Bond Guarantee Program

Bond Guarantee Program

Application - Guarantee

Bond Guarantee Program

OMB: 1559-0044

Community

Development Financial Institutions Fund

CDFI

Bond Guarantee Program - Guarantee

Application

Introduction

Under the CDFI Bond Guarantee Program, a Qualified Issuer that wishes to apply to the CDFI Fund for a Guarantee must submit a Guarantee Application in the form and with the substance that is described herein. A Qualified Issuer must provide all required information in its Guarantee Application to establish that it meets all required criteria to receive a Guarantee and can carry out all Guarantee requirements including, but not limited to, information that demonstrates that the Qualified Issuer has the appropriate expertise, capacity, and experience and is qualified to make, administer and service Bond Loans for Eligible Purposes. The Guarantee Application includes a Capital Distribution Plan, as well as a Secondary Capital Distribution Plan for each Eligible CDFI, among other items. The Guarantee Application must demonstrate that the Qualified Issuer and the proposed Eligible CDFIs have a feasible plan to successfully repay the Bond (including principal, interest, and call premiums) and Bond Loans according to their respective terms, to the satisfaction of the CDFI Fund.

After receipt of a Guarantee Application, the CDFI Fund may request additional, clarifying, confirming or supplemental information on the materials submitted as part of the Guarantee Application.

In order to understand the CDFI Bond Guarantee Program and the roles and responsibilities of the Qualified Issuer, interested parties should review and become familiar with the regulations that govern the program, set forth at 12 C.F.R. 1808 (the Regulations). In addition, Applicants should review and become familiar with the Notice of Guarantee Availability (NOGA) published with respect to FY 2013 and FY 2014 Qualified Issuer Applications and Guarantee Applications. The Regulations and NOGA may be found on the CDFI Fund’s website as www.cdfifund.gov. Capitalized terms in the Guarantee Application are defined in the Regulations.

For purposes of the Guarantee Application, the term “Applicant” also refers to the Qualified Issuer, any Affiliates and third-party entities (i.e., the Program Administrator and the Servicer) that seek to participate in performing the duties of the Qualified Issuer under the proposed Guarantee, as well as each Eligible CDFI that is proposed to participate in the Bond Issue.

Guarantee Applications may be submitted concurrently with Qualified Issuer Applications. However, the CDFI Fund will not recommend a Guarantee Application for approval until it has determined that the entity proposing to serve as the Qualified Issuer meets the requirements of the Regulations.

The Guarantee Application must contain all required documentation. In addition to information regarding the Qualified Issuer (and its Program Administrator and Servicer), certain documentation must be submitted with regard to each proposed Eligible CDFI.

This document provides the format, document organization, naming conventions, and description of requested documentation for Qualified Issuers and Eligible CDFIs to be submitted as part of the Guarantee Application. The Guarantee Application must follow the standardized naming conventions and file organization detailed below.

Under the Paperwork Reduction Act (44 U.S.C. chapter 35), an agency may not conduct or sponsor a collection of information, and an individual is not required to respond to a collection of information, unless it displays a valid Office of Management and Budget (OMB) control number. Pursuant to the Paperwork Reduction Act, the Guarantee Application has been assigned the following control number: ____________.

Document Format

Documentation should be submitted in Microsoft Word, unprotected Microsoft Excel, Adobe PDF, or other mediums as appropriate. Narratives must be submitted in Microsoft Word format in single-spaced, 12 point Arial or Times New Roman font.

Missing or Not Applicable Documentation

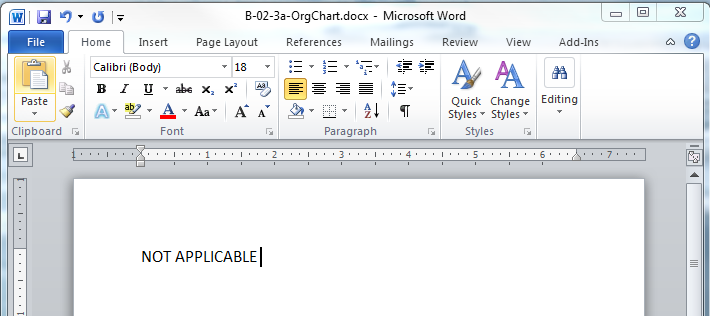

If a specific document is not applicable or otherwise not available, the Applicant must submit a placeholder file stating that the requested document is “Not Applicable”, as appropriate, in place of the file. The placeholder file must retain the naming convention of the respective file it was meant to replace. See Figure 1 for an example.

Figure 1: Sample Documentation Stating Non-ProvisionX

Document Organization and Submission

NOTE: both the Qualified Issuer Application and each of the “Guarantee Application- Eligible CDFI Portion(s)” must be submitted before the “Guarantee Application- Qualified Issuer Portion” can be submitted.

