Form CMS-10411 State Balancing Incentive Payments Program (BIPP) Applic

State Balancing Incentive Payments Program (BIPP)

BIPP App_Clean_083111 [rev 11-29-11]

State Balancing Incentive Payments Program (BIPP) Application

OMB: 0938-1145

DEPARTMENT OF HEALTH AND HUMAN SERVICES

Centers for Medicare & Medicaid Services

Center for Medicaid, CHIP, and Survey & Certification

Patient Protection and Affordable Care Act

Section 10202

State Balancing Incentive Payments Program

Initial Announcement

CFDA 93.543

OMB Control No: 0938-1145, Expiration Date: XXXX

Applicable Dates:

Grant Period of Performance: October 1, 2011 – September 30, 2015

Applications for participation in the Balancing Incentive Payments Program will be accepted on an ongoing basis beginning [insert revised date] through August 1, 2014, or until the full provision of the $3 billion has been projected to be expended, whichever date is earlier.

PRA Disclosure Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0938-1145. The time required to complete this application is estimated to average 40 hours per response, including the time to review instructions and complete/submit the State Medicaid Agency Cover Letter; Project Abstract; Letters of Agreement, Endorsements and Support; Application Narrative; Preliminary Work Plan; Proposed Budget (using the Informational Financial Reporting Form in Attachment B); and the Final Work Plan. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Attn: PRA Reports Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland 21244-1850.

Table of Contents

FUNDING OPPORTUNITY DESCRIPTION 4

Background: Need and Opportunity 5

Grant Program Requirements 5

Number of Grant Awards 16

4. Grant Program Duration and Scope 16

5. Grant Program Technical Element 17

State Eligibility Requirements 17

Defining Long-term Services and Supports 17

Reporting Requirements 19

Services and Financial Reporting 21

AWARD INFORMATION 21

1. Amount of Funding 21

2. Period of Performance 21

ELIGIBILITY INFORMATION 21

1. Eligible Applicants 21

2. Eligibility - Threshold Criteria 21

APPLICATION AND SUBMISSION INFORMATION. 22

1. Submission of Application Materials 22

2. Content and Form of Application Submission 22

Form of Application Submission 22

3. Submission Dates and Times 25

(A) Applicant’s Teleconference 25

(B) Grant Applications.............................................. 25

(C) Late Applications 25

(D) Grant Awards Timeframe…………..……………………………………….25

4. Funding Restrictions 25

5. Review and Selection. 25

AWARD ADMINISTRATION INFORMATION 26

Award Notices 26

AGENCY CONTACTS 26

Programmatic Content 26

ENFORCEMENT ACTIONS 26

Attachment A– Application Submission Checklist

Attachment B– Informational Financial Form

Attachment C– Percentage of LTSS Spending for HCBS Using FFY 2009 Data

FUNDING OPPORTUNITY DESCRIPTION

1. Background: Need and Opportunity

Section 10202 of the Patient Protection and Affordable Care Act (Pub. L. 111-148) (The Affordable Care Act), entitled the “State Balancing Incentive Payments Program,” hereafter referred to as the Balancing Incentive Program, authorizes additional Federal funds to States to provide financial incentives to increase access to non-institutionally based long-term services and supports (LTSS).

Effective October 1, 2011, the Balancing Incentive Program offers a targeted increase in the Federal Medical Assistance Percentage (FMAP) to States that undertake structural reforms to increase access to non-institutional LTSS. The increased matching payments are tied to the percentage of a State’s non-institutional LTSS spending, with lower FMAP increases going to States that need to make fewer reforms. The Balancing Incentive Program provides increased FMAP to States in return for their implementation of structural changes, including a No Wrong Door/Single Entry Point System (NWD/SEP), conflict-free case management services, and a core standardized assessment instrument. Total funding over the four-year period (October 2011 – September 2015) cannot exceed $3 billion in Federal increased matching payments.

Historically, some States have been successful at rebalancing their long-term care systems toward community-based care. The Balancing Incentive Program targets those States that need assistance starting up their rebalancing initiatives, offering support in the form of increased FMAP.

States can qualify for a five percentage point increase in FMAP through Balancing Incentive Program if less than twenty-five percent of the total LTSS expenditures for medical assistance under the State Medicaid program for fiscal year 2009 are for non-institutionally based LTSS, and by submitting an application that meets the programmatic requirements and structural reforms specified in the authorizing legislation (Section 10202 of the Affordable Care Act). These States must achieve a benchmark of twenty-five percent of total Medicaid expenditures on home and community-based LTSS, and complete the structural reforms, no later than September 30, 2015.

Additionally, States can qualify for receiving a two percentage point increase in FMAP through Balancing Incentive Program if less than fifty percent of the total LTSS expenditures for medical assistance under the State Medicaid program for fiscal year 2009 are for non-institutionally based LTSS, and by submitting an application that meets the Balancing Incentive Program provision’s programmatic requirements and structural reforms. These States must achieve a benchmark of fifty percent of total Medicaid expenditures on home and community-based LTSS, and complete the required structural reforms, no later than September 30, 2015.

In both cases, as specified in Section 10202(c) of the Affordable Care Act, States may not restrict eligibility for LTSS more than eligibility standards, methodologies, or procedures in place as of December 31, 2010.

Over the last several decades, the Social Security Act (the Act) has been amended several times to help reduce the institutional bias in Medicaid long-term care. These amendments have given States increasing authority to create community-based systems of care and still receive Federal financial participation (FFP) for the home and community-based services (HCBS) they provide. Under Section 1915(c) of the Act, States can ask the Secretary of Health and Human Services (HHS) – via the Centers for Medicare & Medicaid Services (CMS) – to waive certain statutory requirements of the SSA, including the requirement to provide the same services to everyone who is eligible based on their needs and income ("comparability") and the requirement to provide the same services throughout the State ("statewideness"). Under Section 1915(i), States can amend their Medicaid plans to provide HCBS based on needs-based criteria, rather than diagnosis, and to individuals whose needs do not necessarily rise to institutional level of care. Under Section 1915(j), States can amend their plans to give individuals the power to self-direct their personal assistance services (PAS). Finally, under Section 1115, States can create demonstration programs to deliver community-based care in innovative ways.

In addition to the Balancing Incentive Program, the Affordable Care Act established new authorities for providing Medicaid-funded HCBS and support the balancing of LTSS. These new authorities include the Community First Choice Option, a State Plan option to provide HCBS, which provides an increased FMAP of 6 percentage points for program costs, and a Health Homes State plan option to coordinate care for individuals with chronic conditions, and receive 90 percent FMAP for health home services for the first 8 fiscal quarters. The Affordable Care Act also amended existing authorities that complement the Balancing Incentive Program and support the growth of HCBS. These include the extension of the Money Follows the Person demonstration program and the Aging and Disability Resource Center program.

