Form FERC-922 Performance Metrics for ISOs, RTOs, and Regions Outside

FERC-922, [AD19-16] Performance Metrics for ISOs, RTOs, and Utilities in Regions Outside ISOs and RTOs

922_30day_30dayAttachB_20200124-3070.xls

RTO/ISO and Non-RTO/ISO Reporting Requirements

OMB: 1902-0262

Document [xlsx]

Download: xlsx | pdf

#1 Reserve Margins

#2 Heat Rates

#3 Fuel Diversity

#4 Capacity Factor

#5 EEA Hours

#6 Performance During EEA

#7 Resource Availability

#8 RMR Capacity

#9 RMR Contract

#10 Demand Response

#11 UnitHours Mtgted

#12 Wholesale Power

#13 Price Cost Markup

#14 Fuel Adj Price

#15 Price Convergence

#16 Congestion Management

#17 Admin Cost

#18 Net Revenues

#19 Avail 825 Shortage

#20 Net CONE Comparison

#21 Resource Deliverability

#22 New Capacity (Entry)

#23 Capacity Retire (Exit)

#24 Forecasted Demand

#25 Capacity Procure

#26 Capacity Obligation

#27 Over Perform

#28 Under Perform

#29 Total Bonus

Overview

Instructions#1 Reserve Margins

#2 Heat Rates

#3 Fuel Diversity

#4 Capacity Factor

#5 EEA Hours

#6 Performance During EEA

#7 Resource Availability

#8 RMR Capacity

#9 RMR Contract

#10 Demand Response

#11 UnitHours Mtgted

#12 Wholesale Power

#13 Price Cost Markup

#14 Fuel Adj Price

#15 Price Convergence

#16 Congestion Management

#17 Admin Cost

#18 Net Revenues

#19 Avail 825 Shortage

#20 Net CONE Comparison

#21 Resource Deliverability

#22 New Capacity (Entry)

#23 Capacity Retire (Exit)

#24 Forecasted Demand

#25 Capacity Procure

#26 Capacity Obligation

#27 Over Perform

#28 Under Perform

#29 Total Bonus

Sheet 1: Instructions

| FERC-922 (OMB Control No. 1902-0262) Expiration Date: to be determined | |||||||||

| The views expressed in this Information Collection Request do not represent the views of the Commission, the Chairman, or any Commissioner. | |||||||||

| Structure of the Information Collection Request | |||||||||

| There are three groups of Metrics in this Information Collection Request | |||||||||

| Group 1: Administrative and Descriptive Metrics | |||||||||

| All reporting entities should answer these metrics | |||||||||

| These metrics are identified by yellow shading in the title row of the worksheet and on the worksheet tabs | |||||||||

| Group 2: Energy Market Metrics | |||||||||

| All RTOs/ISOs should answer these metrics | |||||||||

| These metrics are identified by green shading in the title row of the worksheet and on the worksheet tabs | |||||||||

| Group 3: Capacity Market Metrics | |||||||||

| The four RTOs/ISOs with forward capacity markets should answer these metrics | |||||||||

| These metrics are identified by blue shading in the title row of the worksheet and on the worksheet tabs | |||||||||

| Contact Information | |||||||||

| Please complete the following text fields before entering any data in subsequent worksheets. | |||||||||

| Balancing Authority Area Name: | Example: PJM, ISO-NE, etc. | ||||||||

| Name of the Contact Person | John Doe | ||||||||

| Phone Number of the Contact Person | 202-111-1234 | ||||||||

| Email address of the Contact Person | [email protected] | ||||||||

| Data Reporting Period | |||||||||

| Respondents (utilities and RTOs/ISOs) without centralized capacity markets should enter the first calendar year of the five reporting periods. | |||||||||

| RTOs/ISOs with centralized capacity markets should enter the four-digit year of the first delivery period of the five reporting periods. | |||||||||

| For example, if June 2014 is the start of the first delivery period, enter 2014 | |||||||||

| YEAR | |||||||||

| Enter first reporting period (enter a 4 digit year in YYYY format) | 2014 | ||||||||

| Expiration Date | |||||||||

| To be Determined | |||||||||

| Where to Send Comments on Public Reporting Burden | |||||||||

| The burden for the FERC-922 is estimated to average 402 hours per response, including the time for reviewing instructions, | |||||||||

| searching existing data sources, gathering and maintaining the data, and completing and reviewing the collection of information. | |||||||||

| Send comments regarding the burden estimate or any aspect of the collection of information, including suggestions for reducing | |||||||||

| burden, to the Federal Energy Regulatory Commission, 888 First Street NE, Washington, DC 20426 (Attention: Information Clearance Officer); | |||||||||

| and to the Office of Information and Regulatory Affairs, Office of Management and Budget, Washington, DC 20503 (Attention: Desk Officer | |||||||||

| for the Federal Energy Regulatory Commission). No person shall be subject to any penalty if any collection of information does not display | |||||||||

| a valid control number (44 U.S.C. § 3512 (a)). |

Sheet 2: #1 Reserve Margins

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 1: Metric #1 Reserve Margins | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 1.00 | Forecasted Peak Demand (MW). Enter the value of the forecasted net coincident peak load (actual peak, not normalized) integrated over the peak hour; net of behind-the-meter photovoltaic and energy efficiency for the entire Balancing Authority Area for the given reporting period. For some RTOs/ISOs, this number may have been determined prior to an initial capacity auction. | - | - | - | - | |

| 1.01 | Publication Date of the Forecasted Peak Demand. Enter the date in MM/YYYY format of the last binding capacity auction or the date of the forecast from the most recent planning process at which time the peak demand was forecasted. | 00/0000 | 00/0000 | 00/0000 | 00/0000 | 0/0000 |

