Attachment C ERS Literature Review on Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production a

Attachment C ERS Literature Review on Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production and the Environment.docx

Risk Preferences and Demand for Crop Insurance and Cover Crop Programs (RPDCICCP)

Attachment C ERS Literature Review on Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production a

OMB: 0536-0076

Attachment C

Literature Review on Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production and the Environment

October 13, 2015

The Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production and the Environment

Problem Statement: What evidence exists on whether crop insurance premium subsidies and other commodity support have unintended environment effects in nutrient use/water pollution, water use for irrigation, adoption of conservation practice, land use decisions, or tile drainage? What are the most pressing research needs in this arena?

Overview

Farm support programs have evolved from supply control, price supports, and direct payments of various Farm Acts to include support through various insurance mechanisms. Farmer support programs can have unintended production impacts and negative environmental consequences. Based on a wide range of research, consequences include changes in crop mix, expansion of production into environmentally sensitive lands, and changes in input use, such as increased fertilizer use and related decreases in water quality, reduced adoption of practices such as no-till and cover crops and related increases in soil erosion, or even increases in unsustainable water use for irrigation.

In response to policy changes over the past few Farm Acts and the emergence of crop insurance as a key means of support, a large body of research has focused on predicting and measuring how crop insurance premium subsidies – which are now approximately $6 to $7 billion per year – may have one or more of these consequences. As discussed below, most empirical studies suggest that such effects are not detectable in many cases and may be present in some other cases but are likely small in magnitude. This analysis also expands on prior research by exploring the role of existing insurance and other commodity support policy tools to limit unintended environmental consequences and considering whether the expansion of crop insurance to include “shallow loss” coverage is likely to alter these results.

Key Findings

Previous analysis of farm programs has shown that farm support policies have direct and indirect influences on production decision-making.

Economic theory suggests that crop insurance and other commodity support have several channels for producing unintended environmental consequences.

Empirical studies consistently find evidence of limited expansion of cropland into environmentally sensitive areas as a result of commodity programs and insurance premium subsidies.

Evidence of changes in input use or practices associated with crop insurance is ambiguous; empirical findings are often conflicting in magnitude, small, and/or not statistically significant.

Overall, most empirical studies of the impacts of crop insurance and other commodity supports on agricultural production and the environment suggest that such effects are not detectable in many cases and may be present in some other cases but are likely small in magnitude.

Since production impacts of these programs are likely small, then by extension, market price impacts are likely to be small as well.

Limited research has looked at the effects of crop insurance on irrigation, drought vulnerability, and water-related practices.

New price support (PLC) and “shallow-loss” support (ARC, SCO, STAX) programs are at least partially decoupled from production and/or have low uptake, suggesting that the unintended consequences of these programs are likely to be small.

Existing crop insurance programs have tools to limit, to some extent, the possible increase in riskier production practices. These policy tools include premium rate setting, good practice requirements, area-based policies, prevented planting provisions, and water supply reliability studies conducted by RMA.

While the policy tools designed to limit the adoption of riskier practices are not explicitly focused on any possible environmental consequences of those practices, under the new Farm Act RMA does have the ability to explicitly address some environmental consequences through the linking of conservation compliance provisions to insurance premiums.

Conservation compliance may be leveraging commodity payments and crop insurance premium subsidies to encourage soil conservation on highly erodible cropland and wetland conservation.

Recommendations for going forward

Based on our examination of the interactions between crop insurance and other commodity supports, suggested areas for new research include:

“Shallow Loss” Existing research suggests limited impacts of crop insurance on chemical input use, a finding we would we expect to extend to risk-related conservation practices such as no-till. The availability of shallow loss support could induce changes in demand for traditional crop insurance, both via coverage rate choice and acreage enrollment, with consequent potential for production impacts. Future research will be needed in these areas, particularly if enrollment in shallow loss programs increases dramatically under the next Farm Bill.

