Bond Guarantee Program

Bond Guarantee Program

Application_-_Qualified_Issuer

Bond Guarantee Program

OMB: 1559-0044

Community

Development Financial Institutions Fund

Qualified

Issuer Application

Introduction

Under the CDFI Bond Guarantee Program, an entity that wishes to be designated by the CDFI Fund as a Qualified Issuer must submit a Qualified Issuer Application.

The Applicant must provide all required information in its Qualified Issuer Application to establish that it meets all criteria for designation as a Qualified Issuer and can carry out all Qualified Issuer responsibilities and requirements. Such responsibilities and requirements include, but are not limited to, information that demonstrates that the Applicant has the appropriate expertise, capacity, and experience and is qualified to make, administer and service Bond Loans for Eligible Purposes. After receipt of a Qualified Issuer Application, the CDFI Fund may request additional, clarifying, confirming or supplemental information on the materials submitted as part of the Qualified Issuer Application.

In order to understand the CDFI Bond Guarantee Program and the roles and responsibilities of the Qualified Issuer, interested parties should review and become familiar with the regulations that govern the program, set forth at 12 C.F.R. 1808 (the Regulations). In addition, Applicants should review and become familiar with the Notice of Guarantee Availability (NOGA), published with respect to FY 2013 and FY 2014 Qualified Issuer Applications and Guarantee Applications. Before beginning to prepare a Qualified Issuer Application, prospective Applicants should review and become familiar with the Qualified Issuer Application Guidance, which contains detailed information and formatting instructions. The Regulations, the NOGA, and the Qualified Issuer Application Guidance may be found on the CDFI Fund’s website at www.cdfifund.gov. Capitalized terms in the Qualified Issuer Application are defined in the Regulations.

For purposes of the Qualified Issuer Application, the term “Applicant” refers to the applicant organization as well as any Affiliates and third-party entities (i.e., the proposed Program Administrator and the proposed Servicer) that seek to participate in performing the duties of the Qualified Issuer during the term of a Bond.

The Qualified Issuer Application must contain all required documentation regarding the Applicant. In addition, certain information must be provided with respect to at least one Certified CDFI, which must attest that it has designated the Applicant to serve as Qualified Issuer on its behalf.

Application documents will be submitted electronically through myCDFI Fund. The Qualified Issuer Application must follow the standardized naming convention for individual files as well as the file organization detailed in the Qualified Issuer Application Guidance.

Under the Paperwork Reduction Act (44 U.S.C. chapter 35), an agency may not conduct or sponsor a collection of information, and an individual is not required to respond to a collection of information, unless it displays a valid Office of Management and Budget (OMB) control number. Pursuant to the Paperwork Reduction Act, the Qualified Issuer Application has been assigned the following control number: ____________.

Application Requirements

To be deemed complete, the Qualified Issuer Application must include each of the sections 1 through 11 as set forth below. The Applicant must provide a narrative addressing the requirements of Sections 4 through 11, as well as additional supporting documentation as is necessary or appropriate. The entire narrative cannot exceed 25 single-sided pages in size 12 Arial font. The Applicant may choose how to allocate the 25 pages of the narrative. Please note that the 25 pages of narrative are in addition to any supporting documentation or separate requirements of the Qualified Issuer Application. Detailed instructions for uploading additional evidence or attachments for each section of the Qualified Issuer Application are described below.

Document Format

Documentation should be submitted in Microsoft Word, unprotected Microsoft Excel, Adobe PDF, or other mediums as appropriate. If the document type is listed as “Narrative”, provide the required information in the maximum 25-page Narrative Discussion in Microsoft Word rather than a separate document.

Missing or Not Applicable Documentation

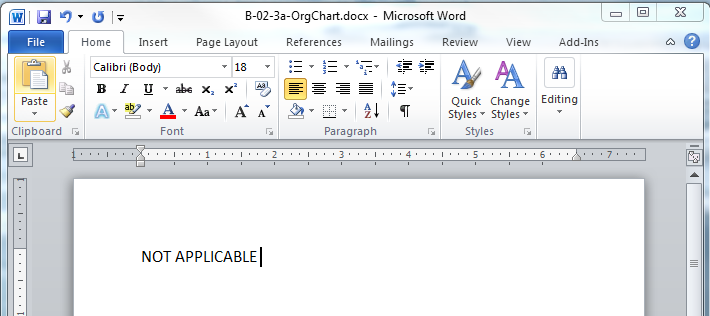

If a specific document is not applicable or otherwise not available, the Applicant must submit a placeholder file stating that the requested document is “Not Applicable,” “Not Performed,” or “None” in place of the file, as appropriate. The placeholder file must retain the naming convention of the respective file it was meant to replace. See Figure 1 for an example.

Figure

1: Sample Documentation

Stating Non-ProvisionX

Figure

1: Sample Documentation

Stating Non-ProvisionX

Document

Organization and Submission

Document

Organization and Submission

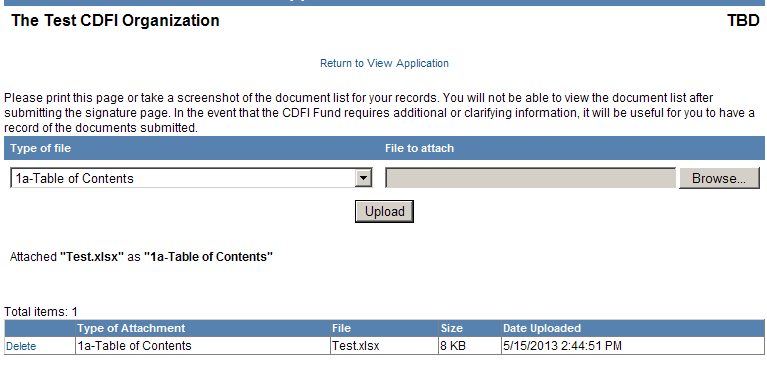

Organizations applying to become Qualified Issuers must create a MyCDFIFund account for their organization and assign a user according to the instructions found on www.cdfifund.gov/MyCDFI. Once completed, the applicant can login to their account and choose “Qualified Issuer Application” from the list of possible applications. X

Carefully follow the instructions found on MyCDFIFund, and upload the application documents following the naming conventions and descriptions listed below in this Qualified Issuer Application. Applications will be submitted via the MyCDFIFund portal and all documents must be uploaded according to the specified file structure.

Figure 2: Screenshot of File Upload Interface

NOTE: myCDFIFund cannot accept files larger than 5 megabytes. If any files such as PDFs are larger than 5MB, please save and upload the files in multiple parts.

The application process is completed by submitting a “Signature Page” and you will not be able to make any edits to the Qualified Issuer Application unless requested to do so by the CDFI Fund. Once the Signature Page has been submitted, print a copy of the Submission Status Page, which will include your Qualified Issuer Application Control Number, and retain this for your records.

Your Qualified Issuer Application Control Number follow the format ##-BQI-######.

If you require assistance or have any questions, please call at (202)-653-0376, or email at [email protected]

Qualified Issuer Application Checklist

Section |

Document |

Included |

N/A |

Format |

QI-1 |

Table of Contents Checklist |

|

|

|

QI-2 |

Organization Information

|

|

|

|

QI-3 |

Licenses and Insurance Requirements

|

|

|

|

QI-4 |

Narrative Discussion |

|

|

Word |

QI-5

5.1

5.2 |

Organization Capability – Bond Issuance

Organization Capability- proposed Program Administrator Organization Capability- proposed Servicer

|

|

|

Word Excel Excel

Word

Word |

QI-6 |

Strategic Alignment

|

|

|

Word Word Word Word |

QI-7 |

Management and Employer Staffing

|

|

|

Word Word Word |

QI-8 |

Financial Strength

|

|

|

Word Word Excel Word Excel Excel |

QI-9 |

Systems and Information Technology

|

|

|

|

QI-10 |

Pricing Structure |

|

|

Excel |

Documentation Checklist Contents

The following sections provide descriptions and naming conventions for the requested documentation for the Qualified Issuer Application. Please note that, to provide consistency between all Qualified Issuer Applications, each item has a specific naming convention that must be followed.

Item |

Discussion |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

QI-1: Table of Contents and Checklist |

Table of Contents

The Table of Contents should be in the order noted in the checklist and should reference file names and not page numbers. If a specific item is listed as N/A on the checklist and Table of Contents, an file should still be uploaded indicating N/A, None, or Not Performed inside the body of the file.

PDF, Template provided by CDFI Fund

QI-1-TOC

Checklist

The Applicant must submit the Qualified Issuer Application Checklist as part of the application materials in myCDFIFund.

QI-1-Checklist

Item |

Description |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

|

|

QI-2: Organization Information Contact Information This may consist of only a single scanned copy of the Standard Form 424 (SF-424) with the following sections filled out: Applicant legal name Employer/Taxpayer Identification Number (EIN/TIN) DUNS number Mailing address, including 9-digit zip code Contact name, email address, and telephone number Contact position/title Authorized Representative name, email address, and telephone number Authorized Representative position/title The entity must sign the Federal Assurances – Non-Construction Programs form (attached to the SF-424).

PDF, Template provided by CDFI Fund QI-2-Qualified Issuer SF424 EIN/TIN Provide a copy of the proof of EIN/TIN from the IRS for each applicable entity.

QI-2-IRS Letter Program Administrator Contact Information If the role of Program Administrator is being performed by an entity other than the applicant to be a Qualified Issuer, an SF-424 and associated documents must be provided for each entity.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PDF, Template provided by CDFI Fund

QI-2-PA

Servicer Contact Information

If the role of Servicer is being performed by an entity other than the applicant to be a Qualified Issuer, an SF-424 and associated documents must be provided for each entity.

PDF, Template provided by CDFI Fund

QI-2-Servicer

Certified CDFI Contact Information

An SF-424 and associated documents must be provided for at least one Certified CDFI that is designating the applicant to be a Qualified Issuer on its behalf.

PDF, Template provided by CDFI Fund

QI-2-CDFI SF-424

Notice Designating Qualified Issuer

If the applicant to be a Qualified Issuer is not a Certified CDFI, a designation notice in a form created by the CDFI Fund must be provided by at least one Certified CDFI.

QI-2-Designation

Item |

Description |

Format |

Naming Convention |

|

|||

|

|

|

|

|

|

|

QI-3: Certifications and Insurance Requirements |

Licenses

A document

identifying licenses required by the Appropriate Federal Banking

Agency or Appropriate State Agency that govern the Applicant, if

applicable.

QI-3-Licenses

Errors and omissions (E&O) insurance certificate of coverage

A document displaying the certificate of coverage for Errors and omissions insurance.

QI-3-E and O

Item

Description

Format

Naming Convention

QI-4: Narrative Discussion

Narrative Discussion

The 25-page narrative discussion begins in this section and continues through Section 10. Where a subsequent part of the application materials calls for a narrative, include the information in this narrative document.

Please note that the Applicant may choose how to allocate the 25-page narrative discussion, but must be sure to discuss each requirement of this Application. The majority of the narrative discussion should focus on Section 5.

The 25-page limit does not include any scanned documents that are separately called for in the Qualified Issuer Application.

Narrative

QI-4Narrative

Item

Description

Format

Naming Convention

QI-5: Organizational Capability – Bond Issuance

Applicant’s capabilities

The majority of the narrative discussion should focus on Section 5.

Describe the Applicant’s capabilities to serve as a Qualified Issuer and its ability to deploy Bond Proceeds and Bond Loan proceeds. This description of capabilities must demonstrate that the Applicant has the appropriate expertise, capacity, and experience to originate, underwrite, service, and administer loan portfolios that serve Eligible Purposes and are targeted toward Low-Income Areas and Underserved Rural Areas.

Provide a brief history and overview of the Applicant, including ownership, size, office locations and summary track record. Describe how the Applicant is organized, including a description of each entity involved in carrying out the roles of the Qualified Issuer, including Program Administration and Servicing.

Demonstrate the core loan administration capabilities,

prior experience in commitment approvals and loan requisition. Specifically describe any prior experience in lending to CDFIs or other similar institutions.

Indicate the Applicant’s organizational risk exposure and the relevant risk mitigation strategies employed by the Applicant. Include risk mitigation strategies by any third party Servicer or Program Administrator, as well as any risk mitigation strategies between applying entities.

Where possible, substantiate claims with quantifiable statistics and relevant qualitative details.

Narrative

QI-Narrative

Sample Bond Issue cash flow model

The Applicant should provide a sample working cash flow model of a sample Bond Issue if the Applicant is not submitting this Qualified Issuer Application concurrently with a Guarantee Application. If submitted concurrently with a Guarantee Application, please include the a copy of the actual cash flow model.

The cash flow model should track the flow of funds through the Qualified Issuer and Eligible CDFIs and through the term of the sample Bond Issue. This financial model should include disbursement and repayments for Bonds, Bond Loans, and Secondary Loans, as well as associated interest, fees, and other costs. The cash flow model should also demonstrate an understanding of the mechanics of the Relending Fund if utilized.

The cash flow should reflect expected upfront and ongoing costs and revenues associated with Qualified Issuer activities under the CDFI Bond Guarantee Program.

Excel

QI-5-Sample Model

Sample Proposed Sources and Uses of Funds

If this Qualified Issuer Application is not submitted concurrently with a Guarantee Application, the Applicant should provide a consolidated chart that details the specific uses and timing of disbursement of a sample Bond Issue. The narrative for this section should be 1 single-sided page or less and separate from the 25-page narrative discussion. [

Excel

QI-5-Sample Sources and Uses

Most recent Statement on Standards for Attestation Engagements 16 (SSAE 16), and, if available, any third party rating history

A copy of the most

recent Statements on Standards for Attestation Engagements 16 (SSAE

16) for the Servicer. Include, if available, any third

party rating reports relevant to servicing.

QI-5-SSAE16

Independent Reports

If a third-party is proposed to perform the role of the Program Administrator or Servicer, provide the most independent report of the third-party organization. Each report should have a separate file.

QI-5-Report Name where “Report Name” is the title of the report including the date of the report.

Item |

Description |

Format |

Naming Convention |

||

|

|||||

|

|

|

QI-5.1: Organizational Capability – Program Administrator |

||

Program Administrator Qualifications and Capabilities

Provide information to demonstrate the capability, expertise and experience of the entity serving in the role of Program Administrator. Applicants should specifically address the proposed Program Administrator’s management and organization, loan administration, and financial capability. Applicants should also specifically address the duties of the Program Administrator as enumerated in 1808.606(b), including:

approving and qualifying Eligible CDFI applications for participation in the Guarantee Application;

Bond and Bond Loan packaging;

reviewing and approving Secondary Loan commitments based on the Secondary Loan Requirements;

compliance monitoring of Bond Loans and Secondary Loans;

preparing and submitting reports required by the Interim Rule, and;

any other duties and related services customarily expected of a Program Administrator.

Narrative

QI-Narrative

Item

Description

Format

Naming Convention

QI-5.2: Organizational Capability – Servicer

Servicer Qualifications and Capabilities

Provide information to demonstrate the respective capability, expertise and experience of the entity serving in the role of Servicer. Applicants should specifically address the proposed Servicer’s management and organization, loan servicing, and financial capability. Applicants should also specifically address the duties of the Servicer as enumerated in 1808.606(c), including:

billing and collecting Bond Loan payments from Eligible CDFIs;

initiation collection activities on past-due Bond Loans;

transferring Bond Loan payments to the respective funds and accounts managed by the Master Servicer/Trustee;

Bond Loan administration and servicing;

systematic and timely reporting of Bond Loan performance through remittance and servicing reports, and providing such reports as may be required by the Interim Rule;

proper measurement of annual outstanding Bond Loan requirements, and;

any other duties and related services that are customarily expected of a Servicer.

Narrative

QI-Narrative

Item

Description

Format

Naming Convention

QI-6: Strategic Alignment

Demonstration of CDFI industry knowledge

Demonstrate the Applicant’s knowledge of the CDFI Industry, especially with regard to evaluation of the financial strength of CDFIs. State the number of years working with CDFIs or similar institutions. Where possible, substantiate claims with quantifiable statistics and relevant qualitative details.

Narrative

QI-6-Narrative

Description of strategic alignment to CDFI Fund goals

Describe the Qualified Issuer’s mission and how the Applicant has a demonstrated track record of commitment to community and economic development and the goals of the CDFI Bond Guarantee Program.

Provide a comparable discussion for third-party Servicer or Program Administrator, if any.

Narrative

QI-6-Narrative

Conflicts of Interest

A document identifying any actual or potential conflicts of interest an Applicant would have in performing as a Qualified Issuer. Include the interests of the Applicant’s parent, subsidiary, and affiliate companies. The Applicant must also describe the specific steps it would take to avoid, mitigate, or neutralize any such conflicts.

Narrative

QI-6- Narrative

Ethics Policies

A document identifying the Applicant’s ethics and compliance policies including any procedures, training materials, and audit practices designed to detect and prevent violations of Federal and state laws and conflicts of interest. If Applicant has a risk or compliance officer, a description of the person’s responsibilities and an assessment of whether the person operates independently from the Applicant’s decision makers who manage the Bond Issues.

Narrative

QI-6-Narrative

|

|

|

|

Item

Description

Format

Naming Convention

Item

Description

Format

Naming Convention

QI-7: Management and Staffing

Staffing plan related to the Bond Guarantee Program

Describe the Applicant’s staffing plan in relation to the Bond Guarantee Program, including any hiring or training to be completed.

Narrative

QI-7-Narrative

Management Discussion and Analysis Report

Discuss management’s ability to manage the organization through the funding, monitoring and collection of the Bond Loans being contemplated with the Bond Proceeds. Describe the past performance of the management team in delivering on past projection. Specific attention should be placed on any experience developing multi-lender loan pools or syndications. Where possible, substantiate claims with quantifiable statistics and relevant qualitative details.

Narrative

QI-7-Narrative

Management and staff retention documentation

Describe the current retention of management and staff. Include documentation of employee retention and related policies of third party Servicers or Program Administrators, if applicable.

Narrative

QI-7-Narrative

Organizational Structure Guide

Provide a scanned copy of the Management Organization hierarchy down to first level manager. Both individual names and titles should be indicated as well as any vacancies. Include the management organizational hierarchy of third party Servicers, or Program Administrators, if applicable.

QI-7-Management Structure

Management or Operating Agreement

If the Qualified Issuer is managed by a separate organization, a scanned copy of the signed Management Agreement should be included. If not appropriate, then place “None” in place of the file name in the Table of Contents.

QI-7-Management Agreement

Managerial staff resumes and tenure

Resumes, job descriptions, and hire/ascension data of all senior managers down to the division head level. Indicate whether each senior manager has any outside employment or serves on other board memberships. Include contingencies, key man insurance, and any succession planning.

Include the above for third party Servicers and Program Administrators, if applicable.

QI-7-Resumes

Item

Description

Format

Naming Convention

QI-8: Financial Strength (All Applicants)

Financial Risk and Risk Mitigation Strategies

Describe the financial risks of the Applicant, including any specific risks (e.g. contingent liabilities) in participation in the Bond Guarantee Program as a Qualified Issuer, as well as risk mitigation strategies related to the above. The Applicant should demonstrate its financial stability in the performance of Bond and Bond Loan administration and servicing activities, loan origination, and underwriting over the term of the Bond.

Narrative

QI-Narrative

Appropriate Federal Banking Agency or Appropriate State Agency

List any Appropriate Federal Banking Agency or Appropriate State Agency which oversees the operations of the Applicant. Please indicate the identifying number by which the organization’s call report or similar financial data can be retrieved from its regulator.

Narrative

QI-8-Regulatory Agencies

Most Recent Three Years Audited Financial Statements

The last three financial audits should be submitted as separate files. Note, the financial statements should be prepared by an independent accounting firm and in accordance with generally accepted accounting principles. Also note that each year should be scanned separately and he notes to the audits for each year and management letters should be included. If appropriate, the statement should show consolidating schedules as an attachment or supplemental information.

If a newer audited financial statement becomes available during the application review period, the Qualified Issuer must notify the CDFI Fund in a timely manner and provide the updated information.

Provide comparable financial statements for third-party Servicers and Program Administrators, if any.

QI-8-YYYYMMDD Audit” where the YYYY is the four-digit year of the statement, the MM is the two-digit month and the DD is the two-digit day. For example: “QI-10-20111231 Audit”

Net Assets, Equity, or Net Capital

If not included in the audited financial statements, provide information on the Applicant’s net assets, equity or net capital, as applicable to the organization, for the most recent three years.

QI-8-Net Assets, Equity or Net Capital

Financing Transactions

Provide sufficient instances of transactions for the most recent three years indicating the Applicant is a financing entity for transactions with a cumulative value of $100 million. Include the type and dollar value of transactions.

Excel

QI-8-Transactions

Item

Description

Format

Naming Convention

QI-8: Financial Strength (Unregulated Organizations Only)

Largest Earned Revenue Sources

The Qualified Issuer should provide a brief discussion of all sources of earned revenue greater than 10 percent of the total earned revenue for each of the past three years. The discussion may be limited to noting interest income but may expand to include a discussion of consulting income sources.

Narrative

QI-8-Narrative

Loan Covenant Compliance Report

A listing of all financial and operating performance covenants with an indication of actual versus prescribed levels. Any violations of covenants should be accompanied by a discussion of remediation actions and waivers if provided.

Excel

QI-8-Covenant Compliance

Off-Balance Sheet Contingencies

A report showing all contingencies including the amount of the contingencies and an estimate of the chances for the contingency resulting in a formal liability.

QI-8-Contingencies

Following Year’s Budget

The approved budget for the next year should be submitted. The budget should contain a comparison of current operations to that budget and any approved modifications to the budget.

Excel

QI-8-Budget_YYYY (where YYYY indicates the four digit year of the next fiscal year)

Item

Description

Format

Naming Convention

QI-9: Systems and Technical Approach

IT Environment documentation

Documentation describing the IT system environment of the Applicant, in relation to program administration, servicing, and monitoring. Include any backup or disaster plans, as well as any written documents relating to information technology policies and procedures. Include comparable documentation for third-party Servicers or Program Administrators, if any.

QI-9-IT Environment

Management activities and documentation retention procedures

Documentation of internal controls as well as procedures for documenting management decisions, and retention of documents relating to loan servicing and administration. Include comparable documentation for third-party Servicers or Program Administrators, if any.

QI-9-Controls and Documentation

Item

Description

Format

Naming Convention

QI-10: Pricing Structure

Guarantee application, Bond Issuance, Servicing, and Program Administration

A table describing the level of effort and pricing related to the all-in costs of submitting a Guarantee application, Bond issuance, servicing, and program administration. The Applicant should represent the Bond Issuance Fees as a percentage (in basis points) of the aggregate principal amount of the Bond Issue and the costs for servicing and program administration in terms of basis point additions to the interest rate of a Bond Issue.

All fees shall be paid for by Eligible CDFIs participating in the Bond Guarantee Program, and in no instance shall program participants have recourse to the CDFI Fund for any debts or liabilities arising from their participation. Although the pricing structure and fees shall be decided by negotiation between market participants, the CDFI Fund will review a potential Qualified Issuer’s pricing structure for soundness with proper implementation of the CDFI Bond Guarantee Program.

Excel

QI-10-Issuance Costs

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Thomas Blackmon |

| File Modified | 0000-00-00 |

| File Created | 2021-01-29 |

© 2026 OMB.report | Privacy Policy