Federal Perkins Loan Assignment Form

Federal Perkins/NDSL Loan Assignment Form

Perkins Assignment Instructions July 2015

Federal Perkins Loan Assignment Form

OMB: 1845-0048

INSTRUCTIONS FOR FEDERAL PERKINS LOAN ASSIGNMENT FORM OMB-1845-0048

Federal Perkins Loan Program Assignment Form

General Instructions

The Department of Education (the Department) is authorized to accept Federal Perkins Loan (Perkins Loan) assignments under Section 463(a)(5) of the Higher Education Act of 1965, as amended [20 U.S.C. 1087cc]. No assignment of a Perkins Loan, a National Direct Student Loan (NDSL), or a National Defense Student Loan (Defense Loan) may take place unless accompanied by a completed Perkins Assignment Form. Schools have the option to utilize the Department’s new Perkins Loan Assignment System (PLAS) to submit assignments electronically. The electronic option allows schools to send multiple loans in a batch process or individual loans through an online, web-based version of this form. This online form is substantially similar to the layout of the paper form. While these instructions are for completing the paper version of the form, the data collected and submitted is the same whether it is manually or electronically submitted. In some instances, we have noted differences relating to the automated process. Please read all instructions carefully before completing this form. Instructions for completing the electronic option(s) for assignment submissions and an overview of the steps are available beginning on page 8 of these instructions and can be found on the website at http://www.efpls.com under PLAS in the Client section.

The Federal Perkins Loan Program Assignment Form has two parts: the Institutional Certification page and the Borrower and Loan Information page:

PLAS, the online system, automates the institutional certification process and manifest listing, making the process more efficient by reducing the chance for error and rejection of assignments. While the electronic process is the preferred method for submitting assignments, schools may still submit paper assignments.

Paper assignments must include the Institutional Certification page along with one original and one photocopy of a completed Institutional Certification page for each batch of paper assignment submissions and a manifest listing the loans that are being submitted. One original and one photocopy (front and back) of the Borrower and Loan Information page for each borrower account being assigned must also be included with the other documents.

The Perkins Assignment Form may be photocopied; however, the paper versions of the Institutional Certification page must have an original signature in Field Item 11.

Retain photocopies of the Perkins Loan Assignment Form for your institutional records.

In completing the Borrower and Loan Information page:

Do not combine Defense, Direct, and Federal Perkins Loan information on the same Borrower and Loan Information page for either the paper or electronic process. In those cases where a borrower received more than one type of loan, a separate Borrower and Loan Information page must be completed for each type of loan.

Provide a Social Security number for each borrower for either the paper or electronic process.

Submit the original promissory note(s) and all required documentation in accordance with applicable regulations (and/or procedures) for each loan submitted for assignment to the U.S. Department of Education for either the paper or electronic process. Note: that while schools can upload the required supporting documentation as part of the electronic process, the original promissory note(s) are still required to be mailed to the Department’s servicer, ECSI.

Enter all financial information as dollars and cents (e.g., $1,200.00 or $1,200.44). The electronic process requires data to be formatted according to either the record file layout for the batch process or online instructions for electronic submission of each individual loan.

Enter all items requiring dates as Month, Day, and Year (e.g., 01/31/2011). The electronic process requires data to be formatted according to either the record file layout for the batch process or online instructions for electronic submission of each individual loan.

Perkins Loan Servicer School Contact Information

The School Customer Service telephone number is (866) 313-4130.

The School Customer Service email address is: [email protected]

Assignment Packages and Correspondence should be mailed to:

ECSI Federal Perkins Loan Servicer

181 Montour Run Road

Coraopolis, PA 15108

Payments received after loans have been accepted for assignment should be mailed to:

