Attachment 1

2559ss02-Attachment 1_Manufacturing industry wage rates 2010-16.xlsx

Procedures for Chemical Risk Evaluation under TSCA (Final Rule)

Attachment 1

OMB: 2070-0202

⚠️ Notice: This form may be outdated. More recent filings and information on OMB 2070-0202 can be found here:

Document [xlsx]

Download: xlsx | pdf

2016 Loaded Industrial Rate

Ref 2016 Loaded Industrial Rate

2015 Loaded Industry Rate

Ref 2015 Loaded Industry Rates

2014 Loaded Industry Rate

Ref 2014 Loaded Industry Rates

2013 LIR with Sept Correction

Ref 2013 LIR with Sept Corr

2013 Loaded Ind Wage Rates

2013 Reference

2012 Loaded Ind Wage Rates

2012 Reference

2011 Loaded Ind Wage Rates

2011 Reference

2010 Loaded Ind Wage Rates

2010 Reference

Overview

TREND2016 Loaded Industrial Rate

Ref 2016 Loaded Industrial Rate

2015 Loaded Industry Rate

Ref 2015 Loaded Industry Rates

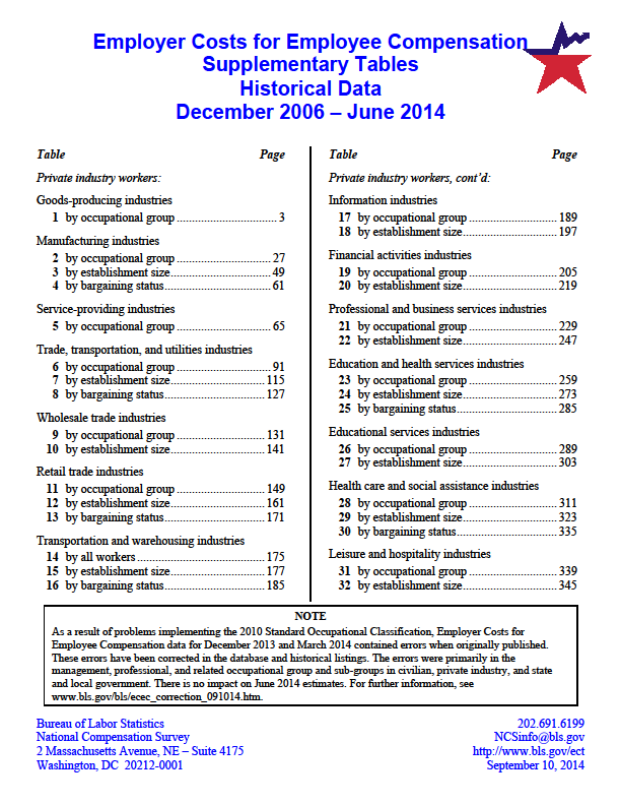

2014 Loaded Industry Rate

Ref 2014 Loaded Industry Rates

2013 LIR with Sept Correction

Ref 2013 LIR with Sept Corr

2013 Loaded Ind Wage Rates

2013 Reference

2012 Loaded Ind Wage Rates

2012 Reference

2011 Loaded Ind Wage Rates

2011 Reference

2010 Loaded Ind Wage Rates

2010 Reference

Sheet 1: TREND

| Year | Managerial | Technical | Clerical |

| 2010 | $77.77 | $67.59 | $30.35 |

| 2011 | $70.73 | $64.66 | $29.86 |

| 2012 | $72.88 | $64.39 | $29.51 |

| 2013 | $77.82 | $64.55 | $30.35 |

| 2014 | $80.22 | $72.22 | $31.26 |

| 2015 | $81.18 | $75.89 | $33.66 |

| 2016 | $83.26 | $78.40 | $34.26 |

Sheet 2: 2016 Loaded Industrial Rate

| Table x: Industry Wage Rates (2016$) | ||||||||

| Labor Category | Data Series a | Date | Wage | Fringe Benefit | Fringes as % Wage | Over-head % wage b | Fringe + Overhead Factor c | Hourly Loaded Wages d |

