Transit Investments in Greenhouse Gas and Energy Reduction Program

Transit Investments in Greenhouse Gas and Energy Reduction (TIGGER) Program

FTAC5010.1D (Circular)

Transit Investments in Greenhouse Gas and Energy Reduction Program

OMB: 2132-0566

FTA

C 5010.1D Page

11/1/08

|

CIRCULAR |

|

U.S. Department of Transportation

Federal Transit Administration |

||

FTA C 5010.1D |

||

November 1, 2008 Rev. 1, August 27, 2012 |

||

Subject: |

GRANT MANAGEMENT Requirements |

|

|

||

PURPOSE. This circular is a re-issuance of guidance for post-award grant administration and project management activities for all applicable Federal Transit Administration (FTA) grant programs. This revision incorporates provisions of the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA–LU), and includes the most current guidance for the Federal public transportation program as of the date of publication.

These requirements are intended to assist grantees in administering FTA-funded projects and in meeting grant responsibilities and reporting requirements. Grantees have a responsibility to comply with regulatory requirements and to be aware of all pertinent material to assist in the management of federally assisted grants.

CANCELLATION. This circular cancels FTA Circular 5010.1C, “Grant Management Guidelines,” dated 10–1–98.

AUTHORITY.

Federal Transit Laws, codified at 49 U.S.C. Chapter 53.

49 CFR 1.51.

WAIVER. FTA reserves the right to waive any provision of this circular to the extent permitted by Federal law or regulation.

FEDERAL REGISTER NOTICE. In conjunction with publication of this circular, a Federal Register notice was published on September 30, 2008 (73 FR 56892), addressing comments received during the development of the circular.

AMENDMENTS TO THE CIRCULAR. FTA reserves the right to update this circular to reflect changes in other revised or new guidance and regulations that undergo notice and comment without further notice and comment on this circular. FTA will post updates on our website: www.fta.dot.gov. The website allows the public to register for notification when FTA issues Federal Register notices or new guidance; visit the website and click on “sign up for e-mail updates.”

ACCESSIBLE FORMATS. This document is available in accessible formats upon request. To obtain paper copies of this circular as well as information regarding these accessible formats, telephone FTA’s Administrative Services Help Desk, at 202–366–4865. Individuals with hearing impairments may contact the Federal Relay Service at 1–800–877–8339 for assistance with the call.

