SPST-0136 - Privacy of Consumer Financial Information (2019) - 2-12-19

SPST-0136 - Privacy of Consumer Financial Information (2019) - 2-12-19.doc

Privacy of Consumer Financial Information

OMB: 3064-0136

SUPPORTING STATEMENT

Privacy of Consumer Financial Information

(OMB Control No. 3064-0136)

INTRODUCTION

The Federal Deposit Insurance Corporation (FDIC) is requesting a three-year renewal of the information collection for its collection (3064-0136) associated with privacy of consumer financial information. The current clearance for the collection expires on January 31, 2019. There is no change in the method or substance of the collection. However, the FDIC has reviewed its previous PRA submission and reassessed its burden hours associated with responding to the existing requirements of sections 503 and 504 of the Gramm-Leach-Bliley Act, 15 U.S.C. §§ 6803, 6804. The FDIC has determined that the time to comply with the statutes has decreased due to streamlined and technological advances.

JUSTIFICATION

Circumstances that make the collection necessary:

The elements of this information collection are required under section 504 of the Gramm-Leach-Bliley Act (Act), Public Law No. 106-102. Section 502 of the Act prohibits a financial institution from disclosing nonpublic personal information about a consumer to nonaffiliated third parties unless the institution satisfies various disclosure requirements (i.e., provides a privacy notice and opt out notice) and the consumer has not elected to opt out of the disclosure. Section 504 requires the Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of Thrift Supervision, National Credit Union Administration, Federal Trade Commission, and Securities and Exchange Commission to issue regulations as necessary to implement the notice requirements and restrictions. The agencies issued final regulations on June 1, 2000 (65 FR 35162), and obtained OMB approval to collect the information in conjunction with that rulemaking. In December 2011, the CFPB recodified in Regulation P, 12 CFR Part 1016, the implementing regulations that were previously issued by the aforementioned agencies in 2000 (see 12 CFR 1016.1(b)).

Use of the information:

Consumers use the privacy notice information to determine whether they want personal information disclosed to third parties that are not affiliated with the institution. Further, consumers use the opt-out notice mechanism to advise the bank of their wishes regarding disclosure of their personal information. Institutions use the opt-out information to determine the wishes of their consumers and to act appropriately.

Consideration of the use of improved information technology:

The collections are disclosures, filings from consumers, and internal institution records. Institutions are not prohibited from using any technology that facilitates consumer understanding and response and that permits review, as appropriate, by examiners.

Effort to identify duplication:

The collections of information are unique and cover the institution’s particular circumstances. No duplication exists.

Methods used to minimize burden if the collection has a significant impact on a substantial number of small entities:

The information collections do not impose any significant burden beyond that required by the statute. Because of the statutory requirements, there are no significant alternatives that minimize burden on small institutions.

This collection has a significant impact on a substantial number of small entities. In particular, according to Call Report data as of September 30, 2018, there were 3,533 FDIC-supervised institutions. 2,726 of these entities have total assets of less than $550 million therefore meeting the Small Business Administration’s definition of a “small entity.”

Consequences to the Federal program if the collection were conducted less frequently:

The collection in the regulation closely follows the Gramm-Leach-Bliley Act, which requires institutions to provide an updated and annually restated notice to their customers of their privacy policies and practices, and to permit consumers to opt-out of disclosure of their personal information.

Special circumstances necessitating collection inconsistent with 5 CFR 1320.5(d)(2):

None. This information collection is conducted in accordance with the guidelines in 5 CFR 1320.5(d)(2).

Efforts to consult with persons outside the agency:

A 60-day Federal Register notice seeking public comment was published on November 2, 2018 (83 FR 55167). No comments were received.

Payment or gift to respondents:

None.

Any assurance of confidentiality:

Information collected is kept private to the extent allowed by law. All required records are subject to the confidentiality requirements of the Privacy Act. In addition, any information deemed to be of a confidential nature is exempt from public disclosure in accordance with the provisions of the Freedom of Information Act (5 U.S.C. 552).

Justification for questions of a sensitive nature:

No questions of a sensitive nature are included in the collection.

Estimate of Hour Burden Including Annualized Hourly Costs:

Summary of Annual Burden and Internal Cost |

|||||||||

Information Collection (IC) Description |

Type of Burden |

Obligation to Respond |

Estimated Number of Respondents |

Estimated Frequency of Responses |

Estimated Time per Response |

Frequency of Response |

Total Annual Estimated Burden |

Labor Cost Per Hourly Burden |

Total Cost of Estimated Annual Burden |

Consumer opt-out/status update |

Reporting |

Voluntary |

404,921 |

1 |

0.25 |

On Occasion |

101,230.25 |

$41.04 |

$4,154,489.46 |

Annual notice and change in terms |

Third-Party Disclosure |

Mandatory |

3,493 |

1 |

8.00 |

On Occasion |

27,944.00 |

$87.53 |

$2,445,938.32 |

Initial notice to consumers |

Third-Party Disclosure |

Mandatory |

156 |

1 |

60.00 |

On Occasion |

9,360.00 |

$87.53 |

$819,280.80 |

Opt-out notice |

Third-Party Disclosure |

Mandatory |

349 |

1 |

8.00 |

On Occasion |

2,792.00 |

$87.53 |

$244,383.76 |

TOTAL HOURLY BURDEN |

141,326.25 hours |

|

|

|

|

|

|

|

|

TOTAL INTERNAL COST |

$7,664,092.34 |

|

|

|

|

|

|

|

|

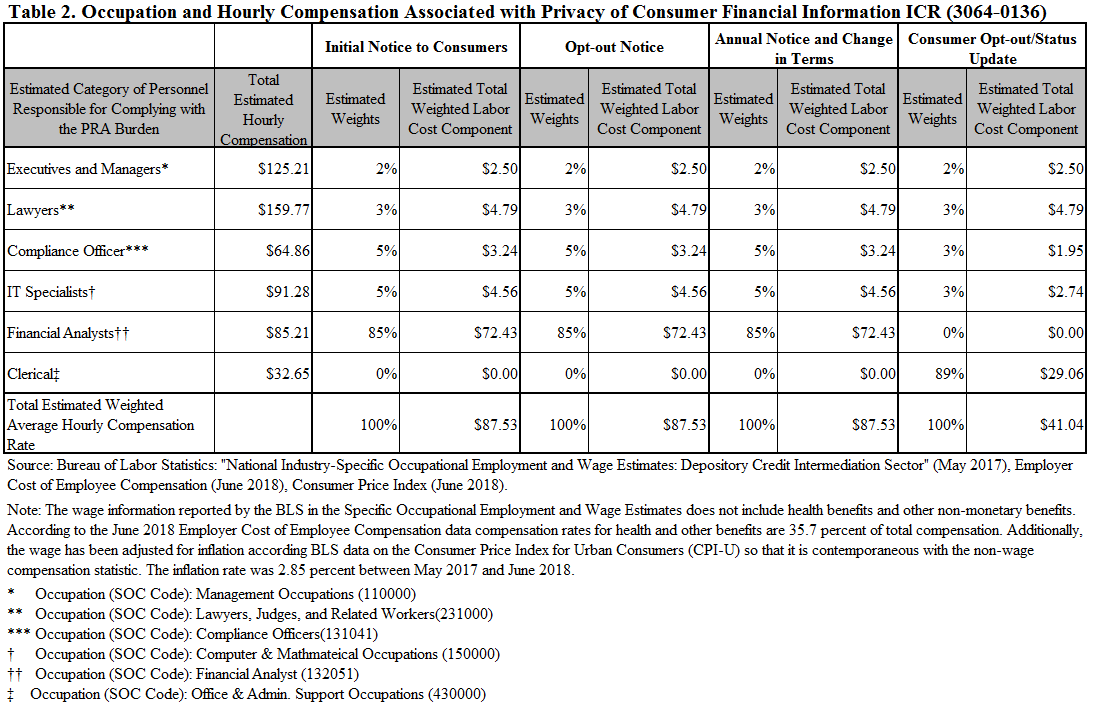

The estimated labor cost1 is $7,664,092.34 and is based on the following:

Estimate of Start-up Costs to Respondents:

None.

Estimate of annualized costs to the government:

None.

Analysis of change in burden:

There is no change in the method or substance of the collection. However, the FDIC has reviewed its previous PRA submission and has reassessed its burden hours associated with responding to the existing requirements of sections 503 and 504 of the Gramm-Leach-Bliley Act. In particular, the time to comply with the consumer opt-out/status update and the initial notice to consumers has decreased due to streamlined and technological advances. The time to comply with the annual notice and change in terms, and the opt-out notice has remained the same. In addition, the FDIC has also updated its estimated number of respondents based on available information. The number of respondents has decreased for the annual notice and change in terms, the initial notice to consumers, and the opt-out notice while the number of respondents for the consumer opt-out/status update has increased. The overall 20,578 decrease in burden hours is the result of these changes.

Information regarding collections whose results are planned to be published for

statistical use:

The results of this collection will not be published for statistical use.

Display of Expiration Date

This information collection is contained in a regulation.

Exceptions to Certification Statement

None.

STATISTICAL METHODS

Statistical methods are not employed in these collections.

1 The wage information reported by the Bureau of Labor Statistics (BLS) in the Specific Occupational Employment and Wage Estimates does not include health benefits and other non-monetary benefits. According to the June 2018 Employer Cost of Employee Compensation data compensation rates for health and other benefits are 35.7 percent of total compensation. Additionally, the wage has been adjusted for inflation according BLS data on the Consumer Price Index for Urban Consumers (CPI-U) so that it is contemporaneous with the non-wage compensation statistic. The inflation rate was 2.85 percent between May 2017 and June 2018. The 75th percentile hourly compensation figures for the occupations associated with this ICR (OMB 3064-0136), adjusted for inflation and including non-wage benefits are presented in the second column of Table 2 (Total Estimated Hourly Compensation).

| File Type | application/msword |

| File Modified | 2019-02-12 |

| File Created | 2019-02-12 |

© 2026 OMB.report | Privacy Policy