RM08-2-002 Supp OMBjust.wpdshort

RM08-2-002 Supp OMBjust.wpdshort.doc

Reporting of No Notice by Interstate Pipelines and Scheduled Volumes by Major Non-Interstate Natural Gas Pipelines

OMB: 1902-0243

FERC-551 (Docket No. RM08-2-002)

Final Rule on Rehearing Issued: July 21, 2010

RIN No. 1902-AD49

Supporting Statement for

FERC-551, Reporting of No Notice Service by Interstate Pipelines and Scheduled Volumes by Major Non-Interstate Natural Gas Pipelines

As Proposed In Docket No. RM08-2-002, Order No. 720-B, RIN No. 1902-AD49

(Order on Rehearing Issued July 21, 2010)

The Federal Energy Regulatory Commission (Commission, FERC) is submitting to the Office of Management and Budget (OMB) for review and approval, FERC-551, No Notice Service by Interstate and Scheduled Volumes by Major Non-Interstate Pipelines. The Commission has issued an Order on Rehearing responding to public comments on revisions to the posting requirements contained in FERC-551. FERC-551 amended Part 284 of the Commission’s regulations in order to facilitate market transparency in natural gas markets in a Final Rule, Order No. 720. (See ICR 200908-1902-002). FERC-551 is currently approved through 3/31/2012. Following the issuance of Order No. 720-A, three entities filed with the Commission seeking clarification and/or rehearing of Order No. 720-A. This order further revises these requirements in order to more clearly state the obligations imposed in Order Nos. 720 & 720-A. In response to the requests for rehearing, the Commission has made several revisions. The revisions in this order will not have a significant impact on the Commission’s burden estimates expressed in Order No. 720-A and so the Commission will retain those estimates.

Background

Congress authorized the Commission to mandate additional reporting requirements to improve market confidence through greater price transparency and included in the Energy Policy Act of 2005 (EPAct 2005)1 authority for the Commission to obtain information on wholesale electric and natural gas prices and availability. Under the Federal Power Act2 and the Natural Gas Act3, the Commission has long borne a responsibility to protect wholesale electric and natural gas consumers. EPAct 2005 emphasized FERC’s responsibility for protecting the integrity of the markets themselves as a way of protecting consumers in an active market environment. In particular, Congress directed the Commission to facilitate price transparency “having due regard for the public interest, the integrity of [interstate energy] markets, [and] fair competition.”4 In the new transparency provisions of section 23 of the Natural Gas Act and section 220 of the Federal Power Act, Congress provided that FERC may, but is not obligated to, prescribe rules for the collection and dissemination of information regarding the wholesale, interstate markets for natural gas and electricity, and authorized the Commission to adopt rules to assure the timely dissemination of information about the availability and prices of natural gas and natural gas transportation and electric energy and transmission service in such markets.

Final Rule (Docket No. RM08-2-000), Order No. 720

On November 20, 2008 in Docket No. RM08-2-000 “Pipeline Posting Requirements under Section 23 of the Natural Gas Act” (Order No. 720)5, the Commission required major non-interstate pipelines, (defined as those natural gas pipelines that are not natural gas companies under the Natural Gas Act and deliver more than 50 million MMBtu per year measured in average deliveries over the past three years), to post scheduled flow information and to post information for each receipt and delivery point with a design capacity greater than 15,000 MMBtu per day. The Final Rule also required that interstate pipelines post information regarding no-notice service.

The postings required by Order No. 720 increases price transparency in the interstate natural gas markets by providing information about the supply and demand fundamentals that underlie those markets. In this way, the Commission will meet the goal set forth by Congress in section 23 of the NGA “to facilitate price transparency in markets for the sale or transportation of physical natural gas in interstate commerce,”6 and, at the same time, responded to commenters’ concerns about the potential cost and burden of both interstate and certain major non-interstate pipelines to post capacity, daily scheduled flow information and daily actual flow information.

Order No. 720 expanded the Commission’s existing posting requirements under 18 CFR 284 to require interstate pipelines to post volumes of no-notice service flows at each receipt and delivery point three days after the gas flow. The Commission stated that, without reporting of no-notice service, the market cannot see large and unexpected increases in gas demand and therefore cannot understand price formation during such occasions. The Commission found that reporting such information after the gas flows, as required by Order No. 720, allows market participants to understand historical patterns of flows and will enable them to better predict future no-notice flows, with less of a burden than requiring full posting of actual flows.

Final Rule, Supplemental Notice (Docket No. RM08-2-000)

On July 16, 2009 the Commission issued a supplemental notice seeking additional comments on the posting requirements adopted in Order No. 720 and codified in § 284.14(a) of the Commission’s regulations7. In response to Order No. 720, FERC received 24 requests for rehearing, clarification, or both of Order No. 720. These rehearing requests questioned how §284.14(a) of the Commission’s regulations applies to major non-interstate pipelines that operate with virtual or pooling points instead of, or in addition to, physical metered points.8 Texas Pipeline Association (TPA) also proposed modifications to § 284.14(a) requiring posting only at points where scheduling occurs.9

The Commission also sought supplemental comments to post information for virtual or pooling receipt and delivery points. In addition, the Commission requested comment on whether and how to adopt a proxy for design capacity for physical points for which the design capacity is unknown. To accomplish this, the Commission proposed revisions to § 284.14(a) of the Commission’s regulations to address these issues.

The Commission recognized that a number of major non-interstate pipelines use virtual or pooling receipt or delivery points. Major non-interstate pipelines that schedule gas to virtual or pooling receipt or delivery points play a vital role in markets for the sale or transportation of natural gas in interstate commerce. To this end, the Commission contemplated that, on rehearing, the posting obligation may apply to metered, virtual, or pooling receipt and delivery points on major non-interstate pipelines.

Final Rule on Rehearing (Docket No. RM08-2-001) Order No. 720-A.

In the Order on Rehearing, issued January 21, 2010, the Commission granted and denied requests for rehearing and clarification of Order No. 720. FERC modified its regulations to require major non-interstate pipelines post daily scheduled volume information and other data for certain points. These modifications included a requirement that major non-interstate pipelines post information for receipt and delivery points at which design capacity is unknown.

The Commission denied requests to revise its regulations requiring interstate natural gas pipelines to post information regarding the provision of no-notice service. The posting requirements help to facilitate price transparency in markets for the sale or transportation of physical natural gas in interstate commerce to implement section 23 of the NGA (15 U.S.C. 717t-2).

Final Rule on Rehearing (Docket No. RM08-2-002)

In the Order on Rehearing, issued July 21, 2010, the Commission is granting and denying requests for rehearing and clarification of Order No. 720 & 720A. Specifically, the Commission clarifies its regulations to require major non-interstate pipelines to post daily scheduled volume information and other data for certain points, as well as its regulations requiring interstate pipelines to post information regarding the provision of no-notice service. These modifications include establishing the compliance deadline for major non-interstate pipelines after the effective date of this rule and clarifying the requirement for interstate pipelines to update posted no-notice service volumes. This rule on rehearing on Pipeline Posting Requirements under Section 23 of the Natural Gas Act will become effective 10/1/10.