| 1.02 | Total Anticipated Installed Capacity (MW). Enter the amount of capacity expected to be available for the entire Balancing Authority Area at the time the Forecasted Peak Demand was calculated for the reporting period. This is the cleared capacity in the binding auction for ISOs/RTOs with a capacity market. For IOUs and RTOs/ISOs without capacity markets use the generation estimate used for the planning process (e.g., Resource Adequacy, etc.) | - | - | - | - | |

| 1.03 | Publication Date of the Estimate of the Total Anticipated Installed Capacity. Enter the date in MM/YYYY format. (This may be the same date as the Date of Forecasted Peak Demand) | 00/0000 | 00/0000 | 00/0000 | 00/0000 | 0/0000 |

| 1.04 | Anticipated Reserve (MW). The value for Anticipated Reserves for the entire Balancing Authority Area for the given reporting period is calculated as [Total Anticipated Installed Capacity – Forecasted Peak Demand]. (Automatically calculated) | - | - | - | - | - |

| 1.05 | Anticipated Reserve Margin (%). The Anticipated Reserve Margin is the ratio of the amount of anticipated reserves in relation to the forecasted demand, calculated as [(Total Anticipated Installed Capacity – Forecasted Peak Demand) / Forecasted Peak Demand]. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 1.06 | Actual Peak Demand (MW). Enter the value of the net coincident peak load (actual peak, not normalized) integrated over the peak hour; net of behind-the-meter photovoltaic and energy efficiency for the entire Balancing Authority Area for the given reporting period. | |||||

| 1.07 | Total Available Installed Capacity (MW). Enter the amount of capacity that was available for the entire Balancing Authority Area at the time the Actual Peak Demand was realized during the reporting period. This is the available capacity at the time of the Actual Peak Demand. | |||||

| 1.08 | Date of the Actual Peak Demand. Enter the date in DD/MM/YYYY format. | 00/00/0000 | 00/00/0000 | 00/00/0000 | 00/00/0000 | 00/00/0000 |

| 1.09 | Actual Reserve (MW). The value for the actual reserves for the entire Balancing Authority Area for the given reporting period calculated as [Total Actual Installed Capacity – Actual Peak Demand]. (Automatically calculated) | - | - | - | - | - |

| 1.10 | Actual Reserve Margin (%). The actual reserve margin is the ratio of the amount of reserves procured for a specific reporting period, calculated as [(Total Actual Installed Capacity – Actual Peak Demand) / Actual Peak Demand]. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 1.11 | Adjustment methodology. Describe your adjustment methodology by technology. | text | ||||

Sheet 3: #2 Heat Rates

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | ||||||

| Group 1: Metric #2 Average Heat Rates | |||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | ||

| 2.00 | Average Heat Rate of Oil-fired Steam Generation (Btu/kWh). | 0 | 0 | 0 | 0 | 0 | |

| 2.01 | Average Heat Rate of Natural Gas-fired Steam Generation (Btu/kWh). | 0 | 0 | 0 | 0 | 0 | |

| 2.02 | Average Heat Rate of Coal-fired Generation (Btu/kWh). | 0 | 0 | 0 | 0 | 0 | |

| 2.03 | Average Heat Rate of Combustion Turbine Generation (Btu/kWh). | 0 | 0 | 0 | 0 | 0 | |

| 2.04 | Average Heat Rate of Combined Cycle Generation (Btu/kWh). | 0 | 0 | 0 | 0 | 0 | |

| 2.05 | Explanatory Text. Explanations, for example, if you haven't used the primary fuel for dual-fuel units, please explain. | text | |||||

Sheet 4: #3 Fuel Diversity

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 1: Metric #3 Fuel Diversity | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Summer Capacity Rating by Fuel Type (MW) | ||||||

| 3.00 | Biomass | - | - | - | - | - |

| 3.01 | Coal | - | - | - | - | - |

| 3.02 | Geothermal | - | - | - | - | - |

| 3.03 | Natural Gas | - | - | - | - | - |

| 3.04 | Other Fuel | - | - | - | - | - |

| 3.05 | Petroleum Products | - | - | - | - | - |

| 3.06 | Solar | - | - | - | - | - |

| 3.07 | Nuclear (All Fuel Types) | - | - | - | - | - |

| 3.08 | Water (Hydro) | - | - | - | - | - |

| 3.09 | Pumped / Hydro Storage | - | - | - | - | - |

| 3.10 | Wind | - | - | - | - | - |

| 3.11 | Battery | - | - | - | - | - |

| Total Energy Generated by Fuel Type (MWh) | ||||||

| 3.12 | Biomass | - | - | - | - | - |

| 3.13 | Coal | - | - | - | - | - |

| 3.14 | Geothermal | - | - | - | - | - |

| 3.15 | Natural Gas | - | - | - | - | - |

| 3.16 | Other Fuel | - | - | - | - | - |

| 3.17 | Petroleum Products | - | - | - | - | - |

| 3.18 | Solar | - | - | - | - | - |

| 3.19 | Nuclear (All Fuel Types) | - | - | - | - | - |

| 3.20 | Water (Hydro) | - | - | - | - | - |

| 3.21 | Wind | - | - | - | - | - |

| 3.22 | Explanatory Text. Add any explanatory text if necessary | Text | ||||

| "Summer Capacity" means the Net Summer Capacity rating as defined by the Energy Information Administration (EIA) | ||||||

| Note: There is no row for Energy Generated (MWh) by Fuel Type for the Pumped Storage and Battery Categories | ||||||

