Tax Compjiance Burden Article

Tax Compliance Burden Article_041518.docx

Return of Organization Exempt From Income Tax Under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

Tax Compjiance Burden Article

OMB: 1545-0047

Tax Compliance Burden

RAAS: John Guyton, Pat Langetieg, Pete Rose, Brenda Schafer

W&I Tax Forms and Publications: Carrie Holland, Tuawana Pinkston, Maria Cheeks

April 15, 2018

INTRODUCTION

The Paperwork Reduction Act of 1980 (PRA)1 was enacted to minimize the public’s paperwork burden resulting from the growing information collection and reporting requirements imposed on it by the federal government. One of the provisions of the Act requires federal agencies to report to Congress the information collection burden they impose. The IRS collects information from taxpayers so that they can fulfil their income reporting requirements and provide sufficient information to claim allowed deductions and credits against their taxable income.

The Wage & Investment (W&I) Media & Publications coordinates all reporting of official burden estimates through the Department of Treasury to the Office of Management and Budget (OMB). The Office of Chief Counsel considers the impact of compliance burden associated with implementation of new regulations. The Department of Treasury Office of Tax Administration (OTA) oversees the methodology used by the IRS to provide burden estimates.

Tax compliance burden would be much greater for the federal government and most of the public without tax forms to provide a framework for determining tax liability and claiming tax benefits. Nevertheless, the Federal tax system imposes an enormous burden on taxpayers. It is estimated that tax compliance burden is 71% of the annual federal paperwork burden.2 Reduction of tax compliance burden is one of the Service's key priorities. However, the IRS must balance its burden reduction efforts with the administrative costs that would otherwise be required to determine a taxpayer’s tax liability.

This paper provides information about both sides of tax compliance burden – the burden experienced by taxpayers and the administrative costs incurred by the IRS to administer the tax code. It is intended to provide insight into the process of estimating tax compliance burden, and how the Service is working to improve those estimates and how they are reported to the public.

What is tax compliance burden?

Tax compliance burden is generally defined as the time and money taxpayers spend to comply with their tax filing responsibilities. Time-related activities include recordkeeping, tax planning, gathering tax materials, learning about the law and what you need to do, and completing and submitting the return. Out-of-pocket costs include expenses such as purchasing tax software, paying a third-party preparer, and printing and postage. Tax compliance burden does not include a taxpayer’s tax liability, economic inefficiencies caused by sub-optimal choices related to tax deductions or credits, or psychological costs.

Drivers of Tax Compliance Burden

The drivers of tax compliance can be generalized into four primary categories:

Volume of Activity

Volume of activity represents the different types of income and expenses as well as the associated dollar amounts and transactions. This activity is observed in a generalized format as the number of forms and statements included in a return, the lines that are completed on the forms, and the frequency with which the return must be filed. A key assumption for the relationship between burden and volume of activity is that if the volume of activity increases, burden is expected to increase but at a decreasing rate.

To provide context, a taxpayer must engage in an activity (e.g., keep records, report income, claim a deduction) to incur burden. A taxpayer with a straightforward tax situation (perhaps a single taxpayer who has no dependents and files Form 1040-EZ) incurs far less compliance burden than a taxpayer who files Form 1040 with many forms attached (such as Schedule A, Itemized Deductions, Form 8582 Passive Losses, and Form 6251, Alternative Minimum Tax). Employers who file quarterly returns incur more burden than employers who are only required to file an annual return.

Availability of Data Sources

Burden is impacted by the number and availability of data sources needed to complete a return. Generally, information that is readily available from processes unrelated to tax drive less burden than information that is not readily available. For tax compliance burden purposes, recordkeeping burden only includes the books and records that a taxpayer keeps solely for tax purposes. For example, a corporation may maintain records using Generally Accepted Accounting Principles (GAAP) for legal purposes. Certain adjustments are made to take into account differences between tax and GAAP rules. Only the time and money spent to create and maintain tax adjustments are considered part of tax compliance burden.

Third-party information returns, such as W-2s, significantly reduce the burden individual taxpayers face. Information returns provided by payors of income allow taxpayers to keep minimal records for the income and other associated information reported on the document. It is important to note that the creation of information returns shifts the compliance burden from individuals to the entities responsible for issuing them so the savings that individuals experience are partially offset by the costs issuing entities incur.

Taxpayer Characteristics

A taxpayer’s compliance burden is related to several different attributes. Individual taxpayers will experience varying levels of burden based on their level of education, the structure of their household, their age, their assets, their income, and their decision to hire a preparer. Entities will experience varying levels of burden based on their industry, their size, their years in business, and their decision to hire a preparer. These variations in attributes can lead to different levels of complexity. Complexity also tends to increase as income increases. This makes sense because higher-income taxpayers are more likely to have many sources of income and claim numerous tax deductions and credits. Businesses may also face additional reporting requirements as they increase in size.

The amount of required recordkeeping is also a significant factor in the amount of burden faced by taxpayers. For example, an individual whose sole source of income is from wages typically has much less burden than a sole proprietor who must keep records of income and retain receipts for deductible expenses.

Technology Infrastructure –

Technology plays a key role in tax compliance burden. Through the early 80s, tax returns were prepared by hand and submitted by mail. Today, 95% percent of returns are prepared using software and 89% percent of returns are electronically filed.3 Technology innovation over the last three decades has also introduced recordkeeping solutions for all filers that provide improved productivity at a significantly reduced price.

