Form 1845-0103 DL PLUS Loan Request for Supplemental Information

William D. Ford Federal Direct Loan Program, Federal Direct PLUS Loan Request for Supplemental Information

1845-0103_DL PLUS Req for Suppl Info 04-19-2017

Federal Direct PLUS Loan Request for Supplemental Information

OMB: 1845-0103

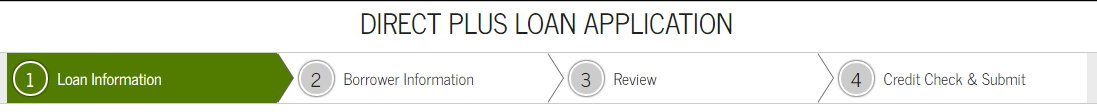

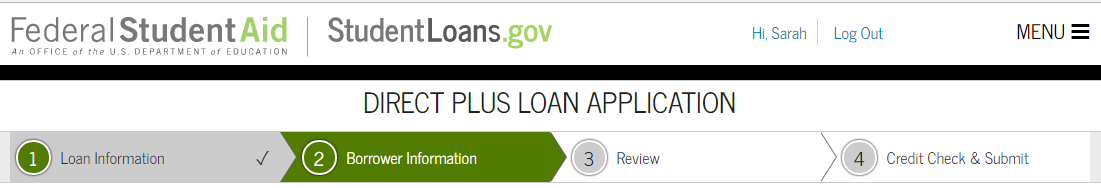

DIRECT PLUS LOAN APPLICATION

[SELECTION PAGE]

William D. Ford Federal Direct Loan Program

Federal Direct PLUS Loan Request for Supplemental Information

This is a request for supplemental information in connection with your application for a Federal Direct PLUS Loan (Direct PLUS Loan) through the William D. Ford Federal Direct Loan (Direct Loan) Program. Some schools may have a different process for obtaining the additional information needed to process your Direct PLUS Loan application.

The information that you provide will be sent to the school that you select. The school you select will use the information collected to determine your eligibility for a Direct PLUS Loan and process your application.

Before you can receive a Direct PLUS Loan, you must complete a Direct PLUS Loan Master Promissory Note (Direct PLUS Loan MPN), which explains all of the terms and conditions of Direct PLUS Loans and constitutes your legally binding agreement to repay all Direct PLUS Loans that you receive under the Direct PLUS Loan MPN. You will have an opportunity to complete the Direct PLUS Loan MPN after you complete the Direct PLUS Loan Request.

The Direct PLUS Loan Request allows you to authorize the school to use your loan funds to satisfy other educationally related charges after tuition and fees, and room and board have been paid. You are not required to provide this authorization.

If you are a parent borrower, the Direct PLUS Loan Request also allows you to:

Designate whether the school pays any credit balance to the student or to you

Request a deferment while the student is in school

Request an additional deferment for 6 months after the student ceases to be enrolled at least half time

Select the type of Direct PLUS Loan Application you would like to complete

[SELECTION POPULATES BORROWER TYPE IN COMPLETED FORM]

Direct PLUS Loan Application for Graduate/Professional Students William D. Ford Federal Direct Loan Program Federal Direct PLUS Loan Request for Supplemental Information

Students must be logged in using their own FSA ID.

Learn More

Preview a read-only version of the Graduate/Professional Direct PLUS Loan Application [OPENS A NEW WINDOW] |

START OMB No. 1845-0103 Form Approved Exp. Date 99/99/9999

|

Direct PLUS Loan Application for Parents William D. Ford Federal Direct Loan Program Federal Direct PLUS Loan Request for Supplemental Information

Parents must be logged in using their own FSA ID.

Learn More

Preview a read-only version of the Parent Direct PLUS Loan Application [OPENS A NEW WINDOW] |

START OMB No. 1845-0103 Form Approved Exp. Date 99/99/9999 |

Some schools may have a different process for obtaining the additional information needed to process your Direct PLUS Loan application. You may verify that your school participates in this process after you select a borrower type below or by contacting the school's financial aid office.

Your school will tell you what loans, if any, you are eligible to receive. If you have questions regarding your loan eligibility, the next steps in the processing of your loan, when the loan will be disbursed (paid out), or no longer wish to receive the loan, contact your school's financial aid office.

[User is directed to this page when the user chooses the “Learn More” link under Direct PLUS Loan Application for Graduate/Professional Students on the selection page. Other paths also bring users to this page.]

DIRECT PLUS LOAN APPLICATION

[GRADUATE/PROFESSIONAL STUDENT LANDING PAGE]

Direct PLUS Loan Application for Graduate/Professional Students

William D. Ford Federal Direct Loan Program

Federal Direct PLUS Loan Request for Supplemental Information

What is a Direct PLUS Loan Application for Graduate/Professional Students?

This is a request for supplemental information in connection with your application for a Federal Direct PLUS Loan (Direct PLUS Loan) through the William D. Ford Federal Direct Loan (Direct Loan) Program. Some schools may have a different process for obtaining the additional information needed to process your Direct PLUS Loan application.

The information that you provide will be sent to the school that you select. The school you select will use the information collected to determine your eligibility for a Direct PLUS Loan and process your application.

Before you can receive a Direct PLUS Loan, you must complete a Direct PLUS Loan Master Promissory Note (Direct PLUS Loan MPN), which explains all of the terms and conditions of Direct PLUS Loans and constitutes your legally binding agreement to repay all Direct PLUS Loans that you receive under the Direct PLUS Loan MPN. You will have an opportunity to complete the Direct PLUS Loan MPN after you complete the Direct PLUS Loan Request.

The Direct PLUS Loan Application allows you to authorize the school to use your loan funds to satisfy other educationally related charges after tuition and fees, and room and board have been paid. You are not required to provide this authorization.

Apply for a PLUS Loan

START

Preview a read-only version of the Graduate/Professional Direct PLUS Loan Direct PLUS Loan Application [Opens a new window]

OMB No. 1845-0103 Form Approved Exp. Date 08/31/2017

|

Who should complete this?

Eligible graduate/professional students

How long will it take?

The entire Direct PLUS Loan Application process must be completed in a single session. It takes approximately 20 minutes to complete the application.