/S/ Original Signed by

James S. Simpson

Administrator

PROGRAM CIRCULAR

TABLE OF CONTENTS

I. introduction and background I–1

1. The Federal Transit Administration (FTA) I–1

2. Authorizing Legislation I–1

3. How to Contact FTA I–1

4. Grants.gov I–2

5. Definitions I–2

II. CIRCULAR OVERVIEW II–1

1. General II–1

2. Applicable Program Descriptions II–1

3. Responsibilities of Grant Management II–6

4. Civil Rights Requirements II–8

5. Cross-Cutting Requirements II–12

iii. Grant AdMinistration III–1

1. Overview III–1

2. Grant Application Process III–1

3. Reporting Requirements III–2

4. Grant Modifications III–9

5. Grant Close-Out III–15

6. Suspension and Termination III–16

7. Retention and Access Requirements for Records III–17

IV. ProJECT MANAGEMENt iv–1

1. General iv–1

2. Real Property iv–1

3. Equipment, Supplies, and Rolling Stock iv–13

4. Design and Construction of Facilities iv–32

FTA OVERSIGHT v–1

1. General V–1

2. General Reviews V–2

3. Program-Specific Reviews V–3

4. Project Level Reviews V–6

Financial Management vi–1

1. General vi–1

2. Internal Controls vi–1

3. Local Match VI–5

Chapter Page

4. Financial Plan VI–5

5. General Principles for Determining Allowable Costs VI–5

6. Indirect Costs VI–7

7. Program Income VI–9

8. Annual Audit VI–10

9. Payment Procedures VI–11

10. De-Obligation of Funds VI–15

11. Debt Service Reserve VI–15

12. Right of FTA to Terminate VI–15

TABLES, GRAPHS, AND ILLUSTRATIONS

1. Application of Insurance Proceeds: Example 1 IV–30

2. Application of Insurance Proceeds: Example 2 IV–31

3. Table of FTA Circulars A–1

4. Example: Rolling Stock Status Report D–2

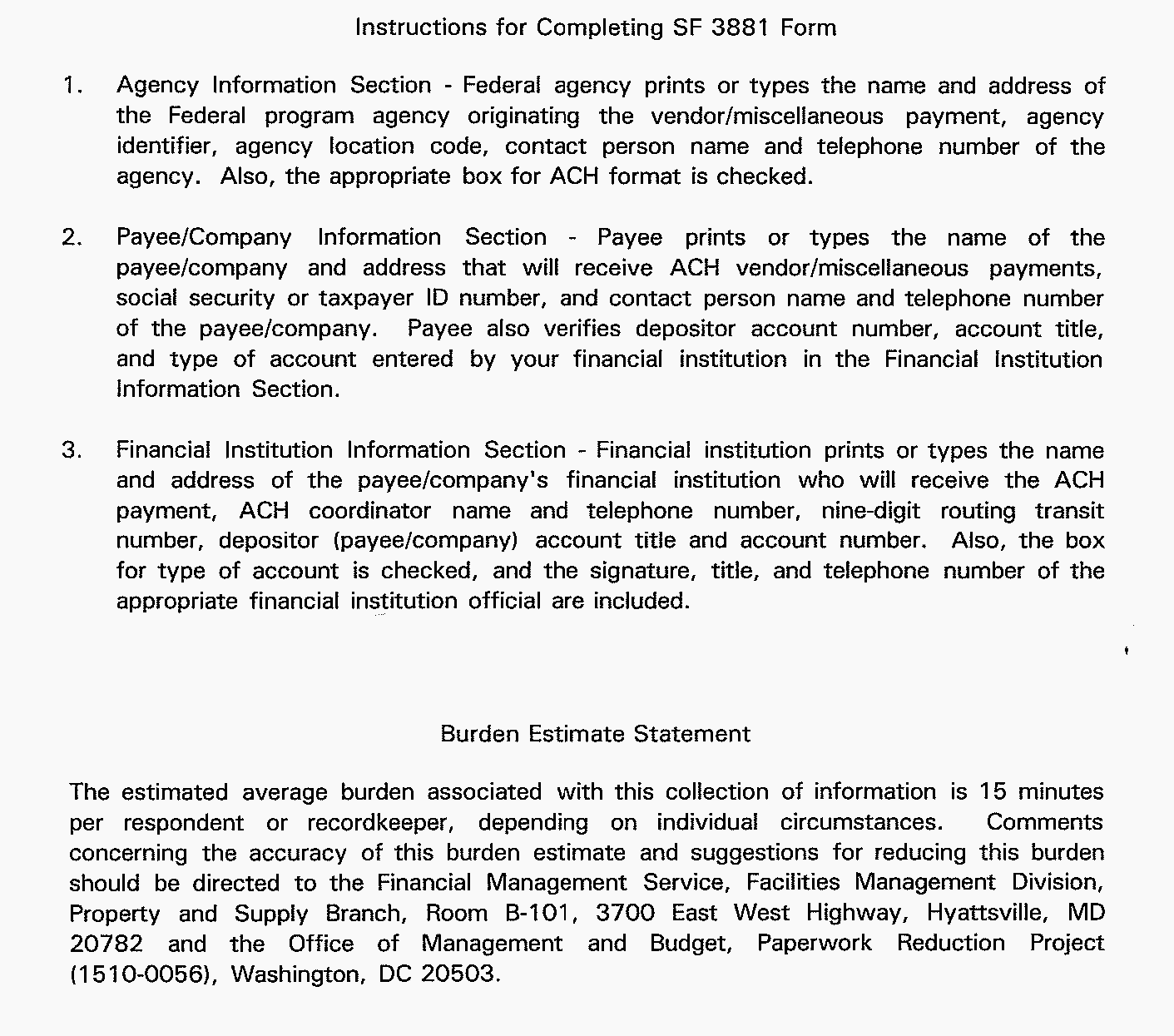

5. Exhibit 1: ACH Vendor/Miscellaneous Payment Enrollment

Form (SF3881) F–3

6. Instructions for Completing SF 3881 Form F–4

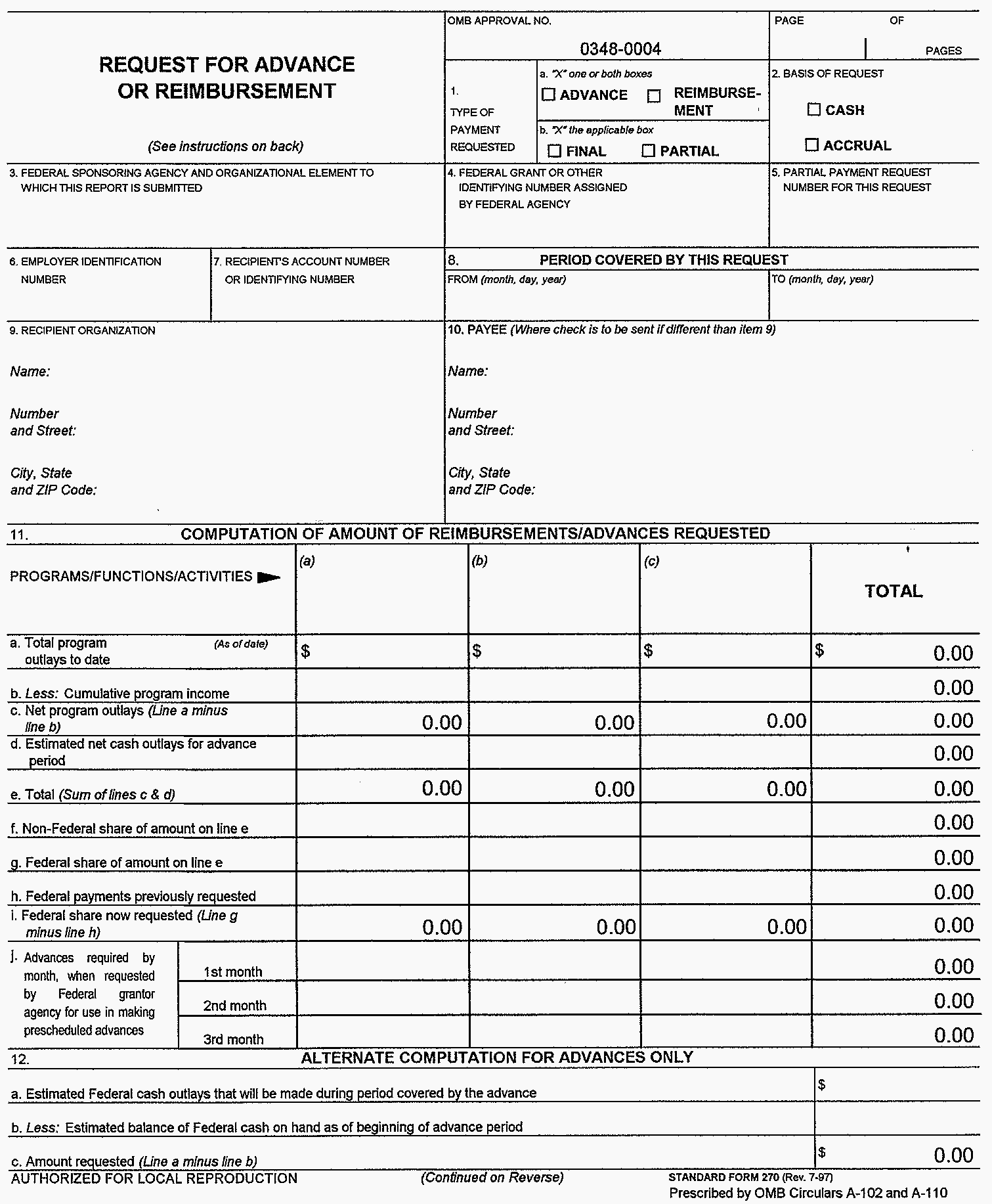

7. Exhibit 2: Request for Advance or Reimbursement (SF–270) F–5

8. Instructions for Completing SF–270 Form F–6

APPENDICES

APPENDIX A TABLE OF FTA CIRCULARS A–1

APPENDIX B FEDERAL FINANCIAL REPORT …………………………..B-1

APPENDIX C REAL ESTATE ACQUISITION MANAGEMENT PLAN C–1

1. General C–1

2. RAMP Content C–1

APPENDIX D GUIDE FOR PREPARING AN APPRAISAL SCOPE

OF WORK D–1

1. General D–1

2. Example D–1

APPENDIX E ROLLING STOCK STATUS REPORT E–1

1. General E–1

2. Replacements at the End of Minimum Useful Life E–1

3. Early Disposition E–1

4. Example: Rolling Stock Status Report/TransAmerica

Buses E–2

Chapter Page

APPENDIX F COST ALLOCATION PLANS F–1

1. Requirements F–1

2. Content F–1

3. Purpose of the Plan F–1

4. Development of Cost Allocation Plan F–2

5. Submission of Cost Allocation Plan/Indirect Cost Rate

Proposals F–3

6. Plan Approval F–3

APPENDIX G REQUEST FOR ADVANCE OR REIMBURSEMENT

(SF–270) G–1

1. General G–1

2. Instructions G–1

3. Review of the SF–270 G–2

APPENDIX H REFERENCES H–1

APPENDIX I FTA REGIONAL AND METROPOLITAN CONTACT

INFORMATION I–1

INDEX SUBJECT AND LOCATION IN CIRCULAR

This page intentionally left blank

CHAPTER I

INTRODUCTION AND BACKGROUND

THE FEDERAL TRANSIT ADMINISTRATION (FTA). FTA is one of ten modal administrations within the U.S. Department of Transportation (DOT). Headed by an Administrator who is appointed by the President of the United States, FTA functions through a Washington, DC, headquarters office, ten regional offices, and five metropolitan offices that assist transit agencies in all 50 States, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, Northern Mariana Islands, and American Samoa and federally recognized Indian tribes.

Public transportation includes buses, subways, light rail, commuter rail, monorail, passenger ferry boats, trolleys, inclined railways, people movers, and vans. Public transportation can be either fixed-route or demand-response service.

The Federal Government, through FTA, provides financial assistance to develop new transit systems and improve, maintain, and operate existing systems. FTA oversees thousands of grants to hundreds of State and local transit providers, primarily through its regional and metropolitan offices. These grantees are responsible for managing their programs in accordance with Federal requirements, and FTA is responsible for ensuring that grantees follow Federal statutory and administrative requirements.

AUTHORIZING LEGISLATION. Most Federal transit laws are codified at 49 U.S.C. Chapter 53. Authorizing legislation is substantive legislation enacted by Congress that establishes or continues the legal operation of a Federal program or agency. Congress typically amends FTA’s authorizing legislation every four to six years. FTA’s most recent authorizing legislation is the Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA–LU), Public Law 109–59, signed into law August 10, 2005. SAFETEA–LU authorizes FTA programs from Federal Fiscal Year (FY) 2006 through FY 2009. Changes have been added to this circular to reflect the SAFETEA–LU changes to Federal transit law and to reflect changes required by other laws that have become effective since the circular was last published in 1998.

HOW TO CONTACT FTA. FTA’s regional and metropolitan offices are responsible for the provision of financial assistance to FTA grantees and oversight of grant implementation for most FTA programs. Certain specific programs are the responsibility of FTA headquarters. Inquiries should be directed to either the regional or metropolitan office responsible for the geographic area in which you are located. See Appendix I of this circular for additional information.

Visit FTA’s website, http://www.fta.dot.gov, or contact FTA Headquarters at the following address and phone number:

Federal Transit Administration

Office of Communication and Congressional Affairs

1200 New Jersey Avenue SE.

Room E56–205

Washington, DC 20590

Phone: 202–366–4043

Fax: 202–366–3472

GRANTS.GOV. FTA posts all competitive grant opportunities on Grants.gov. Grants.gov is the one website for information on all discretionary Federal grant opportunities. Led by the U.S. Department of Health and Human Services (DHHS) and in partnership with Federal grant-makers including 26 agencies, 11 commissions, and several States, Grants.gov is one of 24 Federal cross-agency E-government initiatives. It is designed to improve access to government services via the Internet. More information about Grants.gov is available at http://www.grants.gov.

DEFINITIONS. All definitions in 49 U.S.C. 5302(a) apply to this circular as well as the following definitions:

Accrual Basis of Accounting: The accounting method where income is recorded when earned instead of when received, and expenses are recorded when incurred instead of when paid.

Administrative Amendment: A minor change in a Grant Agreement normally initiated by FTA to modify or clarify certain terms, conditions, or provisions of a grant.

Administrative Settlement: Purchase price for property may exceed the amount offered as just compensation when reasonable efforts to negotiate an agreement at that amount have failed and an authorized Agency official approves such an arrangement. Such an arrangement must be reasonable, prudent, and in the public interest.

Acquisition Cost of Project Property and Purchased Equipment: The purchase price of equipment. This is the net invoice unit price, including the cost of modifications, attachments, accessories, or auxiliary apparatus necessary to make the equipment usable for the intended purpose. Other charges such as the cost of inspection, installation, transportation, taxes, duty or protective in-transit insurance should be treated in accordance with the grantee’s regular accounting practices, as separate line items. The cost of items separately installed and removable from rolling stock, such as fareboxes and radios, is treated as a separate acquisition and not as part of the cost of the vehicle.

Air Rights: The space located above, at, or below (subterranean) the surface of the ground, lying within a project’s property limits.

Brownfields: The Environmental Protection Agency (EPA) defines “Brownfields” (one type of contaminated property), as abandoned, idled, or under-used industrial and commercial land, often found in urban areas, where redevelopment is complicated by real or perceived hazardous contamination. These properties have lower levels of contamination than Superfund sites, but they are a health risk and economic detriment to the communities where they are located.

Budget Revision: Any change within the scope that has impact on budget allocations of the original grant. A budget revision may be a transfer of funds within a project scope or between existing activity line items (ALIs) within an approved grant. It could also include the addition or deletion of an ALI.

Capital Asset: Facilities or equipment with a useful life of at least one year, which are eligible for capital assistance.

Capital Lease: Any transaction whereby the grantee acquires the right to use a capital asset without obtaining ownership.

Cash Basis of Accounting: Cash basis of accounting is the method when revenue is recorded when received, rather than when earned, and expenses are recorded when paid, rather than incurred. FTA does not allow the Federal Financial Report (FFR) to be prepared in the cash method of accounting.

Catalog of Federal Domestic Assistance (CFDA): The Catalog of Federal Domestic Assistance is a government-wide compendium of Federal programs, projects, services, and activities that provide assistance or benefits to the American public. It contains financial and nonfinancial assistance programs administered by departments and establishments of the Federal Government. As the basic reference source of Federal programs, the primary purpose of CFDA is to assist users in identifying programs that meet specific objectives of the potential applicant, and to obtain general information on Federal assistance programs. In addition, the intent of CFDA is to improve coordination and communication between the Federal Government and State and local governments. The CFDA number assigned to each program is used to report and track audit findings related to Federal grants.

Concurrent Non-Project Activities: Also known as betterments, concurrent non-project activities are improvements to the transit project desired by the grant recipient that are nonintegral to the planned functioning of the Federal transit project and are carried out simultaneous with grant execution and are not included in the Federal grant.

Contingency Fleet: Inactive rolling stock reserved/retained for emergencies and separate from spare fleet.

Cost of Project Property: The purchase price of project property. This is the net invoice unit price, including the cost of modifications, attachments, accessories, or auxiliary apparatus necessary to make the equipment usable for the intended purpose. Other charges, such as the cost of inspection, installation, transportation, taxes, duty, or in-transit insurance, should be treated in accordance with the grantee’s regular accounting practices, in the same or as separate line items. The cost of items separately installed and removable from rolling stock, such as fareboxes and radios, is treated as a separate acquisition and not as part of the cost of the vehicle if not included in the procurement of rolling stock.

Depreciation: Method used to calculate the reduction in value of an item of personal or real property over time. Is the term most often used to indicate that personal property has declined in service potential. For the purpose of this circular, it is also a method of determining fair market value when disposing of an asset prior to the end of its useful life.

Discretionary Funding: Grant funds distributed at the discretion of the agency as distinct from formula funding.

Economic Useful Life: The period over which an improvement or structure contributes to property value. This concept is used in conjunction with the concept of “Economic Age,” which is defined as the age of a structure that is based on the amount of observed deterioration and obsolescence it has sustained, which may be different from its chronological age. Appraisers sometimes use an “age-life” ratio to estimate a building’s depreciation. This factor is developed by dividing the structure’s “Economic Age” by its “Economic/Useful Life.” Available building cost services provide guidelines for estimating the economic life of property structures using various construction materials and architectural designs and thus assist in conducting this analysis. Useful life assumes a normal level of on going maintenance of the structure. This applies only to real estate (for vehicular useful life see “Useful Life” in definitions).

Electronic Clearing House Operation (ECHO): ECHO is a Web-based application that processes draw down requests and makes payments to FTA grantees.

Equipment: An article of nonexpendable, tangible personal property having a useful life of more than one year and an acquisition cost which equals or exceeds the lesser of the capitalization level established by the governmental unit for financial statement purposes, or $5,000. Includes rolling stock and all other such property used in the provision of public transit service.

Equipment Inventory: A physical inventory of project (non-real) property taken and results reconciled with the personal property records.

Excess Property: Property which the grantee determines is no longer required for its needs or fulfillment of its responsibilities and has not met its useful life under an FTA assisted grant.

Excess Real Property Inventory and Utilization Plan: The document which lists each real estate parcel acquired with participation of Federal funds that is no longer needed for approved FTA project purposes and which states how the grantee plans to use or dispose of the excess real property.

Facilities: All or any portion of a building or structure including roads, walks, and parking lots.

Fair Market Value: The most probable price equipment or project property would bring in a competitive and open market.

Federally Recognized Indian Tribal Government: The governing body or a governmental agency of any Indian tribe, band, nation, or other organized group or community, (including any native village as defined in Section 3 of the Alaska Native Claims Settlement Act (ANCSA), (43 U.S.C. 1601 et seq.) certified by the Secretary of the Interior as eligible for the special programs and service provided through the Bureau of Indian Affairs.

Fleet Management Plan: The management plan includes an inventory of all buses among other items, such as operating policies, peak vehicle requirements, maintenance and overhaul programs, system and service expansions, rolling stock procurements and related schedules, and spare ratio justification. The plan also calculates the number of rolling stock needed to operate at peak normal days.

Force Account: The use of a grantee’s own labor force to accomplish a capital grant project.

Formula Funding: Grant funding allocated using factors that are specified in the law, or in an administrative formula developed by FTA.

Global Settlement: In real estate this means the combination of all payments, acquisition and relocation, into one payment. This is not permitted on FTA projects as global settlements are considered in conflict with the intent of the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970. Under the Uniform Act, an appraisal sets Just Compensation for the real estate and is made prior to the initiation of negotiations on a particular parcel. The relocation of personal property, on the other hand, is reimbursed based upon the actual, reasonable, and necessary costs that most often cannot be determined until after the move is complete.

Grant: An award of financial assistance, including Cooperative Agreements, in the form of money, or property in lieu of money, by the Federal Government to an eligible grantee or recipient. Used interchangeably with Grant Agreement.

Grant Amendment: The modification of a grant that includes a change in scope and/or change in Federal funds.

Grantee: An entity to which a grant is awarded directly by FTA to support a specific project in which FTA does not take an active role or retain substantial control, as set forth in 31 U.S.C. 6304. In this circular FTA uses the term grantee interchangeably with grant recipient and recipient.

Grant Scope: The broad purpose or objectives of a grant. The scope of a grant may encompass one or more specific projects identified by scope codes in each grant project budget.

Incidental Use of Project Property and Equipment: The authorized use of real property and equipment acquired with FTA funds for purposes of transit service but which also has limited non-transit use due to transit operating circumstances. Such use must be compatible with the approved purposes of the project and not interfere with intended public transportation uses of project assets.

Lapsed Funds: Funds no longer available for obligation to a grantee or project.

Large Urbanized Area: Any urbanized area with a population of at least 200,000.

Legal Settlement: Used in the context of an eminent domain property acquisition. A legal settlement can occur in one of several ways. First, once an acquisition case is referred to legal counsel to initiate condemnation proceedings, a settlement between the parties may occur before a condemnation complaint is filed. The second situation, involves the settlement of a case after the condemnation action has been filed. This may be referred to as a legal or stipulated settlement. In this case a stipulation agreement is prepared and signed by the parties involved after which the court may approve or issue an order approving the stipulation agreement and dismissing the court case. In either case such a settlement would necessarily be justified in writing similarly to an administrative settlement as described in 49 CFR 24.102(i) of the URA regulations.

Local Governmental Authority: Includes (A) a political subdivision of a State; (B) an authority of at least one State or political subdivision of a State; (C) an Indian tribe; or (D) a public corporation, board, or commission established under the laws of a State.

Master Agreement: The official FTA document containing FTA and other cross-cutting Federal requirements applicable to the FTA recipient and its project. The Master Agreement is typically revised annually in October. The Master Agreement is incorporated by reference and made part of each FTA grant, Cooperative Agreement, and amendment thereto.

NEPA: National Environmental Policy Act (NEPA), signed into law by President Nixon January 1, 1970, 42 USC Section 4321–4370d declared a national policy to safeguard the environment and created the Council on Environmental Quality in the Executive Office of the President. To implement the national environmental policy, NEPA requires that environmental factors such as historic resources, noise, air, vibration, groundwater, habitat, and wildlife be considered when Federal agencies make decisions and that a detailed statement of environmental impacts be prepared for all major Federal actions significantly affecting the quality of the human environment.

Net Present Value: The discounted monetized value of expected net benefits (i.e., benefits minus costs). It is calculated by assigning monetary values to benefits and costs, discounting future benefits and costs using an appropriate discount rate to obtain a present value, and subtracting the sum total of discounted costs from the sum total of discounted benefits.

Net Proceeds from the Sale of Project Equipment and Real Property: The amount realized from the sale of property no longer needed for transit purposes less the expense of any actual and reasonable selling and any necessary expenses associated with repairs to make saleable.

Overhaul: Systematic replacement or upgrade of systems whose useful life is less than the useful life of the entire vehicle in a programmed manner. Overhaul is performed as a planned or concentrated preventive maintenance activity and is intended to enable the rolling stock to perform to the end of the original useful life.

Preventive Maintenance: Is defined as all maintenance costs related to vehicles and non-vehicles. Specifically, it is defined as all the activities, supplies, materials, labor, services, and associated costs required to preserve or extend the functionality and serviceability of the asset in a cost effective manner, up to and including the current state of the art for maintaining such an asset.

Program Income: Gross income received by the grantee or subgrantee directly generated by a grant supported activity, or earned only as a result of the Grant Agreement during the grant period (the time between the effective date of the grant and the ending date of the grant reflected in the final financial report).

Program of Projects (POP): A list of projects to be funded in a grant application submitted to FTA by a designated recipient. The POP lists the subrecipients and indicates whether they are private non-profit agencies, governmental authorities, or private providers of transportation service, designates the areas served (including rural areas), and identifies any tribal entities. In addition, the POP includes a brief description of the projects, total project cost, and Federal share for each project.

Project: For the purposes of the FTA program, public transportation improvement activities funded under an executed grant.

Project Activity Line Item (ALI): The description and dollar amount contained in the budget for an approved grant activity associated within a particular scope approved as part of a grant. ALIs under each scope are informational and are used as tools for FTA and the grantee to manage the grant.