Applications will be submitted via the myCDFIFund portal and all documents must be uploaded according to a specified file structure. Guarantee application submission is first divided into a Qualified Issuer (QI) portion and one or more Eligible CDFI portions. Organizations that do not currently have a MyCDFIFund account must register their organization and assign a user according to the instructions found on www.cdfifund.gov/MyCDFI. Eligible CDFIs may consider granting the Qualified Issuer access as a user to their organization so that the QI can monitor the progress of the application process. Once completed, the applicant can login to their account and choose “Guarantee Application- Qualified Issuer Portion” or “Guarantee Application- Eligible CDFI Portion” from the list of possible applications. X

The files for the Qualified Issuer of the proposed Bond Issue should be uploaded under the application entitled “Guarantee Application- Qualified Issuer Portion” and the files for each Eligible CDFI should be uploaded separately under “Guarantee Application- Eligible CDFI Portion.” The files for the Qualified Issuer should be titled “QI Name-Section-File” (e.g.: QI-6-Credit Enhancement). Each Eligible CDFI within the proposed Bond Issue should have its own dedicated set of files which should be titled “Name of Eligible CDFI-Section-File Name” (e.g.: CDFI Name-1-TOC). .

Begin with the Eligible CDFI portions of the Guarantee Application.

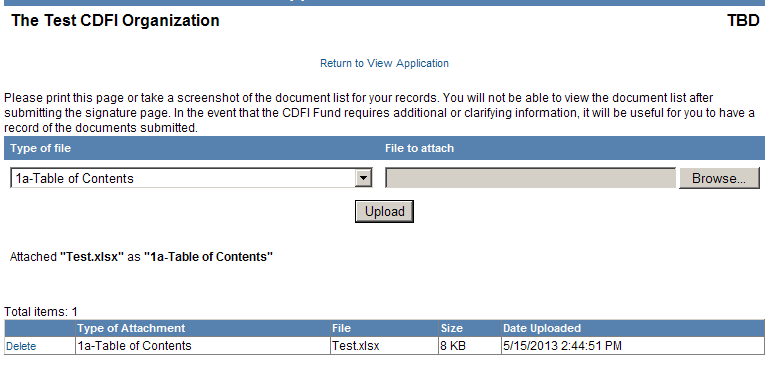

Carefully follow the instructions found on MyCDFIFund, and upload the application documents following the naming conventions and descriptions listed below in this document. Applications will be submitted via the MyCDFIFund portal and all documents must be uploaded according to the specified file structure.

Figure 2: Screenshot of File Upload Interface

NOTE: MyCDFIFund cannot accept files larger than 5 megabytes. If any files such as PDFs are larger than 5MB, please save and upload the files in multiple parts.

The Eligible CDFI’s portion of the application process is completed by submitting a “Signature Page”. You will not be able to make any edits to the application materials unless requested to do so by the CDFI Fund. Once the Signature Page has been submitted, print a copy of the Submission Status Page, which will include your Eligible CDFI Control Number and retain this for your records. You will need to give the Eligible CDFI Control Number to your Qualified Issuer for them to submit the Signature Page associated with their portion of the Guarantee Application.

The Eligible CDFI Control Number follows the format ##-BGC-######.

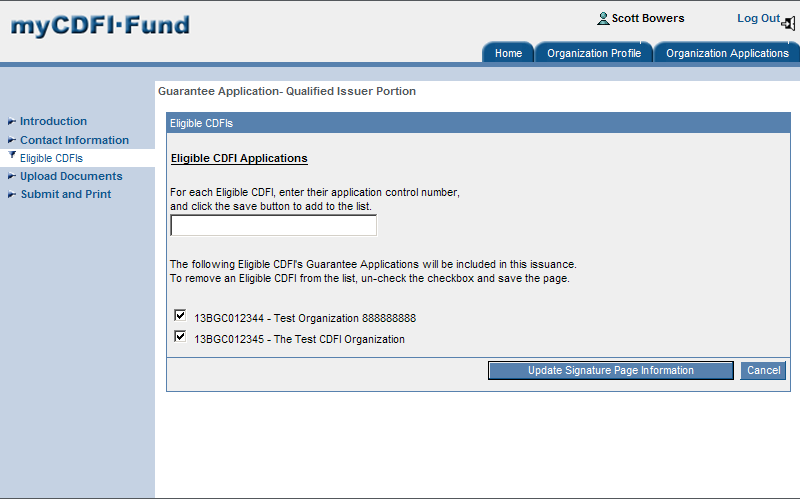

Once the Qualified Issuer has all of the Eligible CDFI Control Numbers for each of the CDFIs that are part of the proposed pool, the Qualified Issuer can complete their portion of the Guarantee Application. The Qualified Issuer will use the MyCDFIFund interface to upload the Eligible CDFI Control Numbers and associate those entities with the proposed pool. See the figure below.

Figure 3: Screenshot of E-CDFI Control Number Interface

The entire application process is completed by submitting the Qualified Issuer’s “Signature Page”. You will not be able to make any edits to the application materials unless requested to do so by the CDFI Fund. Once the Signature Page has been submitted, print a copy of the Submission Status Page, which will include your Qualified Issuer’s Control Number and retain this for your records.

The Control Number for the overall Guarantee Application follows the format ##-#-BG-######.