1. CIRCUMSTANCES THAT MAKE THE COLLECTION OF INFORMATION NECESSARY

With the passage of EPAct 2005, Congress affirmed a commitment to competition in wholesale natural gas and electricity markets as national policy, the fifth major federal law in the last 30 years to do so.10 As part of this commitment to competition, in the transparency provisions, Congress charged the Commission with assuring the integrity of the wholesale markets and assuring fair competition by facilitating price transparency in those markets. It also significantly strengthened the Commission’s regulatory tools in the transparency provisions, specifically, in section 220 of the Federal Power Act and section 23 of the Natural Gas Act.

In section 23(a) (1) of the Natural Gas Act, Congress provided the Commission’s mandate:

The Commission is directed to facilitate price transparency in markets for the sale or transportation of physical natural gas in interstate commerce, having due regard for the public interest, the integrity of those markets, fair competition, and the protection of consumers.11

In section 23(a) (2) of the Natural Gas Act, Congress left to the Commission’s discretion whether to enact rules to carry out this mandate and provided that any rules implementing the transparency provisions provide for public dissemination of the information gathered:

The Commission may prescribe such rules as the Commission determines necessary and appropriate to carry out the purposes of this section. The rules shall provide for the dissemination, on a timely basis, of information about the availability and prices of natural gas sold at wholesale and in interstate commerce to the Commission, State commissions, buyers and sellers of wholesale natural gas, and the public.12

In section 23(a)(3) of the Natural Gas Act, Congress contemplated that the transparency provisions would differ from other provisions in the Natural Gas Act, both as to the entities covered by the Commission’s jurisdiction and the possible involvement of third parties in implementing the rules. That section reads, with emphasis added:

The Commission may –

(A) obtain the information described in paragraph (2) [i.e., information about the availability and prices of natural gas sold at wholesale and interstate commerce] from any market participant; and

(B) rely on entities other than the Commission to receive and make public the information, subject to the disclosure rules in subsection (b).13.

By using the term “any market participant,” Congress deliberately expanded the universe subject to the Commission’s transparency authority beyond the entities subject to the Commission’s rate and certificate jurisdiction under other parts of the Natural Gas Act. The term “market participant” is not defined in the Natural Gas Act and is not on its face limited to otherwise jurisdictional entities.

Congress could have limited the scope of entities subject to the Commission’s transparency authority by referring to “natural gas company” as defined in the Natural Gas Act14 or by referring to sections 1, 3, or 7 of the Natural Gas Act15. The former approach would have excluded intrastate pipelines from the Commission’s transparency authority. The latter approach would have entailed the jurisdictional limitations of those sections, which exclude from the Commission’s jurisdiction first sales, sales of imported natural gas, sales of imported liquefied natural gas, and sales and transportation by entities engaged in production and gathering, local distribution, “Hinshaw” pipelines, or vehicular natural gas.16 These limitations do not apply to the Commission’s transparency authority. Given Congress’ use of the term “market participant,” the Commission’s transparency authority includes any person or form of organization, including, for instance, natural gas producers, processors and users.

The Commission’s authority to obtain information from “any market participant” is not plenary. In the natural gas transparency provisions, Congress limited that authority in two respects: the scope of the markets at issue and the type of information to obtain and disseminate. First, Congress directed the Commission to “facilitate price transparency in markets for the sale or transportation of physical natural gas in interstate commerce….”17 Thus; any information collected and disseminated must be for the purpose of price transparency in those markets. The Commission does not interpret this language to limit its ability to obtain information only about physical natural gas sales or transportation in those markets, provided that the information obtained and disseminated pertains to price transparency in those markets. Second, Congress provided that any rules “provide for the dissemination, on a timely basis, of information about the availability and prices of natural gas sold at wholesale and in interstate commerce….”18 Thus, the Commission’s authority is limited to “information about the availability and prices of natural gas sold at wholesale and in interstate commerce.”19 Again, this language does not limit the type of information the Commission could collect to implement its mandate, provided that such information is “about” (i.e., pertains to) the “availability and prices of natural gas sold at wholesale and in interstate commerce.” For instance, some transportation or sales of natural gas is not in interstate commerce, but, nonetheless, would affect the availability and prices of natural gas at wholesale and in interstate commerce.

The natural gas transparency provisions further provide that the Commission shall “rely on existing price publishers and providers of trade processing services to the maximum extent possible.”20 Thus, Congress authorized the Commission to rely on third parties to collect and disseminate transparency information. The Commission does not herein authorize or empower third parties to collect or disseminate information.

Also, in the transparency provisions, Congress cautioned the Commission in providing for any dissemination of information pursuant to the transparency provisions to ensure that “consumers and competitive markets are protected from the adverse effects of potential collusion or other anticompetitive behaviors by untimely disclosure of transaction-specific information.”21

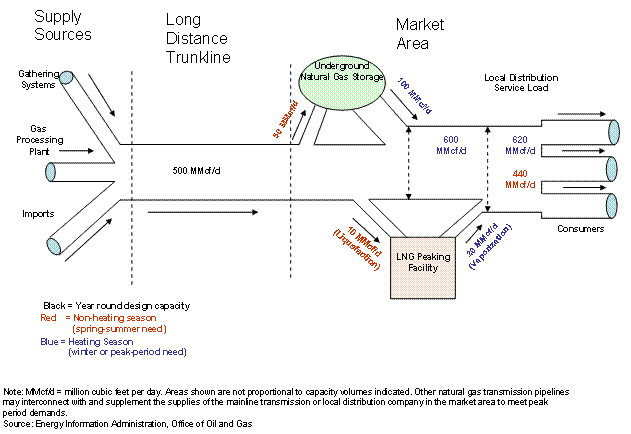

Generalized Natural Gas Pipeline Capacity Design Schematic |

Measures of Pipeline Utilization

There are several ways that natural gas pipeline system utilization may be estimated, as demonstrated in the following cases:

As a measure of the average-day natural gas throughput relative to estimates of system capacity at State and regional boundaries

The systemwide pipeline flow rate, which highlights variations in system usage relative to an estimated system peak throughput level

A system peak-day usage rate, which generally reflects peak system deliveries relative to estimated system capacity

The latter measure is a good indication of how well the design of the system matches current shipper peak-day needs. For example, when a pipeline shows a comparatively low average usage rate (based on annual or monthly data) yet shows a usage rate approaching 100 percent on its peak day, it indicates that the system is called upon and is capable of meeting its shipper's maximum daily needs. Nevertheless, a large spread between average usage rates and peak-day usage rates may indicate opportunities to find better ways to utilize off-peak unused capacity.

In some cases, utilization rates exceeding 100 percent may be an artifact of the data that obscures the true operational status of the pipeline. In some instances the sum of individual transportation transactions may exceed pipeline capacity even though physically the pipeline may not be full. For example, suppose a segment from points A to D (with points B and C between A and D) has a capacity of 200 million cubic feet (MMcf) per day. Suppose further that this segment handles a 100 MMcf per day transaction from A to B, a second of 100 MMcf per day from B to C, and a third of 100 MMcf per day from C to D. The pipeline company will report transportation volumes of 300 MMcf per day, even though its capacity is 200 MMcf per day but is only 50 percent utilized on any one segment.

Source: Energy Information Administration, http://www.eia.doe.gov/pub/oil_gas/natural_gas/analysis_publications/ngpipeline/usage.html#domestix

See also, http://www.aga.org/Kc/aboutnaturalgas/consumerinfo/NGDeliverySystem.htm.

2. HOW, BY WHOM, AND FOR WHAT PURPOSE THE INFORMATION IS TO BE USED AND THE CONSEQUENCES OF NOT COLLECTING THE INFORMATION

The Commission believes that the information requirements in Order Nos. 720, 720-A and reiterated in this Final Rule on Rehearing are needed because the information currently provided by interstate pipelines presents an incomplete picture of the supply and demand fundamentals that underlie the interstate natural gas market. While, as discussed above, Congress has given authority to the Commission to obtain additional information from market participants to increase transparency, the Commission acknowledges that section 23 of the NGA grants it discretion as to whether and how to utilize this authority. The current picture of the interstate natural gas market derives from information on scheduled natural gas volumes and available capacity posted by interstate pipelines. In compliance with the regulations adopted in Order No. 637,22 interstate pipelines currently post daily information on the Internet about scheduled natural gas volumes for most of the continental United States. Shippers and other market participants rely on information posted by interstate pipelines to price both transportation and commodity transactions.23 As the Commission described in the RM08-2-000 NOPR, market participants retrieve the posted information on scheduled volumes from the websites of interstate natural gas pipelines, which they use to estimate in near real-time a variety of supply and demand conditions including geographic and industrial sector consumption, storage injections and withdrawals and regional production.24 This posted scheduled flow information contributes to market transparency by providing information about the supply and demand fundamentals that drive price movements.25 Further, the Commission’s staff relies on this posted information to perform oversight and enforcement functions. In sum, the existing posting requirements for interstate pipelines provide the Commission, market participants, and other market observers with a picture of the availability of natural gas (both the commodity and transportation needed to move the commodity to market centers).26

Nevertheless, this picture is incomplete. Because the FERC’s existing pipeline posting regulations did not apply to non-interstate pipelines, market observers could not determine the availability of natural gas and transportation on a non-interstate pipeline to the same extent as they could for an interstate pipeline. These gaps in information are significant because major gas flows between producing basins and interstate markets occur on non-interstate pipelines and are thus invisible to the market. Often, the availability and price of natural gas on large non-interstate pipelines affects the availability and price of natural gas nation-wide because these pipelines serve as important pricing points and gateways for flows to much of the United States. Interstate and non-interstate pipeline infrastructure is functionally inter-connected in the United States. The gaps in information about non-interstate flows result from the limitations on the Commission’s authority over non-interstate pipelines prior to the enactment of EPAct 2005.

With these additions of flow information from major non-interstate pipelines to the information already available from interstate pipelines, market observers, such as the Commission, state commissions and market participants, can develop a better understanding of the supply and demand conditions that directly affect the U.S. wholesale natural gas markets. Market participants have a better basis for evaluating the prices at which they transact. Consequently, this proposal to increase information from non-interstate pipelines and from interstate pipelines would directly “facilitate price transparency for the sale… of physical natural gas in interstate commerce” as authorized in the natural gas transparency provisions.27

The daily posting of additional information by interstate and major non-interstate pipelines is necessary to provide information regarding the price and availability of natural gas to market participants, state commissions, the Commission and the public. The postings contribute to market transparency by aiding the understanding of the volumetric/availability drivers behind price movements; it provides a better picture of disruptions in natural gas flows in the case of disturbances to the pipeline system; and allows for the monitoring of potentially manipulative or unduly discriminatory activity.

Specifically, the daily posting of flow information by major non-interstate pipelines provides several benefits to the functioning of natural gas markets in ways that protect the integrity of physical, interstate natural gas markets, protect fair competition in those markets and consequently serve the public interest by better protecting consumers. First, by providing a more complete picture of supply and demand fundamentals, these postings improve market participants’ ability to assess supply and demand and to price physical natural gas transactions. Second, during periods when the U.S. natural gas delivery system is disturbed, for instance due to hurricane damage to facilities in the Gulf of Mexico, these postings provide market participants a clearer view of the effects on infrastructure, the industry, and the economy as a whole. Finally, these postings allow the Commission and other market observers to identify and remedy potentially manipulative activity.

Failure by the Commission to collect this information means that it is unable to monitor and evaluate transactions and operations of interstate and major non-interstate pipelines and perform its regulatory functions and statutory responsibilities as enumerated by the Energy Policy Act of 2005.

3. DESCRIBE ANY CONSIDERATION OF THE USE OF IMPROVED INFORMATION TECHNOLOGY TO REDUCE BURDEN AND TECHNICAL OR LEGAL OBSTACLES TO REDUCING BURDEN

There is an ongoing effort to determine the potential and value of improved information technology to reduce burden. As we noted in the Order No. 720 submission, the Commission does not receive any of the information under the FERC-551 data requirements as the information that is required is posted on the pipelines' Internet sites.

4. DESCRIBE EFFORTS TO IDENTIFY DUPLICATION AND SHOW SPECIFICALLY WHY ANY SIMILAR INFORMATION ALREADY AVAILABLE CANNOT BE USED OR MODIFIED FOR USE FOR THE PURPOSE(S) DESCRIBED IN INSTRUCTION NO. 2

Commission filings and data requirements are periodically reviewed in conjunction with

OMB clearance expiration dates. This includes a review of the Commission's regulations and data requirements to identify any duplication. To date, no duplication of the proposed data

requirements have been found. The Commission staff is continuously reviewing its various

filings in an effort to alleviate duplication. There are no similar sources of information available

that can be used or modified for use for the purpose described in Item A (1.).

Existing data sources on gas supply flows are insufficient for participants to adequately evaluate physical daily market activity. As the Commission discussed in Order No. 720, the Energy Information Administration (EIA) publishes data on monthly production by state based on a survey and with a three month lag.28 Similarly, monthly consumption data is published by state with a four month lag.29

5. METHODS USED TO MINIMIZE BURDEN IN COLLECTION OF INFORMATION INVOLVING SMALL ENTITIES

As the Commission noted in Order No. 720 and discussed in its submission, there are few small businesses that are impacted under the FERC-551 posting requirements. Natural gas pipelines are classified under NAICS code, 486210, Pipeline Transportation of Natural Gas. 30 A natural gas pipeline is considered a small entity for the purposes of the Regulatory Flexibility Act if its average annual receipts are less than $7.0 million. 31 The Commission does not believe that any pipeline that would be required to post information under the requirements of Order No. 720 or the subsequent modifications contained in this Final Rule on Rehearing that has annual receipts of less than $7.0 million.

In response to the comments on rehearing in Order No. 720-A and supplemental comments, FERC also exercised an additional regulatory alternative by exempting some major non-interstate pipelines with certain operational characteristics from the posting requirements and otherwise modifying the requirements to lessen the burden on posting pipelines.

The Commission also exempted: major non-interstate pipelines that have stub lines incidental to a processing plant and that deliver all of their transported gas directly into a single pipeline; major non-interstate pipelines that deliver more than 95 percent of their annual flows to end-users as measured by average deliveries over the preceding three calendar years; major non-interstate pipelines that deliver to on-system storage facilities (including deliveries to on-system LNG storage); and pipelines that transport all of their natural gas directly to an end-user that owns or operates the pipeline. These actions reduced the number of non-major interstate pipelines that will have to comply with these regulations.