Sheet 5: #4 Capacity Factor

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | ||||||||||||||||

| Group 1: Metric #4 Capacity Factor by Technology Type | |||||||||||||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||

| Technology / Fuel Type | Units | Capacity Factor* | Capacity Factor* | Capacity Factor* | Capacity Factor* | Capacity Factor* | |||||||||||

| 4.00 | Coal (All types) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.01 | Oil (Steam) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.02 | Natural Gas (Steam) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.03 | Gas / Oil Turbine | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.04 | Combined Cycle | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.05 | Nuclear (All Fuel Types) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.06 | Hydro | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.07 | Wind | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.08 | Solar | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 4.09 | Explanatory Text. Add any explanatory text if necessary | Text | |||||||||||||||

| * Note: The capacity factor will range between 0 and 1. For example, a value of 0.89 indicates a capacity factor of 89 percent. | |||||||||||||||||

Sheet 6: #5 EEA Hours

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 1: Metric #5 Emergency Energy Alerts (EEA Level 1 or Higher) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 5.00 | Number of EEAs (Level 1 or higher) (Integer). Report the number of recognized EEAs during the reporting period. If an alert escalates from a lower level to a higher level (e.g., a Level 1 converts to a Level 2 or 3), report as one event. | 0 | 0 | 0 | 0 | 0 |

| 5.01 | Number of EEA Hours (HH:MM). Report the sum of hours in which any level of an EEA occurred during the reporting period. Report a number in the form HH:MM where HH is the number of hours and MM is the number of minutes. | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 5.02 | Amount of Load Shed during EEA Alerts (MWh). Report the total MWh of load that were shed during the EEAs in the reporting period. (Do not report the amount of interruptible load terminated due to emergency conditions). | - | - | - | - | - |

| 5.03 | Explanatory Text. Add any explanatory text if necessary. | Text | ||||

Sheet 7: #6 Performance During EEA

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | ||||||||||||||||

| Group 1: Metric #6 Performance by Technology Type during EEA Level 1 or Higher | |||||||||||||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||

| Technology / Fuel Type | Units | Performance | Performance | Performance | Performance | Performance | |||||||||||

| 6.00 | Coal (All types) | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.01 | Oil (Steam) | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.02 | Natural Gas (Steam) | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.03 | Gas / Oil Turbine | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.04 | Combined Cycle | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.05 | Nuclear (All Fuel Types) | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.06 | Hydro | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.07 | Wind | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.08 | Solar | All sizes | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||||||||||

| 6.09 | Explanatory Text. Add any explanatory text if necessary | Text | |||||||||||||||

Sheet 8: #7 Resource Availability

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | ||||||

| Group 1: Metric #7 Resource Availability (EFORd) | |||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | ||

| Technology / Fuel Type | Units | EFORd | EFORd | EFORd | EFORd | EFORd | |

| 7.00 | Coal (All types) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.01 | Oil (Steam) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.02 | Natural Gas (Steam) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.03 | Gas / Oil Turbine | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.04 | Combined Cycle | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.05 | Nuclear (All Fuel Types) | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.06 | Hydro | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.07 | Wind | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.08 | Solar | All sizes | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 7.09 | Explanatory Text. Add any explanatory text if necessary. | Text | |||||

Sheet 9: #8 RMR Capacity

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #8 Number and Capacity of Reliability Must-Run Units | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 8.00 | Number of RMR Units (Integer). Number of generation units under reliability must-run (RMR) or equivalent contracts in each reporting period. Please note that RTOs and ISOs use various terms to refer to such arrangements, e.g., “System Support Resources” in MISO. For the purposes of this report, such arrangements are collectively referred to as RMR. (RMR refers to "out of market" contracts for specific generation units in the organized markets.) | 0 | 0 | 0 | 0 | 0 |

| 8.01 | Total Capacity of RMR Units (MW). Sum of the Nameplate capacity of the generation units under RMR or equivalent contracts for each reporting period. | - | - | - | - | - |

| 8.02 | Total Available Installed Capacity (MW). (Automatically copied from Metric 1) | - | - | - | - | - |

| 8.03 | RMR MW as Percent of Total Available Installed Capacity (%). The Total Capacity of RMR units as a percentage of the Total Available Installed Capacity of the Balancing Authority Area. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 8.04 | Explanatory Text. Add any explanatory text if necessary | Text | ||||

Sheet 10: #9 RMR Contract

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #9 Reliability Must-Run Contract Usage | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 9.00 | Hours RMR Units Were Used (Integer). Number of unit hours that generation units under reliability must-run (RMR) or equivalent contracts were called upon. | 0 | 0 | 0 | 0 | 0 |

| 9.01 | Total MWh Provided by RMR Units (Integer). Sum of the MWh that all RMR units provided in each reporting period. | - | - | - | - | - |

| 9.02 | Total Cost of RMR Units ($). Sum of the costs of all RMR contracts for each reporting period. | $- | $- | $- | $- | $- |

| 9.03 | Explanatory Text. Add any explanatory text if necessary | Text | ||||

Sheet 11: #10 Demand Response

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #10 Demand Response Capability | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 10.00 | Total MWh of Demand Response (MWh). MWh of Demand Response resources in each reporting period. (Includes RTO/ISO-registered and controlled demand response. See the User Guide for instructions.) | - | - | - | - | - |

| 10.01 | Total Available Installed Capacity (MW). (Automatically copied from Metric 1) | - | - | - | - | - |

| 10.02 | Demand Response Resources as a Percent of Total Available Installed Capacity (%). The Total MW of Demand Response as a percentage of the Total Available Installed Capacity of the Balancing Authority Area. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 10.03 | Actual Peak Demand (MW). (Automatically copied from Metric 1) | 0 | 0 | 0 | 0 | 0 |

| 10.04 | Demand Response Resources as a Percent of Actual Peak Demand (%). The Total MW of Demand Response as a percentage of the Actual Peak Demand in the Balancing Authority Area. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 10.05 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

Sheet 12: #11 UnitHours Mtgted

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #11 Unit Hours Mitigated | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 11.00 | Number of Unit Hours With Active Mitigation (Day-ahead) (Integer). Provide the number of unit hours in each reporting period that any generation unit(s) offer was mitigated in the day-ahead energy market. | 0 | 0 | 0 | 0 | 0 |

| 11.01 | Number of Unit Intervals With Active Mitigation (Real-time) (Integer). Provide the number of unit intervals in each reporting period that any generation unit(s) was mitigated in the real-time energy market. | 0 | 0 | 0 | 0 | 0 |

| 11.02 | Percent of Unit Hours With Active Mitigation (Day-ahead) (%). Calculate the fraction of unit hours in each reporting period that any generation unit(s) offer cap in the day-ahead energy market was set due to mitigation and report that as a percent of the number of all unit hours. (Automatically calculated) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| 11.03 | Percent of Unit Intervals With Active Mitigation (Real-time) (%). Calculate the fraction of unit intervals in each reporting period that any generation unit(s) offer cap in the real-time market was set due to mitigation and report that as a percent of the number of all unit hours. (Automatically calculated) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| 11.04 | Explanatory Text. Provide any additional information if necessary. | text | ||||

Sheet 13: #12 Wholesale Power

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #12 Wholesale Power Costs by Charge Type | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Net Energy (MWh) | ||||||

| 12.00 | Net Energy for Load. Total generation plus imports minus exports minus losses. From FERC Form No. 714, Schedule 3, Balancing Authority Net Energy for Load and Peak Demand Sources by Month, Net Energy for Load, Column (e), sum the entries in column (e) for the months in the reporting period (Lines 1-12). To compute the Net Energy for Load for a Reporting Period which spans calendar years, you will need to include months from another annual Form No. 714. See User Guide. | |||||

| Wholesale Power Cost Components ($) | ||||||

| 12.01 | Energy Component of Total Wholesale Power Cost ($). Report the total energy component (including system marginal price, congestion and losses) of wholesale power costs paid by load and exports for each reporting period. This component is the real-time load weighted average locational marginal price. | $- | $- | $- | $- | $- |

| 12.02 | Capacity Component of Total Wholesale Power Cost ($). Report the total capacity component of wholesale power costs paid by load for each reporting period. If your RTO/ISO does not have a centralized capacity market enter zero. | $- | $- | $- | $- | $- |

| 12.03 | Transmission Component of Total Wholesale Power Cost ($). Report the total FERC-approved Transmission Charges paid by load for each reporting period. | $- | $- | $- | $- | $- |

| 12.04 | Ancillary Service Component of Total Wholesale Power Cost ($). Report the total ancillary service component of wholesale power costs paid by load for each reporting period. Include the cost for all ancillary services such as black start, reactive power etc. that are not included in the Operating Reserve charge type. | $- | $- | $- | $- | $- |

| 12.05 | Operating Reserves Component of Total Wholesale Power Cost ($). Report the total operating reserves component of wholesale power costs paid by load for each reporting period. Include costs for ancillary services, such as regulation, spinning and non-spinning reserves, and ramp products. | $- | $- | $- | $- | $- |

| 12.06 | RTO and Regulatory Fee Component of Total Wholesale Power Cost ($). Report the total RTO cost and regulatory fee component of wholesale power costs paid by load for each reporting period. Include charges to NERC/Reliability organizations (including Reliability Entity fees), RTO startup and expansion fees, etc. | $- | $- | $- | $- | $- |

| 12.07 | Other Cost Component of Total Wholesale Power Cost ($). If the RTO accounts for cost categories that are not included in the above list (i.e., uplift charges), please report those costs here and describe the cost category in the Explanatory Text category below. Note, for example, that the PJM Balancing Operating Reserve credit and Day Ahead Operating Reserve credit are included in this line. | $- | $- | $- | $- | $- |

| 12.08 | Total Wholesale Power Cost ($). The worksheet calculates the total wholesale power cost paid by load for each reporting period in dollars by summing the cost components in lines 12.01 through 12.07. (Automatically calculated) | $- | $- | $- | $- | $- |

| 12.09 | Explanatory Text. Please report any unusual events that provide context to this metric. For instance, the expansion of the RTO/ISO footprint may explain changes in the capacity costs. | text | ||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Wholesale Power Cost Components ($/MWh) | ||||||

| 12.10 | Energy Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.11 | Capacity Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.12 | Transmission Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.13 | Ancillary Service Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.14 | Operating Reserves Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.15 | RTO/ISO and Regulatory Fee Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.16 | Other Cost Component of Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 12.17 | Total Wholesale Power Cost (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

Sheet 14: #13 Price Cost Markup

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #13 Price Cost Markup | ||||||

| Calculate two supply curves for each five-minute interval of the real-time market in the reporting period. The first curve (price curve) is based on the offer used in the price formation for that interval. The second curve (cost curve) is based on the default bid of the unit for that interval. For each curve, starting at the lowest cost offers, aggregate the MWs of the curves until the aggregated MW value equals the real-time demand for that interval. The intersection of the demand curve with the supply curves provides two prices. | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 13.00 | Average of the Price Cost Margin ($). Report the average price cost markup of all of the hours. | $- | $- | $- | $- | $- |

| 13.01 | Top Ten Percent of the Price Cost Margin ($). Report the average price cost markup of the highest price 10 percent of the hours. | $- | $- | $- | $- | $- |

| 13.02 | Bottom Ten Percent of the Price Cost Margin ($). Report the average price cost markup of the lowest price 10 percent of the hours. | $- | $- | $- | $- | $- |

| 13.03 | Explanatory Text. Explain any variations from this formula, e.g., the RTO/ISO used the difference of Pi and Ci for the marginal resource for each five minute interval. | Text | ||||

| Note: This calculation does not account for physical restrictions on units, transmission constrains or ramping restrictions. | ||||||

