SOI-522 E-Help Desk Focus Groups

Cognitive and Psychological Research

SOI-522 Ehelp OMB Attachment FY18 (Focus Group)c

SOI-522 E-Help Desk Focus Groups

OMB: 1545-1349

Invitation Phone Call

INTRO.

Hello, my name is _______ and I am calling on behalf of ICF, a market research firm working with the Internal Revenue Service (the IRS). We are conducting a paid study to gather feedback and opinions on IRS services.

The study will consist of an one hour telephone focus group session on [DATE] from [START TIME]-[END TIME]. We ask that you access the focus group from a computer to use a platform that will allow all participants to view the same screen. If you are eligible and decide to participate, you will receive an electronic gift card stipend of $75. The focus group discussion will be strictly for research, and all of your comments will be held private to the extent covered by law. Would you be interested in participating?

YES – CONTINUE

NO – TERMINATE

//ASK IF INTRO=YES

I’d now like to ask a few questions to see if you meet the criteria that the focus group is looking for…

Q1. Did you access any of the IRS e-Services products (i.e., IRS e-file Application, Taxpayer Identification Number (TIN) Matching Application, Taxpayer Identification Number (TIN) Matching Program, and Transcript Delivery System (TDS) within the past year?

Q2. Do you recall the e-Services registration process that required a re-registration via Secure Access?

Q3. Do you have a computer that you could call in from to access the focus group application?

//ASK IF Q1-3 all=YES

Thank you for answering our questions. Based on your responses, you qualify for the focus group. We would like to invite you to take part in this study. The focus group will be a discussion of taxpayer experiences surrounding the registration process for accessing IRS e-services. You will receive $75 at the end of the focus group for participating.

I’m glad that you will be able to join us! At this point I need to collect or confirm some contact information from you.

First name:

Last name:

Age:

Gender:

Email:

Daytime phone:

Evening phone:

Street:

City:

State:

Zip Code:

READ ONLY IF ASKED

Note: This information is required only as a part of this study. Your information is kept strictly private to the extent allowed by law. Your phone number is required only for a reminder call that will be made prior to the start of the research study).

Thank you. We are only inviting a few people, so if for some reason you are unable to participate, it is very important that you notify us as soon as possible so we can find someone else to take your place. Please call or email XXX if this should happen. We look forward to having you participate on [DATE].

We are required by law to report to you the OMB (Office of Management and Budget) Control Number for this public information request. That number is 1545-1349.

Thank you for your time. We will be in touch again the day before the session to confirm your attendance.

//ASK IF Q1-3=NO

TERM. Thank you very much for your time, and thank you for answering our questions. Unfortunately, based on the requirements, we are not able to extend you an invitation. Perhaps we can include you in a future research session. Have a good [day/evening].

Invitation Email

Subject: Seeking Paid Volunteers for a Telephone/web Focus Group

Greetings,

ICF, a research and consulting firm in the Washington, DC area, conducts customer satisfaction research and focus groups. We are working with the U.S. Internal Revenue Service (IRS) this year to discuss issues and rate satisfaction related to e-Services you may access online. Earlier this year, you completed the e-Help survey after making a call to the e-Help desk and indicated that you would be willing to be contacted about possibly participating in future research. The specific purpose of this focus group is to evaluate the new e-Services authentication process that was implemented in December 2017.

We are seeking qualified individuals to take part in a telephone focus group on [date]. The focus group will begin at [time] [time zone] time and will take approximately one hour. We will provide a toll-free number to dial in to and you will also need access to a computer.

If you are selected, you will receive compensation of $75 after the focus group.

If you are interested and available to take part in this focus group, please respond to this email with the following information or call at [PHONE NUMBER] by [DATE] with the following information:

Your Name

Age

Gender

Please leave your phone number so that we can contact you within a few days to ask you a few questions. If you are selected, we will provide more instructions on how to participate.

On behalf of the IRS, we look forward to hearing from you.

The Paperwork Reduction Act

requires that the IRS display and OMB control number on all public

information requests. The OMB Control Number for this study is

1545-1349 Also, if you have any comments regarding the time

estimates associated with this study or suggestions on making this

process simpler, please write to: [IRS address]

Confirmation Email

Subject: Telephone/web Focus Group Information

Thank you for volunteering to participate in our telephone/web focus group!

