Tires Focus Groups Final Report

Appx G_Tires Focus Group Final Report 8-5-2011.docx

NHTSA Tire Fuel Efficiency Consumer Information Program Survey Research Plan

Tires Focus Groups Final Report

OMB: 2127-0678

NHTSA: Tires Fuel

Efficiency Consumer Information Program Focus

Group Findings Report August

5, 2011

Themes Identified Across Groups 6

Rating Metrics and Language 12

Implications on Label Design 14

Implications on Consumer Information Program 14

Implications on Quantitative Research 14

Detailed Rating Evaluations 16

Sources and Communication Channels 23

Appendix A: Respondent Profiles 25

Introduction

Background

The Energy Independence and Security Act of 2007 (EISA), enacted in December 2007, included a requirement that the National Highway Traffic Safety Administration (NHTSA) develop a national tire fuel efficiency program to educate consumers about the effect of tires on automobile fuel efficiency, safety and durability. The goal of this program is to provide consumers with a convenient way of determining the effect of tire choices and the potential tradeoffs between tire fuel efficiency and tire safety and durability.

Under the EISA, NHTSA is required to establish a replacement tire fuel efficiency rating system, determine methods for providing tire rating information to consumers and develop a national tire maintenance consumer education program. The enactment of the new rating system will require tire manufacturers to rate their replacement tires across three aspects of tire performance: rolling resistance (one measurement of fuel efficiency), wet traction (one measurement of safety) and tread wear life (one measurement of durability). Comparing the three different ratings for replacement tires will enable consumers to see how different tires can affect the fuel economy performance of their vehicles.

At the time of the final rule, which was signed by Administrator Strickland on March 23, 2010, NHTSA did not specify the content or requirements of the consumer information and education portions. Several comments on the notice of proposed rulemaking (NPRM) suggested the agency consider additional consumer research to decide on the best methods for communicating tire ratings to consumers. These comments, which are summarized in section A8 of this document, have led NHTSA to recognize that a revised consumer research methodology could provide advanced understanding of how the presentation of rating information affects both consumers’ perceptions and behaviors in the replacement tire purchase process. This new collection will focus more on consumer understanding of proposed rating systems, rather than just preference.

In 2010, NHTSA contracted with StrategyOne, the independent market research arm of Edelman, to conduct consumer research to evaluate tire labels and fulfill NHTSA’s statutory requirements pursuant to EISA.

Research Objectives

The goal of this study is to guide the development of a rating system to assist consumers with their tire purchase. This research is the first step in determining consumer understanding and helpfulness of various potential rating systems that can be used for tires. Specifically, the qualitative portion of this research aims to accomplish the following objectives:

Understand the tire purchase process from the consumer’s perspective.

Past research for this initiative demonstrated that 81% of consumers have purchased tires in the past because they were worn, while only 36% said it was because of an emergency (margin of error +/- 2.2%). A number of groups that submitted comments to the NPRM believe most tire replacement purchases come at a time of emergency and that consumers do not research these purchases. Further research is needed to develop a more comprehensive understanding of the process. This will allow NHTSA to explore potential communications channels (including whether or not a paper label is a viable communication tool) and determine the ultimate needs of the consumer information program.

Evaluate comprehension of various ratings, exploring the clarity, meaningfulness and the likely resulting behaviors.

At this point, there is dispute over whether or not consumers see tires before they are installed. Therefore, we cannot assume that the final creative will be a paper label affixed to a tire. However, before determining what channels to use, NHTSA must first explore how well consumers understand the ratings systems. This includes testing ratings based on Rolling Resistance Coefficient (RRC) and Rolling Resistance Force (RRF) to evaluate basic conceptual understanding and to establish which rating system is better understood by consumers based on the need or desire to compare tire ratings across sizes.

We will also determine which rating system is clearest to consumers, or if there is even enough comprehension of the various systems to recommend one as superior. To do so, NHTSA will explore what various ratings (i.e. 1-star vs. 2-star, 50 vs. 60, etc.) mean to consumers and determine whether or not these interpretations are valid. Various graphical treatments including categorical, numerical and endorsement-type rating systems will be tested to determine which consumers understand best.

Explore potential channels for communication.

Once NHTSA establishes which rating system consumers understand best, the agency can then evaluate how best to communicate the information. Various communication channels, such as web-based formats, in-store kiosks, booklets, brochures and paper labels, will be explored, as will the language that will be used to convey the information. This portion of the discussion will focus on the potential channels and will probe for information needs by channel, channel availability, potential for use and consumer preference.

Understand consumers’ knowledge of tire maintenance and performance.

An important piece of the consumer information program will include educating consumers about tire maintenance to help improve the performance of those tires already on the road and build better habits for the future. By developing an understanding of consumers’ current knowledge and behaviors, NHTSA can begin to craft educational messages about tire fuel efficiency, safety and durability that are clear and useful. Additionally, NHTSA will be able to assess how well consumers currently understand the connection between rolling resistance, tread wear, and wet traction with fuel efficiency, durability and safety, so the agency can establish communications that can truly help consumers in their replacement tire purchase decisions.

Research Process

This consumer research program has two components: 1) qualitative focus groups and 2) national quantitative survey. This report includes the findings from the first phase of this research, which will be used to guide the consumer education program and the development of the survey instrument.

Six (6) focus groups were conducted in three (3) cities in order to explore in-depth perceptions of each rating system and ensure geographic diversity.

Focus groups were conducted in the following cities for these specific reasons:

Date |

City |

Rationale |

July 27, 2011 |

San Francisco |

Mild weather climate, congested market |

July 28, 2011 |

St. Louis |

Mid-West market with 4 seasons, longer commutes |

August 2, 2011 |

Boston |

Cold, snowy winters, congested market |

Respondents for the focus groups were screened prior to participation in order to obtain a mix of vehicle drivers and purchasers in the United States. Respondents were screened according to the following criteria:

Participants must be 18 years or older.

Participants must currently own or lease a vehicle.

Participants must have purchased replacement tires in the past 6 months or be planning to purchase replacement tires in the next 6 months.

Participants must be the primary or a shared decision maker for tire purchases in their household.

The focus groups for each city were divided by males and females as past experience has shown that males tend to dominate the conversation when covering technical or vehicle information and females will often defer to their opinion instead of expressing their own well-thought-out opinions.

For each focus group, 12 potential participants were recruited in order to account for individuals who may cancel or not arrive. All cities had eight participants. Group discussions lasted approximately two hours each.

Upon completion of these groups, key themes that emerged from the groups have been evaluated and will be used in guiding the development of the quantitative portion of this research.

Key Findings

Themes Identified Across Groups

In all forms presented, tire ratings are complex and will require a learning curve.

The current process of purchasing tires primarily relies on recommendations from a mechanic or retailer, and then some follow-up evaluation of prices and alternatives. When individuals proactively research their tire purchase independently, they first evaluate prices, and then tend to rely on customer ratings online to make a decision on which tires to purchase.

When evaluating the tire ratings that were tested, respondents initially were very receptive to the ratings, however upon more detailed evaluation it became evident that these individuals do not understand exactly what is being rated.

“If half of us do not understand it [ratings], they need to word it a little better. [I] bet it's an important factor so it really needs to hit home when people read it.”

Respondents want more detailed information about the tires they are purchasing, and they prefer to have that information in real-world terms; how long will this tire last, what does a higher safety rating mean, how much money will I save by purchasing more fuel efficient tires?

Without clear definitions about what each rating specifically means, respondents assign arbitrary values to the ratings; a ‘60’ on the 0-100 scale means 60%, but they aren’t sure what 60% represents. Four stars means 80%, but again, they don’t know what 80% represents. They also assign other values such as saying 3-stars means average, while 4-stars is above average and 2-stars is below average. Regardless of which rating system best conveys useful information to individuals, it will be important for NHTSA to define the values of each point on the rating scale so that individuals can best evaluate tires and the differences between those they are comparing.

It is clear that any tire rating will require some time to be understood by the broad tire-buying public. These are complex ratings that will require explanation. While we can use the research to evaluate the usefulness of presenting the ratings in “real world terms” using a graphic scale can be useful as long as consumers begin to understand what they mean. Just like NCAP – the information does not need to be on the label – the information needs to be available.

Fuel efficiency is the least important rating presented in these groups.