Project Property: Includes equipment, real property, supplies, and rolling stock.

Project Scope: The broad purpose of a specific project within a grant. There may be multiple scopes identifying each of the different projects within a grant and each scope may contain a number of activities which represent the estimate of actions needed to complete the project. FTA reserves the right to consider other information in determining the “scope of the project” when that term is used for legal purposes. See the Master Agreement.

Public Transportation: Transportation by a conveyance that provides regular and continuing general or special transportation to the public, but does not include school bus, charter, sightseeing or intercity bus transportation or intercity passenger rail transportation provided by AMTRAK. The terms “transit,” “mass transportation,” and “public transportation” are used interchangeably in transit law.

Real Property: Land, including affixed land improvements, structures, and appurtenances. It does not include movable machinery and equipment.

Realty/Personalty Report: A realty/personalty report is a listing of items of real estate to be appraised and items of personalty to be moved. Real estate is the land and anything permanently affixed to the land, such as buildings, fences, and those things attached to the buildings, which if removed, deface the structure or integrality of the building, such as plumbing, heating fixtures, etc. Personal property, on the other hand, is the right or interest in things of a temporary or moveable nature. State law varies on the definition of real property and personal property; therefore, the grantee should rely on its State law’s definition of real property and personal property.

Rebuild: A recondition at the end of useful life that creates additional useful life. Rebuild is a capital expense incurred at or near the end of the rolling stock’s useful life that results in a new useful life of the rolling stock that is consistent with the extent of the rebuilding.

Recipient: An entity that receives funds from FTA, whether as a direct recipient or a subrecipient. For purpose of this circular, FTA uses the term recipient interchangeably with the terms grant recipient and grantee and subgrantee.

Refurbishment: Same as overhaul.

Remaining Federal Interest for Dispositions Before the End of Useful Life: Is the amount calculated by multiplying the current fair market value or proceeds from sale by FTA’s share of the equipment. Fair market value is the greater of the unamortized value of the remaining service life based on straight line depreciation of the original purchase price or the Federal share of the sales proceeds.

Remaining Federal Interest for Real Property: Federal interest is the greater of the Federal share of the fair market value of the property, or the straight line depreciated value of improvements plus the Federal share of the current appraised land value.

Rent Schedules: This refers to a method used to document an array of rent and utilities charged in an area or neighborhood for various sized dwellings based on a survey of available dwellings listed for rent.

Rolling Stock Status Report: A report that identifies rolling stock to be retired, or disposed of and identifies both its mileage and age at the time of removal from service, and it discusses the proposed anticipated spare ratio.

Sales Proceeds: Sales Proceeds are the net proceeds generated by the disposition of excess real property or equipment that was purchased in whole or in part with FTA grant funds.

Shared Use: Those instances in which a project partner, separate from the transit agency or grantee, occupies part of a larger facility and pays for its pro rata share of the construction, maintenance, and operation costs. Shared uses are declared at the time of grant award.

Straight Line Depreciation: In absence of fair market value, straight line depreciation method is used to determine the remaining useful life of property. This method is considered as a function of time instead of a function of usage. This method is widely used in practice because of its simplicity. It basically assumes that the asset’s economic usefulness is the same each year.

Subrecipient: A State or local government authority, non-profit organization, or operator of public transportation services that receives a grant indirectly through a recipient.

Supplies: All tangible project property other than equipment with a unit value of less than $5,000.

TEAM-Web: Web-based application used to apply for, administer, and manage FTA grants most commonly referred to as “TEAM.” TEAM stands for Transportation Electronic Award and Management (TEAM) system.

Transit Enhancements: Projects or project elements that are designed to enhance public transportation service or use and are physically or functionally related to transit facilities. Eligible enhancements include historic preservation, rehabilitation and operation of historic public transportation buildings, structures, and facilities; bus shelters; landscaping and other scenic beautification; public art; pedestrian access and walkways; bicycle access; transit connections to parks within the grantee’s transit service area; signage; and enhanced access for persons with disabilities to public transportation.

Uneconomical Remnant: A parcel of real property in which the owner is left with an interest after the partial acquisition or use of the owner’s property, and which the acquiring agency has determined has little or no value or utility to the owner.

Uniform Act: Refers to the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970 (Pub. L. 91–646, 84 Stat. 1894; 42 U.S.C. 4601 et seq. as amended). This act also is referred to with the abbreviation URA per the regulations codified at 49 CFR part 24. All real estate acquisition and relocation assistance undertaken with FTA Federal assistance must be compliant with this act and its implementing regulations at 49 CFR part 24.

Unliquidated Obligations: Funding commitments that have been incurred, but for which outlays have not yet been recorded because goods and services have not been received. Unliquidated obligations should be accounted for on Line I and J of the Federal Financial Report (FFR).

Urbanized Area: An urbanized area is an incorporated area with a population of 50,000 or more that is designated as such by the Bureau of the Census.

Useful Life: The expected lifetime of project property, or the acceptable period of use in service. Useful life of revenue rolling stock begins on the date the vehicle is placed in revenue service and continues until it is removed from service. See Chapter IV of this circular; and current Circular 9030.1 and Circular 9300.1 Capital Program. Used interchangeably with “service life.” Note: Land does not depreciate and therefore does not have a useful life.

Value Engineering: Value engineering is the systematic application of recognized techniques that identify the function of a product or service, establish a value for that function, and provide the necessary function reliably at the lowest overall cost. In all instances, the required function should be achieved at the lowest possible life-cycle cost consistent with requirements for performance, maintainability, safety, security, and aesthetics.

CHAPTER II

CIRCULAR OVERVIEW

GENERAL. This circular provides requirements and procedures for management of all Federal Transit Administration (FTA) programs at 49 U.S.C. Chapter 53, where grant management requirements unique to a particular FTA program are not described in the specific program circular.

FTA implements the requirements of the Uniform Administrative Requirements for States and Local Governments (49 CFR part 18) that have specific provisions to states in the areas of equipment, procurement, and financial management. These requirements apply to those programs that have States as grantees, including 49 U.S.C. Sections 5305, 5310, 5311, 5316, and 5317.

FTA implements the requirements of the Uniform Administrative Requirements (49 CFR part 19) to manage grants to Institutions of Higher Education, Hospitals, and Non-Profit Organizations.

FTA regional and metropolitan offices have responsibility for management oversight of most grants and projects. References in this circular to the cognizant agency mean the FTA regional or metropolitan office, unless otherwise defined.

APPLICABLE PROGRAM DESCRIPTIONS. FTA provides formula and discretionary funding under a variety of programs by awarding grants to eligible recipients. While this circular contains the post-award guidance applicable to all FTA programs, several of the programs including research programs described below have individual program circulars that contain pre-award instructions and unique grant administration and project management guidance. If there is a conflict between 5010 and program specific circulars, program specific circulars should prevail. Please reference FTA’s public website at http://www.fta.dot.gov for a complete listing of FTA programs and their current FTA circulars.

Metropolitan Planning, Statewide Planning, and Planning Programs (Section 5303, Section 5304, and Section 5305). These programs provide funding to support cooperative, continuous, and comprehensive planning for making transportation investment decisions in metropolitan areas and statewide.

For planning activities that:

support the economic vitality of the metropolitan area, especially by enabling global competitiveness, productivity, and efficiency;

increase the safety of the transportation system for motorized and nonmotorized users;

increase the security of the transportation system for motorized and nonmotorized users;

increase the accessibility and mobility of people and for freight;

protect and enhance the environment, promote energy conservation, improve the quality of life, and promote consistency between transportation improvements and State and local planned growth and economic development patterns;

enhance the integration and connectivity of the transportation system, across and between modes, for people and freight;

promote efficient system management and operation; and

emphasize the preservation of the existing transportation system.

Funds are apportioned annually by a formula to States that include consideration of each State’s urbanized area population in proportion to the urbanized area population for the entire nation as well as other factors. States receive no less than 0.5 percent of the amount apportioned. These funds are sub-allocated by States to Metropolitan Planning Organizations (MPOs) by a formula that considers each MPO’s urbanized area population, their individual planning needs, and a minimum distribution. For more information, please refer to the Joint Planning Regulations at 49 CFR part 613 and FTA Circular 8100.1. To be eligible for funding under these programs, projects and strategies must come from the applicable transportation planning process.

Urbanized Area Formula Program (Section 5307). The Urbanized Area Formula Program makes Federal resources available to urbanized areas and to the Chief Executive Officer of a State (Governor) for transit planning, capital, and operating assistance in urbanized areas. An urbanized area is an incorporated area with a population of 50,000 or more that is designated as such by the Bureau of the Census.

For urbanized areas with a population of 200,000 or more, Urbanized Area Formula Program funds are apportioned and flow directly to a designated grantee(s) selected by the Governor to apply for and receive Federal funds. For urbanized areas under 200,000 in population, the funds are apportioned to the Governor of each State for distribution, unless such an area has been designated as a transportation management area at the request of the Governor and the MPO. These areas also receive apportionments directly. Guidance for Section 5307 is found in FTA Circular 9030.1. To be eligible for funding under this program, project and strategies must come from the applicable transportation planning process and contained in a local Transportation Improvement Plan and State Transportation Improvement Plan.

Nonurbanized Area Formula Program (Section 5311). This program provides formula funding to States for the purpose of supporting public transportation in population areas of less than 50,000. It is apportioned in proportion to each State’s nonurbanized population and density factors. Each State prepares an annual program of projects (POP), which must provide for fair and equitable distribution of funds within the States, including Indian reservations, and must provide for maximum feasible coordination with transportation services assisted by other Federal sources.

Funds may be used for capital, operating, and administrative assistance to State agencies, local public bodies, and non-profit organizations (including Indian tribes and groups), and operators of public transportation services. The State must use 15 percent of its annual apportionment to support intercity bus service, unless the Governor certifies that these needs of the State are adequately met. Guidance for Section 5311 is found in FTA Circular 9040.1. To be eligible for funding under this program, projects and strategies must come from the applicable transportation planning process.

Capital Investment Program (Section 5309). The Section 5309 Capital Investment Grants Program funds three different programs: (1) fixed guideway modernization in areas with populations over 200,000 with fixed guideway segments at least seven years old (based on a formula); (2) construction and extension of new fixed guideway systems (New Starts, Small Starts, and Very Small Starts Programs); and, (3) purchase of bus and bus related equipment and facilities in both urbanized and nonurbanized areas (Bus and Bus Facility Program). States and local governmental authorities are eligible applicants for Section 5309 funds. Eligible applicants may apply for Section 5309 bus grants on behalf of private non-profit agencies, private providers of public transportation services, and public subrecipients.

Many recipients look to the Bus Capital Program to supplement vehicles acquired under formula programs or to construct facilities. While distribution of capital program funds is often determined according to Congressional direction, FTA encourages States to apply on behalf of nonurbanized areas and transit operators to apply in behalf of non-profit agencies in their service area that receive earmarks.

Guidance for Section 5309 is found in FTA Circular 9300.1. To be eligible for funding under this program, projects and strategies must come from the applicable transportation planning process.

Elderly Individuals and Individuals with Disabilities (Section 5310). The goal of the Section 5310 program is to improve mobility of elderly individuals and individuals with disabilities throughout the country. Toward this goal, FTA provides financial assistance for transportation services planned, designed, and carried out to meet the special transportation needs of elderly individuals and individuals with disabilities in all areas—urbanized, small urban, and rural. Funds for the Section 5310 program are available for capital expenses as defined in Section 5302(a)(1) to support the provision of transportation services to meet the special needs of elderly persons and persons with disabilities.

Section 5310 funds are apportioned among the States by a formula which is based on the number of elderly persons and persons with disabilities in each State according to the latest available U.S. census data. Up to 10 percent of the States total fiscal year (FY) apportionment may be used to fund program administration costs including administration, planning, and technical assistance. The Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA–LU) requires that projects selected for funding under the Section 5310 program be derived from a locally developed, coordinated public transit-human services transportation plan.

Guidance on the Section 5310 program is contained in FTA Circular 9070.1.

Job Access and Reverse Commute Program (Section 5316). The JARC formula grant program aims to improve access to transportation services to employment and employment related activities for welfare recipients and eligible low-income individuals and to transport residents of urbanized areas and nonurbanized areas to suburban employment opportunities. Funds from the JARC program are available for capital, planning, and operating expenses that support the development and maintenance of transportation services designed to transport low-income individuals to and from jobs and activities related to their employment and to support reverse commute projects.

Of the total JARC funds available, FTA apportions 60 percent among designated recipients in large urbanized areas; 20 percent to the States for small urbanized areas; and 20 percent to the States for rural and small urban areas under 50,000 in population. JARC funds are apportioned by formula. The formula is based on the ratio that the number of eligible low-income individuals and welfare recipients in each area bears to the number of eligible low-income individuals and welfare recipients in all such areas. Up to 10 percent of the recipient’s total FY apportionment may be used to fund program administration costs including administration, planning, and technical assistance. SAFETEA–LU requires that projects selected for funding under the New Freedom program be derived from a locally developed, coordinated public transit-human services transportation plan.

Guidance on the JARC program is contained in FTA Circular 9050.1.

New Freedom Program (Section 5317). The New Freedom formula grant program aims to provide additional tools to overcome existing barriers facing Americans with disabilities seeking integration into the work force and full participation in society. New Freedom program funds are available for capital and operating expenses that support new public transportation services beyond those required by the ADA and new public transportation alternatives beyond those required by the ADA designed to assist individuals with disabilities with accessing transportation services.

Of the total New Freedom funds available, FTA apportions 60 percent among designated recipients in large urbanized areas; 20 percent to the States for small urbanized areas; and 20 percent to the States for rural and small urban areas under 50,000 in population. New Freedom funds are apportioned among the recipients by formula. The formula is based on the ratio that the number of individuals with disabilities in each area bears to the number of individuals with disabilities in all such areas. Up to 10 percent of the recipient’s total FY apportionment may be used to fund program administration costs including administration, planning, and technical assistance. SAFETEA–LU requires that projects selected for funding under the New Freedom program be derived from a locally developed, coordinated public transit-human services transportation plan.

Guidance for the New Freedom Program is contained in FTA Circular 9045.1.

Paul S. Sarbanes Transit in the Parks Program—formerly Alternative Transportation in Parks and Public Lands (ATPPL) (Section 5320). The Paul S. Sarbanes Transit in the Parks Program, 49 U.S.C. 5320, was established by SAFETEA–LU. The program’s purpose is to enhance the protection of national parks and Federal lands, and increase the enjoyment of those visiting them. The program makes available FTA assistance toward capital and planning expenses in projects designed to improve alternative transportation systems in parks and public lands. Eligible applicants are Federal land management agencies and State, tribal, and local governments with jurisdiction over land in the vicinity of an eligible area. All applicants for funds under the parks’ program must have the consent of a Federal land management agency. FTA carries out the program in consultation with the Department of the Interior (DOI) and other Federal land management agencies. Applicants must submit an application in a competitive selection process established by FTA and the Federal land management agencies. The Secretary of the Interior, after consultation with and in cooperation with the Secretary of Transportation, determines the final selection of qualified projects and the funding levels. To be eligible for funding under this program, project and strategies must come from the applicable transportation planning process.

Clean Fuels Grant Program (Section 5308). SAFETEA–LU amended 49 U.S.C. 5308 and changed this program from a formula-based program to a discretionary grant program. This program assists in financing the acquisition of clean-fuel rolling stock and clean-fuel related facilities for agencies providing public transportation and operating in an urbanized area designated as a non-attainment area for ozone or carbon monoxide under Section 107(d) of the Clean Air Act (CAA), 42 U.S.C. Section 7407(d), or a maintenance area for ozone or carbon monoxide. Eligible grant recipients are designated recipients as defined in 5307(a)(2), an urbanized areas over 200,000 in population, and States for urbanized areas with populations of less than 200,000, for areas that are designated as non-attainment areas for ozone or carbon monoxide under Section 107(d) of the CAA, 42 U.S.C. Section 7407(d); or are maintenance areas for ozone or carbon monoxide. Nonurbanized areas are not eligible recipients under this program.

Eligible projects include the following: the purchase or lease of clean-fuel rolling stock, the construction or lease of clean-fuel electrical-recharging facilities, and improvement of existing facilities to accommodate clean-fuel rolling stock. In addition, clean-fuel, bio-diesel, hybrid-electric, or zero-emissions-technology rolling stock that exhibit emissions reductions equivalent or superior to existing clean-fuel or hybrid-electric technologies may be eligible at FTA’s discretion, provided that the Administrator of the Environmental Protection Agency (EPA) has certified the project sufficiently reduces harmful emissions. Section 5308 states that not more than 25 percent of the amount authorized for this program may be used for clean-diesel projects. FTA has implemented this program through a rulemaking to revise 49 CFR part 624. The final rule was published in the Federal Register (72 FR 15049, Mar. 30, 2007).

Applications are solicited through a notice in the Federal Register in each FY that discretionary funds are appropriated by Congress for the program. Grants under this program are subject to the applicable requirements of 49 U.S.C. Section 5307. To be eligible for funding under this program, projects and strategies must come from the applicable transportation planning process.

RESPONSIBILITIES OF GRANT MANAGEMENT. Grantees are responsible for the day-to-day management of their Federal grants and of grant supported activities. FTA monitors grants and federally funded projects to confirm that grantees establish and follow procedures that comply with Federal requirements. Chapter III of this circular describes the mechanics and requirements for grant administration, and Chapter IV describes the requirements for managing federally funded projects.

Grantee’s Role. A grantee must monitor grant supported activities to ensure compliance with applicable Federal requirements. This includes the administration and management of the grant in compliance with the Federal regulations, Grant Agreement, and applicable FTA circulars. A grantee is also responsible for funds that “pass through” to a subrecipient. In general, submission of Annual Certifications and Assurances stands in lieu of detailed FTA oversight before approval of a grant; however, the results of ongoing or routine FTA oversight activities also will be considered as applicable. Annual independent organization wide audits (A–133 audits), audits of grantees, and other recurring and specialized reviews give FTA an opportunity to verify the grantee’s Certifications and Assurances (see Chapter V, “Oversight,” of this circular). The grantee’s responsibilities include but are not limited to actions that:

Demonstrate legal, financial, and technical capacity to carry out the program, including safety and security aspects of the program.

Provide administrative and management support of project implementation.

Provide, directly or by contract, adequate technical inspection and supervision by qualified professionals of all work in progress.

Ensure conformity to Grant Agreements, applicable statutes, codes, ordinances, and safety standards.

Maintain the project work schedule agreed to by FTA and the grantee and monitor grant activities to assure that schedules are met and other performance goals are achieved.

Keep expenditures within the latest approved project budget.

Ensure compliance with FTA and Federal requirements on the part of agencies, consultants, contractors, and subcontractors working under approved third party contracts or inter-agency agreements.

Request and withdraw Federal funds for eligible activities only in amounts and at times as needed to make payments that are due and payable within three business days and retain receipts to substantiate withdrawals.

Account for project property and maintain property inventory records that contain all the elements required.

Demonstrate and retain satisfactory continuing control over the use of project property.

Demonstrate procedures for asset management and adequate maintenance of equipment and facilities.

Ensure that an annual independent organization-wide audit is conducted in accordance with Office of Management and Budget (OMB) Circular, A–133, “Audits of States, Local Governments, and Non-Profit Organizations.”

Prepare force account and Cost Allocation Plans (CAPs) and submit and obtain approval if applicable before incurring costs.

Prepare and submit FTA required reports (see Chapter III, Section 3. “Reporting Requirements”).

Update and retain FTA required reports and records for availability during audits or oversight reviews.

Ensure that effective control and accountability are maintained for all grants and subgrants, cash, real and personal property, and other assets. Grantees and subgrantees must ensure that resources are properly used and safeguarded, and used solely for authorized purposes.

FTA Role. FTA Headquarters in Washington, DC, serves a broad, program-level role in the administration of the programs. FTA Headquarters performs the following functions:

Provides overall policy and is primarily responsible for policy and program guidance for all FTA programs; ensures that programs are consistent with the law.

Ensures consistent administration of programs by regional and metropolitan offices.

Prepares and publishes annual apportionment of funds to the States and designated grantees.

Develops and implements financial management procedures.

Initiates and manages program-support activities, such as training, courses, regional consistency, and oversight reviews.

Conducts national program reviews and evaluations.

Carries out responsibility for national compliance with program requirements.

Develops national standard operating practices.

FTA Regional and Metropolitan Offices are responsible for the day-to-day administration of grants, projects, and programs. Regional and metropolitan offices responsibilities include, but are not limited to, actions that:

Review and approve grant applications, grant amendments, and budget revisions, as necessary.

Obligate and deobligate funds.

Work with grantees to implement and manage the programs and projects and ensure grantee compliance.

Provide technical assistance.

Receive designated grantee’s certifications and amendments to the POP.

Review Milestone Progress Reports and Federal Financial Reports as well as monitor and close grants.

Conduct triennial reviews and other reviews as necessary.

CIVIL RIGHTS REQUIREMENTS. The recipient agrees to comply with all applicable civil rights statutes and implementing regulations including, but not limited to, the following:

Nondiscrimination in Federal Public Transportation Programs. The recipient agrees to comply, and ensures the compliance of each third party contractor at any tier and each subrecipient at any tier under the project, with the provisions of 49 U.S.C. 5332. These provisions prohibit discrimination on the basis of race, color, creed, national origin, sex, or age and prohibit discrimination in employment or business opportunity.

Nondiscrimination—Title VI. The recipient agrees to comply, and ensures the compliance of each third party contractor at any tier and each subrecipient at any tier of the project, with all of the following requirements under Title VI of the Civil Rights Act of 1964:

Title VI of the Civil Rights Act of 1964, as amended (42 U.S.C. 2000d et seq.), provides that no person in the United States shall, on the grounds of race, color, or national origin, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any program or activity receiving Federal financial assistance;

DOT regulations, “Nondiscrimination in Federally-Assisted Programs of the Department of Transportation—Effectuation of Title VI of the Civil Rights Act,” 49 CFR part 21;

FTA Circular 4702.1 “Title VI and Title VI—Dependent Guidelines for Federal Transit Administration Recipients.” This document provides FTA recipients and subrecipients with guidance and instructions necessary to carry out DOT’s Title VI regulations (49 CFR part 21): DOT’s order 5610.0 on Environmental Justice (62 FR 18377, Apr. 15, 1997), and DOT Policy Guidance Concerning Recipient’s Responsibilities to Limited English Proficient (LEP) persons (70 FR 74087, Dec. 14, 2005);

DOT Order to Address Environmental Justice in Minority Populations and Low-Income Populations. This Order describes the process that the Office of the Secretary of Transportation and each operating administration will use to incorporate environmental justice principles (as embodied in Executive Order 12898 on Environmental Justice) into existing programs, policies, and activities; and

Pursuant to Executive Order 13166 and DOT Policy Guidance Concerning Recipients’ Responsibilities to Limited English Proficient (LEP) Persons. This guidance clarifies the responsibilities of recipients of Federal financial assistance from DOT and assists them in fulfilling their responsibilities to Limited English Proficient (LEP) persons, pursuant to Title VI of the Civil Rights Act of 1964 and implementing regulations.

Equal Employment Opportunity. The recipient agrees to comply, and ensures the compliance of each third party contractor and each subrecipient at any tier of the project, with all Equal Employment Opportunity (EEO) requirements of Title VII of the Civil Rights Act of 1964, as amended, (42 U.S.C. Section 2000e), and 49 U.S.C. Section 5332, and FTA Circular 4704.1, “Equal Employment Program Guidelines for Grant Recipients” and any implementing requirements FTA may issue. Grantees who receive $1 million dollars in FTA assistance (or $250,000 in FTA planning assistance) and have 50 transit-related employees must submit an EEO program to FTA. Both criteria must be met in order to meet the requirement for program submission.

Nondiscrimination on the Basis of Sex. The recipient agrees to comply with all applicable requirements of Title IX of the Education Amendments of 1972, as amended, (20 U.S.C. Section 1681 et seq.), with implementing DOT implementing regulations, “Nondiscrimination on the Basis of Sex in Education Programs or Activities Receiving Federal Financial Assistance,” 49 CFR part 25, and with any implementing directives that DOT or FTA may promulgate, which prohibit discrimination on the basis of sex.

Nondiscrimination on the Basis of Age. The recipient agrees to comply with all applicable requirements of the Age Discrimination Act of 1975, as amended, (42 U.S.C. Section 6101 et seq.), and Health and Human Services’ implementing regulations, “Nondiscrimination on the Basis of Age in Programs or Activities Receiving Federal Financial Assistance,” (45 CFR part 90), which prohibit discrimination against individuals on the basis of age (40 years or older). In addition, the recipient agrees to comply with all applicable requirements of the Age Discrimination Act (ADEA), 29 U.S.C. 621 through 634, and Equal Employment Opportunity Commission (EEOC) implementing regulations, “Age Discrimination in Employment Act” (29 CFR part 1625), which prohibits discrimination against individuals on the basis of age.

Nondiscrimination on the Basis of Disability. The recipient agrees to comply, and ensures the compliance of each third party contractor and each subrecipient at any tier of the project, with the applicable laws and regulations, discussed below, for nondiscrimination on the basis of disability.

The Rehabilitation Act of 1973 (Section 504), as amended (29 U.S.C. Section 794), prohibits discrimination on the basis of disability by recipients of Federal financial assistance.

Section 508 of the rehabilitation Act of 1973, (Section 508), as amended (29 U.S.C. Section 794(d)), requires reports and other information prepared in electronic format developed in connection with a third party contract, whether as a contract end item or in compliance with contract administration provisions, must comply with the accessibility standards established under Architectural and Transportation Barriers Compliance Board (ATBCB) regulations, “Electronic and Information Technology Accessibility Standards,” 36 CFR part 1194.

The Americans with Disabilities Act of 1990 (ADA), as amended (42 U.S.C. Section 12101 et seq.), prohibits discrimination against qualified individuals with disabilities in all programs, activities, and services of public entities as well as imposes specific requirements on public and private providers of transportation.

DOT regulations implementing Section 504 and the ADA include 49 CFR parts 27, 37, and 38. Among other provisions, the regulations specify accessibility requirements for the design and construction of new transportation facilities; require that vehicles acquired (with limited exceptions) be accessible to and usable by individuals with disabilities, including individuals using wheelchairs; require public entities, including a private non-profit entity of the State as a subrecipient providing fixed-route service, to provide complementary paratransit service to individuals with disabilities who cannot use the fixed-route service; and include service requirements intended to ensure that individuals with disabilities are afforded equal opportunity to use transportation systems and services.

In addition, recipients of any FTA funds should be aware that they also have responsibilities under Titles I, III, IV, and V of the ADA in the areas of employment, public services, public accommodations, telecommunications, and other provisions, many of which are subject to regulations issued by other Federal agencies.

Disadvantaged Business Enterprise (DBE). To the extent required by Federal law, regulation, or directive, the recipient agrees to take the following measures to make it possible for DBEs to participate in the project:

The recipient agrees and ensures that it will comply with Section 1101(b) of SAFETEA–LU, which requires FTA to make available not less than 10 percent of its funding under that Act for contracts with small business concerns owned and controlled by socially and economically disadvantaged persons. The DOT DBE Regulation at 49 CFR 26.21(2) states that FTA recipients receiving planning, capital and/or operating assistance who will award prime contracts (excluding transit vehicle purchases) exceeding $250,000 in FTA funds in a Federal FY are required to have a DBE program. Grantees must comply with applicable requirements of DOT regulations, “Participation by Disadvantaged Business Enterprises in Department of Transportation Financial Assistance Programs,” 49 CFR part 26, (DBE regulations), in order to receive FTA funding. Contracts funded in whole or in part with FTA funds and subject to FTA’s procurement rule are also subject to the grantee’s DBE Program and are included to the extent of FTA funding in determining (i) whether the grantee meets the DBE threshold for goal setting; and, (ii) the goal if the threshold is met.

The recipient agrees and ensures that it will comply with DOT regulations, “Participation by Disadvantaged Business Enterprises in Department of Transportation Financial Assistance Programs,” 49 CFR part 26. Among other provisions, this regulation requires recipients of DOT Federal financial assistance meeting a threshold funding level of $250,000 to have a DBE program. This applies to all who receive planning, capital and/or operating assistance including State and local transportation agencies, to establish goals for the participation of disadvantaged entrepreneurs and certify the eligibility of DBE firms to participate in their DOT-assisted contracts. FTA recipients are instructed by 49 CFR 26.49 to require in their DBE program that each transit vehicle manufacturer, as a condition of being authorized to bid or propose on a FTA-assisted transit vehicle procurement (new vehicles only), certify that it complied with the requirements of the DBE program.

The recipient agrees and ensures that it shall not discriminate on the basis of race, color, sex, national origin, or disability in the award and performance of any third party contract, or subagreement supported with Federal assistance derived from DOT or in the administration of its DBE program and will comply with the requirements of 49 CFR part 26. The recipient agrees to take all necessary and reasonable steps set forth in 49 CFR part 26 to ensure nondiscrimination in the award and administration of all third party contracts and subagreements supported with Federal assistance derived from DOT. As required by 49 CFR part 26 and approved by DOT, the recipient’s DBE program is incorporated by reference and made part of the Grant Agreement or Cooperative Agreement. The recipient agrees that implementation of this DBE program is a legal obligation, and that failure to carry out its terms shall be treated as a violation of the Grant Agreement or Cooperative Agreement. Upon notification by DOT to the recipient of a failure to implement its approved DBE program, DOT may impose sanctions as provided for under 49 CFR part 26 and may, in appropriate cases, refer the matter for enforcement under 18 U.S.C. 1001, and/or the Program Fraud Civil Remedies Act, (31 U.S.C. 3801 et seq).

CROSS-CUTTING REQUIREMENTS. The grantee understands and agrees that it must comply with all applicable Federal laws, regulations, and directives, except to the extent that FTA determines otherwise, in writing. Refer to FTA’s Master Agreement for a list of applicable laws, regulations, and directives. FTA updates the Master Agreement annually.

CHAPTER III

GRANT ADMINISTRATION

OVERVIEW. This chapter discusses the mechanics and requirements for post-award grant administration. Project management requirements are described in Chapter IV. The following sections emphasize the requirements associated with administering and managing a grant after the grant has been awarded and executed in the Transportation Electronic Award and Management (TEAM) system.

GRANT APPLICATION PROCESS. The Federal Transit Administration’s (FTA’s) pre-award, program-specific circulars describe the grant application process and requirements. Refer to these circulars for instructions for completing a grant application. For a full listing of FTA program circulars, see Appendix A of this circular or visit www.fta.dot.gov.

FTA provides a streamlined electronic interface between grantees and FTA that allows complete electronic grant application submission, review, approval, and management of all grants. This is done through a Web-based electronic system, commonly known by the acronym “TEAM.” Among other things, grantees apply for grants, inquire about the status of grants, file the required financial report and milestone progress reports, and submit annual Certifications and Assurances in TEAM. The TEAM User Guide can be found at FTA’s website in the “Grants and Financing” section under “Apply for and Manage Grants” located at: http://ftateamweb.fta.dot.gov/static/userguide.html.

The TEAM Grant Life Cycle is as follows:

Grant application created,

Grant number assigned,

Signoffs and Approvals,

Grant funds reserved,

Grant awarded,

Grant award executed,

Grant managed, and

Grant closed.

FTA staff notifies grantees by phone or e-mail of grant approval. Grantees also can check the status of grant applications in TEAM to determine when it has been awarded. The Grant Agreement includes the notification of award and the approved project budget. Special conditions of the approval may be included in the award, the current Master Agreement, the electronic grant (screen), or the conditions for using pre-award authority if applicable. In certain cases, pre-award authority may be available for incurring project-related costs prior to approval of an application.

Once a grantee receives the notification of grant award, the grantee executes the grant in TEAM. The electronic execution of the Grant Agreement signifies the grant is active and post-award grant requirements apply.

REPORTING REQUIREMENTS. Once a grant is active, a grantee is subject to one or more of the following types of post-award reporting requirements, several of which can be done using TEAM. The reporting requirements may vary depending on the size of the grantee, the type of funding, or the amount of funding a grantee receives. Please contact the regional or metropolitan office with questions regarding the applicability of the following reporting requirements:

Federal Financial Report and Milestone/Progress Reports. FTA uses the Federal Financial Report (SF-425) and Milestone Progress Reports to evaluate several elements of the grant status, such as:

The purposes of the grant are being achieved;

The project is progressing on time and within budget;

The grantee is demonstrating competence and control in executing the project;

The project meets all program requirements;

There is a problem developing which may require FTA resources to resolve.

FTA monitors grant activities to ensure proper grantee stewardship of Federal funds and compliance with the laws and regulations that govern its grant programs. FTA also must be able to report on program results, industry trends, and its own oversight responsibilities. The information FTA needs for program forecasting, management, and reporting is furnished through the FFRs and narrative Milestone/Progress Reports (MPRs) submitted by grantees about significant events, relevant grant activities, and any changes to or variances in the grant schedule or budget.

With respect to the level of detail required for these reports, FTA treats all approved activity line items (ALIs) alike. Thus, an activity contained in a grant must be presented in the reports in sufficient detail that important information is not lost in aggregation. For example, the number of full-sized buses in a grant must not be reported together with vans under the scope “rolling stock,” but instead should be reported separately under the applicable ALI. FTA staff is available to meet with grantees to agree on the appropriate level of reporting detail and formats for reporting in TEAM. This will ensure that FTA has the information needed to manage its overall program.

All grantees should report significant developments or changes as they occur during the year, including any problems, delays, or adverse conditions that may materially impair the ability to meet the objective of the award, as well as any favorable developments that may enable meeting time schedules and objectives sooner or at a cost substantially less than expected in FFRs.

If necessary, attachments can accompany FFRs and MPRs by using the “paperclip” feature in TEAM.

FTA may withhold payment for failure to submit either FFRs or MPRs in a timely manner. In individual cases, FTA may grant extensions of report due dates for good cause.

Report due dates and additional information about the FFRs and MPRs are described below. Please contact your regional or metropolitan office for questions regarding any of these reports.

Federal Financial Report (FFR). A grantee must submit an FFR for each active/executed grant. The requirement for an FFR applies to all FTA grants covered by this circular. The FFR accompanies the MPR (described below) and is used to monitor project funds. The purpose of the FFR is to provide a current, complete, and accurate financial picture of the grant. This report is submitted electronically in TEAM and must be prepared on the accrual basis of accounting; that is, income is recorded when earned instead of when received, and expenses are recorded when incurred instead of when paid. FTA does not allow the FFR to be prepared in the cash method of accounting. A grantee may keep its books on the cash basis during its accounting year. If this is the case, at the submission of the FFR, the grantee must prepare the necessary accruals and submit the FFR on the accrual basis of accounting.

The FFR must contain the following elements:

All financial facts (e.g., expenditures and obligations) relating to the scope and purpose of each financial report and applicable reporting period should be completely and clearly displayed in the reports.

Reported financial data should be accurate and up to date. The requirement for accuracy does not rule out inclusion of reasonable estimates when precise measurement is impractical, uneconomical, unnecessary, or conducive to delay.

Financial reports should be based on the required supporting documentation maintained in the grantee’s official financial management system that produces information which objectively discloses financial aspects of events or transactions.

Financial data reported should be derived from accounts that are maintained on a consistent, periodic basis; material changes in accounting policies or methods and their effect must be clearly explained.

Reporting terminology used in financial reports to FTA should be consistent with receipt and expense classifications included in the latest approved project.

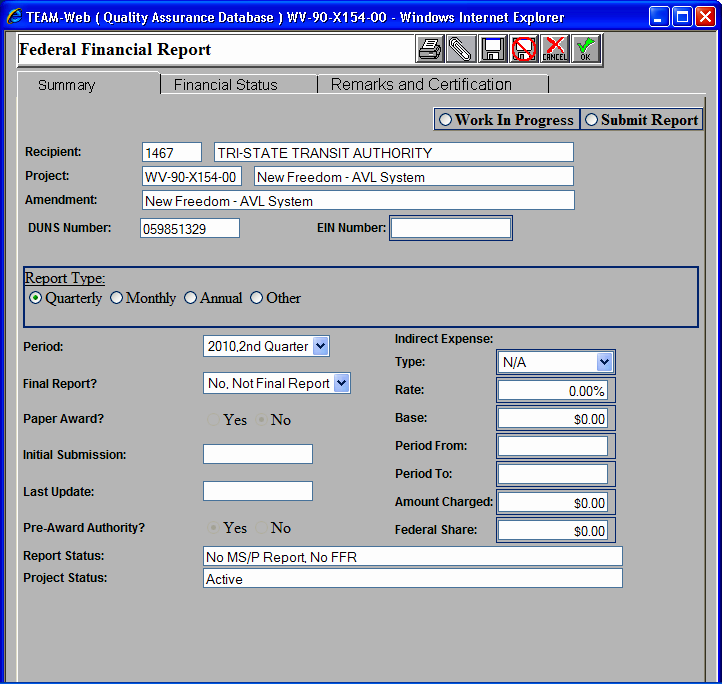

The FFR screen in TEAM consists of three tabs: Summary, Financial Status and Remarks and Certification.

The Summary tab provides basic information, with entry fields for the Period of the FFR, Initial Submission, and Last Update dates. It also allows the grantee to select whether it is a Final Report, a Paper Award, or if the grantee used Pre-Award Authority. It is important to enter in this tab whether the grantee is charging indirect costs to the grant.

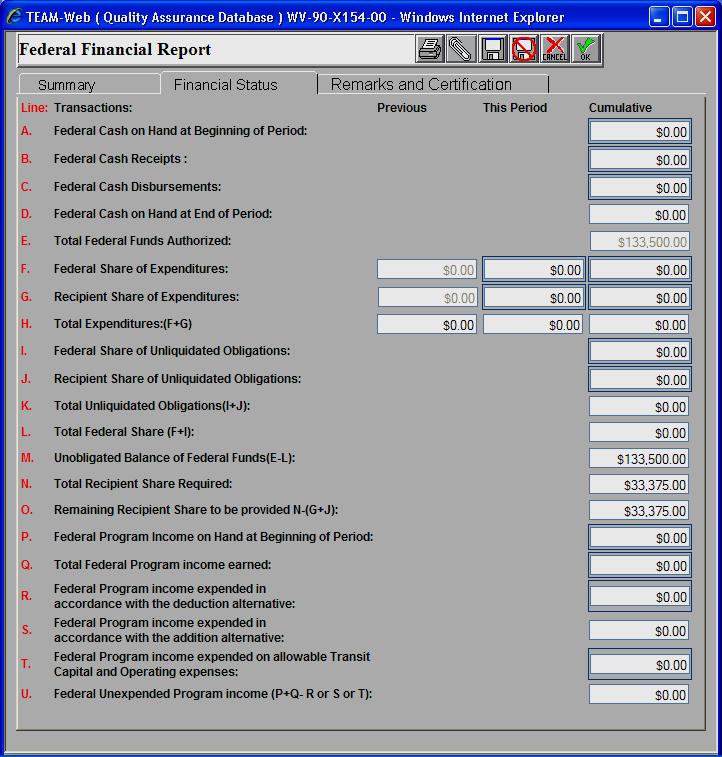

In the Financial Status tab the grantee enters financial information related to Federal Cash, Recipient Share, Unliquidated Obligations, and Program Income. Details on information needed in this tab and definitions can be found in Appendix B.

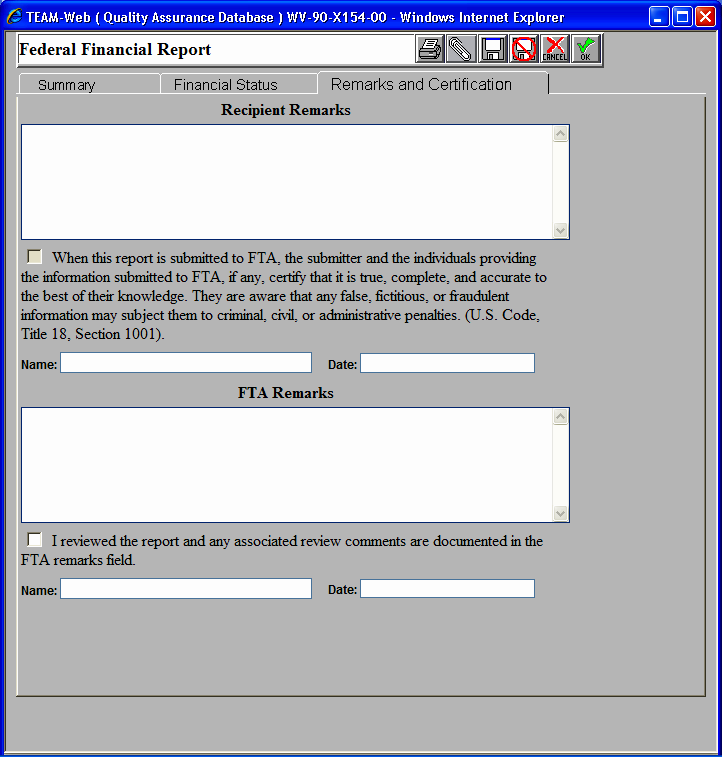

The Remarks and Certification tab has entry fields for Recipient remarks, Certification checkbox and FTA remarks.

Milestone/Progress Reports. The MPR must be submitted for all active/executed grants. The requirement for a MPR applies to all FTA grants covered by this circular. The MPR is the primary written communication between the grantee and FTA. This report should be submitted electronically in TEAM. If only operating assistance is included in the grant, the reporting requirements are limited to the estimated and actual dates when all funding has been expended. Each MPR must include the following data as appropriate:

Current status of each open ALI within the active/executed grant.

A narrative description of projects, status, any problems encountered in implementation, specification preparation, bid solicitation, resolution of protests, and contract awards.

Detailed discussion of all budget or schedule changes.

The dates of expected or actual requests for bid, delivery, etc.

Actual completion dates for completed milestones.

Revised estimated completion dates when original estimated completion dates are not met.

Explanation of why scheduled milestones or completion dates were not met. Identification of problem areas and narrative on how the problems will be solved. Discussion of the expected impacts and the efforts to recover from the delays.

Analysis of significant project cost variances. Completion and acceptance of equipment and construction or other work should be discussed, together with a breakout of the costs incurred and those costs required to complete the project. Use quantitative measures, such as hours worked, sections completed, or units delivered.

A list of all outstanding claims exceeding $100,000, and all claims settled during the reporting period. This list should be accompanied by a brief description, estimated costs, and the reasons for the claims.

A list of all potential and executed change orders and amounts exceeding $100,000, pending or settled, during the reporting period. This list should be accompanied by a brief description.

A list of claims or litigation involving third party contracts and potential third party contracts that:

Have a value exceeding $100,000,

Involve a controversial matter, irrespective of amount, or

Involve a highly publicized matter, irrespective of amount.

A list of all real property acquisition actions, including just compensation, property(s) under litigation, administrative settlements, and condemnation for each parcel during the reporting period.

Report Due Dates.

Grantees located in urbanized areas over 200,000 population. FSRs and MPRs are due to FTA within 30 days after the end of each calendar quarter, i.e., by January 30, April 30, July 30, and October 30.

Grantees located in urbanized areas under 200,000 population. Grantees in areas with less than 200,000 in population submit FSRs and MPRs annually. Annual reports are due October 30, one month after the Federal fiscal year (FY) ends. The FTA regional or metropolitan office may request more frequent reporting or additional reports if circumstances warrant additional reporting.

Exceptions:

Section 5309 Grants: All grant recipients, regardless of location and population area, are required to submit quarterly reports in TEAM according to the dates in Subsection 3.d.(1) above when grants include construction of facility.

State Departments of Transportation (State DOTs): State DOTs are required to report annually for all State administered programs; this includes Section 5303, 5304, 5307 (Governor’s Apportionment), 5310, 5311, 5316, and 5317 Programs. The exception described in the preceding paragraph applies to the State DOTs.

Depending on project complexity, at its discretion, FTA may also request other special reports or quarterly project management meetings.

Transit Enhancement Reports. Transit Enhancement Reports must be submitted by grantees with population areas of 200,000 and above who receive funds under the Urbanized Area Formula Program (Section 5307). Recipients of these funds are required under Section 5307(d)(K)(ii) to submit a report listing the projects carried out during the previous FY with those funds including the amounts expended. This report should be submitted as a narrative attachment to the electronic 4th quarter MPR in TEAM. Certification that this report has been submitted is required as part of the Annual List of Certifications and Assurances.

Civil Rights Reports. Grantees must submit, on a triennial basis, a report on their compliance with the objectives of the current Circular 4702.1, “Title VI and Title VI Dependent Guidelines for FTA Recipients.” This circular provides details on the contents of compliance reports. Grantees covered under FTA’s Equal Employment Opportunity (EEO) Circular must submit triennial reports on their compliance with this circular. Grantees who meet the $250,000 funding threshold of FTA’s Disadvantaged Business Enterprise (DBE) regulations must submit annual DBE goals to FTA by August 1 of each FY. If they do not anticipate reaching the threshold, then they are not required to develop annual goal for that FY in which the contracting opportunities are not available. Grantees must submit a one-time DBE program submission to FTA the first time they meet the threshold. For the first year it is a program and goal submission; the next year it is only a goal submission. Reports and goals are submitted to the Regional Civil Rights Officer. See Chapter III, Subsections 3.f.(1) and (2) below for applicability of these two reporting requirements. Grantees must also submit semi-annual DBE progress reports to the Regional Office. Grantees may also be required to submit, on an as-requested basis, reports on their activities and progress to address findings identified in civil rights compliance reviews and assessments.