U.S. Department of Education

ECSI Federal Perkins Loan Servicer

P.O. Box 105765

Atlanta, GA 30348-5765

Federal Perkins Loan Program

Assignment Form-Detailed Instructions

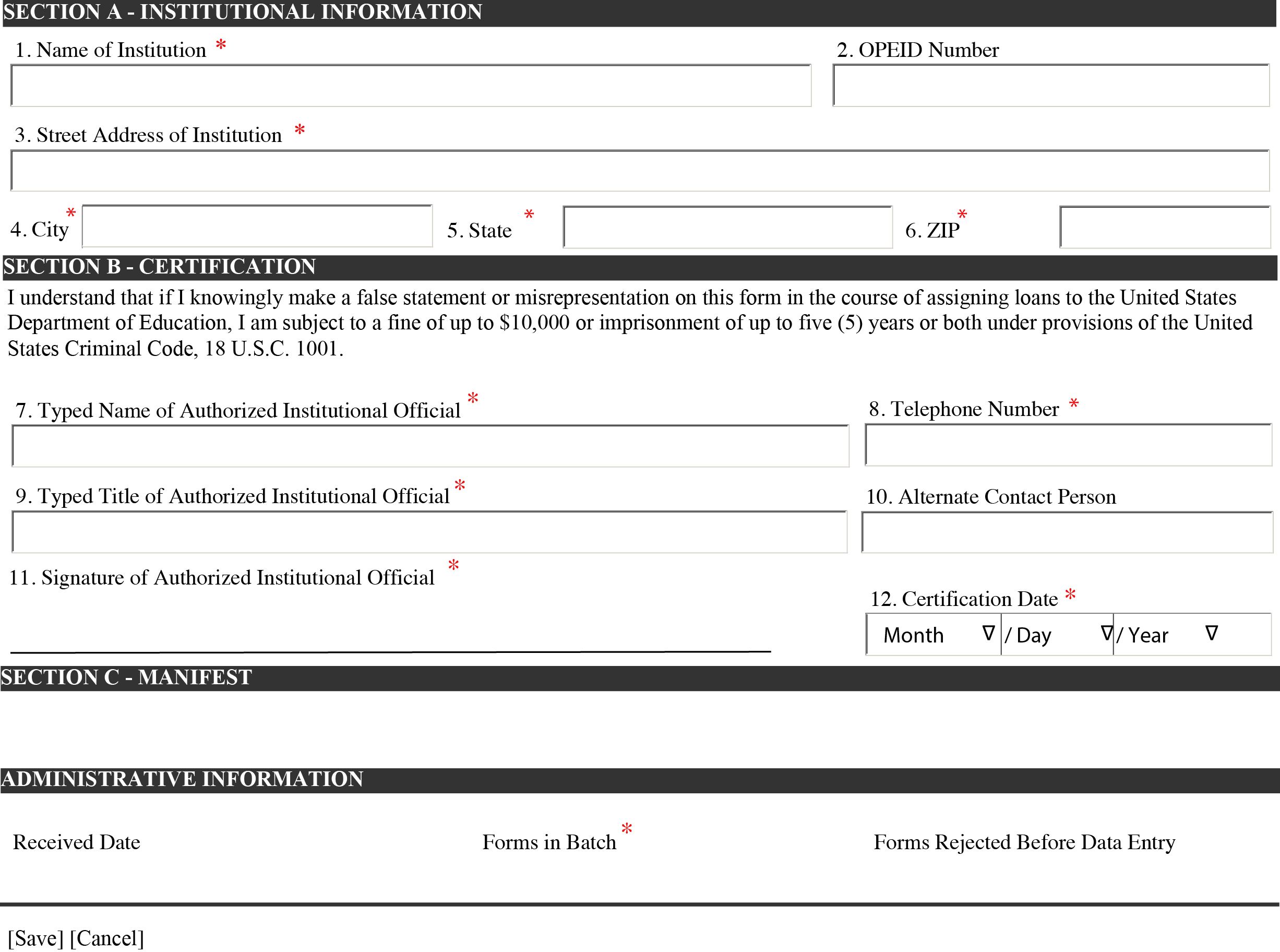

Institutional Certification

As part of the online system, PLAS automates the institutional certification process and manifest listing, making the process more efficient and reducing the chance for error, which could cause an automatic rejection of assignments. See page 8 for more information on electronic filing.

SECTION A – INSTITUTIONAL INFORMATION for PAPER FORM

Field Number Instruction

1 Full name of submitting institution. If a branch campus, identify as such.

2 Eight-digit Office of Postsecondary Education Identifier (OPEID) number.

3 - 6 Full street address of the submitting institution. Field Items 3, 4, 5, and 6 must reflect the address (including city, state and zip code) of the institution submitting the assignment. In no case may the address appearing in these item fields be that of a servicer.

4 City in which submitting institution is located.

5 State in which submitting institution is located.

6 Zip code of submitting institution.

SECTION B – CERTIFICATION for PAPER FORM

7 Full name of the authorized institutional official making the assignment.

8 Telephone number (including area code) of the authorized institutional official making the assignment.

9 Full title of the authorized institutional official making the assignment.

10 Full name of an alternative contact person in the absence of the authorized institutional official.

11 Original signature of authorized institutional official whose name appears in field Item 7.

12 Certification date on which the institution’s authorized official, who has the authority to transfer assets, signs the Perkins Assignment Form. Show as MM/DD/YYYY. Note: The certification date the school reports to NSLDS when transferring the assigned loans should match this certification date reported on the Perkins Assignment Form.

Federal Perkins Loan Program

Assignment Form-Detailed Instructions

Institutional Certification

SECTION C –MANIFEST

Using the electronic system, PLAS creates the manifest listing, making the process more efficient and reducing the chance for error, which could cause the automatic rejection of assignments. PLAS will produce a cover sheet, which the institution will print and attach to its documents. The cover sheet provides the batch ID and loan record and assignment sequence number. This cover sheet will be used to match the documents submitted and uploaded online to for the promissory notes mailed to the Department.

The institution must attach a manifest to the Perkins Assignment Form, listing the loans that are being assigned. The institution name and OPEID Number must appear at the top of each page of the manifest.

List the loans on the manifest in the same way that the loans were initially reported to the National Student Loan Data System (NSLDS). Consistent reporting on the manifest and NSLDS will reduce the possibility of matching errors when the loans are assigned to the Department.

The loan period for a Perkins loan may not exceed one year. Generally, if a borrower received Perkins loans for more than one year of attendance at a school, the loans should be reported to NSLDS as separate loans, and should be listed on the manifest as separate loans. However, if a borrower received Perkins or NDSL loans for more than one year of attendance at a school, and the school reported the separate Perkins or NDSL loans to NSLDS as one loan, the loans should be listed on the manifest as one loan.

If a borrower’s Perkins loans were reported to NSLDS as one loan, report the date of the first disbursement of the first loan the borrower received under “Date of First Disbursement.” If a borrower’s Perkins loans were reported to NSLDS as separate loans, report the date of the first disbursement of each loan the borrower received under “Date of First Disbursement.”

The first disbursement dates reported on the manifest must match the first disbursement dates reported to NSLDS.

If a borrower received loans of different types and/or interest rates, the loans must be assigned as separate loans and listed on the manifest as separate loans, regardless of how they were reported to NSLDS.

Federal Perkins Loan Program

Assignment Form-Detailed Instructions

Borrower and Loan Information

Note: Instructions for completing the electronic option(s) for assignment submission are available via PLAS at www.efpls.com in the Client section. The online form is substantially similar to the layout of the paper form.

SECTION A – BORROWER INFORMATION for PAPER FORM

Field Number Instruction

1 Current or last known name of borrower (Last, First, MI).

2 Any other name by which the borrower may have been known (maiden names, name changes, etc.). The institution is not required to provide this information with the assignment submission.

3 Social Security Number of borrower. Do not provide the borrower’s account number. A Social Security Number must be included for each account that is being submitted. ED will not accept for assignment, for any reason, an account that does not have a valid SSN.

4 Birth date of borrower. Show as MM/DD/YYYY.

5 Specific date or best approximation of date the borrower departed the institution. Show as MM/DD/YYYY.

6-10 Current or last known permanent address and telephone number of the borrower. Do not show an institutional residence hall address.

SECTION B – COSIGNER INFORMATION for PAPER FORM

11 Full name of individual who cosigned this loan for the borrower, if applicable.

12 Social Security Number of cosigner is not required; however, if one has been identified from the application, please provide it.

13 - 17 Current or last known permanent address and telephone number available for any cosigner of this loan.

SECTION C - LOAN INFORMATION: HISTORICAL for PAPER FORM

18 Type of loan disbursed.

19 Interest rate reflected on promissory note used to make this loan or subsequent interest rate changes due to litigation and presence of a judgment. ED acceptance of any promissory note having an interest rate that is not in compliance with the regulations for the applicable timeframe will be reported to the ED Campus-Based Financial Management Section for reconciliation with the assigning institution.

20 Date of last disbursement (show as MM/DD/YYYY), not the original date of loan. (NOTE: In the event of a late disbursement [e.g., after the borrower's departure date], please enter the date on which the promissory note was signed.) The date of last disbursement must be prior to the departure date (Field Item 5) unless an explanation is attached detailing why it is not.

21 Date last grace period ended or will end. This must show that the full 9- or 6-month grace period began after the departure date (Field Item 5).

22 Date following the day on which payment was due and not received, resulting in default. In cases in which the borrower was considered to be “in default” but then made a few additional payments under a satisfactory repayment arrangement, the date of default becomes the day following the day on which the first rescheduled payment was due and not made. In cases in which the borrower made sporadic payments following the default date outside of any agreed upon repayment arrangement and due diligence should have continued, the date of default remains the original date of default. In the case of a total and permanent disability discharge for a loan that has not defaulted, leave this field item blank. Note: If the loan is not in default (e.g., the borrower is in school, in grace or deferment period, or in repayment), leave this field item blank. Indicate the borrower repayment status in Field Item 25.

23 If the loan has been accelerated, check “Yes” and enter the date of acceleration. If the loan has matured (i.e. reached the end of the ten-year repayment period) check “No” and enter the date the loan matured. In the case of a non-defaulted loan that has neither been accelerated nor matured (such as a total and permanent disability discharge or due to the schools closing out the program), check “No” and leave the date blank.

24 If loan was litigated check “Yes” and enter the effective date and attach judgment.

Note: Must enter either “Y” (yes) or “N” (no) in this field.

25 If the loan is not in default, check the status of the borrower: In school; Grace Period; Deferment; Repayment.

26 Indication of primary reason loan is being assigned or has been determined to be uncollectible.

SECTION D – LOAN INFORMATION: FINANCIAL for PAPER FORM

27 Original amount loaned to borrower as indicated on promissory note or disbursement records.

28 Any amount refunded or never disbursed which would reduce the principal amount for which the borrower is liable.

29 Total amount repaid and credited to principal as of certification date.

30 Total amount of principal that has been cancelled on this loan.

31 Total principal amount of this loan that is currently outstanding. (Field Item 27 less 28, 29 and 30).

32 Total amount of collection costs repaid, as of the certification date. This includes any collection fees that were repaid.

33 Total amount of interest repaid as of the certification date.

34 Total amount of interest that has been canceled on this loan.

35 Total amount of interest due as of the certification date.

36 Total amount of collection costs that have been properly assessed on this loan in accordance with program regulations, and any penalty or late charges assessed against the loan that are outstanding as of the certification date. The costs attributable to the following activities can be included: skip-tracing, litigation, address searches, and generation of letters.

37 Total dollar amount currently outstanding on this loan. (Sum of Field Items 31, 35, and 36).

SECTION E - CANCELLATION INFORMATION for PAPER FORM

38 - 43 Any cancellations that have been granted on this loan must be reported. Show dates as MM/DD/YYYY. The sum of the amounts in Field Item 40 must equal the amount in Field Item 30. The sum of the amounts in Field Item 41 must equal the amount in Field Item 34. The institution is not required to provide the supporting cancellation documentation with the assignment submission. However, the documentation must be retained by the institution for at least three years from the date the loan is assigned.

Federal Perkins Loan Program

Automated Assignment-An Overview

For Complete instructions visit PLAS at www.efpls.com

Creating An Assignment

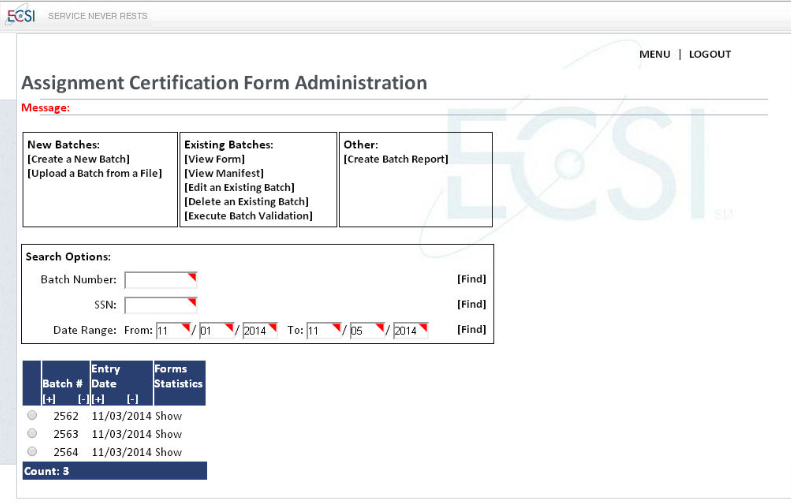

Step 1 |

Begin on the Assignment Certification Administration Page. |

Step 2 |

Activate the radio button for the batch to which you would like to add assignments. |

Step 3 |

Choose the View Manifest action button in the Existing Batches menu. |

Step 4 |

The Assignment Borrower and Loan Form will be displayed. This page will display all functions to create, edit, delete, sort and validate loan forms. It also contains the functionality to upload and attach supporting documents to assignments. |

Step 5 |

Click the Create New Form action button. A blank assignment load form will be displayed. |

Step 6 |

Key in the data in the fields required to complete the assignment form. The layout of the electronic form is substantially similar to the layout of the paper form to make it easier for loan assignment data entry. |

Step 7 |

After all fields have been data entered, click the save button to save the assignment. If all of the required fields have been populated with a valid value the assignment will be saved and the user will be directed back to the Assignment Borrower and Loan Form Page. The newly entered assignment will be displayed in the assignment matrix under the search options section. |

Attaching Supporting Documents To An Assignment

Step 1 |

Beginning on the Assignment Borrower and Loan Form Page, activate the radio button next to the desired assignment. |

Step 2 |

Click the Attach Loan Documents action button in the Existing Forms menu. The Upload Documents Page will open. This page contains placeholders and file navigation to choose and attach supporting loan assignment documents in PDF form. |

Step 3 |

Click on the Choose File button next to the document you wish to upload. Explorer will open allowing access to the files on your computer. |

Step 4 |

Navigate to the location of the PDF version of the document you wish to attach to the assignment. Double click on the file. The explorer window will close and the path to the document will be defined in the Choose File field. |

Step 5 |

Repeat this process for all supporting documents associated with the assignment you are working on. |

Step 6 |

When you have attached all documentation, click the Upload Documents button at the bottom of the Upload Documents page. This will attach the PDF version of the documents to the assignment. |

Step 7 |

The Assignment Borrower and Loan Form Page will again be displayed. Click on the Show link under the Documents heading in the assignment matrix will show a list of supporting documents that have been uploaded and attached to the assignments. Documents that are present will appear as links and can be clicked on for display and review. |

Searching for Assignments

Step 1 |

Beginning on the Assignment Certification Form Admin Page, click in the field for SSN. |

Step 2 |

Key in the SSN for the student whose assignment you wish to work with and click the Find action key

|

Step 3 |

The system will display all batches that contain the SSN that was searched. The assignment can then be viewed by using the View Manifest action button. This will display the assignments in the batch. |

Step 4 |

You can then click the radio button for the assignment matching the SSN you searched for and edit or view the assignment using the action buttons available on the assignment page. |

Viewing Assignments

Step 1 |

Beginning on the Assignment Borrower and Loan Form Page, click the radio button for the assignment you wish to view. |

Step 2 |

Click the View Form action button. The read-only version of the assignment will be displayed in a new tab or window. |

Deleting Assignments

Step 1 |

Beginning on the Assignment Borrower and Loan Form Page, Click the radio button for the assignment you wish to view. |

Step 3 |

Click the Delete Form action button. A message will popup advising that deleting an assignment is permanent. |

Step 3 |

Click “ok” to delete the assignment. |

Editing Assignments

Step 1 |

Beginning on the Assignment Borrower and Loan Form Page, click the radio button for the assignment you wish to Edit. |

Step 2 |

Click on the Edit Form action button. |

Step 3 |

An editable version of the assignment will be displayed in a new tab or window. |

Creating a New Batch through Data Entry

|

|

Click the Assignment Intake link. |

|

|

Click the Create a New Batch link.

|

|

|

Section A - Institutional information will update to reflect the information associated with the user’s login credentials. This includes the OPEID number that was entered during login as well as the school name and address associated with that OPEID. |

|

|

In Section B – Certification, type the appropriate information including the authorized official’s name, phone number, and the date. The authorized official should be someone with authority to approve the transfer of the debt through the assignment. |

|

|

Section C – Manifest will populate automatically as the assignments are later added to the batch. |

|

|

In the Administrative Information section of the form, type the number of assignment forms that will be added to the batch in the Forms in Batch field. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Click the Create Batch link. The system will verify that all required fields have been completed and will create the batch. A batch number will be assigned. |

|

|

The Assignment Certification Administration page will display. The newly created batch will be in the Batch Matrix awaiting further action. |

| File Type | application/msword |

| File Title | IFAP - Dear Partner, Colleague Letters Home SFA Portal Contacts What's |

| Author | Brian Smith |

| Last Modified By | Kate Mullan |

| File Modified | 2015-07-27 |

| File Created | 2015-07-27 |

© 2026 OMB.report | Privacy Policy