Risk Reducing Production Practices In terms of specific practices, most research has focused on nutrient uses – particularly on nitrogen fertilizer – and on pesticide use. There is growing interest in other potentially risk-related practices such as conservation tillage, cover crops, skip-row planting, and even tile drainage. However, there is limited research on whether and when these practices have an impact on risk. Cover crops are now being promoted as being risk reducing – due to potential increases in soil water holding capacity following extended use of cover crops – but they were long thought to be risk increasing, due to potentially delayed planting of the primary crop and competition for nutrients. Research is needed to quantify the impacts of these practices on risk vulnerability and on how this interacts with farmer preferences for other benefits or costs of these inputs.

Impact of Commodity and Crop Insurance Programs The production changes themselves may be relatively small for some crops but because insurance encourages planting on marginal lands the environmental impacts are disproportionately high. The relatively few empirical studies on this relationship generally date to an earlier time when crop insurance was a smaller program with a lower degree of subsidization. Thus, they may understate the effects that the subsidization of programs has in 2015, with a larger, more diversified set of insurance programs at higher subsidy rates. More academic research of this issue at regional or national levels and with more current data is needed.

Risk Management Strategies More research is also needed to measure the extent to which farmers respond to crop insurance subsidies by taking on more risk elsewhere in their operation, such as by shifting to cash rents, practicing less diversification, or underutilizing other risk management strategies like the use forward contracts, futures markets, or myriad other risk mitigation or risk management practices and tools. Prior research by ERS and others has shown that both commodity support and insurance premium subsidies incentivize some expansion into higher-risk, environmentally sensitive areas. Additional research is needed to identify the effectiveness of policies such as conservation compliance that are intended to prevent such expansions for some types of sensitive lands.

Groundwater Conservation and Use Lastly, with respect to irrigation, research is needed on the impact of commodity programs and crop insurance on groundwater. As we have seen recently in California, groundwater provides a substantial buffer against risks related to surface water availability. However, there are limits to and risks from groundwater pumping for irrigation. Research is needed to quantify these risks and to think about both crop insurance programs and conservation programs may impact agricultural use of groundwater.

The Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production and the Environment

Introduction

Farm support programs have previously had various incentive effects that have altered crop production decisions in ways that would not have occurred in the absence of the programs. Considerable analysis has shown how the programs have influenced the decisions regarding crop mix, input use, conversion of land into cropland, and resulting environmental impacts. In addition to dropping fixed support payments and replacing other previous Title I support programs, the 2014 Farm Act added new insurance schemes. Support is now entirely counter-cyclical to price, yield, or revenue losses, and federal crop insurance is projected to be the bulk of federal farm support expenditures. Our experience with insurance as a key support mechanism is limited but we can draw upon some previous analysis to inform our thinking. Previous lessons suggest:

Commodity support and crop insurance provisions provide subsidies that raise the farm revenue and therefore can increase incentives to plant eligible crops.

By reducing risk associated with production on marginal lands, crop insurance and other commodity supports may induce expansion and cultivation on potentially less productive, environmentally sensitive marginal lands that would not have been deemed suitable for production without crop insurance.

Crop insurance can create incentives for producers to substitute crop insurance for other risk management strategies, although evidence of this effect is quite limited.

Given the scale at which many farm programs operate, stakeholders in U.S. agricultural policy have concerns that farm commodity support/risk management programs will have unintended environmental impacts. Given federal government efforts to solve many of these environmental impacts through USDA conservation programs, the availability of both these types of programs may provide the impression that USDA programs are working at cross purposes. This paper provides information on the current state of knowledge about how environmental effects of commodity support programs can occur and the extent to which evidence has been found for or against such effects.

With government expenditures on federal crop insurance overtaking expenditures on the Farm Act’s Title I support (e.g., marketing loan benefits and the now defunct Direct Payments) in recent years, attention on the potential for unintended environmental impacts has shifted away from the latter and toward the impacts of crop insurance subsidies. While economic theory suggests that moral hazard (increased risk taking as a result of having insurance) is a potentially unavoidable consequence of subsidizing risk management, identifying and measure the environmental impacts arising from moral hazard turns out to be very difficult. Based on a substantial body of research, the empirical evidence for negative environmental impacts is limited, finding relatively small impacts in some areas, and finding no impacts or conflicting results in others.