Returns prepared on paper generally take more time to prepare than if software were used. Assisted tax preparation (whether the taxpayer prepares the return himself using software or seeks the services of a paid preparer) generally reduces the time to complete a tax return, but there is a tradeoff of incurring out of pocket costs (money burden) if the taxpayer purchases the software or uses a paid preparer. The use of software offers other important benefits, such as eliminating the need to spend time obtaining tax forms, automated math calculations, interview prompts, and error checking, to name a few. A variety of free and pay-for tax preparation software and tax preparation services are available to most taxpayers.

As with recordkeeping, the costs associated with computers, software, data storage, etc. that a taxpayer maintains for non-tax purposes are not included in tax compliance burden. Costs associated with new equipment and software that a taxpayer would not otherwise need is included in tax compliance burden. Initial startup costs to acquire and put in place technology to handle tax compliance tasks reduces the ongoing burden that would be otherwise incurred.

Estimating Tax Compliance Burden

To better meet the burden reporting requirements of the PRA of 1980, the IRS sponsored a study by Arthur D Little, Inc. (ADL) in 1984. ADL conducted a diary study and several surveys of individuals and businesses to gather data about the time they spent on recordkeeping, learning about the law or form, completing the return, and copying, assembling and submitting the return. ADL worked with the IRS to match the survey data to the respondents’ tax returns. Using the matched data allowed ADL to build the first mathematical model (known as the ADL Model) designed to estimate tax compliance burden. The ADL model was a groundbreaking innovation and the first of its kind in the federal government.

As stated earlier, when the model was being developed, most returns were prepared by hand and filed on paper. No one anticipated the major shift to software preparation. Electronic filing hadn’t yet been introduced. It was assumed that any updates to the model would only require modifying isolated values or changing the activity burden formulas if necessary. Because manual tax preparation on paper requires taxpayers to go through each form they complete, the model was designed to calculate burden for each form separately and assumed taxpayers had to at least consider every line. Because the PRA only required reporting burden hours, the monetary cost of tax compliance was not included in the model.

Perhaps the most important benefit of the ADL model is that it is quite simple to use. The user inputs the number of lines on the form and the expected number of forms that will be filed for that tax year. The model provides the estimated aggregate burden hours.

The AD Little model is still used to estimate the burden for many forms.

A New Look at Tax Compliance Burden Estimation

In 1998, the IRS recognized that changes in the economy, tax laws, and characteristics of the taxpayer population were making the survey data that underlie the estimates in the ADL model increasingly out-of-date. In addition, the model can simulate only a narrow range of policy changes because it does not adequately represent the characteristics of the tax law that generate burden.4 IRS Commissioner Charles Rossotti established a task force to study the issue and make recommendations regarding future research. The task force included representatives from the IRS, Department of Treasury (Office of Tax Analysis and Assistant Secretary for Management), Office of Management and Budget (OMB), and the General Accounting Office (GAO).

A 2000 GAO report5 summarizes the ideal capabilities of the new model. It states that the model would be able to:

estimate the burden associated with all prefiling, filing, and post-filing activities undertaken to comply with federal income, estate and gift, employment, and excise tax rules;

disaggregate total compliance burden by type of tax, taxpayer, and activity;

disaggregate burden by origin of compliance requirements (tax laws, regulations, and administrative procedures);

estimate changes in burden associated with potential tax law changes;

function in an integrated manner, allowing users to see how certain tax changes affect multiple taxpayer groups;

disaggregate burden by IRS function (e.g., submission processing and customer service) for burdens associated with the requirements of, and taxpayer interactions with, those functions;

estimate the impact on tax compliance burden of alternative enforcement programs and techniques providing customer service;

provide different types of estimates for different purposes (e.g., the estimates required for the Information Collection Budget are different from those that IRS would use for performance measurement under Government Performance and Results Act (GPRA));

estimate burden in terms of dollars as well as time; and

incorporate new data with sufficient ease so that the model, itself, would not have to be replaced in the near future.

To mitigate the risks associated with developing the new burden estimation methodology, the IRS implemented a multi-phase strategy. The approach gives the IRS an opportunity to incorporate lessons learned from early phases of the process into later efforts.

The first phase of the development process focused on implementation of a model to estimate the federal income tax compliance burden of Wage & Investment taxpayers—those that derive all of their

income from wages, pensions, interest, dividends, and capital gains. The IRS contracted with IBM to document the components of tax compliance burden, describe the concept and structure of a microsimulation model to estimate burden, and recommend a strategy for gathering new survey data from a sample of individual taxpayers. The study helped develop an improved methodology for measuring and modeling the burdens imposed by the tax system on individual taxpayers, with the expectation that the methodology would be expanded to other taxpayer segments in the future.

The improved burden methodology establishes econometric relationships between tax return characteristics from IRS administrative data and the time and out-of-pocket costs reported by those taxpayers via survey data. Most importantly, it takes a taxpayer-centric view of tax compliance burden, considering taxpayers’ actual pre-filing and filing experience. It recognizes the need to survey taxpayers periodically to ensure that the model can be updated to properly represent the current tax compliance experience.

Taxpayer Burden Surveys

As a key step in estimating tax compliance costs, the IRS conducts taxpayer burden surveys. These surveys are designed to gather statistically representative data regarding the time and out-of-pocket costs incurred by taxpayers in response to their tax obligations.

Individual Taxpayer Burden (ITB) surveys have been conducted for tax years 1984 (original ADL survey), 1999, 2000, 2007, and annually since 2010. The tax year 1999 survey only included wage and investment taxpayers, the tax year 2000 survey only included self-employed taxpayers, and all surveys from tax year 2007 on have included both wage and investment and self-employed taxpayers.

Business Taxpayer Burden (BTB) surveys have been conducted for tax year 1984 (original ADL survey), 2004, 2009, and 2012 and are scheduled to be fielded every year or four years thereafter. The tax year 2004 survey only included small business taxpayers filing Form 1120, 1120-S, 1065, and 1120 Specials. The tax year 2009 survey updated the Small Business Taxpayer Burden Survey of 2004 and added a separate survey instrument for large businesses. This survey included all business taxpayers filing a Form 1120 series or Form 1065 series return. (Note: Previous studies of compliance burden for large businesses were conducted in 1993 by Slemrod and Blumenthal (1996)6 and in 2002 by Slemrod and Venkatesh.7. In addition, the 1986 Arthur D. Little study for Tax Year 1984 also covered business taxpayers, as discussed in Contos, et al. (2012).)

The ITB and BTB surveys are designed to gather statistically representative data on the time and out-of-pocket costs that taxpayers incur. As a result, after accounting for nonresponse and adjusting survey weights to match population control totals, the time and out-of-pocket cost amounts reported on the surveys can be used to estimate the average and aggregate time and out-of-pocket costs for their respective populations. It is important to note that these estimates are representative for the year in which the survey was collected. Any change that occurs before or after the survey fielding must be considered when calculating an estimate for a previous or ensuring year for which survey data are not available.

Individual Taxpayer Burden Survey

Each ITB survey uses a sampling methodology that reflects the primary taxpayer characteristics for the taxpayer segment being surveyed. The sampling methodology for the ITB survey involves a stratified random sample with 20 categories (see Table 1). Returns are first distinguished by preparation method (third-party prepared, self-prepared using tax preparation software, self-prepared by hand, and VITA prepared). Returns are further stratified within the preparation categories (excluding VITA) based on five complexity categories: low, medium-low, medium, medium-high, and high.8 The amount of variation observed in the paid professional medium-high and high strata is significant enough to require the creation of three additional substrata for each. Sufficient sample is drawn for each stratum to ensure adequate an adequate response rate for statistical analysis.

Table 1: Tax Year 2016 Individual Taxpayer Burden Survey Population Strata

Strata |

|

Preparation Method |

Complexity |

Used a Paid Professional |

Low |

Used a Paid Professional |

Medium-Low |

Used a Paid Professional |

Medium |

Used a Paid Professional |

Medium-High - Simpler |

Used a Paid Professional |

Medium-High - Moderate |

Used a Paid Professional |

Medium-High - Difficult |

Used a Paid Professional |

High-Simpler |

Used a Paid Professional |

High-Moderate |

Used a Paid Professional |

High-Difficult |

Self-Prepared by Hand |

Low |

Self-Prepared by Hand |

Medium-Low |

Self-Prepared by Hand |

Medium |

Self-Prepared by Hand |

Medium-High |

Self-Prepared by Hand |

High |

Self-Prepared by Software |

Low |

Self-Prepared by Software |

Medium-Low |

Self-Prepared by Software |

Medium |

Self-Prepared by Software |

Medium-High |

Self-Prepared by Software |

High |

VITA Prepared |

ANY |

The ITB survey instrument consists of several framing questions, such as asking the taxpayer to think about resources they may have used when preparing their return, as well as the key time and out-of-pocket cost questions. These topics are broken down into two separate response items: (1) time, including recordkeeping, tax planning, gathering materials, and completing and submitting the tax return; and (2) out-of-pocket costs, including paid preparer services, tax preparation website or software, fees for early or immediate refund, tax books, classes, or seminars, and postage or filing fees.

To reduce recall bias, the surveys are conducted close to when the taxpayers filed their tax returns. The survey is sent out in four waves, with the first wave sampled from the earliest filers starting around June.

Business Taxpayer Burden Survey

As with the ITB surveys, stratified random sampling is used to select the survey respondents for the Business Taxpayer Burden Survey. Business entities are grouped by entity type based on the tax return they filed (corporation, S corporation, or partnership) and size. (See Table 3)