| (a) | (b) | (c) =(b)/(a) | (d) | (e)=(c)+(d)+1 | (f)=(a)×(e) | |||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec-16 | $50.09 | $24.65 | 49% | 17% | 1.66 | $83.26 |

| Professional / Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec-16 | $45.66 | $24.98 | 55% | 17% | 1.72 | $78.40 |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec-16 | $20.29 | $10.52 | 52% | 17% | 1.69 | $34.26 |

| Footnotes | ||||||||

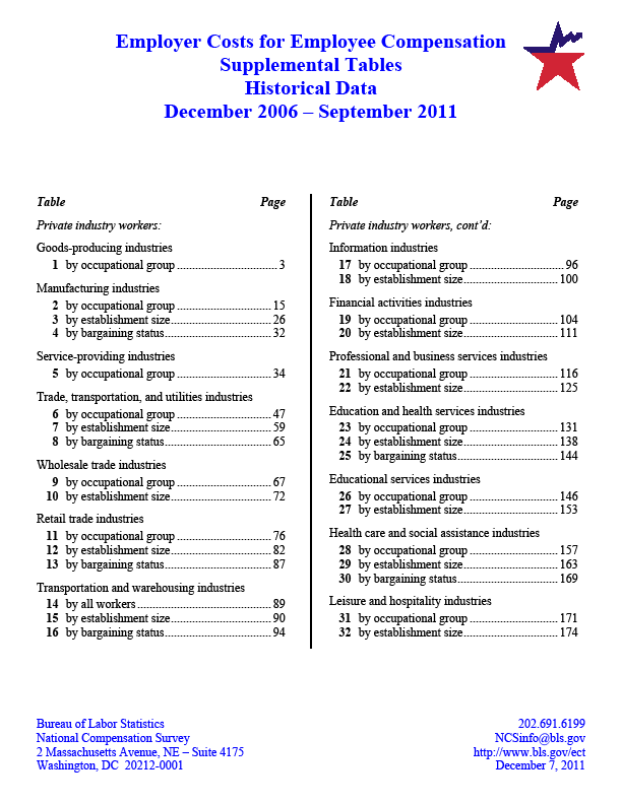

| a Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006 – December 2016 (U.S. Bureau of Labor Statistics, 2017). | ||||||||

| b An overhead rate of 17% is used based on assumptions in Wage Rates for Economic Analysis of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (U.S. EPA, 2002). | ||||||||

| c The inflation factor of “1” in the formula for calculating the fringe + overhead factor means wage data are not escalated to reflect inflation. | ||||||||

| d Wage data are rounded to the closest cent in this analysis. | ||||||||

| Reference Filenames (accessed 3/22/17): | ||||||||

| 1. Dec 2016 Ind wage rate source.pdf | ||||||||

| 2. Wage Rates for the Economic Analysis of the Toxics Release Inventory.pdf | ||||||||

| 3. Revised Economic Analysis for the Amended Inventory Update Rule.pdf | ||||||||

Sheet 3: Ref 2016 Loaded Industrial Rate

| BLS site: | |||

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | |||

| Navigation to BLS site (on date of Access, March 21, 2017): | |||

| 1 | From www.bls.gov | (you are looking for the National Compensation Survey) | |

| 2 | ---hold curser over "Subjects" then "Pay and Benefits" - select "Employment Costs" | ||

| 3 | ---naviagate to "ECT Publications" (by scrolling or link) | ||

| Select "All NCS Publications (including benefits, compensation costs, and wages) »" | |||

| 4 | Under "COMPENSATION COST TREND PUBLICATIONS": | ||

| Select ECEC Supplemental Tables Historical Data, December 2006 Forward [PDF] [TXT]" | |||

| Recommended Reference listings for sources in Footnotes: | |||

| 1. U.S. Bureau of Labor Statistics. (2015). Employer Costs for Employee Compensation Supplementary Tables: December 2006 – December 2015. Retrieved March 21, 2016, from http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | |||

| 2. Rice, C. (2002). Wage Rates for Economic Analysis of the Toxic Release Inventory Program. Washington, D.C.: U.S. EPA, Office of Pollution Prevention and Toxics, Economics and Policy Analysis Branch. | |||

| 3. U.S. EPA. (2002). Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPA-HQ-OPPT-2002-0054-0279). Washington, D.C.: Office of Pollution Prevention and Toxics, Economics and Policy Analysis Branch. | |||

| Reference Filenames: | |||

| 1. Dec 2016 Ind wage rate source.pdf | |||

| 2. Wage Rates for the Economic Analysis of the Toxics Release Inventory.pdf | |||

| 3. Revised Economic Analysis for the Amended Inventory Update Rule.pdf |

Sheet 4: 2015 Loaded Industry Rate

| Table x: Industry Wage Rates (2015$) | ||||||||

| Labor Category | Data Series a | Date | Wage | Fringe Benefit | Fringes as % Wage | Over-head % wage b | Fringe + Overhead Factor c | Hourly Loaded Wages d |

| (a) | (b) | (c) =(b)/(a) | (d) | (e)=(c)+(d)+1 | (f)=(a)×(e) | |||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec-15 | $48.66 | $24.25 | 50% | 17% | 1.67 | $81.18 |

| Professional / Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec-15 | $44.06 | $24.34 | 55% | 17% | 1.72 | $75.89 |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec-15 | $19.91 | $10.37 | 52% | 17% | 1.69 | $33.66 |

| Footnotes | ||||||||

| a Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006 – December 2015 (U.S. Bureau of Labor Statistics, 2016). | ||||||||

| b An overhead rate of 17% is used based on assumptions in Wage Rates for Economic Analysis of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (U.S. EPA, 2002). | ||||||||

| c The inflation factor of “1” in the formula for calculating the fringe + overhead factor means wage data are not escalated to reflect inflation. | ||||||||

| d Wage data are rounded to the closest cent in this analysis. | ||||||||

| Reference Filenames: | ||||||||

| 1. Dec 2015 Ind wage rate source.pdf | ||||||||

| 2. Wage Rates for the Economic Analysis of the Toxics Release Inventory.pdf | ||||||||

| 3. Revised Economic Analysis for the Amended Inventory Update Rule.pdf | ||||||||

Sheet 5: Ref 2015 Loaded Industry Rates

| BLS site: | |||

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | |||

| Navigation to BLS site (on date of Access, March 21, 2016): | |||

| 1 | From www.bls.gov | (you are looking for the National Compensation Survey) | |

| 2 | ---hold curser over "Subjects" then "Pay and Benefits" - select "Employment Costs" | ||

| 3 | ---naviagate to "ECT Publications" (by scrolling or link) | ||

| Select "All NCS Publications (including benefits, compensation costs, and wages) »" | |||

| 4 | Under "COMPENSATION COST TREND PUBLICATIONS": | ||

| Select ECEC Supplemental Tables Historical Data, December 2006 Forward [PDF] [TXT]" | |||

| Recommended Reference listings for sources in Footnotes: | |||

| 1. U.S. Bureau of Labor Statistics. (2015). Employer Costs for Employee Compensation Supplementary Tables: December 2006 – December 2015. Retrieved March 21, 2016, from http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | |||

| 2. Rice, C. (2002). Wage Rates for Economic Analysis of the Toxic Release Inventory Program. Washington, D.C.: U.S. EPA, Office of Pollution Prevention and Toxics, Economics and Policy Analysis Branch. | |||

| 3. U.S. EPA. (2002). Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPA-HQ-OPPT-2002-0054-0279). Washington, D.C.: Office of Pollution Prevention and Toxics, Economics and Policy Analysis Branch. | |||

| Reference Filenames: | |||

| 1. Dec 2015 Ind wage rate source.pdf | |||

| 2. Wage Rates for the Economic Analysis of the Toxics Release Inventory.pdf | |||

| 3. Revised Economic Analysis for the Amended Inventory Update Rule.pdf |

Sheet 6: 2014 Loaded Industry Rate

| Table x: Industry Wage Rates | ||||||||||

| Labor Category | Data Sources a | Date | Wage | Fringe Benefit | Fringes as % Wage | Over-head % wage b | Fringe + Overhead Factor c | Loaded Wages d | Total Compensation | |

