Tires Retailer Interviews Final Report

Appx G_Tires Retailer Interviews Final Report 8-16-2011.docx

NHTSA Tire Fuel Efficiency Consumer Information Program Survey Research Plan

Tires Retailer Interviews Final Report

OMB: 2127-0678

NHTSA: Tires Fuel

Efficiency Consumer Information Program Retailer

Interview Report August

16, 2011

Contents

Themes Identified Across Groups 5

Implications on Label Design 7

Implications on Consumer Information Program 8

Implications on Quantitative Research 8

Detailed Rating Evaluations 10

Sources and Communication Channels 17

Introduction

Background

The Energy Independence and Security Act of 2007 (EISA), enacted in December 2007, included a requirement that the National Highway Traffic Safety Administration (NHTSA) develop a national tire fuel efficiency program to educate consumers about the effect of tires on automobile fuel efficiency, safety and durability. The goal of this program is to provide consumers with a convenient way of determining the effect of tire choices and the potential tradeoffs between tire fuel efficiency and tire safety and durability.

Under the EISA, NHTSA is required to establish a replacement tire fuel efficiency rating system, determine methods for providing tire rating information to consumers and develop a national tire maintenance consumer education program. The enactment of the new rating system will require tire manufacturers to rate their replacement tires across three aspects of tire performance: rolling resistance (one measurement of fuel efficiency), wet traction (one measurement of safety) and tread wear life (one measurement of durability). Comparing the three different ratings for replacement tires will enable consumers to see how different tires can affect the fuel economy performance of their vehicles.

At the time of the final rule, which was signed by Administrator Strickland on March 23, 2010, NHTSA did not specify the content or requirements of the consumer information and education portions. Several comments on the notice of proposed rulemaking (NPRM) suggested the agency consider additional consumer research to decide on the best methods for communicating tire ratings to consumers. These comments, which are summarized in section A8 of this document, have led NHTSA to recognize that a revised consumer research methodology could provide advanced understanding of how the presentation of rating information affects both consumers’ perceptions and behaviors in the replacement tire purchase process. This new collection will focus more on consumer understanding of proposed rating systems, rather than just preference.

In 2010, NHTSA contracted with StrategyOne, the independent market research arm of Edelman, to conduct consumer research to evaluate tire labels and fulfill NHTSA’s statutory requirements pursuant to EISA. In addition to consumer focus groups, StrategyOne executed in-depth interviews with tire retailers to evaluate tire labels from an expert perspective.

Research Objectives

The goal of this study is to guide the development of a rating system to assist consumers with their tire purchase. By speaking with both consumers and retailers, NHTSA has taken a first step in determining consumer understanding and helpfulness of various potential rating systems that can be used for tires. Specifically, the qualitative portion of this research aims to accomplish the following objectives:

Understand the tire purchase process from the consumer & retailer perspective.

Past research for this initiative demonstrated that 81% of consumers have purchased tires in the past because they were worn, while only 36% said it was because of an emergency (margin of error +/- 2.2%). A number of groups that submitted comments to the NPRM believe most tire replacement purchases come at a time of emergency and that consumers do not research these purchases. Further research is needed to develop a more comprehensive understanding of the process. This will allow NHTSA to explore potential communications channels (including whether or not a paper label is a viable communication tool) and determine the ultimate needs of the consumer information program.

Evaluate comprehension of various ratings, exploring the clarity, meaningfulness and the likely resulting behaviors.

At this point, there is dispute over whether or not consumers see tires before they are installed. Therefore, we cannot assume that the final creative will be a paper label affixed to a tire. However, before determining what channels to use, NHTSA must first explore how well consumers understand the ratings systems. This includes testing ratings based on Rolling Resistance Coefficient (RRC) and Rolling Resistance Force (RRF) to evaluate basic conceptual understanding and to establish which rating system is better understood by consumers based on the need or desire to compare tire ratings across sizes.

We will also determine which rating system is clearest to consumers, or if there is even enough comprehension of the various systems to recommend one as superior. To do so, NHTSA will explore what various ratings (i.e. 1-star vs. 2-star, 50 vs. 60, etc.) mean to consumers and determine whether or not these interpretations are valid. Various graphical treatments including categorical, numerical and endorsement-type rating systems will be tested to determine which consumers understand best.

Explore potential channels for communication.

Once NHTSA establishes which rating system consumers understand best, the agency can then evaluate how best to communicate the information. Various communication channels, such as web-based formats, in-store kiosks, booklets, brochures and paper labels, will be explored, as will the language that will be used to convey the information. This portion of the discussion will focus on the potential channels and will probe for information needs by channel, channel availability, potential for use and consumer preference.

Research Process

Retailer interviews were conducted face-to-face at retail locations. Respondents were recruited via a contact list provided to NTHSA by TIA as well as through local searches on Google and in the Yellow Pages.

In order to qualify for the study, respondents had to be a store manager or above. Retailers interviewed for this study spanned seven major metro areas (New York City, NY; Washington, D.C, Atlanta, GA: Houston, TX; Los Angeles, CA; San Francisco/Silicon Valley, CA; and Chicago, IL) and represented a mix of retailer types and sizes. Interviews lasted approximately 30 minutes and were audio recorded to facilitate transcription. All respondents were provided a $75 honorarium for their time.

Upon completion of these interviews, we identified a number of key themes that emerged and will be used in conjunction with consumer focus group findings to guide the development of the quantitative portion of this research.

Key Findings

Themes Identified Across Groups

Understanding the tire ratings comes with experience. Tire ratings are complex and consumers will continue to rely on retailers for information and recommendations no matter what rating is ultimately used.

When comparing our conversations with consumers to our conversations with retailers, it is clear (and expected) that retailers have the knowledge and expertise to look at tire ratings and determine meaning even without deeper explanation on how they are derived. They are better able to articulate what each rating actually means as well as the benefits and drawbacks to choosing tires with higher or lower ratings on different measures.

Retailers know that their customers are not tire experts and many consumers are not even interested enough to look up information to help with their replacement purchase, but they believe it is important to have these ratings available to provide consumers with as much information as possible so they are confident in their purchase decisions.

