2015 Modal Profile Report

Modal Profile Report.docx

Workforce Development (WFD) Survey

2015 Modal Profile Report

OMB: 2130-0621

Railroad

Industry Modal Profile: An Outline of the Railroad Industry

Workforce Trends, Challenges, and Opportunities - Update

U.S.

Department of Transportation Federal

Railroad Administration

Office

of Research

and Development

Washington, DC 20590![]()

DOT/FRA/ORD-XX/XX

Draft

Final Report

June 2015

NOTICE

This document is disseminated under the sponsorship of the Department of Transportation in the interest of information exchange. The United States Government assumes no liability for its contents or use thereof. Any opinions, findings and conclusions, or recommendations expressed in this material do not necessarily reflect the views or policies of the United States Government, nor does mention of trade names, commercial products, or organizations imply endorsement by the United States Government. The United States Government assumes no liability for the content or use of the material contained in this document.

NOTICE

The United States Government does not endorse products or manufacturers. Trade or manufacturers’ names appear herein solely because they are considered essential to the objective of this report.

REPORT DOCUMENTATION PAGE |

Form Approved OMB No. 0704-0188 |

||||||

Public reporting burden for this collection of information is estimated to average 1 hour per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to Washington Headquarters Services, Directorate for Information Operations and Reports, 1215 Jefferson Davis Highway, Suite 1204, Arlington, VA 22202-4302, and to the Office of Management and Budget, Paperwork Reduction Project (0704-0188), Washington, DC 20503. |

|||||||

1. AGENCY USE ONLY (Leave blank)

|

2. REPORT DATE June 2015 |

3. REPORT TYPE AND DATES COVERED Technical Report |

|||||

4. TITLE AND SUBTITLE Railroad Industry Modal Profile: An Outline of the Railroad Industry Workforce Trends, Challenges, and Opportunities - Update |

5. FUNDING NUMBERS

|

||||||

6. AUTHOR(S) Ms. Monique Stewart (Federal Railroad Administration) Mr. Lloyd Parker (T. White Parker Associates, Incorporated) |

|||||||

7. PERFORMING ORGANIZATION NAME(S) AND ADDRESS(ES) T. White Parker Associates, Incorporated 22636 Davis Drive, #345 Sterling, VA 20164 |

8. PERFORMING ORGANIZATION REPORT NUMBER N/A |

||||||

9. SPONSORING/MONITORING AGENCY NAME(S) AND ADDRESS(ES) U.S. Department of Transportation Federal Railroad Administration Office of Railroad Policy and Development Office of Research and Development Washington, DC 20590 |

10. SPONSORING/MONITORING AGENCY REPORT NUMBER

DOT/FRA/ORD-XX/XX |

||||||

11. SUPPLEMENTARY NOTES COR: Ms. Monique Stewart |

|||||||

12a. DISTRIBUTION/AVAILABILITY STATEMENT This document is available to the public through the FRA Web site at http://www.fra.dot.gov. |

12b. DISTRIBUTION CODE

|

||||||

13. ABSTRACT (Maximum 200 words) In 2011, the Federal Railroad Administration (FRA) Office of Research and Development (R&D) published the first edition of the “Railroad Industry Modal Profile: An Outline of the Railroad Industry Workforce Trends, Challenges, and Opportunities” in response to the DOT National Transportation Workforce Initiative. The profile provided a comprehensive assessment of the railroad workforce and identified six key workforce challenges facing the industry at that time. Since the initial publication, the profile has been widely used as a source of information and insight regarding railroad industry workforce development. Thus, the FRA Office of R&D determined that it should be updated periodically to reflect the latest industry trends, issues, and best practices. Recently, the FRA Office of R&D conducted another analysis to gauge the current and future state of the industry’s workforce based on available quantitative employment data and industry stakeholder dialogs, which led to the identification of the following key workforce challenges. Although it is not the FRA’s intent to solve these challenges, the FRA continues to foster industry collaboration to increase the visibility of key issues and innovative workforce development initiatives.

|

|||||||

14. SUBJECT TERMS Aging Workforce, Diversity, Federal Railroad Administration, PreK-12, Railroad Industry Workforce, Recruiting, Retention, STEM, Training and Development, Work-Life Balance |

15. NUMBER OF PAGES 43 |

||||||

16. PRICE CODE

|

|||||||

17.

SECURITY CLASSIFICATION Unclassified |

18.

SECURITY CLASSIFICATION Unclassified |

19.

SECURITY CLASSIFICATION Unclassified |

20. LIMITATION OF ABSTRACT

|

||||

METRIC/ENGLISH CONVERSION FACTORS

ENGLISH TO METRIC |

METRIC TO ENGLISH |

|||||||||

LENGTH (APPROXIMATE) |

LENGTH (APPROXIMATE) |

|||||||||

1 inch (in) |

= |

2.5 centimeters (cm) |

1 millimeter (mm) |

= |

0.04 inch (in) |

|||||

1 foot (ft) |

= |

30 centimeters (cm) |

1 centimeter (cm) |

= |

0.4 inch (in) |

|||||

1 yard (yd) |

= |

0.9 meter (m) |

1 meter (m) |

= |

3.3 feet (ft) |

|||||

1 mile (mi) |

= |

1.6 kilometers (km) |

1 meter (m) |

= |

1.1 yards (yd) |

|||||

|

|

|

1 kilometer (km) |

= |

0.6 mile (mi) |

|||||

AREA (APPROXIMATE) |

AREA (APPROXIMATE) |

|||||||||

1 square inch (sq in, in2) |

= |

6.5 square centimeters (cm2) |

1 square centimeter (cm2) |

= |

0.16 square inch (sq in, in2) |

|||||

1 square foot (sq ft, ft2) |

= |

0.09 square meter (m2) |

1 square meter (m2) |

= |

1.2 square yards (sq yd, yd2) |

|||||

1 square yard (sq yd, yd2) |

= |

0.8 square meter (m2) |

1 square kilometer (km2) |

= |

0.4 square mile (sq mi, mi2) |

|||||

1 square mile (sq mi, mi2) |

= |

2.6 square kilometers (km2) |

10,000 square meters (m2) |

= |

1 hectare (ha) = 2.5 acres |

|||||

1 acre = 0.4 hectare (he) |

= |

4,000 square meters (m2) |

|

|

|

|||||

MASS - WEIGHT (APPROXIMATE) |

MASS - WEIGHT (APPROXIMATE) |

|||||||||

1 ounce (oz) |

= |

28 grams (gm) |

1 gram (gm) |

= |

0.036 ounce (oz) |

|||||

1 pound (lb) |

= |

0.45 kilogram (kg) |

1 kilogram (kg) |

= |

2.2 pounds (lb) |

|||||

1 short ton = 2,000 pounds (lb) |

= |

0.9 tonne (t) |

1 tonne (t)

|

= = |

1,000 kilograms (kg) 1.1 short tons |

|||||

VOLUME (APPROXIMATE) |

VOLUME (APPROXIMATE) |

|||||||||

1 teaspoon (tsp) |

= |

5 milliliters (ml) |

1 milliliter (ml) |

= |

0.03 fluid ounce (fl oz) |

|||||

1 tablespoon (tbsp) |

= |

15 milliliters (ml) |

1 liter (l) |

= |

2.1 pints (pt) |

|||||

1 fluid ounce (fl oz) |

= |

30 milliliters (ml) |

1 liter (l) |

= |

1.06 quarts (qt) |

|||||

1 cup (c) |

= |

0.24 liter (l) |

1 liter (l) |

= |

0.26 gallon (gal) |

|||||

1 pint (pt) |

= |

0.47 liter (l) |

|

|

|

|||||

1 quart (qt) |

= |

0.96 liter (l) |

|

|

|

|||||

1 gallon (gal) |

= |

3.8 liters (l) |

|

|

|

|||||

1 cubic foot (cu ft, ft3) |

= |

0.03 cubic meter (m3) |

1 cubic meter (m3) |

= |

36 cubic feet (cu ft, ft3) |

|||||

1 cubic yard (cu yd, yd3) |

= |

0.76 cubic meter (m3) |

1 cubic meter (m3) |

= |

1.3 cubic yards (cu yd, yd3) |

|||||

TEMPERATURE (EXACT) |

TEMPERATURE (EXACT) |

|||||||||

[(x-32)(5/9)] F |

= |

y C |

[(9/5) y + 32] C |

= |

x F |

|||||

For more exact and or other conversion factors, see NIST Miscellaneous Publication 286, Units of Weights and Measures. Price $2.50 SD Catalog No. C13 10286 Updated 6/17/98

Acknowledgements

The Federal Railroad Administration’s (FRA) Office of Research and Development (R&D) would like to thank the following railroad industry stakeholders for sharing their perspectives in support of this study. These stakeholders include representatives from academia, associations, Class I freight and passenger railroads, labor unions, and state Departments of Transportation, along with other organizations who contribute to the railroad industry.

Associations

American Public Transportation Association (APTA)

Association of American Railroads (AAR)

Academia

Michigan Technological University

National Academy of Railroad Sciences (NARS)

San José State University

Texas A&M Transportation Institute

University of Tennessee - Knoxville

Virginia Polytechnic Institute and State University

Class I Railroads

Amtrak

CSX

Norfolk Southern Corporation

Union Pacific

General

Operation Lifesaver, Incorporated (OLI)

North Carolina Department of Transportation

Labor Unions

Brotherhood of Railroad Signalmen (BRS)

United Transportation Union (UTU)

Contents

Contents…………………………………………………………………………………………...v

Illustrations………………………………………………………………………………………vii

Tables……………………………………………………………………………………………viii

2. Railroad Industry Workforce Composition 11

2.1 Class I Freight Railroads 11

2.2 Class I Passenger Railroad: Amtrak 12

2.3 Regionals and Short Line Railroads 12

2.5 Rolling Stock Manufacturers and Suppliers 13

3.1 Issues Update from Prior Report - 2011 16

3.1.3 Overall Image of the Industry 17

3.1.4 National Training Standards for Freight Rail Trade and Craft Positions 17

3.1.6 Quality of Data and Metrics 18

3.2 Current Railroad Industry Workforce Issues – 2014 18

3.2.5 Generational Matriculation 22

3.3 Industry Workforce Development Initiatives 22

3.3.1 Training and Development 22

3.3.2 PreK-12 and Collegiate Science, Technology, Engineering and Mathematics Outreach 23

4. Railroad Workforce Outlook 24

4.1.1 Efficiency and Technology 24

4.3 Positive Train Control (PTC) 25

4.4 Railroad Workforce Outlook 25

References………………………………………………………………………………………..31

Illustrations

Figure 1: Railroad Industry Age Distribution in 2008, 2010 and 2012 1

Figure 2: FRA-WDT Focus, Scope, and Accomplishments 5

Figure 3: FRA-WDT Roadmap for Improving 2011 Workforce Challenges 7

Figure 5: Class I Freight and Passenger Labor Distributions 11

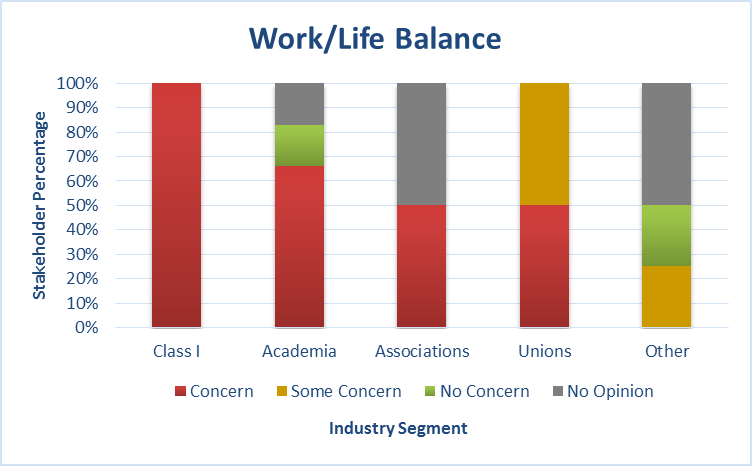

Figure 6: Railroad Work-life Balance Sentiment by Stakeholder Category 19

Figure 7: Railroad Workforce Aging Sentiments by Stakeholder Category 20

Figure 8: Railroad Workforce Diversity Sentiments by Stakeholder Category 21

Figure 9: Railroad Recruiting Sentiments among Stakeholders by Category 21

Figure 10: Railroad Sentiments Regarding Generational Matriculation by Category 22

Figure 11: Five-Year Railroad Workforce Population Projection 25

Tables

Table 1: 2014 Railroad Industry Workforce Challenges 3

Table 2: FRA-WDT Program Activities Summary 5

Table 3: Top Railroad Industry Challenges – 2011 Report 6

Table 4: FRA Workforce Development Program Element Mapping to 2011 Railroad Industry

Challenges 7

Table 5: 2011 Railroad Industry Modal Profile References in Industry 8

Table 6: Identified Workforce Challenges from 2011 Modal Profile 16

Table 7: 2014 Railroad Industry Workforce Challenges 19

Executive Summary

In 2011, the Department of Transportation’s (DOT) Federal Railroad Administration (FRA) published the first Railroad Industry Modal Profile: An Outline of the Railroad Industry Workforce Trends, Challenges, and Opportunities, which provided a comprehensive overview of the railroad industry workforce as of December 31, 2008. The Railroad Industry Modal Profile was a response to the DOT National Transportation Workforce Development Initiative that required each DOT Operating Administration (OA), also referred to as modes, to produce an analysis of its industry workforce.

The prevailing workforce concerns during the early stages of the DOT National Transportation Workforce Development Initiative were the large number of retirement-eligible employees in transportation related fields and the national shortages in science, technology, engineering, and math (STEM) graduates. Since the railroad industry had done very little hiring in the late 1980s and throughout most of the 1990s, the retirement-eligible population became quite large, which exacerbated the concern regarding retirement eligibility, even beyond that of most other industries and transportation modes (each of which were also grappling with similar retirement population concerns).

Figure 1:

Railroad Industry Age Distribution in 2008, 2010 and 2012

While several factors have contributed to the slower-than-expected exit of those employees eligible for retirement, it is impossible to isolate any particular causal factor. However, world events offer some insight; during the period of the prior modal profile, the United States (U.S.) was fighting foreign wars in Iraq and Afghanistan, and the world was still in economic recovery from the Global Recession (also known as the Financial Crisis of 2008). These major national priorities drew employees out of the domestic labor force into military service, and may have led some workers to stay in the labor force longer than they otherwise might have. Also, many workers may have lacked the financial foundation for their retirement due to diminished savings and overall poor economic conditions. Lastly, railroad companies recognized the age distribution concern and began aggressive human capital programs aimed at knowledge management, recruiting, training, and retention.

This report serves as an update to the 2011 Railroad Industry Modal Profile publication and uses the latest available employment data possible, and suggests that the state of the rail workforce has steadily improved since the last Railroad Industry Modal Profile publication. This is consistent with both the rail workforce analysis and stakeholder dialogues. Following the same methodology used in the 2011 study, the FRA Office of R&D discussed this subject with industry stakeholders from the following segments.

Academia

Associations

Class I Railroads

Labor Unions

Regional and Short Line Railroads

State Departments of Transportation

After the discussions, responses for each industry segment were aggregated and areas of consensus were identified for each workforce development focus area. The collected responses were also used to determine sentiments and perspectives by segment. Where possible, segment aggregated responses were compared across stakeholder segments to identify commonalities and differences. Finally, the most common challenges were identified and considered the key workforce challenges currently facing the railroad industry. Those challenges were then compared to the challenges highlighted in the initial Railroad Industry Modal Profile to determine if industry sentiments had changed and if progress had been made.

Based on the discussions with stakeholders that were conducted as part of this study, many of the issues facing the railroad industry (see Table 1), are similar to those that were discussed previously; however, the overall impact of each issue is reduced in significance since the 2011 study.

Table 1: 2014 Railroad Industry Workforce Challenges

# |

2014 Workforce Challenge |

Issue in 2011 |

1 |

Work-Life Balance |

■ |

2 |

Aging Workforce |

■ |

3 |

Recruiting (New) |

|

4 |

Diversity |

■ |

5 |

Generational Matriculation (New) |

|

In 2011, the Department of Transportation (DOT), Federal Railroad Administration (FRA) published the first edition of the Railroad Industry Modal Profile: An Outline of the Railroad Industry Workforce Trends, Challenges, and Opportunities in response to a DOT National Transportation Workforce Development Strategy Initiative. This department-wide initiative partnered staff from each DOT Operating Administration (OA), also referred to as modes, to discuss issues and trends across the entire transportation sector. Each OA produced a modal profile, which broadly addressed the composition and challenges of its respective industry workforce. The modal profile was used by DOT to establish a national, cross-modal workforce strategy framework.

When FRA published the Railroad Industry Modal Profile in tandem with numerous supporting activities led by the Administration (e.g. stakeholder dialogs, conference briefings, conference publications, research projects, and responses to external railroad industry workforce data requests), it spurred a wide-scale interest in railroad workforce development throughout the industry. As a result, FRA continues to support its workforce development strategy and policy through outreach, industry stakeholder engagement, workforce analysis, and reporting.

In 2007, FRA’s Office of Policy and Program Development conducted a study entitled An Examination of Employee Recruitment and Retention in the U.S. Railroad Industry which identified the recruitment and retention challenges that the U.S. freight railroad industry faced, given the increase in the retirement-eligible population and growth in freight railroad transportation. After conducting structured interviews and focus groups with several industry stakeholders, it was determined that the lack of work-life balance was a primary challenge to recruitment efforts, due to demanding work schedules, the incremental pay rate system for particular craft positions, and the lack of an available pipeline to train and develop qualified talent. The study also determined that relocation, furloughs, misperceptions of job functions, and demanding work schedules made it difficult for the industry to retain talent. Additional findings from this study can be found in Appendix A.

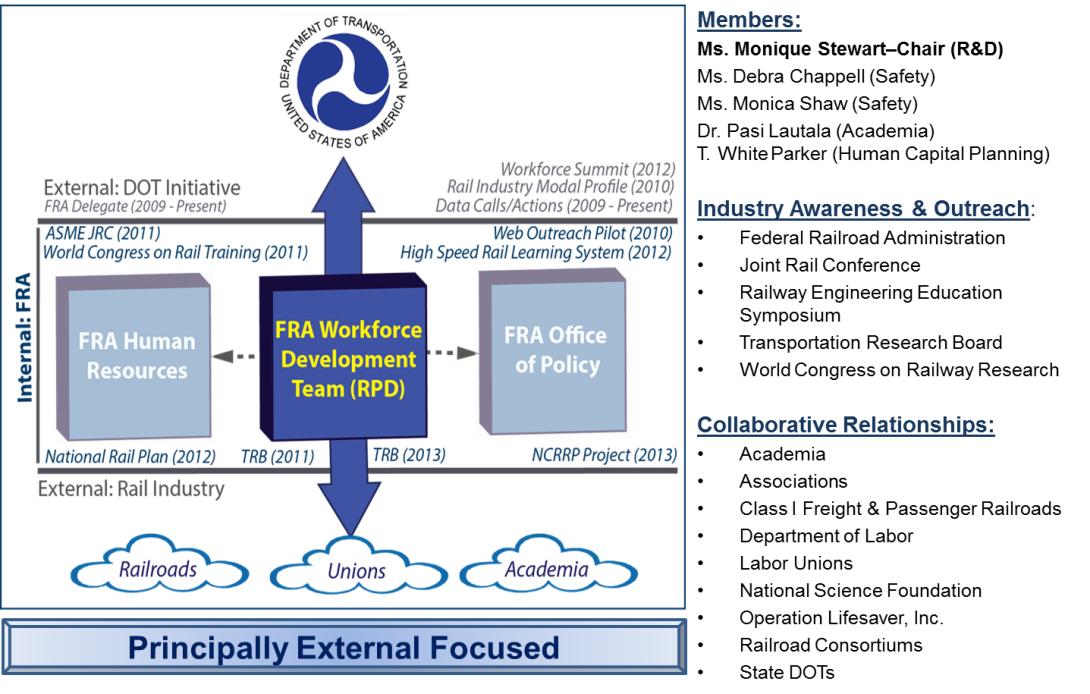

In early 2009, the FRA was requested to support the DOT National Transportation Workforce Development Strategy Initiative, led by DOT’s Office of the Secretary of Transportation (OST). This initiative’s goal was to develop an Analytical Foundation which outlines the need for a national cross-modal approach to addressing transportation workforce development challenges. Each DOT OA was asked to support the development of the Analytical Foundation by developing a modal profile for its respective industry; this profile identified the current state of the industry from a workforce perspective and it included challenges as well as potential solutions. In response to OST’s request, Ms. Monique Stewart was designated as the FRA Workforce Development Lead and the FRA-Workforce Development Team (WDT) was formed (see Figure 2), which consisted of representatives from the FRA Office of Research and Development, FRA Office of Railroad Safety, railroad academia, and a Subject Matter Expert (SME) in Human Capital Planning.

Figure 2: FRA-WDT Focus, Scope, and Accomplishments

The FRA-WDT focuses on external (non-FRA) industry perspectives and convenes regularly to discuss FRA industry related workforce development data calls and actions. Additionally, several projects have been initiated to expand the outreach function of the FRA-WDT, some of which are highlighted in Table 2. The FRA-WDT is continuously considering innovative projects that may improve the industry’s awareness of workforce issues, heighten the level of perception regarding the nuances of the rail industry workforce, or otherwise contribute to promoting the interest of the broader rail industry across the active labor force.

Table 2: FRA-WDT Program Activities Summary

Project Name |

Project Description |

Web-based PreK – 12 Outreach Portal |

A prototype STEM-based outreach portal for elementary school-aged students and their teachers to learn about railroad technology, occupations, and community importance. |

High Speed Rail Learning System (HSRLS) |

A prototype online learning system to deliver high-speed rail and other rail related courses to the public in an effort to develop the skills needed to support and sustain the U.S. high-speed rail system. |

Railway Engineering Education Symposium (REES) Scholarship |

A collegiate sponsorship for faculty to participate in the annual REES where railroad engineering education is highlighted. |

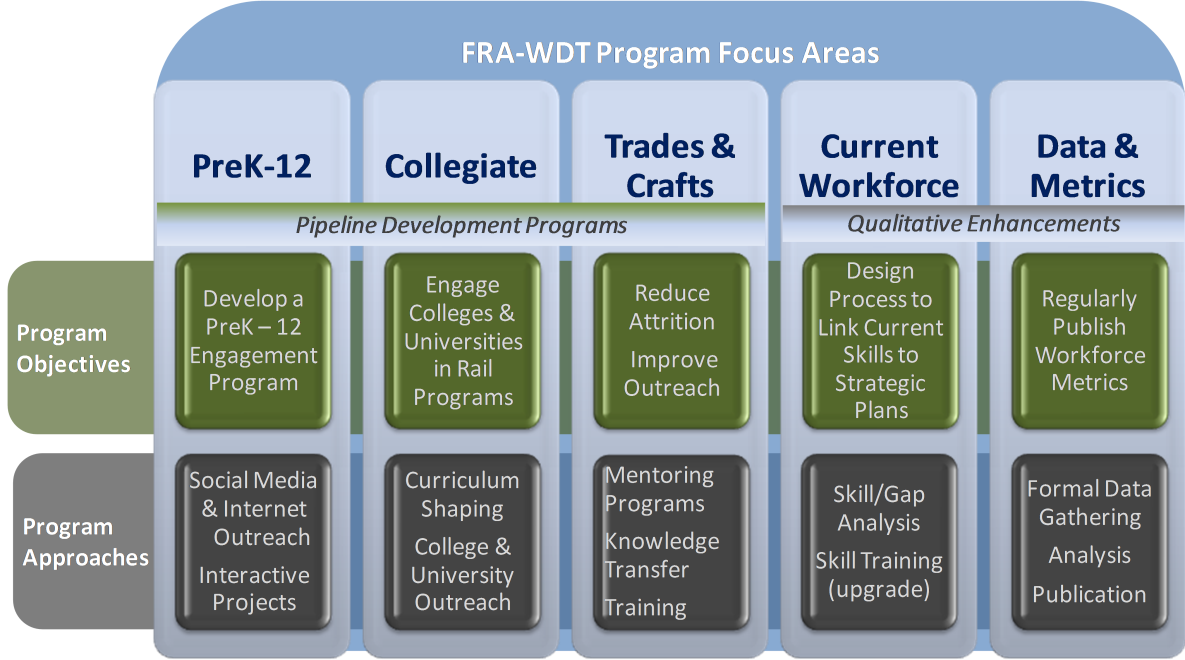

With the FRA-WDT established, efforts to develop the Railroad Industry Modal Profile commenced in 2010. Expanding upon the recruitment and retention study conducted by the FRA three years prior, the FRA-WDT conducted focused discussions with several industry stakeholders representing academia, associations, Class I freight railroads, labor unions, and state Departments of Transportation, among others to fully understand the railroad industry workforce. Each industry stakeholder participated in an informal dialog about the current state of the railroad industry and the railroad industry workforce, as well as their thoughts on the future of the railroad workforce. The information from the collected dialogs is presented in Table 3. Once the key challenges had been identified, the FRA-WDT defined the workforce development program’s areas of focus (depicted in Figure 3), which serves as the action framework for which industry workforce development efforts can be aligned. Elements can be added or removed from the conceptual action framework, as the nature of the railroad industry continues to evolve.

Table 3: Top Railroad Industry Challenges – 2011 Report

# |

Workforce Challenge |

Academia |

Associations |

Class I Railroads |

FRA |

Labor Unions |

Short Lines & Regionals |

1 |

Aging Workforce – Knowledge Transfer |

■ |

■ |

■ |

■ |

■ |

■ |

2 |

Workforce Diversity (Women, Minorities, Other) |

|

|

■ |

■ |

|

|

3 |

Overall Image of the Industry |

■ |

■ |

■ |

■ |

■ |

|

4 |

National Training Standards for Freight Rail Trade and Craft Positions |

|

|

|

|

■ |

|

5 |

Work-Life Balance (Attrition in the 0-5 Year Population of Rail Employees) |

|

|

■ |

|

■ |

|

6 |

Quality of Data and Metrics Available to Monitor Rail Industry Workforce Trends |

■ |

■ |

|

■ |

|

|

Pipeline

Development Programs

- Programs geared toward reshaping the public image of the railroad

industry and emphasizing the multitude of railroad career options

available. Qualitative

Enhancements -

Initiatives to help improve the information and data available from

which to gauge and monitor the health of the railroad industry

workforce.

Figure 3:

FRA-WDT Roadmap for Improving 2011 Workforce Challenges

Each workforce challenge was then aligned with one or more of the FRA-WDT program focus areas. This mapping allowed the team to maintain focus on each challenge while workforce activities and projects were being executed. Table 4 shows how the program elements were aligned to the key challenges.

Table 4:

FRA Workforce Development Program Element

Mapping to 2011

Railroad Industry Challenges

# |

Workforce Challenge |

FRA Workforce Development Program Element |

1 |

Aging Workforce – Knowledge Transfer |

Pipeline Programs: PreK-12; Collegiate; Trade & Craft |

2 |

Workforce Diversity (Women, Minorities, Other) |

Pipeline Programs: PreK-12; Collegiate; Trade & Craft |

3 |

Overall Image of the Industry |

Pipeline Programs: PreK-12; Collegiate; Trade & Craft |

4 |

National Training Standards for Freight Rail Trade and Craft Positions |

Qualitative Enhancements: Current Workforce Development |

5 |

Work-Life Balance (Attrition in the 0-5 Year Population of Rail Employees) |

Pipeline Programs: PreK-12; Collegiate; Trade & Craft |

6 |

Quality of Data and Metrics Available to Monitor Rail Industry Workforce Trends |

Qualitative Enhancements: Data & Metrics |

The FRA–WDT did not attempt to directly solve railroad workforce challenges; instead, the group encouraged industry-wide collaboration that: 1) fosters broader industry dialog and 2) brings cohesion to the efforts of individual organizations expended on workforce development.

The 2011 publication of the Railroad Industry Modal Profile was well received by the railroad community and the general public. In fact, the document was cited by the industry workforce related publications and initiatives shown in Table 5.

Table 5: 2011 Railroad Industry Modal Profile References in Industry

Date |

Event/Organization |

Publication/Initiative |

March 2011 |

American Society of Mechanical Engineers (ASME) Joint Rail Conference (JRC) |

“Railroad Industry Workforce Assessment – Next Steps: Working Together To Shape the Rail Workforce of the 21st Century” publication |

April 2011 |

1st World Congress on Rail Training |

“Railroad Industry Workforce Assessment – Next Steps: Working Together To Shape The Rail Workforce Of The 21st Century” publication |

April 2012 |

National Transportation Workforce Summit |

“Railroad Industry Workforce Assessment – Next Steps: Working Together To Shape The Rail Workforce Of The 21st Century” publication |

2013 |

Transportation Research Board (TRB) |

National Cooperative Rail Research Program (NCRRP) Project 06-01: Building and Retaining Workforce Capacity for the Railroad Industry |

2013 |

U. S. Department of Labor Employment and Training Administration |

Transportation, Distribution, and Logistics Competency Model |

This report updates the 2011 Railroad Industry Modal Profile study (which analyzed railroad industry data as of December 31, 2008) by providing a look at the state of the railroad industry workforce as of December 31, 2012. For the purposes of this study, updated data for the railroad industry workforce was collected, new stakeholder dialogs were facilitated, analyses were conducted, and new results identified. The findings from the 2011 Railroad Industry Modal Profile were revisited to determine the degree to which those issues have changed since the last publication.

While some aspects of the document have been enhanced or expanded (e.g., additional stakeholder discussion), the focus remains on highlighting the railroad industry workforce and the challenges it faces. No attempts are made to correct or otherwise solve any of the industry issues presented herein. However, monitoring the state of the workforce and keeping salient issues at the forefront within DOT and the broader industry adds value to the industry and its stakeholders. Periodic updates to the document ensure adequate consideration of factors that may impact the state of the railroad industry workforce.

This study follows the approach introduced in the 2011 Railroad Industry Modal Profile with the intent to: 1) research and collect available workforce data pertaining to the railroad industry (e.g., quantitative data as of December 31, 2012); 2) validate quantitative data with information obtained through industry stakeholder discussions; 3) identify indicators from across the industry that might impact the workforce (e.g., high-speed rail progress, Positive Train Control (PTC)); and 4) use the aggregation of all information obtained to forecast the future status of the railroad industry workforce.

The FRA-WDT recognizes that there are a number of entities and stakeholders that comprise the railroad industry. These entities range from manufacturing firms to the railroad companies themselves. For the purposes of this study, the railroad industry workforce is defined as:

Class I freight railroads

Class I passenger railroad (Amtrak)

Federal Railroad Administration

Regional railroads

Rolling stock manufacturers and suppliers

Short line railroads

Quantitative Data

To obtain quantitative employment data for each industry segment, the FRA-WDT relied heavily on data provided by the Surface Transportation Board (STB), which collects quarterly employment data for each Class I freight railroad and Amtrak. In addition, the group used the most current data provided by the Bureau of Labor Statistics (BLS), Railroad Retirement Board (RRB), Association of American Railroads (AAR), and the FRA Office of Human Resources. Given the publication cycles of the employment data maintained by BLS, RRB, and AAR, the FRA-WDT determined that it would use employment data as of December 31, 2012. The use of 2012 data ensured that an equal comparison of employment data for each industry segment was conducted.

Qualitative Data – Railroad Industry Stakeholder Dialogs

For the collection of qualitative data on the current state of the railroad industry and its workforce, the FRA-WDT facilitated dialogs with representatives from the industry segments (mentioned above). In order to guide the dialogs, the FRA-WDT developed discussion frameworks for each segment to address topics such as industry and workforce outlooks, workforce challenges, recruiting, retention, training, and diversity. While the discussion frameworks were created to guide each dialog through similar topics, participants could provide any pertinent information deemed appropriate to the topic area.

Next, the FRA-WDT selected a wide range of industry representatives, including participants from academia, various associations, Class I freight railroads, Amtrak, labor unions, and state DOTs. Representatives ranged from technical staff to Human Resources professionals with knowledge of workforce strategies, plans, and activities. Several of the participants were also contributors to the prior study, allowing for continuity in the dialogs.

Once the dialogs were conducted, responses for each industry segment were aggregated and areas of consensus were identified for each workforce development focus area. The collected responses were also used to determine sentiments and perspectives by segment. Where possible, segment aggregated responses were compared across stakeholder segments to identify commonalities and differences.

Finally, the FRA-WDT determined the most common workforce development challenges identified by the stakeholders. Those challenges were then compared to the challenges highlighted in the initial Railroad Industry Modal Profile to determine if industry sentiments had changed and if progress had been made.

The railroad industry employs an estimated 224,193 employees across the country. This total includes Class I freight railroads, Amtrak, labor unions, short line and regional railroads, and rolling stock manufacturers as well as suppliers.

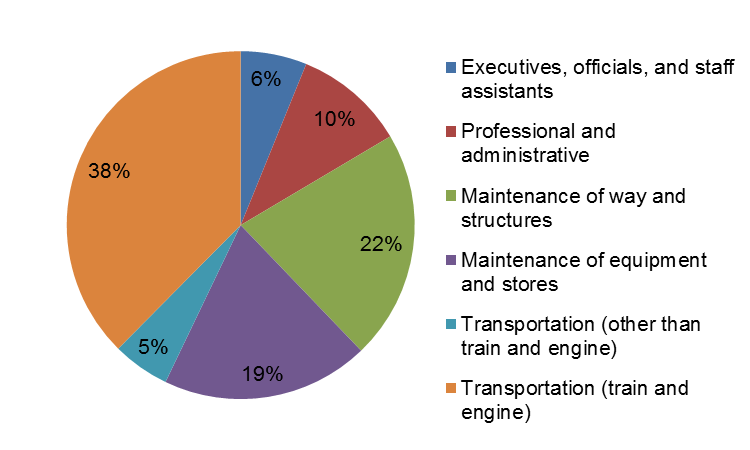

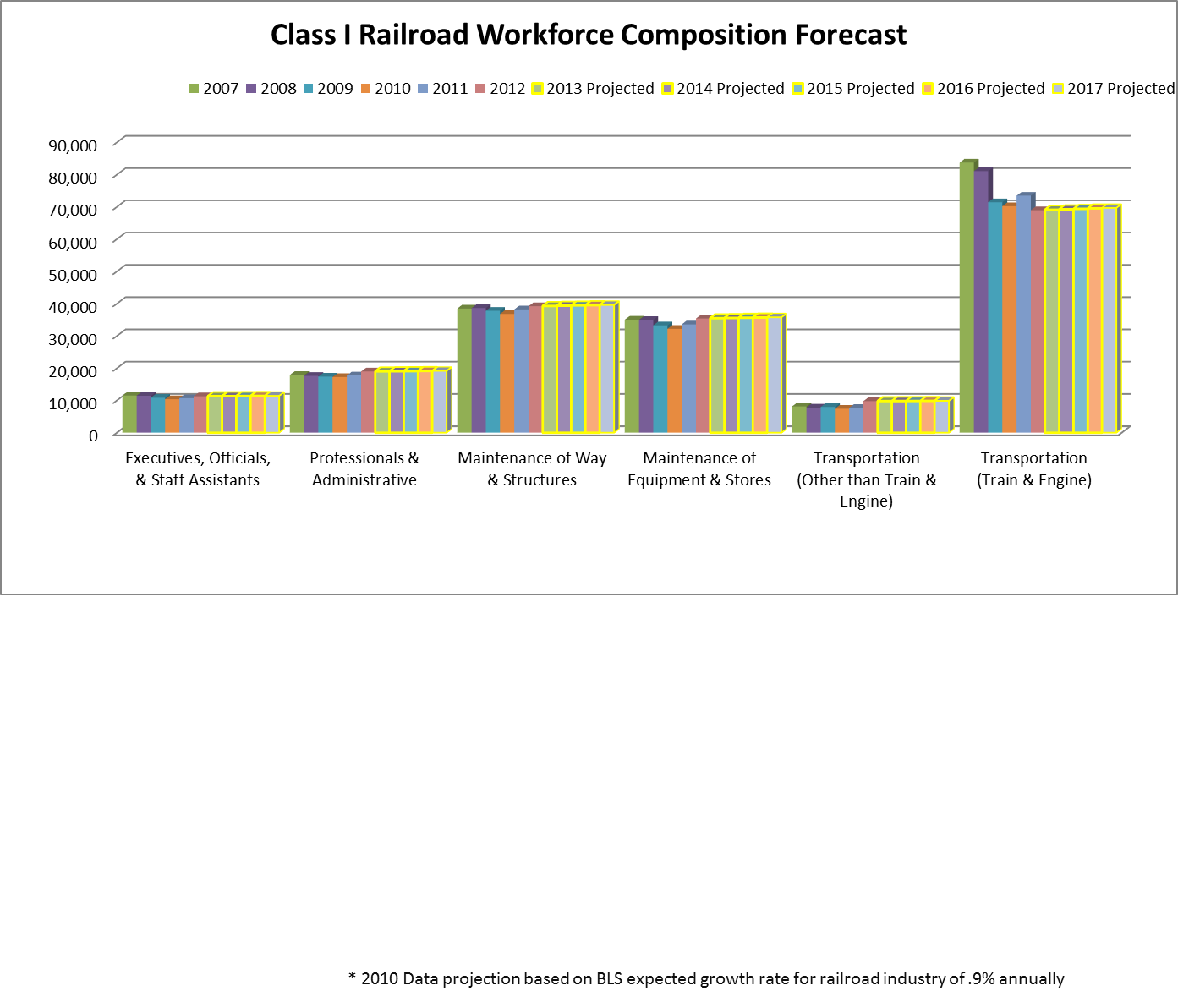

Class I freight railroads are defined as carriers with annual operating revenues of $452.7 million or more.2 According to the Code of Federal Regulations (CFR) Title 49 Part 1245, Class I freight and passenger railroad workforce groups are divided into six major occupational categories, including:

1. Executives, Officials, and Staff Assistants

2. Professional and Administrative

3. Maintenance of Way and Structures

4. Maintenance of Equipment and Stores

5. Transportation, Other Than Train and Engine

6. Transportation, Train and Engine

Title 49 CFR §1245 also provides sub-occupational categories for railroad employees, category descriptions, and typical position titles. In alignment with 49 CFR §1245, STB requires that all Class I freight and passenger railroads report their employment populations for each occupational category on a quarterly basis. According to STB, the total employment population for Class I railroads, including Amtrak, is 184,363 with Class I railroads representing 82 percent of the total railroad workforce. As shown in Figure 5, the transportation (train and engine) occupational category accounts for a large fraction of the total Class I railroad workforce and is typically comprised of trade and craft positions, which have significant union representation.3

Figure 5: Class I Freight and Passenger Labor Distributions

In 1970, Congress created Amtrak to take over the passenger rail services that had been operated by U.S. private freight railroads. When Amtrak began service on 1971, more than half of the rail passenger routes operated by the freight railroad companies were eliminated.

Today, Amtrak serves over 500 locations across the nation and transports an average of 86,000 passengers daily using over 300 Amtrak trains operated by 20,8994 employees.5 Amtrak also provides a significant amount of the nation’s commuter rail services via the following organizations:

MARC (Maryland Area Regional Commuter)

Metrolink (California)

Shore Line East (Connecticut)6

There are 450 railroads (see full listing) that do not meet the Class I operating revenue threshold and are therefore considered Regional and Short Line railroads (which employ 17,8007 workers). Regional railroads, also referred to as Class IIs, are carriers with annual operating revenues of $36.2 million or more and less than Class I minimum.8 Short Line railroads, also referred to as Class IIIs, are carriers with annual operating revenues of less than $36.2 million.9

Of the 84 percent of the employees performing trade and craft job functions, nearly all of them are represented by a labor union. Unions within the rail industry span various trade and craft segments, and have an extensive history of ensuring that railroad employment rights are protected, which includes advocating for safer work environments, appropriate compensation, reasonable hours of service, and equality for union members.

The largest unions representing the railroad workforce are:

International Brotherhood of Teamsters (IBT)

Brotherhood of Locomotive Engineers and Trainmen (BLET) Local Divisions

Brotherhood of Maintenance-of-Way Employees Division (BMWED) Local Lodges

Graphics Communications Conference (GCC) Locals

Teamsters Locals (Canada)

Teamsters Locals (United States)10

Transportation Communications International Union (TCIU)

American Railway and Airway Supervisors Association (ARASA)

Brotherhood of Railway Carmen of America

Brotherhood of Sleeping Car Porters

Order of Railroad Telegraphers

Railway Patrolmen's International Union

United Transport Services Employees Union

Western Railway Supervisors Association11

Transportation Trades Department (TTD)

American Train Dispatchers Association (ATDA)

Brotherhood of Railway Signalmen (BRS)

Transportation Workers Union of America (TWU)

United Transportation Union (UTU)12

The total number of manufacturers and suppliers is difficult to determine accurately. The BLS reports that there are roughly 22,03013 employees in railroad rolling stock manufacturing and supply, but this number does not include all employees in this area of the industry. For example, those working for conglomerate contractors, such as Lockheed Martin, General Electric, or Siemens are not accounted for by BLS.

The manufacturers and suppliers in the railroad industry support both the trains and the track. On the train side, manufacturers create individual train cars, locomotives, and all of the mechanical components and devices that enable trains to function (e.g., brakes, couplers, carriages, wheels, bearings, etc.). Items such as rails, ties, and ballast are included on the track side, as well as other wayside components, such as signals, switches, and sensors.

There are many groups that represent one or more segments of the railroad industry. These entities regularly interact with their constituents and have significant policy and directional influence within the industry. The primary rail associations are listed below.

American Association of Railroad Superintendents (AARS)

American Association of State Highway and Transportation Officials (AASHTO)

American Public Transportation Association (APTA)

American Railway Engineering and Maintenance-of-Way Association (AREMA)

American Short Line and Regional Railroad Association (ASLRRA)

Association of American Railroads (AAR)

National Association of Railroad Passengers (NARP)

North American Rail Shippers Association (NARS)

United States High Speed Rail (USHSR) Association

Despite the steady growth of the railroad industry and the need for a sufficient talent pipeline at all industry levels, a minimal number of U.S. collegiate institutions are focused on cultivating prospective rail talent; however, interest has increased over the past few years. Often, candidates with engineering backgrounds to include civil, mechanical, industrial, environmental, etc. are sought and once hired, are offered rail specific training by their organization. A few U.S. four-year collegiate institutions with railway education programs, research programs, and course offerings are provided below.

Colorado State University - Pueblo

Michigan State University

Michigan Technological University

North Dakota State University

University of Illinois at Chicago

University of Illinois at Urbana–Champaign

University of Kansas

University of Kentucky

University of Maryland-College Park

University of Memphis

University of North Florida

University of Wisconsin-Madison

South Dakota State University

Vanderbilt University

Virginia Polytechnic Institute and State University

In addition to efforts made by U.S. academic institutions to promote rail education, the U.S. DOT and the Council of University Transportation Centers (CUTC) established a National University Rail (NURail) Center, which is a rail-focused, Tier-1 University Transportation Center (UTC). NURail is a consortium comprised of seven U.S. universities and led by the Rail Transportation and Engineering Center (RailTEC) at the University of Illinois at Urbana-Champaign (UIUC). NURail partners include:

Massachusetts Institute of Technology

Michigan Technical University

Rose-Hulman Institute of Technology

University of Kentucky

University of Illinois at Chicago

University of Illinois at Urbana-Champaign

University of Tennessee Knoxville14

The NURail Center’s primary objective is to improve and expand education, research, workforce development, and technology transfer in the U.S. railroad industry by developing and implementing diverse rail-oriented curricula. The Center is hosted at the Department of Civil and Environmental Engineering at UIUC and it focuses on three primary research areas: 1) railroad infrastructure, 2) railroad vehicles, and 3) railroad systems with an overall theme of shared rail corridors.15

Not only is rail education offered by four-year U.S. academic institutions, but it is also available in U.S. community and technical colleges. Community and technical colleges promote the development of skills needed for trade and craft positions that represent a significant percentage of the railroad industry’s workforce. The following U.S. community and technical colleges offer an array of rail related degrees, certifications and training programs:

Dakota County Technical College (Minnesota) – Railroad Conductor Technology Certificate16

Gateway Community College (Connecticut) – Associate in Applied Science: Railroad Engineering17

Johnson County Community College (Kansas) – Railroad Degrees and Fast Track Certificates18

Metropolitan Community College (Missouri) – Associate in Applied Science: Railroad Conductor (Affiliated with Johnson County Community College)19

Tarrant County College (Texas) – Railroad Dispatcher Training Program20

At a global level, U.S. and international academic institutions are collaborating on the development of the UIC Railway Academy, a recognized MBA program that will be a partnership between EM LYON Business School in France, Michigan State University in the U.S., and Moscow Institute of Transportation in Russia. The MBA program aims to develop high performing rail leaders that are capable of:

Understanding the rail sector in addition to policy and managerial innovations

Engaging stakeholders in change management (e.g. policy changes) that improves efficiency and safety

Developing critical leadership skills

Identifying and seizing opportunities to enhance competitiveness and customer satisfaction21

One of the primary data sources used in the development of the Railroad Industry Modal Profile, both in 2011 and for this study, is dialogs with stakeholders from across the railroad industry. Each stakeholder’s unique perspective provides valuable insight into the challenges facing the industry, best practices at addressing those challenges, and source of validation for issues found in industry literature.

Stakeholders from six major industry segments were consulted during the development of the modal profile:

Academia: Faculty, staff at major colleges and institutions offering rail specific programs or closely related fields of study.

Associations: Organizations serving the railroad industry, such as the Association of American Railroads (AAR), or U.S. High Speed Rail Association (USHSR).

Class I Railroads: Major railroad companies which can be classified as Class I. They are the majority of the railroad industry. Amtrak is also included in this group.

Federal Railroad Administration (FRA): An agency with the U.S. DOT that is responsible for ensuring the safety, reliability, efficiency of the Nation’s railroad transportation system.

Unions: Major labor unions which represent the majority of the railroad workforce.

Short Line and Regional Railroads: All other railroads serving the country, including Class II, and Class III railroads (many large firms that are just below the threshold for Class I designation).

When the modal profile study was first performed in 2010, six workforce issues were identified across the railroad workforce (Table 6) that informed the report-related discussions with the industry stakeholders. While some of these concerns are still challenges for the railroad industry today, several of these have diminished in significance and are not currently considered substantial issues. Each challenge will be discussed briefly in this section, and those issues that are relevant at the time of this update will be examined in section 3.2.

Table 6: Identified Workforce Challenges from 2011 Modal Profile

# |

Workforce Challenge |

Workforce Challenges By Stakeholder |

|||||

Academia |

Associations |

Class I |

Class II & III |

FRA |

Unions |

||

1 |

Aging Workforce – Knowledge Transfer |

▪ |

▪ |

▪ |

▪ |

▪ |

▪ |

2 |

Workforce

Diversity (Women, Minorities, |

|

|

▪ |

|

▪ |

|

3 |

Overall Image of the Industry |

▪ |

▪ |

▪ |

|

▪ |

▪ |

4 |

National Training Standards for Freight Rail Trade and Craft Positions |

|

|

|

|

|

▪ |

5 |

Work-Life Balance (Attrition in the 0-5 Year Population of Rail employees) |

|

|

▪ |

|

|

▪ |

6 |

Quality of Data and Metrics Available to Monitor Rail Industry Workforce Trends |

▪ |

▪ |

|

|

▪ |

|

This was the hallmark issue that led to calls for transportation-related industry studies such as the Railroad Industry Modal Profile. For rail, these concerns were exacerbated by a workforce shortage of 30 – 40 year olds who could assume the duties of the retirees. Given the physical and demanding nature of railroad work, common knowledge management approaches (i.e., sophisticated databases and systems that can capture domain knowledge electronically for use across the enterprise) were not viable options, which meant that the railroad industry’s situation appeared dire.

Based on our discussions with railroad company representatives, retirements are still occurring. However, employee attrition due to retirement has not been as significant as initially predicted in the 2011 publication. Some suggest that the economic downturn caused workforces nationwide, including the railroads, to stabilize because many retirement eligible employees chose to continue working. Several stakeholders also indicated that railroads often attempt to hire retirees into other roles, which could have mitigated exit risk and also aided in knowledge transfer.

Diversity was studied broadly in the 2011 Railroad Industry Modal Profile and included ethnicity and gender (age was considered separately); however, no formal metrics were provided or studied. Additionally, public data related to the railroad industry workforce did not provide granular workforce data beyond gender.

Stakeholders stated that their primary recruiting source, at that time, was employee referrals, which helped boost employee loyalty but did not improve diversity. Currently, railroad data suggests that more hires are occurring through recruiting departments, which may help overall diversity. Most railroads have diversity recruiting initiatives and they offered insight into their efforts to attract and retain more females. While no statistics were offered, participating stakeholders suggested that there had been some improvement but added that much more work was needed in this area.

Many of the stakeholders that supported the 2011 Railroad Industry Modal Profile have been concerned that the public viewed the railroad industry as antiquated and “old fashioned” and this perception was limiting interest in railroad careers among the Millennials entering the labor force. It was believed that Millennials, beyond those with prior ties to the industry, would not be interested in rail careers because they perceived it to be a fading industry.

Today, it appears that the industry’s image has improved. Many stakeholders credit AAR and CSX commercials for establishing new interest in the value of rail to communities, which drove improvements in how the industry was perceived. The railroads have indicated that there are currently no significant challenges with attracting candidates for employment. However, the overall perception of the railroad industry is still a concern and the industry still feels the need to highlight engineering and technical advances to students and workers primarily in STEM fields. Finally, some stakeholders noted that the recovering economy benefitted the railroad industry by mitigating the impact of the lingering perception of the industry.

The union representatives that were involved in the 2011 Railroad Industry Modal Profile dialogs were concerned with establishing training standards for the freight rail workforce that would be similar to those that existed on the transit side of the industry. The FRA Railroad Safety Advisory Committee (RSAC) is currently working the training issue, a point noted by several stakeholders consulted for this study.

In the 2011 Railroad Industry Modal Profile, many stakeholders stated that work-life balance was a major issue in the railroad workforce. Long shifts and extensive travel topped the list of factors which create an environment that makes it difficult for many employees to stay in a rail career. Attrition could lead to half of an incoming class of employees resigning shortly after initial training was completed.

The dialogs held in support of this report suggest that work-life balance is still a major concern among the railroads. Many of the Class I stakeholders stated that this problem is their top workforce development-related issue.

In the 2011 Railroad Industry Modal Profile, the participants said they were unable to obtain the data that was required to conduct a full analysis on the railroad industry workforce. At that time, it was not possible to get complete data on the industry workforce that was earlier than two years old. Often, it was impossible to determine whether a program or approach shared by a railroad industry stakeholder was having an impact because current data was not yet available. This challenge still exists; however, more data is available as this report is being developed than was available when the 2011 Railroad Industry Modal Profile was developed. The AAR “Freight Rail Works” campaign provides a number of web-based data reports that are easily accessible. While this data cannot be leveraged to perform root-cause analysis of the identified issues, this data does make it easier to quantify the volume of traffic and impact of railroad services.

The AAR publishes a wealth of information about the railroad industry and much of the data in the 2011 and 2014 studies were taken from AAR data. However, to completely analyze the railroad industry workforce requires more granularity (e.g., attrition rates, gender breakdowns, total population by ethnicity) to arrive at some of the root-cause issues impacting the workforce. Additionally, many of the publically available data sets on the railroad workforce are not published during the same timeframes (i.e., different years), which hampers analysis. The addition of demographic data at an aggregate level would be a benefit to studies such as this while still affording specific companies enough anonymity to still fully control their respective approaches and improvement efforts.

This section discusses the top issues identified in this study that present challenges to the railroad industry workforce. Each issue noted here surfaced during stakeholder dialogs. As was done in the 2011 Railroad Industry Modal Profile, all dialog responses for the 2014 study were aggregated by stakeholder category. The dialogs are an invaluable element of the study as they provide direct insight into the workforce development experiences of those on the front-lines of the industry.

Based on the dialog with stakeholders that were conducted as part of this study, many of the issues currently facing the railroad industry (see Table 7), are similar to those that were discussed identified in the 2011 publication; however, the overall impact of each issue is reduced in significance since 2011.

Table 7: 2014 Railroad Industry Workforce Challenges

# |

Workforce Challenge |

Issue in 2011 |

1 |

Work-Life Balance |

■ |

2 |

Aging Workforce |

■ |

3 |

Recruiting (New) |

|

4 |

Diversity |

■ |

5 |

Generational Matriculation (New) |

|

In each sub-section, an issue will be discussed and each stakeholder’s reaction will be depicted graphically in a bar chart to illustrate that issue. Each bar is colored based on the degree of concern (from red indicating concern to green indicating no concern). A gray colored bar indicates that no response was provided and, as such, there was no data for analytical consideration.

W ork-life

balance was the most significant issue facing the railroad workforce.

Nearly every stakeholder noted this as a concern, indicated by the

“red” and “yellow” bars in Figure 6.

Additionally, some social media posts from current rail workers

suggest that attrition among new hires is still high, which indicates

that while overall attrition across the industry appears to be below

ten percent, the attrition among employees with zero to five years of

experience may be much higher.

ork-life

balance was the most significant issue facing the railroad workforce.

Nearly every stakeholder noted this as a concern, indicated by the

“red” and “yellow” bars in Figure 6.

Additionally, some social media posts from current rail workers

suggest that attrition among new hires is still high, which indicates

that while overall attrition across the industry appears to be below

ten percent, the attrition among employees with zero to five years of

experience may be much higher.

Figure 6:

Railroad Work-life Balance Sentiment by Stakeholder Category

Work-life balance is the ability of an employee to accommodate their personal situation (e.g., spouses, children, dependents, etc.) given the demands of the job. Typically, flexible work schedules and ability to request alternate work schedules and locations are considered elements of work-life balance. Physically demanding jobs such as railroad work do not easily accommodate such flexibility, though some stakeholders suggest that the view of flexibility across the industry is dated and that some aspects of flexibility could be worked into railroad employee life without sacrificing productivity.

While data was being gathered for this report, discussions about work-life balance centered on long shifts and extensive travel requirements. Several stakeholders stated that these factors made the industry appealing to only a small number of workers (e.g., those with few family responsibilities). This may also contribute to the attrition of workers with less than five years of experience; once life progresses and family dynamics change, the hours and travel become less appealing.

Figure 6 illustrates the sensitivity of this issue by stakeholder segment. In our current hiring climate, where attrition rates seem stable and the economy is improved but not fully recovered, it can be easy to view this issue as less significant. As the railroad workforce issues become more and more mainstream, pressure will increase to offer a work experience that more closely aligns with those of other industries. A slight improvement in the economy could quickly make this a critical issue again for the railroad industry.

Ideas such as innovative shift scheduling arose as possible solutions but any such change requires trade-offs, each of which may impact operating costs. As railroad recruiting continues to evolve and more and more of the traditional workforce exits the industry, railroads may be forced to identify new ways to maintain operations in a manner that offers more work-life balance than is common today.

T he

aging workforce remains an issue for the railroad industry. Since

industry retirees opted not to exit the workplace all at once, the

negative impact of the exit wave is delayed. While several of the

railroad company stakeholders suggested that they believe that

retirements have already peaked, the current data on average industry

age indicates that there are still a large number of workers who are

eligible for retirement. As the 2011 Railroad Industry Modal Profile

stated, departing from the workforce is a personal decision, and it

is unrealistic to think that all seasoned workers will decide to

depart at the same time. However, as these workers continue to age,

they will no longer be able to meet the physical demands of their

jobs.

he

aging workforce remains an issue for the railroad industry. Since

industry retirees opted not to exit the workplace all at once, the

negative impact of the exit wave is delayed. While several of the

railroad company stakeholders suggested that they believe that

retirements have already peaked, the current data on average industry

age indicates that there are still a large number of workers who are

eligible for retirement. As the 2011 Railroad Industry Modal Profile

stated, departing from the workforce is a personal decision, and it

is unrealistic to think that all seasoned workers will decide to

depart at the same time. However, as these workers continue to age,

they will no longer be able to meet the physical demands of their

jobs.

Figure 7:

Railroad Workforce Aging Sentiments by Stakeholder Category

Workforce diversity with regards to ethnicity and gender remains a concern for the railroad industry specifically among Class I railroads and academia according to recent stakeholder dialogs. The prevalence of this concern among the two segments may be attributed to the significant representation of Class I railroad employees in the workforce and academia’s role in developing the rail workforce pipeline. Figure 8 shows stakeholder sentiments about diversity, several had no opinion. Please Note: Age diversity is analyzed separately.

Figure 8:

Railroad Workforce Diversity Sentiments by Stakeholder Category

etween

1997 and 2010, railroad gender representation was fairly constant at

90 percent male.

etween

1997 and 2010, railroad gender representation was fairly constant at

90 percent male.

This lack of gender diversity appears both in

the railroad workforce and among the railroad academic programs

(e.g., rail engineering, trades, etc.). Since only gender diversity

metrics are available, it is not currently possible to determine the

full extent of the issue considering that workforce diversity covers

a broad spectrum of employee attributes. If the gender disparities

are considered independently, diversity is still significant for

rail.

Figure 9:

Railroad Recruiting Sentiments among Stakeholders by Category

he

surfacing of recruiting as an issue for the railroad workforce is a

good sign even though it is a challenge for the railroad workforce.

Figure 9 illustrates the responses from the stakeholders regarding

recruiting. When stakeholders discussed recruiting, they indicated

that the railroads are struggling to find potential employees that

possess the appropriate STEM skills and some of the specialty skills

possessed by welders and electricians. The new focus suggests that

the industry is recovering from the low levels of hiring in the 1990s

and moving away from the lingering concerns regarding the sizable

number of retirement eligible workers. However, in order to ensure

that the railroads attract and retain their share of STEM trained

workers, the rail industry must be able to offer competitive benefits

without any hindrances to entry or career development. Issues such as

work-life balance and diversity can severely impair recruiting

efforts, especially when the job market is competitive.

he

surfacing of recruiting as an issue for the railroad workforce is a

good sign even though it is a challenge for the railroad workforce.

Figure 9 illustrates the responses from the stakeholders regarding

recruiting. When stakeholders discussed recruiting, they indicated

that the railroads are struggling to find potential employees that

possess the appropriate STEM skills and some of the specialty skills

possessed by welders and electricians. The new focus suggests that

the industry is recovering from the low levels of hiring in the 1990s

and moving away from the lingering concerns regarding the sizable

number of retirement eligible workers. However, in order to ensure

that the railroads attract and retain their share of STEM trained

workers, the rail industry must be able to offer competitive benefits

without any hindrances to entry or career development. Issues such as

work-life balance and diversity can severely impair recruiting

efforts, especially when the job market is competitive.

The stakeholder perspective on recruiting was widespread with Class I railroads being concerned with specialty and STEM disciplines, and some of the other stakeholders speaking to concerns regarding senior leadership succession and more composite employees (e.g., those with railroad experience coupled with technological savvy to be able to handle new technologies currently implemented).

Figure 10:

Railroad Sentiments Regarding Generational Matriculation by Category

ecently,

the railroad industry has received an influx of Millennials. Younger

workers are reaping the benefits of the current wave of retirements

and receiving promotions much quicker, which may put them in charge

of older and more experienced co-workers despite having minimal

management experience. These factors create interesting dynamics for

the railroad industry and more focus in this area may be needed. It

is notable that safety issues over the past few years have continued

to decline, which suggests that railroads are ensuring that their new

hire practices do not adversely impact safety. However, there may

also be a need to increase focus on generational and workforce

sensitivity issues to prevent any impact to operational productivity

over time. Figure 10 shows the stakeholders’ sentiment about

generational matriculation.

This section highlights a few noteworthy rail industry training and development programs and STEM programs. There are several other programs, not noted here, that are also contributing greatly to the development of existing and future railroad talent.

The industry must ensure that prospective candidates possess the skills needed by railroad industry employers. They must also provide the existing railroad workforce with the proper training to advance professionally. Many employers (such as the Class I railroads) offer in-house training for employees, including management trainee programs and specialized training for trade and craft positions. In addition, collaboration between academia and Class I railroads furthers employee advancement and helps to understand employer needs to equip prospects with the necessary skills to hit the ground running once hired. Indicated below, are a few innovative training initiatives led by the industry currently.

CSX Railroad Education and Development Institute (REDI)

CSX REDI, located outside Atlanta, Georgia, offers novice and advanced specialized rail training which emphasizes transportation, mechanics, engineering, and safety. Not only does the Institute train CSX personnel, it also extends its curriculum to various external stakeholders, which leads to cohesive operational and safety best practices throughout the industry.

National Academy of Railroad Sciences (NARS)

NARS, a partnership between Johnson County Community College (JCCC) in Overland Park, Kansas and BNSF Railway, leads the industry in providing training and certifications to various rail stakeholders. With seasoned industry professionals as instructors, NARS is able to offer hands-on training relevant to multiple rail professions. NARS provides Mechanical Training, Transportation Training, Engineering Training, and Signal/Telecom Training to interested professionals.22

With growing national focus on the importance of STEM, especially among women23, DOT has made great strides in supporting efforts that allow students to develop proficiencies in STEM subjects. Further, DOT recognizes that a qualified talent pipeline, capable of meeting future transportation workforce demands, is needed. Following the lead of DOT, FRA also realizes the importance of improving the perception of the rail industry and the career opportunities it offers. Thus, this section describes several STEM related initiatives led or supported by DOT and the FRA.

Summer Transportation Internship Program for Diverse Groups (STIPDG)

STIPDG, led by the Federal Highway Administration (FHWA) Office of Civil Rights On-the-Job Training Supportive Services Program, enables undergraduate students to obtain summer internships and receive hands-on transportation related professional experience that aligns with their academic pursuits.24 The program also allows students to improve their understanding of the transportation industry and industry-specific professions. Finally, the program provides opportunities for students to establish a professional network comprised of fellow interns and DOT staff.

DOT Youth Employee STEM (YES) Mentoring Program

The YES Mentoring Program gives DOT employees the opportunity to mentor elementary, middle, and high school students across the nation, expose them to transportation related occupations and technology, and educate them on the importance of STEM and its applications in transportation. To support the YES Mentoring Program, FRA’s Office of Research and Development coordinated a December 2013 field trip to Amtrak Union Station for seven Chesapeake Math and IT (CMIT) Academy students, who were preparing for the 2014 Future City Competition that was themed “Tomorrow’s Transit.” The trip aimed to expand the students’ knowledge of various transportation modes, specifically transit and rail. In addition to field trips like the one above, the employees of the FRA continuously seek opportunities to expose youth in their local communities to the multitude of rail career opportunities and the importance of STEM.

