SOI-462 Adjustments Focus Groups

Cognitive and Psychological Research

SOI-462 Adustments Focus Groups -Attachments

SOI-462 Adjustments Focus Groups

OMB: 1545-1349

Approval Request to Conduct Customer Satisfaction Research

W&I CAS Adjustments Amended Return Focus Groups Research

OMB # 1545-1349

Attachments:

A: Visual Aids to be used during focus groups

B: Moderator’s Guide

A: Visual Aids to be used during focus groups

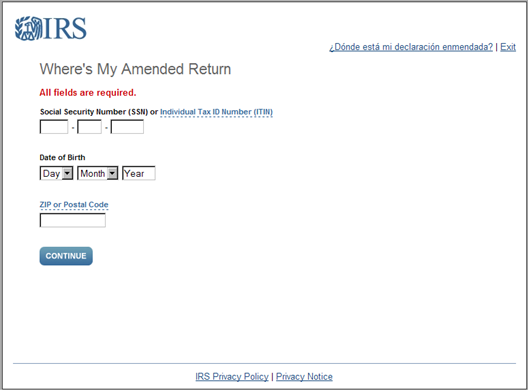

WMAR Authentication Screen:

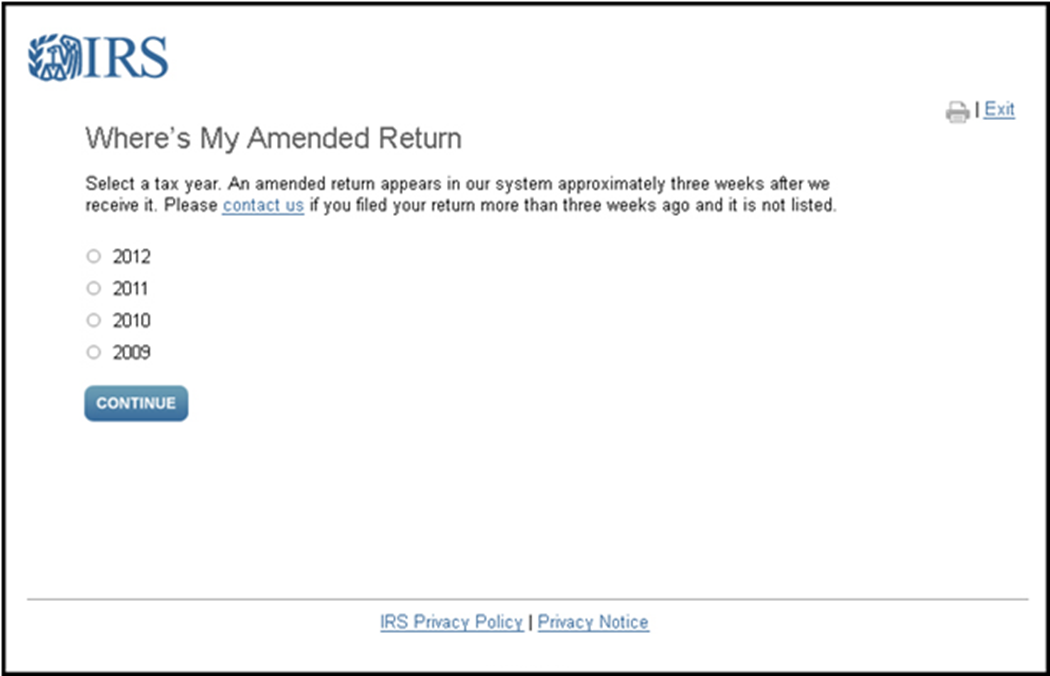

WMAR Amended Return Year Selection

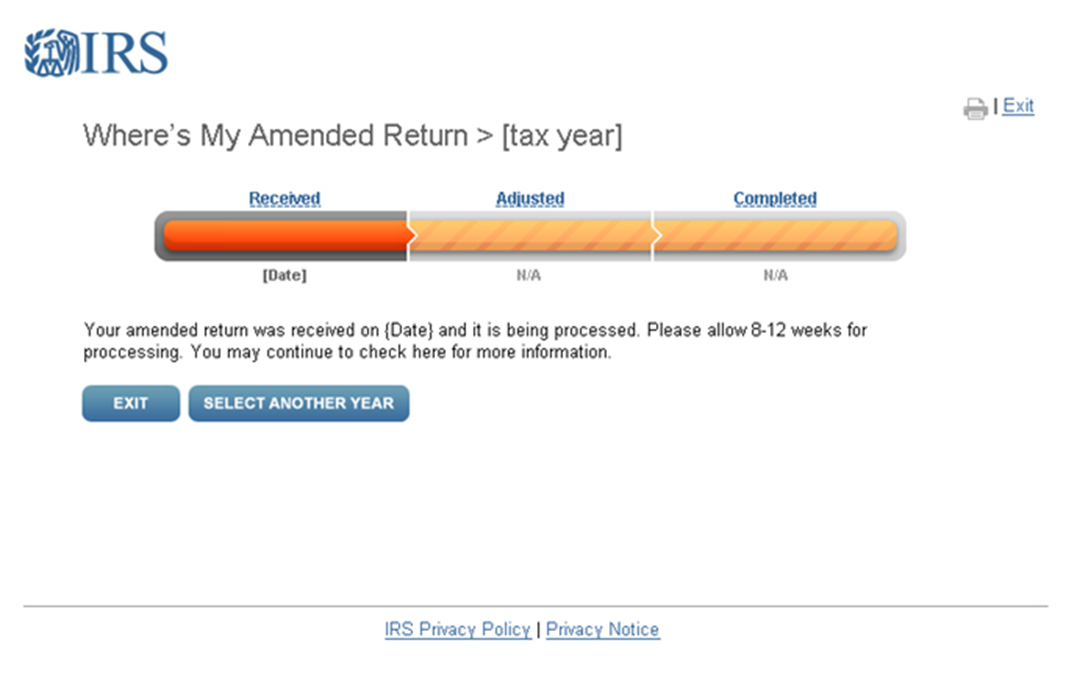

WMAR Received Status:

WMAR Adjusted Status:

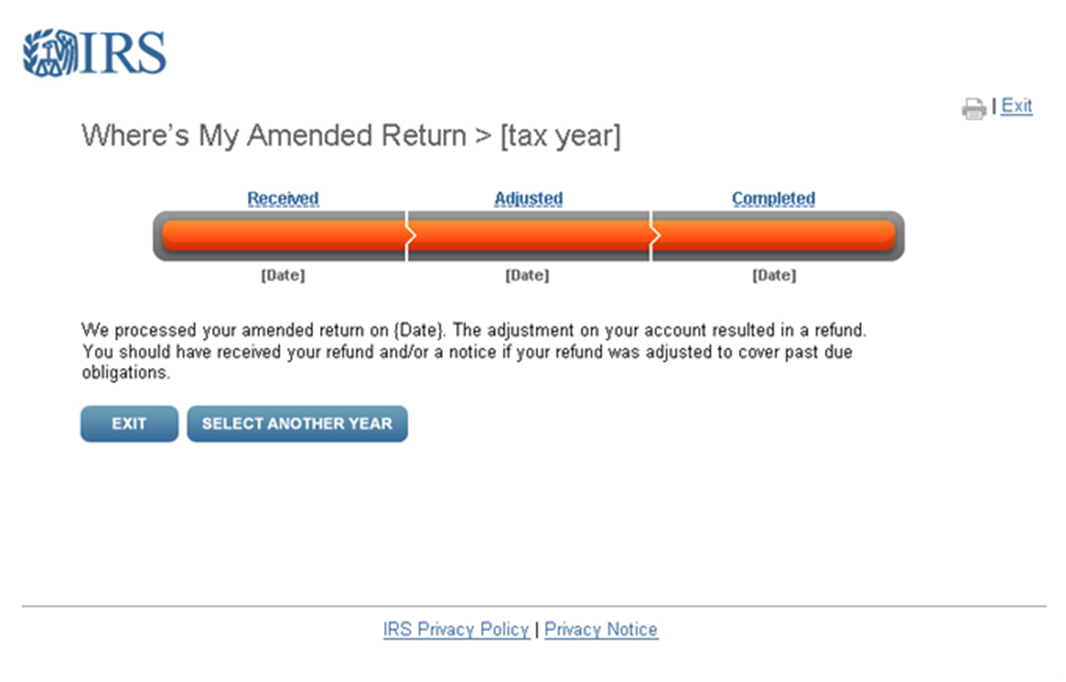

WMAR Completed Status:

B: Moderator’s Guide

DRAFT - IRS Adjustments Focus Group Moderator’s Guide

Welcome and Topic Introduction 5 Minutes

Hello, I’m <MODERATOR>, and I am a researcher with Fors Marsh Group. We receive feedback from people, like you, that helps to make products and organizations better.

We’ve asked you to join this online focus group today to discuss IRS’s amended return process. Your contributions to our discussion will be private to extent allowed by law, and your names will not appear in the summary report.

There are a few things I’d like to go over to help make our discussion more productive:

Please speak one at a time and speak loudly enough so we can all hear you. I want to hear what everyone has to say – either today or when I go back to listen to the audio files to write up my summary.

I want to hear from everyone, but not every person has to answer every question.

I want to hear a range of experiences, so if you have an opinion different from what most in the group are saying, please don’t hesitate to speak up - there are no right or wrong answers.

Are there any questions about anything I’ve said so far?

[Allow participants to introduce themselves. Ask first name and where they live.]

Past experiences with the amended return process 20 Minutes

When I say “amended return,” what kinds of things do you think of?

What prompted you to amend your tax return?

Additional income was realized?

A mistake was made on the form?

Victim of identity theft?

What went right with the process?

Did you receive a response in a timely manner?

Was the explanation for the decision clear?

Were the instructions clear on how to amend your return?

What went wrong with the process?

Was the process inefficient?

Was the explanation for the decision not clear?

Were the instructions not clear on how to amend your return?

Did you receive communications from the IRS throughout the process?

What did you think of the communication throughout the process?

Was it handled in a professional manner?

Did anyone use the IRS’s “Where’s My Amended Return” tool during the process?

What did you think about this tool?

Was this tool helpful?

What do you think about the explanation that you received about the resolution of your issue?

Was the resolution explained clearly?

Did anyone disagree with the resolution?

Did disagreeing with the resolution affect if you thought it was clear?

Do you contact anyone at the IRS during the amended return process?

How did you contact the IRS?

Was the person helpful?

Demonstration and feedback of the “Where’s My Amended Return” tool. 20 Minutes

Let’s talk more about IRS’s online tools. We’re interested in getting people’s feedback on the IRS’s “Where’s My Amended Return” website. You’re going to see the log in page of the tool on your screen in just a moment.

So this is where you would input your information to login into the tool.

On the next, page you can select the tax year that you’re interested in finding more information about.

What do you think about the tool so far?

Let’s say that you sent in your amended return in the last few weeks. This would be the page you would see.

What do you think about this page?

What do you think about the information that is presented to you here?

What do you think about the design of this page?

Let’s say another 8 weeks has gone by and you go back into “Where’s My Amended Return.” You would see this page after you log in.

What do you think about this page?

What do you think about the information that is presented to you here?

What do you think about the design of this page?

Let’s say another 3 weeks has gone by and you log back into “Where’s My Amended Return.” You would see this page after you log in.

What do you think about this page?

What do you think about the information that is presented to you here?

What do you think about the design of this page?

Now that you have seen the “Where’s My Amended Return” tool, what do you think about it?

For those who had not used it before, is this what you expected?

Is this something that you would use?

Is this something that would be helpful to you?

How could the IRS improve this tool?

Conclusion 5 Minutes

We’re almost finished with the session; I just have a couple of final questions.

If we wanted to let people like you know about a tool like this, what would be the best way to get people that information?

Thank you for participating. This has been really informative and interesting and will be of great use to us.

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1349. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the, Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | 17XHB |

| File Modified | 0000-00-00 |

| File Created | 2021-01-29 |

© 2026 OMB.report | Privacy Policy