2. Grant Program Requirements

The Balancing Incentive Program provides that participating State grantees make important structural changes to qualify for the increased Federal match, including the development of a No Wrong Door/Single Entry Point System (NWD/SEP), Conflict-free Case Management, and the development and use of a Core Standardized Assessment Instrument, and must submit a detailed budget (outlined later) that specifies how States plan to expand non-institutional LTSS to achieve their rebalancing targets. Grantees must create a statewide system of LTSS that ensures that: all individuals have the same access to information and resources on LTSS, regardless of their first point of entry into the system; individuals are assessed once for the entire range of LTSS for which they may be eligible; and that the eligibility determination and enrollment process proceeds in a streamlined manner, with the functional and financial components of eligibility coordinated. An important part of a NWD/SEP system is that individuals are assessed for the entire range of services and programs for which they might be eligible only once using a single instrument – a Core Standardized Assessment Instrument. By facilitating access to LTSS, the Balancing Incentive Program aims to reduce institutionalization and improve access to care.

States must submit a preliminary work plan at the time of application that describes in detail the plans for achieving the requirements of the Balancing Incentive Program within the program period. States must commit to produce a final work plan within six months from the date of application submission. The State must also submit a proposed budget that details the State’s plan to expand and diversify medical assistance for non-institutionally-based long-term services and supports during the balancing incentive period and achieve the target spending percentage applicable to the State.

Implementation of Structural Changes

As part of this application, the State agrees to make the following structural changes:

1. A No Wrong Door/Single Entry Point system (NWD/SEP);

2. Conflict-free case management services; and

3. A core standardized assessment instrument.

CMS strongly urges States to use this opportunity to think strategically about implementation of other provisions in the Affordable Care Act that require these structural changes or a variation thereof. Several of these provisions are discussed in more detail beginning on page 14 of this document.

CMS supported an environmental scan of opportunities and challenges to the implementation of a NWD/SEP and utilization of core standardized assessment instruments. This information informs this application and a subsequent Balancing Incentive Program user manual. The user manual will be made available to all States in September 2011.

As part of the application process, States will be expected to provide a letter of commitment to make structural changes and to submit a work plan for the implementation of the structural changes within six months from the date of application submission. The draft work plan must demonstrate that the structural changes will be in affect no later than September 30, 2015.

In addition to the structural changes, States are encouraged to consider other structural changes, such as optional presumptive eligibility, which are outside of those required in the legislation but can be used as tools to help the State achieve the target spending percentages.

Structural Changes Required

No Wrong Door/Single Entry Point System

A key component of the structural changes promoted by the Balancing Incentive Program is development of a “No Wrong Door/Single Entry Point System” (NWD/SEP) for long-term care services and supports. A NWD/SEP requires the development of a statewide system to enable consumers to access all long-term services and supports through an agency, organization, coordinated network, or portal, in accordance with such standards as the State shall establish and that shall provide information regarding the availability of such services, how to apply for such services, referral(s) for services and supports otherwise available in the community, and determinations of financial and functional eligibility for such services and supports, or assistance with assessment processes for financial and functional eligibility.

A Statewide System:

A NWD/SEP ensures that individuals accessing the system experience the same process and receive the same information about LTSS options wherever they enter the system. After entering the system, the needs assessment and eligibility determination process proceeds smoothly, with designated NWD/SEP agencies guiding the individual through the entire process from eligibility determination to enrollment in services.

LTSS Information & Initial Assessment:

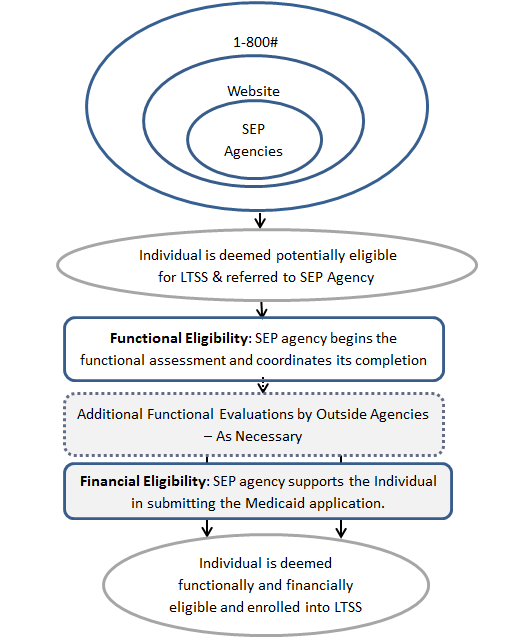

An important component of a Balancing Incentive Program NWD/SEP system is that it is a statewide system. A true statewide system ensures that individuals can access the system from any location within the State, and assures all individuals accessing the system experience the same process and receive the same information about LTSS options. To be statewide, a NWD/SEP system must include the following three components, which make up the key entry points to the system:

1) A set of designated Single Entry Point (SEP) agencies

2) An informative website about LTSS options in the State

3) A statewide 1-800 number that connects individuals to the SEP agencies or their partners

The three components of a NWD/SEP system are also the entry points through which an individual may enter the system.

A set of designated Single Entry Point (SEP) agencies form the core of the “no wrong door” system in each State. The Medicaid Agency is the lead SEP agency. Other participating agencies might include agencies such as: Area Agencies on Aging, Aging and Disability Resource Centers, and Centers for Independent Living. The SEP agencies have physical locations where individuals can inquire about LTSS, and receive initial and comprehensive eligibility assessments and determinations for Medicaid-funded LTSS. The SEPs design and disseminate standardized processes for information and referral and eligibility assessments for LTSS to all participating SEP agencies, ensuring a consistent experience for individuals seeking information and assistance.

An informative website about LTSS options in the State is another important component of a statewide NWD/SEP system. The content of the NWD/SEP website must be overseen by the lead SEP agency and must contain, at a minimum, basic information about the range of LTSS services available in the State and must list the statewide NWD/SEP 1-800 number and provide contact information for local SEP offices by county. The State must ensure that the NWD/SEP website is accessible to individuals with disabilities and compliant with Section 508 of the Rehabilitation Act of 1973.

A recent CMS statewide inventory determined that almost all States currently make available an informational website for potential LTSS applicants, and over one quarter of States currently have initial assessments online. Nearly all of these assessments are part of a general self-assessment tool which allows individuals to conduct initial eligibility checking for a host of medical and social public programs within the State (e.g., the Children’s Health Insurance Program, Temporary Assistance for Needy Families). Tools tend to result in a list of programs for which the individual may be eligible; a list of agencies and contact information are provided. In some cases results are tailored for the county where an applicant lives and a few systems let an applicant download the list of recommended agencies or convert it into a printer-friendly format. Additionally, a few States provide a mechanism for individuals to create a log in and save their data, with the option to pass the data forward to the appropriate agency for the next step in the assessment process.

Even a simple self-evaluation is a valuable component of a NWD/SEP system. Self-assessments can be an important tool for informing consumers about the range of services for which they might be eligible. These systems also provide a way for individuals to make initial inquiries about services casually and outside of business hours. CMS encourages States to consider incorporating an online self-assessment into their NWD/SEP system, and ideally one that allows data to be passed forward to the SEP agency.

A 1-800 number is another important component of a NWD/SEP system, especially for individuals who are more comfortable talking to a “real person” rather than searching extensively for information on a website or for those individuals who do not have internet access. Toll-free numbers can also provide the ability to create a person to person hand off. For example, a consumer may call an 800 number, receive an initial screening of needs and eligibility for LTSS, and an appointment may be made over the phone for the next step in a needs assessment or application process. Toll-free numbers should also provide a web link to information and referral services for those with internet access and provide translation services for non-English speaking individuals. A recent environmental scan found that, while the majority of States do operate an 800 number that can provide callers with general information about LTSS options, few States indicated that callers could be screened for eligibility for such options. CMS encourages States to set up systems by which individuals are able to have an initial evaluation completed via the 800 number. Additionally, States must ensure that the toll-free number is accessible to participants with disabilities.

