Exhibit F Instructions

SBIC Management Assessment Questionnaire & License Application; Exhibits to SBIC License App./Mgmt. Assessment Questionnaire

SBIC Assesment Exhibit F Instructions 7-10

SBIC Management Assessment Questionnaire & License Application; Exhibits to SBIC License App./Mgmt. Assessement Questionnaire

OMB: 3245-0062

Instructions

for Exhibit F Page

SECTION 1: GENERAL GUIDELINES FOR COMPLETING THE EXHIBIT F 1

SECTION 2: INVESTMENTS THAT QUALIFY FOR INCLUSION IN EXHIBIT F 2

SECTION 3: NAMING YOUR EXHIBIT F FILES 4

SECTION 4: DEFINITIONS OF TERMS USED IN EXHIBIT F 5

SECTION 5: EXHIBIT F1-- INVESTMENT EXPERIENCE OF PRINCIPALS OVERVIEW 13

SECTION 6: EXHIBIT F2--FUND EXPERIENCE 16

SECTION 7: EXHIBIT F3—OTHER EXPERIENCE 20

SECTION 1: GENERAL GUIDELINES FOR COMPLETING THE EXHIBIT F

By providing the information in Exhibit F, you are acknowledging that these investments represent your complete investment experience during the designated period and are compliant with the guidelines for inclusion (see Section 2 of these instructions). As part of the due diligence process, SBA will carefully review investment attribution and data. Please be prepared to provide SBA with documentation to substantiate performance, cash flows, etc.

SBA requires that you demonstrate your experience by providing information on any fund or other private equity experience you have had. SBA gives the greatest weight to experience gained by the Applicant’s principals as a management team in a fund environment. Experience of individual principals in funds that were co-managed with others is more difficult to evaluate, but will also be considered. The same is true of experience gained in a non-fund environment or as a non-principal in a fund.

SBA understands that not all relevant investment experience is gained in a formal, traditional principal investment fund setting. Applicants may present investment experience gained outside of a formal fund as a “SYNTHESIS” of investments, but must adhere strictly to the guidelines and rules for compiling and reporting on the investments (see Section 2 of these instructions).

SBA assumes that individuals completing these exhibits will have sufficient experience working in MS Excel and knowledge of fund / investment accounting and analysis to complete the exhibits accurately. The model is flexible and should accommodate a broad range of fund types, however, formula changes may be necessary to achieve 100% accurate results. Prior to submitting the forms, please carefully review all entries for accuracy.

You may adjust the width and height of cells to accommodate your information, however, please also adjust print and page settings to ensure that all information is clearly visible on both the electronic and hardcopy.

You are responsible for print formatting and ensuring that all information in the files is legible and included in the hard copy presentation. SBA will not accept Exhibit F filings where the hardcopy presentation is not properly formatted and printed.

Please contact Program Development for guidance on how to present non-traditional track records that are not easily presented by vintage year – e.g., large loan portfolios.

Definitions of Terms are provided in Section 4 and contain explanations of terms used throughout these exhibits.

Yellow cells represent the areas in which you should enter information. Other cells are populated with formulas, however, applicants are ultimately responsible for providing accurate calculations specific to each fund represented and in some cases, formula changes may be necessary.

For consistency, enter only whole dollar amounts throughout your exhibits. For example, enter one million dollars as 1,000,000, not as 1,000,000.00 or 1,000 or 1. Do not use “K”, “M”, “MM” or similar abbreviations.

If you are preparing an Exhibit F for a participating securities SBIC fund, please treat SBIC leverage like limited partner capital. Any repayments of the leverage or any amounts paid to SBA as prioritized payments or profit participation should be treated as distributions. No interest or fees should be included. Analysts will take into consideration the potential leverage effect, not captured, in their analysis of the track record.

SECTION 2: INVESTMENTS THAT QUALIFY FOR INCLUSION IN EXHIBIT F.2

The following “rules” will help you to identify those investments that are qualified for inclusion in Exhibit F.2.

Rule 1: You must identify all funds you have been involved with that are ongoing or that included any investments terminated within the past ten years.

Rule 2: If you have been a manager or a principal (defined as a voting member of the Investment Committee), you must present the data for the performance of the entire fund. If you joined a fund or joined the Investment Committee of a fund after the fund was in progress, you should only include those investments made after you joined, and it should be noted (in footnotes) that the fund is only “partially” presented. If you departed your position as a principal in a fund prior to the conclusion of that fund, you may claim the performance of those investments up to the date of your departure (which will become your “Valuation Date”), and it should be noted that the fund is only “partially” presented. However, the SBA reserves the right to request additional information and conduct due diligence on investment performance subsequent to your departure or Valuation Date. If you were a principal of a fund, but for less than 50% of the life of the fund, you may claim the performance of the investments using the “SYNTHESIS” (see Rule 4 below).

Rule 3: If you were working at a formal fund, but not in a manager or principal role, you may claim specific investments as your track record ONLY if ALL of the following criteria are true for that investment: (1) you had major responsibility for due diligence, (2) you were the lead person in structuring the investment, (3) you were the lead in recommending the deal to the investment committee, AND (4) you were the lead for your firm in post-closing oversight over an extended period of time.

Rule 4: If you made investments on a one-off basis and your record lends itself to being viewed as if it were an actual fund (meaning that the quantity of investments and magnitude of dollars resemble an actual fund), you should prepare a “SYNTHESIS” of those investments in Exhibit F2. The file name and name of fund for the exhibit should clearly indicate that the investment performance is synthesized. For a synthesized fund, you must include all qualifying investments currently held or terminated within the past ten years. Investments that qualify for inclusion in a synthesized fund are only those that satisfy items 1, 2, AND 3 below:

1. You made the investment under one of the following circumstances:

(a) Individually with your personal funds;

(b) Through an entity for which you had full discretionary voting authority, such as a trust of which you were the trustee;

(c) Through a formal fund in which you were a principal, but were not with the fund for more than half of its life,

(d) Through an entity (such as a limited partnership or LLC) that was formed for the specific purpose of making the investment, where you had decision-making authority over all aspects of the investment as general partner or managing member and were primarily responsible for raising the entity’s capital from investors.

2. You were NOT a founder of the company, an officer or employee of the company, or an advisor or consultant to the company, prior to your initial investment in the company.

3. The investment was in a company in which your total investment (in one or more rounds) was at least $250,000 if you did not serve as a member of the Board of Directors and at least $100,000 if you did serve as a member of the Board of Directors. If the investment was made through an entity specifically described in item 1(b), 1(c) or 1(d) above, you may count the entire amount invested by the entity. Otherwise, if you invested as part of a syndicate or investment club, do not count investment amounts other than your own.

If your primary activity in connection with an investment was as an investment banker, consultant, advisor, officer or employee of the company and the amount you invested was relatively small compared to the size of the overall round, do not include those investments in Exhibit F2. Exhibit F3 is available for describing any other relevant investment experience.

Based on the information above, determine for each principal which Exhibit F file(s) to prepare. Each principal must complete Exhibit F1. The remaining exhibits to be completed depend on the type of investment experience the principal has had. Principals who share the same track record with respect to a particular fund or SYNTHESIS of investments (i.e., they managed the same fund over the same period of time) should submit a single Exhibit F2 as appropriate, for that fund.

File |

Description |

Exhibit F1.xls |

Investment Experience of Principals Overview: Identifies principals of the fund, their overall experience, and their role within the fund. COMPLETE FOR ALL PRINCIPALS |

Exhibit F2.xls |

Fund Experience: Describes financing, cashflow, and performance record for investments made by a principal in his or her role as a manager of a traditional principal investment fund. Funds that are a “SYNTHESIS” of investments or for which only a part of the investments are being presented should be clearly identified. |

Exhibit F3.xls |

Other Investment Experience: Describes any other relevant investment experience not eligible for inclusion in Exhibit F2. |

SECTION 3: NAMING YOUR EXHIBIT F FILES

To ensure consistency, we ask that applicants use the following naming convention for Exhibit F files:

For Exhibit F1, please use the following “file name” convention: “F1-[applicant name]”

NOTE: [Applicant name] identifies the prospective SBIC for which this MAQ is being submitted. The maximum length allowed is 10 characters, so please abbreviate if your actual fund name is longer.

For Exhibit F2, please use the following “file name” convention: “F2-[applicant name];[Vintage Year or First Year of Investment for Synthesized Funds];[First and last name initials for each principal for which the workbook applies (separated by commas)];[Date the report was prepared( in YYYYMMDD format)]”

For Exhibit F3, please use the following “file name” convention: F3-[applicant name];[First and last name initials for each principal for which the workbook applies (separated by commas)];[Date the report was prepared( in YYYYMMDD format)]”

After you have completed all your exhibits, place the files into a zipped file, using a WINZIP compatible program. Name the zipped file “Exhibit F– [applicant name]; [last date prepared/updated ( in YYYYMMDD format)]”.

SECTION 4: DEFINITIONS OF TERMS USED IN EXHIBIT F

This section explains terms used throughout Exhibit F. The terms are listed in the order you would encounter them if you worked through the Exhibit F from start to finish.

Term |

|

Definition |

SBIC Applicant |

F1 F2-A F3-A |

Full name of the SBIC applicant (not the 10-character abbreviation you may have used to name your data files).

|

Name of Fund

|

F2-A |

Full name of the formal venture fund being presented in this exhibit. |

Fund Location |

F2-A |

Street address, city, state and zip code for the fund being presented in this exhibit. Include a current telephone number if one is available.

|

Valuation Date |

F2-A |

The assets in the portfolio are valued “as of” the valuation date. For a fund that is fully realized, the “Fund Closing Date” should be used.

|

Vintage Year |

F2-A |

The year in which the fund began making investments. If synthesized, the year that the oldest investment was made.

|

Principal(s) Involved

|

F2-A F3-A |

Full name of the principal or principals including first name, middle initial, and last name, separated using “;”. |

Total Committed LP Capital |

F2-A |

The total amount of capital pledged to a fund by private limited partners. Do not include SBA debenture leverage, if applicable. Do include SBA participating securities leverage, if applicable. (see General Guidelines)

|

SBA Debenture Leverage Committed

|

F2-A |

The total amount of SBA debenture leverage commitments, if applicable. |

Total Fund Size |

F2-A |

The dollar amount that results from the sum of Total Committed LP Capital plus SBA Debenture Leverage Committed.

|

Cash and Cash Equivalents |

F2-A |

Enter the dollar amount of all cash and cash equivalents held by your fund as of the “Valuation Date or Fund Closing Date.”

|

Liabilities |

F2-A |

Enter the current dollar amount of all liabilities of your fund, including management fees payable, excluding SBA debenture leverage if the fund is an SBIC.

|

Management Fee % |

F2-A |

Enter the percentage amount for management fees as defined by the fund’s LP Agreements during the fund’s active investment period.

|

Carried Interest % |

F2-A |

Enter the percentage amount for GP carry as defined by the fund’s LP Agreements.

|

Preferred Return % (aka Hurdle Rate) |

F2-A |

The minimum return to investors to be achieved before a carry is permitted. A hurdle rate of 8% means that the private equity fund needs to achieve a return of at least 8% per annum before the profits are shared according to the carried interest arrangement.

|

Portfolio Company |

F2-B F2-C F2-D F2-E |

Input the name of the portfolio company in which the formal or synthesized fund invested. The name fields for F2-C will populate automatically. Please continue to use the exact name, including capitalization and punctuation, for each portfolio company throughout the exhibit.

|

State of Company’s Primary Offices |

F2-B |

Enter the U.S. state of the company’s primary office at initial investment. You may also select “Puerto Rico”, “Virgin Islands”, or “Non-U.S.” if the company’s primary offices were outside of the United States.

|

Industry |

F2-B |

Select what you consider to be the primary industry of the company at initial investment, choosing from the following:

|

Description of Products/Services |

F2-B F3-B |

Briefly list the key product(s) of the company, such that the reader can get a feel for the company’s business, e.g., “Encryption software for cell phones”, “Medical devices”, “Telecom – Call center management software”, “Manufacturing – screen doors & vinyl clad window-frames”. Please do not enter overly generic terms such as “Enterprise software”, “Telecom software”, or “Business Services”.

|

Stage |

F2-B F3-B |

Select the stage of the company at initial investment, choosing from the following:

|

Type of Security |

F2-B |

Enter the type of security (e.g. senior loan, sub-debt, sub-debt with warrants, convertible debt, common stock, preferred stock). If there were any special terms, such as a minimum return, enter them here. If you provided two types of financing, such as preferred stock and a loan, you should enter both (e.g. sub-debt with equity co-invest). Enter the round of financing only if applicable (i.e. Series A, Series B, etc.)

|

Month/Year of Initial Investment

|

F2-B F3-B |

Enter the month and year when you initially invested. |

Total Investment Amount |

F2-B |

Enter the amount in dollars invested in corresponding portfolio company. Enter only the amount of the investment by the fund, not the full round of financing including co-investors.

|

Status |

F2-B F2-D |

Enter “R” if an investment is fully exited including any warrants, and enter “U” if an investment is unrealized.

For an event to be considered an exit one of the following must have occurred:

If none of the above applies, the investment has not been “exited” and should be identified with a “U” for unrealized.

|

Co-investors |

F2-B |

Enter the names of firms that were co-investors. If you co-invested with angel investors, enter "Angel". If sole investor, enter “None”.

|

Deal Lead (Pre-Investment Role) |

F2-C |

Enter the initials of the principal(s) within your firm that were “lead” on this investment (even if your firm did not lead the investment). If no one in your firm, leave blank.

|

Deal Co-Lead (Pre-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that were “co-leads” on this investment (even if your firm did not lead the investment). If no one in your firm, leave blank.

|

Deal Source (Pre-Investment Role) |

F2-C |

Enter the initials of the principal(s) within your firm that sourced this investment. If no one in your firm, leave blank.

|

Financial Analysis (Pre-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that performed the financial analysis for this investment. If no one in your firm, leave blank.

|

Market Research (Pre-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that performed the market research for this investment. If no one in your firm, leave blank. |

Lead Structuring (Pre-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that structured this investment. If no one in your firm, leave blank.

|

Lead Due Diligence (Pre-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that led the due diligence for this investment. If no one in your firm, leave blank. |

Made Recommendation to Investment Committee

|

F2-C |

Enter the initials of the principal(s) within your firm that recommended this investment to the Investment Committee. If no one in your firm, leave blank.

|

Investment Committee (Pre-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that voted on the Investment Committee during approval of this investment by your firm. If no one in your firm, leave blank. |

Negotiation (Pre-Investment Role) |

F2-C |

Enter the initials of the primary principal(s) within your firm to negotiate the terms of this investment. If no one in your firm, leave blank.

|

Closing (Pre-Investment Role) |

F2-C |

Enter the initials of the primary principal(s) within your firm to help with the closing materials for this investment. If no one in your firm, leave blank.

|

Discussion (Pre-Investment Role) |

F2-C |

Provide supporting details concerning any pre-investment activities that you marked and any other information you feel is critical to SBA’s understanding of your contribution to the deal. If more than one principal claims credit for involvement in a particular deal, identify each principal’s activity by prefacing it with his/her initials.

|

Top Ranking Officer Replaced (Post-Investment Role)

|

F2-C |

Enter "X" if you (individually or as a member of your firm’s Investment Committee) acted to replace the Top Ranking Officer in the company. If no one in your firm, leave blank.

|

Board of Directors (Post-Investment Role) |

F2-C |

Enter the initials of the principal(s) within your firm that served on the board of directors of this company. If no one in your firm, leave blank. If you played this role, describe your contribution in the “Discussion” column. Include the length of time you served as a director. If you are a “Board Observer”, leave this space blank and type “Board Observer” in the “Discussion” column.

|

Committees (Post-Investment Role) |

F2-C |

Enter the initials of the principal(s) within your firm that served on a committee of the board of directors. If you were not on any committees, leave blank.

|

Exit Process (Post-Investment Role) |

F2-C |

Enter the initials of the principal(s) within your firm that played a significant role in this company's exit. If involvement was little or none, or if the deal is unrealized, leave blank.

|

Workouts, etc. (Post-Investment Role)

|

F2-C |

Enter the initials of the principal(s) within your firm that actively participated in any workouts or restructurings of the company. If no one in your firm, leave blank. |

Officer of the company (Post-Investment Role) |

F2-C |

Enter the initials of the principal(s) within your firm that either temporarily or on an extended basis stepped in as an officer of the company after the investment was made. If no one in your firm, leave blank. Include the length of time you served as an officer in the “Discussion” column.

|

Discussion (Post-Investment Role) |

F2-C |

Provide supporting details concerning any post-investment activities that you marked and any other information you feel is critical to SBA’s understanding of your contribution to the deal. If more than one principal claims credit for involvement in a particular deal, identify each principal’s activity by prefacing it with his/her initials.

|

Realized Investments |

F2-D |

Enter the names of companies representing realized investments. Unhide columns as needed to add additional investments. Delete or re-hide any unused columns. Enter quarterly cash inflows/outflows by date of occurrence for each realized investment. Input cash outflows as negative numbers and cash inflows as positive numbers. If there are cash outflows and inflows in the same quarter, enter the cash inflows in the subsequent quarter. Leave zeros in all blank cells.

|

Unrealized Investments |

F2-D |

Enter the names of companies representing unrealized investments. Unhide columns as needed to add additional investments. Delete or re-hide any unused columns. Enter quarterly cash inflows/outflows by date of occurrence for each unrealized investment. Input cash outflows as negative numbers and cash inflows as positive numbers. If there are cash outflows and inflows in the same quarter, enter the cash inflows in the subsequent quarter. Leave zeros in all blank cells. Enter the Valuation Date in the cell to the right of ‘Current Valuation’ and below the quarterly dates. Enter the valuations for all unrealized investments as of the Valuation Date in the Current Valuation row.

Valuations should reflect unrealized appreciation and depreciation when warranted, but should be limited to those investments that have a sustained economic basis for an increase or decrease in value. Debt investments should be valued no greater than cost, with unrealized depreciation being recognized when value is impaired. Debt investments for which pricing information is publicly available should be carried at fair market value. Detailed guidelines for valuation of unrealized holdings are available at: http://www.sba.gov/idc/groups/public/documents/sba_program_office/inv_valuation.pdf.

|

Total |

F2-D |

Enter quarterly management fees/organizational costs, GP carry and Other Revenues/Expenses. Use the Other Revenues/Expenses column to make any necessary adjustments to the GP’s allocation of portfolio proceeds. Enter any accrued but unpaid (i) management fees, (ii) GP carry (including carried interest on the residual value of assets) or (iii) other expenses as a negative number in the Current Valuation row. Enter any revenues accrued but not yet received as a positive number in the Current Valuation row.

|

Amount Invested in Companies

|

F2-E F2-B |

Enter the total amount of capital invested in portfolio companies as a positive number for each year. |

Gross Cash Receipts

|

F2-E F2-B |

Enter cash proceeds from all investments as a positive number for each year. Do not enter the value of proceeds still held by the fund in tradable securities. |

Residual Value of Assets |

F2-E F2-B |

Enter the total residual or unrealized value of the portfolio as a single positive entry in the row of the Valuation Date or Fund Closing Date.