| (a) | (b) | (c) =(b)/(a) | (d) | (e)=(c)+(d)+1 | (f)=(a)×(e) | |||||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec-14 | $47.90 | $24.18 | 50% | 17% | 1.67 | $80.22 | $72.08 | |

| Professional / Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec-14 | $42.19 | $22.86 | 54% | 17% | 1.71 | $72.22 | $65.05 | |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec-14 | $18.68 | $9.40 | 50% | 17% | 1.67 | $31.26 | $28.08 | |

| Footnotes | ||||||||||

| a Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006 – December 2014 (U.S. Bureau of Labor Statistics, 2015). | ||||||||||

| b An overhead rate of 17% is used based on assumptions in Wage Rates for Economic Analysis of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (U.S. EPA, 2002). | ||||||||||

| c The inflation factor of “1” in the formula for calculating the fringe + overhead factor means wage data are not escalated to reflect inflation. | ||||||||||

| d Wage data are rounded to the closest cent in this analysis. | ||||||||||

Sheet 7: Ref 2014 Loaded Industry Rates

| BLS site: | |||

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | |||

| Navigation to BLS site (on date of Access, March 19, 2015): | |||

| 1 | From www.bls.gov | (you are looking for the National Compensation Survey) | |

| 2 | ---hold curser over "Subjects" then "Pay and Benefits" - select "Employment Costs" | ||

| 3 | ---naviagate to "ECT Publications" (by scrolling or link) | ||

| Select "All NCS Publications (including benefits, compensation costs, and wages) »" | |||

| 4 | Under "COMPENSATION COST TREND PUBLICATIONS": | ||

| Select ECEC Supplemental Tables Historical Data, December 2006 Forward [PDF] [TXT]" | |||

| Recommended Reference listings for sources in Footnotes: | |||

| 1. U.S. Bureau of Labor Statistics. (2015). Employer Costs for Employee Compensation Supplementary Tables: December 2006 – December 2014. Retrieved March 19, 2015, from http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | |||

| 2. Rice, C. (2002). Wage Rates for Economic Analysis of the Toxic Release Inventory Program. Washington, D.C.: U.S. EPA, Office of Pollution Prevention and Toxics, Economics and Policy Analysis Branch. | |||

| 3. U.S. EPA. (2002). Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPA-HQ-OPPT-2002-0054-0279). Washington, D.C.: Office of Pollution Prevention and Toxics, Economics and Policy Analysis Branch. | |||

| Reference Filenames: | |||

| 1. Dec 2014 Ind wage rate source.pdf | |||

| 2. Wage Rates for the Economic Analysis of the Toxics Release Inventory.pdf | |||

| 3. Revised Economic Analysis for the Amended Inventory Update Rule.pdf |

Sheet 8: 2013 LIR with Sept Correction

| Table : Loaded Industry Wage Rates (December 2013) | ||||||||||

| EPAB Labor Category | Data Sourcesd | Date | Wage | Fringe Benefit | Fringes as % wage | Over-head % wageb | Fringe + overhead factorc |

Loaded Wagesa | Total Compensation | |

| (A) | (B) | (C) =(B)/(A) | (D) | (E) =(C)+(D)+1 | (F) =(A)*(E) | |||||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec '13 | $46.21 | $23.70 | 51.29% | 17% | 1.68 | $77.77 | $69.91 | |

| Professional/ Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec '13 | $39.70 | $21.14 | 53.25% | 17% | 1.70 | $67.59 | $60.84 | |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec '13 | $18.05 | $9.23 | 51.14% | 17% | 1.68 | $30.35 | $27.28 | |

| Notes: | ||||||||||

| a Wage data are rounded to the closest cent in this table; however, in calculations using these numbers for this report, unrounded values were used. | ||||||||||

| b An overhead rate of 17% was used based on assumptions in Wage Rates for Economic Analyses of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPAB, 2002). | ||||||||||

| c An inflation factor of “1” means wage data were not escalated to reflect inflation. | ||||||||||

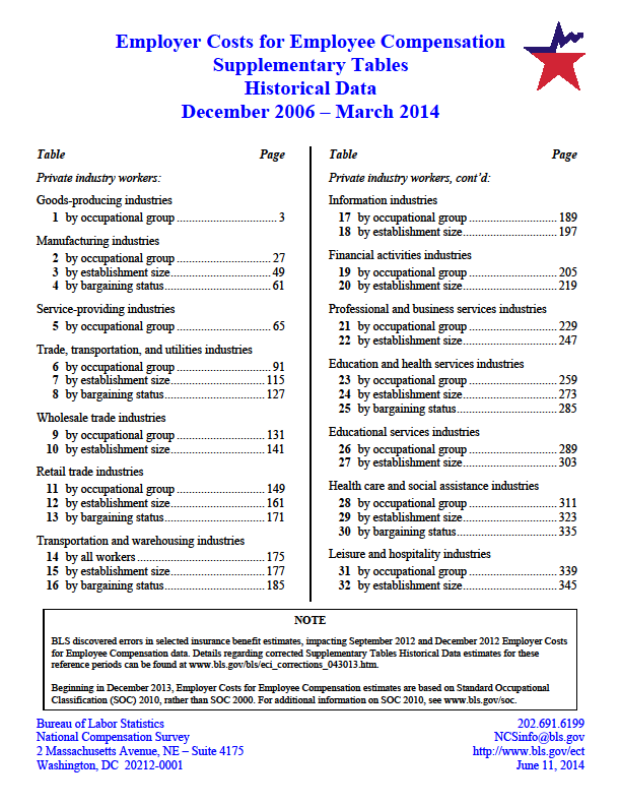

| d Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006-March 2014, US Bureau of Labor Statistics,September 10, 2014 (pp 31,33,37) (http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf, accessed October 23, 2014). | ||||||||||

Sheet 9: Ref 2013 LIR with Sept Corr

| notice of correction: | http://www.bls.gov/bls/ecec_correction_091014.htm | |||||||

| revised reference document: | ||||||||

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | accessed October 23, 2014 | |||||||

|

||||||||

Sheet 10: 2013 Loaded Ind Wage Rates

| Table : Loaded Industry Wage Rates (December 2013) | ||||||||||

| EPAB Labor Category | Data Sourcesd | Date | Wage | Fringe Benefit | Fringes as % wage | Over-head % wageb | Fringe + overhead factorc |

Loaded Wagesa | Total Compensation | |

| (A) | (B) | (C) =(B)/(A) | (D) | (E) =(C)+(D)+1 | (F) =(A)*(E) | |||||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec '13 | $46.25 | $23.71 | 51% | 17% | 1.68 | $77.82 | $69.96 | |

| Professional/ Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec '13 | $38.16 | $19.90 | 52% | 17% | 1.69 | $64.55 | $58.06 | |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec '13 | $18.05 | $9.23 | 51% | 17% | 1.68 | $30.35 | $27.28 | |

| Notes: | ||||||||||

| a Wage data are rounded to the closest cent in this table; however, in calculations using these numbers for this report, unrounded values were used. | ||||||||||

| b An overhead rate of 17% was used based on assumptions in Wage Rates for Economic Analyses of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPAB, 2002). | ||||||||||

| c An inflation factor of “1” means wage data were not escalated to reflect inflation. | ||||||||||

| d Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006-March 2014, US Bureau of Labor Statistics, June 11, 2014 (pp 31,33,37) (http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf, accessed July 7, 2014). | ||||||||||

