Form 6710/07 Application Pursuant to Secton 19 of the Federal Deposit

Application Pursuant to Section 19 of the Federal Deposit Insurance Act

Reformatted 6710-07

Application Pursuant to Secton 19 of the Federal Deposit Insurance Act

OMB: 3064-0018

FEDERAL DEPOSIT INSURANCE CORPORATION APPLICATION PURSUANT TO SECTION 19 OF THE FEDERAL DEPOSIT INSURANCE ACT

PRIVACY ACT STATEMENT 2-9-12 copy of revised draft

Form FDIC 6710/07, Application Pursuant to Section 19 of the Federal Deposit Insurance Act

Public reporting burden for this collection of information is estimated to average 16 hours per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the FDIC Legal Division (Paperwork Reduction Act), 550 17th Street, NW, Washington, DC 20429; and to the Office of Management and Budget (OMB), Paperwork Reduction Project, Washington, DC 20503. An agency may not conduct or sponsor and a person is not required to respond to a collection of information unless it displays a currently valid OMB control number.

Pursuant to Section 19 of the Federal Deposit Insurance Act, 12 U.S.C. § 1829(a), persons convicted of certain criminal offenses are prohibited from participating in the affairs of an insured depository institution without the express written consent of the FDIC. This prohibition applies to any person convicted of a criminal offense involving dishonesty, breach of trust, or money laundering or who has entered into a pretrial diversion or similar program in connection with a prosecution for such offense. In the absence of prior FDIC approval, such persons are prohibited from being directly or indirectly affiliated with an insured depository institution; owning or controlling an insured depository institution; or otherwise directly or indirectly participating in the conduct of the affairs of an insured depository institution. Insured depository institutions are also prohibited from permitting such persons from engaging in any of the aforementioned activities.

The FDIC will evaluate the information provided in this Application in accordance with the statement of policy announced in FDIC Financial Institution Letters 125-98 (December 2, 1998) and 57-2011 (August 8, 2011). Your Social Security Number is requested for us to verify the accuracy of the information in this application and to differentiate you from other prospective directors, officers, or employees with similar or identical names. The collection of this information is authorized pursuant to 12 U.S.C. § 1819 and Executive Order 9397. Although providing your Social Security Number and other requested information is voluntary, your omission of pertinent information may adversely affect the assessment of your Application.

The information collected in the Application will be maintained as part of the FDIC System of Records #30-64-000, “Financial Institutions Investigative and Enforcement Records.” This information may be disclosed in accordance with the applicable routine uses set forth in the Notice of the System of Records. This may include disclosure to (1) A court, magistrate, or administrative tribunal in the course of presenting evidence, including disclosures to counsel or witnesses in the course of civil discovery, litigation, or settlement negotiations or in connection with criminal proceedings, when the FDIC is a party to the proceeding or has a significant interest in the proceeding and the information is determined to be relevant and necessary; (2) The appropriate federal, state, or local agency or authority, or to licensing boards, professional associations or administrative bodies responsible for investigating or prosecuting a violation of or for enforcing or implementing a statute, rule, regulation, or order when the information indicates a violation or potential violation of law, rule, regulation or order, whether civil, criminal, or regulatory in nature, and whether arising by general statute or particular program statute, or by regulation, rule, or order issued pursuant thereto; (3) A congressional office in response to an inquiry made by the congressional office at the request of the individual to whom the record pertains; (4) A financial institution affected by enforcement activities or criminal activities; (5) Other federal, state, or foreign financial institutions supervisory or regulatory authorities; (6) A consultant, person, or entity who contracts or subcontracts with the FDIC, to the extent necessary for the performance of the contract or subcontract; and (7) The Department of the Treasury, federal debt collection centers, other appropriate federal agencies, and private collection contractors or other third parties authorized by law, for the purpose of collecting or assisting in the collection of delinquent debts owed to the FDIC.