Beyond price, which is respondents’ primary purchase decision criterion, respondents tend to prioritize the ratings that are most important to them. Consistent across all cities evaluated, safety and durability are primary ratings that have the greatest impact on these individuals. Fuel efficiency is not understood in the context of tires as these individuals believe tire maintenance is what has the greatest impact on fuel economy (pressure and rotation), as opposed to the compounds in the tires themselves. Additionally, when presented with specific dollar figures as to how much money a fuel efficient tire could save these individuals, they mention that amount is insignificant compared to what they may be giving up on safety and durability.

“…I still think that fuel efficiency is going to be lower than durability and safety. There is a threshold for fuel, I don’t think it is going to be as high as the other two…”

It is evident among these individuals that in today’s environment, consumers are still thinking about the ultimate impact to their wallet, and think about the actual cost of replacement as opposed to small amounts that can be saved through tire fuel efficiency. For this reason, respondents talk about durability having a strong impact on their purchase decision (it’s better to get an extra 2 years out of my tires than to save $25 per year on fuel), or they talk about safety and the ability to avoid an accident or personal injury to themselves or a family member. Additionally, the relationship between tires and fuel efficiency is not immediately clear to consumers. Respondents believe that other factors like the vehicle you drive and the way you drive have more of an impact fuel economy than the tires you buy.

One exception to this is whether individuals are purchasing tires for themselves or for someone else’s vehicle. Among the male groups in each city, respondents expressed that for them, durability and the life of the tire is a primary concern (indicating again that price is crucial to the decision), however when purchasing tires for their wives or daughters, they are willing to spend more for a safer, smoother-riding tire. These individuals purchase priorities shift based on the vehicle the tires are mounted on, and the ratings do assist them in determine which tires to buy based on who will be driving the vehicle.

Ratings should remain independent so that consumers can evaluate tires depending on which criteria are most important to them.

The majority of respondents indicate that one or two of the factors rated on the label are more important to them (typically safety and durability being more important than fuel efficiency). While the overall rating was desired by a few respondents, the underlying calculations to create an overall rating are brought into question. When exploring whether an overall rating should be equally weighted among the three factors rated or whether there should be a weighted score giving more preference to the attributes that are more important to these respondents, it is clear that a weighted score is preferred but each individual prefers a different weight given to different factors.

As individuals evaluate the ratings and determine which tire they would purchase from the options available, they proceed with one of two methods:

They create an average score in their mind to determine the best overall tire, giving more preference to the metrics that are more important to them, or

They focus on the metric that is most important to their decision, selecting the safest rated tire or the most durable, regardless of other scores.

“Safety should always be first in my view. I don’t care what the fuel or durability are. It depends on what is more important to you, it’s what you’re going to. It doesn't matter what is first, what is second. What is more important to the purchaser.”

Male respondents suggested creating a database through which consumers would be able to select which criteria is most important to them, and receive a list of tires that match their needs that they could then evaluate further based on additional criteria, such as price, consumer reviews, and other factors.

“I could think that if you had some kind of, at the shop where you buy the tires, if they had a program where you could say this is my most important feature and this is my second most important feature and third and then by that select the best tire…I want more durability. I want wet performance. I want this or that. Fuel efficiency. Show me which one is the best one but software that is intelligently programmed. Of course, so you’re not depending on the mechanic or someone who has a personal opinion. You just want cold facts.”

An overall rating is helpful, but only when placed next to the individual ratings.

When participants evaluate ratings, most are creating a custom average in their mind. They ensure each measure has met their minimum standard and determine which is the best tire overall. Creating this personal average in their mind allows them to put more weight on those criteria that are more important to them, as noted in the previous finding.

An overall rating can help guide the purchase decision, or identify a potentially ‘bad’ tire, but if an overall rating is provided respondents prefer that it be provided in addition to the individual ratings. They would also require additional information regarding the underlying calculation to understand how the overall rating was achieved.

“I find it [overall score] helpful as a starting point. That enables me to say okay, they’re saying it’s an overall rating. How do they arrive at that, and the information is there? To a certain level as to how they arrive at it, by the individual categories. I like it as a starting point, that addition of the overall rating.”

There are clear thresholds for each rating scale that consumers would not consider purchasing below.

While these individuals recognize that there must be some minimum standard tires need to meet in order to be sold in the US, they identify a point on each rating below which they would not purchase a tire. This threshold is typically the mid-point of each scale (below a C on the A to E scale, below 50 on the 0 to 100 scale, etc.). They associate these mid-points with an ‘average’ tire, and anything above that point is above average, and anything below it being below average.

This mid-point threshold is consistent for safety and durability, however the fuel efficiency threshold tends to vary based on individual preferences. Respondents tend to place less emphasis on the fuel efficiency of their tires, believing that driver behaviors and maintenance have a more significant impact on overall fuel efficiency of a vehicle than tires, and they would purchase a tire rated below the mid-point for fuel efficiency if the tire had high ratings for safety and durability.

The colors on each scale have an impact on this perception as respondents in each city mentioned that green represents ‘good’ or ‘go’ and red represents ‘danger’ or ‘stop’. Therefore, any rating approaching the red section of the scale is viewed as a bad rating and creates hesitation in the purchase of that tire.

“The way I looked at it when I first started looking at them, what I think is for the red it’s below pretty much the 50% mark, which means caution. That’s how I took it. The lighter colors, there’s probably a yellow like a neutral and the dark green is like go. That’s how I took it.”

The tire purchase process differs based on the circumstances for which replacement is required, though the majority of respondents indicate they proactively change tires as opposed to replacing them in an emergency.

Most respondents replace tires due to wear. They claim to either be visually inspecting their tires looking for wear, or they are being told by their mechanics at service intervals or oil changes that they should consider replacing their tires. A few individuals mention the ‘penny test’ (if the tread doesn’t reach Lincoln’s head, it’s time to replace the tires), indicating there is some knowledge of the need to check tires and evaluate independently whether replacement is required. Many will also check their tires if they feel the car is not driving as it is supposed to or if it feels like it is skidding of slipping.

“Over the years I've gotten to know my car. I was just working on my car recently and kind of looking at them [tires] and you know they say the thing about putting the penny in them and his head disappears or something. Sometimes when you have a service they'll say you need new tires.”

Those who are replacing worn tires are more likely to research their options and are looking at tire reviews or talking to people they trust, like their mechanic, in order to evaluate their options and make a decision that meets their needs and fits their budget.

Female groups often talk about their fathers or husbands informing them that it’s time to replace the tires, but those who are driving a lot of miles (particularly parents) are also regularly checking their tires and keeping track of their mileage.

An emergency replacement leaves consumers with less time to potentially research options. In this situation, respondents are looking for a quick, cost-effective option to remedy the situation. The first evaluation is whether the tire can be repaired or not, and if this is not an option, then they are shopping primarily on convenience and price.

In Boston specifically, one other reason for changing tires is a chance in the season. Some individuals are switching to snow tires in the winter, indicating they have different needs in their purchase decision based on the season the tire will be used.

Mechanics, retailers and third-party reviews are all trusted sources for tire information, but ultimately the mechanic or retailer replacing the tire is trusted to recommend a tire that is best.

There is a lot of information about tires that individuals do not know, and while they do perform some cursory research primarily regarding prices and consumer reviews, they rely heavily on recommendations from their mechanics or retailers. When evaluating these rating scales, many respondents said they would ask the retailer to explain what the ratings mean in order to be able to use them. Other respondents felt that these ratings would be a good validating factor to ensure the tires recommended by a retailer meet their needs and purchase criteria.

“Right now we’re all saying we trust the mechanics we go to. That’s still going to weight. But perhaps if Joe Blow says, oh, I suggest that tire, and I see a D, I’m going to wonder is he getting a spiff on this tire or isn’t he? So it would help me. I still want people’s input but if I’m getting input and it’s a low rating now I might come out a little more educated…”

Overall, respondents indicate that they would be likely to utilize these ratings during the purchase process, however this result suggests a need to work with retailers to ensure they can interpret and communicate the ratings with their customers to assist with the purchase decision.

Additional sources of information that consumers rely on are trusted friends and family, consumer reviews, third-party websites (TireRack is specifically mentioned), Consumer Reports, manufacturer websites and retailer fliers and pamphlets (primarily for sale and pricing information).

Most respondents see a demo tire prior to installation rather than the actual tires they’re considering for purchase.

Respondents claim that they see ‘the tire they’re purchasing’ when at the retailer, but upon further exploration it is evident that individuals are either seeing the demo in the retailer showroom, or the few who purchase online are not seeing the tires at all. Respondents believe that the ratings must be available at the tire retailer to be utilized for greatest impact, and that a paper label on a tire would be a good medium for this information; however, the complexities of the ratings and the fact that most consumers are not seeing the actual tire that goes on their vehicles makes this difficult.

“Yeah, there's usually a demo. Like at Sears or any of these National Tire, Sullivan Tire; all those places have them out in the lobby.”

Respondents suggest that this information be in the showroom available in a binder of information containing information on all the tire options being sold by the retailer so that comparisons and evaluations can be made. They also request that this information be available online, preferable accessible at the retailer, but at least in a centralized site accessible on the Internet.

“I’d find it on the display. I don’t think you’re going to go look at all the tires. They’re not going to let you in the back…They should have some sort of binder that shows tire ratings.”

One group of males suggested that a database be created that would allow users to input the criteria that are most important to them in the purchase decision, and return a list of tires meeting those criteria. This would simplify the purchase process for them instead of requiring an evaluation of individual tires and then a comparison of ratings.

Some male respondents suggested requiring retailers give the customer the label off the tire that was installed on their vehicle to ensure it matches the tires selected, while another respondent suggested that the ratings for the tire you purchase should appear on the receipt. While these do not help with the purchase decision process, it is a verification that the tires meet the specifications of what they selected, and a record of the ratings for future reference or warranty claims.

Additional channels of communications can add credibility and access points to receive this information.

In addition to information available at the retailer or a searchable database, individuals mention that this information would be valuable at places where they are a captive audience and already in the mindset for vehicle decisions and repairs. Putting this information in the waiting room at oil change retailers or at the local Department of Motor Vehicles can help to educate consumers about the ratings that are available to help them choose replacement tires for their vehicles. Oil change retailers are particularly beneficial since many respondents mention the mechanic is letting them know their tires are worn and ready for replacement during routine maintenance.

Though there are some concerns with ‘the government’ as a credible source of information, there is general agreement that NHTSA Tire Ratings would be credible.

The timing of these groups coincided with a period in time when we are hearing general skepticism in government overall, however specific agencies such as NHTSA are viewed as being highly credible in providing this specialized information. There was a general concern with labeling these ratings as ‘Government Tire Ratings’ and respondents would prefer these be labeled ‘NHTSA Tire Ratings’. Very few respondents have concerns with the government providing this information, and would be much more skeptical if it were compiled by manufacturers and provided for government distribution.

SaferCar.gov is also viewed as a credible source of information, and the website makes sense to individuals as a place that would contain this type of information.

Rating Metrics and Language

Each rating metric was prioritized by various respondents in each city, and evaluated independently.

Safety

Safety is one of the most important purchase criteria to respondents in each city. Individuals talk about the need for a tire that will grip the road and keep them, their families, and their vehicles safe. Males in particular talked about this as the most important criteria when purchasing tires for a vehicle their wives or daughters may be driving.

However, the rating itself is not clear to all respondents. On scale ratings (stars, 0 to 100, letter grades), individuals are not able to clearly articulate what a rating represents aside from an arbitrary evaluation that 4 stars must be better than 3, or an 80 is better than a 65. Respondents desire concrete details on what these ratings mean with regard to safety.

Rating F (stopping distance calculations) provided some of this information, but was ultimately more confusing for respondents to understand as they couldn’t determine whether ’25 feet more in stopping distance’ was good or bad. Providing this rating in a scale is most useful to respondents in supporting their tire purchase decision, but there is a desire for the scale points to be clearly defined.

Overall, the term ‘safety’ was easy to understand, but listing more detailed information about the rating, such as the ‘wet traction’ currently listed on these ratings is helpful to consumers.

Durability

Of nearly equal importance as safety to respondents interviewed throughout these focus groups, durability is a measure that these individuals are keenly aware of. In today’s economy, these individuals are extremely interested in the impact their purchases have on their bottom line. When looking at the three criteria rated on these labels, they focus on durability as having the greatest impact on their wallets. While fuel efficiency is rated on potential dollars saved for some of these labels, respondents disregard those small numbers as being insignificant when compared to replacing 4 tires on their vehicle that could cost between $500 and $800.

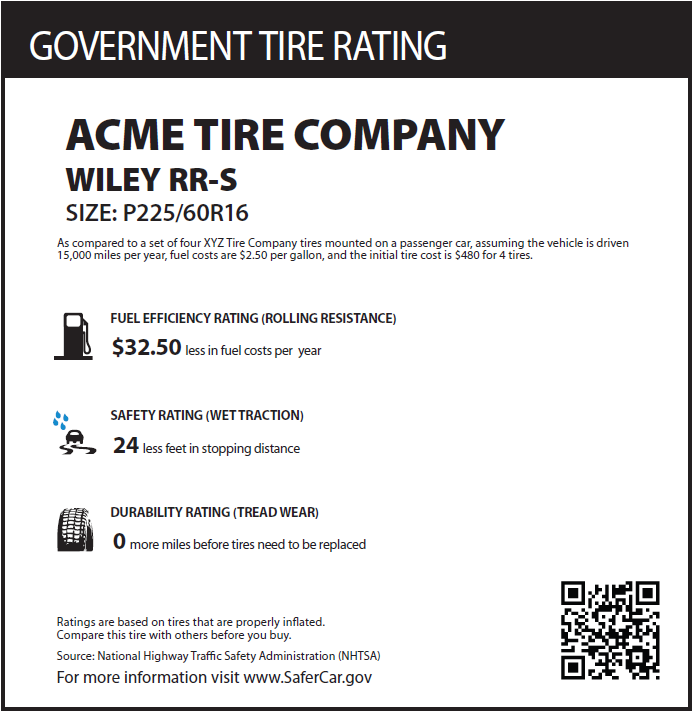

Respondents are aware that tires today are already rated for a certain mileage distance by manufacturers, and as a result are looking for more specific information in the durability ratings presented on these labels. They prefer the tread wear rating be presented in actual number of miles as opposed to a scale, however they don’t understand a comparison of mileage to a control tire as is included on Rating F (see appendix for rating labels). The scales provide respondents with a clear point of comparison that is easy to understand, but providing a tire rating that says a specific tire gets ‘0 more miles before tire needs to be replaced’ is confusing because many respondents are seeking quick information from the label and don’t read the disclaimer about the control tire.

Fuel Efficiency

The majority of respondents in each of these groups are unaware of the impact tires can have on fuel efficiency aside from maintenance behaviors (pressure and rotation). This rating is the least impactful to individuals’ purchase decision. For males, rolling resistance is understood, but they don’t believe that it has a significant impact on the overall fuel efficiency of a vehicle and point instead towards the vehicle itself and driver behaviors that impact the fuel mileage a vehicle gets. As they evaluate ratings that put fuel efficiency in a dollar value, they mention specifically that those numbers are insignificant and would not impact their purchase decision.

When presented as a visual scale, fuel efficiency can provide a tipping point for a decision provided that safety and durability are rated similarly between the tires individuals are evaluating. However, the fuel efficiency rating is more often disregarded in favor of safety and durability, which have a greater personal and financial impact to these tire purchasers.

Control Tire versus Average Tire

When evaluating language utilized on these ratings, one area of confusion regarded switching between the use of ‘control tire’ comparisons or ‘average tire’ comparisons. Respondents understand the concept of an average tire, and while they don’t necessarily ask about the safety, durability or fuel efficiency of an average tire, they do seek this information when the ratings mention a comparison to a control tire. They want to know how the control tire was rated, where it was rated, and whether it was rated in real-world conditions or in a sterile environment. They specifically think about fuel economy numbers on new vehicle Monroney labels, which they consider inaccurate, and they believe that unless these tires are rated in a real-world environment, the ratings could be inaccurate.

Ratings in Comparison

Overall, there was no clear winner across all cities and groups as being most helpful and easiest to understand in assisting the tire purchase process. Respondents in all cities prefer a rating that is simple to grasp and easy to compare. Scales appear to be the best approach to tire ratings, however respondents do want access to additional information should they desire performing additional background research into what the ratings represent, how they are calculated, and other criteria tires could be evaluated on in addition to these three metrics.