Together these three components form the basis of a statewide NWD/SEP system, allowing access to local services by phone, internet, and in person. More information regarding the physical proximity of individuals to SEP agencies is available below.

Beneficiary is deemed potentially eligible for LTSS & referred to SEP Agency -

Beneficiary is assigned an eligibility coordinator at SEP Agency:

In a NWD/SEP system, the SEP agency coordinates all components of the eligibility determination: both functional and financial, allowing individuals to receive streamlined eligibility determinations. SEP staff complete initial assessments and a comprehensive assessment. The same SEP agency also assists the individual to complete and submit the Medicaid financial application and any accompanying documentation, following the process through to eligibility determination. After determinations are made, SEP agencies help individuals choose among programs for which they are eligible, enroll in services, and apply eligibility decisions when appeals are requested by individuals. Ideally, under a NWD/SEP system one person – an eligibility coordinator – takes ownership of the complete eligibility determination process for an individual, providing the individual a single point of contact within the SEP agency.

States should consider co-locating functional and financial eligibility determination staff, as this will help expedite eligibility determinations.

The basic concept of how a person moves through a NWD/SEP system is illustrated by the following diagram, which presents the “person flow” through a NWD/SEP system. CMS expects that States will create a NWD/SEP system that reflects the person flow concept and expands it.

Data Considerations

In addition to considering the “person flow” of a NWD/SEP system, States will need to consider the “data flow” of such a system; that is the path data take from the point of initial collection of financial or functional information through to the final eligibility determination. There are many ways a State can structure data flow within a NWD/SEP system, and a robust NWD/SEP system considers data systems on many levels.

At the point of entry into the NWD/SEP system, the following are just a few questions States must consider: what information to include on the NWD/SEP website, how to keep this information up to date, whether to build an initial self-assessment tool into the website, and whether to create an option to save and transmit initial assessment data to NWD/SEP agencies. In cases where States maintain websites with comprehensive information about local LTSS resources, the SEP agency must keep this information up to date.

Coordination of financial and functional data is a key component of a NWD/SEP system and another important data consideration. All functional assessment data collected via the Core Standardized Assessment must be stored in a central location by the State Medicaid Agency. States will need to determine how the financial data required to determine eligibility for Medicaid LTSS will be handled. If financial data are processed in a separate system from the functional assessment data, the State will have to create a way to allow SEP staff to access both types of data – or the eligibility determinations based on both data sets – in order to make eligibility determinations. It is important that the SEP agency staff be apprised of the status of the financial eligibility determination and that data be processed quickly, and the results shared quickly as well. Ideally, States have systems in which financial and functional data systems are integrated or “talk to each other,” and the SEP agency staff are able to both input data into these systems and extract data necessary for making eligibility determinations.

Access to & Advertising for the NWD/SEP System

States should consider how true statewide access to the NWD/SEP system will be achieved. While the NWD website and 1-800 number will provide statewide access to LTSS information and to SEP agencies, individuals in each State will need to have local access to physical SEP agencies – or partners - in order to complete the full Core Standardized Assessment (CSA)/functional assessment. States must consider how SEPs are distributed relative to individuals likely to need them for evaluations and determinations. In the ideal situation, all individuals needing to interact with an SEP agency would be able to travel there and return home within a single day, accompanied or alone, by private or by public transportation. Individuals who can travel to a given SEP are considered to be in its service area. Individuals who cannot travel to a given SEP fall outside its service area. States must consider how individuals with disabilities and older adults will access the local SEP agency, including how access can be made available to individuals needing public transportation.

For a NWD/SEP system to be truly statewide, a large share of a State’s population should live within the service area of at least one SEP. CMS recognizes, however, that individuals living in rural areas may not fall within the service area of any SEPs. For this share of the population, the State should consider making other arrangements, such as contracting with home health agencies to make visits, either in-home or at a central location (such as a nearby hospital).

States should also plan to advertise their NWD/SEP system. The SEP agencies should become known as the “go to” agencies for LTSS. Advertisements and educational materials about the system must be made available in a variety of formats in order to be accessible to people of all disabilities, and must be made available to individuals in locations throughout the State.

Timeliness of Eligibility Determinations

If States are to truly balance their LTSS systems from institutional to community-based care, the timeliness of LTSS eligibility determinations must be improved. Often, people inquire about LTSS when they have an acute need for supports with activities of daily living (ADLs). In these cases, individuals need assistance immediately and cannot wait for a lengthy eligibility determination process to be completed before receiving services. For a variety of reasons, institutions are often more willing to admit individuals and provide services immediately. CMS encourages States to propose innovative methods for improving efficiencies in the eligibility determination process for LTSS.

Conflict-Free Case Management Services

States that participate in the Balancing Incentive Program will develop, as part of their NWD/SEP system, conflict-free case management services to develop a service plan, arrange for services and supports, support the beneficiary (and, if appropriate, the beneficiary's caregivers) in directing the provision of services and supports for the beneficiary, and conduct ongoing monitoring to assure that services and supports are delivered to meet the beneficiary's needs and achieve intended outcomes.

For purposes of Balancing Incentive Program, States will establish conflict of interest standards for the independent evaluation and independent assessment. In this section, we refer to persons or entities responsible for the independent evaluation, independent assessment, and the plan of care as “agents” to distinguish them from “providers” of home and community–based services.

The design of services, rate establishment, payment methodologies, and methods of administration by the State Medicaid agency may all contribute to potential conflicts of interest.

These contributing factors can include obvious conflicts such as incentives for either over- or under-utilization of services; subtle problems such as interest in retaining the individual as a client rather than promoting independence; or issues that focus on the convenience of the agent or service provider rather than being person-centered. Many of these conflicts of interest may not be deliberate decisions on the part of individuals or entities responsible for the provisions of service; rather, in many cases they are outgrowths of inherent incentives or disincentives built into the system that may or may not promote the interests of the individual receiving services.

To mitigate any explicit or implicit conflicts of interest, the independent agent should not be influenced by variations in available funding, either locally or from the State. The plan of care must offer each individual all of the LTSS that are covered by the State that the individual qualifies for, and that are demonstrated to be necessary through the evaluation and assessment process. The plan of care must be based only on medical necessity (for example, needs-based criteria), not on available funding. Conflict-free case management prohibits certain types of referrals for services when there is a financial relationship between the referring entity and the provider of services. Payment to the independent agent for evaluation and assessment, or qualifications to be an independent agent, cannot be based on the cost of the resulting care plans.

We are aware that in certain areas there may only be one provider available to serve as both the agent performing independent assessments and developing plans of care, and the provider of one or more of the LTSS. To address this potential problem, the State may permit providers in some cases to serve as both agent and provider of services, but with guarantees of independence of function within the provider entity. In certain circumstances, CMS may require that States develop "firewall" policies, for example, separating staff that perform assessments and develop plans of care from those that provide any of the services in the plan (and ensuring that the evaluations of that staff are not based on the cost of the care plan); and meaningful and accessible procedures for individuals and representatives to appeal to the State. States should not implement policies to circumvent these requirements by suppressing enrollment of any qualified and willing provider.

