Risk Preferences and Demand Experiment for Crop Insurance and Cover Crop Programs (RPDCICCP)

Risk Preferences and Demand for Crop Insurance and Cover Crop Programs (RPDCICCP)

Attachment D Instructions 20161102

Risk Preferences and Demand Experiment for Crop Insurance and Cover Crop Programs (RPDCICCP)

OMB: 0536-0076

Instructions

Instructions

Welcome to the ENRE Simlab. This site is a web-based extension of our integrated experimental laboratory facilities at the Coastal Institute. We study problems of cooperation, competition, game theory, problem solving and risk in the areas of environmental and natural resource management and applied economics.

This study has received funding from the United Stated Department of Agriculture. In this experiment, you will make a series of decisions involving risk. Please pay careful attention to the instructions as real money is at stake. Your earnings will be paid to you in cash at the end of the experiment, which is expected to last 90 minutes or less. The precise rules and procedures will be explained to you below.

General Procedure:

This experiment has four sections, and each section consists of a number of stages. In each stage, you will be asked to make one or more decisions involving risky outcomes.

You will earn a show-up fee of $10 for participating today. You are entitled to this show-up fee even if you cannot complete the full experiment.

In addition to your show-up fee, you will receive a payment based on your earnings or losses in the experiment. Depending on your choices and on random chance you may earn substantial additional money or you may lose some of your show-up fee. When the full experiment is completed, one stage will be randomly selected for payment from the entire experiment. You will receive a cash payment based on the decisions you made in that specific stage. For stages that involve multiple risky decisions, only one decision from that stage will be randomly selected for payment.

Your best strategy for earning the most money for participating in this experiment is to try to earn as much money as possible in each stage.

Your total earnings will be paid to you in cash at the end of the experiment.

[End of welcome instructions. Subjects will now read the instructions for the next section.]

Instructions for Part I

This part of the experiment has 20 stages.

In each stage, you will fill out a menu of risky choices. Each menu will have two columns, Option A and Option B. Each row of the menu has a different set of risk choices with different odds and payoffs for each Option. For each row of the menu, please compare the risky choice in Option A and Option B in each row, and select the option you like best.

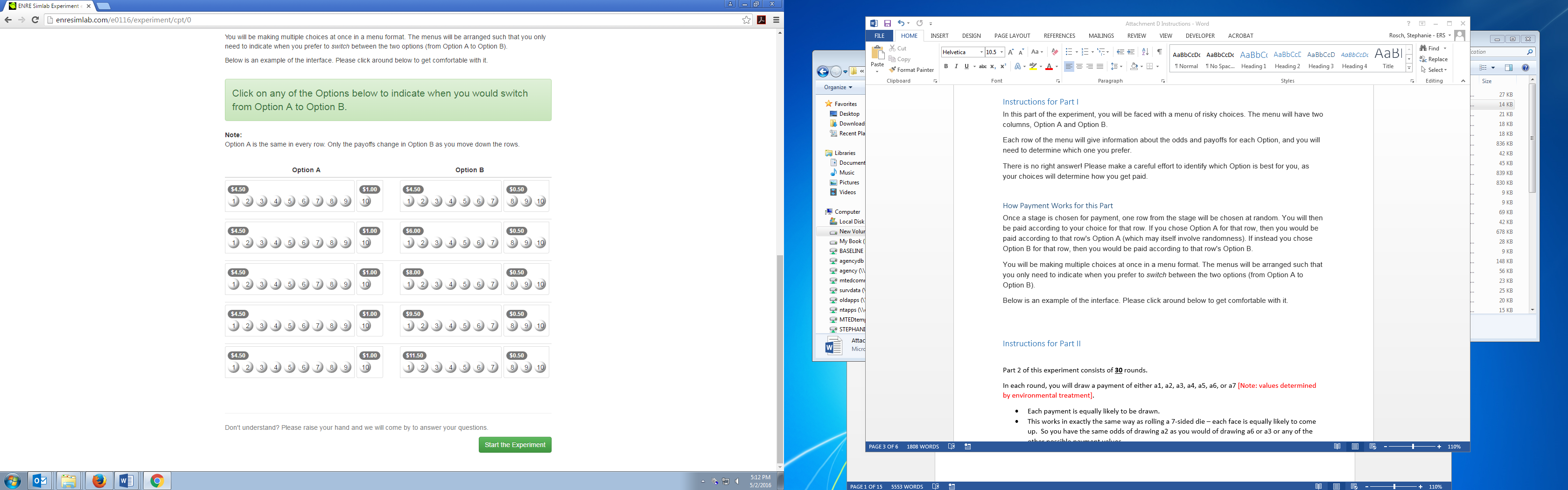

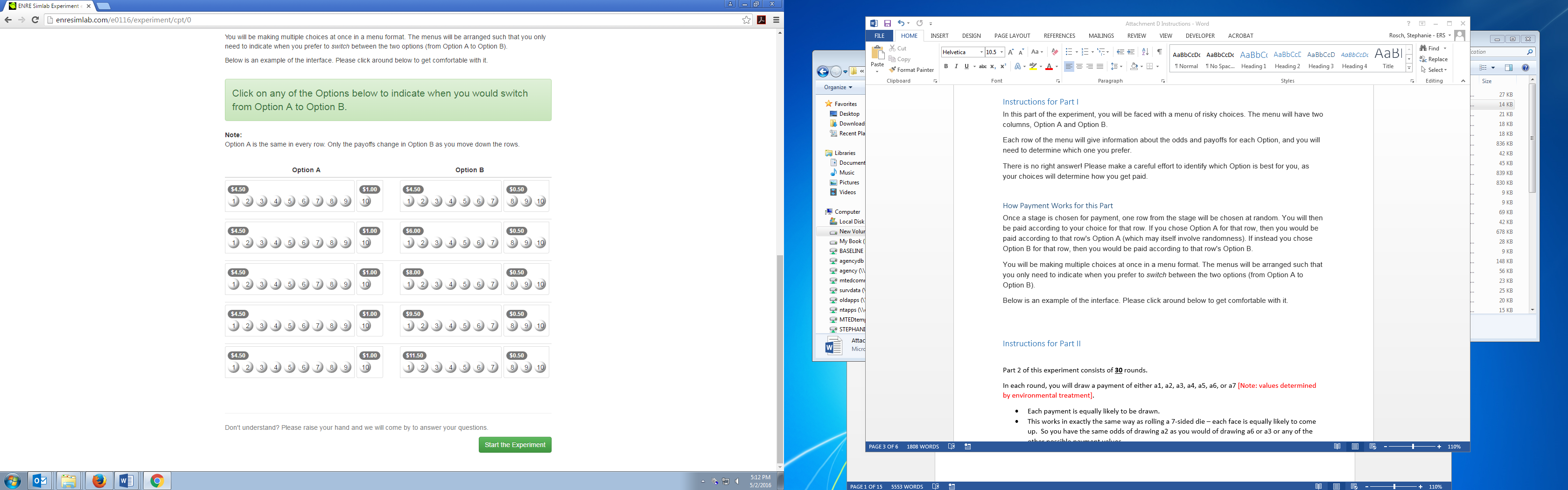

Figure 1: Example of a Risky Choice

For example, Figure 1 shows a menu with only two rows. In each row, Option A and Option B have different possible payoffs as well as different probabilities attached to each payoff. In the first row, Option A pays either $4.50 or $1.00. 9 out of 10 times, Option A pays $4.50. 1 out of 10 times, Option A pays $1.00. Option B pays either $4.50 or $0.50. 7 out of 10 times, Option B pays $4.50. 3 out of 10 times, Option B pays $0.50.

In the second row, notice that Option A is the same risky decision as in the first row. Now, however, Option B pays $6.00 7 out of 10 times, and pays $0.50 3 out of 10 times. For each row, you can select the option you prefer by clicking anywhere in the associated boxes.

There is no right answer! Please make a careful effort to identify which Option is best for you, as your choices will determine how you get paid.

How Payment Works for this Part

Once a stage is chosen for payment, one row from the menu in that stage will be chosen at random. You will then be paid according to your choice for that row. If you chose Option A for that row, then you would be paid according to that row's Option A (which may itself involve randomness). If instead you chose Option B for that row, then you would be paid according to that row's Option B.

You will be able to make choices for multiple rows with a single click on each menu. The menus will be arranged such that you only need to indicate when you prefer to switch between the two options (from Option A to Option B). Then all the rows above the point where you click will be marked as Option A, and all the rows below the point where you click will be marked as Option B. You will only be allowed to switch between Option A and Option B once per menu.

Below is an example of the interface. Please click around below to get comfortable with it.

Figure 2: Screenshot of Interface for 1st Task

Don’t understand? Please raise your hand and we will come by to answer your questions.

Instructions for Part II

The next section of experiment consists of 15 stages.

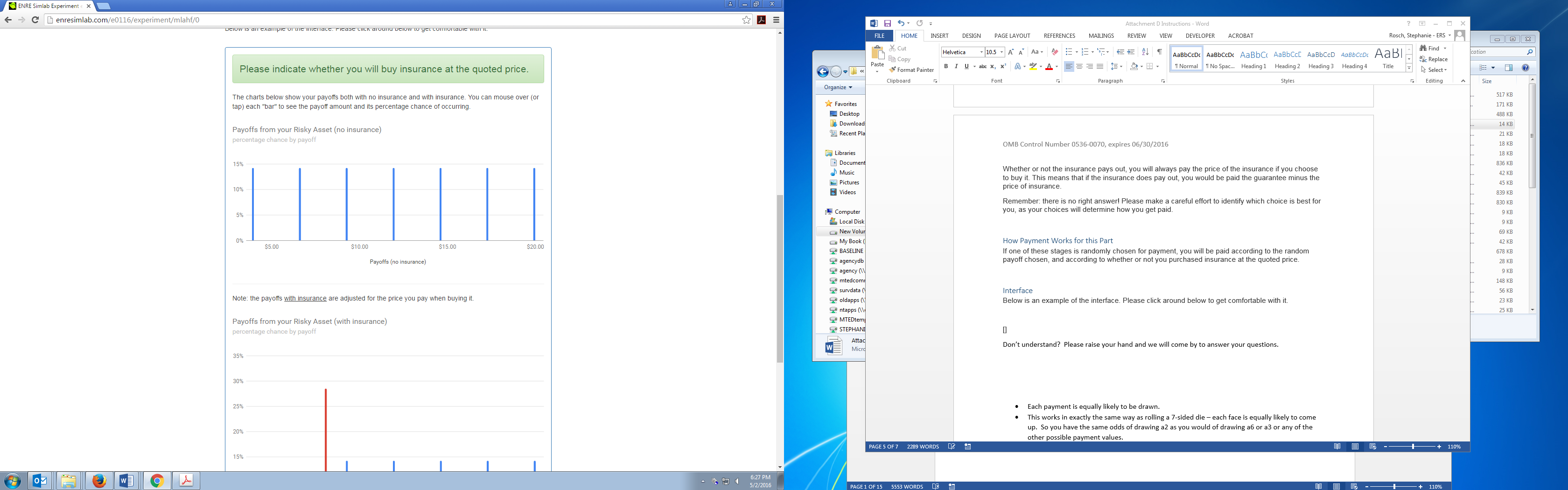

In each stage, you will be making choices about whether or not to buy insurance to protect a risky asset. You will be given information about the possible payoffs from your risky asset, and the probability of each payoff happening. These payoffs and probabilities will be the same for all rounds in this section of the experiment.

In each stage you will be quoted a price for insurance, and you will be told the amount of the insurance guarantee. After you make your decision whether to buy insurance, a random payoff will be chosen from your payoffs according to their respective probabilities. If you bought insurance and the randomly chosen payoff is below the guarantee, then the insurance will pay you the difference.

Whether or not the insurance pays out, you will always pay the price of the insurance if you choose to buy it. This means that if the insurance does pay out, you would be paid the guarantee minus the price of insurance.

Remember: there is no right answer! Please make a careful effort to identify which choice is best for you, as your choices will determine how you get paid.

How Payment Works for this Part

If one of these stages is randomly chosen for payment, you will be paid according to the random payoff chosen, and according to whether or not you purchased insurance at the quoted price.

Interface

Below is an example of the interface. Please click around below to get comfortable with it.

Figure 3: Truncated Screenshot of Interface for 2nd Task

[Please note: this screenshot is for one particular risk environment treatment. Subjects will see different parameterizations of risk distribution depending on the assigned treatment.]

Don’t understand? Please raise your hand and we will come by to answer your questions.

Instructions for Part III

The next section of experiment consists of 15 stages.

In the next part of the experiment, you will be making choices about whether or not to buy insurance to protect your risky asset. Your asset's payoffs and probabilities are the same as in the previous stages. However, this part of the experiment is different:

In each stage, you will be offered insurance, but your insurance choice will be binding for the next five (5) stages.

After you make your decision whether to buy insurance, a random payoff will be chosen from your payoffs five times. You will then be shown your results for all five stages.

Remember: there is no right answer! Please make a careful effort to identify which choice is best for you, as your choices will determine how you get paid.

How Payment Works for this Part

If one of these stages is randomly chosen for payment, you will be paid according to the random payoff chosen, and according to whether or not you purchased insurance at the quoted price.

Interface

The interface is identical to the previous stages. The only difference is in the time commitment for the insurance (you now commit five stages at a time).

Don’t understand? Please raise your hand and we will come by to answer your questions.

Instructions for Part IV

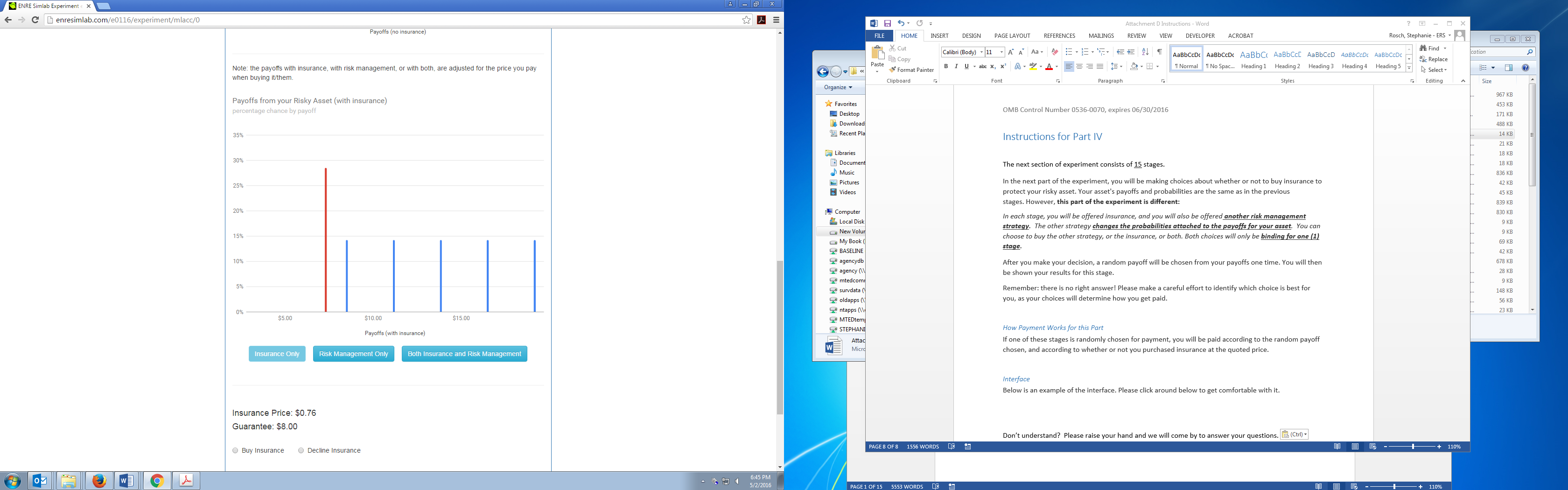

The next section of experiment consists of 15 stages.

In the next part of the experiment, you will be making choices about whether or not to buy insurance to protect your risky asset. Your asset's payoffs and probabilities are the same as in the previous stages. However, this part of the experiment is different:

In each stage, you will be offered insurance, and you will also be offered another risk management strategy. The other strategy changes the probabilities attached to the payoffs for your asset. You can choose to buy the other strategy, or the insurance, or both. Both choices will only be binding for one (1) stage.

After you make your decision, a random payoff will be chosen from your payoffs one time. You will then be shown your results for this stage.

Remember: there is no right answer! Please make a careful effort to identify which choice is best for you, as your choices will determine how you get paid.

How Payment Works for this Part

If one of these stages is randomly chosen for payment, you will be paid according to the random payoff chosen, and according to whether or not you purchased insurance at the quoted price.

Interface

Below is an example of the interface. Please click around below to get comfortable with it.

Figure 4: Truncated Screenshot of Interface for 4th Task

[Please note: this screenshot is for one particular risk environment treatment. Subjects will see different parameterizations of risk distribution depending on the assigned treatment.]

Don’t understand? Please raise your hand and we will come by to answer your questions.

Supporting Statement: Attachment D Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Rosch, Stephanie - ERS |

| File Modified | 0000-00-00 |

| File Created | 2021-01-21 |

© 2026 OMB.report | Privacy Policy