But, a key consideration in consumer understanding of these ratings is how well a retailer is able to explain the ratings. Even those customers who are more knowledgeable and are researching their purchase options still rely on the retailers to provide them with tire recommendations and information. Consumer comprehension is not solely based on the design of the scale, but on how easy or hard it is for a retailer to use it in their conversations with customers.

The tire ratings, in any form that is selected, will require a learning process for retailers as well as consumers.

While retailers were more able to articulate rating meaning, many admitted that they did not know what the rating meant or that they wanted more information about the rating. They see themselves as an important source of information in the tire process and know that if a rating system like this was released, they would need to become experts in communicating the ratings.

There was little agreement across retailers as to which rating scale would be easiest for consumers to understand, so ultimately, the usefulness of these ratings will depend on how well NHTSA is able to educate retailers about the ratings. The retailer’s ability to communicate the ratings and the background information that is available on how ratings are calculated will be more important to consumer understanding than the graphical design of the rating.

Retailers recommend tires that fit a customer’s specific needs based on the vehicle they drive, what they use it for and how they drive. They are likely to use these ratings in the same way.

When consumers looked at the tire ratings, they said they wanted the best possible rating on every scale. However, when retailers look at the ratings they evaluate the tire based on individual needs. If a customer is coming to their store looking for performance tires, the retailer knows the durability rating will not be very high. But, if a customer is looking for tires for a truck he plans to drive off-road, the retailer would recommend a higher durability rating.

The information program should provide consumers with the benefits and drawbacks of various ratings. NHTSA will need to teach consumers how to use the ratings beyond the idea that a low rating is ‘bad’ and a high rating is ‘good.’

Safety and durability are the most important measures displayed on these ratings. Fuel efficiency is a “nice-to-know,” but has little impact on retailer recommendations.

Many of the retailers recognize that there are consumers who are looking for eco-tires or lower rolling resistance tires that help save fuel, but the vast majority of consumers are not concerned with this rating. Some talked about this measure as not necessary to include on these ratings, particularly when demonstrated in dollar figures as the amount saved is too insignificant to impact decisions. In addition, as we heard in the consumer focus groups, tires are only a small factor in a vehicle’s fuel economy. Retailers believe it is more important that consumers purchase tires that fit their driving needs, then ensure that the tires are inflated and rotated properly in order to get optimum fuel efficiency.

Rating F (real-world figures) is written using the terms that retailers currently use when discussing replacement tire options with customers; however, there is some confusion in the language used and there are some obvious concerns.

Retailers currently use measures like mileage and stopping distance to talk with customers about their tire options. However, the way the metrics are presented in Rating F seem to cause confusion. Retailers question whether durability is measuring actual miles or if it’s being compared to another tire. When looking at stopping distance, the “more feet” versus “less feet” also created some confusion.

In addition, one retailer was concerned that presenting these numbers in print would create problems. A consumer that purchases a tire with a label saying it saves $32 per year may feel cheated if they don’t actually achieve that level of savings.

As we saw with the consumers, respondents seemed to bypass the information on how the rating was calculated and simply focused on the numbers available. By not reading this information, the rating becomes misleading.

Tire rating information must be readily available in a variety of sources so that consumers who want the information can find it.

Aside from in-store sources like paper labels and brochures, retailers believe this information should be present on a variety of online sources. Manufacturer websites and sites like TireRack.com are key sources that they feel must have this information. These websites are ones that consumers are already turning to for information. If tire rating information is consistently available in a number of sources that a consumer may use when considering a replacement tire purchase, they will be more likely to comprehend and trust the information.

Implications

Implications on Label Design

Label design is less important to retailers than the education and information program behind the launch of the ratings system. There is a lot of disagreement over which rating is easiest for consumers to understand. Some believe the star ratings are simple and easy to comprehend, while others believe these ratings are too vague. Many believe the 0-100 scale provides more specific ratings that consumers will understand, while others see the scale as overwhelming. If using real-world terms, some retailers see this as another way to communicate the information they are already providing their customers, while others see giving hard numbers like ‘will save you $32 in fuel per year’ resulting in angry customers and potential lawsuits if that mark is not met.

Retailers see themselves as the ultimate source of tire recommendations for their customers. While some customers do come to the store armed with information they found online or have gathered through experience, they are still talking with the retailer to understand the pros and cons of different tires to determine what best fits their needs.

Retailers are not against government tire ratings. They believe the ratings will provide additional useful information for the consumers to consider during their purchase decision, but without a strong education program the ratings will not be as effective.

In addition, many retailers interviewed do not find the fuel efficiency rating useful for consumers. They believe there are too many factors that determine a vehicle’s fuel economy and although they understand that lower rolling resistance tires help contribute to this fuel economy, safety and durability are far more important when considering which tire to purchase.

Implications on Consumer Information Program

The success of the consumer information program will likely be dependent on how successful NHTSA is at educating retailers about the ratings and providing the tools they need to communicate ratings with consumers. Retailers will continue to be a key source of replacement tire information no matter how easy to understand the government ratings are. By arming retailers with the knowledge and expertise to clearly explain ratings to customers, NHTSA will be ensuring that the ratings help those consumers who are doing their own research as well as those who are less informed and relying more on retailer recommendations.

In addition, NHTSA should consider using the consumer information program to demonstrate why a consumer may make certain tradeoffs for tires. This may help to alleviate the view that a tire with a lower durability rating is a “bad tire” and instead help consumers better evaluate what tire is right for them, personally.

Implications on Quantitative Research

After the focus groups, we recommended the following considerations for the quantitative research phase of this study:

We should consider focusing more of our time in the survey on the ratings that have tested most positively in the qualitative findings; stars, 0 to 100, and real-world figures.

We should plan to test color versus black-and-white ratings to determine whether helpfulness of the label is impacted by removing red-to-green color shading. This could be a determining factor in feeling certain tires are ‘bad’. Particularly related to the star ratings, we heard through these groups that it could be more useful to see just the number of stars a tire receives instead of all 5 stars being displayed, and the rating being shaded in a certain color.

