Ownership Report for Noncommercial Educational Broadcast Station

Ownership Report for Noncommercial Educational Broadcast Station, FCC Form 2100, Schedule 323-E (formerly FCC Form 323-E); Section 73.3615, Ownership Reports

Instructions for Revised Forms 323 and 323-E (2016)

Ownership Report for Noncommercial Educational Broadcast Station

OMB: 3060-0084

APPENDIX D

DRAFT FCC FORM 2100, SCHEDULE 323

Federal

Communications Commission

3060-0010 NOT YET APPROVED BY

Washington,

D.C. 20554 OMB

DRAFT FCC FORM 2100, SCHEDULE 323

INSTRUCTIONS FOR OWNERSHIP REPORT FOR COMMERCIAL BROADCAST STATIONS

GENERAL INSTRUCTIONS

1. Definitions. For the purposes of completing this form:

A Licensee is a natural person or an entity that holds a Commission license for a commercial broadcast station.

A Permittee is a natural person or an entity that holds a Commission construction permit for a commercial broadcast station.

A Respondent is any person or entity that is required to file Form 2100, Schedule 323.

2. Filing Requirements: Non-Biennial Ownership Reports. Licensees and Permittees of commercial AM, FM, or full power television stations must file Form 2100, Schedule 323 to report all attributable interests in the Licensee or Permittee as follows.

Transfers of Control/Assignment of License or Construction Permit. Licensees and Permittees must file Form 2100, Schedule 323 within 30 days after the consummation of a transfer of control or an assignment of a commercial AM, FM, or full power television station license or construction permit. See 47 C.F.R. Section 73.3615(c). Note: FCC consent is required prior to consummation of transfers of control/assignments of broadcast authorizations.

Post-grant of Construction Permit. A Permittee of a new commercial AM, FM, or full power television broadcast station must file Form 2100, Schedule 323 within 30 days after the grant of an original construction permit. See 47 C.F.R. Section 73.3615(b)(i).

Application for Station License. On the date that a Permittee applies for a license to cover an original construction permit for a new commercial AM, FM, or full power television broadcast station, the Permittee must file Form 2100, Schedule 323 to update its ownership information. A filer may choose to certify the continuing accuracy and completeness of a previously-filed ownership report. If the permit was not assigned or transferred since it was first granted, the filer may certify the continuing accuracy and completeness of a previously-filed report that was submitted pursuant to item (1), above (i.e., a report that was filed in connection with grant of the original construction permit). If the permit was assigned or transferred since it was first granted, the filer may certify the continuing accuracy and completeness of a previously-filed report that was submitted pursuant to item (2), above (i.e., a post-consummation ownership report). In either case, the information in the previously-filed report must remain accurate. See 47 C.F.R. Section 73.3615(b)(ii).

In the case of organizational structures that include holding companies or other forms of indirect ownership, a separate FCC Form 2100, Schedule 323 must be filed for each entity in the organizational structure that has an attributable interest in the Licensee or Permittee. If a Permittee or Licensee holds multiple construction permits and/or station licenses for which the filing of a non-biennial ownership report was triggered pursuant to (1), (2), or (3), above, and the information submitted on the Permittee’s or Licensee’s ownership report is equally applicable to each such permit and/or license, the Licensee or Permittee may file a single Form 2100, Schedule 323 listing all such licenses and/or permits. Similarly, if a non-Licensee/Permittee Respondent holds attributable interests in multiple Licensees or Permittees and the information submitted on the Respondent’s ownership report is equally applicable to each such Licensee/Permittee and all associated licenses/permits, the Respondent may file a single Form 2100, Schedule 323 listing all such Licensees/Permittees and licenses/permits. Notwithstanding the foregoing, any Respondent that both (1) is a Licensee and/or Permittee and (2) holds attributable interests in one or more Licensees and/or Permittees must file two ownership reports – one as a Licensee/Permittee and one as a non-Licensee/Permittee Respondent.

3. This form is not to be used to request a transfer of control or assignment of license or construction permit. The appropriate forms for use in connection with such transfers or assignments are FCC Forms 314, 315, and/or 316. See 47 C.F.R. Sections 73.3540 and 73.3541. It is the responsibility of the Licensee or Permittee to determine if a given transaction constitutes a transfer of control or an assignment. However, for purposes of example only, and for the convenience of interested persons, there are listed below some of the more common types of transfers. A transfer of control takes place when:

An individual stockholder gains or loses affirmative or negative (50 percent) control. (Affirmative control consists of control of more than 50 percent of voting stock; negative control consists of control of exactly 50 percent of voting stock.)

Any family group or any individual in a family group gains or loses affirmative or negative (50 percent) control.

Any group in privity gains or loses affirmative or negative (50 percent) control.

The following are examples of transfers of control or assignments requiring prior Commission consent:

A, who owns 51 percent of the Licensee’s or Permittee’s stock, sells 1 percent or more thereof. A transfer has been effected.

X corporation, wholly owned by Y family, retires outstanding stock which results in family member A’s individual holdings being increased to 50 percent or more. A transfer has been effected.

A and B, husband and wife, each owns 50 percent of the Licensee’s or Permittee’s stock. A sells some of his stock to B. A transfer has been effected.

A is one of the partners in the Licensee. A sells any part of his interest to newcomer B or existing partner C. An assignment has been effected.

X partnership incorporates. An assignment has been effected.

Minority stockholders form a voting trust to vote their 50 percent or more combined stockholdings. A transfer has been effected.

A, B, C, D, and E each own 20 percent of the stock of X corporation. A, B, and C sell their stock to F, G, and H at different times. A transfer is effected at such time as 50 percent or more of the stock passes out of the hands of the stockholders who held stock at the time the original authorization for the Licensee or Permittee corporation was issued.

4. Filing Requirements: Biennial Reports. Licensees of commercial AM, FM, and full power television broadcast stations, as well as Licensees of Class A Television and Low Power Television (LPTV) stations, must file FCC Form 2100, Schedule 323 every two years to report all attributable interests in the Licensee. Ownership reports must be filed by December 1 in all odd-numbered years. The information in each ownership report shall be current as of October 1 of the year in which the ownership report is filed. See 47 C.F.R. Section 73.3615(a).

In the case of organizational structures that include holding companies or other forms of indirect ownership, a separate FCC Form 2100, Schedule 323 must be filed for each entity in the organizational structure that has an attributable interest in the Licensee. If a Licensee holds multiple station licenses and the information submitted on the Licensee’s ownership report is equally applicable to each such license, the Licensee may file a single Form 2100, Schedule 323 listing all such licenses. Similarly, if a non-Licensee Respondent holds attributable interests in multiple Licensees and the information submitted on the Respondent’s ownership report is equally applicable to each such Licensee and all licenses, the Respondent may file a single Form 2100, Schedule 323 listing all such Licensees and licenses. Notwithstanding the foregoing, any Respondent that both (1) is a Licensee and (2) holds attributable interests in one or more Licensees must file two ownership reports – one as a Licensee and one as a non-Licensee Respondent.

If there has been no change in the information submitted since the filing of the last biennial report, and that last biennial report was filed on the current version of Form 2100, Schedule 323, a Licensee or other Respondent may electronically validate and resubmit its previously-filed biennial Form 2100, Schedule 323.

5. Electronic Filing of FCC Form 2100, Schedule 323. All Form 2100, Schedule 323 filings must be submitted electronically. Use the Media Bureau Electronic Filing system (http://www.fcc.gov/encyclopedia/media-bureau-filing-systems-and-databases).

