Young Adult Reentry Partnership (YARP)

DOL Generic Solution for Funding Opportunity Announcements

FOA YARP for OIRA 3-9-20

Young Adult Reentry Partnership (YARP)

OMB: 1225-0086

U.S. DEPARTMENT OF LABOR

Employment and Training Administration

Notice of Availability of Funds and Funding Opportunity Announcement for: Young Adult Reentry PArtnership (YARP)

ANNOUNCEMENT TYPE: Initial

Funding Opportunity Number: FOA-ETA-20-05

Catalog of Federal Domestic Assistance (CFDA) Number: 17.270

Key Dates: The closing date for receipt of applications under this Announcement is

[insert date XX days after the date of publication on Grants.gov]. We must receive applications no later than 4:00:00 p.m. Eastern Time.

Addresses: Address mailed applications to:

The U.S. Department of Labor

Employment and Training Administration, Office of Grants Management Attention: Melissa Abdullah, Grant Officer

Reference FOA-ETA-20-05

200 Constitution Avenue, NW, Room N4716

Washington, D.C. 20210

For complete application and submission information, including online application instructions, please refer to Section IV.

TABLE OF CONTENTS

I. FUNDING OPPORTUNITY DESCRIPTION 2

III. ELIGIBILITY INFORMATION 6

1. Application Screening Criteria 7

2. Number of Applications Applicants May Submit 8

IV. APPLICATION AND SUBMISSION INFORMATION 9

A. HOW TO OBTAIN AN APPLICATION PACKAGE 9

B. CONTENT AND FORM OF APPLICATION SUBMISSION 10

1. SF-424, “Application for Federal Assistance” 10

4. Attachments to the Project Narrative 25

C. SUBMISSION DATE, TIME, PROCESS, AND ADDRESS 28

2. Electronic Submission through Grants.gov 29

D. INTERGOVERNMENTAL REVIEW 32

2. Salary and Bonus Limitations 33

3. Intellectual Property Rights 33

4. Use of Grant Funds for Participant Wages 34

F. OTHER SUBMISSION REQUIREMENTS 35

V. APPLICATION REVIEW INFORMATION 35

B. REVIEW AND SELECTION PROCESS 37

1. Merit Review and Selection Process 37

VI. AWARD ADMINISTRATION INFORMATION 40

B. ADMINISTRATIVE AND NATIONAL POLICY REQUIREMENTS 40

1. Administrative Program Requirements 40

2. Other Legal Requirements 41

3. Other Administrative Standards and Provisions 45

4. Special Program Requirements 45

1. Quarterly Financial Reports 46

2. Quarterly Performance Reports 46

3. Quarterly Narrative Performance Reports 47

B. INDUSTRY COMPETENCY MODELS AND CAREER CLUSTERS 47

E. PAST DOL EVALUATIONS AND EVIDENCE 48

F. DIRECTIONS FOR USING CENSUS DATA TO IDENTIFY HIGH-POVERTY AREA IN URBAN OR RURAL AREAS 49

The Employment and Training Administration (ETA), U.S. Department of Labor (DOL, or the Department, or we), announces the availability of approximately $25,000,000 in grant funds authorized by the Department of Labor Appropriations Act, 2019 (Pub. L. 115-245), for ex-offender activities under Section 169 of the Workforce Innovation and Opportunity Act (WIOA) for Young Adult Reentry Partnership (YARP) projects, as part of the Reentry Employment Opportunities (REO) grant program.

This Funding Opportunity Announcement (FOA) provides community- or faith-based organizations with IRS 501(c)(3) non-profit status—including women’s and minority organizations and postsecondary educational institutions—and any Indian and Native American entity eligible for grants under section 166 of WIOA the opportunity to partner with community colleges and the criminal justice system to improve the employment outcomes for young adults who have been involved in the juvenile or adult criminal justice system. Applicants must be intermediary organizations that have sub-grantees, an affiliate network, or offices in at least three communities and across at least two states and that propose to serve at least three communities across at least two states for this project. Applicants, through their sub-grantees, must partner with at least one community college to provide education/credentialing in locally in-demand industries and occupations. Priority consideration will be given to applicants that identify serving communities in high-poverty and high-crime areas and that have at least one census tract in at least one of their sub-grantees’ target areas designated by the Secretary of Treasury as a qualified opportunity zone.

ETA plans to award approximately six grants of up to $4,500,000 each. These grants will have a 42-month period of performance, including a period of up to six months for planning, at least 24 months of operation, and 12 months of follow-up services. Future funding opportunities will take into account grantee performance on this grant. These projects will serve young adults ages 18-24 years old who are currently or have previously been involved with the juvenile or adult criminal justice system or are high school dropouts, are low-income as defined under WIOA, and either reside in or are returning to the target area. As a result of these services, this initiative intends to protect community safety by ensuring these individuals involved in the criminal justice system:

Become productive, responsible, and law-abiding members of society;

Receive positive opportunities to engage in pro-social activities, such as employment and/or education;

Maintain long-term financially sustaining employment;

Sustain a stable residence; and

Successfully address their substance abuse issues and mental health needs, as applicable, through partnerships with local programs.

Grants under this FOA must provide occupational training facilitated by a community college in locally in-demand industries, including but not limited to healthcare, information technology, and energy. Projected high-demand occupations include not only newly created jobs but also consider the increasing demands in certain industry sectors due to the retirements of an aging workforce. There are many considerations beyond occupational projections for placing individuals in jobs, training, or select career pathways. These considerations include: educational attainment, aptitude and strengths, age, and the ability to support themselves or their family.

Applicants must ensure that sub-grantees consult with the state and local workforce boards and verify that the selected industry sector and high-growth jobs offer employment opportunities in their local communities. Applicants must also identify the specific career pathways/occupations within each sector for which participants will receive training. Applicants must ensure that the occupational training provided has no state or local licensing regulations that prevent individuals with criminal records from obtaining licenses in that career.

The Department is also interested in program models that provide work-based learning opportunities, which could include apprenticeships, and models that exhibit strong partnerships with employers. Under the June 15, 2017, Executive Order on Expanding Apprenticeships in America, it is the policy of the Federal Government to provide more affordable pathways to secure high-paying jobs by promoting apprenticeships and effective workforce development programs.

The Department will competitively select applicants whose sub-grantees partner with community colleges to provide education and training to improve workforce outcomes for justice-involved young adults, the criminal justice system, and employers. Applicants must have a clear framework for delivering services and accomplishing performance outcomes identified by DOL. The Department encourages applicants to leverage evidence-based approaches in developing their proposals.

Applicants must provide a detailed description of the need for services in their target communities; how they plan to accomplish outcomes; their project design; past performance and programmatic capability; and their organizational, administrative, and fiscal capacity.

This FOA solicits applications for Young Adult Reentry Partnership projects. The purpose of this program is to partner organizations that provide reentry services with community colleges to provide education and training services to improve the employment outcomes for young adults involved in the criminal justice system. Young adults served under this grant are between the ages of 18 and 24 and currently or previously have been involved in the juvenile or adult criminal justice system or are high school dropouts, are low-income as defined under WIOA, and either reside in or are returning to the targeted geographic area.

These projects ensure that young adults transitioning from the criminal justice system are prepared to meet the needs of their local labor markets with the skills required by employers. Applicants must establish a partnership with the criminal justice system. Applicants also must establish partnerships through their sub-grantees with community colleges that have designed their courses and career pathways/guided pathways program curricula to ensure relevance to the needs of local industries and jobs. Grantees must ensure that each sub-grantee budgets no more than 25 percent of their grant funds on community college capacity building to support innovative models of accelerated learning for the target population of this FOA. Applicants must include the amount of this expenditure in their budget. This 25 percent limitation can be used to provide allowable activities, such as those listed below. Applicants must ensure participants are provided comprehensive and personalized student support services and career guidance, which must include a Learning Plan. Additionally, applicants must include at least one of the below activities:

Providing online and technology-based learning strategies where feasible to allow participants who may be on house arrest or have transportation limitations to participate;

Providing competency-based assessments and training courses to recognize skills proficiency and attainment;

Aligning education with industry-recognized stacked and latticed credentials on an in-demand career pathway;

Supporting evidence-based remediation policies and practices; and

Where possible, assessing credit for prior learning and awarding credits for prior learning.

NOTE: In order to focus grant funds on services that directly benefit participants, ETA expects grant budgets to limit community college adaptations or capacity building to 25 percent of the grant budget. However, ETA will consider higher percentages in cases where the applicant can demonstrate value to the target population through higher community college expenditures in these areas.

Grantees will provide reentry services and will spend at least 75 percent of grant funds (or, if the above 25 percent limit is increased, the entire remaining portion of the grant funds outside of the percentage spent on community college capacity building) to offer the following services:

Job assistance services;

Job preparatory experiences;

Career exploration activities, which include information on barriers to employment and requirements for entering their occupation;

Assistance with applying for financial aid for postsecondary education, particularly for programs of study leading to degrees;

Tuition assistance, where financial aid is not available (see note below);

Case management, including the development of an Individual Development Plan (IDP) that identifies strategies for achieving their employment goal, including overcoming barriers and acquiring supportive services;

Legal services, such as record expungement, modifying child support arrears, or obtaining a state driver’s license;

Assistance with linking participants to the social services required to help participants transition back to their communities; and

Providing 12 months of follow-up services.

Applicants must ensure that occupational training provided has no state or local licensing regulations that restrict individuals with criminal records from obtaining licenses in that career.

The opportunity to earn credentials in less than two years may be attractive for young adults who may be at risk, be out of school, or have some other barriers to employment, as well as for workers who are dislocated and need to gain skills to compete in the current labor market, even those who may already have a degree. Credentials such as certificates or certifications that can be earned in as little as six months to two years provide an alternative to lengthier and costlier undergraduate degrees. Providing individuals with opportunities to earn “credit for prior learning” is a strategy that recognizes past learning and experience, and accelerates the earning of meaningful credentials. Please refer to Training and Employment Guidance Letter (TEGL) 15-10 for additional information on the various types and characteristics of credentials. Well-paying jobs in high-demand industries generally require some form of post-secondary education or training, and the earnings gains that accompany postsecondary credentials are well established.1

Teaching young adults involved in the criminal justice system the foundational skills, such as job readiness, employability, and job search strategies, in addition to providing work experiences and occupational training leading to industry-recognized credentials, can provide access to employment, including apprenticeships, and reduce the likelihood of reoffending.

NOTE: The Department expects that grantees will work with their sub-grantees to ensure that community college services are provided through Pell Grants or other financial assistance first and that grant funds should only be used for tuition costs, as needed, to cover any remaining costs of services where federal funding is not available. For more information on Pell Grants, see Volume 3 Chapter 3 of the 19-20 FSA Handbook, available at https://ifap.ed.gov/sites/default/files/attachments/2019-10/1920FSAHbkVol3Ch3.pdf.

All projects under this FOA must include the following grant activities and components:

Employment-focused services which lead to hiring and must include a variety of the following approaches:

Occupational education leading to industry-recognized credentials;

Work-based learning, which could include apprenticeship; and

Work experience;

Case management, including an individual development plan, assessments, and career exploration;

Documented strategies to address and overcome barriers;

Legal services (such as record expungement, modifying child support arrears, or obtaining a state driver’s license);

Job placement assistance;

Collaboration with agencies to provide supportive services, such as substance abuse and mental health treatment, healthcare, transportation, childcare, housing, legal aid, and other social services; and

Assistance with securing identification, such as a driver’s license and state-issued identification.

Grantees will be allowed to use up to 5 percent of their grant to provide housing, substance abuse, and mental health services for participants. However, grantees must submit a written policy on the use of these funds as a condition of award.

This program is authorized by the Department of Labor Appropriations Act, 2019 (Pub. L. 115-245), for ex-offender activities under Section 169 of WIOA.

Funding will be provided in the form of a grant.

We plan to award at least $25,000,000 to fund approximately six grants. You may apply for up to $4,500,000. Awards made under this FOA are subject to the availability of federal funds. In the event that additional funds become available, we reserve the right to use such funds to select additional grantees from applications submitted in response to this FOA.

Applicants must indicate the number of participants they propose to serve and the cost per participant required to meet the outcomes of their project. Applicants must select and identify in their application their intended sub-grantees. DOL does not require applicants to competitively select local sub-grantees. Applicants may, but are not required to, select their local offices, affiliates, or members to serve as one or more sub-grantees.

These grants have a 42-month period of performance, which includes up to six months of planning, a required 24-month period of employment and training services, and a required 12-month period for follow-up services. Grantees must meet their enrollment goal, ensure that each participant receives the full menu of services within the period of operation, and be able to ensure that each participant receives the 12 months of follow-up services during the performance period of the grant. A minimum of 5 percent of total funds must be reserved for the 12-month follow-up period. The anticipated start date for these projects is July 1, 2020.

To ensure that grantees are prepared to begin program implementation, the Federal Project Officer (FPO) will review the completion of specific preliminary steps within the identified planning period of the grant. Grantees must complete these key preliminary steps during the planning period: hiring key staff (Director and Fiscal Manager), securing locations to house the program, finalizing sub-grant agreements, meeting with any additional partners identified in the application to solidify partnerships, and ensuring readiness for inputting data into the DOL Workforce Integrated Performance System (WIPS) and any DOL provided Case Management or Access Database system (if deemed applicable by DOL). The Department may subject grantees that do not meet these preliminary steps to corrective action. The application to the FOA serves as the Statement of Work for the grant.

All applicants must comply with the eligibility requirements below:

The following organizations are eligible to apply:

All applicants must be community- or faith-based intermediary organizations (organizations that have sub-grantees, an affiliate network, or offices in at least three communities and across at least two states, and that propose to serve at least three communities across at least two states for this project), with IRS 501(c)(3) non-profit status (including women’s and minority organizations and postsecondary education institutions), or any Indian and Native American entity eligible for grants under section 166 of WIOA that have a presence in at least three communities and across at least two states.

Entities eligible for WIOA Section 166 grants include: Federally recognized Indian tribes; Tribal organizations as defined in 25 U.S.C. 450b; Alaska Native-controlled organizations; Native Hawaiian-controlled organizations; Indian-controlled organizations serving Indian and Native Americans (INA); a consortium of eligible entities that meet the legal requirements for a consortium as defined at 20 CFR 684.200(e); and State-recognized tribal organizations as defined in 20 CFR 684.200(g).

The Department requests applicants applying with IRS 501(c)(3) non-profit status submit verification of the non-profit status. If you have submitted this documentation previously in another application submission, please submit it again for this application. For applicants applying with IRS 501(c)(3) non-profit status that do not submit documentation of this status, the Department will check IRS data to ensure the applicant has this status.

Eligible applicants include current or former DOL grantees. New applicants that have not received previous DOL grants are also encouraged to apply.

This program does not require cost sharing or matching funds. Including such funds is not one of the application screening criteria and applications that include any form of cost sharing or match will not receive additional consideration during the review process. Instead, the agency considers any resources contributed to the project beyond the funds provided by the agency as leveraged resources. Section IV.B.2 provides more information on leveraged resources.

You should use the checklist below as a guide when preparing your application package to ensure that the application has met all of the screening criteria. Note that this checklist is only an aid for applicants and should not be included in the application package. We urge you to use this checklist to ensure that your application contains all required items. If your application does not meet all of the screening criteria, it will not move forward through the merit review process.

Application Requirement |

Instructions |

Complete? |

The deadline submission requirements are met |

Section IV.C |

|

Eligibility |

Section III.A |

|

If submitted through Grants.gov, the components of the application are saved in any of the specified formats and are not corrupt. (We will attempt to open the document, but will not take any additional measures in the event of problems with opening.) |

Section IV.C.2 |

|

Application federal funds request does not exceed the ceiling amount of $4,500,000 |

Section II.A |

|

SAM Registration |

Section IV.B.1 |

|

SF-424, Application for Federal Assistance |

Section IV.B.1 |

|

SF-424 includes a DUNS Number |

Section IV.B.1 |

|

SF-424A, Budget Information Form |

Section IV.B.2 |

|

Budget Narrative |

Section IV.B.2 |

|

Project Narrative |

Section IV.B.3 |

|

MOUs or Letters of Commitment between the applicant and their sub-grantees |

Section IV.B.3 |

|

We will consider only one application from each organization. If we receive multiple applications from the same organization, we will consider only the most recently received application that met the deadline. If the most recent application is disqualified for any reason, we will not replace it with an earlier application.

Participants Eligible to Receive Training

An individual is eligible to participate in a program funded through this FOA if that individual, on the date of enrollment (the date of enrollment is when the individual has gone through the application process, been accepted, and received confirmation that they will participate in the program):

is at least 18 years and not older than 24 years of age;

is a high school dropout* or currently involved or has been involved with the juvenile or adult criminal justice system, which includes:

currently or previously incarcerated;

under the supervision of the criminal justice system, either in out-of-home placements, on probation, or on parole;

under an alternative sentence by the criminal justice system; or

under a diversion program as an alternative to prosecution

is low-income as defined by WIOA, Sec. 3(36)(A-B);

is eligible to enroll in a community college;

resides in or is returning to the targeted geographic area; and

is eligible to work in the United States.

Note: Up to 10 percent of participants may reside outside the targeted geographic area.

*Not more than 10 percent of participants may be high school dropouts without being involved in the juvenile or adult criminal justice system.

Grantees have the discretion to enroll individuals convicted of violent offenses or sexual offenses and those assessed as high-risk of either offense. Grantees that choose to serve these populations must conduct a rigorous risk assessment of each participant assessing criminogenic need, (i.e., causing or likely to cause criminal behavior). Applicants proposing to serve these populations may adjust their outcomes accordingly; enrollment goals based on cost-per-participant may not be reduced. In all cases, grantees must have clear and consistent written enrollment policies that address program enrollment. Grantees must submit their written enrollment policies as a condition of award. More information on risk assessments can be found at http://csgjusticecenter.org/reentry/the-reentry-and-employment-project/, as well as in Section VIII, Part H of this FOA.

NOTE: Male participants are required to register for the Selective Service before participating in services. Grantees should determine eligibility of male participants by accessing the Selective Service System at https://www.sss.gov/. For additional guidance, including how this requirement applies to male participants incarcerated at the time of their 18th birthdays, please see TEGL 11-11. Change 2 clarifies the implementation of the Selective Service registration requirements of the Workforce Investment Act (WIA) of 1998 § 189(h) for grantees funded or authorized by Title I of WIA, located at https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=8779. This guidance applies to grants funded or authorized by WIOA.

Veterans’ Priority for Participants

38 U.S.C. 4215 requires grantees to provide priority of service to veterans and spouses of certain veterans for the receipt of employment, training, and placement services in any job training program directly funded, in whole or in part, by DOL. The regulations implementing this priority of service are at 20 CFR Part 1010. In circumstances where a grant recipient must choose between two qualified candidates for a service, one of whom is a veteran or eligible spouse, the veterans’ priority of service provisions require that the grant recipient give the veteran or eligible spouse priority of service by first providing him or her that service. To obtain priority of service, a veteran or spouse must meet the program’s eligibility requirements. Grantees must comply with DOL guidance on veterans’ priority. TEGL 10-09 (issued November 10, 2009) provides guidance on implementing priority of service for veterans and eligible spouses in all qualified job training programs funded in whole or in part by DOL. TEGL 10-09 is available at https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=2816. This guidance applies to programs funded under WIOA. For additional information on veteran’s priority of service and WIOA, please see TEGL 19-16. TEGL 19-16 is available at https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=3851.

This FOA, found at www.Grants.gov and https://www.doleta.gov/grants/find_grants.cfm, contains all of the information and links to forms needed to apply for grant funding.

Applications submitted in response to this FOA must consist of four separate and distinct parts:

1. The SF-424 “Application for Federal Assistance”;

2. Project Budget, composed of the SF-424A and Budget Narrative;

3. Project Narrative; and

4. Attachments to the Project Narrative.

You must ensure that the funding amount requested is consistent across all parts and sub-parts of the application.

You must complete the SF-424, “Application for Federal Assistance” (available at https://www.grants.gov/web/grants/forms/sf-424-family.html#sortby=1.

In the address field, fill out the nine-digit (plus hyphen) zip code. Nine-digit zip codes can be looked up on the USPS website at https://tools.usps.com/go/ZipLookupAction!input.action.

The SF-424 must clearly identify the applicant and must be signed by an individual with authority to enter into a grant agreement. Upon confirmation of an award, the individual signing the SF-424 on behalf of the applicant is considered the Authorized Representative of the applicant. As stated in block 21 of the SF-424 form, the signature of the Authorized Representative on the SF-424 certifies that the organization is in compliance with the Assurances and Certifications form SF-424B (available at https://www.grants.gov/web/grants/forms/sf-424-family.html#sortby=1. You do not need to submit the SF-424B with the application.

In addition, subject to the provisions of the Religious Freedom Restoration Act (RFRA), 42 U.S.C. § 2000bb, the applicant’s Authorized Representative’s signature in block 21 of the SF-424 form constitutes assurance by the applicant of compliance with the following requirements in accordance with the WIOA 188 rules issued by the Department at 29 CFR 38.25 which includes the following language:

As a condition to the award of financial assistance from the Department under Title I of WIOA, the grant applicant assures that it has the ability to comply fully with the nondiscrimination and equal opportunity provisions of the following laws: Section 188 of WIOA, which, as interpreted through Departmental regulations, prohibits discrimination against all individuals in the United States on the basis of race, color, religion, sex (including pregnancy, childbirth, and related medical conditions, transgender status, and gender identity), national origin (including limited English proficiency), age, disability, political affiliation or belief, and against beneficiaries on the basis of either citizenship status or participation in any WIOA Title I—financially assisted program or activity; Title VI of the Civil Rights Act of 1964, as amended, which prohibits discrimination on the bases of race, color and national origin; Section 504 of the Rehabilitation Act of 1973, as amended, which prohibits discrimination against qualified individuals with disabilities; The Age Discrimination Act of 1975, as amended, which prohibits discrimination on the basis of age; and Title IX of the Education Amendments of 1972, as amended, which prohibits discrimination on the basis of sex in educational programs.