We should potentially explore additional information separate from the label, such as descriptions of the control tire or an average tire, and explore whether a durability rating is more or less useful than a manufacturer mileage rating.

Finally, we should explore using interactive technologies on the web survey to allow respondents to interact with the labels and provide comments and remarks about the label aspects they like versus those they dislike. This can provide additional insight to help determine which rating is most helpful for consumers in their purchase decision.

In addition to these recommendations, based on our conversations with tire retailers, we recommend the following:

We should consider testing label understanding aided and unaided. Whether or not the details of what the ratings mean appear on the label or in some other form, we should present these explanations to consumers to see how, if at all, comprehension is affected.

We should consider including tire prices and manufacturer-reported mileage ratings when asking respondents to select a tire. This information is available at the point-of-sale and we have learned that they are currently key factors in the purchase decision. This will help us determine what tradeoffs consumers are actually willing to make when evaluating these ratings and whether or not ratings are easy to understand when displayed with other tire information. Brand and tire size will be the constants in our tests, while price, ratings and mileage are the variables.

Finally, once a label is selected and agreed upon by NHTSA and key constituents, we recommend conducting additional research to guide consumer and retailer education programs. Education will be the key to providing ratings that are useful to the replacement tire purchase process, so testing the messages and materials that will be part of this program will help to ensure the information that is available to both parties is clear and understandable.

Detailed Findings

Tire Purchase Process

In speaking with different retailers, it is obvious that there is no one clear answer on whether most tire replacements are “planned” or “emergency.” Some of the retailers we interviewed have more experience with emergency replacements. These are customers who are walk-ins; they do not make appointments and are not likely to be conducting research prior to entering the store. Other retailers are more likely to get customers who come in for planned replacements.

The main difference in the purchase process between an emergency replacement and a planned replacement is the amount of information that the retailer has to walk through with a customer. Those who are planning to replace their tires tend to do more research online on sites like TireRack.com and call around to multiple retailers for estimates. While individuals with emergency replacements may also comparison shop based on price, the retailer will have to walk through a lot more information with these customers.

No matter how much information they have, though, most consumers come into the store looking for the same size or identical tire to the ones they already have on their vehicle. They are not tire experts and are making a decision based on the experience that they have. They trust the tire they have been using and as long as they haven’t had significant problems, they would prefer to simply replace their current tires with the same model.

In the store, retailers work with customers to determine their individual needs based on the vehicle they drive, their primary purpose for driving and the way that they drive. They use manufacturer-provided information (Michelin and Goodyear were mentioned specifically as having good point-of-sale information) as well as internet resources to provide consumers with the information they need to make a decision. Some retailers even have databases that they use with the customer to determine what tire is appropriate for their car and needs.

“I try to get the customers, not pre-qualify them, but see what their use is of the vehicle. Then I’ll go from there, ‘This is what you need as far as durability.’ If it’s a truck, that’s when you go into a different rating on your durability if you’re going off the road…”

Currently, retailers are using ratings for tread wear, temperature and traction when speaking with customers. They find these measures easy for consumers to comprehend, although the decision often depends on price alone.

Detailed Rating Evaluations

In general, retailers see ratings like the ones NHTSA is testing to be useful for the replacement tire purchase process. Safety (wet traction) and durability (tread wear) are two key areas when they are discussing potential tires with consumers. They believe having these ratings available outside the store can help to arm consumers with additional information and allow them to make an informed decision.

However, retailers are still ultimately the source of tire information and recommendations and these ratings are not likely to change that role.

“We would use those ratings if some customer asks for it. But, a lot of times the customer just wants to get your opinion of what is the best tire for them.”

When retailers see these ratings, they are looking at the ratings as a whole, rather than as three separate qualities of the tire. Retailers’ experiences allow them to understand the tradeoffs that will be made between each rating and don’t expect perfection across all three measures. Whereas consumers were looking for the tire that had the highest rating in every category, retailers articulate the benefits of tires with lower ratings on certain measures.

“Lower tread wear, that doesn’t mean it’s not a good tire.”

“The customer might think [a tire with a higher tread rating] is better, but to me, usually if you get more traction, you tend to get less tread wear. So mostly this kind of tire is like you go with a performance tire, low-profile tire.”

Retailers see safety and durability as the most important measures provided on these rating scales. Though some recognize fuel efficiency as currently relevant to consumers (due to the economy and gas prices), this rating will have little impact on retailer recommendations.

“… lower rolling resistance is what they used to talk about all the time, but most people don’t even pay attention to that type of thing.”

The government rating also provides another level of endorsement for the tires. They can help to validate retailer recommendations, build brand trust for quality tires and provide an independent third-party perspective.

Although the retailers are better able than consumers to explain what specific ratings mean, they recognize there will be a learning curve for themselves, not just consumers. In fact, for retailers to truly assess the usefulness of these ratings, retailers need to know how they are calculated so they can decide how best to use and explain them to their customers.

Overall, there was a mix of responses as to which rating is easiest to understand. Overall, Rating B was chosen by the most retailers (6); followed by Rating F (5); Rating A and Rating D (4 each); and Rating E and Rating C (1 each). One respondent felt all ratings were equally understandable and three did not provide an answer.

The disagreement over which is most understandable may be due in part to the fact that most ratings tested did not contain any explanation of what the ratings mean or how the ratings were derived. For retailers, as long as the appropriate details are provided about the ratings (whether on a label or through some other source), they will be able to effectively explain any of these ratings to their customers. Retailers understand the definitions of these measures (wet traction, tread wear and rolling resistance) at an expert level and can communicate this information regardless of the graphical design.

R ating

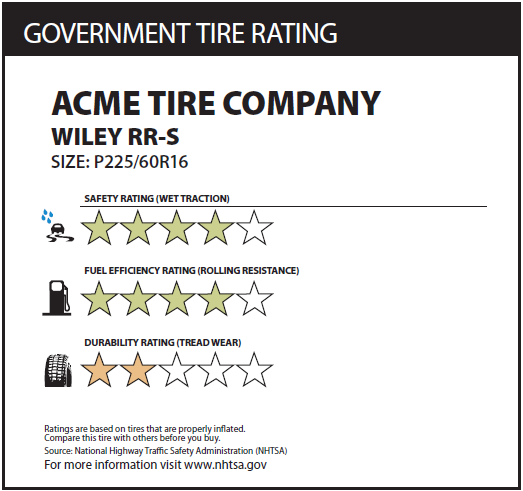

A (Stars)

ating

A (Stars)

While Rating A received generally positive reviews from retailers, many were concerned that the scale was too vague.

Overall, they felt Rating A would be easy for their customers to understand at a general level, because consumers are familiar with 5-star rating scales through things such as movie and restaurant reviews and even in current tire manufacturer ratings.

“They use [stars] quite a bit. I know that Goodyear uses this type of rating.”

Retailers see these star ratings as a starting point for replacement tire information, but because of the scale’s simplicity, it is not the most effective method for consumers to compare tires on their own. However, the retailers often said this rating scale would be easy for them as sources of information to explain. Ultimately, without guidelines, they believe it is difficult for customers to determine what the stars actually mean, but since they are familiar with the form of rating, they can get a sense of what is better or worse. Then, the retailer will be able to add the context of what the ratings actually mean.

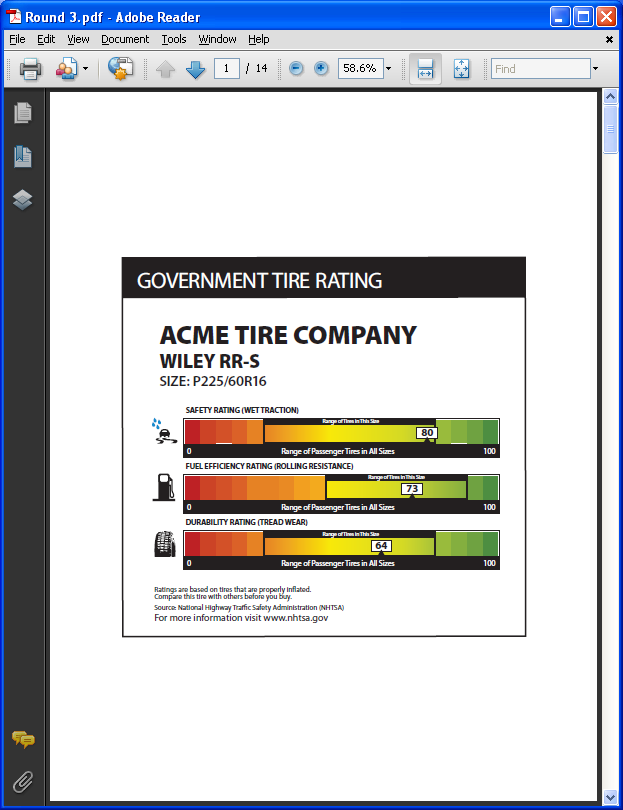

Rating B (0 to 100 scale)

T he

majority of retailers found Rating B to be both easy to explain and

easy for customers to understand and would be likely to use a rating

like this in the purchase process. They liked how the rating was

based on a 100-point scale, and felt that not only do consumers

relate better to numbers, but that the size of the scale lends itself

to more detailed, specific information as a opposed to a generalized

rating.

he

majority of retailers found Rating B to be both easy to explain and

easy for customers to understand and would be likely to use a rating

like this in the purchase process. They liked how the rating was

based on a 100-point scale, and felt that not only do consumers

relate better to numbers, but that the size of the scale lends itself

to more detailed, specific information as a opposed to a generalized

rating.

“It’s kind of user-friendly too… I don’t think it’s a hard system to read. I think that it’s fairly easy.”

There were some retailers that expressed negative perceptions and felt it was too overwhelming for someone who was not an expert on tires, particularly their customers. They cited the complicated display of information as being too difficult for customers to understand and did not think customers would be able to choose a tire from the label without retailer assistance. One retailer suggested adding a footnote on the label to explain how to use the rating. Other retailers felt that the system was difficult to use at first glance, but given time, they as retailers could easily understand how to effectively evaluate tires using Rating B, and then communicate this information to their customers.

In addition to disagreement on the usefulness of this scale, there were varying opinions on what would constitute a significant difference in tire performance; some retailers thought a 3-point difference between two numbers showed a significant difference in performance, while others felt a twenty-point difference showed a change in performance.

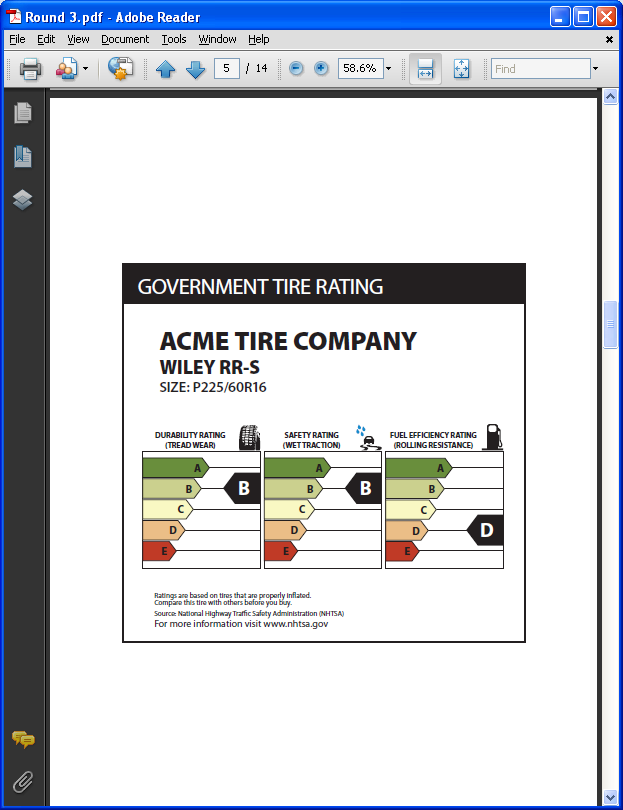

Rating C (Letter grades)

Among the retailers we interviewed, Rating C had mixed reviews. Like the stars, some retailers appreciated the simplicity of the rating, while others felt it was too vague and did not disclose enough information. Retailers that liked the rating felt that it gave customers a simplified version of tire information, which is often helpful with uninformed customers, but ultimately found the star ratings to be the superior 5-point scale that was evaluated in this study.

