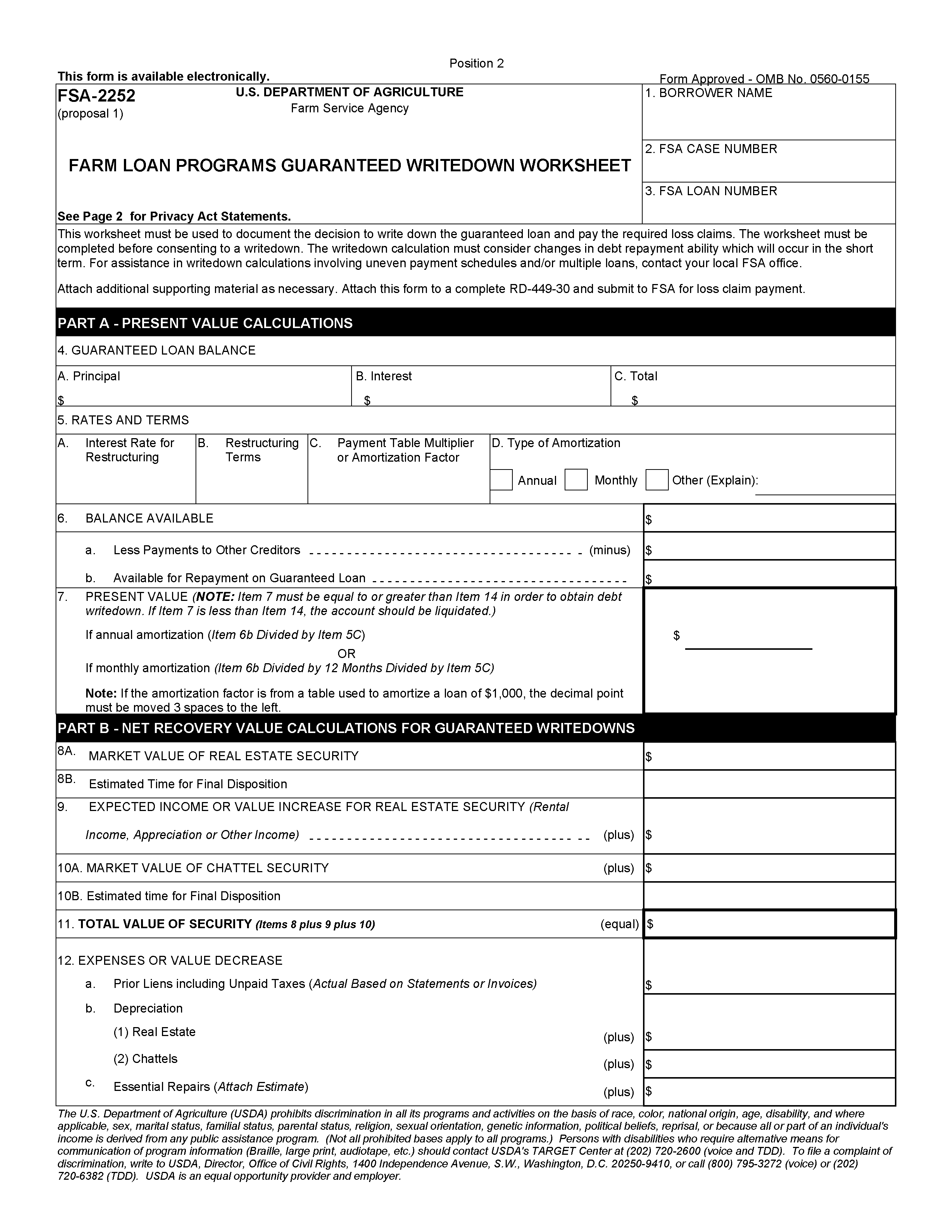

Form FSA-2252 Farm Loan Programs Guaranteed Writedown Worksheet

Guaranteed Farm Loan Programs

FSA2252formandinstruction[1]

Guaranteed Farm Loan Programs

OMB: 0560-0155

FORMS MANUAL INSERT FORM FSA-2252

Used by lenders to document the decision to write down the guaranteed loan(s) and pay the required loss claim(s).

PROCEDURE FOR PREPARATION : FSA handbook 2-FLP.

PREPARED BY : Lender in consultation with FSA.

NUMBER OF COPIES : Preparer.

SIGNATURE REQUIRED : Original and three copies.

DISTRIBUTION OF COPIES : Original copy to FSA servicing office. Copy to the lender and attach a copy to

Form RD-449-30, Guaranteed Loan Report of Loss.

INSTRUCTIONS FOR PREPARATION

Lenders must complete Items 1 through 23.

Items 1-23

Fld Name / |

Instruction |

1 Borrower Name |

Enter the Borrower’s name as shown on the promissory note. |

2 FSA Case Number |

Enter the Borrower’s 15-digit case number. Show the state and county code and the borrower’s social security or Internal Revenue Service Tax Identification Number. Example: 29-037-0987654328 |

3 FSA Loan Number |

Enter the Agency assigned loan number. All guaranteed loan numbers begin with 50. (Example: 50-01, 50-02. The loan number can be obtained from the FSA 1980-41, Guaranteed Loan Status Report). If a borrower has multiple guaranteed loans, complete this form for each loan being considered for write down. |

4A Principal |

Enter the principal balance of the guaranteed loan being considered for write down. |

4B Interest |

Enter the amount of unpaid accrued interest on the guaranteed loan being considered for write down. |

4C Total |

Enter the result of adding Items 4A and 4B. |

5A Interest Rate for Restructuring |

Enter the proposed interest rate for restructuring the loan after write down. |

5B Restructuring Terms |

Enter the proposed term for restructuring the loan after write down. |

5C Payment Table Multiplier or Amortization Factor |

Enter the payment table multiplier or the amortization factor for the loan. If the Lender does not use published amortization tables, enter result of entering $1.00 into Lender’s loan payment calculator. |

5D Type of Amortization |

Check the box that identifies the type of amortization payment schedule show on the promissory note. |

6 Balance Available |

Enter the balance available to pay debt from the plan developed by the Borrower and the Lender. |

6A Less Payments to Other Creditors |

Enter the amount to be paid to other creditors. This amount will be taken from the plan developed by the Borrower and the Lender. |

6B Available for Repayment on Guaranteed Loan |

Enter the result of subtracting Item 6A from Item 6. This is the amount available to pay on the Guaranteed Loan. |

7 Present Value |

If annual amortization was used enter the result of Item 6B divided by Item 5C. If monthly amortization was used enter the result of Item 6B divided by 12 months divided by Item 5C multiplied by 12. (Note: If the amortization factor is from a table used to amortize a loan of $1,000 the decimal point must be moved 3 spaces to the left.)

NOTE: Item 7 must be equal to or greater than Item 14 in order to obtain debt write down. If Item 7 is less than Item 14, the account should be liquidated. |

8A Market Value of Real Estate Security |

Enter the market value of the real estate based on a current appraisal. |

8B Estimated Time For Final Disposition |

Enter the estimated liquidation period in months. |

9 Expected Income or Value Increase For Real Estate Security |

Enter the total income or value increase for the entire holding period. This includes, but not limited to, rent, royalties, projected property appreciation, values gained due to restrictions placed on collateral (such as Conservation Easements, Conservation Reserve Program, etc.) |

10A Market Value of Chattel Security |

Enter the market value of the chattel security based on a current appraisal. |

10B Estimated Time For Final Disposition |

Enter the estimated liquidation period in months. |

11 Total Value of Security |

Enter the result of adding Items 8A, 9, and 10A. |

12a Prior Liens |

Enter the dollar amount of the prior liens including unpaid taxes. Use actual amounts based on statements or invoices. |

12b(1) Real Estate Depreciation |

Enter the dollar amount of depreciation anticipated during the holding period. |

12b(2) Chattel Depreciation |

Enter the dollar amount of depreciation anticipated during the holding period. |

12c Repairs |

Enter the estimated dollar amount of essential repairs needed during the holding period. Attach an itemized estimate. |

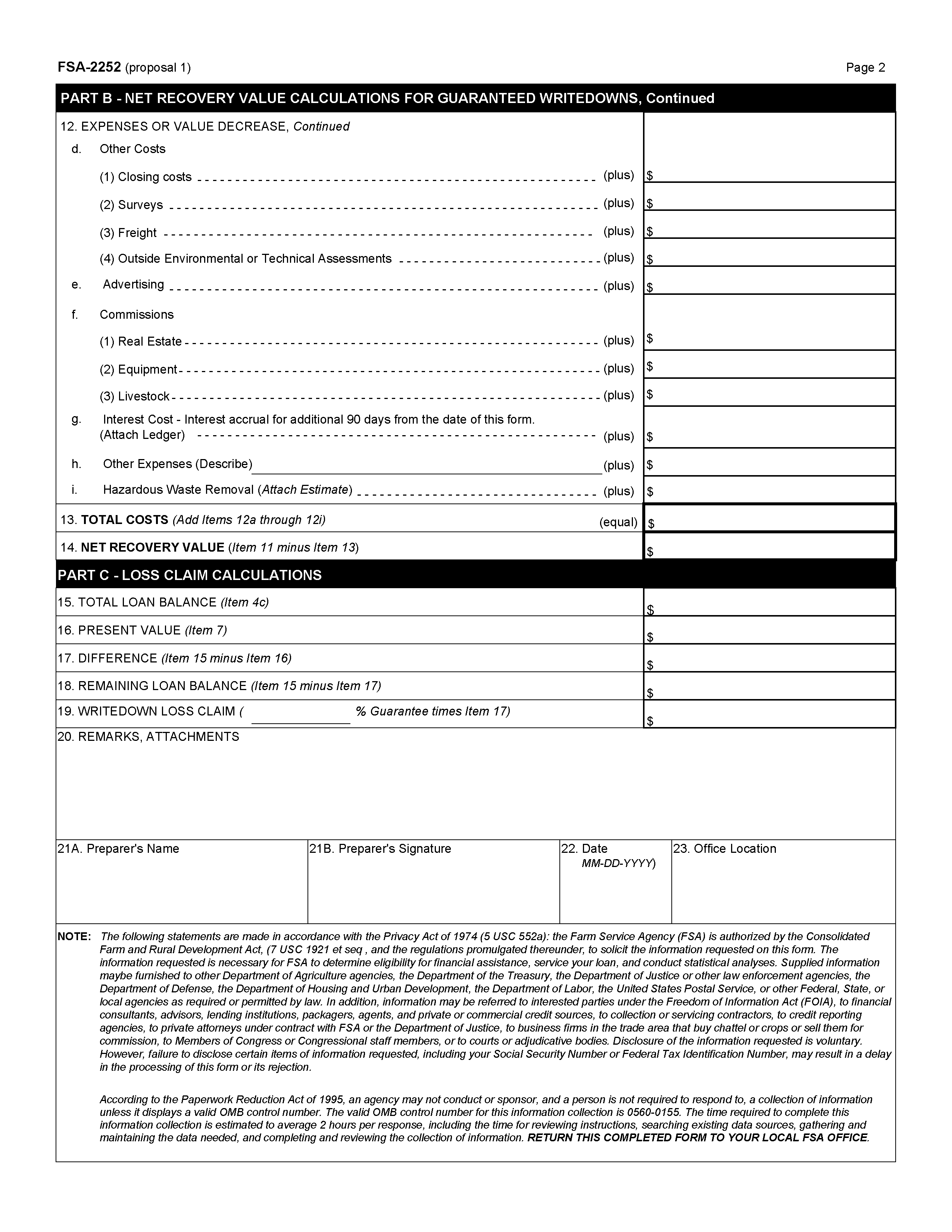

12d(1) Closing Costs |

Enter the estimated dollar amount of closing costs. |

12d(2) Surveys |

Enter the dollar amount of the cost to be incurred for a real estate survey. |

12d(3) Freight |

Enter the estimated dollar amount of freight expenses. (Example: hauling equipment or livestock to an auction) |

12d(4) Outside Environmental or Technical Assessments |

Enter the dollar amount of estimated costs if outside assistance is needed for environmental and technical assessments on the property. |

12e Advertising |

Enter the estimated dollar amount of advertising costs. |

12f(1) Real Estate Commission |

Enter the estimated dollar amount of commission to be paid if the property is to be listed with a broker. |

12f(2) Equipment Commission |

Enter the estimated dollar amount of commission to be paid if the equipment is to be sold at auction. |

12f(3) Livestock Commission |

Enter the estimated dollar amount of commission to be paid if the livestock are to be sold at auction. |

12g Interest Cost |

Enter the dollar amount of interest accrual for additional 90 days from the date of this form. Attach a ledger. |

12h Other Expenses |

Enter the dollar amount of other estimated expenses. Itemize the expenses. |

12i Hazardous Waste Removal |

Enter the dollar amount of anticipated costs for removal of hazardous waste from the property. |

13 Total Costs |

Enter the results of adding Items 12a through 12i. |

14 Net Recovery Value

|

Enter the result of subtracting Item 13 from Item 11. |

15 Total Loan Balance |

Enter the dollar amount from Item 4c. |

16 Present Value |

Enter the dollar amount from Item 7. |

17 Difference |

Enter the result of subtracting Item 16 from Item 15. |

18 Remaining Loan Balance |

Enter the result of subtracting Item 17 from Item 15. |

19 Write Down Loss Claim |

Enter the result of multiplying the percentage of the guarantee by Item 17. (Example: 90% X $1,000) |

20 Remarks or Attachments |

Enter any remarks that may further explain any of the above information. |

21A & 21B Preparer’s Name |

Enter the printed or typed name of the person preparing this form followed by the preparer’s signature. |

22 Date |

Enter the date the form was prepared. |

23 Office Location |

Enter the office location. |

(XX-XX-XX)

FSA PN Issue No. FMI Page

| File Type | application/msword |

| File Title | Used by |

| Author | USDA-MDIOL00000DG8C |

| Last Modified By | Maryann.ball |

| File Modified | 2007-06-07 |

| File Created | 2007-06-07 |

© 2026 OMB.report | Privacy Policy