The

potential for moral hazard to influence production should not be

overstated – Moral hazard

is the situation where an individual will engage in risky behavior

because of the presence of insurance, i.e., they do not have to

incur the full costs of their behavior. The potential effects of

crop insurance on production via moral hazard may exist but should

not be overstated. The structure of insurance contracts, which

usually base indemnity (insurance) payments on the farmer’s

yield (whether through yield or revenue loss policies), likely

attenuate moral hazard. Historically, most federal crop insurance

contracts have provided coverage with a significant deductible –

usually between 25 and 50 percent. However, the liability level

(revenue guarantee) a farmer can cover also depends the farm’s

yield history, and as such, can moderate moral hazard. For example,

if the farmer undertakes activities that purposely lower harvested

yield and thus increase the indemnity payment, this action can

reduce the revenue guarantee which the insurance farmer can cover

the next year.

If commodity support/risk management program lead to changes in land use, crop mix, water use, and other inputs, these changes could lead to unforeseen secondary effects on environmental quality. Converting grassland to crop production may mean increased use of fertilizers, pesticides, and other chemicals in vulnerable areas, thus potentially leading to additional runoff and water pollution. Changes in crop mix towards more erosive and chemical-intensive crops, such as from hay to corn, may also lead to increased runoff and leaching and water contamination. Increased irrigation could draw down aquifers. On the other hand, commodity and risk management programs could also reduce input use, and improve environmental outcomes.

Empirical Research: What have we found so far?

A long line of research has examined the impacts of disaster assistance, crop insurance, and commodity programs on farmer production decisions. As these pertain to unintended environmental consequences, these studies can be grouped into three types of outcomes:

Limited expansion of cropland acreage is well established as an impact of crop insurance and other programs.

Shifts in crop selection, and the related indirect impacts on environmental outcomes, are fairly well established.

Most studies do not find direct impacts on chemical use (holding crop choice constant), or find small reductions in response to crop insurance.

Land Use Change -- Conversion to Cropland

The strongest empirical evidence that farm programs, including crop insurance, may have unintended environmental consequences shows that there is probably a small but meaningful increase in total cropland, including in environmentally sensitive areas. A 2006 ERS study found that there was an almost 1 percent increase in cultivated cropland between 1987 and 1997 because of crop insurance, with much of that land coming from hay and pasture. A 2011 ERS study found that In the Northern Plains found that cropland acreage was 2.9 percent larger than it would have been without disaster assistance, crop insurance, and commodity programs. Roughly one-third of the effect was due to crop insurance. Other research has produced similar findings. In general, the national effect of crop insurance on total cropland are small nationally, particularly compared to the 190 million acres that has been added to the crop insurance program over the past two decades (Figure 1). There are several overarching results from these findings:

Controlling for the impact of changes in commodity market process, farm disaster, commodity, and crop insurance programs increase total cropland, but by a relatively small percentage.

While small, these effects are environmentally significant, because the marginal (higher risk) land brought into production is also, on average, more vulnerable to erosion and more likely to include wetlands and imperiled species habitat than cultivated cropland that would have been in production without the program.

Conservation compliance provisions – including the swampbuster and sodbuster programs – are one of the main policy tools in place to address these impacts. Under the 2014 Farm Act there is now an explicit link between conservation compliance and crop insurance premium subsidies.

