Rp 20049-29

Rev. Proc. 2004-29.docx

Revenue Procedure 2004-29 - Statistical Sampling in Sec. 274 Context

RP 20049-29

OMB: 1545-1847

Page

Rev. Proc. 2004-29; 2004-1 C.B. 918;

2004 IRB LEXIS 193, *; 2004-20 I.R.B. 918

Revenue Procedure 2004-29

Rev. Proc. 2004-29; 2004-1 C.B. 918; 2004 IRB LEXIS 193; 2004-20 I.R.B. 918

May 17, 2004

[*1]

APPLICABLE SECTIONS:

26 CFR 601.105: Examination of returns and claims for refund, credit or abatement; determination of correct tax liability. (Also Part I, §§ 132, 162, 274; 1.132-6.)

TEXT:

SECTION 1. PURPOSE

This revenue procedure provides the statistical sampling methodology that a taxpayer may use in establishing the amount of substantiated meal and entertainment expenses excepted from the 50% deduction disallowance of § 274 (n) (1) of the Internal Revenue Code by reason of § 274 (n) (2) (A), (B), (C), (D), or (E).

SECTION 2. BACKGROUND

.01 Section 162 (a) allows a deduction for all ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including certain expenses for meals and entertainment.

.02 Section 274 (d) disallows a § 162 deduction for any expense for travel (including meals and lodging while away from home), entertainment, gifts, or listed property unless the taxpayer substantiates the elements of the expense by adequate records or by sufficient evidence. See § 1.274-5T of the Income Tax Regulations.

.03 Section 274 (n) (1) provides that the amount allowable as a deduction for any expense for food or beverages, or any item with respect to an activity that [*2] is of a type generally considered to constitute entertainment, amusement, or recreation, or with respect to a facility used in connection with these activities, may not exceed 50% of the amount of the expense.

.04 Section 274 (n) (2) (A) provides that the 50% deduction disallowance of § 274 (n) (1) does not apply to expenses described in § 274 (e) (2) (expenses treated on the taxpayer's return as compensation to an employee under chapter 1 and as wages to the employee for purposes of chapter 24), (e) (3) (expenses paid or incurred under a reimbursement or similar arrangement in connection with the performance of services). (e) (4) (recreational and similar expenses for employees), (e) (7) (expenses relating to items available to the public), (e) (8) (expenses relating to entertainment sold to customers), or (e) (9) (expenses includible in income of persons who are not employees).

.05 Section 274 (n) (2) (B) provides that the 50% deduction disallowance of § 274 (n) (1) does not apply to an expense for food or beverages that is excludable from the gross income of the recipient under § 132 (e) (relating to de minimis fringe benefits excluded from income under § 132 (a) (4)).

.06 Section 132 (e) [*3] defines a de minimis fringe as any property or service the value of which is (after taking into account the frequency with which similar fringes are provided by the employer to the employer's employees) so small as to make accounting for it unreasonable or administratively impracticable. Under § 1.132-6 (c), a cash fringe benefit (other than overtime meal money and local transportation fare) is never excludable as a de minimis fringe benefit. For example, expenses for meals and entertainment reimbursed to employees under an accountable plan (as defined in § 1.62-2 (c) (2)) do not qualify as de minimis fringe benefits.

.07 Section 1.132-6 (b) provides that the frequency with which similar fringes are provided by the employer to the employer's employees is generally determined by reference to the frequency with which the employer provides the fringes to each individual employee. However, if it would be administratively difficult to determine frequency with respect to individual employees, the frequency with which similar fringes are provided by the employer to the employer's employees is determined by reference to the workforce as a whole. This exception to the employee-measured frequency [*4] requirement does not apply to overtime meals, meal money, or local transportation fare.

.08 Section 274 (n) (2) (C) provides that the 50% deduction disallowance of § 274 (n) (1) does not apply to an expense covered by a package involving a ticket described in § 274 (l) (1) (B) (exception for certain charitable sports events).

.09 Section 274 (n) (2) (D) provides that the 50% deduction disallowance of § 274 (n) (1) does not apply to taxable payments or reimbursements of moving expenses of an employee by the employer.

.10 Section 274 (n) (2) (E) provides that the 50% deduction disallowance of § 274 (n) (1) does not apply to expenses for food or beverages (i) required by Federal law to be provided to crew members of a commercial vessel, (ii) provided to crew members of certain commercial vessels, or (iii) provided on or in proximity to certain oil or gas platforms or drilling rigs.

SECTION 3. SCOPE

This revenue procedure applies to a taxpayer filing an original return, under examination, in litigation, or making a refund claim that desires to establish with respect to its income tax liability the amount of substantiated expenses paid or incurred for meals and entertainment excepted from the 50% deduction [*5] disallowance of § 274 (n) (1) by reason of § 274 (n) (2) (A), (B), (C), (D), or (E).

SECTION 4. APPLICATION

.01 In general. A taxpayer filing an original return, under examination, in litigation, or making a refund claim, may use statistical sampling in connection with establishing, with respect to its income tax liability, the amount of the taxpayer's substantiated expenses paid or incurred for meals and entertainment excepted from the 50% deduction disallowance of § 274 (n) (1) by reason of § 274 (n) (2) (A), (B), (C), (D), or (E) by following the procedures provided in Appendix A (Sampling Plan Standards), Appendix B (Sampling Documentation Standards), Appendix C (Technical Formulas), and (in the case of de minimis fringes) in paragraph 4.02 of this revenue procedure.

.02 Additional procedures required for de minimis fringe benefits.

(1) Reimbursements under accountable plans. In conducting the study, expenses for meals and entertainment reimbursed by employers to employees under an accountable plan may not be treated as de minimis fringe benefits.

(2) Determination of frequency. To establish the amount of identified expenses that are excepted from § 274 (n) (1) by reason of § 274 (n) (2) (B), [*6] a taxpayer is required to determine the frequency with which similar fringes were provided by the taxpayer to the taxpayer's employees on an employee-measured or employer-measured basis, as described in paragraphs (3) and (4) below. Thus, after selecting a statistical sample, as discussed below, the taxpayer may be required to review documentation from outside both the sample and the target population (the set of items from which the sample is drawn) to identify similar fringes included in employees' gross income and similar fringes previously excluded from employees' gross income as de minimis fringe benefits.

(3) Employee-measured frequency.

(a) In general. When using employee-measured frequency to determine the amount of identified expenses that are excepted from § 274 (n) (1) by reason of § 274 (n) (2) (B), the taxpayer must establish the frequency with which similar fringes were provided to each individual employee of the taxpayer. Therefore, after identifying the statistical sample, the taxpayer must review the remainder of the target population (and records that document similar fringes that are not included in the target population) to identify the aggregate number of similar fringes [*7] provided to the individual employees included in the statistical sample.

(b) Example. Taxpayer maintains a meal and entertainment expense account that includes invoices for meals provided in-kind to Taxpayer's employees that may be de minimis fringe benefits. The invoices specifically identify the employees who received the in-kind meals. Therefore, it would not be administratively difficult to determine the frequency with which in-kind meals were provided to individual employees, and Taxpayer must determine the frequency with which it provided in-kind meals to each of the individual employees included in the sample. Taxpayer has no other accounts that include expenses for in-kind meals provided to employees.

Taxpayer selects a statistical sample of the meal and entertainment expense account that identifies 10 employees who have received in-kind meals. In order to determine if the meals are de minimis fringes, Taxpayer must review documentation (such as invoices) in the remainder of the target population to identify all in-kind meals provided to each of the 10 individual employees included in the sample. Taxpayer must consider in-kind meals that Taxpayer included in each employee's gross [*8] income and similar fringes previously excluded from the employees' gross income as de minimis fringe benefits in determining the frequency with which similar fringes were provided to each of the 10 employees. After conducting this review, Taxpayer determines (after considering both the value and frequency of the meals) that the meals provided to 4 of the 10 employees in the sample are de minimis fringe benefits not subject to the 50% deduction disallowance of § 274 (n) (1). Taxpayer may increase proportionately the deductible amount of expenses in the population not subject to the § 274 (n) (1) limitation. See paragraph 6 of Appendix A.

(4) Employer-measured frequency.

(a) In general. When using employer-measured frequency to determine the amount of identified expenses that are excepted from § 274 (n) (1) by reason of § 274 (n) (2) (B), the taxpayer must establish the frequency with which similar fringes were provided to the taxpayer's workforce as a whole. Thus, the target population must include all relevant records prior to selection of the statistical sample in order to determine the aggregate number of similar fringes provided to all eligible employees and the aggregate number of employees [*9] eligible to receive such fringes.

(b) Example. Taxpayer maintains a meal and entertainment expense account that includes invoices for meals provided in-kind to Taxpayer's employees that may be de minimis fringe benefits. The invoices are for in-kind meals of a type for which it is administratively difficult to identify the particular employees who received the meals, and the invoices done specifically identify those employees. Therefore, it would be administratively difficult to determine the frequency with which in-kind meals were provided to individual employees, and taxpayer may determine the frequency with which similar fringes were provided by Taxpayer to Taxpayer's employees by reference to all employees eligible to receive in-kind meals. Taxpayer maintains an account in addition to the meal and entertainment expense, account that includes expenses for in-kind meals provided to employees. Taxpayer's workforce includes 500 employees who are eligible to receive the fringe benefit of in-kind meals.