Overall, Rating A (stars) and Rating B (0 to 100 scale) were the simplest to quickly understand and evaluate multiple tires against, and the ratings that respondents selected as best assisting them in making their decision. However, Rating F (real-world figures) is selected by a few respondents as being most helpful because they can understand the impact on their vehicle performance (stopping distance), their wallet (amount saved in fuel) and durability (X miles more or less than a control tire). However, the terms and figures on Rating F did cause significant confusion among respondents, and would need to be further developed to ensure it is easily digestible and provides the information respondents need in a clear and concise manner.

Ultimately, the most desired label according to these respondents is one that provides clear, simple information at the point of sale, with the ability to search for much more detailed information should the purchaser desire it.

Implications

Implications on Label Design

It is evident from this research that consumers prefer a simple, easy-to-understand label design that utilizes a rating scale to compare various tires in consideration. The most useful outlet for this information is on-site at the tire retailer, and therefore consumers expect a label that they can view at a glance to quickly evaluate the pros and cons of a particular tire they are considering. However, for individuals that desire additional information, providing these ratings online with more detailed descriptions of the rating process, meanings behind each rating point, and searchable archives will fulfill the needs of those more personally involved in the decision-making process.

Implications on Consumer Information Program

Any rating system will take time to gain widespread understanding and acceptance, however communicating the benefits of a simple rating system and the fact that ratings are conducted independently of manufacturers will help this system gain widespread credibility. It will be important to define what each point on a rating scale means for individuals so that they can either compare various tires, or evaluate a single tire and understand its benefits without the need for a comparison.

Throughout these groups, we learned that individuals have a minimum threshold for each rating below which they would not consider purchasing a tire. As a part of the information program, NHTSA should consider communicating about minimum standards that all tires must meet in order to be sold. This will reassure consumers that all tires are safe and meet a minimum quality standard, but that beyond this minimum standard tires vary greatly and the rating system is designed to provide consumers with additional knowledge and help them make more informed purchase decisions.

Finally, it will be critical to work with tire retailers to ensure they are equipped to help customers utilize these ratings in their tire purchase decision process. These respondents rely heavily on the recommendations of their mechanics and retailers, and partnering with tire industry and retailer associations will ensure retailers are assisting consumers with understanding this information and utilizing it to make more informed purchase decisions.

Implications on Quantitative Research

As we focus on more statistically reliable national testing of these tire ratings, it will be important to utilize the findings from the qualitative research to refine and enhance the quantitative results we will receive.

We should consider focusing more of our time in the survey on the ratings that have tested most positively in the qualitative findings; stars, 0 to 100, and real-world figures.

We should plan to test color versus black-and-white ratings to determine whether helpfulness of the label is impacted by removing red-to-green color shading. This could be a determining factor in feeling certain tires are ‘bad’. Particularly related to the star ratings, we heard through these groups that it could be more useful to see just the number of stars a tire receives instead of all 5 stars being displayed, and the rating being shaded in a certain color.

We should potentially explore additional information separate from the label, such as descriptions of the control tire or an average tire, and explore whether a durability rating is more or less useful than a manufacturer mileage rating.

Finally, we should explore using interactive technologies on the web survey to allow respondents to interact with the labels and provide comments and remarks about the label aspects they like versus those they dislike. This can provide additional insight to help determine which rating is most helpful for consumers in their purchase decision.

Detailed Findings

Tire Purchase Process

The tire purchase process often begins with recognition that tires are worn and require replacement. While tires are also replaced as a result of an emergency, this is less frequent according to the respondents interviewed during this research process. Others consider changing tires as a result of changing seasons, though this is much less frequent with the prevalence of all-season tires. The recognition that tires are worn typically comes from a mechanic performing routine maintenance on an individual’s vehicle, such as an oil change. It is at this point the respondents begin the research phase.

Research often begins with a recommendation from the retailer. The majority of respondents defer to their retailer to tell them which tires they should consider, and will then evaluate tires by price. Some respondents prefer to research the tire options available to them independently, but the main factor impacting purchase is price. Consumers will look through circulars and fliers in the newspaper for price comparisons and sales, or evaluate options at warehouse clubs to look for quality tires that fit within their budget. Ultimately, once the options available have been evaluated, they often still defer to the retailer to make a recommendation on the final tire decision.

Aside from consumer reviews, there is no awareness of tire ratings similar to those evaluated in this research program. These ratings are recognized for their simplicity and visual representation of information, and will ultimately help consumers make more informed decisions, or at least feel more comfortable with the selection they made based on a recommendation from their mechanic or tire retailer.

Overall, ratings are received well and would support the tire purchase process, however certain criteria are more important than others, and individuals in these focus groups prioritize safety and durability of their tires over fuel efficiency. It is clear from these groups, and will be explored further in quantitative research, that fuel efficiency of a tire is not understood by the general consumer in the US, and it not a major consideration factor for the purchase.

It is very uncommon for individuals to see the actual tires they purchase, and are instead seeing a demo model at the retailer that may or may not be the same size as the tire required for their vehicle. Most feel comfortable with this, but it indicates that a rating label placed on the tire itself may not be the most effective medium for this rating information to be presented. Information at the retailer in a binder or kiosk could be more effective, and it will be important for retailers themselves to be knowledgeable partners for this education program to be most effective.

Detailed Rating Evaluations

While all ratings were evaluated with pros and cons, certain ratings were more helpful than others in conveying useful, easy-to-comprehend information that would assist consumers in their purchase decision.

Rating A (Stars)

Overall, Rating A is perceived positively for its simplicity and similarity to so many other rating scales individuals are familiar with today. Respondents cite movie ratings, restaurant ratings, online consumer reviews, and other sources of 5-star ratings as being a simple medium to convey this information. They talk about the simplicity and ease of interpreting this rating.

However, there is disagreement on whether there is enough detail in this rating system or not. In comparison to other, finer scales (such as 0 to 100), there is difficulty in defining what 3 stars means compared to 4 stars, or what 4 stars means compared to 5 stars. Respondents talk about these ratings as meaning ‘average’ (3 stars), ‘above average’ (4 stars) or ‘below average’ (2 stars), but don’t know what an average tire is. They also talk about 4 stars equaling 80%, and 3 stars equaling 60%, but they can’t articulate a percentage of what. Because there are only 5 points on the scale, they also question whether some of the differences are significant or not, debating whether half-stars could be used on a scale like this.

Ultimately this scale is appreciated for its simplicity and ability to convey ratings quickly when making a purchase decision, but more information is desired to support the information on this label, whether available online or through a retailer. Additionally, some respondents were not in favor of the coloring of the stars. They recommended potentially only showing the number of stars each factor received in the rating instead of an outline of all 5 stars and coloring in the number for which each factor received.

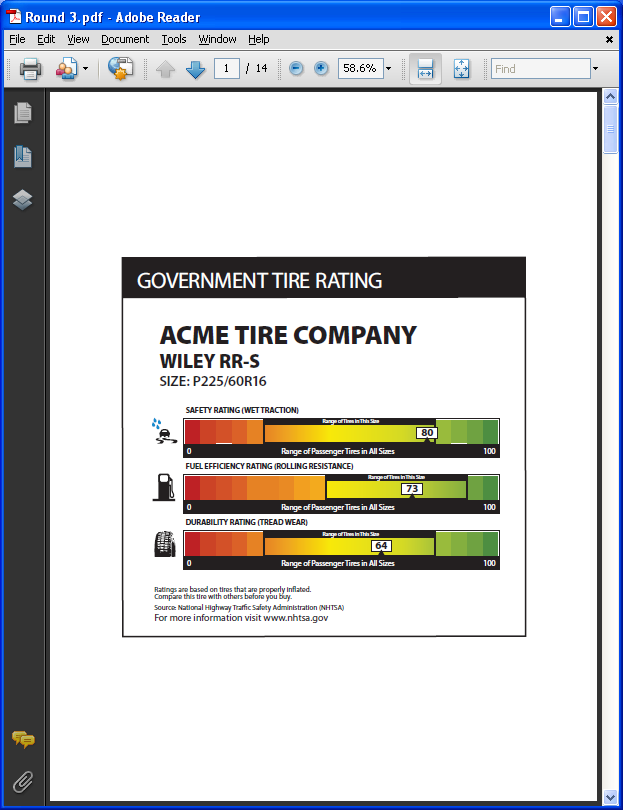

Rating B (0 to 100 scale)

Respondents’ feelings towards Rating B were mixed. While some appreciated the variability a 100-point scale provided and believed it was easier to evaluate whether a tire was good or not, others felt that in comparison to other scales a 5-point scale is a simpler presentation of this information to convey whether a tire is good or not. When evaluating the scale, many individuals interpreted the ratings as a percentage, believing that a tire rated 80% on safety, or 73% on fuel efficiency, but weren’t sure again what that percentage indicated.

Color coding was perceived positively on this scale, providing the ability to quickly determine whether a tire was good or bad. Many respondents talked about a threshold below which they would not purchase a tire on this scale, indicating that 50 or 60 and below would be an unacceptable tire to them because it is approaching the red area, which is perceived as ‘danger’ or ‘stop’.

The range of tires in this size bracket was helpful to most respondents and allowed them to look at a single tire they are considering and determine how it fares against other tires that would fit on their vehicle. This is useful because respondents would not be required to compare two or more tires to understand the range of ratings available. It was also clear through these interviews that the general tire buying individual is not looking to replace the tires on their vehicle with different size tires, and therefore providing this range is helpful to allow consumer to compare to the same size tires.

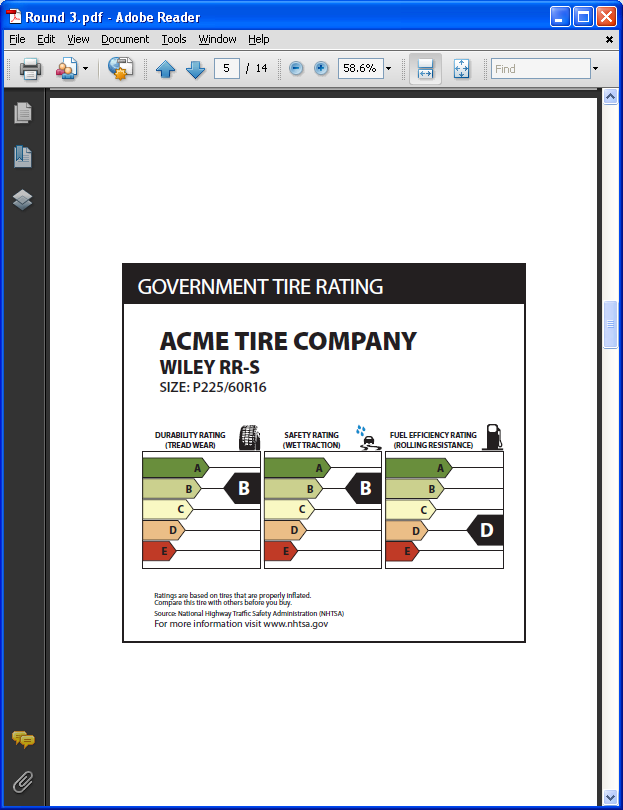

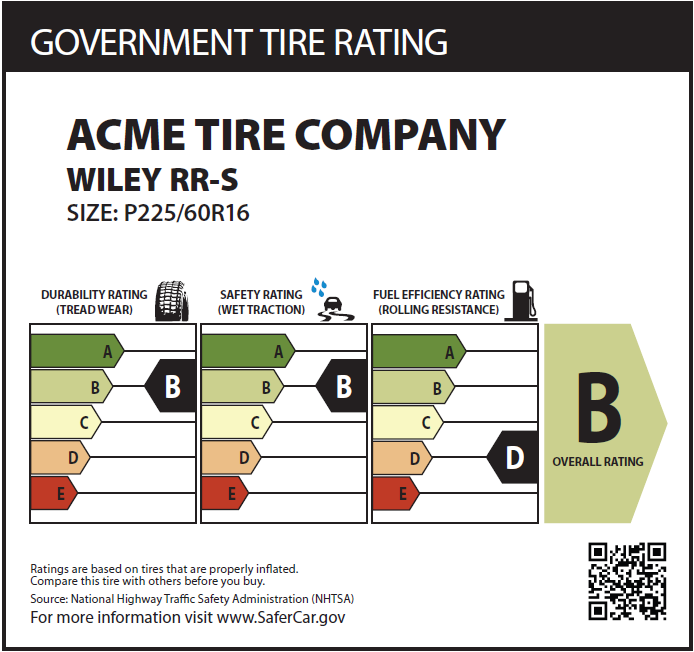

Rating C (Letter grades)

Rating C received similar comments as the Rating A due to its 5-point system, however is not received as positively as the star ratings. The visual display of this rating was not as simple as the 5-star ratings, and respondents in some groups felt that with this rating there was no need to provide the range of ratings; instead it would be possible to just have a legend at the top indicating an ‘A’ was the best and an ‘E’ was the worst rating, and then provide a single letter grade for each factor.

Letters are a scale that most respondents are familiar with as a result of school grades (with the exception of ‘E’), but are interpreted differently than stars. While stars were perceived to have an equal distribution, some respondents didn’t have that same interpretation of letter grades as a result of the US school system. They perceived an A to translate to 90%, B equaled 80%, and so on. Again, the threshold below which individuals would not purchase a tire on this rating was anything less than a C.

Overall, if a 5-point rating system is utilized going forward, it appears that stars will be more widely received and understood than letters, and is a more visually appealing rating.

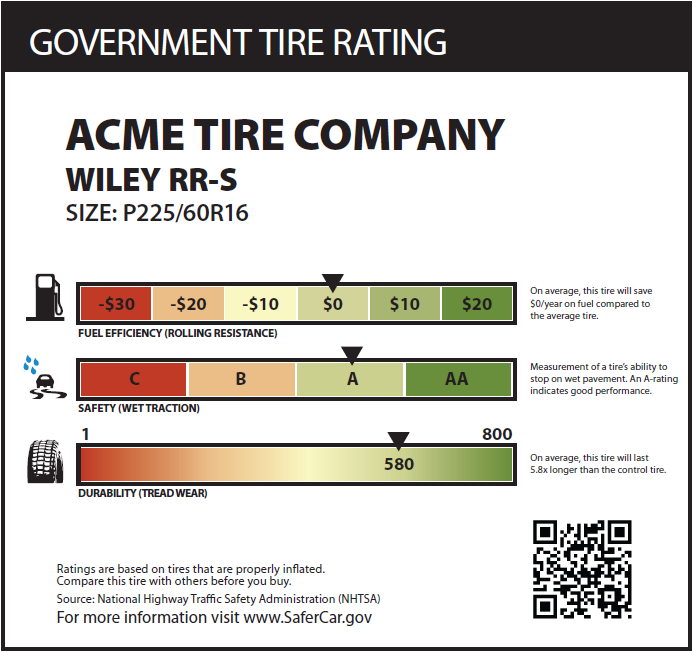

Rating D (Mixed scales)

Rating D presents three different ratings for individuals to evaluate the various metrics rated. Respondents were least positive of this rating among all scale ratings. Individuals felt that this rating takes too much time to interpret and understand, and is designed in a way that will confuse consumers, and allow retailers to potentially convince consumers to spend more on a tire that doesn’t provide additional benefits. They feel this does not work to the advantage of the consumer.

The additional information on this rating provides valuable information that respondents appreciate having on any label that will be utilized to assist with the purchase decision. This label presents information regarding what each rating represents, and respondents want this information to differentiate what stars mean, or what the differences between different points on a 0 to 100 scale would represent in real-world values.

Respondents evaluating this scale find a common rating more useful to their purchase decision and more effective in being able to compare various tires under consideration. They don’t find the fuel efficiency savings presented on this label to be significant ($10 a year is nothing). They don’t understand why the safety scale is from C to AA, and they don’t understand why there is a scale from 1 to 800 without any additional context.

Respondents are seeking simplicity in any tire rating that is actually utilized, and in comparison to 5-point scales or 0 to 100 scales, this is confusing and does not provide the information they expect to help them in their decision.

Rating E (Endorsement)

The Energy Star and SmartWay logos were evaluated in each group as examples of logos that could be utilized to certify tires as meeting a minimum standard of safety, durability and fuel efficiency and providing consumers with a simple item to assist with their purchase decision. Across groups, these two logos do not resonate as being related to tires, however a new tire specific label is also not as useful to these respondents as individual ratings for each metric is.

There is a general concern among respondents that this type of label has too little information. With detailed information on each rating metric, individuals are able to create a mental average prioritizing the rating that is most important to their purchase decision. In this system, respondents lose the ability to see the underlying calculations and prioritize the factors that are more important to them. They also don’t know from this rating whether there was even weighting of the various metrics, or whether metrics that are less important to them were given more weight, such as fuel efficiency.

Ultimately, individuals in these groups are seeking simple, easy to understand information, but there is a point that information becomes too simple and does not provide as much value. With a product as complex as tires, where there is a safety, durability and fuel efficiency impact, a certification like Energy Star or SmartWay over-simplifies the information that is desired as a part of the purchase process, and these respondents do not believe this will help them in their purchase decision.

Rating F (Real-world terms)

Though respondents appreciated the level of detail in real-world terms that Rating F provided, this label did more to confuse respondents than help them in their decision process. The safety rating being presented as this tire’s impact on a vehicle’s stopping distance was helpful, however consumers could not determine whether less feet in stopping distance or more feet in stopping distance was good. The terminology and way the information is written was confusing.

Similarly for durability, this particular label created confusion when it indicates that this tire gets ‘0 more miles before tires need to be replaced’. Individuals in the groups felt that this meant as soon as they left the retailer with new tires on their vehicle, they would immediately need to be replaced. It was clear that respondents did not see or read the qualifying language at the top of the label explaining what these ratings are in relation to. This is problematic in a real-world situation at a tire retailer, where individuals are looking for simple, quick information to qualify their tire decisions.

With regard to fuel efficiency, the amount of money that can be saved is described by respondents as being insignificant compared to the overall cost of replacement tires, and does not impact the decision process.

Overall, the majority of respondents in all groups prefer graphical representations of ratings that are simple to understand at a glance and determine if one tire is better than another on the factors that are most important to the individual purchasing that tire. While they prefer additional information be accessible should they desire to seek it, the level of detail on this label is not required and requires too much interpretation to support the tire purchase process.

.

Overall Rating

Finally, an overall rating was evaluated on Rating C to determine whether the addition of an overall score is useful in the tire decision process for individuals. Understanding that individuals prefer to prioritize the rating that they find most important to their tire purchase decision, it is evident from these groups that the overall rating is not necessary. While some found it to be a useful starting point to eliminate certain tires from their consideration, in the end they are still going to evaluate the individual ratings that they determine to be most important to them.

Additionally, in the example shown above, individuals question how a tire with two B ratings and one D could get an overall B rating. The overall rating leads to some confusion over the calculation that may not make logical sense to them. They prefer to be able to create a mental average in their own minds as opposed to having the overall rating presented to them in a way that may weight factors they find to be unimportant.

Sources and Communication Channels

While retailers are the key source of information regarding the tire purchase decision, consumers do typically seek additional information from other sources, whether online, in the newspaper, or from independent third-parties such as Consumer Reports. Manufacturers are viewed skeptically as a source of information or ratings such as these, but are good for technical specs.

NHTSA is seen as a very credible agency to provide this information, and respondents suggest that the labels be updated to say ‘NHTSA Tire Rating’ at the top instead of ‘Government Tire Rating’. SaferCar.gov is also a site that makes sense to have this information, and is a place respondents may look in the future if they are aware the resource is available to them.

Ultimately, respondents want this rating information available to them at the retailer, but recognize that in a brochure, binder or kiosk would be most useful since they rarely see the actual tires they are purchasing. Online resources and databases for further information and search capabilities would be required for those who seek additional information.

Appendix

Participant Profiles

Screener

Discussion Guide

Workbook Activity Results

Appendix A: Participant Profiles

San Francisco, Females |

|

|

|

|

|

|

|

|

Age |

Passenger Vehicle |

Model Year |

How often do you drive? |

Replacement Tires |

Decision Maker |

Education |

Ethnicity |

Household Income |

45-54 |

1 |

1997 |

Once or twice a day |

Next 6 months |

Primary |

High School |

Black |

Under $25,000 |

35-44 |

1 |

1991 |

Multiple times a week |

Next 6 months |

Primary |

High School |

Black |

$50,000 - < $75,000 |

18-24 |

2 |

2001 |

Once or twice a day |

Next 6 months |

Primary |

College Graduate |

White |

Under $25,000 |

45-54 |

2 |

2003 |

Once or twice a day |

Past 6 months |

Primary |

High School |

Black |

$25,000 - < $50,000 |

25-34 |

2 |

2004 |

Once or twice a day |

Next 6 months |

Primary |

Technical/Vocational School |

White |

$25,000 - < $50,000 |

25-34 |

1 |

2006 |

Once or twice a day |

Next 6 months |

Primary |

College Graduate |

White |

$50,000 - < $75,000 |

45-54 |

1 |

2004 |

Majority |

Next 6 months |

Shared |

College Graduate |

White |

$100,000 - < $150,000 |

45-54 |

4 |

2000 |

Once or twice a day |

Next 6 months |

Shared |

College Graduate |

White |

$75,000 - < $100,000 |

San Francisco, Males |

|

|

|

|

|

|

|

|

Age |

Passenger Vehicle |

Model Year |

How often do you drive? |

Replacement Tires |

Decision Maker |

Education |

Ethnicity |

Household Income |

35-44 |

1 |

2003 |

Multiple times a week |

Next 6 months |

Primary |

College Graduate |

Black |

$100,000 - < $150,000 |

25-34 |

2/1 |

2010 |

Once or twice a day |

Next 6 months |

Primary |

College Graduate |

White |

$100,000 - < $150,000 |

65+ |

2 |

2002 |

Multiple times a week |

Past 6 months |

Shared |

Technical/Vocational School |

White |

$50,000 - < $75,000 |

35-44 |

1 |

2003 |

Multiple times a week |

Next 6 months |

Primary |

College Graduate |

White |

$100,000 - < $150,000 |

45-54 |

2 |

2002 |

Majority of the day |

Past 6 months |

Primary |

Post-Graduate |

White |

$75,000 - < $100,000 |

35-44 |

2 |

2011 |

Once or twice a day |

Past 6 months |

Primary |

College Graduate |

White |

$25,000 - < $50,000 |

45-54 |

2 |

2008 |

Majority of the day |

Next 6 months |

Primary |

College Graduate |

Black |

$100,000 - < $150,000 |

25-34 |

2 |

2002 |

Once or twice a day |

Next 6 months |

Primary |

Some College |

Black |

$50,000 - < $75,000 |

St Louis, Females |

|

|

|

|

|

|

|

|

Age |

Passenger Vehicle |

Model Year |

How often do you drive? |

Replacement Tires |

Decision Maker |

Education |

Ethnicity |

Household Income |

35-44 |

2 |

2004 |

Once or twice a day |

Next 6 months |

Shared |

Post-Graduate |

White |

$75,000 - < $100,000 |

25-34 |

2 |

2007 |

Once or twice a day |

Past 6 months |

Primary |

College Graduate |

White |

$100,000 - < $150,000 |

35-44 |

2 |

2009 |

Majority of the day |

Past 6 months |

Primary |

Some College |

White |

$50,000 - < $75,000 |

18-24 |

2 |

2007 |

Once or twice a day |

Past 6 months |

Primary |

College Graduate |

White |

$50,000 - < $75,000 |

35-44 |

3 |

2001 |

Once or twice a day |

Next 6 months |

Shared |

Post-Graduate |

Black |

$50,000 - < $75,000 |

25-34 |

1 |

2007 |

Once or twice a day |

Past 6 months |

Primary |

Some College |

White |

Under $25,000 |

25-34 |

2 |

2005 |

Once or twice a day |

Next 6 months |

Primary |

Post-Graduate |

Asian |

$25,000 - < $50,000 |

55-64 |

2 |

2005 |

Once or twice a day |

Past 6 months |

Primary |

High School |

|

$50,000 - < $75,000 |

65+ |

2 |

2005 |

Multiple times a week |

Next 6 months |

Primary |

College Graduate |

Black |

Under $25,000 |

St Louis, Males |

|

|

|

|

|

|

|

|

Age |

Passenger Vehicle |

Model Year |

How often do you drive? |

Replacement Tires |

Decision Maker |

Education |

Ethnicity |

Household Income |

35-44 |

4 |

2008 |

Majority of the day |

Past 6 months |

Primary |

Technical/Vocational School |

White |

$50,000 - < $75,000 |

55-64 |

3/1 |

2002 |

Majority of the day |

Past 6 months |

Primary |

Some College |

White |

$50,000 - < $75,000 |

35-44 |

1 |

1996 |

Once or twice a day |

Next 6 months |

Primary |

Technical/Vocational School |

Black |

$25,000 - < $50,000 |

35-44 |

3 |

2007 |

Once or twice a day |

Next 6 months |

Primary |

Post-Graduate |

Asian |

$50,000 - < $75,000 |

25-34 |

2 |

2011 |

Majority of the day |

Next 6 months |

Primary |

College Graduate |

White |

$100,000 - < $150,000 |

45-54 |

3 |

2003 |

Majority of the day |

Next 6 months |

Primary |

College Graduate |

White |

$75,000 - < $100,000 |

35-44 |

2 |

1999 |

Once or twice a day |

Past 6 months |

Primary |

Post-Graduate |

White |

$25,000 - < $50,000 |

35-44 |

2 |

2008 |

Once or twice a day |

Past 6 months |

Primary |

College Graduate |

Black |

$75,000 - < $100,000 |

Boston, Females |

|

|

|

|

|

|

|

||

Age |

Passenger Vehicle |

Model Year |

How often do you drive? |

Replacement Tires |

Decision Maker |

Education |

Ethnicity |

Household Income |

|

45-54 |

4 |

2009 |

Majority of day |

Next 6 months |

Primary |

College Graduate |

White |

$100,000 - < $150,000 |

|

25-34 |

3 |

2000 |

Once or twice a day |

Past 6 months |

Shared |

College Graduate |

Hispanic |

$50,000 - < $75,000 |

|

45-54 |

3 |

2005 |

Once or twice a day |

Next 6 months |

Shared |

College Graduate |

Asian |

$150,000 - < $200,000 |

|

55-64 |

1 |

2009 |

Once or twice a day |

Next 6 months |

Primary |

Post-Grad |

White |

$75,000 - < $100,000 |

|

35-44 |

2 |

2006 |

Majority of day |

Next 6 months |

Shared |

College Graduate |

Asian/White |

$75,000 - < $100,000 |

|

55-64 |

4 |

2010 |

Once or twice a day |

Past 6 months |

Primary |

Post-Grad |

White |

$50,000 - < $75,000 |

|

25-34 |

1 |

2006 |

Once or twice a day |

Past 6 months |

Primary |

Some College |

Asian |

$25,000 - < $50,000 |

|

55-64 |

2 |

1997 |

Once or twice a day |

Past 6 months |

Primary |

Some College |

Black |

$50,000 - < $75,000 |

|

Boston, Males |

|

|

|

|

|

|

|

|

Age |

Passenger Vehicle |

Model Year |

How often do you drive? |

Replacement Tires |

Decision Maker |

Education |

Ethnicity |

Household Income |

25-34 |

4 |

1999 |

Once or twice a day |

Past 6 months |

Primary |

College Graduate |

Asian |

$75,000 - < $100,000 |

55-64 |

2 |

2004 |

Once or twice a day |

Next 6 months |

Primary |

College Graduate |

Hispanic |

$25,000 - < $50,000 |

45-54 |

4 |

2006 |

Once or twice a day |

Next 6 months |

Primary |

Post-Graduate |

White |

$100,000 - < $150,000 |

25-34 |

3 |

2007 |

Once or twice a day |

Past 6 months |

Primary |

Post-Graduate |

White |

$50,000 - < $75,000 |

35-44 |

2 |

2000 |

Majority of the day |

Next 6 months |

Primary |

Some College |

Black |

$100,000 - < $150,000 |

18-24 |

3 |

1993 |

Majority of the day |

Next 6 months |

Primary |

Some College |

White |

$75,000 - < $100,000 |

65+ |

4 |

2006 |

Majority of the day |

Past 6 months |

Primary |

College Graduate |

White |

$75,000 - < $100,000 |

35-44 |

2 |

2007 |

Once or twice a day |

Past 6 months |

Primary |

High School |

White |

$50,000 - < $75,000 |

Appendix B: Screener

In which of the following categories is your age?

Under 18 [TERMINATE]

18 to 24

25 to 34

35 to 44

45 to 54

55 to 64

65 or older

REFUSED [TERMINATE]

Are you…?

Male

Female

REFUSED [TERMINATE]

Do you or a family member currently, or have you or a family member previously worked in any of the following industries?

Automobile manufacturer or retail

Tire manufacturing or retail

Market research or the market research department of a company

01 Yes [TERMINATE]

No

DON’T KNOW [TERMINATE]

How many passenger vehicles does your household currently own or lease?

Owned: [ENTER NUMBER]

Leased: [ENTER NUMBER]

[TERMINATE IF ZERO VEHICLES ARE CURRENTLY OWNED OR LEASED]

What model year is the primary vehicle you own?

Which of the following best describes how often you drive?

The majority of my day is spent driving

I drive once or twice a day

I drive multiple times in a week, but not every day

I only drive on weekends

I seldom drive

I never drive

Which of the following statements best represents your plans for purchasing replacement tires for your vehicle? This means purchasing one to four tires to replace worn or damaged tires on your current vehicle.

I purchased replacement tires longer than 6 months ago [TERMINATE]

I purchased replacement tires in the past 6 months

I plan to purchase replacement tires in the next 6 months

I plan to purchase replacement tires longer than 6 months from now [TERMINATE]

I have no plans to purchase replacement tires [TERMINATE]

DON’T KNOW [TERMINATE]

Thinking about purchasing replacement tires for your vehicle, would you say you [SELECT BASED ON RESPONSE IN Q7: are/were] the primary decision maker, [have/had] shared responsibility, or [will/did] someone else make the decision on which tires to purchase?

I am the primary decision maker

I have shared responsibility with someone else

Someone else is the primary decision maker [TERMINATE]

DON’T KNOW [TERMINATE]

We would like to invite you to participate in a research discussion at [FACILITY] on [DATE] at [TIME]. This discussion will be about vehicle replacement tires and will be in a group setting with other individuals like you. The group will last approximately 2 hours and you would be paid $### for your time and cooperation. Would you be willing to participate?

Yes

No [TERMINATE]

The demographic information we plan to collect as a part of the screening process is to ensure we are obtaining a broad cross-section of American opinion in this research. The demographic information will remain completely anonymous, as will all identifying respondent information. This information is used for classification purposes only, and results will never be linked back to an individual. The demographic questions to be asked are:

What is the last grade you completed in school?

Some grade school (1-8)

Some high school (9-11)

High school graduate (12)

Technical or vocational school

Some College

College Graduate

Graduate or Professional School

Other

Select one or more of the following that best describes your race? [ACCEPT MULTIPLE RESPONSES]

American Indian or Alaska Native

Asian

Black or African American

White

Native Hawaiian or other Pacific Islander

Are you of Hispanic or Latino descent?

Yes

No

What is your marital status?

Single

Married or living together

Separated, divorced, or widowed

Other

Refused

What is your current employment status?

Employed full-time

Employed part-time

Not employed

Retired

Student

Homemaker / Caregiver / Stay-at-home parent

Other

Which ONE of the following best describes your total household income?

Under $25,000

$25,000 to less than $50,000

$50,000 to less than $75,000

$75,000 to less than $100,000

$100,000 to less than $150,000

$150,000 to less than $200,000

$200,000 or more

Refused

How many children under the age of 18, if any, do you currently have living in your household?

None

1

2 - 4

5 or more

Appendix C: Discussion Guide

Introduction

Welcome, why we’re here, privacy

Group rules

Before we start I’d like to go around the room and have you introduce yourselves. Please tell us,

Name

How often do you personally drive?

What is your primary purpose for driving?

Tire purchase (15-20 minutes)

How do you know it’s time to replace your tires?

PROBE: Mechanic tells you, Dealer/Manufacturer suggestions, Tires look worn, Someone else tells you it’s time, Emergency

In your experience, what most often motivates you to replace your tires?

PROBE: Tire wear vs. Emergency replacement

How often do you purchase replacement tires?

Explain to me how you go about getting tires replaced. What is the process?

Does the process you go through to purchase a replacement tire change based on whether it is an emergency or if it is to address tire wear?

If you have a flat tire and need to replace it, how do you decide which tire to buy?

What criteria do you consider? What is the most important criterion?

If you know you’re going to need to purchase replacement tires soon, how do you decide which tire to buy?

Do you research your choices? [IF YES] What are you looking for?

What criteria do you consider? What is the most important criterion?

Where do you go to purchase replacement tires?

Tire retailer? Other retailer/department store (i.e. Walmart/Sears/Costco)? Mechanic? Online? Dealer?

Do you see the actual tires prior to your purchase?

[IF YES] Are these the actual tires that are installed on your vehicle or a model tire that matches the model of the tires that will be installed on your vehicle?

Do you look for information about tires before you buy?

What kind of information are you looking for during the process?