Figure 1 Trends in cropland and insured acres

Source: (O’Donoghue, 2014)

Crop selection

There are a number of studies showing that crop insurance and other programs could lead to some changes in allocations between crops. Most of these studies use statistical or programming models to directly estimate the impact of insurance on crop choice and then follow with simulations of environmental that capture what are sometimes large differences in input use across crops. Since many riskier crops are also higher in chemical input use, these studies often find that insurance is likely to induce indirect changes (both increases and decreases) in chemical use. However, the responsiveness of crop mix varies by region. Also, as with the extensive margin effects, the shifts in acreage are often small overall. For example, one study finds that even in the most extreme case with a 30% drop in insurance premiums, corn acreage increases by only 0.3 - 0.5%. Other studies show that Marketing Loan Benefits (MLB) can also affect allocation of land among crops when crop prices are low enough to trigger MLBs:

There is strong evidence of small impacts of crop insurance and other programs on crop selection.

These effects are likely small because of a combination of rotational considerations and the availability of insurance for most crops.

The environmental impacts of shifts in crop selection include both positive and negative changes in desired environmental outcomes, which ranges from changes in nitrogen runoff and leaching, erosion, and soil carbon loss.

Working-lands conservation programs are one of the main policy tools in place to address these issues.

Input use

Empirical evidence that crop insurance increases chemical input use (holding crop choice fixed) is mixed, at best. Early studies showed that crop insurance lead to large increases in pesticide use, but these were followed by studies with similar data and revised methodologies showing modest decreases in chemical use. The former results are consistent with finding that crop insurance is associated with increases in yields, but the latter results are consistent with the idea that most chemical inputs are risk reducing and are therefore substitutes for crop insurance. Studies have also found that insurance is associated with small reductions in nitrogen fertilizer use. Evidence for intensive margin effects on fertilizer and pesticide use is ambiguous due to conflicting results in the research.

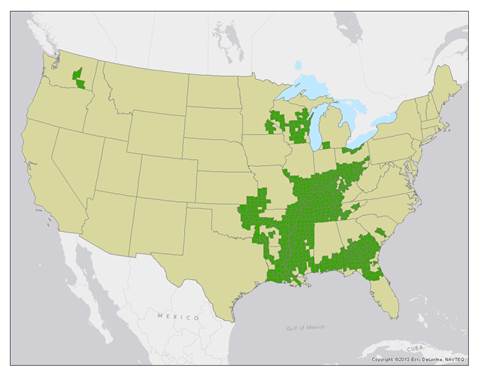

Very few studies have looked at the impacts of insurance on other input decisions such as irrigation or tillage or cover crops. However, trends in these practices, over the period during which participation in crop insurance has been increasing, are opposite of one would expect if crop insurance was having a large impact. Irrigation in riskier areas (e.g., CA, CO, TX) is declining due to a combination of declining supplies of water and competition with urban uses, while irrigation in less risky areas (e.g., NE, AR, MO) is increasing. Conservation tillage and no-till adoption are generally increasing for some crops. In addition, in some analyses that suggest there may be changes in production practices often neglect to include various mitigating aspects of crop insurance program. Factors such as rate-setting or eligibility determinations (i.e., “best practices”) can dampen the influences of insurance on production practices. For example, in some areas RMA sets premium rates distinguishing between irrigated or non-irrigated crops, or between single-cropped and double-cropped fields, which provides producers with a price signal that discourages (to some extent) the riskier practices (Figures 2).

Figure 2 RMA provides practice-based actuarial premium rates for double-cropping in some areas.

Note: Double-cropping ratings are in effect for the following crops: cotton, beans, grain sorghum, soybeans, and buckwheat. Counties with at least one double-cropping actuarial rating in 2012 are shown in green.

Source: Economic Research Service calculations based on Risk Management Agency (RMA) actuarial rating data for 2012. (http://www.ers.usda.gov/publications/eib-economic-information-bulletin/eib125.aspx)

