FS Form 285-A Schedule of Excess Risks

Schedule of Excess Risks

excess-risks-2018.xlsx

OMB: 1530-0062

⚠️ Notice: This form may be outdated. More recent filings and information on OMB 1530-0062 can be found here:

Document [xlsx]

Download: xlsx | pdf

Specific Instructions - SER

Schedule Of Excess Risks

Overview

General Instructions - SERSpecific Instructions - SER

Schedule Of Excess Risks

Sheet 1: General Instructions - SER

| GENERAL INSTRUCTIONS - SCHEDULE OF EXCESS RISKS | |||||||||

| A. | REPORT EACH RISK SEPARATELY WITH THE EXCEPTION OF TREATY REINSURANCE AND PAYMENT TONDS AS MENTIONED BELOW. | ||||||||

| B. | SURETY RISKS: All surety risks should be reported in detail. | ||||||||

| C. | CONTRACT BONDS: A separate entry on the form may be used to report the performance bond and the payment bond on a single contract. However, in cases where the performance bond and the payment bond for a single contract are reinsured in the same manner it is permissible to report the details of the performance bond and a statement indicating "payment bond also protected in the same manner". | ||||||||

| D. | FACULTATIVE REINSURANCE: All excess risks protected by facultative reinsurance should be reported in detail. Use a separate line on the form for each risk. | ||||||||

| E. | RISKS COVERED BY TREATIES: In property - liability lines of business such as automobile and public liability, where the excess risks may be quite numerous and where reinsurance of such risks is covered automatically under reinsurance agreements or treaties, it is not necessary to report risks in detail. A condensed summary showing the names of the reinsuring companies and the limits accepted by them on the various classes of business should be noted on the schedule. Treaty reinsurance should be reported in dollar amounts rather than percentages, with dollar amounts inserted for the largest risk written under the treaty. Each treaty should be reported separately on the form. If it is necessary to submit the details of a particular treaty in successive quarterly reports reproduced summaries may be submitted attached to form 285-A. | ||||||||

| F. | BLANK FORMS: FMS 285-A. A supply of blank forms is available from the Treasury. Blank reinsurance agreement forms are also available, i.e., Standard Forms (SF) 273, 274, 275. A set of two FS 285-A forms is mailed to each reporting company each quarter. | ||||||||

| G. | SPECIMEN FORMS: A specimen form, FS 285-A properly filled out, is available from the Treasury upon request. | ||||||||

| H. | TREASURY EMAIL ADDRESS / TELEPHONE: Requests for blank forms, specimen forms, and questions should be emailed to: [email protected] (and/or the financial analyst assigned to examine the company) Telephone: (202) 874-6850 |

||||||||

| I. | REPORTING DATES: The completed Schedule of Excess Risks (form FS 285-A) together with the reporting company's quarterly financial statement should be submitted to the email address, within 45 days after the close of each quarter. | ||||||||

Sheet 2: Specific Instructions - SER

| SPECIFIC INSTRUCTIONS - SCHEDULE OF EXCESS RISKS | |||||||||

| Column A | "Number" - Insert number of bond or policy. | ||||||||

| Column B | "Date" - Insert date bond or policy was written. | ||||||||

| Column C | "Principal (if surety) or Class (if other lines)" - Insert name of principal (if bond) or class (if other line). | ||||||||

| Column D | "Obligee (if fidelity or surety) or Insured (if other lines)" - Insert name of obligee if fidelity or surety or name of insured if other line. | ||||||||

| Column E | "Penal Sum (if bond) or Face Amount (if policy)" - Insert penal amount of bond or face amount of insurance policy. | ||||||||

| Column F | "Maximum Liability (if less than penal sum or face amount)" - Insert maximum liability if less than penal sum of bond or face amount of insurance policy. This column is used only in cases where policies cover more than one risk, i.e., casualty policies covering more than one location, or where bonds, such as fiduciary bonds are given for more than the value of the assets in an estate. (See Section 223.13 of Treasury Circular 297 - 31 CFR 223.13.) | ||||||||

| Column G | "Net Retention" - Insert net retention (amount of risk retained by company after coinsurance, reinsurance or admissible collateral is obtained). | ||||||||

| Column H | "Date of Coinsurance or Reinsurance" - Insert date of coinsurance or reinsurance. | ||||||||

| Column I | "Name of Coinsuring or Reinsuring Company" - Insert names of coinsuring or reinsuring companies. | ||||||||

| Column J | "Amount of Treasury Authorized Coinsurance or Authorized Reinsurance" - Insert amount of coinsurance or reinsurance ceded to companies recognized by Treasury for reinsurance purposes opposite their names. See lists of reinsurers which accompanied Treasury's last Annual Letter to Executive Officers of Surety Companies Reporting to the Treasury for names of companies recognized by the Treasury for reinsurance purposes. Indicate coinsurance by single asterisk. | ||||||||

| Column K | "Amount of Unauthorized Coinsurance or Authorized Reinsurance" - Insert amount of coinsurance or reinsurance ceded to companies not recognized by the Treasury opposite their names. | ||||||||

| Column L | "Market Value of Admissible Assets Pledged (attach copy of trust, joint control or indemnity agreement)" - Insert market value of any admissible assets held to secure each excess risk. If protection of the excess liability is being achieved by pledged assets, assets held in trust, assets held under collateral agreement of indemnity or joint control, insert market value of such assets. In order to qualify, pledged assets should be of the type that would be admissible if owned directly by the reporting company. See Sections 223.10 - .11 of Treasury Circular 297 for applicable regulations (31 CFR 223.10 - .11). | ||||||||