Sheet 11: 2013 Reference

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | accessed July 7, 2014 | ||||||||

|

|||||||||

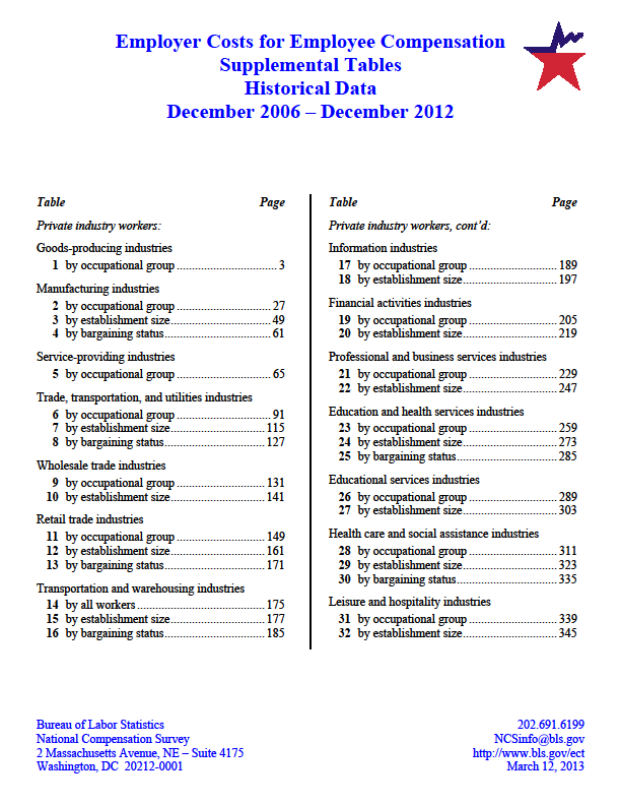

Sheet 12: 2012 Loaded Ind Wage Rates

| Table : Loaded Industry Wage Rates (December 2012) | ||||||||||

| EPAB Labor Category | Data Sourcesd | Date | Wage | Fringe Benefit | Fringes as % wage | Over-head % wageb | Fringe + overhead factorc |

Loaded Wagesa | Total Compensation | |

| (A) | (B) | (C) =(B)/(A) | (D) | (E) =(C)+(D)+1 | (F) =(A)*(E) | |||||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec '12 | $43.95 | $21.46 | 49% | 17% | 1.66 | $72.88 | $65.41 | |

| Professional/ Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec '12 | $38.53 | $19.31 | 50% | 17% | 1.67 | $64.39 | $57.84 | |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec '12 | $17.64 | $8.87 | 50% | 17% | 1.67 | $29.51 | $26.51 | |

| Notes: | ||||||||||

| a Wage data are rounded to the closest cent in this table; however, in calculations using these numbers for this report, unrounded values were used. | ||||||||||

| b An overhead rate of 17% was used based on assumptions in Wage Rates for Economic Analyses of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPAB, 2002). | ||||||||||

| c An inflation factor of “1” means wage data were not escalated to reflect inflation. | ||||||||||

| d Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006-December 2012, US Bureau of Labor Statistics, March 12, 2013 (pp 31,33,37) (http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf, accessed March 28, 2013). | ||||||||||

Sheet 13: 2012 Reference

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | To open pdf file, Right click and select "Acrobat Document Object" and "open" | ||||||||

