Interview Guide

Panama Canal - Interview Guide (#2) - 8-17-12.docx

Maritime Administration's Panama Canal Expansion Study Outreach Program

Interview Guide

OMB: 2133-0544

Interview

Objectives and Questions Prepared

for: The

United States Department of Transportation,

Maritime

Administration (MARAD) 1200

New Jersey Avenue, SE,

Washington,

DC 20590 Prepared

by: Economic

Development Research Group, Inc. 2

Oliver Street, 9th Floor, Boston, MA 02109 in

association with: Parsons

Brinckerhoff Mercator

International, LLC. WorleyParsons

Group

Interview Guide for Ports and Port Operators 1

Assumptions and Initial Findings (or Suppositions) 1

General Assumptions and Findings 1

Specific Port and Corridor Assumptions and Findings 2

1

Interview Guide for Ports and Port Operators

Objectives

The principal objective of the interviews is to inform the analysis and projections of the study, most importantly concerning the key questions that will drive major conclusions and findings. A summary of key assumptions and findings as they are currently understood is outlined below. However, a secondary objective of the interviews is to raise issues and formulate questions that may not have been identified or addressed in the current summary of key questions.

Assumptions and Initial Findings (or Suppositions)

There are two levels of assumptions and findings, the first concerning more general impacts that will be addressed by most interviewees and the second concerning specific ports and corridors. Questions concerning port and corridor-specific assumptions and findings will be discussed with selected interviewees depending on the specific ports and corridors with which they are familiar. The initial assumptions and findings will not be presented to the interviewees. They are included here to provide background information and a framework for the questions.

General Assumptions and Findings

Focus is on U.S. containerized imports from Northeast Asia.

Secondary impact is on U.S. exports, especially grains.

Larger ships up to 13,000 TEUs will be deployed on all-water routes, but timing is uncertain.

Use of large ships will impact physical operating requirements at ports and inland infrastructure.

Use of larger ships will result in longer and more concentrated ship calls, and service patterns will focus more on larger ports.

Use of larger ships will decrease gross transportation costs.

Container volume imports will not be boosted due to lower costs.

Some gross cost reduction savings will be retained by ocean carriers, the Panama Canal and others, leaving net cost reductions that may affect decisions on shipping patterns.

Larger ships will also be used on West Coast routes, lowering West Coast gateway gross transportation costs and cost reductions relative to East Coast ports.

Based on a reduction in relative costs, there could be shifts in volumes from the West Coast to the East Coast. However, the magnitude and timing of such shifts will depend on product and geographic dimensions and the size of net cost reductions, which in turn depends on East Coast port development, specifically in the Southeast.

The Mid-Atlantic ports (i.e. New York/New Jersey, Baltimore and Norfolk) and inland rail connections are now or will be ready to handle larger ships.

Miami and the FEC are moving towards large-ship readiness.

The Federal government (Secretary La Hood) has indicated a commitment to fund dredging in Savannah and the Army Corps of Engineers has released a final report recommending dredging to 47 feet.

Development at the Port of Charleston is less certain.

Additional development of transshipment ports in Panama and the Caribbean could occur as an alternative if South Atlantic port developments are slowed, but this could reduce net cost reductions.

Shifts in container volumes are also possible to Gulf ports but the magnitude of such shifts will be more modest than to the East Coast based on smaller ships likely to be used on Gulf Coast services.

Specific Port and Corridor Assumptions and Findings

Mid-Atlantic ports and corridors are in good position to reach inland markets, particularly in the Ohio Valley.

The Bayonne Bridge air draft restriction is being resolved with plans to raise the Bridge deck. Before this resolution Global Terminal will be able to serve large ships. Development of Greenville Yard will allow intermodal connections.

Norfolk’s connection to the Heartland Corridor will allow that corridor to effectively compete for some Ohio Valley cargo.

Baltimore’s connection to the CSX hub in Northwest Ohio will possibly allow it to serve Ohio Valley markets.

The Ohio Valley will be relatively non-competitive from Southeast Atlantic ports.

How much cargo is served by these gateway ports will depend on comparative costs and volumes moving to local ports.

South Atlantic ports including Savannah, Charleston and Miami will compete with West Coast services for serving Atlanta and the broader Southeast market.

Savannah could be expected to maintain its dominance, but this could be threatened by delays in dredging the Savannah River and by dredging limited to 47 feet rather than 50 feet.

Miami could compete based on port and rail improvements, but relative costs and port and rail capacity could limit this potential.

For Charleston to be competitive, dredging plans will need to be completed. The port is now relatively less competitive based on limited rail connectivity from the port to intermodal rail yards.

Though Norfolk could make some inroads, the Southeast is largely non-competitive for mid-Atlantic ports.

In the Gulf, impacts are likely very much smaller than in the East Coast. Houston could see increased cargo to the large local market. Improved rail service to Dallas could increase Houston’s competitiveness with Southern California ports.

Total exports of grain through Gulf ports, especially New Orleans, are likely. In addition grain exports out of Pacific Northwest ports are likely to shift to the Mississippi River based on lower transportation costs.

Key Questions

General Questions

In what U.S. trade segments do you see Panama Canal expansion having the most impact? Specifically, in addition to U.S. containerized imports from Northeast Asia and U.S. grain exports to Asia, are there other trade segments that you believe could be significantly affected? (e.g. dry bulk, liquid bulk, LNG, car carriers/RoRo, refrigerated, general cargo/break bulk)

What are your views about likely deployment of large ships on Panama Canal all-water container routes? What ship sizes will be utilized over what period?

How will deployment develop on West Coast services? What factors are likely to affect this deployment?

What is the likely growth in ship size at West Coast ports?

What are the limits to growth in ship size at West Coast ports?

Is there a potential for development of more differentiated services to effectively compete for lower value products?

What are your views on the potential for cost reductions resulting from use of larger ships, on Asia-U.S. container trade?

What magnitude of cost reductions do you expect? To the U.S. East Coast? To the West Coast?

What share of such cost reductions will be retained by ocean carriers, railroads, the Panama Canal and others? What competitive dynamics and other factors will affect such retention?

Do you expect that aggregate U.S. import volumes will increase as a result of transportation cost reductions?

Will U.S. export volumes increase as a result of transportation cost reductions? If so, for what products?

Will mid-Atlantic ports be in a position to handle much larger ships after Canal expansion? Specifically, are there other factors besides the Bayonne Bridge restriction that you see constraining New York/New Jersey, Baltimore, or Norfolk in effectively being able to handle containers destined either to local markets or inland regions (such as the Ohio Valley?)

What factors beyond dredging in Savannah and Charleston do you see affecting South Atlantic ports (from the Carolinas to Miami) in (1) serving local markets and (2) for reaching inland regions (such as Atlanta)?

What impacts do you see on liner service port calls from use of larger ships? More concentrated calls? Fewer port calls?

Are carriers likely to continue operating most Panama Canal all-water services using multiple ports of call along the Atlantic Coast (e.g. at least one in the North-Atlantic and one in the South-Atlantic)?

If Yes:

If you believe this pattern is unlikely to be modified, to what extent will use of larger ships be restricted based on current and projected limitations at South Atlantic ports (e.g. deepening of Savannah to 47 feet)?

If No:

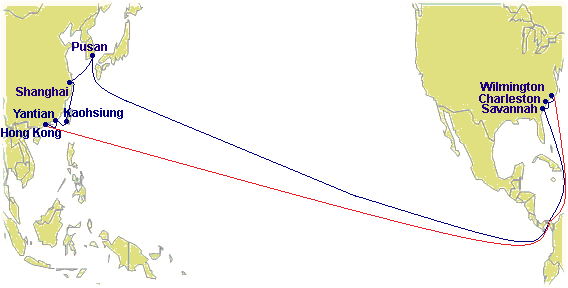

If service patterns are likely to be modified, how would you see this evolving? What is the likelihood that specialized services will be developed (1) focusing on mid-Atlantic ports (using larger ships) versus (2) calling only on South Atlantic ports (see Yang Ming service map below) that would be served using smaller ships?

Exhibit 1. Yang Ming South Atlantic Liner Service

Do you see additional development of transshipment ports in Panama and the Caribbean as an alternative to direct services to South Atlantic ports? To what extent would this reduce net cost reductions?

What are your views on which containerized products and U.S. regions are most likely to be affected by potential shifts in coastal cargo flows? What factors will affect these impacts?

How competitive are West Coast railroads with Panama Canal all water services? What are the railroads’ capabilities and strategies for competing?

What are we missing? What is other issues or questions do you think are important in examining impacts of Panama Canal expansion?

Specific Port and Corridor Questions

For East Coast ports, for Northeast Asia-U.S. container trade, what inland regions do you view as your local markets (where you are dominant) and what regions do you view as competitive?

For Gulf and East Coast ports, what are the specific impacts and impediments that your port/corridor is facing related to growth in volume or increased use of large ships that could occur as a result of Panama Canal expansion?

For Gulf and East Coast ports, for Northeast Asian container cargo is there potential for increasing Panama Canal all water shares for your local markets or has that trade reached maturity? (i.e. is there land-bridge cargo through the West Coast that may still be available to your port?)

For mid-Atlantic ports, what are the key cost differentiators that will affect competition for reaching inland markets (such as the Ohio Valley), both between these ports and relative to the West Coast? Port costs, local infrastructure, on-dock rail, rail services and connectivity?

For South-Atlantic ports, what are the key cost differentiators that will affect competition for reaching inland markets (such as the Atlanta region), both between these ports and relative to the West Coast?

Can Miami effectively compete for Atlanta cargo? What factors will affect this? Savannah deepening, FEC rates, improved intermodal connections?

Can Charleston be more competitive with Savannah? If so, what factors will affect this?

Do you see a potential for South-Atlantic ports to effectively compete in other ports’ local markets? What regions are truly local and which are competitive?

What is the potential for increasing grain exports out of Gulf ports based on lower shipping costs? What are possible port and inland impediments?

Proposed Interviews

As indicated in Part A of the Paperwork Reduction Act Supporting Statement (see attachment), the one-on-one interviews One-on-one interviews will be conducted with up to 30 key executives from maritime port community to identify their specific plans, investment strategies, and perspectives concerning the trends that are the subject of the study. The purpose of these one-on-one interviews will be to provide pre-expansion assessments of commodity, mode and industry-specific information about markets, costs, and logistics changes anticipated by these stakeholders once the Panama Canal expansion is completed in 2014. The results of these interviews will be summarized and presented to MARAD for review and evaluation before being incorporated into one of a series of reports developed for this project.

The one-on-one interviews will be undertaken in a private setting and a summary of the discussions will be drafted for evaluation by MARAD and supporting technical staff and contractors. MARAD will not release the information obtained during this process to the public. Each interviewee will be advised that the summary of the interview may be obtained through public information requests authorized under the Freedom of Information Act (5 U.S.C. § 552, et seq.). MARAD is not collecting confidential business information and can only protect information provided to the extent that it satisfies the provisions under 5 U.S.C. § 552(c)4.

As stated, the interviews are expected to involve up to 30 separate one-on-one interviews of approximately 97 minutes each (see Exhibit 2). This is expected to amount to a total of 49 hours of interviews – roughly 36.84% of the total time burden for the entire Outreach Program. Refer to the PRA Supporting Statement – Part A for additional information regarding the one-on-one interview burden estimate.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Economic Development Research Group (EDRG) appreciates your interest in our services |

| Author | Joe Langlitz |

| File Modified | 0000-00-00 |

| File Created | 2021-01-31 |

© 2026 OMB.report | Privacy Policy