CMS recognizes that the development of appropriate plans of care often requires the inclusion of individuals with expertise in the provision of long-term services and supports or the delivery of acute care medical services. As discussed previously, this is not intended to prevent providers from participating in these functions, but to ensure that an independent agent retains the final responsibility for the evaluation, assessment, and plan of care functions.

The State must ensure the independence of persons performing evaluations, assessments, and plans of care. Written conflict-free case management ensures, at a minimum, that persons performing these functions are not:

related by blood or marriage to the individual,

related by blood or marriage to any paid caregiver of the individual,

financially responsible for the individual

empowered to make financial or health-related decisions on behalf of the individual,

providers of State plan LTSS for the individual, or those who have interest in or are employed by a provider of State plan LTSS; except, at the option of the State, when providers are given responsibility to perform assessments and plans of care because such individuals are the only willing and qualified provider in a geographic area, and the State devises conflict of interest protections. (If the State chooses this option, specify the conflict of interest protections the State will implement).

Core Standardized Assessment Instruments

States participating in Balancing Incentive Program will develop core standardized assessment (CSA) instruments for determining eligibility for non-institutionally-based long-term services and supports, which shall be used in a uniform manner throughout the State, to determine a beneficiary's needs for training, support services, medical care, transportation, and other services, and to develop an individual service plan to address such needs.

There are two major benefits of adopting a CSA for statewide use. First, because CSAs focus on an individual’s need for assistance with ADLs and instrumental activities of daily living (IADLs), the evaluation is focused on an individual’s true needs, rather than on their current or potential diagnoses; in other words, a CSA promotes a person-centered approach to needs assessment. Second, a CSA used statewide will provide States with a true picture of the needs of all individuals seeking LTSS in their State. A dataset comprised of CSA data for all LTSS consumers can help States with future budget and services planning. CSA data can also be used to help States prioritize individuals with the highest need in cases where services have wait lists. Finally, CSAs may be used to develop individualized budgets for self-directed consumers.

CMS expects that the CSA will be developed under the leadership of the designated lead NWD/SEP agency in each State and that each SEP agency will have staff trained to administer the CSA. The CSA should provide the minimum dataset for eligibility for Medicaid-funded LTSS.

In practice, CMS anticipates that States will implement a CSA that involves two parts: an initial evaluation and a comprehensive evaluation. Not everyone who enters the NWD/SEP system will be an appropriate candidate for a complete CSA evaluation. In other words, not everyone who walks in the door of a NWD/SEP agency, or otherwise inquires about LTSS services (e.g. via phone or website) will be a likely candidate for these services. Therefore, individuals making initial inquiries about LTSS will go through an initial assessment to determine whether a full CSA is warranted.

The initial assessment will point to potential needs and program eligibility, and may be conducted over the phone or in person by trained designated agency staff, or completed as a self-assessment online. If an individual “tests positive” for LTSS needs on the initial evaluation, they may complete the full CSA evaluation. The CSA provides a more complete picture of an individual’s abilities and needs and must be completed in person by trained designated agency staff.

Advantages to Participating States

Technical Assistance to States

CMS will provide a User Manual to all States in September, 2011. The Manual will provide guidance to State grantees on implementing Balancing Incentive Program, including materials such as: example case studies of person flow and data flow in a NWD/SEP system, presentation of varied models for data sharing in a NWD/SEP system, guidance for selecting a vendor or an internal team to develop or administer NWD/SEP data systems, guidance on developing the Balancing Incentive Program work plan, and a checklist for grantees to evaluate their planned NWD/SEP system against the Balancing Incentive Program criteria.

CMS is also creating a prototype CSA, which may be adopted by grantees. The prototype CSA will be provided to grantees upon award. Grantees that do not wish to adopt the prototype CSA will have the option to use an alternate CSA, provided it collects a core set of data elements. The core set of data elements will likely contain data items in the following categories: demographic information and current enrollment in programs such as Medicare and Social Security Income (SSI), ADLs, IADLs, known medical conditions, and problem behaviors. The final core data set will be provided to grantees in the Manual. The Manual will also include guidance on cross-walking an alternate CSA to the core set of data elements under the Balancing Incentive Program.

Streamlined Eligibility & Enrollment Requirements

Streamlining and simplifying eligibility and enrollment into Medicaid is an important focus of the Affordable Care Act. By 2014, States will upgrade their eligibility systems to process Medicaid enrollment using a simplified eligibility determination process for most non-aged, non-disabled beneficiaries, as well as support integrated eligibility determination among insurance affordability programs. We encourage States to consider the relationship between their Affordable Care Act-related system changes, and how they plan to accommodate eligibility verification and enrollment (including functional and financial eligibility) for LTSS programs.

Funding Available for Development & Implementation of NWD/SEP System & CSA

Because the increased Federal matching dollars under the Balancing Incentive Program can only be used to cover services, States will need to utilize other funding sources to cover the costs of the structural changes required to participate in the Balancing Incentive Program. Various provisions of the Affordable Care Act align with the goals of the Balancing Incentive Program; in some cases where goals and requirements overlap, funding for these initiatives may be used to cover the Balancing Incentive Program activities. The following potential funding sources may be sources for funding NWD/SEP system development. Additional guidance on the potential use of these funds to support the Balancing Incentive Program infrastructure development will be forthcoming.

Medicaid Management Information Systems (MMIS): On April 19, 2011, CMS released a final rule titled “Medicaid: Federal Funding for Medicaid Eligibility Determination and Enrollment Activities.” The rule increases the Federal matching rate for Medicaid eligibility and enrollment system development from 50 percent to 90 percent through December 2015, contingent on States meeting certain conditions and standards. The rule explicitly expanded the definition of Medicaid Management Information Systems (MMIS) activities to include eligibility determinations (eligibility determinations had previously been explicitly excluded from MMIS functions eligible for enhanced Federal Financial Participation (FFP)). The final rule can be found at http://edocket.access.gpo.gov/2011/pdf/2011-9340.pdf.

In order to be eligible for the enhanced MMIS match, States must meet certain standards and requirements applicable to both claims management and eligibility and enrollment procedures within MMIS. For example, both the eligibility system and the MMIS will need to process claims, communicate with providers, beneficiaries, and the public, produce transaction data and reports, and ensure coordination between Medicaid, CHIP and the Exchanges. In addition, States must build a MMIS infrastructure based on the Medicaid Information Technology Architecture (MITA) standards. A key goal of MITA is to modernize State Medicaid systems, with a focus on streamlining and simplifying enrollment, and moving away from sub-system components toward a Service Oriented Architecture. States should consider how to incorporate functional assessment, financial eligibility processing, enrollment, and key data sharing for LTSS into their transformed MMIS. It is important to note that these enrollment and eligibility systems must be in compliance with Section 504 of the Americans with Disabilities Act (ADA), which requires that individuals with disabilities have an equal opportunity to benefit from Federally-funded programs, including those using electronic and information technology. More information about the standards and requirements are available at the link above.