Transportation YOU

Transportation YOU is designed for female youth between the ages of 13 and 18, and it uses mentoring opportunities to increase interest in STEM education and transportation related professions. The program’s goals include:

Educate and empower girls on opportunities in the transportation industry

Connect girls with role models through one-on-one mentorship programs

Provide internships and career development opportunities

Assist girls in building leadership skills and self-confidence

Assist in improving STEM education programs

Assist in making STEM education more accessible through scholarship opportunities

Build awareness of transportation as an exciting and rewarding career choice for girls

Contribute to the diversity and creativity of the transportation workforce25

The future state of the railroad industry, per input from stakeholders, will include mild growth and ongoing replacement of retirees. Several stakeholders believed that rapid growth is on the horizon because rail is a “greener” way to ship goods and it reduces highway congestion. Expansion in multi-modal shipments and increased demand from energy suppliers is also anticipated. Anticipated population growth could lead to increased demand for rail services.

Because operations are becoming more efficient and new technologies are assisting with certain manual tasks, increases in demand do not correspond to immediate increases in the workforce. Thus, the railroad industry may be able to respond to increased demand without major shifts in operations. However, at the same time, the current workforce will need to become technologically advanced. New services such as High-Speed Rail and PTC will continue to infuse new technology into the industry and maintaining these service capabilities will create new opportunities for workers.

The railroad industry will encounter increased competition for talent while the current workforce challenges facing the industry, most significantly work-life balance and diversity, will become more important. A potential marketing strategy for rail may be to capitalize on the national push to be healthier and more active. Given that railroad occupations are in large part outdoors, involve travel and working with heavy equipment, there could be an alignment between staying healthy and rail careers. Railroad careers have physical activity integrated into the work day, which many other industries cannot offer.

High-speed rail continues to evolve nationally, with the first signs of operational capability emerging in California, Texas, and Florida. As of December 2013, a large number of infrastructure development efforts have been funded and initiated, principally through federal grant programs. It is uncertain how this capability will transform the national economy, but high-speed rail may open up segments of the labor force that otherwise would not be reachable for many cities.

Early estimates suggest that high-speed rail operations may begin as early as 2017, which could potentially bring permanent jobs to the industry and bolster interest on other national high-speed rail projects. While not all states that currently have high-speed rail programs have begun detailed workforce planning, California’s planning may offer the best glimpse into the total projected jobs from its new high-speed rail networks. In a report26 about the impact of high-speed rail on the California economy, it was estimated that a steady-state 5,000 workers would support the high-speed rail system for the state. By scaling for size, the total impact by state can be estimated and then used to project total anticipated hires for the system.

Given those projections, state DOTs should consider the workforce issues that are associated with high-speed rail while they are planning their infrastructures. The FRA-sponsored HSRLS, which is currently in the prototype phase, may be a promising option for states that need access to relevant railroad and high-speed rail training. If they do not consider workforce needs early in their high-speed rail program, states may lack the talent to staff the new service corridors or a temptation to hire under-qualified workers.

Currently, Class I railroads must implement PTC by December 31, 2015. PTC is an integrated collection of systems (including wireless technology, computers, advanced railroad wayside sensors, monitoring, and control systems) that will enable trains to stop or slow automatically before certain types of accidents occur. PTC is complex and involves connecting many disparate systems. However, successful deployment should have a measureable impact on railroad safety. PTC implementation is progressing but there are a number of systems integration challenges that still require research and development27. Since all systems must be interoperable, an additional layer of complexity is being added to the deployment. PTC technology will usher in a host of new jobs, which will include the personnel who will install and maintaining the various systems as well as the operators who will be monitoring railroad traffic.

The BLS suggests that the job outlook for rail will be relatively flat, largely because the opportunities created will probably be replacements for retirees rather than new positions. Further, BLS suggests that advances in productivity may negatively impact the workforce as fewer workers will be needed to address the same or even larger amount of work.

Based on the analysis conducted for this report, the BLS assessment appears to be somewhat conservative. There will likely be some growth, but it will not be quantitatively significant until high-speed rail becomes operational. Figure 11 below contains a projection of the growth in the railroad industry’s workforce over the next five years. The year-over-year increase constitutes about one percent annually and the impact of high-speed rail is not considered. Consistent with the BLS assessment, technological advances (e.g., PTC) may result in fewer jobs created while overall productivity continues to increase.

Figure 11:

Five-Year Railroad Workforce Population Projection

The railroad workforce continues to strengthen and adapt to the expectations of the labor market. As with all vibrant industries, innovation must continue if long-term viability is possible. Rail has certainly demonstrated its staying power and all indicators suggest this trend will continue. The challenge for rail seems to be conveying the historical significance and importance of the rail industry to the “new” labor force.

The industry would benefit from sharing its value proposition to the American economy and continuing to focus on re-branding and more public transparency. It seems that significant strides are being made by the AAR Freight Rail Works campaign and advertisements by some of the railroads, but additional effort is needed. Some of the workforce challenges that persist in the industry, specifically, those pertaining to work-life balance, should be confronted head-on with innovative approaches and solutions from non-traditional sources such as the military.

Younger generations are growing up with social media, video games, information about nearly everything at their finger-tips, and regular availability of computers and mobile devices. Now that railroad industry recruiting is facing the same concerns as most U.S. corporations, railroad firms should recalibrate as well. Rail companies should look ahead and begin to prepare for the expectations and demands of the next generation. This may give the industry time to confront its traditional mindset (e.g., work-life balance and diversity challenges) and become a truly attractive career choice for next generation workers. Much like cars, planes, ships, and tanks, trains have a natural appeal and can be inspiring, but that may not be enough to convince the up and coming labor force to choose railroad careers. An unwillingness to adapt or change fast enough could be a missed opportunity for a remarkable and history-rich segment of the transportation industry.

Appendix A. “An Examination of Employee Recruitment and Retention in the U.S. Railroad Industry” Study Findings

In 2007, the FRA Office of Policy and Program Development conducted a study entitled An Examination of Employee Recruitment and Retention in the U.S. Railroad Industry to identify the recruitment and retention challenges facing the U.S. freight railroad industry, due to the increase in the retirement-eligible population and the growth in freight railroad transportation. Several industry stakeholders participated in the study through structured interviews and focus groups. It was determined that recruiting new personnel was a challenge due to the lack of work-life balance and this lack of balance was due to demanding work schedules, the incremental pay rate system for particular craft positions, and the availability of a pipeline to train and develop qualified talent. The study also determined that relocation, furloughs, misperceptions of job functions, and demanding work schedules made it difficult for the industry to retain talent.

General Findings

Employee demographics will continue to match the areas or regions across the country in which employees are hired and work. The result is likely to be greater ethnic and racial diversity within the railroad industry over time, matching trends across the country as a whole.

The railroad industry will need to accommodate the various and disparate needs of multiple generations of employees. As the participating Human Resources representatives mentioned in our discussions, the newest generation of railroad employees appears to have different priorities than previous generations. Railroads, since they are large employers with multiple generations of employees, will need to adjust to and be able to accommodate the needs of its complex workforce.

Recruitment Successes

The Internet has become a critical recruitment tool in the U.S. freight railroad industry. Most, if not all, Class I railroads require those interested in a job to apply online. Prospective employees are referred to a railroad’s Web site. Furthermore, the Internet is becoming a major marketing and advertising tool. Railroads are placing more and more information about available jobs on their own Web sites and are advertising jobs on other Web sites, including job placement and railroad related sites.

Employee referrals, i.e., word of mouth, are still a major source of new hires. Many focus group participants indicated that they would recommend a railroad job to friends or family, and in fact, some already have. This recommendation; however, may depend on the person and their specific situation.

The U.S. Class I railroad industry has found recent success by partnering with the U.S. Military and the National Academy of Railroad Sciences (NARS). Among the possible explanations for the industry’s success in recruiting former members of the military is that the railroad industry and the military share similar job attributes, such as 24/7 operations, using heavy equipment, and working in the outdoors. NARS provides technical training and education to individuals preparing for a career in the railroad industry.

According to focus group participants, railroad benefits, especially health insurance, retirement, and salary, are major attractions to working for the industry.

Recruitment Challenges

Adjusting work schedules to achieve an attractive work–life balance

Overcoming an incremental pay scale for some crafts

Finding individuals with the right skill sets for the job. For example, railroads prefer to hire carmen with welding experience and signalmen with technical (electronics) backgrounds. Further complicating this problem are certain rural areas where a railroad operates and where the working-age population is relatively small.

Attracting women to the industry. Railroads reported that many of the jobs women filled in the past have been eliminated (e.g., clerical positions); furthermore, railroads felt that many of the blue collar jobs that the railroad industry does have to offer may be less appealing to women.

Retention Successes

Common features that many focus group participants liked about their job included the job variety, their coworkers, the pay and benefits, the lack of direct supervision, and a feeling of job security.