The grant applicant also assures, subject to RFRA, that as a recipient of WIOA Title I financial assistance [as defined at 29 CFR 38.4(zz)], it will comply with 29 CFR part 38 and all other regulations implementing the laws listed above. This assurance applies to the grant applicant's operation of the WIOA Title I-financially assisted program or activity, and to all agreements the grant applicant makes to carry out the WIOA Title I-financially assisted program or activity. The grant applicant understands that the United States has the right to seek judicial enforcement of this assurance. Note that RFRA applies to all federal law and its implementation. If an applicant organization is a faith-based organization that makes hiring decisions on the basis of religious belief, it may be entitled to receive federal financial assistance under this grant solicitation and maintain that hiring practice. If a faith-based organization is awarded a grant, the organization will be provided with more information.

Requirement for DUNS Number

All applicants for federal grant and funding opportunities must have a DUNS number, and must supply their DUNS Number on the SF-424. The DUNS Number is a nine-digit identification number that uniquely identifies business entities. If you do not have a DUNS Number, you can get one for free through the D&B website https://fedgov.dnb.com/webform/displayHomePage.do.

Grant recipients authorized to make subawards must meet these requirements related to DUNS Numbers:

Grant recipients must notify potential subawardees that no entity may receive a subaward unless the entity has provided its DUNS number.

Grant recipients may not make a subaward to an entity unless the entity has provided its DUNS number.

(See Appendix A to 2 CFR Part 25.)

Requirement for Registration with SAM

Applicants must register with the System for Award Management (SAM) before submitting an application. Find instructions for registering with SAM at https://www.sam.gov.

A recipient must maintain an active SAM registration with current information at all times during which it has an active federal award or an application under consideration. To remain registered in the SAM database after the initial registration, the applicant is required to review and update the registration at least every 12 months from the date of initial registration or subsequently update its information in the SAM database to ensure it is current, accurate, and complete. For purposes of this paragraph, the applicant is the entity that meets the eligibility criteria and has the legal authority to apply and to receive the award. If an applicant has not fully complied with these requirements by the time the Grant Officer is ready to make a federal award, the Grant Officer may determine that the applicant is not qualified to receive a federal award and use that determination as a basis for making a federal award to another applicant.

You must complete the SF-424A Budget Information Form (available at https://www.grants.gov/web/grants/forms/sf-424-family.html#sortby=1). In preparing the Budget Information Form, you must provide a concise narrative explanation to support the budget request, explained in detail below.

Budget Narrative

The Budget Narrative must provide a description of costs associated with each line item on the SF-424A. The Budget Narrative should also include a section describing any leveraged resources provided (as applicable) to support grant activities. Leveraged resources are all resources, both cash and in-kind, in excess of this award. Valuation of leveraged resources follows the same requirements as match. Applicants are encouraged to leverage resources to increase stakeholder investment in the project and broaden the impact of the project itself.

The budget narrative must demonstrate the cost-per-participant.

Up to 5 percent of grant funds may be used to provide emergency assistance for housing, substance abuse treatment, and mental health treatment for participants. Additionally, up to 1.5 percent of grant funds may be used for needs-related payments.

Each category should include the total cost for the period of performance. Use the following guidance for preparing the Budget Narrative.

Personnel: List all staff positions by title (both current and proposed) including the roles and responsibilities. For each position, give the annual salary, the percentage of time devoted to the project, and the amount of each position’s salary funded by the grant.

Fringe Benefits: Provide a breakdown of the amounts and percentages that comprise fringe benefit costs such as health insurance, FICA, retirement, etc.

Travel: For grantee staff only, specify the purpose, number of staff traveling, mileage, per diem, estimated number of in-state and out-of-state trips, and other costs for each type of travel.

Equipment: Identify each item of equipment you expect to purchase that has an estimated acquisition cost of $5,000 or more per unit (or if your capitalization level is less than $5,000, use your capitalization level) and a useful lifetime of more than one year (see 2 CFR 200.33 for the definition of Equipment). List the item, quantity, and the unit cost per item.

Items with a unit cost of less than $5,000 are supplies, not “equipment.” In general, we do not permit the purchase of equipment during the last funded year of the grant.

Supplies: Identify categories of supplies (e.g., office supplies) in the detailed budget and list the item, quantity, and the unit cost per item. Supplies include all tangible personal property other than “equipment” (see 2 CFR 200.94 for the definition of Supplies).

Contractual: Under the Contractual line item, delineate contracts and subawards separately. Contracts are defined according to 2 CFR 200.22 as a legal instrument by which a non-federal entity purchases property or services needed to carry out the project or program under a federal award. A subaward, defined by 2 CFR 200.92, means an award provided by a pass-through entity to a subrecipient for the subrecipient to carry out part of a federal award received by the pass-through entity. It does not include payments to a contractor or payments to an individual that is a beneficiary of a federal program.

For each proposed contract and subaward, specify the purpose and activities to be provided, and the estimated cost.

Construction: Construction costs are not allowed and this line must be left as zero. Minor alterations to adjust an existing space for grant activities (such as a classroom alteration) may be allowable. We do not consider this as construction and you must show the costs on other appropriate lines such as Contractual.

Other: Provide clear and specific detail, including costs, for each item so that we are able to determine whether the costs are necessary, reasonable, and allocable. List items, such as stipends or incentives, not covered elsewhere.

Indirect Costs: If you include an amount for indirect costs (through a Negotiated Indirect Cost Rate Agreement or De Minimis) on the SF-424A budget form, then include one of the following:

a) If you have a Negotiated Indirect Cost Rate Agreement (NICRA), provide an explanation of how the indirect costs are calculated. This explanation should include which portion of each line item, along with the associated costs, are included in your cost allocation base. Also, provide a current version of the NICRA.

or

b) If you intend to claim indirect costs using the 10 percent de minimis rate, please confirm that your organization meets the requirements as described in 2 CFR 200.414(f). Clearly state that your organization has never received a Negotiated Indirect Cost Rate Agreement (NICRA), and your organization is not one described in 2 CFR 200, Appendix VII(D)(1)(b).

Applicants choosing to claim indirect costs using the de minimis rate must use Modified Total Direct Costs (see 2 CFR 200.68 below for definition) as their cost allocation base. Provide an explanation of which portion of each line item, along with the associated costs, are included in your cost allocation base. Note that there are various items not included in the calculation of Modified Total Direct Costs. See the definitions below to assist you in your calculation.

2 CFR 200.68 Modified Total Direct Cost (MTDC) means all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and up to the first $25,000 of each subaward (regardless of the period of performance of the subawards under the award). MTDC excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $25,000. Other items may only be excluded when necessary to avoid a serious inequity in the distribution of indirect costs, and with the approval of the cognizant agency for indirect costs.

The definition of MTDC in 2 CFR 200.68 no longer allows for any sub-contracts to be included in the calculation. You will also note that participant support costs are not included in modified total direct cost. Participant support costs are defined below.

2 CFR 200.75 Participant Support Cost means direct costs for items such as stipends or subsistence allowances, travel allowances, and registration fees paid to or on behalf of participants or trainees (but not employees) in connection with conferences or training projects.

See Section IV.B.4 and Section IV.E.1 for more information. Additionally, the following link contains information regarding the negotiation of Indirect Cost Rates at DOL: https://www.dol.gov/agencies/oasam/centers-offices/business-operations-center/cost-determination.

Note that the SF-424, SF-424A, and Budget Narrative must include the entire federal grant amount requested (not just one year).

Do not show leveraged resources on the SF-424 and SF-424A. You should describe leveraged resources in the Budget Narrative.

Applicants should list the same requested federal grant amount on the SF-424, SF-424A, and Budget Narrative. If minor inconsistencies are found between the budget amounts specified on the SF-424, SF-424A, and the Budget Narrative, ETA will consider the SF-424 the official funding amount requested. However, if the amount specified on the SF-424 would render the application nonresponsive, the Grant Officer will use his or her discretion to determine whether the intended funding request (and match if applicable) is within the responsive range.

The Project Narrative must demonstrate your capability to implement the grant project in accordance with the provisions of this FOA. It provides a comprehensive framework and description of all aspects of the proposed project. It must be succinct, self-explanatory, and well-organized so that reviewers can understand the proposed project.

The Project Narrative is limited to 25 double-spaced single-sided 8.5 x 11 inch pages with Times New Roman 12 point text font and 1-inch margins. You must number the Project Narrative beginning with page number 1.

We will not read or consider any materials beyond the specified page limit in the application review process.

The following instructions provide all of the information needed to complete the Project Narrative. Carefully read and consider each section, and include all required information in your Project Narrative. The agency will evaluate the Project Narrative using the evaluation criteria identified in Section V.A. You must use the same section headers identified below for each section of the Project Narrative.

Scoring under this criterion will be based on the extent to which the following factors are clearly and accurately addressed:

Participants Served: Applicants must clearly indicate the number of participants that each sub-grantee will serve, as well as the total cumulative number of participants to be served by all sub-grantees combined, and demonstrate that there is a sufficient pool of eligible potential participants in the target areas to recruit into the program and providing evidence to support the number of proposed participants in each sub-grantee target area to be served. (2 points)

Selected Occupational Education Programs: Applicants must identify and fully describe the need for the selected occupational training program(s) in the area(s) to be served and identify the source of this information, such as Workforce Development Boards (WDBs), business/industry groups, or labor market projections. (2 points)

Performance Strategies (20 points)

Applicants must identify the outcomes they expect to accomplish by the end of the grant and explain their strategy for meeting the outcomes below and how they will track the performance data. Please note that applicants will be held to outcomes provided, and failure to meet those outcomes may result in technical assistance or other intervention by ETA, and may also have a significant impact on decisions about future grants with ETA. Applicants must include the following in the Project Narrative:

Outcomes Strategies: Grant applicants must describe their strategies for meeting their identified outcomes and striving to reach the highest level of performance for the WIOA primary indicators and achieving the REO-specific measure outlined below, and explain how the strength of their proposed strategies will ensure that the highest level of performance would be achieved. Strategies are to be specific, quantifiable statements and clearly linked to each WIOA primary indicator of performance and REO-specific measure. Applicants should draw on evidence-based practices for serving youth involved in the criminal justice system in developing their application. (10 points)

Tracking Measures: Applicants must fully describe the system they will use to track and report the stated outcomes pre- and post-release, particularly follow-up services, including how they will co-enroll participants in WIOA if applicable. DOL encourages grantees to use technology for coordinated services with the public workforce system, including existing state case management systems. (6 points)

Recidivism: Applicants must fully describe their plan to track and report recidivism data. (4 points)

The Department expects grantees to track and report on five of the six primary indicators of performance as listed in WIOA section 116(b)(2)(A)(i-ii), as well as an REO-specific measure. As part of their data collection, all REO grantees are directed to request participants’ social security numbers (SSNs). However, while REO grantees are required to request participants’ SSNs, participants cannot be denied services if they choose not to disclose.

WIOA Primary Indicators of Performance

Grantees must report on five of the six WIOA primary indicators of performance. These indicators are:

Education & Employment Rate – Second Quarter After Exit

Education & Employment Rate – Fourth Quarter After Exit

Median Earnings – Second Quarter After Exit

Credential Attainment

Measurable Skill Gains

Additional information for the methodology of calculating these performance indicators can be found in TEGL 10-16, Change 1: “Performance Accountability Guidance for Workforce Innovation and Opportunity Act (WIOA) Title I, Title II, Title III and Title IV Core Programs,” found at https://wdr.doleta.gov/directives/corr_doc.cfm?docn=3255.

The Department will use the data reported for the WIOA indicators as baseline information, except for the credential attainment measure, for which there is a specific goal, described below. The other four WIOA indicators do not have established goals at this time; however, the Department may determine goals for the WIOA indicators post-award.

REO-Specific Measure and Goals

As described above, ETA is setting a program goal for REO grantees for the Credential Attainment WIOA indicator. The goal for this indictor is 60 percent.

Grantees are also expected to track, report, and meet the recidivism rate: The percentage of participants who were in or returning from an adult correctional facility prior to enrolling in the program and have been convicted of a new criminal offense committed within 12 months of their release from the correctional facility. Grantees have until the end of the grant period of performance to achieve this measure. The goal for this measure is lower than the recidivism rate in the state in which the grantee is operating.

Scoring under this criterion will be based on the extent to which the following factors are clearly and accurately addressed:

Educational Opportunities in Community College Institutions: Applicants must fully describe their program model, including how they will provide relevant education and training to participants and the use of innovative models of accelerated learning for the target population. Applicants must describe how they will ensure participants are provided comprehensive and personalized student support services and career guidance, including a required Learning Plan. Applicants must also ensure that at least one of the following services will be incorporated:

Providing online and technology-based learning strategies where feasible to allow participants who may be on house arrest or have transportation limitations to participate;

Providing competency-based assessments and training courses to recognize skills proficiency and attainment;

Aligning education with industry-recognized stacked and latticed credentials on an in-demand career pathway;

Supporting evidence-based remediation policies and practices; and

Where possible, assessing credit for prior learning and awarding credits for prior learning. (2 points)

(ii) Approaches and Methods: Applicants must outline the documented strategy that will be used to address and overcome barriers. Outline the approaches and methods that will be used to implement the program and explain their integration into the program model, as well as the milestones showing the achievement of major tasks and outcomes within the 42-month grant period. Justify the proposed approaches and state the reason for their selection rather than other approaches. Describe how such methods will lead to the stated outcomes. While budgeting for this work, note that up to 5 percent of grant funds may be used to provide emergency assistance for housing, substance abuse treatment, and mental health treatment for participants. However, grantees must submit a written policy on the use of these funds as a condition of award. Up to 1.5 percent may be used for needs-related payments. (2 points)

Project Timelines: Applicants must identify reasonable timelines for completion of work and describe how the applicant will support and assist its sub-grantees to achieve the overarching work plan to implement this grant. (2 points)

Planning Phase: Applicants must clearly describe a plan to meet the preliminary steps to be completed during the planning phase: hiring key staff (Director, Fiscal Manager); securing locations to house the skills training; finalizing sub-grantee agreements; meeting with required partners and any additional partners identified in the application to solidify partnerships; and ensuring readiness for inputting data into the DOL Workforce Integrated Performance system (WIPS) and any DOL provided Case Management or Access Database system (if deemed applicable by DOL) and assist sub-grantees to meet these preliminary steps. (2 points)

Work Plan: Applicants must provide, as an attachment to the Project Narrative, a detailed narrative description of the proposed plan for accomplishing the work (the work plan) describing how the project will operate throughout the funding period, as well as a graphic illustration, such as a Gantt chart or a flow chart (as described in Section IV.B.4.b(6)), showing how the applicant will successfully achieve outcomes. Include in the work plan: 1) all functions, activities or major tasks and the assignment of responsibilities for those major tasks identified in the application; 2) factors that might accelerate or delay the work and how the applicant will address such factors amid program operations; and 3) any potential barriers with a description of how the project will overcome these barriers. Applicants must clearly identify the roles and responsibilities of both the applicant and all sub-grantees. NOTE: The Work Plan must be included as an attachment and will not be counted against the page limit for the project narrative. (4 points)

Employment-focused Services: Employment-focused services must be included in the project design and must span throughout the participant’s participation in the program. Applicants must identify the employment-focused service(s) that will be incorporated in your program model including at least one of the following approaches: occupational education leading to industry-recognized credentials, apprenticeship, work-based learning or work-experience. Applicants must ensure that the skills training provided has no state or local licensing regulations that prohibit individuals with criminal records from obtaining a license in that career. Applicants must identify and provide a persuasive explanation of how their approach will lead to improved employment outcomes for program participants. (6 points)

Case Management and Legal Services: Case management and legal services are fundamental services that are essential in all reentry programs. Both of these types of services must begin at the time of enrollment and continue throughout the participant’s participation in the program, including the follow-up period, and must be consistent with the regulations and guidance under WIOA. Applicants must fully describe how they will ensure that sub-grantees provide case management and legal services. Specifically, applicants must at a minimum describe how sub-grantees will:

Identify and provide justification for the ratio of case managers to participants and how the case managers will act as advocates for program participants, including the frequency of their interactions;

Identify the specific legal services, such as but not limited to expungement or diversion, that will be available to program participants and how these services will be provided; and

Describe how case management and legal services will be provided at the time of enrollment and continue throughout the participant’s participation in the program, including the follow-up period.

(2 points)

Applicants must propose methods that the project will use to address the stated outcomes and clearly outline a plan of action that describes the scope and detail of how the project will accomplish the proposed work and include timelines for completion of work. (2 points)

Applicants must ensure that their sub-grantees identify their primary partners and describe the specifics of their partnership by providing a Memorandum of Understanding (MOU) or Letter of Commitment signed by the authorizing agent of each primary partnership organization. Applicants will be scored based on the Memorandum of Understanding or Letter of Commitment from each partner that fully describes:

Services provided to the organization or participants;

Procedures for enrollment or recruitment, if applicable; and

Plan for coordination of services between partners.

Applicants that do not provide a Memorandum of Understanding or Letter of Commitment between each sub-grantee and each member in the primary partnership will receive zero (0) points for the Primary Partnership section. Primary Partners must include:

Community College(s)

Applicants must ensure that all sub-grantees partner with one or more community colleges that will provide education and training and that have designed their courses and career pathways/guided pathways program curricula to ensure relevance to the needs of local industries and jobs.

Criminal Justice System

Applicants must ensure that all sub-grantees partner with the criminal justice system. Applicants must explain how criminal justice system partner(s) will support program operations and ensure that all program participants can participate in all required services. Criminal justice system partners may include the following: correctional facilities, parole, probation, residential reentry centers, law enforcement, and/or courts.

Employer(s) and/or Employer Association(s)

Applicants must ensure that all sub-grantees partner with at least one employer and/or employer association. Applicants must explain how employer(s) and/or employer association partner(s) will be engaged in the program to provide employment, job shadowing, mentoring, work-based learning, occupational training, work experience, and curriculum development (if applicable).

Additional Partnerships (4 points)

The Department strongly encourages recipients of funding under this FOA to participate as additional one-stop partners. Partnering with the workforce system provides mutual benefits, including the enhancement of services and outreach. For additional information about the roles and responsibilities of additional partners, please see TEGL 17-16.

Applicants must ensure that their sub-grantees leverage resources by partnering with:

Local and State Workforce Development Boards; and

Local organizations that provide housing, transportation, substance abuse and mental health services, and other supportive services as needed.

Applicants must ensure that their sub-grantees identify their partners and describe the specifics of their partnership in a Memorandum of Understanding or Letter of Commitment signed by the authorizing agent of the partner organization. Applicants will be scored based on the Memorandum of Understanding or Letter of Commitment provided by the additional partner which fully describes:

Services provided to the organization or participants

Procedures for enrollment or recruitment, if applicable; and

Plan for coordination of services between partners, including coordination between pre-release and post-release service providers, if applicable.

NOTE: Memoranda of Understanding and Letters of Commitment must be included as attachments and will not be counted against the page limit for the project narrative.

Applicants will be scored based on:

A complete description of how staff, organizational structure, and multi-site management contribute to the ability of the applicant to conduct the project and meet program expectations and requirements. Include information about any organization(s) under contract with the applicant that will have a significant role in implementing the project and any previous experience implementing projects of similar design or magnitude. (2 points)

A complete description of the applicant’s fiscal and administrative controls in place to manage federal funds, including the applicant’s plan and capacity to sustain some or all project activities after federal financial assistance has ended. (4 points)

Organizations will receive points based on past performance data. All applicants must submit information for the past performance criteria identified below. This past performance document will not be counted against the page limit.

If you have received federally and/or non-federally funded assistance agreements (federal assistance agreements include federal grants and cooperative agreements but not federal contracts) similar in size, scope, and relevance to the proposed project that have been completed within the last five years of the closing date of this FOA, the applicant must submit a Past Performance Chart for the most recently completed agreement.

If you have completed an REO grant within the past 5 years, your Past Performance Chart must reflect that grant. However, if you have not completed an REO grant but have completed any other ETA agreement, you must submit a chart for that agreement. A completed grant means the period of performance has ended. Please note that current REO grantees that are still within their period of performance and have not completed any other REO grants within the past five years must include past performance data for a different completed grant similar in size, scope, and relevance. Examples of REO grants that may have been completed within the past five years include some Training to Work, Face Forward, Reentry Demonstration Projects, Pathways to Justice Careers, and Linking to Employment Activities Pre-release Specialized American Job Centers grants. If you are unsure if you have a past REO grant, please contact the agency contact listed in Section VII of this FOA.

Applicants who have completed an REO grant award or ETA agreement within the past five years of the closing date of this FOA are required to submit a chart for that agreement. NOTE: The Past Performance Chart must be included as an attachment and will not be counted against the page limit for the project narrative.

Performance Chart

The Past Performance Chart must include the following information:

Grantor name and contact information

Project information/grant objectives

Performance goals and spending rate analysis

Below is a sample format for the Past Performance Chart. For non-ETA grants, the chart must be signed by the grantor or a signed letter must be provided from the grantor verifying the past performance data. This letter must be on grantor letterhead and contain contact information for the grantor. Applicants that do not provide all of the following will receive 0 points for sections 1 and 2 below:

Performance chart;

Previous grantor contact information; and

A signed past performance chart or an associated grantor verification letter on grantor letterhead (for non-ETA grants)

Performance Goals: (24 points)

The Past Performance Chart must include the overall objectives of the grant, population served, funding amount and grantor contact information. The chart must detail the two performance goals below and the outcomes of those goals, to demonstrate the degree of their performance.

Applicants must use the performance indicators below in their chart:

employment/education placement, and

credential/degree attainment.

ETA views the above indicators as the most critical to demonstrating that the applicant’s past success in a similar program has prepared its organization to succeed in operating an REO project.

The Past Performance Chart must include the overall objectives of the grant, population served, funding amount, and grantor contact information. The chart must detail: 1) placement in education or employment, and 2) credential/degree attainment. Applicants substituting alternative outcomes will receive zero points for any alternative outcome submitted.

(ii) In the chart, applicants must identify the total number of participants enrolled in the program and the performance outcome for each performance indicator. The performance outcome for each performance indicator must be displayed as both a fraction (i.e., the numerator equal to the number of program participants who achieved the identified indicator (Performance Outcome) and the denominator equal to the Performance Goal for the identified indicator) and a percentage. For example, if using the employment/education placement measure, the performance metric description might be; participants who were placed into unsubsidized jobs within one year of program completion divided by total program participants eligible to be placed into unsubsidized jobs within one year of program completion.

(iii) Applicants will receive points based on past performance demonstrated in the performance chart as follows:

Applicants that met or exceeded both of the performance goals for their most recently completed grant will receive 24 points for this subsection.

• Applicants that met or exceeded one performance goal but did not meet the other performance goal will receive 12 points for this subsection.

Applicants that did not meet either performance goal will receive 0 points for this subsection.

Spending Rate Analysis: (6 points)

Applicants must submit, as part of the chart of past performance described above, the total grant amount and the percentage of grant funds spent during the original period of performance for their most recently completed grant, as specified above. Applicants will receive points for their spending rate, as demonstrated in the chart they provide, as follows:

Applicants that expended at least 98 percent of the grant funds for their most recently completed grant will receive 6 points.

Applicants that expended at least 90 percent but less than 98 percent of the grant funds for their most recently completed grant will receive 4 points.

Applicants that expended at least 80 percent but less than 90 percent of the grant funds for their most recently completed grant will receive 2 point.

Applicants that expended less than 80 percent of the grant funds for their most recently completed grant will receive 0 points.

Below is a sample format for the chart:

Name of Previous Grantor Organization: |

||||||

Grantor Contact - Name, Title, Signature (if non-ETA grant), E-mail Address, and Telephone Number: |

||||||

Project Title and Grant Number: |

||||||

Project Period of Performance: |

||||||

Number of Participants Enrolled: |

||||||

Population Served: |

||||||

Performance Goals |

||||||

Metric |

Performance Goal |

Performance Outcome |

Performance Outcome / Performance Goal |

Percentage Rate of Actual Achievement |

||

Placement into education or employment |

60 |

58 |

58/60 |

97% |

||

Credential/degree attainment |

|

|

|

|

||

Spending Rate Analysis |

||||||

Grant Funds Received: |

Grant Funds Spent by end of Period of Performance: |

Total Spent / Total Grant Funds |

Percentage Rate of Spending: |

|||

Example: $1,000,000 |

$800,000 |

$800,000/ $1,000,000 |

89% |

|||

Budget and Budget Narrative (4 points)

The Budget and Budget Narrative will be used to evaluate this section. Please see Section IV.B.2 for information on the requirements. The Budget and Budget Narrative do not count against the page limit requirements for the Project Narrative.

The extent the proposed expenditures will address all project requirements, and whether key personnel have adequate time devoted to the project to achieve project results. (1 point)

The extent to which the budget narrative provides a description of costs associated with each line item on the SF-424A and to which the totals on the SF-424A and the Budget Narrative align. (1 point)

The extent to which the cost-per-participant is reasonable and reflects the program models ability to successfully meet all outcomes identified in the application. (2 points)

Priority Consideration

Applicants will also receive priority consideration of one (1) bonus point for serving communities with rates of high poverty and high crime. Furthermore, applicants will receive priority consideration of one (1) bonus point if a sub-grantee has at least one-census tract in their target area designated by the Secretary of the Treasury as a qualified opportunity zone; applicants will not receive additional bonus points for more than one opportunity zone sub-grantee. For more information on opportunity zones, go to https://www.irs.gov/newsroom/irs-and-treasury-finalize-opportunity-zone-guidance.

High-Poverty, High-Crime Target Area – (1 bonus point)

Applicants that demonstrate in number 10 of the abstract that at least one of their sub-grantees’ target areas is in an area of high poverty and high crime will receive one (1) bonus point. High-poverty communities are communities with poverty rates of at least 25 percent, as exhibited through the use of American Community Survey (ACS) data. Applicants must provide the poverty rate and cite the source in number 10 of the abstract. High-crime communities have crime rates within the targeted area that are higher than the crime rate of the overall city (for sub-areas of cities); of the overall county (if the entire city is the target area), etc. Applicants must compare the most recently available crime rates of the police precinct, sheriff’s office, county police department, or other relevant jurisdiction that most closely overlaps with their target community to the crime rate of the overall city (for sub-areas of cities) etc. and cite the source of the data in number 10 of the abstract. See instructions in using the American Community Survey (ACS) data in Section VIII.F. Other Information. Note that these are new instructions given that the Census Bureau has changed its website since last year for obtaining American Community Survey Data.

Designated Qualified Opportunity Zone – (1 bonus point)

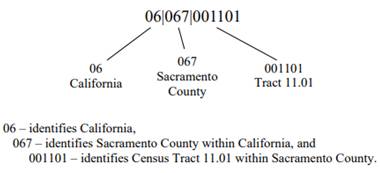

Applicants that demonstrate, in item number 9 of their abstract, at least one census tract in at least one of their sub-grantees’ target area is designated by the Secretary of Treasury as a qualified opportunity zone will receive one (1) bonus point. Designated opportunity zone census tracts can be found at https://www.cdfifund.gov/Pages/Opportunity-Zones.aspx. Please be aware the IRS list provides the full 11-digit census tract number. Use the example below to identify your census tract number:

In addition to the Project Narrative, you must submit attachments. All attachments must be clearly labeled. We will exclude only those attachments listed below from the page limit. The Budget and Budget Justification do not count against the page limit requirements for the Project Narrative.

You must not include additional materials such as resumés or general letters of support. You must submit your application in one package because documents received separately will be tracked separately and will not be attached to the application for review.

Save all files with descriptive file names of 50 characters or fewer and use only standard characters in file names: A-Z, a-z, 0-9, and underscore (_). File names may not include special characters (e.g. &,–,*,%,/,#), periods (.), blank spaces or accent marks, and must be unique (e.g., no other attachment may have the same file name). You may use an underscore (example: My_Attached_File.pdf) to separate a file name.

Required Attachments

Abstract

You must submit an up to two-page abstract summarizing the proposed project including, but not limited to, the scope of the project and proposed outcomes. Omission of the abstract will not result in your application being disqualified; the lack of the required information in the abstract, however, may impact scoring. See Section III.C.1 for a list of items that will result in the disqualification of your application. The abstract must include:

the applicant’s name;

the project title;

the number of participants to be served;

the funding level requested;

the total cost per participant;

a list of all sub-grantees that will implement the proposed project design including the name and address of each sub-grantee;

the name and the address of the mandatory partners: community college(s), criminal justice system, and employer and/or employer associations;

a description of the area to be served by each sub-grantee (list of the specific cities, towns, or counties);

Opportunity Zone census tract, and name of sub-grantee serving that census tract, if applying for Priority Consideration;

Data indicating that at least one sub-grantee target area is located in a high-poverty and high-crime area (as described in section IV.B.3.(h) above), including the cited sources of the data, if applying for Priority Consideration; and

a brief summarization of the proposed project including, but not limited to, the scope of the project and proposed outcomes, including:

the in-demand industry(s) in which the community college partner(s) will provide occupational training, alongside employer(s) and/or employer association(s) partnership(s).

The Abstract is limited to two double-spaced single-sided 8.5x11 inch pages with 12 point font and 1 inch margins. When submitting in grants.gov, this document must be uploaded as an attachment to the application package and specifically labeled “Abstract.”

MOUs or Letters of Commitment with Sub-grantees

Submit signed and dated Memoranda of Understanding or Letters of Commitment between the applicant and their sub-grantees. Omission of a Letter of Commitment or Memoranda of Understanding from all sub-grantees will result in the screening out of your application.

When submitting in grants.gov, these letters must be uploaded as an attachment to the application package and specifically labeled “Sub-grantee Letters of Commitment.”

Requested Attachments

We request the following attachments, but their omission will not cause us to disqualify the application. Furthermore, the omission of the attachment will affect scoring unless otherwise noted.

Past Performance Documentation

This attachment must include both the Chart of Past Performance and the Grantor Verification Letter (if the chart is not signed by the Grantor). See Section IV.B.3.f for which applicants are to submit this documentation and additional instructions.

When submitting in grants.gov, these documents must be uploaded as an attachment to the application package and specifically labeled “Past Performance.”

Indirect Cost Rate Agreement

If you are requesting indirect costs based on a Negotiated Indirect Cost Rate Agreement approved by your federal Cognizant Agency, then attach the most recently approved Agreement. (For more information, see Section IV.B.2. and Section IV.E.1.) This attachment does not impact scoring of the application.

When submitting in grants.gov, this document must be uploaded as an attachment to the application package and specifically labeled “NICRA.”

Documentation of Non-Profit 501(c)(3) Status

All Applicants applying as a non-profit, including current DOL grantees, must submit documentation from the Internal Revenue Service that verifies the applicant’s non-profit 501(c)(3) status (for entities applying as 501(c)(3) non-profit organizations only). If not provided, the Department will review Internal Revenue Service data to ensure an applicant’s non-profit 501(c)(3) status. This attachment does not impact scoring of the application, but if ETA determines that the applicant does not have non-profit 501(c)(3) status, the application will be disqualified and will not move through the merit review process.

When submitting in grants.gov, this document must be uploaded as an attachment to the application package and specifically labeled “Non-Profit Status.”

MOUs or Letters of Commitment

Submit signed and dated MOUs or Letters of Commitments between the applicant’s sub-grantees and their primary and additional partner organizations that propose to provide services to support the program model and lead to the identified outcomes (See Section IV.B.3.d).

When submitting in grants.gov, these letters must be uploaded as an attachment to the application package and specifically labeled “Letters of Commitment.”

Financial System Assessment Information

All applicants are requested to submit Funding Opportunity Announcement Financial System Assessment Information. See Section V.B.2 for a sample template and additional instructions. This attachment does not impact the scoring of the application.

Work Plan

Provide a detailed narrative description of the proposed plan for accomplishing the work and describing how the project will operate throughout the funding period and include a graphic illustration, such as a Gantt chart or a flow chart, as an attachment to the Project Narrative, showing how the applicant will successfully achieve the project scope.

When submitting in grants.gov, this item must be uploaded as an attachment to the application package and specifically labeled “Work Plan.”

We must receive your application by [insert date XX days after the date of publication on Grants.gov]. You must submit your application either electronically on https://www.grants.gov or in hard copy by mail or in hard copy by hand delivery (including overnight delivery) no later than 4:00:00 p.m. Eastern Time on the closing date.

Applicants are encouraged to submit their application before the closing date to minimize the risk of late receipt. We will not review applications received after 4:00:00 p.m. Eastern Time on the closing date. We will not accept applications sent by e-mail, telegram, or facsimile (FAX).

All applications submitted in hardcopy by mail or hand delivery (including overnight delivery), must be received at the designated place by the specified closing date and time. Applicants submitting applications in hard copy by mail or hand delivery must submit a copy-ready version free of bindings, staples, or protruding tabs to ease in the reproduction of the application by DOL. Applicants submitting applications in hard copy must also include in the hard copy submission an identical electronic copy of the application on compact disc (CD) or flash drive. If we identify discrepancies between the hard copy submission and CD/flash drive copy, we will consider the application on the CD/flash drive as the official submission for evaluation purposes. Failure to provide identical applications in hardcopy and CD/flash drive format may have an impact on the overall evaluation.

If an application is submitted both by hard copy and through https://www.grants.gov, a letter must accompany the hard-copy application stating which application to review. If no letter accompanies the hard copy, we will review the copy submitted through https://www.grants.gov.

We will grant no exceptions to the mailing and delivery requirements set forth in this notice. Further, we will not accept documents submitted separately from the application, before or after the deadline, as part of the application.

Address mailed applications to the:

U.S. Department of Labor

Employment and Training Administration

Office of Grants Management

Attention: Melissa Abdullah, Grant Officer

Reference FOA-ETA- 20-05

200 Constitution Avenue, NW, Room N4716

Washington, D.C. 20210

Please note that mail decontamination procedures may delay mail delivery in the Washington DC area. We will receive hand-delivered applications at the above address at the 3rd Street Visitor Entrance. All overnight delivery submissions will be considered to be hand-delivered and must be received at the designated place by the specified closing date and time.

Applicants submitting applications through Grants.gov must ensure successful submission no later than 4:00:00 p.m. Eastern Time on the closing date. Grants.gov will subsequently validate the application.

The process can be complicated and time-consuming. You are strongly advised to initiate the process as soon as possible and to plan for time to resolve technical problems. Note that validation does not mean that your application has been accepted as complete or has been accepted for review by the agency. Rather, grants.gov only verifies the submission of certain parts of an application.

How to Register to Apply through Grants.gov

Read through the registration process carefully before registering. These steps may take as long as four weeks to complete, and this time should be factored into plans for timely electronic submission in order to avoid unexpected delays that could result in the rejection of an application.

Applicants must follow the online instructions for registration at https://www.grants.gov/web/grants/applicants/organization-registration.html. We recommend that you prepare the information requested before beginning the registration process. Reviewing and assembling required information before beginning the registration process will alleviate last-minute searches for required information and save time.

An application submitted through Grants.gov constitutes a submission as an electronically signed application. The registration and account creation with Grants.gov, with E-Biz Point of Contact (POC) approval, establishes an Agency Organizational Representative (AOR). When an application is submitted through Grants.gov, the name of the AOR who submitted the application is inserted into the signature line of the application, serving as the electronic signature. The E-Biz POC must authorize the individual who is able to make legally binding commitments on behalf of your organization as the AOR; this step is often missed and it is crucial for valid submissions.

How to Submit an Application to DOL via Grants.gov