This focus group will take about 60 minutes to complete, and we will send you $75 after the completion of the focus groups as a thank you for your time.

We have you scheduled for our focus group on:

Date: [date]

Time: [time] [time zone]

To confirm you will participate:

**Please reply to this email to confirm that you will be participating in this focus group and that you will have access to a computer.**

Prior to participating in the focus group:

Please review the attached Informed Consent document before you call in. This document details how we will use your responses and your rights as a participant in the focus group. Also, please ensure you will have a quiet area to call in from, free from noise and distraction.

Participating in the focus group:

Please call in to the conference line 5 minutes before the focus group is scheduled to start, so that we can be sure to begin the discussion on time.

Call-in Number: [local call-in number] Passcode: [passcode]

You will be greeted by the moderator when you join. Please only use your first name when introducing yourself.

We have only invited a limited number of people to participate in this focus group. If for any reason you cannot attend, please let us know as soon as possible by emailing us at [EMAIL] or calling [PHONE NUMBER]. You can also contact us if you have any questions.

Thank you,

Reminder Email

Subject: Reminder: Telephone/web Focus Group

Hello,

This is a quick reminder that you are scheduled to participate in our telephone/web focus group on [date] at [time] [time zone].

If for any reason you cannot attend, please let us know right away by emailing us at [EMAIL] or calling [PHONE NUMBER].

We look forward to speaking with you!

2018 IRS E-Services Secure Access

Focus Group Moderator Guide

Topic 0: Welcome and Introductions (10 min)

Hello everyone. My name is _______________ and I will be your moderator for this discussion. I work for ICF, a market research firm located just outside of Washington, D.C. We have been asked to speak with you today by the Internal Revenue Service or IRS as you likely know them. Right away, I want to let everyone know that I’m not an IRS employee, and I am not a tax expert. I am here to help guide the discussion as a focus group moderator and ensure we get through the questions we have today. I want to hear your honest opinions about the topics we will discuss today. There are no right or wrong answers to the questions I’m going to ask. Please just relax and enjoy the discussion.

Please keep in mind that your participation in this discussion is completely voluntary. If for any reason you wish to leave the discussion, you may.

Ground Rules

Before we begin, I’d like to review some ground rules for today’s discussion. Ground rules are our guidelines for operating so that we can complete our task in a manner that is respectful of everyone and provides all of you with the opportunity to express your thoughts safely and confidentially.

The OMB Control Number for this study is 1545-1349. If you have any comments concerning the time estimates associated with this study or on how to make this process simpler, we will provide this address to you at the completion of our discussion.

Everything that you say will be kept private to the extent allowed by law. We will use first names only and names will not be used in any report. Again, all of your comments will be held private to the extent allowed by the law, so please feel free to tell me what you think.

Your participation in this session is entirely voluntary. You have been invited here to offer your views and opinions so everyone’s participation is important. You do not have to answer any questions that you do not wish to answer but please keep in mind, there are no wrong answers.

Please speak one at a time.

It’s okay to be critical. I want to hear your views and opinions about whether you like or dislike something. You do not have to reach a consensus, but please be respectful of each other’s opinions.

This session will be audiotaped. This allows us to capture everything that is being said today, and we will include the information in a report to our client. However, we will not tie your name to anything specific you say today.

There are people who are listening into the discussion. Some are coworkers of mine listening in to take notes on the discussion. Others are from the IRS and are simply listening to hear things first hand before the report comes out; they have all signed an observer confidentiality agreement.

Again, all of your answers will remain private to the extent allowed by law, so feel free to say exactly what is on your mind. Nothing will be attributed to any particular person in our report.

You may excuse yourself from the conversation at any time for any reason.

Because we’re on the phone, I ask that you say your first name before speaking so I know who is speaking. I may call on those I haven’t heard from in a while.

General Understanding

We’re here today because the IRS wants to know more about your experiences with e-Services. E-Services is a suite of web-based tools that allow tax professionals, reporting agents, mortgage industry and payers to complete transactions online with the IRS. These services are only available to approved IRS business partners and not to the public. The tools include, IRS e-file Application, Taxpayer Identification Number (TIN) Matching Application, Taxpayer Identification Number (TIN) Matching Program, and Transcript Delivery System (TDS). The e-Help Desk assistors are responsible for providing quality service to external customers who may encounter problems or need information about e-Services products.

Are there any questions before we get started?

Topic 1: Use of Websites for Information (5 min)

To get us started, let’s simply introduce ourselves, where you’re calling from, and what you do.

[participants introduce themselves]

Let’s start by talking about your time spent online. What are some websites that you visit on a regular basis?

What websites do you use to gain information about U.S. taxes? IRS website? Others?

How often do you visit the IRS website, IRS.gov?

Where did you go or what were you looking for on the IRS.gov site?

Were you able to find information that pertained to you?

How often do you access the e-Services page of the IRS website?

What products do you access? [e-file application, TIN application, TIN Matching program, Transcript Delivery System, etc]

Were you able to find information that pertained to you?

How often do you contact the e-Help line for assistance?

If called helpline:

What issues have you called about?

How satisfied have you been with the assistance you were given? Were your issues resolved?

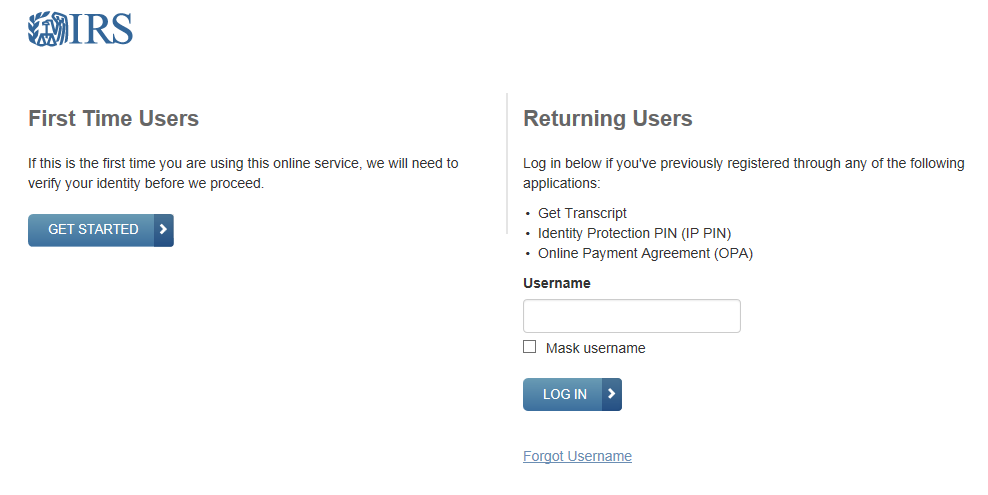

Topic 2: Secure Access (40 min)

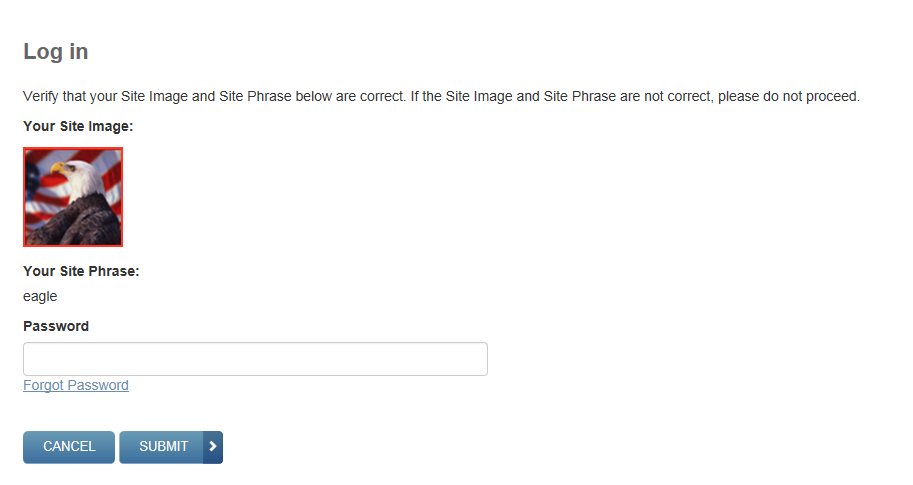

As you may be aware, as of December 10, 2017, all e-Services users had to re-register and create new accounts using a more rigorous two-factor authentication process called Secure Access. This meant that before accessing certain IRS online self-help tools, users had to go through several steps in the registration process to authenticate their identities. Thereafter, each time registered users return to the tool, they must enter both their credentials (username and password) plus a security code sent via mobile phone text or the IRS2Go app to receive a security code within the IRS2Go app. We are interested in finding out more about how this new secure access registration process may have impacted you.

How many of you remember having to re-register in order to access products on the IRS e-Services page?

If needed: You would have had to create new accounts if you accessed any e-Services products (i.e., IRS e-file Application, Taxpayer Identification Number (TIN) Matching Application, Taxpayer Identification Number (TIN) Matching Program, and Transcript Delivery System (TDS)) after December 10, 2017

What do you remember about the registration process?

In general, did you find registration easy/challenging? Why?

Did you have any technical challenges with the website? (as suggested on the landing page of e-Services on IRS.gov it is best to use the supported browser)

How long did the registration process take? Were you able to complete it in one sitting?

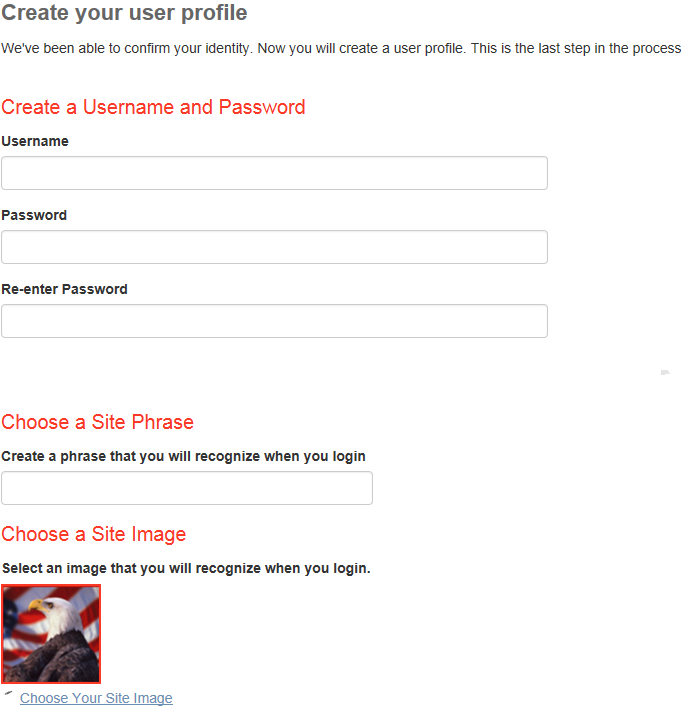

Now we are going to look at a series of screen shots from the registration process. To jog your memory, these first four screenshots are what you would see when initiating the registration process:

You enter your current username.

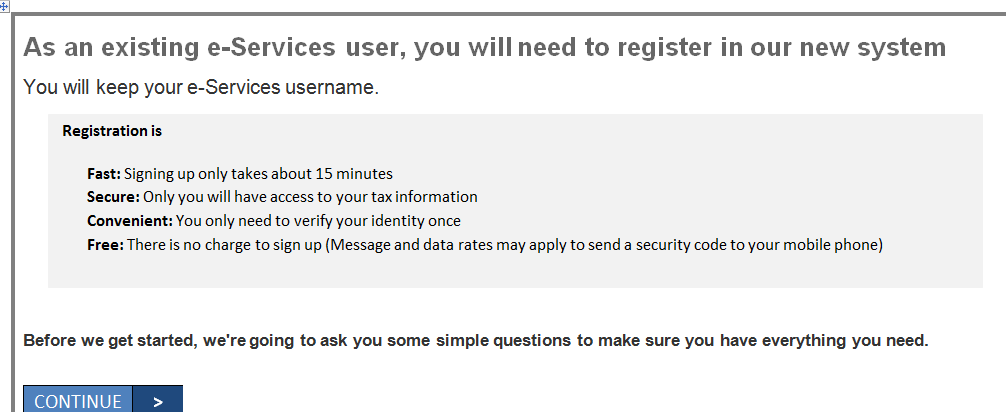

The next screen informs you that you need to register in the new system.

