Notice 89-61

Notice 89-61.rtf

Notice 89-61, Imported Substances; Rules for Filing a Petition

Notice 89-61

OMB: 1545-1117

Page

Notice 89-61; 1989-1 C.B. 717;

1989 IRB LEXIS 225, *; 1989-21 I.R.B. 25

1 of 50 DOCUMENTS

Notice 89-61

Notice 89-61; 1989-1 C.B. 717; 1989 IRB LEXIS 225; 1989-21 I.R.B. 25

January 1989

[*1]

SUBJECT MATTER: Imported Substances; Rules for Filing a Petition

TEXT:

This Notice informs taxpayers of the procedures for filing a petition requesting that a substance be added to or removed from the list of taxable substances in section 4672 (a) (3) ("List") of the Internal Revenue Code ("Code"). These procedures will be adopted by the Internal Revenue Service in regulations implementing an amendment made by section 2001 (b) of the Technical and Miscellaneous Revenue Act of 1988 (Pub. L. 100-647) ("1988 Act") to the tax on certain imported substances under section 4672 of the Code. These procedures will be effective as of May 9, 1989.

I. BACKGROUND

Section 4671 of the Code imposes a tax on the sale or use, after December 31, 1988, by the importer of any taxable substance. The rate of tax for each taxable substance is based upon the rate of tax on the taxable chemicals from which the taxable substance is derived. The amount of tax imposed on a taxable substance is equal to the amount of tax that would have been imposed on the taxable chemicals used as materials in the manufacture of the taxable substance if such substance had been manufactured in the United States.

Section 4672 of the Code provides that a [*2] substance shall be added to the List if the Secretary determines, in consultation with the Administrator of the Environmental Protection Agency and the Commissioner of Customs, that taxable chemicals constitute more than 50 percent of the weight or more than 50 percent of the value of the materials used to produce such substance (determined on the basis of the predominant method of production). The Secretary may remove from the List only substances that meet neither the weight nor the value test. If an importer or exporter of any substance requests that the Secretary determine whether such substance should be added to the List or removed from the List, the Secretary shall make such determination within 180 days after the date the request was filed.

II. DEFINITIONS

A taxable substance is any substance listed in section 4672 (a) (3) of the Code. A taxable chemical is any chemical listed in section 4661 (b) that is not exempted from the chemical tax by section 4662 (b). For purposes of determining whether a manufacturer or importer has "used" a taxable chemical or a taxable substance and thus is subject to the tax imposed on "sale or use," taxable chemicals and taxable substances are used [*3] when they are consumed, when they function as a catalyst, or when they change their characteristics or chemical composition. However, loss or destruction through spillage, fire, or other casualty is not considered a use. For purposes of computing the rate of tax for a taxable substance, the term "conversion factor" means the number of tons of each taxable chemical consumed in the manufacture of one ton of the taxable substance, and the term "percentage" means the percentage in the taxable substance of metal that is listed as a taxable chemical.

The types of taxable substances enumerated in section 4672 (a) (3) of the Code reflect the intent of Congress that only chemicals that are intended for further chemical conversion and certain metals should be subject to the imported substances tax. Thus, petitions to add substances to the List will be entertained only for similar types of chemical derivatives and metals. Accordingly, for synthetic organic chemicals, the term "substance" excludes textile fibers, yarns, and staple, and fabricated products that are molded, formed, woven, or otherwise finished into end-use products. For inorganic chemicals, the term "substance" excludes fabricated [*4] products that are molded, formed, or otherwise finished into end-use products. For metals, the term "substance" includes certain wrought metal and scrap.

For petitions based on value, the term "value" means the average market price during the preceding twelve months of each material in the chemical formula describing the production of the substance.

The importer is the person who enters a taxable substance into the United States for consumption, use, or warehousing. A taxable substance is entered into the United States for consumption, use, or warehousing when an entry summary (Customs Form 7501) is filed with the appropriate customs officer, in proper form, with estimated duties attached. The person entering the taxable substance is the person who files the entry summary. If the person filing the entry summary is filing as an agent for another person (for example, the person filing the entry summary is a Customs broker engaged by the owner), then the principal for whom the agent is acting is deemed to be the person filing the entry summary. The exporter is the person named as shipper or consignor in the export bill of lading. The United States includes the 50 States, the District of [*5] Columbia, the Commonwealth of Puerto Rico, any possession of the United States, the Commonwealth of the Northern Mariana Islands, the Trust Territory of the Pacific Islands, the continental shelf areas (applying the principles of section 638 of the Code), and foreign trade zones.

III. REQUESTS FOR MODIFICATIONS TO THE LIST

An importer or exporter of any substance that is not on the List or an importer or exporter of any taxable substance may request that the List be modified by either adding or removing such substance. Any person other than an importer or exporter may write suggesting modifications to the List, but such person may not petition. Suggestion letters do not require a response, and any action taken on such information is at the discretion of the Secretary.

The request is made by petition to the Commissioner of the Internal Revenue Service. Any substance for which it is claimed that taxable chemicals constitute more than 50 percent of the weight or more than 50 percent of the value of the materials used to produce such substance (determined on the basis of the predominant method of production) may be the subject of a petition. A separate petition must be filed for each substance [*6] for which a claim is being made. A separate petition is required for each molecular form of any substance that can include more than one molecular form.

IV. FILING OF PETITIONS

Petitions must be addressed to the Commissioner of the Internal Revenue Service, Attn: CC:CORP:T:R (Petition), Room 4429, Washington, D.C. 20224.

A petition must be sent by certified mail, return receipt requested. A petition is not considered "filed" until it has been accepted. A petition will be accepted only if it includes all the required information. Each petition will be acknowledged by letter mailed within thirty days of the petition's receipt (as stamped on the return receipt from the Post Office). The acknowledgement letter will either accept the petition, or reject and return it because of insufficient information. If the petition is accepted, its filing date is the date the petition was received. If rejected, the petition may be resubmitted with the additional required information, and the filing date would be the date the resubmitted petition is accepted.

In order to be accepted, the petition must include the following:

The name of the substance, including its physical state and form, that is the subject [*7] of the petition.

The Harmonized Tariff System (HTS) item number as officially classified by the United States Customs Service, the Schedule B item number, and if applicable the Chemical Abstract Service (CAS) number, for the substance.

The names, and HTS and Schedule B numbers, and CAS numbers if applicable, of all the taxable chemicals that constitute the materials used in the production of the substance.

The name of the process that the petitioner is claiming is the predominant method of production for the substance.

The data supporting the petitioner's position that the production process selected as the basis for the petition is the predominant one.

An explanation of the process chosen as the predominant method of production of the substance, emphasizing the overall chemical reaction from the taxable chemicals to the substance.Molecular weight unit quantities

The stoichiometric material consumption formula, assuming a 100-percent yield, based on the predominant method of production, for the substance that shows that taxable chemicals constitute over 50 percent of the molecular weight or over 50 percent of the value of the raw materials used to produce the substance. [*8] Included in the formula must be all materials, taxable chemicals, nontaxable chemicals, solvents and catalysts not recovered or recycled, that are consumed in the process. If the request is to remove a taxable substance from the List, the petitioner must show that the taxable substance meets neither the weight nor the value test.

The unit quantities (UQ) on a weight basis of all materials involved in the production of a unit of substance. Materials recycled in the process would have a UQ based on the amount consumed, lost, purged, or destroyed per unit of substance produced.

In the case of a petition based upon value, the value of the materials multiplied by the unit quantity of each material.

The name, address, taxpayer identification number, and principal place of business of the petitioner; the name and official capacity in such business of the person filling out the petition; any Form 637 registration numbers held by the business or the individuals involved; and the district in which Form 720 is filed, if any. The petition must include an explanation of the petitioner's eligibility (as an importer or exporter of the substance that is the subject of the petition) to file [*9] a petition, including the type of business and how long such business has been conducted.

The statement, signed under penalties of perjury, that the petitioner has examined the petition and to the best of petitioner's knowledge and belief, it is true, correct, and complete.

V. EXAMPLES OF REQUIRED INFORMATION

A. Predominant method of production.

The following are examples, according to industry sources, of information satisfying items (4) and (5) of the petition, relating to the predominant method of production.

(1) Ethylene oxide is generally produced by the direct oxidation of ethylene. Direct oxidation has replaced the chlorohydrin process as the predominant method.

(2) Ethylbenzene is produced by the Friedel-Crafts alkylation between benzene and ethylene. Only 3 percent of the ethylbenzene produced is isolated by superfractionation.

B. Stoichiometric material consumption formula.

The following is an example of a stoichiometric formula.

C. Rate of tax based upon conversion factors.

The following is an example of how to calculate the rate of tax for a substance.

The rate of tax for ethylbenzene, based upon the unit quantity of each chemical consumed in production, is calculated as follows:

The [*10] rate of tax for benzene ($4.87 per ton) is multiplied by the conversion factor for benzene derived from the above equation (0.75) which equals $3.65. The rate of tax for ethylene ($4.87 per ton) is multiplied by the conversion factor for ethylene derived from the above equation (0.28) which equals $1.36. Thus, the rate of tax that would have been imposed on benzene and ethylene used in the United States to produce one ton of ethylbenzene equals $3.65 plus $1.36 or $5.01 per ton. Therefore, the rate of tax for ethylbenzene, based on the predominant method of production, is $5.01 per ton.

D. Unit quantities formula.

The following is an example of how to show, by using unit quantities, that taxable chemicals constitute more than 50 percent of the weight of all the materials used in the production of a unit of substance.

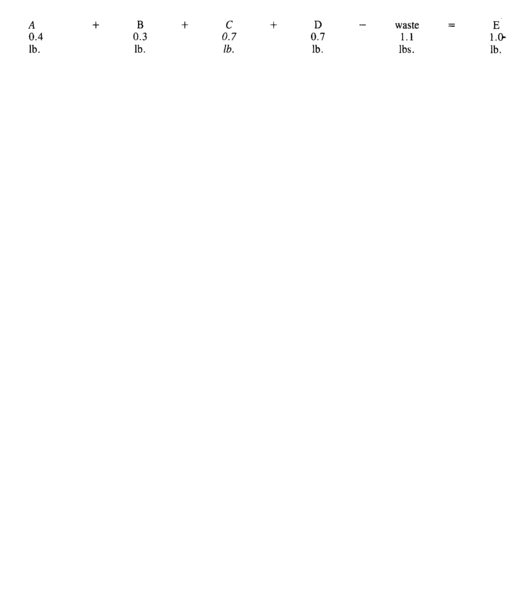

Assume that A, B, C, and D represent the materials used to produce substance E, and that A and C are taxable chemicals.

Thus, 2.1 pounds of materials were consumed to produce 1.0 pound of substance (0.4 + 0.3 + 0.7 + 0.7 = 2.1). Of the 2.1 pounds of materials consumed, 1.1 pounds were taxable chemicals (0.4 + 0.7 = 1.1). The ratio of the amount of taxable chemicals consumed [*11] (1.1) to the total amount of materials consumed (2.1), converted to percent, is the percentage by weight of taxable chemicals in the substance.

1.1/2.1 × 100 = 52%

Therefore, 52 percent of the weight of substance E is comprised of taxable chemicals.

VI. PUBLIC NOTICE, COMMENTS, REQUESTS FOR A PUBLIC HEARING

After a petition has been filed, a "Notice of Filing" summarizing the petition and requesting comments will be published in the Federal Register and in the Internal Revenue Bulletin. The complete petition will be available in the Internal Revenue Service Freedom of Information Reading Room for copying by the public. The Notice of Filing will be based upon the information provided by the petitioner. The Notice of Filing of the petition will include -

the name of the substance that is the subject of the petition;

the HTS and Schedule B number, and CAS number if applicable;

the filing date of the petition;

a brief description of the basis for the petition;

the claimed predominant method of production for the substance;

the stoichiometric material consumption formula for the substance;

the identity of the petitioner; and

the rate of tax for the substance, based upon the conversion [*12] factors derived from the unit quantities formula, that would apply if the determination were made to add the substance to the List.

Before the determination is made, consideration will be given to any written comments that are submitted to the Internal Revenue Service within sixty days of the date that the Notice of Filing is published in the Federal Register. In addition to substantive comments on the petition, the Service requests comments that identify the primary importers or exporters, as appropriate, known to have an adverse interest to the petition, to make it more likely that the principal interested parties will learn of the filing of the petition. All comments will be made available for public inspection and copying. A public hearing will be held upon written request to the Internal Revenue Service by any person that also submits written comments. If a public hearing is scheduled, notice of the time and place will be published in the Federal Register.

VII. DETERMINATIONS

A determination on each petition filed will be made by the Secretary after public notice and an opportunity for comments, and after consultation with the Administrator of the Environmental Protection Agency [*13] and the Commissioner of Customs. A determination will be made within 180 days after the date the petition is filed. The determination period may be extended by agreement between the petitioner and the Commissioner.

When a decision is reached, a "Notice of Determination" will be published in the Federal Register and in the Internal Revenue Bulletin. This Notice will include -

the determination of the Secretary;

the identification of the substance, including HTS and Schedule B number, and CAS number if applicable;

a synopsis of the reasons for the determination, including the technical data on which the determination is based;

a synopsis of the material comments received for and against the petition;

the date of the determination;

the effective date for any modification to the List; and, in the case of substances added to the List,

the identification of the predominant method of production of the substance; and

the rate of tax prescribed by the Secretary for the substance based upon the predominant method of production.

VIII. EFFECTIVE DATE FOR MODIFICATIONS TO THE LIST

The date of the determination by the Secretary is not the date that a substance is added to or removed [*14] from the List. The effective date of any modification to the List will be as follows:

Determinations made between |

Listed as of |

July 1 and September 30 |

January 1 |

October 1 and December 31 |

April 1 |

January 1 and March 31 |

July 1 |

April 1 and June 30 |

October 1 |

As set forth in the above table, determinations made during a quarter will be reflected in the list of taxable substances as of the first day of the second quarter following the quarter in which the determination is made. The listing dates would thus provide at least 90 days' notice to persons that would be liable for tax upon their use or sale of the newly listed substance, and to persons that would no longer be eligible to claim a credit or refund of the tax paid on taxable chemicals used in the manufacture, for export, of substances removed from the List. The dates are chosen to correspond to the calendar quarters on Form 720, Quarterly Federal Excise Tax Return, which is the return filed by excise taxpayers.

IX. ADMINISTRATIVE PRONOUNCEMENT AND DRAFTING INFORMATION

This document serves as an "administrative pronouncement" as that term is described in section 1.6661-3 (b) (2) of the Income Tax Regulations and may be relied upon to the same extent [*15] as a revenue ruling or revenue procedure.

The collection of information contained in this Notice has been reviewed and approved by the Office of Management and Budget in accordance with the requirements of the Paperwork Reduction Act (44 U.S.C. 3507) under control number 1545-1117. The estimated average burden associated with the collection of information in this Notice is one hour per respondent.

These estimates are an approximation of the average time expected to be necessary for a collection of information. They are based on such information as is available to the Internal Revenue Service. Individual respondents/recordkeepers may require greater or less time, depending on their particular circumstances.

Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Internal Revenue Service, Washington, D.C. 20224, Attention: IRS Reports Clearance Officer TR:FP; or to the Office of Management and Budget, Paperwork Reduction Project (1545-1117), Washington, D.C. 20503.

112C3K

********** Print Completed **********

Time of Request: Wednesday, August 14, 2013 13:59:36 EST

Print Number: 1828:422798018

Number of Lines: 253

Number of Pages:

Send To: SHIELDS, GERALD

IRS ADMINISTRATIVE/MANAGEMENT/OTHER

1111 CONSTITUTION AVE NW

WASHINGTON, DC 20224-0002

| File Type | text/rtf |

| Author | Department of Treasury |

| Last Modified By | Department of Treasury |

| File Modified | 2013-08-14 |

| File Created | 2013-08-14 |

© 2026 OMB.report | Privacy Policy