Social Security Statement Focus Groups

Generic Clearance for the Collection of Qualitative Feedback on Agency Service Delivery (Fast Track)

Focus Group Discussion Guide

Social Security Statement Focus Groups

OMB: 0960-0788

Materials

and supplies for focus groups Sign-in

sheet Consent

forms (one copy for participants, one copy for the team) Evaluation

sheets, one for each participant Name

tents Pads

& Pencils for each participant Focus

Group Discussion Guide for Facilitator 1

recording device Batteries

for recording device Extra

tapes for recording device Permanent

marker for marking tapes with FGD name, facility, and date Notebook

for note-taking

Introduction

Ipsos researchers will be using the below bullet points as a script to introduce the discussion topics for the focus group.

Introduce both Researchers and Ipsos on behalf of the Social Security Administration

We are interested in learning about users experience with the My Social Security website and ways that they feel it could be improved.

You have been chosen to participate because you have shared that you have created and use a My Social Security account and we are hoping that you can help our colleagues continue to develop and improve it.

We are video and audio recording our session, but we will not share your comments or those video / audio files with anyone outside of our organization and our colleagues at the Social Security Administration.

Thank you for agreeing to participate.

Description of the Focus Group Process

[Moderator] I wonder if any of you have had experience participating in focus groups before? For those of you who haven’t, or have only once or twice, focus groups are being used more and more to help agencies or companies develop products and services that more closely relate to what their customers, clients, or patients want and need.

Focus Group Basics:

We learn from you! Your views are important to us.

Not trying to achieve consensus, we’re gathering information. While we want and expect that you will interact with each other respectfully we learn as much from where you disagree as from where you agree so feel free to share your thoughts even if, especially if, you think you might be the only one!

No virtue in long lists: we’re looking for priorities.

This focus group will last about two hours. Feel free to get up and move around if you need a break. There is a table with snacks and beverages and restrooms are located down the hall.

Focus Group Rules:

Everyone should participate

Please do not share any information that you learn here with others

Please participate with the group, side conversations may be interesting, but we would like to capture views you express in them

Turn off your cell phones.

[Moderator] Does anyone have any questions?

Ok, let’s go around the room and introduce ourselves before we get started.

Discussion Questions:

What Features Have Users Used, Found Useful, and Return To

Ipsos will broadcast a generic blank version of the online My Social Security statement on a monitor within the facility.

[Moderator] Let’s first discuss what it has been like to use your My Social Security account.

What is your preferred way to receive communications like statements from the SSA?

[Probe] What mode do you prefer – online only, online and download, mailed paper statement or no preference?

What encouraged you to look at your Social Security Statement?

[Probe] Did you receive some communication from SSA in the mail?

Tell us about whether you accomplished the goal you had when you checked your statement?

[Probe] What was your goal in checking your statement?

[Probe] How did you accomplish your goal?

[Probe] Did you have any difficulty accomplishing this goal?

If so, tell us why you had difficulty?

[Probe] Tell us what could have made checking your social security statement less difficult?

Thinking about how often you access your My Social Security Account during the course of a year, what would help you access your account more often?

[Probe] A more user-friendly interface

[Probe] Relevant features to your needs

[Probe] Receiving reminders from Social Security Administration, if so, do you prefer paper or online?

Brainstorming Activity

[Moderator] Let’s talk about new features that you might like to see added to the online features. Maybe we could take a moment to reflect and write down some ideas. Don’t worry if your ideas are the same as others, we just want to get an idea of how people might think about this. Remember, there are no bad or wrong answers just as there are no bad or wrong ideas.

Focus Group Participants to write down a list of ideas.

Thank you for writing down a list of features that would be most beneficial for you. Now we are going to shift our focus slightly and discuss features the Social Security Administration is considering introducing. We will introduce these features, discuss how useful they would be for you and ask you to choose features that would be most beneficial to you. Once we are finished discussing these features, we will return to your suggested list of ideas and learn more about what you are specifically looking for.

Features Proposed by Social Security

Ipsos will have enlarged printouts hanging on the walls of the facility describing each feature and provide printouts to each participant.

Each feature will be introduced in the below order. Ipsos will describe the new feature, its purpose and the benefit it would provide to the user. Ipsos moderator will then guide the discussion to assess if the feature would be useful the users. Once all features are discussed, participants will be asked to choose one feature that would be most beneficial to them and explain the reasoning for choosing this feature.

The following probes will be utilized during the discussion.

[Probe] Would this feature be useful for you?

If so, why would it be useful

If not, describe why it won’t be useful

[Probe] How would you use the information collected from this feature?

[Probe] If this feature would not be useful for you, explain why.

Even if the feature would not be useful to you, can you think of anyone it would benefit?

Feature 1: Interactive Graphs and Tables of Estimated Benefits

What is it? Graphs and tables that provide estimates of your future retirement benefits at claim ages from 62 through 70 under three different assumptions about work and earnings: 1. that you stop work at your current age, so you see what you have earned so far, 2. that you continue working at your current earnings level until you claim benefits, so you can see how your benefits change if you plan to continue working until retirement, and 3. that you continue working at an earnings level you can input yourself, which could be higher or lower than your current earnings level.

How will it work? The graphs and tables would automatically calculate estimated retirement benefits for you based on the first two assumptions. The third assumption allows you to change your future earnings level and see how that affects your future benefits. Each time you change the value of your future earnings, the graphs and tables will recalculate your benefits to correspond to the new earnings level you have inputted.

How will it benefit you? These interactive graphs and tables allow you to compare side-by-side different benefit estimates based on different assumptions about your future earnings. In particular, you can see the difference in your future estimated benefits if you were to stop working now compared to you continuing to work. This clearly shows the impact that continued work has on your future Social Security retirement benefits.

Below are examples of the graphs and tables illustrating this feature:

-

Benefit Estimate at:

Earnings Amount

Based on:

62

FRA

70

$0

Assuming No Future Earnings

$752

$1,001

$1,240

$65,785

Last Reported Earnings

$1,251

$1,723

$2,052

$75,000

Your Input

$1,389

$1,921

$2,257

Feature 2: Benefit Estimates under Different Assumptions for Users without 40 Credits

What is it? This tool will provide users who are not yet insured for Social Security retirement benefits (i.e., they do not have 10 years of work) with the ability to see benefit estimates. Currently, a my Social Security account user with less than 40 credits (i.e., less than 10 years of work) cannot see benefit estimates when they access their online Statement.

How will it work? This feature would provide users who do not have 40 credits with three different benefit estimates based on the following scenarios:

No further earnings (i.e., basically what the use has earned thus far), so they would see $0 for all claiming ages because they are not insured for benefits

Assuming the user continues working at their current earnings level (i.e., they would eventually obtain the 40 credits necessary to receive benefits in the future) and benefit estimates would be shown for all claiming ages

Estimates based on the user’s own input(s).

The user can enter various customization for their work and earnings. When each option is selected, benefit estimates for each of the above scenarios will appear.

How will it benefit you? This will allow users who cannot currently see retirement benefit estimates in the Statement to get a sense of what their future benefit estimates would be if they were to continue working. It will also allow the user to input their own earnings estimates to get customized scenarios.

Below is an example of a graph showing benefits under the three assumptions.

Feature 3: Estimated Benefits of Spouse

What is it? This is a tool that will allow married couples to see joint benefit estimates. You could enter your spouse’s estimated Social Security benefit based on their earnings record and compare that with what your spouse would receive by claiming spousal benefits on your record. Currently, your Social Security Statement provides estimates of your benefits only.

How will it work? The tool contains a box for you to enter your spouse’s estimated Social Security benefit and date of birth. The tool will then allow you to compare your own benefit with your spouse’s benefit on their own record and the spousal benefits they would receive claiming on your record.

How will it benefit you? Seeing estimates of your spouse’s benefits alongside your own benefits may allow for joint calculations of your expected benefits as a married couple. It will help both you and your spouse decide on the best ages to claim your benefits.

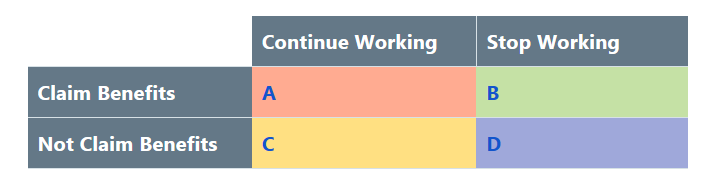

Feature 4: Diagram of Claiming and Working Options

What is it? A matrix providing detailed information on your work/retirement benefit claiming options. These options are the following:

claim benefits AND continue working

claim benefits AND stop working

NOT claim benefits AND continue working

NOT claim benefits AND stop working

How will it work? As a visual tool to compare the various work/claim options you face when thinking about how long you want to work and when you want to claim.

How will it benefit you? For each option, you will learn how your retirement benefits might be affected and what you need to do about Medicare.

Below is a diagram of the work/claim options. The user will be able to click on each part of the diagram to learn more about their retirement option.

Feature 5: Information on Non-Taxed Earnings

What is it? This is a tool that provides information on and helps you calculate how your Social Security benefits will be affected if you have a pension from work not covered by Social Security. A small percentage of workers have earnings from work not covered by Social Security. This work is usually for federal, state, or local government or in a foreign country and the worker and their employer did not pay Social Security taxes.

How will it work? This tool explains why a pension from work not covered by Social Security affects benefits. It provides a box for entering the expected non-covered monthly pension amount, and then shows the potential effect of the pension on the user’s Social Security benefits.

How will it benefit your user experience? Through this feature, users will be able to calculate how a pension from work not covered by Social Security will reduce their Social Security benefits.

[Moderator] Now let’s discuss which feature would be most beneficial for you.

Moderator to guide discussion and ask participants to choose one feature that would be most beneficial to them. Notetaker to record the top 3 features chosen with descriptions on why they would beneficial to the user.

Great, thank you so much for the candid discussion. Now let’s return to the suggestions you wrote down earlier today. Looking at your list of suggested features, what are some suggestions that have not already been proposed by the Social Security Administration.

Notetaker to record each feature discussed. Moderator to guide a discussion about the proposed features and insure all participants are given a chance to share their ideas and proposed features.

[Probe] Why would this feature be beneficial to you?

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Helen Fisun |

| File Modified | 0000-00-00 |

| File Created | 2021-01-15 |

© 2026 OMB.report | Privacy Policy