|

|||||||||

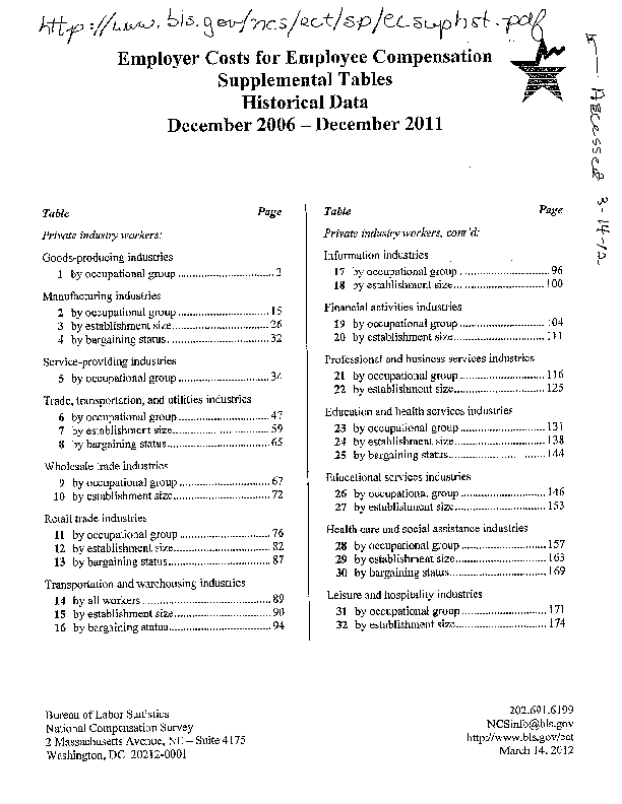

Sheet 14: 2011 Loaded Ind Wage Rates

| Table : Loaded Industry Wage Rates (December 2011) | ||||||||||

| EPAB Labor Category | Data Sourcesd | Date | Wage | Fringe Benefit | Fringes as % wage | Over-head % wageb | Fringe + overhead factorc |

Loaded Wagesa | Total Compensation | |

| (A) | (B) | (C) =(B)/(A) | (D) | (E) =(C)+(D)+1 | (F) =(A)*(E) | |||||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec '11 | $43.01 | $20.41 | 47% | 17% | 1.64 | $70.73 | $63.42 | |

| Professional/ Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec '11 | $38.48 | $19.64 | 51% | 17% | 1.68 | $64.66 | $58.12 | |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec '11 | $17.89 | $8.93 | 50% | 17% | 1.67 | $29.86 | $26.82 | |

| Notes: | ||||||||||

| a Wage data are rounded to the closest cent in this table; however, in calculations using these numbers for this report, unrounded values were used. | ||||||||||

| b An overhead rate of 17% was used based on assumptions in Wage Rates for Economic Analyses of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPAB, 2002). | ||||||||||

| c An inflation factor of “1” means wage data were not escalated to reflect inflation. | ||||||||||

| d Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006-December 2011, US Bureau of Labor Statistics, March 14, 2012 (pp 17,18,20) (http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf, accessed March 14, 2012). | ||||||||||

Sheet 15: 2011 Reference

|

|||||||||

Sheet 16: 2010 Loaded Ind Wage Rates

| Table : Loaded Industry Wage Rates (December 2010) | ||||||||||

| EPAB Labor Category | Data Sourcesd | Date | Wage | Fringe Benefit | Fringes as % wage | Over-head % wageb | Fringe + overhead factorc |

Loaded Wagesa | Total Compensation | |

| (A) | (B) | (C) =(B)/(A) | (D) | (E) =(C)+(D)+1 | (F) =(A)*(E) | |||||

| Managerial | BLS ECEC, Private Manufacturing industries, “Mgt, Business, and Financial” | Dec '10 | $42.82 | $19.64 | 46% | 17% | 1.63 | $69.74 | $62.46 | |

| Professional/ Technical | BLS ECEC, Private Manufacturing industries, “Professional and related“ | Dec '10 | $36.93 | $18.50 | 50% | 17% | 1.67 | $61.71 | $55.43 | |

| Clerical | BLS ECEC, Private Manufacturing industries, “Office and Administrative Support” | Dec '10 | $17.36 | $8.67 | 50% | 17% | 1.67 | $28.98 | $26.03 | |

| Notes: | ||||||||||

| a Wage data are rounded to the closest cent in this table; however, in calculations using these numbers for this report, unrounded values were used. | ||||||||||

| b An overhead rate of 17% was used based on assumptions in Wage Rates for Economic Analyses of the Toxics Release Inventory Program (Rice, 2002), and the Revised Economic Analysis for the Amended Inventory Update Rule: Final Report (EPAB, 2002). | ||||||||||

| c An inflation factor of “1” means wage data were not escalated to reflect inflation. | ||||||||||

| d Source: Employer Costs for Employee Compensation Supplementary Tables: December 2006-June 2011, US Bureau of Labor Statistics, September 8, 2011 (pp 17,18,20) (http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf, accessed October 12, 2011). | ||||||||||

Sheet 17: 2010 Reference

| http://www.bls.gov/ncs/ect/sp/ecsuphst.pdf | To open pdf file, Right click and select "Acrobat Document Object" and "open" | |||||||||

| pp. 17, 18, 20 | ||||||||||

|

||||||||||

| File Type | application/vnd.openxmlformats-officedocument.spreadsheetml.sheet |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy