3245-Supporting Statement_ELI Data Elements 5-24-19

3245-Supporting Statement_ELI Data Elements 5-24-19.docx

Women's Digitalization (Entrepreneur Learning) Initiative Registration

OMB: 3245-0399

U.S. Small Business Administration

Women’s Digitalization (Entrepreneur Learning) Initiative Registration

A: JUSTIFICATION

1. Circumstances necessitating the collection of information

Explain the circumstances that make the collection of information necessary. Identify any legal or administrative requirements that necessitate the collection. Attach a copy of the appropriate section of each statute and regulation mandating or authorizing the collection of information.

Congress created the U.S. Small Business Administration (SBA) to aid, counsel, assist, and protect the interests of small business concerns in order to preserve free competitive enterprise, a cornerstone of the nation’s economic system. 15 U.S.C. 631. The statute also authorized SBA to provide management and technical assistance training programs to encourage small enterprises in all areas, including, as stated in section 29(g) of the Small Business Act (15 U.S.C. 656), women’s business enterprises. (See ATTACHMENT 1)

In the 21st century between 2002 and 2012, the number of women-owned firms increased 2.5 times the national average (52% vs. 20%)1, and employment in women-owned firms grew 4.5 times that of all firms (18% vs. 4%)2. However, in terms of revenue, women-owned businesses are smaller. Despite accounting for more than one-third of businesses in the U.S., women-owned businesses generate only 11.7% of sales3, and fewer than one in 50 women-owned firms generate revenue over $1 million4. Women-owned businesses also fall behind when it comes to job growth: Only 2% of women-owned firms have more than 10 employees, and 89.5% of women-owned firms have no employees at all.5

As part of its mission to provide management and technical assistance training programs to encourage small enterprises in all areas, including women entrepreneurs, the SBA is developing an e-learning platform to help women entrepreneurs grow their businesses and compete on a more level playing field. This effort is expected to address the market gap for growth-oriented women-owned small businesses by using a learning path approach to deliver a modern, complete learning platform for women entrepreneurs. The e-learning approach will reach more women, particularly those in rural and underdeveloped areas, without adding more brick and mortar locations. This cloud-based learning platform will incorporate networking and peer-to-peer learning-- two critical components identified by SBA’s National Women’s Business Council as supportive to women entrepreneurs.6

Content within the platform offers multiple approaches to ensure learner comprehension, such as developing infographics to convey data analysis; using case studies to demonstrate and support topics; providing audio and video to enhance the user experience. In addition to rich content provided within the system, additional external resources are referenced through various methods which will complement the topics and/or provide materials that offer different perspectives.

The platform will launch with seven “learning paths” that cover the following general topics:

Entrepreneurial Leadership - offers a personal assessment to measure self-confidence; evaluating success; developing a risk reduction plan; identifying a leadership approach.

Opportunity & Innovation – guides users in identifying new business opportunities, developing new products and services, and applying the practice of design thinking.

Opportunity Assessment – includes evaluation a product or service, analyzing potential risks, and assessing an opportunities compatibility with your current business.

Strategic Marketing – allows user to explore the marketing plan development process, value propositions, market size, and target markets.

Your People – focuses on skills necessary to attract, hire, develop, and retain the people needed to grow a small business.

Your Business Financial Strategy – focuses on creating and evaluation financial statements such as income statements, balance sheets, and cash flow statements.

Access to Capital – guides the user in exploring sources of capital by delving into topics such as financial language, lending institutions, crowdfunding, angels, venture capital, and SBA loan guarantee programs.

Four additional learning paths will be developed at a later date.

2. How, by whom, and for what purpose information will be used

Indicate how, by whom, and for what purpose the information is to be used. Except for a new collection, indicate the actual use the agency has made of the information received from the current collection.

This information collection will facilitate registration for the new e-learning and networking platform for women entrepreneurs interested in accessing resources to support growing an existing business. This information collection will enable the Agency to track customer use of the platform and its resources. By collecting basic demographic information and data on the registrant’s entrepreneurial goals, the SBA will better understand who is using the platform and their business goals, and can develop a platform that would enable the user to tailor delivery of content to meet their needs. This data collection will also facilitate user connectivity to relevant resources (peer-to-peer learning, networking, mentoring, etc.). Information collected will be used for determining the scope of user participation on the platform, as well as user satisfaction with platform content.

3. Technological collection techniques

Describe whether, and to what extent, the collection of information involves the use of automated, electronic, mechanical, or other technological collection techniques or other forms of information technology, e.g. permitting electronic submission of responses, and the basis for the decision for adopting this means of collection. Also describe any consideration of using information technology to reduce the burden.

The registration is built into the platform as an online, web-based collection, permitting electronic responses, ultimately lessening the burden on respondents.

4. Avoidance of Duplication

Describe efforts to identify duplication. Show specifically why any similar information already available cannot be used or modified for use for the purposes described in item 2 above.

The SBA does not know who will register for this learning and networking platform so it is difficult to identify duplication. Given the platform’s limited data collection, the agency has no way to match platform users with those people that may have used other SBA services such as loans, mentoring, etc.

5. Impact on small businesses or other small entities

If the collection of information impacts small businesses or other small entities (Item 5 of OMB Form 83-I), describe any methods used to minimize burden.

Most platform participants will be women small business entrepreneurs who are interested in growing their existing business but have not yet done so and are seeking information and helpful resources. The SBA does not expect that this collection will have a significant economic impact on these women business owners. Providing the requested data is voluntary but necessary for access to courses and resources. In order to lessen the burden on participants, registration for the web-accessible learning platform is online and available 24 hours a day, seven days a week. This allows the SBA to accommodate the varying and hectic schedules of entrepreneurs.

6. Consequences if collection of information is not conducted

Describe the consequence to the Federal program or policy activities if the collection is not conducted or is conducted less frequently, as well as any technical or legal obstacles to reducing burden.

Failure to collect certain information about the small business platform user could impact SBA’s ability to develop meaningful content to meet the user’s entrepreneurial goals that ultimately he or she can tailor obtain a more effective and rewarding experience. SBA would be unable to determine the specific demographics that are being served by the learning platform, and the level of their platform participation. Having this information would help SBA to assess the value of continuing the service. ,.

7. Existence of special circumstances

Explain any special circumstances that would cause an information collection to be conducted in a manner:

- requiring respondents to report information to the agency more often than quarterly;

- requiring respondents to prepare a written response to a collection of information in fewer than 30 days after receipt of it;

- requiring respondents to submit more than an original and two copies of any document;

- requiring respondents to retain records. other than health, medical, government contract, grant-in-aid, or tax records for more than three years;

- in connection with a statistical survey, that is not designed to produce valid and reliable results that can be generalized to the universe of study;

- requiring the use of a statistical data classification that has not been approved by OMB;

- that includes a pledge of confidentiality that is not supported by authority established in statue or regulation, that is not supported by disclosure and data security policies that are consistent with the pledge, or which unnecessarily impedes sharing of data with other agencies for compatible confidential use;

- requiring respondents to submit proprietary trade secret, or other confidential information unless the agency can demonstrate that it has instituted procedures to protect the information's confidentiality to the extent permitted by law.

There are no special circumstances.

8. Solicitation of Public Comment

If applicable, provide a copy and identify the date and page number of publication in the Federal Register of the agency's notice, required by 5 CFR 1320.8(d), soliciting comments on the information collection prior to submission to OMB. Summarize comments received. Describe efforts to consult with persons outside the agency to obtain their views…

To obtain views of persons outside the agency, a 60-day Federal Register Notice was published on October 1, 2018 at 83 FR 49452. The comment period ended on November 30, 2018. No comments were received.

9. Payment of gifts

Explain any decision to provide any payment or gift to respondents, other than remuneration of contractors or grantees.

None.

10. Assurance of Confidentiality

Describe any assurance of confidentiality provided to respondents and the basis for the assurance in statute, regulation, or agency policy.

Registrants are informed at the beginning of the platform how the SBA will use the information, and that the user’s Personally identifiable information is maintained in a Privacy Act system of record - SBA SOR 5- Business and Entrepreneurial Initiatives for Small Businesses, and further that the information collected will be protected to the extent permitted by law, including the Privacy Act of 1974 and the Freedom of Information Act.

11. Questions of a sensitive nature

Provide additional justification for any questions of a sensitive nature, such as sexual behavior and attitudes, religious beliefs, and other matters that are commonly considered private. This justification should include the reasons why the agency considers the questions necessary, the specific uses to be made of the information, the explanation to be given to persons from whom the information is requested, and any steps to be taken to obtain their consent.

In

this data collection, individuals will be asked for the following

information which may be considered sensitive: gender, race,

ethnicity, and information about their business situation, including

percent of business ownership and number of employees.

Collection of this data in aggregate will be used to

determine audience reach and demographics.

Zip code and business data are requested to segment participant use of the platform and to facilitate connectivity to relevant resources (peer-to-peer learning, networking, mentoring, etc.) that support their current business need(s). For example, some SBA products and services require businesses to meet certain criteria, such as being majority-owned. If a business is not 51% owned, the user may not qualify for certain SBA programs and services. As a result, the user will not receive notice of resources, products, or services for which they are not qualified to consider.

The information collected is essential to the mission of the agency and to monitor business and platform performance. SBA only reports the data in aggregate.

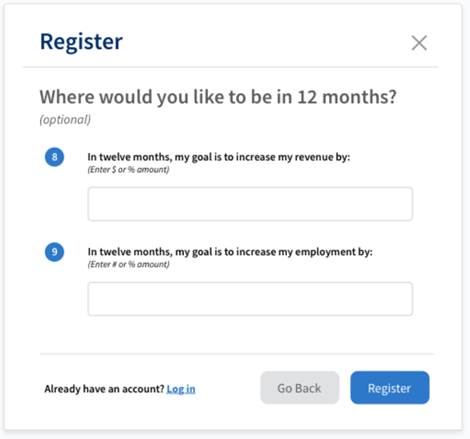

Questions #8 and #9 (below) would be used similarly to how brick and mortar offices collect data for the purposes of providing electronic performance support. For example, when a user creates a profile, they can enter their revenue goal. In a year, through an email notification, SBA will follow-up with the user to see whether the platform was helpful in reaching the business goal.

12. Estimate the hourly burden of the collection of information

Provide estimates of the hour burden of the collection of information. Indicate the number of respondents, frequency of response, annual hour burden, and an explanation of how the burden was estimated...

The annual hour burden is determined to be approximately 46,667 hours. The estimate is based upon a consultation with a potential respondent who sampled the draft registration form, averaging eight minutes for completion.

Although the goal for the ELI is to reach about 500,000 women in the first year of operation, the hourly burden estimate is based on 350,000 responses. This estimate is derived from information collection for a similar SBA program with a 70% response rate.(500,000 x .70 = 350,000). The average total annual cost burden to respondents is $1,120,000. This estimate is calculated using the average annual salary of $50,347 for an entrepreneur (based on SBA Office of Advocacy 2018 Small Business Profile) and the eight minutes to complete the registration. The individual cost burden is approximately $3.20.

13. Estimate the total annual cost burden for submission

Provide an estimate for the total annual cost burden to respondents or record keepers resulting from the collection of information…

There are no additional costs anticipated from this information collection.

14. Annualized Cost to the Federal Government

Provide estimates of annualized costs to the Federal Government. Also provide a description of the method used to estimate cost, which should include quantification of hours, operational expenses (such as equipment, overhead, printing, and support staff), and any other expense that would not have been incurred without this collection of information.

In FY2018, $3.1 million was obligated for Development, Modernization and Enhancement (DME) of the program.There is no cost to the federal government that would not have been incurred without this collection.

15. Explanation of program changes in Items 13 or 14 on OMB Form 83-I

Explain reasons for any program changes or adjustments reported in Items 13 or 14 of the OMB Form 83-I

This is a new information collection request (ICR).

16. Collection of information whose results will be published.

For collection of information whose results will be published, outline plans for tabluation and publiaction. Address complex analytical techniques… Proivide time schedules for the entire project…

Any reporting of the collected information will be at the aggregate level and will not contain individual PII.

17. Expiration date for collection of information

If seeking approval to not display the expiration date for OMB approval of the information collection, excplain the reasons why the display would be inappropriate.

Not Applicable, SBA plans to display the OMB expiration date.

18. Exceptions to certification in block 19 on OMB Form 83-I

Explain each exception to the certiifcation statement identiifed in Item 19, “Certfication for Paperwork Reduction Act Submission,” of OMB Form 83-I

There are no exceptions.

B. COLLECTION OF INFORMATION EMPLOYING STATISTICAL METHODS

Describe (including a numerical estimate) the potential respondent universe and any sampling or other respondent select

None

ATTACHMENT 1

SMALL BUSINESS ACT 15 U.S.C. 631 , et seq.

Section § 2(a) – 15 U.S.C. 631

*** It is the declared policy of the Congress that the Government should aid, counsel, assist, and protect, insofar as is possible, the interests of small-business concerns in order to preserve free competitive enterprise, to insure that a fair proportion of the total purchases and contracts or subcontracts for property and services for the Government (including but not limited to contracts or subcontracts for maintenance, repair, and construction) be placed with small business enterprises, to insure that a fair proportion of the total sales of Government property be made to such enterprises, and to maintain and strengthen the overall economy of the Nation.

Section 29 (g)(2)(B) -- 15 U.S.C. 656(g)(2)(B)

The responsibilities of the Assistant Administrator shall be to administer the programs and services of the Office of Women’s Business Ownership established to assist women entrepreneurs in the areas of—

(I) starting and operating a small business;

(II) development of management and technical skills;

(III) seeking Federal procurement opportunities; and

(IV) increasing the opportunity for access to capital

1 https://www.sba.gov/sites/default/files/NSBW-Fact-sheet-Women-Entreps.pdf

2 https://www.nwbc.gov/2017/12/31/2017-annual-report-accelerating-the-future-of-women-entrepreneurs-the-power-of-the-ecosystem/

3 Ibid

4 Ibid

5 Ibid

6 Ibid

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy