Form FDIC Form 6710-07 FDIC Form 6710-07 Application Pursuant to Section 19 of the Federal Deposi

Application Pursuant to Section 19 of the Federal Deposit Insurance Act

6710-07

Application Pursuant to Secton 19 of the Federal Deposit Insurance Act

OMB: 3064-0018

OMB No.: 3064-0018

Expiration Date: 11/30/2010

PRIVACY ACT STATEMENT

Form FDIC 6710/07, Application Pursuant to Section 19 of the Federal Deposit Insurance Act

Pursuant to Section 19 of the Federal Deposit Insurance Act, 12 U.S.C. § 1829(a), persons convicted of certain criminal offenses are prohibited from participating in the affairs of an insured depository institution without the express written consent of the FDIC. This prohibition applies to any person convicted of a criminal offense involving dishonesty, breach of trust, or money laundering or who has entered into a pretrial diversion or similar program in connection with a prosecution for such offense. In the absence of prior FDIC approval, such persons are prohibited from being directly or indirectly affiliated with an insured depository institution; owning or controlling an insured depository institution; or otherwise directly or indirectly participating in the conduct of the affairs of an insured depository institution. Insured depository institutions are also prohibited from permitting such persons from engaging in any of the aforementioned activities.

The FDIC will evaluate the information provided in this Application in accordance with the statement of policy announced in FDIC Financial Institutions Letter 125-98 (December 2, 1998). Your Social Security Number (SSN) is requested for us to verify the accuracy of the information in this Application and to differentiate you from other prospective directors, officers, or employees with similar or identical names. The collection of this information is authorized pursuant to 12 U.S.C. § 1819 and Executive Order 9397. Although providing your SSN and other requested information is voluntary, your omission of pertinent information may adversely affect the assessment of your Application.

The information collected in the Application will be maintained as part of the FDIC System of Records #30-64-000, “Financial Institutions Investigative and Enforcement Records.” This information may be disclosed in accordance with the applicable routine uses set forth in the Notice of the System of Records. This may include disclosure to (1) A court, magistrate, or administrative tribunal in the course of presenting evidence, including disclosures to counsel or witnesses in the course of civil discovery, litigation, or settlement negotiations or in connection with criminal proceedings, when the FDIC is a party to the proceeding or has a significant interest in the proceeding and the information is determined to be relevant and necessary; (2) The appropriate Federal, State, or local agency or authority, or to licensing boards, professional associations or administrative bodies responsible for investigating or prosecuting a violation of or for enforcing or implementing a statute, rule, regulation, or order when the information indicates a violation or potential violation of law, rule, regulation or order, whether civil, criminal, or regulatory in nature, and whether arising by general statute or particular program statute, or by regulation, rule, or order issued pursuant thereto; (3) A congressional office in response to an inquiry made by the congressional office at the request of the individual to whom the record pertains; (4) A financial institution affected by enforcement activities or criminal activities; (5) Other Federal, State, or foreign financial institutions supervisory or regulatory authorities; (6) A consultant, person, or entity who contracts or subcontracts with the FDIC, to the extent necessary for the performance of the contract or subcontract; and (7) The Department of the Treasury, federal debt collection centers, other appropriate federal agencies, and private collection contractors or other third parties authorized by law, for the purpose of collecting or assisting in the collection of delinquent debts owed to the FDIC.

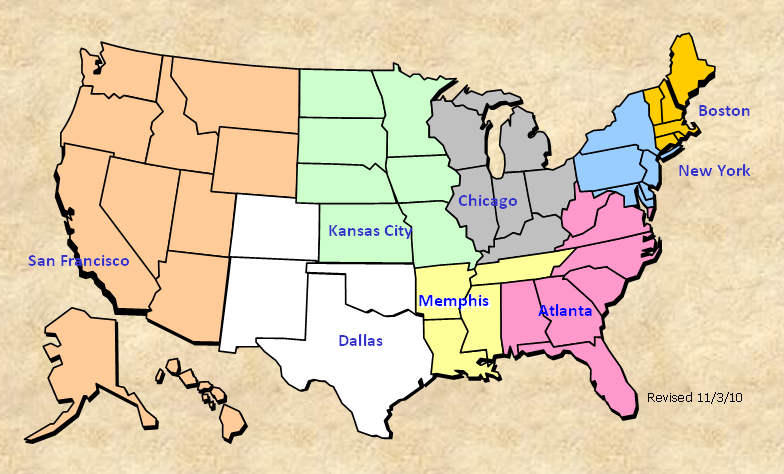

FDIC REGIONAL AND AREA OFFICES

(Send applications to the appropriate office as indicated below.)

-

ATLANTA

10 Tenth Street, NE

Suite 800

Atlanta, GA 30309-3906

800-765-3342 or 678-916-2200

States Covered: Alabama, Florida, Georgia,

North Carolina, South Carolina, Virginia, West Virginia

KANSAS CITY

2345 Grand Boulevard

Suite 1200

Kansas City, MO 64108

800-209-7459 or 816-234-8000

States Covered: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota

BOSTON AREA OFFICE

15 Braintree Hill Office Park

Suite 100

Braintree, MA 02184-8701

866-728-9953 or 781-794-5500

States Covered: Connecticut, Maine, New Hampshire, Rhode Island, Vermont, Massachusetts

MEMPHIS AREA OFFICE

5100 Poplar Avenue

Suite 1900

Memphis, TN 38137-1900

800-210-6354 or 901-685-1603

States Covered: Arkansas, Louisiana, Mississippi,

Tennessee

CHICAGO

300 South Riverside Plaza

Suite 1700

Chicago, IL 60606

800-944-5343 or 312-382-6000

States Covered: Illinois, Indiana, Kentucky, Michigan, Ohio, Wisconsin

NEW YORK

350 Fifth Avenue

Suite 1200

New York, NY 10118

800-334-9593 or 917-320-2500

States Covered: Delaware, District of Columbia, Maryland, New Jersey, New York, Pennsylvania, Puerto Rico, Virgin Islands

DALLAS

1601 Bryan Street

Dallas, TX 75201

800-568-9161 or 214-754-0098

States Covered: Colorado, New Mexico, Oklahoma, Texas

SAN FRANCISCO

25 Jessie Street at Ecker Square

Suite 2300

San Francisco, CA 94105-2780

800-756-3558 or 415-546-0160

States Covered: Alaska, American Samoa, Arizona, California, Federated States of Micronesia, Guam, Hawaii, Idaho, Montana, Nevada, Oregon, Utah, Washington, Wyoming

Federal Deposit Insurance Corporation |

CORPORATION GUIDELINES AND POLICIES WITH RESPECT TO SECTION 19 |

Paperwork Reduction Act Notice: The FDIC may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB number. Section 19 of the Federal Deposit Insurance Act (12 U.S.C. § 1829) requires the FDIC’s written consent prior to any participation in the affairs of an insured depository institution by a person who has been convicted of crimes involving dishonesty or breach of trust. An insured depository institution that desires to obtain the FDIC’s consent must submit an application to the FDIC on form FDIC 6710/07. The estimated burden for this collection of information is 16 hours per response. Send comments regarding this burden estimate or any other aspect of this collection, including suggestions for reducing this burden, to the Paperwork Reduction Officer, Legal Division, Federal Deposit Insurance Corporation, 550 17th Street, N.W., Washington, D.C. 20429 |

On September 27, 1968, the Federal Deposit Insurance Corporation’s Chairman addressed the following memorandum to all insured banks.

“The Federal Deposit Insurance Corporation has for some time been studying in detail Section 19 of the Federal Deposit Insurance Act (12 U.S.C. 1829), relating to the requirement for this Corporation’s consent prior to any insured bank employing persons who have been convicted of crimes involving dishonesty or breach of trust.”

“Section 19 provides as follows:

‘Except with the written consent of the Corporation no person shall serve as a director, officer, or employee of an insured bank who has been convicted, or who is hereafter convicted of any criminal offense involving dishonesty or breach of trust. For each willful violation of this prohibition, the bank involved shall be subject to a penalty of not more than $100 for each day this prohibition is violated, which the Corporation may recover for its use.’”

“Since the enactment of this law in 1950, our Board has reviewed cases coming under it on an ad hoc basis and each case has been judged on its own merits according to the particular facts and circumstances involved. The need for guidelines and standards to be applied prospectively has increased in recent years. Inquiries continue to come in from banking institutions asking what standards should be applied by them in determining whether an application under Section 19 is required. In addition, programs are now underway on both the federal and state levels to hire and retrain the hardcore unemployed, some of whom may have criminal records, and the banking community will no doubt participate in these programs to some degree. For these reasons, the Board of Directors has adopted the following general guidelines and policies with respect to Section 19. It is our hope that these guidelines will be of assistance to all banks having questions concerning the applicability of our law, and that they will, at the same time, serve to insure the continuing stability and confidence in our banking system.”

I. STANDARDS TO BE APPLIED IN DETERMINING WHETHER AN APPLICATION FOR CONSENT IS REQUIRED UNDER SECTION 19

B. The conviction must be for a criminal offense involving dishonesty or breach of trust. Felonies as well as misdemeanors wherein dishonesty or breach of trust is involved are included within the definition. Dishonesty is defined to mean “to cheat or defraud for monetary gain or its equivalent, directly or indirectly, or to wrongfully take from any person, property lawfully belonging to that person in violation of any criminal statute or code.” [Acts of dishonesty are further defined to include, but not limited to, such acts which involve want or integrity; lack of probity; or involve a disposition to distort, defraud, cheat, or to act deceitfully or fraudulently. Furthermore, dishonesty may also include crimes which by federal or state criminal statutes and codes are defined as dishonest.] Breach of trust is defined to mean “a wrongful use, misappropriation, or omission with respect to any property or fund which has been lawfully committed to a person in a fiduciary capacity.”

C. Youth Offenders

1. Adjudgment by a court against a person as a “youthful offender,” under any youthful offender law or adjudgment as a “juvenile delinquent” by a family court or any other court having jurisdiction over minors as defined by state law will not require an application under Section 19. Such adjudications are not considered convictions for criminal offenses.

1. The conviction of any adult or minor by a court of competent jurisdiction for any criminal offense involving dishonesty or breach of trust as defined in paragraph B above will require an application for consent prior to a bank’s employment of that person.

II. THE CORPORATION’S POLICY WITH RESPECT TO APPLICATIONS MADE UNDER SECTION 19

A. In considering any application made by an insured bank to employ a person who has been convicted of a criminal offense involving dishonesty or breach of trust, the factors to be considered will include but will not be limited to the following:

1. The specific nature of the offense involved and the circumstances surrounding it. 2. The evidence of rehabilitation of the person since the date of his/her conviction (parole, suspension of sentence, and reputation of the person since conviction) will be given consideration. Participation by the person in programs on the national or state levels to hire and retain the hard-core unemployed also will be given consideration. 3. The age of the person at the time of his/her conviction. 4. The position to be held by the person in the bank. 5. The fidelity bond coverage applicable (or to be applicable) to the person.

CORPORATION STATEMENT OF POLICY

The Board of Directors of the Federal Deposit Insurance Corporation approved the following statement of policy at its offices in Washington, D.C., on the 21st day of September, 1976:

The Corporation does not view Section 19 as being punitive in intent. Rather, the essential criterion in assessing such applications is whether the prospective director, officer, or employee constitutes a significant threat or risk to the safety and soundness of the applicant bank, and our policy is to approve applications in which this risk is absent.

Existing Corporation policy on Section 19 applications has involved consideration of the nature and circumstances of the offense, the evidence of rehabilitation, the position to be held by the employee in the bank, and the applicability of the bank’s fidelity bond coverage to the employee. These remain important considerations in determining the risk to the bank in the employment of the prospective employee.

On this basis, many applications can be routinely approved because the prospective employee will not be in a position to constitute any substantial risk to the safety and soundness of the bank. Employees who will occupy clerical, maintenance, or service positions or, in many banks, administrative or teller positions generally pose no such risk, and on application from the board of directors of the bank, normally will be able to be routinely approved. A more detailed analysis will be required in the case of directors, officers, or other employees in a position to control or influence the disposition of sums of money large in relation to the size of the bank. |

FEDERAL DEPOSIT INSURANCE CORPORATION

APPLICATION PURSUANT TO SECTION 19 OF THE FEDERAL DEPOSIT INSURANCE ACT

SECTION A – APPLICANT BANK INFORMATION |

|||||

1. NAME OF BANK |

2. DATE OF APPLICATION |

||||

3. ADDRESS OF BANK (Street, City, County, State, and ZIP Code) |

|||||

We have, in connection with this Request, read the following provisions of the Federal Deposit Insurance Act which governs requests by insured banks for the written consent of the Federal Deposit Insurance Corporation to the employment, by the Bank, of a person who has been convicted of a crime involving dishonesty or breach of trust, namely:

“Section 19. Except with the written consent of the Corporation, no person shall serve as a director, officer, or employee of an insured bank who has been convicted, or who is hereafter convicted, of any criminal offense involving dishonesty or a breach of trust. For each willful violation of this prohibition, the bank involved shall be subject to penalty of not more than $100 for each day this prohibition is violated, which the Corporation may recover for its use.”

In support of this Request, the following statements, representations and information are submitted for the purpose of inducing the Federal Deposit Insurance Corporation to grant its written consent to the service as a director, officer, or employee of the bank, a person who has been convicted of a crime involving dishonesty or a breach of trust: |

|||||

SECTION B = BIOGRAPHICAL INFORMATION CONCERNING THE PROSPECTIVE DIRECTOR, OFFICER, OR EMPLOYEE |

|||||

1. NAME |

2. ADDRESS (Street, City, State and ZIP Code) |

||||

3. DATE OF BIRTH (Mo., Day, Yr.) |

|||||

4. PLACE OF BIRTH (City and State) |

|||||

5. SOCIAL SECURITY NUMBER |

|||||

6. NAME AND ADDRESS OF PRESENT OR MOST RECENT EMPLOYER (Street, City, State and ZIP Code) |

|||||

7. INDICATE TOTAL NUMBER OF VOTING SHARES OF THE BANK’S STOCK DIRECTLY OR INDIRECTLY OWNED OR OTHERWISE CONTROLLED (Answer “none” if appropriate.) |

|||||

SECTION C – INFORMATION RELATIVE TO CONVICTION(S) |

|||||

1. DESCRIPTION OR NATURE OF CRIME (a) |

DATE OF CONVICTION (b) |

NAME AND ADDRESS OF COURT (c) |

DISPOSITION (d) |

||

|

|

|

|

||

NOTE: If additional convictions for crimes involving dishonesty or breach of trust are discovered subsequent to approval of this request, another request may be necessary. |

|||||

2. Briefly describe the nature of the offense and the circumstances surrounding it. Include age of prospective employee at the time of conviction, date of the offense, and any mitigating circumstances (parole, suspension of sentence, pardon, etc.) |

|||||

3. Briefly describe the extent of rehabilitation of the prospective director, officer, or employee and attach supporting documents, if any. |

|||||

4. Attach copies of the Indictment, Information, or Complaint and Final Decree of Judgment, if available. (Normally these can be obtained from the clerk of the court. If not provided, explain reasons for unavailability). |

|||

5. List any other pertinent facts relative to the crime which are not disclosed in the indictment.

|

|||

I do hereby certify that the Biographical Information (Section B) and Information Relative to Conviction (Section C) are true and correct to the best of my knowledge and belief. |

|||

SIGNATURE OF PROSPECTIVE DIRECTOR, OFFICER, OR EMPLOYEE |

DATE SIGNED |

||

NOTE: The information requested in Sections B and C above, including the Social Security Number of the prospective director, officer, or employee, is solicited pursuant to Section 19 of the Federal Deposit Insurance Act (12 U.S.C. §1829). This information is necessary to assist the FDIC in assessing the merits of the application. Some of the information, including the Social Security Number, may be provided to any appropriate Federal or State bank regulatory agency and, law enforcement or other government agencies for identity verification purposes. Should the information indicate a violation of law, the application may be referred to any agency responsible for investigating or prosecuting such a violation. In addition, in the event of litigation, the application may be presented to the appropriate court as evidence and to counsel in the course of discovery. While submission of the information is voluntary, an omission or inaccuracy may result either in delay in processing the application or in a denial of the application. Falsification of any of the information may serve as a basis for removal of the director, officer, or employee if employed by the bank and as grounds for criminal charges. |

|||

SECTION D – POSITION TO BE OCCUPIED BY THE PROSPECTIVE DIRECTOR, FFICER OR EMPLOYEE |

|||

1. TITLE OF POSITION(S) |

|||

2. Describe the duties and responsibilities of the prospective director, officer, or employee. Include extent of supervision exercised over others and/or by others. |

|||

|

|||

NOTE: Should this request be approved, any significant change in the duties and/or responsibilities of the prospective director, officer, or employee which occurs within 12 months subsequent to such approval must be reported in writing to the Regional Director of the Federal Deposit Insurance Corporation Region in which the bank is located. |

|||

SECTION E – NOTIFICATION OF FIDELITY INSURER |

|||

The bank’s fidelity insurer is to be notified of all pertinent information regarding the conviction of the prospective employee. Assurances from the fidelity insurer must be obtained, in writing, stating that the prospective director (if applicable), officer, or employee will be covered by the bank’s fidelity bond.

The application and the information requested herein may be submitted prior to notification of the bonding company; however, the Corporation’s consent will be subject to a condition that written assurance of fidelity coverage to the same extent as others in similar positions be obtained by the bank. |

|||

SECTION F – ADDITIONAL INFORMATION IN SUPPORT OF THIS REQUEST |

|||

List any other appropriate information. |

|||

I do hereby certify that the Board of Directors adopted a resolution which delegated the undersigned the authority to make applications pursuant to Section 19 of the Federal Deposit Insurance Act or has adopted a resolution authorizing this application pursuant to Section 19 of the Federal Deposit Insurance Act. |

|

||

|

|

||

SIGNATURE OF BANK OFFICIAL |

|

||

This is an official document of the Federal Deposit Insurance Corporation. Providing false information may be grounds for prosecution under the provisions of Title 18, Section 1001 or 1007 of the United States Code and may be punishable by fine or imprisonment

FDIC 6710/07 (6-91) Addendum

| File Type | application/msword |

| File Title | Paperwork Reduction Act Notice for Application For Federal Deposit Insurance FDIC 6710/07 |

| Author | lwest |

| Last Modified By | leneta gregorie |

| File Modified | 2010-11-17 |

| File Created | 2010-11-17 |

© 2026 OMB.report | Privacy Policy