Sheet 15: #14 Fuel Adj Price

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | ||||||

| Group 2: Metric #14 Fuel-Adjusted Wholesale Energy Price | |||||||

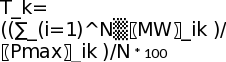

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | ||

| 14.00 | System-wide LMP ($). Provide the average real-time LMP for the reporting period. | $- | $- | $- | $- | $- | |

| 14.01 | Reference Year (YYYY). Report the reference year for the fuel price adjustment. | 0 | 0 | 0 | 0 | 0 | |

| 14.02 | Fraction of Hours that Natural Gas was the Marginal Fuel. For purposes of this metric, estimate the fraction of hours in the reporting period that natural gas was the marginal fuel. Report the fraction with two decimal places. | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 14.03 | Fraction of Hours that Coal was the Marginal Fuel. For purposes of this metric, estimate the fraction of hours in the reporting period that coal was the marginal fuel. Report the fraction with two decimal places. | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 14.04 | Fuel Adjustment Factor Natural Gas. Calculate the natural gas price adjustment for each reporting period compared to the Reference Year. Report the fraction with two decimal place. | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 14.05 | Fuel Adjustment Factor Coal. Calculate the coal price adjustment for each reporting period compared to the Reference Year. Report the fraction with two decimal places. | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 14.06 | Fuel-Adjusted Wholesale Price ($). The spreadsheet will automatically calculate the adjustment based on the equation above. (Automatically calculated) | $- | $- | $- | $- | $- | |

| 14.07 | Explanatory Text. Explain any variations from this formula, e.g., unable to estimate the fraction of hours that a fuel was marginal. | Text | |||||

Sheet 16: #15 Price Convergence

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||||

| Group 2: Metric #15 Energy Market Price Convergence | ||||||||

| Compute this metric four different ways using these two values, the load-weighted average of real time prices and the load-weighted average of day-ahead prices. | ||||||||

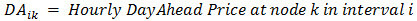

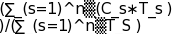

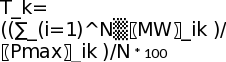

| Equation 1: |

||||||||

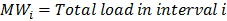

| Equation 2: |

||||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |||

| 15.00 | Equation 1 ($/MWh). Load weighted average of price differences between DA and RT market. See Equation 1. | $- | $- | $- | $- | $- | ||

| 15.01 | Equation 2 ($/MWh). Load weighted average of absolute value of price differences. See Equation 2. | $- | $- | $- | $- | $- | ||

| 15.02 | Equation 3 ($/MWh). Load weighted average of quotient of price difference and DA price. See Equation 3. | $- | $- | $- | $- | $- | ||

| 15.03 | Equation 4 ($/MWh). Load weighted average of absolute value of quotient of price difference and DA price. See Equation 4. | $- | $- | $- | $- | $- | ||

| 15.04 | Explanatory Text. Provide any additional information if necessary. | Text | ||||||

| Zonal Convergence (optional) | ||||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |||

| 15.05 | Zone Name | |||||||

| 15.06 | Equation 1 ($/MWh). Load weighted average of price differences between DA and RT market. See Equation 1. | $- | $- | $- | $- | $- | ||

| 15.07 | Equation 2 ($/MWh). Load weighted average of absolute value of price differences. See Equation 2. | $- | $- | $- | $- | $- | ||

| 15.08 | Equation 3 ($/MWh). Load weighted average of quotient of price difference and DA price. | $- | $- | $- | $- | $- | ||

| 15.09 | Equation 4 ($/MWh). Load weighted average of absolute value of quotient of price difference and DA price. | $- | $- | $- | $- | $- | ||

Sheet 17: #16 Congestion Management

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #16 Congestion Management | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 16.00 | Total Day-Ahead Congestion Charges (RTO/ISO wide) ($). For each reporting period, enter the sum of (Day-Ahead MWh*CLMP) where Day-Ahead MWh consists of MWh settled at day-ahead market energy prices (which includes financial schedules and virtual transactions) and CLMP is the congestion component of the day-ahead energy market price. | $- | $- | $- | $- | $- |

| 16.01 | Net Payments to FTR Holders (RTO/ISO wide) ($). Enter the sum of reporting period congestion charges distributed to holders of Financial Transmission Rights (FTRs) or their equivalent such as Transmission Congestion Rights (TCR) or Congestion Revenue Rights (CRRs), net of revenue received from counterflow FTR holders. | $- | $- | $- | $- | $- |

| 16.02 | Net Energy for Load (RTO/ISO wide) (MWh). (Automatically copied from Metric 12) | - | - | - | - | - |

| 16.03 | Congestion Charges per MWh of Load Served (RTO/ISO wide) ($/MWh). The worksheet will calculate the ratio of the Total Day-Ahead Congestion Charges divided by the Net Energy for Load. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 16.04 | Net Payments to FTR Holders as a percent of Total Congestion Charges (RTO/ISO wide) (%). The worksheet will calculate the ratio of Net Payments to FTR Holders divided by the Total Day-Ahead Congestion Charges. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 16.05 | Net Payments to Load Serving Entities (LSEs) through FTRs, ARRs, etc. ($). Total revenue received by LSEs through financial instruments such as auction revenue rights and financial transmission rights, net of charges paid for counterflow ARRs or FTRs. If an ARR is "self-scheduled" (i.e. converted) into an FTR, please report only the revenue (or charge) received from the FTR. | $- | $- | $- | $- | $- |

| 16.06 | Net Payments to Load Serving Entities (LSEs) as a percent of Total Congestion Charges (%) The worksheet will calculate the percentage of revenue received by LSEs through FTRs and ARRs as a percent of Total Day-Ahead Congestion Charges for the reporting period expressed as a percent. (Automatically Calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

16.07 |

Explanatory Text. Provide any additional information if necessary. | |||||

Sheet 18: #17 Admin Cost

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #17 Administrative Costs | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 17.00 | Administrative Costs ($). Sum the administrative costs (both capital and non-capital) billed by the RTO/ISO for each reporting period. RTOs/ISOs with capacity markets should see the User Guide for instructions. | $- | $- | $- | $- | $- |

| 17.01 | Administrative Costs (FERC Form No. 1) ($). Report the TOTAL Administrative & General Expenses (row 197), page 323 from the last quarter of the filing for the reporting period. RTOs/ISOs with capacity markets should see the User Guide for instructions. | $- | $- | $- | $- | $- |

| 17.02 | Net Energy for Load (MWh). (Automatically copied from Metric 12) | - | - | - | - | - |

| 17.03 | Administrative Costs per MWh of Load Served (%). The worksheet will calculate Administrative Costs divided by the Net Energy for Load for each reporting period . (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 17.04 | Administrative Costs (FERC Form No. 1) per MWh of Load Served (%). The worksheet will calculate Administrative Costs (FERC Form No. 1) divided by the Net Energy for Load for each reporting period. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 17.05 | Explanatory Text. Describe any significant changes to administrative charges that influence the Administrative Costs reported above, such as prior-year collection true-ups, expansion of RTO/ISO footprint, etc. | text | ||||

Sheet 19: #18 Net Revenues

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 2: Metric #18 New Entrant Net Revenues | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Net Revenue for New Entrant (Combustion Turbine) | ||||||

| 18.00 | Prototypical New Entrant Variable Production Cost (Combustion Turbine) ($). Enter the new entrant's estimated variable production cost for a combustion turbine for the reporting period. | $- | $- | $- | $- | $- |

| 18.01 | Prototypical New Entrant Energy Revenues Received (Combustion Turbine) ($). Enter the new entrant's estimated revenue received from RTO/ISO energy and ancillary services (as defined in the RTO/ISO Tariff) for a combustion turbine for the given reporting period. | $- | $- | $- | $- | $- |

| 18.02 | Size in MW of Prototypical New Entrant (Combustion Turbine) (MW). Enter the nameplate capacity of the unit used in the calculation. | - | - | - | - | - |

| 18.03 | Net Revenue for New Entrant (Combustion Turbine) ($). The difference between the Prototypical New Entrant Energy Revenues Received less the Prototypical New Entrant's Variable Production Cost. (Automatically calculated) | $- | $- | $- | $- | $- |

| Net Revenue for New Entrant (Combined Cycle) | ||||||

| 18.04 | Prototypical New Entrant Variable Production Cost (Combined Cycle) ($). Enter the new entrant's estimated variable production cost for a combustion cycle for the reporting period. | $- | $- | $- | $- | $- |

| 18.05 | Prototypical New Entrant Energy Revenues Received (Combined Cycle) ($). Enter the new entrant's estimated revenue received from RTO/ISO energy and ancillary services (as defined in the RTO/ISO Tariff) for a combined cycle for the given reporting period. | $- | $- | $- | $- | $- |

| 18.06 | Size in MW of Prototypical New Entrant (Combined Cycle) (MW). Enter the nameplate capacity of the unit used in the calculation. | - | - | - | - | - |

| 18.07 | Net Revenue for New Entrant (Combined Cycle) ($). The difference between the Prototypical New Entrant Energy Revenues Received less the Prototypical New Entrant's Variable Production Cost. (Automatically calculated) | $- | $- | $- | $- | $- |

| 18.08 | Explanatory Text. Please provide a description on how the cost and revenue estimate were derived for a hypothetical new entrant, including the assumed location (i.e., high cost zone, etc.) | Text | ||||

Sheet 20: #19 Avail 825 Shortage

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

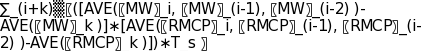

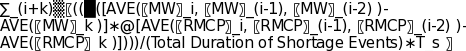

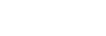

| Group 2: Metric #19 Order No. 825 Shortage Intervals and Reserve Price Impacts | ||||||

| s = a shortage event Ts = duration of event s i = 5-minute interval before shortage in reporting period k = 5-minute interval during shortage in reporting period MW = reserves for 5-minute interval RMCP = Reserve Market Clearing Price for highest quality product (i.e., spinning reserve) for 5-minute interval |

||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 19.00 | Number of Shortage Events. Total number of distinct shortage events in reporting period. An event is a contiguous set of shortage intervals defined by Order No. 825 that occurred in the reporting period. Report an integer. | - | - | - | - | - |

| 19.01 | Total Duration of Shortage Events. Total minutes/hours where shortage occurred during the reporting period. Report an integer. | - | - | - | - | - |

| 19.02 | Average Duration of Shortages. The worksheet will calculate the ratio of the Total Duration of Shortage Events divided by the Number of Shortage Events. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 19.03 |