Money Follows the Person (MFP): Money Follows the Person was established by the Deficit Reduction Act of 2005, with a goal of helping States to balance their long-term care systems and help Medicaid enrollees transition from institutions to the community. Section 2403 of the Affordable Care Act extended the MFP Demonstration Program through 2016 and appropriated an additional $2.25 billion to the program; $450 million for each fiscal year during 2012-2016. The new funding is to strengthen existing Demonstration Programs, and for additional States to participate. Currently, 43 States and the District of Columbia participate in MFP and have been awarded $2,095,172,282 for program efforts through 2016.

MFP funding provides increased FMAP for HCBS received by individuals transitioned from an institution into the community. As stated in the MFP application, “The increased FMAP funding, as well as significant financial resources to support the administration of the demonstration are available for the implementation of broader infrastructure investments. These investments include initiatives such as…building “no wrong door” access to care systems.”1

Aging and Disability Resource Centers Funding (ADRC): ADRC funding, administered by the Administration on Aging (AoA), is one potential source of funding for the structural changes promoted by the Balancing Incentive Program. While the Balancing Incentive Program mission differs from the ADRC mission in some key ways, some components of the ADRC mission align with the NWD/SEP component of the Balancing Incentive Program. For example, ADRCs are to serve as “a visible and trusted source of information on the full range of long-term care options, including both institutional and home and community-based care, which are available in the community.” They are to provide a single point of entry to all publicly funded LTSS, including Medicaid. ADRCs are expected to perform consumer intake and screening, needs assessment, development of service plans, and both functional and financial eligibility.2

In partnership with the State Unit on Aging and other ADRC operating agencies, States should be able to make a fairly straightforward case for using ADRC funding to support development of a truly statewide comprehensive NWD/SEP system under the Balancing Incentive Program, which enables consumers streamlined access to all long-term services and supports. Additionally, using ADRC funds to support development of a CSA would be supporting the ADRC mission to conduct intake, screening, and needs assessment based on both financial and functional eligibility. Using a single CSA statewide would support the ADRC being a true single point of entry to all LTSS in the State. ADRCs may be “users” of or partners within the NWD/SEP system under Balancing Incentive Program, and supporting the Balancing Incentive Program can help ADRCs move toward the ideal of a statewide system of access to LTSS.

In 2010, HHS dedicated $60 million through the Affordable Care Act to “help people navigate their health and long-term care options” (Department of Health and Human Services, 2010). ADRCs are among the entities eligible for this funding, with a section of the legislation (Section 2405) specifically dedicating $10,000,000 each FY between 2010 and 2014 to ADRCs. In particular, recent ADRC funding has focused on options counseling standards to support the functions of intake, assessment, action plan development and follow-up through ADRCs, in turn improving ADRCs’ activities with regard to the Money Follows the Person initiative, and to coordinate with State Medicaid programs to help individuals leave nursing homes for community care (Department of Health and Human Services, 2010). Additional guidance on the potential use of these funds as well as others to support the Balancing Incentive Program infrastructure development will be forthcoming.

Other Administration on Aging (AoA) Funding: The AoA also provides ongoing formula grants for the general implementation of their mission. Many of these grants complement and support the functions within a NWD/SEP system, even if the grants do not specifically mention ADRC (Administration on Aging website http://www.aoa.gov/AoARoot/Grants/Funding/).

3. Number of Grant Awards

CMS will accept only one application from each State Medicaid Agency interested in participating in the Balancing Incentive Program. CMS expects that the Medicaid agency to partner with other State agencies; however the State Medicaid agency must be the lead applicant.

The number of grant awards approved by CMS depends on the scope (i.e., proposed enrollment and scope of services) and quality of the proposed programs; however, CMS anticipates the funding level to be sufficient to support approximately 20-25 States with up to $3 billion dollars over the life of the program.

4. Grant Program Duration and Scope

Applications for participation in the Balancing Incentive Payments Program opportunity will be accepted on an ongoing basis beginning September 1, 2011 through August 1, 2014, or until the full provision of the $3 billion has been expended, whichever date is sooner. Funding will be awarded for the Federal Fiscal Year beginning October 1, 2011. Continued funding will be awarded on an annual basis to all participating States, contingent upon progress, through September 30, 2015, or until the full $3 billion has been expended. To receive continued funding in subsequent years (every 12 months), grantees will be awarded through a non-competitive process contingent upon the progress of the State towards meeting the benchmarks set forth in the State’s Work Plan and detailed in the Terms and Conditions.

5. Grant Program Technical Elements

A. State Eligibility Requirements

A Balancing Incentive Program State is a State in which less than fifty percent of the total LTSS expenditures for medical assistance under the State Medicaid program for fiscal year 2009 are for non-institutionally based LTSS and which submits an application that meets the programmatic requirements and structural reforms dictated by the authorizing legislation (Section 10202 of the Affordable Care Act). Specifically, States in which 25-50 percent of the total expenditures for medical assistance under the State Medicaid program are for non-institutionally-based LTSS are eligible for a two percentage point FMAP increase. States in which less than twenty-five percent of total expenditures are for non-institutionally based LTSS are eligible for five percentage point FMAP increase.

Eligible States receiving two percentage point increase in FMAP must achieve benchmarks of fifty percent of total LTSS expenditures under the State Medicaid program for non-institutionally based LTSS, while eligible States receiving five percentage point increase in FMAP must achieve benchmarks of twenty-five percent of total LTSS expenditures under the State Medicaid program for non-institutionally based LTSS, no later than September 30, 2015. The Balancing Incentive Program State must agree to use the increased FMAP only for purposes of providing new or expanded offerings of home and community-based LTSS. States must also commit to implement key structural reforms including a no NWD/SEP system, conflict-free case management services, and a core standardized assessment instrument. Finally, the State may not restrict eligibility for LTSS more than eligibility standards, methodologies, or procedures in place as of December 31, 2010.

Conditions for Receiving Increased FMAP under the Balancing Incentive Program: In order to receive the increased FMAP for services provided to Balancing Incentive Program-participating States, grantees must demonstrate ongoing progress toward developing a statewide NWD/SEP system utilizing a CSA, and progress toward implementing conflict-free case management. Progress will be measured by each grantee meeting the milestones specified in their Work Plan; the progress towards the achievement of these milestones will be reported to CMS through a semi-annual reporting process. CMS will provide, via the Balancing Incentive Program User Manual, a set of core milestones to grantees for incorporation into the Balancing Incentive Program Work Plan. Milestones may include, but are not limited to, the following example milestones:

• Development of MOUs with SEP agencies

• Development of protocol for information & referral

• Development of a training plan for staff administering the CSA

• Identification & training of individuals to administer CSAs

• Securing a vendor or identifying an in-house group to develop the State CSA database

• Identifying provider or services agencies to serve as potential partners to administer the

CSA for local individuals in areas far from a SEP agency location.

B. Defining Long-Term Services and Supports

The classification of LTSS is important for several aspects of Balancing Incentive Program implementation: determining State eligibility for Balancing Incentive Program participation; establishing the appropriate services for increased FMAP; and service reporting dictated by the authorizing legislation.

State Eligibility for Program Participation: During CMS deliberations to determine the service classifications to establish State eligibility for the Balancing Incentive Program, several issues were considered, including: State variation in service definitions for LTSS, LTSS that are provided in institutional and non-institutional settings, variation within and across States in claiming for LTSS by funding authority, and the quality and timeliness of key LTSS program and expenditure data. Using available data sources, CMS established a high-level classification of institutional and non-institutional LTSS (as defined below) to establish State eligibility for the Balancing Incentive Program. A presumptive summary of State expenditures based on data available to CMS, and Balancing Incentive Program eligibility based upon this classification, is in the Attachment C of this application.

States may provide more detailed information than included in Attachment C regarding total Medicaid expenditures for institutional and non-institutional LTSS for fiscal year 2009 for purposes of determining Balancing Incentive Program eligibility. Further, States may possess more detailed information than available on the national level and are therefore encouraged to do so. Additional data submitted by States for eligibility purposes is subject to verification by CMS. CMS will review submitted financial data and service classifications for meeting eligibility on a State by State basis. Please note, State eligibility is based on total Medicaid expenditures for LTSS and may not be based on expenditures by target populations. However, please be advised that during the Balancing Incentive Program application and implementation period, we intend to work with eligible States to establish a more robust service categorization and reporting structure.

LTSS Eligible for the Balancing Incentive Program Increased FMAP:

The applicable percentage point increase is two percent for non-institutionally-based LTSS in States in which 25-50 percent of the total expenditures for medical assistance under the State Medicaid program are for non-institutionally-based LTSS and five percentage point increase in FMAP for non-institutionally-based LTSS in States in which less than twenty-five percent of total expenditures are for non-institutionally based LTSS. The increased FMAP under Balancing Incentive Program does not apply to the FMAP determined under Section 1905(y) of the Social Security Act for newly eligible mandatory individuals.

However, CMS acknowledges that data limitations using the eligibility methodology proposed above do exist. For example, the program authorities listed below where non-institutionally-based services may actually afford services provided in institutional settings. In order to meet the legislative intent of the Balancing Incentive Program and progress beyond existing measurement limitations, CMS will work with each State to establish a mechanism to expand the Balancing Incentive Program service classification and determine how State-specific services and encounters will be mapped to the Balancing Incentive Program service classifications.

The States’ claiming process for the base FMAP for LTSS will not change; those services will continue to be reported on the traditional Form CMS 64. During the Balancing Incentive Program implementation period, CMS will partner with the Balancing Incentive Program grantees to improve the quality and timeliness of data for CMS, and to make national Medicaid data more readily available to States and other stakeholders. We expect to see an evolution in the service categorization that will enrich the national portrayal of LTSS.

Balancing Incentive Program Service Categorization

Institutionally-Based Services: For purposes of Balancing Incentive Program eligibility, CMS defines institutionally-based Medicaid LTSS as services provided in:

• Nursing facilities;

• Intermediate Care Facilities for the Mentally Retarded (ICF-MR);

• Institutions for Mental Diseases (IMD) for people under age 21 or age 65 or older;

• Long-term care hospitals as defined for the Medicare program (i.e., those with an average length of stay of 25 or more days); and

• Psychiatric hospitals that are not IMDs.

Non-institutionally-Based Services: CMS defines non-institutionally-based Medicaid LTSS as services provided only in integrated settings that are home and community-based and therefore not provided in the institutions defined above. Non-institutionally based LTSS are provided under the following Medicaid program authorities:

• HCBS under 1915 (c) or (d) or under an 1115 Waiver;

• Home health care services;

• Personal care services;

• PACE;

• Home and community care services defined under Section 1929(a); and

• LTSS provided under managed long-term care programs authorized under Sections 1915(a) or 1915(b), including programs that do not have a co-occurring 1915(c) waiver.

There are several LTSS that were not included in the initial Balancing Incentive Program eligibility calculation due to the lack of available or sufficient data, or limited program implementation. These include, but are not limited to, State plan rehabilitation services authorized under 1905(a)(13), self-directed personal assistance services in 1915 (j), services provided under 1915(i), private duty nursing authorized under Section 1905 (a)(8) (provided in home and community-based settings only), services that may be offered under new program authorities authorized by the Affordable Care Act (Community First Choice, Health Homes, etc.). CMS will work with interested States to collect the data necessary to include other LTSS in determining each States’ service eligibility for the Balancing Incentive Program increased FMAP.

C. Reporting Requirements

Work Plan: Upon application, States will submit a preliminary Work Plan. Within six months of the date of application submission, each grantee must submit a Finalized Work Plan describing in detail how the NWD/SEP utilizing a CSA and conflict-free case management will be operationalized in the State during the four year Balancing Incentive Program period. The Work Plan must be developed by the SEP Agencies in consultation with key stakeholders. The Work Plan should include a detailed operational plan and budget for all years, which describe how the grantee plans to develop the NWD/SEP system, develop and implement use of a CSA, and what funding sources the grantee plans to utilize to develop the system. The budget should include details of the grantee’s plan to expand and diversify services for non-institutional LTSS and achieve the applicable targeted spending percentage for these services, and projections of estimated LTSS expenditures through the end of the performance period. This Work Plan must also describe measurable milestones to be achieved throughout the performance period. As previously stated, CMS will provide a Work Plan template to Balancing Incentive Program grantees within the Balancing Incentive Program User Manual.

Balancing Incentive Program Reporting Requirements: The Balancing Incentive Program provision (Affordable Care Act Section 10202) describes key data to be reported under the program. Each grantee will submit an annual Data Report and Programmatic Progress Report. The Balancing Incentive Program Data Report must include data that will delineate the grantee’s current standing concerning meeting the milestones specified in their Work Plan. Progress Reports will be measured based on implementing core milestones necessary to successfully implement the program prior to the end of the grant period. These include: services data from providers of non-institutional LTSS, quality data that are linked to population-specific outcomes measures and accessible to providers, and specific outcomes measures to be collected and submitted that measure beneficiary and family caregiver experience and satisfaction with providers and services. Data will also be collected on employment, participation in community life, health stability, and prevention of loss in function. During the Balancing Incentive Program implementation period, CMS will work with grantees to finalize data specifications and procedures for the approved services, quality, and outcomes measures specified in the legislation. However, if a grantee consistently and materially fails to demonstrate satisfactory progress in reaching their milestones, it will be asked to submit a Corrective Action Plan. Failure to carry out their Corrective Action Plan may result in suspension or termination for non-compliance.

All grantees will submit services data from providers of non-institutional LTSS, quality data linked to population-specific outcomes, and outcomes measures data as directed by CMS and required by the Balancing Incentive Program legislation. Data will be submitted to CMS via the reporting platform designated by CMS. Upon award, CMS will work in consultation with grantees to develop and finalize all aspects of data reporting requirements and procedures.

The quality measures are derived from: Medicaid Adult Health Quality Measures: a subset, to be determined, of the identified core set of health care quality measures as determined in the Final rule for Section 2701 of the Affordable Care Act; Medicaid Experience of Care Measures: a subset, to be determined, of the HCBS experience of care measures(Consumer Assessment of Healthcare Providers and Systems, or CAHPS); and Functional Assessment Elements Measures: a subset, TBD, of functional assessment information collected by States in their HCBS programs.