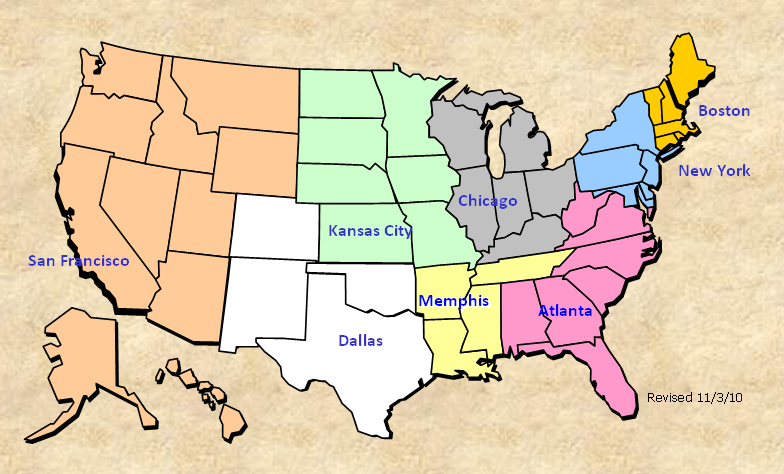

ATLANTA REGIONAL OFFICE 10 Tenth Street, NE Suite 800 Atlanta, GA 30309-3906 800-765-3342 or 678-916-2200 States Covered: Alabama, Florida, Georgia, North Carolina, South Carolina, Virginia, West Virginia |

|

KANSAS CITY REGIONAL OFFICE 1100 Walnut Street Suite 2100 Kansas City, MO 64106 800-209-7459 or 816-234-8000 States Covered: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota |

BOSTON AREA OFFICE 15 Braintree Hill Office Park Suite 100 Braintree, MA 02184-8701 866-728-9953 or 781-794-5500 States Covered: Connecticut, Maine, New Hampshire, Rhode Island, Vermont, Massachusetts |

|

MEMPHIS AREA OFFICE 5100 Poplar Avenue Suite 1900 Memphis, TN 38137-1900 800-210-6354 or 901-685-1603 States Covered: Arkansas, Louisiana, Mississippi, Tennessee |

CHICAGO REGIONAL OFFICE 300 South Riverside Plaza Suite 1700 Chicago, IL 60606 800-944-5343 or 312-382-6000 States Covered: Illinois, Indiana, Kentucky, Michigan, Ohio, Wisconsin |

|

NEW YORK REGIONAL OFFICE 350 Fifth Avenue Suite 1200 New York, NY 10118 800-334-9593 or 917-320-2500 States Covered: Delaware, District of Columbia, Maryland, New Jersey, New York, Pennsylvania, Puerto Rico, Virgin Islands |

DALLAS REGIONAL OFFICE 1601 Bryan Street Dallas, TX 75201 800-568-9161 or 214-754-0098 States Covered: Colorado, New Mexico, Oklahoma, Texas

|

|

SAN FRANCISCO REGIONAL OFFICE 25 Jessie Street at Ecker Square Suite 2300 San Francisco, CA 94105-2780 800-756-3558 or 415-546-1810 States Covered: Alaska, American Samoa, Arizona, California, Federated States of Micronesia, Guam, Hawaii, Idaho, Montana, Nevada, Oregon, Utah, Washington, Wyoming |

Paperwork Reduction Act Notice: The FDIC may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB number. Section 19 of the Federal Deposit Insurance Act (12 U.S.C. § 1829) requires the FDIC’s written consent prior to any participation in the affairs of an insured depository institution by a person who has been convicted of crimes involving dishonesty or breach of trust. An insured depository institution that desires to obtain the FDIC’s consent must submit an application to the FDIC on form FDIC 6710/07. The estimated burden for this collection of information is 16 hours per response. Send comments regarding this burden estimate or any other aspect of this collection, including suggestions for reducing this burden, to the Paperwork Reduction Officer, Legal Division, Federal Deposit Insurance Corporation, 550 17th Street, N.W., Washington, D.C. 20429

FDIC GUIDELINES AND POLICIES WITH RESPECT TO SECTION 19 (12 U.S.C. §1829)

On December 2, 1998, the FDIC issued Financial Institutions Letter (FIL) 125-98 which announced that the FDIC Board of Directors had approved a statement of policy (SOP) regarding applications filed pursuant to Section 19 of the Federal Deposit Insurance Act (12 U.S.C. §1829). The SOP was effective December 1, 1998. In 2011, the SOP was clarified, and FIL 57-2011 was distributed to explain the clarifications. The SOP can be found at http://www.fdic.gov/regulations/laws/rules/5000-1300.html#fdic5000applicationsus.