If you require assistance or have any questions, please call at (202)-653-0376, or email at [email protected]

Section |

Document |

Included |

N/A |

Format |

A-1 |

Table of Contents

Checklist |

|

|

|

A-2 |

Qualified Issuer Information and No Material Change Certification

|

|

|

|

A-3 |

Bond Issue narrative

|

|

|

Word |

A-4 |

Statement of Proposed Sources and Uses of Funds |

|

|

Excel |

A-5 |

Bond Issue Qualified Issuer cash flow model |

|

|

Excel |

A-6 |

Credit Enhancement |

|

|

Excel |

Secondary Capital Distribution Plan(s)

Section |

Document |

Included |

N/A |

Format |

B-ID-1 |

Table of Contents

Checklist |

|

|

|

B-ID-2 |

Eligible CDFI Organization and Contact Information

|

|

|

|

B-ID-3 |

Secondary Capital Distribution Plan Narrative

|

|

|

Word |

B-ID-4 |

Eligible CDFI Statement of Proposed Sources and Uses of Funds |

|

|

Excel |

B-ID-5 |

Eligible CDFI Cash Flow Model |

|

|

|

B-ID-6 |

Organizational Capacity

|

|

|

Word Excel |

B-ID-7 |

Policies and Procedures

|

|

|

|

B-ID-8 |

Financial Statements

|

|

|

|

B-ID-9 |

Loan Portfolio

|

|

|

Excel Excel Excel Excel Excel |

B-ID-10 |

Funding Sources and Capitalization

|

|

|

Excel Excel Excel Excel Excel Excel Excel Excel |

Documentation Checklist Contents

The following sections provide descriptions and naming conventions for the requested documentation for the Qualified Issuer and Eligible CDFIs in a Bond Issue.

Capital Distribution Plan (Qualified Issuer)

The Capital Distribution Plan is the component of the Guarantee Application that demonstrates the Qualified Issuer’s comprehensive plan for lending, disbursing, servicing, and monitoring each Bond Loan. The Capital Distribution Plan includes, among other components, a Statement of Proposed Sources and Uses of Funds and one or more Secondary Capital Distribution Plans. The Secondary Capital Distribution Plans will be uploaded as part of the Eligible CDFI materials in Section 2.0

The following is guidance for compiling the information for the Capital Distribution Plan items listed in Section 1.0 of the Guarantee Application. Please note that to provide consistency between Guarantee Applications, each file will have specific naming conventions that should be followed.

The files noted below should be uploaded to the appropriate section of the myCDFIFund submission page.

Item |

Discussion |

Format |

Naming Convention |

||

|

|||||

|

|

|

|

||

|

|

|

A-1: Table of Contents and Checklist |

||

Table of Contents

The Table of Contents (TOC) should be in the order noted in the checklist and should reference file names and not page numbers. If a specific item is not included in the submission and listed as N/A on the check list, the item should still be listed on the Table of Contents with N/A in place of the file name.

A-1a-TOC

Capital Distribution Plan Checklist

The Applicant must submit the Capital Distribution Plan Checklist as part of the application materials in myCDFIFund.

PDF, Template provided by CDFI Fund

A-1b-Checklist

Item |

Description |

Format |

Naming Convention |

A-2: Qualified Issuer Information and No Material Change Certification

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No Material Change Certification

If the Qualified Issuer Application is not submitted in concurrence with this Guarantee Application, the Qualified Issuer shall provide a scanned document, using the Certification of Material Events form, certifying that no material changes have occurred regarding the organization and certifications provided in the previously submitted Qualified Issuer Application. Further, should any material changes occur while the Guarantee Application is under review, the Qualified Issuer shall notify the CDFI Fund in a timely manner.

PDF, Template provided by the CDFI Fund

A-2a-Material Change

SF-424

The Qualified Issuer must provide a Standard Form SF-424 with organizational contact information for the Guarantee Application, regardless of whether it is submitted in concurrence or separately from the Qualified Issuer Application. The Qualified Issuer must provide the following information:

Applicant legal name

Employer/Taxpayer Identification Number (EIN/TIN)

DUNS number

Mailing address, including 9-digit zip code

Contact name, email address, and telephone number

Contact position/title

Authorized Representative name, email address, and telephone number

Authorized Representative position/title

PDF, Template provided by the CDFI Fund

A-2b-SF424

Federal Assurances and Certifications

The Qualified Issuer shall also provide a signed Federal Assurances and Certifications as an attachment to the SF-424 for the Guarantee Application, regardless of whether it is submitted in concurrence or separately from the Qualified Issuer Application.

PDF, Template provided by the CDFI Fund

A-2c-Certifications

EIN/TIN letter from IRS

The Qualified Issuer must provide a copy proof of its EIN/TIN letter from the IRS.

A-2d-IRS Letter

Item |

Description |

Format |

Naming Convention |

|

|||

|

|

|

A-3: Bond Issue Narrative |

Bond Issue Narrative

Provide a narrative no more than 10 single-sided pages in length of proposed uses of funds (Bond Proceeds), including the extent to which Bond Loans will serve Low-Income or Underserved Rural Areas. The narrative must include the amount of the Bond Issue (minimum and maximum of $100 million and $500 million, respectively) and the amount of each Bond Loan (minimum of $10 million)

The narrative must describe the Qualified Issuer’s plan for lending, disbursing, servicing, and monitoring each Bond Loan. In addition, the narrative must concisely describe the aggregate activities relating to the Bond Guarantee Program of each of the underlying Eligible CDFIs.

Word

A-3a-Bond Issue Narrative

Item |

Description |

Format |

Naming Convention |

|

|||

|

|

|

A-4: Bond Issue Statement of Proposed Sources and Uses of Funds |

Bond Issue Statement of Proposed Sources and Uses of Funds

Provide a consolidated table detailing the specific uses and timing of disbursements for the proposed Bond Issue. The Bond Issue Sources and Uses of Funds should be informed by Eligible CDFIs’ Statement of Proposed Uses of Funds to include the following information per disbursement of funds:

Date of disbursements

Amount of disbursement

Term of disbursement

Amortization schedule for each disbursement

Relending plan for each Eligible CDFI.

The statement should indicate that sources of funds to repay principal and interest on the Bond and Bond Loan.

The consolidated table should demonstrate that 100 percent of Bond proceeds will be used for Eligible Purposes.

Excel

A-4a-Sources and Uses

Item

Description

Format

Naming Convention

A-5: Bond Issue Qualified Issuer Cash Flow Model

Cash Flow Model

The Qualified Issuer should provide a working cash flow model of the proposed Bond Issue. The cash flow model should track the flow of funds through the Qualified Issuer and Eligible CDFIs through the term of the Bond Issue. This financial model should include disbursement and repayments for Bonds, Bond Loans, and Secondary Loans, as well as associated interest, and fees. The cash flow model should also demonstrate an understanding of the mechanics of the Relending Fund if utilized.

The cash flow model should match the aggregated cash flows of each of the underlying Eligible CDFIs.

Excel

A-5a-Cash Flow Model

Item

Description

Format

Naming Convention

A-6: Credit Enhancements

Credit Enhancements

Provide a description of Credit Enhancements, if any, which may be applicable to any and all Eligible CDFIs presented in this Guarantee Application. Include for each Credit Enhancement the following information, as relevant:

Provider of Credit Enhancement

Amount of Credit Enhancement, term and any specific conditions ( maturity, expiration, or renewal options)

Indicate any limiting conditions or revocability of the Credit Enhancement.

Additionally, provide the amount and quality of any other financial resources to be pledged, or risk mitigation to be provided, by an Affiliate of the Eligible CDFI through its management structure.

Excel

A-6a-Credit Enhancements

Secondary Capital Distribution Plan (Eligible CDFI)

The Secondary Capital Distribution Plan section lists the documentation to be submitted regarding each Eligible CDFI represented by the Guarantee Application. The Secondary Capital Distribution Plan must demonstrate comprehensive plans for lending, disbursing, servicing and monitoring Secondary Loans, including a description of how the proposed Secondary Loans will meet Eligible Purposes. The documentation listed in this checklist is to be provided for each Eligible CDFI in the proposed Bond Issue. Please Note: Only Certified CDFIs may apply as part of a proposed Bond Issue. Entities that are not certified CDFIs may not apply to be an Eligible CDFI as part of a proposed Bond Issue.

The table below provides guidance for compiling the information for Eligible CDFI items listed in Section 2.0 of the Guarantee Application. Please note that to provide consistency between Guarantee Applications, each item will have specific naming conventions that should be followed.

Files for each Eligible CDFI within the proposed Bond Issue should be uploaded to the appropriate section of the myCDFIFund submission page and should be titled “B-ID-Name of Eligible CDFI” (e.g.: B-02-CDFI Name). The ID number refers to each CDFI in the proposed Bond Issue, and is used to ensure that files for different CDFIs are not comingled.

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

B-ID-1: Table of Contents and Checklist |

Table of Contents

The Table of Contents (TOC) should be in the order noted in the checklist and should reference file names and not page numbers. If a specific item is not included in the submission and listed as N/A on the check list, the item should still be listed on the Table of Contents with N/A, None, or Not Performed in place of the file name as appropriate.

B-ID-1a-TOC

Checklist

Each Eligible CDFI must submit a Secondary Capital Distribution Plan Checklist as part of the application materials in myCDFIFund.

PDF, Template provided by CDFI Fund

B-ID-1b-Secondary Checklist

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B-ID-2 : Eligible CDFI Organization and Contact Information |

Eligible CDFI Organization and Contact Information

This section consists of the Standard Form-424 (SF-424) with the following sections filled out:

Applicant legal name

Employer/Taxpayer Identification Number (EIN/TIN)

DUNS number

Mailing address, including 9-digit zip code

Contact name, email address, and telephone number

Contact position/title

Authorized Representative name, email address, and telephone number

Authorized Representative position/title

SF-424, Template provided by CDFI Fund

B-ID-2a-SF 424

Federal Assurances and Certifications

The CDFI Fund will provide a template of all certifications to which the Eligible CDFI must attest, including Federal Assurances and Certifications.

PDF, Template provided by CDFI Fund

B-ID-2b-Certifications

EIN/TIN Letter

Each Eligible CDFI must submit proof of the EIN/TIN letter from the IRS.

BI-ID-2c-IRS Letter

Ownership Chart

If the Eligible CDFI is an affiliate or subsidiary of another larger organization(s), then a chart similar to the Management Organization Chart should be constructed showing the organizational hierarchy and any other Affiliates of that parent organization. The chart should note whether the assets of the Eligible CDFI and the related organization would be comingled in a bankruptcy estate, or relies on any Affiliate or parent organization financial support or management services.

B-ID-2d-Ownership Chart.

Entity Organization Chart of Affiliates

A list of all Affiliates and subsidiaries of the Eligible CDFI should be constructed in the same format as the management hierarchy chart. A brief narrative should also detail the purpose of each organization and if the affiliated organization’s financial information is rolled up into the consolidated statement of the Eligible CDFI. The narrative should note whether assets of the Affiliate or subsidiary would be comingled in a bankruptcy estate, and whether any Affiliate or subsidiary relies on the Eligible CDFI for financial support or management services.

B-ID-2e-Affiliates

Item |

Discussion |

Format |

Naming Convention |

|

|

||||

|

|

|

B-ID-3: Secondary Capital Distribution Plan Narrative |

|

Secondary Capital Distribution Plan Narrative

Provide a narrative no more than 10 single-sided pages in length of proposed uses of funds. In particular, the Eligible CDFI must: (1) attest that 100 percent of the Bond Loan proceeds shall be used to make Secondary Loans according to Secondary Loan Requirements (2) indicate the expected asset classes to which it will lend under Secondary Loan Requirements; (3)provide examples of previous lending and years of experience lending to a specific asset class; ; (4) describe how its Secondary Loan products in each asset class will address specific market gaps in available financing; (5) describe the extent to which Secondary Loans will serve Low-Income Areas or Underserved Rural Areas, how the Secondary Loans will contribute to community development, and the extent to which it expects to contribute to comprehensive community revitalization strategies in those areas; (6) describe the Eligible CDFI’s plan for lending, disbursing, servicing, and monitoring Secondary Loans; (7)

if it plans to acquire the capabilities to lend to specific asset classes, describe how it will obtain this capacity; and (8) a community impact analysis, including how Secondary Loans will address financing needs that the private market is not adequately serving, as well as specific community benefit metrics.

Word

B-ID-3-Narrative

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

B-ID-4: Eligible CDFI Statement of Proposed Sources and Uses of Funds |

Statement of Proposed Uses of Bond Loan Funds

Provide a table detailing the specific uses and timing of disbursements of the Bond Loan. Include the following information per disbursement of funds:

Date of disbursements

Amount of disbursement

Term of disbursement

Amortization Schedule for each disbursement

Estimated rate

Applicable fees

Relending plans

Expected asset classes to be used

The total dollar amount of disbursements should be equal to the amount requested by the organization under the Qualified Issuer's Sources and Uses of Funds.

Excel

B-ID-4-Proposed Uses

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

B-ID-5: Eligible CDFI Cash Flow Model |

Cash Flow Model

The Eligible CDFI should provide a working cash flow model of the proposed Bond Loan. The cash flow model should track the flow of funds through the Qualified Issuer and Eligible CDFI through the term of the Bond Issue. This financial model should include disbursement and repayments for Bonds, Bond Loans, and Secondary Loans, as well as associated interest, fees, and other costs. The cash flow model should also demonstrate an understanding of the mechanics of the Relending Fund, if utilized.

The cash flow model should match each Eligible CDFIs’ portion of the Qualified Issuer's cash flow model.

Excel

B-5-Cash Flow Model

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B-ID-6: Organizational Capacity |

Eligible CDFI Organizational Chart

Provide documentation showing the Management Organization hierarchy down to first level manager level. Both individual names and titles should be indicated as well as any vacancies.

B-ID-5a-Org Chart

Organizational Documents

Each Eligible CDFI should include a copy of the Articles of Incorporation, By-Laws and any amendments thereto. Also included should be a copy of the most recent Certificate of Good Standing and, if applicable, the IRS 501(c)(3) determination letter.

B-ID-5b-Articles;

B-ID-5b-Bylaws;

B-ID-5b-Good Standing

B-ID-5b-501c3

Management or Operating Agreement

If the Eligible CDFI is managed by a separate organization, provide a copy of the signed Management Agreement.

B-ID-5c-Management Agreement

Key Management Analysis

No more than 5 page, single-sided narrative of the current management’s ability to manage the organization through the funding, monitoring and collection of the loans being contemplated with the Bond Proceeds. Identify the management team and roles in relation to the Eligible CDFI’s participation in the CDFI Bond Guarantee Program, including any relevant contingency plans.

Word

B-ID-5d-Management Discussion

Board of Directors Information

An Excel chart of the Eligible CDFI’s board of directors indicating:

Date the director was originally elected

Start date of director’s most recent term

Date of current term expiration

Board committees or officer position

Director’s current employer and position

Director’s area of expertise

Director is/not independent of an affiliate entity

Plans to fill any current board vacancies or any upcoming vacancies/expirations in the next year.

Excel

B-ID-5e-Board Listing

Governance Narrative

No more than 3 page, single-sided narrative describing whether the Board of Directors has:

Appropriate controls

Term limits

Documentation of deliberative processes

An appropriate balance between senior executives and the board chair

Duly constituted and appropriately separated committees

B-ID-5f-Governance

Senior Managers’ Biographies

Resumes, job descriptions, and hire/ascension data of all senior managers, down to the division head level, should be provided indicating date of hire and date of position accession. If the individual has been with the organization less than five years, the previous employer(s) should be detailed. Indicate whether each senior manager has any outside employment or serves on other board memberships. Include contingencies, key manager insurance (i.e. insurance policies to protect against disruptions from the loss of a crucial senior manager), and any succession planning.

B-ID-5g-Management Biographies

Employee Information

A general discussion of the Eligible CDFI’s employee base, which should include a brief discussion of turnover rates, number of staff, average years of experience, average time at the organization, and training programs, if any. Include currently vacant or new unfilled positions.

B-ID-5h-Employee Information

Independent Reports

All independent reports, other than audited financial statements, within the last three years about the organization as a whole should be provided.

Each report should have a separate file.

B-ID-5i-Report Name where “Report Name” is the title of the report including the date of the report.

Strategic Plan and Related Progress Reports

The Eligible CDFI’s current strategic plan for a designated period should be submitted as well as the most recent report to the board of directors indicating progress of the CDFI to established goals contained in the plan. Indicate when the plan will next be reviewed and updated.

B-ID-5j-Strategic Plan

MIS Systems Report

A discussion of the Management Information Systems used to manage the Eligible CDFI should be submitted including a description of hard/software and how these support the organization. The discussion should address loan accounting, portfolio management, impact reporting, fundraising, project management, disaster recovery plans, and general ledger systems, as well as how the systems are integrated. Include a copy of the most recent IT audit, if available.

B-ID-5k-MIS

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

B-ID-7: Policies and Procedures Asset Liability Matching Policy Submit a copy of the Asset-Liability Matching policy. B-ID-7a-Asset-Liability Policy. Loan Policies and Procedures The current loan policies and procedures as well as all appendices should be submitted as a single document. The submitted loan policies should address origination, underwriting, credit review approval, closing, documentation, portfolio monitoring, and loss mitigation including a sample internal portfolio management report. If not noted in the policies, a separate sheet should be included indicating how often the policies are reviewed, who reviews the policies, and when the policies will be reviewed next. If not included in the loan policies or any of the appendices, a discussion of the risk rating definition, charge-offs, and loan loss reserve methodology should be added. B-ID-7b-Loan Policies

|

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B-ID-8: Financial Statements |

Most Recent Three Years Audited Financial Statements

The three most recent audited financial statements should be submitted separately. Note the financial statements should be prepared by an independent accounting firm an in accordance with generally accepted accounting principles. Also note that each year should be separate and include all notes to the audits and management letter for each year. If appropriate, the statement should include all consolidating schedules and/or any supplementary information. If a more recent audited financial statement becomes available during the application review period, the Qualified Issuer must notify the CDFI Fund in a timely manner and provide the updated information.

B-ID-8a-YYYY_MM_DD Audit” where the YYYY is the four-digit year of the statement, the MM is the two-digit month and the DD is the two-digit day. For example: “B-02-8a-2011_12_31 Audit”

Current Year-to-Date Financial Statements

The current year-to-date financial statements should be provided and should include, at a minimum, the balance sheet and statement of activities (or income statement if appropriate), for the consolidated organization as well as consolidating schedules, if available.

Interim financial information should be presented on a quarterly basis and include the most recent quarterly information, not more than 45days in the past, as appropriate. For example, if the application is submitted after November 15, the September 30 quarter end statement should be submitted. If the submission is made after February 15, the December 31 statement should be submitted. If a more recent interim statement becomes available during the application review period, the Qualified Issuer must notify the CDFI Fund in a timely manner and provide the updated information.

B-ID-8b-YYYY_MM_DD Interim” where the YYYY is the four-digit year of the statement, the MM is the two-digit month and the DD is the two-digit day. For example: “B-02-8b-2012_09_30 Interim”.

Current Fiscal Year’s Approved Budget

The approved budget for the current fiscal year should be submitted. The budget should contain a comparison with current operations.

Excel

B-ID-8c-YYYY Budget where the YYYY is the four-digit year of the statement.

Three Year Operating Projection

Provide a projection for the operational budget of the organization for the next three years with and without the effects of funding from the Bond Guarantee Program. Indicate any assumptions underlying the operating projection, including the forecasted effects of funding from the Bond Guarantee Program. Note any projected adverse effects on current covenants financial or operational covenants described in Section 10e of the Secondary Capital Distribution Plan checklist (Covenant Compliance).

Excel

B-ID-8d-YYYY Projection where the YYYY is the four-digit beginning year of the statement.

Net Assets, Equity, or Net Capital

If not available in the audited financial statements, provide information about the Eligible CDFI’s net assets, equity, or net capital for the most recent three years.

B-ID-8e-Net Assets

(Regulator information) Insured Depository Institutions only

If the applicant is an Insured Depository Institution, please indicate the identifying number by which the organization’s call report or similar financial data can be retrieved from its Appropriate Federal Banking Agency or Appropriate State Agency.

B-ID-8f-Regulatory Agency

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B-ID-9: Loan Portfolio1 |

Loan Portfolio Quality Report

This report should show the last three years of portfolio performance reported by quarter, horizontally across from left (earliest) to right (latest).

Vertically the rows will indicate:

Quarter end total loans outstanding

Number and dollar amount of loans funded in the quarter

Quarter end delinquency in number and dollars of loans ( by over 30, 60, and 90 days)

Delinquency percent of dollars (by over 30, 60, and 90 days

Restructured loans not included in delinquency in terms of dollars and number of loans

Foreclosed property or other real estate owned on the balance sheet in terms of dollars and number

Number of loans charged off during the quarter

Dollar amount of loans charged off during the quarter

Percentage of loans charged off during the quarter in terms of dollars

Amount of recoveries during the quarter.

Excel, see Table 1 for a sample format.X

B-ID-9a-Portfolio Quality Report

Pipeline Report

The Eligible CDFI should submit a current pipeline of loan applicants showing:

Borrower ID

Other debt with the Eligible CDFI

Project type

Proposed loan amount

Total project debt from all sources

Total project costs including soft costs

Estimated closing date

Projected debt service coverage

Collateral type

Collateral value

Valuation date

Indication of whether the loan is expected to be made as part of the CDFI Bond Guarantee Program.

Excel file, see Table 2 for a sample format.X

B-ID-9b-Pipeline

Portfolio Listing

The Eligible CDFI should submit a portfolio listing showing:

Loan Number

Borrower ID

Loan Type

Dollar and Percentage Outstanding Principal Balance

Unfunded Commitment

Total Commitment

Interest Rate

Borrowing Date

Disbursement Date

Maturity and Maturity Date

Principal Repayment Terms or Amortized Payment Amount

Delinquent Amount

Delinquency Date

Days Past Due

Security Status (Secured/Unsecured)

Security Position (first/senior position, subordinate position)

Risk Rating

Include reports on portfolio yield and portfolio concentration including, but not limited to: individual borrowers, sectors, geography, asset classes, or other appropriate segmentation as appropriate. Indicate all borrowers whose combined loans total the lesser of $1,000,000 or 5 percent of the organization’s total portfolio.

Excel file, see X

Table 3 for a sample format

B-ID-9c-Portfolio Listing

Other Loan Assets Under Management (non-owned)

A detailed listing of all loan portfolios that are managed but not owned (including those managed by affiliates) should be discussed in separate sections but be included as one document or file.

The portfolio discussions should include what functions are managed by the Eligible CDFI; what contingent liability is present; how large the portfolio is in terms of both dollars and number of loans; how long the portfolio has been managed; what fees the Eligible CDFI earns for the management; and the entity on whose behalf the Eligible CDFI manages the portfolio.

B-ID-9d-Managed Portfolios

Loan Products

Provide a narrative, no more than 5 single-sided pages in length, of all loan products offered or anticipated to be offered within the next year. The discussion should include collateral required, loan-to-value requirements, amortization, length of term, range of rates and fees charged and intended borrower type or sector.

B-ID-9e-Loan Products

Independent Loan Review Report

The most recent portfolio review should be provided. The file should contain any management response to the review.

B-ID-9f-Portfolio Review

Impact Report Case Studies

Submit no more than a 3-page single-sided narrative of three examples where funding benefited a particular borrower. Discuss how impact and success in impacts are measured.

B-ID-9g-Impact Case Studies

Loan Portfolio by Risk Rating and Loan Loss Reserves

Provide a breakdown of the portfolio by risk rating for the last two year ends as well as the most recent quarter. Include a description of risk ratings used, numerical rating (if applicable), number and dollar amount of loans in each risk rating, percent and total loan loss reserve.

Include a comparison of calculated loan loss reserves and the actual loan loss reserve for the last two year ends and most recent quarter. Indicate how the loan loss reserves are calculated.

Excel file

B-ID-9h-Risk Ratings

Cumulative financing transactions

If not available from the preceding documents, provide information indicating that the Eligible CDFI has engaged in financing transactions in the previous three years with a cumulative value equal to the amount of the proposed Bond Loan (minimum amount of $10 million)

Excel file

B-ID-9i-Cumulative transactions

Item

Discussion

Format

Naming Convention

B-ID-10: Funding Sources and Capitalization

Current Grant Information

The Eligible CDFI should submit a chart showing a list of grantors providing more than 10 percent of total grant funding or more than $100,000, whichever is less.

The chart should show the name or other identifying characteristic, the amount of the current year’s grant, previous grants from the same source over the prior three years (itemized by year), key terms, covenants and restrictions, and any projected grants from the source.

Excel

B-ID-10a-Grant Information

Funding Projections

Provide a chart showing Projected Grant Funding for the next three years indicating the source of the grant (or other identifying characteristic that can be tied to 9a above if appropriate), the amount of the grant, the required use of the grant if any, and the estimated likelihood of receiving that grant.

Excel

B-ID-10b-Projected Funding

Credit Enhancements

Provide a document describing any current or future committed credit enhancements provided to the Eligible CDFI by a third party. Include for each credit enhancement the following information, as relevant:

Provider of credit enhancement

Amount of credit enhancement, term and any specific conditions (maturity, expiration, or renewal options)

Indicate any limiting conditions or revocability of the credit enhancement

In addition to specific guarantees, items falling under this category can include forgivable debt or credit enhancement grants for specific loan programs.

Excel

B-ID-10c-Credit Enhancements

Historical Investor Renewal Rate

Provide information on the historical lender/investor renewal rates for the Eligible CDFI to include, annual loan/investment dollars and the historical percentage of renewals by lender/investor. (e.g.: Eligible CDFI renewed $5 million last year and has a lender/investor renewal rate of 80 percent). Figures should be provided for both the historical average and the most recent year.

Excel

B-ID-10d-Investor Renewal Rate

Covenant Compliance

Provide a listing of all financial and operating performance covenants for the Eligible CDFI, as well as the expiration of such covenants. Include historical performance against these covenants including any covenant defaults. Any covenant defaults should be accompanied by a discussion of remediation actions and waivers if provided.

A review of the covenants should also be made to ensure that any funding under the CDFI Bond Guarantee Program does not violate any covenant that is currently in compliance and noted when appropriate.

Excel

B-ID-10e-Covenant Compliance

Off-Balance Sheet Contingencies

Provide a report showing all contingencies, including project contingencies, dollar amount of the contingencies, percentage chance of draw under guarantee and/or contingency resulting in a formal liability, and a brief narrative of status.

Excel

B-ID-10f-Contingencies

Earned Revenues

The Eligible CDFI should provide a discussion of all sources of earned revenue greater than 10 percent of the total earned revenue for each of the past three years.

Excel

B-ID-10g-Revenue Discussion

Debt Capital Statistics

Submit a document listing the calculation of weighted average term of the debt capital and weighted average interest rate. Include information on:

Lender

Amount

Interest Rate

Term

Percentage of total capital and overall weighted average cost of capital

Balloon payments.

Excel

B-ID-9h-Debt Statistics

Appendix: Selected Chart Formatting

The following tables represent sample information reporting templates for the Guarantee application.

Table 1: Portfolio Quality Report FormatX

|

Loans Carried on the Balance Sheet |

Q12 |

Q2 |

Q3 |

Q4 |

Q5 |

Q6 |

Q7 |

Q8 |

Q9 |

Q10 |

Q11 |

Q12 |

|||||||||||

1 |

Period End Portfolio Balance |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

2 |

Number of Loans Made |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

|||||||||||

3 |

Dollar Amount of New Loans Made |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

4 |

Delinquency $ (over 30 days) |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

5 |

Delinquency # (over 30 days) |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

|||||||||||

6 |

Delinquency $ (over 90 days) |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

7 |

Delinquency # (over 90 days) |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

|||||||||||

8 |

Delinquency

% based on $ |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

|||||||||||

9 |

Restructured Loans not included in delinquency figures ($) |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

10 |

Restructured Loans not included in delinquency figures (#) |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

|||||||||||

11 |

Foreclosed and Owned Real Estate Properties ($) |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

12 |

Foreclosed and Owned Real Estate Properties (#) |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

|||||||||||

13 |

Total

Nonperforming Assets |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

14 |

Loans Charged Off During Quarter (#) |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

# |

|||||||||||

15 |

Loans Charged Off During Quarter ($) |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

16 |

Charge

Off % based on $ |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

|||||||||||

17 |

Amount Recovered on Previously Charged Off Loans |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||

Table 2: Pipeline ReportX

Borrower ID |

Other Debt Held with Eligible CDFI |

Project Type |

Proposed Loan Amount |

Total Project Debt |

Total Project Cost |

Estimated Closing Date |

Projected Debt Service Coverage (DSC) |

Collateral Type |

Collateral Value |

Valuation Date |

Source of Value Estimate |

Bond Guarantee Program Funded |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 3: Loan Portfolio Listing formatX

Loan ID |

Borrower ID |

Loan Type |

Outstanding Balance ($) |

Outstanding Balance (%) |

Unfunded Commitment |

Total Commitment |

Interest Rate |

Borrowing Date |

Maturity Date |

Maturity |

Principal Repayment Terms/Amortized Payment Amount |

Delinquent Amount ($) |

Delinquency Date |

Days Past Due

|

Security Status |

Risk Rating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cleared

Don Graves – Small Business, Community Development, and Housing Policy 4/15/13

Karen Weber- Office of Policy and Legislative Review 4/19/13

Sabrina Siddiqui – Office of Public Affairs 4/24/13

1 Items B-ID-9a through B-ID-9h should NOT be submitted as a single file with multiple tabs. The items should be submitted as independent files.

2 The Q1 through Q12 designations should be replaced with actual quarter end dates.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Thomas Blackmon |

| File Modified | 0000-00-00 |

| File Created | 2021-01-29 |

© 2026 OMB.report | Privacy Policy