TIFIA_Program Guide_(07.17.2013)

TIFIA_Program Guide_(07.17.2013).docx

TRANSPORTATION INFRASTRUCTURE FINANCING AND INNOVATION ACT (TIFIA)

OMB: 2105-0569

Table of Contents

PROGRAM GUIDE

Inside Cover Contacting the TIFIA Joint Program Office

Chapter 1 Introduction to TIFIA

Chapter 2 Terms and Funding of Credit Instruments

Chapter 3 Eligibility Requirements

Chapter 4 Application Process

Chapter 5 Selection Process

Chapter 6 Transaction Documents and Ongoing Monitoring Requirements

Chapter 7 Special Issues Related to Loan Guarantees

APPENDICES

Chapter 1: Introduction to TIFIA

The Transportation Infrastructure Finance and Innovation Act of 1998 (TIFIA) established a Federal credit program (referenced hereafter as the TIFIA Program or the Program) for eligible transportation projects under which the U.S. Department of Transportation (DOT) may provide three forms of credit assistance – secured (direct) loans, loan guarantees, and standby lines of credit. The Program’s fundamental goal is to leverage Federal funds by attracting substantial private and other non-Federal co-investment to support critical improvements to the nation’s surface transportation system. The DOT awards credit assistance to eligible applicants, which include state departments of transportation, transit operators, special authorities, local governments, and private entities.

This Program guide, written for prospective TIFIA applicants, describes how the DOT administers the TIFIA Program. This chapter introduces the Program’s objectives and provides an overview of how the Program operates. Chapter 2 details the required terms for individual credit instruments and describes how these instruments are funded. Chapter 3 describes the eligibility requirements concerning types of projects, activities, cost limits, and applicants. Chapter 4 describes the process by which potential applicants may apply for TIFIA credit assistance. Chapter 5 describes the review process that the DOT uses to determine who receives credit assistance. Chapter 6 discusses the contractual documents, prerequisites for executing such documents, and the ongoing monitoring requirements. Chapter 7 discusses special issues related to loan guarantees.

Electronic copies of this Program Guide can be found on the TIFIA web site located at http://www.fhwa.dot.gov/ipd/tifia, as can all application materials and additional information regarding the TIFIA Program.

Legislative Reference

The Transportation Infrastructure Finance and Innovation Act of 1998 was enacted as part of the Transportation Equity Act for the 21st Century (TEA 21) (Public Law 105-178, §§1501-04), as amended in 1998 by the TEA 21 Restoration Act (Title IX of Public Law 105-206), further amended in 2005 by the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU) (Public Law 109-59), and most recently, in 2012, by the Moving Ahead for Progress in the 21st Century Act (MAP-21) (Public Law 112-141). The TIFIA statute is codified within sections 601 through 609 of title 23 of the United States Code (23 U.S.C. §§601-609), with supporting regulations appearing in part 80 of title 49 of the Code of Federal Regulations (49 CFR 80). These documents are available on the TIFIA website, which can be found at: http://www.fhwa.dot.gov/ipd/tifia/legislation_regulations/index.htm.

Policy Considerations

The public policy underlying the TIFIA Program asserts that the Federal Government can perform a constructive role in supplementing, but not supplanting, existing markets for financing large transportation infrastructure projects. Section 1502 of TEA 21 states that “a Federal credit program for projects of national significance can complement existing funding resources by filling market gaps, thereby leveraging substantial private co-investment.” Because the TIFIA Program offers credit assistance, rather than grant funding, its potential users are infrastructure projects capable of pledging revenue streams generated through user charges or other dedicated funding sources.

Identifying a constructive role for Federal credit assistance begins with the acknowledgement that, when compared to most investors, the Federal Government has a naturally longer-term investment horizon, which enables it to more readily absorb the relatively short-term risks of project financings. Absent typical capital market investor concerns regarding timing of payments and financial liquidity, the Federal Government can become the “patient investor” whose long-term view of asset returns enables the project’s non-Federal financial partners to meet their investment goals, allowing the borrower to receive a more favorable financing package.

Funding Levels

The TIFIA Program is governed by the Federal Credit Reform Act of 1990, which requires the DOT to establish a capital reserve, or “subsidy amount,” sufficient to cover the estimated long-term cost to the Federal Government of a Federal credit instrument, including any expected credit losses, before the DOT can provide TIFIA credit assistance.1 Pursuant to MAP–21, the DOT announced availability of funding authorized in the amount of $1.75 billion ($750 million in Federal Fiscal Year (FY) 2013 funds and $1 billion in FY 2014 funds (and any funds that may be available from prior fiscal years)) to provide TIFIA credit assistance for eligible projects.2 The FY 2013 and FY 2014 funds are subject to an annual obligation limitation that may be established in appropriations law, as well as annual reobligation requirements, as further discussed in Section 2-5. Historically, each dollar budgeted relates to $10 in credit assistance. As a result, these funding levels could translate to potentially $17 billion in TIFIA credit assistance.

Program Administration

Implementation of the TIFIA Program is the responsibility of the Secretary of Transportation (the Secretary). A 13-member DOT Credit Council provides policy direction and makes recommendations to the Secretary regarding the selection of projects for credit assistance. The DOT Credit Council members include six representatives from the Office of the Secretary of Transportation (OST): the Deputy Secretary of Transportation (Chair), the Assistant Secretary for Budget and Programs (Vice-Chair), the Under Secretary of Transportation for Policy, the General Counsel, the Assistant Secretary for Transportation Policy, and the Director of the Office of Small and Disadvantaged Business Utilization. The Administrators of the Federal Highway Administration (FHWA), the Federal Transit Administration (FTA), the Federal Railroad Administration (FRA), and the Maritime Administration (MARAD) also sit on the DOT Credit Council. Additionally, at-large members to the DOT Credit Council (DOT employees designated by the Secretary) comprise the other three members.

The Office of the Assistant Secretary for Budget and Programs and Chief Financial Officer oversees the TIFIA Program and the TIFIA Joint Program Office (JPO) on behalf of the Secretary, including the evaluation of individual projects, and provides overall policy direction and program decisions for the TIFIA Program. Final approval of TIFIA credit assistance is reserved for the Secretary.

Implementation Process

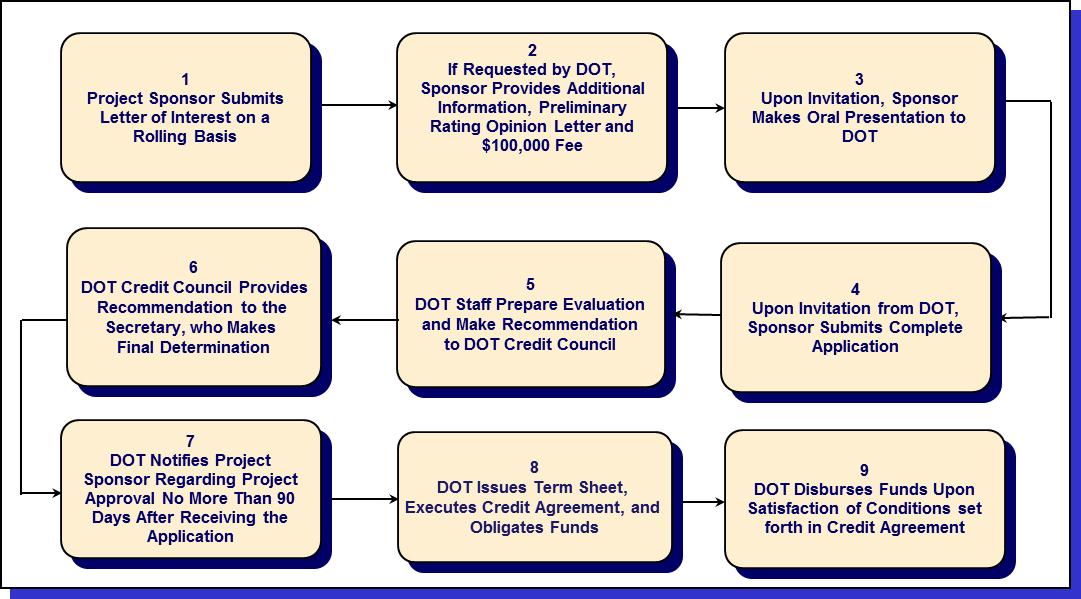

All TIFIA credit assistance will be awarded based on a project’s merits and its satisfaction of TIFIA statutory eligibility requirements. On July 31, 2012, the DOT issued a Notice of Funding Availability (NOFA), which announced the availability of funding and the revised TIFIA application process under MAP-21. The application process includes the following steps, detailed further in this Program Guide:

Letter of Interest. Each potential applicant must submit a detailed Letter of Interest using the form provided on the TIFIA web site, which can be found at: http://www.fhwa.dot.gov/ipd/tifia/guidance_applications/tifia_applications.htm, when the project is ready to proceed.3 The Letter of Interest form has been expanded to allow potential applicants to describe the project (including location, purpose, and cost), demonstrate the project sponsor’s ability to meet the requirements related to satisfying the project fundamentals, detail how the TIFIA statutory eligibility requirements are met, and outline the proposed financial plan, including the requested TIFIA credit assistance.4 Potential applicants should submit this form electronically via email at [email protected]. The DOT will review this submission to determine whether the project meets the requirements for TIFIA participation and will contact the potential applicant subsequently to review the project’s eligibility and readiness to apply for program assistance. The initial eligibility review of a Letter of Interest is intended to identify any major statutory, regulatory, financing or timing issues that would prevent the project from receiving TIFIA credit assistance.

Creditworthiness Review. After concluding its initial review of the Letter of Interest and upon making a determination that the project is reasonably likely to satisfy all of the eligibility requirements of the TIFIA Program, the DOT will conduct an in-depth creditworthiness review of the project sponsor and the proposed revenue stream. The creditworthiness review involves evaluation of the plan of finance, financial model, and feasibility of the anticipated pledged revenue. In connection with this review, the DOT will ask project sponsors to provide any additional materials necessary to facilitate its review of the project’s creditworthiness. Once the DOT has concluded that the project satisfies statutory eligibility criteria, including a preliminary review of a project’s creditworthiness and satisfaction of readiness requirements,5 the DOT will ask a project sponsor to provide a preliminary rating opinion letter from at least one nationally recognized statistical rating organization (NRSRO or Credit Rating Agency)6 and submit $100,000 to the DOT to reimburse it for the costs incurred for services provided by its outside financial and legal advisors in connection with the review of the TIFIA Letter of Interest and application and the negotiation of the TIFIA transaction documents.

Following completion of the DOT’s in-depth review of the Letter of Interest and receipt of a preliminary rating opinion letter and the $100,000, the DOT will request that the potential applicant gives an oral presentation on the project and its plan of finance to the DOT, followed by a question and answer session. The DOT will provide guidance regarding the structure and content of the presentation at the time of the request.

Application. Once both the preliminary rating opinion letter and the $100,000 have been received, the project sponsor has made its oral presentation to the DOT, and the DOT has determined that the project satisfies all statutory eligibility requirements, including a full review of the creditworthiness of the project, the project sponsor will then be invited to submit a complete application with all required materials. The DOT will not review incomplete applications or applications for projects that do not satisfy TIFIA requirements.

No later than 30 days after the date of receipt of the application by the TIFIA Program, the DOT shall notify the applicant in writing that the application is complete or requires additional information or materials to complete the application.7

Please note that an invitation by the DOT to submit an application does not guarantee that a project will receive TIFIA credit assistance, which remains subject to a project’s continued eligibility.

3. Project Recommendation. Based upon the written application, the oral presentation, and any supplemental information submitted by an applicant, DOT staff will prepare a project evaluation and recommendation for the DOT Credit Council.

4. Project Selection. The DOT Credit Council, in turn, provides a recommendation to the Secretary, who makes the final determination regarding project selection. The DOT will not obligate funds for a project that does not satisfy statutory requirements such as obtaining environmental clearances.

5. Project Approval. The DOT will notify the project sponsor regarding project approval or disapproval no more than 60 days notifying the project sponsor that its application was complete.8

6. Term Sheet Issuance, Credit Agreement Execution, and Funding Obligation and Disbursement. For each approved project, the DOT will issue two documents; a term sheet, which sets forth the basic terms and conditions of TIFIA credit assistance, and a credit agreement, which is the definitive agreement between the DOT and the borrower and specifies all the terms and conditions of the TIFIA credit assistance and authorizes disbursement of funds. Prior to execution of the credit agreement, the borrower must satisfy all Program requirements – including receipt of two investment grade ratings on the project’s debt obligations senior to TIFIA and two ratings on the TIFIA credit instrument itself.9 For all credit assistance, the DOT will disburse funds only to reimburse eligible project costs.10

Exhibit 1-A shows each of these seven steps as a flow chart.

Exhibit 1-A: Selection and Funding of TIFIA Projects

Chapter 2: Terms and Funding of Credit Instruments

The TIFIA Program’s secured (direct) loans, loan guarantees, and standby lines of credit may offer more flexible repayment terms and more favorable interest rates compared to other lenders. This chapter summarizes the terms that apply generally to TIFIA credit assistance and describes the major features of each credit instrument. A section on loan repayment and prepayment structuring provides information on financing structures and related repayment issues that may arise during negotiations. The chapter also provides an explanation of the funding controls that govern the amount of credit assistance available under the TIFIA Program.

Section 2-1

Summary of Basic Terms for TIFIA Credit Assistance

Certain features of TIFIA credit assistance are the same regardless of whether the credit instrument is a secured loan, loan guarantee, or line of credit. For example, the maximum maturity of all TIFIA credit instruments is the lesser of: (i) 35 years after a project’s substantial completion or (ii) the useful life of the project being financed by TIFIA.11 The DOT, at its discretion, has the ability to defer the first TIFIA payment up to five years after substantial completion, depending on the needs of the project.12 Exhibit 2-A provides an illustrative TIFIA repayment structure for any of the three credit instruments.

E

xhibit

2-A: Illustrative TIFIA Repayment Structure as Permitted by Statute

The TIFIA credit instrument can be junior (i.e., subordinate) to the project’s other debt obligations in the priority of its lien on the project’s cash flow. However, in the event of bankruptcy, insolvency, or liquidation, the DOT is required by statute to have a parity lien with respect to the project’s senior creditors.13 The credit agreement will clearly specify the DOT’s interest in the pledged security relative to other creditors.14

The TIFIA statute places two other important limits on the Federal Government’s exposure to credit risk. First, TIFIA credit assistance is limited to no more than 49 percent of reasonably anticipated eligible project costs for a TIFIA secured loan or loan guarantee and no more than 33 percent of reasonably anticipated eligible project costs for a TIFIA standby line of credit.15 This is designed to ensure that the DOT shares the credit risk with other participants. Second, the applicant must obtain two investment-grade ratings (Baa3/BBB- or higher) on the senior debt obligations and two ratings on the TIFIA credit instrument, both from a Credit Rating Agency, in order to execute a TIFIA credit agreement.16 If TIFIA is the senior and/or the only debt in the project, then it must receive two investment grade ratings.17 If the total amount of debt in the project is less than $75 million, then the applicant must obtain only one investment-grade rating on the senior obligations and one rating on the TIFIA credit instrument from a Credit Rating Agency.18 Chapter 3 provides further details on eligible project costs and credit ratings.

Section 2-2

TIFIA Credit Instruments

The main features of TIFIA secured loans, loan guarantees, and lines of credit are summarized below. These features are established by statute. This section also addresses the rules that govern the setting of interest rates, disbursement of funds, and repayment of the TIFIA debt.

Secured Loans (23 U.S.C. §603)

A TIFIA secured loan is a debt obligation involving the DOT as the lender and a non-Federal entity as the borrower. Actual terms and conditions will be negotiated between the DOT and the borrower, but the general characteristics include:

Use of Proceeds. The proceeds of a secured loan must be used either to finance eligible project costs or to refinance (i) interim construction financing of eligible project costs; (ii) existing Federal credit instruments for rural infrastructure projects; or (iii) long-term project obligations or Federal credit instruments if the refinancing provides additional funding capacity for the completion, enhancement, or expansion of an eligible project.19 In the case of refinancing interim construction financing, the DOT loan may refinance existing debt no later than one year following substantial completion of the project.20

Amount. The principal amount of a secured loan (in combination with other TIFIA credit assistance, if any) may not exceed 49 percent of the reasonably anticipated eligible project costs.21 To date, TIFIA secured loans have only covered up to 33 percent of reasonably anticipated eligible project costs and applicants requesting assistance in excess of this amount must provide a rationale for such additional assistance. If the project is supported by debt senior to the TIFIA lien, the TIFIA credit instrument must be secured by the same revenues pledged to the senior debt. If the TIFIA secured loan is rated below investment grade, then the amount of the TIFIA loan may not exceed the amount of the senior debt.22

Interest Rate. The interest rate on a secured loan will be equal to or greater than the yield on U.S. Treasury securities of comparable maturity on the date of execution of the credit agreement.23 The DOT identifies the Treasury rates through use of the daily rate tables published by the Bureau of the Public Debt for the State and Local Government Series (SLGS) investments. Adding one basis point to the SLGS rates produces the estimated average yields on comparable Treasury securities. The SLGS tables can be found on-line at https://www.treasurydirect.gov/GA-SL/SLGS/selectSLGSDate.htm. The daily TIFIA interest rate can be found on the TIFIA web site at http://www.fhwa.dot.gov/ipd/tifia. Interest begins to accrue on TIFIA proceeds immediately upon disbursement of funds to the borrower.

MAP-21 allows for secured loans to be provided to rural infrastructure projects at a discounted interest rate of one-half of the Treasury Rate.24 The reduced interest rate applies only to secured loans at the discounted interest rate for rural infrastructure projects the subsidy cost of which is funded out of amounts set aside from the TIFIA Program’s annual budget authority specifically for such reduced interest rate secured loans.25 MAP-21 allows the TIFIA Program to set aside up to 10 percent of its annual budget authority to fund the subsidy costs of secured loans to rural infrastructure projects at the reduced interest rate.26 In reviewing Letters of Interest for rural infrastructure projects, the DOT may prioritize rural infrastructure projects to receive the reduced rate based on the project’s (i) location outside of an urbanized area (as defined in Section 101(a)(34) of title 23), (ii) alignment with MAP-21’s reduced total minimum eligible project cost requirement of $25 million for rural infrastructure projects, and (iii) readiness to proceed. MAP-21 requires that any amounts set aside in a fiscal year to fund the subsidy cost of secured loans to rural infrastructure projects at the reduced interest rate that have not been obligated by June 1 of such fiscal year must be made available to fund projects not receiving the reduced interest rate to the extent sufficient funds are not otherwise available.27

In addition, MAP-21 allows project sponsors to buydown the interest rate on a secured loan in the event the rate has increased between the date on which the project sponsor submitted its complete application and the date on which the secured loan is executed.28 Project sponsors can reduce the interest rate by way of a limited buydown up to 1 1/2 percentage points (150 basis points) or the amount of the increase in the interest rate, whichever is less.

Timing of Disbursements. The DOT will disburse funds as often as monthly, on a reimbursement basis, as costs are incurred for eligible project purposes.29 The credit agreement will specify a draw schedule, which may be amended if necessary.

Maturity. The final maturity date of a secured loan must be no later than 35 years after the date of substantial completion of the project or the useful life of the project, whichever is less.30

Repayment Terms. Scheduled repayments must commence no later than five years after the date of substantial completion of the project.31 Debt service will be structured based on project economics and risk to the DOT.32 Debt service payments are scheduled semi-annually.

Deferrals. In the event revenues are insufficient to meet scheduled TIFIA loan payments, the DOT, in its sole discretion, may allow payment deferrals. Any such deferrals shall be contingent on the project’s meeting requirements established by the Secretary, including standards for reasonable assurance of repayment. There can be no assurance the Secretary will exercise this authority, however, so borrowers should only agree to a debt service schedule they are confident they can meet.33

Prepayment Conditions. In general, a secured loan may be prepaid in whole or in part at any time without penalty.34

Lien Priority. The TIFIA lien on pledged revenues can be subordinated to those of senior lenders to the project except in the event of bankruptcy, insolvency, or liquidation of the obligor. In such an instance, the TIFIA lien would be on par with the lien of the project’s senior creditors35. This provision will be implemented by way of incorporation into the TIFIA credit agreement and any other appropriate financing agreements entered into at the time of execution of the TIFIA credit agreement. As noted in Section 2-1 above, this provision can be waived under certain circumstances for public agency borrowers having senior bonds under preexisting indentures so long as certain conditions are met.36

Loan Guarantees (23 U.S.C. §603(e))

A TIFIA loan guarantee is a pledge by the DOT to pay a third-party lender all or part of the debt service on a borrower’s debt obligation. The DOT will seek to recover from the borrower all funds paid to the guaranteed lender, pursuant to a reimbursement agreement executed simultaneously with the loan guarantee.

By statute (23 U.S.C. §601(a)(5)), the guaranteed lender must be a “non-Federal qualified institutional buyer” as defined in 17 CFR §230.144A(a), including qualified retirement plans and governmental plans. Prospective applicants and lenders should contact the DOT with any questions about what constitutes a “non-Federal qualified institutional buyer.”

The DOT may give preference to applications for loan guarantees rather than other forms of credit assistance.37 This preference is consistent with Federal policy that, when Federal credit assistance is necessary to meet a Federal objective, loan guarantees should be favored over direct loans, unless attaining the Federal objective requires a subsidy deeper than can be provided by a loan guarantee. Applicants requesting only a direct loan and/or a line of credit are required to specify in their application how the plan of finance for the project would be impacted if TIFIA credit assistance was instead provided in the form of a loan guarantee.

Characteristics of a guaranteed loan include:

Use of Proceeds. The proceeds of a guaranteed loan must be used either to finance eligible project costs or to refinance (i) interim construction financing of eligible project costs; (ii) existing Federal credit instruments for rural infrastructure projects; or (iii) long-term project obligations or Federal credit instruments if the refinancing provides additional funding capacity for the completion, enhancement, or expansion of an eligible project.38 In the case of refinancing interim construction financing, the DOT loan may refinance existing debt no later than one year following substantial completion of the project.39

Amount. The principal amount of a DOT loan guarantee, in combination with any other TIFIA credit assistance, may not exceed 49 percent of the reasonably anticipated eligible project costs.40 To date, TIFIA credit assistance has only covered up to 33 percent of reasonably anticipated eligible project costs and applicants requesting assistance in excess of this amount must provide a rationale for such additional assistance.

Interest Rate. The interest rate on a guaranteed loan will be negotiated between the guaranteed lender and the borrower, subject to consent from the DOT.41 Interest payments on a guaranteed loan are subject to Federal income taxation.

Maturity. The final maturity date of the guaranteed loan must be no later than 35 years after the date of substantial completion of the project or the useful life of the project, whichever is less.42

Repayment Terms. Scheduled repayments to the guaranteed lender must commence no later than five years after the date of substantial completion of the project.43 Level debt service may not be required for project financings where the pledged revenues are projected to increase over time.44

Deferrals. In the event that revenues are insufficient to meet scheduled loan payments, the DOT may, in its sole discretion, consent to payment deferrals and a rescheduling of the guaranteed debt service. Approval of any such payment deferrals shall be contingent on the project’s meeting requirements established by the Secretary, including standards for reasonable assurance of repayment. There can be no assurance the Secretary will exercise this authority, however, so borrowers should negotiate a debt service schedule they are confident they can meet.45

Prepayment Conditions. The prepayment features on a guaranteed loan will be negotiated between the guaranteed lender and the borrower, subject to the consent of the DOT.46

Default Feature. In the event of an uncured borrower payment default, the guaranteed lender will receive payment from the DOT for the guaranteed payment due.47 The DOT will seek recovery from the borrower of all funds advanced, pursuant to a reimbursement agreement executed simultaneously with the loan guarantee.

Lien Priority. The TIFIA lien on pledged revenues can be subordinated to those of senior lenders to the project except in the event of bankruptcy, insolvency, or liquidation of the obligor. In such an instance, the TIFIA lien would be on par with the lien of the project’s senior creditors.48 This provision will be implemented by way of incorporation into the TIFIA loan guarantee agreement and any other appropriate financing agreements entered into at the time of execution of the TIFIA loan guarantee agreement. As noted above, this provision can be waived under certain circumstances for public agency borrowers having senior bonds under preexisting indentures so long as certain conditions are met.49 In the event of a draw on the DOT guarantee, the guaranteed lender remains in a senior position if not repaid in full by the DOT, and the DOT loan for the amount of all such draws becomes a junior lien.

Lines of Credit (23 U.S.C. §604)

A TIFIA line of credit provides a contingent loan that may be drawn upon after substantial completion of the project to supplement project revenues during the first 10 years of the project’s operations.50 The DOT will disburse funds only under certain conditions, which will be specified in the TIFIA credit agreement.51

Characteristics of a line of credit include:

Use of Proceeds. The proceeds from a draw on a line of credit may be used only to pay debt service on project obligations (other than a TIFIA credit instrument) issued to finance eligible project costs, extraordinary repair and replacement costs, operation and maintenance expenses, and/or costs associated with Federal or state environmental restrictions arising after the transaction closed.52

Amount. The total principal amount of a line of credit may not exceed 33 percent of the reasonably anticipated eligible project costs.53 The total combined TIFIA credit assistance for a project receiving a TIFIA line of credit plus a secured loan or loan guarantee may not exceed 49 percent of eligible project costs.54

Condition Precedent for Draws. A draw may be made only if revenues from the project are insufficient to pay the costs enumerated above in “Use of Proceeds.” Reserve funds need not be tapped prior to a TIFIA draw.55

Availability. A line of credit may be available for a period of 10 years following substantial completion of the project.56

Interest Rate. The interest rate on a direct loan resulting from a draw on a line of credit will be equal to or greater than the yield on a 30-year U.S. Treasury security on the date of the execution of the line of credit agreement.57 The DOT identifies the Treasury rates through use of the daily rate tables published by the Bureau of the Public Debt for the State and Local Government Series investments. Adding one basis point to the SLGS rates produces the estimated average yields on comparable Treasury securities. The SLGS tables can be found on-line at The SLGS tables can be found on-line at https://www.treasurydirect.gov/GA-SL/SLGS/selectSLGSDate.htm. The daily TIFIA interest rate can be found on the TIFIA web site at http://www.fhwa.dot.gov/ipd/tifia. Interest accrual on TIFIA proceeds begins immediately upon disbursement of funds to the borrower.

Maturity. The final maturity date of a direct loan resulting from a draw on a line of credit must be no later than 35 years after the date of substantial completion of the project or the useful life of the project, whichever is less.58

Repayment Terms. Scheduled repayments of a draw on a line of credit must commence no later than five years after the end of the 10-year period of availability and be fully repaid no later than 25 years after the end of the 10-year period of availability.59 Level debt service is not required.60 Debt service payments should be scheduled semi-annually.

Prepayment Conditions. A direct loan resulting from a draw on a line of credit may be prepaid in whole or in part at any time without penalty.

Lien Priority. The TIFIA lien on pledged revenues can be subordinated to those of senior lenders to the project except in the event of bankruptcy, insolvency, or liquidation of the obligor. In such an instance, the TIFIA lien would be on par with the lien of the project’s senior creditors.61 This provision will be implemented by way of incorporation into the TIFIA credit agreement and any other appropriate financing agreements entered into at the time of execution of the TIFIA credit agreement. As noted above, this provision can be waived under certain circumstances for public agency borrowers having senior bonds under preexisting indentures so long as certain conditions are met.62

Section 2-3

TIFIA Loan Repayment and Prepayment Structuring

The TIFIA statute gives the DOT discretion to defer the commencement of debt service repayments for up to five years after substantial completion.63 The DOT also has the flexibility to structure a debt service schedule so that repayment is aligned with projected cash flows.64

1. Scheduled TIFIA Debt Service. Projects are not entitled to debt service deferral. In exercising its discretion to defer the commencement of debt service repayments, the DOT will evaluate the economics and risks to the DOT of each project on a project-by-project basis to determine an appropriate repayment schedule.65 Factors in this assessment include:

Availability of revenues for debt service. Some projects are not true “project financings,” but rely on tax or other non-project revenues, which may be available for debt service even before the project is completed. In such cases, the DOT is likely to require commencement of debt service upon substantial completion, although the DOT may require commencement of debt service during construction for a project not financed with user revenues. Projects more likely to be favorably considered for interest deferral and backloading of principal are those where project revenues support the financing and borrowers anticipate a long ramp-up period.

Amortization of senior debt. When the financial plan includes other project debt senior to TIFIA, the DOT expects that the capitalized interest period for the project’s senior debt is likely to end before the capitalized interest period for the TIFIA loan. Thus, the DOT may agree to continue deferring an appropriate amount of its loan interest to ensure that revenue is adequate to pay full interest on the senior debt. However, the DOT will not increase its investment in a project by deferring interest when other creditors are withdrawing their investment. Therefore, the DOT’s policy is not to permit any amortization of a project’s senior debt while TIFIA interest is being deferred.

Returns on equity. The DOT requires equity investors, who will be subordinate to TIFIA, to defer commencement of their return. The DOT will not permit any distribution to equity until all currently accruing TIFIA interest is paid. The DOT will negotiate, on a project-by-project basis, the priority and relationship of TIFIA repayment and equity distributions.

2. Prepayment and Refinancing. Although TIFIA provides long-term financing, the DOT does not intend that TIFIA become part of a project’s permanent capital structure where a strong revenue stream and vigorous project economics permit prepayment or substitution of the TIFIA credit instrument. The DOT will negotiate a debt service schedule that provides a high probability of repayment and avoidance of default. In return, the DOT typically requires that excess revenues – not needed for project purposes – be applied to prepayment of the TIFIA loan. The DOT also will seek to structure the financing in a way that encourages borrowers to replace the TIFIA loan with capital markets debt at such time as project economics support refinancing.

Exhibit 2-B shows a typical flow of funds for a project that includes both senior and subordinate TIFIA debt. The chart demonstrates how senior debt service (as well as reserve accounts for the benefit of senior bondholders) generally accumulates revenues ahead of TIFIA debt service and reserve accounts for TIFIA debt service, if applicable.

Exhibit 2-B: Example of Project Flow of Funds

Section 2-4

TIFIA Taxation Issues

With regard to the TIFIA Program, the TEA 21 Conference Report states:

“The Conference recognizes that the Congress enacted the Deficit Reduction Act of 1984 provision prohibiting the combination of Federal guarantees with tax-exempt debt, because of concerns that such a double-subsidy could result in the creation of a ‘AAA’ rated security superior to U.S. Treasury obligations. Accordingly, any project loan backed by a loan guarantee as provided in TIFIA must be issued on a taxable basis….

“...The Conferees are aware that present Federal income tax law prohibits the use of direct or indirect Federal guarantees in combination with tax-exempt debt (section 149(b) of the Internal Revenue Code of 1986). The TIFIA provisions of the conference agreement do not override or otherwise modify this provision of the Code.”

The DOT urges all applicants, and particularly those intending to use tax-exempt bonds in connection with TIFIA loans or lines of credit, to consult with the Internal Revenue Service, the U.S. Department of the Treasury, and/or their bond counsel.

Section 2-5

TIFIA Program Funding

The TIFIA Program is governed by the Federal Credit Reform Act of 1990 (FCRA), which requires the DOT to establish a capital reserve, or “subsidy amount,” to cover expected credit losses before it can provide TIFIA credit assistance.66 Congress places limits on the annual subsidy amount available.

MAP-21 authorizes $750 million in FY 2013 and $1 billion in FY 2014 in TIFIA budget authority from the Highway Trust Fund to pay the subsidy cost of TIFIA credit assistance.67 Additional funds may also be available from budget authority carried over from previous fiscal years. Any budget authority not obligated in the fiscal year for which it is authorized remains available for obligation in subsequent years.68 However, if the cumulative unobligated and uncommitted balance of funding available as of April 1 of any fiscal year, beginning in FY 2014, is more than 75 percent of the amount made available for such fiscal year, then the Secretary must distribute the amount in excess of 75 percent of such amount among the States.69

The TIFIA budget authority is subject to an annual obligation limitation that may be established in appropriations law. Like all funds subject to the annual Federal-aid obligation ceiling, the amount of TIFIA budget authority available in a given year may be less than the amount authorized for that fiscal year.

After reductions for administrative expenses and application of the annual obligation limitation, TIFIA will have approximately $690 million available in FY 2013 and $920 million in FY 2014 to provide credit subsidy support to projects. Although dependent on the individual risk profile of each credit instrument, collectively, and based on historic subsidy costs, this budget authority could support approximately $6.9 billion in lending capacity in FY 2013 and $9.2 billion in lending capacity in FY 2014. Given statutory changes in the TIFIA Program under MAP-21 and the need to calculate credit subsidies on a project-by-project basis, actual TIFIA lending capacity could vary.

The amount of TIFIA budget authority available in a given year is subject to several factors, as described below.

Federal-aid Highway Obligation Limitation. This obligation limitation pertains to most of the programs funded from the Federal Highway Trust Fund (including the TIFIA Program) and is determined through the appropriations process each year. As with appropriations processes for other Federal programs, this limitation typically reduces the total funds available for obligation in the year ahead. A typical limitation reduces obligation authority between 10 percent and 15 percent.

Program Administration Expenses. The TIFIA statute authorizes the DOT to use up to 0.5 percent of authorized budget authority for each fiscal year to administer the TIFIA Program.70 In addition, the statute authorizes the DOT to collect and spend fees to cover expenses related to reviewing, negotiating, monitoring and servicing credit agreements.71

Carry-over Resources. Any budget authority made available but not obligated in previous fiscal years may carry over and increase the amount of budget authority available in a given fiscal year.72

Chapter 3: Eligibility Requirements

The TIFIA statute sets forth several prerequisites for an award of credit assistance. This chapter describes the types of projects, costs, applicants, regulatory, and statutory requirements upon which TIFIA credit assistance is conditioned.

Section 3-1

Eligible Projects and Costs

Highway, transit, passenger rail, certain freight facilities, certain port projects, and rural infrastructure projects may receive credit assistance through the TIFIA Program.

Eligible highway facilities include interstates, state highways, bridges, toll roads, international bridges or tunnels, and any other type of facility eligible for grant assistance under title 23, the highways title of the U.S. Code (23 U.S.C.).73 This also includes a category specifically permitted under the TIFIA statute, i.e., a project for an international bridge or tunnel for which an international entity authorized under Federal or State law is responsible.74

Eligible transit projects include the design and construction of stations, track, and other transit-related infrastructure, purchase of transit vehicles, and any other type of project that is eligible for grant assistance under the transit title of the U.S. Code (chapter 53 of 49 U.S.C.).75 Additionally, intercity bus vehicles and facilities are eligible to receive TIFIA credit assistance.76

Rail projects involving the design and construction of intercity passenger rail facilities or the procurement of intercity passenger rail vehicles are eligible for TIFIA credit assistance.77

Public freight rail facilities, private facilities providing public benefit for highway users by way of direct freight interchange between highway and rail carriers, intermodal freight transfer facilities, projects that provide access to such facilities, and service improvements (including capital investments for intelligent transportation systems) at such facilities, are also eligible for TIFIA credit assistance.78 In addition, a logical series of such projects with the common objective of improving the flow of goods can be combined.79

Projects located within the boundary of a port terminal are also eligible to receive TIFIA credit assistance, so long as the project is limited to only such surface transportation infrastructure modifications as are necessary to facilitate direct intermodal interchange, transfer, and access into and out of the port.80

MAP-21 expands eligibility to encourage rural infrastructure projects. As much as 10 percent of the TIFIA Program’s budget authority can be set aside to fund the subsidy cost of secured loans for rural infrastructure projects at a reduced interest rate of one-half of the Treasury Rate.81 Rural infrastructure projects are defined as surface transportation infrastructure projects located in any area other than a city with a population of more than 250,000 inhabitants within the city limits.82 In reviewing Letters of Interest for rural infrastructure projects, the DOT may prioritize rural infrastructure projects to receive the reduced rate based on the project’s (i) location outside of an urbanized area (as defined in Section 101(a)(34)), (ii) alignment with MAP-21’s reduced total minimum eligible project cost requirement of $25 million for rural infrastructure projects, and (iii) readiness to proceed.

Additionally, MAP-21 expands eligibility to include related transportation improvement projects grouped together in order to reach the minimum cost threshold for eligibility, so long as the individual components are eligible and the related projects are secured by a common pledge.83

TIFIA credit assistance is available to cover only eligible project costs.84 A calculation of total eligible project costs is important to determine whether the project meets the eligibility test for minimum project size85 and whether the credit request does not exceed applicable thresholds of reasonably anticipated eligible project costs86, as required by statute.

The TIFIA statute, codified at 23 U.S.C. §601 et seq, defines eligible project costs as those expenses associated with the following:

Development phase activities, including planning, feasibility analysis, revenue forecasting, environmental review, permitting, preliminary engineering and design work, and other pre-construction activities;87

Construction, reconstruction, rehabilitation, replacement, and acquisition of real property (including land related to the project and improvements to land), environmental mitigation, construction contingencies, and acquisition of equipment;88 and

Capitalized interest necessary to meet market requirements, reasonably required reserve funds, capital issuance expenses, and other carrying costs during construction.89

Capitalized interest on TIFIA credit assistance may not be included as an eligible project cost.

Also, TIFIA administrative charges, such as application fees, transaction fees, loan servicing fees, and credit monitoring fees will not be considered among the eligible project costs.90 In all cases, eligible project costs should be calculated and presented on a cash basis (that is, as year-of-expenditure dollars) with the year of planned expenditure clearly identified.91

In determining eligible project costs, the following two clarifications should be considered:

Acquisition of Real Property. While acquisition of real property is eligible for TIFIA reimbursement, such property must be physically and functionally related to the transportation project. If excess land surrounding the project’s immediate right-of-way is acquired for development, the cost of this real property may not be included among eligible project costs. The acquisition of real property must be in accordance with the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970 (see page 3-6).92

Costs Incurred Prior to Application. It is permissible for an applicant to incur costs prior to submitting an application for TIFIA credit assistance. However, these costs may be considered eligible project costs for TIFIA purposes only upon approval from the DOT.93 Generally, such costs will be confined to development phase or right-of-way acquisition expenses. This eligibility determination will be made on a case-by-case basis, depending on the nature and timing of the costs. Project sponsors that intend to request the inclusion of such costs as eligible project costs are encouraged to provide the DOT with supporting materials and information for such costs as early as possible to provide adequate time for DOT staff to review and make a determination as to eligibility.

Section 3-2

Government Requirements

The TIFIA statute requires all projects receiving TIFIA credit assistance to comply with 23 U.S.C. (for highway projects) and chapter 53 of 49 U.S.C. (for transit projects), as applicable.94 In addition, all projects receiving TIFIA credit assistance must comply with generally applicable Federal laws and regulations, including title VI of the Civil Rights Act of 1964, the National Environmental Policy Act of 1969, the Disadvantaged Business Enterprises (DBE) Program (49 C.F.R. Part 26), and the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970.95

Some of the key Federal Government requirements related to TIFIA credit assistance are listed below. In addition, applicants seeking TIFIA credit assistance are advised to contact the TIFIA JPO as well as the relevant modal agencies (FHWA, FRA, FTA, FAA, and MARAD) for further information on these and other Federal laws and regulations that may apply. Applicants seeking TIFIA credit assistance must comply with all applicable modal and Federal laws and regulations. We encourage project sponsors to coordinate with the TIFIA JPO and the relevant modal agencies early in their planning process to ensure satisfaction of all Federal requirements.

Title 23 – Highway Projects

Title 23 of the U.S. Code (U.S.C.) and related implementing regulations in title 23 of the Code of Federal Regulations (C.F.R.) set forth the rules that govern the design, construction, and operation of federally assisted highway infrastructure. These rules cover a broad range of activities. The following bullet points provide an example of some of the relevant regulations:

Design. Part 625 of 23 C.F.R. requires that all federally assisted roads, highways, and bridges (i.e., “Federal-aid projects”) adhere to minimum design standards and specifications. Generally speaking, the regulations refer all applicants for Federal-aid projects to the relevant standards and specifications published by the American Association of State Highway and Transportation Officials.

Procurement. Part 172 of 23 C.F.R. prescribes policies and procedures related to procurement of engineering and design related services. Part 636 of 23 C.F.R. describes FHWA policies and procedures relating to design-build projects financed under title 23. Part 635 of 23 C.F.R. covers many topics related to purchasing materials and procuring construction services. For example, Section 635.107 requires the applicant to affirmatively encourage disadvantaged business enterprise participation in the highway construction program. Section 635.410 (“Buy America”) limits the amount of foreign-produced steel and iron that may be used on Federal-aid projects.

Construction. Part 633 Subpart A relates to required contract provisions for Federal-aid construction contracts. Part 635 contains construction and maintenance procedures and includes a number of labor and employment rules that apply to employees working on a Federal-aid construction project. For example, the minimum wage rates that the Secretary of Labor determines to be prevailing for the same type of work on similar construction in the same locality must be part of the construction contract. Labor rules also state that no construction work may be performed by convict labor unless the convicts are on parole, supervised release, or probation.

Title 49 – Transit and Public Transportation Projects

As with title 23, title 49 of the U.S.C. and related regulations in title 49 of the C.F.R. concern a wide range of activities. Chapter 53 of 49 U.S.C. and related regulations, address public transportation projects. For example, drug and alcohol rules specific to FTA-funded projects appear at 49 C.F.R. §655. In other cases, the regulations appearing in 49 C.F.R. apply common types of rules specifically to transit-oriented concerns, such as the procurement of buses and rail cars. For example, the “Buy America” regulations, described above, appear also at 49 C.F.R. §661, and provide that Federal funds may not be obligated unless steel, iron, and manufactured products used in FTA-funded projects are produced in the United States, unless a waiver has been granted by the FTA, or the product is subject to a general waiver. The FTA has published a best practices manual on transit procurement regulations. This manual can be found on-line at: http://www.fta.dot.gov/grants/13054_6037.html.

The regulations that implement chapter 53 of 49 U.S.C. apply to all Federally assisted transit projects, including those receiving credit assistance under the TIFIA Program. For transit projects, all regulatory requirements of chapter 53 are contained in a standard compliance agreement that is attached to and incorporated in the TIFIA credit agreement.

Projects receiving TIFIA credit assistance also must comply with the provisions of 49 U.S.C. §5333(a). Commonly referred to as “Davis-Bacon,” this citation concerns labor protections ensuring that all labor contracts executed by the applicant adhere to prevailing wage rates as determined by the Secretary of Labor.

Title VI of the Civil Rights Act of 1964

Title VI of the Civil Rights Act of 1964 states that no person in the Unites States shall, on the grounds of race, color, or national origin, be excluded from participation in, be denied the benefits of, or be otherwise subjected to discrimination under any program or activity for which the recipient receives Federal assistance.96 Companion legislation extends these protections such that no person shall be subjected to discrimination on the basis of sex, age, or disability. As applied to transportation programs, regulations to implement this statute appear at 49 C.F.R. §21.

National Environmental Policy Act of 1969 (NEPA)97

To comply with NEPA, each proposed TIFIA project must be evaluated to determine its impact on the environment. The DOT will not obligate funds for a project until it has received a final agency decision, including (if necessary) a Record of Decision (ROD).98 The three scenarios for addressing NEPA requirements are outlined below.

Categorical Exclusion. Some projects, such as minor widening, rehabilitation, safety upgrading, or bus replacements, do not individually or cumulatively affect the environment significantly. These projects are termed Categorical Exclusions, and thus are exempt from the requirement to prepare an Environmental Assessment or an Environmental Impact Statement (EIS).

Environmental Assessment. An Environmental Assessment is usually prepared for a project that does not qualify as a Categorical Exclusion. The Environmental Assessment may reveal that the project’s impacts are not significant, in which case a Finding of No Significant Impact (FONSI) is issued for the project.

Environmental Impact Statement and Record of Decision. Assuming that a project does not qualify for a Categorical Exclusion or FONSI, the applicant is required to prepare a draft EIS. For highway projects, this is typically done in cooperation with the state department of transportation. For major investments, the draft EIS must include an analysis of various alternative solutions.

A variety of agencies and the public at large have the opportunity to comment on the draft EIS. These comments are addressed during the preparation of the final EIS. This second iteration ensures that adequate consideration has been given to public comments and the anticipated effects of the project. Depending on the nature of the project, the FHWA, FRA, FTA, or MARAD issues a Record of Decision to signify Federal approval of the final EIS. We encourage project sponsors to coordinate with the relevant modal agencies early in their planning process to ensure full compliance with and satisfaction of all NEPA requirements.

To ensure project readiness99, an applicant must have circulated a draft EIS at the time it submits an application, unless the project has received either a FONSI or a Categorical Exclusion.

Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970

Construction of a surface transportation project may displace current residents or businesses. Under the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970,100 every displaced resident must be offered a comparable replacement dwelling that is decent, safe, and sanitary. Additionally, relocation advisory services must be furnished and payments made to those residents who must relocate. Such payments cover moving expenses, the cost of replacement housing, and certain incidental expenses. Businesses, farms, and non-profits must also be reimbursed for moving and related expenses.

Section 3-3

Eligible Applicants

Public or private entities seeking to finance, design, construct, own, or operate an eligible surface transportation project may apply for TIFIA credit assistance. Examples of such entities include state departments of transportation; local governments; transit agencies; special authorities; special districts; railroad companies; and private firms or consortia that may include companies specializing in engineering, construction, materials, and/or the operation of transportation facilities.101

All applicants must demonstrate relevant experience, strong qualifications, a sound project approach, and financial stability, as each of these items ultimately has a bearing on the project’s creditworthiness.

Applicants also must meet various Federal standards for participation in a Federal credit program as well as modal-specific requirements, among other factors, to receive TIFIA credit assistance.102 For example, applicants may not be delinquent or in default on any Federal debts.103 Such requirements will be specified in the contractual documents between the DOT and each applicant.

In the context of a public-private partnership, where multiple bidders may be competing for a concession such that the obligor has not yet been identified, the procuring agency must submit the project’s Letter of Interest on behalf of the eventual obligor.104 The DOT will not consider Letters of Interest from entities that have not obtained rights to develop the project.105 However, the DOT is able to work with the procuring agency to better facilitate the integration of the TIFIA application process into the public-private partnership procurement. In this context, the DOT may negotiate a preliminary indicative term sheet with the procuring agency that sets forth the general intent of the DOT, which the procuring agency may provide to potential bidders. An indicative term sheet will assist private bidders in understanding certain basic terms and conditions for TIFIA credit assistance and will help to reduce any delays in the application process and ultimate negotiation of a credit agreement.

Section 3-4

Threshold Requirements

A project’s eligibility to apply for TIFIA credit assistance depends on its satisfaction of the requirements listed at U.S.C. Title 23, Chapter 6. This section details these statutory threshold requirements.

Total Eligible Costs

The project’s eligible costs, as defined under 23 U.S.C. §601106, must be reasonably anticipated to total at least $50 million, or, alternatively, equal 33 1/3 percent or more of the state’s Federal-aid highway apportionments for the most recently completed fiscal year, whichever is less.107 The DOT will revisit apportionments to states annually, to determine if any states qualify under the alternative test.

MAP-21 sets a lower eligible cost threshold for rural infrastructure projects, requiring such projects to have reasonably anticipated total project costs of at least $25 million or 33 1/3 percent or more of the state’s Federal-aid highway apportionments for the most recently completed fiscal year, whichever is less.108 As noted above, rural infrastructure projects are defined as surface transportation infrastructure projects located in any area other than a city with a population of more than 250,000 inhabitants within the city limits.109

In addition, MAP-21 expands eligibility to include related improvement projects grouped together to meet the eligible cost threshold, so long as the individual components are eligible and the related projects are secured by a common pledge.110

For projects that principally involve the installation of an intelligent transportation system (ITS), eligible project costs must be reasonably anticipated to total at least $15 million. This $15 million threshold applies only to projects for which the ITS component is the central feature of the project and not an ancillary component.111

In all cases, the principal amount of the requested credit assistance is limited to 49 percent of reasonably anticipated eligible project costs for a TIFIA secured loan or loan guarantee and 33 percent for a TIFIA standby line of credit.112 Applicants should calculate and represent all costs, including both eligible project costs and the credit assistance request, on a cash (year-of-expenditure) basis.113

Transportation Planning Process

The TIFIA statute conditions a project’s receipt of TIFIA credit assistance on the project’s satisfaction of all applicable planning and programming requirements.114 That generally means inclusion in both the state’s long-range transportation plan and the approved State Transportation Improvement Program (STIP).115

State transportation plans extend as far as 20 years into the future and are often geared to setting general priorities rather than listing individual projects. Therefore, at the time of submitting an application, each applicant must certify that the proposed project is consistent with the transportation plan(s) of the affected state(s). For projects in metropolitan areas, the applicant must also demonstrate that the project is or can be included in the metropolitan transportation plan.116

In contrast to the long-range state transportation plan, the STIP focuses on specific projects to be funded in the near term; STIPs typically look ahead no more than three years. The TIFIA statute requires that the project satisfy planning and programming requirements of Section 134 (“Metropolitan Planning”) and Section 135 (“Statewide Planning”) of Title 23, at such time as a TIFIA credit agreement is executed.117 Therefore, the applicant must demonstrate that the proposed project is part of the appropriate STIP(s) before the DOT will select the project, issue a term sheet, and obligate funds.118

Dedicated Revenue Sources

The TIFIA statute states that the TIFIA credit instrument shall be repayable, in whole or in part, from tolls, user fees or other dedicated revenue sources that also secure the senior project obligations.119

The DOT interprets “dedicated revenue sources” to include such levies as tolls, user fees, special assessments, tax increment financing, and any portion of a tax or fee that produces revenues that are pledged for the purpose of retiring debt on the project. The Secretary may accept general obligation pledges or corporate promissory pledges and will determine the acceptability of other pledges or forms of collateral as dedicated revenue sources on a case-by-case basis. Without exception, the Secretary will not accept a pledge of Federal funds, regardless of source, as security for the TIFIA credit instrument.120

Public Approval of Privately Sponsored Projects

Any private entity applying for TIFIA credit assistance must demonstrate state support for the project through the project’s inclusion in the state’s planning documents (the long-range plan and the STIP), as noted above.121

Invitation to Submit Application

Each potential applicant seeking TIFIA credit assistance must demonstrate its ability to meet the statutory eligibility requirements, including an in-depth review of a project’s creditworthiness, at the Letter of Interest stage. A project sponsor may only submit an application once a determination of eligibility, including a satisfactory review of a project’s creditworthiness, is made and the project sponsor has received an invitation from the DOT to submit a formal application.122 A downloadable version of the application for the current fiscal year can be found on the TIFIA website at http://www.fhwa.dot.gov/ipd/tifia/guidance_applications/tifia_applications.htm.

Section 3-5

Rating Opinions

In addition to the requirements described in Section 3-4, the TIFIA statute requires each potential applicant to provide a preliminary rating opinion letter from at least one NRSRO123 indicating that the project’s senior obligations (which may include the TIFIA credit instrument) have the potential to achieve an investment grade rating and providing a preliminary rating opinion on the TIFIA credit instrument.124 Before the DOT completes its review of a Letter of Interest and renders a determination of eligibility, the DOT will request that a project sponsor provide this preliminary rating opinion letter.

Prior to execution of a TIFIA credit instrument, the senior debt obligations for each project receiving TIFIA credit assistance must obtain investment grade ratings from at least two NRSROs and the TIFIA credit instrument must obtain ratings from at least two NRSROs, unless the total amount of the debt is less than $75 million, in which case only one investment grade rating on the senior debt obligations and one rating on the TIFIA credit instrument are required.125 The TIFIA debt cannot exceed the amount of the senior obligations unless the TIFIA credit assistance receives two investment grade ratings.126 If the TIFIA credit instrument is proposed as the senior debt, then it must receive two investment grade ratings, unless the total amount of the debt is less than $75 million, in which case only one investment grade rating is required.127

Both the preliminary rating opinion letter and the final credit ratings must be based on the contemplated tenor of both the project’s senior debt obligations and the TIFIA credit instrument.

The following discussion summarizes the DOT’s use of Credit Rating Agency analyses.

The DOT’s Use of Credit Ratings

Credit ratings on TIFIA-supported projects are used for three purposes.

Statutory Rating Requirement. By statute, a project cannot receive TIFIA credit assistance unless the senior debt obligations funding the project, i.e., those obligations having a lien senior to that of the TIFIA credit instrument on the pledged security, receive investment grade ratings from at least two Credit Rating Agencies, as discussed above. Therefore, even though a project may be selected for TIFIA credit assistance, this credit assistance will not be provided; that is, the DOT will not close on the credit agreement, until two Credit Rating Agencies assign an investment grade rating to the project’s senior debt obligations, or the TIFIA facility itself, if there are no debt obligations senior to the TIFIA credit instrument.

Capital Allocation Requirement. Default risk is a key component of the DOT’s assessment of expected losses related to the TIFIA Program. The Federal Credit Reform Act of 1990 requires Federal agencies with credit programs to allocate capital, in the form of budget authority, to cover these expected losses. The DOT uses the TIFIA Capital Allocation Model to estimate credit exposure. The model employs such variables as the repayment structure, the drawdown assumptions, the nature of the dedicated revenues securing the TIFIA credit instrument, and the ratings assigned to the TIFIA credit instrument.

Annual Capital Reserve Adjustments. As part of its ongoing portfolio monitoring, the DOT is required to annually adjust, or “reestimate,” its allowance for credit losses based on updated loss expectations.128 The DOT will incorporate information from credit surveillance reports, including changes in credit ratings, on TIFIA-supported projects in this annual reassessment process.

Preliminary Rating Opinion Letter

The DOT requires potential applicants to provide a preliminary rating opinion letter that sets forth an indicative rating on the project’s senior obligations and the TIFIA credit instrument and provides rating rationales for both indicative ratings. The letter must address the creditworthiness of both the senior debt obligations funding the project (i.e., those which have a lien senior to that of the TIFIA credit instrument on the pledged security) and the TIFIA credit instrument. The letter must conclude that there is a reasonable probability for the senior debt obligations (or the TIFIA credit instrument if there are no debt obligations senior to the TIFIA facility) to receive an investment grade rating.129 This requirement applies to all potential TIFIA applicants, even those with current credit ratings on other debt instruments. The DOT will not complete its review of a Letter of Interest and make a determination of eligibility until a project sponsor has provided a preliminary rating opinion letter. As part of the DOT’s review, the DOT will also request that the TIFIA applicant provide copies of all documents submitted to the Credit Rating Agency in connection with the preliminary rating process. The DOT will use the preliminary rating opinion letter for two purposes.

1. Potential for Senior Obligations to Receive Investment Grade Rating. The letter must indicate that the senior obligations funding the project have the potential to receive an investment grade rating. This preliminary assessment by the Credit Rating Agencies will be based on the financing structure proposed by the applicant. The DOT will not consider projects that do not demonstrate the potential for their senior obligations to receive an investment grade rating.

2. Default Risk. The DOT will also use the preliminary rating opinion letter to assess the project’s overall economic, legal, and financial viability and the default risk on the requested TIFIA instrument and on any senior project obligations. Therefore, the letter should provide a preliminary rating and rating analysis of the financial strength of the overall project and the default risk (i.e., without regard to recovery potential) of the requested TIFIA credit instrument and the project’s senior debt.

Credit Ratings of Senior Obligations

In addition to providing the preliminary rating opinion letter, prior to execution of a TIFIA credit instrument, the senior debt obligations for each project receiving TIFIA credit assistance must obtain investment grade ratings from at least two NRSROs, and the TIFIA credit instrument must obtain ratings from at least two NRSROs, unless the total amount of the debt is less than $75 million, in which case only one investment grade rating on the senior debt obligations and one rating on the TIFIA credit instrument are required. The applicant must provide confirmation of the assigned ratings at least two weeks prior to execution of a TIFIA credit instrument.

The rating requirement offers security to the DOT only if the same repayment source is being pledged to both the senior debt obligations and the subordinate TIFIA credit instrument. In such a structure, the investment grade ratings for senior debt helps the DOT evaluate its credit risk as a subordinate lender. To maintain the value implied by the senior debt rating, the TIFIA debt cannot exceed the amount of the senior obligations unless the TIFIA credit instrument receives two investment grade ratings.130

Ongoing Rating Requirements

Throughout the life of the Federal credit instrument, the borrower must obtain annually, at no cost to the Federal Government, current credit evaluations of the project, the project obligations, and the Federal credit instrument.131 The current credit evaluations must be performed by a Credit Rating Agency.132 By “current credit evaluation,” the DOT means: (i) in the case of a project with a published rating, either a current rating or the borrower’s certification stating that the rating and outlook are unchanged from the previous year, and (ii) in the case of a project without a published rating, a current rating of the project obligations and the Federal credit instrument.

Use of Underlying Ratings

Neither the preliminary rating opinion letter nor the credit ratings should reflect the use of bond insurance or other credit enhancement that does not also secure the TIFIA instrument.133 The assessment of the senior obligations’ investment grade potential and the default risk for the TIFIA credit instrument and the senior obligations should be based on the underlying ratings of the unenhanced debt obligations and the project’s fundamentals. The DOT will not consider projects where the TIFIA loan is subordinate to debt that is supported by credit enhancement or other credit support not shared by TIFIA.

Applicant Questions about Rating Requirements

Applicants should contact the TIFIA JPO with any questions about the rating process and the requirements for a preliminary rating opinion letter, two investment grade credit ratings on the senior obligations’ and two ratings on the TIFIA credit instrument. The Credit Rating Agencies will be able to answer questions concerning fees, timing of assessments, information requirements, and surveillance practices associated with obtaining preliminary opinion letters, credit ratings, periodic rating updates, and credit surveillance reports.

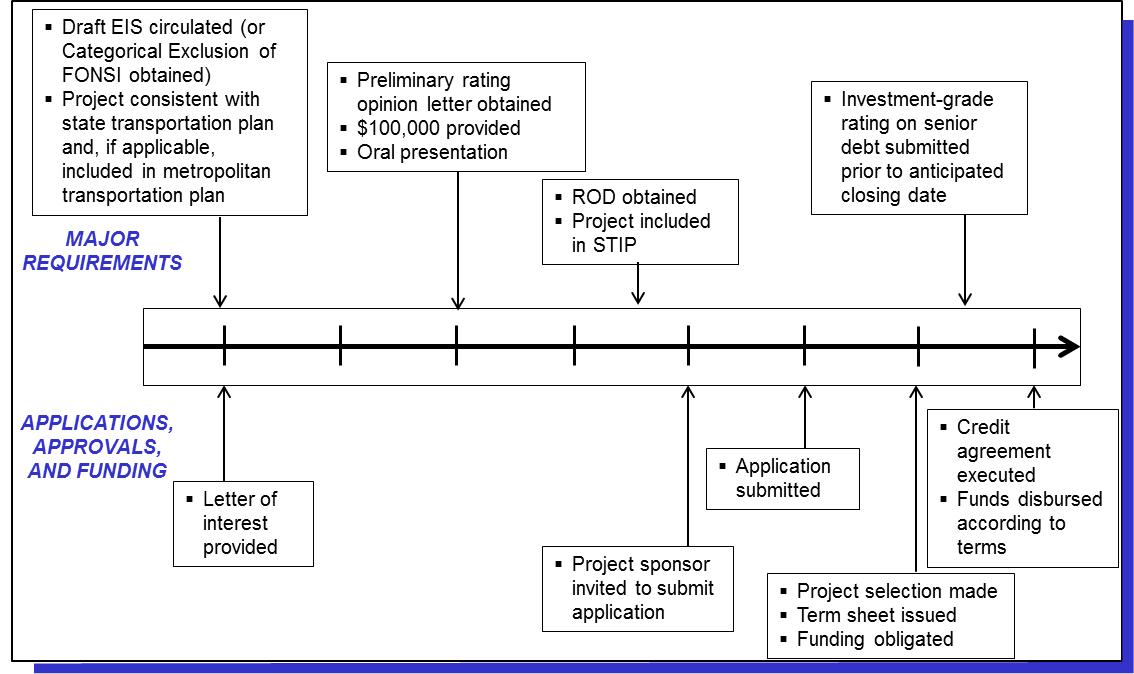

Section 3-6

Timing of Environmental, Planning, and Credit Documents

Requirements for environmental, planning, and credit documents correspond with the application and selection processes, which are described in Chapters 4 and 5, respectively. Exhibit 3-A provides an overview of how these requirements relate to the various stages of the application and selection processes.

Exhibit 3-A: Major Documentation Required During the Application and Selection Processes

Chapter 4: Application Process

This chapter describes the process to apply for TIFIA credit assistance. The DOT welcomes informal consultations with prospective applicants at any time. TIFIA staff contact information is on the inside front cover of this Program Guide.

Section 4-1

Solicitation for Letters of Interest

All projects wishing to apply for TIFIA credit assistance must first submit a Letter of Interest in order to be eligible to receive an invitation from the DOT to submit a formal application.134 The submission of Letters of Interest will be conducted on a rolling basis by the DOT.135 All TIFIA credit assistance will be awarded based on a project’s merits and its satisfaction of the eligibility requirements discussed above. When new funding is available, the DOT will issue a NOFA in the Federal Register. In addition to publication in the Federal Register, the NOFA (and other program information) will be posted on the TIFIA web site, located at: http://www.fhwa.dot.gov/ipd/tifia.

Section 4-2

Initial Submission: Letter of Interest

MAP-21 establishes a process for applying for TIFIA credit assistance that begins with the submission of a Letter of Interest and determination of eligibility.136 Project sponsors must submit a Letter of Interest that: (i) describes the project and the location, purpose, and cost of the project, (ii) outlines the proposed financial plan, including the requested credit assistance and the proposed obligor, (iii) provides a status of environmental review, and (iv) provides information regarding satisfaction the eligibility requirements of the TIFIA Program.137 The DOT template for the required Letter of Interest for the specified Federal fiscal year can be found on the TIFIA website, which can be found at: www.fhwa.dot.gov/ipd/tifia/guidance_applications/tifia_applications.htm. The form has been expanded to address the TIFIA eligibility requirements, and it identifies the specific information that must be provided to the DOT. Potential applicants must submit detailed Letters of Interest so the DOT can review creditworthiness and the other TIFIA statutory eligibility requirements detailed in Chapter 5. The DOT requests that project sponsors submit the Letter of Interest by attaching it via email to [email protected].

In order to maximize the credit assistance available for rural infrastructure projects, the DOT will establish a date by which rural infrastructure projects requesting the reduced interest rate should submit their Letters of Interest for review and evaluation by the DOT. The applicable date for each fiscal year will be posted on the TIFIA website, commencing with the date for FY2014 submissions. This will ensure that the DOT is able to optimize its deployment of credit assistance for rural infrastructure projects in each fiscal year.138

The eligibility criteria require a determination by the DOT that: (i) the project is creditworthy;139 (ii) Federal credit assistance (a) would foster (if appropriate) partnerships that attract public and private investment for the project,140 (b) would enable the project to proceed at an earlier date than the project would otherwise be able to proceed or would reduce lifecycle costs (including debt service costs) of the project,141 and (c) would reduce the contribution of Federal grant assistance for the project;142 and (iii) the applicant has demonstrated that the construction contracting process for the project can commence no more than 90 days after the execution of a TIFIA credit instrument143.

A technical review team drawn from agencies throughout the Department (e.g., FHWA, FRA, FTA, MARAD, and OST) will review the Letter of Interest upon receipt by the DOT. This team will conduct an initial review of the Letter of Interest to determine whether the project meets the threshold requirements for TIFIA participation, including whether any major statutory, regulatory, or timing issues exist that would require modifications to the project’s intended plan of finance or prevent the project from receiving TIFIA credit assistance. The DOT may contact project sponsors for clarification of specific information included in the Letter of Interest or for additional information to supplement the Letter of Interest and complete the DOT’s eligibility determination. Project sponsors will be notified by the DOT if it is determined that their projects are not eligible or if the DOT is unable to continue reviewing their Letter of Interest until eligibility requirements are addressed. All requested material must be received by the DOT before the DOT can proceed with its in-depth review of a project’s creditworthiness.

After concluding its initial review of the Letter of Interest and upon making a determination that the project is reasonably likely to satisfy all of the eligibility requirements of the TIFIA Program, the DOT will conduct an in-depth creditworthiness review of the project sponsor and the proposed revenue stream. In connection with this review, the DOT will request that the project sponsor provide a preliminary rating opinion letter, a feasibility study (as applicable), and a fully functional Microsoft Excel-based financial model. At this time, the project sponsor will also be required to submit $100,000 to the DOT in order to continue the review process. These funds will be used to reimburse the DOT for costs incurred for services provided by the DOT’s outside financial and, as and when necessary, legal advisors in connection with the review of the TIFIA Letter of Interest. After the $100,000 has been received, the DOT will engage an independent financial advisor to prepare a report and recommendation to the DOT. The DOT may also engage an independent legal advisor and other advisors to help complete its review of a project’s eligibility. For projects seeking more than $1 billion in TIFIA credit assistance, two financial advisors will be hired to produce independent financial evaluations and recommendations to the DOT. The DOT will not complete its creditworthiness review until the project sponsor has provided all requested information and materials, including a preliminary rating opinion letter, and the $100,000 necessary to enable the DOT to engage its outside financial and, as and when necessary, legal advisors.