As amended by the Financial Institutions Reform, Recovery and Enforcement Act of 1989, the Comprehensive Thrift and Bank Fraud Prosecution and Taxpayer Recovery Act of 1990, and the Financial Services Relief Act of 2006, Section 19 prohibits, without the prior written consent of the FDIC, a person convicted of any criminal offense involving dishonesty or breach of trust or money laundering (covered offenses), or who has entered into a pretrial diversion or similar program in connection with a prosecution for such covered offense, from becoming or continuing as an institution-affiliated party, owning or controlling, directly or indirectly, an insured depository institution, or otherwise participating, directly or indirectly, in the conduct of the affairs of an insured depository institution (covered person). In addition, Section 19 forbids an insured depository institution from permitting such a person to engage in any conduct or to continue any relationship prohibited by Section 19.

The FDIC is precluded from granting consent for ten years, beginning on the date the conviction or agreement of the person becomes final, to a person convicted of certain crimes enumerated in Title 18 of the United States Code, absent a motion by the FDIC and approval by the sentencing court.

Whoever knowingly violates the prohibitions of Section 19 shall be fined not more than $1,000,000 for each day such prohibition is violated or imprisoned for not more than five years, or both.

De Minimis Rule: Automatic Consent

The SOP maintains the FDIC’s previous requirement that an application seeking the FDIC’s consent must be filed by an insured depository institution, except as noted in the comment below under Written Application for FDIC Consent. However, the SOP provides that consent is automatically granted and application will not be required where the covered offense is considered de minimis because it meets all of the following criteria:

There is only one conviction or program entry of record for a covered offense; and

the offense was punishable by imprisonment for a term of one year or less and/or a fine of $1,000 or less, and the individual did not serve jail time; and

the conviction or program was entered at least five years before the application; and

the offense did not involve an insured depository institution or insured credit union. An offense based on the issuing of insufficient fund checks (bad checks) in an aggregate face value of $1,000 or less where no insured depository institution or insured credit union was a payee on any of the checks, will be considered as not involving an insured depository institution or insured credit union.

In addition, the SOP requires that any person who meets these criteria must be covered by a fidelity bond to the same extent as others in similar positions. A person availing themselves of the automatic consent under this provision will disclose the presence of the conviction or program to which they have claimed such consent pursuant to the de minimis criteria to all insured depository institutions in whose affairs such person will participate. If an insured depository institution or person avails themselves of the criteria, documentation should be maintained to should maintain to support the de minimis nature of the covered crime(s).

Written Application for FDIC Consent

There are two methods by which a covered person can apply to the FDIC for written permission to become an institution-affiliated party or participate in the affairs of an insured depository institution. The first method involves an insured depository institution filing a Section 19 application on behalf of a prospective director, officer, or employee (Sponsorship). When an insured depository institution will not file a Section 19 application on behalf of a covered person, a second method allows that individual to seek a waiver of the requirement that an insured depository institution file a Section 19 application on their behalf (Individual Waiver)

Sponsorship

When an application is required, forms and instructions should be obtained from, and the application filed with, the appropriate FDIC Regional or Area Office where the sponsoring institution is headquartered (a list of FDIC Offices is included in this application). Only an insured depository institution may file an application on behalf of a covered person, under Section 19, unless the FDIC first grants a waiver for an individual to file a Section 19 application on his/her behalf.

Individual Waivers

Individual Waivers per Section 19 will be considered on a case-by-case basis where substantial good cause exists for granting the waiver. Application for an Individual Waiver must be submitted to the appropriate FDIC Regional Office where the applicant currently resides. Since de minimis offenses may qualify for automatic approval (see de minimis discussion above), the expectation is that Individual Waivers will be granted on an infrequent basis, and only in truly meritorious cases and upon good cause shown. If an individual is seeking a waiver, do not complete Sections A & B of the application. An individual should complete Sections D-F, and in particular the INDIVIDUAL WAIVER STATEMENT, as well as the INDIVIDUAL WAIVER CERTIFICATION.

Application Considerations

I. STANDARDS TO BE APPLIED IN DETERMINING WHETHER AN APPLICATION FOR CONSENT IS REQUIRED UNDER SECTION 19

Section 19 applies to employees of an insured depository institution as well as to any other person who is in a position to influence control over the management or participate in the affairs of an insured depository institution. Please note that in addition to the requirement to file an application with the FDIC, some individuals may also need to comply with any filing requirements established by the Board of Governors of the Federal Reserve System, in the case of a bank or savings and loan holding company. Absent the FDIC’s written approval, persons covered by Section 19 are precluded from owning or controlling 25 percent or more of an insured depository institution’s voting securities, or ten percent or more of the insured depository institution’s voting securities if that person is the largest shareholder. The following standards are used in the determination as to whether Section 19 is applicable.

A. There must be a conviction of record. Arrests, pending cases not brought to trial, acquittals, or any conviction which has been reversed on appeal, or a complete expungement will be excluded from the requirements of Section 19. For an expungement to be considered complete, no one, even by court order or law enforcement, can be permitted access to the record under the state or federal law which was the basis for the expungement. A conviction which is being appealed will require a Section 19 application until or unless otherwise reversed. Note: Participation in a pretrial diversion or similar program in connection with a prosecution for a covered offense is included within the provisions of Section 19 and an application is required even if the charges were dismissed upon completion of the program.

Pretrial Diversion or Similar Program. Program entry, whether formal or informal, is characterized by a suspension or eventual dismissal of charges or criminal prosecution upon agreement by the accused to treatment, rehabilitation, restitution, or other noncriminal or nonpunitive alternatives. Whether a program c constitutes a pretrial diversion will be considered by the FDIC on a case-by-case basis. Program entries prior to November 29, 1990, are not covered by section 19.

B. The conviction or program entry must be for a criminal offense involving dishonesty, breach of trust or money laundering. Misdemeanors as well as felonies are included. “Dishonesty” means directly or indirectly to cheat or defraud; or wrongfully to take property belonging to another in violation of any criminal statute. Dishonesty includes acts involving lack of integrity; lack of probity, or a disposition to distort, cheat, or act deceitfully or fraudulently; and includes crimes which federal, state, or local laws define as dishonest. “Breach of trust” means a wrongful act, use, misappropriation, or omission with respect to any property or fund which has been committed to a person in a fiduciary or official capacity, or the misuse of one’s official or fiduciary position to engage in a wrongful act, use, misappropriation, or omission. Whether a crime involves dishonesty or breach of trust will be determined from the statutory elements of the crime itself.

Section 19 applies to drug crimes in which money laundering is an element. Whether a crime involving possession of drugs is covered by Section 19 will be determined by the nature of the crime as defined in the relevant criminal statute. All convictions for offenses concerning the illegal manufacture, sale, and distribution of or trafficking in controlled substances shall require an application.

Youthful Offenders

Adjudgement by a court against a person as a “youthful offender” under any youth offender law or adjudgement as a “juvenile delinquent” by a family court or any other court having jurisdiction over minors as defined by state law will not require an application under Section 19. Such adjudications are not considered convictions for criminal offenses.

Adults and All Minors Convicted of Crimes

The conviction of any adult or minor by a court of competent jurisdiction for any criminal offense involving dishonesty or breach of trust or money laundering as defined in paragraph B and not excluded under the automatic consent provision of the de minimis criteria will require an application to, and consent by, the FDIC prior to an insured depository institution’s employment of such person, or such person owning or controlling, directly or indirectly, the insured depository institution, or otherwise participating in the affairs of an insured depository institution.

II. THE CORPORATION’S POLICY WITH RESPECT TO APPLICATION MADE UNDER SECTION 19

A. The essential criteria in assessing an application is whether the person has demonstrated his or her fitness to participate in the conduct of the affairs of an insured depository institution, and whether the affiliation, ownership, control, or participation by the person in the conduct of the affairs of the insured depository institution may constitute a threat to the safety and soundness of the insured depository institution or the interests of its depositors or threaten to impair public confidence in the insured depository institution. In determining the degree of risk, the FDIC will consider:

The conviction or program entry and the specific nature and circumstances of the covered offense;

Evidence of rehabilitation including the person’s reputation since the conviction or program entry, the person’s age at the time of conviction or program entry, and the time which has elapsed since the conviction or program entry;

The position to be held or the level of participation by the person at an insured institution;

The amount of influence and control the person will be able to exercise over the management or affairs of an insured institution;

The ability of management of the insured institution to supervise and control the person’s activities;

The degree of ownership the person will have of the insured institution;

The applicability of the insured depository institution’s fidelity bond coverage to the person;

The opinion or position of the primary federal and/or state regulator; and

(9) Any additional factors in the specific case that appears relevant.

B. FDIC policy on Section 19 applications includes consideration of the items listed above. These are the important considerations in determining the risk to the insured depository institution in the employment of the prospective employee.

If additional space is needed for any information requested by the form, applicants should attached appropriately labeled additional pages to provide a full response.

SECTION A – INSURED DEPOSITORY INSTITUTION INFORMATION

Note: If an individual is seeking an individual waiver of the requirement that an insured depository institution file a Section 19 application on his/her behalf, do not complete Sections A and B, and start at Section D.

|

1. NAME OF THE INSURED DEPOSITORY INSTITUTION

_________________________________________________________________________________________________________

2. DATE OF APPLICATION

_________________________________________________________________________________________________________

3. ADDRESS OF THE INSURED DEPOSITORY INSTITUTION (Street, City, County, State and Zip Code)

_____________________________________________________________________________________________

SECTION B – POSITION TO BE OCCUPIED BY THE COVERED PERSON IF THEY ARE A PROSPECTIVE DIRECTOR, OFFICER OR EMPLOYEE.

Title of Position(s) or Prospective Position(s)

__________________________________________________________________________________________________________

Describe the duties and responsibilities of the prospective director, officer, or employee. Include extent of supervision exercised, or potentially exercised, over others and/or by others.

__________________________________________________________________________________________________________

SECTION C – NOTIFICATION OF FIDELITY INSURER

The

insured depository institution’s fidelity insurer is to be

notified of all pertinent information regarding the conviction of the

prospective employee. Assurances from the fidelity insurer must be

obtained, in writing, stating that the prospective director (if

applicable), officer, or employee will be covered by the insured

depository institution’s fidelity bond. This

application and the information requested herein may be submitted

prior to notification of the bonding company; however, the FDIC’s

consent will be subject to a condition that written assurance of

fidelity coverage to the same extent as others in similar positions

be obtained by the insured depository institution.

PROCEED TO SECTION D

SECTION D – BIOGRAPHICAL INFORMATION OF THE COVERED PERSON*

1. DATE OF APPLICATION

______________________________________________________________________________________________

2. NAME

______________________________________________________________________________________________

3. ADDRESS (Street, City, State and ZIP Code)

______________________________________________________________________________________________

4. TELEPHONE NUMBER AND/OR E-MAIL ADDRESS

______________________________________________________________________________________________

5. DATE OF BIRTH (Month, Day, Year)

_______________________________________________________________________________________

6. PLACE OF BIRTH (City and State)

______________________________________________________________________________________________

7. SOCIAL SECURITY NUMBER

______________________________________________________________________________________________

8. NAME AND ADDRESS OF MOST RECENT EMPLOYER (Street, City, State and ZIP Code)

______________________________________________________________________________________________

9. INDICATE THE TOTAL NUMBER OF VOTING SHARES OF THE INSURED DEPOSITORY INSTITUTION’S (PROPOSED EMPLOYER) STOCK DIRECTLY OR INDIRECTLY OWNED OR OTHERWISE CONTROLLED BY THE COVERED PERSON. (Answer “none” if appropriate.)

_______________________________________________________________________________________________

* In addition to a completed Form 6710/07, additional documents will be provided for completion. These documents include, but are not limited to: Name Check Form, Consent for Release of Information Form, a Fingerprint Card. Instructions for the completion of these required documents will be provided. Further, other items may be requested and will be identified in the application or sought on a case-by-case basis.

PROCEED TO SECTION E

If the Applicant is subject to more than one covered offense, attach additional pages labeled as “SECTION E,” and provide all the information relative to the conviction(s) or pretrial diversion or similar program(s).

SECTION E – INFORMATION RELATIVE TO CONVICTION(S)

OR PRETRIAL DIVERSION OR SIMILAR PROGRAM(S)

1. DESCRIPTION OR NATURE OF CRIME

___________________________________________________________________________________________________________

2. DATE OF CONVICTION OR DATE OF PRETRIAL DIVERSION OR SIMILAR PROGRAM ENTRY

___________________________________________________________________________________________________________

3. NAME AND ADDRESS OF COURT

___________________________________________________________________________________________________________

4. DISPOSITION

___________________________________________________________________________________________________________

Note: This application covers only those convictions or entry into pretrial diversion or similar programs listed in this Section. If additional convictions or completion of pretrial diversion or similar programs for crimes involving dishonesty or breach of trust or money laundering are discovered subsequent to approval of this request, the applicant will be covered by Section 19, and prohibited from participating in the affairs of an insured depository institution. A subsequent application pursuant to Section 19 will be required.

5. Briefly describe the nature of the offense and the circumstances surrounding it. Include age of prospective

employee at the time of conviction, date of the offense, and any mitigating circumstances (parole, suspension of

sentence, pardon, etc.)

___________________________________________________________________________________________________________

6. Briefly describe the extent of rehabilitation of the covered person and attach supporting

documents, if any (e.g., a resume, school transcripts). Evidence of an individual’s rehabilitation may include:

Subsequent convictions or lack thereof;

Employment history after conviction or completion of pretrial diversion or similar programs, highlighting any demonstrated fiduciary responsibility;

Letter of references from current or former employers, or influential members of the community, or probation or parole officers;

Subsequent educational achievements, if any. Documentation must be provided to support any educational achievement.

If currently going to school, letter of references from a professor, dean, or other school official;

Community service or volunteer work.

Note: Please provide contact information for individuals who may be contacted to verify evidence of rehabilitation for each item you wish to have considered as evidence of your rehabilitation. References have greater weight when the party providing the reference is aware of the individual’s prior history.

__________________________________________________________________________________________________________

(Section E continued)

7. Attach copies of the Indictment, Information, or Complaint and Final Decree of Judgment, or documentation to support the completion of a Pretrial Diversion or Similar Program, if available. (Normally these can be obtained from the clerk of the court or prosecutor’s office. If not provided, explain reasons for unavailability.)

___________________________________________________________________________________________________________

8. List any other pertinent facts relative to the crime which are not disclosed in the Indictment, Information, or Complaint and Final Decree of Judgment.

___________________________________________________________________________________________________________

I do hereby certify that the Biographical Information (Section D) and Information Relative to Conviction(s) or Pretrial Diversion or Similar Program (Section E) are true and correct to the best of my knowledge and belief.

____________________________________________________________________

TYPE OR PRINT NAME OF COVERED PERSON

__________________________________________________________ ____________________________

SIGNATURE OF COVERED PERSON DATE SIGNED (Month, Day, Year)

NOTE: The information requested in Sections D and E above, including the Social Security Number of the covered person is solicited pursuant to Section 19 of the Federal Deposit Insurance Act (12 U.S.C. 1829). This information is necessary to assist the FDIC in assessing the merits of the application. Some of the information, including the Social Security Number, may be provided to any appropriate federal or state insured depository institution regulatory agency and law enforcement or other governmental agencies for identity verification purposes. Should the information indicate a violation of law, the application may be referred to any agency responsible for investigating or prosecuting such a violation. In addition, in the event of litigation, the application may be presented to the appropriate court as evidence and to counsel in the course of discovery. While submission of the information is voluntary, an omission or inaccuracy may result in a delay in processing the application, a return of the application as incomplete, or a denial of the application. Falsification of any of the information may serve as a basis for denial of the application or the removal of the director, officer, or employee if employed by the insured depository institution as well as grounds for criminal charges.

INSURED DEPOSITORY INSTITUTIONS SHOULD PROCEED TO SECTION F

INDIVIDUAL APPLICANTS SHOULD PROCEED TO SECTION G

SECTION F – ADDITIONAL INFORMATION IN SUPPORT OF THIS REQUEST

Insured depository institutions may list any other appropriate information. (Enter “NONE” if desired.)

INSURED DEPOSITORY INSTITUION SHOULD PROCEED TO THE CERTIFICATION FOR APPLICATION

SECTION G – INDIVIDUAL WAIVER STATEMENT

If an individual is seeking a waiver of the requirement that an insured depository financial institution file a Section 19 application on his/her behalf, provide a summary statement in the space below describing why the FDIC should grant the waiver of the institution filing requirement in their case. (Use additional sheets if needed)

INDIVIDUAL APPLICANTS SHOULD PROCEED TO THE INDIVIDUAL CERTIFICATION FOR WAIVER AND APPLICATION

FOR INSURED DEPOSITORY INSTITUTION CERTIFICATION FOR APPLICATION

I do hereby certify that the Board of Directors adopted a resolution

which delegated the undersigned the authority to make applications

pursuant to Section 19 of the Federal Deposit Insurance Act or has

adopted a resolution authorizing this application pursuant to Section

19 of the Federal Deposit Insurance Act.

do hereby certify that the Board of Directors adopted a resolution

which delegated the undersigned the authority to make applications

pursuant to Section 19 of the Federal Deposit Insurance Act or has

adopted a resolution authorizing this application pursuant to Section

19 of the Federal Deposit Insurance Act.

_______________________________________________________________________

NAME AND TITLE OF INSURED DEPOSITORY INSTITUTION OFFICIAL (Type or Print)

_____________________________________________________________ _____________________

SIGNATURE OF INSURED DEPOSITORY INSTITUTION OFFICIAL DATE (Month, Date, Year)

FOR INDIVIDUAL CERTIFICATION FOR WAIVER AND APPLICATION

To be signed by the individual seeking a waiver of the requirement that an insured depository institution file a Section 19 application on his/her behalf

I certify that, to the best of my knowledge and belief, all of the

information on and attached to this waiver application is true,

correct, and complete and provided in good faith. I understand that

falsification of any of the information may serve as a basis for my

removal as an employee of an insured depository institution and as

grounds for criminal charges. I understand that any information I

give may be investigated. I further understand that any decision

made regarding my individual waiver and application will be a public

document, and will be posted on the FDIC’s website.

certify that, to the best of my knowledge and belief, all of the

information on and attached to this waiver application is true,

correct, and complete and provided in good faith. I understand that

falsification of any of the information may serve as a basis for my

removal as an employee of an insured depository institution and as

grounds for criminal charges. I understand that any information I

give may be investigated. I further understand that any decision

made regarding my individual waiver and application will be a public

document, and will be posted on the FDIC’s website.

_______________________________________________________________________

INDIVIDUAL SEEKING WAIVER (Type or Print)

_______________________________________________________ _____________________

SIGNATURE OF INDIVIDUAL SEEKING WAIVER DATE (Month, Date, Year)

This is an official document of the Federal Deposit Insurance Corporation. Providing false information may be grounds for prosecution under the provisions of Title 18, Section 1001 or 1007 of the United States Code and may be punishable by fine or imprisonment.

Page

4

Page

4

| File Type | application/msword |

| File Title | PRIVACY ACT STATEMENT |

| Author | gkuiper |

| Last Modified By | gkuiper |

| File Modified | 2012-04-24 |

| File Created | 2012-04-24 |

© 2026 OMB.report | Privacy Policy