Lender Qualifications for Multifamily Accelerated Processing (MAP)

Lender Qualifications for Multifamily Accelerated Processing (MAP)

04 Appdx - for PRA

Lender Qualifications for Multifamily Accelerated Processing (MAP)

OMB: 2502-0541

OMB REVIEW READY

Appendix 4

Application Processing Documents

Appendix 4 provides application checklists and submission protocols for FHA multifamily mortgage insurance program (excluding Risk Share programs) applications and concept meetings. Appendix 4 also provides a sample MAP Invitation Letter, Firm Commitment templates, and instructions for requesting an FHA Project Number and paying Multifamily program fees on the Pay.gov website.

General Application Submission Instructions

Application Submission Instructions

All pre-applications and Firm Commitment applications submitted under Multifamily Accelerated Processing (MAP) or Traditional Application Processing (TAP) must follow the below submission protocol:

One electronic copy on a removable USB flash drive (encrypted, if possible) must first be submitted via mail to the appropriate HUD Office

Once the application has been screened for completeness, accepted into processing, and assigned to a HUD Underwriter, the HUD Office will provide instructions for mailing the following supplemental hard copies:

One complete original

One additional hard copy with a separately-bound mortgage credit package

HUD is currently developing an online portal that will soon be used for electronic submissions of applications and other documents to HUD. A Mortgagee Letter with details and revised application submission instructions will be issued when the portal is ready for implementation. Until then, the instructions in Appendix 4 should be followed.

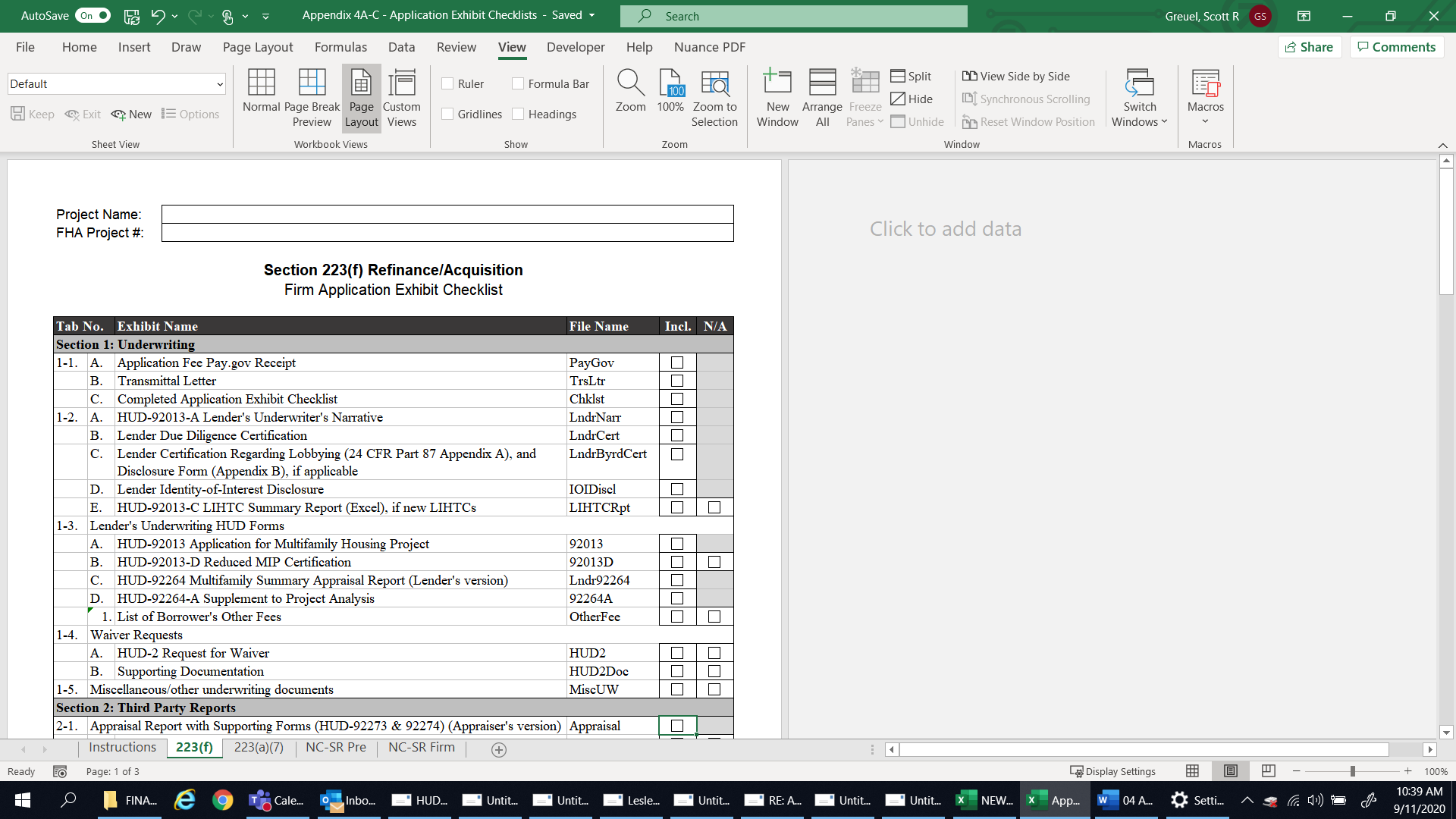

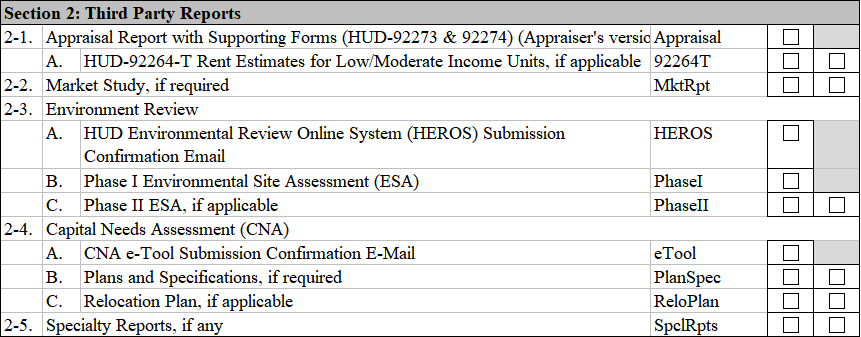

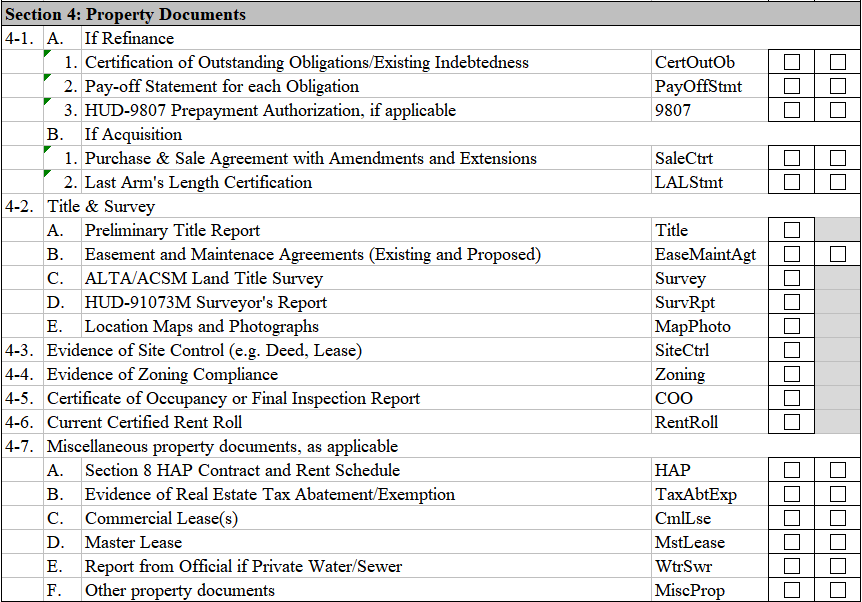

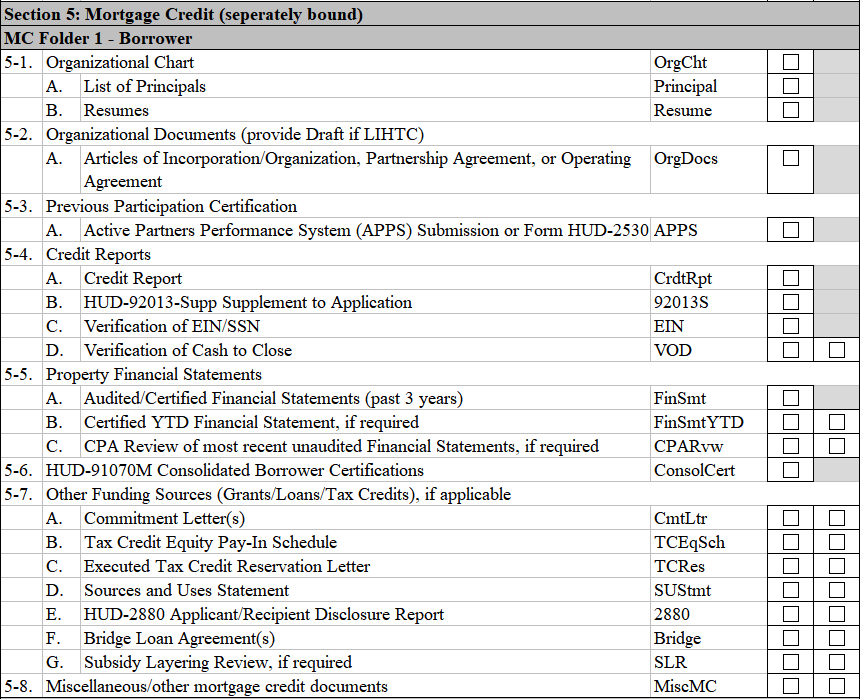

Application Exhibit Checklists

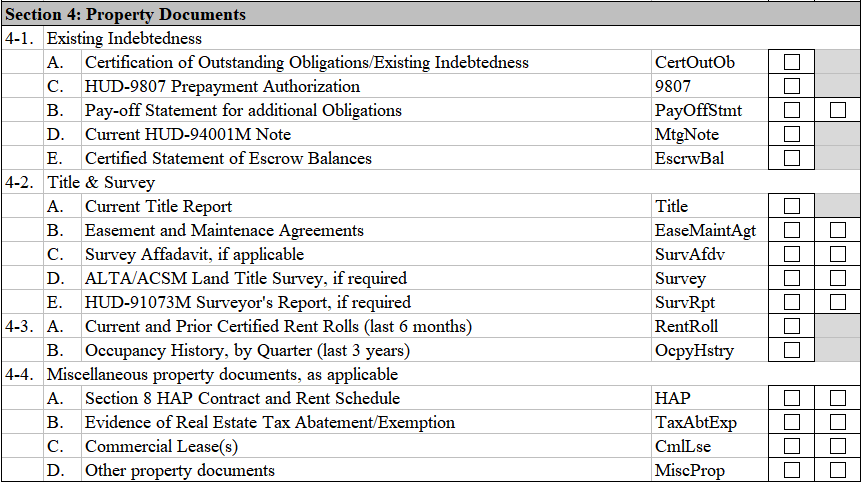

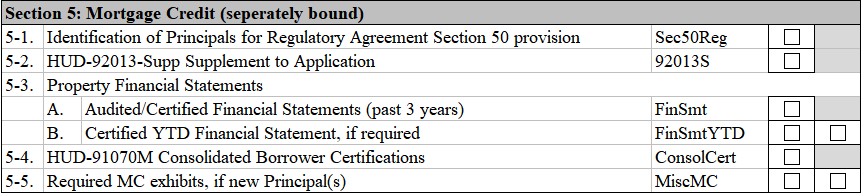

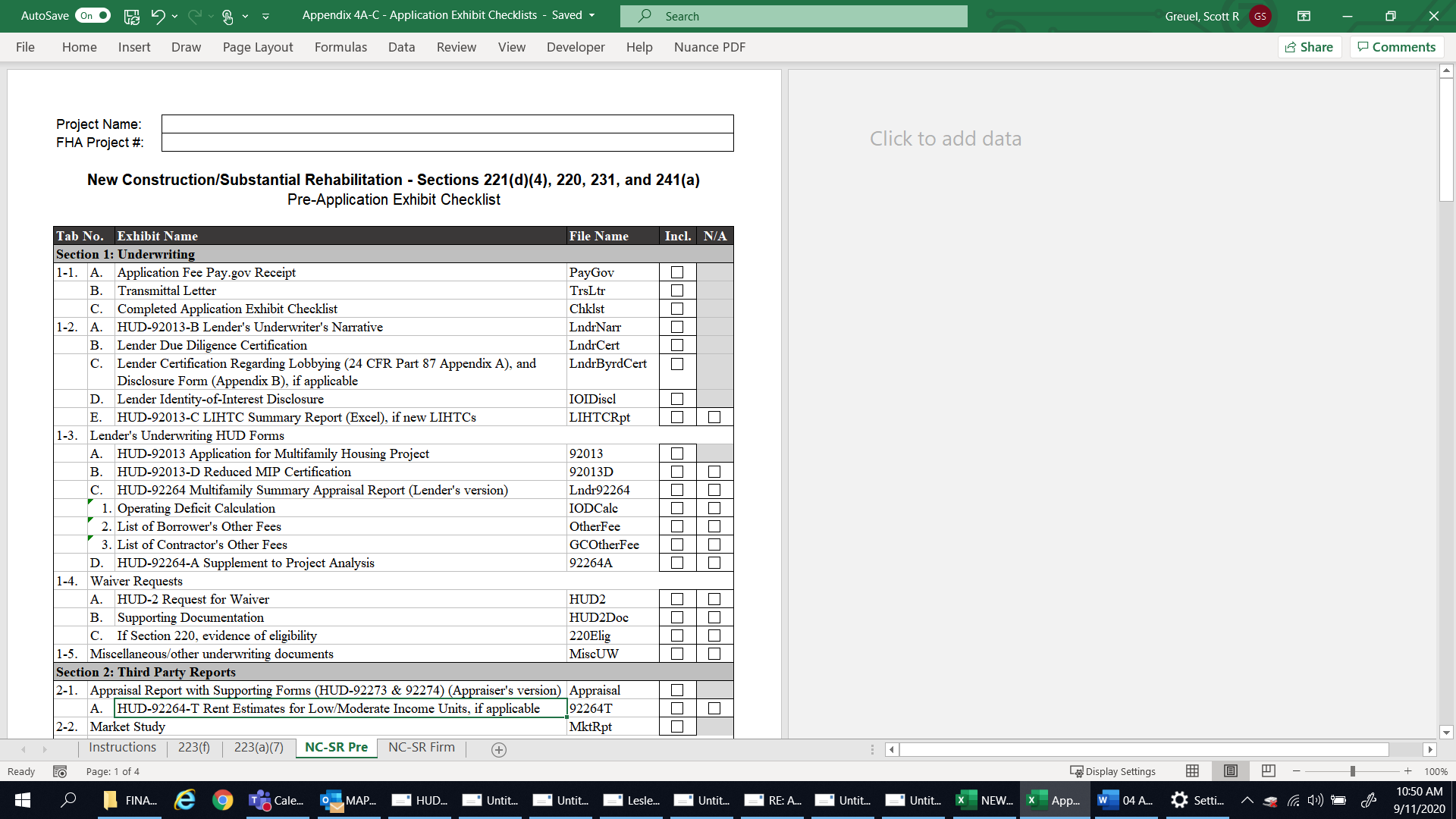

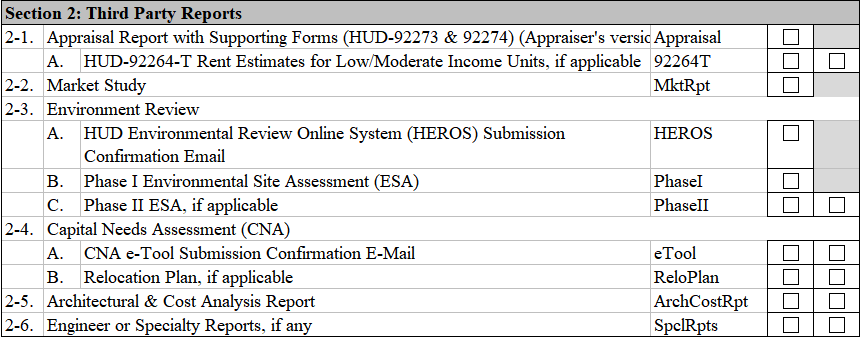

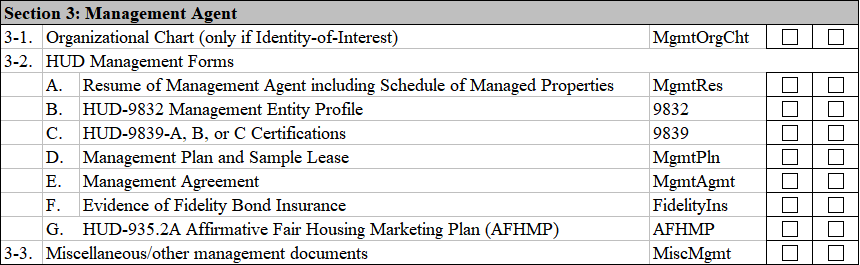

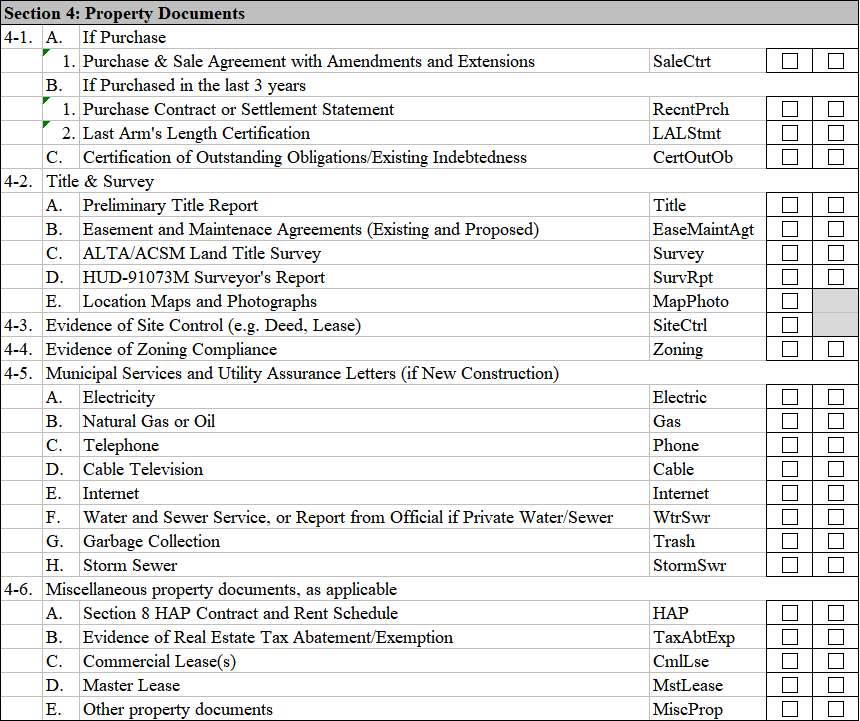

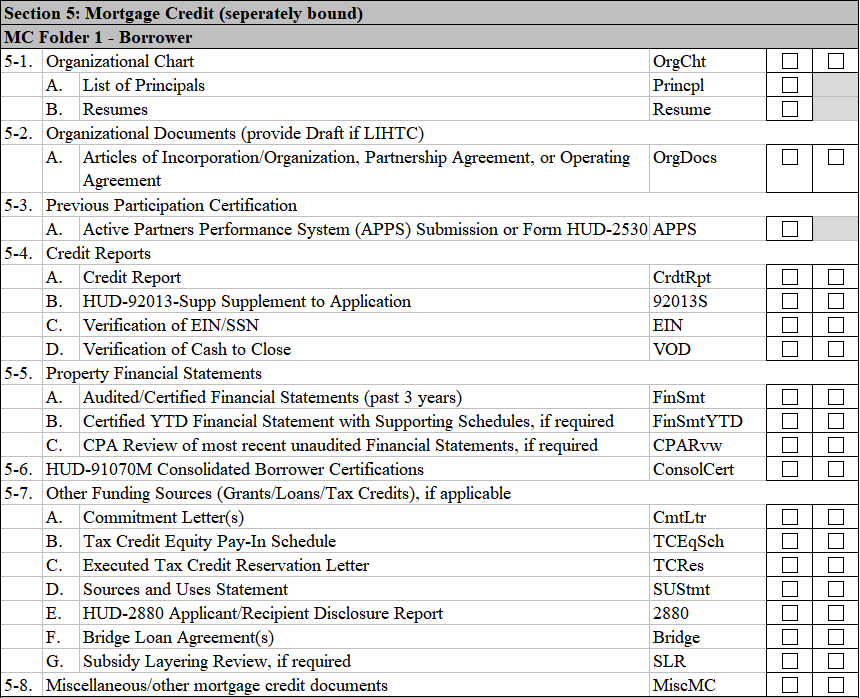

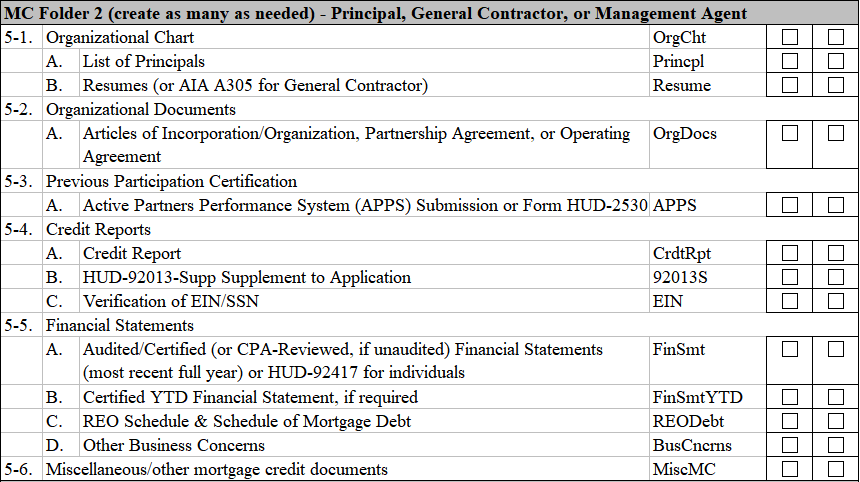

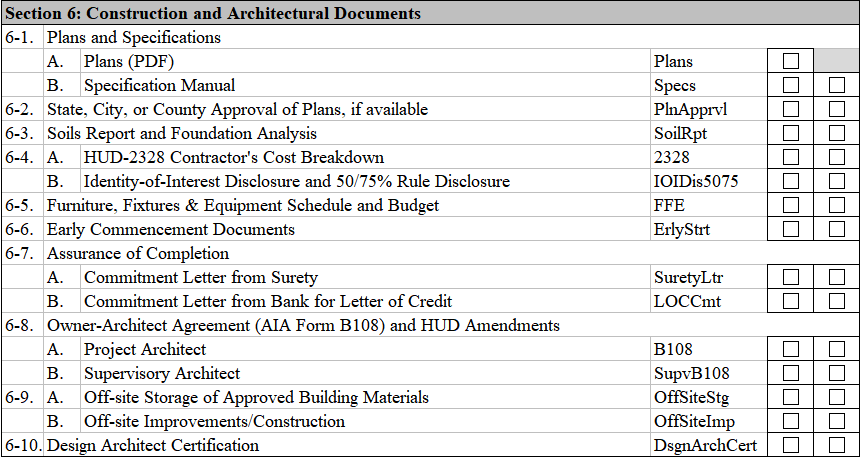

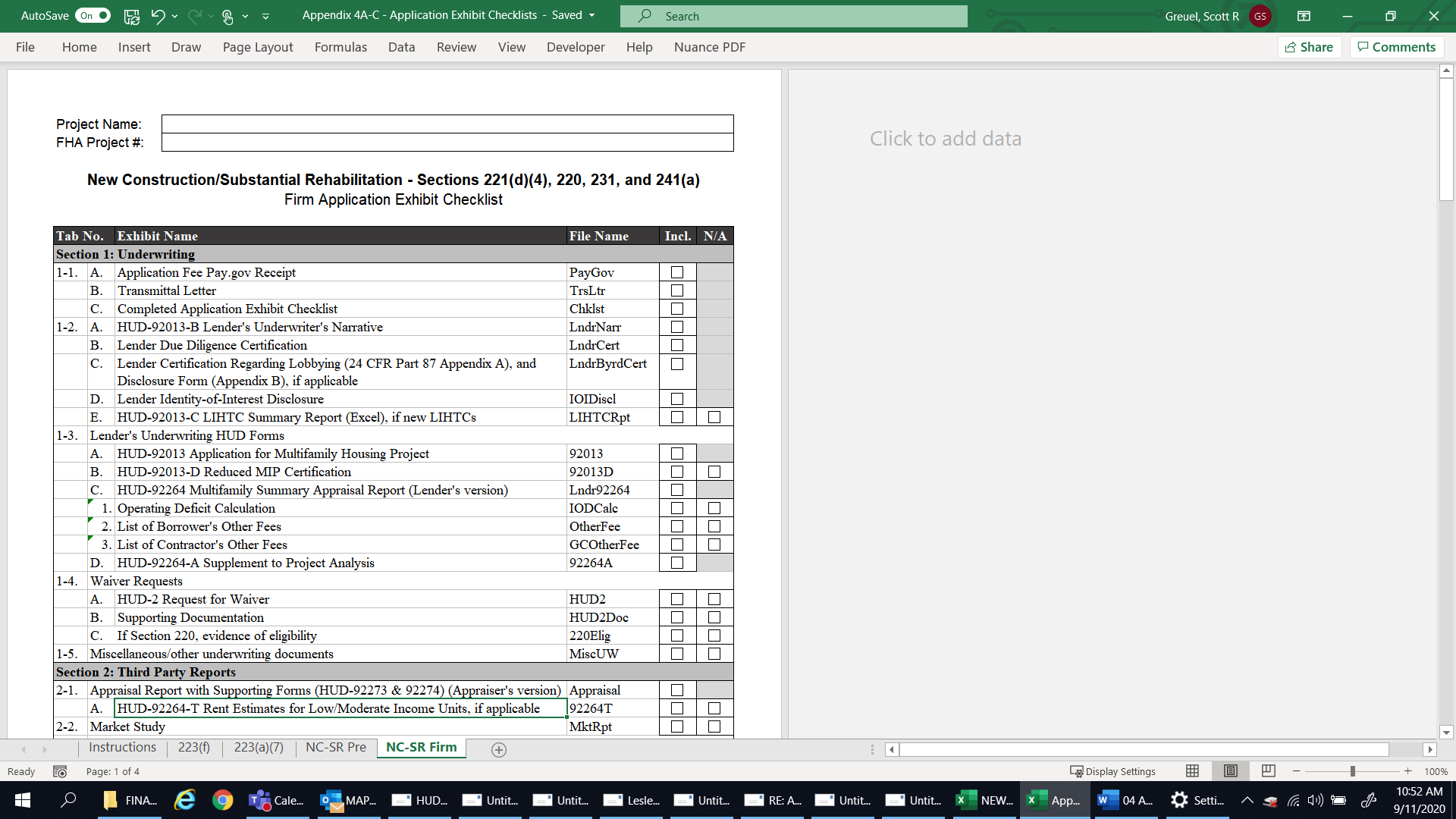

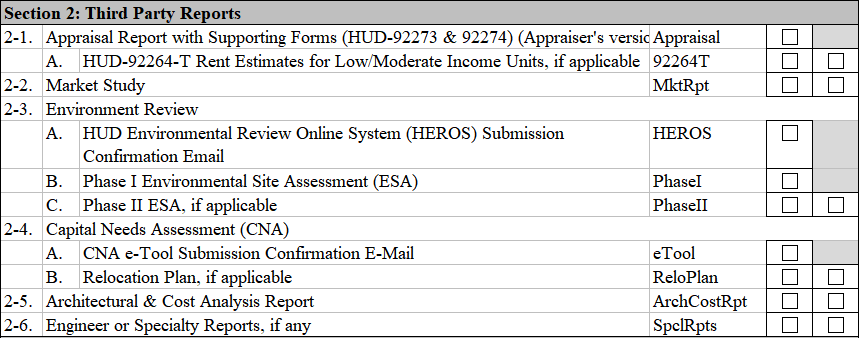

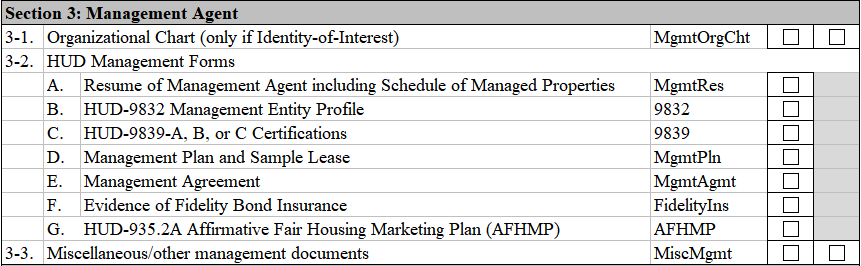

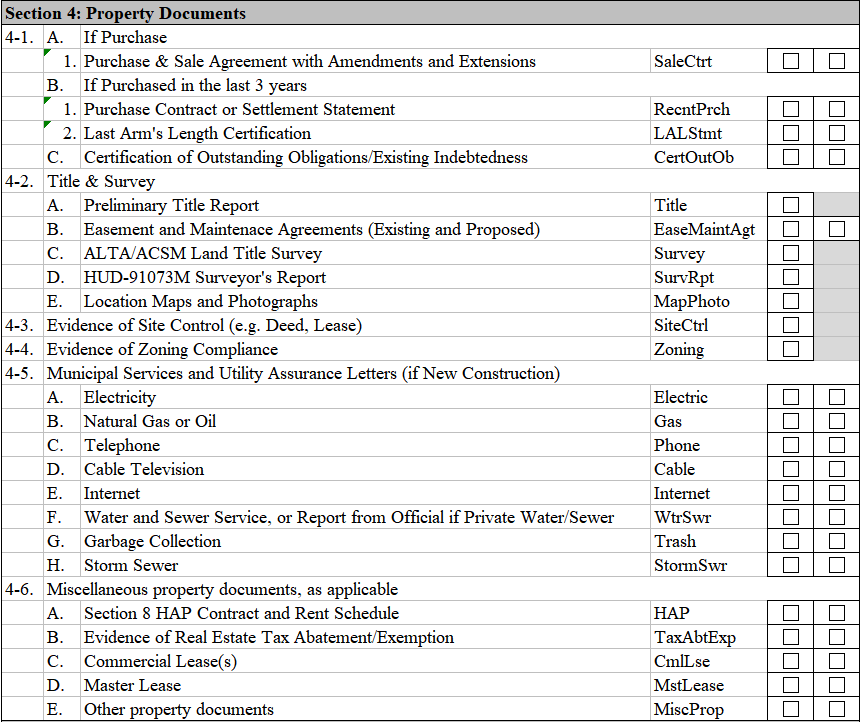

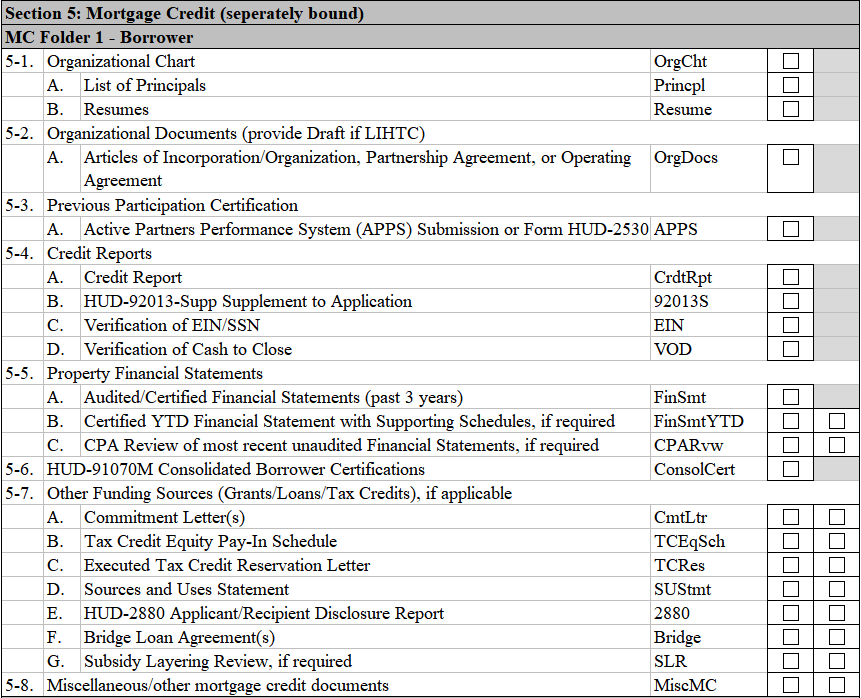

All MAP and TAP applications under Section 223(f), 223(a)(7), and the New Construction/Substantial Rehabilitation programs must use the applicable application exhibit checklist below.

Instructions for Using the Checklists

Please indicate whether each application exhibit is included in the application or not applicable by placing a checkmark in the appropriate column. If the N/A column is grayed-out, that exhibit is required for applications under that program and phase and must be submitted. For exhibits specified as N/A by the Lender, please also place a filler page labeled “N/A” in that tab in the original and hard copy of the application.

Tabs and File Names

The original and hard copy of the application should be tabbed according to the tab numbering protocol on the applicable checklist below. The electronic copy should also be organized with a folder structure matching the tab numbering system.

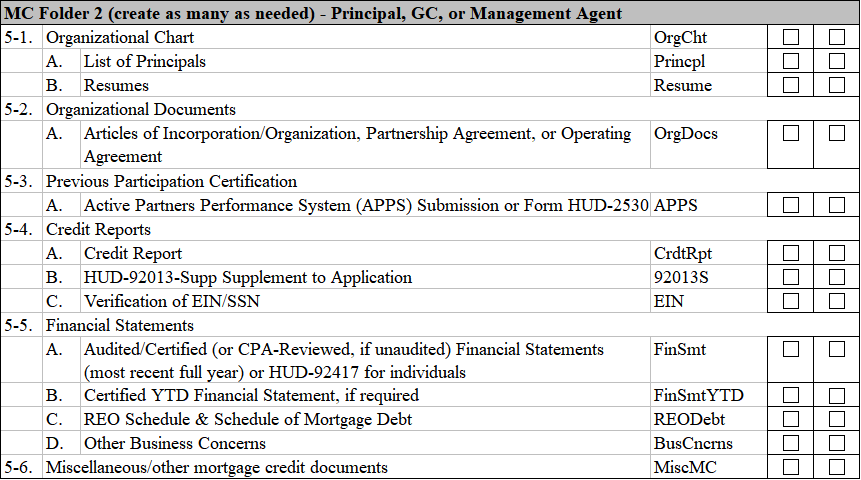

Create as many additional Section 5: Mortgage Credit folders as needed for Principals, the General Contractor, and/or Management Agent, and include the entity’s or individual’s name in the folder name.

Electronic files for each exhibit should be named according to the file naming convention specified in the checklist (see the “File Name” column). If additional files must be included, please follow the below guidelines for file names:

Use no more than 40 characters

Avoid using special characters (e.g., \ / : * ? " < > | # { } % ~ &)

Avoid using spaces; use an underscore (“_”) or hyphen (“-“) instead

Avoid adding the FHA # to the file name, as it only adds characters

For example: Instead of “Tab 1-2.A. HUD-92013-A Lender’s Underwriter’s Narrative 171-22000” (65 characters), use “1-2A_LndrNarr” (only 13 characters).

Below in each section are screenshot of the checklist. Microsoft Excel versions of the below application checklists can be downloaded at: https://www.hud.gov/program_offices/administration/hudclips/guidebooks/hsg-GB4430

Concept Meeting Checklists

Concept Meetings are discussed in Chapter 4. If a Concept Meeting is required or requested, use the below Concept Meeting Checklists and follow the HUD Office’s instructions for submitting the required Concept Meeting exhibits.

Section 223(f) Refinance/Acquisition Checklists

Concept Meetings

The following information/exhibits must be included in all Section 223(f) Concept Meeting packages:

Form HUD-92013 “Application for Multifamily Housing Project”, completed to the extent possible

Project name and address

Number of units (market-rate and affordable)

Section of the Act and activity (refinance or acquisition)

Projected mortgage amount

Mortgage term and estimated remaining economic life

Basic information on developer and principals

Management company

Previous HUD experience

Geographic location with map

Photographs of the subject and immediate surroundings

Actual and effective property age, class

Physical condition (CNA e-Tool not required at this point)

Prior/proposed renovations (per unit cost)

Discuss eligibility for Section 223(f) versus substantial rehabilitation

Amenities

Existing debt/cash out

Current occupancy (physical/economic)

Income and expenses

Green/sustainability issues

General market conditions, competitive properties and comparables

Environmental issues

Actual/potential risks and mitigating factors

Any anticipated waiver requests

Firm Applications

The following checklist should be used for all Section 223(f) Firm Applications:

Section 223(a)(7) Refinance Checklists

Concept Meetings

Concept Meetings are generally not necessary for 223(a)(7) applications. See Chapter 4 for more details, and contact the HUD Office with questions.

Firm Applications

The following checklist should be used for all Section 223(a)(7) Firm Applications:

![]()

New Construction and Substantial Rehabilitation Checklists – Sections 221(d)(4), 220, 231, and 241(a)

Concept Meetings

The following information/exhibits must be included in Concept Meeting packages for all New Construction or Substantial Rehabilitation proposals:

Form HUD-92013 “Application for Multifamily Housing Project”, completed to the extent possible

Project name and address

Number of units (market-rate and affordable)

Section of the Act and activity (new construction or substantial rehabilitation)

Projected mortgage amount

Mortgage term

Basic information on developer and principals

Management company

General contractor

Previous HUD experience

Geographic location with map

Photographs of the subject and immediate surroundings

Site improvements (existing/proposed)

Commercial component – discuss potential tenants

Amenities

Community/city/state support

Green/sustainability issues

Development status (e.g., have any permits/approvals been obtained?)

