Automated Export System (AES) Program

Automated Export System (AES) Program

Attachment E - AESDirect User Guide

Automated Export System (AES) Program

OMB: 0607-0152

Attachment E

AESDirect

User

Guide

Updated 11/3/15

The

complete guide to file Electronic Export Information to the

Automated Export System

About the Automated Export System (AES) and the Data

The AES is the primary instrument used for collecting export trade data, which are used by the Census Bureau for statistical purposes. The AES record provides the means for collecting data on U.S. exports. Public Law 107-228 of the Foreign Trade Relations Act of 2003 authorizes this collection. Title 13, U.S.C., Chapter 9, Sections 301-307, mandates the collection of these data. The data collected in the AES is confidential under Section 301(g), which prohibits public disclosure of export data collected by the Census Bureau unless the Secretary of Commerce determines that such exemption would be contrary to the national interest. The regulatory provisions detailing the mandatory reporting of these data are contained in the Foreign Trade Regulations (FTR), Title 15, Code of Federal Regulations (CFR), Part 30.

The official export statistics collected from these tools provide the basic component for the compilation of the U.S. position on merchandise trade. These data are an essential component of the monthly totals provided in the U.S. International Trade in Goods and Services (FT900) press release, a principal economic indicator and a primary component of the Gross Domestic Product.

In addition to developing the FT900, other federal agencies have used the data for export control purposes to detect and prevent the export of certain items by unauthorized parties or to unauthorized destinations or end users.

Burden Estimate

Public reporting burden for this collection of information is estimated to average approximately 3 minutes (.05 hour) per transaction for the Automated Export System, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden to: ECON Survey Comments 0607-0152, U.S. Census Bureau, 4600 Silver Hill Road, Room EMD-6K064, Washington, DC 20233. You may e-mail comments to [email protected]. Be sure to use ECON Survey Comments 0607-0152 as the subject. This collection has been approved by the Office of Management and Budget (OMB). The eight-digit OMB approval number is 0607-0152. Without this approval we could not conduct this survey.

Table of Contents

General Information on Shipments 4

Parties Involved in an Export Transaction 6

Getting Started with AESDirect 6

Create Export Filing 7

Step 1: Shipment…………………………………………………………………………………….………………………8

Step 2: Parties………………………………………………………………………………………………………………10

Step 3: Commodities………………………………………………………………………………………….…………17

Step 4: Transportation……………………………………………………………………………….…………………20

Template Manager 26

Party Profile Manager 31

AES Responses 34

AES Proof of Filing Citations 34

General

Information on Shipments

Before learning to file Electronic Export Information (EEI) using AESDirect, here is some general information regarding EEI. We will refer to EEI as “Shipments” from this point forward.

Sections in each shipment

Transportation

details

Shipment

details

Parties

related to the shipment

Goods

being exported

Transportation

Shipment

Parties

Commodities

Transportation Contains

transportation details for the shipment, including carrier

information. (Required

for all shipments.)

Commodities Contains

commodity information. (Required

for all shipments.)

Parties Contains

information about the USPPI (the person or entity in the United

States that receives the primary benefit, monetary or otherwise,

from the export transaction), the Ultimate Consignee (the person or

entity overseas who receives the product), and the Freight

Forwarder and Intermediate Consignee (if applicable).

(Required

for all shipments.)

Shipment

Contains

general shipment information.

(Required

for all shipments.)

Special

Shipments

Routed

export transactions -

Transactions where the Foreign Principal Party in Interest (FPPI)

authorizes a U.S. agent to facilitate export of items from the

United States on its behalf and also prepare and file the shipment.

Shipments to Puerto Rico – The following is required:

List a Port of Unlading

Addresses should be listed with:

City – List municipality in Puerto Rico

State – Indicate Puerto Rico (PR)

Country – Indicate United States (U.S.)

Postal Code – Indicate a valid postal code in Puerto Rico

Shipments From Puerto Rico – The following is required:

List a Port of Unlading

Addresses should be listed with:

City – Indicate city of destination

Country – Indicate country of destination

Parties Involved

in an Export Transaction

Foreign

Principal Party in Interest (FPPI) The

party abroad who purchases the goods for export or to whom final

delivery or end-use of the goods will be made. This may be the

ultimate consignee. Ultimate

Consignee The

ultimate consignee is the person, party or designee that is located

abroad and actually receives the export shipment. This may be the

end-user or FPPI.

U.S.

Principal Party in Interest (USPPI) The

USPPI is the person or entity in the United States that receives the

primary benefit, monetary or otherwise, from the export transaction.

Definitions of

Parties in the AES

Freight

Forwarder – Authorized Agent The

person in the United States who is authorized by the principal party

in interest to facilitate the movement of the cargo from the United

States to the foreign destination and/or prepare and file the

required documentation.

Intermediate

Consignee The

intermediate consignee is the person or entity in the foreign

country that acts as an agent for the principal party in interest

with the purpose of effecting delivery of items to the ultimate

consignee.

Getting Started

with AESDirect

AESDirect

Interface

Colors and Symbols

(1) RED asterisk indicates a mandatory field (Required)

(2) RED asterisks indicates a conditional field (May be required)

No asterisk indicates an optional field (Not required)

Help (i)

Available to the right of most sections to determine what is needed for each field and when fields are required.

Log in to Account

Step |

Action |

|---|---|

1 |

Go to https://ace.cbp.dhs.gov. |

2 |

Enter Username and Password |

3 |

Click Continue. |

Create

Export Filing

Step |

Action |

|---|---|

1 |

Log in to ACE account. |

2 |

Navigate to Main Menu. |

4 |

Click Create Export Filing. |

The following sections provide instructions for completing each of the required sections, as well as definitions of all of the data fields for each section.

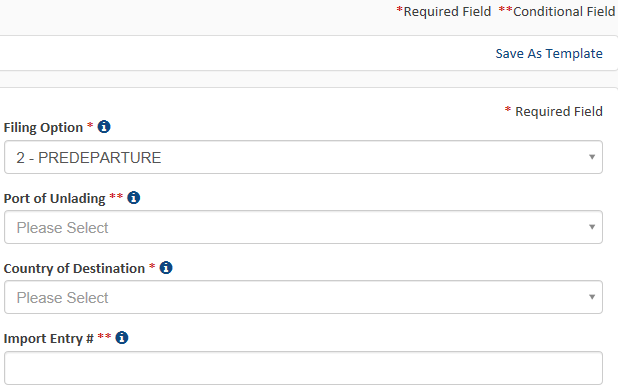

Step 1: Shipment

Step |

Action |

|---|---|

1 |

Select Step 1: Shipment |

2 |

Complete all of the shipment details as required. |

|

|

Explanation

of Data Fields for this section

Are USPPI and Ultimate Consignee related?

When USPPI and/or Ultimate Consignee owns directly or indirectly 10 percent or more of either party.

Step 2: Parties

Step |

Action |

|---|---|

1 |

Select Step 2: Parties |

2 |

Complete all of the information for the involved parties in this transaction. NOTE: You will need at least one USPPI and one Ultimate Consignee for each transaction. |

USPPI

(mandatory) If

you are the exporter, you will need to enter your information into

the USPPI section.

Company

Name -

Provide the company’s

name.

Required:

names must have at

least two letter; special characters are not allowed

IRS

Number - If you select ‘DUNS’

as the ID Number Type, then the EIN would also be required.

Conditional:

required if ID Number Type is DUNS

Explanation

of Data Fields for this section

Required:

address where the

merchandise actually begins its journey to the port of export

Address

Line 1 -

Indicate address (no P.O. box

number) of the location from which the merchandise actually began

its journey to the port of export.

Example:

Goods loaded in a truck at a warehouse in Georgia for transport to

Florida to then be loaded on a vessel for export to a foreign

country must show the address of the warehouse in Georgia.

For

shipments of multiple cargo origins, report the address from where

the commodity with the greatest value begins its export journey. If

such information is not known, report the address in state where the

merchandise is consolidated.

Required:

telephone number

Phone Number -

Provide the contact telephone

number.

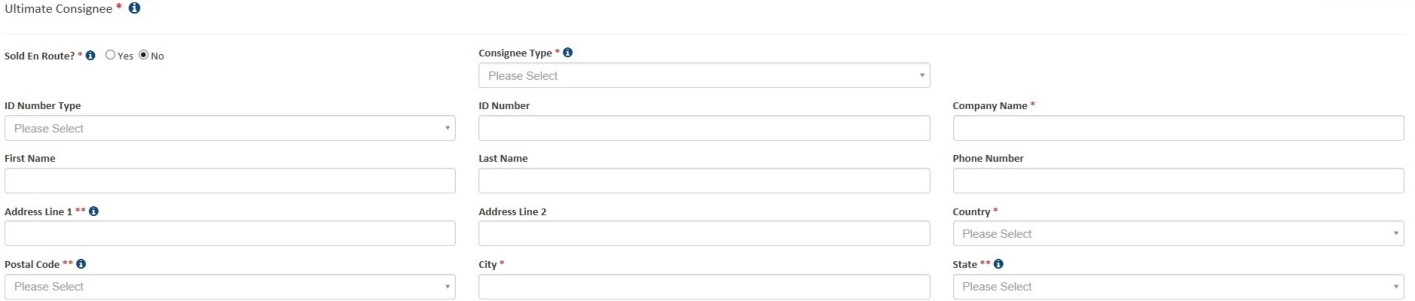

Ultimate Consignee (mandatory)

The Ultimate Consignee section is always required. Please complete each data field as required.

Explanation

of Data Fields for this section

Phone

Number –

The contact person’s telephone number.

Optional

Optional

First

and Last Name -

The contact person’s name.

Optional

ID

Number: Employer

Identification Number (EIN), DUNS, or Foreign Entity ID (ex:

passport number).

Intermediate

Consignee Section

(conditional) The

intermediate consignee is the person or entity in the foreign

country that acts as an agent for the principal party in interest

with the purpose of effecting delivery of items to the ultimate

consignee. Please complete this section if applicable. See ‘Ultimate

Consignee’ section for explanation of data fields.

Explanation

of Data Fields for this section

Phone Number –

The contact person’s telephone number

Required

Required:

names must have at

least two letter; special characters are not allowed

First and Last

Name - Provide the contact

person’s first and last name

Required

ID Number -

Enter either Employer

Identification Number (EIN) DUNS or Foreign Entity ID.

Freight

Forwarder (conditional) If

you are the freight forwarder, you will need to enter your

information into the Freight Forwarder section, and the exporter’s

information into the USPPI section.

Step

3: Commodities

Step |

Action |

|---|---|

1 |

Select Step 3: Commodities |

2 |

Select Add Line to open up a new commodity line. |

|

Complete all of the commodity details as required.

Note: You may add multiple commodity lines by selecting Add Line. |

Required: type of export

Export Information Code - Select the code that identifies the type or condition of the export transaction being made.

Explanation of Data Fields for this section

Conditional:

Not required if Export Code is HH (personal and household effects

and tools of the trade) is selected.

Schedule

B or HTS Number –

Report commodity classification codes. Some HTS Numbers are not

valid for Export (see “Invalid

HTS” ). Provide 10 digits without periods. If you do not

have a Schedule B number, use the ’Schedule B Search Engine’

link to locate it.

Conditional: Not required if Export Code is HH.

Conditional: Not required if Export Code is HH (personal and household effects and tools of the trade) is selected.

1st and 2nd Quantity - Report the total quantity of the commodity being exported for each commodity code classification. Report in the unit of measure as required by the Schedule B or HTS Number.

Conditional: not required if Export Code is HH. If the origins vary for the same classification number, report foreign goods separately from domestic goods.

Origin of Goods - Select “domestic” if commodity is grown, produced or manufactured in the U.S. Select “foreign” for goods grown, produced or manufactured in foreign countries, but have not been changed in form or condition in the U.S.

1st and 2nd UOM- The Unit of Measure (UOM) is determined by the Schedule B or HTS number entered. When a valid Schedule B or Harmonized Tariff number is entered, the unit of measure required will automatically populate.

Required: selling price in whole numbers, no symbols. Only report $US dollars

Value of Goods - Report the value of the goods at the U.S. port of export. The value shall be the selling price of the goods including inland or domestic freight, insurance, and other charges to the U.S. For details, see Foreign Trade Regulations 30.6 (a)(17).

Required: weight in whole numbers, no symbols

Shipping Weight - Must be reported in kilograms. Include the weight of the commodity and weight of normal packaging. For details, see Foreign Trade Regulations 30.6(a)(16).

ECCN - This number is used to identify items on the Commerce Control List (CCL).

A complete listing of license codes and descriptions for the U.S. Department of Commerce, Office of Foreign Assets Control (OFAC), Nuclear Regulatory Commission, U.S. Department of State and other Partnership Agency licenses, can be found under Appendix F of the AES Trade Interface Requirements (AESTIR).

Conditional: Only required for certain commodities

Required: determines if other fields need to be reported

License Type Code/License Exemption Code - Select the appropriate license type for the commodity. You may be required to enter additional information based on the license type selected.

Required: indicate yes or no

Does the filing include used vehicles? - A used vehicle, according to Customs and Border Protection CFR 192.2, is defined as “any self-propelled vehicle the equitable or legal title to which has been transferred by a manufacturer, distributor, or dealer to an ultimate purchaser.” You will be required to complete additional information if you are reporting a used vehicle.

Required: indicate yes or no, complete additional fields as required.

Agriculture and Marketing Services (AMS) Permit Required - Does the filing require an Agriculture and Marketing Services (AMS) permit?

Required: indicate yes or no complete additional fields as required.

Environmental Protection Agency (EPA) Permit Required - Does the filing require an Environmental Protection Agency (EPA) Permit?

Step 4: Transportation

Commodity lines should be separated based on their commodity classification code, origin of goods, commodities valued at over $2500, or requiring an export license per commodity classification code. After saving the first commodity, select “Add Line” to open a new Commodity Line.

Adding more than one commodity

Step |

Action |

|---|---|

1 |

Select Step 4: Transportation |

2 |

Complete all of the transportation details as required. |

Conveyance Name/Carrier Name – Provide the vessel name for ocean shipments and the carrier name for air, truck, and rail.

You may not report UNKNOWN for the Conveyance Name.

Carrier SCAC/IATA – Carrier Code that identifies the transportation company. Contact your transportation company to obtain their carrier code.

Explanation of Data Fields in this section

Conditional:

only required for Air, Vessel, Rail, and Truck shipments. Not

required for USPS shipments.

Conditional:

only required for Air, Vessel, Rail, and Truck shipments. Not

required for USPS shipments.

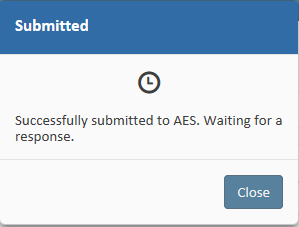

Submit

Shipment to AES

Step |

Action |

|---|---|

1 |

Click Submit Filing. |

2 |

Observe your response from AES.

|

Retrieve

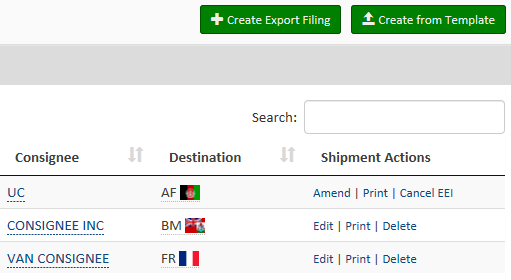

and Amend/Edit a Shipment

From

the Shipment Manager, you can search for previously filed shipments

by entering your search criteria into the Search

box.

Step |

Action |

|---|---|

1 |

Navigate to Shipment Manager |

2 |

Enter your search criteria into the Search box |

3 |

Once you have located your shipment, you can retrieve the filing by clicking the Amend or Edit link to the right. |

Print

a Shipment

Step |

Action |

|---|---|

1 |

Navigate to Shipment Manager |

2 |

Enter your search criteria into the Search box |

3 |

Once you have located your shipment, you can print the filing by clicking the Print link to the right.

|

Delete/Cancel

EEI

Step |

Action |

|---|---|

1 |

Navigate to Shipment Manager |

2 |

Enter your search criteria into the Search box |

3 |

Once you have located your shipment, you can delete the filing by clicking the Delete or Cancel EEI link to the right. |

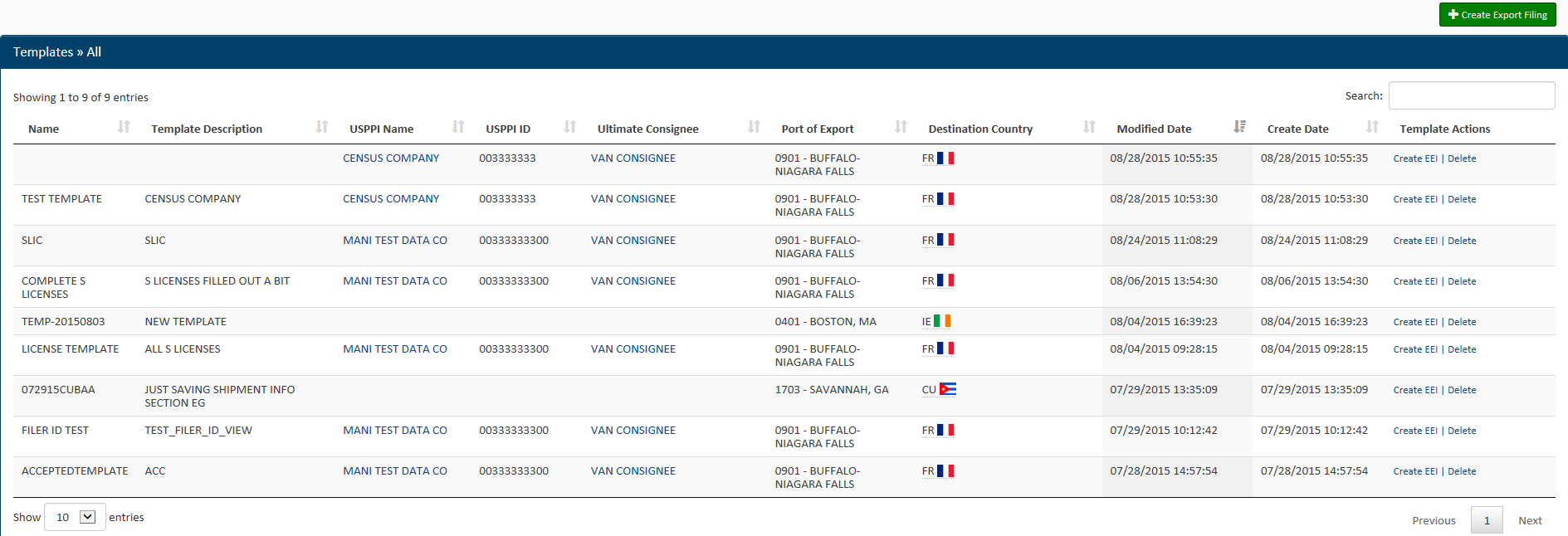

Template

Manager

This

feature saves frequent shipment information. The only fields not

stored in a template are:

Shipment

Reference Number Transportation

Reference Number Origin

State Departure

Date 1st

and 2nd

Quantity Value Gross

Weight

The

Template Manager shows a preview of each template. The

Create EEI, Edit or Delete

options will

allow you to manage your templates directly from this screen.

Open

the Template Manager

Step |

Action |

|---|---|

1 |

Click Tools Menu at the top right |

2 |

Select Template Manager |

Once

selected, the Template Manager will display, and you will have

access to all of your templates.

Create

EEI from Template

Step |

Action |

|---|---|

1 |

From the Template Manager, identify the template you would like to use for your new EEI |

2 |

Click on the Create EEI option next to the template you want to use for your EEI. |

3 |

A new filing session will open up with your template data pre-populated into the form.

|

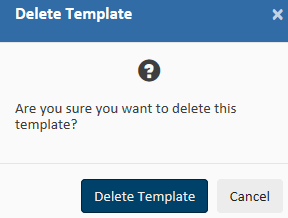

Delete

template

Step |

Action |

|---|---|

1 |

From the Template Manager, identify the template you would like to delete. |

2 |

Click Delete |

3 |

Confirm that you would like to delete this template. |

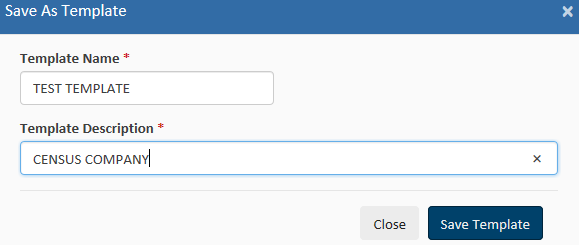

Create

New Template

At

any point while filing your AES data, you can create a new template.

Step |

Action |

|---|---|

1 |

Open up a new EEI Filing and begin entering the information. |

2 |

Once you have entered the desired information for your template, click Save as Template at the top right. |

3 |

Enter a name and description for the template. When finished, click Save Template. |

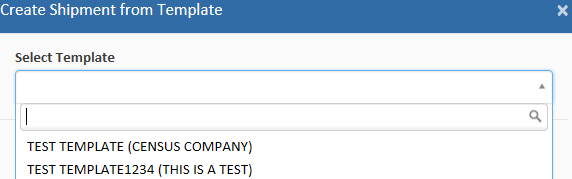

Load

an Existing Template

|

Action |

|---|---|

1 |

In the ‘Shipment Manager’ screen, click Create from Template |

2 |

Locate the desired template. |

3 |

Click the template name to load. |

4 |

Complete the empty fields and submit the EEI. |

Party

Profile Manager

This

feature saves company information for frequent USPPIs, Freight

Forwarders and/or Ultimate Consignees.

Click

the Tools menu

from the Main Menu and select

Party Profile Manager.

Open

the Party Profile Manager

Step |

Action |

|---|---|

1 |

Click Tools Menu at the top right. |

2 |

Select Party Profile Manager |

Once

selected, the Party Profile Manager will display, and you will have

access to all of your profiles.

Create

Party Profile

Step |

Action |

|---|---|

1 |

Create a new EEI Filing |

2 |

Navigate to Step 2: Parties |

3 |

Enter the information for the profile you would like to save |

4 |

Once complete, select Save to Profile. |

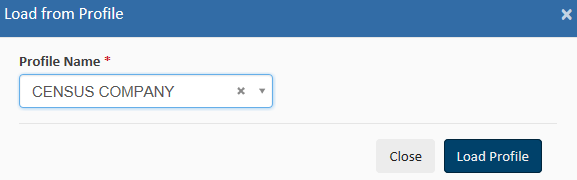

Loading

Profiles

Step |

Action |

|---|---|

1 |

Create a new EEI Filing |

2 |

Navigate to Step 2: Parties |

3 |

Select Load from Profile. |

4 |

In the Search box, enter the first few characters of the profile name. |

5 |

Select your profile and click Load Profile. |

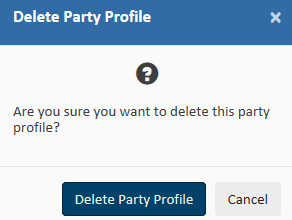

Delete

profile

Step |

Action |

|---|---|

1 |

From the Party Profile Manager, identify the profile you would like to delete. |

2 |

Click Delete. |

3 |

Confirm that you would like to delete this profile by selecting Delete Party Profile. |

AES

Responses

AES

Proof of Filing Citations

Response

E-mail

E-mails

are sent to the address listed in the Shipment section. If the

filing has been accepted, then the Response E-mail will have your

ITN included. If the filing has been rejected, the Response E-mail

will provide you with a rejection statement.

Once shipments are

processed by the Automated Export System (AES), a response message

will indicate the status of the shipment. You can access responses

in your response

e-mail

or through the Shipment

Manager.

The

ITN

(Internal Transaction Number) is a confirmation number that proves a

shipment has been accepted by AES. This number is unique for every

shipment and must be provided to the U.S. Customs and Border

Protection (CBP) at the port of export.

Exporters

must

cite the ITN on the first page of the bill of lading, air waybill,

and/or other commercial loading documents.

Postdeparture

Citations:

If

an Authorized Agent files on behalf of an approved post-departure

participant

AESPOST

USPPI ID FILER ID Date of Export Example:

AESPOST 12345678900 987654321 10/01/2015 If

USPPI files shipments directly to AES

AESPOST

USPPI ID – Date of Export

Example:

AESPOST 23456789000 10/01/2015

Predeparture

and Advanced Export Citations (AEI) Citations : AES

ITN

Example:

AES X20151002111111

Additional

Resources

Under

the “Related Sites” section on the Homepage, you can

find useful links to Government Sites and Partner Agency Websites.

Government

Websites

Census Bureau

– International Trade Management Division (ITMD) http://www.census.gov/trade Provides

information on Foreign Trade Statistics, Regulations, reference

materials, and extensive details on the AES.

Department of

State – Directorate of Defense Trade Controls (DDTC) Provides

information for registering with the DDTC and applying for a

license to ship items on the U. S. Munitions List (USML). Includes

a link to the International Traffic in Arms Regulations (ITAR).

Department of

the Treasury – Office of Foreign Assets Control (OFAC) http://www.ustreas.gov/offices/enforcement/ofac Provides

information regarding specially designated nationals (SDN), blocked

persons lists, sanction programs and country summaries.

Customs and

Border Protection (CBP) http://www.cbp.gov/xp/cgov/trade/automated/aes Provides

access to the Customs Export section, including information on: AES Blocked,

denied and debarred persons lists Export

documents, licenses and requirements

Export.gov –

U.S. Commercial Service, International Trade Administration (ITA) Provides

access to all export-related assistance and market information

offered by the federal government.

Department of

Commerce – Bureau of Industry and Security (BIS) http://www.bis.doc.gov Provides

information on export control basics, export administration

policies and regulations, compliance and enforcement, seminars and

training, and links to Export

Administration Regulations (EAR), including the Commerce Control

List.

ACE

Support Help Desk

CONTACT

US

Call

the ACE Support Help Desk for help with: Account

Registration help Username

and Password issues

Toll Free: 1-866-530-4172

E-mail: [email protected]

Commodity

Classifications Toll

Free: 800-549-0595- Option

2 Hours:

M – F: 8 AM - 5:30 PM, EST E-mail:

[email protected] Schedule

B Classification Assistance Commodity

related reporting issues Parameter

Change Requests

Automated

Export System (AES)

Toll

Free: 800-549-0595- Option

1 Hours:

M – F: 7:30 AM - 5:30 PM, EST E-mail:

[email protected] AES

Filing Problems AES

Fatal Errors AES

Monthly Reports Filing

Post-Departure

U.S.

Census Bureau

Trade

Data Toll

Free: 800-549-0595- Option

4 Hours:

M – F: 8 AM - 5:30 PM, EST E-mail:

Questions

about U.S. International Trade Statistics

Help

with USA Trade Online

Trade

Data Products and Subscriptions

Regulations

on Filing Export Data Toll

Free: 800-549-0595- Option

3 Hours:

M – F: 7:30 AM - 6:30 PM, EST E-mail:

[email protected] Clarifying

Regulations

Responsibilities

of the Parties in Export Transactions

Trade

Outreach Toll

Free: 800-549-0595- Option

5 Hours:

M – F: 7:30 AM - 6:00 PM, EST E-mail:

[email protected] AES

Compliance Seminars

Licensing Issues

United States Munitions List (USML) & Commerce Control List (CCL)

U.S. Department of State Licenses

Directorate of Defense Trade Controls:

202-663-2700

Bureau of Industry and Security

Washington, DC: 202-482-4811

Western Regional Office: 949-660-0144

Assistance in Exporting Worldwide -U.S. Commercial Service: 1-800-USA-TRADE

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Microsoft Word - AESDirect User Guide.doc |

| Author | mille387 |

| File Modified | 0000-00-00 |

| File Created | 2021-01-24 |

© 2026 OMB.report | Privacy Policy