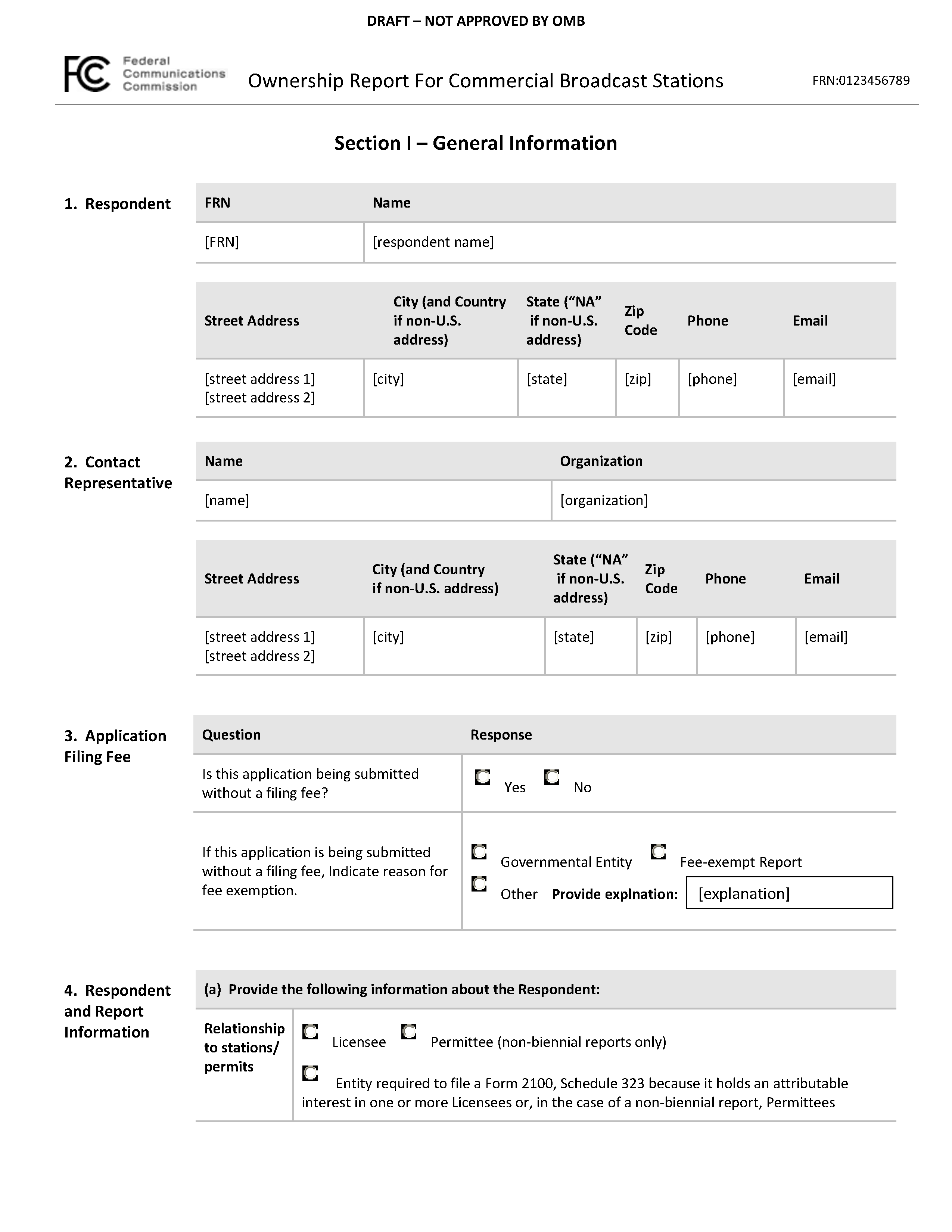

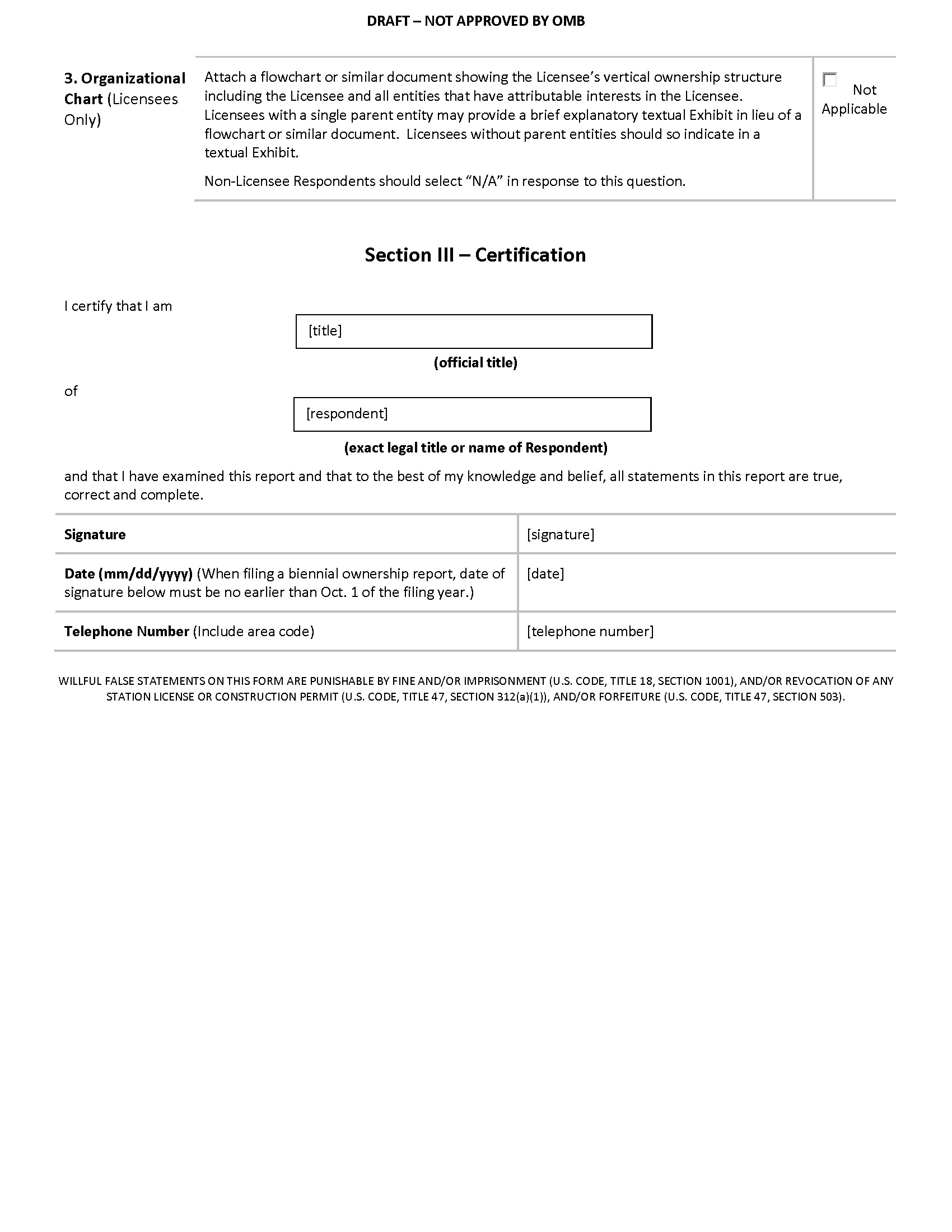

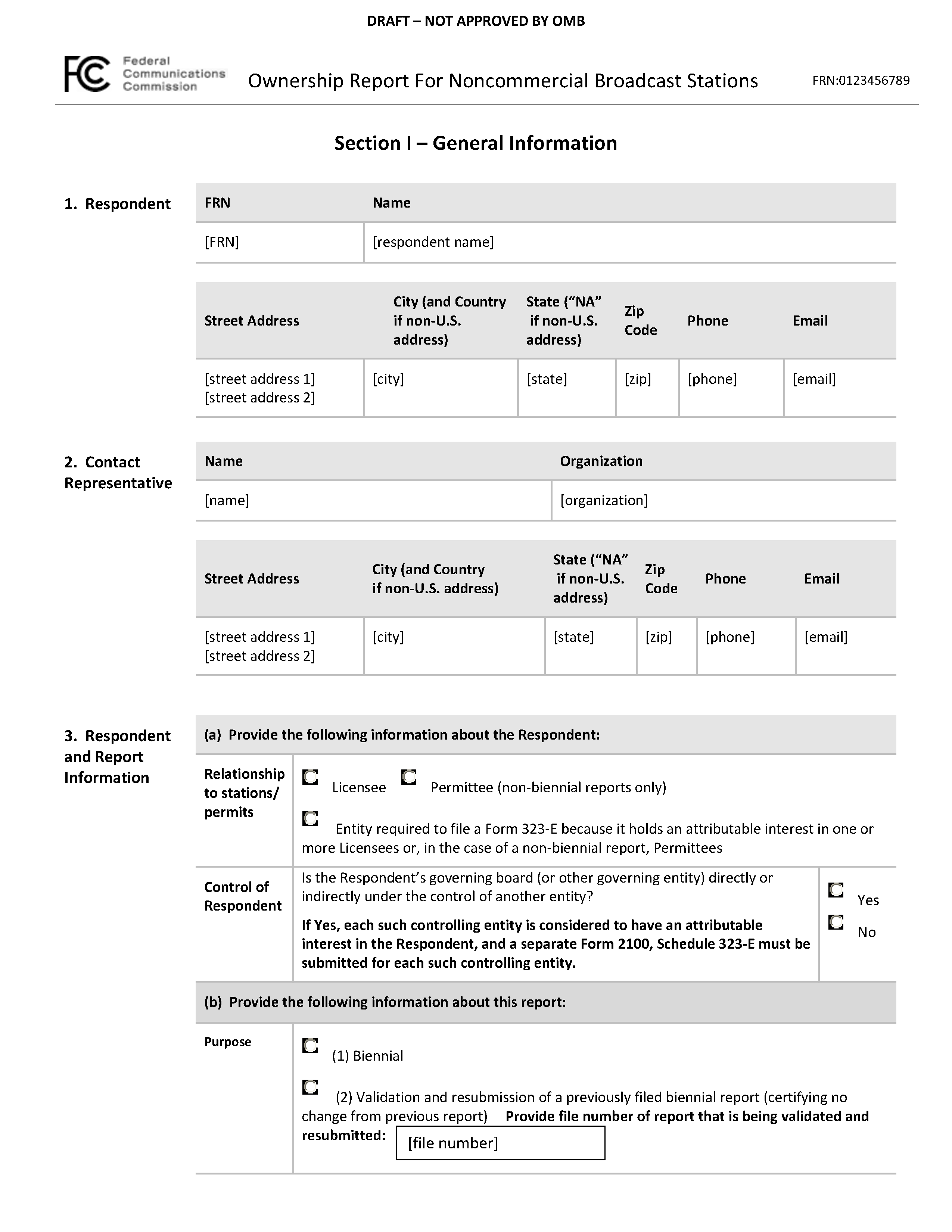

Section I – General Information (All Respondents Must Complete)

Questions 1 and 2: Respondent and Contact Representative. In response to Question 1, enter the legal name, address, contact information and FCC Registration Number of the Respondent. If the report is filed on behalf of more than one license/permit, enter the call sign and Facility ID Number of one of the licenses/permits covered by the report. Provide the name, organization, and contact information for the Respondent’s representative in response to Question 2.

For non-U.S. addresses, include the country name with the city in the City field, and answer “NA” in the State field. Provide a U.S. zip code or non-U.S. postal code, as applicable, in the Zip/Postal Code field.

Licensees/Permittees. The name of the Licensee or Permittee should be stated exactly as it appears on the station’s existing license or construction permit. The current street address or post office box used by the Licensee or Permittee for receipt of Commission correspondence should be set forth. Any change in the name of the Licensee or Permittee, which does not involve a change in ownership requiring prior Commission approval, can be communicated to the Commission by letter. Changes in the mailing address previously used by the Licensee or Permittee should be promptly transmitted to the Commission. See 47 C.F.R. Section 1.5. To report any changes in the mailing address, use the Media Bureau Electronic Filing system (http://www.fcc.gov/encyclopedia/media-bureau-filing-systems-and-databases).

FCC Registration Number (FRN). The Respondent must provide its FRN – a ten-digit unique entity identifier. An FRN can be obtained through the Commission Registration System, CORES, which is listed among the FCC E-Filing systems (http://www.fcc.gov/e-file/).

If a Respondent submits and/or is listed as an attributable interest holder on multiple ownership reports, it must provide the same FRN on all such ownership reports. Filers should coordinate with each other to ensure such consistency.

Questions concerning the FCC Registration Number can be directed to the Commission’s Registration System help desk via email at [email protected] or by calling 1-877-480-3201 (Mon.-Fri. 8 a.m.-6 p.m. ET).

Facility ID Number. Facility ID numbers can be located by using the “Station Search” at the Media Bureau Electronic Filing system (http://www.fcc.gov/mb/elecfile.html). In addition, the Facility ID Number is included on all broadcast authorizations and postcards.

Question 3: Application Filing Fee. By law, the Commission is required to collect charges for certain of the regulatory services it provides to the public. A fee is required to be paid and submitted with the filing of a Licensee’s biennial ownership report only. All other Form 2100, Schedule 323 reports are fee-exempt reports. Amendments to filed reports do not require payment of additional fees.

In cases where there has been no change in information since the last filing of a station’s biennial ownership report, and a Respondent electronically validates and resubmits its previously-filed Form 2100, Schedule 323, such resubmission constitutes the station’s biennial ownership report for that year and the required fee must also be submitted. The fee for the biennial ownership report (whether on a new Form 2100, Schedule 323 or as a resubmission) is payable by the Licensee and is calculated on an individual station basis. It is the number of stations for which a report is filed that determines the total fee due; not the number of Form 2100, Schedule 323 filings submitted to provide a complete set of ownership information.

Fee Exemption: Entities with Attributable Interests. Respondents that are not Licensees but that are required to file Form 2100, Schedule 323 because they have an attributable interest in one or more Licensees are not required to pay the biennial report fee. Such filers should select the option marked “Fee-exempt Report” in response to Question 3.

Fee Exemption: Governmental Entities. Governmental entities, which include any possession, state, city, county, town, village, municipal corporation or similar political organization or subpart thereof controlled by publicly elected and/or duly appointed public officials exercising sovereign direction and control over their respective communities or programs, are exempt from payment of a fee in connection with the filing of any Form 2100, Schedule 323. Such filers should select the option marked “Governmental Entity” in response to Question 3.

If “other” is selected, provide the reason for the fee exemption.

Question 4: Respondent and Report Information. In response to subsection (a), select the appropriate option to indicate whether the Respondent, is

a Licensee;

a Permittee (non-biennial reports only); or

an entity required to file a Form 2100, Schedule 323 because it holds an attributable interest in one or more Licensees or, in the case of non-biennial reports, Permittees.

Also indicate the nature of the Respondent. If “other” is selected, provide an exhibit describing the nature of the Respondent.

In response to subsection (b), indicate the report is (1) filed to satisfy the biennial filing requirement; (2) a validation and resubmission of a previously-filed biennial report (certifying no change from the previously-filed biennial report), (3) filed in connection with a transfer of control or assignment of permit or license, (4) a report by a Permittee within 30 days after the grant of a construction permit; (5) a report in conjunction with a Permittee’s application for a station license; (6) an certification of accuracy of an previously report filed ownership report by a Permittee (report in conjunction with a Permittee’s application for a station license); or (7) for the purposes of amending a previously-filed report.

A Respondent with a current and unamended biennial ownership report on file with the Commission that is still accurate and that was filed using this version of Form 2100, Schedule 323 may select option (2) to validate and resubmit the Respondent’s previously-filed biennial ownership report. A Respondent that selects option (2) will not be permitted to make changes to the information contained in Section I, Question 5, or Section II-B of the new biennial report. If such changes are needed, the Respondent should NOT select option (2) but instead should make use of the report copying or prefilling capabilities within CDBS to create the new report.

If a report is filed pursuant to option (6), provide the file number of the previously-filed report that is being certified. A Respondent that selects option (6) will not be permitted to make changes to the information contained in Section I, Question 5, or Section II-A of the new report. If such changes are needed, the Respondent should NOT select option (6) and should instead select option (5) and make use of the report copying or prefilling capabilities within CDBS to create the new report.

A Respondent should select option (7) only if the purpose of the filing is to correct one or more errors in a previously-submitted report. Filing under option (7) will update the previously-filed report, and the report will have the same file number as the previously-filed report. If the report is being submitted pursuant to option (7), provide the File Number of the previously-filed report and an exhibit listing, by Section and Question Number, the portions of the previous report that are being revised. A Respondent that wishes to create a new report based on data contained in a previously-submitted report should NOT select option (7). Instead, the Respondent should make use of the report copying or prefilling capabilities within the Commission’s electronic filing system to create the new report.

Also enter the “as of” date in the field provided. When filing a biennial ownership report (option (1) or (2)), the date entered must be Oct. 1 of the filing year.

Question 5: Licensee/Permittee and License/Permit Information. All Licensee/Permittee Respondents must enter the name and FRN of the Licensee/Permittee and provide information for each license/permit held by the Licensee/Permittee and covered by the ownership report, including call sign, Facility ID Number, community of license, and class of service. All non-Licensee/Permittee Respondents must enter the name and FRN for each Licensee/Permittee covered by the ownership report. In addition, such Respondents must provide the required information for each license/permit that is held by one of those Licensee(s)/Permittee(s) and covered by the ownership report.

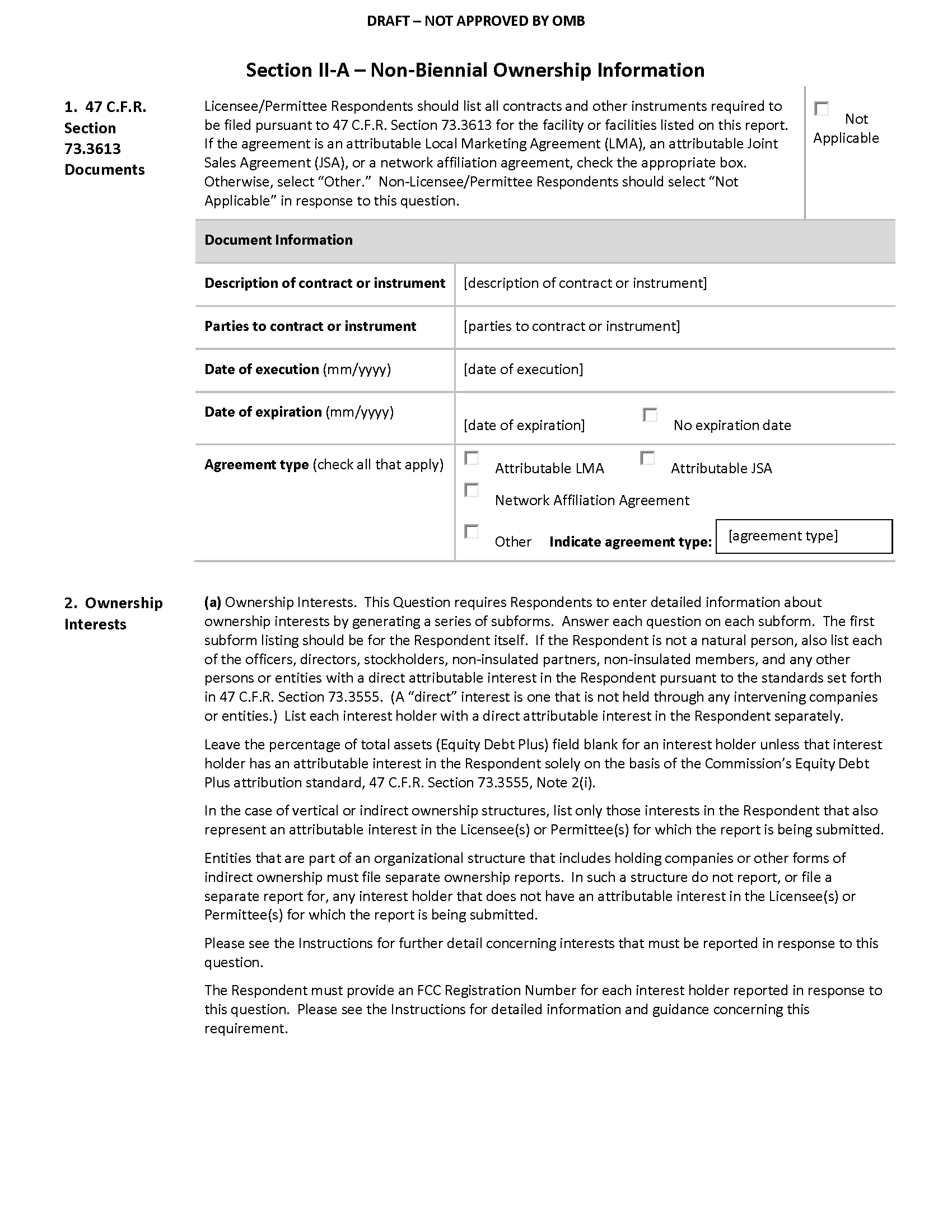

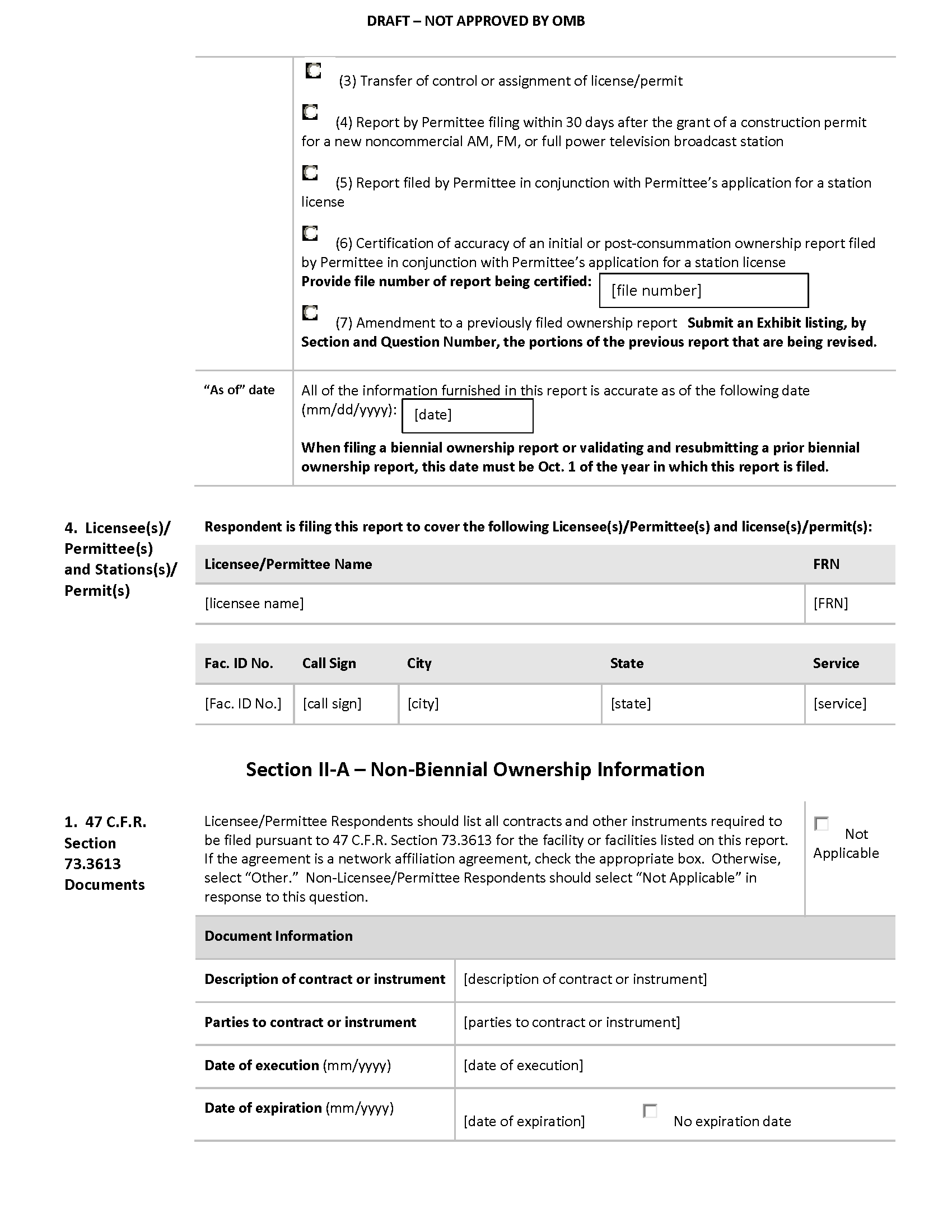

Section II-A – Non-Biennial Ownership INFORMATION

Question 1: Contract Information. Licensees and Permittees of full power commercial television stations, AM radio stations, and FM radio stations are required to file with the Commission any contracts or other instruments, or modifications thereof, relating to the ownership, control, or management of the Licensee or Permittee or to its stock. See 47 C.F.R. Section 73.3613. Licensees and Permittees must file all contracts or instruments of the types specified in Section 73.3613. The filing requirement is not limited to executed contracts, but includes documents such as options, pledges, and other executory agreements and contracts relating to ownership, control, or management.

Licensee/Permittee Respondents should list all documents required to be filed pursuant to Section 73.3613 for all of the stations covered by the report. For each contract or instrument, the Respondent should provide a description of the document, a listing of the parties, the month and year of execution, and the month and year of expiration (if the agreement is perpetual or does not have a fixed expiration date, select “No Expiration Date”). In addition, the Respondent should use the checkboxes provided to indicate whether each document is an attributable local marketing agreement (LMA), an attributable joint sales agreement (JSA), a network affiliation agreement or a document that does not fall into any of these categories. If an agreement falls into multiple categories, check each applicable box. If “other” is selected, indicate the agreement type. Each contract/instrument must be identified and listed directly in the fields provided. For the purposes of completing Question 1, only a listing of the relevant contract and instruments, including the specific information discussed above, is required. Do not attach copies of the contracts/instruments to the form.

Non-Licensee/Permittee Respondents should select “Not Applicable” in response to this question and should not provide any information concerning contracts or other instruments.

Question 2: Ownership Interests. As used in Question 2, an attributable interest is an ownership interest in or relationship to a Licensee that confers on its holder a certain degree of influence or control over the Licensee as defined in the Commission’s rules. For guidance concerning attributable interests, Respondents should consult the instructions below. In addition, Respondents should review the Commission’s attribution policies and standards, which are set forth in 47 C.F.R. Section 73.3555, as revised and explained in Review of the Commission’s Regulations Governing Attribution of Broadcast and Cable/MDS Interests, MM Docket No. 94-150, 14 FCC Rcd 12559 (1999), recon. granted in part, 16 FCC Rcd 1097 (2000) and Report and Order in MM Docket No. 83-46, 97 FCC 2d 997 (1984), recon. granted in part, 58 RR 2d 604 (1985), further modified on recon., 61 RR 2d 739 (1986). Finally, Respondents should consult Promoting Diversification of Ownership in the Broadcasting Services, MB Docket No. 07-294, Second Report and Order, and Order on Reconsideration, FCC 16-1, ¶¶ 47-50 (Jan. 20, 2016).

Part (a). This Question requires Respondents to enter detailed information about ownership interests by generating a series of subforms. Answer each question on each subform. The first subform listing should be for the Respondent itself. If the Respondent is not a natural person, also list each of the officers, directors, stockholders, non-insulated partners, non-insulated members and other persons or entities with a direct attributable interest in the Respondent. (A “direct” interest is one that is not held through any intervening companies or entities.) In the case of vertical or indirect ownership structures, report only those interests in the Respondent that also represent an attributable interest in the Licensee(s) and/or Permittee(s) for which the report is being submitted.

List each person or entity with a direct attributable interest in the Respondent separately. Entities that are part of an organizational structure that includes holding companies or other forms of indirect ownership must file separate ownership reports. In such a structure, do not report or file separate reports for persons or entities that do not have an attributable interest in the Licensee(s) and/or Permittee(s) for which the report is being submitted.

The following interests are attributable, and the holders of such interests must be reported in response to Question 2(a):

If a Corporation: Each officer, director, and owner of stock accounting for 5 percent or more of the issued and outstanding voting stock of the Respondent is considered the holder of an attributable interest, and must be reported. Where the 5 percent stock owner is itself a corporation, each of its directors and executive officers (president, vice-president, secretary, treasurer or their equivalents) is considered a holder of an attributable interest. In certain circumstances, however, one or more of a corporation’s officers and directors may be exempted from attribution and need not be reported in response to Question 2(a). Refer to Question 2(e) for additional explanation and instructions.

In addition, a party that holds voting stock in the corporate stockholder of a corporate Respondent is considered the holder of an attributable interest, and must be reported, if that voting interest, when multiplied by the corporate stockholder’s interest in the Respondent, would account for 5 percent or more of the issued and outstanding voting stock of the Respondent, except that, other than for purposes of subsection (i) of Note 2 to 47 C.F.R. § 73.3555, the multiplier does not apply to any link in the ownership chain representing an interest greater than 50 percent. For example, where Corporation X owns stock accounting for 25 percent of the Respondent’s votes, only Corporation X shareholders holding 20 percent or more of the issued and outstanding voting stock of Corporation X have a 5 percent or more indirect interest in the Respondent (0.25 x 0.20 = 0.05) and, therefore, are considered to have an attributable interest in the Respondent. For purposes other than subsection (i) of Note 2 to 47 C.F.R. § 73.3555, any shareholder holding more than 50 percent of the issued and outstanding voting stock of Corporation X will be deemed to have an interest in the Respondent equal to the interest held by Corporation X. For example, where Corporation X owns stock accounting for 25 percent of the Respondent’s votes, a Corporation X shareholder holding more than 50 percent of the issued and outstanding voting stock of Corporation X will be considered to have a 25 percent indirect interest in the Respondent. For such ownership structures, report on Form 2100, Schedule 323 only interests that amount to 5 percent or more of the issued and outstanding voting stock of the Licensee after the multiplier is applied. Where the 5 percent stock owner is a partnership, each general partner and any limited partner that is not insulated, regardless of the partnership interest, is considered to have an attributable interest that must be reported.

Stock subject to stockholder cooperative voting agreements accounting for 5 percent or more of the votes in a corporate respondent will be treated as if held by a single entity and any stockholder holding 5 percent or more of the stock in that block is considered a holder of an attributable interest.

Pursuant to the Commission’s single majority shareholder exemption, if a single party holds more than 50 percent of a Respondent’s voting stock, and a simple majority is all that is required to control the Respondent’s corporate affairs, the voting stock holdings of the Respondent’s other stockholders are not attributable interests. As a result, such minority stockholders need not be reported on ownership report filings based on their voting stock holdings. Notwithstanding the foregoing, if such a minority shareholder holds a positional interest in the Respondent (e.g., is an officer or director of the Respondent that is not exempted from attribution), or if the minority shareholder’s combined equity and debt interests in the Respondent are attributable under the Commission’s Equity Debt Plus attribution standard (described below), such minority shareholder has an attributable interest in the Respondent and must be reported.

An investment company, insurance company or trust department of a bank is not considered a holder of an attributable interest, and a Respondent may properly certify that such entity’s interest is non-attributable (see Question 2(b), below), IF its aggregated holding accounts for less than 20 percent of the outstanding votes in the Respondent AND IF such entity exercises no influence or control over the corporation, directly or indirectly; and such entity has no representatives among the officers and directors of the corporation, unless that entity’s combined equity and debt interests in the Respondent give rise to attribution under the Commission’s Equity Debt Plus attribution standard described below.

If a PARTNERSHIP: All partners, including all limited partners, are considered attributable interest holders. However, a limited partner in a limited partnership is not considered an attributable interest holder IF the limited partner is not materially involved, directly or indirectly, in the management or operation of the media-related activities of the partnership and the Respondent so certifies (see Question 2(b), below). Sufficient insulation of a limited partner for purposes of this certification would be assured if the limited partnership arrangement:

(1) specifies that any exempt limited partner (if not a natural person, its directors, officers, partners, etc.) cannot act as an employee of the limited partnership if his or her functions, directly or indirectly, relate to the media enterprises of the company;

(2) bars any exempt limited partner from serving, in any material capacity, as an independent contractor or agent with respect to the partnership’s media enterprises;

(3) restricts any exempted limited partner from communicating with the Licensee or the general partner on matters pertaining to the day-to-day operations of its business;

(4) empowers the general partner to veto any admissions of additional general partners admitted by vote of the exempt limited partners;

(5) prohibits any exempt limited partner from voting on the removal of a general partner or limits this right to situations where the general partner is subject to bankruptcy proceedings, as described in Sections 402 (4)-(5) of the Revised Uniform Limited Partnership Act, is adjudicated incompetent by a court of competent jurisdiction, or is removed for cause, as determined by an independent party;

(6) bars any exempt limited partner from performing any services to the limited partnership materially relating to its media activities, with the exception of making loans to, or acting as a surety for, the business; and

(7) states, in express terms, that any exempt limited partner is prohibited from becoming actively involved in the management or operation of the media businesses of the partnership.

Notwithstanding conformance of the partnership agreement to these criteria, the requisite certification cannot be made IF the limited partner’s interest is attributable under the Commission’s Equity Debt Plus attribution standard described below; or IF the Respondent has actual knowledge of a material involvement of a limited partner in the management or operation of the media-related businesses of the partnership. In the event that the Respondent cannot certify as to the noninvolvement of a limited partner, the limited partner will be considered as an attributable interest holder and the interest must be reported. Moreover, a limited partner cannot be insulated, and must be reported as an attributable interest holder, if that limited partner’s combined equity and debt interests in the limited partnership give rise to attribution under the Commission’s Equity Debt Plus attribution standard, described below, or if that limited partner holds an officer or director position and is not exempted from attribution (as discussed below).

If one or more insulated limited partners would, absent insulation, have voting rights in the Respondent, the voting interests reported for the non-insulated partners should be adjusted (i.e., increased) as necessary to reflect the effective voting interests of the non-insulated partners.

Partnerships sometimes have officers and directors. Each executive officer or director of a partnership is considered to be a holder of an attributable interest. In some cases, however, one or more of a partnership’s officers and directors may be exempted from attribution and need not be reported in response to Question 2(a). Refer to Question 2(e) for additional explanation and instructions.

If a LIMITED LIABILITY COMPANY: The Commission treats a limited liability company as a limited partnership, each of whose members is considered to be an attributable interest holder. However, where a limited liability company member is insulated in the manner specified above with respect to a limited partnership and where the relevant state statute authorizing the limited liability company permits a limited liability company member to insulate itself in accordance with the Commission’s criteria, that limited liability company member is not considered an attributable interest holder. A member cannot be insulated, however, and must be reported as an attributable interest holder, if that member’s combined equity and debt interests in the limited liability company give rise to attribution under the Commission’s Equity Debt Plus attribution standard, described below, or if that member holds an officer or director position and is not exempted from attribution (as discussed below).

If one or more insulated members would, absent insulation, have voting rights in the Respondent, the voting interests reported for the non-insulated members should be adjusted (i.e., increased) as necessary to reflect the effective voting interests of the non-insulated members.

Limited liability companies sometimes have officers and directors. Each executive officer or director of a limited liability company is considered to be a holder of an attributable interest. In some cases, however, one or more of a limited liability company’s officers and directors may be exempted from attribution and need not be reported in response to Question 2(a). Refer to Question 2(e) for additional explanation and instructions.

Attributable Agreements. Pursuant to Section 73.3555, Notes 2(j) and 2(k), certain agreements give rise to an attributable interest in a Licensee or Permittee. Any party to such agreement that creates an attributable interest in the Licensee/Permittee by virtue of the standards set forth in 73.3555, Notes 2(j) and 2(k) must be listed in response to Question 2(a) in the ownership report filed by the Licensee/Permittee – regardless of whether or not the Licensee/Permittee itself is a party to the agreement(s). In addition, each such party must file its own ownership report(s), pursuant to the standards set forth in these Instructions, in connection with the relevant Licensee/Permittee and license(s)/permit(s).

Equity Debt Plus Attribution Standard. Certain interests held by substantial investors in, or creditors of, the Respondent may also be attributable, and the investor/creditor must be reported, if the interest falls within the Commission’s Equity Debt Plus (EDP) attribution standard. Under the EDP standard, the interest held is attributable if, aggregating both equity and debt, it exceeds 33 percent of the total asset value (all equity plus all debt) of the Respondent – a broadcast station licensee, cable television system, daily newspaper or other media outlet subject to the Commission’s broadcast multiple ownership or cross-ownership rules – AND the interest holder also holds (1) an attributable interest in a media outlet in the same market, or (2) supplies over 15 percent of the total weekly broadcast programming hours of the station in which the interest is held. For example, the equity interest of an insulated limited partner in a limited partnership Respondent would normally not be considered attributable, but, under the EDP standard, that interest would be attributable if the limited partner’s interest exceeded 33 percent of the Respondent’s total asset value AND the limited partner also held a 5 percent voting interest in another radio or television station licensee in the same market. See Section 73.3555, Note 2(i), of the Commission’s rules.

Pursuant to a 2008 Commission order, an interest holder may exceed the 33 percent EDP threshold without triggering attribution where the investment would enable an Eligible Entity (as that term is defined by the Commission) to acquire a broadcast station provided that: (1) the combined equity and debt of the interest holder in the Eligible Entity is less than 50 percent, or (2) the total debt of the interest holder in the Eligible Entity does not exceed 80 percent of the asset value of the station being acquired by the Eligible Entity and the interest holder does not hold any equity interest, option, or promise to acquire an equity interest in the Eligible Entity or any related entity. See In re Promoting Diversification of Ownership in the Broadcasting Services, MB Docket No. 07-294, Report and Order and Third Further Notice of Proposed Rule Making, 23 FCC Rcd 5922 (2008). However, the Commission subsequently suspended this application of the Eligible Entity definition. See Media Bureau Provides Notice of Suspension of Eligible Entity Rule Changes and Guidance on the Assignment of Broadcast Station Construction Permits to Eligible Entities, Public Notice, 26 FCC Rcd 10370 (Med. Bur. 2011).

FCC Registration Numbers (FRNs). Respondents must provide an FRN – a ten-digit unique entity identifier – for each person or entity reported on Form 2100, Schedule 323. An FRN can be obtained through the Commission Registration System, CORES, which is listed among the FCC E-Filing systems (http://www.fcc.gov/e-file/).

Individuals (but not entities) may report either a CORES FRN or a Restricted Use FRN (RUFRN) on Form 2100, Schedule 323. If an RUFRN or CORES FRN has been previously reported for an individual on one or more ownership report filings (either commercial or noncommercial), the Respondent must use that previously-reported RUFRN or CORES FRN for that individual on all current and future ownership report filings.

In limited circumstances, a Respondent may report a Special Use FRN (SUFRN) for an individual. Before generating or submitting an SUFRN for an individual, Respondents should read the Commission’s Form 2100, Schedule 323 and Form 2100, Schedule 323-E Frequently Asked Questions concerning the SUFRN (http://www.fcc.gov/bureaus/mb/industry_analysis/form323faqs.html). By reporting an SUFRN for an individual, the Respondent affirms to the Commission that after using reasonable and good faith efforts, the Respondent is unable to obtain an FRN and/or obtain and/or receive permission to use the Social Security Number or other identifying information of that individual in order to generate a CORES FRN or RUFRN for that individual. If an individual interest holder does not already have a CORES FRN, we expect filers to acquire an RUFRN or CORES FRN for that individual or instruct the individual to obtain his or her own RUFRN or CORES FRN and to provide the FRN to the filer for reporting on the ownership report form. Filers must take specific steps to substantiate that they are making the required reasonable and good faith efforts, which include informing reportable individuals of their obligations and the risk of enforcement action for failing to provide an RUFRN or CORES FRN or to permit an RUFRN or CORES FRN to be obtained on their behalf. An SUFRN may be obtained only if an individual still refuses to provide a means of reporting a valid RUFRN or CORES FRN after the filer has taken such steps. See Promoting Diversification of Ownership in the Broadcasting Services, MB Docket No. 07-294, Report and Order, Second Report and Order, and Order on Reconsideration, FCC 16-1, ¶¶ 56-58 (Jan. 20, 2016) (Second Report and Order). Respondents are encouraged to refer individual interest holders who are resistant to providing the Respondent with the means of reporting a CORES FRN or RUFRN to the Second Report and Order and to the Commission’s Form 2100, Schedule 323 and Form 2100, Schedule 323-E website.

While the burden to obtain an RUFRN or CORES FRN or to permit the filer to acquire an RUFRN or CORES FRN falls to the interest holder, the Commission reminds filers of their obligation to review the ownership report and affirm that, to the best of the filer’s “knowledge and belief, all statements in [the ownership report] are true, correct, and complete.” This includes verifying that the CORES FRN or RUFRN reported for each reported party is correct and that no SUFRN has been used for an individual in the absence of reasonable and good-faith efforts to obtain an RUFRN or CORES FRN, including informing a recalcitrant interest holder of the obligation and potential for enforcement action. However, the filer itself will be exempt from enforcement action if the filer substantiates that it has used reasonable and good-faith efforts as described herein.

If an SUFRN has not been reported previously for an individual on any ownership report filings (either commercial or noncommercial), and, pursuant to the instructions and standards set forth above, the Respondent is unable to obtain a CORES FRN or RUFRN for that individual, the Respondent should click the button on the relevant subform for this question to generate an SUFRN for that individual. If an SUFRN has been previously reported for an individual on one or more ownership report filings (either commercial or noncommercial) and, pursuant to the discussion and standards set forth above, the Respondent remains unable to obtain a CORES FRN or RUFRN for that party, the Respondent must report the previously-used SUFRN for the individual.

RUFRNs and SUFRNs may only be used to file ownership reports, and may not be used for any other purpose at the FCC. RUFRNs and SUFRNs are only available for natural persons. In addition, RUFRNs and SUFRNs are not available for any natural person who is a Respondent on one or more ownership reports.

If a party submits and/or is listed as an attributable interest holder on multiple ownership reports, it must provide the same FRN on all such ownership reports, regardless of whether that FRN is a CORES FRN, RUFRN, or SUFRN. Filers should coordinate with each other to ensure such consistency.

The guidance concerning Special Use FRNs provided in Media Bureau Announces Online Availability of Revised Biennial Form 323, an Instructional Workshop on the Revised Form, and the Possibility of Obtaining a Special Use FRN for the Form, MB Docket No. 07-294, Public Notice, 24 FCC Rcd 14329 (Med. Bur. 2009) has been superseded as discussed herein and as provided in the Second Report and Order.

Questions concerning the FCC Registration Number can be directed to the Commission’s Registration System help desk via email at [email protected] or by calling 1-877-480-3201 (Mon.-Fri. 8 a.m.-6 p.m. ET).

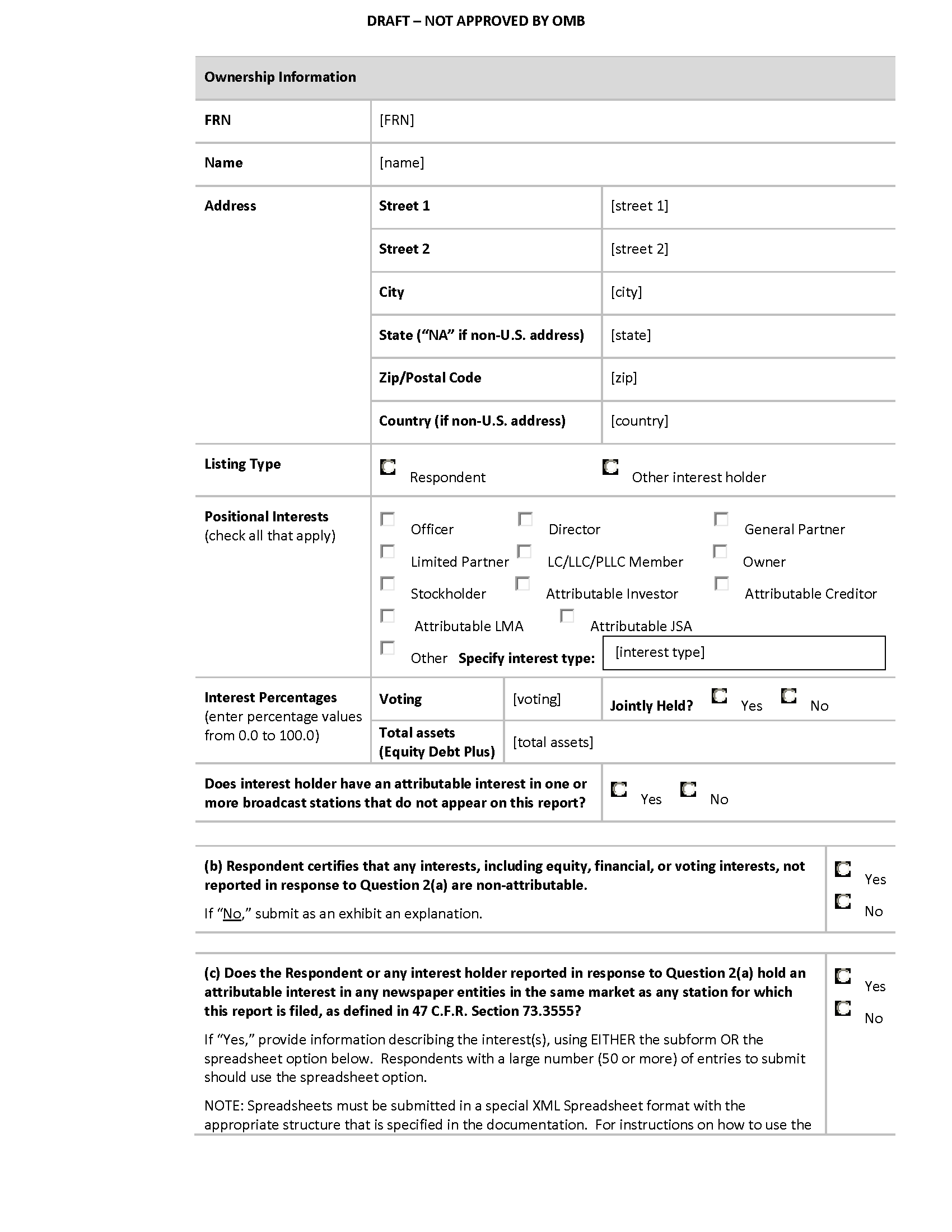

Address Information. Provide address information for the interest holder in the relevant fields. Provide a U.S. zip code or non-U.S. postal code, as applicable, in the Zip/Postal Code field. If the interest holder has a non-U.S. address, select “NA” in the State field and provide the name of the country in the Country field. Otherwise, select the proper state abbreviation for the State field and leave the Country field blank.

Listing Type. Indicate whether the interest holder is the Respondent on the report. Respondent interest holders should be identified on the first subform of this question.

Positional Interests. Check the boxes for each type of interest in the Respondent held by the interest holder. If “other” is selected, specify the interest type.

Percentages of Votes and Total Assets (Equity Debt Plus). Provide the interest holder’s voting percentage in the Respondent in the field provided. If the interest holder holds an attributable interest in the Respondent solely pursuant to the Commission’s Equity Debt Plus attribution standard, discussed above, provide the interest holder’s percentage of total assets (Equity Debt Plus) in the field provided. Otherwise, leave the total assets (Equity Debt Plus) field blank.

Jointly Held Voting Interests. In certain circumstances, two or more parties hold a voting interest in a Respondent jointly. Two parties may, for example, hold 100 percent of the voting interest in an entity together, as joint tenants (as opposed to each individual holding 50 percent of the voting interests). Similarly, agreements for partnerships or limited liability companies may provide that two or more individuals exercise voting power together. Use the radio buttons on the subform to indicate whether the voting interest reported on that subform is held jointly.

Other Broadcast Interests. Use the radio buttons on the subform to indicate whether the interest holder reported on that subform also has attributable interests in one or more broadcast stations other than those covered by the ownership report.

Part (b). Respondents must indicate that the information provided in part (a) of Question 2 is complete by certifying that all interests, including equity, financial, or voting interests, not reported in response to Question 2(a) are non-attributable.

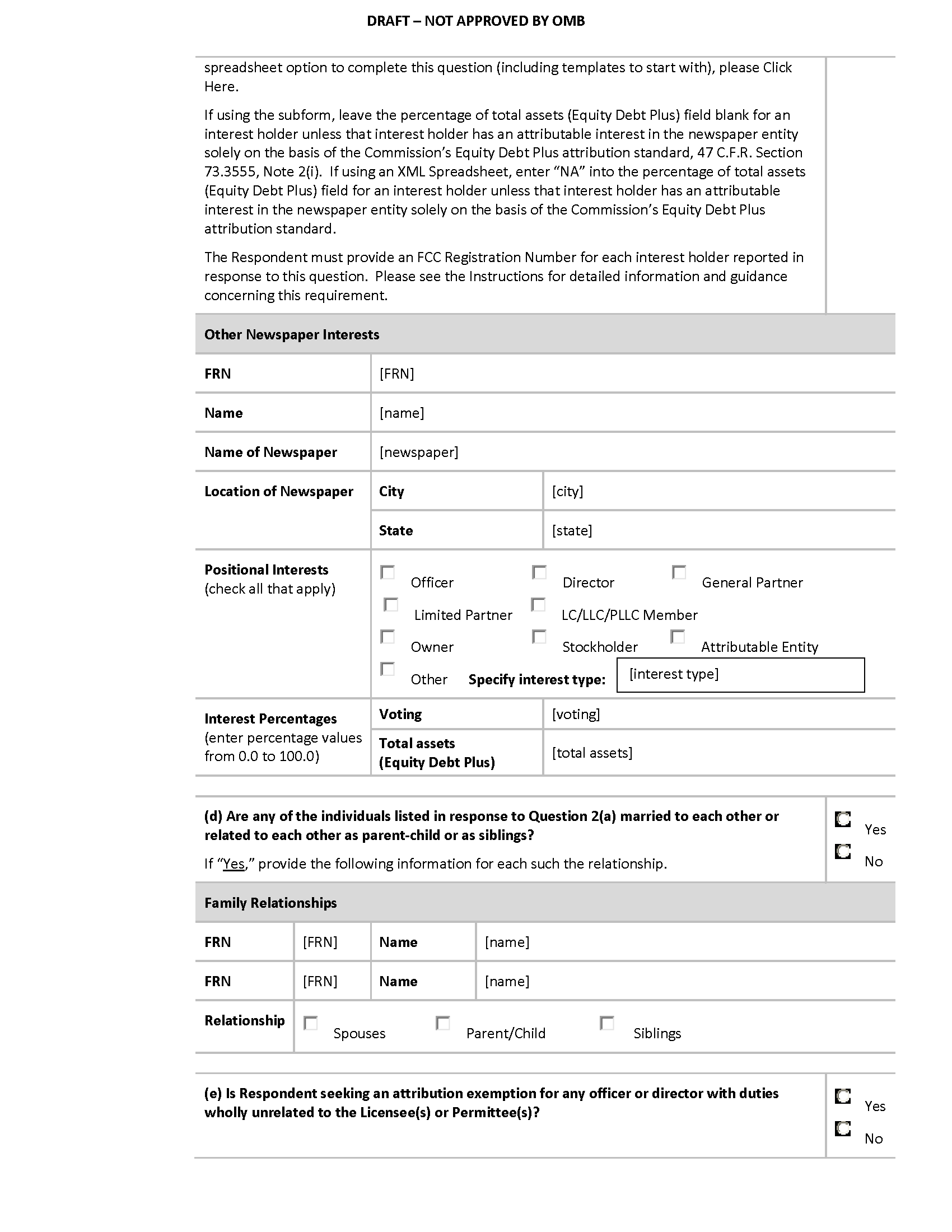

Part (c). Use either the question subforms or one or more XML attachments to provide information concerning any daily newspapers in which any of the interest holders listed in response to Question 2(a) has an attributable interest and that are located within the pertinent in-market signal contours of any broadcast stations for which this report is filed. See 47 C.F.R. Section 73.3555. List each interest holder/newspaper combination on a separate line, and provide the name and FRN of the interest holder, the name and location of the newspaper publication, and the interest holders’ voting percentage interest and positional interest(s) in the newspaper entity. If the interest holder holds an attributable interest in the newspaper entity solely on the basis of the Commission’s Equity Debt Plus attribution standard (discussed above), also provide a figure for percentage of total assets (Equity Debt Plus). Otherwise, either leave the field blank (if using the subform) or enter “NA” into the field (if using XML attachments).

Both direct and indirect ownership interests must be reported, and percentage figures provided for each interest holder should represent the aggregate of all direct and indirect interests held by that interest holder.

The Respondent must provide an FRN for each interest holder reported in response to this question. Because any interest holder listed in response to this question must also be listed in response to Section II-A, Question 2(a), each FRN provided for an interest holder in response to this question must match an FRN provided for an interest holder in response to Section II-A, Question 2(a). Detailed information and guidance concerning the FRN requirement is provided in the section of these Instructions addressing Section II-A, Question 2(a), above.

Part (d). Indicate whether any individuals listed in Question 2(a) are married to each other or related to each other as parent-child or siblings. If the answer is “Yes,” enter the names and FRNs of the married and/or related individuals and select the applicable option indicating the familial relationship.

Part (e). If the Respondent seeks an attribution exemption for any officer or director with duties wholly unrelated to the Licensee(s)/Permittee(s), select “Yes” and enter the name and title of the each such individual in the applicable fields. For each such individual, provide an exhibit establishing that he or she will not exercise authority or influence in areas that will affect the Respondent or the Licensee(s)/Permittee(s) and station(s) covered by the report. This exhibit should describe that individual’s duties and responsibilities and explain the manner in which such individual is insulated from the Respondent and, therefore, should not be attributed an interest. Attach any such explanation as Exhibit 4.

When answering this question, Respondents should note that exemption from attribution cannot be invoked for an officer or director unless he or she does not, and will not, have the ability to influence the broadcast operations of the Permittee(s)/Licensee(s) or Station(s). See 47 C.F.R. § 73.3555, Note 2(g).

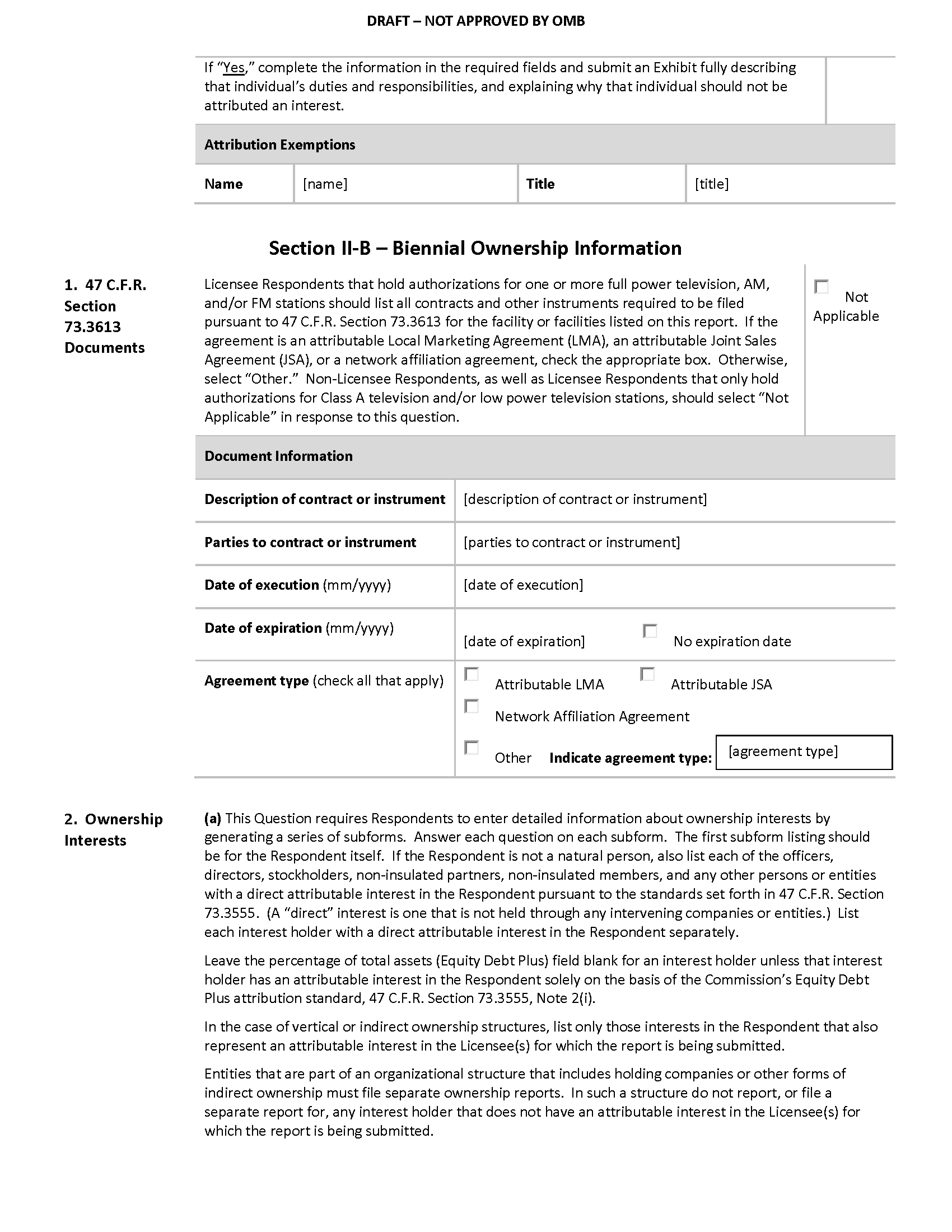

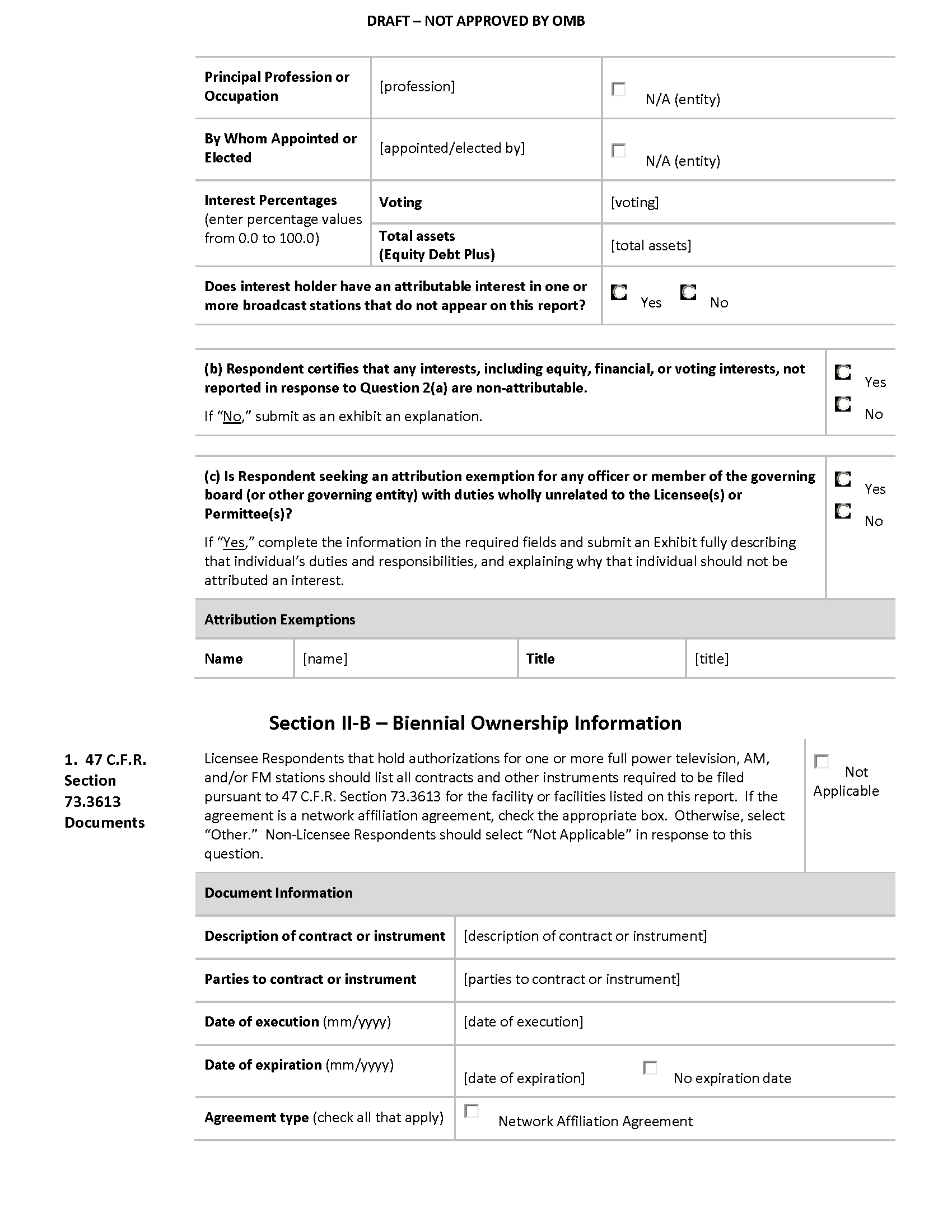

Section II-B – Biennial Ownership INFORMATION

Question 1: Contract Information. Licensees of full power commercial television stations, AM radio stations, and FM radio stations are required to file with the Commission any contracts or other instruments, or modifications thereof, relating to the ownership, control, or management of the Licensee or to its stock. See 47 C.F.R. Section 73.3613. Licensees must file all contracts or instruments of the types specified in Section 73.3613. The filing requirement is not limited to executed contracts, but includes documents such as options, pledges, and other executory agreements and contracts relating to ownership, control, or management.

Licensee Respondents that hold one or more licenses for full power commercial television stations, AM radio stations, and/or FM radio stations should list all documents required to be filed pursuant to Section 73.3613 for all of the stations covered by the report. For each contract or instrument, the Respondent should provide a description of the document, a listing of the parties, the month and year of execution, and the month and year of expiration (if the agreement is perpetual or does not have a fixed expiration date, select “No Expiration Date”). In addition, the Respondent should use the checkboxes provided to indicate whether each document is an attributable local marketing agreement (LMA), an attributable joint sales agreement (JSA), a network affiliation agreement or a document that does not fall into any of these categories. If an agreement falls into multiple categories, check each applicable box. If “other” is selected, indicate the agreement type. Each contract/instrument must be identified and listed directly in the fields provided. For the purposes of completing Question 1, only a listing of the relevant contract and instruments, including the specific information discussed above, is required. Do not attach copies of the contracts/instruments to the form.

Non-Licensee Respondents, as well as Licensee Respondents that hold only authorizations for Class A Television or LPTV stations, should select “Not Applicable” in response to this question and should not provide any information concerning contracts or other instruments.

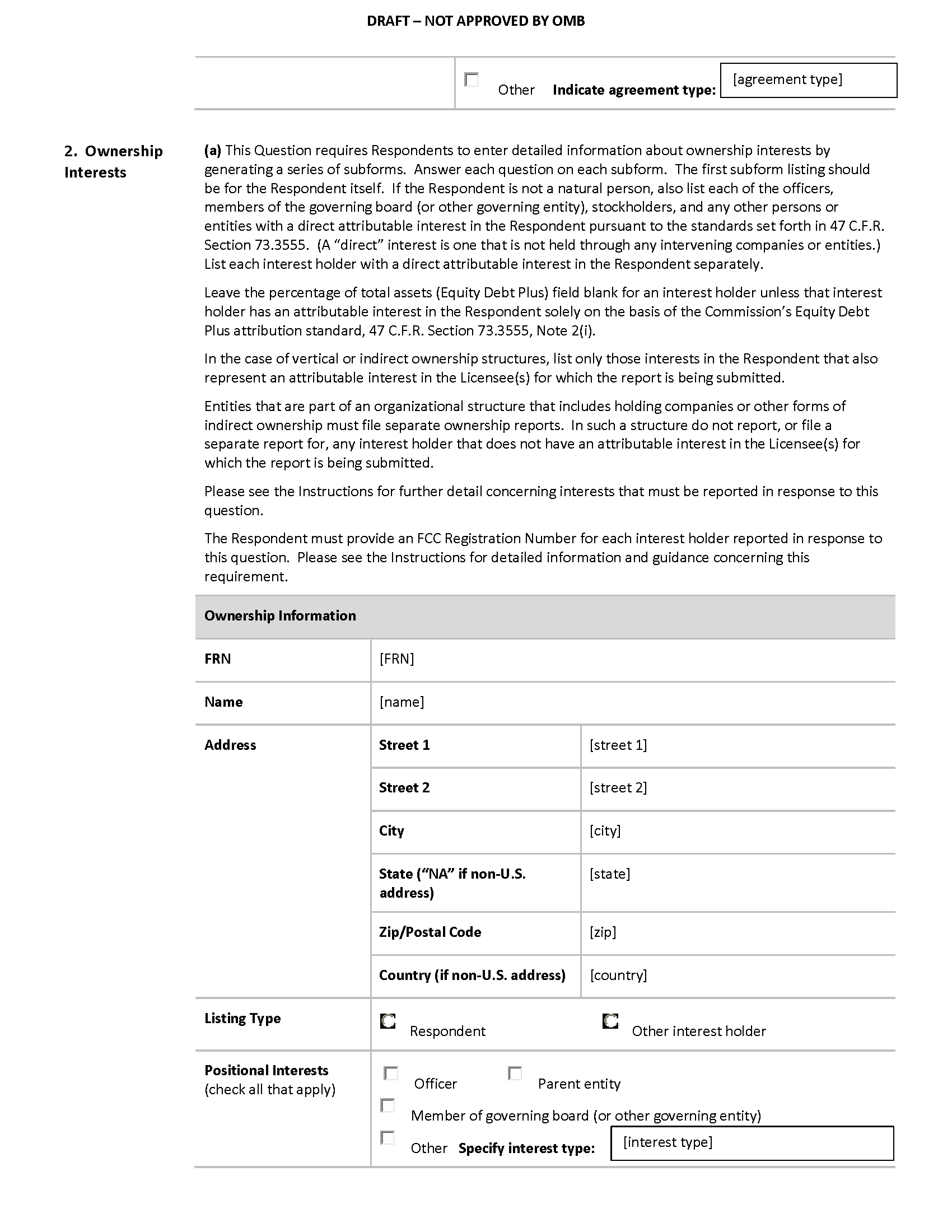

Question 2: Ownership Interests. As used in Question 2, an attributable interest is an ownership interest in or relationship to a Licensee that confers on its holder a certain degree of influence or control over the Licensee as defined in the Commission’s rules. For guidance concerning attributable interests, Respondents should consult the instructions below. In addition, Respondents should review the Commission’s attribution policies and standards, which are set forth in 47 C.F.R. Section 73.3555, as revised and explained in Review of the Commission’s Regulations Governing Attribution of Broadcast and Cable/MDS Interests, MM Docket No. 94-150, 14 FCC Rcd 12559 (1999), recon. granted in part, 16 FCC Rcd 1097 (2000) and Report and Order in MM Docket No. 83-46, 97 FCC 2d 997 (1984), recon. granted in part, 58 RR 2d 604 (1985), further modified on recon., 61 RR 2d 739 (1986). Finally, Respondents should consult Promoting Diversification of Ownership in the Broadcasting Services, MB Docket No. 07-294, Second Report and Order, and Order on Reconsideration, FCC 16-1, ¶¶ 47-50 (Jan. 20, 2016).

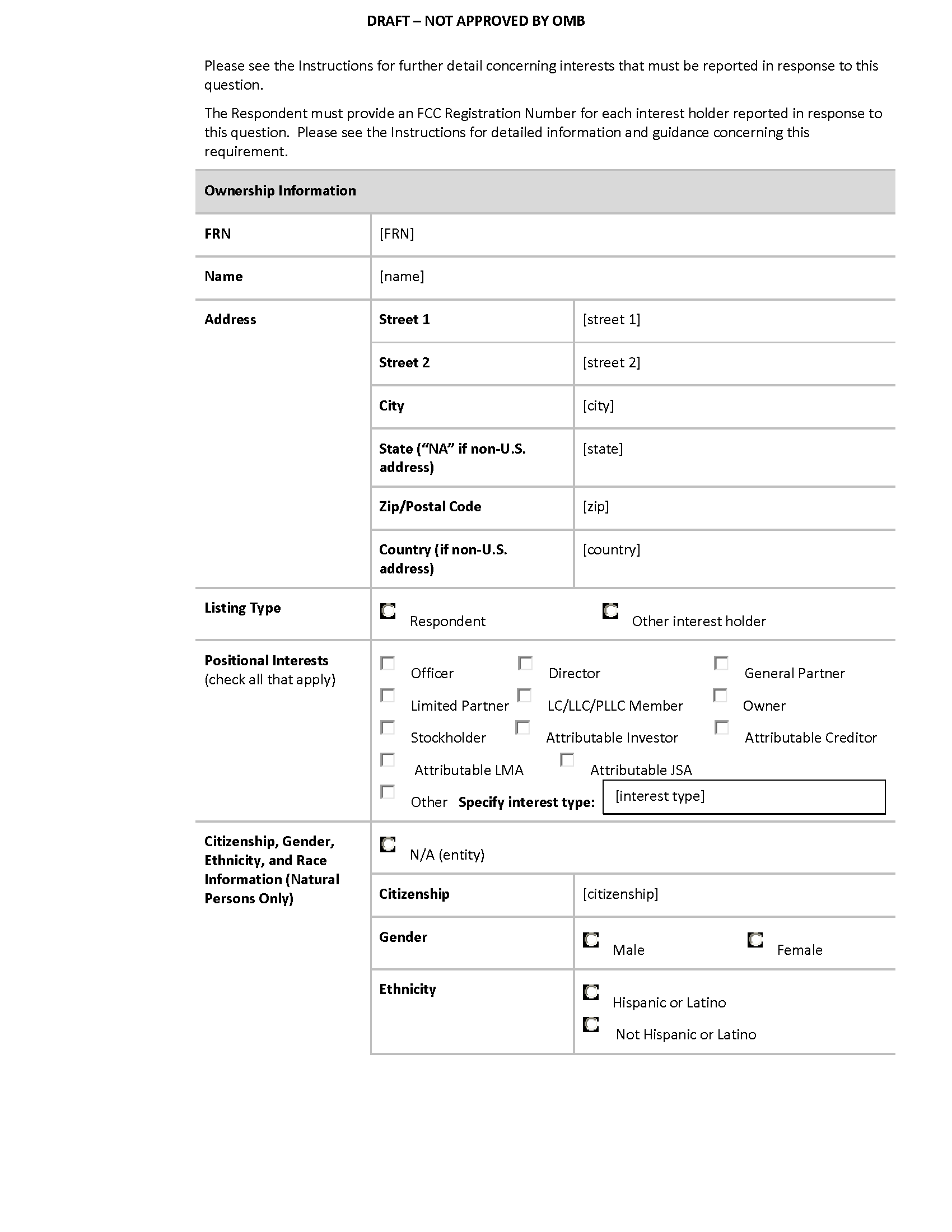

Part (a). This Question requires Respondents to enter detailed information about ownership interests by generating a series of subforms. Answer each question on each subform. The first subform listing should be for the Respondent itself. If the Respondent is not a natural person, also list each of the officers, directors, stockholders, non-insulated partners, non-insulated members and other persons or entities with a direct attributable interest in the Respondent. (A “direct” interest is one that is not held through any intervening companies or entities.) In the case of vertical or indirect ownership structures, report only those interests in the Respondent that also represent an attributable interest in the Licensee(s) for which the report is being submitted.

List each person or entity with a direct attributable interest in the Respondent separately. Entities that are part of an organizational structure that includes holding companies or other forms of indirect ownership must file separate ownership reports. In such a structure, do not report or file separate reports for persons or entities that do not have an attributable interest in the Licensee(s) for which the report is being submitted.

The following interests are attributable, and the holders of such interests must be reported in response to Question 2(a):

If a Corporation: Each officer, director, and owner of stock accounting for 5 percent or more of the issued and outstanding voting stock of the Respondent is considered the holder of an attributable interest, and must be reported. Where the 5 percent stock owner is itself a corporation, each of its directors and executive officers (president, vice-president, secretary, treasurer or their equivalents) is considered a holder of an attributable interest. In certain circumstances, however, one or more of a corporation’s officers and directors may be exempted from attribution and need not be reported in response to Question 2(a). Refer to Question 2(e) for additional explanation and instructions.

In addition, a party that holds voting stock in the corporate stockholder of a corporate Respondent is considered the holder of an attributable interest, and must be reported, if that voting interest, when multiplied by the corporate stockholder’s interest in the Respondent, would account for 5 percent or more of the issued and outstanding voting stock of the Respondent, except that, other than for purposes of subsection (i) of Note 2 to 47 C.F.R. § 73.3555, the multiplier does not apply to any link in the ownership chain representing an interest greater than 50 percent. For example, where Corporation X owns stock accounting for 25 percent of the Respondent’s votes, only Corporation X shareholders holding 20 percent or more of the issued and outstanding voting stock of Corporation X have a 5 percent or more indirect interest in the Respondent (0.25 x 0.20 = 0.05) and, therefore, are considered to have an attributable interest in the Respondent. For purposes other than subsection (i) of Note 2 to 47 C.F.R. § 73.3555, any shareholder holding more than 50 percent of the issued and outstanding voting stock of Corporation X will be deemed to have an interest in the Respondent equal to the interest held by Corporation X. For example, where Corporation X owns stock accounting for 25 percent of the Respondent’s votes, a Corporation X shareholder holding more than 50 percent of the issued and outstanding voting stock of Corporation X will be considered to have a 25 percent indirect interest in the Respondent. For such ownership structures, report on Form 2100, Schedule 323 only interests that amount to 5 percent or more of the issued and outstanding voting stock of the Licensee after the multiplier is applied. Where the 5 percent stock owner is a partnership, each general partner and any limited partner that is not insulated, regardless of the partnership interest, is considered to have an attributable interest that must be reported.

Stock subject to stockholder cooperative voting agreements accounting for 5 percent or more of the votes in a corporate respondent will be treated as if held by a single entity and any stockholder holding 5 percent or more of the stock in that block is considered a holder of an attributable interest.

Pursuant to the Commission’s single majority shareholder exemption, if a single party holds more than 50 percent of a Respondent’s voting stock, and a simple majority is all that is required to control the Respondent’s corporate affairs, the voting stock holdings of the Respondent’s other stockholders are not attributable interests. As a result, such minority stockholders need not be reported on ownership report filings based on their voting stock holdings. Notwithstanding the foregoing, if such a minority shareholder holds a positional interest in the Respondent (e.g., is an officer or director of the Respondent that is not exempted from attribution), or if the minority shareholder’s combined equity and debt interests in the Respondent are attributable under the Commission’s Equity Debt Plus attribution standard (described below), such minority shareholder has an attributable interest in the Respondent and must be reported.

An investment company, insurance company or trust department of a bank is not considered a holder of an attributable interest, and a Respondent may properly certify that such entity’s interest is non-attributable (see Question 2(b), below), IF its aggregated holding accounts for less than 20 percent of the outstanding votes in the Respondent AND IF such entity exercises no influence or control over the corporation, directly or indirectly; and such entity has no representatives among the officers and directors of the corporation, unless that entity’s combined equity and debt interests in the Respondent give rise to attribution under the Commission’s Equity Debt Plus attribution standard described below.

If a PARTNERSHIP: All partners, including all limited partners, are considered attributable interest holders. However, a limited partner in a limited partnership is not considered an attributable interest holder IF the limited partner is not materially involved, directly or indirectly, in the management or operation of the media-related activities of the partnership and the Respondent so certifies (see Question 2(b), below). Sufficient insulation of a limited partner for purposes of this certification would be assured if the limited partnership arrangement:

(1) specifies that any exempt limited partner (if not a natural person, its directors, officers, partners, etc.) cannot act as an employee of the limited partnership if his or her functions, directly or indirectly, relate to the media enterprises of the company;

(2) bars any exempt limited partner from serving, in any material capacity, as an independent contractor or agent with respect to the partnership’s media enterprises;

(3) restricts any exempted limited partner from communicating with the Licensee or the general partner on matters pertaining to the day-to-day operations of its business;

(4) empowers the general partner to veto any admissions of additional general partners admitted by vote of the exempt limited partners;

(5) prohibits any exempt limited partner from voting on the removal of a general partner or limits this right to situations where the general partner is subject to bankruptcy proceedings, as described in Sections 402 (4)-(5) of the Revised Uniform Limited Partnership Act, is adjudicated incompetent by a court of competent jurisdiction, or is removed for cause, as determined by an independent party;

(6) bars any exempt limited partner from performing any services to the limited partnership materially relating to its media activities, with the exception of making loans to, or acting as a surety for, the business; and

(7) states, in express terms, that any exempt limited partner is prohibited from becoming actively involved in the management or operation of the media businesses of the partnership.

Notwithstanding conformance of the partnership agreement to these criteria, the requisite certification cannot be made IF the limited partner’s interest is attributable under the Commission’s Equity Debt Plus attribution standard described below; or IF the Respondent has actual knowledge of a material involvement of a limited partner in the management or operation of the media-related businesses of the partnership. In the event that the Respondent cannot certify as to the noninvolvement of a limited partner, the limited partner will be considered as an attributable interest holder and the interest must be reported. Moreover, a limited partner cannot be insulated, and must be reported as an attributable interest holder, if that limited partner’s combined equity and debt interests in the limited partnership give rise to attribution under the Commission’s Equity Debt Plus attribution standard, described below, or if that limited partner holds an officer or director position and is not exempted from attribution (as discussed below).

If one or more insulated limited partners would, absent insulation, have voting rights in the Respondent, the voting interests reported for the non-insulated partners should be adjusted (i.e., increased) as necessary to reflect the effective voting interests of the non-insulated partners.

Partnerships sometimes have officers and directors. Each executive officer or director of a partnership is considered to be a holder of an attributable interest. In some cases, however, one or more of a partnership’s officers and directors may be exempted from attribution and need not be reported in response to Question 2(a). Refer to Question 2(e) for additional explanation and instructions.

If a LIMITED LIABILITY COMPANY: The Commission treats a limited liability company as a limited partnership, each of whose members is considered to be an attributable interest holder. However, where a limited liability company member is insulated in the manner specified above with respect to a limited partnership and where the relevant state statute authorizing the limited liability company permits a limited liability company member to insulate itself in accordance with the Commission’s criteria, that limited liability company member is not considered an attributable interest holder. A member cannot be insulated, however, and must be reported as an attributable interest holder, if that member’s combined equity and debt interests in the limited liability company give rise to attribution under the Commission’s Equity Debt Plus attribution standard, described below, or if that member holds an officer or director position and is not exempted from attribution (as discussed below).

If one or more insulated members would, absent insulation, have voting rights in the Respondent, the voting interests reported for the non-insulated members should be adjusted (i.e., increased) as necessary to reflect the effective voting interests of the non-insulated members.

Limited liability companies sometimes have officers and directors. Each executive officer or director of a limited liability company is considered to be a holder of an attributable interest. In some cases, however, one or more of a limited liability company’s officers and directors may be exempted from attribution and need not be reported in response to Question 2(a). Refer to Question 2(e) for additional explanation and instructions.

Attributable Agreements. Pursuant to Section 73.3555, Notes 2(j) and 2(k), certain agreements give rise to an attributable interest in a Licensee. Any party to such agreement that creates an attributable interest in the Licensee by virtue of the standards set forth in 73.3555, Notes 2(j) and 2(k) must be listed in response to Question 2(a) in the ownership report filed by the Licensee – regardless of whether or not the Licensee itself is a party to the agreement(s). In addition, each such party must file its own ownership report(s), pursuant to the standards set forth in these Instructions, in connection with the relevant Licensee(s) and license(s).

Equity Debt Plus Attribution Standard. Certain interests held by substantial investors in, or creditors of, the Respondent may also be attributable, and the investor/creditor must be reported, if the interest falls within the Commission’s Equity Debt Plus (EDP) attribution standard. Under the EDP standard, the interest held is attributable if, aggregating both equity and debt, it exceeds 33 percent of the total asset value (all equity plus all debt) of the Respondent – a broadcast station licensee, cable television system, daily newspaper or other media outlet subject to the Commission’s broadcast multiple ownership or cross-ownership rules – AND the interest holder also holds (1) an attributable interest in a media outlet in the same market, or (2) supplies over 15 percent of the total weekly broadcast programming hours of the station in which the interest is held. For example, the equity interest of an insulated limited partner in a limited partnership Respondent would normally not be considered attributable, but, under the EDP standard, that interest would be attributable if the limited partner’s interest exceeded 33 percent of the Respondent’s total asset value AND the limited partner also held a 5 percent voting interest in another radio or television station licensee in the same market. See Section 73.3555, Note 2(i), of the Commission’s rules.

Pursuant to a 2008 Commission order, an interest holder may exceed the 33 percent EDP threshold without triggering attribution where the investment would enable an Eligible Entity (as that term is defined by the Commission) to acquire a broadcast station provided that: (1) the combined equity and debt of the interest holder in the Eligible Entity is less than 50 percent, or (2) the total debt of the interest holder in the Eligible Entity does not exceed 80 percent of the asset value of the station being acquired by the Eligible Entity and the interest holder does not hold any equity interest, option, or promise to acquire an equity interest in the Eligible Entity or any related entity. See In re Promoting Diversification of Ownership in the Broadcasting Services, MB Docket No. 07-294, Report and Order and Third Further Notice of Proposed Rule Making, 23 FCC Rcd 5922 (2008). However, the Commission subsequently suspended this application of the Eligible Entity definition. See Media Bureau Provides Notice of Suspension of Eligible Entity Rule Changes and Guidance on the Assignment of Broadcast Station Construction Permits to Eligible Entities, Public Notice, 26 FCC Rcd 10370 (Med. Bur. 2011).

FCC Registration Numbers (FRNs). Respondents must provide an FRN – a ten-digit unique entity identifier – for each person or entity reported on Form 2100, Schedule 323. An FRN can be obtained through the Commission Registration System, CORES, which is listed among the FCC E-Filing systems (http://www.fcc.gov/e-file/).

Individuals (but not entities) may report either a CORES FRN or a Restricted Use FRN (RUFRN) on Form 2100, Schedule 323. If an RUFRN or CORES FRN has been previously reported for an individual on one or more ownership report filings (either commercial or noncommercial), the Respondent must use that previously-reported RUFRN or CORES FRN for that individual on all current and future ownership report filings.

In limited circumstances, a Respondent may report a Special Use FRN (SUFRN) for an individual. Before generating or submitting an SUFRN for an individual, Respondents should read the Commission’s Form 2100, Schedule 323 and Form 2100, Schedule 323-E Frequently Asked Questions concerning the SUFRN (http://www.fcc.gov/bureaus/mb/industry_analysis/form323faqs.html). By reporting an SUFRN for an individual, the Respondent affirms to the Commission that after using reasonable and good faith efforts, the Respondent is unable to obtain an FRN and/or obtain and/or receive permission to use the Social Security Number or other identifying information of that individual in order to generate a CORES FRN or RUFRN for that individual. If an individual interest holder does not already have a CORES FRN, we expect filers to acquire an RUFRN or CORES FRN for that individual or instruct the individual to obtain his or her own RUFRN or CORES FRN and to provide the FRN to the filer for reporting on the ownership report form. Filers must take specific steps to substantiate that they are making the required reasonable and good faith efforts, which include informing reportable individuals of their obligations and the risk of enforcement action for failing to provide an RUFRN or CORES FRN or to permit an RUFRN or CORES FRN to be obtained on their behalf. An SUFRN may be obtained only if an individual still refuses to provide a means of reporting a valid RUFRN or CORES FRN after the filer has taken such steps. See Promoting Diversification of Ownership in the Broadcasting Services, MB Docket No. 07-294, Report and Order, Second Report and Order, and Order on Reconsideration, FCC 16-1, ¶¶ 56-58 (Jan. 20, 2016) (Second Report and Order). Respondents are encouraged to refer individual interest holders who are resistant to providing the Respondent with the means of reporting a CORES FRN or RUFRN to the Second Report and Order and to the Commission’s Form 2100, Schedule 323 and Form 2100, Schedule 323-E website.

While the burden to obtain an RUFRN or CORES FRN or to permit the filer to acquire an RUFRN or CORES FRN falls to the interest holder, the Commission reminds filers of their obligation to review the ownership report and affirm that, to the best of the filer’s “knowledge and belief, all statements in [the ownership report] are true, correct, and complete.” This includes verifying that the CORES FRN or RUFRN reported for each reported party is correct and that no SUFRN has been used for an individual in the absence of reasonable and good-faith efforts to obtain an RUFRN or CORES FRN, including informing a recalcitrant interest holder of the obligation and potential for enforcement action. However, the filer itself will be exempt from enforcement action if the filer substantiates that it has used reasonable and good-faith efforts as described herein.

If an SUFRN has not been reported previously for an individual on any ownership report filings (either commercial or noncommercial), and, pursuant to the instructions and standards set forth above, the Respondent is unable to obtain a CORES FRN or RUFRN for that individual, the Respondent should click the button on the relevant subform for this question to generate an SUFRN for that individual. If an SUFRN has been previously reported for an individual on one or more ownership report filings (either commercial or noncommercial) and, pursuant to the discussion and standards set forth above, the Respondent remains unable to obtain a CORES FRN or RUFRN for that party, the Respondent must report the previously-used SUFRN for the individual.

RUFRNs and SUFRNs may only be used to file ownership reports, and may not be used for any other purpose at the FCC. RUFRNs and SUFRNs are only available for natural persons. In addition, RUFRNs and SUFRNs are not available for any natural person who is a Respondent on one or more ownership reports.

If a party submits and/or is listed as an attributable interest holder on multiple ownership reports, it must provide the same FRN on all such ownership reports, regardless of whether that FRN is a CORES FRN, RUFRN, or SUFRN. Filers should coordinate with each other to ensure such consistency.

The guidance concerning Special Use FRNs provided in Media Bureau Announces Online Availability of Revised Biennial Form 323, an Instructional Workshop on the Revised Form, and the Possibility of Obtaining a Special Use FRN for the Form, MB Docket No. 07-294, Public Notice, 24 FCC Rcd 14329 (Med. Bur. 2009) has been superseded as discussed herein and as provided in the Second Report and Order.

Questions concerning the FCC Registration Number can be directed to the Commission’s Registration System help desk via email at [email protected] or by calling 1-877-480-3201 (Mon.-Fri. 8 a.m.-6 p.m. ET).

Address Information. Provide address information for the interest holder in the relevant fields. Provide a U.S. zip code or non-U.S. postal code, as applicable, in the Zip/Postal Code field. If the interest holder has a non-U.S. address, select “NA” in the State field and provide the name of the country in the Country field. Otherwise, select the proper state abbreviation for the State field and leave the Country field blank.

Listing Type. Indicate whether the interest holder is the Respondent on the report. Respondent interest holders should be identified on the first subform of this question.

Positional Interests. Check the boxes for each type of interest in the Respondent held by the interest holder. If “other” is selected, specify the interest type.

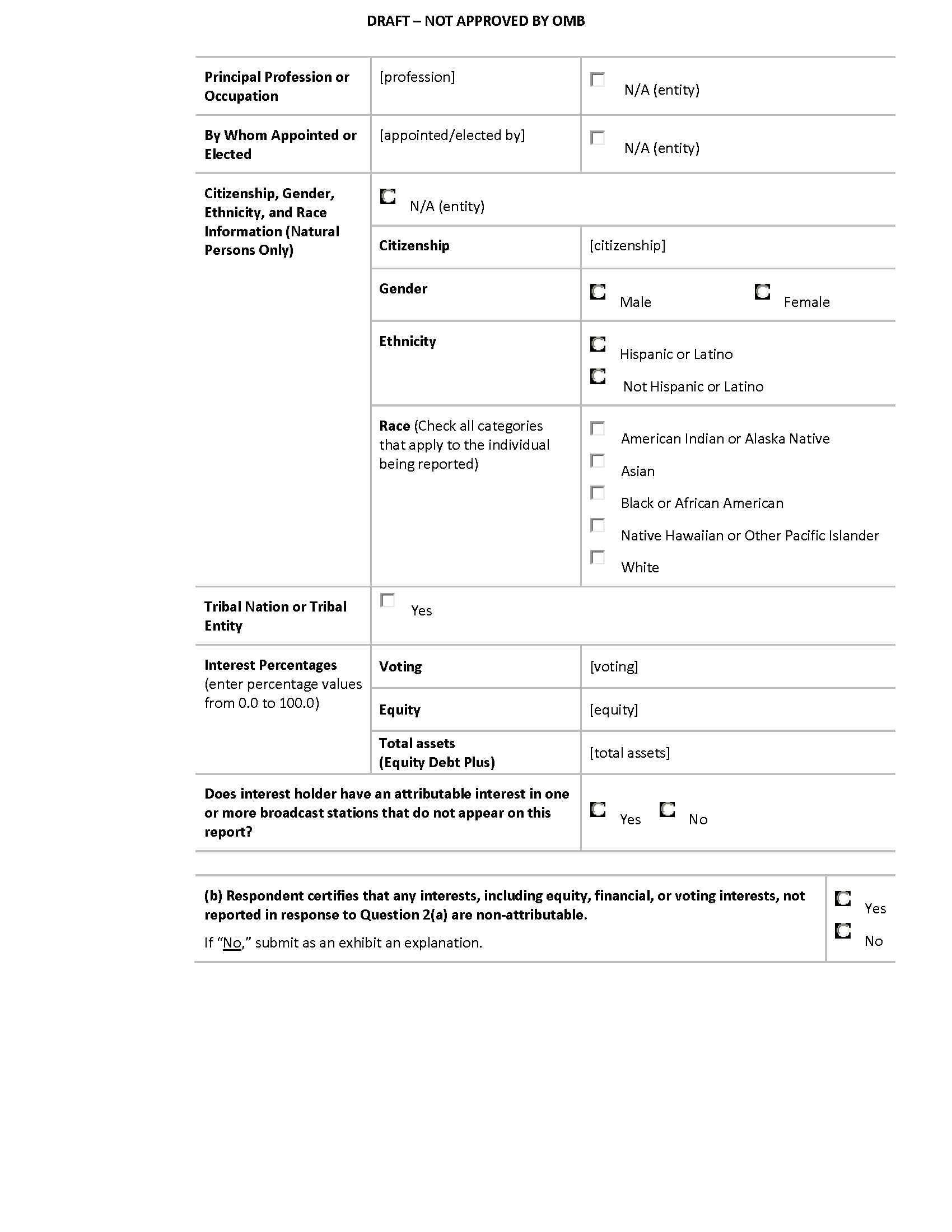

Citizenship, Gender, Ethnicity and Race Information. Among other things, Question 2(a) seeks information as to those persons to which the Commission’s minority and female ownership policies have historically applied. In addition to citizenship and gender information, Question 2(a) seeks information concerning the ethnicity and race of reported individuals. Interest holders that are not natural persons should answer “N/A” in response to this question.

Ethnicity. Indicate whether or not the individual being reported is Hispanic or Latino (i.e., a person of Cuban, Mexican, Puerto Rican, South or Central American, or other Spanish Culture or origin, regardless of race).

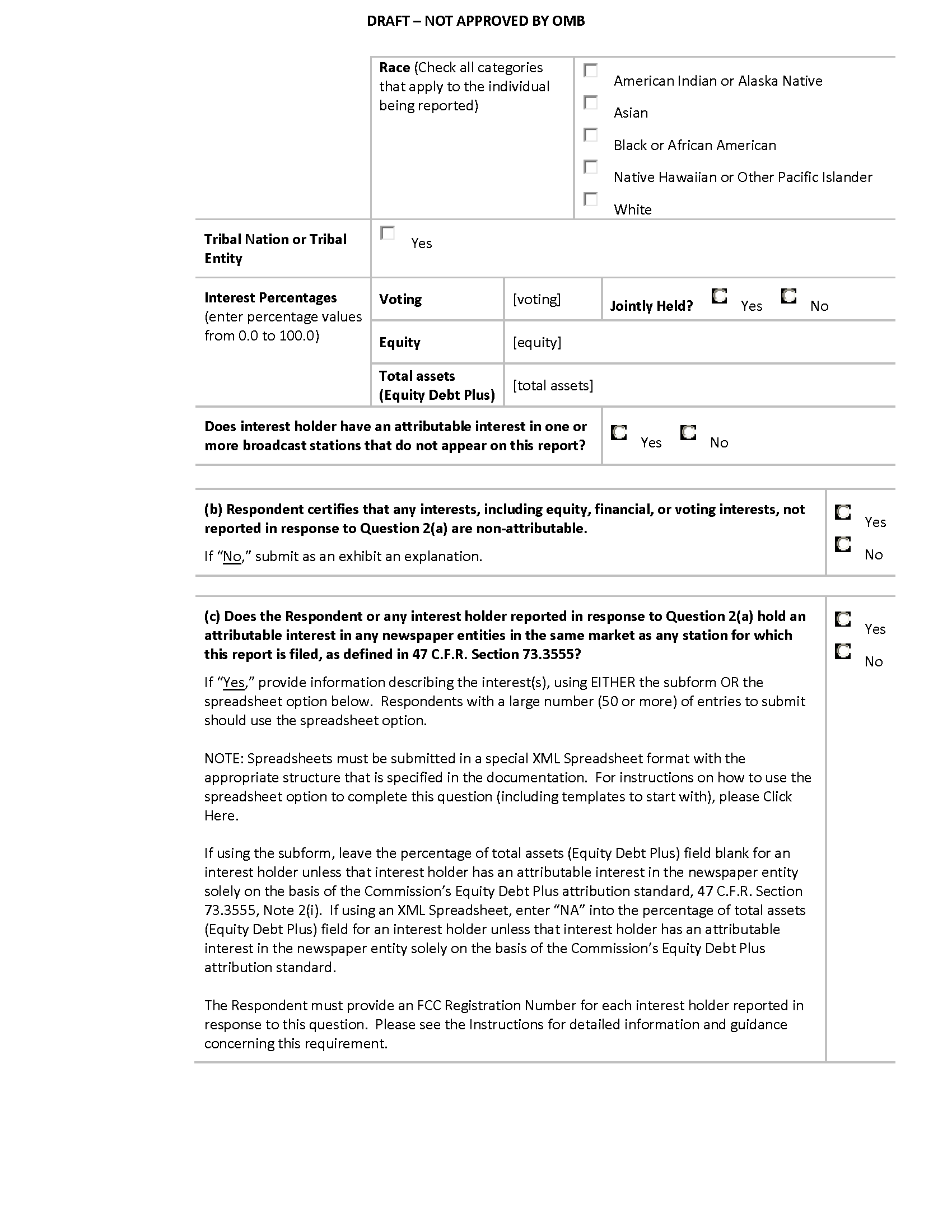

Race. The five racial categories are as follows:

American Indian or Alaska Native. A person having origins in any of the original peoples of North and South America (including Central America), and who maintains tribal affiliation or community attachment.

Asian. A person having origins in any of the original peoples of the Far East, Southeast Asia, or the Indian Subcontinent including, for example, Cambodia, China, India, Japan, Korea, Malaysia, Pakistan, the Philippine Islands, Thailand, and Vietnam.

Black or African American. A person having origins in any of the black racial groups of Africa.

Native Hawaiian or Other Pacific Islander. A person having origins in any of the original peoples of Hawaii, Guam, Samoa, or other Pacific Islands.

White. A person having origins in any of the original peoples of Europe, the Middle East, or North Africa.

Check all racial categories that apply to the individual being reported.

Tribal Nation or Tribal Entity. The Respondent may use the checkbox provided to identify any entity reported in response to Question 2(a) that is a Tribal Nation or Tribal entity. For purposes of this question, a Tribal Nation or Tribal entity means any Indian or Alaska Native Tribe, band, nation, pueblo, village or community which is acknowledged by the federal government to constitute a government-to-government relationship with the United States and eligible for the programs and services established by the United States for Indians. See The Federally Recognized Indian Tribe List Act of 1994 (Indian Tribe Act), Pub. L. 103-454, 108 Stat. 4791 (1994) (the Secretary of the Interior is required to publish in the Federal Register an annual list of all Indian Tribes which the Secretary recognizes to be eligible for the special programs and services provided by the United States to Indians because of their status as Indians); Statement of Policy on Establishing a Government-to-Government Relationship with Indian Tribes, Policy Statement, 16 FCC Rcd 4078, 4080 (2000); see also 47 C.F.R. §§ 73.3573(f)(6) & Note 5, 73.7000.

Percentages of Votes, Equity, and Total Assets (Equity Debt Plus). Provide the interest holder’s voting and equity percentages in the Respondent in the fields provided. If the interest holder holds an attributable interest in the Respondent solely pursuant to the Commission’s Equity Debt Plus attribution standard, discussed above, provide the interest holder’s percentage of total assets (Equity Debt Plus) in the field provided. Otherwise, leave the total assets (Equity Debt Plus) field blank.

Jointly Held Voting Interests. In certain circumstances, two or more parties hold a voting interest in a Respondent jointly. Two parties may, for example, hold 100 percent of the voting interest in an entity together, as joint tenants (as opposed to each individual holding 50 percent of the voting interests). Similarly, agreements for partnerships or limited liability companies may provide that two or more individuals exercise voting power together. Use the radio buttons on the subform to indicate whether the voting interest reported on that subform is held jointly.

Other Broadcast Interests. Use the radio buttons on the subform to indicate whether the interest holder reported on that subform also has attributable interests in one or more broadcast stations other than those covered by the ownership report.

Part (b). Respondents must indicate that the information provided in part (a) of Question 2 is complete by certifying that all interests, including equity, financial, or voting interests, not reported in response to Question 2(a) are non-attributable.

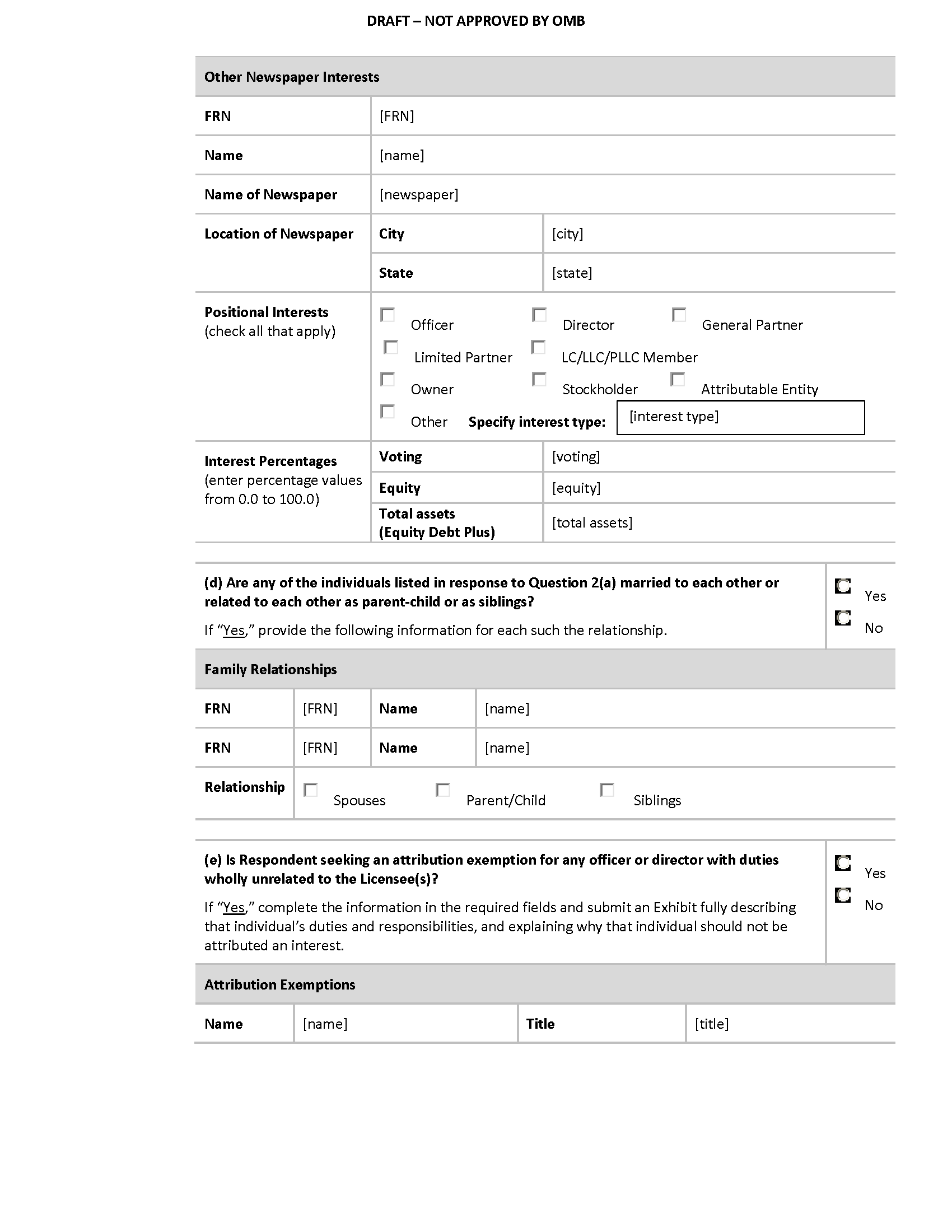

Part (c). Use either the question subforms or one or more XML attachments to provide information concerning any daily newspapers in which any of the interest holders listed in response to Question 2(a) has an attributable interest and that are located within the pertinent in-market signal contours of any broadcast stations for which this report is filed. See 47 C.F.R. Section 73.3555. List each interest holder/newspaper combination on a separate line, and provide the name and FRN of the interest holder, the name and location of the newspaper publication, and the interest holders’ voting percentage interest, equity percentage interest, and positional interest(s) in the newspaper entity. If the interest holder holds an attributable interest in the newspaper entity solely on the basis of the Commission’s Equity Debt Plus attribution standard (discussed above), also provide a figure for percentage of total assets (Equity Debt Plus). Otherwise, either leave the field blank (if using the subform) or enter “NA” into the field (if using XML attachments).

Both direct and indirect ownership interests must be reported, and percentage figures provided for each interest holder should represent the aggregate of all direct and indirect interests held by that interest holder.

The Respondent must provide an FRN for each interest holder reported in response to this question. Because any interest holder listed in response to this question must also be listed in response to Section II-B, Question 2(a), each FRN provided for an interest holder in response to this question must match an FRN provided for an interest holder in response to Section II-B, Question 2(a). Detailed information and guidance concerning the FRN requirement is provided in the section of these Instructions addressing Section II-B, Question 2(a), above.

Part (d). Indicate whether any individuals listed in Question 2(a) are married to each other or related to each other as parent-child or siblings. If the answer is “Yes,” enter the names and FRNs of the married and/or related individuals and select the applicable option indicating the familial relationship.

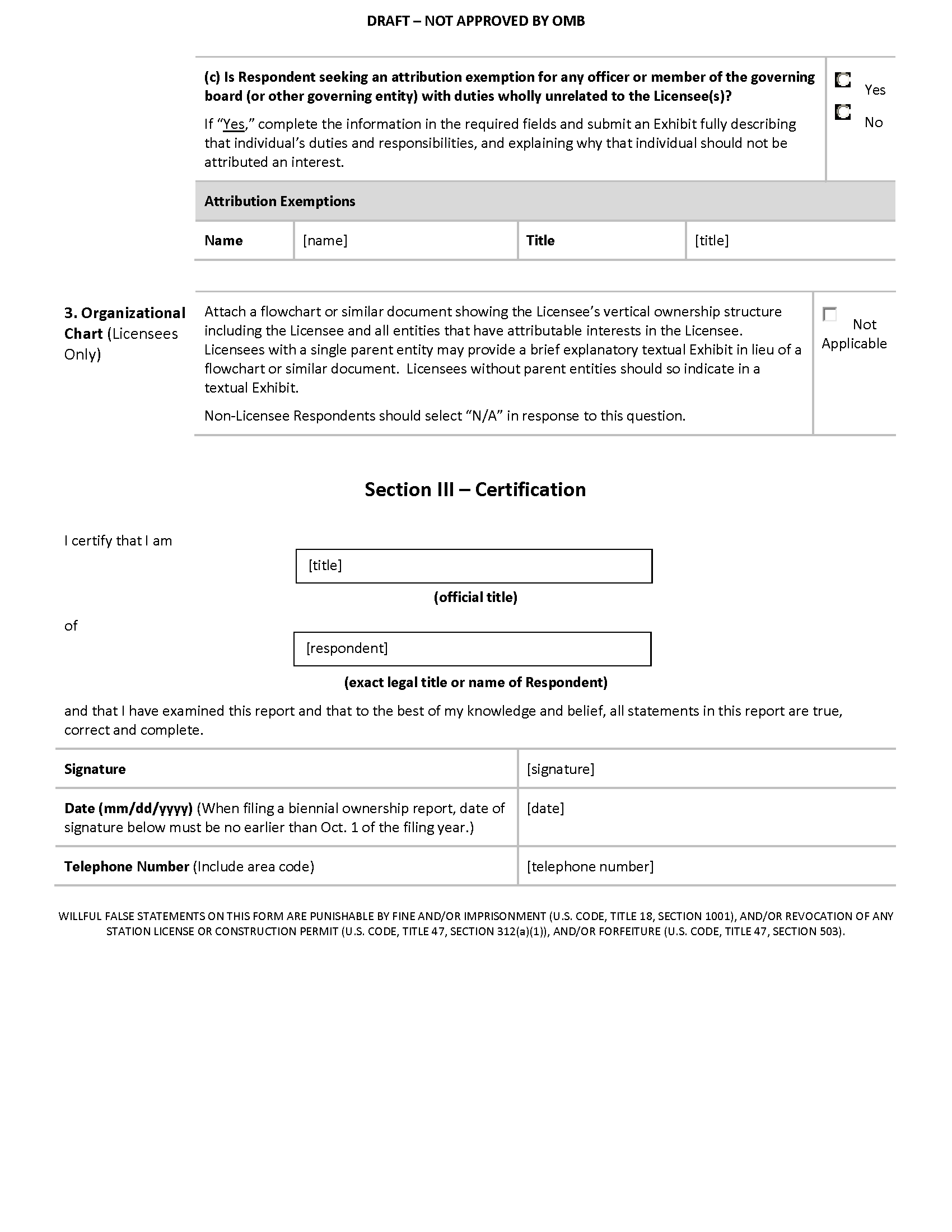

Part (e). If the Respondent seeks an attribution exemption for any officer or director with duties wholly unrelated to the Licensee(s), select “Yes” and enter the name and title of the each such individual in the applicable fields. For each such individual, provide an exhibit establishing that he or she will not exercise authority or influence in areas that will affect the Respondent or the Licensee(s)/Permittee(s) and station(s) covered by the report. This exhibit should describe that individual’s duties and responsibilities and explain the manner in which such individual is insulated from the Respondent and, therefore, should not be attributed an interest. Attach any such explanation as Exhibit 4.

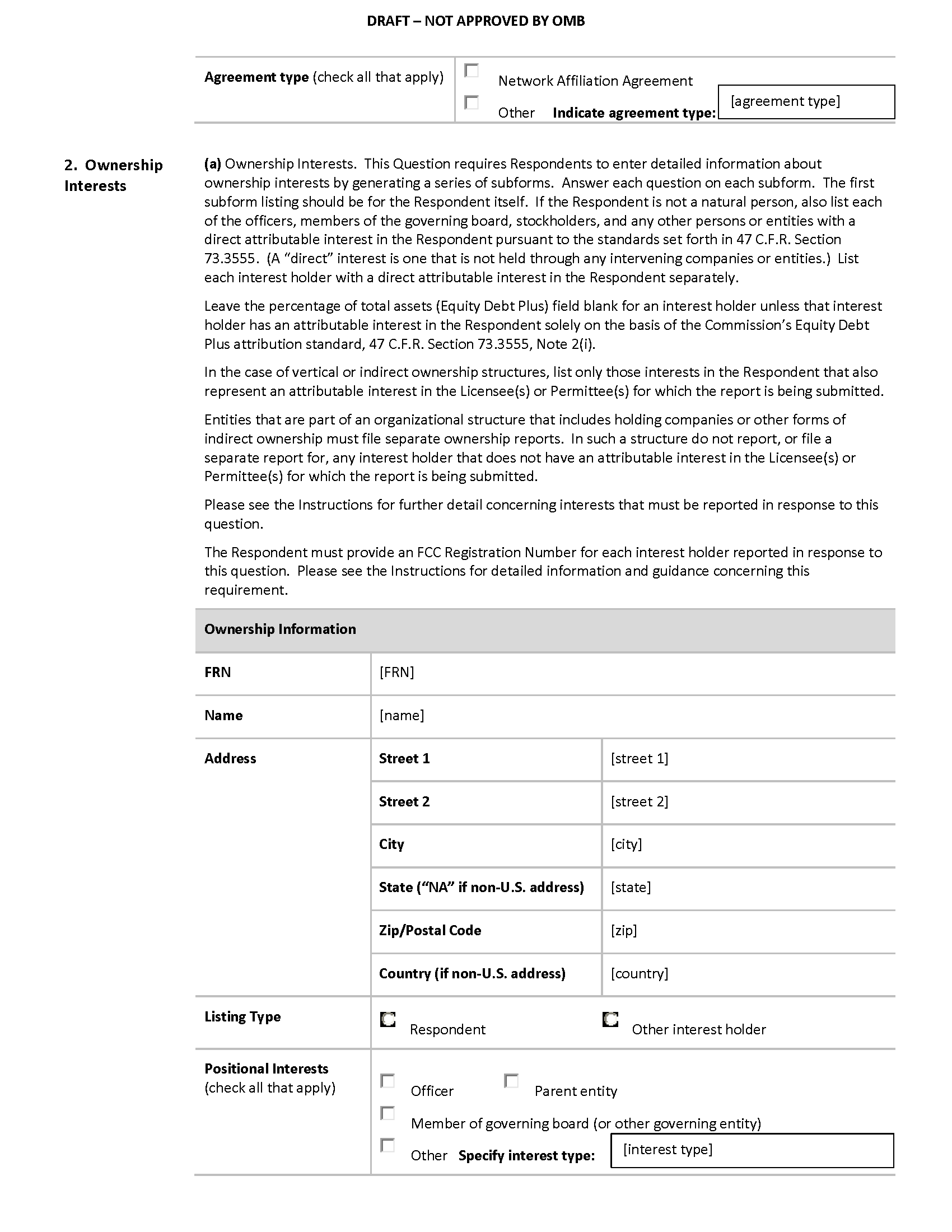

When answering this question, Respondents should note that exemption from attribution cannot be invoked for an officer or director unless he or she does not, and will not, have the ability to influence the broadcast operations of the Licensee(s) or Station(s). See 47 C.F.R. § 73.3555, Note 2(g).