FSA-2236 Guaranteed Loan Closing Report

Guaranteed Farm Loan Programs

FSA2236FMIform and instruction (2)[1]

Guaranteed Farm Loan Programs

OMB: 0560-0155

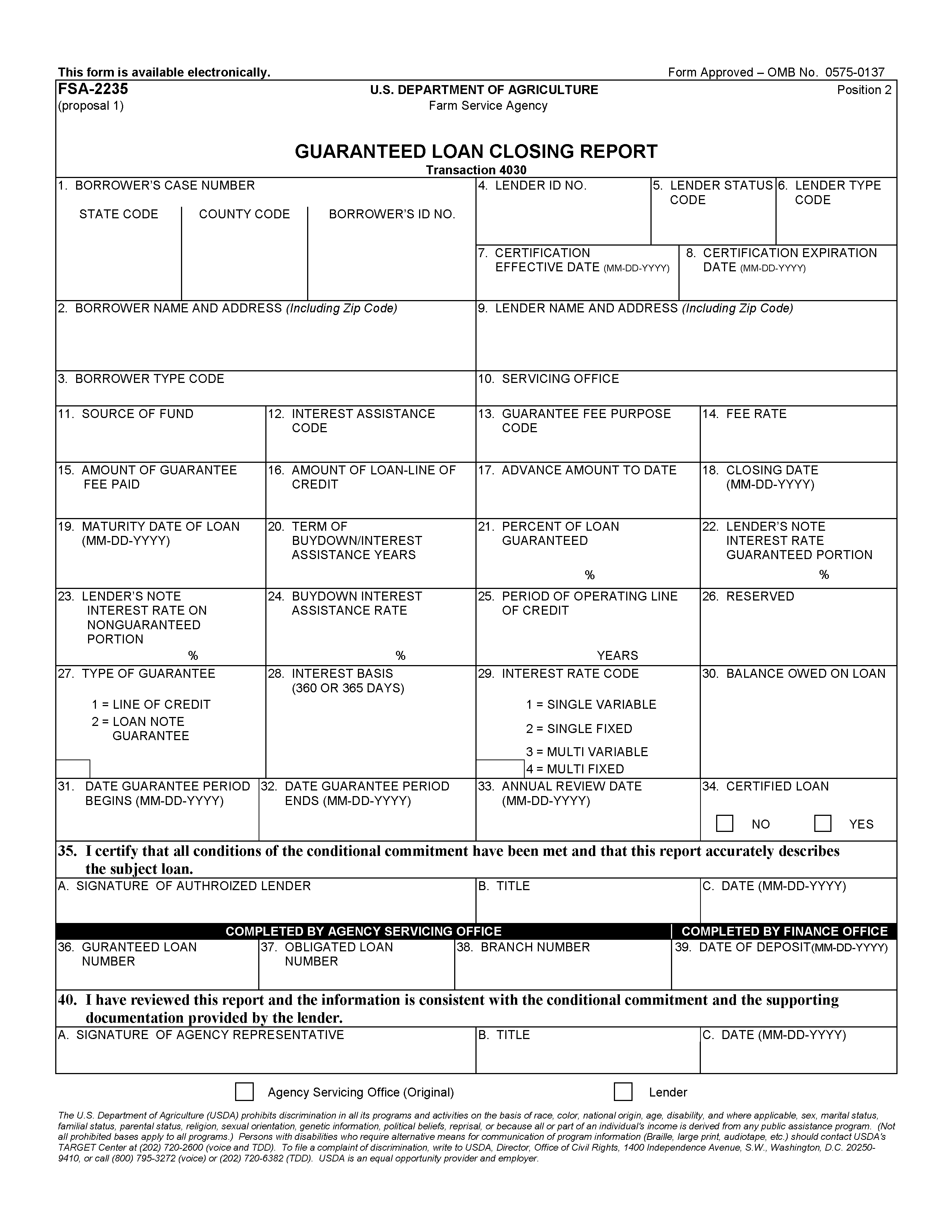

FORMS MANUAL INSERT FORM FSA-2235

Used by lenders for

(1) each loan at the time the guarantee is issued, (2) conversion of an existing guaranteed loan to one with interest assistance, (3) payment of guaranteed loan fees, and (4) consolidation of guaranteed loans. The Guaranteed Loan Closing Report must accompany all guarantee fee payments.