Valuations should reflect unrealized appreciation and depreciation when warranted, but should be limited to those investments that have a sustained economic basis for an increase or decrease in value. Debt investments should be valued no greater than cost, with unrealized depreciation being recognized when value is impaired. Debt investments for which pricing information is publicly available should be carried at fair market value. Detailed guidelines for valuation of unrealized holdings are available at: http://www.sba.gov/idc/groups/public/documents/sba_program_office/inv_valuation.pdf.

|

Gross Investment CF & Cumulative Gross Investment CF

|

F2-E |

No entry is required. |

Leverage and Borrowings |

F2-E |

Enter by year the amount of any debt drawn by the fund, including SBA debenture leverage, as a positive number. Leave blank if the fund did not use Leverage or Borrowings.

|

Expenses & Mgmt. Fees

|

F2-E |

Enter by year all expenses of the fund, including but not limited to management fees and organizational costs, as a positive number. Do not include interest expense associated with Leverage and Borrowings.

|

Paid-In Capital

|

F2-E |

Enter by year the amount of capital your investors paid in to the fund. Net proceeds of SBA participating securities draws should be included in Investor Takedowns. Do not include SBA debenture leverage.

|

Interest Expense |

F2-E |

Enter by year the interest expense associated with debenture Leverage and Borrowings as a positive number. Leave blank if the fund did not use Leverage or Borrowings.

|

Distributions |

F2-E |

Enter the dollar amount of cash distributions actually distributed to limited partners in your fund as a positive number (including SBA as a limited partner if the fund is a participating securities SBIC). Enter the dollar value of all non-cash distributions actually distributed to limited partners in your fund (including SBA as a limited partner if the fund is a participating securities SBIC).

|

Carried Interest |

F2-E |

Enter by year all carried interest earned by management on actual distributions as a positive number (do not include projected carried interest on remaining residual value of the fund).

|

Carried Interest on Residual |

F2-E |

As a single positive entry in the row of the Valuation Date or Fund Closing Date for the fund, enter the portion of the fund’s residual value that you calculate would go towards the general partner’s carried interest, assuming the residual value was realized.

|

Leverage Repayment

|

F2-E |

Enter by year the amount of Leverage and Borrowings repaid as a negative number. As a single positive entry in the row of the closing date or valuation date for the fund, enter the full outstanding principal repayment amount as if the fund was fully realized. Leave blank if the fund did not use Leverage or Borrowings.

|

Cash – Other Liabilities |

F2-E |

As a single positive entry in the row of the Valuation Date or Fund Closing Date for the fund, enter the cash held on the balance sheet of the fund, less any liabilities not already accounted for in previous entries on the Table F2-E.

|

Fund Information |

F2-F |

Input the name of the portfolio company in which the formal or synthesized fund invested. Please continue to use the exact name, including capitalization and punctuation, for each portfolio company throughout the exhibit.

|

Investment Statistics |

F2-F |

Enter the investment date, number of employees, enterprise value, revenue, last twelve months’ EBITDA, and investment multiple as of the Investment Date.

|

Exit/Current Statistics |

F2-F |

Enter the Exit or Current Valuation date, number of employees, enterprise value, revenue, last twelve months’ EBITDA, and exit/current multiple as of the Exit or Current Valuation date. |

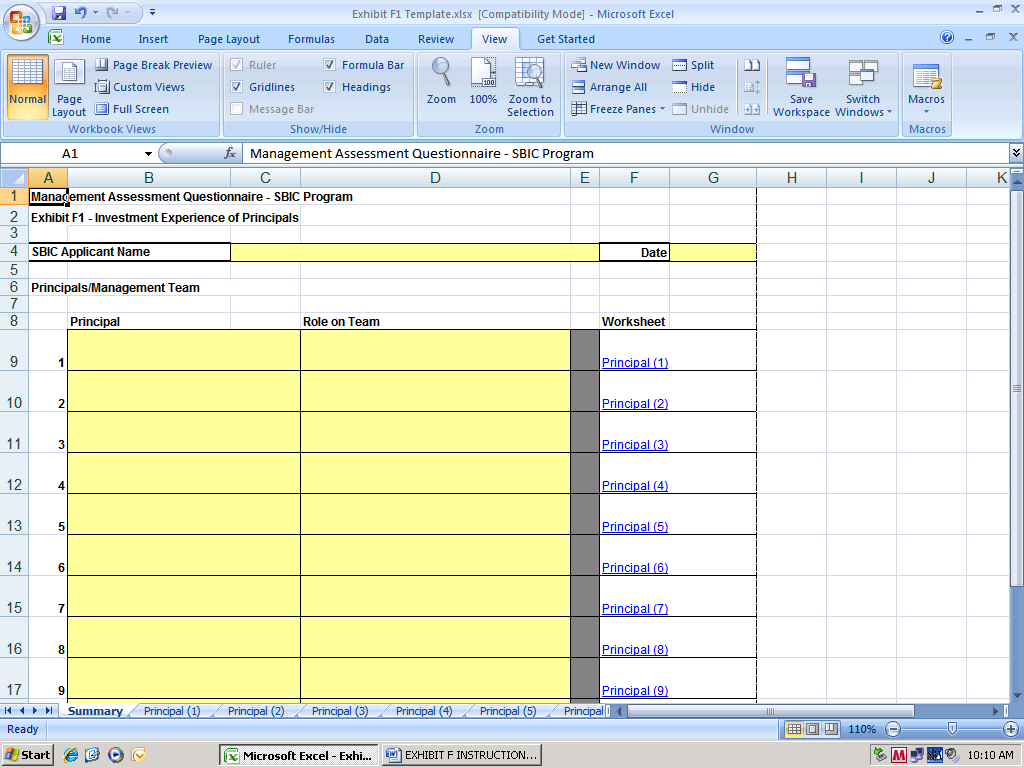

SECTION 5: EXHIBIT F1-- INVESTMENT EXPERIENCE OF PRINCIPALS OVERVIEW

This section is designed to present an overview of the investing experience for each principal on the SBIC Applicant’s team.

Open the template, “Exhibit F1.xls”. The following screen will appear:

Perform the following steps:

Enter your SBIC Applicant Name and the date on which this information was prepared.

For each principal, enter the individual’s name and a short phrase that captures the individual’s primary contribution to the team (you will have an opportunity later to expand on each person’s role).

Click on the corresponding worksheet to fill out individual information on each principal in your management team. The following screen will appear:

For each principal, complete the associated “principal” worksheet (shown above). Each field is described below.

Years with this group: Identify the number of years you have been with this SBIC applicant group. Use decimals as needed, e.g. 1.5 years.

Number of years of investing experience as principal: Identify the number of years you have had as a principal of a fund or making principal investments. If you had a break in years in which you did not invest, subtract that time. Do not include any time in which you invested as an angel, or served as investment banker, advisor or consultant.

Number of private equity investments (companies) as a principal: Identify the number of companies in which you invested as a principal of a fund or which meet SBA’s criteria for inclusion in Exhibit F.2.

Describe other relevant business activities and number of years in each activity: Specify the business activities related to the principal’s intended role and function in the proposed SBIC and the number of years in each activity.

Brief description of key role & functions in the SBIC: Describe the principal’s intended role and functions in the proposed SBIC.

In five lines or fewer, state what you consider to be your primary and/or special contribution to the management team, relative to other members of the team: Typically, team members combine their talents to form a complete team. Discuss your unique skills and how they contribute to a well-rounded management team.

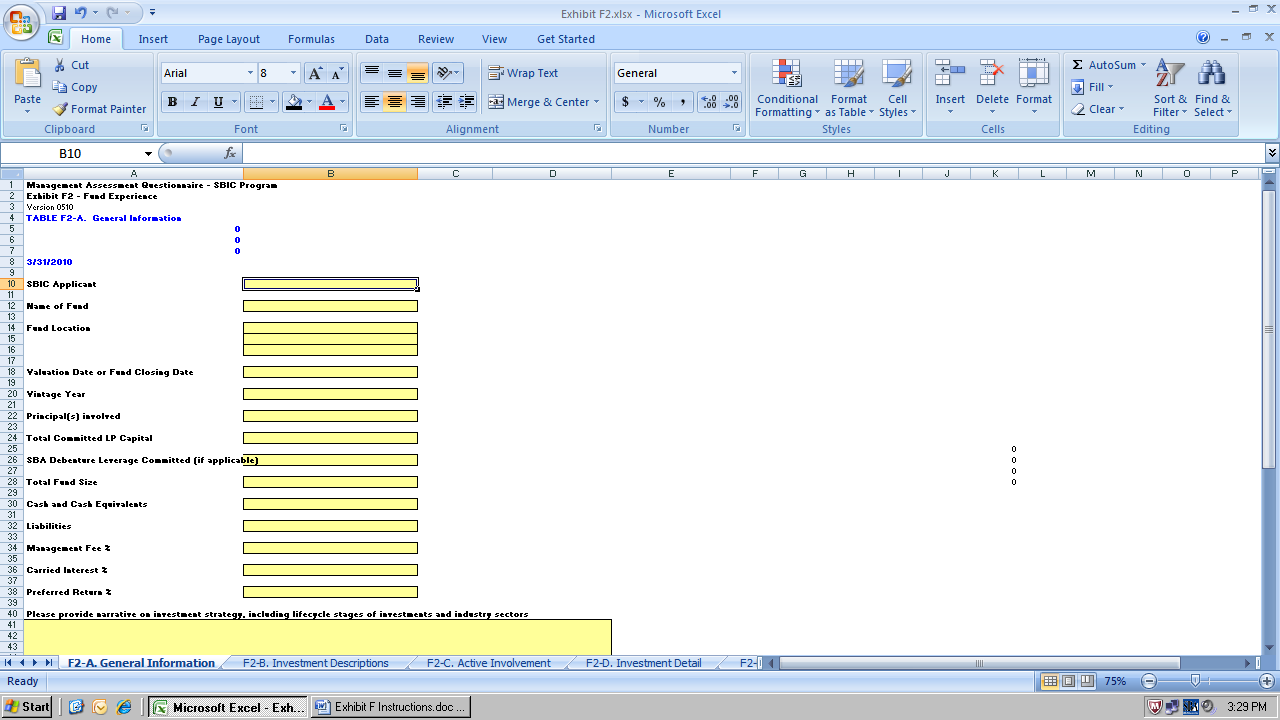

SECTION 6: EXHIBIT F2--FUND EXPERIENCE

If you reviewed SECTION 2 titled “INVESTMENTS THAT QUALIFY FOR INCLUSION IN EXHIBIT F2” and determined that Exhibit F2 is the appropriate worksheet to use, proceed with the steps outlined below:

Go to Table F2.A – General Information

Description: This table allows you to enter general information on the fund you are presenting.

Enter your information in the yellow cells.

Refer to the Definition of Terms of these instructions for further explanation of the fields to be completed.

The Footnotes area is for any information about the data in the exhibit that requires further explanation.

Go to Table F2-B. Investment Descriptions

Description: This table provides a format for you to identify and describe each of the fund’s portfolio companies. Include all companies in which the fund invested, even if they have been exited or written off.

Enter your information in the yellow cells.

Refer to the Definitions of Terms for further explanation of the fields to be completed.

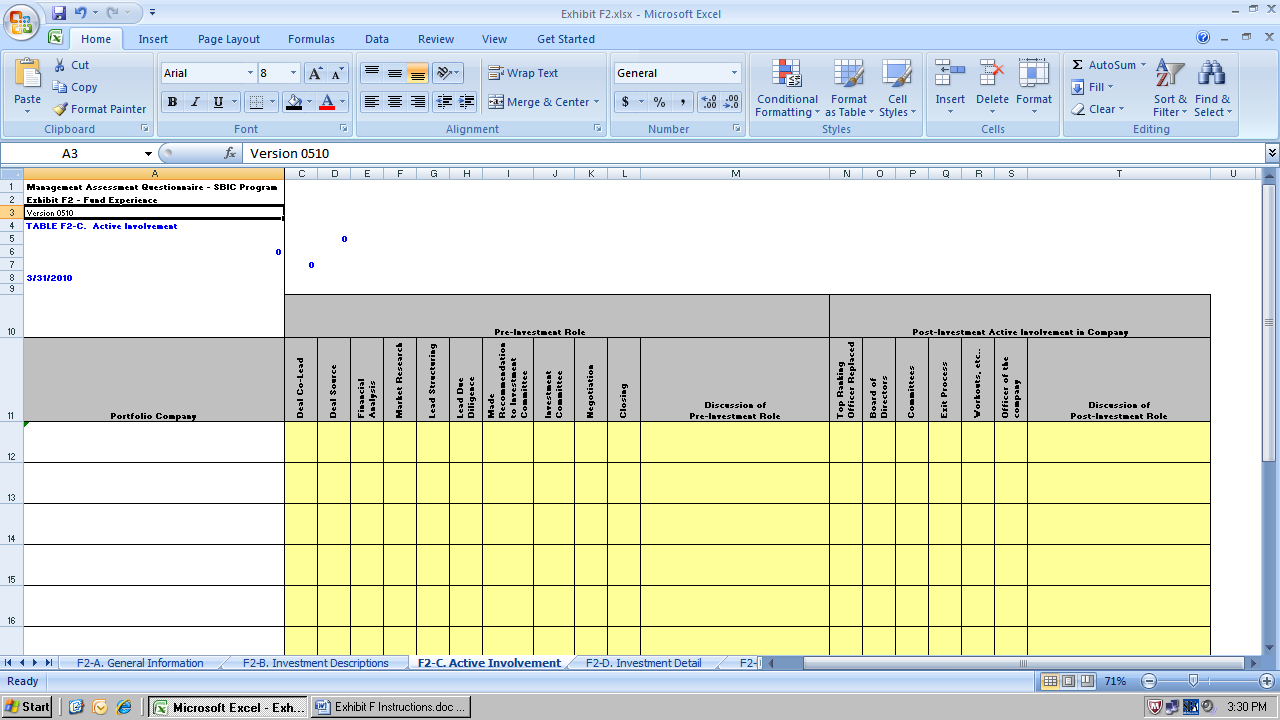

Go to Table F2-C. Active Involvement

Description: This table provides a format for you to describe the involvement of individual principals in the fund’s investments.

The spreadsheet will automatically fill in the names of all the portfolio companies you identified in Table F2-B.

Enter your information in the yellow cells.

For each portfolio company identify the role of each principal pre and post investment by placing the initials of the principal in the box. Use the “Discussion” space on the right of each row to provide detail.

Refer to the Definitions of Terms for further explanation of the fields to be completed.

NOTE: Please be careful to characterize the role of each principal accurately; SBA will use these descriptions as a starting point for its own due diligence.

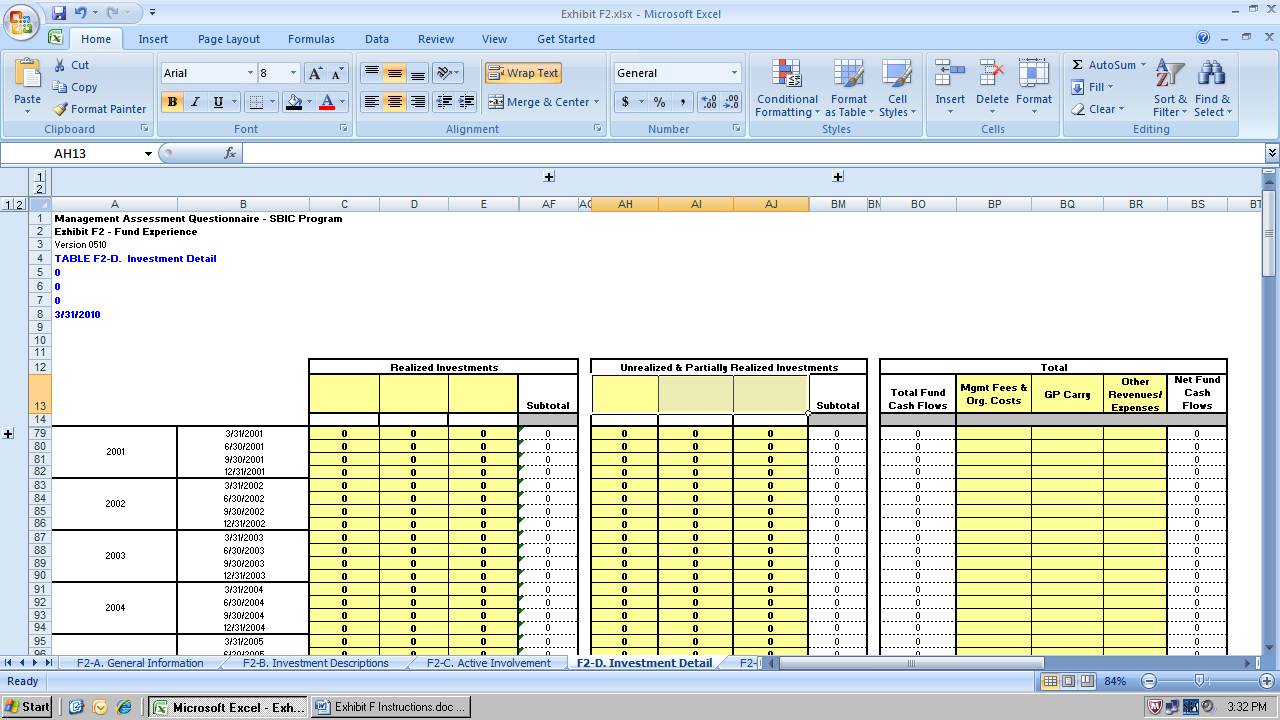

Go to Table F2-D. Investment Detail

Description: This table provides a format for you to enter quarterly (i) cash flows for each portfolio company and (ii) allocations of fund expenses, carried interest and other revenue/expenses. Note that you must enter the portfolio company names exactly as you entered them in Table F2-B. Based on this information, the spreadsheet will calculate investment-specific and overall fund statistics investment and proceed amounts, and other helpful ratios.

Enter your information in the yellow cells.

Refer to the Definition of terms of these instructions for further explanation of the fields to be completed.

Go to Table F2-E. Fund Performance Summary

Description: This table provides a format for you to enter overall fund cash flows and expenses, including investor takedowns, distributions, management expenses, carried interest and other summary fund information. All entries are by year. Based on this information, the spreadsheet will calculate overall fund statistics including IRR, distributions to paid-in capital, residual value to paid-in capital and total value to paid-in capital.

NOTE: These statistics will form the basis for SBA to evaluate your fund relative to other funds of the same vintage year and investment style. In some cases, SBA staff may request supporting documentation for the entries. If you are preparing Exhibit F2 for a synthesis of investments, do not include management fees and carry unless they were actually charged. Treat all participating securities SBIC leverage as if it were LP capital.

Go to Table F2-F. Investments & Multiples

Description: This table provides a format for you to enter important data about your portfolio company investments as of their respective investment dates and as of their Exit/Current Valuation date(s). All entries are by year. Based on this information, the spreadsheet will calculate totals and/or averages.

SECTION 7: EXHIBIT F3—OTHER EXPERIENCE

If you reviewed SECTION 2 titled “INVESTMENTS THAT QUALIFY FOR INCLUSION IN EXHIBIT F2” and determined that Exhibit F3 is the appropriate worksheet to use, proceed with the steps outlined below:

Go to Table F3.A – General Information

Description: This table allows you to enter general information on the investments you are presenting.

Enter your information in the yellow cells.

Refer to the Definition of terms of these instructions for further explanation of the fields to be completed.

The Footnotes area is for any information about the data in the exhibit that requires further explanation.

Go to Table F3.B – Investment Detail

Description: This table allows you to enter details on the investments you are presenting.

Enter your information in the yellow cells.

Refer to the Definition of terms of these instructions for further explanation of the fields to be completed.

Version 0510

| File Type | application/msword |

| File Title | GENERAL GUIDELINES FOR COMPLETING THE EXHIBIT F |

| Author | KWCraig |

| Last Modified By | CBRICH |

| File Modified | 2010-07-30 |

| File Created | 2010-07-30 |

© 2026 OMB.report | Privacy Policy