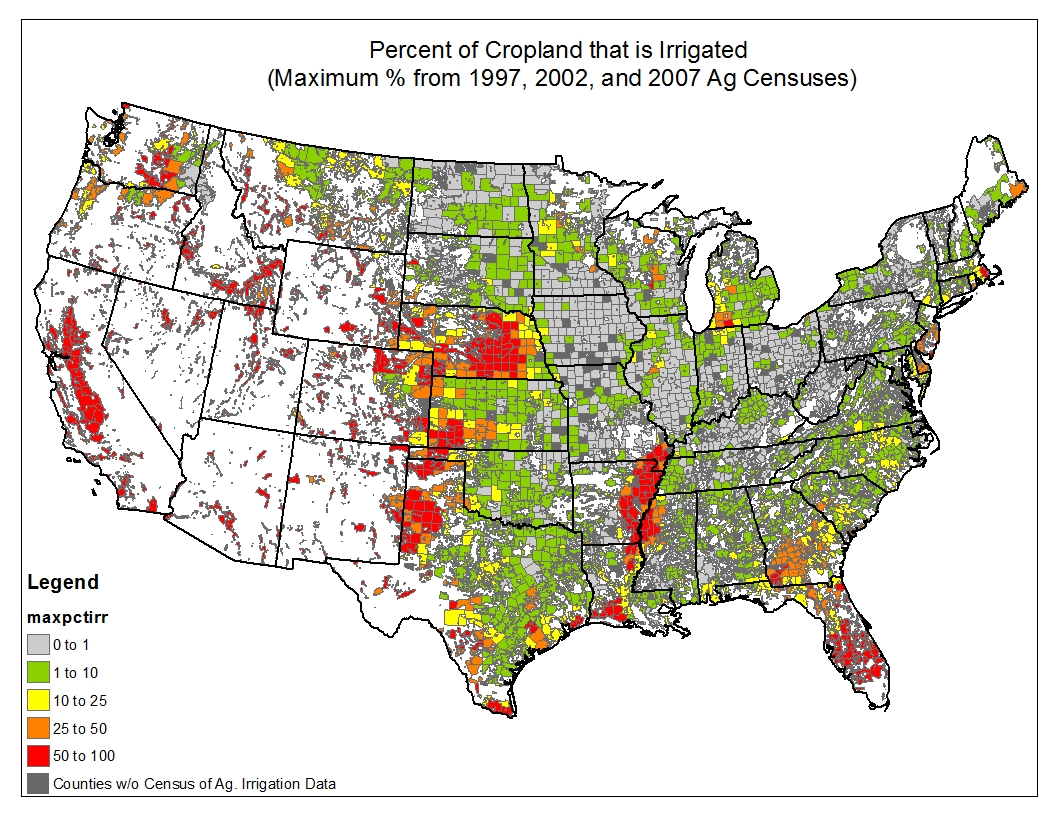

With respect to the impacts of crop insurance on irrigation, one important consideration is the fact that irrigation is largely supply-driven, i.e., irrigation is used where water is available and cheap. Despite perceptions that farmers will irrigate whenever rainfall is insufficient to grow crops, maps of irrigation in the U.S. indicate that farmers will irrigate whenever there is a large supply of relatively inexpensive water, as is the case for the Mississippi Alluvial Aquifer and the southern Florida aquifers (Figure 3). This implies that even if crop insurance impacts the demand for irrigation, there may not be a large impact on observed changes in irrigation due to water supply constraints.

Figure 3 Spatial patterns in irrigation reflects the extent of water availability

Source: ERS calculations from Census of Agriculture Data

Looking across the aggregation of land use change, crop selection, and input use in total, most empirical studies of the impacts of crop insurance and other commodity support on agricultural production and the environment suggest that such effects are not detectable in many cases and wile may be present in some other cases, they are likely small in magnitude. Since production impacts of these programs are likely small, then by extension, market price impacts are likely to be small. Empirical research by ERS on the 2002 Farm Act commodity support programs found relatively small impacts of those programs on market prices.

Direct measurement of environmental outcomes

In most cases, researchers are not able to directly link commodity programs and crop insurance to environmental outcomes. In general there is a paucity of data on environmental outcomes. Even when there is good data, it is difficult to detect the (likely) small effects of crop insurance which are masked by the large variations in things like water quality. One exception was a study designed to estimate the effect of crop insurance programs on soil erosion and found no large measurable increases in erosion as a result of increased insurance participation.