Table 3: Tax Year 2016 Business Taxpayer Burden Survey Population Strata

Strata |

||

|

Industry |

Business Size |

Form 1120 |

ANY |

No Business Activity |

ANY |

Assets Under 50k and Turnover Under 20k |

|

ANY |

Assets From 50k to 175k or Turnover From 20k to 70k |

|

ANY |

Assets From 175k to 500k or Turnover From 70k to 200k |

|

ANY |

Assets From 500k to 1.5M or Turnover From 200k to 600k |

|

ANY |

Assets From 1.5M to 5M or Turnover From 600k to 2M |

|

ANY |

Assets From 5M to 15M or Turnover From 2M to 6M |

|

ANY |

Assets From 15M to 50M or Turnover From 6M to 20M |

|

ANY |

Assets From 50M to 1000M or Turnover From 20M to 400M |

|

ANY |

Assets Over 1B or Turnover Over 400M |

|

Form 1120-S |

ANY |

No Business Activity |

ANY |

Assets Under 50k and Turnover Under 20k |

|

ANY |

Assets From 50k to 175k or Turnover From 20k to 70k |

|

ANY |

Assets From 175k to 500k or Turnover From 70k to 200k |

|

ANY |

Assets From 500k to 1.5M or Turnover From 200k to 600k |

|

ANY |

Assets From 1.5M to 5M or Turnover From 600k to 2M |

|

ANY |

Assets From 5M to 15M or Turnover From 2M to 6M |

|

ANY |

Assets From 15M to 50M or Turnover From 6M to 20M |

|

ANY |

Assets From 50M to 1000M or Turnover From 20M to 400M |

|

ANY |

Assets Over 1B or Turnover Over 400M |

|

Form 1065 |

ANY |

No Business Activity |

Not Real Estate |

Assets Under 50k and Turnover Under 20k |

|

Not Real Estate |

Assets From 50k to 175k or Turnover From 20k to 70k |

|

Not Real Estate |

Assets From 175k to 500k or Turnover From 70k to 200k |

|

Not Real Estate |

Assets From 500k to 1.5M or Turnover From 200k to 600k |

|

Not Real Estate |

Assets From 1.5M to 5M or Turnover From 600k to 2M |

|

Not Real Estate |

Assets From 5M to 15M or Turnover From 2M to 6M |

|

Not Real Estate |

Assets From 15M to 50M or Turnover From 6M to 20M |

|

Not Real Estate |

Assets From 50M to 1000M or Turnover From 20M to 400M |

|

Not Real Estate |

Assets Over 1B or Turnover Over 400M |

|

Real Estate |

Assets Under 50k and Turnover Under 20k |

|

Real Estate |

Assets From 50k to 175k or Turnover From 20k to 70k |

|

Real Estate |

Assets From 175k to 500k or Turnover From 70k to 200k |

|

Real Estate |

Assets From 500k to 1.5M or Turnover From 200k to 600k |

|

Real Estate |

Assets From 1.5M to 5M or Turnover From 600k to 2M |

|

Real Estate |

Assets From 5M to 15M or Turnover From 2M to 6M |

|

Real Estate |

Assets From 15M to 50M or Turnover From 6M to 20M |

|

Real Estate |

Assets From 50M to 1000M or Turnover From 20M to 400M |

|

Real Estate |

Assets Over 1B or Turnover Over 400M |

|

Form 1120-L |

ANY |

ANY |

Form 1120-REIT |

ANY |

ANY |

Form 1120-PC |

ANY |

ANY |

Form 1120-F |

ANY |

ANY |

|

|

|

Also similar to the ITB survey, the BTB survey instrument consists of framing questions to improve recall for the key time and out-of-pocket cost questions. The key time and out-of-pocket costs questions are also similar. Time-related questions asked respondents to allocate their time burden across (1) tax compliance activities (such as recordkeeping, tax planning, calculating payroll taxes, and completing and submitting the federal income tax return) and (2) the type of employee (owners, executives, clerical, and other) performing those activities. Cost-related questions include fees paid to external service providers for tax and tax-related services, the cost of tax-related software, and the amount spent on other tax-related activities (copies of tax returns, postage, etc.). Survey fielding is also conducted close to when the taxpayers filed their tax returns to reduce recall bias.

To take into account likely pay rate differences within and across firms, the Business Taxpayer Burden Survey asks respondents to report the average hour weighted hourly cost for the Form W-2 employees spending their work hours completing the federal income tax requirements. This measure can be used to help determine the monetary costs of the time spent by firms complying with federal income tax requirements.

Building an Improved Model

The IRS Taxpayer Burden Model (TBM) was developed with oversight from the Department of Treasury Office of Tax Analysis, OMB, and GAO. It was first used to provide the PRA estimate for individual tax compliance burden in 2005. The TBM was updated to its current form in 2010, following the methodology in Contos et al. (2009a)9 and Contos et al. (2009b)10, which modeled the compliance burden of small businesses.

The current TBM uses a log-linear specification in which the logarithm of the burden is linearly related to a set of explanatory variables, described in further detail in Contos, et al. (2010)11. The dependent variable is based on survey responses and is defined as the logarithm of total pre-filing and filing compliance costs — that is, the monetized time and money taxpayers spend to comply with federal tax laws.

The coefficients for the Individual Taxpayer Burden Model are shown in Table 2.

The most unique aspect of modeling compliance burden is the need to control for the type and volume of activities performed by taxpayers to meet their federal tax obligations. As a proxy for the volume of activities, we use the money amounts reported by each taxpayer for that item. This is based on the assumption that a larger dollar amount reported for a tax item is associated with more activity related to that item.

Table 2 Individual Taxpayer Regression Variables

|

Each tax item from the primary forms and schedules is rated as “Low,” “Medium,” or “High,” assuming that burden increases as a function of both the type of tax-related activities completed by the taxpayer as well as the volume completed. For example, if an individual completes an additional tax item one year, holding all else constant, compliance burden should increase because the taxpayer will have adjusted his recordkeeping, familiarized himself with the relevant taxpayer instructions, or perhaps paid higher preparation fees. The Low, Medium, and High Complexity coefficients are the logarithms of the sums of all the values on lines categorized as having the corresponding complexity. Based on these coefficients, an additional dollar of activity in the high category will increase burden more than an additional dollar in medium and low.

Dummy variables are included to measure the effect of preparation method on compliance burden when self-preparation is the reference category. The remaining preparation categories represent paid and software preparation. The coefficients for the preparation dummies are positive because fixed costs are associated with using assisted methods.

The trade-off for additional tax preparation costs is a reduction in the amount of time it would have taken a taxpayer to research and complete the tax return unassisted. In addition to preparation of their tax returns, taxpayers may also receive tax-planning advice and can be reasonably assured that they receive all of the tax benefits to which they are entitled. Taxpayers may also benefit from representation in the event they are contacted by the IRS about their tax return.

To control for the efficiency gains associated with hiring a paid professional, we include in the specification an interaction term between the dummy variable for paid preparation and the logarithm of modified positive income (MPI.) This interaction term takes into account the lower marginal compliance costs associated with using a paid preparer. To control for additional efficiency gains associated with hiring a paid professional or using software, we include three line-count variables that reflect the difference in salience of inapplicable tax rules conditional on the taxpayer’s preparation method.

The coefficients for the Business Taxpayer Burden Model are shown in Table 4.

Table 4

Business Taxpayer Regression Variables

Intercept |

Ln(Total Assets) |

No Assets Indicator |

Ln(Total Receipts) |

No Receipts Indicator |

Low Complexity |

High Complexity |

No Complexity |

Partnership Indicator |

S Corporation Indicator |

Self-Prepared Indicator |

Positive Tax Liability |

Industry Controls |

The dependent variable is the logarithm of total monetized compliance costs. Independent variables include the logarithms of total assets, total receipts, and the sum of dollars reported for line items requiring either very little or conversely significant tax-specific recordkeeping. Dummy variables for organizational form, industry, and use of a paid tax return preparer are also included. Controlling for both assets and total receipts provides a better fit across a range of types and sizes of businesses. Dummy variables are used for cases where either assets or receipts are not reported.

The methodology used to develop the ITB and BTB regression specifications provides a framework that enables the IRS to simulate the impact of changes to the underlying filing requirements that were captured by the surveys. This capability enables the IRS to use the TBM parameters in conjunction with administrative data to predict the impact of a changing filing requirement environment.

How the Taxpayer Burden Model is Used

Reporting for PRA

Under the ADL method, tax compliance burden is estimated for each separate form, regardless of its relationship to other forms. Burden estimation calculations for many forms are still calculated using the ADL Model. Illustration 1 provides an example of burden reporting under the ADL method.

I llustration

1. Example of PRA Reporting Using the ADL Method – TY 2004 Form

1040

llustration

1. Example of PRA Reporting Using the ADL Method – TY 2004 Form

1040

Source: TY 2004 Form 1040 instructions, page 75, available at https://www.irs.gov/pub/irs-prior/i1040gi--2004.pdf. Last accessed 10/24/2017.

The RAAS method was first used to estimate the tax compliance burden for individual taxpayers in 2005. With this change, compliance burden for individuals is now reported by the main form filed (Form 1040, 1040-A, or 1040-EZ), with time categories that are more relevant to today’s tax return preparation experience (see Illustration 2). In addition, the estimated average monetary cost of tax compliance is also provided. Because self-employed taxpayers generally incur substantially higher burden than other taxpayers, the average burden is broken out by business and non-business taxpayers. An example of the updated reporting format is shown in Illustration 2.

Illustration

2: Example of PRA Reporting Using the RAAS T

axpayer

Burden Model

Source: Tax Year 2016 Form 1040 Instructions, page 100, available at https://www.irs.gov/pub/irs-prior/i1040gi--2016.pdf

Beyond PRA

The benefits of estimating tax compliance burden go far beyond being able to meet the requirements of the Paperwork Reduction Act. It helps the IRS support or achieve several important goals:

Fulfill its mission to provide top quality service to taxpayers.

Better understand taxpayer time and out-of-pocket cost burden.

Improve the accuracy and comparability of the information collection budget estimates it provides under the Paperwork Reduction Act (44 U.S.C. 3501 et seq.).

Provide data to be used in micro-simulation models to allow estimation of the impact of proposed legislation on tax compliance burden before the legislation is enacted.

Support ongoing analysis of the role of compliance costs in influencing taxpayer behavior and identifying taxpayer needs.

Provide information to the Executives and Operating Divisions for assessing the impact of programs on tax compliance burden.

Support the Operating Divisions and IRS executives in their efforts to identify and implement burden reduction initiatives.

Support tax analysis in the Treasury Department Offices.

Assist the IRS in evaluating the effectiveness and associated impact on taxpayer costs and behavior of IRS initiatives.

IRS employees who are responsible for implementing programs, policies, and procedures that impact taxpayers perform a burden risk evaluation during the initial implementation phase or when changes are being considered. This evaluation is used in conjunction with other business metrics to guide decision making. In keeping with a balanced measures approach, tax compliance burden reduction is not considered in isolation. It is viewed as a component of customer service/satisfaction and is balanced with compliance. By weighing these two components and the number of taxpayers impacted, the IRS can ensure that unnecessary tax compliance burden is addressed and that tax compliance is not jeopardized.

Individual Compliance Costs by Major Segments of the Tax code

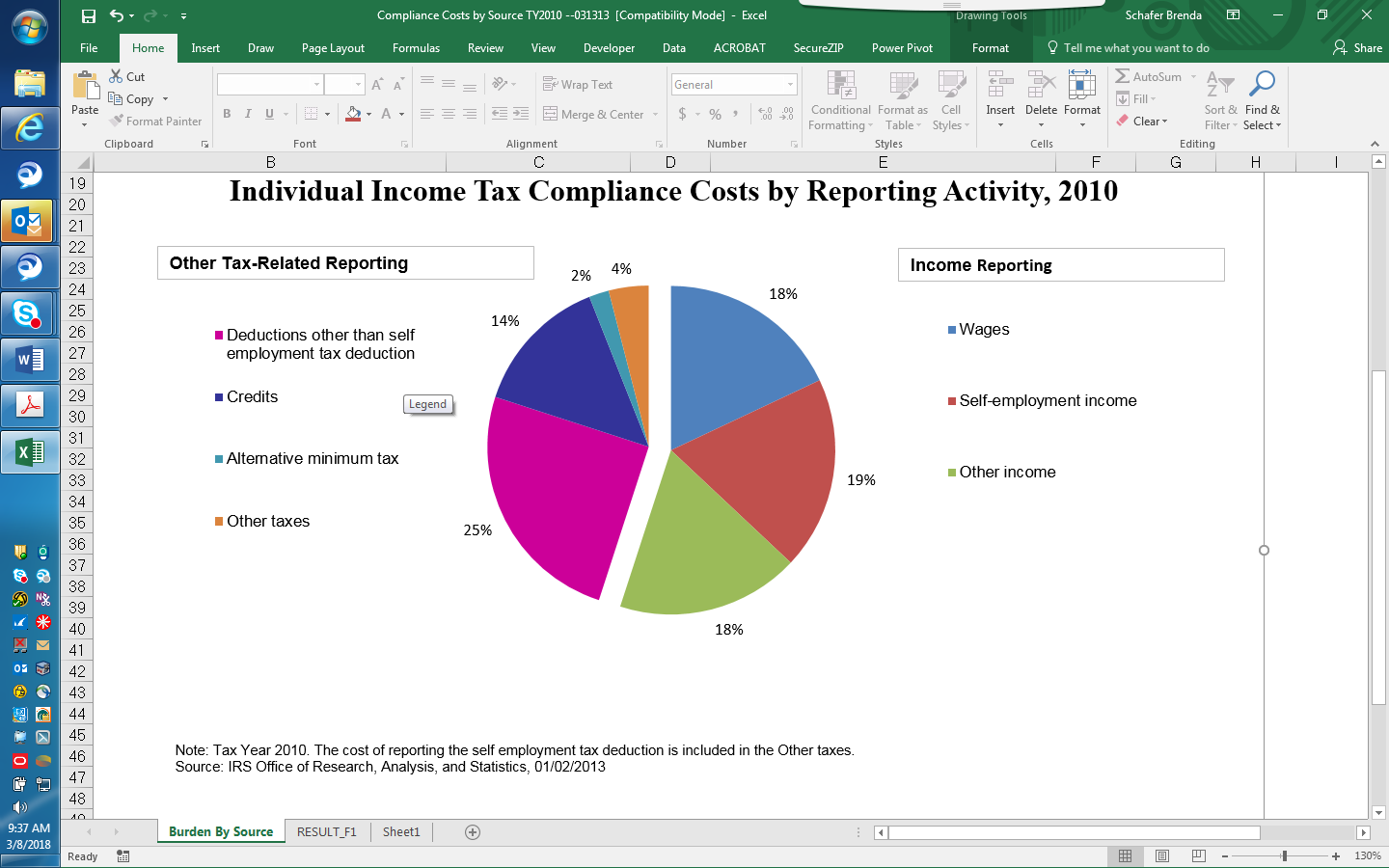

One might think that the myriad of tax deductions and credits available to individuals would contribute to the bulk of the complexity faced by these taxpayers. However, as shown in Chart 1, the elements of the tax law that deal solely with reporting income (before claiming any deductions or credits) comprise more than half of individual tax compliance burden.

The pie chart was created by estimating the ITB model before and after removing each reporting item segment. The order in which segments were removed was based on line item dependencies, generally following the reverse order of line items reported on Form 1040.

We found that over half of the individual income tax compliance costs are associated with reporting and substantiating income, even for taxpayers with relatively simple sources of income. Taxpayers with simpler sources of income also tend to have fairly simple deductions and credits, or none at all. Note that this analysis only considers the cost to the taxpayer. If we were to consider the costs of issuing information returns such as Forms W-2 and 1099, the overall share of income tax compliance costs would be even more heavily weighted towards reporting and substantiating income.

Chart 1: Individual Income Tax Compliance Costs by Reporting Activity, 2018

Note: Tax Year 2010. The cost of reporting the self-employment tax deduction is included in the Other taxes.

Source: IRS Office of Research, Analysis, and Statistics, 01/02/2013

One limitation of the measurement methodology shown in Chart 1 is that it ignores the impact that complexity has on what taxpayers choose not to do because it is too burdensome, such as choosing not to keep records necessary to claim a tax benefit or even not to comply with certain reporting requirements. Also, we recognize that we may undervalue self-employed taxpayers’ time, given that net self-employment income may not properly reflect the opportunity cost of starting a new business or the complexity associated with deductions that offset the business’s income.

Administrative Burden

The Paperwork Reduction Act also requires federal agencies to provide the annualized administrative costs incurred by the Federal government to collect information. These costs include personnel work hours, operational expenses (such as equipment, overhead, printing, and support staff), and any other expense that would not have been incurred without this collection of information.

IRS work is unique compared to other agencies in that it is driven by the tax laws passed by Congress. The IRS develops regulations that define the information collection process and creates the collection instruments (tax forms). The tax forms streamline the tax reporting requirements.

The IRS Special Service Section in Wage and Investment Tax Forms and Publications (TF&P) Division is responsible for service-wide PRA compliance. In most agencies, the PRA program is managed at a much higher level organizationally thereby providing data access and an enterprise view of efforts across the agency. While Special Services Branch performs the same tasks, this sometimes presents special challenges when gathering cost information from all the contributing units and processing the requests for information. This coupled with the complexity of the calculation and the fact that data is not gathered in this manner across the Service made an accurate cost estimates difficult to develop.

Until recently, the Internal Revenue Service did not provide the government cost estimates with its Information Collection Requests because the IRS had not developed a model to determine level of effort and cost. It is the intent of Internal Revenue Service (IRS) to address this situation to improve transparency and be in full compliance of the Paperwork Reduction Act.

Methodology

To devise a methodology that accurately addresses the requirements of the PRA, the technical staff from Tax Forms and Publications responsible for the PRA collaborated with the IRS’s Central Finance Office (CFO) and RAAS to develop a sound methodology as outlined below. Government costs were separated into three cost areas: Form development, printing and distribution for forms and downstream impacts associated with form development.

For Form Development, the key variables are the job series of the staff performing the work, the percentage of time the task was completed, and the source of cost data. This method was repeated for printing and distribution costs and in addition we identified the costs for printing and distribution for each form

Downstream costs were identified as aggregated costs of all support functions as allocated to each function performing tasks in form development and printing and distribution.

Category |

Functions |

*Source |

Form Development |

TFP: Tax Law Specialists, Reviewers, Technical Leads, Management Publishing: Composition Specialist, Webmasters, Management Chief Counsel: Attorneys (10%) |

Data from CFO, IFS |

Printing and Distribution |

Distribution: NDC Staff and HQ forecasting analysts Publishing: Contract information |

Data from CFO, IFS, Printing and Distribution |

Downstream Impacts |

Aggregated costs of all support functions as allocated to functions above |

Data from CFO, IFS |

Total Government Cost Estimate ** CFO will provide aggregate data for developing products beginning to end to be used in our weighted model |

||

Once costs areas were identified, a weighted factor was created to determine a per-product cost. Each product was assigned a weighted number. All aggregated costs for allocable costs for form development and downstream impacts are applied to each product in the ratio of the products weighted number to the total of all products’ weighted number. The results were modified to take into account the amount of work required based on whether the document is a publication, form instructions, a tax form, etc.

The weighted number for a product is determined as follows:

Number of pages in the product multiplied by adjustment factors below.

Forms’ page count is deemed to be 50 because of the WRNs and other work involved per page of a form; Instructions’ page counts are multiplied by 2; Publications and other products are not adjusted (multiplied by 1).

Annual and quarterly products are multiplied by 3; Continuous use products are multiplied by 1 since they aren’t revised as often.

Products with TFP Signoff level that is at the branch level are multiplied by 1.3; those less complicated products for which the reviewer has the final signoff are multiplied by 1. Those reviewed at the Branch level are more complicated thus requiring the extra review.

Critical products, CIFS and CTB, are multiplied by 1.3 (all others multiplied by 1) due to the extra management and other work required.

Form 1040 and Instructions weights are doubled due to the extra work involved.

Note: The relative weighted factors for each product were developed based on the metadata available for each product and historical knowledge of the impact on workload of each piece of metadata as described above using over 20 years of subject matter expertise.

Burden Estimate Transition

At the request of the OMB Office of Information and Regulatory Affairs, W&I’s Tax Forms and Publications team and RAAS has implemented a five-year plan to transition the tax compliance burden estimation method for all tax forms and regulations to the preferred RAAS method. Doing so will allow IRS to consolidate 707 OMB control numbers into as few as nine taxpayer-centric segments, including the individual taxpayer and business entity taxpayer segments that have already been transitioned. One additional control number may be needed for information collections that don’t fit elsewhere.

Forms that are used solely by one type of taxpayer (e.g., Form 1040 is filed only by individual taxpayers) will be included in the OMB data collection for that segment. Forms that are used by more than one type of taxpayer will be consolidated into the OMB number of the segment whose taxpayers incur most of the annual compliance burden. The same process will be used to consolidate the related regulations.

Important: Because the RAAS burden method takes into account the tax compliance burden incurred on the returns that are actually filed, it automatically considers all of the forms and schedules used by a given segment and all of the underlying regulations that apply, regardless of the OMB number to which a form or regulation is assigned.

To complete the burden estimation transition work, RAAS must gather the burden data from the relevant taxpayers, analyze that data and the matched administrative data, and develop and test the related modeling capability. As each transition occurs, the Federal Register Notice will include information about the transition and list the forms, schedules, and regulations that are included in the resulting consolidated segment.

Table 5: Schedule of Planned Burden Estimate Transition

|

Fiscal Year of Transition |

Consolidated OMB # |

Individual Taxpayers |

2005* |

1545-0074 |

Business Entities |

2014* |

1545-0123 |

Tax-Exempt Entities |

2018 |

1545-0047 |

Employer |

2018 |

1545-0029 |

Information Return Issuers |

2018 |

1545-0008 |

Trust and Estate Income Tax |

2020 |

1545-0092 |

Transfer Taxes (Estate and Gift) |

2021 |

1545-0015 |

Pension Plans |

2021 |

1545-0197 |

Excise Taxes |

2022 |

1545-0023 |

Reserved |

2022 |

TBD |

*Completed

In addition to transitioning all tax compliance estimates to the RAAS method, the IRS will begin reporting the administrative burden associated with each burden information collection. Doing so will help make the total cost of tax compliance transparent to taxpayers and policy makers.

Summary

Unlike other Federal information collection burden, tax compliance burden is imposed by legislation created and passed into law by Congress. The Internal Revenue Service is tasked with administering and enforcing these law, taking tradeoffs between burden imposition and revenue protection into consideration. Although the IRS is required to estimate and report tax compliance burden, the benefits of doing so go far beyond complying with the Paperwork Reduction Act.