Taxpayer merges the meal and entertainment expense account and the other account that includes expenses for in-kind meals to create a target population that includes all relevant records [*10] and conducts a statistical sample of the merged accounts. In determining whether the in-kind meals included in the sample are de minimis fringes. Taxpayer must consider in-kind meals that taxpayer included in eligible employees' gross income and similar fringes previously excluded from employees' gross income as de minimis fringe benefits. Taxpayer identifies in the sample 50 in-kind meals provided to employees. The 50 meals represent 1000 in-kind meals in the target population as a whole, or two meals per eligible employee. Assuming that the provision of two meals with a given cost per eligible employee results in a value that is so small as to make accounting for it unreasonable or administratively impracticable, Taxpayer may treat all of the in-kind meals in the meal and entertainment expense account as de minimis fringe benefits not subject to the 50% deduction disallowance of § 274 (n) (1), subject, however, to a pro rata reduction to the extent that any in-kind meals are evaluated under employee-measured frequency and fail to qualify as de minimis fringes.

.03 Limitations.

(1) This revenue procedure does not authorize the use of statistical sampling to substantiate meal and entertainment [*11] expenses as required by § 274 (d).

(2) This revenue procedure does not authorize the use of statistical sampling to determine a taxpayer's liability for employment taxes or whether an amount is excludable from a taxpayer's income.

(3) This revenue procedure does not establish the correctness of a taxpayer's interpretation of § 274 (n) or characterization of meal and entertainment expenses as expenses excepted from § 274 (n) (1).

(4) This revenue procedure does not preclude the Internal Revenue Service from raising or pursuing any income, employment, or other tax issues identified in the review of a statistical sample.

SECTION 5. EFFECTIVE DATE

This revenue procedure is effective for taxable years ending on or after May 3, 2004. However, with respect to the use of statistical sampling by a taxpayer for a taxable year ending before May 3, 2004, for which the applicable period of limitations has not expired, the Service will permit, but not require, application of this revenue procedure.

SECTION 6. PAPERWORK REDUCTION ACT

The collection of information contained in this revenue procedure has been reviewed and approved by the Office of Management and Budget in accordance with the Paperwork Reduction Act [*12] (44 U.S.C. 3507) under control number 1545-1847.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the collection of information displays a valid OMB control number.

The collection of information in this revenue procedure is in Appendix B. This information is required to ensure compliance with the statistical sampling methodology contained in this revenue procedure. The information will be used to evaluate compliance with the procedures described in this revenue procedure. The collection of information is mandatory. The likely recordkeepers are businesses or other for profit institutions.

The estimated total annual recordkeeping burden is 3200 hours. The estimated annual burden per recordkeeper varies from six to ten hours, depending on individual circumstances, with an estimated average of eight hours. The estimated number of recordkeepers is 400.

Books or records relating to a collection of information must be retained as long as their contents may become material in the administration of any internal revenue law. Generally tax returns and tax return information are confidential, as required by 26 U.S.C. 6103.

DRAFTING INFORMATION

The [*13] principal author of this revenue procedure is Kari L. Fisher of the Office of Associate Chief Counsel (Income Tax and Accounting). For further information regarding this revenue procedure, contact Ms. Fisher at (202) 622-4970 (not a toll-free call). For further information regarding Appendices A, B and C, contact Ed Cohen of the Large and Mid-Size Business Division at (212) 719-6693 (not a toll-free call).

ATTACHMENTS:

APPENDIX A

SAMPLING PLAN STANDARDS

The statistical sampling must be conducted in accordance with the following methodology.

1. Statistical (probability) sampling methodology may not include the use of judgment sampling.

2. Taxpayers may apply the results of a statistical sample only to the taxable years included in the sample.

3. A statistical sample may include data from no more than three consecutive taxable years.

4. Data from a taxable year may be included in only one statistical sample.

5. The estimated amount of expenses not subject to the § 274 (n) (1) limitation must be based on a statistical (probability) sample, in which each sampling unit has a known (non-zero) chance of selection, using either a simple random sampling method or stratified random sampling method.

