SAR Supporting Statement 7.28.2020. Final Version

SAR Supporting Statement 7.28.2020. Final Version.docx

Suspicious Activity Report by Insurance Companies

OMB: 1506-0029

Supporting Statement

Office

of Management and Budget (OMB) Control Numbers 1506-0001,

1506-0006, 1506-0015, 1506-0019, 1506-0029, 1506-0061, and

1506-0065

Reports by Financial Institutions of Suspicious Transactions

and FinCEN Report 111 - Suspicious Activity Report (SAR)

1. Circumstances Necessitating Collection of Information.

The Financial Crimes Enforcement Network (“FinCEN”) exercises regulatory functions primarily under the Currency and Financial Transactions Reporting Act of 1970, as amended by the USA PATRIOT Act of 2001 and other legislation. This legislative framework is commonly referred to as the “Bank Secrecy Act” (“BSA”).1 The Secretary of the Treasury has delegated to the Director of FinCEN the authority to implement, administer, and enforce compliance with the BSA and associated regulations.2 Pursuant to this authority, FinCEN may issue regulations requiring financial institutions to keep records and file reports that “have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, including analysis, to protect against international terrorism.”3 Under 31 U.S.C. 5318(g), the Secretary of the Treasury is authorized to require financial institutions to report any suspicious transaction relevant to a possible violation of law or regulation. Regulations implementing 31 U.S.C. 5318(g) are found at 31 CFR 1020.320, 1021.320, 1022.320, 1023.320, 1024.320, 1025.320, 1026.320, 1029.320, and 1030.320.

The regulations and related reports correspond to the following OMB control numbers: 1506-0001, 1506-0006, 1506-0015, 1506-0019, 1506-0029, 1506-0061, and 1506-0065.4 This supporting statement is being issued in connection with the renewal of all seven of these OMB control numbers. An administrative burden of one hour is assigned to each of the SAR regulation OMB control numbers in order to maintain the requirements in force.5 The reporting and recordkeeping burdens are reflected in FinCEN Report 111 – Suspicious Activity Report (“SAR”) under OMB control number 1506-0065. The rationale for assigning one burden hour to each of the SAR regulation OMB control numbers is that the annual burden hours would be double counted if FinCEN estimated burden in the industry SAR regulation OMB control numbers and in the SAR OMB control number.

2. Method of Collection and Use of Data.

Financial institutions generally are required to report any suspicious transaction relevant to a possible violation of law or regulation. These transactions are reported on SARs. Financial institutions submit SARs to FinCEN electronically via the BSA E-filing system.

FinCEN’s Privacy Act system of record for SARs is the Suspicious Activity Report System (the “SAR System”) - Treasury/FinCEN.002.6 The SAR System is maintained for the purpose of permitting coordinated and enhanced analysis and tracking, and rapid dissemination of SAR information. The information is distributed to Federal, state, and local agencies that engage in criminal, regulatory and tax investigations and proceedings, agencies that engage in intelligence and counterintelligence activities, including analysis, to protect against international terrorism, certain self-regulatory organizations, appropriate foreign agencies, and foreign financial intelligence units.

3. Use of Improved Information Technology to Reduce Burden.

The BSA E-filing system supports electronic filing of BSA reports, including SARs (either individually or in batches)7 through a FinCEN secure network. BSA E-filing provides a faster, and more convenient, secure and cost-effective method for submitting BSA reports. Discrete and batch versions are available on the FinCEN BSA E-file website at http://bsaefiling.fincen.treas.gov/main.html. FinCEN also upgraded to the industry standard of XML file format for both discrete and batch filers of SARs.

4. Efforts to Identify Duplication.

There is no similar information available; thus, there is no duplication.

5. Methods to Minimize Burden on Small Businesses or Other Small Entities.

The SAR is designed so only the fields normally associated with the filing financial institution are displayed. This design minimizes the time required for a financial institution to complete the report and thus decreases the impact on small financial institutions. However, SARs provide valuable information to Federal, state and local agencies that engage in criminal, regulatory and tax investigations and proceedings, agencies that engage in intelligence and counterintelligence activities, certain self-regulatory organizations, appropriate foreign agencies, and foreign financial intelligence units in their efforts to combat money laundering and other financial crimes. Without these collections from entities of all sizes, the government’s efforts to counter financial crimes would be negatively impacted.

6. Consequences to the Federal Government of Not Collecting the Information.

SARs provide valuable information to Federal, state and local agencies that engage in criminal, regulatory and tax investigations and proceedings, agencies that engage in intelligence and counterintelligence activities, certain self-regulatory organizations, appropriate foreign agencies, and foreign financial intelligence units in their efforts to combat money laundering and other financial crimes. Without these collections from entities of all sizes, the government’s efforts to counter financial crimes, such as money laundering and the financing of terrorism, would be negatively impacted.

7. Special Circumstances Requiring Data Collection Inconsistent with Guidelines in 5 CFR 1320.5(d)(2).

Reporting suspicious activity on a SAR may occur more frequently than quarterly, depending on the frequency of the suspicious activity. This information must be reported in a timely manner to enable law enforcement to take appropriate investigative action. Under 31 CFR 1010.430(d), all records that are required to be retained by 31 CFR Chapter X must be retained for a period of five years. Records must be kept for five years because the substantive violations of law that are reported on the FinCEN SAR are generally subject to statutes of limitation longer than three years.

8. Consultation with Individuals Outside of the Agency on Availability of Data, Frequency of Collection, Clarity of Instructions and Forms, and Data Elements.

The 60-day notice was published on May 26, 2020.8 The notice requested public comments on the proposed renewal, without change, of currently approved information collections relating to the SAR regulations and report. Although no changes were proposed to the information collections themselves, the notice requested public comments on a proposed updated burden estimate for the information collections. Specifically, the notice proposed for review and comment (a) a re-calculation of the portion of the Paperwork Reduction Act of 1995 (“PRA”) burden that has been subject to notice and comment in the past (the “traditional annual PRA burden”), and (b) a method to estimate the portion of the PRA burden that FinCEN previously had not included (the “supplemental annual PRA burden”).

As explained in the notice, FinCEN intends to conduct more granular studies of the filing population in the future, to arrive at more realistic estimates that take into consideration a more specific breakdown of the SAR production process. The data obtained in these studies may result in a significant variation of the estimated total annual PRA burden

FinCEN received 22 public comments in response to this notice. Commenters were generally supportive of FinCEN’s effort to more accurately estimate the costs and burdens associated with the SAR filing process.

Some commenters had specific recommendations regarding the traditional and supplemental annual PRA burden estimates described in the notice. FinCEN appreciates the specific recommendations we received and we intend to use that information to calculate future PRA burden and cost estimates as part of a larger project FinCEN is undertaking to better understand the PRA hourly burden and cost of the BSA as a whole. Some of the specific recommendations from commenters are as follows:

Time estimates should be significantly increased to reflect the actual amount of time needed to process a SAR.

The requirement to maintain SAR metrics and the costs associated with governance of the entire SAR process should be considered in the proposal.

Much of the SAR process is still manual and increases the labor costs associated with SAR filing, and should be incorporated into the burden. FinCEN may be placing too much emphasis on automation.

FinCEN should survey the industry to develop a representative sample of all types and sizes of financial institutions from all geographies to develop a representative percentage of the number of alerts that become cases and, in turn, SARs.

The proposal does not allocate any time or costs to filing amendments to SARs or for the quality assurance work that is done as part of the SAR process.

Different types of financial institutions have more senior staff members working on SARs as the products and services are more complicated. Higher wages should be incorporated into the proposal than are currently listed.

9. Payments or Gifts.

There were no payments or gifts made to respondents.

10. Assurance of Confidentiality of Responses.

Information provided to the government on a SAR is expressly prohibited from disclosure under 31 U.S.C. 5318(g)(2), except as necessary to fulfill official duties. The information collected under this requirement is made available to appropriate agencies and organizations as disclosed in FinCEN's Privacy Act System of Records Notice relating to SAR reports.9

11. Justification of Sensitive Questions.

There are no questions of a sensitive nature in the collection of information. Any personally identifiable information collected under the BSA is strictly controlled as outlined in FinCEN’s Privacy Act Systems of Records Notice relating to SAR reports.10

12. Estimated Annual Hourly Burden.

Frequency: As required.

Estimated Burden of OMB Control Numbers 1506-0001, 1506-0006, 1506-0015, 1506-0019, 1506-0029, and 1506-0061:

An administrative burden of one hour is assigned to each of the SAR regulation OMB control numbers in order to maintain the requirements in force.11 The reporting and recordkeeping burden is reflected in FinCEN Report 111 – SAR, under OMB control number 1506-0065. The rationale for assigning one burden hour to each of the SAR regulation OMB control numbers is that the annual burden hours would be double counted if FinCEN estimated burden in the industry SAR regulation OMB control numbers and in the FinCEN Report 111 – SAR OMB control number.

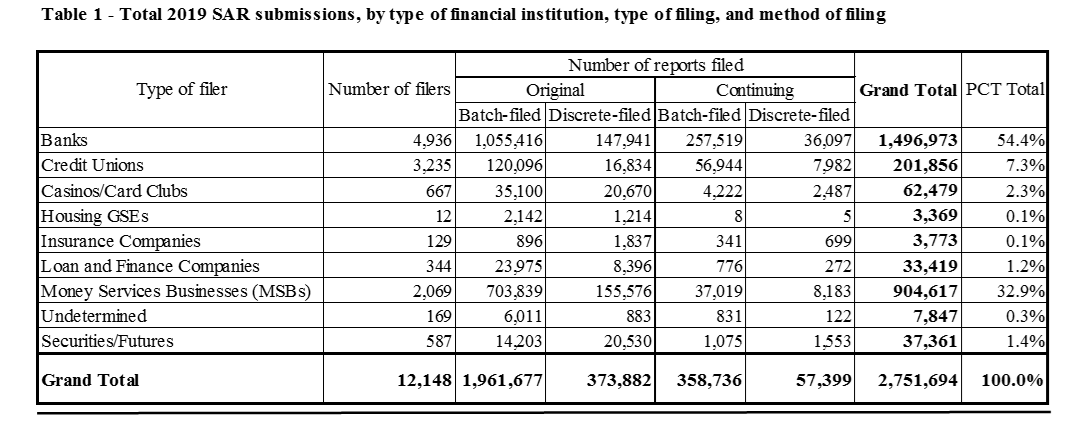

Estimated Number of Respondents: 12,148 financial institutions. (See Table 1 below). The tables used in this supporting statement are the tables summarizing the total burden and cost estimates from the 60-day notice to renew these OMB control numbers. For that reason, the table numbers correspond to the table numbers in the notice. Refer to the notice for additional tables that support the summary calculations in these tables.12

Estimated Total Annual Responses: 2,751,694 SARs.13 (See Table 1 below.)

Estimated Reporting and Recordkeeping Burden Per Process or Report: The estimated reporting and recordkeeping burden by type of process and report is described in Table 21 below:14

Table 21 – PRA burden per report and by type of process

Estimated Total Annual Reporting and Recordkeeping Burden: 5,462,026 hours (See Table 22 and Table 23 below.) 15

13. Estimated Annual Cost to Respondents for Hourly Burdens.

Estimated Total Annual Reporting and Recordkeeping Cost: $206,422,989 (See Table 24.)16

14. Estimated Annual Cost to the Federal Government.

2,751,69417 x $0.1018 per filing = $275,169.40.

15. Reasons for Change in Burden.

In prior renewals, FinCEN limited its annual SAR burden estimate to the SAR filing process. In this renewal, FinCEN expanded the burden estimate to include the burden to (i) evaluate cases for potential SAR filing, and (ii) create and maintain records of cases that are not converted into SARs. More specifically, the burden estimate in this renewal includes the burden involved in evaluating cases to determine whether or not the event constitutes a suspicious activity that must be reported, and documenting the decision that led the financial institution to conclude that an event did not warrant filing a SAR. The burden estimate also includes the burden involved in the following aspects of the SAR filing process: (a) selecting supporting documentation; (b) completing the report, including drafting the narrative; (c) filing the report through batch or discrete filing; and (d) storing the filed report and supporting documentation in physical or electronic form.19

16. Plans for Tabulation, Statistical Analysis and Publication.

The information will not be tabulated or compiled for publication.

17. Request not to Display Expiration Date of OMB Control Number.

FinCEN requests that the expiration date of the control number of the FinCEN Report 111-SAR not be displayed on the report so that there is no confusion as to whether the report is still valid. This request will not affect the normal 3-year PRA renewal process.

18. Exceptions to the Certification Statement.

There are no exceptions to the certification statement.

1 The BSA is codified at 12 U.S.C. 1829b, 12 U.S.C. 1951–1959, 31 U.S.C. 5311–5314 and 5316–5332 and notes thereto, with implementing regulations at 31 CFR Chapter X. See 31 CFR 1010.100(e).

2 Treasury Order 180-01 (Jan. 14, 2020).

3 31 U.S.C. 5311.

4 The SAR regulatory reporting requirements are currently covered under the following OMB control numbers: 1506-0001 (31 CFR 1020.320 – Reports by banks of suspicious transactions); 1506-0006 (31 CFR 1021.320 – Reports by casinos of suspicious transactions); 1506-0015 (31 CFR 1022.320 – Reports by money services businesses of suspicious transactions); 1506-0019 (31 CFR 1023.320 – Reports by brokers or dealers in securities of suspicious transactions, 31 CFR 1024.320 – Reports by mutual funds of suspicious transactions, and 31 CFR 1026.320 – Reports by futures commission merchants and introducing brokers in commodities of suspicious transactions); 1506-0029 (31 CFR 1025.320 – Reports by insurance companies of suspicious transactions); and 1506-0061 (31 CFR 1029.320 – Reports by loan or finance companies of suspicious transactions). OMB control number 1506-0065 applies to FinCEN Report 111 – SAR.

5 One hour of burden is estimated under each of the following OMB control numbers: 1506-0001, 1506-0006, 1506-0015, 1506-0019, 1506-0029, and 1506-0061.

6 79 FR 20969, 20972 (April 14, 2014). This document is available at https://www.federalregister.gov/documents/2014/04/14/2014-08254/privacy-act-of-1974-as-amended-system-of-records-notice.

7 In batch-filing, a filer submits a single electronic file containing several reports. In discrete-filing, the filer fills in an electronic form individually, using a data entry screen that FinCEN provides.

8 See 85 FR 31598 at https://www.govinfo.gov/content/pkg/FR-2020-05-26/pdf/2020-11247.pdf.

9 See supra note 6.

10 Id.

11 One hour of burden is estimated under each of the following OMB control numbers: 1506-0001, 1506-0006, 1506-0015, 1506-0019, 1506-0029, and 1506-0061.

12 85 FR 31598, 31600( May 26, 2020)(Table 1).This document is available at https://www.govinfo.gov/content/pkg/FR-2020-05-26/pdf/2020-11247.pdf.

13 Numbers are based on actual 2019 filings as reported to the BSA E-Filing System, as of 12/31/2019.

14 85 FR 31598, 31611 (May 26, 2020)(Table 21).

15 Id. at 31611- 612..

16 Id. at 31612.

17 See supra note 12 and accompanying text.

18 Cost per response received as listed in the BSA E-filing Federal contract for 2020.

19 For a more detailed explanation of the methodology to estimate the burden associated with this renewal of the SAR regulations and report see 85 FR 31598.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | #1506-0065 supporting statement |

| Author | Financial Crimes Enforcement Network (FinCEN) |

| File Modified | 0000-00-00 |

| File Created | 2021-01-13 |

© 2026 OMB.report | Privacy Policy