Through tax compliance burden research conducted by the IRS Research, Applied Analytics, and Statistics department, with guidance from OMB, W&I’s Tax Forms & Publications group, the Treasury Office of Tax Analysis, and input from other internal and external stakeholders, the IRS is better able to understand the drivers of compliance burden as well as how changes in tax law and IRS administrative processes impact burden. It also allows the IRS to estimate tax compliance burden based on a taxpayer-centric view of the time and money taxpayers spend to comply with their federal income tax filing requirements, amend a return, or resolve an issue with a return. Taxpayer burden surveys ensure that the Taxpayer Burden Model, which is used to produce the tax compliance burden estimates, reflects the impact of changing tax law, administrative practices, technology infrastructure, and choice of return preparation and filing method.

The transition of all form burden estimation from the legacy A.D. Little method to the preferred RAAS method is an important step in improving how taxpayers and the IRS understand tax compliance burden, both in terms of time and monetary costs. By also providing information on related administrative burden, the full picture of the cost of complying with tax law can be reported.

Note: The IRS appreciates the taxpayers who are selected to receive a taxpayer burden survey and who take the time to respond. The information they provide makes it possible to create, update, and expand the Taxpayer Burden Model and helps ensure that the model produces estimates that are representative of all taxpayers’ tax compliance burden. We can only survey a small sample of taxpayers each time, so every response counts.

Appendix A – Individual Taxpayer Burden Survey Complexity Strata Definitions

Strata |

Definition |

Low |

Wage income; Interest income; Unemployment income; Withholding; Earning income tax credit (with no qualifying children) or advanced EIC; Does not meet any of the conditions for higher levels of differential burden |

Low-Medium |

Capital gain income (includes capital gains distributions and undistributed capital gains); Dividend income; Earned income tax credit (with qualifying children); Estimated tax payments; Retirement income (includes SS benefits, IRA distributions, or pensions and annuities); Any non-refundable credit (includes child and dependent care expenses, education credits, child tax credit, elderly or disabled credit); Household employees; Non-business adjustments; Does not meet any of the conditions for higher levels of differential burden |

Medium |

Itemized deductions (includes mortgage interest, interest paid to financial institution; charitable contributions, and medical expenses); Foreign income, expense, tax, credit, or payment; Moving expenses; Simple Schedule C or C-EZ; General business credit; Does not meet any of the conditions for higher levels of differential burden |

Medium-High |

Farm income as reported on Schedule F; Owns rental property as reported on Schedule E, including farm rental and low-income housing; Estate or trust income as reported on Schedule E; Employee business expense deductions; Files AMT without AMT preference items; Prior year alternative minimum tax credit; Investment interest expense deduction; Net loss as reported on Schedule C; Depreciation or amortization as reported on Schedule C; Expenses for business use of home as reported on Schedule C; Does not meet any of the conditions for higher levels of differential burden |

High |

Cost of goods sold as reported on Schedule C; Partnership or S-Corp income as reported on Schedule E; Files AMT with AMT preference items |

1 Paperwork Reduction Act of 1980, summary available at https://www.congress.gov/bill/96th-congress/senate-bill/1411 (last accessed 10/23/2017)

2 ROCIS report dated April 2, 2018 All Agency PRA Inventory report -Detail Inventory report for IRS paperwork burden total, 8,063,777,920 hours in 707 information collections. ROCIS report dated April 2, 2018 All Agency PRA Inventory report -All Agency Summary report for annual federal paperwork burden total, 11,399,930,195 hours. 8,063,777,920/11,399,930,195=70.7%

33 Source: TY 2016 IRTF Table via CDW by W&I Strategies & Solutions, Research Group 2, extracted on January 31, 2018, from data thru Cycle 52

4 Guyton, John L. & O'Hare, John F. & Stavrianos, Michael P. & Toder, Eric J., 2003. "Estimating the Compliance Cost of the U.S. Individual Income Tax," National Tax Journal, National Tax Association, vol. 56(3), pages 673-688, September.

5 GAO Report (2000), TAX ADMINISTRATION: IRS Is Working to Improve Its Estimates of Compliance Burden, May 2000 available at https://www.gpo.gov/fdsys/pkg/GAOREPORTS-GGD-00-11/pdf/GAOREPORTS-GGD-00-11.pdf. Last accessed 01/11/18

6 Slemrod, Joel and Marsha Blumenthal, 1996. “The Income Tax Compliance Cost of Big Business.” Public Finance Quarterly, vol. 24, 4: pp. 411-438.

7 Slemrod, Joel and Varsha Venkatesh. 2002. “The income tax compliance cost of large and mid-size businesses.” Technical report, IRS, LMSB Division.

8 Appendix A provides more information on the five complexity categories.

9 Contos, George, Ardeshir Eftekaharzadeh, Brian Erard, John Gutyon, and Scott Stilmar, 2009a. “Econometric Simulation of the Income Tax Compliance Process for Small Business.” In Proceedings of the 2009 Winter Simulation Conference, 2762-2795. Winter Simulation Conference. http://informs-sim.org/wsc09popers/prog09soc.html (last accessed 04/05/2018).

10 Contos, George, John Guyton, Patrick Langetieg, and Susan Nelson, 2009b. “Taxpayer Compliance Costs For Small Businesses: Evidence From Corporations, Partnerships, and Sole Proprietorships.” In Proceedings of the One Hundred Second Annual Conference on Taxation, 50-59. National Tax Association, Washington, DC.

11 Contos, George, John Guyton, Patrick Langetieg, and Melissa Vigil, 2010. “individual Taxpayer Compliance Burden: The Role of Assisted Methods in Taxpayer Response to Increasing Complexity.” In Proceedings of the 2100 IRS Research Conference, 191-220. Internal Revenue Service, Washington, DC.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Schafer Brenda |

| File Modified | 0000-00-00 |

| File Created | 2021-01-14 |

© 2026 OMB.report | Privacy Policy