What do I need?

Return to the Direct PLUS Loan Application selection page [Links to selection page]

|

[User is directed to this page when the user chooses the “Learn More” link under Direct PLUS Loan Application for Parents on the selection page. Other paths also bring users to this page.]

DIRECT PLUS LOAN APPLICATION

[PARENT LANDING PAGE]

Direct PLUS Loan Application for Parents

William D. Ford Federal Direct Loan Program

Federal Direct PLUS Loan Request for Supplemental Information

What is a Direct PLUS Loan Application for Parents?

This is a request for supplemental information in connection with your application for a Federal Direct PLUS Loan (Direct PLUS Loan) through the William D. Ford Federal Direct Loan (Direct Loan) Program. Some schools may have a different process for obtaining the additional information needed to process your Direct PLUS Loan application.

The information that you provide will be sent to the school that you select. The school you select will use the information collected to determine your eligibility for a Direct PLUS Loan and process your application.

Before you can receive a Direct PLUS Loan, you must complete a Direct PLUS Loan Master Promissory Note (Direct PLUS Loan MPN), which explains all of the terms and conditions of Direct PLUS Loans and constitutes your legally binding agreement to repay all Direct PLUS Loans that you receive under the Direct PLUS Loan MPN. You will have an opportunity to complete the Direct PLUS Loan MPN after you complete the Direct PLUS Loan Request.

The Direct PLUS Loan Application allows you to authorize the school to use your loan funds to satisfy other educationally related charges after tuition and fees, and room and board have been paid. You are not required to provide this authorization.

As a parent borrower, the Direct PLUS Loan Application also allows you to:

Designate whether the school pays any credit balance to the student or to you.

Request a deferment while the student is in school

Request an additional deferment for 6 months after the student ceases to be enrolled at least half time.

Apply for a PLUS Loan

START

Preview a read-only version of the Parent Direct PLUS Loan Application [OPENS IN A NEW WINDOW]

OMB No. 1845-0103 Form Approved Exp. Date 08/31/2017

|

Who should complete this?

Eligible parents of eligible dependent undergraduate students [LINKS TO THE DEFINITION OF “ELIGIBLE PARENTS”; OPENS IN A NEW WINDOW]

How long will it take?

The entire Direct PLUS Loan Application process must be completed in a single session. It takes approximately 20 minutes to complete the application.

What do I need?

Personal Information [POPUP WITH MORE INFORMATION]

Return to the Direct PLUS Loan Application selection page [LINKS TO SELECTION PAGE]

|

Borrower: [BORROWER NAME] Social Security Number: [XXX-XX-9999] Date of Birth: [XX/XX/9999]

[POPULATED FROM FSAID AND CANNOT BE CHANGED ON STUDENTLOANS.GOV; DISPLAYS THROUGHOUT]

Warning: Any person who knowingly makes a false statement or misrepresentation on this form will be subject to penalties which may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

Select an Award Year [PRESENTED TO ALL]

Award Year: [DROPDOWN]

Student Information [PRESENTED ONLY TO PARENTS]

Select student or enter student information below:

Verify Social Security Number and Date of Birth by clicking in the corresponding text box.

[DROPDOWN]

[PROVIDES A LIST OF STUDENTS WHO HAVE COMPLETED THE FAFAS AND ARE ASSOCIATED WITH THE PARENT; PRE-POPULATES FIELDS IN THIS SECTION WITH THE FAFSA DATA.]

Name More Information [POPUP WITH MORE INFORMATION REQUESTED DATA]

First Name: Middle Initial:

[ENTRY BOX] [ENTRY BOX]

Last Name:

[ENTRY BOX]

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

NAME - MORE INFORMATION Close

Provide words or Roman numerals for the name suffix.

Example: Write the last name as Smith III, instead of Smith 3rd.

If you have only one name, enter it in the Last Name box.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Personal Information

Social Security Number: Date of Birth:

[ENTRY BOX] [MM/DD/YYYY] [ENTRY BOX]

[SOCIAL SECURITY NUMBER AND DATE OF BIRTH DISPLAY WHEN CURSOR IS IN THE ENTRY BOX; MASKED WHEN CURSOR IS OUT OF THE ENTRY BOX]

Permanent Address More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Address (line 1): State:

[ENTRY BOX] [DROPDOWN]

Address (line 2): Zip Code:

[ENTRY BOX] [ENTRY BOX]

City: Country:

[ENTRY BOX] [DROPDOWN]

[CHECKBOX] This is my current permanent address. If permanent address information is incorrect, update as needed.

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

PERMANENT ADDRESS - MORE INFORMATION Close

Enter your permanent address (number, street, apartment number, or rural route number and box number, then city, state, zip/postal code, and country).

If your mailing address is a post office box or general delivery, you must list both your permanent address and your mailing address. (Mailing address isn't required for Income-Driven Repayment, Co-Sign Income-Driven Repayment, or Direct Consolidation Loan applications.)

If you do not have a permanent street address or rural route number and box number, provide the physical location of your residence.

A temporary school address is not acceptable.

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Contact Information

Telephone Number:

[ENTRY BOX]

Request for Deferment While Student is Enrolled in School [PRESENTED ONLY TO PARENTS]

If you select Yes below, your servicer will contact you shortly before your Direct PLUS Loan enters repayment. A Direct PLUS Loan enters repayment on the date the final disbursement of the loan is made. At this time, your servicer will:

(1) Provide you with the complete terms and conditions of the deferment; and

(2) Give you the opportunity to cancel your deferment request and begin making payments on your loan.

Unless you cancel your deferment request, your servicer will grant a deferment on your Direct PLUS Loan that will begin on the date your Direct PLUS Loan enters repayment, and will end on the date the student ceases to be enrolled on at least a half-time basis or, if you request the additional deferment period described below, six months after the student ceases to be enrolled on at least a half-time basis.

During the deferment period, you will not be required to make any payments on your Direct PLUS Loan. However, interest will continue to accrue. You will receive interest statements during the deferment period and may pay the accruing interest at any time. Any interest that you do not pay will be capitalized (added to your loan principal balance) at the end of the deferment period. Capitalization will increase your loan principal amount and the total cost of your loan.

If you select No below, the first payment on your Direct PLUS Loan will be due within 60 days after the date of the last disbursement of the loan. Your servicer will notify you of your payment due date and payment amount. If you later change your mind and decide that you wish to defer payments while the student is in school, you may request a deferment at any time while the student remains enrolled on at least a half-time basis.

Do you want to defer repayment of your Direct PLUS Loan while the student on whose behalf you obtained the loan is enrolled at an eligible school on at least a half-time basis?

[RADIO BUTTON] Yes

[RADIO BUTTON] No

Request for 6-Month Post-Enrollment Deferment [PRESENTED ONLY TO PARENTS]

If you select Yes below, your servicer will contact you shortly before your Direct PLUS Loan enters repayment. A Direct PLUS Loan enters repayment on the date the final disbursement of the loan is made. At this time, your servicer will:

(1) Provide you with the complete terms and conditions of the deferment; and

(2) Give you the opportunity to cancel your deferment request and begin making payments on your loan.

Unless you cancel your deferment request, your servicer will grant a deferment on your Direct PLUS Loan that will begin on the date the student ceases to be enrolled on at least a half-time basis and will end six months after that date.

During the deferment period, you will not be required to make any payments on your Direct PLUS Loan. However, interest will continue to accrue. You will receive interest statements during the deferment period and may pay the accruing interest at any time. Any interest that you do not pay will be capitalized (added to your loan principal balance) at the end of the deferment period. Capitalization will increase your loan principal amount and the total cost of your loan. If you also requested a deferment while the student is enrolled in school on at least a half-time basis, unpaid interest that accrues during both deferment periods will be capitalized only once, at the end of the additional 6-month deferment period.

If you select No below and you requested a deferment while the student is enrolled on at least a half-time basis, the first payment on your Direct PLUS Loan will be due within 60 days after the date the student ceases to be enrolled on at least a half time basis. Your servicer will notify you of your payment due date and payment amount. If you later change your mind and decide that you wish to defer payments for an additional six months after the student ceases to be enrolled on at least a half-time basis, you may request a deferment at any time while the student remains enrolled on at least a half-time basis.

Do you want to defer repayment of your Direct PLUS Loan for 6 months beginning on the date the student ceases to be enrolled on at least a half-time basis?

[RADIO BUTTON] Yes

[RADIO BUTTON] No

Authorization for School to Use Loan Funds to Satisfy Other Charges [PRESENTED ONLY TO PARENTS]

Your Direct PLUS Loan will be applied to the student's school account to pay for tuition and fees, and room and board. By selecting the box below, you authorize the school to use your Direct PLUS Loan to satisfy other educationally related charges that the student incurred at the school. Examples of other charges that may be paid with your authorization include, but are not limited to, library fines, campus parking tickets, lab fees, and charges for minor damage to school property.

You aren't required to provide this authorization. If you provide this authorization, you may revoke or modify the authorization at any time by contacting the school.

[CHECK BOX] I authorize the school to use my Direct PLUS Loan to pay for other educationally related charges that the student incurs at the school, as described above.

Credit Balance Option [PRESENTED ONLY TO PARENTS]

Your Direct PLUS Loan will first be applied to the student's school account to pay for tuition and fees, room and board, and, if you provide authorization, other educationally related charges. Any loan amount that remains after these charges have been paid is called a credit balance. You may choose to have the school pay the credit balance directly to you or to the student.

If there is a credit balance after your Direct PLUS Loan has been applied to the student's school account, to whom do you want the school to pay the credit balance?

[RADIO BUTTON] Me

[RADIO BUTTON] The Student Authorization for School to Use Loan Funds to Satisfy Other Charges

Authorization for School to Use Loan Funds to Satisfy Other Charges [PRESENTED ONLY TO GRADUATE/PROFESSIONAL STUDENT]

Your Direct PLUS Loan will be applied to your school account to pay for tuition and fees, and room and board. By selecting the box below, you authorize the school to use your Direct PLUS Loan to satisfy other educationally related charges that you incurred at the school. Examples of other charges that may be paid with your authorization include, but are not limited to, library fines, campus parking tickets, lab fees, and charges for minor damage to school property.

You are not required to provide this authorization. If you provide this authorization, you may revoke or modify the authorization at any time by contacting the school.

[CHECK BOX] I authorize the school to use my Direct PLUS Loan to pay for other educationally related charges that I incur at the school, as described above.

School and Loan Information [PRESENTED TO ALL]

Select School to Notify

Choose a state: [DROPDOWN] Search school by name: [Select or type] [SEARCH BOX AND DROPDOWN]

|

The

school you selected is participating in the Direct PLUS Loan

application process through StudentLoans.gov.

School Name: [SCHOOL NAME] School Code/Branch: xxxxx School Address: [STREET ADDRESS] [CITY, STATE ZIP] Remove this school |

Loan Amount Requested

For each academic year, you may borrow up to - but not more than - the school's cost of attendance, minus the amount of other financial assistance that you receive. The school determines the cost of attendance based on federal guidelines. It is important not to borrow more than you can afford to repay, even if you are eligible to borrow more.

[RADIO BUTTON] I want to borrow the maximum Direct PLUS Loan amount for which I am eligible, as determined by the school.

[RADIO BUTTON] I would like to specify a loan amount.

Loan Amount Requested: [ENTRY BOX]

(may not exceed the school's cost of attendance, minus other financial assistance that I receive).

[RADIO BUTTON] I don't know the amount I want to borrow. I will contact the school.

[OR THE FOLLOWING IS PRESENTED IF THE BORROWER PREVIOUSLY COMPLETED A PLUS REQUEST FOR THE AWARD YEAR SELECTED (AND THE STUDENT SELECTED, IF A PARENT) AT THE SCHOOL SELECTED]

Reason for Direct PLUS Loan Request

Specify a reason for submitting this Direct PLUS Loan Request:

[RADIO BUTTON] New (I am submitting a new Direct PLUS Loan Request).

[RADIO BUTTON] Change (I am requesting a change to the loan amount specified in a previously submitted Direct PLUS Loan Request).

Select the Direct PLUS Loan Request you want to modify:

Previous Loan Reference Number:

[DROPDOWN LISTING PREVIOUSLY COMPLETED PLUS REQUESTS]

More Information [POPUP WITH MORE INFORMATION ABOUT PREVIOUS REFERENCE NUMBER]

[POPUP WITH MORE INFORMATION ABOUT PREVIOUS REFERENCE NUMBER]

PREVIOUS LOAN REFERENCE NUMBER - MORE INFORMATION Close

The loan reference number(s) that displays is for your previous PLUS Loan Request(s). Your loan reference number(s) was also sent to you by e-mail when you submitted your original Direct PLUS Loan Request. Obtain your Loan Reference Number and review your previous Direct PLUS Loan Request(s). [LINK TO PREVIOUSLY COMPLETED PLUS REQUESTS; OPENS NEW WINDOW]

CLOSE

[POPUP WITH MORE INFORMATION ABOUT PREVIOUS REFERENCE NUMBER]

Loan Amount Requested

For each academic year, you may borrow up to - but not more than - the school's cost of attendance, minus the amount of other financial assistance that you receive. The school determines the cost of attendance based on federal guidelines. It is important not to borrow more than you can afford to repay, even if you are eligible to borrow more.

[RADIO BUTTON] I want to borrow the maximum Direct PLUS Loan amount for which I am eligible, as determined by the school.

[RADIO BUTTON] I would like to specify a new total loan amount.

Previous Loan Amount Requested: [DISPLAYS AMOUNT FROM PLUS REQUEST SELECTED ABOVE]

Total Loan Amount Requested: [ENTRY BOX]

(may not exceed the school's cost of attendance, minus other financial assistance that I receive).

Loan Period More Information [POPUP WITH MORE INFORMATION ABOUT LOAN PERIODS]

Specify the loan period for which you are requesting a Direct PLUS Loan:

Loan Period Requested: [DROPDOWN WITH SCHOOL DEFINED LOAN PERIODS]

[OR THE FOLLOWING IF SCHOOL HASN’T DEFINED LOAN PERIODS]

Loan Period More Information [POPUP WITH MORE INFORMATION ABOUT LOAN PERIODS]

Specify the loan period for which you are requesting a Direct PLUS Loan:

Requested Loan Period Start Date

Month: [DROPDOWN] Year: [DROPDOWN]

Requested Loan Period End Date

Month: [DROPDOWN] Year: [DROPDOWN]

EXIT CONTINUE

Borrower Information [PRESENTED TO ALL]

Loan Default Status [THE BORROWER’S DEFAULT STATUS IS PULLED FROM NSLDS]

Your default status can't be determined at this time. [PRESENTED WHEN NSLDS IS UNAVAILABLE]

[OR]

You aren’t in default on any federal student loans. [PRESENTED WHEN THE BORROWER HAS NO FEDERAL STUDENT LOANS IN DEFAULT PER NSLDS]

Based on information received from the National Student Loan Data System, you aren’t in default on any federal student loans.

[OR]

You are in default on one or more federal student loans. [PRESENTED WHEN THE BORROWER IS IN DEFAULT ON ONE OR MORE FEDERAL STUDENT LOANS PER NSLDS]

Based on information received from the National Student Loan Data System, you are in default on one or more federal student loans.

You aren’t eligible to receive a Direct PLUS Loan. If this information is incorrect or you have made satisfactory repayment arrangements, contact your school to provide supporting documentation.

Citizenship Status [PRESENTED ONLY TO PARENTS] More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[RADIO BUTTON] U.S. Citizen or National

[RADIO BUTTON] Permanent Resident/Other Eligible Non-Citizen

Alien Registration Number: [ENTRY BOX]

[RADIO BUTTON] Neither of the above

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

CITIZENSHIP STATUS - MORE INFORMATION Close

Select the option that corresponds to your citizenship status. If you choose Permanent Resident/Other Eligible Non-Citizen, enter your Alien Registration Number.

"U.S. Citizen" includes citizens of the 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, and the Northern Mariana Islands. "National" includes not only all U.S. citizens, but also citizens of American Samoa and Swain's Island.

"Permanent Resident" means someone who can provide documentation of this status from the U.S. Citizenship and Immigration Services (USCIS). "Other Eligible Non-Citizen" includes individuals who can provide documentation from the USCIS that they are in the United States for a purpose that is not temporary, with the intention of becoming a citizen or permanent resident. This category includes refugees, persons granted asylum, Cuban-Haitian entrants, temporary residents under the Immigration Reform and Control Act of 1986, and others.

NOTE: If your citizenship status is not one of the categories described above, you are not eligible to receive a Direct PLUS Loan.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Permanent Address [PRESENTED TO ALL] More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Address (line 1): State:

[ENTRY BOX] [DROPDOWN]

Address (line 2): Zip Code:

[ENTRY BOX] [ENTRY BOX]

City: Country:

[ENTRY BOX] [DROPDOWN]

[CHECKBOX] This is my current permanent address. If permanent address information is incorrect, update as needed.

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

PERMANENT ADDRESS - MORE INFORMATION Close

Enter your permanent address (number, street, apartment number, or rural route number and box number, then city, state, zip/postal code, and country).

If your mailing address is a post office box or general delivery, you must list both your permanent address and your mailing address. (Mailing address isn't required for Income-Driven Repayment, Co-Sign Income-Driven Repayment, or Direct Consolidation Loan applications.)

If you do not have a permanent street address or rural route number and box number, provide the physical location of your residence.

A temporary school address is not acceptable.

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Is your mailing address different than your permanent address? [PRESENTED TO ALL] More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[RADIO BUTTON] Yes

[RADIO BUTTON] No

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

MAILING ADDRESS QUESTION - MORE INFORMATION Close

If your mailing address is different than your permanent address, you must select 'Yes' and enter your mailing address in the Mailing Address fields.

If your Permanent Address is foreign, select 'Yes' and enter a U.S. Mailing Address, if you have one, in the fields provided.

An answer is required to proceed.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Mailing Address [PRESENTED IF ANSWERS “YES” ABOVE.]

Address (line 1): State:

[ENTRY BOX] [DROPDOWN]

Address (line 2): Zip Code:

[ENTRY BOX] [ENTRY BOX]

City: Country:

[ENTRY BOX] [DROPDOWN]

[CHECKBOX] This is my current mailing address. If mailing address information is incorrect, update as needed.

[THE FOLLOWING DISPLAYS IF ONLY A FOREIGN PERMANENT ADDRESS IS PROVIDED OR A FOREIGN ADDRESS IS PROVIDED FOR BOTH PERMANENT AND MAILING ADDRESSES. A US ADDRESS IS NEEDED FOR CREDIT CHECKS.]

You haven't provided an address within the United States (U.S.). Do you have a U.S. Address? More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[RADIO BUTTON] Yes

[RADIO BUTTON] No

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

U.S. ADDRESS - MORE INFORMATION Close

The address(es) you entered is (are) outside the United States.

If you have a U.S. address you can provide, select "Yes."

If you don't have a U.S. address you can provide, select "No".

An answer is required to proceed.

If you are attending school in the U.S., provide the U.S. address you are using while attending school.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

U.S. Address [PRESENTED IF ANSWERS “YES” ABOVE.]

You indicated that you have an address within the United States. Provide that address as your U.S. Address.

Address (line 1): State:

[ENTRY BOX] [DROPDOWN]

Address (line 2): Zip Code:

[ENTRY BOX] [ENTRY BOX]

City: Country:

[ENTRY BOX] [DROPDOWN]

Contact Information

E-Mail Address: More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[ENTRY BOX]

Confirm E-Mail Address:

[ENTRY BOX]

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

E-MAIL ADDRESS - MORE INFORMATION Close

Enter your preferred e-mail address for receiving communications from StudentLoans.gov. You are not required to provide this information unless you have selected to receive correspondence and/or notifications by e-mail.

If you have chosen to receive correspondence electronically under "Account Settings", any update to the e-mail address will change the e-mail address on file and future correspondence will be sent to the updated e-mail address.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Telephone Number:

[ENTRY BOX]

Mobile Phone Number:

[ENTRY BOX]

Employer's Information More Information [POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[CHECKBOX] I am not employed

Employer's Name: Work Number:

[ENTRY BOX] [ENTRY BOX]

Address (line 1): State:

[ENTRY BOX] [ENTRY BOX]

Address (line 2): Zip Code:

[ENTRY BOX] [ENTRY BOX]

City: Country:

[ENTRY BOX] [ENTRY BOX]

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

EMPLOYER'S INFORMATION - MORE INFORMATION Close

Enter your employer's name and address (street, city, state, zip/postal code, and country).

If you're self-employed, enter the name and address (street, city, state, zip/postal code, and country) of your business.

If you're unemployed, check the box next to "I am not employed."

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

EXIT CONTINUE

Borrower:

[BORROWER

NAME] Social Security

Number: [XXX-XX-9999]

Date of Birth:

[XX/XX/9999]

Borrower:

[BORROWER

NAME] Social Security

Number: [XXX-XX-9999]

Date of Birth:

[XX/XX/9999]

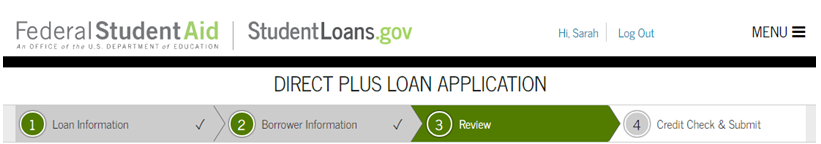

Review all information provided and verify that it is correct.

Award Year Information

Award Year:

9999 - 9999

Student, School and Loan Information Edit [LINK TO EDIT DATA]

First Name: [DATA ENTERED]

Middle Initial: [DATA ENTERED]

Last Name: [DATA ENTERED]

Social Security Number: [XXX-XX-9999]

Student Date of Birth: [99/99/9999]

Permanent Address:

Address (line 1): [DATA ENTERED]

Address (line 2): [DATA ENTERED]

City: [DATA ENTERED]

State/U.S. Territory: [DATA SELECTED]

Zip Code: [DATA ENTERED]

Country: [DATA ENTERED]

Telephone Number: [DATA ENTERED]

Request for Deferment While Student is Enrolled in School

If you select Yes below, your servicer will contact you shortly before your Direct PLUS Loan enters repayment. A Direct PLUS Loan enters repayment on the date the final disbursement of the loan is made. At this time, your servicer will:

(1) Provide you with the complete terms and conditions of the deferment; and

(2) Give you the opportunity to cancel your deferment request and begin making payments on your loan.

Unless you cancel your deferment request, your servicer will grant a deferment on your Direct PLUS Loan that will begin on the date your Direct PLUS Loan enters repayment, and will end on the date the student ceases to be enrolled on at least a half-time basis or, if you request the additional deferment period described below, six months after the student ceases to be enrolled on at least a half-time basis.

During the deferment period, you will not be required to make any payments on your Direct PLUS Loan. However, interest will continue to accrue. You will receive interest statements during the deferment period and may pay the accruing interest at any time. Any interest that you do not pay will be capitalized (added to your loan principal balance) at the end of the deferment period. Capitalization will increase your loan principal amount and the total cost of your loan.

If you select No below, the first payment on your Direct PLUS Loan will be due within 60 days after the date of the last disbursement of the loan. Your servicer will notify you of your payment due date and payment amount. If you later change your mind and decide that you wish to defer payments while the student is in school, you may request a deferment at any time while the student remains enrolled on at least a half-time basis.

Do you want to defer repayment of your Direct PLUS Loan while the student on whose behalf you obtained the loan is enrolled at an eligible school on at least a half-time basis? [ANSWER]

Request for 6-Month Post-Enrollment Deferment

If you select Yes below, your servicer will contact you shortly before your Direct PLUS Loan enters repayment. A Direct PLUS Loan enters repayment on the date the final disbursement of the loan is made. At this time, your servicer will:

(1) Provide you with the complete terms and conditions of the deferment; and

(2) Give you the opportunity to cancel your deferment request and begin making payments on your loan.

Unless you cancel your deferment request, your servicer will grant a deferment on your Direct PLUS Loan that will begin on the date the student ceases to be enrolled on at least a half-time basis and will end six months after that date.

During the deferment period, you will not be required to make any payments on your Direct PLUS Loan. However, interest will continue to accrue. You will receive interest statements during the deferment period and may pay the accruing interest at any time. Any interest that you do not pay will be capitalized (added to your loan principal balance) at the end of the deferment period. Capitalization will increase your loan principal amount and the total cost of your loan. If you also requested a deferment while the student is enrolled in school on at least a half-time basis, unpaid interest that accrues during both deferment periods will be capitalized only once, at the end of the additional 6-month deferment period.

If you select No below and you requested a deferment while the student is enrolled on at least a half-time basis, the first payment on your Direct PLUS Loan will be due within 60 days after the date the student ceases to be enrolled on at least a half time basis. Your servicer will notify you of your payment due date and payment amount. If you later change your mind and decide that you wish to defer payments for an additional six months after the student ceases to be enrolled on at least a half-time basis, you may request a deferment at any time while the student remains enrolled on at least a half-time basis.

Do you want to defer repayment of your Direct PLUS Loan for 6 months beginning on the date the student ceases to be enrolled on at least a half-time basis? [ANSWER]

Authorization for School to Use Loan Funds to Satisfy Other Charges

Your Direct PLUS Loan will be applied to the student's school account to pay for tuition and fees, and room and board. By selecting the box below, you authorize the school to use your Direct PLUS Loan to satisfy other educationally related charges that the student incurred at the school. Examples of other charges that may be paid with your authorization include, but are not limited to, library fines, campus parking tickets, lab fees, and charges for minor damage to school property.

You aren't required to provide this authorization. If you provide this authorization, you may revoke or modify the authorization at any time by contacting the school.

I authorize the school to use my Direct PLUS Loan to pay for other educationally related charges that the student incurs at the school, as described above. [ANSWER]

Credit Balance Option

Your Direct PLUS Loan will first be applied to the student's school account to pay for tuition and fees, room and board, and, if you provide authorization, other educationally related charges. Any loan amount that remains after these charges have been paid is called a credit balance. You may choose to have the school pay the credit balance directly to you or to the student.

If there is a credit balance after your Direct PLUS Loan has been applied to the student's school account, to whom do you want the school to pay the credit balance? [ANSWER]

School Name: [SCHOOL SELECTED]

School Code/Branch: [SCHOOL CODE]

School Address: [SCHOOL ADDRESS]

Reason for Direct PLUS Loan Request: [DATA ENTERED]

Loan Amount Requested: [DATA ENTERED]

Loan Period: [DATA ENTERED]

Borrower Information Edit [LINK TO EDIT DATA]

Loan Default Status [RESULTS FROM NSLDS]

Citizenship Status [DATA ENTERED]

Permanent Address:

Address (line 1): [DATA ENTERED]

Address (line 2): [DATA ENTERED]

City: [DATA ENTERED]

State/U.S. Territory: [DATA ENTERED]

Zip Code: [DATA ENTERED]

Country: [DATA ENTERED]

Contact Information

Telephone Number: [DATA ENTERED]

Mobile Phone Number: [DATA ENTERED]

E-Mail Address: [DATA ENTERED]

Employer's Information

Employer's Name: [DATA ENTERED]

Employer's Address:

Address (line 1): [DATA ENTERED]

Address (line 2): [DATA ENTERED]

City: [DATA ENTERED]

State/U.S. Territory: [DATA ENTERED]

Zip Code: [DATA ENTERED]

Country: [DATA ENTERED]

Work Number: [DATA ENTERED]

EXIT CONTINUE

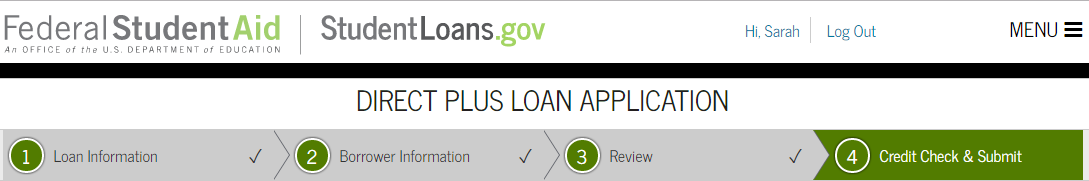

Certifications [PRESENTED TO ALL.]

You must review the IMPORTANT NOTICES before you can continue.

OPEN IMPORTANT NOTICES [POPUP WITH IMPORTANT NOTICES]

You must read and agree to the statements below by clicking on the boxes.

[CHECKBOX] I certify that

(1) the information I have provided on this Direct PLUS Loan Request for Supplemental Information is true, complete, and correct to the best of my knowledge and belief and is made in good faith, and

(2) I have read and understood the entire Direct PLUS Loan Request for Supplemental Information, including the Important Notices.

[CHECKBOX] For the loan that I am requesting by completing this Direct PLUS Loan Request for Supplemental Information, I authorize the U.S. Department of Education to check my credit history for the purpose of determining my eligibility for the loan(s), and to report information about my loan eligibility to persons and organizations permitted by law to receive that information.

Your Direct PLUS Loan Request for Supplemental Information cannot be processed unless you authorize the U.S. Department of Education to check your credit history. One of the eligibility requirements for receiving a Direct PLUS Loan is that you must not have an adverse credit history, unless you meet certain other requirements. The credit decision resulting from your credit decision will be sent to the school that you have selected.

EXIT CONTINUE

[POPUP WITH IMPORTANT NOTICES]

IMPORTANT NOTICES [PRESENTED TO ALL.]

GRAMM-LEACH-BLILEY ACT NOTICE

In 1999, Congress enacted the Gramm-Leach-Bliley Act (Public Law 106-102). This Act requires that lenders provide certain information to their customers regarding the collection and use of nonpublic personal information.

We disclose nonpublic personal information to third parties only as necessary to process and service your loan and as permitted by the Privacy Act of 1974. See the Privacy Act Notice below. We do not sell or otherwise make available any information about you to any third parties for marketing purposes.

We protect the security and confidentiality of nonpublic personal information by implementing the following policies and practices. All physical access to the sites where nonpublic personal information is maintained is controlled and monitored by security personnel. Our computer systems offer a high degree of resistance to tampering and circumvention. These systems limit data access to our staff and contract staff on a “need-to-know” basis, and control individual users’ ability to access and alter records within the systems. All users of these systems are given a unique user ID with personal identifiers. All interactions by individual users with the systems are recorded.

PRIVACY ACT NOTICE

The Privacy Act of 1974 (5 U.S.C. 552a) requires that the following notice be provided to you:

The authority for collecting the requested information from and about you is §451 et seq. of the Higher Education Act (HEA) of 1965, as amended (20 U.S.C. 1087a et seq.) and the authorities for collecting and using your Social Security Number (SSN) are §§428B(f) and 484(a)(4) of the HEA (20 U.S.C. 1078-2(f) and 1091(a)(4)) and 31 U.S.C. 7701(b). Participating in the William D. Ford Federal Direct Loan (Direct Loan) Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

The principal purposes for collecting the information on this form, including your SSN, are to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan (such as a deferment, forbearance, discharge, or forgiveness) under the Direct Loan Program, to permit the servicing of your loan(s), and, if it becomes necessary, to locate you and to collect and report on your loan(s) if your loan(s) become delinquent or in default. We also use your SSN as an account identifier and to permit you to access your account information electronically.

The information in your file may be disclosed, on a case-by-case basis or under a computer matching program, to third parties as authorized under routine uses in the appropriate systems of records notices. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loan(s), to enforce the terms of the loan(s), to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default. To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions. To assist program administrators with tracking refunds and cancellations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal or state agencies. To provide a standardized method for educational institutions to efficiently submit student enrollment status, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

In the event of litigation, we may send records to the Department of Justice, a court, adjudicative body, counsel, party, or witness if the disclosure is relevant and necessary to the litigation. If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.S.C. Chapter 71. Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards. Disclosures may also be made to qualified researchers under Privacy Act safeguards.

FINANCIAL PRIVACY ACT NOTICE

Under the Right to Financial Privacy Act of 1978 (12 U.S.C. 3401-3421), ED will have access to financial records in your student loan file maintained in compliance with the administration of the Direct Loan Program.

PAPERWORK REDUCTION NOTICE

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a currently valid OMB control number. The valid OMB control number for this information collection is 1845-0103. Public reporting burden for this collection of information is estimated to average 0.5 hours (30 minutes) per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. The obligation to respond to this collection is required to obtain or retain a benefit (34 CFR 685.201).

If you have any comments or concerns regarding the status of your individual submission of this form, write directly to:

U.S. Department of Education

Common Origination and Disbursement School Relations Center

Attn: Applicant Services

PO Box 9002

Niagara Falls, NY 14302

CLOSE

[POPUP WITH IMPORTANT NOTICES]

Confirmation [PRESENTED WHEN CREDIT IS APPROVED]

You have successfully submitted a Direct PLUS Loan application and your credit has been approved.

You will receive a confirmation email shortly. The school you selected will be notified within the next 24 hours.

Though your credit has been approved, all other eligibility requirements must be met before your loan can be awarded.

Your school will tell you what loans, if any, you are eligible to receive. If you have questions regarding your loan eligibility, the next steps in the processing of your loan, when the loan will be disbursed (paid out), or no longer wish to receive the loan, contact your school’s financial aid office.

View your completed Direct PLUS Loan applications.

Next Steps Required in the Direct PLUS Loan Process

[PRESENTED TO ALL BORROWER TYPES WHEN THERE IS NO FAFSA FOR THE STUDENT OR NO “AVIALABLE” MPN FOR THE BORROWER (GRAD) OR BORROWER/STUDENT COMBINATION (PARENT)]

Complete an MPN

[PRESENTED TO ALL BORROWER TYPES WHEN THERE IS NO “AVAILABLE” MPN FOR THE BORROWER (GRAD) OR BORROWER/STUDENT COMBINATION (PARENT)]

You don’t have a Direct PLUS Loan MPN on file for [Student’s First Name & Last Name].

If you are borrowing for more than one student, you will need to complete a separate MPN for each student. [PRESENTED TO PARENT WHEN THERE IS NO “AVAILABLE” MPN FOR THE BORROWER/STUDENT COMBINATION (PARENT)]

You don't have a Direct PLUS Loan MPN on file. [PRESENTED TO STUDENT WHEN THERE IS NO “AVAILABLE” MPN]

Loans cannot be disbursed without an accepted Master Promissory Note on file. You may either complete the MPN(s) now, or come back at a later time. [For all users]

Each MPN must be completed in a single session and may take up to 30 minutes to complete. [PRESENTED TO ALL WHEN THERE IS NO “AVAILABLE” MPN ON FILE FOR THE BORROWER (GRAD) OR BORROWER/STUDENT COMBINATION (PARENT)]

Complete a FAFSA® [PRESENTED WHEN THERE IS NO FAFSA ON FILE FOR THE AWARD YEAR SELECTED WHEN COMPLETING THE PLUS REQUEST]

[Student’s First Name and Last Name] doesn’t have a FAFSA® on file for the award year requested. [PRESENTED TO PARENT WHEN THE STUDENT HAS NO FAFSA ON FILE FOR THE AWARD YEAR SELECTED WHEN COMPLETEING THE PLUS REQUEST]

You don't have a FAFSA® on file for the award year requested. [PRESENTED TO THE STUDENT WHEN THERE IS NO FAFSA ON FILE FOR THE AWARD YEAR SELECTED WHEN COMPLETEING THE PLUS REQUEST]

Visit FAFSA.ed.gov for more information. [PRESENTED TO ALL WHEN THERE IS NO FAFSA ON FILE FOR THE AWARD YEAR SELECTED WHEN COMPLETEING THE PLUS REQUEST]

Final Step [PRESENTED WHEN CREDIT IS DENIED]

Based on the credit history returned by the credit agency, we are unable to approve your credit.

You may still borrow a Direct PLUS Loan if you:

• Obtain an endorser [tooltip] and complete PLUS Credit Counseling

or

• Document extenuating circumstances to the satisfaction of the U.S. Department of Education and complete PLUS Credit Counseling.

All other eligibility requirements must also be met before your loan can be awarded and your school will tell you what, if any, loans you are eligible to receive.

How would you like to proceed?

Indicate how you want to proceed by checking the appropriate box below and then clicking "Submit". Your response will be reported to the school that you selected when completing the Direct PLUS Loan Request (application).

[RADIO BUTTON] I want to obtain an endorser. More Information [POPUP WITH MORE INFORMATION ABOUT ENDORSERS]

[POPUP WITH MORE INFORMATION ABOUT ENDORSERS]

I WANT TO OBTAIN AN ENDORSER - More Information [POPUP WITH MORE INFORMATION ABOUT ENDORSERS]

An endorser is someone who agrees to repay your Direct PLUS Loan if you do not repay the loan. If you are a parent borrower, the endorser may not be the student on whose behalf you are requesting a Direct PLUS Loan.

If you choose to obtain an endorser the endorser may complete the Endorser Addendum electronically at this Web site or you may print the endorser addendum and provide it to him or her.

Additionally, you will be required to complete PLUS Credit Counseling once your endorser is accepted and before your loan funds may be made available. All other eligibility requirements must also be met before your loan can be awarded and your school will tell you what, if any, loans you are eligible to receive.

If your endorser chooses to complete the Endorser Addendum electronically, he or she will need:

• An FSA ID

Endorsers must be logged in with their own FSA ID.

• Endorser Code or Award ID and Borrower's Last Name

You must provide your endorser with the endorser code or the award identification number and your last name.

The endorser code will be provided to you in an email. View your completed Direct PLUS Loan applications to obtain the endorser code.

OR

Print a paper Direct PLUS Loan Endorser Addendum for your endorser to complete and mail.

Mail the paper Direct PLUS Loan Endorser Addendum to the following address:

U.S. Department of Education

P.O. Box 9002

Niagara Falls, NY 14302

Or

Overnight the paper Direct PLUS Loan Endorser Addendum to the following address:

U.S. Department of Education

2429 Military Road

Suite 200

Niagara Falls, NY 14304

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[RADIO BUTTON] I want to provide documentation of extenuating circumstances. More Information [POPUP WITH MORE INFORMATION ABOUT EXTENUATING CIRCUMSTANCES]

[POPUP WITH MORE INFORMATION ABOUT EXTENUATING CIRCUMSTANCES]

DOCUMENT EXTENUATING CIRCUMSTANCES - MORE INFORMATION

Document to the satisfaction of the U.S. Department of Education that:

• The information causing the adverse credit decision is incorrect.

OR

• There are extenuating circumstances relating to the adverse credit history. (Note: Endorsers aren't eligible for this option.)

AND

• Complete PLUS Credit Counseling

• All other eligibility requirements must also be met before your loan can be awarded and your school will tell you what, if any, loans you are eligible to receive.

To document extenuating circumstances, provide:

• A statement explaining your extenuating circumstances and how those circumstances relate to your adverse credit history, and

• Documentation supporting your claim.

The Secretary is able to use discretion and, based on your circumstances, consider whether extenuating circumstances allow you to qualify for a loan. All other eligibility requirements must also be met before your loan can be awarded and your school will tell you what, if any, loans you are eligible to receive.

• The information below is a non-exhaustive list of examples of extenuating circumstances.

• If you believe that your situation fits within these examples, or presents a situation that otherwise qualifies for extenuating circumstances, review the information under Proof of Extenuating Circumstances to determine if your circumstances could qualify you for review.

• Review does not guarantee approval.

• Previous approval based on extenuating circumstances doesn’t guarantee further approvals.

• Additional documentation may be required beyond the basic requirements listed below.

• Loss of a job, poor economy, etc. alone are generally not considered extenuating circumstances.

Adverse credit conditions include, but aren't limited to:

[LIST OF ADVERSE CREDIT CRITERIA AND EXAMPLES OF DOCUMENTATION SHOWING EXTENUATING CIRCUMSTANCES]

There may be other documentation required depending on your specific circumstances.

If you have reviewed the information above and no longer wish to document extenuating circumstances, you have the following options:

Obtain an endorser and complete PLUS Credit Counseling. All other eligibility requirements must also be met before your loan can be awarded and your school will tell you what, if any, loans you are eligible to receive.

• Notify the school's financial aid office of your decision.

• Not pursue a Direct PLUS Loan at this time. Contact the school's financial aid office to discuss other options that may be available.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT EXTENUATING CIRCUMSTANCES]

[RADIO BUTTON] I do not want to pursue a Direct PLUS Loan at this time. More Information [POPUP WITH MORE INFORMATION FOR THOSE WHO DON’T PLAN TO TAKE ADDITIONAL ACTIONS TO RECEIVE A PLUS LOAN]

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

I do not want to pursue a Direct PLUS Loan at this time. More Information Close

Contact your school's financial aid office to learn more about your available options.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

[RADIO BUTTON] Undecided. More Inforamtion [POPUP WITH MORE INFORMATION IF UNDECIDED]

POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

UNDECIDED - MORE INFORMATION Close

If you are not sure of your best choice, contact the school's financial aid office to discuss your options.

CLOSE

[POPUP WITH MORE INFORMATION ABOUT REQUESTED DATA]

Under federal law, you're entitled to a free credit report if a company takes adverse action against you, such as denying your application for credit, insurance, or employment, and you ask for your report within 60 days of receiving notice of the action. The notice will give you the name, address, and phone number of the credit reporting company. Otherwise, a credit reporting company may charge you up to $11.00 for another copy of your report within a 12-month period. View Credit Check Details [OPENS IN NEW WINDOW] |

To obtain a copy of your credit report, contact:

|

SUBMIT

[ONCE SUBMITTED, USER IS TAKEN TO A PAGE EXPLAINING MORE ABOUT THE OPTION SELECTED AND PROMTED TO BEGIN NEXT STEPS]

| File Type | application/msword |

| File Title | SECTION A: BORROWER INFORMATION |

| Author | jon.utz |

| Last Modified By | Ingalls, Katrina |

| File Modified | 2017-04-20 |

| File Created | 2017-04-20 |

© 2026 OMB.report | Privacy Policy