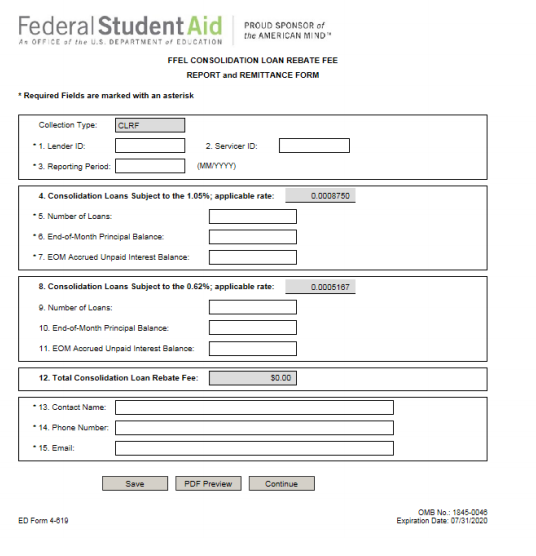

Consolidation Loan Rebate Fee Report ED Form 4-619

Consolidation Loan Rebate Fee Report

CLRF Form and Instructions

Consolidation Loan Rebate Fee Report ED Form 4-619

OMB: 1845-0046

APPENDIX

B – Consolidation Loan Rebate Fee Report Instructions

Applicability: This Consolidation Loan Rebate Fee Report is used to

report to the U.S. Department of Education (ED) the Federal

Consolidation Loan Interest Payment Rebate Fee authorized by

subsection 428C(f) of the Higher Education Act of 1965, as amended. A

servicer providing loan services to several different lenders must

submit a separate Consolidation Loan Rebate Fee Report for each

lender that it services. Help on completing this Consolidation Loan

Rebate Fee Report and on correcting or adjusting prior Reports can be

obtained from ED by emailing [email protected].

NOTE: A lender holding one or more Federal Consolidation Loans at the end of the month must submit a payment for the Consolidation Loan Rebate Fee within 30 days of the end of the month for which the Fee is calculated.

Fee Calculation: The Federal Consolidation Loan Interest Payment Rebate Fee is calculated and paid monthly to ED. It is equal on a monthly basis to 0.0875 percent of the unpaid balance of principal and the accrued unpaid interest on all Federal Consolidation Loans disbursed after October 1, 1993, and held by the lender on the last day of the month. (This is equal to an annualized rate of 1.05 percent.) Except for loans based on applications received during the period from October 1, 1998 through January 31, 1999, inclusive, for which the rebate is equal on a monthly basis to .05167 percent of the unpaid balance of principal and the accrued unpaid interest. (This is equal to an annualized rate of 0.62 percent.)

Use the item-by-item instructions in the following paragraphs to calculate the Fee and to complete the Consolidation Loan Rebate Fee Report. 1. Lender ID: Enter your six-digit lender identification number (LID). 2. Servicer ID: Enter your six-digit servicer identification number, if applicable. 3. Reporting Period: Enter the date of the last day of the month of the reporting period for which this Consolidation Loan Rebate Fee Report is being submitted. Enter the date in a "month/year" format. Enter the month as two digits. Enter the year as four digits. For the purpose of the Consolidation Loan Rebate Fee Report, a month is always a calendar month, starting on the first of the month and ending on the last day (the 30th or 31st, except for February). A calendar month reporting cycle must be used for the Consolidation Loan Rebate Fee Report even if you use a different reporting cycle (e.g. from the 26th day of one month to the 25th day of the following month) for internal or other reporting purposes. 4. Applicable rate for Consolidation Loans Subject to the 1.05% fee: This field has been pre-filled for you. 5. Number of Loans: Enter the number of loans subject to the 1.05% fee used to calculate the Consolidation Loan Rebate Fee. To determine this number, review all Federal Consolidation Loans held by you at the end of the month and identify the loans that were disbursed on or after October 1, 1993, except for loans based on applications received during the period from October 1, 1998 through January 31, 1999, inclusive which are subject to the 0.62% fee. Include a loan even if you were not the originating lender, you only purchased it at a later date. Include all loans eligible for insurance, even if an insurance claim has been filed, but not paid, as of close of business on the last day of the month. 39 6. End-of-Month Principal Balance: Enter the Principal Balance used to determine the Consolidation Loan Rebate Fee. For all Federal Consolidation Loans meeting the requirements in item 5, Number of Loans, determine the unpaid principal balance at the end of the day on the last day of the month. Payments received from borrowers on the last day of the month should be credited prior to determining the unpaid principal balance. Add the unpaid principal balances for all loans to determine the End-of-Month Principal Balance. You may round this total to the nearest dollar if desired. 7. End-of-Month Accrued Unpaid Interest Balance: Enter the End-of-Month Accrued Unpaid Interest Balance used to determine the Consolidation Loan Rebate Fee. For each loan for which an End-of-Month Principal Balance (see item 6) was determined, determine its accrued unpaid interest balance at the end of the day on the last day of the month. Payments received from borrowers or ED on the last day of the month should be credited prior to determining the accrued unpaid interest balance. Add the accrued unpaid interest balances for all loans to determine the End-of-Month Accrued Unpaid Interest Balance. You may round this total to the nearest dollar if desired. (Items 8 through 11 – Repeat the instructions for Items 4 through 7, as they apply to Consolidation loans based on applications received during the period from October 1, 1998 through January 31,1999, inclusive, which are subject to the 0.62% fee.) 12. Consolidation Loan Rebate Fee: The Fee Amount will calculate automatically for you as data is entered on the online form. To determine the amount of the Fee for the month, add the End-of-Month Principal Balance (see item 6) to the End-of-Month Accrued Interest Balance (see item 7). Multiply this sum by 0.0875 percent (that is, .0008750). To this amount, add the End-of-Month Principal Balance (see item 10) to the End-of-Month Accrued Interest Balance (see item 11) and then multiplied by .05167 percent (that is, .0005167). Round the resulting product to the nearest dollar if desired

Reporting Burden: According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. The valid OMB control number for this information collection is 1845-0046. The time required to complete this information collection is estimated to average 1 hour per response, including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection.

If you have any comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: U.S. Department of Education, Washington, D.C. 20202-4651. If you have comments or concerns regarding the status of your individual submission of this form, write directly to U.S. Dept. of Education, 830 First Street, N.E., 5th Floor – Accounting Operations Division, Washington, D.C. 20202. Warning: Although the law does not explicitly state that this information be reported, such reporting is necessary to implement the required monthly payments of the Consolidation Loan Rebate Fee (CLRF). Failure to report would be the basis for the initiation of an action to limit, suspend or terminate the lender's participation in the Federal Family Education Loan Programs pursuant to 20 U.S.C. Sections 1080, 1082, 1085 and 1094. Also, any person who knowingly and willfully destroys or conceals any record relating to the provision of assistance under Title IV of the Higher Education Act of 1965, as amended, or attempts to so destroy or conceal with intent to defraud the United States or to prevent the United States from enforcing any right obtained by subrogation under Part B of Title IV, shall upon conviction thereof, be fined not more than $20,000 or imprisoned not more than 5 years, or both, under the provisions of 20 U.S.C. 1097.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Roca-Baker, Angela |

| File Modified | 0000-00-00 |

| File Created | 2021-01-14 |

© 2026 OMB.report | Privacy Policy