The Balancing Incentive Program grantees will not be required to submit any quality data until the beginning of calendar year (CY) 2012. Data reporting and submission requirements will be phased in, that is, after CMS completes the development of data specifications, conducts necessary training, and provides guidance for the collection of data at the State and Provider level for each of the major areas of data listed above.

D. Services and Financial Reporting

All Balancing Incentive Program State grantees will submit the financial reporting form on an annual basis (see Attachment B). This form will provide projected and actual LTSS expenditures. It will allow the State and CMS to track expenditures associated with the demonstration participants. Grantees will provide CMS with their current FMAP rate, eligible increased Balancing Incentive Program percentage, and service codes used that map to those services. They will also project the cost of their LTSS services for each budget period.

II. AWARD INFORMATION

Amount of Funding

Section 10202 of the Affordable Care Act includes an appropriation for $3 billion. The amount of funding for each grant approved by CMS depends on the scope (i.e., proposed enrollment and scope of services) and quality of the proposed programs; however, CMS anticipates the funding level to support between 20-25 States with $3 billion over the life of the program.

Period of Performance

The grant period-of-performance begins upon application approval. Increased FMAP is available beginning October 1, 2011 through September 30, 2015.

III. ELIGIBILITY INFORMATION

Eligible Applicants

Applicants must be any single State Medicaid Agency. Only one application can be submitted for a given State. The term ‘‘State Medicaid program’’ means the State program for medical assistance provided under a State plan under title XIX of the Social Security Act and under any waiver approved with respect to such State plan.

The CMS expects that the single State Medicaid Agency will partner with local governments, other agencies, and service providers who contribute to successful public health preventive initiatives in the State.

Applicants are strongly encouraged to include, in an appendix, letters of support indicating a history of collaboration from major partners, including consumers and advocacy groups. These letters and memorandums of agreement should critique and substantiate the applicant’s readiness to implement the structural changes.

Eligibility - Threshold Criteria

Applications for participation in the Balancing Incentive Payments Program opportunity will be accepted on an ongoing basis beginning [insert revised date] through August 1, 2014 or until the full provision of the $3 billion has been projected to be expended, whichever date is earlier. However, an application will not be funded if the application fails to meet any of the requirements as outlined in Section III., Eligibility Information, and Section IV., Application Submission Information.

IV. APPLICATION AND SUBMISSION INFORMATION

Submission of Application and Materials

Applicants must submit their applications via email to [email protected].

Content and Form of Application Submission

Form of Application Submission

Cover Letter

A letter from the State Medicaid Director identifying the Medicaid agency applicant as the lead organization, indicating the title of the project, the Principal Investigator, contact person, amount of funding requested, and the name of the agency that will administer the grant under the Medicaid office and all major partners, departments, divisions, services, and organizations actively collaborating in the project is required. This letter should be addressed to:

Jennifer Burnett

Centers for Medicare & Medicaid Services

Disabled and Elderly Health Programs Group

7500 Security Boulevard

Mail Stop: S2-14-26

Baltimore, MD 21244-1850

Project Abstract and Profile (maximum of one page)

The one-page abstract should serve as a succinct description of the proposed project and should include a summary of the overall project, the total budget, the State’s plan for increasing the percentage of Medicaid LTSS dollars spent on community-based care, and a preliminary timeline for completing the structural changes promoted by the Balancing Incentive Program.

Preliminary Work Plan

Each State must submit a Preliminary Work Plan describing in detail how the NWD/SEP system, utilizing a CSA and conflict-free case management will be operationalized in the State during the four year Balancing Incentive Program period. The Work Plan must be developed by the SEP Agencies in consultation with key stakeholders. The Work Plan should include a detailed operational plan and budget for all years (see budget details below), which describe how the State plans to develop the NWD/SEP system, develop and implement the use of a CSA, and what funding sources the State plans to utilize to develop the system. The budget should include State projections of estimated LTSS expenditures through the end of the performance period. This Work Plan must also describe measurable milestones to be achieved throughout the performance period. A Finalized Work Plan will be due to CMS within six months of the date of application.

Required Letters of Endorsement

Letters of endorsement from major partners that are not the lead agency, but will be integrally involved in developing and implementing the demonstration grant to the target population(s), are expected. Please submit all letters in support and memoranda/letters of agreement for your application in an application appendix with a table of contents for all included documents.

Application Narrative

The application is expected to address how the State will implement the grant program, and ultimately, meet the requirements of Section 10202 of the Affordable Care Act for the Balancing Incentive Payments Program.

The required elements (sections) of the application are listed below. Also, provided is a brief description of the type of information that is required to be addressed within each specific section. The application must be organized by these headings, noted as the operational element sections, outlined below.

In general, CMS is looking for initial plans for NWD/SEP systems, conflict-free case management, and implementation of Core Standardized Assessments in the application. CMS expects States to provide more detailed plans for each component of the NWD/SEP system in the Work Plan due six months after application. CMS will provide States with additional guidance on Balancing Incentive Program standards prior to the Work Plan deadline, including but not limited to the Balancing Incentive Program User Manual.

Required Elements

a. Understanding of Balancing Incentive Program Objectives: The State has demonstrated an understanding of and a commitment to the goals of the Balancing Incentive Program, and the concepts of a true NWD/SEP system for LTSS.

b. Current System’s Strengths and Challenges: The State has provided a description of the existing LTSS information and referral, eligibility determination, and case management processes in the State.

c. NWD/SEP Agency Partners and Roles: The State has described the designated agencies that will likely comprise the SEP Agencies and has described each agency’s anticipated role in the NWD/SEP system.

d. NWD/SEP Person Flow: The State has provided an initial description of the planned “person flow” through the NWD/SEP system (i.e., the experience of the eligibility determination process from an individual’s perspective, from start to finish), including how the State plans to coordinate functional and financial eligibility within the eligibility determination process and how these processes differ from the current system.

e. NWD/SEP Data Flow: The State has provided a discussion of the “data flow” within the eligibility determination process and has described where functional and financial assessment data will be housed and how they will be accessed by SEP Agencies to make eligibility determinations.

f. Potential Automation of Initial Assessment: The State has described potential opportunities for and challenges of automating the initial assessment tool via the NWD/SEP website.

g. Potential Automation of CSA: The State has described potential opportunities for and challenges of automating a CSA/functional assessment tool. Automation includes, at a minimum, real time electronic collection of functional assessment data.

h. Incorporation of a CSA in the Eligibility Determination Process: The State has described the current functional assessment instruments and processes used to determine eligibility for LTSS. Does the State currently use a single CSA for all LTSS populations? If not, how might the State incorporate a CSA into its current process? What would be the major challenges to adopting a CSA? What technical assistance might the State need to make this happen?

i. Staff Qualifications and Training: The State has discussed considerations related to staff qualifications and training for administering the functional assessment.

j. Location of SEP Agencies: The State has provided a discussion of the issue of access to physical SEP agency locations. How will the State ensure access to physical SEP agency locations? What share of the State’s population is likely to live within the service area of at least one SEP? (Rough estimates are acceptable.) What will the State do to maximize the share of the State’s population living within the service area of at least one SEP? How will the State arrange evaluation services for individuals who do not live within the service area of any SEPs? How will the State ensure that these physical locations are accessible by older adults and individuals with disabilities requiring public transportation?

k. Outreach and Advertising: The State has described plans for advertising the NWD/SEP system.

l. Funding Plan: The State has provided a discussion of anticipated funding sources to support the requirements of Balancing Incentive Program, including development of a NWD/SEP system and use of CSA.

m. Challenges: The State has provided a discussion of the characteristics of the State’s current system of LTSS that might present barriers to rebalancing.

n. NWD/SEP’s Effect on Rebalancing: The State has discussed how the NWD/SEP system will help the State achieve rebalancing goals.

o. Other Balancing Initiatives: The State has described other current initiatives in which it is currently involved that share similar goals and requirements as the Balancing Incentive Program. The State has described any more general commitment made toward rebalancing LTSS.

p. Technical Assistance: The State has described anticipated technical assistance needs to achieve rebalancing.

Proposed Budget

The applicant must submit a proposed budget that details the State’s plan to expand and diversify medical assistance for non-institutionally-based long-term services and supports during the balancing incentive period and achieve the target spending percentage applicable to the State. The budget should include the funding sources for the establishment of the structural changes and a description of the new or expanded offerings of such services that the State will provide and the projected costs of such services.

Submission Dates and Times

A. Applicant’s Teleconference

Information regarding the date, time and call-in number for an open applicants’ teleconference will be e-mailed to all State Medicaid Directors.

Grant Applications

Applications for participation in the Balancing Incentive Payments Program opportunity will be accepted on an ongoing basis beginning [insert revised date] through August 1, 2014 or until the full provision of the $3 billion has been expended, whichever is earlier.

Late Applications

Late applications will not be reviewed.

Grant Awards Timeframe

Grants are planned to be awarded within 60 days of application.

4. Funding Restrictions

All funds awarded under the Balancing Incentive Program are for non-institutionally-based long-term services and supports only for the balancing incentive period.

5. Review and Selection Process

CMS has the authority to approve or deny any or all proposals for funding that do not meet the programmatic requirements of this funding opportunity.

VI. AWARD ADMINISTRATION INFORMATION

Award Notices

Successful applicants will receive an award letter will set forth the amount of the award and other pertinent information. The award will also include Terms and Conditions, and may also include additional “special” terms and conditions. Potential applicants should be aware that special requirements could apply to grant awards based on the particular circumstances of the effort to be supported and/or deficiencies identified in the application by the review panel.

Prohibited Uses of Grant Funds:

Balancing Incentive Program Grant funds may not be used for any of the following:

To match any other Federal funds.

To provide services, equipment, or supports that are the legal responsibility of another party under Federal or State law (e.g., vocational rehabilitation or education services) or under any civil rights laws. Such legal responsibilities include, but are not limited to, modifications of a workplace or other reasonable accommodations that are a specific obligation of the employer or other party.

To supplant existing State, local, or private funding of infrastructure or services such as staff salaries for programs and purposes other than those disclosed in the application for the Balancing Incentive Program, etc.

VII. AGENCY CONTACTS

Programmatic Content

Questions about the Balancing Incentive Program should be addressed to [email protected] or to

Effie R. George, Ph.D.

Centers for Medicare & Medicaid Services

Disabled and Elderly Health Programs Group

7500 Security Boulevard

Mail Stop: S2-14-26

Baltimore, MD 21244-1850

VIII. ENFORCEMENT ACTIONS

A grantee’s failure to comply with the terms and conditions of award may cause CMS to take one or more of the following enforcement actions, depending on the severity and duration of the non-compliance. CMS will undertake any such action in accordance with applicable statutes, regulations, and policies. CMS will afford the grantee an opportunity to correct the deficiencies before taking enforcement action. However, even if a grantee is taking corrective action, CMS may take proactive steps to protect the Federal government’s interests, including placing special conditions on awards or precluding the grantee from obtaining future awards for a specified period, or may take action designed to prevent future non-compliance, such as closer monitoring.

Modification of the Terms and Conditions of Award

During grant performance, CMS may include special conditions in the award to require correction of identified financial or administrative deficiencies. When the special conditions are imposed, CMS will notify the grantee of the nature of the conditions, the reason why they are being imposed, the type of corrective action needed, the time allowed for completing corrective actions, and the method for requesting reconsideration of the conditions. (See 45 CFR 92.12.)

CMS may also withdraw approval of the Project Director (PD) or other key personnel if there is a reasonable basis to conclude that they are no longer qualified or competent to perform. In that case, CMS may request that the recipient designate a new PD or other key personnel. The decision to modify the terms of an award—by imposing special conditions, by withdrawing approval of the PD or other key personnel, or otherwise—is discretionary on the part of CMS.

Suspension or Termination

If a grantee has failed to materially comply with the terms and conditions of award or to demonstrate satisfactory progress in reaching their milestones, CMS may suspend the award or temporarily or permanently stop the payment of increased FMAP, pending corrective action, or may terminate the grant for cause. The regulatory procedures that pertain to suspension and termination are specified in 45 CFR 92.43. CMS generally will suspend (rather than immediately terminate) an award and allow the recipient an opportunity to take appropriate corrective action before making a termination decision. CMS may decide to terminate the grant if the grantee does not take appropriate corrective action during the period of suspension.

CMS may terminate—without first suspending—the award if the deficiency is so serious as to warrant immediate termination. Termination for cause may be appealed under the HHS grant appeals procedures.

An award also may be terminated, partially or totally, by the grantee or by CMS with the consent of the grantee. If the grantee decides to terminate a portion of a grant, CMS may determine that the remaining portion of the award will not accomplish the purposes for which the award was originally awarded. In any such case, the grantee will be advised of the possibility of termination of the entire award and will be allowed to withdraw its termination request. If the grantee does not withdraw its request for partial termination, CMS may initiate procedures to terminate the entire award for cause.

Attachment A – Application Submission Checklist

_____ State Medicaid Agency Cover Letter

_____ Project Abstract

_____ Letters of Agreement, Endorsements and Support

_____ Application Narrative

_____ Preliminary Work Plan

_____ Proposed Budget (using the Informational Financial Reporting Form in Attachment B)

Please see Section IV Required Contents for detailed information on the application submission requirements.

The final work plan is due to CMS no later than six months from date of application.

Attachment B

DEPARTMENT

OF HEALTH & HUMAN SERVICES |

||||||||

|

||||||||

State |

|

|

State FMAP Rate |

|

||||

Agency Name |

|

|

Extra Balancing Incentive Program Portion (2 or 5 %) |

|

||||

Quarter Ended |

|

|

|

|

|

|

|

|

Year of Service (1-4) |

|

|

|

|

|

|

|

|

|

Projected LTSS Spending |

|||||||

LTSS |

Total Service Expenditures |

Regular FEDERAL Portion |

Regular STATE Portion |

Amount Funded By Balancing Incentive Program (4 year total) |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

|

Case Management |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Homemaker |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Homemaker Basic |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Homemaker Chore services |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Home Health Aide |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Personal Care |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Personal care ADLs |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Personal Care IADLs |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$0 |

$0 |

$0 |

$0 |

|

|

|

|

LTSS |

Total Service Expenditures |

Regular FEDERAL Portion |

Regular STATE Portion |

Amount Funded By Balancing Incentive Program (4 year total) |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

|

Personal Care Health-related |

|

|

|

|

|

|

|

|

Service 1 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

Service 2 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|