6. CONSEQUENCE TO FEDERAL PROGRAM IF COLLECTION WERE CONDUCTED LESS FREQUENTLY.

As noted above, the daily posting of flow information by intrastate pipelines provides several benefits to the functioning of natural gas markets in ways to protect the integrity of physical, interstate natural gas markets, protect fair competition in those markets and consequently serve the public interest by better protecting consumers including:

(a) improving market participants’ ability to assess supply and demand and to price physical natural gas transactions;

(b) providing market participants a clearer view of the effects on infrastructure, the industry, and the economy as a whole particularly as result severe natural changes as reflected in hurricane damage; and

(c) allows the Commission and other market observers to identify and remedy potentially manipulative activity.

To have effective monitoring, the Commission needs timely information. Any reporting

period longer than daily postings hinders the Commission in meeting this objective and the Commission would be responding to information that is either stale or no longer relevant nor would the Commission be able under the Natural Gas Act to ensure both competitiveness and improved efficiency of the industry's operations. The daily posting of flow information by intrastate pipelines is necessary to provide information regarding the price and availability of natural gas to market participants, State commissions, the FERC and the public.

7. EXPLAIN ANY SPECIAL CIRCUMSTANCES RELATING TO THE INFORMATION COLLECTION

These information collection requirements meet most of OMB's section 1320.5 requirements. The data provided under FERC-551 as noted above will not be filed with the Commission but instead be posted on the pipelines’ Internet websites. However, section 1320.5(d) (2) (iv) limits the retention of records other than “health, medical, government contract, grant-in-aid, or tax records” for more than 3 years. In Order No. 720, the Commission required that records be retained for a period of five years, or an additional two years beyond the current retention requirements.

As the Commission explained in the Order No. 720 submission, there is no explicit statute of limitations set forth in NGA section 4A or in FPA section 222, and no statute of limitations of general applicability appears in the NGA or FPA. The Commission declined in Order No. 670 to designate a statute of limitations or otherwise adopt an arbitrary time limitation on complaints or enforcement actions that may arise under NGA section 4A and FPA section 222. The Commission noted, however, that when a statutory provision under which civil penalties may be imposed lacks its own statute of limitations, the general statute of limitations for collection of civil penalties, 28 U.S.C. 2462, applies.32 Section 2462 in 28 U.S.C. imposes a five-year limitations period on any “action, suit, or proceeding for the enforcement of any civil fine, penalty, or forfeiture, pecuniary or otherwise.”33

For these reasons, the Commission will exercise prosecutorial discretion in determining whether to pursue an alleged violation based on all the facts presented, including the time elapsed since the violation is alleged to have occurred, and will adhere to the five-year statute of limitations where it seeks civil penalties.

8. DESCRIBE EFFORTS TO CONSULT OUTSIDE THE AGENCY: SUMMARIZE PUBLIC COMMENTS AND THE AGENCY'S RESPONSE TO THESE COMMENTS

The Commission's procedures require that a rulemaking notice be published in the Federal Register, thereby allowing all pipeline companies, state commissions, federal agencies, and other interested parties an opportunity to submit comments, or suggestions concerning the proposal. The rulemaking procedures also allow for public conferences to be held as required.

Following the issuance of Order No. 720-A, three parties filed pleadings with the Commission seeking clarification and/or rehearing of Order No. 720-A: Interstate Natural Gas Association of America (INGAA); American Gas Association (AGA); and Atmos Pipeline-Texas, a division of Atmos Energy Corporation (Atmos).

Request for Clarification or Rehearing

When the design capacity of a point is unknown or does not exist, major non-interstate pipelines must post scheduling information for that point if its scheduled volumes were equal to or greater than 15,000 MMBtu on any day within the prior three calendar years. Order No. 720-A held that major non-interstate pipelines need only review scheduled volume data annually to determine whether points where no design capacity is known must be posted. Therefore, such points do not become eligible for posting until January 1 of the year after the first day on which scheduled volumes equaled or exceeded 15,000 MMBtu.34 This means that major non-interstate pipelines do not have to begin posting the required information about that point until 45 days after January 1, or on February 15.

AGA contends that a January 1 eligibility date for points where design capacity is unknown or does not exist is problematic because it means that, by February 15 of each year, the pipeline must, both collect and analyze the data necessary to determine whether a point would be eligible and make the necessary system changes to begin posting each eligible point. AGA recommended that the Commission clarify that for a point where the physically metered design capacity is not known or does not exist, such points become eligible for posting on February 1 of the following year, thus, postponing the date when the major non-interstate pipeline must begin posting information about the points until March 15 of the following year. Atmos supported AGA’s request for clarification.

FERC’s Response

The Commission is denying AGA’s request. The eligibility determination for points whose design capacity is unknown or does not exist is based on calendar year data. Therefore, it is appropriate that the point be considered eligible for posting immediately upon completion of the calendar year during which scheduled volumes at the point reached or exceeded 15,000 MMBtu for at least one day. By requesting that the Commission move the eligibility date for such points from January 1 to February 1, AGA is effectively asking that the Commission extend the 45-day deadline to commence posting by one month, to 75 days. In denying earlier requests to expand the 45-day period, the Commission found that major non-interstate pipelines have access to, and utilize on a daily basis all of the information necessary to determine whether a receipt or delivery point must be posted under the new regulations.35 Further, the Commission found that the posting of newly eligible points is of substantial value to market participants as new receipt and delivery points or increased scheduled flow to points could have immediate, substantial effect on market prices.36 Balancing the transparency benefits of timely posting for newly eligible points with this burden, the Commission concluded that 45 days is appropriate.37 AGA has not provided any specific evidence that would contradict the Commission’s findings, even where design capacity is unknown or does not exist. Therefore, its request is denied.

In Order No. 720-A, the Commission required major non-interstate pipelines to begin Internet posting for newly-eligible receipt and delivery points within 45 days of the date the point becomes eligible for posting.38

AGA asserted that it is not clear when a newly-installed point with a physically metered design capacity equal to or greater than 15,000 MMBtu per day should be considered to become eligible for posting for purposes of triggering the 45-day period after which the pipeline must post information about the point. AGA recommended that the Commission clarify that such a new point does not become eligible for posting until the date the point has volumes scheduled to it. Atmos supported AGA’s request for clarification.

FERC’s Response

The Commission clarifies that a newly installed point with a physically metered design capacity equal to or greater than 15,000 MMBtu per day becomes eligible for posting on its in-service date. Therefore, the major non-interstate pipeline must begin posting the required information about that point 45 days after its in-service date. Scheduled volume information is only one category of the information. §284.14(a)(4) of the Commission’s regulations requires major non-interstate pipelines to post. Also required is information regarding a point’s design capacity. As the Commission found in Order No. 720, market participants can utilize design capacity and scheduled volume information to help determine available capacity at a particular point and therefore, required posting of both design capacity and scheduled volume information.39 When a new point is placed into service its capacity is available for use by shippers, and therefore the major non-interstate pipeline should begin posting the availability of capacity at that point within 45 days, regardless of whether volumes have yet been scheduled at that point. AGA’s and Atmos’ request to delay posting until volumes are first scheduled to a new point would frustrate this very purpose and therefore, their request is denied.