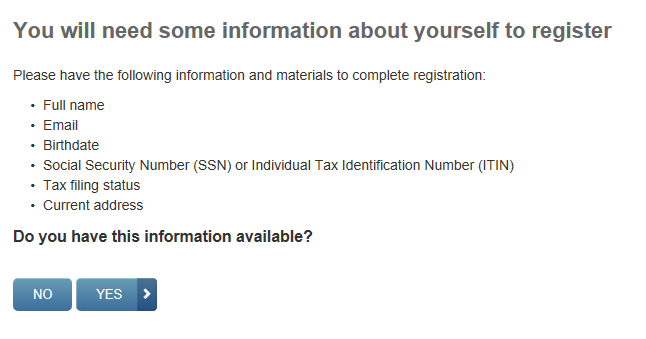

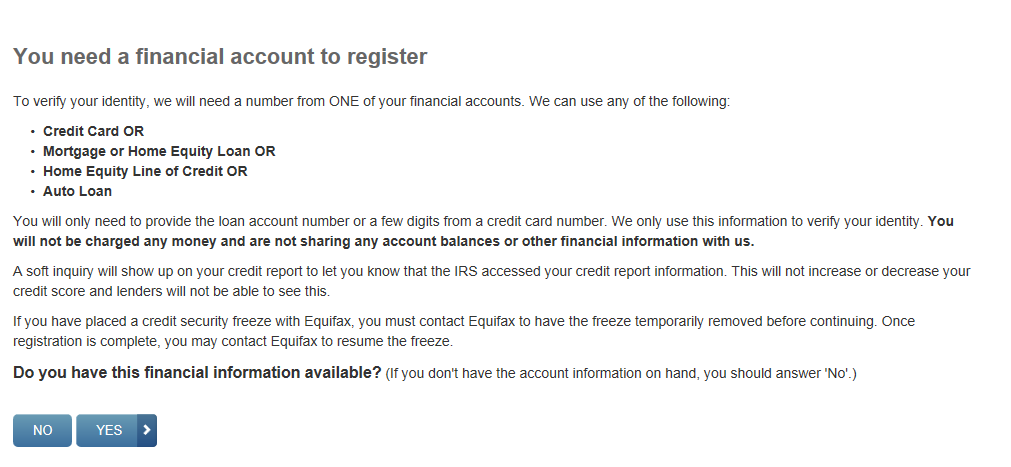

The following 3 screen shots show the pages with the information you will be asked to provide

Verifying identity

Required info to register

Getting assistance with registration

The username from an existing legacy account must meet the requirements of the newer Secure Access. If you are not prompted to update the invalid username, then you need to call our help desk to resolve the issue. Did anyone experience this? Please tell us about your experience.

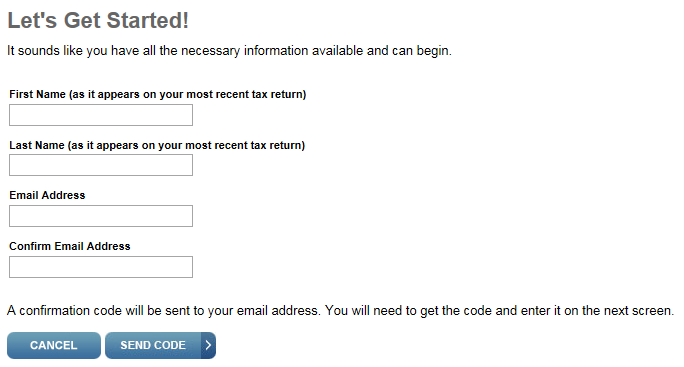

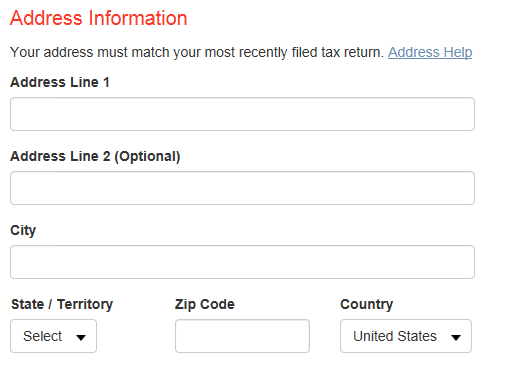

The registration process starts with you having to provide some basic contact information:

Did anyone have issues completing this first part of the registration (i.e., providing name, and email)?

If yes: What issues did you experience?

The next step in the process is entering the confirmation code that would have been sent to your email:

Did anyone have issues completing this first part of the registration (i.e., receiving you’re the email with confirmation code and entering it in the box as shown above)?

If yes: What issues did you experience?

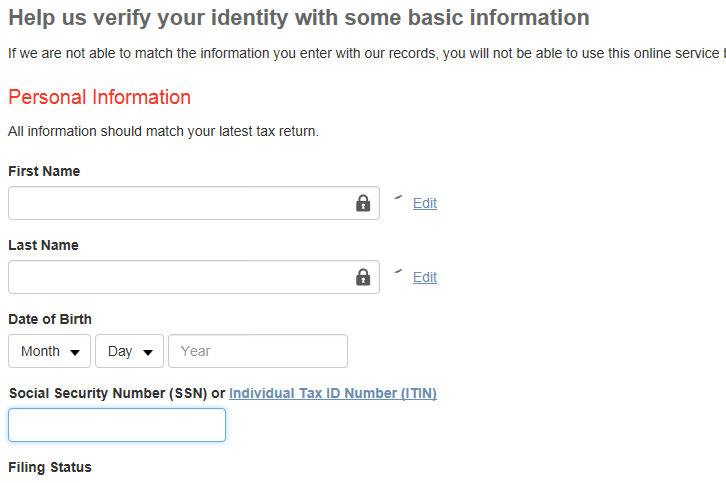

The next step in the process is entering basic identity information:

Did anyone have issues completing this part of the registration (i.e, providing personal and address information)?

If yes: What issues did you experience?

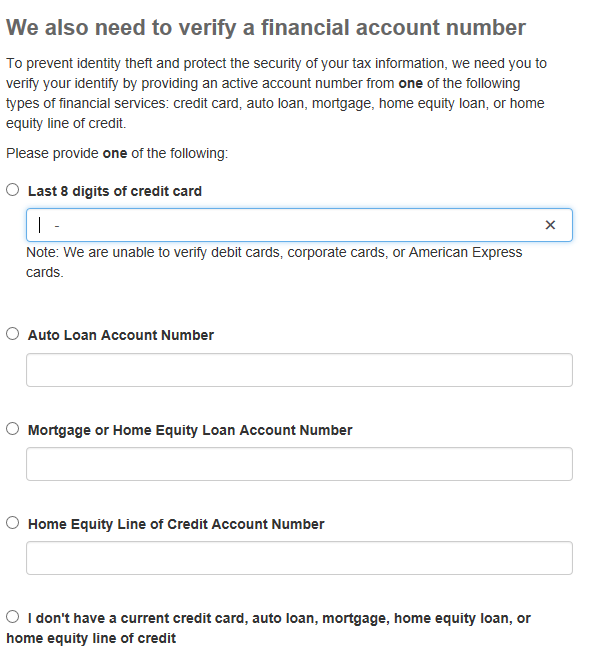

The next step in the process is verifying financial information:

Did anyone have issues completing this part of the registration (i.e., providing financial information)?

If yes: What issues did you experience?

How readily available is this information for you?

Which option did you choose to provide? Why did you choose this option over the other options?

Did anyone have to lift a credit freeze with Experian? If so, how did this affect your registration process?

Currently, you cannot make multiple attempts to pass this financial validation step with the same account number. Accounts will lock for 72 hours and then 90 days at this time. Has anyone experienced this? Please tell us about your experience.

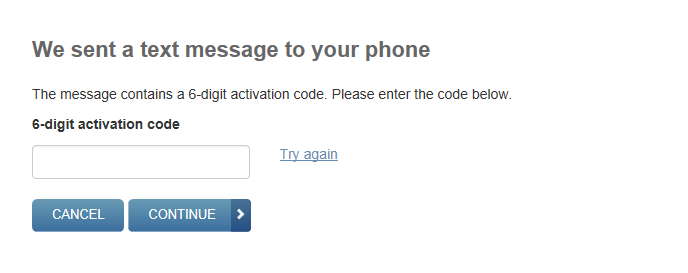

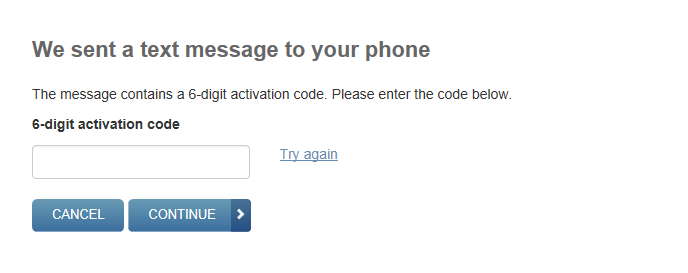

The final step in the process is verifying your phone number. You can either enter your phone number to receive a 6 digit code by text or request to have the 6 digit code sent via mail:

