0003-agprice-20-SSB - Aug 2020

0003-agprice-20-SSB - Aug 2020.docx

Agricultural Prices

OMB: 0535-0003

1Supporting Statement – Part B

AGRICULTURAL PRICES

B. COLLECTION OF INFORMATION EMPLOYING STATISTICAL METHODS

1. Describe (including a numerical estimate) the potential respondent universe and any sampling or other respondent selection method to be used. Data on the number of entities (e.g., establishments, State and local government units, households, or persons) in the universe covered by the collection and in the corresponding sample are to be provided in tabular form for the universe as a whole and for each of the strata in the proposed sample. Indicate expected response rates for the collection as a whole. If the collection has been conducted previously, include the actual response rate achieved during the last collection.

Universe lists for the prices received surveys include all known establishments that purchase agricultural commodities directly from producers. Sample sizes for the prices received surveys are selected to meet target coefficients of variation (generally between 0.5 percent and 2.5 percent, dependent on the commodity). The collection of price data from known buyers, instead of producers, greatly reduces respondent burden and provides price data for many purchase transactions from a single reporting unit. The farm-to-farm sales marketing channel is not currently surveyed except for collecting hay prices. Farm-to-farm sales make up a small proportion of total sales for other commodities and that portion of total sales is valued based on the market channels that are surveyed.

Samples for the NASS prices paid surveys consist of firms selected from a target population of establishments that sell selected production input items directly to farmers and ranchers. Regional Field Offices (RFOs) add retail outlets or establishments to replace known retailers that no longer sell to farmers and ranchers to maintain a viable universe of known retailers. Establishments are obtained from internet sites, telephone directories, business directories, regulatory lists, and through industry wholesalers, and trade associations. Currently there are no sampling target coefficients of variation. Sample weights are not available and are not generated from the sampling process. Questionnaires and summary processes are being redesigned to address these issues. State-level estimates from the prices paid surveys are averages of the data reported from usable reports. State estimates are primarily weighted based on data from the annual Agricultural Resource and Management Survey (ARMS 0535-0218) and available industry data. Prices paid samples are rotated annually, replacing approximately 20 percent with a new replicate of 20 percent from the target population. This rotation is performed to reduce respondent fatigue while controlling overlap.

For the Annual Prices Paid Survey:

Based on Chapter 3 of the NASS Price Methodology Report at:

The target population for each survey group includes all retail outlets or establishments where producers purchase input items, for their operations. A retail outlet or establishment can be identified for selling items across any of the five survey categories. Therefore, it is possible for a retail outlet or establishment to be identified in all five target populations. If a business operates at multiple locations, or if it is part of a franchise (chain), each individual location is treated as a separate operation eligible for sampling. The list sampling frame (LSF) operations have procedures for handling agribusinesses with multiple locations. The list of agribusinesses is comprised of current establishments used by producers to purchase the targeted survey items. The LSF is reviewed annually in advance to ensure that the list of businesses targeted for the prices paid surveys is complete, accurate, and up-to date.

The Regional Field Offices (RFOs) along with the NASS Frames Maintenance Group in St. Louis, MO, maintains each universe to cover the minimum number of operations required to meet the target sample. Samples are refreshed by 20 percent each year, meaning 20 percent of the sample is replaced. This reduces respondent burden while maintaining sufficient overlap.

Listings of these operations to build and maintain the list frame are obtained from; internet sites, telephone directories, business directories, regulatory lists, industry wholesalers, and Trade associations. The National Association of State Departments of Agriculture (NASDA) enumerators, county extension personnel, and other individuals associated with the farming industry also provide sources of information about retailers and other agribusinesses.

Samples are drawn for the five prices paid surveys. The sample design for the Prices Paid program follows a quota-sampling scheme. A quota sample is used because NASS does not maintain populations of agribusinesses that sell these commodities. There is an effort to target samples at the state level for each survey group. The sample becomes a non-probability stratified sample with the strata defined as States within a survey group. Each RFO is given a sample size requirement for each of the five surveys. RFOs add retail outlets or establishments to replace the dropped sample units based on the case disposition codes. If the target sample size is greater than the carryover from the previous year, the RFOs search for other establishments to replace the sample units removed from sample.

Prices received and prices paid universes are updated annually. An important part of this process is updating the prices received control data on the NASS List Frame with the latest storage capacity, commodities purchased, control data identifier, and other appropriate criteria needed for list stratification.

The overall response rates for prices surveys are shown below. NASS will continue to look into standardization and centralization of data collection for more of these surveys. Ideally, this will continue to improve response rates while lowering costs and respondent burden.

A sample for hay prices is difficult to establish, as growers may not have sales every year. Farmers and ranchers may not sell hay every year so oversampling hay growers is needed to provide a sufficient number of respondents with positive price data. RFOs utilize reliable State administrative and auction data for establishing reliable state estimates. NASS is continually working on a better method to establish hay prices.

For the Prices Received Commodities:

Sampling of producers and buyers varies considerably depending on the structure of the marketing channels. Samples are drawn to reduce respondent burden and to centralize data collection as much as possible. More specifics can be found in Chapter 2 of the NASS Prices Methodology at:

The universe for agricultural commodity prices is all sales from producers to first buyers. Prices for points of first sale can be obtained from either producers or first buyers. Individual producers generally market commodities relatively few times during the year. A single buyer is a more active participant on a continuing basis and can report on many transactions. Buyers, then, are the preferred data collection contacts. Price reporters include independent local buyers like grain elevators and produce dealers, cooperative marketing organizations, Federal milk market administrators, State fruit boards, other marketing agencies, processors, canneries, slaughtering plants, other Government agencies, and producers or growers. Data furnished by the different types of reporters vary in usefulness, depending on accessibility, timeliness, and completeness. The cost of developing a complete sampling frame of all buyers of farm products far exceeds any available resources. Market channel surveys provide information on major sales localities of major agricultural products. Sample surveys are then concentrated in the market channels accounting for the bulk of commercial sales.

The sampling frames for agricultural commodities are segmented into several commodity areas. Grain price information is obtained from grain elevators and buyers. Hay price indications are gathered from surveys of growers, dealers, hay auctions, and other buyers or other lists such as dairies or cattle feeders. Cotton price information is obtained from contacts to cotton buyers, including cooperatives and private merchants. Peanut price data is gathered from all known peanut buyers. Firms are stratified or grouped according to size or volume of products purchased.

This universe and sample process allows NASS to cover a high proportion of products sold at minimum cost. Livestock prices are collected by the Agricultural Marketing Service (AMS). Probability sample surveys used to collect price data for most major crops increase accuracy, give greater quality control, provide a method for estimating sampling error and use smaller but more representative samples. Price surveys for prices received for corn, wheat, soybeans, cotton, and rice are designed to provide a coefficient of variation (CV) of less than one percent at the U.S. level and less than five percent at the State level. State level CVs for major producing States run as low as two to three percent. Non-sampling errors in conducting the surveys may be larger than the sampling errors. Current methods of summarization for nonprobability commodities are not designed to calculate sampling errors. Any non-sampling errors are attributed to obtaining correct data, differences in interpreting questions and definitions, and mistakes in coding or processing the data. Efforts are made at each step in the survey process to minimize non-sampling errors.

Primary sales data used to determine grain prices are obtained from probability samples of some 2,200 mills and elevators to target the population form all 50 States. The probability survey procedures ensure that virtually all grain moving into commercial channels has a chance of selection in the survey. Livestock prices are obtained from USDA‟s Agricultural Marketing Service (AMS). Sales between farms are not included since they represent very small percentages of the total marketing. Fruit (0535-0039) and vegetable (0534-0037) prices are obtained from sample surveys and market data from private marketing organizations, State agencies, universities, and from USDA‟s AMS. The universe for agricultural commodity prices is all sales from producers to first buyers. The universe for Prices Received by producers for commodities sold, therefore, is comprised from various sources. Sample units for frame construction are classified in the following categories: merchants, farm produce dealers at local shipping points, mills, and elevators, Federal Milk Order Administrators, State milk control agencies, milk distribution and manufacturing plants, cooperative marketing organizations, bankers, and farm and ranch operators. The frame development for the following Prices Received commodity groups vary dependent on business type and commodity.

A commodity type is one of the following five groups. Livestock and Livestock Products Poultry and Specialty Commodities, Field Crops, Fruit and Nuts and Commercial Vegetables. When building the frame for all five commodity types, responsibility for universe building is shared between the NASS List Frame Maintenance Group, commodity analysts, and survey statisticians.

Livestock and Livestock Products Poultry and Specialty Commodities

The target population for livestock products such as milk are any entity that is involved with the purchase of livestock products from producers.

Livestock prices are obtained from AMS; so, a frame for livestock is not needed for the frame development and maintenance of livestock products which includes: Producers in the Quarterly Milk Production Survey, buyers, cooperatives, wool pools, and Farm Service Agency (FSA) records, data from AMS, State Departments of Agriculture, and State universities Poultry and Specialty Commodities.

NASS collects no price data from producers for the highly integrated poultry industry. A list frame of handlers, slaughtering plants, and packing plants is maintained for surveying when Agricultural Marketing Service / Market News Service (AMS/MNS) price data for chickens and live turkeys are not available. State departments of agriculture, national poultry associations, State poultry improvement associations, extension poultry agents at State universities and county agents provide names of egg handlers.

A sampling frame of bee and honey producers is developed and maintained.

Field Crops

The target population for field crops includes establishments, which sell or purchase field crops directly from producers. Historically, thirty-seven monthly program States were sampled on a probability basis. In 2017, NASS expanded the program to cover all 50 States. NASS constructs field, oilseed, specialty and other crop Prices Received lists using the following procedures:

Develop and maintain a list of elevators, dealers, and specialty buyers that purchase grain, oilseeds, rice, peanuts, dry beans, pulse crops or cotton for monthly and probability surveys that purchase directly from farmers. Information captured also includes capacity size and multi-unit status for each operation. Lists are kept current and complete through processing of monthly updates.

Develop and maintain a list of growers, buyers, ginners, and other agricultural entities for crops surveyed on a nonprobability, non-monthly basis. Updates are processed on a regular basis to keep lists current and complete with priority given to the largest growers and buyers.

Develop and maintain universe lists to conduct supplementary surveys when additional price data are needed to strengthen price indications. Sources of operations, buyers, and other entities for the Prices Received probability and non-probability populations include: - Farm Service Agency, - Agricultural Marketing Service / Market News Service.

State Departments of Agriculture, - Various organizations such as licensing bureaus, grain associations, commodity associations, cooperatives, extension crop specialists at universities, dealers, auction facilities, factories, mills, buyers, feeders, brewers, ginners, processors, distributors and other related organizations.

Fruit and Nuts

The target population for fruits and nuts consists of entities involved with the sale or purchase of fruits and nuts at the first point of sale. NASS constructs fruit and nut Prices Received lists using the following procedures:

Obtain grower contacts from the following sources: Farm Service Agency (FSA), Agricultural Marketing Service (AMS), and various organizations like grower associations, marketing associations, cooperatives, dealers, packers, shippers, processors, wineries, exchanges, marketing boards, administrative committees, county extension agents and other related persons or groups.

Maintain current grower lists and other non-grower lists related to the fruit and nut industries for commodities included in the NASS estimation program.

Obtain price data from direct purchases from producers by non-grower entities.

Maintain complete coverage of the largest growers and buyers as no area frame is utilized to supplement the list frame populations.

Maintain a list of packers, processors, cooperatives, and other related entities purchasing directly from producers. Sources include AMS, State Departments of Agriculture, Extension fruit specialists at universities, Trade magazines, and States with access to administrative data sources.

Utilize these sources and do not necessarily maintain a list of other contacts.

Maintain a list frame to conduct supplementary surveys when additional price data are needed to strengthen price indications.

Commercial Vegetables

The target population for vegetables consists of any entity involved with the sale or purchase of vegetables at point of first sale (POFS). POFS prices reflect the point in the marketing chain where the grower no longer owns the commodity. NASS constructs commercial vegetable contact lists using the following procedures:

Maintain a list of contacts with knowledge of fresh market prices, to supplement administrative data or when these data are not available.

The list includes growers, roadside and farmer markets, U-pick sales, grower auctions, dealers, packers, commodity marketing associations, producer co-ops or market orders.

Other sources include terminal markets and packinghouses.

Maintain current and complete list frame, to help manage the variability within different vegetable industries and localities. Priority given to maintaining complete coverage of the largest growers and buyers.

Maintain an up-to-date list of processors to represent plant door pricing.

Processor sources include canners‟ and freezers' associations, trade journals, State licensing boards, and health inspection records. Federal/State Market News Service provide sufficient coverage for major producing areas during the primary marketing season.

Maintain a list frame to conduct a survey when no administrative data and/or when administrative data needs strengthening.

2. Describe the procedures for the collection of information.

• statistical methodology for stratification and sample selection,

• estimation procedure,

• degree of accuracy needed for the purpose described in the justification,

• unusual problems requiring specialized sampling procedures

The first time a respondent is included in a sample for prices received including cotton, grains, pulse crops, oil seeds, peanuts, or rice, the respondent is contacted in person to introduce the NASS price program and complete an operation profile (see information collection list for this and other forms mentioned below). The profile interview verifies that each firm is purchasing the commodities of interest and data can be reported according to technical specifications such as standard moisture content, only purchases made directly from farmers, and exclusion of storage costs. Follow-up visits are made when necessary to answer any questions a respondent may have. After the initial interview, questionnaires are generally mailed to the respondent or data collected by telephone or Electronic Data Reporting (EDR) via the internet. Most RFOs use telephone follow-up to improve mail non-response. RFOs are also encouraged to mail an informational letter at the beginning of each cycle. For surveys available on the Web, reporting instructions accompany the questionnaire and are included in the minutes-per-response allowance.

As part of the prices received surveys, information is collected on the quantity purchased and associated dollars paid to the farmer for the entire previous month. The quantity purchased during the previous full month includes all purchases made on a daily basis "over the scale" as well as purchases made under contract for which payment was made during the month the commodity was received. The dollars paid for the comparable quantities reflect all premiums and discounts for the commodity at the "point of first sale."

For some commodities, other surveys contain prices questions for the ease of securing information and reducing respondent burden. For example, the hay price questions are included on state cattle on feed questionnaires (OMB No. 0535-0213) and the quarterly milk production survey instruments (OMB No. 0535-0020). The advantage of sending a respondent one questionnaire rather than two reduces cost and respondent burden. The burden minutes reported on the monthly milk production questionnaire are split between the Milk docket and the Prices docket. The hay price surveys included in this docket are conducted primarily in the states that do not have a large enough sample of dairy farmers or operations with cattle on feed to set price estimates for hay.

The prices paid surveys use mail, phone, EDR, and personal interviews for data collection. During this period of social distancing caused by the pandemic, RFOs are limiting the use of personal interviews and relying more heavily on phone and internet contacts to increase response rates and reduce respondent burden by assisting with the completion of the form(s). NASS continually evaluates how administrative data can best be utilized for use in constructing price indices. NASS utilizes selected Consumer Price Indices (CPI) and Producer Price Indices (PPI) to construct monthly indices. NASS periodically meets with the Bureau of Labor Statistics (BLS) to discuss how NASS could better use BLS indices, as well as what Producer Price Indices and retail margin indices could be used to improve NASS Prices Paid indices. The focus on the discussion was farm machinery, because other NASS prices paid groups are more complex. BLS does not have a method to combine PPI and retail margin indices to estimate a retail price index but does construct a retail margin index. BLS expressed an interest in assisting NASS in the use of their retail margin index. The collection of farm machinery price data for use in index construction is difficult as equipment utilized varies greatly across the United States and newer technology is constantly being implemented. The changing technology makes it resource intensive to manage and to obtain reliable data. NASS uses petroleum data from Energy Information Administration in establishing a monthly fuel index. The annual Prices Paid surveys have a reference period, which is equivalent to the administrative data. The annual survey data provide the base for revising monthly indices based on the administrative data.

In the past, the data collection timeframe was the three-week period around March 15 for the five prices paid commodity groups. Data collection has been expanded by one week to make it the full month of March. Data will be collected by mail, phone, field enumeration, or by internet reporting. The reference date for each survey is March 15. Other seeds data are also collected in March. Target response rate is 80 percent for the prices paid surveys. Agribusinesses are requested to report the prices for the item most commonly sold that meets the general specification on the questionnaire.

Outside of March, when the Prices Paid Surveys are conducted as a benchmark, the Prices Paid Index is adjusted monthly using administrative data from a variety of reliable sources, mostly from BLS indices and data from other federal agencies.

In a follow-up meeting with BLS on Tuesday, March 8, 2016, Troy Joshua, Tony Dorn, Daryl Brinkman, Kuan Chen, Greg Gholson, Courtney Charles, Jennifer Rhorer, and Gavin Corral from NASS met with Ralph Bradley, Division Director of the Division of Price and Index Number Research at BLS, to discuss implementing NASS price relative indices for monthly probability grains. Ralph did extensive preparation for the meeting. First, he provided a handout of his article from the Journal of Economics and Social Measurement on the Pitfalls of using unit values as price measure of price index. His paper concludes that unit values will usually introduce bias, but one cannot sign a direction nor magnitude for this bias. Another takeaway from the meeting was because NASS indices are trying to measure (or solve) the farmer producer problem instead of a consumer utility problem, using a superlative index such as the Jevons or Tornqvist might not be the most appropriate because of substitution limitations of crops produced. An index such as a Lowe might be more appropriate, depending on the actual production function of farmers.

(A listing of Price Index Formulas can be found at:

https://en.wikipedia.org/wiki/List_of_price_index_formulas.)

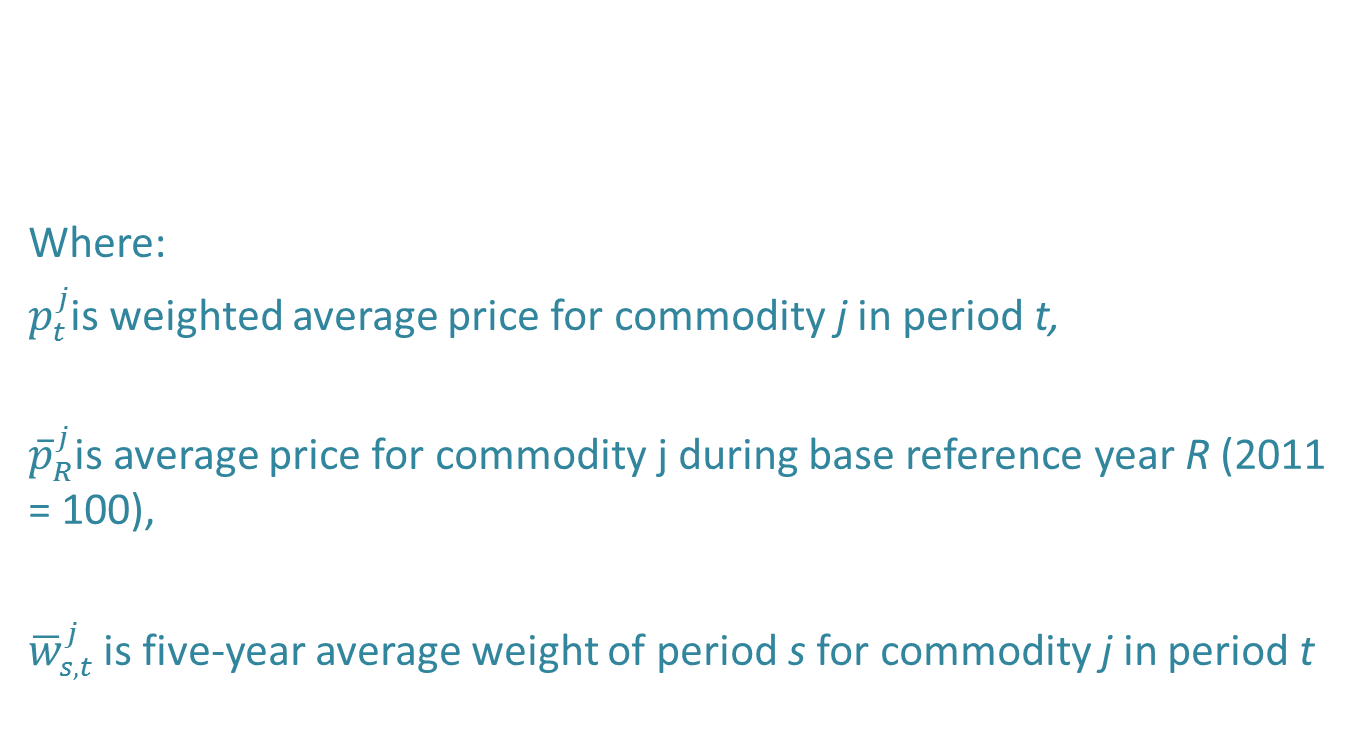

The current formula used by NASS in its index construction is:

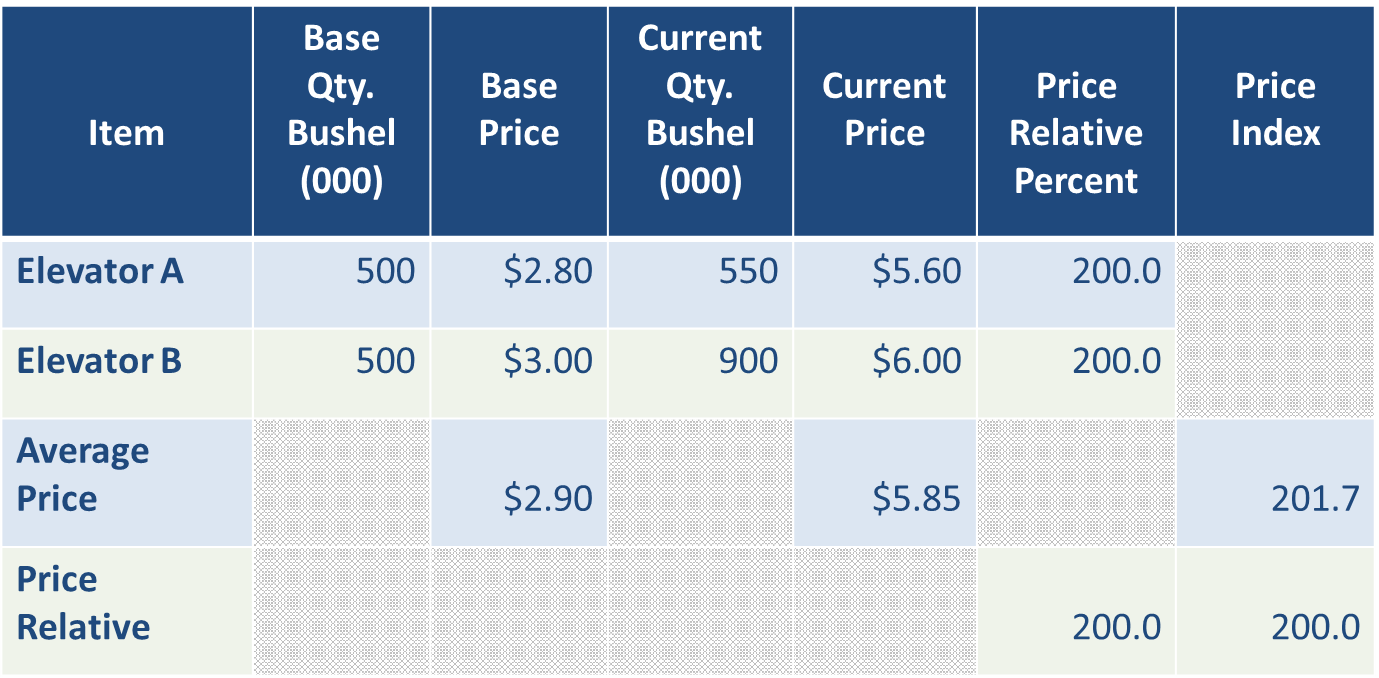

The following example shows potential bias using this formula.

Elementary Price Relative vs. Average Price

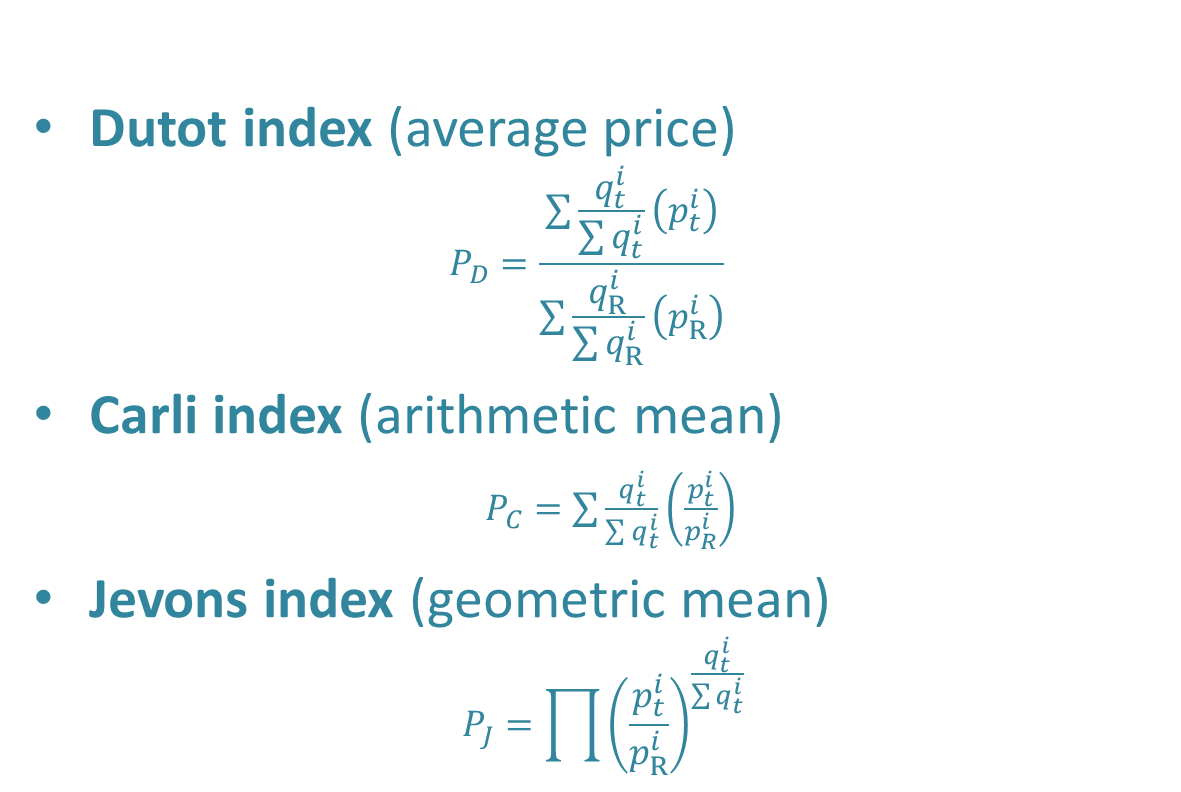

NASS is currently researching elementary price index formula for prices received field crop commodities. Data is currently collected to construct Lespyres, Paasche, and Fischer indices. The Fischer provides the aggregation index to evaluate the Lespyres and Paasche indices. These indices are constructed from the three widely used elementary indices. The formula for the three elementary indices follows.

In January 2017, NASS integrated field crop indices based on aggregated respondent price relatives rather than aggregated average prices.

3. Describe methods to maximize response rates and to deal with issues of non-response. The accuracy and reliability of information collected must be shown to be adequate for intended uses.

In April 2010, NASS headquarters began providing RFOs with a review and listing of potential updates to the master List Frame for firms or agribusinesses that interact (buy or sell products) with farmers or ranchers. The lists contain the names and addresses of operations that sell feed, fertilizer, farm machinery, etc. The RFOs use the screening form to determine if these establishments sell the items of interest to farmers and ranchers. This screening survey is included in this docket, with a target mailing to approximately 5,000 agri-businesses.

