Appendix C

Appendix C - 2011 Fuel Economy Focus Group Report_KH.docx

Fuel Economy, GHG, Other Emissions, and Alternative Fuels Education ProgramQuantitative Materials Testing Research Plan

Appendix C

OMB: 2127-0713

NHTSA: Fuel Economy, GHG,

Other Emissions, and Alternative Fuels Education Program Focus

Group Findings Report August

2, 2011

Themes Identified Across Groups 5

Regional Differences Identified 9

Implications on Consumer Education Program 10

Implications on Quantitative Research 12

Appendix A: Detailed Findings 14

Fuel Economy Content Evaluation 14

Thermal Management Technologies 20

Greenhouse gases and other emissions 21

Message Testing & Communication Channels 21

Appendix B: Focus Group Schedule 24

Appendix C: Participant Profiles 25

Appendix E: Discussion Guide 36

Introduction

Background

The Energy Independence and Security Act of 2007 (EISA) requires the NHTSA, in consultation with Environmental Protection Agency (EPA) and Department of Energy (DOE), to develop and implement a consumer information and education program to improve consumer understanding of automobile fuel economy, GHG and other pollutant emissions, alternative fuels, and thermal management technologies. To address the requirements set forth, EPA and NHTSA came to the agreement that EPA would conduct all research in collaboration with NHTSA to implement the fuel economy labeling requirements set forth by EISA.

As such, EPA took the lead conducting the necessary market research portion related to fuel economy label content and, in particular, content related to Electric Vehicles (EV), Extended Range Electric Vehicles (EREV) and Plug-in Hybrid Electric Vehicles (PHEV). This research guided the creation of the new labels, which were introduced to the public at a press event on May 25, 2011.

NHTSA has taken the lead developing the necessary steps to meet the consumer education campaign requirements as defined in EISA regarding Fuel Economy, GHG and other emissions labeling leveraging the EPA lead research. NHTSA will also be independently leading the obligations associated with developing rules for a permanent and prominent display on automobiles capable of operating on alternative fuels, ensuring that owner manuals of vehicles capable of operating on alternative fuels include information describing capability and benefits of using alternative fuels and educating consumers about the benefits of thermal management technologies including energy efficient air conditioning systems and glass.

In 2010, NHTSA contracted with StrategyOne, the independent market research arm of Edelman, to conduct consumer research in support of developing a consumer education program and fulfilling NHTSA’s statutory requirements pursuant to EISA.

Research Objectives

The goal of this study is to guide the development of a consumer education program by determining what consumers know, what they need to know, and what issues they care most about with regard to fuel economy-related content. The qualitative portion of this research begins to answer the following questions:

Among consumers, what is the existing level of knowledge regarding fuel economy and where did consumers obtain the information they already have?

What knowledge gaps are important to address through NHTSA’s consumer education program?

In terms of fuel economy, GHG and other emissions, alternative fuels and thermal management technologies, what issues do consumers care most about?

Does the existing fuel economy-related content already collected by NHTSA (Appendix C) add to their current levels of knowledge?

Is the fuel economy-related content written in a way that is clear and comprehendible?

The focus group research also provided an opportunity to evaluate and refine consumer-facing messages related to NHTSA’s consumer education campaign by using direct consumer input. Messages were tested to determine the following:

Do these marketing messages effectively encourage consumers to seek fuel-economy related content from NHTSA?

What are the best methods (i.e., channels of communication) for reaching consumers with these messages?

Research Process

This consumer research program has two components: 1) qualitative focus groups and 2) national quantitative survey. This report includes the findings from the first phase of this research, which will be used to guide the consumer education program and the development of the survey instrument.

Eight (8) focus groups were conducted in four (4) cities in order to explore in-depth consumer awareness, perceptions, beliefs and understanding of fuel economy, alternative fuels, greenhouse gases and other pollutant emissions and thermal management technologies. These focus groups also provided a forum for discussing trusted sources of information and evaluating potential messages that could be utilized to guide consumers to a government website to learn more information about each of these topics.

Focus groups were conducted in the following cities for these specific reasons:

Date |

City |

Rationale |

July 13, 2011 |

Minneapolis, MN |

Highest concentration of alternative fuel stations in the U.S., harsh winter climate |

July 14, 2011 |

Phoenix, AZ |

Hot climate where thermal management technologies may provide significant benefit |

July 19, 2011 |

Atlanta, GA |

High-congestion market in the southeast |

July 20, 2011 |

Fort Lee, NJ (NYC metro area) |

High-congestion market in the northeast |

Respondents for the focus groups were screened prior to participation in order to obtain a mix of vehicle drivers and purchasers in the United States. Respondents were screened according to the following criteria:

Participants must be 18 years or older.

Participants must currently possess a valid driver’s license.

Participants must currently own or lease a vehicle.

Participants must be the primary or a shared decision maker for vehicle purchases in their household.

The focus groups for each city were divided by males and females as past experience has shown that males tend to dominate the conversation when covering technical or vehicle information and females will often defer to their opinion instead of expressing their own well-thought-out opinions.

For each focus group, 12 potential participants were recruited in order to account for individuals who may cancel or not arrive. Only one group, the male group in Atlanta, had a low show rate with only seven participants. All other cities had eight participants. Group discussions lasted approximately two hours each.

Upon completion of these groups, key themes that emerged from the groups have been evaluated and will be used in guiding the development of the quantitative portion of this research.

Key Findings

Themes Identified Across Groups

Consumers have a general sense of how to improve their fuel economy, but they are often misinformed or under-informed.

Whether consumers are putting 300+ miles a week on their vehicles commuting or just driving around town running errands, fuel economy is relevant to each of them. Particularly in today’s economy with high national gas prices, fuel economy is a top concern for drivers.

While respondents in all cities were able to name some behaviors and actions they can take to achieve better fuel economy, there is a lot of misinformation. There was the occasional disagreement within the groups – fuel economy impact of the air conditioner versus open windows – and outdated information that no longer applies to modern vehicles like allowing the vehicle to warm up for a few minutes before driving.

Some gender differences were also observed when it comes to how informed consumers are about fuel economy. Throughout the cities, the female respondents were able to articulate general concepts that can lead to improved fuel economy, but some of the technical information is misunderstood. They spoke of planning out trips, driving slower and keeping up with general vehicle maintenance. When evaluating the content provided to them, females were more likely to take the information at face value and not require additional details.

Males, however, were better able to offer technical know-how and discussed specifics on why certain behaviors had an impact. They were also more likely to discuss the different tips they’ve heard and hash out whether it’s valid or not within the group discussion. When presented with fuel economy content, they were more likely to question the tips if it refuted what they had believed and asked for technical information as to how a behavior impacts fuel economy.

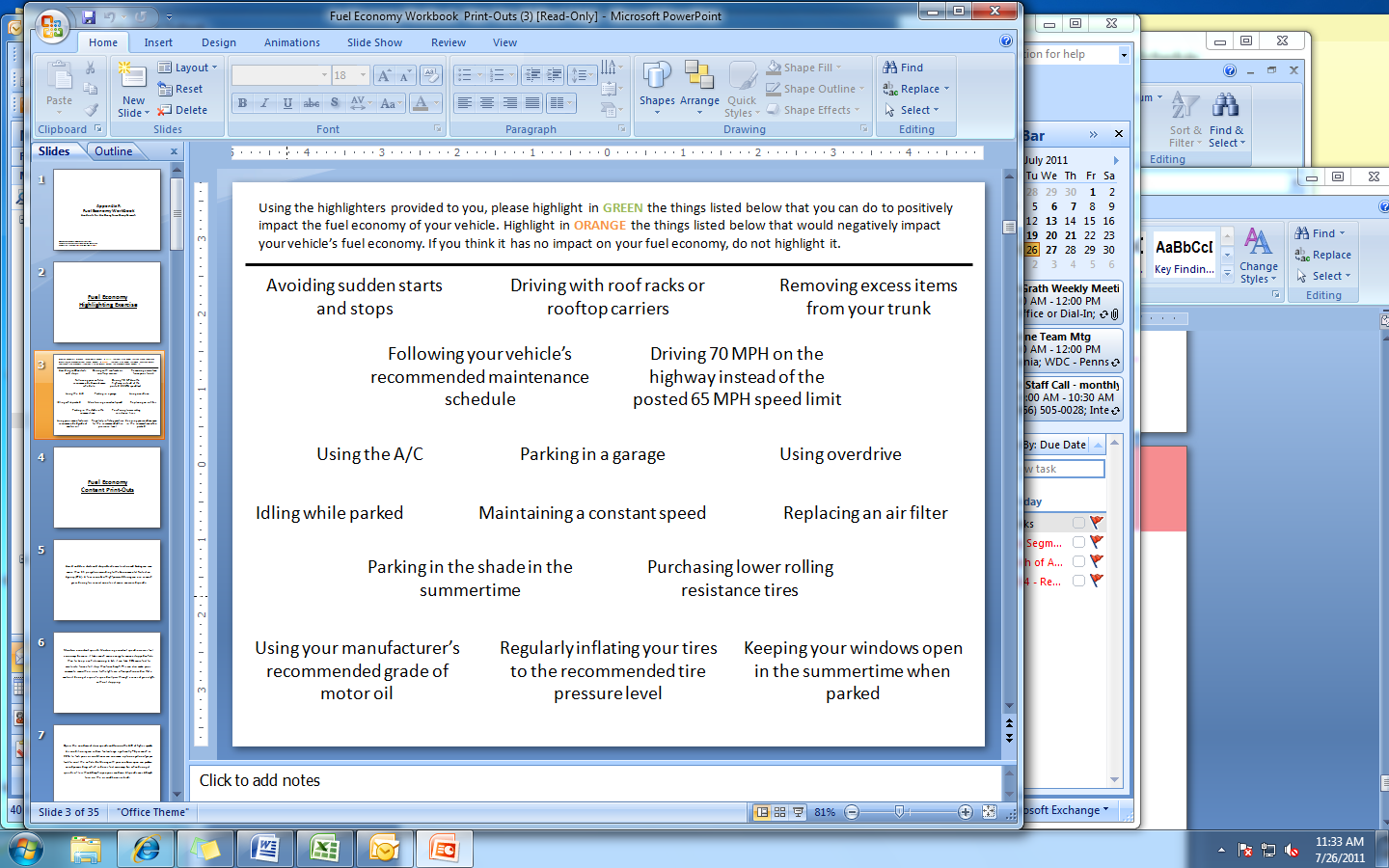

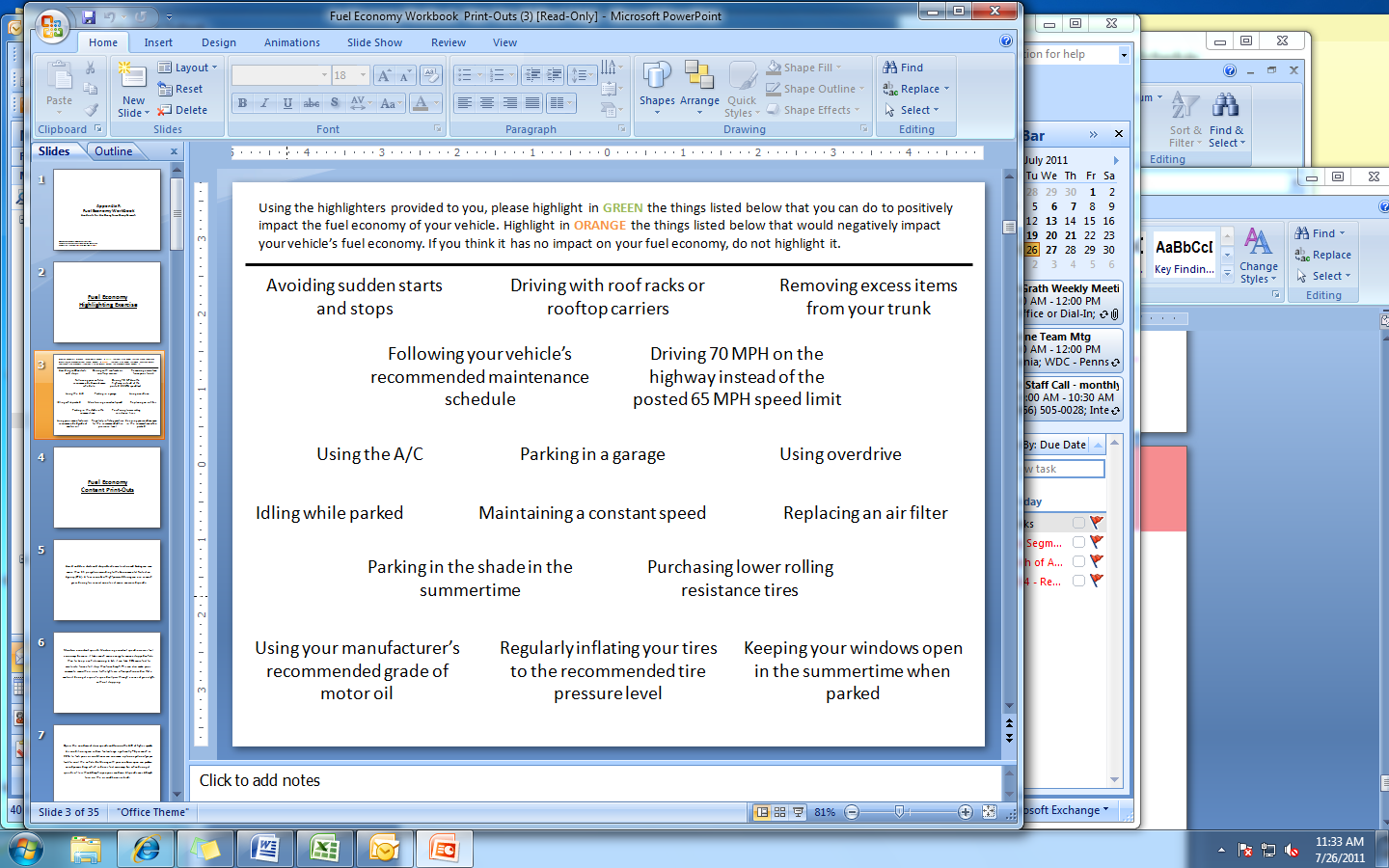

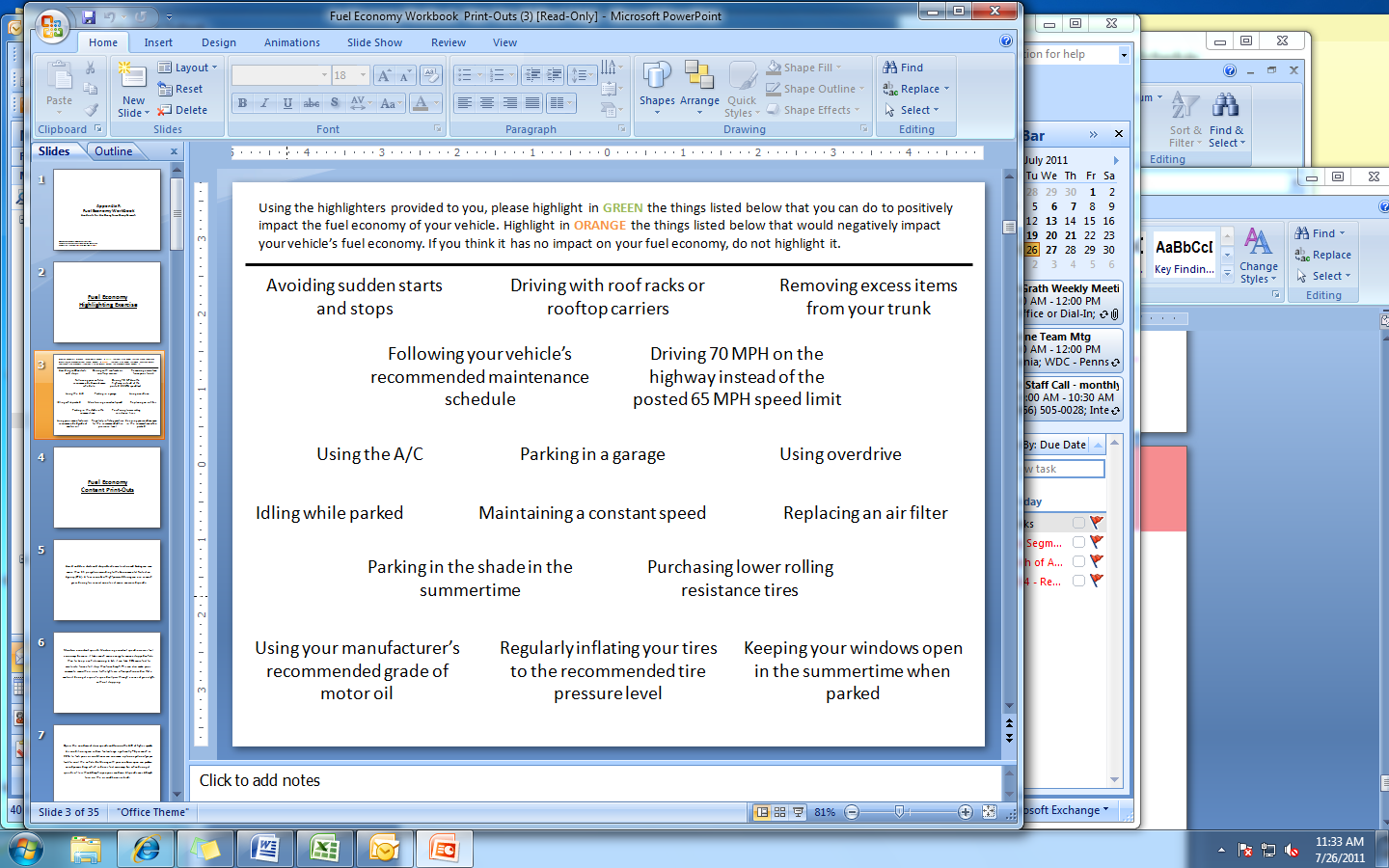

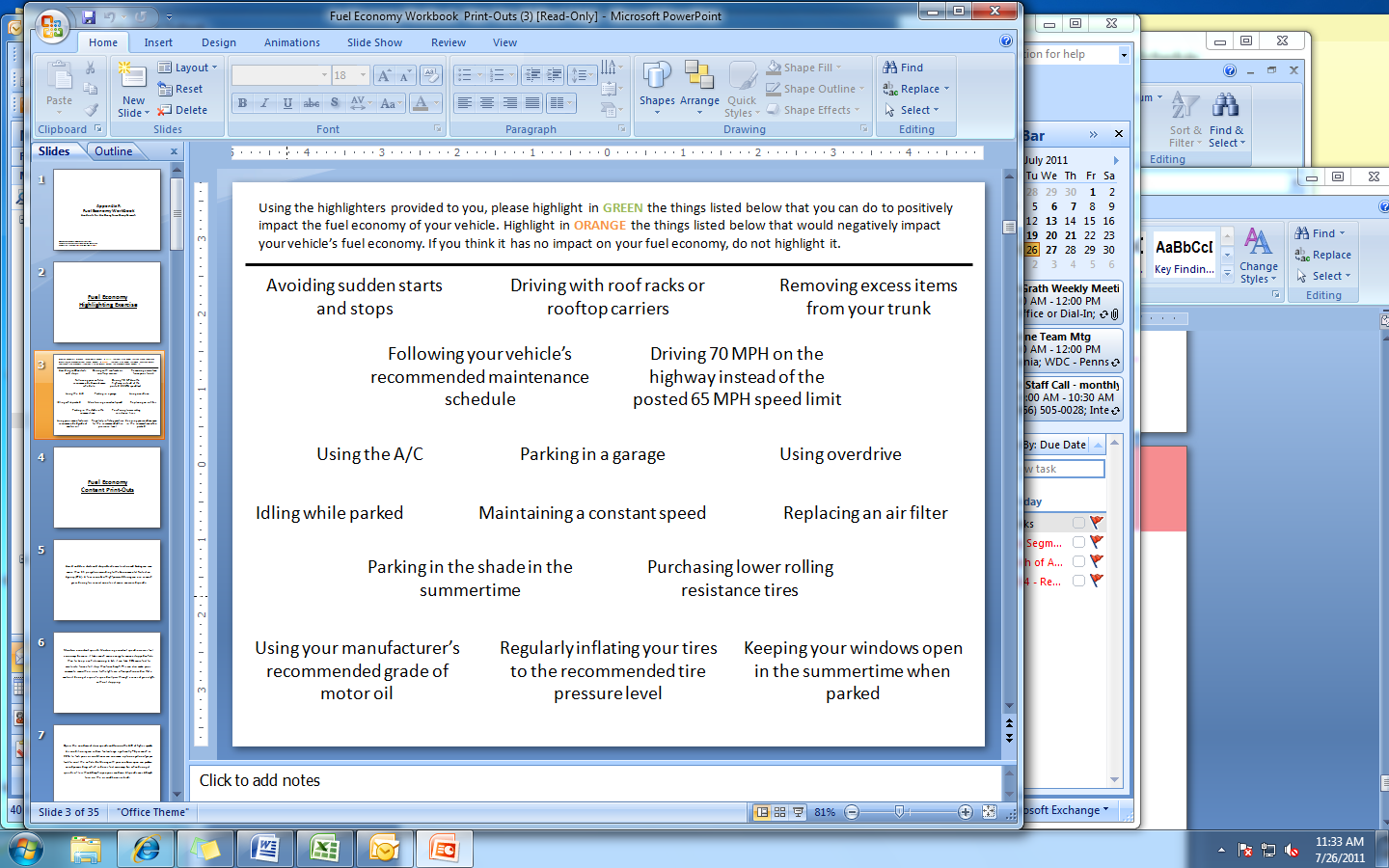

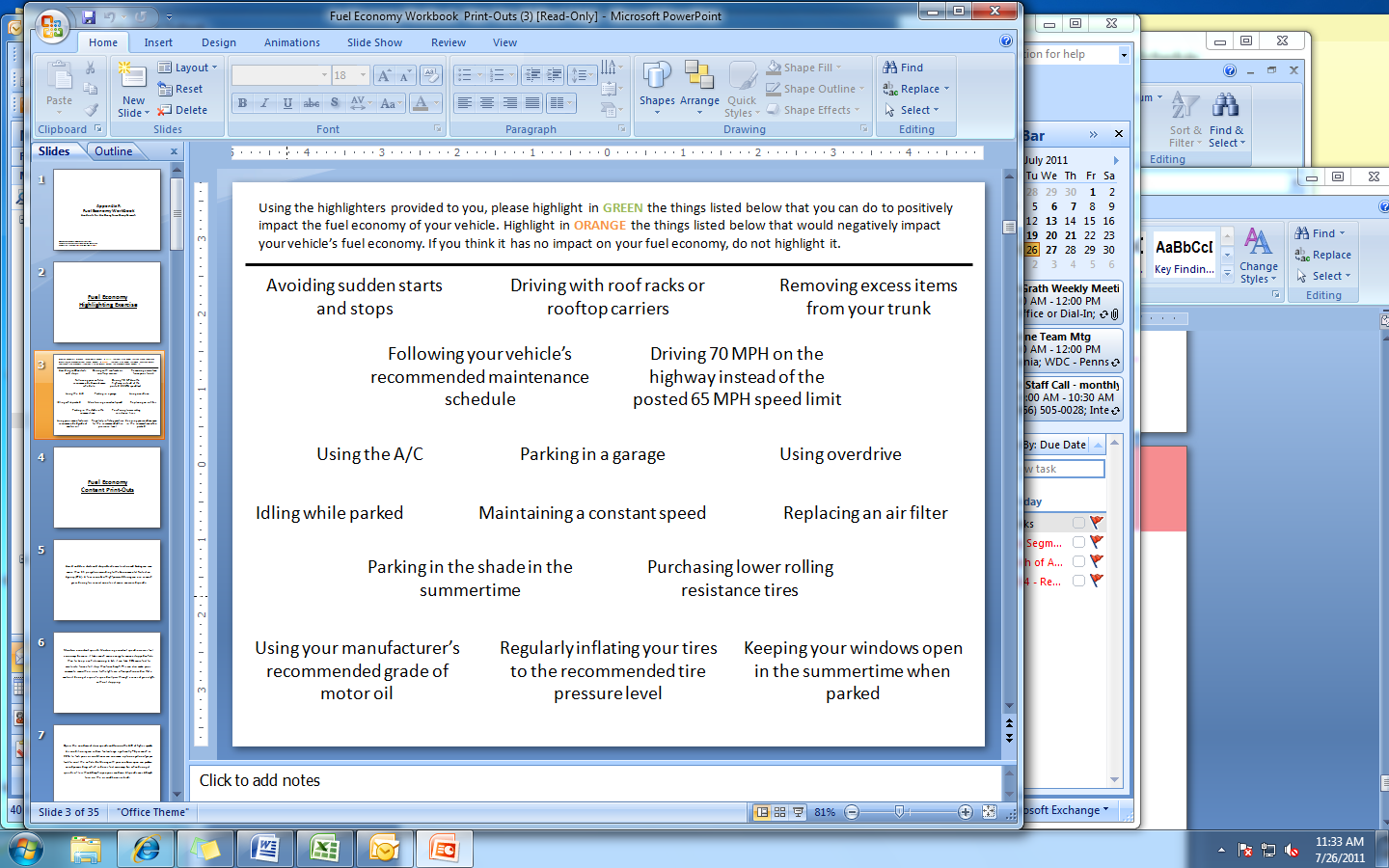

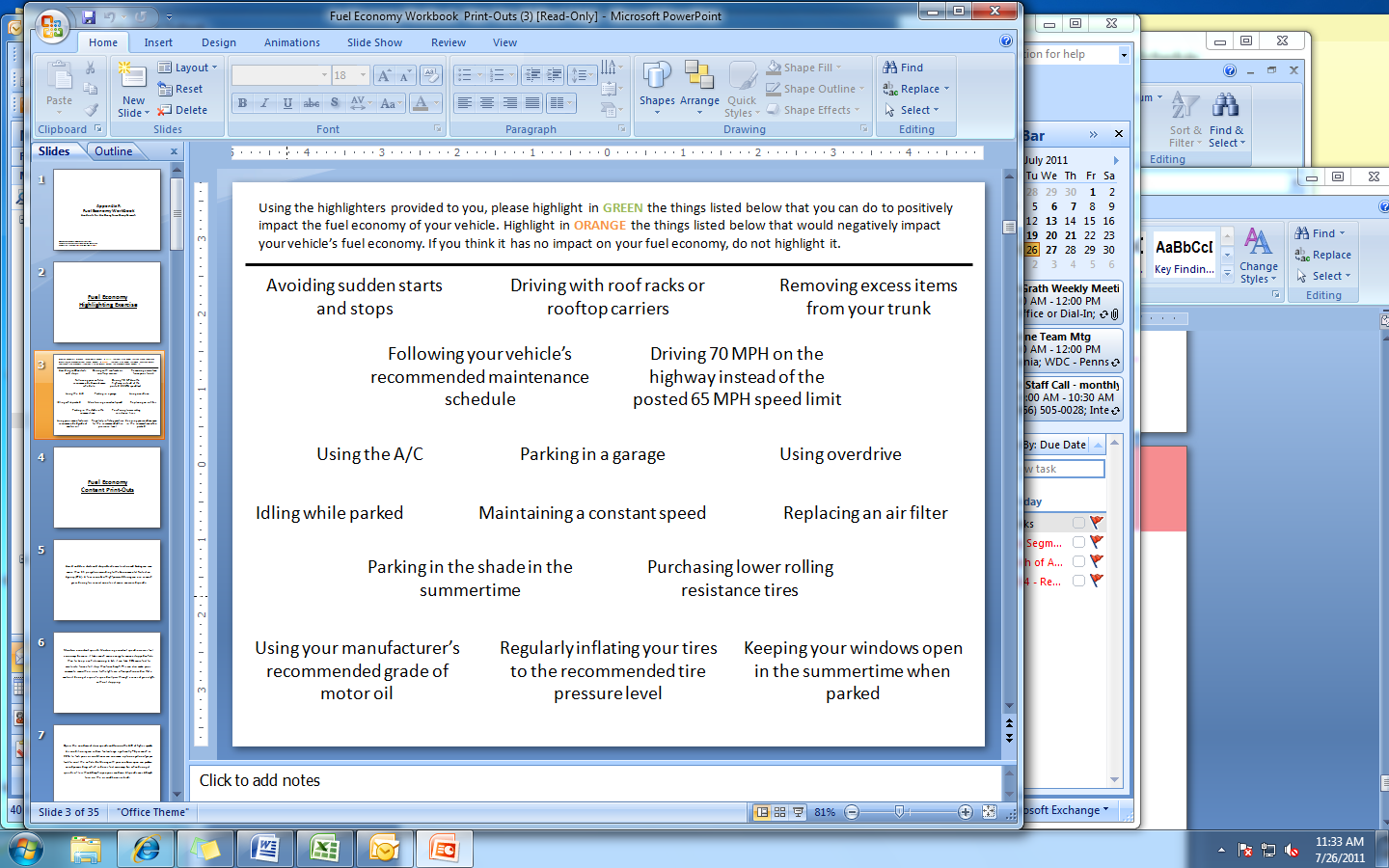

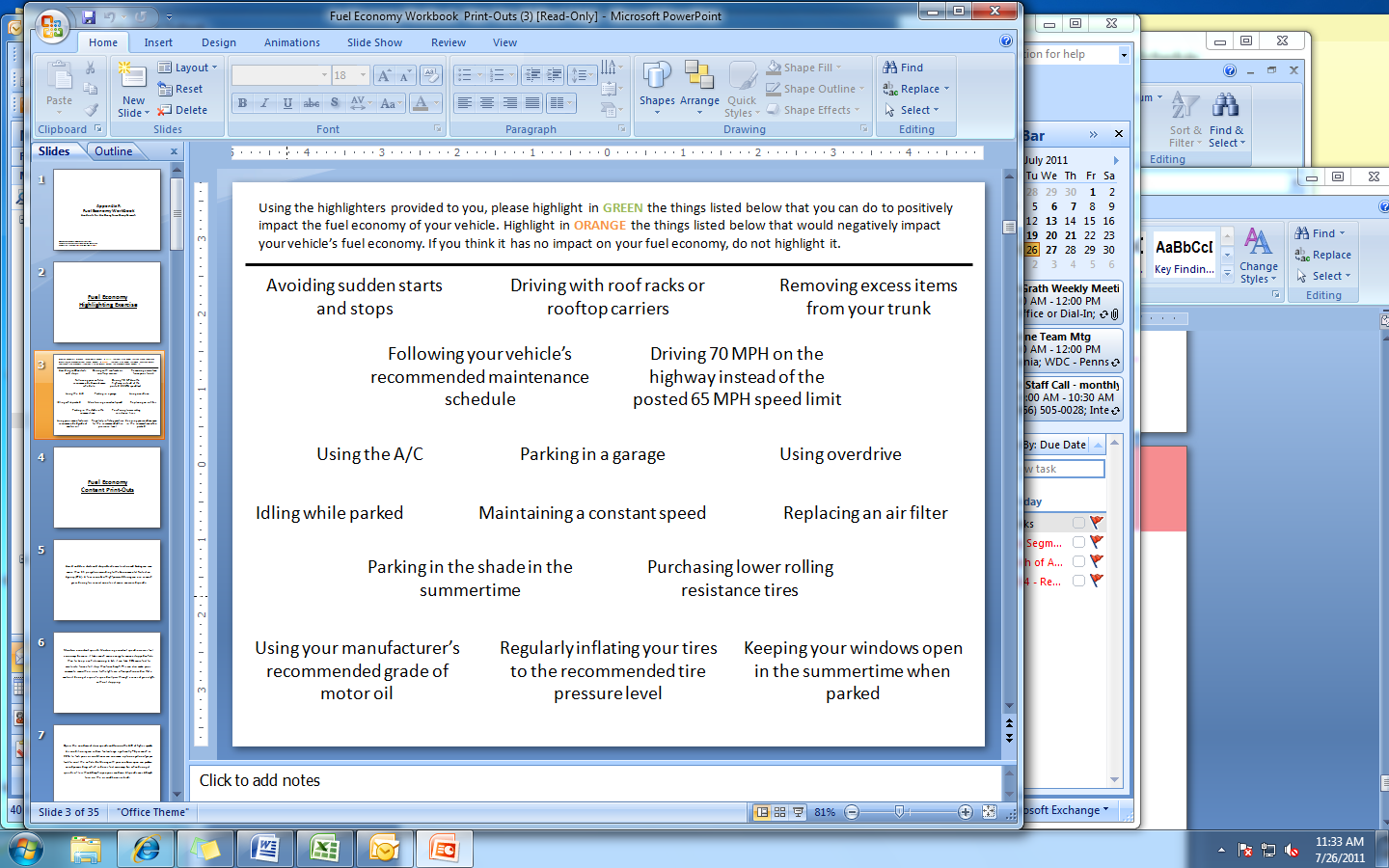

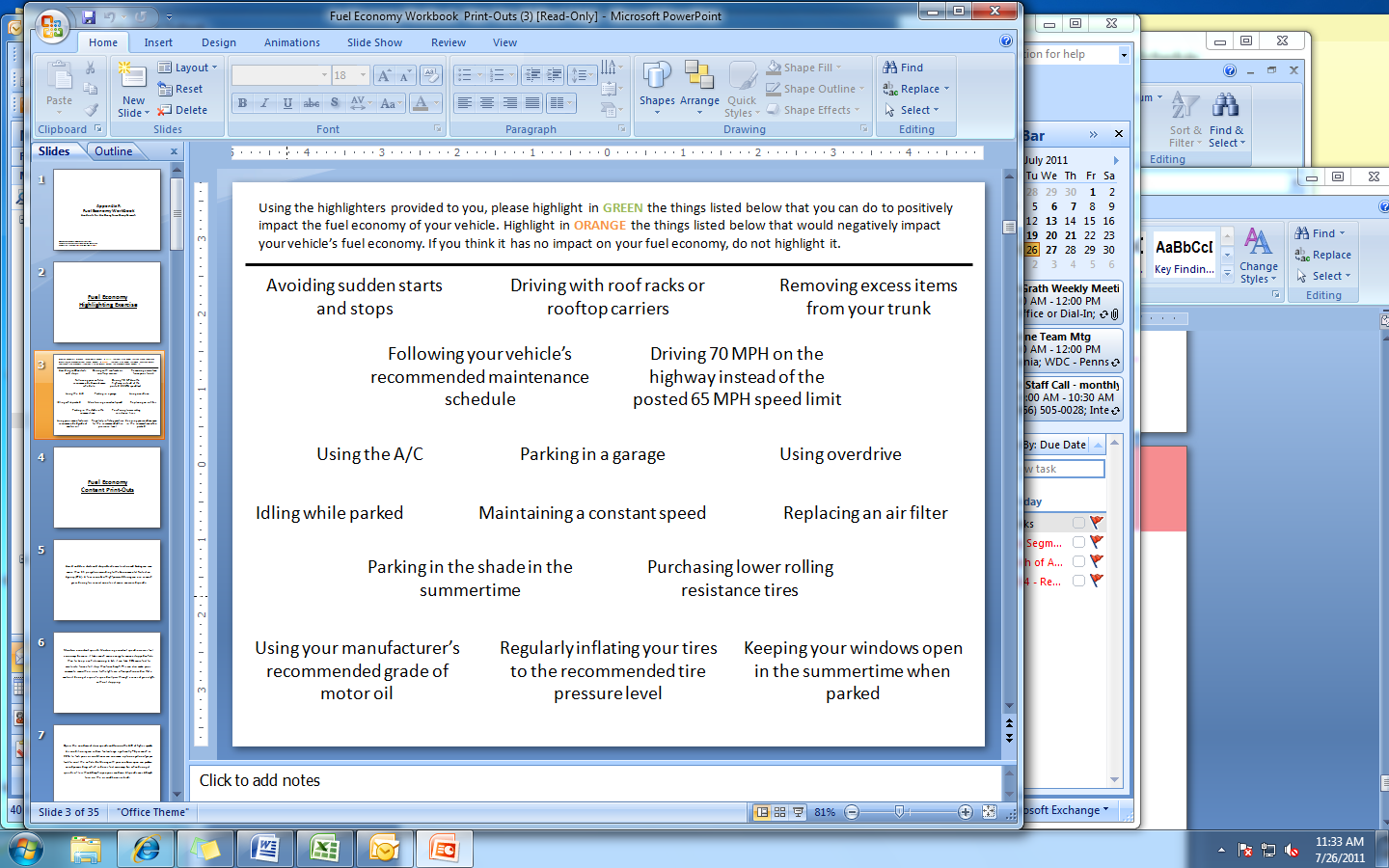

Detailed results of a worksheet activity in which respondents selected which behaviors and maintenance habits have a positive or negative impact on fuel economy is available in Appendix D.

Currently, the main source of fuel economy information is word-of-mouth through family, friends and mechanics.

Local mechanics, friends and fathers are key sources for driving information in general, and are main sources of current fuel economy knowledge. These trusted sources have offered tips over the years on how to properly maintain their vehicles and saving fuel is part of the equation.

The impact of many of the behaviors and maintenance habits discussed were also learned through experience and logical conclusions.

Because respondents are often relying on information that has been imparted on them throughout their years of driving experience, it is difficult to change their thinking even though some of the facts they believe are outdated. For example, many respondents throughout all cities believe changing the air filter on a vehicle improves fuel economy. When presented with the idea that this action improves performance, but not fuel economy, many respondents were skeptical.

“Based on what we have learned before and then what we just read a while ago, it just seems like the performance would affect the fuel economy.”

Though the current levels of fuel economy knowledge have come from word-of-mouth and experience, if a question about fuel economy arises, consumers are likely to turn to Google for an answer. From there, they assess the validity of sites offering fuel economy information. Cars.com, Edmunds.com, KelleyBlueBook.com were all mentioned as trusted websites among male respondents. Female respondents were more likely to mention news websites like CNN.com and search engine homepage (ex., Yahoo.com) top news sections as sources they trust. Consumer Reports was also mentioned as a trusted source for this information across all groups.

When considering what websites they would trust, participants discussed the credibility of a .org website or .gov website versus a .com website. If visiting or directed to a website they are not familiar with, consumers are more likely to find information on a .org website more credible than either a .gov website or a .com website. These websites indicate to them that the source is an independent third party that will offer an unbiased opinion. While some respondents raised concerns with the use of a .gov website to communicate the information presented in the groups, they were more likely to trust SaferCar.gov than a .com website they are unfamiliar with.

There is a desire to learn more about fuel economy, but there are barriers to actual behavior change.

Throughout the groups there were items that were new for participants and they reported a desire to search for information and learn more about the topics discussed. Considering the current economic state, many of these individuals are interested in learning how they can conserve gas to save money, but factors like convenience, schedule and comfort also impact driving behaviors.

Some of the barriers to change are personal (“I drive with a lead foot and am hard on the brake, and I know it, but I don’t care”), some are about cost (“But I wouldn’t buy [lower rolling resistance tires] because of the fact that if you are going to use that car in the wintertime, you almost have to replace the tires. With me it’s a $700 or $800 deal to go out and buy good winter tires”), and some are regional (“[In Phoenix] you have to have air conditioning in the summertime”).

In addition to these barriers, some of the facts and figures presented in the fuel economy content are not enough to motivate change.

“1-2%... will you actually see that when you go fill up at the pump?”

When looking for tips on saving fuel, participants want relatable information that they can easily apply to their own driving if they want to. Scenarios can help consumers comprehend the information more easily and decide whether or not the impact is worth it to them. For example, one participant suggested the content be written in the following way, “It saves a dollar a day for a person who drives 200 miles a week.”

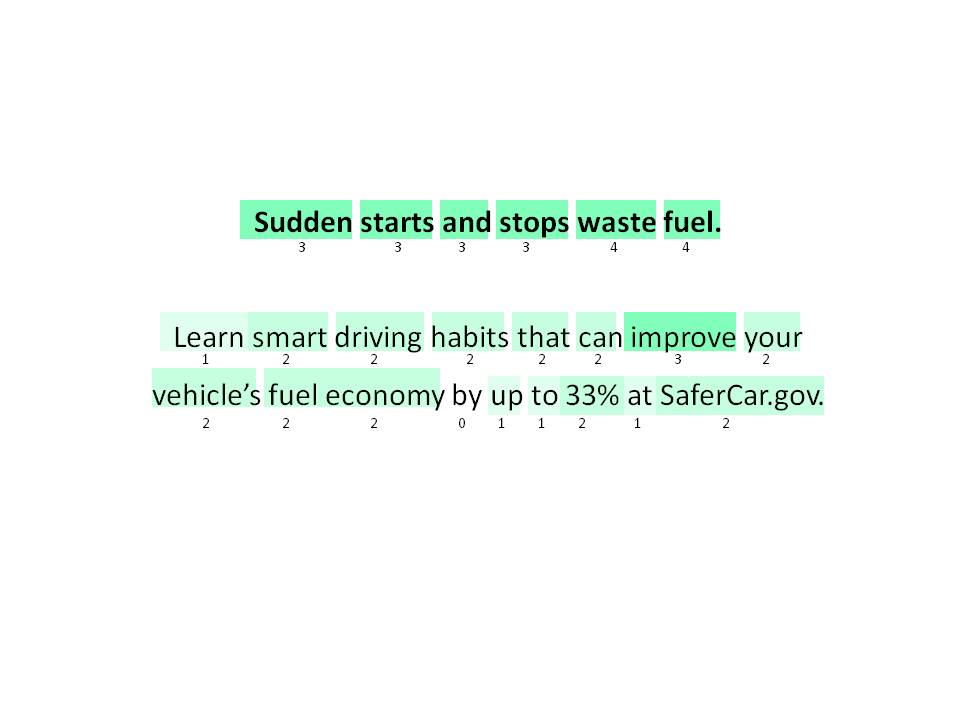

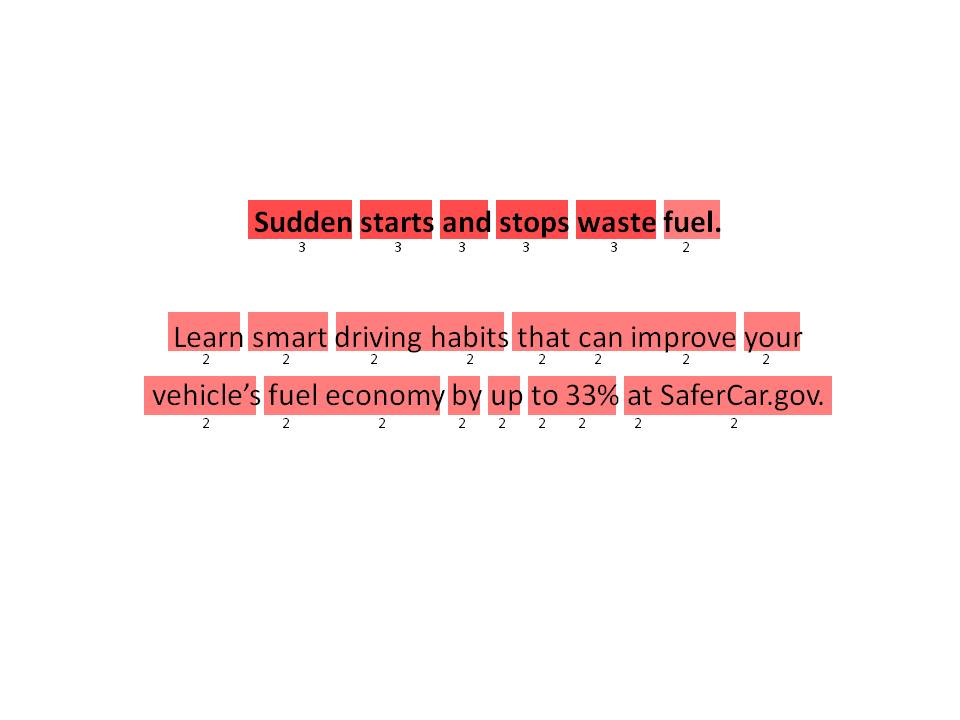

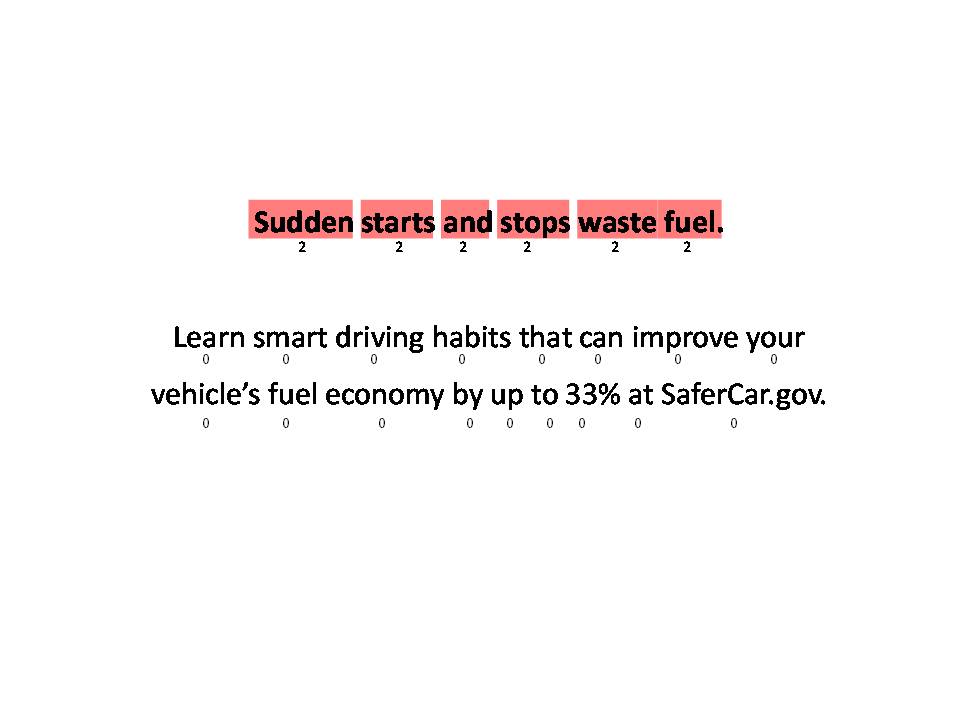

They are also looking for specific information based on their cities’ driving conditions. For example, in high-traffic cities, “avoid sudden starts and stops” was clear and understandable, but didn’t resonate with respondents because in rush hour traffic they feel there is no way to practice this.

Personal, environmental and national benefits all resonate with consumers, but personal benefits, specifically costs, are more likely to capture attention and encourage potential behavior change.

Consumers want to consider the ‘big picture’, but ultimately they need to see the tangible impact of their small behavior changes or alternative fuel use. They are thinking more about the dollars they are saving than reducing their emissions or easing political tensions.

When asked the benefits of owning a more fuel efficient vehicle respondents immediately bring up benefits like money in your wallet, fewer fill-ups and the ability to drive in the HOV lane.

Environmental benefits are also mentioned, but even these benefits are often spoken about in terms of personal impact.

“We all have kids, so they will have a place to live…”

When thinking about alternative fuels, however, consumers are skeptical of the actual environmental impact. A few years ago they heard about ethanol and its benefits, and now they hear that ethanol is not a good option. They are confused and wonder if anyone actually knows whether or not these fuels are going to have a positive impact. In order to trust these alternative fuels, they want to hear from independent third-party sources that the fuels are safe to use.

When considering fuel savings, the collective impact of fuel savings as a country isn’t compelling enough to drive these individuals to seek small fuel savings themselves. For example, the ethanol content tested in these groups mentions the benefit of economic development for most Midwestern states. In many cities we heard,

“Most Midwestern states? Not us.”

These respondents were more concerned with the impact these topics have on their own lives and their local community rather than economic development in another part of the country.

The one concept separate from personal savings that resonates most with consumers is that alternative fuels may help to reduce dependence on foreign oil.

“I think that if the United States would take what they have available to them and expand upon that, it would solve an unemployment problem and put some people to work.”

However, personal benefits are easier to grasp and more motivating for widespread change.

Respondents are skeptical of the government as a source of this information in general and do not necessarily see SaferCar.gov as the resource for this information.

In some cities, as soon as we approach government as a source of information, the conversation with males devolves into debt ceiling discussion, Iraq and Iran, and overall government inefficiency and waste. Others, particularly female respondents, are more open to the government as a source of information.

There is more trust put in a specific agency, like EPA, DOT or DOE, rather than “the government” overall to provide this information, but consumers still need more proof. For all groups, independent third-party partners add credibility and trust. “I would use [a government website] as a jumping off point, but it would never be a sole point to help me make decisions.”

Throughout the groups it was apparent that a .gov website is more trustworthy than a .com that they are unfamiliar with, but ultimately, there are many consumers who are concerned that the information provided fulfills some sort of agenda. Keeping the tone of the web content educational and providing access to research and external sources for those who want more information can help to ease skepticism.

However, in the minds of respondents SaferCar.gov does not relate to the information presented in the groups. They do not see a connection between vehicle safety and fuel economy. This disconnect could lead to lower levels of recall among those exposed to messaging. Respondents suggested that FuelEconomy.gov or a new website domain name like EconomicCar.gov would be more likely sources for this information.

There are low levels of alternative fuel familiarity and little knowledge about the benefits and drawbacks of most alternative fuels.

Across all groups, experience with and knowledge about alternative fuels is limited. Most respondents in these cities have primarily heard only of using ethanol and electricity to fuel vehicles. There is also some awareness of biodiesel, though this is not often mentioned by name as many respondents have simply heard that people are using recycled cooking oil as vehicle fuel.

Males tend to discuss technical information about how the fuels impact engines and vehicle performance, while the discussion with females focused on the environmental and political impact of use.

They are able to consider both the potential benefits and drawbacks of alternative fuel use. While these alternative fuels may burner cleaner and have the potential to save money at the pump, electricity has range limitations, ethanol is recognized as having an impact on food prices and there are questions as to whether it produces fewer emissions and natural gas doesn’t have infrastructure. Still, the limited levels of knowledge make it difficult to determine whether or not the benefits outweigh the positives.

Additionally, in nearly all cities there was discussion about which technology will win, bringing up discussion of VHS vs. Betamax. Respondents are hesitant to choose an alternative fuel now when it might lose the battle and be obsolete. Ultimately, consumers are not willing to take a gamble on an alternative fuel until it is proven. It still comes back to the cost impact on the consumer. In addition to the concerns listed above, respondents expressed concerned with the costs to convert to a fuel and the length of time to recoup expenses.

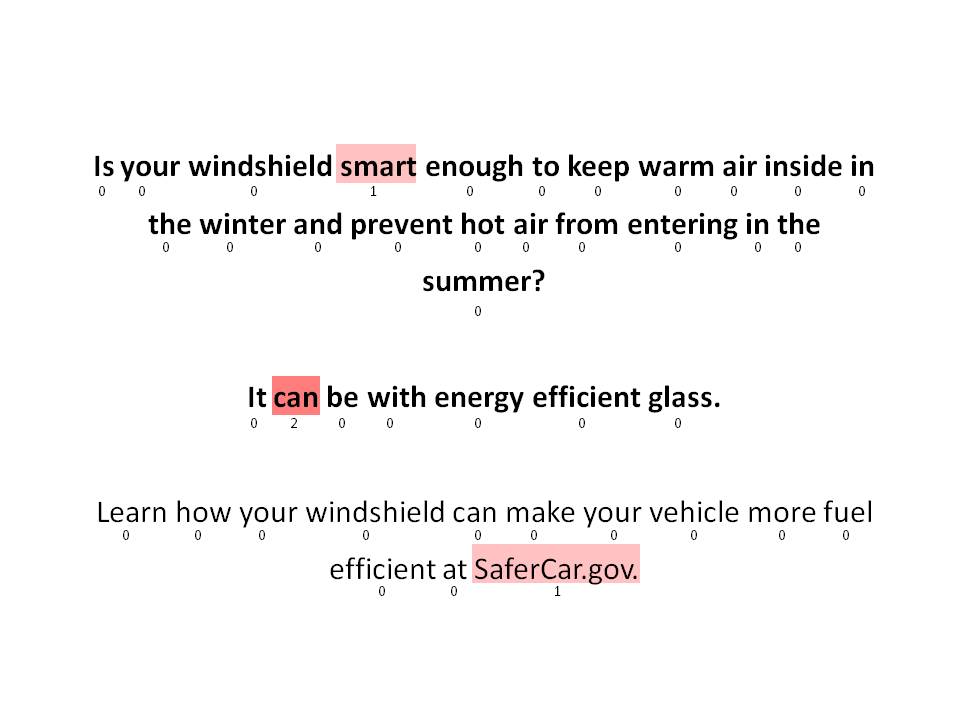

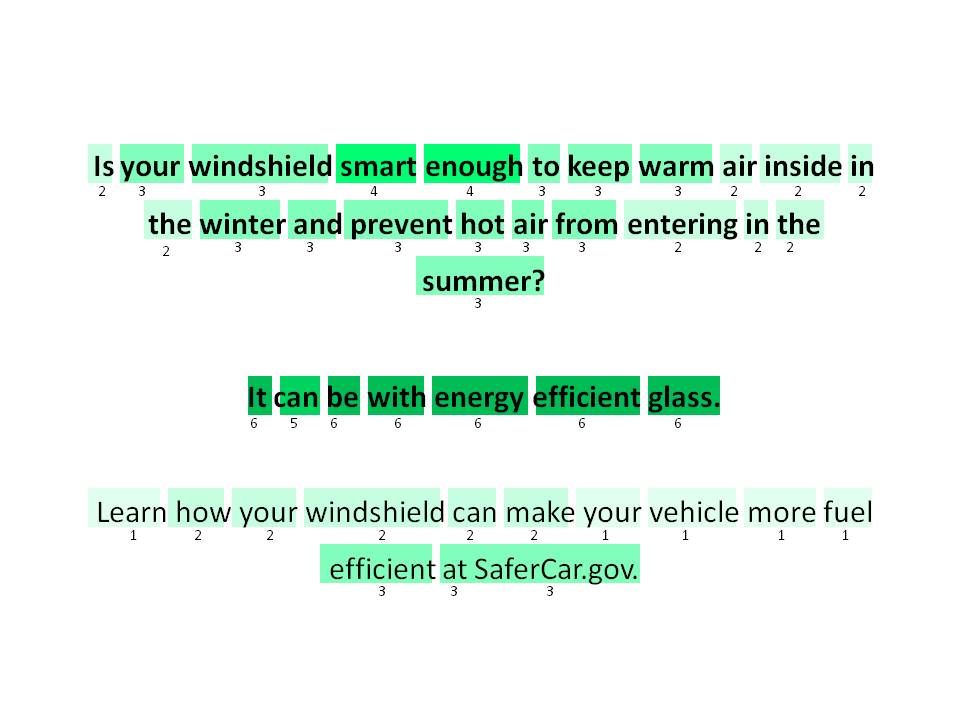

Thermal management technologies have low levels of awareness, but high levels of interest and excitement.

After reading thermal management technology content, many participants nodded their heads and said ‘sign me up.’ There is a keen interest in making mechanical improvements to vehicles in order to help them run more efficiently, particularly if these are standard features.

Despite the excitement for such technologies, there are still some concerns and questions that need answering prior to considering adding these to their vehicles. In addition to concerns with the cost to add these technologies to their existing vehicles or to include them on future purchases, participants were concerned that maintenance and repair costs would be higher than that of their current glass and air conditioning systems.

“…if I have a $40,000 car that now becomes a $50,000 car because of the windows, you many think twice about it”

They also wondered if the technology works, if the energy-efficient glass is just as safe and durable as regular glass and if there are any negative effects of using this technology.

In order to get the information they need, they want to test the technology themselves, talk with people who have used the technology or refer to third-party testing like Consumer Reports.

Regional Differences Identified

Potential behavior change often depends on region, though in order to actually make a change, consumers need to hear specifically what they can do to make an impact and how much of an impact they can make in their local area. In Minneapolis, respondents were not interested in purchasing lower rolling resistance tires because they may encounter snow from October through May. In Phoenix, the concept of parking in the shade is not always possible. Offering tips that can be applied regionally will help consumers to more clearly understand the steps they can take to improve their fuel economy.

There are also concerns that will be more motivating in certain cities. For example, in Phoenix, consumers are used to hearing about air quality concerns and have even experienced Ozone Alert Days when air quality is especially poor. For these consumers, information related to improving air quality will resonate as they will view behavior changes as a way to improve their local community.

When trying to motivate fuel-economy-related behavior change, it is important to understand all the benefits for consumers in certain regions. Some cities offer additional benefits for purchasing fuel efficient vehicles. For example, Atlanta respondents talked about tax breaks and the ability to ride in the HOV lane if your vehicle gets a certain amount of miles per gallon. In other cities, like New York City, tickets are given out for idling. Communicating regional benefits and ramifications related to fuel economy can help make the content more impactful and ultimately more useful for consumers.

There are also regional considerations for communications channels. Atlanta respondents talked about Clark Howard, a local consumer advocate, as a trustworthy source for information. In high-traffic cities, billboards were mentioned as a potential messaging channel as consumers are spending their commute either stopped or driving at slow speeds and will find these messages relevant.

Implications

Implications on Consumer Education Program

As we begin to craft messaging with the goal of educating consumers, it is important to understand what the general consumer knows and does not know. When it comes to fuel economy and the impact of driving behaviors and maintenance have on it, consumers have a general sense of ways they can improve their fuel economy. However, this knowledge is often fraught with misinformation.

Females in the groups talk about all the tips “Dad” used to give them, like idle to warm up the car, only use ‘plus’ gas or only buy gas from specific fuel station brands. Some of these tips are inaccurate or no longer applicable to modern cars. Reaching these females with straightforward information based in fact can help to inform these women beyond the things that Dad told them; however, they do not want all the technical details on how things work. For proof, these women look to personal experience, reviews from others with experience as well as research from trusted sources. However, the research presented must be easily digestible.

Males also have some misinformation, but in general are better able to discuss the technical reasons why certain actions have an impact on fuel economy. So, whether or not they knew these tips before, they try to rationalize information and determine whether or not it is valid. Males are more interested in technical details as proof that this information is true.

When creating messages around behaviors and maintenance tips, it is important to be specific and present tangible information. For example, when discussing the impact that idling has on fuel economy, providing consumers with guidelines about how long is too long to idle would be helpful. By providing tips in a way that is easy to apply, consumers are more likely to at least try to change their behaviors.

Current perceptions about fuel efficient vehicles suggest a tradeoff between safety and fuel efficiency. Consumers picture a fuel efficient vehicle as a small passenger vehicle and do not feel safe driving these vehicles on the same road as large trucks. Future fuel economy messaging should address safety in conjunction with fuel economy – assuring consumers that all vehicles sold in the US must still reach certain safety standards and that fuel efficiency and safety is not always a tradeoff.

While some in the groups expressed skepticism for government sites and were more likely to visit a .org website than a .gov website for this information, most agreed that the government can be one source among many. To minimize the skepticism, it will be important to maintain an informational tone, present both pros and cons and provide consumers with suggestions on where to learn more. An educational program needs to guide consumers rather than tell them what they should and should not do.

SaferCar.gov is not a recognized website and there are some concerns with this site being the source of fuel economy, alternative fuel, GHG and other emissions and thermal management technology information. Participants would be interested in visiting SaferCar.gov, but don’t believe it is relevant to fuel economy as vehicle safety was not discussed in the groups.

The messaging tested in these groups resonated well with focus group participants. Respondents liked the tips being offered and the idea that the messages encourage readers to “learn.” Maintaining an educational tone will be important to the success of this consumer information program and can help to not only entice consumers to seek more information, but also lend credibility to the content.

Messaging should focus on the personal benefits consumers can gain from behavior change or new technology adoption. Participants want to know how they can save money, whether through less trips to the pump, changing to an established and cheaper alternative fuel, or including energy-saving technologies on their vehicles. Reducing GHG emissions was the least impactful message tested among consumers. Since there is a direct relationship between GHG and fuel economy, it is better to focus on personal, tangible benefits.

Implications on Quantitative Research

With the quantitative survey instrument, which is currently in development, we will continue to explore these topics in detail to gauge how well understood fuel economy, alternative fuels, GHG and other emissions and thermal management technologies are at a national level. Gaining an understanding of what consumers know and don’t know will help to guide messaging and content development for the consumer information program.

Through the screening for this survey, we will work to obtain a nationally representative sample across various demographic characteristics. In addition to providing a national snapshot of consumer knowledge and understanding, we will be able to cut the data by gender, age, region and other demographics to detect differences in knowledge and motivation.

Beyond demographic characteristics, we recommend including a short battery of psychographic statements and behavior statements so that we have a clearer picture of what messages resonate best.

Based on our findings from the focus group research, we recommend focusing the quantitative survey on fuel economy, alternative fuels and message testing. It is apparent from our groups that there is little knowledge of thermal management technologies and with the potential for these technologies to become standard on passenger vehicles, we believe this valuable survey space can be better utilized on other topics.

In summary, we recommend a quantitative survey that will cover the following topic areas:

Fuel economy knowledge and understanding evaluation

Alternative fuel awareness and perception evaluation

GHG and emissions awareness

Current behaviors

Motivations and potential for behavior change

Communication channel evaluation

Message testing

For the message testing portion of the survey, we recommend developing mock-ups that can be evaluated by consumers. Combining this with data evaluating motivations for behavior change and potential communication channel, we will be able to recommend those messages which will be most impactful with consumers.

This quantitative information collection request will be prepared and available for NHTSA review by Friday, August 12, 2011.

Appendix

Detailed Findings

Focus Group Schedule

Participant Profiles

Screener

Discussion Guide

Fuel Economy Content Evaluation Worksheet Tally

Message Testing Workbook Tally

Appendix A: Detailed Findings

Fuel Economy vs.

Fuel Efficiency

“The

economy is the impact on your wallet, the efficiency is the impact

on the car.” – Male,

Atlanta

“…fuel

economy would be more like the price and how well-priced or

high-priced it is, and the efficiency is how good the gas is…

how clean the gas is.” –

Female, New Jersey

“…the

economy would be more like what we are doing to cut down on the

miles where efficiency would be what the manufacturers are doing to

cut down” – Male,

New Jersey

“…in

reality I just use them interchangeably all the time.”

–

Female, Phoenix

“…

fuel efficiency and fuel

economy, I kind of think of them as synonymous” – Male,

Phoenix

Fuel Economy Content Evaluation

Fuel Efficiency

– Female, Phoenix

When the topic of fuel economy arises, consumers in all cities immediately think of costs. Gas prices, saving money on fuel, saving trips to the pump are all top-of-mind when the term ‘fuel economy’ is mentioned.

Across cities, there is little consensus on the definitions of fuel economy and fuel efficiency and varying opinions on whether or not there is a difference between ‘fuel economy’ and ‘fuel efficiency.’ For males in Minneapolis, fuel efficiency is a measure of cost while fuel economy is a measure of mileage. Females in Minneapolis explain the differences as efficiency as a function of the vehicle as a whole while economy is simply MPG. Other respondents in Phoenix and Atlanta discussed the terms as interrelated, “I look at it as if it’s efficient, it’s economical,” said one male in Atlanta.

Fuel economy as a concept comes with its benefits and its drawbacks, and purchasing a vehicle with high fuel economy is not always a viable option for these respondents. When thinking about a ‘fuel efficient vehicle’ respondents see a tradeoff between the cost savings at the pump and safety. When it comes to the purchase decision, safety is ultimately more important.

In most cities, vehicles with high fuel economy are perceived to be “small” and as a result, more dangerous. Respondents picture SMART cars or small, 2-seater vehicles with no trunks and do not want to drive vehicles, especially in high traffic areas with large vehicles on the road (e.g., Atlanta at rush hour).

When deciding which vehicle to purchase, cost (both sticker price and ultimate upkeep costs), comfort and style also factor into the decision – fuel economy is just a part of the value equation. Though fuel economy is an early consideration factor, consumers tend to first narrow down their options before evaluating this information; however, the difference between two vehicles is not always significant enough to make it a true factor in the decisions. There is a threshold that would be more impactful (ex., 25 MPG vs. 40 MPG), but large differences in fuel economy come with additional considerations, so as long as a vehicles’ MPG falls within an acceptable range for that class of vehicle, it is less likely to have an impact on the final decision.

Those consumers who are considering purchasing an SUV have already convinced themselves they will not be getting good fuel economy. They know some larger vehicles perform better than others, but don’t believe there will be a significant difference.

Thinking about their current vehicles and driving behaviors, respondents were asked to list things they could do to achieve better fuel economy. The following behaviors and maintenance tips were mentioned unaided among focus group participants:

Behaviors with a Positive Impact on Fuel Economy |

Unaided Mentions |

|||||||

MINN (F) |

MINN (M) |

PHX (F) |

PHX (M) |

ATL (F) |

ATL (M) |

NJ |

NJ (M) |

|

Check your tire pressure |

X |

X |

X |

X |

X |

X |

|

|

Drive the speed limit |

|

|

X |

|

|

|

|

|

Follow the maintenance schedule |

X |

X |

X |

X |

X |

X |

X |

X |

Replace air filter |

X |

X |

X |

X |

|

|

|

|

Regularly replace fluids |

|

|

X |

X |

|

|

|

|

Don’t accelerate & brake hard/too much |

X |

X |

X |

|

|

|

X |

|

Plan your trips |

X |

|

X |

|

X |

|

|

X |

Don’t use the A/C |

|

|

X |

|

|

|

|

|

Combine trips |

|

|

X |

|

|

|

|

|

Roll down the windows on the freeway |

|

|

X |

|

X |

|

|

|

Remove excess weight |

X |

|

X |

|

X |

X |

X |

X |

Get tires aligned |

|

|

X |

|

|

|

|

|

Drive in the correct gear |

X |

|

|

|

|

|

|

|

Maintain an optimum speed/ Don’t speed |

X |

|

X |

|

|

|

|

|

Carpool |

X |

X |

|

|

X |

|

|

|

Run your car before driving in the winter |

X |

|

|

|

|

|

|

|

Don’t idle |

X |

X |

|

|

|

|

|

|

Change the oil |

X |

|

|

|

|

|

X |

|

Remove roof racks |

X |

|

|

|

|

|

|

|

Drafting |

|

X |

|

|

|

|

|

|

Consistent speed |

|

X |

|

X |

X |

|

|

X |

Cruise control |

|

X |

|

X |

X |

X |

|

X |

Avoid rush hour |

|

X |

|

|

|

|

|

|

Cylinder deactivation |

|

|

|

X |

|

|

|

|

Use the A/C & close your windows |

|

|

|

X |

|

|

|

X |

Tire tread |

|

X |

|

X |

|

|

X |

|

Drive highways instead of local |

|

|

|

X |

|

|

X |

|

Watch your efficiency gauge |

|

|

|

X |

|

|

|

|

Let gas run low |

|

|

|

|

|

|

X |

|

Don’t turn A/C off and on |

|

|

|

|

|

|

X |

X |

Turn lights off |

|

|

|

|

|

|

X |

|

Turn radio off |

|

|

|

|

|

|

X |

|

Take public transportation |

|

|

|

|

X |

|

|

X |

Anticipate traffic lights |

|

|

|

|

|

|

|

X |

Ride a bike |

X |

|

|

|

|

|

|

|

For the female groups, a lot of this information was imparted on them by their fathers when they were young drivers. Other sources of information for both males and females include personal experience, newspapers, news websites like CNN, manufacturer websites, owner’s manuals, maintenance notices and mechanics.

After opening the discussion about fuel economy and top-of-mind behaviors consumers can do to achieve better fuel economy, we presented participants with a worksheet to aid in the discussion and discovery of what consumers know and comprehend about fuel economy.

While the impact of some behaviors and maintenance actions was apparent across all groups (i.e., following a vehicle’s maintenance schedule, removing excess weight and roof racks, regularly inflating tires, etc.) other items elicited some confusion. Most respondents across all groups believed replacing an air filter has a positive impact on fuel economy. This is something they’ve been told to do their whole life in order to improve vehicle performance and in their mind, improved vehicle performance should lead to better fuel economy. As one woman in Atlanta said, “…if your car is running better, then it’s going to use gas better.”

Another behavior that was a source of confusion was using overdrive. Males were likely to correctly select this as having a positive impact on fuel economy, but most female participants had never heard of overdrive and were unaware of the technical aspects of this feature. Many respondents said that they do not currently have or have never used overdrive, so this content was not relevant to them.

Overall, participants were capable of accurately choosing which items had a positive or negative impact on fuel economy, but were often unsure how they can apply some of these tips to their own driving. They are interested to know more about what they can do to save money and save fuel, but prefer tips that they can use or not use at their own discretion.

When reviewing the fuel economy content, many respondents pointed out that the impact of some of these behaviors was minimal and not likely to motivate their behavior. For example, when reviewing the content regarding using the recommend grade of motor oil, which states, “According to the EPA, you can improve your fuel economy by 1-2% by using the manufacturer's recommended grade of motor oil,” one respondent in Atlanta read this content and responded, “…my problem is with the 1-2%... what does that mean?” They are more interested in relatable, tangible benefits as motivation to change their behavior.

Educating consumers on not only what behaviors have and do not have an impact on fuel economy is important, but teaching them how to apply this information to their own driving is likely to have more of an impact. Maintaining this educational tone will be important to this consumer information program as participants suggested they are more likely to pay attention to these types of messages.

In addition, focusing on the personal benefits in a way that is clear and relatable to consumers will have more of an impact than ambiguous percentages or country-wide fuel saving numbers.

Alternative Fuels

While there is some awareness of alternative fuels like ethanol and electricity, there is little familiarity with, and even less use of, these fuels. Even those respondents with flex fuel vehicles indicate that it is difficult and expensive to find ethanol. When probed, male respondents are more able than females to name alternative fuels; however, familiarity with most alternative fuels is low across the board. Ethanol and electricity are the most commonly mentioned alternative fuels. In addition, respondents tend to associate hybrid vehicles like the Prius with the concept of alternative fuels.

Alternative Fuels Mentioned Unaided |

Unaided Mentions |

|||||||

MINN (F) |

MINN (M) |

PHX (F) |

PHX (M) |

ATL (F) |

ATL (M) |

NJ |

NJ (M) |

|

E85 / Ethanol / Corn |

X |

X |

X |

X |

X |

X |

|

|

Biodiesel / Cooking Oil / Recycled Oil |

X |

X |

X |

X |

X |

X |

|

X |

Electricity |

X |

X |

X |

X |

X |

|

|

X |

Water |

X |

|

X |

|

|

|

|

|

Solar |

X |

X |

|

X |

|

|

|

X |

Hydrogen |

X |

X |

|

X |

|

X |

|

|

Algae |

X |

X |

X |

|

|

|

|

|

Wind |

X |

|

|

|

X |

|

|

|

Natural Gas |

|

X |

X |

|

X |

|

|

|

Fuel Cell |

|

X |

|

|

|

|

|

X |

Synthohol |

|

|

X |

|

|

|

|

|

Propane |

|

|

X |

X |

|

X |

|

|

Battery |

|

|

X |

|

|

X |

|

|

Diesel |

|

|

X |

X |

X |

X |

|

|

Hybrid |

|

|

|

X |

X |

X |

|

|

Petrol Deactivates |

|

|

|

X |

|

|

|

|

When thinking about alternative fuels, participants questioned the true impact of these fuels and suggest that many of the ones discussed are unproven. As one respondent in Minneapolis said, “See, the biggest problem I see is: Which one of those is Beta[max] versus VHS?” Consumers are hesitant to begin using an alternative fuel because they do not want to choose a technology that will quickly become obsolete.

They are also concerned with costs. This includes cost to purchase a vehicle with alternative fuel capability, maintenance costs for such a vehicle and cost to purchase the actual fuel. Many male consumers are aware of the negative impact of ethanol – “in Georgia the ethanol is killing high-efficiency motors” – and as a result worry that the use of this alternative fuel can come with more extreme maintenance or replacement costs.they will not be

One of the most significant concerns with these fuels is a lack of availability and infrastructure to support widespread use. “It is one thing to say that everyone should jump on the alternative fuel thing, but practically speaking it will be difficult to replace all the gas stations, for example with alternative fuel.”

Participants do recognize the potential positive environmental impact of alternative fuels, as they are perceived as cleaner burning and often come from renewable resources, but as a whole they do not believe enough information and research is available to prove this impact. They mentioned that when cars started using gasoline, we did not realize the negative ramifications, and the same could occur with these new fuels.

In most groups, political impact of using domestic alternative fuels is mentioned unaided. They recognize the importance of a lower reliance on foreign oil, but still, the ultimate cost to the consumer is the main motivating factor to adoption. The environmental and political benefits are simply added value that would help reinforce their decision. Adoption of alternative fuels is more likely to come with increased availability, cost savings and proof of performance.

Across the eight groups, we explored four fuels in depth:

Ethanol

Electricity

Natural Gas

Biodiesel

Ethanol

Ethanol was the most widely-known alternative fuel mentioned in the groups. Participants have heard of ethanol or gasoline with ethanol added and in general, have negative perceptions of the fuel. “E85 is here in some gas stations, I have been seeing it and it is a little cheaper, but you are going to get worse gas mileage.” This perception that ethanol use results in reduced miles per gallon was common throughout the groups, particularly among males.

Respondents spoke about ethanol as a reason for not trusting alternative fuels. Males commented that for a long time we heard a lot about ethanol and that it was a safe, clean-burning alternative fuel. But then, as time passed, it was discovered that the fuel was hurting engines and vehicle fuel economy.

They are seeing additional drawbacks to using ethanol beyond those that affect ethanol users. Despite the fact that the U.S. is able to produce corn domestically, which is a benefit of the fuel, participants are seeing an impact on their food supply. “Then you have got food prices up, too. That’s a problem, too. Corn went up 74 percent last year.”

Electricity

There is some familiarity with the use of electricity in vehicles like the Chevy Volt, but many consumers still believe this is a concept for the future rather than currently in use. As with other alternative fuels, the concept of using electricity to fuel a vehicle elicits some concerns including infrastructure and availability, cost to use and the use of non-renewable resources to generate the electricity.

Availability seemed the biggest concern, particularly with females who picture themselves on a long trip needing to stop in the middle of the night to charge up. Instead of the five minutes needed to fill up the gas tank, they are concerned they would have to wait an hour or so to charge. In addition, the use of an electric vehicle may limit the places you can travel. “If you want to go camping in Colorado, is there going to be an electrical station?”

Some consumers also see these vehicles as being slower than other cars, which leads to safety concerns and there is little knowledge of the ultimate environmental impact of using electricity. “But, then, you know, we don’t see behind the scenes and what it takes to plug that in and use all that. I don’t know how you know what the footprint really is.”

The concept, overall, is positive for consumers as they assume maintenance costs would be lower and the difference between gasoline costs and electricity costs would be beneficial to their wallets, but there is more interest in gas-electric hybrid vehicles than plug-in only. These vehicles offer the benefits of electricity, while addressing concerns about being stranded with no plug-in station.

Natural Gas

While overall, awareness of the use of natural gas in vehicles is fairly low, some respondents are aware of the fuel being used in public transportation.

When thinking about natural gas as an alternative fuel source, there are clear differences between the male and female thought processes.

One female respondent in Phoenix currently uses compressed natural gas in her vehicle that she primarily uses for commuting. Other group members immediately began asking questions about this fuel – Where does she get it? Is it expensive? How often does she have to fill up? What made her try this fuel?

In addition to these questions, male participants wanted more technical information and wondered where the natural gas would be sourced and how the engine would work running off the fuel.

Overall, consumers need a lot more information about the use of compressed natural gas, including those questions asked in Phoenix as well as information about how natural gas is sourced and its ultimate impact on the environment as compared to gasoline, in order to consider using the fuel.

Biodiesel

Biodiesel is a fuel that consumers are aware exists, but few know by name. Male respondents were far more likely than females to name biodiesel as an alternative fuel, but many females have heard of the use of recycled cooking oil in vehicles.

Females in Minneapolis recognize the benefits of using recycled products, but question the benefits of diesel. “I thought people have gone away from diesel. You know, there was a time period when there were a lot of diesel cars and now it doesn’t seem like there’s as many, and the price I think is higher, isn’t it, on diesel?” These respondents wondered if the recycled oil helped make the diesel fuel cleaner.

Males were more knowledgeable about biodiesel. They had heard of this fuel, heard about biodiesel plants and other news stories and explored more. When they spoke about the benefits, they were more authoritative than the women. Instead of asking questions, they made statements like “…[biodiesel] is clean, but also diesel engines are known for their fuel efficiency. So, not only are you burning cleaner fuel, but you are getting better gas mileage, especially in an engine that is pretty much bulletproof.”

Overall, when evaluating alternative fuel content, biodiesel and electricity were perceived most positively. Natural gas is a fuel on which consumers have little information and they need more information before considering this option. These fuels are of interest to consumers and they are likely to pay attention to relevant messaging, particularly if the information available answers their lingering questions.

When communicating information about alternative fuels, it is important to understand consumer skepticism. Any content regarding these fuels must be impartial and demonstrate both the benefits and drawbacks of these fuels so that consumers are armed with the information necessary to form an opinion.

Thermal Management Technologies

Across all groups there was little to no awareness of the use of thermal management technologies like energy-efficient glass and air conditioning in vehicles. However, despite the low awareness, the topic of thermal management technologies elicited a lot of interest in all the groups.

Some respondents, particularly in Phoenix and Atlanta discussed the use of energy-efficient glass in homes and used their experience with this technology as a reference in forming an opinion on these new technologies. After reading descriptions of both energy-efficient glass and energy-efficient air conditioning, the most common reaction was “sign me up.” These technologies are relevant and seen as mechanical upgrades to the modern vehicle.

When asked what additional information they need, participants in all groups had a lot of questions about the technologies:

Does it work?

Is the glass as safe as the glass I currently have?

Are there any concerns about the air quality in the vehicle because of these technologies?

How much does it cost and how much does it cost to repair?

Do I have to replace my vehicle or can I install this on my current car?

To quell concerns about how well the technologies work and if they feel safe given the additions, many participants say they are willing to try the technology (as long as there are no upfront costs associated with trying it). “You would have to try it first, you know, or see, I mean, talk to somebody who has tried it or used it.” These participants would trust their peers who have experience with the technologies as well as mechanics to provide them with the background information necessary. Many would also trust dealers, but only if the technology is a standard feature. They need to hear the information from an unbiased party.

One group, the males in Atlanta, demonstrated a level of skepticism that differed from all other groups. These men wondered how the technology worked and whether they would actually see the benefits of using these technologies. “If I have to pay an extra $10,000 on top of my car to get this done, am I ever going to recoup that? Probably not just by having some energy-efficient glass.”

Overall, consumers are interested in the concept of thermal management technologies and the messaging related to these technologies may help to encourage consumers to seek out more fuel economy information.

Greenhouse gases and other emissions

There is some awareness of emissions that result from fuel consumption, but overall knowledge about GHG and other pollutant emissions is low. In fact, among females in New Jersey, there was almost no familiarity with the term ‘greenhouse gas emissions.’

Males associate the term GHG with CO2, climate change and Ozone Alert Days. Some females also associate GHG with climate change and the ozone layer, but they are less likely to discuss the science behind the concept.

For females, most of the knowledge about emissions comes simply from the fact that consumers are required by law to bring their vehicles for emissions testing. However, female respondents did not necessarily know what this is test means or how different driver behaviors can have an impact on emissions.

Reducing emissions was the least impactful message for consumers. They either understand the direct relationship between emissions and fuel economy, and focus instead of saving fuel or they have too little knowledge of emissions to be affected by related messaging.

Message Testing & Communication Channels

The messaging presented in the groups tested very well with consumers as they are interested to learn more about improving their fuel economy. They were interested in the tips being offered, and liked that the message invited them to be educated rather than promoting an agenda.

The word “learn” stood out among respondents across all groups as a message element that catches their attention in a positive way. Consumers don’t want to be told what to do, but they do want to hear tips and ways that they can improve their fuel economy and save some money.

Participants in some groups suggested using fuel-saving tips that they are unaware of in order to entice consumers to learn more. ‘Avoiding stops and starts’ is driving behavior that most consumers recognize as having an impact on their fuel economy and for many consumers who sit in traffic during their commutes, changing this behavior is not always possible, therefore this message is not one that will motivate consumers to want to learn more about it. However, based on the findings of this qualitative research and the quantitative to follow, we will be able to prioritize messages that individuals are least aware of.

When evaluating the motivations to seek more information, saving money or saving fuel were the most impactful. Reducing emissions was the least impactful across all groups. The benefits of learning more and changing behaviors need to be communicated in terms of personal benefits in order to command the attention of these consumers.

When thinking of channels of communications for these messages, respondents suggested places where fuel economy and their vehicles are top of mind. This includes advertising on billboards (particularly in high-traffic areas), on gas pump televisions, on the radio as well as providing materials at the DMV, oil change and auto repair shops and other vehicle-related locations.

Online banners, though initially mentioned as a potential place for these ads, are widely mistrusted. In order to have an impact, these banner ads must be simple and be placed on trusted websites like news websites or well-known automotive sites like KelleyBlueBook.com or Edmunds.com.

Across all groups, it was apparent that partnerships are essential to the success of this consumer education program:

Agency partners - While some participants trust NHTSA to provide information about fuel economy, many believe EPA and DOE are more likely sources. If endorsed by multiple groups, the information is more likely to be trusted and less likely to be seen as driven by agenda.

Third-party experts - The technical data that the males in these groups are looking for, particularly when it comes to alternative fuels and new technologies, is most credible when coming from a third-party source. While NHTSA can be the aggregator of this information in order to reach consumers, statements should be backed up with research that consumers can access if they so choose.

Insurance companies - Partnerships with insurance companies and organizations like AAA can be helpful as these organizations are able to reach their customers in their homes and have already established a relationship lending credibility to communications.

Appendix B: Focus Group Schedule

Focus groups were conducted in four cities, with two groups per city (one male and one female group). In each group, five pieces of fuel economy content and two alternative fuels were scheduled to be tested. All groups evaluated two thermal management technologies, one piece of GHG content and five messages.

Date |

City |

Gender |

Fuel Economy Content Tested |

Alternative Fuels Tested |

7/13 |

Minneapolis, MN |

Female |

|

|

7/13 |

Minneapolis, MN |

Male |

|

|

7/14 |

Phoenix, AZ |

Female |

|

|

7/14 |

Phoenix, AZ |

Male |

|

|

7/19 |

Atlanta, GA |

Female |

|

|

7/19 |

Atlanta, GA |

Male |

|

|

7/20 |

Fort Lee, NJ (New York City Suburb) |

Female |

|

|

7/20 |

Fort Lee, NJ (New York City Suburb) |

Male |

|

|

Appendix C: Participant Profiles

Minneapolis, Females |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

25-34 |

7-12 months |

Shared |

Own |

Saturn Vue |

Gas-engine |

200 to 299 mi. |

White |

College Graduate |

$75,000

– |

25-34 |

No plans to purchase |

Shared |

Own |

Isuzu

Ascender |

Gas-engine |

100 to 199 mi. |

White |

College Graduate |

$75,000

– |

35-44 |

7-12 months |

Shared |

Own |

Honda Accord |

Gas-engine |

300 to 499 mi. |

White |

College Graduate |

$75,000

– |

35-44 |

4-6 months |

Shared |

Own |

Mazda

6 |

Gas-engine |

200 to 299 mi. |

White |

Post-Graduate |

$50,000

– |

45-54 |

12+ months |

Primary |

Own |

Toyota Prius Chevrolet 1/2 ton truck |

Gas-electric Diesel |

300 to 499 mi. |

White |

Post-Graduate |

$75,000

– |

55-59 |

7-12 months |

Primary |

Own |

Toyota Corolla |

Gas-engine |

100 to 199 mi. |

White |

College Graduate |

$50,000

– |

55-59 |

12+ months |

Primary |

Own |

Ford

Mustang |

Gas-engine |

200 to 299 mi. |

White |

Some College |

$50,000

– |

55-59 |

4-6 months |

Shared |

Own |

Volkswagen Passat |

Gas-engine |

500+ mi. |

White |

College Graduate |

$100,000

– |

Minneapolis, Males |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

25-34 |

7 to 12 months |

Primary |

Own |

Honda Accord |

Gas-engine |

300 to 499 mi. |

White |

College Graduate |

$75,000

– |

35-44 |

7 to 12 months |

Primary |

Own |

Chrysler Town & Country Pontiac G6 Toyota Corolla |

Gas-engine |

300 to 499 mi. |

White |

Some College |

$75,000

– |

35-44 |

7 to 12 months |

Primary |

Own |

Mazda 626 Dodge Grand Caravan |

Gas-engine |

300 to 499 mi. |

White |

Post-Graduate |

$75,000

– |

35-44 |

12+ months |

Shared |

Own |

Pontiac Grand AM |

Gas-engine |

300 to 499 mi. |

White |

Technical or Vocational School |

$100,000

– |

45-54 |

12+ months |

Primary |

Own |

Chevy Impala Ford F150 |

Gas-engine Diesel |

500+ mi. |

White |

College Graduate |

$50,000

– |

55-64 |

1 to 3 months |

Shared |

Own |

Honda Accord Mazda 3 |

Gas-engine |

200 to 299 mi. |

White |

College Graduate |

$150,000

– |

55-64 |

12+ months |

Primary |

Own |

Oldsmobile Aurora Chrysler Pacifica |

Gas-engine |

500+ mi. |

White |

Post-Graduate |

$75,000

– |

55-64 |

12+ months |

Shared |

Own |

Ford Explorer Ford F250 |

Gas-engine Diesel |

500+ mi. |

White |

College Graduate |

$100,000

– |

Phoenix, Females |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

25-34 |

7 to 12 months |

Primary |

Own |

Scion TC |

Gas-Engine |

50 - 99 mi. |

Hispanic |

Some College |

$25,000 – < $50,000 |

55-64 |

12+ months |

Shared |

Own |

Dodge Neon |

Gas-Engine |

100 -199 mi. |

Hispanic |

Post-Graduate |

$50,000 – < $75,000 |

55-64 |

12+ months |

Shared |

Own |

Kia Sorrento |

Gas-Engine |

200 - 299 mi. |

Black |

Some College |

$25,000 – < $50,000 |

45-54 |

No plans to purchase |

Shared |

Own |

Toyota Prius |

Gas-Electric Hybrid |

100 - 199 mi. |

White |

College Graduate |

$75,000 – < $100,000 |

35-44 |

No plans to purchase |

Primary |

Own |

Toyota Highlander Hybrid |

Gas-Electric Hybrid |

100 - 199 mi. |

White |

College Graduate |

$50,000 – < $75,000 |

45-54 |

4 to 6 months |

Primary |

Own |

Chevrolet Cavalier |

Flex Fuel/Alternative Fuel |

300 - 499 mi. |

White |

College Graduate |

$50,000 – < $75,000 |

45-54 |

7 to 12 months |

Shared |

Own |

Mercedes E320 |

Gas-Engine |

200 299 mi. |

White |

Some College |

$100,000 – < $150,000 |

25-34 |

12+ months |

Primary |

Own |

Honda Civic |

Gas-Engine |

100 - 199 mi. |

White |

College Graduate |

Under $25,000 |

Phoenix, Males |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

55-64 |

4-6 months |

Primary |

Own |

Nissan Pathfinder |

Gas-Engine |

200-299 mi. |

White |

Post-Graduate |

$25,000 – < $50,000 |

25-34 |

No plans |

Primary |

Own |

Pontiac Grand Prix |

Gas-Engine |

300-499 mi. |

Hispanic |

College Graduate |

$25,000 – < $50,000 |

35-44 |

12+ months |

Shared |

Own |

Chevrolet Suburban |

Gas-Engine |

100-199 mi. |

Hispanic |

Post-Graduate |

$100,000 – < $150,000 |

25-34 |

12+ months |

Primary |

Own |

Infiniti Q45 |

Gas-Engine |

0-49 mi. |

Black |

College Graduate |

$75,000 – < $100,000 |

55-64 |

7-12 months |

Shared |

Own |

Ford E150 |

Gas-Engine |

100-199 mi. |

White |

Post-Graduate |

$75,000 – < $100,000 |

35-44 |

7-12 months |

Primary |

Own |

Toyota Prius |

Gas-Electric Hybrid |

100-199 mi. |

White |

College Graduate |

$75,000 – < $100,000 |

55-64 |

No plans to purchase |

Primary |

Own |

Ford Taurus |

Flex-Fuel/Alternative |

50-99 mi. |

White |

Some High School |

$25,000 – < $50,000 |

25-34 |

7-12 months |

Shared |

Own |

Nissan Altima |

Gas-Engine |

50-99 mi. |

White |

College Graduate |

$100,000 – < $150,000 |

Atlanta, Females |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

35-44 |

4-6 months |

Primary |

Own |

Ford Explorer |

Gas-Engine |

500+ mi. |

Black |

College Graduate |

$50,000 – < $75,000 |

45-54 |

7-12 months |

Shared |

Own |

Toyota Camry |

Gas-Engine |

300 to 499 mi. |

White |

Post-Graduate |

$100,000 – < $150,000 |

45-54 |

1-3 months |

Primary |

Own |

Saturn Forester |

Gas-Engine |

200 to 299 mi. |

White |

Some College |

$25,000 – < $50,000 |

45-54 |

7-12 months |

Shared |

Own |

Jeep Grand Cherokee |

Gas-Engine |

100 to 199 mi. |

White |

College Graduate |

$50,000 – < $75,000 |

35-44 |

7-12 months |

Primary |

Own |

Nissan Altima |

Gas-Engine |

500+ mi. |

Black |

College Graduate |

$25,000 – < $50,000 |

18-24 |

12+ months |

Primary |

Own |

Nissan Altima |

Gas-Engine |

500+ mi. |

White |

High School |

$25,000 – < $50,000 |

25-34 |

7-12 months |

Primary |

Own |

Chevy Lumina |

Gas-Engine |

50 to 90 mi. |

White |

Some College |

$25,000 – < $50,000 |

18-24 |

4-6 months |

Primary |

Own |

Toyota Corolla |

Gas-Engine |

100 to 199 mi. |

White |

College Graduate |

$50,000 – < $75,000 |

Atlanta, Males |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

25-34 |

7-12 months |

Primary |

Own |

Ford F150 |

Gas-Engine |

50 to 99 mi. |

Black |

College Gradute |

$25,000 – < $50,000 |

45-54 |

4-6 months |

Primary |

Own |

Honda CRV |

Gas-Engine |

300 to 499 mi. |

White |

College Gradute |

$75,000 – < $100,000 |

45-54 |

7-12 months |

Primary |

Own |

Toyota Sienna |

Gas-Engine |

100 to 199 mi. |

White |

College Gradute |

$75,000 – < $100,000 |

25-34 |

No plans to purchase |

Primary |

Own |

Ford F150 |

Gas-Engine |

200 to 299 mi. |

White |

College Gradute |

$50,000 – < $75,000 |

45-54 |

7-12 months |

Primary |

Own |

Saturn L200 |

Gas-Engine |

200 to 299 mi. |

White |

Post Graduate |

$25,000 – < $50,000 |

35-44 |

7-12 months |

Primary |

Own |

Saturn Outback |

Gas-Engine |

200 to 299 mi. |

White |

Post Graduate |

$200,000+ |

35-44 |

7-12 months |

Primary |

Own |

Infiniti I30 |

Gas-Engine |

100 to 199 mi. |

White |

Some College |

$50,000 – < $75,000 |

Fort Lee, Females |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

55-64 |

12+ months |

Primary |

Own |

Hyundai Elantra |

Gas-Engine |

100-199 mi. |

White |

College Graduate |

$25,000 – < $50,000 |

18-24 |

7-12 months |

Primary |

Own |

Nissan Sentra |

Gas-Engine |

50-99 mi. |

White |

College Graduate |

$100,000 – < $150,000 |

18-24 |

4-6 months |

Primary |

Own |

Lexus SUV |

Gas-Engine |

100-199 mi. |

Black |

Some College |

$100,000 – < $150,000 |

25-34 |

No plans to purchase |

Primary |

Own |

Honda Odyssey |

Gas-Engine |

100-199 mi. |

Black |

Some College |

$50,000 – < $75,000 |

45-54 |

7-12 months |

Shared |

Lease |

BMW 328i |

Gas-Engine |

300-499 mi. |

White |

College Graduate |

$100,000 – < $150,000 |

35-44 |

12+ months |

Shared |

Lease |

Acura MDX |

Gas-Engine |

0-49 mi. |

White |

College Graduate |

$75,000 – < $100,000 |

45-49 |

4-6 months |

Primary |

Lease |

Mitsubishi Outlander |

Gas-Engine |

100-199 mi. |

White |

Some College |

$50,000 – < $75,000 |

35-39 |

1-3 months |

Primary |

Lease |

Hyundai Sonata |

Gas-Engine |

50-99 mi. |

Black |

College Graduate |

$75,000 – < $100,000 |

Fort Lee, Males |

|||||||||

Age |

Plans to Purchase |

Vehicle Decision Responsibility |

Own/ Lease |

Current Vehicle |

Vehicle Fuel Capabilities |

Weekly Mileage |

Ethnicity |

Education |

HHI |

55-64 |

7-12 months |

Shared |

Own |

Honda Accord |

Gas-Engine |

100-199 mi. |

White |

High School |

$50,000 – < $75,000 |

25-34 |

7-12 months |

Primary |

Own |

Ford Explorer |

Gas-Engine |

200-299 mi. |

White |

Some College |

$100,000 – < $150,000 |

35-44 |

4-6 months |

Primary |

Own |

Audi Quattro |

Gas-Engine |

200-299 mi. |

Asian |

Post-Graduate |

$50,000 – < $75,000 |

65+ |

12+ months |

Primary |

Lease |

Nissan Altima |

Gas-Engine |

300-499 mi. |

White |

College Graduate |

$50,000 – < $75,000 |

25-34 |

4-6 months |

Primary |

Own |

Lexus RS315 |

Gas-Engine |

200-299 mi. |

Asian |

College Graduate |

$50,000 – < $75,000 |

35-44 |

12+ months |

Shared |

Lease |

Dodge Ram 1500 |

Flex Fuel |

100-199 mi. |

White |

High School |

$75,000 – < $100,000 |

18-24 |

12+ months |

Primary |

Lease |

Toyota Camry |

Gas-Engine |

100-199 mi. |

Hispanic |

College Graduate |

$100,000 – < $150,000 |

18-24 |

1-3 months |

Primary |

Lease |

Ford Fiesta |

Gas-Engine |

100-199 mi. |

White |

High School |

Under $25,000 |

Appendix D: Screener

In which of the following categories is your age?

Under 18 [TERMINATE]

18 to 24

25 to 34

35 to 44

45 to 54

55 to 64

65 or older

REFUSED [TERMINATE]

Are you…?

Male [RECRUIT FOR GROUP 2]

Female [RECRUIT FOR GROUP 1]

REFUSED [TERMINATE]

Do you or a family member currently, or have you or a family member previously worked for any of the following?

The automotive industry [TERMINATE]

An ethanol or alternative fuel producer [TERMINATE]

A market research company or department [TERMINATE]

A marketing company or department [TERMINATE]

None of the above

DON’T KNOW [TERMINATE]

Are you a licensed driver?

Yes

No [TERMINATE]

REFUSED [TERMINATE]

Do you currently own or lease a passenger vehicle?

Yes – OWN

Yes – LEASE

No [TERMINATE]

REFUSED [TERMINATE]

Which of the following statements best represents your plans for purchasing or leasing a new vehicle for you or your family? By new vehicle, we mean new model year vehicle, not used or previously owned.

I plan to purchase or lease a new vehicle in the next 1 to 3 months

I plan to purchase or lease a new vehicle in the next 4 to 6 months

I plan to purchase or lease a new vehicle in the next 7 to 12 months

I plan to purchase or lease a new vehicle longer than 12 months from now

I have no plans to purchase or lease a new vehicle

DON’T KNOW

[RECRUIT MIX OF PURCHASE MINDSETS IN EACH GROUP]

Thinking about your next vehicle purchase or lease, would you say you are the primary decision maker, have shared responsibility, or will someone else make the decision?

I am the primary decision maker

I have shared responsibility with someone else

I do not have any responsibility for vehicle purchasing decisions [TERMINATE]

Approximately how many miles do you drive your primary vehicle per week?

0 to 49 miles

50 to 99 miles

100 to 199 miles

200 to 299 miles

300 to 499 miles

500 miles or more

DON’T KNOW

[RECRUIT BROAD MIX OF DRIVING DISTANCES IN EACH GROUP]

What type of vehicle(s) do you currently own or lease? [MULTIPLE RESPONSE]

Gasoline-engine vehicle

Gasoline-electric hybrid vehicle

Diesel engine vehicle

Flex-fuel or alternative fuel vehicle

DON’T KNOW

[REPEAT FOR EACH TYPE OF VEHICLE FROM Q9]

What is the make and model of this [INSERT FROM Q9] vehicle?

[OPEN ENDED]

Make:

Model:

Which of the following statements best describes you?

I prefer to be the first to buy and try new technologies

I prefer to wait until new product hype has calmed before I purchase and try new technologies

I prefer to wait until new technologies have been thoroughly tested and reviewed, and others I know have purchased and used new technologies before I purchase

None of the above

What is the last grade you completed in school?

Some grade school (1-8)

Some high school (9-11)

High school graduate (12)

Technical or vocational school

Some College

College Graduate

Graduate or Professional School

Other

Select one or more of the following that best describes your race? [ACCEPT MULTIPLE RESPONSES]

American Indian or Alaska Native

Asian

Black or African-American

Native Hawaiian or other Pacific Islander

White

Are you of Hispanic or Latino descent?

Yes

No

Which ONE of the following best describes your total household income?

Under $25,000

$25,000 to less than $50,000

$50,000 to less than $75,000

$75,000 to less than $100,000

$100,000 to less than $150,000

$150,000 to less than $200,000

$200,000 or more

Unsure or Refused

Appendix E: Discussion Guide

Sample Discussion Guide for Group 1

The below discussion guide includes the questioning featured in group 1. Discussion guides for each group included the same line of questioning. The only changes made between groups were the fuel economy content and alternative fuel content being evaluated. This schedule for which content was tested in which group can be found in Appendix A.

Introduction

Welcome, group rules, privacy

Group introductions

First name

How often do you drive?

What is your primary purpose for driving?

Fuel economy Content Evaluation

When you think of fuel economy, what comes to mind?

What about fuel efficiency? What does this mean to you? How, if at all, is it different from fuel economy?

When looking for a new vehicle, how important would you say a vehicle’s fuel economy is to your purchase decision?

At what point in your decision process, if at all, do you look at fuel economy?

What fuel economy information do you specifically look for?

What are some of the benefits of owning a vehicle with better fuel economy?

Personal benefits vs. environmental benefits

Thinking about the vehicle you currently have, what are some things that you do that can positively impact the fuel economy of your vehicle? [MODERATOR TO WRITE RESPONSES ON FLIP CHART]

[PROBE DRIVER BEHAVIORS/ACTIONS]

I’m going to hand out some highlighters and a sheet of paper with a list of driving behaviors and maintenance tips. I’d like you to go through this list with your highlighters – please highlight those things on the list that you think can POSITIVELY impact your vehicle’s fuel economy in GREEN. Then, go back through the list and using your ORANGE highlighter, highlight the things on the list that can NEGATIVELY impact your vehicle’s fuel economy. If you think something may have no impact on a vehicle’s fuel economy, do not highlight it. After you complete the exercise, we’ll discuss the list as a group. [HAND OUT WORKSHEET]

[WHEN GROUP IS FINISHED HIGHLIGHTING] Before we discuss, I’d like you to go back through the list one more time and circle the things that you, personally do. Remember, this exercise is anonymous

Let’s talk about a few of these in detail.

[MODERATOR READ ALOUD] Avoiding sudden starts and stops

By a show of hands, how many marked this with the green highlighter? Orange? How many did not highlight this?

Those who highlighted it in green, why did you do so?

Where did you hear about this activity’s impact on fuel economy?

Those who highlighted it in orange, why did you do so?

Where did you hear about this activity’s impact on fuel economy?