“It is giving [consumers] very vague information and it is not really expressing to them what they are looking for in their buying of the tires… [Consumers] are going to have to spend more time in trying to figure out what this means to them…”

S ince

there are no specifications as to how each letter grade is

determined, retailers found the rating to be too subjective for both

themselves and their customers. Across interviews, different

assumptions were made as to what the difference between letter grades

actually means. Some retailers believed one letter-grade was a

significant difference, others were unsure know how to use the rating

and therefore, would likely defer to their own perceptions and tire

knowledge when explaining the rating to a customer, which suggests

the ratings would add no value to the purchase process.

ince

there are no specifications as to how each letter grade is

determined, retailers found the rating to be too subjective for both

themselves and their customers. Across interviews, different

assumptions were made as to what the difference between letter grades

actually means. Some retailers believed one letter-grade was a

significant difference, others were unsure know how to use the rating

and therefore, would likely defer to their own perceptions and tire

knowledge when explaining the rating to a customer, which suggests

the ratings would add no value to the purchase process.

Although there was variation on how the scale was interpreted, the majority of retailers interviewed associated tires with a grade of D or lower as being “bad tires” and would not feel comfortable selling a tire of that perceived lower quality. They also believed that customers would only buy tires with a rating of C and above on each measure.

Rating D (Mixed scales)

Rating D resonated with many retailers in the interviews, but some believed it was more useful to them as retailers than to the consumers. This rating may not be easy for the customer to understand if they saw it in the store, but it would be easy for the retailer to explain.

Most retailers who evaluated this rating felt that the varying rating scales were easy to understand and depicted what each scale is actually rating better than others tested. However, there was some desire for scale consistency.

W hen

evaluating the different measures on this rating, it was clear that

the retailers believed that fuel efficiency was not as important as

the other measures. Some of the retailers talked about $10 in savings

as not significant enough to impact a purchase decision. One retailer

specifically warned against the use of negative numbers as seeing a

negative number could make the customer think negatively about the

tire overall.

hen

evaluating the different measures on this rating, it was clear that

the retailers believed that fuel efficiency was not as important as

the other measures. Some of the retailers talked about $10 in savings

as not significant enough to impact a purchase decision. One retailer

specifically warned against the use of negative numbers as seeing a

negative number could make the customer think negatively about the

tire overall.

When looking at the durability rating for this scale, retailers were more likely to describe the numbers in terms of mileage.

“Well, the 320 will give you like a 40,000-mile warranty. The 560 will probably give you like a 60,000.”

Despite mostly positive evaluations, one retailer was concerned with including language about a control tire, suggesting that consumers do not have enough information about the testing to make this information useful.

Rating E (Endorsement)

M

ost

retailers are familiar with the EnergyStar program (11 of 13

retailers), but few have heard of SmartWay (2 of 13 retailers). They

have an understanding of what EnergyStar means when they see the logo

and believe that if a tire were to be marked EnergyStar, it would

communicate fuel efficiency. However, in their experience most of the

retailers we spoke with believe that a label endorsing a tire for

fuel efficiency may help customers who are looking to be more green

or specifically looking for fuel efficiency as a criteria, but that

most of their customers do not fit this description. In addition,

many retailers throughout the interviews believe that tires that are

“fuel efficient” or have lower rolling resistance tend to

be less durable, so they may not make that recommendation since the

total cost to own may actually be more.

ost

retailers are familiar with the EnergyStar program (11 of 13

retailers), but few have heard of SmartWay (2 of 13 retailers). They

have an understanding of what EnergyStar means when they see the logo

and believe that if a tire were to be marked EnergyStar, it would

communicate fuel efficiency. However, in their experience most of the

retailers we spoke with believe that a label endorsing a tire for

fuel efficiency may help customers who are looking to be more green

or specifically looking for fuel efficiency as a criteria, but that

most of their customers do not fit this description. In addition,

many retailers throughout the interviews believe that tires that are

“fuel efficient” or have lower rolling resistance tend to

be less durable, so they may not make that recommendation since the

total cost to own may actually be more.

If an endorsement-type label were used that was meant to communicate more than just fuel efficiency, retailers find that it would be useful, but not necessarily enough and they would still rely on their experience and expertise when making a recommendation.

“If [a tire with an endorsement] was a good tire, I’d recommend it”

One retailer spoke about this type of system as representative of 3rd party independent testing procedures, which would lend credibility to the tire manufacturer. The label would then take on the form of a “stamp of approval,” and as the retailer thought about this further concluded that a tire without that label would then be considered a “junk tire.”

With this type of rating, the purchase process would likely be unchanged. Retailers would still communicate the specific benefits of the tire and explain what the endorsement means, then make recommendations based on the needs of each individual customer. The endorsement then becomes more of a “nice to have” or a validation of a recommendation, rather than a deciding factor.

When asked whether or not this type of rating system would be useful for consumers, a number of retailers believed that consumers are familiar enough with these types of rating systems that they would use it in their decision making process, but that they would still rely on the retailer to explain. Some retailers suggested this would be more useful for a consumer with little knowledge about tires who has come to the store without doing any research. In addition, if the endorsement was to be based on fuel efficiency, that would be helpful in this economy because saving on fuel costs is top of mind, but only if the label standards are available and clear.

Rating F (Real-world terms)

R ating

F received mixed reviews from retailers. Most retailers thought the

ratings were simple and clear. They generally use these measures

(miles, stopping distance) when talking to customers about different

tires, but there are apparent concerns with a label such as this.

ating

F received mixed reviews from retailers. Most retailers thought the

ratings were simple and clear. They generally use these measures

(miles, stopping distance) when talking to customers about different

tires, but there are apparent concerns with a label such as this.

“It doesn’t seem like [Rating F] could possibly be accurate because to put exact number of feet and mileage is subjective”

While the retailers believe these measures are easy to understand, there was clearly some confusion when evaluating the durability rating. Many retailers seemed to think that the mileage rating meant the number of miles you can expect from the tire, a confusion that was also heard in the consumer focus groups.

“Why does this [durability rating] say zero?... So [it needs to be replaced] right away, when it drives off the lot?”

Manufacturers already report durability at the point-of-sale in a way that consumers understand (i.e., miles you can expect from a tire). Reporting another mileage metric in the store or on the tire may create even more confusion, particularly if consumers are not reading the details of how the government rating is calculated (which it seems they are not). The two mileage numbers may actually appear to be conflicting information rather than the government rating providing additional context to evaluate the durability of the tire.

There was also some confusion with the safety rating.

“Twenty-five more feet in stopping distance; twenty-five less feet in stopping distance. That’s a little confusing. Why did they put more or less on the other one?”

Another concern brought up by some retailers is the assumptions being made in order to calculate these measures. Some believed that the assumptions being made were clear, and that they could easily explain this to their customers, while others felt the assumptions rendered the measures misleading. Not only do these measures make it difficult to discuss how a tire might benefit one specific customer, since “everybody drives different,” but it opens up the government, manufacturers and retailers to potential consumer backlash.

“…especially here in California, people are just… sue-happy… I could actually see customers coming in and saying ‘I actually spent the same amount on gas mileage, so you lied to me.”

This retailer continued to explain these concerns when evaluating the durability rating.

“If the customer does not get that mileage [that is on the label], now you’ve got an irate customer. And it doesn’t matter if it’s their fault [because of how they drive]”

In addition to these concerns, many retailers believe that if consumers see these measures, they will want to know how the replacement tire compares to the tires that are currently on their vehicle. How much better or worse will the new tires be in terms of fuel savings, stopping distance and mileage? This information will not be available if the consumer is replacing their vehicle’s original tires and may result in them feeling under-informed.

It seems that although these are the terms retailers are currently using to communicate the quality of a tire, the assumptions made and the language used may ultimately lead to more questions than answers.

Overall Rating

Most retailers believe that an overall rating would be helpful to include in these ratings systems; however, the overall score should not be a standalone item. In concept, the overall rating can provide customers with an idea of the quality of the tire, then, the retailer can walk through individual ratings with the customer to determine what tire is best for their specific needs.

While some retailers believed the overall score should be evenly weighted across all three measures, many felt that safety and durability are far more important than fuel efficiency and therefore should have more consideration in the calculation of this score. However, when communicating with consumers, whether the overall score is weighted or not, retailers will still be using their expertise and the individual ratings to determine which tire works for which customer.

RRC versus RRF

While there is some more understanding of the concepts of rolling resistance force versus rolling resistance coefficient, retailers do not seem to have much of an opinion on which rating system should ultimately be used to measure fuel efficiency.

Some believe it will be useful for all fuel efficiency ratings to fall on a 0 to 100 scale, while others do not really see a difference. Based on these interviews, it seems that NHTSA and its constituents should decide on which rating system they will use, then ensure the system is clearly communicated to the retailers so that they can accurately depict how tires are rated for this measure.

Sources and Communication Channels

In order for a government rating to effectively help the consumer replacement tire purchase process, information about the ratings and how consumers can use these ratings must be readily available and consistent across all sources. Retailers do not believe NHTSA can rely on simply a paper label to communicate the information.

A paper label or a handout of some sort would be helpful for all consumers. It will provide additional information at the point-of-sale for any customer who chooses to use it, whether or not they do research prior to entering the store. To provide context to the ratings, brochures should be available in store so that those customers who want more detailed information have immediate access to it.

Information about what the tire ratings mean, how they are derived and how they can be used should also be available online so that it is accessible for those who want to educate themselves prior to entering the tire store. Many consumers will still rely solely on tire prices, but the information about the ratings should be present on manufacturer websites, comparison sites like TireRack.com, other relevant websites and SaferCar.gov.

Finally, an important channel through which to communicate the ratings will be the retailers themselves. The availability of tire ratings is not likely to change the role that the retailer has in the tire purchase decision. They will still be relied upon for recommendations and will be looked to as experts on these ratings. NHTSA must ensure retailers are armed with the information, knowledge and tools they need to effectively discuss the ratings with their customers.

Appendix: Discussion Guide

Introduction

Introduce, why I’m here

This discussion should last around 25-30 minutes

We will keep your personal information private to the extent permitted by law and will not tie any of your responses back to you directly in reporting. We’d like to hear your personal opinions based on your experience as a retailer.

Tire replacement purchase process

In your experience, what generally motivates customers to come to you looking for replacement tires?

Which do you see more often – emergency replacements or planned replacements?

When do you first hear from the consumer? Walk-in? Call for information?

Where, other than from you, do you notice consumers getting tire information?

Are they proactively seeking out tire information before coming to you?

What kind of information do they look for during the process?

Do they understand the information they are finding about tires?

How do they use this information?

In your experience, how much would you say consumers rely on you and your staff throughout the decision?

How often do your customers request new replacement tires that are identical to the tires that are currently installed on their vehicle?

Thinking about all the tire replacement orders you place in an average week…

What percentage of purchases are tires that are currently in stock?

What percentage of purchases are tires that are not in stock, but can be delivered for same day installation?

What percentage of orders are for tires that are not in stock and must be ordered for installation at a later date?

What sources do you use when advising a customer on a tire replacement purchase?

What sources do you/would you recommend to consumers?

In-store, what is the process that you go through to help a customer with a purchase?

What information do you make sure the customer is armed with before making a decision?

How do you communicate this information to consumers?

Do they compare different tires?

What do they look at when comparing tires?

How do they get this comparison information?

Do they see the tires before installation?

Do they see the actual tires that are installed on their vehicle or a display tire?

[IF DISPLAY] Does the display tire match the size and model of the tire that will be installed on their vehicle?

Do customers generally consider only tires that match the size of the original tires on their vehicle, or do they consider multiple tire sizes that would fit their vehicle?

Do you recommend multiple tire sizes to your customers?

Do you ever make a customer aware that they can change the diameter of their tire, so long as the tire is designed to carry the weight of the vehicle?

[IF YES] How if at all does this impact their purchase process?

Do you ever make a customer aware that they can “plus-size” their tire & wheel combination, so long as the tire is designed to carry the weight of the vehicle?

[IF YES] How if at all does this impact their purchase process?

How, if at all, does the purchase process change based on different motivations (i.e. emergency vs. planned replacement)?

Thinking about any labels that you currently see on tires, which if any do you believe to be helpful? [PROBE: PAPER LABEL VS. OTHER TYPES OF LABELS]

Are there other sources of information or information displays that you find helpful?

Why are these helpful? What information do they include?

How, if at all, do you personally use the tire labels or manufacturer displays for information?

How, if at all, do customers use these labels or manufacturer displays for information?

Does any one manufacturer stand out as providing a label that is most helpful to the tire purchase decision?

What information do they provide that makes them standout as helpful?

Does any one manufacturer stand out as providing helpful materials designed to be displayed near a tire?

Evaluate tire ratings [3 PER INTERVIEW]

Do you currently use tire ratings when evaluating different tire replacement options?

Do you find that consumers look to these ratings during the process?

Mock up of Rating A: Looking at this tire rating, what does it mean to you?

I’d like to show you another tire that was rated using the same system. Overall, in your own words how would you describe the differences between these two tires?

3 star rating vs. a 4 star rating for fuel efficiency

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

4 star rating vs. 5 star rating for wet traction

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

2 star vs. 4 star rating for tread wear

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

Looking at these labels, how might you communicate the ratings a customer?

How easy or hard is it to compare tires using this rating system? You vs. your customers?

How likely are you to use these ratings when recommending which tire a customer should purchase?

Based on this information, which tire, if any, would you recommend assuming the prices are equal? Why?

Mock up of Rating B: Looking at this tire rating, what does it mean to you?

I’d like to show you another tire that was rated using the same system. Overall, in your own words how would you describe the differences between these two tires?

50 vs. 58 fuel efficiency rating; 58 vs. 80 fuel efficiency rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

72 vs. 90 wet traction rating; 72 vs. 73 wet traction rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

64 vs. 61 tread wear rating ; 39 vs. 61 tread wear rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

Looking at these labels, how might you communicate the ratings a customer?

How large or small a difference between numbers would indicate a significant difference in tire performance?

How easy or hard is it to compare tires using this rating system? You vs. your customers?

How likely are you to use these ratings when recommending which tire a customer should purchase?

Based on this information, which tire, if any, would you recommend assuming the prices are equal? Why?

Mock up of Rating C: Looking at this tire rating, what does it mean to you?

I’d like to show you another tire that was rated using the same system. Overall, in your own words how would you describe the differences between these two tires?

B vs. C fuel efficiency rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

B vs. A wet traction rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

D vs. C tread wear rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

Looking at these labels, how might you communicate the ratings a customer?

How easy or hard is it to compare tires using this rating system? You vs. your customers?

How likely are you to use these ratings when recommending which tire a customer should purchase?

Based on this information, which tire, if any, would you recommend assuming the prices are equal? Why?

Mock up of Rating D: Looking at this tire rating, what does it mean to you?

$-10 vs. $10 fuel efficiency rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

A vs. AA wet traction rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

580 vs. 560 tread wear rating; 320 vs. 560 tread wear rating

What do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

What, if anything, do you see as potential tradeoffs your customers may have to make when deciding between tires with these two ratings?

Looking at these labels, how might you communicate the ratings a customer?

For tread wear, how large or small a difference between numbers do you believe would indicate a significant difference in tire performance?

How easy or hard is it to compare tires using this rating system? You vs. your customers?

Notice for this scale, each point is measured on a different scale. How does this impact how well you understand the ratings? Would having all the ratings on the same scale make it easier or harder to understand? Does it matter?

How likely are you to use these ratings when recommending which tire a customer should purchase?

Based on this information, which tire, if any, would you recommend assuming the prices are equal? Why?

Mock up of Rating E: Are you familiar with the EnergyStar or SmartWay systems? Are you more familiar with one over the other?

In your own words, what does EnergyStar mean?

In your own words, what does SmartWay mean?

If a tire were to be marked with an EnergyStar label, what do you believe that would tell you about the tire?

If a tire were to be marked with a SmartWay label, what do you believe that would tell you about the tire?

How helpful do you believe this type of rating would be for customers? For you as a retailer?

In your own words, what do you personally see as the benefits of purchasing a tire with a symbol like this?

What, if any, drawbacks do you personally see for purchasing a tire with a symbol like this?

If a separate, tire-specific label (like EnergyStar or SmartWay) were created, how helpful do you believe that would be for customers? For you as a retailer?

If tires were to be rated using a system like this, how might you communicate this information to your customers?

How likely are you to use these ratings when recommending which tire a customer should purchase?

Based on this information, which tire, if any, would you recommend assuming the prices are equal? Why?

Mock up of Rating F: People have suggested using other metrics to rate tires. How easy or hard would these be to discuss with your customers:[SHOW RATING F]

Dollars saved - Potential fuel savings for fuel efficiency as compared to a control tire

Would you use a measure like this when discussing potential tire options with your customers?

How useful would this be to your customers as they are trying to decide which tire to purchase?

The fuel savings range is based on a number of assumptions like the type of vehicle driven, average distance driven per year, and climate and road conditions. How, if at all, does this change your opinion on the usefulness of this measure?

Miles – the number of more or less miles you can drive on a tire before they wear as compared to a control tire

Would you use a measure like this when discussing potential tire options with your customers?

How useful would this be to your customers as they are trying to decide which tire to purchase?

The miles until replacement measure is based on assumptions like average distance drive, vehicle load, road conditions and a number of other measures. How, if at all, does this change your opinion on the usefulness of this measure?