The first time a prices received or prices paid respondent is included in a sample for cotton, grains, pulse crops, oil seeds, peanuts, or rice, the respondent is contacted and the NASS price program is explained. Follow-up visits are made as necessary to answer any respondent questions. After the initial interview, questionnaires are mailed to the respondent unless a different arrangement is requested. There is a full telephone follow-up of mail non-response. Recurring non-respondents may be personally visited by RFO management to encourage cooperation.

NASS has established targets of precision for the prices received program. Survey results are assessed for eight different commodities in two of their respective peak marketing months. The commodities are No. 2 yellow corn, soybeans, upland cotton, all wheat, barley, oats, sorghum, and all sunflowers. Standards are given in terms of the coefficient of variation and range from 0.5 percent for the most common crops (corn and soybeans) to 2.5 percent for smaller volume crops (barley and oats). On average in any given year, NASS survey results meet prescribed standards 87 percent of the time.

Point estimates for the prices paid program are average prices paid by farmers for production inputs. No expanded totals are computed. The March indices are constructed using the annual survey price data and are evaluated with the March indices based on administrative data. The annual survey-based indices are used as a base for revising monthly indices constructed using administrative data. The general level of adjustment is less than three percent for the annual survey index groups and one percent or less for the monthly indices.

The 2016 value of production for hay totaled $15.6 billion. Data collection for hay prices requires special procedures as a high percentage of sales are between farmers and ranchers, hay purchases are relatively infrequent, and there is a lack of organized marketing channels. A biennial survey is conducted to determine the difference between the price level for hay sold to dealers and for all hay sold to farmers and ranchers. Monthly prices reported by hay dealers are adjusted by this difference.

Estimates from the prices received are used to administer programs involving budget outlays. Consequently, this program is periodically audited by the USDA office of the Inspector General.

4. Describe any tests of procedures or methods to be undertaken.

During 2017, NASS conducted cognitive interviews on the prices paid questionnaires to see what changes could be made to make the surveys more user friendly and improve on the quality of the data summarized. Respondents said that they would be able to provide quantity of items sold in conjunction with the prices paid by farmers for the data items in the five primary data collection categories. This allowed NASS to change to a more acceptable elementary formula of aggregating individual report price changes and minimize any bias inherent in the current average price aggregation. Cognitive testing also gave us insight into some items that were on the questionnaires that are sold so rarely that they could be omitted from future questionnaires.

No testing was conducted during the current approval. However, included in this renewal request, in Supporting Statement A, there is additional burden included to allow up to 30 cognitive interviews to be conducted annually, if the need arises.

5. Provide the name and telephone number of individuals consulted on statistical aspects of the design and the name of the agency unit, contractor(s), grantee(s), or other person(s) who will actually collect and/or analyze the information for the agency.

The samples and survey data are reviewed by NASS Summary, Estimation, and Disclosure Methodology Branch, Methodology Division. The Branch Chief is Jeff Bailey, (202) 690-8141.

Survey design and methodology are determined by the Sampling, Editing, and Imputation Methodology Branch, Methodology Division; Branch Chief is Mark Apodaca, (202) 690-8141.

Data collection is carried out by NASS Field Offices; Eastern Field Operation’s Director is Jay Johnson, (202) 720-3638, and the Western Field Operation’s Director is Troy Joshua, (202) 720-8220.

The NASS Survey Administration Branch is responsible for coordination of sampling, questionnaires, data collection, training, Interviewers Manual, Survey Administration Manual, data processing, and other RFO support. The Census and Survey Division; Survey Administration Branch Chief is Gerald Tillman, (202) 720-3895.

The NASS commodity statisticians in Headquarters for the Agricultural Prices Surveys are responsible for national and regional summaries, analysis, presentations to the Agricultural Statistics Board for final estimates, publication, and the Estimation Manual. The Environmental, Economics, and Demographics Branch of Statistics Division; Branch Chief is Jody McDaniel (202)720-6146.

August 2020

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | David Hancock |

| File Modified | 0000-00-00 |

| File Created | 2021-01-13 |

© 2026 OMB.report | Privacy Policy