- | - | - | - | - | |

| 19.04 |

#DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | ||

| 19.05 |

||||||

| 19.06 |

#DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | ||

19.07

|

||||||

19.08

|

#DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | |

| 19.09 | Explanatory Text (if necessary). Report any relevant information about this metric that is not captured above e.g. including the product the price change is associated with, improvements to the methodology, etc. | text | ||||

Sheet 21: #20 Net CONE Comparison

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #20 Net Cost of New Entry (Net CONE) value | ||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | ||

| Net Cost of New Entry | ||||||

| 20.00 | Capacity Zone Name | |||||

| 20.01 | Net CONE value Used at the Most Recent Update ($/MW-Year). Report the estimated Net CONE value used in the most recent update to the Net CONE value for each reporting period. | $- | $- | $- | $- | $- |

| 20.02 | Date of the Most Recent Net CONE Update (MM/YYYY). Enter the date in MM/YYYY format. | 00/0000 | 00/0000 | 00/0000 | 00/0000 | 00/0000 |

| 20.03 | Actual Net CONE value in Reporting Period ($/MW-Year). Rerun the estimate for each historical reporting period using the actual value of local marginal prices (LMP) realized in that reporting period (e.g., if the estimate for 2014 was produced in 2011 for the initial auction, use the 2014 LMPs and re-run the Net CONE for 2014). | $- | $- | $- | $- | $- |

| 20.04 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

Sheet 22: #21 Resource Deliverability

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #21 Resource Deliverability | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Resource Deliverability - Maximum Importable External Capacity into a Capacity Zone | ||||||

| 21.00 | Capacity Zone Name | |||||

| 21.01 | Import Limitation into a zone (MW). The amount of external capacity that can be imported into this zone for purposes of the capacity auction. Determined at the time of the initial auction. Report for all capacity zones that are separately modeled. | - | - | - | - | - |

| 21.02 | Locational Generation Requirement (or equivalent) in the zone (MW). The amount of capacity located inside the zone necessary (or is it available) to meet the estimated demand in the zone (calculated at the time of the initial auction). Report for all capacity zones that are separately modeled. | - | - | - | - | - |

| 21.03 | Locational Generation Procured in the zone (MW). The amount of capacity that was actually procured for the zone in the auction. An RTO/ISO with a downward sloping demand curve may actually procure more capacity than the Locational Requirement. Report the actual amount of capacity procured in the auction for this zone. | - | - | - | - | - |

| 21.04 | Explanatory Text. Report any relevant information about this zone during the reporting period (e.g., changes in boundaries, significant changes in load). | text | ||||

Sheet 23: #22 New Capacity (Entry)

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #22 New Capacity (Entry) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| New Capacity Added | ||||||

| 22.00 | Capacity Zone Name | |||||

| 22.01 | Number of Generation Units Added (Integer). Total number of generation units added during the reporting period. | - | - | - | - | - |

| 22.02 | Increase in Capacity with Supply Obligations (MW). Amount of generating capacity that has cleared in an auction, that now has an obligation to offer into the capacity market during the reporting period. Do not report existing capacity that has been uprated. | - | - | - | - | - |

| 22.03 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

Sheet 24: #23 Capacity Retire (Exit)

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #23 Capacity Retirement (Exit) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Capacity Retirement (Exit) | ||||||

| 23.00 | Capacity Zone Name | |||||

| 23.01 | Number of Generation Units Taken out of Service (Integer). Total number of generation units taken out of service during the reporting period. | - | - | - | - | - |

| 23.02 | Decrease in Capacity with Supply Obligations (MW). Amount of generating capacity that no longer has an obligation to offer into the capacity market during the reporting period. Do not report generation capacity that has been de-rated. | - | - | - | - | - |

| 23.03 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

Sheet 25: #24 Forecasted Demand

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #24 Forecasted Demand | ||||||

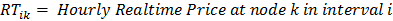

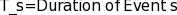

|

||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Forecasted Demand | ||||||

| 24.00 | Capacity Zone Name | |||||

| 24.01 | Demand in the Zone (time of initial auction) (MW). Total estimated coincident peak demand integrated over the hour needed for this zone at the time of the initial auction for the reporting period. Note that this load value is not weather-normalized and is the peak value assigned to that zone from the estimated region peak at the time of the initial auction. | - | - | - | - | - |

| 24.02 | Peak Demand Realized in the Zone (during actual reporting period) (MW). Peak demand (not weather normalized) realized in this zone during the reporting period. | - | - | - | - | - |

| 24.03 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

Sheet 26: #25 Capacity Procure

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #25 Capacity Market Procurement and Prices | ||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | ||

| Capacity Market Procurement & Prices (RTO-wide) | ||||||

| 25.00 | Date That the Capacity Auction took Place (MM-YYYY). Enter the date that the initial capacity auction took place. | 00-0000 | 00-0000 | 00-0000 | 00-0000 | 00-0000 |

| 25.01 | Start Date of the Reporting Period of capacity auction (MM-YYYY). | 00-0000 | 00-0000 | 00-0000 | 00-0000 | 00-0000 |

| 25.02 | Total Capacity Offered into the Auction (RTO-wide) (MW). Enter the total capacity that offered into the entire RTO for the relevant reporting period. | - | - | - | - | - |

| 25.03 | Total Capacity Cleared (RTO-wide) (MW). Enter the total capacity the cleared for the entire RTO during the relevant reporting period. | - | - | - | - | - |

| 25.04 | Capacity Market Clearing Price (RTO-wide) ($/MW-day). Enter the RTO-wide clearing price for the relevant reporting. | $- | $- | $- | $- | $- |

| 25.05 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

| Capacity Market Procurement & Prices (Zonal) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 25.06 | Capacity Zone Name | |||||

| 25.07 | Total Capacity Offered into the Auction (Zonal) (MW). Enter the total capacity that offered into each zone where price separation occurred for the relevant reporting period. | - | - | - | - | - |

| 25.08 | Total Capacity Cleared (Zonal) (MW). Enter the total capacity that cleared in each zone where price separation occurred during the relevant reporting period. | - | - | - | - | - |

| 25.09 | Capacity Market Clearing Prices (Zonal) ($/MW-day). Enter the clearing price for each zone where price separation occurred for the relevant reporting period. | $- | $- | $- | $- | $- |

| 25.10 | Amount of Capacity in this Zone in Bilateral Contracts, if Known (MW). Total capacity of bilateral contracts in this zone during the relevant period. | - | - | - | - | - |

Sheet 27: #26 Capacity Obligation

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #26 Capacity Obligations and Performance Assessment Events | ||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | ||

| Capacity Obligations (RTO-wide) | ||||||

| 26.00 | Total Capacity with Capacity Obligation (RTO-wide) (MW). Enter the cleared capacity eligible for bonus payments or subject to penalties for the entire RTO during the reporting period. | |||||

| 26.01 | Total Number of Performance Assessment Events (RTO-wide) (Integer). | - | - | - | - | - |

| 26.02 | Total Duration of Performance Assessment Events (RTO-wide) (Hours). | - | - | - | - | - |

| 26.03 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

| Capacity Obligations (Zonal) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 26.04 | Capacity Zone Name | |||||

| 26.05 | Total Capacity with Capacity Obligations (Zonal) (MW). Enter the cleared capacity eligible for bonus payments or subject to penalties for the zone during the reporting period. | - | - | - | - | - |

| 26.06 | Total Number of Performance Assessment Events (Zonal) (Integer). | - | - | - | - | - |

| 26.07 | Total Duration of Performance Assessment Events (Zonal) (Hours). | - | - | - | - | - |

Sheet 28: #27 Over Perform

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

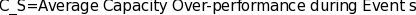

| Group 3: Metric #27 Capacity Over-Performance | ||||||

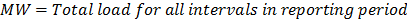

|

||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Capacity Eligible for Bonus Payments for Over-Performance (RTO-wide) | ||||||

| 27.00 | Total Number of Units That Over-Performed During Assessment Events (RTO-wide) (Integer). | - | - | - | - | - |

| 27.01 | Weighted Average Capacity that Over-Performed During Assessment Events (RTO-wide) (MW). See Equation 1. | - | - | - | - | - |

| 27.02 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

| Capacity Eligible for Bonus Payments for Over-Performance (Zonal) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 27.03 | Capacity Zone Name | |||||

| 27.04 | Total Number of Units That Over-Performed During Assessment Events (Zonal) (Integer). | - | - | - | - | - |

| 27.05 | Weighted Average Capacity that Over-Performed During Assessment Events (Zonal) (MW). See Equation 1. | - | - | - | - | - |

Sheet 29: #28 Under Perform

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

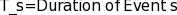

| Group 3: Metric #28 Capacity Under-Performance | ||||||

| Equation 1. |

||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Capacity Facing Penalty Payments for Under-Performance (RTO-wide) | ||||||

| 28.00 | Total Number of Units That Under-Performed During Assessment Events (RTO-wide) (Integer). | - | - | - | - | - |

| 28.01 | Weighted Average Capacity that Under-Performed During Assessment Events (RTO-wide) (MW). See Equation 1. | |||||

| 28.02 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

| Capacity Facing Penalty Payments for Under-Performance (Zonal) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 28.03 | Capacity Zone Name | |||||

| 28.04 | Total Number of Units That Under-Performed During Assessment Events (RTO-wide) (Integer). | - | - | - | - | - |

| 28.05 | Weighted Average Capacity that Under-Performed During Assessment Events (RTO-wide) (MW). See Equation 1. | - | - | - | - | - |

Sheet 30: #29 Total Bonus

| Balancing Authority Area Respondent Name: | Example: PJM, ISO-NE, etc. | |||||

| Group 3: Metric #29 Total Capacity Bonus Payments and Penalties | ||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | ||

| Total Capacity Bonus Payments and Penalties (RTO-wide) | ||||||

| 29.00 | Total Bonus Payments for Over-Performance (RTO-wide) ($). | $- | $- | $- | $- | $- |

| 29.01 | Total Penalties Charged for Under-Performance (RTO-wide) ($). | $- | $- | $- | $- | $- |

| 29.02 | Total Capacity that Under-Performed (RTO-wide) (Integer). (Automatically copied from Metric #28.01) | - | - | - | - | - |

| 29.03 | Total Capacity with Supply Obligations (RTO-wide) (Integer). (Automatically copied from Metric #26.00) | - | - | - | - | - |

| 29.04 | Fraction of Capacity That did not Meet its Obligation (%). The spreadsheet will calculate the ratio by dividing the total capacity that did not meet its obligations by the total obligation. (Automatically calculated) | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! | #DIV/0! |

| 29.05 | Explanatory Text. Provide any additional information if necessary. | Text | ||||

| Total Capacity Bonus Payments and Penalties (Zonal) | ||||||

| Reporting Period | 2014 | 2015 | 2016 | 2017 | 2018 | |

| 29.06 | Capacity Zone Name | |||||

| 29.07 | Total Bonus Payments for Over-Performance (Zonal) ($). | $- | $- | $- | $- | $- |

| 29.08 | Total Penalties Charged for Under-Performance (Zonal) ($). | $- | $- | $- | $- | $- |

| File Type | application/vnd.ms-excel |

| File Modified | 2020-01-24 |

| File Created | 2020-01-24 |

© 2026 OMB.report | Privacy Policy