2408ss02_01_04_2012

2408ss02_01_04_2012.docx

Recordkeeping and Reporting Related to E15 (Final Rule)

OMB: 2060-0675

SUPPORTING STATEMENT – PART A

RECORDKEEPINGAND REPORTING RELATED TO E15

Docket EPA-HQ-OAR-2010-0448

A. JUSTIFICATION

1. Identification of the Information Collection

a. Title: Recordkeeping and Reporting Related to E15, EPA ICR No.2408.01.

b. Short characterization:

In two recent actions under the Clean Air Act (CAA), EPA granted partial waivers that allow gasoline containing greater than 10 volume percent (vol%) ethanol up to 15 vol% ethanol (E15) to be introduced into commerce for use in model year (MY) 2001 and newer light-duty motor vehicles, subject to certain conditions. EPA has issued final rule1 establishing several measures to mitigate misfueling of other vehicles, engines and equipment with E15 and the potential emissions consequences of misfueling. The rule prohibits the use of gasoline containing more than 10 vol% ethanol in vehicles, engines and equipment that are not covered by the partial waiver decisions. The final rule also requires all E15 gasoline fuel dispensers to have a specific label when a retail station or wholesale-purchaser consumer chooses to sell E15. In addition, the rule requires that product transfer documents (PTDs) specifying ethanol content and Reid Vapor Pressure (RVP) accompany the transfer of gasoline blended with ethanol, and a survey of retail stations to ensure compliance with these requirements. The rule also modifies the Reformulated Gasoline (RFG) program by updating the Complex Model to allow fuel manufacturers to certify batches of gasoline containing up to 15 vol% ethanol. This ICR supporting statement addresses recordkeeping and reporting items in the final rule.

Specifically, after carefully considering the public comments, EPA finalized four measures to help mitigate misfueling. . The recordkeeping and reporting measures in this ICR are related to the four measures, which are:

1. A regulatory prohibition on misfueling. With adoption of the misfueling prohibition, gasoline and ethanol producers, distributors, retailers and consumers have a legal obligation not to make, distribute, sell or use gasoline containing more than 10 vol% ethanol for (or in) vehicles, engines and equipment not covered by the partial waiver decisions.

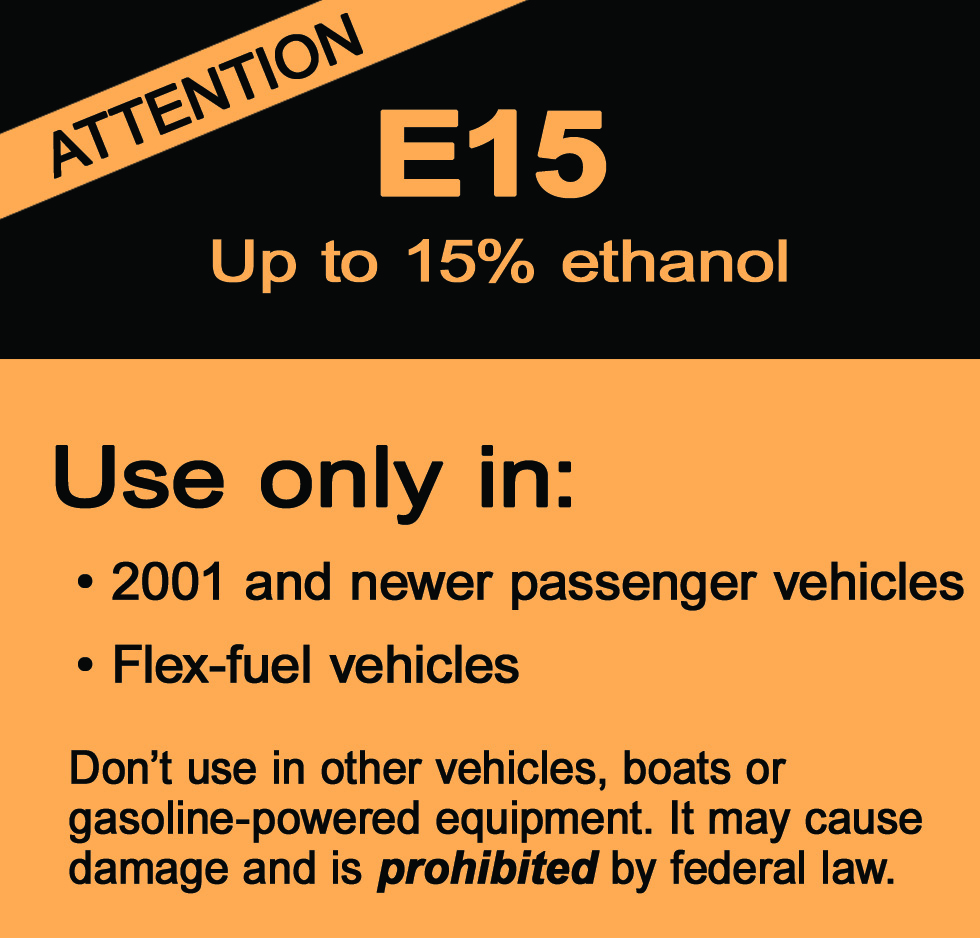

2. A pump labeling requirement. To provide consumers with information at the pump to avoid misfueling, the regulation requires an E15 pump label that reflects many commenters’ suggestions and our consultation with consumer labeling experts at the Federal Trade Commission (FTC).2 Before EPA issued its partial waiver decisions, FTC had proposed labels for gasoline-ethanol blends containing more than 10 vol% ethanol to address issues within its jurisdiction. Commenters on our proposed E15 label urged us to work with FTC to develop a coordinated labeling program to avoid multiple, potentially conflicting labels. Commenters also recommended that we seek advice from labeling experts. In developing the final labeling requirements, we consulted with FTC consumer labeling experts and other staff about effective label design and potential coordination with FTC labels. Since EPA is dictating the content and appearance of the label, there is no “information collection” except in the narrow circumstance where an individual seeks an alternative label, which must be submitted to EPA for approval. We expect very few (if any) requests for alternative labels. However, as described below, we have provided an estimate for this item.

EPA’s final E15 label incorporates public and FTC staff suggestions for more simply and effectively communicating the information consumers need to avoid misfueling with E15. The label also adopts FTC’s color scheme for alternative fuel labels and other aspects of the design of FTC’s proposed gasoline-ethanol blend labels, such as size, shape, and font, so that the two agencies’ labels could work together as a coordinated labeling scheme for gasoline-ethanol blends containing more than 10 vol% ethanol. We believe that the final E15 label provides consumers with the key information they need about the appropriate use of E15.

The required label in the regulation appears as follows:

3. A product transfer document (PTD) requirement. The final rule includes PTD requirements that have been revised and refined in response to public comments to better accomplish their purpose. The fine rule required that PTDs provide pertinent information, and provided a good deal of flexibility in how that information is conveyed to help ensure that fuel producers, distributors and retailers have the information they need to properly blend, track and label E15. PTDs are commonly used in the course of business and, once programmed, are generally produced via a quick, automated process.

4. A survey requirement. For surveys of whether E15 is being properly blended and labeled, the final rule provides options that allow the businesses involved to match the geographic scope of an ongoing survey to their business plans and to share the cost of surveys among themselves as they see fit. The final rule requires that surveys collect RVP information for fuel samples labeled as E15 to help ensure implementation of the waiver condition that E15 be limited to 9.0 psi RVP in the summertime. In the aggregate, these measures will provide strong incentives for fuel providers to properly blend and label E15 and for consumers to avoid misfueling. As discussed below, we believe that most parties will choose to use the existing survey association (i.e. we expect one respondent and certainly fewer than nine respondents). However, we have provided an option for doing an individual survey and have priced that option, as described below.

2. Need For, and Use of, the Collection

Authority for the Collection

Sections 114 and 208 of the Clean Air Act (CAA), 42 U.S.C. §§ 7414 and 7542, authorize EPA to require recordkeeping and reporting regarding enforcement of the provisions of Title II of the CAA.

b. Practical Utility/Uses of the Data

The recordkeeping and reporting requirements of this regulation will allow EPA to monitor compliance with the E15 labeling rule.

3. Non-duplication, Consultation, and other Collection Criteria

a. Non-duplication

Efforts have been made to eliminate duplication in this information collection.

b. Public Notice

EPA is sought comment on proposed recordkeeping and reporting as part of the NPRM. We docketed a copy of the supporting statement with the proposed and final rule, but received no comments on the estimates. We then sent the supporting statement to four industry representatives seeking comment. We received two responses, as discussed in section 6(d) – Estimating the Respondent Universe – below.

c. Consultations

We have drawn upon our experience with similar fuels regulations to develop the estimates in this supporting statement. We also sought comment from potential industry respondents, as discussed in section 6(d) – Estimating the Respondent Universe – below.

d. Effects of Less Frequent Data Collection

Less frequent collection of data would make it impossible to carry out the provisions of the Clean Air Act and the final rule.

e. General Guidelines

This rule does not exceed any of the OMB guidelines.

f. Confidentiality

We inform respondents that they may assert claims of business confidentiality (CBI) for information they submit. Information that is received without a claim of confidentiality may be made available to the public without further notice to the submitter under 40 CFR § 2.203.

g. Sensitive Information

This information collection does not require submission of any sensitive information.

4. The Respondents and the Information Requested

a. Respondents/with NAICS and SIC Codes

The respondents are related to the following major group Standard Industrialization Classification (SIC) codes:

2869 - Denatured Alcohol Manufacturing

2911 - Petroleum Refineries

4212 - Gasoline Distributors

5171 - Gasoline Bulk Stations and Terminals

5172 - Gasoline Merchant Wholesalers (except bulk stations, terminals)

5541 - Retailers/Wholesale Purchaser-consumers

The respondents are related to the following major group NAICS codes:

324110 - Petroleum Refineries

325193 - Denatured Alcohol Manufacturing

424710 - Gasoline Bulk Stations and Terminals

424720 - Gasoline Merchant Wholesalers (except bulk stations, terminals)

Using the terminology associated with E15, we have assumed the following classes of party, with the number of each in parenthesis:

Gasoline refiners (150) and gasoline/ethanol importers (50), for a total of 200 parties

Gasoline/ethanol blenders (terminals) (1,000)

Gasoline/ethanol blenders (carriers) 800

In addition, retailers and wholesale purchaser consumers may apply for alternative labels. We only expect a small number of parties to apply for an alternative labels. Using the terminology associated with E15, we have assumed the following classes of party, with the number of each expected to apply in parenthesis:

Branded retailer (10)

Other retailer (25)

Wholesale purchaser-consumer (25)

The numbers of parties we have estimated are based upon information we have in our databases for other fuels programs requiring these parties to register (e.g., reformulated gasoline, renewable fuels standard) under 40 CFR Part 80. We believe our registration databases for existing programs are sufficient to characterize the universe of potential respondents under the E15 labeling rule.

Retailers and wholesale purchaser-consumers are only required to retain PTDs, and already do so under existing fuels programs for a period of five (5) years. In addition, since such parties normally retain copies of PTDs as customary business practice (CBP), we do not estimate any ICR burden for those parties.

b. Information Requested

A) Reporting: The E15 final rule contains information collection provisions that permit a party to apply for approval of an alternative or additional E15 label. We anticipate that this provision may be utilized by some refiners for their branded retailers, as well as by some individual retailers and wholesale purchaser-consumers. However, we anticipate very few respondents (applicants) based upon our experience with prior regulations that included provisions for alternative labeling under 40 CFR Part 80 (e.g. oxygenated gasoline labels). It is also quite possible that no party will request an alternative label. However, we have provided an estimate for this item because it is possible we will receive applications for alternative labeling under this program.

A party may elect to satisfy the survey requirements of this rule individually rather than through using a nationwide, consortium survey option (i.e., they may elect “Survey Option 1.” In such circumstances, the individual information collection requirements associated with “Survey Option 1” will apply. Parties that may be subject to survey information collection requirements include gasoline refiners, gasoline and ethanol importers, gasoline and ethanol blenders (including terminals and carriers), and ethanol producers. We anticipate that few, if any, parties will elect to satisfy the survey by choosing “Survey Option 1.” When we have offered this option in the past under other 40 CFR Part 80 fuels programs (e.g. RFG), no party has elected to do so. Therefore it is quite possible that no party will choose “Survey Option 1.” However, we have provided an estimate for this option because the opportunity to choose “Survey Option 1” exists under this program.

Under the terms of the E15 partial waiver, which is separate from the final rule but closely related to it, fuel and fuel additive manufacturers must submit a written plan to EPA for approval.3 The plan must include provisions designed to prevent misfueling. The plan must be submitted by all fuel and fuel additive manufacturers, regardless of whether a party elects “Survey Option 1” (individual) or “Survey Option 2” (nationwide). Parties that may be subject to this information collection item may include gasoline refiners, gasoline and ethanol importers, gasoline and ethanol blenders (including terminals and carriers), and ethanol producers. These estimates were not included in the draft supporting statement prepared for the notice of proposed rulemaking, but we have included them in this supporting statement to accompany the final rule.

The final rule contains provisions related to product transfer documents (PTDs). Parties upstream of the retail station or wholesale purchaser-consumer will be required to develop and program new codes and statements for PTDs. These codes will reflect the ethanol content, as well as the Reid Vapor pressure (RVP). Parties subject to this one time burden include gasoline refiners, gasoline importers, and gasoline and ethanol blenders (including terminals and carriers).

In addition to the one time burden of establishing/programming codes and statements for PTDs, parties will be required to apply the new codes and statements to PTDs as part of the normal course of business. The application of codes and statements is typically an automated process. We have discussed our estimates with regulated parties who use PTDs and they concurred with our characterization as to the burden. Typically, refiners and wholesale purchaser-consumers who are not acting as blenders merely accept PTDs given to them by upstream parties. The following parties may have the burden of applying codes and statements: gasoline refiners, gasoline importers, gasoline and ethanol blenders (including terminals and carriers).

B) Recordkeeping: Parties must retain PTDs and other records related to compliance, such as QA results, for five (5) years. Retention of PTDs is already a customary business practice (CBP) for the industry. In addition, parties are already required to retain these records for five (5) years under existing 40 CFR Part 80 fuels programs. Therefore, this final rule imposes no changed or additional recordkeeping burden.

5. The Information Collected, Agency Activities, Collection Methodology, and Information Management

a. Agency Activities

We are not establishing any periodic compliance reporting provisions under this regulation. The frequency of reporting is determined by the activities of the respondents themselves. The estimates in this ICR for use of PTDs, or application to EPA for an alternative label, are based upon our expectations and experience with similar programs. EPA may request production of records, particularly in situations where a violation is suspected or observed.

b. Collection and Methodology and Management

Normally, we will not collect records or reports from regulated parties, but we may, particularly in connection with enforcement actions. A party may claim that information is submits to EPA is confidential business information (CBI). Information claimed as CBI will be stored in appropriately controlled areas and will be treated in accordance with 40 CFR Part 2 and EPA policies and procedures for handling of CBI.

c. Small Entity Flexibility

The final rule and its information collection requirements will not have any substantial impact on small entities.

d. Collection Schedule

Reporting is occasional. The frequency of reporting is determined by the respondent.

6. Estimating the Burden and Cost of Collection

a. Estimating the Respondent Universe

We drew upon experience implementing similar regulations among the same and similar entities to develop estimates of the burden associated with this collection.

b. Estimating Respondent Costs

Estimating Labor Costs

In discussions with industry, four labor categories were identified as having involvement: managerial, legal, professional/technical (prof/tech) and clerical. According to the Bureau of Labor Statistics, May 2008 National Industry-Specific Occupational Employment and Wage Estimates, mean wages were:

Wages

Managerial $60.42 per hour

Legal $84.56 per hour

Prof/Tech $60.05 per hour

Clerical $17.34 per hour

Doubling for company overhead and employing a 2% annual inflation factor to bring the rates to the year 2011, and, for convenience, rounding to the nearest dollar, gives the following rates that will be used for this ICR:

Total Employer Cost

Managerial $128

Legal $179

Prof/Tech $127

Clerical $ 36

The labor mix for each task is assumed to be about 0.05 hour managerial, 0.05 hour legal, 0.7 hour professional/technical, and 0.2 hour technical. This gives an average labor cost of about $110 per hour, which will be used in this ICR. Our estimates are summarized in the following table:

DETAILED ICR ESTIMATES |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collection |

|

Type of |

No. of |

No. of |

Total No. of |

Time Per |

Cost Per |

Total Hours |

Total Cost |

|

Assumes: |

Activity |

|

Party |

Parties |

Responses |

Responses |

Response |

Hour |

|

|

|

|

|

|

|

|

per Party |

|

Hours |

|

|

|

|

|

80.1501(b)(5) |

Branded |

|

|

|

|

|

|

|

|

|

|

Submission of Alt. or |

Retailer |

10 |

1 |

10 |

24 |

110 |

240 |

26400 |

|

|

|

Additional Labels for |

|

|

|

|

|

|

|

|

|

|

|

EPA Approval |

Other |

|

|

|

|

|

|

|

|

|

|

REPORTING |

Retailer |

25 |

1 |

25 |

24 |

110 |

600 |

66000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WP-C |

25 |

1 |

25 |

24 |

100 |

600 |

60000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80.1502(a) |

|

G Refiner |

5 |

1 |

5 |

200 |

110 |

1000 |

110000 |

|

|

Survey Option 1 |

G/E Importer |

5 |

1 |

5 |

200 |

110 |

1000 |

110000 |

|

|

|

REPORTING |

G/E Blender |

5 |

1 |

5 |

200 |

110 |

1000 |

110000 |

|

|

|

|

|

E Producer |

5 |

1 |

5 |

200 |

110 |

1000 |

110000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80.1503 - Use of PTDs |

|

|

|

|

|

|

|

|

|

HOURS: |

|

indicating RVP and |

G Refiner |

150 |

22,000 |

3300000 |

0.0002778 |

110 |

916.66667 |

100833.33 |

|

1 second/ |

|

and EtOH content |

G Importer |

50 |

22,000 |

1100000 |

0.0002778 |

110 |

305.55556 |

33611.111 |

|

report |

|

(Upstream of terminal) |

|

|

|

|

|

|

|

|

|

||

REPORTING |

|

|

|

|

|

|

|

|

|

12,222 hrs. |

|

|

|

|

|

|

|

|

|

|

|

|

$1,344,420 |

PTDs for downstream |

G/E blender |

1,000 |

22,000 |

22000000 |

0.0002778 |

110 |

6111.1111 |

672222.22 |

|

|

|

indicating RVP and |

(terminal) |

|

|

|

|

|

|

|

|

|

|

EtOH content |

G/E blender |

800 |

22,000 |

17600000 |

0.0002778 |

110 |

4888.8889 |

537777.78 |

|

|

|

REPORTING |

(carrier) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOURS: |

80.1503 - Programming |

G Refiner |

150 |

4 |

600 |

0.33 |

110 |

198 |

21780 |

|

One time |

|

PTDS (statements/codes) |

G Importer |

50 |

4 |

200 |

0.33 |

110 |

66 |

7260 |

|

burden |

|

|

|

G/E Blender |

1000 |

4 |

4000 |

0.33 |

110 |

1320 |

145200 |

|

(note: div. |

|

|

(terminal) |

|

|

|

|

|

|

|

|

by 3 to |

|

|

G/E Blender |

800 |

4 |

3200 |

0.33 |

110 |

1056 |

116160 |

|

get annual |

REPORTING |

(carrier) |

|

|

|

|

|

|

|

|

burden) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Waiver - Submission |

G Refiner |

150 |

1 |

150 |

8 |

110 |

1200 |

132000 |

|

One time |

|

of Waiver Plan |

G/E Importer |

50 |

1 |

50 |

8 |

110 |

400 |

44000 |

|

burden |

|

by Fuel and |

G/E Blender |

1000 |

1 |

1000 |

8 |

110 |

8000 |

880000 |

|

(note: div. |

|

Fuel Additive |

(terminal) |

|

|

|

|

|

|

|

|

by 3 to get |

|

Manufacturers |

G/E Blender |

800 |

1 |

800 |

8 |

110 |

6400 |

704000 |

|

annual |

|

|

|

(carrier) |

|

|

|

|

|

|

|

|

burden) |

REPORTING |

E Producer |

131 |

1 |

131 |

8 |

110 |

1048 |

115280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

131 is the |

REPORTING TOTALS |

|

6211 |

|

44010211 |

|

|

37350.222 |

4102524.4 |

|

number of |

|

|

|

|

|

|

|

|

|

|

|

|

registered |

See NOTES below regarding retention of QA records. |

|

|

|

|

|

|

ethanol |

||||

RECORDKEEPING |

|

|

|

|

|

|

|

|

|

producers |

|

|

|

|

0 |

|

0 |

|

|

0 |

0 |

|

as of |

RECORDKEEPING |

|

|

|

|

|

|

|

|

|

3/14/2011. |

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GRAND |

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

6211 |

|

44010211 |

|

|

37350.22 |

4102524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES ON THE ESTIMATES: |

|

|

|

|

|

|

|

|

|

||

REPORTING |

|

|

|

|

|

|

|

|

|

|

|

Under survey option 2, there is assumed to be only one possible respondent (the survey association) which would seek |

|

||||||||||

approval of labs. See 80.1502(b)(3)(iii)(B). Since there is only one non-Fed respondent, no burden is included. |

|

|

|||||||||

RECORDKEEPING |

|

|

|

|

|

|

|

|

|

|

|

Parties already retain PTDs as CBP and under existing fuels programs, so "new" 80.1507(a)(1)(i) represents no added burden. |

|

||||||||||

Similarly, parties already retain records of QA assurance, so "new" 80.1507(a)(1)(ii) represents no added burden. |

|

|

|||||||||

c. Estimating the Agency Burden and Cost

The annual Agency burden consist of 0.48 of a GS-13 professional employee (estimated at $161,000 including overhead), or $ 70,840. The burden estimates reviewing twenty (20) survey plans for twenty (20) respondents (whom we estimate will choose “Survey Option 1.”. This also includes the effort of the employee reviewing one survey plan for a survey consortium under “Survey Option 2.” This assumes a total of 24 weeks of burden, including 21 weeks to complete review survey plans (one week each) and three (3) weeks to review and approval alternative labels for a total of sixty (60) respondents.

d. Estimating the Respondent Universe

We were able to estimate the number of regulated entities drawing upon experience regulating the same or similar entities. We docketed a copy of the supporting statement with the proposed and final rule, but received no comments on it. We then sent the supporting statement to four industry representatives seeking comment on all estimates in the supporting statement, including the characterization of respondents and all cost estimates. We received two responses. One representative (Mr. Buster Brown) from Colonial Pipeline observed that our cost estimate for recording RVP on the PTDs would be too low if companies are expected to record the actual, measured RVP versus the maximum RVP of the product. (The maximum RVP is something that can be pre-programmed as a code. The actual RVP would have to be entered “by hand” each time.) In fact, we are requiring that the PTD indicate the maximum RVP (which may be represented by a code). Another representative (Mr. James Holland) from Kinder Morgan generally concurred with the estimates provided and confirmed that the actual application of a PTD code is an automated process that would take one second or less.

e. Bottom Line Burden Hours and Costs

From the tables, we estimate the following totals:

The annual burden is estimated as: 6,211 respondents; 44,010,211 responses; and 37,350 hours. The annual ICR cost is estimated at $4,102,524.

f. Reason for Change in Burden

Not applicable, as this is a new information collection.

g. Burden Statement

The annual public reporting and recordkeeping burden for this collection of information is estimated to be .000849 hours per response. (Note: Most responses under this ICR will consist of the simple application of codes/statements to PTDs, a process that takes less than 1 second. Burden means the total time, effort, or financial resources expended by persons to generate, maintain, retain, or disclose or provide information to or for a Federal agency. This includes the time needed to review instructions; develop, acquire, install, and utilize technology and systems for the purposes of collecting, validating, and verifying information, processing and maintaining information, and disclosing and providing information; adjust the existing ways to comply with any previously applicable instructions and requirements; train personnel to be able to respond to a collection of information; search data sources; complete and review the collection of information; and transmit or otherwise disclose the information. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. The OMB control numbers for EPA's regulations are listed in 40 CFR part 9 and 48 CFR chapter 15.

To comment on the Agency's need for this information, the accuracy of the provided burden estimates, and any suggested methods for minimizing respondent burden, including the use of automated collection techniques, EPA has established a public docket for this ICR under Docket ID number EPA-HQ-OAR-2010-0448, which is available for online viewing at www.regulations.gov, or in person viewing at the Air Docket in the EPA Docket Center in Washington, DC (EPA/DC). The docket is located in the EPA West Building, 1301 Constitution Avenue, NW, Room 3334, and is open from 8:30 a.m. to 4:30 p.m., Eastern Standard Time, Monday through Friday, excluding legal holidays. The telephone number for the Reading Room is (202) 566-1744, and the telephone number for the Air Docket is (202) 566-1742.

You may use www.regulations.gov to submit or view public comments, access the index listing of the contents of the public docket, and to access those documents in the public docket that are available electronically. When in the system, select “search,” then key in the Docket ID Number EPA-HQ-OAR-2010-0448. Also, you can send comments to the Office of Information and Regulatory Affairs, Office of Management and Budget, 725 17th Street, NW, Washington, D.C. 20503, Attention: Desk Officer for EPA. Please include the EPA Docket ID Number EPA-HQ-OAR-2010-0448 and OMB Control Number 2060-NEW in any correspondence.

1 “Regulation To Mitigate the Misfueling of Vehicles and Engines With Gasoline Containing Greater Than Ten Volume Percent Ethanol and Modifications to the Reformulated and Conventional Gasoline Programs – FINAL RULE.” A copy of the rule is available in this docket, EPA-HQ-OAR-2010-0448.

2 The FTC has experience designing labels to help consumers make informed decisions at the point-of-sale. See, e.g., 16 CFR Part 305 (EnergyGuide and Light Bulb labels); 16 CFR Parts 306 and 309 (Automotive Fuel labels); and 16 CFR Part 423 (Clothing Care labels).

3 75 FR 68094, 68149-68150 (November 4, 2010).

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | SUPPORTING STATEMENT FOR |

| Author | Courtney Kerwin |

| File Modified | 0000-00-00 |

| File Created | 2021-01-31 |

© 2026 OMB.report | Privacy Policy