PROCEDURE FOR PREPARATION : RD Instructions 1951-B, 1980-D, 1980-E, 4279-B,

HB-1-3565, RUS transferred 1980-A, and FSA handbook 2-FLP.

PREPARED BY : Lender with assistance from Agency.

NUMBER OF COPIES : Original and one copy.

SIGNATURE REQUIRED : Lender and Agency official.

DISTRIBUTION OF COPIES : Original to Agency servicing official and a copy retained by lender.

GLS TRANSACTION : Add Loan Closing

INSTRUCTIONS FOR PREPARATION

Lenders complete Items 1 through 35.

Fld Name / |

Instruction |

1 Borrower’s Case Number |

Enter Borrower’ s Case Number. Show the state and county code and the borrower’ s Social Security or Internal Revenue Service Tax Identification Number. |

2 Borrower’s Name and Address |

Enter Borrower’ s Name and Address. |

3 Borrower Type Code |

Enter applicable Borrower’ s Type Code. Example:

1 = Individual 2 = Corporation 3 = Proprietorship 4 = Cooperative 5 = Public Body 6 = Partnership 7 = Other 8 = Indian Tribe 9 = Trust 10 = Limited Partnership 11 = Association of Farmers 12 = Organization of Farm Workers 13 = Joint Operation |

4 Lender ID No. |

Enter the lender’ s Internal Revenue Service Tax Identification Number. |

5 Lender’s Status Code |

Enter the applicable Lender Status Code. Example:

1 = Approved – no longer have 2 = Eligible 3 = Certified 4 = Preferred |

6 Lender Type Code |

Enter the applicable Lender type Code. Example:

1 = Commercial Bank 2 = Mortgage Loan Co. 3 = Insurance Co. 4 = Production Credit 5 = Federal Land Bank 6 = Credit Union 7 = Savings & Loan 8 = Banks for Coops 9 = Small Business Investment Co. 10 = Broker 11 = Other 12 = Non-Traditional |

7 Certification Effective Date |

Enter the date the lender’ s certification became effective. Completed only if Lender’ s Status Code (Item 5) is 3. |

8 Certification Expiration Date |

Enter the date the lender’ s certification expires. Completed only if Item 7 is valued. |

9 Lender Name and Address |

Enter lender Name and Address. Enter name(s) and address on separate lines. Enter the city, state, and zip code on the same line abbreviating the state to two characters. Do not skip lines. |

10 Servicing Office |

Enter the applicable Agency Servicing Office. Form FSA-2235 (Rev. XX-XX-XXXX). |

11 Source of Fund |

Enter the applicable Source of Funds code. Example:

1 = New Guaranteed Loan (includes all loan types) 2 = Reserved (used for Direct Loan programs) 3 = Reserved 4 = Reserved 5 = Consolidation of Guaranteed Loans Without Interest Assistance 6 = New Guaranteed Farm Loan Program Loan (FLP) with Interest Assistance 7 = FLP Interest Assistance Only 8 = New Guaranteed SFH Loan with Interest Assistance

New Guaranteed B&I Loan with Interest Rate Buydown. |

12 Interest Assistance Code |

Enter the applicable Interest Assistance code. Used for Single Family Housing loans only. Example 1:

1 = Eligible for Interest Assistance Program 2 = Ineligible for Interest Assistance Program

NOTE: Only enter 2 if the borrower does not qualify for the Interest Assistance Program at the time of loan closing, and the borrower will not be eligible for interest assistance during the remaining life of the loan. You should enter 1, if the borrower is eligible to participate in the Interest Assistance Program even though he may not be receiving interest assistance at the time of loan closing. |

13 Guarantee Fee Purpose Code |

Enter the Guarantee Fee Purpose Code. Leave blank if Source of Funds code (Item 11) is input as 7 (FLP Interest Assistance Only).

1 = Substitution 2 = Extension 3 = Initial Closing Fee 4 = Second Half Payment 5 = Consolidation (No Fee on Consolidated Loans) 6 = Reserved 7 = Initial Closing—No Fee

NOTE: If consolidating loans (Item 13 equals 5), all loans must be closed. This form will not close and consolidate loans at the same time.

|

14 Fee Rate |

Enter 4.0 if the guarantee fee purpose code equals 6 (Item 13). Otherwise, leave blank. Example: 1 1/12 percent = 0 1 5 0 0. |

15 Amount of Guarantee Fee Paid |

Enter amount of Guarantee Fee to be Paid with this report.

Examples of the computations for each Guaranteed Fee Purpose Code (Item 13) are given below:

Item 13 equals 1 (Substitution)

Balance Owed on loan (Item 30) 46,928.52 Percent of Guarantee (Item 21) x.90 Total 42,235.67 One Percent x.01 Guarantee Fee 422.36

Item 13 equals 2 (Extension)

The guarantee fee should equal 1/2 of 1 percent of the principal balance on the loan if maturity date is 1 year or less. The guarantee fee should equal 1 percent if the maturity date is greater than 1 year with the option that 1/2 of the fee may be paid as of the date of the Extension (Renewal) and second half payable in a single installment within 1 year and 10 days.

Loan Maturing In 1 Year Or Less:

Balance owed on Loan (Item 30) 46,928.52 1/2 of One Percent x.005 Guarantee Fee 234.64

Loan Maturing In More Than 1 Year:

Balance owed on Loan (Item 30) 46.928.52 One Percent x.01 Guarantee Fee 469.29 Item 13 equals 3 (Initial Closing)—The guarantee fee should equal the guarantee rate multiplied by the guaranteed portion of the loan. Example:

Amount of Loan (Item 16) 50,000.00 Percent of Guarantee (Item 21) x.90 Total 45,000.00 One Percent x.01 Guarantee Fee 450.00

Item 13 equals 4 (Second Half Payment)

The guarantee fee is the second 1/2 of the extension payment. Computations to check this are not necessary.

Item 13 equals 5 (Consolidation)

There is no fee required. Leave Item 15 blank.

Item 13 equals 7 (Initial Closing—No Fee)

There is no fee required. Leave Item 15 blank. |

16 Amount of Loan-Line of Credit |

Enter the amount of loan as follows:

(A) Enter the full amount of the loan for new loans or for new loans with buydown or interest assistance.

(B) Enter the principal balance of an existing loan when establishing interest assistance on an existing loan.

(C) Enter the full amount of an existing line of credit if the interest assistance is established during the period of advances. Otherwise, enter the principal balance. Example:

Original Line of Credit Amount $100,000.00 Length of Loan 7 years Period of Advances 3 years Establishing Interest Assistance in Year 1 enter $100,000.00 Establishing Interest Assistance in Year 2 enter $100,000.00 Establishing Interest Assistance in Year 3 enter $100,000.00 Current Principal Balance in Year 4 $76,450.00 Establishing Interest Assistance in Year 4 enter $76,450.00

NOTE: THE AMOUNT ENTERED IN THIS Item MUST MATCH THE AMOUNT OBLIGATED. |

17 Advance Amount to Date

|

Enter cumulative loan advances as of date of loan closing. If the loan is fully advanced, enter amount of loan. If a line of credit, enter current unpaid principal balance. If no advances have been made, enter 0.00. |

18 Closing Date |

Enter the closing date. The date will be the date of loan for new loans or the effective date of the buydown or interest assistance for existing loans. |

19 Maturity Date of Loan |

Enter the maturity date of the loan. |

20 Term of Buydown/ Interest Assistance Years |

For Farm Loan Program loans with Interest Assistance only, enter the term or length of the Interest Assistance Program in years. Must equal 1 - 10. Leave blank for all other loans. |

21 Percent of Loan Guaranteed |

Enter the percent of loan guarantee as determined by Agency Instructions. |

22 Lender’s Note Interest Rate Guaranteed Portion |

Enter the lender’ s interest rate on the guaranteed portion of the loan prior to any interest rate reduction due to buydown, interest assistance, or subsidy. For Rural Housing loans, enter the note rate. |

23 Lender’s Note Interest Rate on Nonguaranteed Portion |

Enter the rate that will be used to compute the interest charged to the borrower on the non-guaranteed portion of the note prior to any interest rate reduction due to buydown, interest assistance, or subsidy. For Rural Housing Loans, enter the note rate. |

24 Buydown Interest Assistance Rate |

Enter 4.0. |

25 Period of Operating Line of Credit |

For Farm Loan Program Operating Lines of Credit only (Type of Guarantee in Item 27 is input as 1), enter the length of the operating line of credit in years. Must equal 1, 2, 3, 4, or 5. Leave blank if Type of Guarantee in Item 27 is input as 2. |

26 Reserved |

Reserved. |

27 Type of Guarantee |

Enter the applicable type of guarantee. Line of credit loans are coded 1; all others are 2. |

28 Interest Basis |

Enter the interest basis. (number of days: 360 or 365). |

29 Interest Rate Code |

Enter the applicable interest rate code. Multi-rates could involve different interest rates on the guaranteed portion and the non-guaranteed portion of the loan. Example: 1. |

30 Balance Owed on Loan |

Enter the principal balance owed on loan as of substitution or extension date (Item 13 equals 1 or 2). In all other cases leave this Item blank. |

31 Date Guarantee Period Begins |

Enter the ending date of the previous guarantee period if Item 13 equals 2 (Extension). In all other cases leave this Item blank. |

32 Date Guarantee Period Ends |

If Item 13 equals 2, enter the date the guarantee period ends. The guarantee fee period is 1 year for loans repayable in 1 year or less; 3 years for loans for operating purposes repayable in more than 1 year; and 5 years for loans for real estate purposes repayable in more than 1 year.

If Item 13 equals 3, 5, 6, or 7, and the guarantee period is shorter than the length of the loan, enter the date the guarantee period ends. In all other cases, this Item is blank. |

33 Annual Review Date |

Enter the First Annual Review Date on this loan (FLP and SFH Loans with Interest Assistance Only) For Annual Payment loans, this should be the First Annual Payment Due Date. For all other loans, this will be the date established by the lender as being the last day of the first period of interest assistance and will be the date in block 23 in the Interest Assistance Agreement, or Form FSA-2221. This date must be no more than 12 months from the closing date of the note. Once established, all future claims and reviews will be made effective on the anniversary of this date each year. |

34 Certified Loan |

Check “YES” or “NO” to identify whether this is a Certified Loan. |

35A Signature of Authorized Lender

|

Enter the authorized lender’ s signature. THIS FORM WILL BE RETURNED IF IT IS NOT SIGNED. |

35B Title |

Enter the title of the person authorized to sign this form. |

35C Date |

Enter the date signed by the lender’ s representative. |

36 Guaranteed Loan Number |

Enter the loan number from the GLS Add Loan Closing Screen or the GLS Loan View Screen. |

37 Obligated Loan Number |

Enter the obligation loan number. Example: 46/01 (The 01 is the obligation loan number). |

38 Branch Number |

Enter the Agency assigned lender branch number. Verify that this branch number is correct for the name and address shown in Item 9 using the GSA Lender List. |

39 Date of Deposit |

Finance Office will enter the deposit date for corrections to the deposit fund. |

40A Signature of Agency Representative |

Enter the agency representative’s signature |

40B Title |

Enter the title of the agency representative. |

40C Date |

Enter the date signed by the agency’s representative. |

(XX-XX-XX)

FSA PN Issue No. FMI Page

| File Type | application/msword |

| File Title | Used by |

| Author | USDA-MDIOL00000DG8C |

| Last Modified By | Maryann.ball |

| File Modified | 2007-06-07 |

| File Created | 2007-06-07 |

© 2026 OMB.report | Privacy Policy