2080ss07

2080ss07.doc

Motor Vehicle and Engine Compliance Program Fees (Renewal)

OMB: 2060-0545

Supporting Statement

for

Information Collection Request

Motor Vehicle and Engine Compliance Program Fees (Renewal)

EPA ICR 2080.07

Compliance Division

Office of Transportation and Air Quality

Office of Air and Radiation

U.S. Environmental Protection Agency

Part A Of The Supporting Statement

1. Identification of the Information Collection

1(a) Title and Number of the Information Collection

Motor Vehicle and Engine Compliance Program Fees (Renewal), ICR 2080.06, OMB 2060-0545.

1(b) Short Characterization

As required by the Clean Air Act (42 USC 7401 et seq.), the Environmental Protection Agency (EPA or Agency) has regulations establishing emission standards (and other requirements) for various classes of vehicles and engines. In accordance with the Clean Air Act, these regulations also require that compliance be demonstrated prior to EPA granting a "Certificate of Conformity." Such certification is necessary before the product can be introduced into commerce.

In the case of passenger cars, highway motorcycles, light trucks, and heavy-duty truck engines, EPA has charged fees for administering these compliance programs since 1992. These regulations appeared in 40 CFR Part 86, Subpart J. In 2004, EPA promulgated regulations to add several classes of recently regulated vehicles and engines (referred to as “nonroad” for convenience) to the fees program (69 FR 2621, May 11, 2004, effective July 12, 2004; 40 CFR Part 86, Subpart Y). The Information Collection Request (ICR) for that rule was 2080.02, OMB 2060-0545, the most recent series was renewed until December 31, 2019 in ICR 2080.06. As a part of a rulemaking primarily covering emissions standards for certain nonroad spark-ignition engines and evaporative emissions standards covering a wide variety of engines, vehicles, and evaporative "components", the fees regulations were restated with minor amendments in 40 CFR Part 1027 (73 FR 59034, October 8, 2008). Most notably, these regulations added evaporative component applications to the categories of certifications requiring fees covered by this ICR. This affected the size of the respondent class but did not create any new category of burden. The present ICR 2080.07 is a renewal of the current collection.

In order to collect fees and accurately account for them, a certain amount of information is required, such as who is paying the fee, the category of vehicle, engine, evaporative emissions system, or evaporative component "equipment" to which it applies; the name of the vehicle, engine, evaporative, or component engine family/test group; and the method of payment. This information is collected by the main Fee Form. By regulation, fees must be paid before EPA begins its review of a manufacturer's application. This information is used by EPA's Office of Air and Radiation, Office of Transportation and Air Quality, Compliance Division, to ensure that the required fee has been paid before an application for certification is processed; to be sure that we know which vehicle, engine, evaporative, or component engine family/test group a payment is intended to be for; to have a contact person and address in case of payment issues and an address to which acknowledgment of receipt of the payment can be sent; and to provide an early check on other problems, such as failure to name an engine family/test group following EPA's naming rules or failure to go through EPA's manufacturer registration process. It also provides part of the documentation used by EPA’s Office of the Chief Financial Officer in processing fee refunds. During model year 2017, 611 separate manufacturing and importing corporate entities filed forms associated with approximately 5094 actions concerning certification fees.

The fee form is an electronic form which is available online at www.Pay.gov. It incorporates fillable sections for fee filing, corrections, miscellaneous payments, and refund requests. The form can be filed online at Pay.gov with or without payment; payment can be made online by credit card, PayPal or electronic funds transfer. Payments may be made offline using an Automated Clearing House (ACH) or wire transactions. The Pay.gov fee form has been issued the EPA Form Number 3520-29.

It should be noted that this ICR does not include the burden of complying with the actual certification requirements (including the monetary value of the fees themselves); only the burden associated with completing and filing the form is covered here. Substantive certification burdens have been addressed elsewhere, including the on-road certification ICR, 0783 (OMB 2060-0104), and the various ICRs covering the nonroad certification programs.

2. Need for and Use of the Collection

2(a) Need/Authority for the Collection

Information supplied on the fee form assures that the correct fee for certification has been paid and is posted to the appropriate account. This collection is authorized by the Clean Air Act (42 USC 7552) and the Independent Offices Appropriations Act (31 USC 9701).

2(b) Practical Utility/Users of the Data

EPA uses the information collected to verify that appropriate fees have been paid and that the amounts are posted to the proper account, that corrections are accurately entered, that fees match the engine families/test groups certified, that refunds are properly processed, and to provide a record in the case of need to audit fee matters. In addition, the forms help insure that a knowledgeable person can be contacted in case of payment issues and that the applicant is applying for a valid engine family/test group and has a valid manufacturer code attesting completion of EPA's registration process.

3. Nonduplication, Consultations and Other Collection Criteria

3(a) Nonduplication

The information contained on the fee form is necessary to link the fees paid with certificate applications. At this time, the data systems containing fees and certification information are linked so that certificates may not be issued before a fee has been paid, however, without the fee form there would be no way to ensure that fees are paid for each engine family/test group prior to certification. In some but not all cases, financial documents (EPA's deposit records and online Treasury resources) contain engine family/test group information in relevant data fields that could be used to associate payments with engine families, but since this information is not always available, it is at present necessary to rely on the fee form. In cases where it is clear what a payment is intended to be used for, the necessity to provide a separate form for each engine family/test group being certified may seem to constitute unnecessary duplication. Nonetheless, this requirement has in many cases disclosed problems and mistakes that would not have come to light otherwise. In addition, it is important to have a contact name of someone who is familiar with the fee payment, who is not necessarily the same person as the one who is familiar with the application for certification, particularly in large organizations. It is worth noting in this regard that manufacturers who register with Pay.gov can save their filled-in forms and use them as a template for multiple filings, thus eliminating the need to replicate fields in the forms that do not change from one payment to another.

3(b) Public Notice

An announcement soliciting public comment on this ICR will be published in the Federal Register. No relevant comments were received.

3(c) Consultations

EPA consulted with the following individuals in preparing this ICR:

Individual Firm

Thomas Hofmann BMW

Alan Parker Yanmar America

Kim Sinacola General Motors

Kim Sinacola of General Motors had some specific suggestions that would make filling out the fee form more streamlined and user friendly.

Thomas Hofmann of BMW stated that the current online fee form filing process is easy to use and works very well.

3(d) Effects of Less Frequent Collection

The Clean Air Act requires that emission certification be done on a yearly basis (42 USC 7525(a)). EPA allows applicants to define their own annual production period, thus granting some flexibility in this regard. However, as certification is an annual event, and the fee is for the work involved in reviewing the certification application, submission of the fee payment information is generally annual.

3(e) General Guidelines

This information collection activity complies with the requirements of 5 CFR 1320.5(d).

3(f) Confidentiality

After a certificate of conformity has been issued, most information associated with the manufacturer/importer's application is available to the public. Under section 208 of the Clean Air Act (42 USC 7542(c)) all information, other than trade secret processes or methods, must be publicly available. Information about fee payments are treated as confidential information prior to certification.

3(g) Sensitive Questions

No sensitive questions are asked in this information collection. This collection complies with the Privacy Act and OMB Circular A-108.

4. Respondents and Information Requested

4(a) Respondents/SIC Codes

The respondents are manufacturers or importers of various engines, vehicles, and evaporative components (fuel lines, fuel tanks, and related parts). The following Standard Industrial Classification codes are associated with this information collection:

Category |

NAICS Codes (1) |

SIC Codes(2) |

Examples of Potentially Regulated Entities |

Industry |

333111 |

3523 |

Farm Machinery and Equipment Manufacturing |

Industry |

333112 |

3524 |

Lawn and Garden Tractor and Home Lawn and Garden Equipment Manufacturing |

Industry |

333120 |

3531 |

Construction Machinery Manufacturing |

Industry |

333131 |

3532 |

Mining Machinery and Equipment Manufacturing |

Industry |

333132 |

3533 |

Oil & Gas Field Machinery |

Industry |

333210 |

3553 |

Sawmill & Woodworking Machinery |

Industry |

333924 |

3537 |

Industrial Truck, Tractor, Trailer, and Stacker Machinery Manufacturing |

Industry |

333991 |

3546 |

Power Driven Handtool Manufacturing |

Industry |

336111 |

3711 |

Automotive and Light-Duty Motor Vehicle Manufacturing |

Industry |

336120 |

3711 |

Heavy Duty Truck Manufacturing |

Industry |

336213 |

3716 |

Motor Home Manufacturing |

Industry |

336311 |

3592 |

Motor Vehicle Gasoline Engine and Engine Parts Manufacturing |

Industry |

336312 |

3714 |

Gasoline Engine & Engine Parts Manufacturing |

Industry |

336991 |

3751 |

Motorcycle, Bicycle, and Parts Manufacturing |

Industry |

336211 |

3711 |

Motor Vehicle Body Manufacturing |

Industry |

333618 |

3519 |

Gasoline, Diesel & dual-fuel engine Manufacturing |

Industry |

811310 |

7699 |

Commercial & Industrial Engine Repair and Maintenance |

Industry |

336999 |

3799 |

Other Transportation Equipment Manufacturing |

Industry |

421110 |

------ |

Independent Commercial Importers of Vehicles and Parts |

Industry |

333612 |

3731 |

Manufacturers of marine vessels |

|

|

3732 |

Boat building and repairing |

Industry |

333613 |

3568 |

Mechanical Power Transmission Equipment Manufacturing |

Industry |

333618 |

3519 |

Other Engine Equipment Manufacturing |

Industry |

811112 |

7533 |

Commercial importers of vehicles and vehicle components |

Industry |

811198 |

7549 |

Automotive services |

(1) North American Industry Classification System (NAICS)

(2) Standard Industrial Classification (SIC) system code.

4(b) Information Requested

(i) Data items, including recordkeeping requirements.

Manufacturers of regulated vehicles and engines are required to pay fees to support EPA’s compliance activities. As such, they are required to submit certain information and undertake certain actions. A copy of the electronic form has been submitted to the docket. The regulatory provisions governing the content are as follow:

Indication of fee category 40 CFR 1027.105

Request for fee reduction, if applicable 40 CFR 1027.120

Request for refund, if applicable 40 CFR 1027.125

Applicant information 40 CFR 1027.130

Reduced fee certificate holders are required to retain records pertaining to the reduced fee calculation for three years after the date of the certificate and produce them within 30 days upon request (40 CFR 1027.120(e)).

(i) Respondent Activities

Respondents prepare the fee form with the applicant’s name and address, the engine family/test group/test group being certified, the amount being paid, the name and email address of a contact person, and the form of payment. If there is a mistake in the form (wrong engine family/test group name, model year, change in manufacturer code, etc.) then the applicant submits the information on the correction portion of the fee form. If there is an underpayment, the applicant normally prepares and submits a fee form with the additional payment. If there has been an overpayment or the application is denied or withdrawn, the applicant may submit the refund request portion of the fee form. The fee form will also allow application of an overpayment to the fee for an upcoming certification request. This saves manufacturers the trouble and delay of preparing and receiving a refund and saves EPA the burden of processing such refund requests.

If the aggregate estimated retail sales value of the vehicles, engines, or evaporative components covered by the engine family/test group/evaporative component certified is less than one percent of the full fee, the applicant may file a reduced fee equal to that one percent or $750, whichever is greater. Most such reduced fee applicants are alternative fuel vehicle converters; a few are independent commercial importers, covering certain importers of past model year light vehicles. Such submissions are for a specific number of vehicles. Additional vehicles, engines, or units (such as additional imports) require an amended certificate and submission of additional one percent payments with accompanying fee forms. It is the reduced fee payer's obligation to reconcile sales, actual retail sales, retail sales values, fees paid, and the number of vehicles covered by the certificate.

5. The Information Collected--Agency Activities, Collection Methodology, and Information Management

5(a) Agency Activities

Prior to reviewing an application for certification, EPA certification staff verify that the appropriate fee has been paid. Fees program staff track all fee payments and fee forms. They list as paid and cleared for certification review those families, and only those families, for which a fee form as well as the proper fee payment (including a reduced fee calculation where applicable) have been received. A database of this information is maintained using a computer program dedicated to fees tracking and processing. Fees information is entered from data on the fee forms and then verified. The data file is shared with EPA’s certification program, EV-CIS, which prevents the certification of engine families that do not have correct fee payments recorded. The data file is prepared and updated on work days within the Agency. EPA certification representatives and fees staff use information on fee forms to contact manufacturer representatives in case of problems or other fees business, such as to obtain account information for refund purposes or to clarify necessary procedures. With the aid of the fees computer program, an email is sent to the address of the contact listed on the form acknowledging payment, short payment, or overpayment. EPA’s Office of the Chief Financial Officer records deposits to EPA’s certification account, which serves as a quality control for the accuracy of the fees program's payment information, and processes fee refund payments.

5(b) Collection Methodology and Management

Fee payment documentation as well as fee forms are downloaded by EPA fees staff. This documentation and the forms come from Pay.gov forms and payment records and queries to the Federal Transaction Reporting System database. The paper records and fees database as well as the Office of the Chief Financial Officer's deposit records are available as an ongoing permanent record of fees payments and paperwork.

5(c) Small Entity Flexibility

Although the reduced fee provisions are not explicitly limited to small entities, nearly all of such applications are from small business alternative fuel converters, or a few Independent Commercial Importers.

5(d) Collection Schedule

While the manufacturer or importer must obtain certification on an annual basis, they have considerable flexibility in defining their annual production period. The fee must be submitted prior to EPA's processing the application for emission certification. Corrections, refunds, and miscellaneous payments are submitted as the need arises. Reconciliation of reduced fee payments must occur within 45 days of the end of the model year and refunds must be requested within six months of the end of the model year.

6. Estimating the Burden and Cost of the Collection

(a) Estimating Respondent Burden

EPA consulted with three manufacturer representatives to determine the burden estimate for competing the fee form (0.2 hours). This is an estimated average; in the latest consultations the time per form estimates ranges from three minutes to 10 minutes per form. There was also a slight difference of time estimated that depended upon the function selected such as a refund request or regular fee payment. The average accounts for these differences.

Online payment methods, via Pay.gov, include electronic funds transfer, PayPal and credit card. Offline payment options include electronic funds transfer and wire payments. This burden estimate does not include the financial arrangements that manufacturers make for effectuating these and other payments in the course of doing business (i.e., banking arrangements). Manufacturers may make one payment covering several certification fees, as long as the payment can be linked through the fee forms with the engine families being reviewed for certification.

6(b) Estimating Respondent Costs

(i) Estimating Labor Costs.

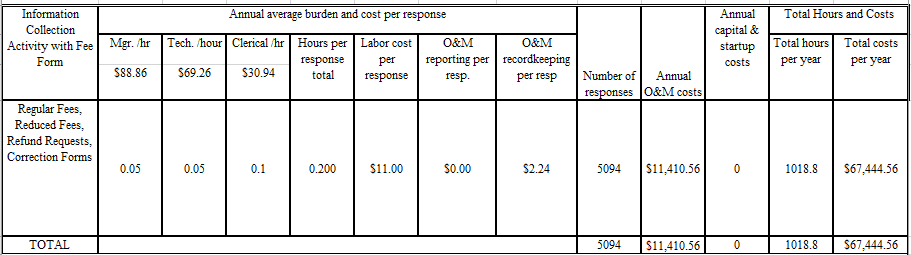

Because of the wide variety of industries covered, labor costs are approximated by the motor vehicle manufacturing industry, NAICS 336100. Rates for managers, mechanical engineers, and secretaries (except legal, medical, and executive) are from the May 2017 National Industry-Specific Occupational Employment and Wage Estimates (http://www.bls.gov/oes/current/naics4_336100.htm, accessed March 12, 2019). With a 160 percent overhead multiplier, these are $88.5586, $69.26, and $30.94, respectively. For some manufacturers, filing fee forms is largely secretarial; many others use technicians, and many foreign manufacturers hire local agents to handle application mechanics. Manufacturers’ estimates of time were used to estimate the time spent by each labor category per activity.

(ii) Estimating Capital and Operations and Maintenance Costs

The paperwork cost estimate includes a recordkeeping cost of $2.24 per item. This cost includes an increase over the previous estimate for inflation. No other Capital and Operations and Maintenance Costs are applicable.

(iii) Capital/Start-up vs. Operating and Maintenance (O&M) Costs

There are no capital or start-up costs associated with this collection.

6(c) Estimating Agency Burden

The overall administration of the fees program is conducted by a fees team in EPA’s Compliance Division. Secondarily, it is administered by each of the certification representatives in the division, who have a responsibility to determine that fees have been paid prior to certification review, and by EPA’s contractor. Updates have been made to the certification portion of EV-CIS that shows whether fees have been paid for an engine family/test group. This reduces the amount of time that certification engineers need to spend researching the fees before certification. If the system shows that a fee has not been paid, the certification engineer will need to do some research, as in prior years, but this situation represents a small fraction of applications for certification that are received. In addition, EPA’s Office of Financial Services (OFS) keeps deposit records and processes fee refunds. Thirty percent of one GS 12/3 full time equivalent (FTE) employee, and 64 percent of one FTE Senior Environmental Employee (SEE) Program employee (the SEE Program is an employment program for older workers authorized by the Environmental Programs Assistance Act, passed by Congress in l984, and provides employment opportunities to senior citizens age 55 and over), are allocated to the fees team. An additional three quarters of one percent of 25 FTE and seven SEE employees is also allocated to fees-related activity in the process of certification reviews. Although the numbers of FTEs and SEEs may fluctuate, the average number of hours per action spent on this activity remains the same because fees must be checked before each certificate is issued. Government cost is based on a GS-12/3 general schedule salary for ($67,840 per year) obtained from the Office of Personal Management 2019 Salary Table; and $12.74 per hour for SEE employees, with a 1.6 multiplier for overhead applied to both. The contract work for the upcoming period is estimated as $73,939 based on actual contract cost for one year. The OFS cost is estimated as 302 hours and $9,850 annually. The estimated total Agency cost is $225,838.

6(d) Estimating the Respondent Universe and Total Burden and Costs

Our certification fees database for model year 2017 lists 611 separate manufacturers that submitted fees. These respondents vary from large, multinational corporations to small independent commercial importers.

EPA queried its certification fees database and records for the numbers of activities where a fee form was submitted including fee payments, corrections, miscellaneous payments, reduced fee payments and refund requests received for model year 2017 vehicles. The total number of fees-related transactions for that model year is 5094.

6(e) Bottom Line Burden Hours and Cost

(i) Respondent Tally

Bottom-line burden and costs per year for the combined on-road and nonroad certification fees program are summarized in Table 1. EPA estimates a total of 5094 responses and 1019 hours per year for the next three years at a total cost to the industry of $67,445, of which $11,411 is allocated to O&M and the rest, $56,034, to labor.

(ii) Agency tally

EPA estimates that it takes the agency approximately 4356 hours and $225,838 per year to administer the entire certification fees program.

6(f) Reasons for Change in Burden

The

increase in hours and O&M costs since the previous ICR are the

result of an increase in the number of fees transactions processed.

The hours and O&M costs per transaction remains the same, however

the number of fees transactions has increased because the number of

applications for certification has increased.

Table 1

6(g) Burden Statement

The annual public reporting and recordkeeping burden for this collection of information is estimated to average less than one hour per response. Burden means the total time, effort, or financial resources expended by persons to generate, maintain, retain, or disclose or provide information to or for a Federal agency. This includes the time needed to review instructions; develop, acquire, install, and utilize technology and systems for the purposes of collecting, validating, and verifying information, processing and maintaining information, and disclosing and providing information; adjust the existing ways to comply with any previously applicable instructions and requirements; train personnel to be able to respond to a collection of information; search data sources; complete and review the collection of information; and transmit or otherwise disclose the information.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. The OMB control numbers for EPA's regulations are listed in 40 CFR part 9 and 48 CFR chapter 15.

To comment on the Agency's need for this information, the accuracy of the provided burden estimates, and any suggested methods for minimizing respondent burden, including the use of automated collection techniques, EPA has established a public docket for this ICR under Docket ID Number EPA-HQ-OECA-2013-0338. An electronic version of the public docket is available at http://www.regulations.gov/ which may be used to obtain a copy of the draft collection of information, submit or view public comments, access the index listing of the contents of the docket, and to access those documents in the public docket that are available electronically. When in the system, select “search,” then key in the docket ID number identified in this document. The documents are also available for public viewing at the Enforcement and Compliance Docket and Information Center in the EPA Docket Center (EPA/DC), EPA West, Room 3334, 1301 Constitution Ave., NW, Washington, DC. The EPA Docket Center Public Reading Room is open from 8:30 a.m. to 4:30 p.m., Monday through Friday, excluding legal holidays. The telephone number for the Reading Room is (202) 566-1744, and the telephone number for the docket center is (202) 566-1927. Also, you can send comments to the Office of Information and Regulatory Affairs, Office of Management and Budget, 725 17th Street, NW, Washington, DC 20503, Attention: Desk Officer for EPA. Please include the EPA Docket ID Number EPA-HQ-OECA-2013-0338 and OMB Control Number 2060-0434 in any correspondence.

To comment on the Agency's need for this information, the accuracy of the provided burden estimates, and any suggested methods for minimizing respondent burden, including the use of automated collection techniques, EPA has established a public docket for this ICR under Docket ID Number EPA-HQ-OAR-2013-0119. An electronic version of the public docket is available at http://www.regulations.gov/ which may be used to obtain a copy of the draft collection of information, submit or view public comments, access the index listing of the contents of the docket, and to access those documents in the public docket that are available electronically. When in the system, select “search,” then key in the docket ID number identified in this document. The documents are also available for public viewing at the EPA Docket Center (EPA/DC), EPA West, Room 3334, 1301 Constitution Ave., NW, Washington, DC. The EPA Docket Center Public Reading Room is open from 8:30 a.m. to 4:30 p.m., Monday through Friday, excluding legal holidays. The telephone number for the Docket Center Reading Room is (202) 566-1744, and the telephone number for the Office of Air and Radiation Docket Center is (202) 566-1742. Also, you can send comments to the Office of Information and Regulatory Affairs, Office of Management and Budget, 725 17th Street, NW, Washington, DC 20503, Attention: Desk Officer for EPA. Please include the EPA Docket ID Number EPA-HQ-OAR-2013-0119 and OMB Control Number 2060-0434 in any correspondence.

Attachment I

Legal Authority

42 USC 7552. - Motor vehicle compliance program fees

(a) Fee collection. Consistent with section 9701 of title 31, the Administrator may promulgate (and from time to time revise) regulations establishing fees to recover all reasonable costs to the Administrator associated with -

(1) new vehicle or engine certification under section 7525(a) of this title or part C of this subchapter,

(2) new vehicle or engine compliance monitoring and testing under section 7525(b) of this title or part C of this subchapter, and

(3) in-use vehicle or engine compliance monitoring and testing under section 7541(c) of this title or part C of this subchapter.

The Administrator may establish for all foreign and domestic manufacturers a fee schedule based on such factors as the Administrator finds appropriate and equitable and nondiscriminatory, including the number of vehicles or engines produced under a certificate of conformity. In the case of heavy-duty engine and vehicle manufacturers, such fees shall not exceed a reasonable amount to recover an appropriate portion of such reasonable costs.

(b) Special Treasury fund. Any fees collected under this section shall be deposited in a special fund in the United States Treasury for licensing and other services which thereafter shall be available for appropriation, to remain available until expended, to carry out the Agency's activities for which the fees were collected.

(c) Limitation on fund use. Moneys in the special fund referred to in subsection (b) of this section shall not be used until after the first fiscal year commencing after the first July 1 when fees are paid into the fund.

(d) Administrator's testing authority. Nothing in this subsection shall be construed to limit the Administrator's authority to require manufacturer or confirmatory testing as provided in this part

31 USC. 9701. - Fees and charges for Government services and things of value

(a) It is the sense of Congress that each service or thing of value provided by an agency (except a mixed-ownership Government corporation) to a person (except a person on official business of the United States Government) is to be self-sustaining to the extent possible.

(b)The head of each agency (except a mixed-ownership Government corporation) may prescribe regulations establishing the charge for a service or thing of value provided by the agency. Regulations prescribed by the heads of executive agencies are subject to policies prescribed by the President and shall be as uniform as practicable. Each charge shall be -

(1) fair; and

(2) based on -

(A) the costs to the Government;

(B) the value of the service or thing to the recipient;

(C) public policy or interest served; and

(D) other relevant facts.

(c)This section does not affect a law of the United States -

(1) prohibiting the determination and collection of charges and the disposition of those charges; and

(2) prescribing bases for determining charges, but a charge may be determined under this section consistent with the prescribed bases.

| File Type | application/msword |

| Author | wvandenb |

| Last Modified By | SYSTEM |

| File Modified | 2019-10-31 |

| File Created | 2019-10-31 |

© 2026 OMB.report | Privacy Policy