Stopping distance – the number of more or less feet in stopping distance based on a wet traction rating as compared to a control tire

Would you use a measure like this when discussing potential tire options with your customers?

How useful would this be to your customers as they are trying to decide which tire to purchase?

This measure is based on assumptions like the handling characteristics of the vehicle, vehicle load and the force with which the brakes are applied. How, if at all, does this change your opinion on the usefulness of this measure?

Wet traction and tread wear could also be displayed as dollars saved based on potential savings based on the length of time between replacements for tread wear or potential savings in terms of a tire contributing to fewer crashes for wet traction.

Would you use a measure like this when discussing potential tire options with your customers?

How useful would this be to your customers as they are trying to decide which tire to purchase?

Are there any other metrics that you use when discussing potential tires with customers?

If these metrics were included on one of the other ratings we looked at today, do you believe it would make the ratings easier or harder to understand, or would it have no impact?

Let’s take a look as some of the terminology used on the labels we just reviewed.

What, in your opinion does “durability” mean to your customers?

What language would you use when discussing these ratings - tread wear or durability?

What, in your opinion does “safety” mean to your customers?

What language would you use when discussing these ratings - wet traction or safety?

What, in your opinion does “fuel efficiency” mean to your customers?

What language would you use when discussing these ratings – rolling resistance or fuel efficiency?

With all these ratings systems, there is the potential to calculate an overall score based on these three measures. For example, [SHOW SAMPLE OVERALL SCORE].

Looking at this label what do you believe to be the difference between these two ratings in terms of personal benefits for your customers?

Would you find an overall tire rating helpful or not helpful?

Are you more likely to use the individual ratings, the overall tire rating, or both when recommending which tire to purchase?

Which would you expect your customers to use?

How does the overall rating impact how easy or hard it is to decide which tire to purchase?

This overall rating example was calculated as an average rating for each of the three measures – fuel efficiency, safety and durability.

Does this method of calculating an overall rating make sense to you?

Would you recommend that each measure receive equal weight when calculating this overall score, or is one factor more important or less important that others?

Knowing how this particular overall rating is calculated, how, if at all, does this change how useful or helpful this rating is to your purchase decision?

There has been discussion as to whether to rate the fuel efficiency of replacement tires based on Rolling Resistance Force or Rolling Resistance Coefficient.

Are you familiar with these terms?

[IF YES] Do you personally have an opinion on which should be used?

How, if at all, would you explain this rating to your customers?

Do you believe one is easier to explain to consumers?

Do you believe one is easier for consumers to comprehend?

Do you find that consumers want to be able to compare tires across sizes when looking for replacement tires?

How many options might they consider?

Do you want to be able to compare tires across different sizes?

How many options would you consider when helping a customer?

If your customer owned a large SUV, like a Chevy Suburban and a smaller vehicle like a Honda civic and they came to you to purchase replacement tires. Do you think they would be ok if the fuel efficiency ratings for all the tires that fit the Chevy Suburban are all only in a 0-30 range, while the ratings for all the tires that fit the Honda Civic fall between 30 and 100? Or would they want all tires, no matter what the size, to fall between 0 and 100?

Thinking again about the two ways tires could be measured – one measurement system allows you to compare the ratings for tires no matter what the size. Using the other measurement system, you would only be able to compare the ratings for tires within the same size.

Which, if any, measure do you think your customers would you prefer?

Evaluate different rating scales in comparison

Thinking about how you interact with your customers, would you use these ratings?

What format would be most helpful to you, in your opinion?

How well does each scale convey the characteristics of the tire?

Which scale do you feel would be easiest for consumers to comprehend?

Which scale do you feel would be easiest for you to explain to your customers?

Which scale do you believe would help consumers identify the most fuel efficient tire? Why?

Which scale do you believe would help consumers identify the safest tire? Why?

Which scale do you believe would help consumers identify the most durable tire? Why?

What additional information, if any, do you believe is necessary to include on these labels?

Which scale do you personally prefer?

Evaluate communications channels (ties back to tire purchase information above)

How, if at all, do you see consumers using this information?

Where would they look for it? Where do they need it?

Do you believe they would come to your store knowing this, or is it more likely that they would look to you for this information?

Thinking about how you interact with your customers, what format would you need to see these ratings in to best communicate?

Paper label on tire?

Brochure?

Online database?

Poster?

Others?

What are some other sources that should be used to communicate this information to consumers?

Thank and close.

Schedule of Rating Tests:

Interview |

City |

Rating Test 1 |

Rating Test 2 |

Rating Test 3 |

Rating Test 4 |

1 |

Chicago |

B |

C |

A |

F |

2 |

Chicago |

D |

A |

B |

F |

3 |

New York |

B |

E |

A |

F |

4 |

DC |

E |

B |

C |

F |

5 |

Texas |

A |

C |

E |

F |

6 |

Chicago |

C |

B |

D |

F |

7 |

Texas |

D |

B |

C |

F |

8 |

LA |

C |

E |

B |

F |

9 |

San Francisco / Silicon Valley |

D |

A |

C |

F |

10 |

DC |

C |

E |

D |

F |

11 |

DC |

B |

C |

A |

F |

12 |

LA |

D |

A |

B |

F |

13 |

New York |

E |

A |

B |

F |

14 |

Atlanta |

E |

B |

D |

F |

15 |

Atlanta |

E |

C |

A |

F |

16 |

LA |

A |

E |

D |

F |

17 |

San Francisco / Silicon Valley |

E |

B |

D |

F |

18 |

New York |

A |

D |

C |

F |

19 |

San Francisco / Silicon Valley |

A |

D |

E |

F |

20 |

New York |

C |

D |

E |

F |

21 |

Atlanta |

B |

A |

C |

F |

22 |

Chicago |

A |

D |

E |

F |

23 |

DC |

C |

D |

A |

F |

24 |

San Francisco / Silicon Valley |

D |

C |

B |

F |

25 |

Texas |

B |

E |

D |

F |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Ellen Rienzi |

| File Modified | 0000-00-00 |

| File Created | 2021-01-31 |

© 2026 OMB.report | Privacy Policy