Impacts of changing in level of federal crop insurance premium subsidies and other commodity support on farmer’s risk management strategies

The interplay between the above discussed federal crop insurance premium subsidies and other commodity support and land use, crop selection, and input use suggests that producers have a variety of ways to management risk besides federal commodity support. In fact, farmers utilize a combination of strategies and tools to manage risk:

Crop management decisions (e.g., acreage decision, crop selection, input use)

Government programs federal crop insurance and other commodity supports

Contracting sales and purchases

Enterprise diversification

Off-farm employment

Debt management and credit availability (financial leverage)

Self-insure (savings)

Futures and options markets

Is it likely that if federal commodity support or insurance premium subsidy levels were reduced, that producers’ relative use of other risk management approaches above might increase? Basic economic principles tell us little about whether or how such changes might affect environmental outcomes. New empirical research is needed to shed light on this question.

What do economic principles suggest about the impacts 2014 Farm Bill crop insurance provisions?

Direct federal support to farmers is provided through federal crop insurance legislation as well and Titles I and XI of the 2014 Farm Act. These commodity support and crop insurance programs are projected to account for 5 and 9 percent of USDA outlays, respectively, over 2014-2018 (ERS, 2015b). Our analysis focuses on programs with significant budgetary outlays, i.e., traditional “deep loss” federal crop insurance, and principle new 2014 Farm Act programs – Price Loss Coverage (PLC) and the “shallow loss” programs Agricultural Risk Coverage (ARC), Supplemental Coverage Option (SCO), and Stacked Income Protection Plan (STAX). The concern that crop insurance subsidies and commodity support will have unintended effects can be summarized from an economics perspective in two different dimensions of farmer decision making: crop choice and level of output, referred to as the extensive margin and the type and amount of inputs used, i.e., intensive margin.

The extensive margin effects arise because of a possible increase in total production. Commodity support tied to prices and/or production that increase revenues can stimulate farmers to produce more by planting more acres (extensive margin) and/or seeking to increase yields through the intensive use of more inputs, e.g., fertilizer (intensive margin).1 An increase in insurance support could induce farmers to use more risk-increasing inputs and fewer risk-decreasing inputs. For example, farmers may over-apply nitrogen fertilizer to reduce the risk of very low yields, in which case subsidized crop insurance would reduce nitrogen use. Whether an input is risk-increasing or risk-decreasing, and consequently how insurance affects input use, is an empirical question for which there is not a lot of evidence.

The provisions of Agriculture Risk Coverage (ARC) as well as actual producer selections for this coverage suggest a low scope of potential intensive/extensive margin changes for this program:

ARC payments are made to the farmer’s base (historic) acres, thus lowering the scope for the program to draw more land into production or inducing crop selection changes.

Agriculture Risk Coverage-County Option (ARC-CO) program makes payments based an area basis, which makes payments based on county level revenue losses. Hence, an individual producer cannot alter per acre ARC payments via intensive margin changes, and the scope for inducing moral hazard is limited.

The Agriculture Risk Coverage-Individual Option (ARC-IC) makes payments for revenue based on a farm revenue calculation, and as such, does require some farm level production for the payment calculation to be made, suggesting potential for moral hazard.

While the ARC-IC appears to have a greater theoretical basis for extensive-intensive margin effects than ARC-CO, in aggregate, these effects of ARC-IC will be inconsequential; only one percent of total base acres elected to ARC are in ARC-IC (FSA, 2015b) through 2018.

Price Loss Coverage (PLC) payments are not dependent on the crops planted and/or considered planted for the current crop year, except in the limited case of “generic” base acres. Hence, while PLC may indirectly induce some production impacts, either in outputs or inputs, by reducing price risk and increasing farm wealth, any changes by the farmer will not alter payments over the life of the 2014 Fact Act, thus likely limiting the incentive for the farmer to change input levels.

The impacts of Supplemental Coverage Option (SCO) and Stacked Income Protection Plan (STAX) on production should be different than for traditional “deep loss” insurance as SCO and STAX are area-based programs and are covering lower risk losses than individual-based traditional crop insurance programs (although not necessarily much lower). As such, SCO and STAX could have regional differences in their output choice impacts. In particular, premium subsidies for SCO and STAX will be higher relative to traditional deep loss premium subsidies in lower risk regions. Nonetheless, SCO and STAX appear likely to have relatively low impacts on production:

Unlike ARC and PLC, SCO and STAX payments are tied to planted acres, suggesting a potential avenue, albeit small, for production impacts. However, since the effect of traditional crop insurance is limited, and SCO/STAX cover only a fraction of the crop value covered by traditional crop insurance, it would appear unlikely that these programs will have a significant impacts.

However, like ARC, the new SCO and STAX programs also make payments using area (county) yield calculations. Hence, an individual producer cannot alter per acre SCO and STAX payments via changes in yields.

In the end, actual production impacts of SCO are likely to be small given the low participation in this program to date relative to the limited impacts of traditional deep loss programs. Using figures as of August, 2015, for the 2015 crop year, producers purchased only 25 thousand SCO policies versus 1.7 million RP and APH “deep loss” policies (RMA, 2015a). Cotton producers purchased 12 thousand STAX policies (and hardly any SCO policies) versus 74 thousand RP and YP deep loss policies (RMA, 2015b).2

Other provisions of the 2014 Farm Act include changes to the Noninsured Crop Disaster Assistance Program (NAP) and the Whole-Farm Revenue Protection Policy (WFRP). Many specialty crop producers and livestock producers do not have access to Federal crop insurance policies within their counties. These specialty crop farmers are eligible for the FSA administered NAP, which in the past has provided catastrophic yield protection for an administrative fee. Under the 2014 Farm Act, producers are offered the option of increased coverage under NAP for an additional premium. The WFRP is being offered as a pilot program by RMA for the 2015 insurance year. This new policy will offer fruit and vegetable growers and producers with diversified farms expanded insurance coverage options for specialty and organic crops, allowing them to insure all the crops at once instead of one commodity at a time, and with a higher premium subsidy than previously available.

While it is too early to know what the impacts of WFRP and the NAP revisions may be, by lowering the cost of risk protection for crops not covered by Federal crop insurance and other commodity support, these programs could induce a shift of more land to specialty crops – assuming the changes to these programs are perceived as more attractive than the 2014 Farm Act changes to the other support programs, and/or change production practices for specialty crops along the same principles discussed earlier.

Conclusions

The almost exclusive use of insurance as a means of supporting farmers is somewhat unchartered territory. We have demonstrated here what we know about the impact of crop insurance on production and the environment in an era where crop insurance played a relatively minor role relative to other commodity support mechanisms. At this point, with limited actual experience with crop insurance as the dominate support mechanism, we conclude its impact on production decision, commodity prices and the environment are expected to be generally small and limited. But we also strongly conclude there is much research to be done. We’ve outlined in the beginning of the document a series of research areas that we feel need to be pursued based on the discussion of issues in this document. Also, because actuarially defined insurance premiums do not in general create incentives for risky or adverse behavior, and as such they are recommended as economically efficient policy instruments. In addition to the research outlined above, there is a continued need for sufficient data to estimate and understand the variance in yields or prices for calculating actuarially fair insurance premiums.

1There is considerable evidence that both direct payments and crop or pasture insurance premium subsidies are at least partially capitalized into agricultural land values. Given that his support impacts land values, it would be surprising if these programs had no extensive margin effect. However, this also means that increased rental rates due to commodity support need to be taken into account when modeling and estimating these effects). s

2 Note though, that STAX policy purchases should be able to vary more from year to year over the life of the 2015 Farm Act than SCO purchases as cotton producers are not eligible for ARC, whose election precludes SCO purchase for the life the Farm Act.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 2021-01-21 |

© 2026 OMB.report | Privacy Policy