INGAA’s request for clarification or rehearing focuses on Order No. 720-A’s statement that, “if subsequent to an initial posting, more complete no-notice service data becomes available, interstate pipelines must update previously posted information.” INGAA requested that the Commission clarify that an interstate pipeline’s obligation to update previously posted information is limited to providing no-notice information where none was available within three days after the day of gas flow, as opposed to revising information that has already been posted.40 If, however, the obligation to update previously posted data goes beyond supplying missing data to revising data that has already been posted, INGAA prefers that the Commission eliminate the update requirement in its entirety or, in the alternative, limit it to one update for each posted figure, to be provided within ten business days after the end of the month in which the posted service was rendered.41

INGAA argued that the Commission promulgated the after-the-fact obligation to update initially posted no-notice information without developing a record on the cost of assembling and reporting this information or the benefit that updated no-notice data would provide either to market participants, price formation and other market behavior, or market transparency. INGAA contends that updated no-notice data is of no value to market participants, price formation or market transparency and that the minor and non-substantive changes that would be made to the originally posted data do not warrant the additional costs associated with providing it.

INGAA contends that meter adjustments and the receipt of corrected data from third parties cause minor departures from initially posted no-notice information and as a result, certain no-notice quantities are not fully known until the “close of measurement,” which is defined by NAESB as five business days after the end of the month. If the Commission insists on some form of updating, INGAA urges limiting it to one update for each posted figure, to be provided within ten business days after the end of the month in which the posted service was rendered.

FERC’s Response

The Commission is granting INGAA’s request for rehearing in part and modifies 18 CFR 284.13(d) to provide that an interstate pipeline must provide no-notice transportation information based on its best estimate before 11:30 a.m. central clock time three days after the day of gas flow and make one update to each posted figure as necessary within ten business days after the month in which the posted service was performed. The Commission finds that requiring a single update should ensure that interstate pipelines provide accurate information about no-notice gas flows, without burdening pipelines with a requirement to make frequent, minor changes in posted volumes. As stated in Order No. 720, information on no-notice volumes is valuable even posted after the no-notice gas flows because it allows market participants and other market observers to understand the historical patterns of flows and will enable them to better predict future no-notice flows.42 Updating the initially posted flow data based on corrected information obtained through the close of the NAESB measurement period will assist in understanding historical flow patterns and predicting future no-notice flows. The Commission therefore declines to limit an interstate pipeline’s obligation to update previously posted information to providing no-notice information where none was available within three days after the day of gas flow.

Based upon INGAA’s comments, interstate pipelines have access to reasonably accurate no-notice information within 3 days after gas flow, but within five business days of the end of the month of gas flow the no-notice information is more fully known by the interstate pipelines. The revised regulation takes into account this lag time in information, thus reducing the burden on interstate pipelines to continuously update estimated no-notice information. At the same time, however, this modification presents the Commission and the market with continued access to the most-accurate data, thereby enhancing transparency.

9. EXPLAIN ANY PAYMENT OR GIFTS TO RESPONDENTS

There are no payments or gifts to respondents in the proposed rule.

10. DESCRIBE ANY ASSURANCE OF CONFIDENTIALITY PROVIDED TO RESPONDENTS

The Commission generally does not consider the data posted concerning transactions to be confidential. Specific requests for confidential treatment to the extent permitted by law will be entertained pursuant to 18 C.F.R. Section 388.112.

In Order No. 720, the Commission required that all postings by major non-interstate pipelines pursuant to this rule be public. The Commission recognized that posting scheduled gas flows at eligible delivery points dedicated to a single customer could have some effect on the competitive position of that customer. However, the Commission found that posting such information will provide useful information to the Commission, market participants, and other market observers and will greatly increase market transparency. The Commission concluded that this benefit outweighs concerns about publicly posting information about scheduled flows to a customer with a dedicated delivery point.43 The Commission pointed out that interstate pipelines are required to post daily scheduled volumes for delivery points dedicated to a single customer, and there have been no indications that competitive balance has been harmed since the interstate requirement to post was instituted.

In Order No. 720-A, the Commission denied rehearing of its requirement that all postings be public. The Commission rejected contentions that this requirement would cause disclosure of potentially sensitive information regarding the physical location of receipt and delivery points or actual natural gas flows that would implicate national security. The Commission also found that there had been no showing that the public posting requirement would result in the violation of state commission rules regarding the disclosure of private customer data.

AGA requested that the Commission clarify that major non-interstate pipelines have flexibility in the manner in which they comply with the rule’s posting requirements in order to prevent the disclosure of confidential information or the violation of state law or other regulatory requirements. Alternatively, AGA sought rehearing on the grounds that the Commission’s explanations for dismissing AGA’s concerns are unsupported and contrary to law. AGA raised generally the same arguments that were discussed and rejected in Order Nos. 720 and 720-A.

AGA contends that not affording pipelines flexibility in this regard would be contrary to section 23 of the NGA, which provides that in determining the information to be disclosed, “the Commission shall seek to ensure that consumers and competitive markets are protected from the adverse effects of potential collusion or other anti-competitive behaviors that can be facilitated by untimely public disclosure of transaction-specific information.”44 AGA contends that, under the revised regulations, if a particular delivery point services a single large customer and the current Location Name of the delivery point were designated as the name of the customer, then listing the Location Name as the name of the customer, the Posted Capacity of the customer’s delivery point, and the customer’s Scheduled Volumes on a daily basis would each disclose customer-specific information. AGA contends that this could be a violation of state law if a utility were prohibited from disclosing customer-specific information under state law. Likewise, AGA contends that if a Location Name is the name of a military installation, disclosing daily scheduled volumes could have national security implications. Further, AGA argued that the posting of scheduled natural gas volumes could have anti-competitive effects.

AGA also contends that potential ways of affording flexibility to major non-interstate pipelines would be to allow: (a) the Location Name to be changed to a region or county to protect the identity of the customer (e.g., [County Name] 1 –Delivery, [County Name] 2- Delivery); (b) the pipeline to post information at an upstream aggregation point served by more than one customer; (c) the aggregation of customer data within given regions, instead of requiring the posting of the scheduled volumes of a single customer.

FERC’s Response

The Commission is granting in part AGA’s request for clarification in order to give major non-interstate pipelines some flexibility in how they comply with the requirement that they publicly post scheduled flows at delivery points dedicated to a single customer. Specifically, the Commission would be amenable to a major non-interstate pipeline labeling a customer-specific point according to the city or county within which it is located, as opposed to the specific name of the customer, as proposed by AGA. Such an identification should provide the Commission, market participants, and other market observers sufficient information about the location where the gas flow is being delivered, to analyze and understand the demand conditions affecting price formation in that area, while not revealing the name of the specific customer to whom the gas is being delivered. However, AGA’s other suggestions would appear to allow the pipeline to use broader geographic areas than just a single city or county for purposes of identifying the location of the delivery point. This could significantly reduce the value of the posted information to understand demand conditions affecting price formation. Therefore, the Commission denies AGA’s request for clarification with respect to its other proposals for identifying delivery points serving a single customer.

With regard to AGA’s concern about the posting requirement violating state regulatory requirements, the Commission will not, in Order on Rehearing, grant major non-interstate pipelines a blanket exemption from posting scheduled flows to delivery points dedicated to a single customer whenever they believe such a posting might violate a state regulatory requirement. In section 23(a)(2) of the NGA, Congress called for any transparency rule to provide for the “dissemination, on a timely basis, of information about the availability and prices of natural gas sold at wholesale and interstate commerce to the Commission, State commissions, buyers and sellers of wholesale natural gas, and the public.”45 The Commission believes that requiring all postings to be public is specifically in keeping with this directive. Moreover, the posting information will provide useful information to the Commission, market participants, and other market observers, thereby greatly increasing market transparency. As stated previously, the Commission believes that this benefit outweighs the concerns about publicly posting information about scheduled volumes to a customer.

AGA pointed out that section 23(b)(2) provides, “In determining the information to be made available under this section and the time to make the information to be available, the Commission shall seek to ensure that consumers and competitive markets are protected from the adverse effects of potential collusion or other anti-competitive behaviors that can be facilitated by untimely public disclosure of transaction-specific information.” AGA appears to read this provision as requiring the Commission to exempt from public posting any information that might have some effect on the competitive position of a particular participant in the natural gas market. However, this provision only provides that, in requiring public disclosure, the Commission should seek to ensure that consumers and competitive markets are protected from “the adverse effects of potential collusion or other anti-competitive behaviors” (emphasis supplied). AGA has provided no explanation as to how public disclosure of scheduled deliveries at points dedicated to a single customer would contribute to “collusion or other anti-competitive behaviors.” In fact, as the Commission found in Order No. 720-A, “understanding ... demand in large non-interstate pipelines downstream of the interstate market will enable market observers to better understand prices and, therefore, identify potential cases of market manipulation.”46 We therefore believe that the requirement to disclose scheduled flows at delivery points with significant load47 likely to affect market prices is more likely to minimize anti-competitive behaviors, than contribute to them.

Moreover, the Commission is not persuaded, based upon the limited information provided by AGA, that its requirement that major non-interstate pipelines post scheduled flows at major delivery points dedicated to a single customer are in conflict with state prohibitions regarding the disclosure of private customer data. For example, AGA cites a provision in the tariff of Pacific Gas and Electric Co. (PG&E), approved by the California Public Utilities Commission (CPUC), providing that “to preserve customer privacy, PG&E will not release confidential information, including financial information, to a third party without the customers electronic signature or the written consent.”48 However, it is not clear that scheduled deliveries at a major delivery point would be considered confidential information, subject to this provision. As the Commission noted in Order No. 720-A, not a single state commission has raised this issue in this proceeding.

Nevertheless, if a major non-interstate pipeline believes that posting scheduled flows to eligible delivery points dedicated to a single customer violates a state regulatory confidentiality requirement, and if the flexibility provided in this order to identify the point by county or city is insufficient to avoid a violation of that requirement, the pipeline may request a waiver from the posting requirement. In any such waiver request, the pipeline should provide a complete explanation of why the state regulatory requirement is applicable, together with citations to any applicable state agency or court precedent supporting its interpretation of the state regulatory requirement. The Commission would also expect that such a waiver request would be made with the express support of the applicable state regulatory agency.

11. PROVIDE ADDITIONAL JUSTIFICATION FOR ANY QUESTIONS OF A SENSITIVE NATURE THAT ARE CONSIDERED PRIVATE

There are no questions of a sensitive nature proposed in the subject Final Rule.

12. ESTIMATED BURDEN OF COLLECTION OF INFORMATION

In Order No. 720, the Commission estimated the burden to be 47,683 hours (an average

of 1.0 hour per entity) for the information requirement collections under FERC-551. This was based on the presumption that major non-interstate pipelines already collect flow information for receipt and delivery points and, therefore, the burden that would be imposed by this proposed requirement is only for the posting of this information in the required format.

In Order 720-A, the Commission made modifications that reduced the number of major non-interstate pipelines who have to comply with the requirements and reduced the initial burden estimates in Order No. 720. The FERC-551burden estimates in Order No. 720-A are shown below:

Data Collection |

No. of Respondents |

No. of Daily Postings per Respondent |

Estimated Annual Burden Hours per Respondent |

Total Annual Hours For All Respondents

|

Estimated Start-Up Burden Per Respondent |

Part 284 FERC-551 |

|

|

|

|

|

Major Non-Interstate Pipeline Postings |

70 |

2 |

365 |

25,550 |

40 |

The total annual hours for collection (including recordkeeping) for all major non-interstate respondents in Order No. 720-A is estimated to be 25,550 hours (no. of respondents reduced) + 18,483 hours for interstate pipelines (retained from Order No. 720).

For this Order on Rehearing (Order No. 720-B):

CURRENT OMB Proposed

DATA REQUIREMENT (FERC-551) INVENTORY Rehearing

Estimated number of respondents : 171 171

Estimated number of responses per respondent: 259 259

(rounded off)

Estimated number of responses per year : 44,033 44,033

Estimated number of hours per response : 1.0 1.0

Total estimated burden (hours per year) : 44,033 44,033

Program change in industry burden hours : -0- -0-

Adjustment change in industry burden hours : -0- -0-

Total hours FERC-551 44,033 44,033

While the Commission is making substantive changes in this Order on Rehearing, therefore requiring submission to OMB, the changes will result in having offsetting impacts on the burden estimates reported in Order No. 720-A. As a result, the Commission will retain the estimates identified in Order No. 720-A.

13. ESTIMATE OF THE TOTAL ANNUAL COST BURDEN TO RESPONDENTS

The estimated annualized start-up and ongoing costs to respondents for the data collection/requirements as proposed in the subject Final Rule on Rehearing are as follows:

Order No. 720: The Commission declared that each interstate and non-major interstate pipeline would be required to post daily to the Internet the capacities of, and volumes flowing through, their major receipt and delivery points. Postings would be required within 24 hours from the close of the gas day on which gas flowed, i.e., at or before 9:00 a.m. central clock time for flow that occurred on the gas day that ended 24 hours before. The Commission estimated that compliance would require an initial start-up cost for intrastate pipelines to develop an Internet website at a cost of 17.3 hours @ $82/hr. This will result in a total startup cost of $1,420 annualized over 10 years for $142 per year for Major Non-Interstate Pipelines. For interstate pipelines to make the additional filings, the Commission estimates that compliance would require no initial start-up costs. For operations and maintenance, the Commission estimated 60 minutes per day @ $3.42/hr to post data already collected in-house for $30,000 per year for Major Non-Interstate Pipelines and $5,000 per year for pipeline postings. This would result in a total cost of $35,142 per year. The Commission does not believe that installation of additional equipment will be necessary to meet major non-interstate pipelines’ obligations. The burden that is imposed by these regulations is largely for the collection and posting of this information in the required format.

No petitioner objected to the Commission’s estimate of compliance costs for interstate pipelines. However, two petitioners questioned the compliance costs for major non-interstate companies. California LDCs claimed that initial compliance costs for each LDC may exceed $500,000 to calculate and record the design capacity of delivery points as well as establishing procedures to capture new delivery points for which posting is required. Based upon these costs, the California LDCs concluded that the cost of compliance far outweighs the benefits of the rule.49

The Commission stated in Order No. 720-A that it disagreed with the California LDCs and TPA and found, as it did in Order No. 720, that the benefits of its transparency regulations substantially outweigh the cost of compliance. Enhanced transparency will result in a more efficient wholesale natural gas market, more informed and better market choices made by market participants, and, ultimately, lower natural gas prices for consumers.

The Commission noted that Order No. 720’s cost of compliance estimates were based upon comments received in response to the NOPR and the substantial reduction in compliance costs attendant in the Commission’s decision not to require posting of actual natural gas flows or on pipeline segments. Further, Order No. 720 acknowledged that both start-up and annual compliance costs would vary among pipelines.50

The Commission emphasized that only scheduled natural gas volumes are to be posted. The comments by TPA did not dissuade the Commission from the determination that “most if not all of the gas control divisions of the affected companies currently have ready access to the information captured” by the rule.51 As clarified in Order 720-A, the Commission’s regulations allow for posting of aggregated scheduled flows to virtual or pooling points. The Commission does not believe that major non-interstate pipelines will incur significant expenses adopting new scheduling procedures as the Commission regulations do not require such changes.

Finally, the high costs expressed by some commenters seemed disproportionately high given that other major non-interstate pipelines have not expressed similar concerns on rehearing. The Commission also found such claims doubtful given the sophistication of these pipelines, their experience with electronic data capture, and their familiarity with the receipt and delivery points on their systems, and, for at least some of these pipelines, their substantial experience with posting flow data on electronic databases.

The additional modifications in this latest order on rehearing should further alleviate any concerns that commenters have expressed in Order No. 720-A on the high costs that would be incurred and bring into line the Commission’s original contention of what the impact will be of Order No. 720’s requirements.

Information Posting Costs: The average annualized cost for each respondent is projected to be:

|

Annualized Capital/Startup Costs (10 year amortization) |

Annual Costs |

Annualized Costs Total

|

FERC-551 |

|

|

|

Major Non-Interstate Pipeline Postings

|

$142 |

$30,000 |

$30,142 |

Additional Interstate Natural Gas Pipeline Postings |

$0 |

$ 5,000 |

$ 5,000 |

14. ESTIMATED ANNUALIZED COST TO FEDERAL GOVERNMENT

On Order No. 720, the Commission estimated the annualized cost to the Federal government related to the data collections/requirements in the Final Rule as shown below:

Data Analysis Estimated FERC Forms Total Cost

Requirement of Data Salary 0952 Clearance One Year's

Number (FTEs) 1053 x Per Year + (FY '10 = Operation

FERC-551 -0- -0 - $ -0- $ -0-

.5 $137,874 $ 1,528 $1,528

Total .5 $137,874 $ 1,528 $70,465

We are adjusting these costs to reflect fiscal year 2010. :

15. REASONS FOR CHANGES IN BURDEN INCLUDING THE NEED FOR ANY INCREASE

While the Commission has granted several clarifications, these changes will not result in changes to the burden estimates that the Commission made in Order No. 720-A and as noted above. These changes as more fully described above, will assist pipelines in how and when they report the information. In particular, the Commission’s change to the regulations takes into consideration operational conditions on when pipelines provide no-notice information by reducing the number of instances when the posted information must be updated. This modification will not deter the Commission and market participants from continuing to have the most accurate data and meet the goal of enhancing transparency.

16. TIME SCHEDULE FOR THE PUBLICATION OF DATA

The time schedule for FERC‑551 is as follows:

Regarding the timing of postings, the Commission considers that scheduled flow information that is not provided on a daily basis is simply untimely and of vastly diminished use to market participants. The Commission believes that, in this regard, its interstate natural gas pipeline postings set an appropriate standard: postings should occur at least on a daily basis. Further, this standard conforms to Congress’ direction in section 23 of the NGA, which requires that the Commission’s transparency rules “provide for the dissemination, on a timely basis, of information about the availability and prices of natural gas….”54

These postings will provide information comparable to the daily postings made by interstate natural gas pipelines. Major non-interstate pipelines must post scheduled volumes according to a daily posting deadline. Currently, interstate natural gas pipelines must provide at least four nomination cycles to their shippers with the following nomination: timely, evening, intra-day 1, and intra-day 2.55 Once these volumes are scheduled, they must be posted on the public Internet under Operationally Available Capacity section of an interstate natural gas pipeline’s Informational Postings according to the following cycle deadlines: timely (no later than 4:30 p.m. central clock time for the day prior to gas flow); evening (no later than, 9:00 p.m. central clock for the day prior to gas flow); intra-day 1 (no later than 5:00 p.m. on flow day); and intra-day 2 (no later than 9:00 p.m. on flow day). Currently, major non-interstate pipelines employ a variety of nomination deadlines on their systems. Some use the standard North American Energy Standards Board (NAESB) guidelines followed by interstate natural gas pipelines; others do not have specific nomination deadlines.

The Commission will require that major non-interstate pipelines post scheduled volumes no later than 10:00 p.m. central clock time the day prior to gas flow. This deadline occurs after interstate natural gas pipelines are required to post their evening cycle schedule confirmations by receipt and delivery point. The deadline enables non-interstate pipelines ample time to review their gas control set-up for the next day and limits the burden of posting to a single, daily reporting cycle.

Changes to Order Nos. &20 and 720-A made in this Order on Rehearing will become effective October 1, 2010.

17. DISPLAY OF EXPIRATION DATE

Not applicable. The data requirements under FERC-551 are based on regulations and not filed on formatted/printed forms but rather to be posted on intrastate pipelines web sites.

18. EXCEPTIONS TO THE CERTIFICATION STATEMENT

The Commission does not use statistical methodology for FERC-551.

B. COLLECTION OF INFORMATION EMPLOYING STATISTICAL METHODS

Not applicable. As noted in item number 18 above, the Commission does not use statistical methodology for FERC-551.

1 Energy Policy Act of 2005, Pub. L. No. 109-58, 119 Stat. 594 (2005).

2 16 U.S.C. 824 et seq.

3 15 U.S.C. 717 et seq.

4 Section 23(a)(1) of the Natural Gas Act, 15 U.S.C. 717t-2(a)(1); see also section 220 of the Federal Power Act, 16 U.S.C. 824t (identical language). Section 316 of EPAct 2005 added section 23 to the Natural Gas Act (natural gas transparency provisions); section 1281 of EPAct 2005 added section 220 to the Federal Power Act (electric transparency provisions) (together, the transparency provisions).

5 Pipeline Posting Requirements under Section 23 of the Natural Gas Act, Order No. 720, FERC Stats. & Regs. ¶ 31,283 (2008). The Commission is not requesting additional comments regarding 18 CFR 284.14(b) which was also added by Order No. 720.

6 Section 23(a)(1) of the NGA; 15 U.S.C. section 717t-2(a)(1) (2000 & Supp. V 2005).

7 18 CFR 284.14(a).

8 Requests for rehearing, clarification, or both filed by the following participants raise this question: American Gas Association, Atmos Pipeline, Nicor Gas Company, ONEOK Gas Transportation, L.L.C., and ONEOK WesTex Transmission, L.L.C.

9 See Post-Technical Conference Comments of the Texas Pipeline Association (submitted March 30, 2009).

10 See Energy Policy Act of 1992, Pub. L. No. 102-486, 106 Stat. 2776 (1992), codified as amended in scattered sections of 16 U.S.C.; Natural Gas Wellhead Decontrol Act of 1989, Pub. L. No. 101-60, 103 Stat. 157 (1989), codified in scattered section of 15 U.S.C.; Public Utility Regulatory Policies Act of 1978, 16 U.S.C. 2601-2645 (2000); Natural Gas Policy Act of 1978, 15 U.S.C. 3301-3442 (2000).

11 15 U.S.C. 717(v) (a) (1). The electric transparency provisions of the Federal Power Act are nearly identical as to the electric wholesale markets. Section 220 of the Federal Power Act, 16 U.S.C. 824t. Because the Commission’s proposals in the NOPRs addressed natural gas transparency, the Commission did not analyze the electric transparency provisions, although the Commission expected that analysis of electric transparency provisions would be substantially similar.

12 15 U.S.C. 717t-2(a).

13 15 U.S.C. 717t-2(a) (3).

14 Section 2(6) of the Natural Gas Act, 15 U.S.C. 717a (6).

15 15 U.S.C. 717, 717b, 717f.

16 Section 1(b)-(d) of the Natural Gas Act, 15 U.S.C. 717(b)-(d); section 3 of the Natural Gas Act, 15 U.S.C. 717b; section 7(f) of the Natural Gas Act, 15 U.S.C. 717f(f); see, also, section 601(a) of the Natural Gas Policy Act, 15 U.S.C. 3431(a). The Commission has previously explained that the Natural Gas Policy Act of 1978 (NGPA or Natural Gas Policy Act) and the Natural Gas Wellhead Decontrol Act of 1989 narrowed its jurisdiction under the Natural Gas Act:

Under the NGPA, first sales of natural gas are defined as any sale to an interstate or intrastate pipeline, LDC [Local Distribution Company] or retail customer, or any sale in the chain of transactions prior to a sale to an interstate or intrastate pipeline or LDC or retail customer. NGPA Section 2(21)(A) sets forth a general rule stating that all sales in the chain from the producer to the ultimate consumer are first sales until the gas is purchased by an interstate pipeline, intrastate pipeline, or LDC. Once such a sale is executed and the gas is in the possession of a pipeline, LDC, or retail customer, the chain is broken, and no subsequent sale, whether the sale is by the pipeline, or LDC, or by a subsequent purchaser of gas that has passed through the hands of a pipeline or LDC, can qualify under the general rule as a first sale on natural gas. In addition to the general rule, NGPA Section 2(21)(B) expressly excludes from first sale status any sale of natural gas by a pipeline, LDC, or their affiliates, except when the pipeline, LDC, or affiliate is selling its own production. Order No. 644 at P 14.

17 Section 23(a) (1) of the Natural Gas Act, 15 U.S.C. 717t-2(a) (1).

18 Section 23(a) (2) of the Natural Gas Act, 15 U.S.C. 717t-2(a) (2).

19 Id.

20 Section 23(a) (4) of the Natural Gas Act, 15 U.S.C.717t-2(a) (4).

21 Section 23(b) (2) of the Natural Gas Act, 15 U.S.C. 717t-2(b) (2).

22 Regulation of Short-Term Natural Gas Transportation Services and Regulation of Interstate Natural Gas Transportation Services, Order No. 637, 65 FR 10,156 (Feb. 25, 2000), FERC Stats. & Regs. ¶ 31,091, at 31,332, clarified, Order No. 637-A, FERC Stats. & Regs. ¶ 31,099, reh’g denied, Order No. 637-B, 92 FERC ¶ 61,062 (2000), aff’d in part and remanded in part sub nom. Interstate Natural Gas Ass’n of America v. FERC, 285 F.3d 18 (D.C. Cir. 2002), order on remand, 101 FERC ¶ 61,127 (2002), order on reh’g, 106 FERC ¶ 61,088 (2004), aff’d sub nom. American Gas Ass’n v. FERC, 428 F.3d 255 (D.C. Cir. 2005).

23 In this regard, the Commission disagreed with commenters, such as Atmos, that increased transparency would harm competition. Such has not been the Commission’s experience with interstate natural gas pipeline posting requirements. To the contrary, increased transparency has allowed for more informed decision making by market participants. In the scenario posited by Atmos (i.e., two pipelines, one of which is at capacity, that could serve a single customer), the posting of scheduled flow information at a particular point would typically not be sufficient to affect competition. Even if disclosure did have an effect, the effect would be to allow all market participants to make efficient determinations based upon equal access to relevant information.

24 Posting NOPR at P 55. See also Comments of Bentek, Docket No. AD06-11-000 (filed Oct. 11, 2006).

25 See, e.g., Comments of Platt’s at 11-13, Docket No. AD06-11-000 (filed Nov. 1, 2006) (information regarding the supply and demand of natural gas explains prices and such information is available from interstate pipelines, but not intrastate pipelines).

26 See, e.g., id. at 11 (explaining that, to understand prices, “the marketplace must look to… information on [the] availability of and demand for natural gas….”).

27 Section 23(a) (1) of the Natural Gas Act, 15 U.S.C. 717t-2(a) (1) (2000 & Supp. V 2005).

28 Energy Information Administration, Natural Gas Deliveries to All Consumers by State 2007-2009 (Nov. 2009) (available at http://www.eia.doe.gov/oil_gas/natural_gas/data_publications/natural_gas_monthly/ngm/current/pdf/table_16.pdf).

29 Energy Information Administration, Marketed Production of Natural Gas in Selected States and the Federal Gulf of Mexico (Nov. 2009) (available at http://www.eia.doe.gov/oil_gas/natural_gas/data_publications/natural_gas_monthly/current/pdf/table_05.pdf).

30 This industry comprises establishments primarily engaged in the pipeline transportation of natural gas from processing plants to local distribution systems. 2002 North American Industry Classification System (NAICS) Definitions, http://www.census.gov/epcd/naics02/def/ND486210.HTM.

31 See U.S. Small Business Administration, Table of Small Business Size Standards, http://www.sba.gov/idc/groups/public/documents/sba_homepage/serv_sstd_tablepdf.pdf (effective July 31, 2006).

32 See, e.g., United States v. Godbout-Bandal, 232 F.3d 637, 639 (8th Cir. 2000).

33 28 U.S.C. 2462 (2000). The five-year limitation runs “from the date the claim first accrued.” Id. We intend that any administrative action for violation of the Final Rule be commenced within five years of the date of the fraudulent or deceptive conduct.

34 Order No. 720-A at P 94.

35 Id. P 116.

36 Id.

37 Id.

38 Id. P 115. This requirement is set forth in § 284.14(a)(3) of the Commission’s regulations, as revised by Order No. 720-A.

39 Order No. 720 at P 82, 84.

40 INGAA Request for Rehearing and Clarification at 2-3.

41 Id. at 3-4.

42 Order No. 720 at P 162.

43 Order No. 720 at P 88-89.

44 AGA Request for Rehearing at 11 (citing NGA § 23(b)(2)).

45 Section 23(a)(2) of the NGA; 15 U.S.C. 717t-2(a)(2) (2000 & Supp. V 2005) (emphasis added).

46 Order No. 720-A at P 62.

47 As discussed in Order No. 720, at P 90, the posting requirement only applies at delivery points with significant load, such as major pipeline interconnections and points with substantial industrial load.

48 AGA Request for Rehearing at 14.

49 California LDCs Request for Rehearing and Clarification at 12-13.

50 Order No. 720 at P 171.

51 Id. P 56.

52?/ "Salary" represents the allocated cost per gas program employee at the Commission based on its appropriated budget for fiscal year 2010. The $137,874 "salary" consists of $110,299 in salaries and $27,575 in benefits.

53?/ An "FTE" is a "Full Time Equivalent" employee that works the equivalent of 2,080 hours per year.

54 Section 23(a)(2) of the NGA; 15 U.S.C. 717t-2(a)(2) (2000 & Supp. V 2005).

55 Standard 1.3.2, Nominations Related Standards, North American Energy Standards Board, Wholesale Gas Quadrant, July 31, 2002.

| File Type | application/msword |

| Author | Michael Miller |

| Last Modified By | michael miller |

| File Modified | 2010-07-30 |

| File Created | 2010-06-24 |

© 2026 OMB.report | Privacy Policy