How do you use this information in your purchase process?

Where do you look for tire information?

Home (current tires, vehicle owners’ manual, etc.)? Online? In-store? Word-of-mouth?

Are you more likely to proactively look for information or are you more likely to rely on information available at the place of purchase?

How much impact does this information have on your purchase decision? Which sources have the most impact on your purchase decisions?

How much would you say you rely on recommendations from tire sales staff?

How trustworthy is sales staff? Versus other sources?

Do you consider more than one tire? [IF YES] How would you go about comparing tires?

At a retail store, have you been presented with more than one option for tires to purchase?

Do you go with what is recommended or do you ask about additional options?

In a store, have you ever seen either on a tire label or displayed near a tire, information about a tire you considered purchasing?

What information did these labels or displays include?

Did the labels or displays include information that could be used to compare different tires?

How useful is this information to your purchase?

Do different manufacturers use different labels or presentations of information?

Which manufacturers do you recall having labels?

Which manufacturers do you recall displaying other forms of information?

Did any one label or information display stick out as the most helpful or useful to your tire purchase decision? Which manufacturer?

Have you seen any tire-related ratings before?

Where did you see these ratings?

What information was conveyed by the ratings?

How well did you comprehend the meaning of these ratings?

How, if at all, did you use the ratings in your purchase decision?

Thinking about the information you get from these various sources, how well would you say you comprehend the information?

Thinking about replacement tires, what are you main purchase criteria?

What is the most important factor in your decision?

[PROBE: brand, cost, durability/life of tires, safety, fuel efficiency, tradeoffs, availability/in stock, something else?]

When considering replacement tires, do you seek replacement tires that match the size of the original tires that came on your vehicle?

Are you aware that multiple tire sizes may fit your vehicle?

Have you ever considered changing the diameter of the tires you currently have on your vehicle?

[IF YES] Why?

[IF YES] How much bigger or smaller a diameter would you consider?

Do you want to be able to compare tires across different sizes? Why?

How might you go about comparing tires across different sizes? What sources would you consult?

How many in the group have more than one vehicle in your household?

What types of vehicles are these? (small passenger vehicle, SUV, light truck, etc.)

For those who have different sized vehicles, how helpful, if at all, would it be for you to compare the tire you purchase for your [INSERT TYPE OF VEHICLE] and the tire you purchase for your [INSERT TYPE OF VEHICLE]?

What criteria would you want to compare the tires on? (PROBE: safety, fuel economy, durability, stopping distance, etc.)

Evaluate tire ratings (80 minutes)

National Highway Traffic Safety Administration (NHTSA) is a Federal agency that is part of the U.S. Department of Transportation. NHTSA is exploring different ways to provide tire ratings to help consumers as they purchase tires. Today, I am going to show you some new methods that NHTSA could use to rate tires. Keep in mind, these are meant to help keep you as consumers informed in your purchase decisions, so while we go through these ratings I’d like to hear everything that you think about these ratings.

First, I’d like you to complete a short individual activity. On each page of your workbooks, you will see three tires rated using one of several potential rating scales. I want you to look at the ratings and circle which tire you would elect to purchase. Then, at the bottom of the page, answer the corresponding questions. I’ll give you about 10 minutes to complete this activity. When you are finished, turn your packet over so that I know when everyone is done. After the activity, we are going to talk about each rating scale in detail, and I’ll ask some of you to share your answers.

|

|

|

Rating Scale A

|

Rating Scale B |

Rating Scale C

|

|

|

|

Rating Scale D

|

Rating Scale E |

Rating Scale F |

|

||

Sample Label with Overall Rating |

||

[NOTE: WORKBOOK ACTIVITY IS INCLUDED IN THIS ICR PACKAGE AS APPENDIX H AND A DOCUMENT CONTAINING ALL THE LABEL MOCK-UPS USED IN THIS DISCUSSION IS ATTACHED AS APPENDIX I]

Order of Rating Evaluation:

Group 1: A, B, C, D, E, F

Group 2: B, D, A, E, C, F

Group 3: C, E, B, A, D, F

Group 4: D, B, C, E, A, F

Group 5: E, C, D, B, A, F

Group 6: A, D, E, C, B, F

[MODERATOR TO ASK OF THE FIRST RATING PRESENTED:]

What is your initial impression of this rating?

What did you notice first about this rating?

What do these tire ratings mean?

Looking at this rating you can see three things are measured.

Would you look at each rating separately or as a whole?

In your own words, explain to me what you think each of these ratings means:

Fuel efficiency rating (Rolling Resistance)

Safety rating (Wet Traction)

Durability rating (Tread Wear)

How valuable do you believe this information is to your purchase?

Do you see any one measure as more important than others, or are they all equally important?

Which is most important? Which is least important?

Is there any information missing from this label that would be helpful to you when purchasing a replacement tire?

Notice that the source listed on the rating is NHTSA.

How trustworthy do you feel this source is?

If the source was instead listed as “Manufacturer’s reported rankings compiled by NHTSA” would that be more trustworthy, less trustworthy, or make no difference.

Rating A:

What is your initial impression of this rating?

What did you notice first about this rating?

Looking at the fuel efficiency rating, in your own words, how would you explain what you think the difference is between a 4-star rating and a 3-star rating? [MODERATOR NOTE IF SPECIFIC MPG CHANGE IS MENTIONED]

In your own words, what do you personally see as the benefits of purchasing a tire with a higher rating?

What, if any, drawbacks do you personally see for purchasing a tire with a higher rating?

How large or small a difference between star ratings would indicate a significant difference in tire performance?

Looking at the tread wear rating, in your own words, how would you explain what you think the difference is between a 4-star rating and a 2-star rating?

In your own words, what do you personally see as the benefits of purchasing a tire with a higher rating?

What, if any, drawbacks do you personally see for purchasing a tire with a higher rating?

How large or small a difference between star ratings would indicate a significant difference in tire performance?

Looking at the wet traction rating, in your own words, how would you explain what you think the difference is between a 4-star rating and a 5-star rating?

In your own words, what do you personally see as the benefits of purchasing a tire with a higher rating?

What, if any, drawbacks do you personally see for purchasing a tire with a higher rating?

How large or small a difference between star ratings would indicate a significant difference in tire performance?

Looking at these ratings as a whole, how would the information presented impact your decision on which tire to purchase?

How easy or hard is it to compare tires using this rating system?

Would you say this rating is clear or confusing? Why?

What if anything would you recommend changing to improve this rating to more clearly convey the information you need when evaluating tires?

How likely are you to use these ratings when deciding which tire to purchase?

Looking at how you evaluated the choice between three tires using this rating scale in your workbook, how many selected Tire A to purchase? Why?

How many selected Tire B? Why?

How many selected Tire C? Why?

Rating B:

What is your initial impression of this rating?

What did you notice first about this rating?

Looking at the fuel efficiency rating, in your own words, how would you explain what you think the difference is between a rating of 50 and a rating of 58?

How would you explain the difference between a rating of 58 and a rating of 80?

In your own words, what do you personally see as the benefits of purchasing a tire with a higher rating?

What, if any, drawbacks do you personally see for purchasing a tire with a higher rating?

How large or small a difference between numbers would indicate a significant difference in tire performance?

Looking at the tread wear rating, in your own words, how would you explain what you think the difference is between a rating of 64 and a rating of 61?

How would you explain the difference between a rating of 61 and a rating of 39?

In your own words, what do you personally see as the benefits of purchasing a tire with a higher rating?

What, if any, drawbacks do you personally see for purchasing a tire with a higher rating?

How large or small a difference between numbers would indicate a significant difference in tire performance?

Looking at the wet traction rating, in your own words, how would you explain what you think the difference is between a rating of 73 and a rating of 72?

How would you explain the difference between a rating of 73 and a rating of 90?

In your own words, what do you personally see as the benefits of purchasing a tire with a higher rating?

What, if any, drawbacks do you personally see for purchasing a tire with a higher rating?

How large or small a difference between numbers would indicate a significant difference in tire performance?

Looking at these ratings as a whole, how would the information presented impact your decision on which tire to purchase?

How large or small a difference between numbers would indicate a significant difference in tire performance?

How, if at all, does the “range of tires in this size” display impact how you interpret the rating number?

How easy or hard is it to compare tires using this rating system?

Would you say this rating is clear or confusing? Why?

What if anything would you recommend changing to improve this rating to more clearly convey the information you need when evaluating tires?