6. In general, [*14] the computation of the estimated amount of expenses not subject to the § 274 (n) (1) limitation must be at the least advantageous 95% one-sided confidence limit. The "least advantageous" confidence limit is either the upper or lower limit that results in the least benefit to the taxpayer. However, if the precision of the change in the estimated deductible amount of expenses not subject to the § 274 (n) (1) limitation (see paragraph 9 below) divided by the change in the estimated deductible amount of expenses not subject to the § 274 (n) (1) limitation does not exceed 10%, the point estimate may be used in place of the least advantageous confidence limit. All strata for which "substantially all" of the population sampling units are sampled will be treated as 100% strata. That is, the overall point estimate and its precision will be estimated by treating all 100% strata appropriately for the sample design used. Also, the calculation of the denominator for the relative precision will exclude all 100% strata. For this revenue procedure, "substantially all" is defined as 80% or more.

7. Recognizing that many methods exist to estimate population values from the sample data, the Service will [*15] consider acceptable only the following estimators. Variable estimators permitted include the mean (also known as the direct projection method), difference (using "paired variables"), (combined) ratio (using a variable of interest and a "correlated" variable), and (combined) regression (using a variable of interest and a "correlated" variable). The first variable used for the difference, ratio and regression estimators must be the variable used in the mean estimator. The second variable used for the difference, ratio and regression estimators must be a variable that can be paired with the first variable and should be related to the first variable. For example, in a typical audit-sampling situation, the first variable would be the audited value of a transaction and the second variable would be the originally reported value of the same transaction. Since the latter two variable methods are statistically biased, there must be a demonstration that the bias is negligible before the Service will accept the method.

8. Variable sampling plans must use the qualifying final estimate with the smallest overall standard error as an absolute value (for example, the size of the estimate is irrelevant [*16] in the determination of the reported value).

9. Variable sampling plans must calculate confidence limits by addition and subtraction of the precision of the estimate from the point estimate in which the determination of precision proceeds by multiplication of the standard error by (i) the 95% one-sided confidence coefficient based on the Student's t-distribution with the appropriate degrees of freedom, or (ii) 1.645 (the normal distribution), assuming the sample size is at least 100 in each non-100% stratum.

10. For either the (combined) ratio or regression methods, to demonstrate little statistical bias exists, the following applies after excluding all strata tested on 100% basis (the entire population of a stratum is selected for evaluation).

a. The total sample size of all strata must be at least 100 units.

b. Each stratum for a population estimate should contain at least 30 sample units.

c. The coefficient of variation of the paired variable must be 15% or less. The coefficient of variation of the paired variable (y) is defined as the standard error of the total "y" variables divided by point estimate of the total "y" variables when the "y" variables are commonly the reported values [*17] in accounting situations.

d. The coefficient of variation of the primary variable of interest, represented by either the corrected value or the difference between the reported and corrected values in common accounting situations, must be 15% or less. The coefficient of variation for the corrected value (x) is defined as the standard error of the total "x" variables divided by point estimate of the total "x" variables when the "x" variables are commonly the corrected values in accounting situations. The coefficient of variation for the difference (d) between the reported and corrected values (x-y) is defined as the smaller of the standard error of the total "x-y" or total "d" variables divided by the amount equaling total population value represented by "Y" plus point estimate of the total "x-y" or total "d" variables or the standard error of the total "x-y" or total "d" variables divided by the total "x-y" or total "d" variables when the "x-y" variables are commonly the difference ("d") between the reported ("y") and corrected ("x") values in accounting situations.

e. For only the (combined) ratio method, the reported values of units must be of the same sign.

11.When sampling the same [*18] expense accounts for multiple taxable years, if a single projection does not materially affect other computations that are more appropriately, made on a yearly basis, it is permissible to combine the accounts into one population. There should be allocation of the combined result by a reasonable method determined prior to the selection of the sampling units.

12. A written sampling plan is required prior to the execution of a sample: A plan must include the following:

The objective of the plan including a description of the value for estimation and the applicable taxable year(s);

Population definition and reconciliation of the population to the tax return;

Definition of the sampling frame;

Definition of the sampling unit;

Source of the random numbers, the starting point or seed, and the method of selection;

Sample size, along with supporting factors in the determination;

Method to associate random numbers to the frame;

Steps to ensure that the serialization of the frame is independent of the drawing of random numbers;

Steps for evaluating the sampling unit; and

The estimator that was used for appraising the sample.

APPENDIX B

SAMPLING DOCUMENTATION, STANDARDS

The taxpayer must [*19] retain adequate documentation to support the statistical application, sample unit findings, and all aspects of the sample plan and execution. The execution of the sample must include information for each of the following items:

The seed or starting point of the random numbers;

The pairing of random numbers to the frame along with supporting information to retrace the process;

List of sampling units selected and the results of the evaluation of each unit;

Supporting documentation such as notes, invoices, purchase orders, project descriptions, etc., which support the conclusion reached about each sample item;

The calculation of the projected estimate (5) to the population, including computation of the standard error of the estimate (5);

A statement describing any slips or blemishes in the execution of the sampling procedure and any pertinent decision rules; and

Computation of all associated adjustments.

APPENDIX C

TECHNICAL FORMULAS

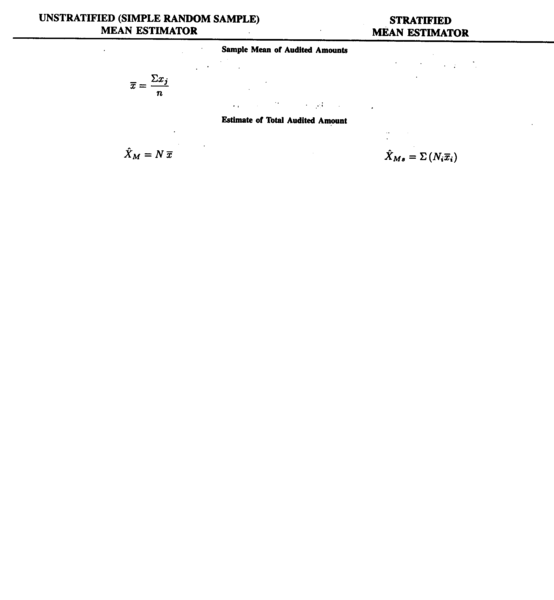

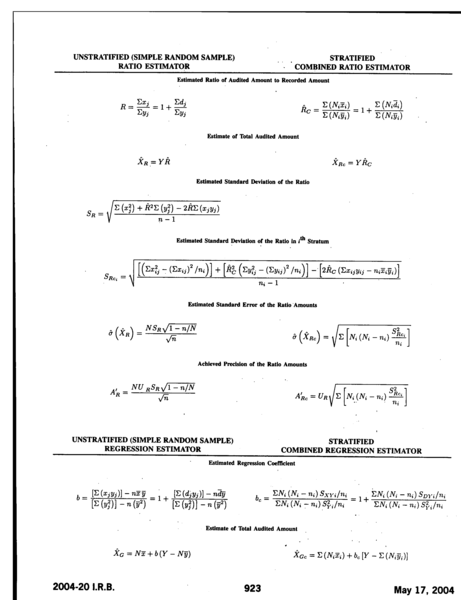

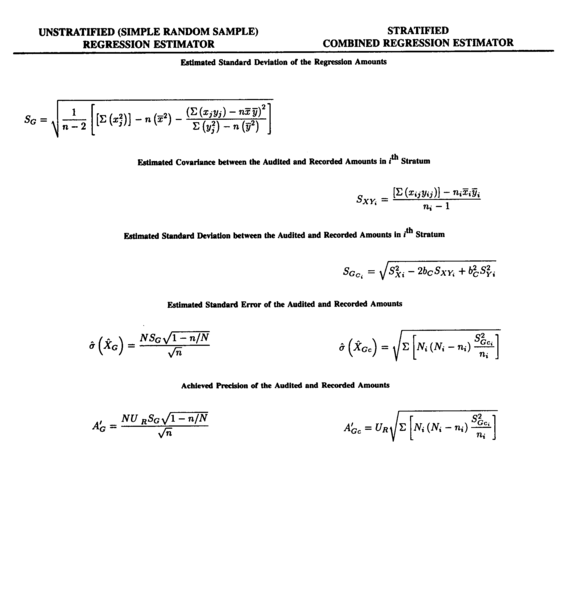

The formulas below are included

to clarify the statistical sampling terms used and to ensure

consistent application of the procedures described in the revenue

procedure.

|

Definition of Symbols |

TERM |

DEFINITION |

Y |

The total value of the variable that is paired with variable of interest. In audit sampling, this would be the total reported value of the population. Typically, this value is known for the entire population and may be estimated based on the probability sample selected. |

D |

The total value of the difference between the "paired" variable and the variable of interest. In audit sampling, this would be the estimated total difference of the population. Typically, this value is not known for the entire population and is estimated based on the probability sample selected. |

UR |

The confidence coefficient which is based on either the Student's t-distribution or the normal distribution. For example, a 95% one-sided confidence coefficient based on the normal distribution is 1.645. This term is often referred to as the t-value and the z-value. |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Department of Treasury |

| File Modified | 0000-00-00 |

| File Created | 2021-01-22 |

© 2026 OMB.report | Privacy Policy