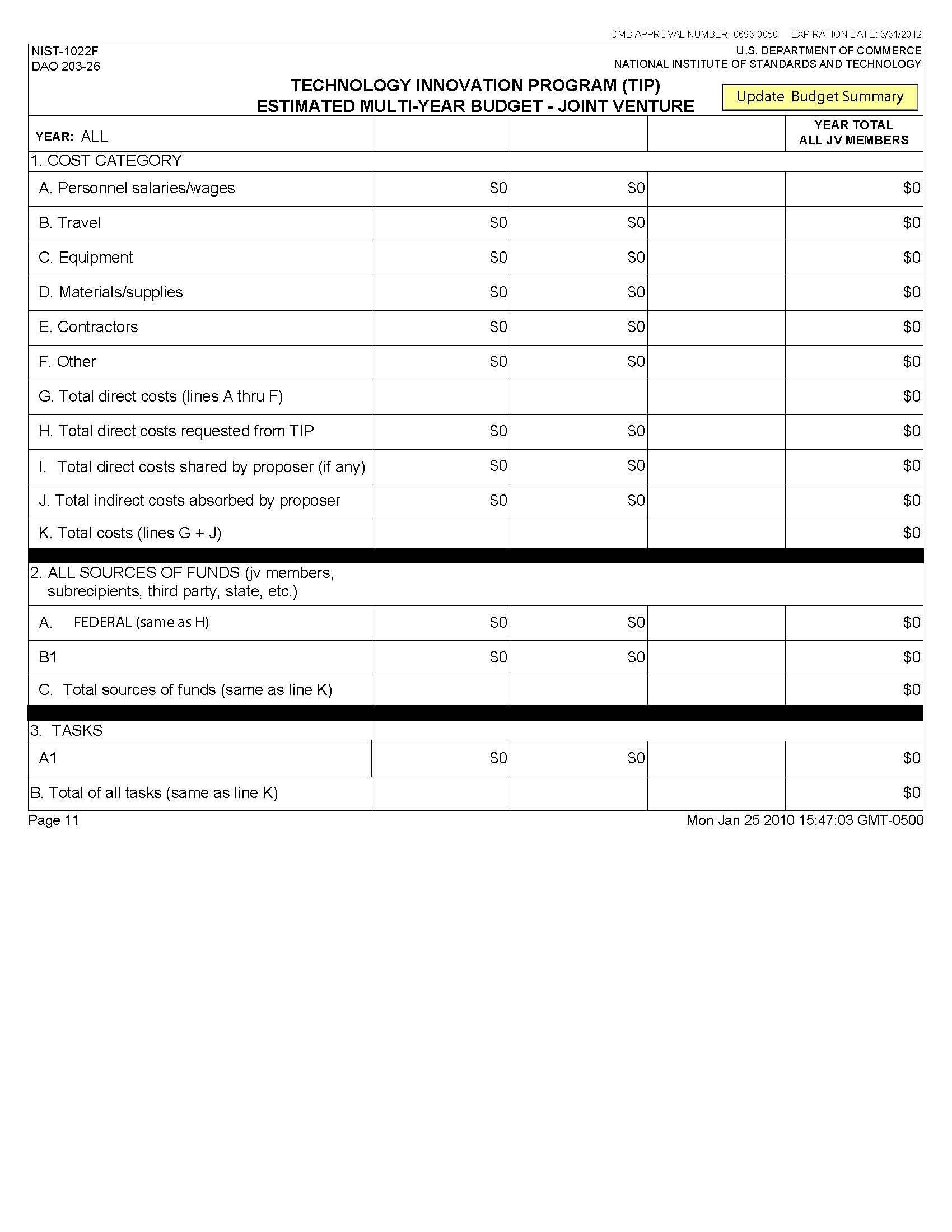

Instructions for Filling Out the NIST-1022F Form

“Estimated Multi-Year Budget – Joint Venture”

Year. A sufficient number of forms will be generated reflecting the information entered on the forms NIST-1022, NIST-1022A, and NIST-1022C. The year will be shown at the top of each form; the first column will be for the submitting organization and the remaining column headings for each year will be populated automatically with the names of each joint venture member beginning with the submitting organization followed in order with the other joint venture members as they appear on the NIST-1022A form “Other Joint Venture Members.”

1. COST CATEGORY. The data for Section 1 is populated automatically from previously entered data on the NIST-1022C form “Budget Narrative.” Therefore, no data entry is required for Section 1.

2. ALL SOURCES OF FUNDS. List in the left-most column the names of all sources of funds individually. Line 2.A. is the TIP source of funding that is automatically populated from Section 1.H. of this form, therefore, no data entry is required. Click on the “Add Source Line” button and B.1. will automatically appear below 2.A. Enter the name of each nonfederal source of funds, e.g., submitting organization, joint venture member, third party in-kind contributions, state/local government, etc., followed by the source amounts under each column for the appropriate joint venture member. Click the “Add Source Line” after each source data is entered until all sources are listed. For example, if there are four nonfederal sources of funds, each source will be identified below line 2.A. as B.1, B.2., B.3., and B.4. The form will allow you to type past the end of the box in the left-most column, but only the visible data will be displayed and printed. Enter short references to sources in the visible part of this form. The last line 2.C. of each column will be computed automatically and must match the total sources in line 1.K.

Note that the appendix to this chapter provides additional information on how to enter sources of funds data for applicants with multiple sources. Both single company and joint venture examples are included.

3. TASKS. List in the left-most column, beginning with A1, all of the proposed tasks by name, and enter the associated costs in the appropriate rows and columns. (Click the “Add Task Line” button as needed to generate new lines.) Tasks should be a high-level aggregation of subtasks that have costs that can be easily updated as a group on an annual basis. TIP does not prescribe the appropriate number of tasks. Task names and amounts must correspond with those in the Gantt chart in the R&D plan discussion in the proposal.

Once all data for each year is entered, a cumulative total page will automatically be generated. The last page(s) of this form will show “ALL” in the Year box and provide a consolidated budget by joint venture member for all years.

IMPORTANT: At the top right side of this form is an “Update Budget Summary” button, which must be pressed to update the consolidated view if changes are made to the NIST-1022C form “Budget Narrative” or the NIST-1022F form “Multi-Year Budget—Joint Venture” after the last save.

If Section 2 “ALL SOURCES OF FUNDS” and Section 2 “TASKS” are lengthy and result in the total lines being shifted to second page, be sure to review all totals in Lines 2.C. and 3.B. to ensure that they match the totals on line 1.K.

If changes are made to the NIST-1022C form, they will not appear on the NIST-1022E form until the data is saved. To insure accurate data, manually save the file before printing or submitting to be sure the changes are reflected on the NIST-1022E form. Check the totals of lines 2.C. and 3.B. to be sure they still match totals in 1.K. after the changes apply.

Data does not update on this form automatically.

Examples: Entering Multiple Sources of Funds

While the NIST-1022 “Family of Forms" were developed to help applicants prepare budgets and budget narratives, they may be confusing to an applicant with multiple sources of funds. Therefore, to help illustrate how the sources of funds should be entered, we propose the following examples that include a simple worksheet for each year of the proposed project and each recipient. In this worksheet (Exhibit A) the sources of funds used to meet project expenses are listed in rows and how the funds are used (i.e., as either direct or indirect costs) are listed in columns. Note that the worksheet in Exhibit A is intended for illustrative purposes only and should not be submitted with the proposal.

Single Company Example

In our example, we assume that a company, Acme, Inc. is preparing a budget for a single company TIP proposal. The proposal requests $3 million from TIP over a three year period. In the first year Acme, Inc. plans to receive $1 million from TIP. These funds are used to cover the project’s direct cost and so the amount is entered on line 1 of our worksheet (Exhibit A) under Direct Cost Contributions.

Acme, Inc. provides $225,000 a year from internal sources to cover direct costs and $400,000 a year from internal sources to cover indirect costs. These amounts are entered on line 2 as shown. Acme, Inc. will also be working with an informal collaborator, Baker International, who agrees to provide $200,000 per year to cover direct costs. This amount is contributed to the project through Acme, Inc. and so it is entered on line 3 under Direct Cost Contributions. Another company, Contributores, Inc., is a third party contributor who agrees to provide a piece of essential machinery to Acme, Inc. This piece of machinery has an annual market value of $200,000 and is entirely dedicated for use on the TIP project. The amount of this contribution is entered on line 4 under Direct Cost Contributions.

With this information we can now fill out Section H “SOURCE OF FUNDS” on Acme, Inc.’s NIST-1022C form for Year 1 as shown in Exhibit B. From our worksheet, “Total Federal Funds Provided” in the first year amounts to $1 million. “Total Nonfederal Funds” used for direct costs only for the first year amounts to $625,000 ($225,000+$200,000+$200,000). “Total Nonfederal Funds” used for indirect costs only for the first year amount to $400,000. The “Total Federal and Nonfederal Funds Provided” is therefore $2,025,000. Note that this amount must also equal the total annual project costs of this project in year 1 which will also appear in Section J of this form.

Once the NIST-1022C form is filled out, a set of NIST-1022F “Multi-Year Budget” forms are generated and automatically populated with the expense data from each of the annual NIST-1022C forms. However, the source of funds data is not automatically entered and must be done so manually.

Using data from the year 1 worksheet, $1 million is entered on Line A for Year 1 on the NIST-1022E form as shown in Exhibit C. Again this is the amount provided by TIP. The name of the recipient, Acme, Inc. is then entered on line B1 along with their Year 1 contribution which is $625,000 ($225,000 direct + $400,000 indirect). The name of the informal collaborator, Baker International is entered on line B2 and $200,000 is entered as their Year 1 contribution. Finally the name of the third party in-kind contributor, Contributores, Inc. is entered on line B3 and $200,000 is entered for their Year 1 contribution. The total amount of Year 1 contributions is $2,025,000 which again equals the total project cost for year 1.

After the first year’s project narrative is prepared, the process is repeated for the remaining two years of this single company proposal. In our example, the completed “ALL SOURCES OF FUNDS” table in Acme, Inc.’s NIST-1022E form appears as follows (Exhibit D):

With the budget and budget narrative complete, the recipient’s cost share can now be calculated. For any point in time, the federal share of the project is calculated by dividing the total amount of federal funds received to date by the total amount of funds from all sources received to date and then multiplied by 100. In our example, the federal share for the entire project is

The proposed project budget in this example is therefore in compliance with TIP’s cost share requirement because single company award recipients must cost share at least 50% of the yearly total project costs (direct plus indirect costs.) The proposer should note that if the budget is accepted and an award made, the proposer will be responsible for maintaining the project’s annual cost share ratios throughout the life of the award.

Joint Venture Example

Entering the source of funds for a joint venture proposal can also be simplified using the same worksheet for each member of the joint venture in each year of the proposal. In our joint venture example, we assume that two eligible companies, Xample, Inc. and DeltaEx, LLC have agreed to submit a joint venture proposal that requests $6.5 million from TIP over a five year period.

In the first year Xample, Inc. plans on receiving $600,000 from TIP. These funds are used to cover a portion of their annual direct cost and so they are entered on line 1 of our worksheet under Direct Cost Contributions. Xample, Inc. will provide $300,000 per year to cover direct project costs and $125,000 per year to cover indirect project costs. These amounts are entered on line 2.

To meet their cost share requirement, Xample, Inc. has sought additional funds from two other nonfederal sources. The first source is their JV partner, DeltaEx, LLC. DeltaX, LLC agrees to provide Xample, Inc. an additional $100,000 per year to cover Xample, Inc.’s direct costs and $40,000 per year to help cover Xample, Inc.’s indirect costs. The second source of funds is from iDNK, Inc. who is a subrecipient of a subaward issued by Xample, Inc. In addition to being paid for the work they perform on the subaward, the company iDNK, Inc. agrees to provide an annual contribution of $50,000 to help Xample, Inc. cover their cost share. This annual contribution to Xample, Inc.’s cost share is then entered on line 3.

From our worksheet we see that the total amount of federal funds provided by TIP to Xample, Inc. in Year 1 is $600,000 and the total amount of nonfederal funds is $615,000 ($450,000 for direct costs and $165,000 for indirect costs.) This information can now be entered into Xample, Inc.’s NIST-1022C form as show in Exhibit F.

Once a NIST-1022C form is filled out for each of the joint venture members and for each year of the project, a set of NIST-1022F “Multi-year budget” forms are generated. These forms show the annual budget data for each member of the joint venture. Note that when these forms are generated, expense data from the NIST-1022C form is automatically entered on the NIST-1022F form. However, the source of funds data must be entered by manually.

To do this we take data from Xample, Inc.’s worksheet and enter it in Section 2 “ALL SOURCES OF FUNDS” under the column for Xample, Inc. As show in Exhibit F, on line A enter $600,000 to identify the funds that come from TIP. On line B1 enter the name “Xample, Inc.” and the amount $425,000 ($300,000 direct plus $125,000 indirect.) On line B2 enter the name “DeltaEx, LLC” and their total contribution to Xample, Inc. of $140,000 ($100,000 direct plus $40,000 indirect.) On line B3 enter the name “iDNK, Inc. (Subrecipient)” and their contribution of $50,000.

To simplify matters, we will assume that similar worksheets are prepared for DeltaEX, LLC and that in Year 1 the total amount of federal funds provided by TIP to DeltaEX, LLC is $700,000 and the total amount of nonfederal funds provided by DeltaEx, LLC is $750,000. These amounts are then entered on line A and line B2 under the column for DeltaEx, Inc.

After the first year’s project narrative is prepared, the process is repeated for the remaining years of this five year joint venture proposal. In our example, the completed “ALL SOURCES OF FUNDS” table in the NIST-1022E form appears as follows (Exhibit G):

With the budget and budget narrative complete the recipient’s cost share can be calculated. For any point in time, the federal share of the project is calculated by dividing the total amount of federal funds received to date by the total amount of funds from all sources received to date and then multiplying by 100. In our example, the federal share for the entire project is

The proposed project budget in this example is therefore in compliance with TIP’s cost share requirement because joint venture award recipients must cost share at least 50% of the yearly total project costs (direct plus indirect costs.) The proposers should note that if the budget is accepted and an award made, the proposers will be responsible for maintaining the project’s annual cost share ratios throughout the life of the award.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Administrator |

| File Modified | 0000-00-00 |

| File Created | 2021-02-03 |

© 2026 OMB.report | Privacy Policy