Once you select to receive a text, the 6 digit code is sent to your phone and you enter it on the screen below:

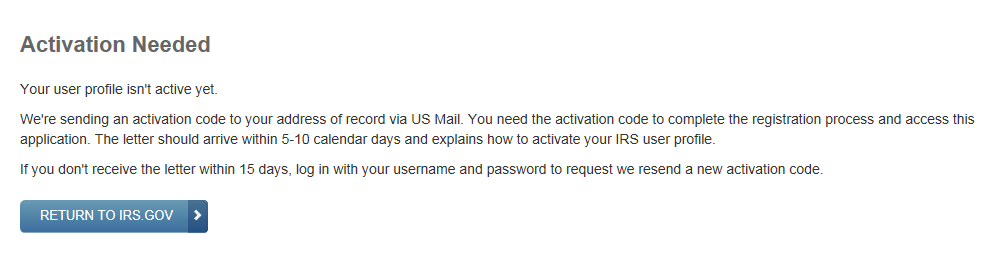

If you select to have the code sent by mail, you are notified that a code will be mailed to the address that is on file:

How many of you opted to receive the 6 digit code via text message? What about via mail?

If you completed registration by text:

Did you receive the text right away?

If you completed your registration by mail:

How did you feel about this?

When did you receive your activation code in the mail?

Were the steps you needed to take to finish the registration process clear to you?

This step requires your name to be associated with your mobile account, and cannot accommodate prepaid plans. Has this been an issue for anyone?

Did anyone have any other issues completing this part of the registration (i.e., receiving the 6 digit code to complete registration via text message or mail)?

If yes: What issues did you experience?

The final step in registering is to log back in with your existing username and a new password. If you had received your 6 digit code via text, this is the final step in registering.

[Mail activators only. Questions for these people resume on following page in red]: If you had opted to receive your 6 digit code by mail, you would enter your existing username and new password, but there are additional steps after this.

Did anyone have issues completing this part of the registration (i.e., issues with username, password, etc)?

If yes: What issues did you experience?

[Ask the following questions if any participants had received their code via mail]

After entering your username and new password, you are notified that your 6 digit code will be sent in the mail.

After you receive the code and return to the website, you are prompted to enter your username and password.

You are then prompted to insert your 6 digit activation code from the IRS mailing.

Did anyone have issues completing this part of the registration (i.e., issues with remembering their username, creating a password, entering activation code, etc)?

If yes: What issues did you experience?

If you forgot your password, there is a “forgot password” feature. Did anyone use this feature?

If yes: Did anyone have issues with this?

After entering the activation code, the final part of the registration process is entering a mobile number or setting up a security code via the IRS2Go app.

Receiving the code via text:

Receiving the code IRS2Go app:

How many of you completed the registration with a text message? What about the IRS2Go app?

If app: Did you experience any issues with this process?

Did anyone have issues completing this part of the registration (i.e., issues with receiving the text, accessing the code via the app, etc)?

If yes: What issues did you experience?

False Close (5 min)

Tell participants that you are going to speak with observers to see whether they have any follow-up questions. Check email for questions you need to follow-up on.

Closing

This concludes today’s session. On behalf of the IRS, I wish to thank all of you for your participation today. As I mentioned at the beginning:

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1349. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please let us know and we can email you the address to:

Internal Revenue Service

Special Services Committee,

SE: W:CAR:MP:T:M:S – Room 6129, 1111 Constitution Avenue, NW,

Washington, DC 20224

Before we go, is there anything else anyone would like to add?

Thanks again!

Page |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Patti Davis-Smith |

| File Modified | 0000-00-00 |

| File Created | 2021-01-20 |

© 2026 OMB.report | Privacy Policy