General market conditions, competitive properties, and comparables

Environmental issues

Actual/potential risks and mitigating factors

Any anticipated waiver requests

Pre-Applications

The following checklist should be used for all New Construction or Substantial Rehabilitation Pre-Applications:

Firm Applications

The following checklist should be used for all New Construction or Substantial Rehabilitation Firm Applications:

Sample MAP Invitation Letter

<Date>

Mr./Ms.<Name>

<Title>

<Address>

< >

< >

Dear Mr./Ms. <Name>.:

Subject: MAP Invitation Letter

Project No:<XXX-XXXXX>

Section <SOA>

<Project Name>

<City, State>

This is to inform you that our staff has reviewed the Pre-application materials for the subject proposal and finds it to be worthy of further consideration should you decide to submit a Firm Commitment application for mortgage insurance. There is a market for the proposal based upon our review of the appraisal and market study subject to updating all market assumptions before Firm Commitment. Subject to later confirmation or completion of the HUD environmental review, the site appears acceptable based on our preliminary inspection and the information provided.

In the event that you desire to continue with this project and submit an application for Firm Commitment, it is understood that the project will have the following characteristics:

-

Type of Unit

Sq. Ft.

Number

Monthly Market Rental

Efficiency

______

______

___________________

One Bedroom

______

______

___________________

Two Bedroom

______

______

___________________

Three Bedroom

______

______

___________________

Four Bedroom

______

______

___________________

Total

______

______

___________________

Equipment and Services included in the rent are:

Number of Parking Spaces: Enclosed ____________________ Open ________________

Estimated Monthly Parking Rental $ ___________________

Residential Accessory Income $ ____________________

Commercial Area ____________ sq. ft. Estimated Monthly Rental $ _______________

The operating expense estimate of $___________ per unit per annum is preliminarily acceptable subject to updated and relevant data before the Firm Commitment. The total for all improvements appears to be within a reasonable range. Attached is the current wage decision for this area. Please go to WDOL.gov for any updates while preparing your Firm Commitment application.

Land value/as-is value will be determined at the Firm Commitment stage. Excess costs resulting from any unusual site conditions identified in the construction cost estimate at the Firm Commitment stage will be deducted from the land value fully improved (with offsite improvements installed). The HUD environmental review and environmental assessment and HUD previous participation (Form HUD-2530) will not be completed until the Firm Commitment package is submitted to HUD.

It is important to understand that this letter is not to be construed as a commitment on the part of FHA to insure a mortgage for your proposal. It is intended only to establish general agreement on the basic concept, market, rents and expenses for your proposal. If the Firm Commitment application submitted is consistent with the Pre-application submission, does not trigger the thresholds for a more extensive review, and no problems arise because of environmental or previous participation issues, HUD should be able to complete its review within the scheduled time. If there are significant changes from the concept agreed to at the Pre-application submission, HUD will need more time to complete an extensive review and will not be bound by the scheduled review time and could result in rejection of the Firm Commitment application. Significant changes would include changes in location, building type, project market, rents, unit number, unit mix or gross project area that could cause a change in income, expense and demand assumptions and/or require a new market study and HUD review.

Therefore, you are invited to submit a Firm Commitment application for mortgage insurance on Form HUD-92013, Application for Multifamily Housing Project, along with the required MAP lender deliverables, by <insert date 120 days after the date of the letter>. Under MAP, HUD requires an application fee of $3 (30 basis points) per thousand of the mortgage amount; $2 per thousand for market-rate and affordable properties located in qualified opportunity zones; or $1.50 per thousand for broadly affordable properties located in qualified opportunity zones1. The balance due for the application fee must be paid at the Firm Commitment stage. Evidence of payment must be submitted with the Firm Commitment application.

The lender must advise HUD in writing within 30 days of the date of this letter of invitation whether or not it plans to submit an application for the particular project. If the lender fails to notify HUD within the time required, the invitation letter expires, and the lender will be required to repeat the Pre-application process.

The application for a Firm Commitment must be submitted within 120 days of the date of the letter of invitation. The Regional or Satellite Office may authorize extensions of up to 90 days past this 120-day limit, but there is no requirement that the extensions be approved. The HUD office will review the circumstances reported by the lender to justify an extension of time. The lender must certify and the Regional or Satellite Office must determine that the request to extend beyond 120-days is not likely to change the underwriting data on which the invitation was based or to undermine the feasibility of the project due to a change in the market or other factors determined at Pre-application. Where there is justifiable cause, a request for an extension of time beyond the 90-days may be allowed. These requests must be submitted by the Regional Director to the Director of the Office of Multifamily Development (Headquarters) or his/her designee. The authorization request must provide the additional time requested, the Regional or Satellite Office’s recommendation, and the reasons the extension is needed.

Sincerely,

<Space for ink signature>

< >

< >

<Underwriter Name>

<Job Title>

<Office>

Firm Commitment Templates

HUD staff will use the most current versions of the standard Firm Commitment templates published by HUD. Updated versions of the standard Firm Commitment templates for Sections 220, 221(4), 223(a)(7), 223(f), 231, and 241(a) can be found on HUDCLIPS in Housing Notice 2018-03. Further changes to these templates will be announced in future HUD Notices.

Section Reserved for Future Use

Requesting an FHA Project Number and Paying Fees on Pay.gov

Requesting an FHA Project Number

To request an FHA Project Number for a new application for FHA multifamily mortgage insurance, the Lender must email a completed FHA Project Number Request Form (see below) or the below information on company letterhead to the appropriate HUD Office.

It is expected that the full application will be submitted within 30 calendar days of the request for the FHA Project Number.

All requests must include the below information:

Application Purpose & Type

Section of the Act – specify the applicable SOA/program (e.g., 221(d)(4), 223(f), 223(a)(7), etc.)

Activity – specify the applicable activity (e.g., new construction, substantial rehabilitation, purchase, refinance, improvements, additions)

Timing of Insurance – specify Insurance of Advances or Insurance Upon Completion

Application Phase – specify Pre-Application or Firm Commitment Application

MAP or TAP – specify MAP or TAP

If 223(f), provide the date of the final Certificate of Occupancy from the project’s construction or most recent sub rehab

If 241(a), provide the Parent/Primary FHA Project Number of the underlying insured first mortgage loan

Is the property currently HUD insured, held, or owned? – Yes or No

If yes, provide the Superseded FHA Project Number(s) for the existing insured mortgage loan(s) being refinanced

Does the property have a current Section 8 HAP Contract or PRAC? – Yes or No

If yes, provide the Section 8 HAP Contract or PRAC Number

Mortgage Information

Borrower Type – specify the applicable borrower type (e.g., Profit-Motivated, Non-Profit, Cooperative, etc.)

Lender Name – provide the Lender’s name

Lender ID Number – provide the Lender’s 5-digit Lender ID Number

Mortgage Amount – provide the proposed mortgage amount (subject to change)

Permanent Interest Rate – provide the proposed interest rate (subject to change)

If 223(f), is Cash Out being requested? – Yes or No

If yes, provide the proposed Cash Out amount (subject to change)

Property Information

Project Name – provide the project name (this is the name that will be used for loan closing and servicing)

Primary Street Address – provide the primary street address of the project (if the proposed project does not yet have a street address, specify the nearest intersection or provide another location identifier)

City – provide the name of the city where the project is located

State – provide the name of the state or commonwealth where the project is located

ZIP Code – provide the ZIP Code where the project is located

County – provide the name of the county where the project is located

Is the project comprised of multiple/scattered sites? – Yes or No

If yes, provide the number of sites and an address for each site

Congressional District – identify the Congressional District where the project is located

Unit Breakdown

Revenue Units – provide the number of revenue units

Non-Revenue Units – provide the number of non-revenue units

Total Units – provide the total number of units

Facility Type – specify Apartments or Cooperative

Special Characteristics

Is the project receiving a Low-Income Housing Tax Credit (LIHTC) equity investment or does it currently have LIHTC use restrictions? – Yes or No

If yes, specify one:

4% LIHTC/Tax Exempt Bonds; or

9% LIHTC

If yes, also specify one:

New credits; or

Existing/prior credits but still under use restriction

If new credits, is the application being submitted under the LIHTC Pilot? (see Notice H 2019-03) – Yes or No

If yes, specify one:

Expedited Track; or

Standard Track

Is the project located in a qualified Opportunity Zone? (see Notice H 2019-10) – Yes or No

If yes, is the project receiving an equity investment from a Qualified Opportunity Fund? – Yes or No

MIP Category – specify the applicable MIP category (refer to the Federal Register) by selecting one:

Market

Market/Green

Affordable

Affordable/Green

Broadly Affordable

Broadly Affordable/Green

Upfront MIP % – specify the applicable Upfront MIP %

Annual MIP % – specify the applicable Annual MIP %

Is the project undergoing a simultaneous Rental Assistance Demonstration (RAD) conversion? (see Notice H 2019-09) – Yes or No

Is the project receiving HOME funds as a source of a financing? – Yes or No

Is the project receiving CDBG funds as a source of a financing? – Yes or No

A Microsoft Excel version of the FHA Project Number Request Form can be downloaded at: https://www.hud.gov/program_offices/administration/hudclips/guidebooks/hsg-GB4430

HUD is currently developing an online portal that will soon be used for FHA Project Number requests, as well as electronic submissions of applications and other documents to HUD. A Mortgagee Letter with details and revised instructions will be issued when the portal is ready for implementation. Until then, the instructions in Appendix 4 should be followed.

Paying Multifamily Fees on Pay.gov

Pay.gov must be used for the online payment of the following Multifamily Fees for all FHA multifamily mortgage insurance applications:

Application/Exam Fee

Reopening Fee, if required

Upfront MIP

Inspection Fee

Creating a User Account

Lenders are to establish their own internal procedures for paying Multifamily Fees through Pay.gov. These procedures will not be dictated by HUD; however, Lenders that are planning to access the Pay.gov public form on a recurring basis may find it useful to create a Pay.gov user account through the self-enrollment process. To create an account, click the “Create an Account” button in the upper right corner at the following website and follow the instructions: https://www.pay.gov/public/home

Completing the Payment Form

To pay a Multifamily Fee, visit the following website and complete the HUD Office of Multifamily Production Programs Fees form: https://www.pay.gov/public/form/start/67950760.

The following fields must be carefully completed on the form:

Transaction Type – select “Lender”

Transaction Date – this will be populated automatically

FHA Lender Name – enter the Lender’s name (up to 200 characters)

FHA Lender Number – enter the Lender’s 5-digit Lender ID Number

FHA Project Number – enter the 8-digit FHA Project Number

Project Name – enter the project name (up to 200 characters)

Project City – enter the name of the city where the project is located

Project State – enter the name of the state or commonwealth where the project is located

Program Type – select the appropriate SOA/program type from the pull-down menu

Project Type – select the appropriate activity/project type from the pull-down menu (Note: this selection can only be made after the Program Type has been selected)

Does the project have new or existing Low-Income Housing Tax Credits (LIHTC)? – select one:

Yes – 4% LIHTC / Tax Exempt Bonds

Yes – 9% LIHTC

No

Is the project located in an Opportunity Zone? – select one:

Section of the Act – this 3-digit SOA code will be populated automatically after the Program Type and Project Type have been selected

Fee Type – select the appropriate fee type from the pull-down menu:

Application/Exam Fee (fee type 7)

Reopening Fee (fee type 6)

Upfront Mortgage Insurance Premium (MIP) (fee type 2)

Inspection Fee (fee type 6)

Fee Amount – enter the correct fee or Upfront MIP amount

Fund – this will populate automatically after the Program Type, Project Type, and Fee Type have been selected

After the information has been submitted and accepted, Pay.gov will provide the submitter a receipt of the transaction which includes the information entered into the form and a Pay.gov Tracking ID. The receipt confirms that a payment was processed through Pay.gov but does not confirm that the funds have cleared. ACH transactions generally require one banking business day to settle. In instances of insufficient funds, a supplemental payment will be required. A copy of the receipt must be included in the application or closing package submitted to the HUD Office. If it is later discovered that any of the information that was entered into Pay.gov is incorrect, the lender should notify the HUD Office so that it can be corrected.

1 Housing Notice 2019-07 Incentives for FHA Mortgage Insurance for Properties Located in Opportunity Zones, allows reduced application fees for properties located in qualified opportunity zones. Broadly affordable and affordable in this context are defined in HUD’s Federal Register notice dated March 31, 2016 (81 FR 18473).

Appendix

4 Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Greuel, Scott R |

| File Modified | 0000-00-00 |

| File Created | 2021-01-13 |

© 2026 OMB.report | Privacy Policy