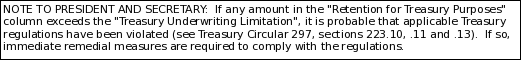

| Column M | "Retention for Treasury Purposes" - Insert Retention for Treasury purposes. This amount should equal the company's net retention plus cessions to unauthorized coinsurers or reinsurers, less the market value of any admissible assets held to secure the risk and must not exceed the reporting company's Treasury underwriting limitation. | ||||||||

| Column N | "Remarks" - Insert any remarks to clarify. If the risk being reported is a surety bond naming the United States or one of its agencies or instrumentalities as obligee, a copy of the appropriate reinsurance agreement should be attached and a remark written in column (17) "Reinsurance Agreement Attached." Reinsurance Agreements on Federal bonds should be executed on Standard Forms (SF) 273, 274, or 275. Use SF-273 for Miller Act performance bonds; SF 274 for Miller Act payment bonds; and SF 275 for other Federal bonds. The previous Treasury form nos. FMS 6317, FMS 6318, and FMS 6319 may continue to be used. (See paragraph) 223.11 (b) (1) of Treasury Circular 297 - 31 CFR 223.11 (b) (1).) | ||||||||

| Note: If no risks are written in excess of the underwriting limitation, indicate such by inserting the word "NONE" on the form. | |||||||||

Sheet 3: Schedule Of Excess Risks

| Company Name | Contact Person | ||||||||||||

| Location of Company | Contact Person Title | ||||||||||||

| NAIC Company Code | Contact Person Telephone No. | ||||||||||||

| Quarter Ended | Contact Person E-Mail | ||||||||||||

| Treasury Underwriting Limitation | |||||||||||||

| Report each risk written in excess of the underwriting limitation established by the Treasury. (This applies to casualty and other lines of business as well as surety risks whether or not the United States is obligee.) In protecting excess risks, the underwriting limitation in force on the date of the execution of the risk, as shown in Treasury Circular 570, will govern absolutely. | |||||||||||||

| Number | Date | Principal (If Surety) Or Class (If Other Lines) | Obligee (If Fidelity Or Surety) Or Insured (If Other Lines) |

Date Of Coinsurance Or Reinsurance | Name Of Coinsuring Or Reinsuring Company | Amount of Treasury Authorized Coinsurance (Denote With*) Or Authorized Reinsurance | Amount of Unauthorized Coinsurance (Denote With*) Or Unauthorized Reinsurance | Market Value Of Admissible Assets Pledged (Attach Copy Of Trust, Joint Control Or Indemnity Agreement | Retention For Treasury Purposes | Remarks | |||

| AFFIDAVIT State of ___________________________________ County of__________________________________ _____________________________________, President, and __________________________________, Secretary of the_________________________________ of ____________________________________, being duly sworn, depose and say, and each for himself says, that they are the above-described officers of the said company, that the foregoing schedule (with the accompanying exhibits) contains a full, true, and correct statement of all recognizances, stipulations, bonds, undertakings, or other risks, whereon the liabilities are in excess of its Treasury underwriting limitation, executed by the said company and its agents on behalf of any individual, firm, association, or corporation, during the quarter ended___________________, 20____; and, further, that the statements and declarations contained herein are correct and true in every particular. Subscribed and sworn to before me this_______________________day of___________________, 20___ _____________________________________________________ Notary Public _____________________________________________________ President _____________________________________________________ Secretary

|

|||||||||||||

| Number | Date | Principal (If Surety) Or Class (If Other Lines) | Obligee (If Fidelity Or Surety) Or Insured (If Other Lines) | Penal Sum (If Bond) Or Face Amount (If Policy) | Maximum Liability (If Less Than Penal Sum Or Face Amount) | Net Retention | Date Of Coinsurance Or Reinsurance | Name Of Coinsuring Or Reinsuring Company | Amount of Treasury Authorized Coinsurance (Denote With*) Or Authorized Reinsurance | Amount of Unauthorized Coinsurance (Denote With*) Or Unauthorized Reinsurance | Market Value Of Admissible Assets Pledged (Attach Copy Of Trust, Joint Control Or Indemnity Agreement | Retention For Treasury Purposes | Remarks |

| Number | Date | Principal (If Surety) Or Class (If Other Lines) | Obligee (If Fidelity Or Surety) Or Insured (If Other Lines) | Net Retention | Retention For Treasury Purposes | Remarks | |||||||

| Number | Date | Principal (If Surety) Or Class (If Other Lines) | Obligee (If Fidelity Or Surety) Or Insured (If Other Lines) | Net Retention | Retention For Treasury Purposes | Remarks | |||||||

| File Type | application/vnd.openxmlformats-officedocument.spreadsheetml.sheet |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy