1545-2168 Supporting Statement v2 5-31-16

1545-2168 Supporting Statement v2 5-31-16.doc

Tax Return Preparer Complaint Process

OMB: 1545-2168

Supporting Statement

(Tax Return Preparer Complaint)

1545-2168

1. CIRCUMSTANCES NECESSITATING COLLECTION OF INFORMATION

Information is being collected to adhere to Treasury Inspector General for Tax Administration (TIGTA) recommendations found in TIGTA report 2009-40-032, The Process Taxpayers Must Use to Report Complaints Against Tax Return Preparers Is Ineffective and Causes Unnecessary Taxpayer Burden.

In Calendar Year 2007, the IRS processed approximately 83 million individual Federal income tax returns prepared by paid tax return preparers. Under those prior processes, the IRS could not determine how many complaints against tax return preparers it received, how many complaints were worked, or the total number of multiple complaints against a specific firm or preparer. Taxpayer complaints about tax return preparers can provide valuable information about understanding the root causes of taxpayer problems, identify areas of noncompliance, and help the IRS address core processes that need improvement.

The final TIGTA findings recommended that the Deputy Commissioner for Services and Enforcement

1) Clarify guidance to taxpayers on the public IRS web site (IRS.gov) regarding the preparer complaint process, and

2) Develop a form, both web-based and paper, specifically for tax return preparer complaints that routes to the correct function based on type of tax return preparer and include the items necessary for the IRS to appropriately evaluate the legitimacy of the complaint.

Taxpayers may visit the following website for initial guidance and form links:

https://www.irs.gov/Tax-Professionals/Make-a-Complaint-About-a-Tax-Return-Preparer.

The forms are used by taxpayers to report allegations of misconduct by tax return preparers. These forms are designed specifically for tax return preparer complaints and include the items necessary for the IRS to evaluate and route to the appropriate function.

This information collection also includes non-form responses, such as taxpayer emails and letters of complaint.

2. USE OF DATA

This information will be used by IRS to identify tax return preparer non- compliance. Taxpayers will use this form to report allegations of tax return preparer misconduct.

3. USE OF IMPROVED INFORMATION TECHNOLOGY TO REDUCE BURDEN

We have no plans at this time to offer electronic filing because of the low volume compared to the cost of electronic enabling.

4. EFFORTS TO IDENTIFY DUPLICATION

We have attempted to eliminate duplication within the agency wherever possible.

5. METHODS TO MINIMIZE BURDEN ON SMALL BUSINESSES OR OTHER SMALL ENTITIES

There are no small entities affected by this collection.

6. CONSEQUENCES OF LESS FREQUENT COLLECTION ON FEDERAL PROGRAMS OR POLICY ACTIVITIES

The consequences for collecting this information are that the IRS will not be able to clearly determine how many complaints against tax return preparers it receives, how many complaints are worked, or the total number of multiple complaints against a specific firm or preparer. This affects taxpayer confidence and compromises the Agency’s ability to enforce tax compliance effort to the public. Tax compliance is a vital part of the government’s ability to meet its’ mission and serve the public.

7. SPECIAL CIRCUMSTANCES REQUIRING DATA COLLECTION TO BE INCONSISTENT WITH GUIDELINES IN 5 CFR 1320.5(d)(2)

There are no special circumstances requiring data collection to be inconsistent with Guidelines in 5 CFR 1320.5(d)(2).

8. CONSULTATION WITH INDIVIDUALS OUTSIDE OF THE AGENCY ON AVAILABILITY OF DATA, FREQUENCY OF COLLECTION, CLARITY OF INSTRUCTIONS AND FORMS, AND DATA ELEMENTS

Periodic meetings are held between IRS personnel and representatives of various professional groups to discuss tax law and tax forms. During these meetings, there is an opportunity for those attending to make comments regarding the collection requirements under this program.

In response to the Federal Register notice (81 FR 12782), dated March 10, 2016, we received no comments during the comment period regarding this Preparer Complaint program.

9. EXPLANATION OF DECISION TO PROVIDE ANY PAYMENT OR GIFT TO RESPONDENTS

No payment or gift has been provided to any respondents.

10. ASSURANCE OF CONFIDENTIALITY OF RESPONSES

Generally, tax returns and tax return information are confidential as required by 26 U.S.C. 6103.

11. JUSTIFICATION OF SENSITIVE QUESTIONS

A privacy impact assessment (PIA) has been conducted for information collected under this request as part of the “Preparer Inventory, PREP-INV” system and a Privacy Act System of Records notice (SORN) has been issued for this system under:

IRS 24.046- Customer Account Data Engine Business Master File

IRS 24.030- CADE Individual Master File

IRS 34.037- IRS Audit Trail and Security Records System

IRS 22.063- Electronic Filing Records

The Internal Revenue Service PIAs can be found at http://www.irs.gov/uac/Privacy-Impact-Assessments-PIA.

Title 26 USC 6109 requires inclusion of identifying numbers in returns, statements, or other documents for securing proper identification of persons required to make such returns, statements, or documents and is the authority for social security numbers (SSNs) in IRS systems.

12. ESTIMATED BURDEN OF INFORMATION COLLECTION

Form 14157 and Form 14157-A often come directly to the Return Preparer Office (RPO). If the taxpayer needs victim’s assistance, we forward the form to the Identity Theft Victim’s Assistance (IDTVA) group. Some of the Form 14157-A’s go directly to Identity Theft Victim’s Assistance group. If a return preparer was not involved, the form is not sent to RPO.

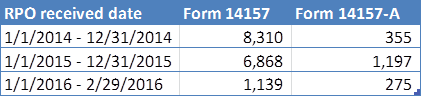

RPO data pulled:

Overall Composite Estimated Annual totals:

-

Estimated Number of Responses per year

Estimated time per response

Total estimated annual Burden

11,000

12 min.

2,337

12 minutes is the average time per response based upon Forms 14157, 14157-A, received and other correspondence such as taxpayer's emails and letters of complaint sent to the IRS offices.

13. ESTIMATED TOTAL ANNUAL COST BURDEN TO RESPONDENTS

As suggested by OMB, our Federal Register notice dated March 10, 2016, requested public comments on estimates of cost burden that are not captured in the estimates of burden hours, i.e., estimates of capital or start-up costs and costs of operation, maintenance, and purchase of services to provide information. However, we did not receive any responses from taxpayers on this subject. As a result, we do not believe there is any burden cost to the respondents not captured in the estimates of burden hours.

14. ESTIMATED ANNUALIZED COST TO THE FEDERAL GOVERNMENT

The complaints vary a great deal based on the complexity of the issue(s). A basic, one issue complaint can be completed in a few minutes while other complaints are as thick as a telephone book and take much longer. Some complaints take days, depending on how much supporting documentation the complainant gathers. The costs to the Federal government will vary depending on whether the IRS will incur printing or copying costs for all the materials. Currently, the program office consists of:

A manager = IR-FM-950-05

Five Case Specialists = GS-950-12

Two Case Processors = GS-0303-06

Two Clerks = GS-303-05

The estimated annual salary costs associated with maintaining the program office are $630,000.

15. REASONS FOR CHANGE IN BURDEN

With the addition of the Form 14157-A and updated filing estimates related to this program, we are requesting an increase in burden of 837 hours per year. The new estimates will also result in an increase in the estimated number of responses per year by 9,500.

This submission is to update the records and extend the current approval.

16. PLANS FOR TABULATION, STATISTICAL ANALYSIS AND PUBLICATION

There are no plans for tabulation, statistical analysis and publication.

17. REASONS WHY DISPLAYING THE OMB EXPIRATION DATE IS INAPPROPRIATE

We believe that displaying the OMB expiration date is inappropriate because it could cause confusion by leading taxpayers to believe that the regulation sunsets as of the expiration date. Taxpayers are not likely to be aware that the Service intends to request renewal of OMB approval and obtain a new expiration date before the old one expires.

18. EXCEPTIONS TO THE CERTIFICATION STATEMENT

There are no exceptions to the certification statement.

Note: The following paragraph applies to all of the collections of information in this submission:

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the collection of information displays a valid OMB control number. Books or records relating to a collection of information must be retained as long as their contents may become material in the administration of any internal revenue law. Generally, tax returns and tax return information are confidential, as required by 26 U.S.C. 6103.

| File Type | application/msword |

| File Title | #1545-2168 supporting statement |

| Author | mcgroartypatrickt |

| Last Modified By | Christophe Elaine H |

| File Modified | 2016-05-31 |

| File Created | 2016-05-31 |

© 2026 OMB.report | Privacy Policy