Non-entitlement units of government (NEU) Distribution Template

Coronavirus State and Local Fiscal Recovery Funds Program

SLFRF_Treasury Portal User_Guide

Non-entitlement units of government (NEU) Distribution Template

OMB: 1505-0271

Coronavirus State and Local Fiscal Recovery Fund

User Guide: Treasury’s Portal for Recipient Reporting

August XX, 2021

DRAFT

Table of Contents

Section I. Reporting Basics 3

Section II. Navigation and Logistics 5

Section III. Reporting Requirements 9

Section IV. Interim Report 10

Section V. NEU Distribution Template 18

Section VI. Non-UGLG Distribution Template 21

Section VII. Recovery Plan Performance Report 23

Section VIII. Frequently Asked Questions (FAQ) 27

List of Figures

Figure 3 – Sample Bulk Upload Icon with Template Download Link 6

Figure 4 – Successful Bulk Upload Example 7

Figure 5 – Unsuccessful Bulk Upload 7

Figure 6 – Manual Entry Text Box 8

Figure 7 – Project Funding Diagram 10

Figure 8 – Recipient Information 11

Figure 9 – Recipient Profile Discrepancies Entry 11

Figure 10 – Expenditure Category Reporting Sample, Public Health 12

Figure 11 – Revenue Replacement Entry Screen 14

Figure 12 – Required Programmatic Data Sample Screen for NEUs 15

Figure 13 – Required Programmatic Data Example, Non-UGLG 16

Figure 14 – Official Certification 17

Figure 15 – Recipient Information 25

Figure 16 – Recipient Profile Discrepancies Entry 25

Overview

This document provides information on using Treasury’s Portal to submit required Coronavirus State and Local Fiscal Recovery Fund (SLFRF) reports. It is a supplement to the Compliance and Reporting Guidance (Reporting Guidance), which contains relevant information and guidance on reporting requirements.

Additionally, you should visit the Treasury’s SLFRF home page for the latest guidance and updates on programmatic and reporting topics, as well as information on Treasury’s Interim Final Rule.

Each SLFRF recipient is required to submit periodic reports with current performance and financial information including background information about the SLFRF projects that are the subjects of the reports; and financial information with details about obligations, expenditures, direct payments, and subawards.

What is Covered in this User Guide?

This User Guide contains detailed guidance and instructions for SLFRF recipients in using the Treasury reporting portal for submitting the required reports. All recipients must submit the required reports via the Treasury reporting portal. This guide is not comprehensive and is meant to be used in conjunction with the references mentioned above.

Section I: Reporting Basics

Section II: Navigation and Logistics

Section III: Reporting Requirements

Section IV: Interim Report

Section V: NEU Distribution Template

Section VI: Non-UGLG Distribution Template (note: applicable only to AK, CT, MA, RI, VT, U.S. Virgin Islands, and American Samoa)

Section VII: Recovery Plan Performance Report

Section VIII: Frequently Asked Questions (FAQ)

Appendix A: Bulk Upload Overview

Appendix B: Key Terminology

Designated Staff for Key Roles in Managing SLFRF Reports User Designations

SLFRF recipient organizations are required to designate staff or officials for the following three roles in managing reports for their SLFRF award. Recipients must make the required designations prior to accessing Treasury’s Portal. The required roles are as follows:

Account Administrator for the SLFRF award has the administrative role of maintaining the names and contact information of the designated individuals for SLFRF reporting. The Account Administrator is also responsible for working within your organization to determine its designees for the roles of Point of Contact for Reporting and Authorized Representative for Reporting and providing their names and contact information via Treasury’s Portal. Finally, the Account Administrator is responsible for making any changes or updates to the user roles as needed over the award period. We recommend that the Account Administrator identify an individual to serve in his/her place in the event of staff changes.

Point of Contact for Reporting is the primary contact for receiving official Treasury notifications about reporting on the SLFRF award, including alerts about upcoming reporting, requirements, and deadlines. The Point of Contact for Reporting is responsible for completing the SLFRF reports.

Authorized Representative for Reporting is responsible for certifying and submitting official reports on behalf of the SLFRF award recipient. Treasury will accept reports or other official communications only when submitted by the Authorized Representative for Reporting. The Authorized Representative for Reporting is also responsible for communications with Treasury on such matters as extension requests and amendments of previously submitted reports. The official reports may include special reports, quarterly reports, interim reports, and final reports.

An individual may be designated for multiple roles. For example, the individual designated as the Point of Contact for Reporting may also be designated as the Authorized Representative for Reporting. In addition, the recipient may designate one individual for all three roles. Multiple individuals can be designated for each role.

The guidance on the process for designating individuals for the three roles was provided via email to SLFRF recipients.

The designated individuals’ names and contact information will be pre-populated in the “Recipient Profile” portion of the recipient’s SLFRF reports, and recipients will be able to update the information, if necessary.

Each designated individual must register with ID.me for gaining access to Treasury’s portal. Please contact [email protected] for additional information on procedures for registering with ID.me.

Questions?

If you have any questions about the SLFRF program’s reporting requirements, please contact us by email via [email protected].

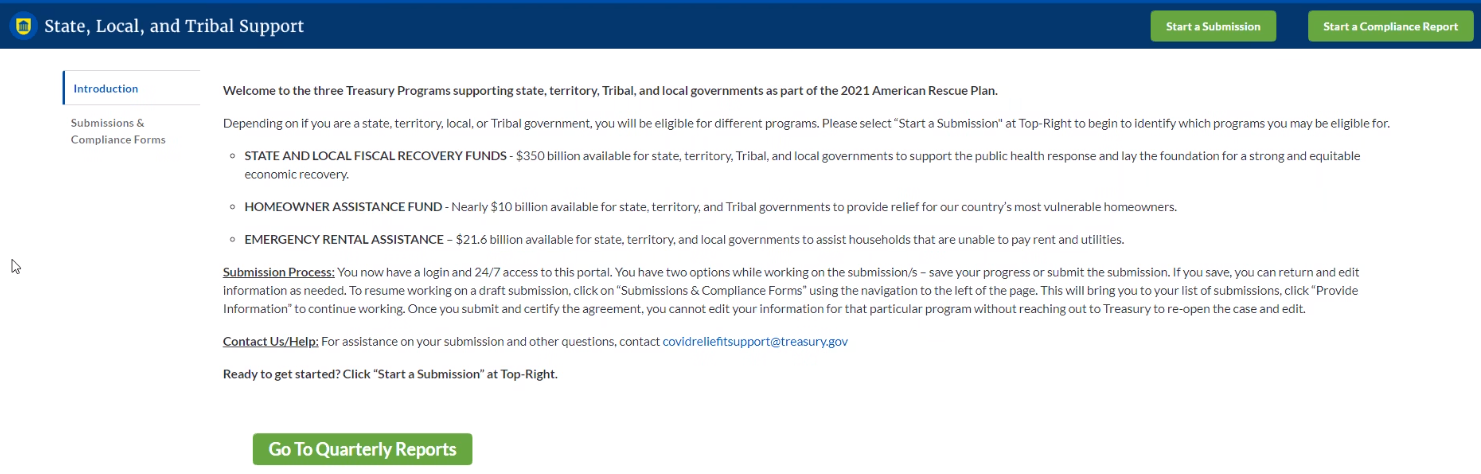

After logging into the Treasury reporting portal, the landing page (see Figure 1) will appear listing the application for the ORP-administered program from which your organization received funding.

From the landing page, select “Start a Submission” to be taken to a list of options for the programs you have access to.

At this time, you may select either the Interim Report or the Recovery Plan Performance Report (Recovery Plan).

Each listed report constitutes a link to that specific report’s online forms. Selecting a report from the landing page will open the first in a series of screens.

To begin completing a specific report, click on a given report’s link. Refer to the Reporting Guidance for details about each type of required report for submittal.

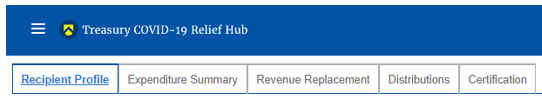

The Navigation Bar (see Figure 2) on the top of Treasury’s Portal will allow you to freely move between screens.

Helpful Tips/Shortcuts for Submitting Data to Treasury’s Portal

Treasury’s Portal leads you through a series of online forms that, when completed, will fulfill your reporting obligations. While navigating through the Treasury Poral and submitting required information, users will have the option of manually entering data directly into the portal or providing information via a bulk upload file that includes all relevant information in a Treasury approved process and format.

You are strongly encouraged to provide a bulk upload, if possible, to reduce data entry errors and time spent on data entry; however, manual data entry may be more appropriate for smaller programs with lower data burdens.

The bulk file upload approach is encouraged for users with vast amounts of data to ease the administrative burden and minimize data entry errors. The manual data entry option is available to all users but may be more feasible for smaller programs with fewer data burdens.

Bulk Upload File

Recipients can use the bulk upload function for providing required information for three modules listed here:

NEU Distribution- Eligible NEUs

NEU Distribution- Ineligible Local Governments

NEU Distribution- Transactions

When using the bulk upload, recipients must provide the required information in specified formats and use the Treasury approved templates for each respective bulk upload. Recipients may download each of the templates separately from within the relevant Portal module.

Recipients that choose to use the bulk upload functionality should navigate to each of the above-listed modules and download each bulk file upload template as an early step in planning for the required quarterly report.

Please see Appendix A – Bulk Upload Overview for complete guidance on using this important function.

Modules and submodules accepting bulk upload files are clearly marked in Treasury’s Portal and identified in later sections of this User Guide. The template for each upload file is available in the relevant module/submodule for download (see Figure 3).

Figure 3 – Sample Bulk Upload Icon with Template Download Link

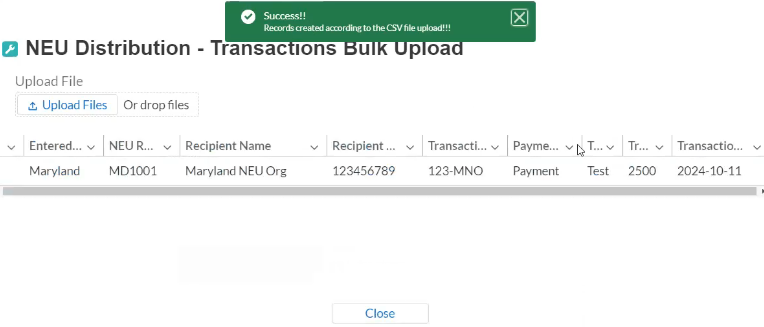

When you click the upload button you will be directed to an upload screen (see Figure 4). You can either choose to add files or drag and drop files to initiate the bulk upload.

Figure 4 – Successful Bulk Upload Example

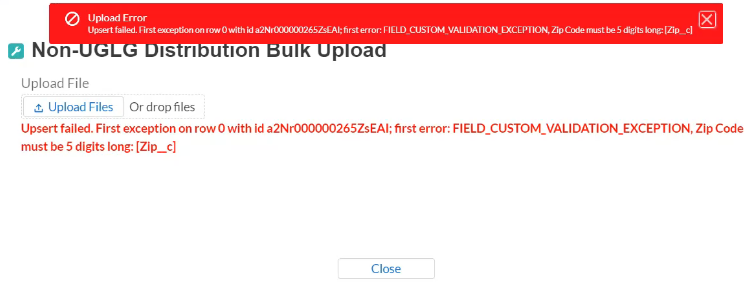

Treasury’s reporting portal will reject the file if an incorrect template or file format other than .csv is used for upload (see Figure 5). The Treasury reporting portal will display an error message on screen (see Figure 5) if the bulk data upload file contains errors. If you receive an error message, you will need to correct the errors in the bulk upload file and re-submit the corrected version.

Figure 5 – Unsuccessful Bulk Upload

Manual Data Entry

Manual data entry requires you to provide inputs as instructed on the screen. Manual inputs are described in detail below for each section of this user guide.

Note: * indicates a required field. Entry into the field is required before you can save or proceed to the next screen.

Your inputs will be subject to validation by Treasury’s Portal to ensure that the data provided is consistent with expected format or description (e.g., entering “one hundred” instead of 100). If a given data entry fails a validation rule, the portal will display an error for you to address.

The portal will provide failed validation notices for data on the final screen.

You will not be able to submit manually entered data that does not satisfy the data validation rules.

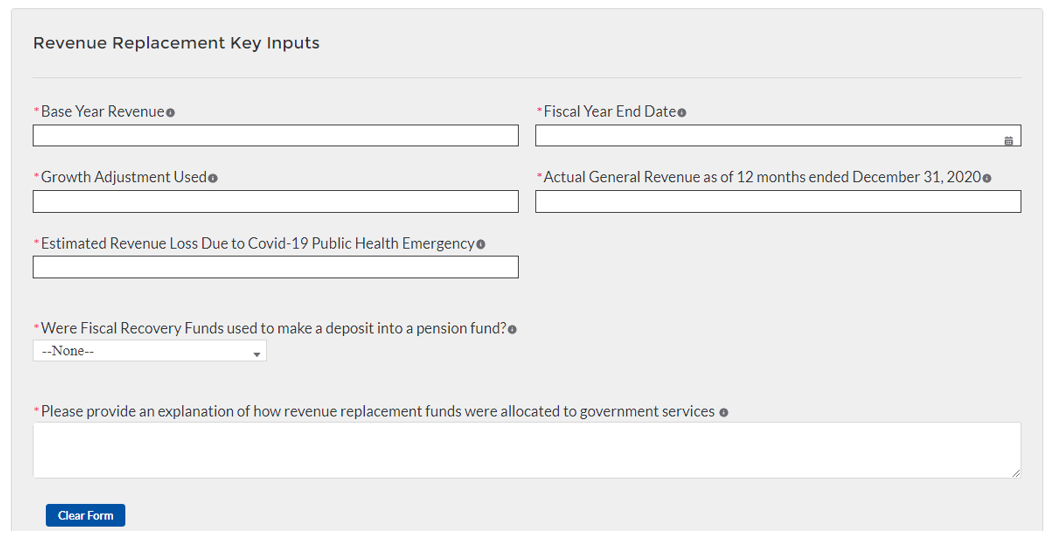

Narrative Boxes

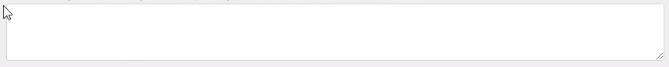

When filling out detailed narratives, you are encouraged to type out responses in a word processing application (such as Microsoft Word) to minimize grammatical errors, track word count, and concisely answer all required narrative details. You can then copy and paste the final written narratives directly into the text boxes.

The text boxes (see Figure 6) can be expanded by clicking and dragging the icon in the bottom-right corner.

Figure 6 – Manual Entry Text Box

Reporting Requirements by Recipient

For the SLFRF program, reporting requirements vary by Recipient type, as shown in Table 1. Detailed instructions for completion and submission of each report are covered in Part 2 of the Reporting Guidance.

Recipient |

Interim Report |

Project and Expenditure Report |

Annual Recovery Plan Performance Report |

States, U.S. Territories, Metropolitan cities and Counties with a population that exceeds 250,000 residents |

By August 31, 2021, with expenditure summary by category

|

By October 31, 2021, and then 30 days after the end of each quarter thereafter1 |

By August 31, 2021, and annually thereafter by July 31 2 |

Metropolitan cities and Counties with a population below 250,000 residents which received more than $5 million in SLFRF funding |

Not required |

||

Tribal Governments |

|||

Metropolitan cities and Counties with a population below 250,000 residents which received less than $5 million in SLFRF funding |

By October 31, 2021, and then annually thereafter3

|

||

NEUs

|

Not required |

Table 1 – Reporting Requirements by Recipient

Key Concepts for Reporting

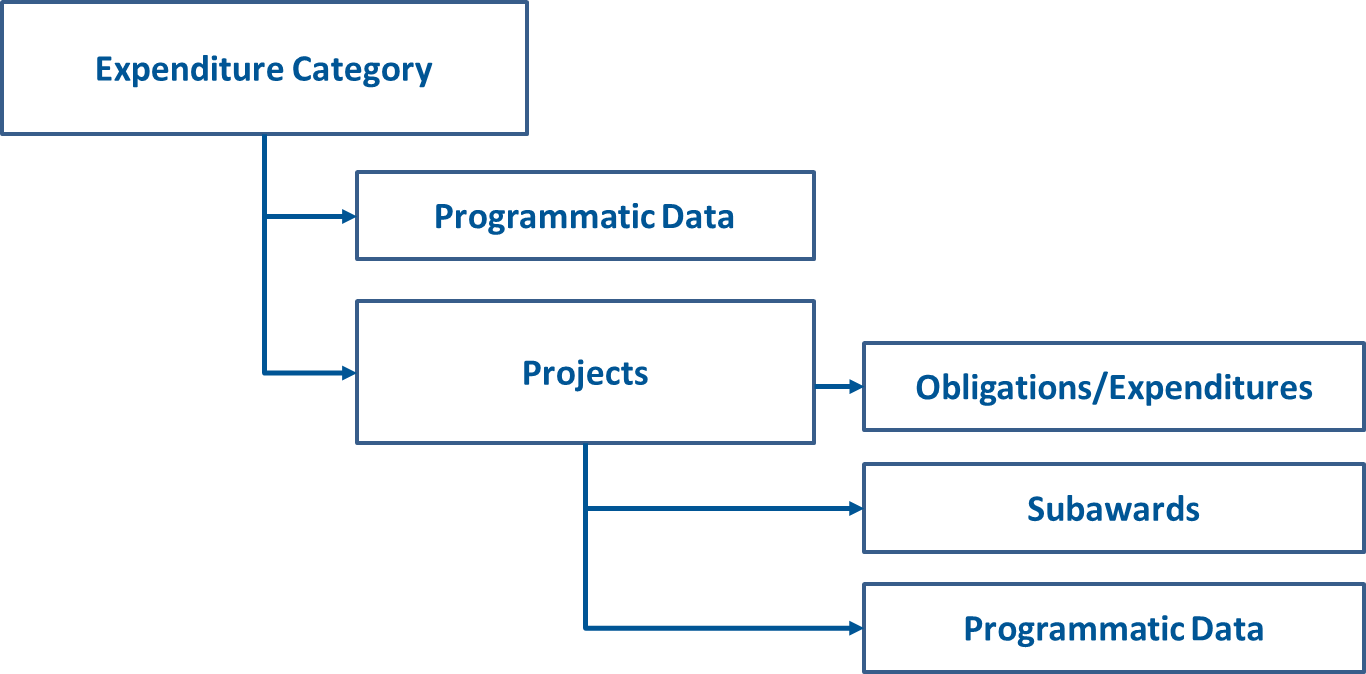

The following concept structure applies to all report types:

Each recipient will have expenditures in a number of Expenditure Categories (EC), as further detailed in Appendix 1 of the Reporting Guidance.

For each Expenditure Category you use funding for, you will have one or more projects.

For each project, you will need to track obligations and expenditures, as well as any subawards made.

Treasury will collect some programmatic data at both the expenditure category level as well as the project level.

Figure 7 depicts the relationship between EC and a project.

Figure 7 – Project Funding Diagram

On these screens, you will review and confirm key information on your organization, and input information required for the Interim Report. Please refer to Part 2, Section A, of the Reporting Guidance.

The Interim Report provides an initial overview of status and uses of funding for SLFRF programs. It is a one-time report due August 31, 2021. It covers spending from March 3 to July 31, 2021, due August 31, 2021, and requires a breakdown by all Expenditure Categories (e.g., 1.1 COVID-19 Vaccination)

The Interim Report will include a table in the Treasury reporting portal which lists all the Expenditure Categories listed in Appendix 1 of the official guidance. Recipients will be asked to enter any obligations and expenditures through July 31. It will also capture NEU and non-UGLG distributions.

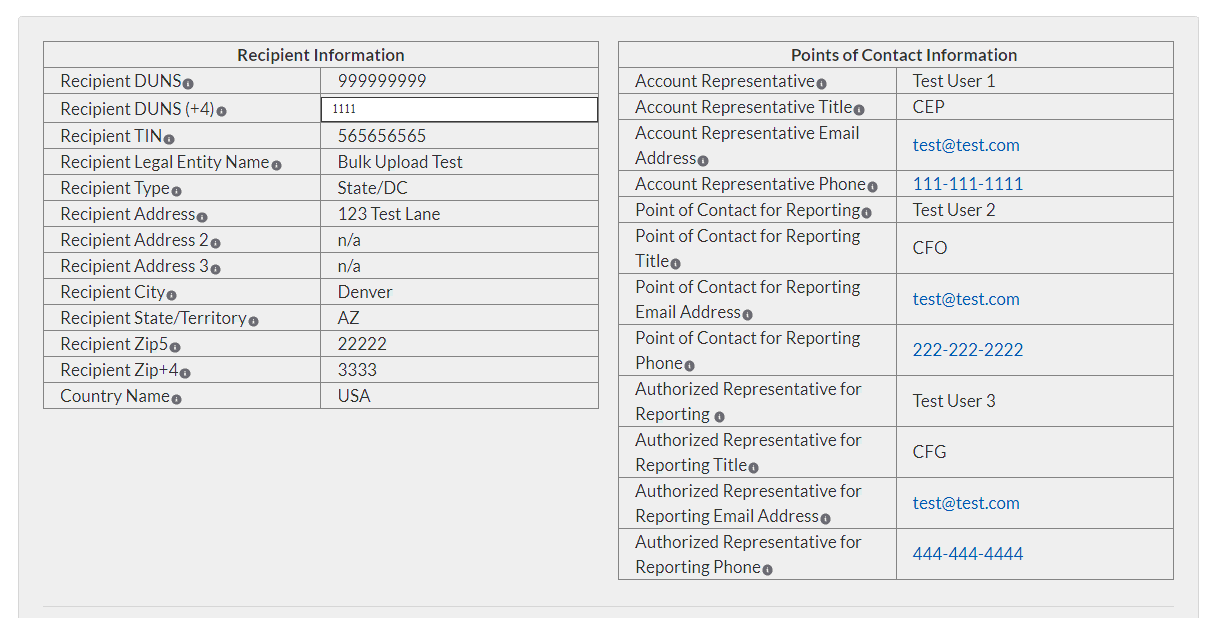

Upon login, you will be directed to the recipient information page, which is intended to verify relevant information in the Treasury system.

Recipient Information

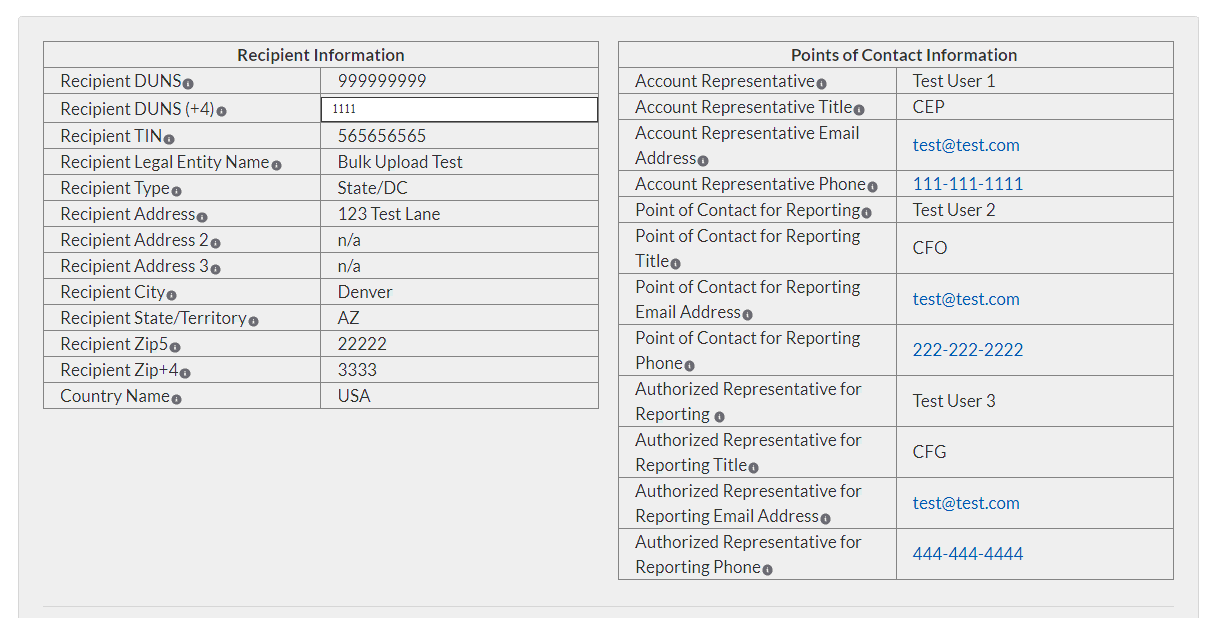

Review and confirm your Recipient Profile pre-populated from your SLFRF Application file (see Figure 8). If you have previously entered a DUNS (+4) number, it will appear here. If you have a Recipient DUNS (+4) number and the field is not populated, update as necessary.

The screen will also display the names and contact information for individuals the Recipient has designated for key roles for the SLFRP program.

Figure 8 – Recipient Information

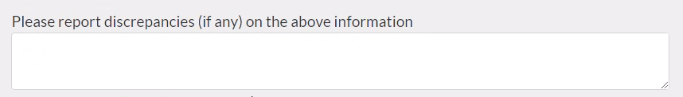

Please use the textbox (see Figure 9) to flag errors, notifying Treasury if any information is incorrect

Figure 9 – Recipient Profile Discrepancies Entry

Once all fields have been reviewed and verified, click the Next button to proceed to the following screen.

Expenditure Summary Level Information

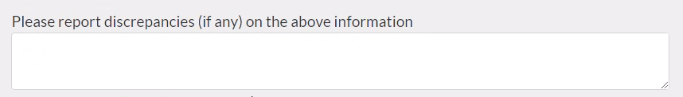

On this screen, you will enter Cumulative Obligations to Date and Cumulative Expenditures to Date for each Expenditure Category. This summary level report provides a detailed view of what project categories the Recipient had obligations for and the expenditure performance to date. Users may leave blank Expenditure Categories that do not apply.

You should refer to the Reporting Guidance, Appendix 1, for the full Expenditure Category list. References to Expenditure Categories are identified by “EC” followed by numbers from the table in Appendix 1.

Figure 10 – Expenditure Category Reporting Sample, Public Health

After navigating to this screen from the previous screen, enter data pertaining to the Cumulative Obligations to Date and Cumulative Expenditures to Date for each of the Expenditure Categories (see Figure 10).

The Cumulative Obligations to Date and Cumulative Expenditures to Date must be disaggregated between the listed Expenditure Categories. Figure 10 presents a portion of the required information.

Within each Expenditure Category, disaggregate by listed sub-category. If an expenditure sub-category does not apply, you may leave it blank. For the dollar amounts, enter whole numbers only and do not use a dollar sign.

Review and verify the auto-calculated totals generated from the reporting fields.

Once all of the above information is entered, click Save. Click the Next button to proceed to the following screen.

Revenue Replacement

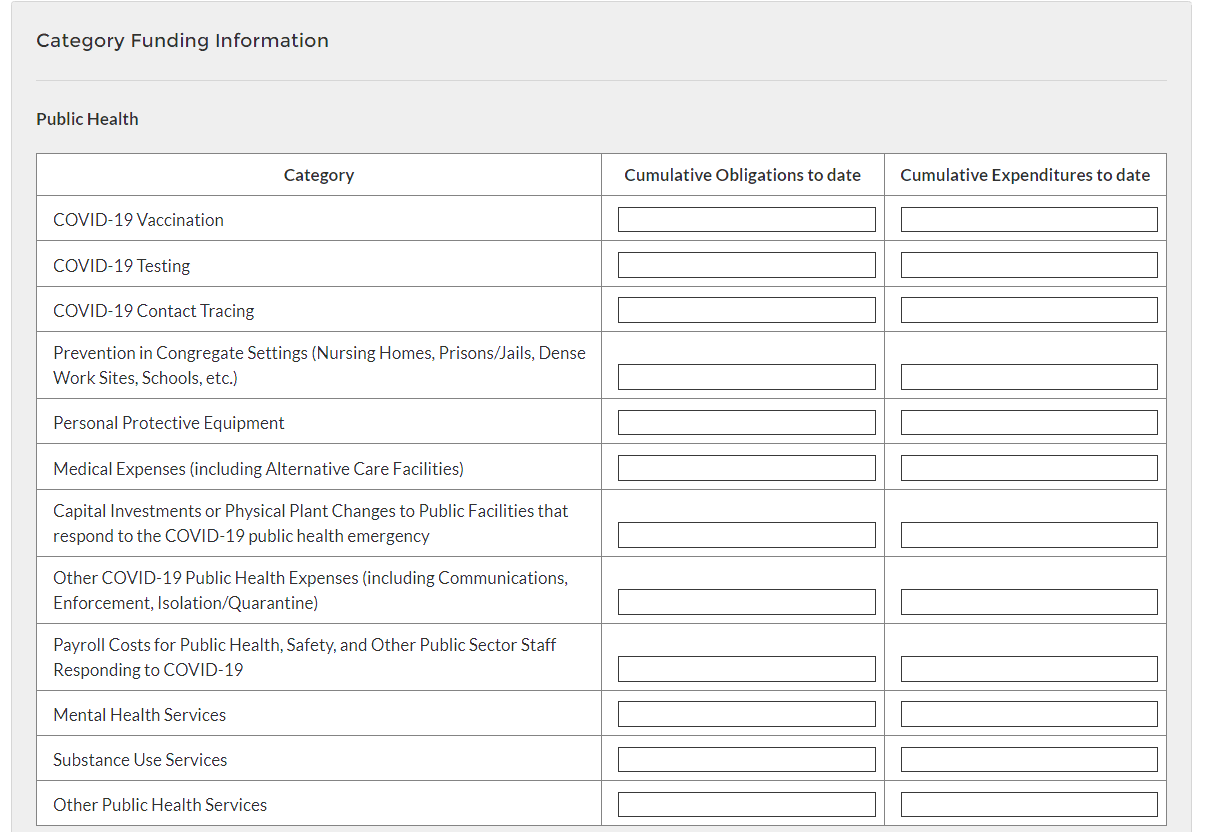

On this screen, recipients are asked to provide information pertaining to the Revenue Replacement Funding. The revenue replacement formula is outlined in the Interim Final Rule4. In addition to providing certain data, Recipients will provide a written explanation of how revenue replacement funds were allocated.

The IFR establishes a formula for calculating revenue loss as follows.

![]()

Where: Base

Year Revenue is the

recipient’s general revenue for the most recent full fiscal

year prior to the COVD–19 public health emergency; Growth

Adjustment is equal

to the greater of 4.1 percent (or 0.041) and the recipient’s

average annual revenue growth over the three full fiscal years prior

to the COVID–19 public health emergency. n

equals the number of months elapsed from the end of the base year to

the calculation date. Actual

General Revenue is

a recipient’s actual general revenue collected during 12-month

period ending on each calculation date. Subscript

t

denotes the specific calculation date.

The IFR also describes a step-by-step process for calculation.

To calculate the extent of the reduction in revenue for December 31, 2020, follow the four-step process as outlined in the Interim Final Rule:

Step 1: Identify revenues collected in the most recent full fiscal year prior to the public health emergency (i.e., last full fiscal year before January 27, 2020), called the base year revenue.

Step 2: Estimate counterfactual revenue, which is equal to base year revenue * [(1 + growth adjustment) ∧ (n/ 12)], where n is the number of months elapsed since the end of the base year to the calculation date, and growth adjustment is the greater of 4.1 percent and the recipient’s average annual revenue growth in the three full fiscal years prior to the COVID–19 public health emergency.

Step 3: Identify actual revenue, which equals revenues collected over the past twelve months as of the calculation date.

Step 4: The extent of the reduction in revenue is equal to counterfactual revenue less actual revenue. If actual revenue exceeds counterfactual revenue, the extent of the reduction in revenue is set to zero for that calculation date.

Enter the computed information for Base Year Revenue, Fiscal Year End Date, Growth Adjustment Used, Actual General Revenue as of 12 months ended December 31, 2020, and Estimated Revenue Loss due to COVID-19. (see Figure 11)

Respond to the question, Were Fiscal Recovery Funds used to make a deposit into a pension fund? Select “Yes” or “No”.

In the text box, provide a written explanation on how the revenue replacement funds were allocated towards government services.

Figure 11 – Revenue Replacement Entry Screen

Once all of the above information is entered, click Save. Click the Next button to proceed to the following screen.

Non-Entitlement Units of Local Government (NEUs) (States and Territories only)

On this screen, States and Territories will provide information pertaining to distributions made to non-Entitlement Units of Local Government (NEUs). Users not classified as States or Territories will not see this screen.

Specific, step-by-step instructions for filling out the NEU templates are included in Section V of this guide.

The following NEU Distribution templates are uploaded to this screen:

NEU Distribution: Eligible NEUs

NEU Distribution: Ineligible Local Governments

NEU Distribution: Transactions

In addition, a written narrative of the recipient’s NEU distribution process is also required, including any instructions or guidelines that were given to the NEUs. For NEU specific guidance, visit Treasury’s SLFRF website for NEUs.

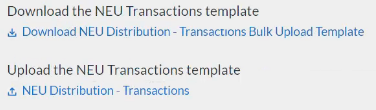

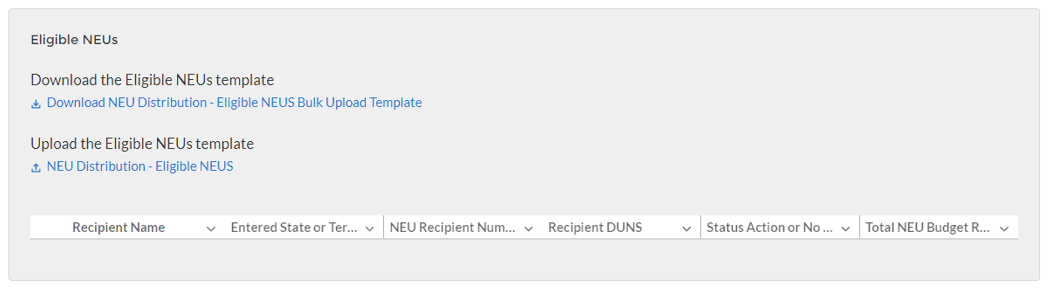

Download the NEU Distribution Templates from Treasury’s Portal screen (see Figure 12).

Fill the downloaded templates with information specific to the distributions to NEUs, as per Section V of this guide.

Upload each NEU Distribution Template separately as a .csv file. The NEU Distribution templates include 1) NEU Distribution – Eligible NEUs, 2) NEU Distribution – Ineligible (for listing ineligible Local Governments), and 3) NEU Distribution – Transactions, by using the respective Upload buttons on the screen.

Upload the PDF Treasury forms for NEUs declining funding and requesting transfer to state under Section 603(c)(4).

After uploading the applicable templates and documentation, provide a written summary of the State’s NEU distribution process, including any substantive instructions or guidance provided to the NEUs.

Once all of the above information is entered, click Save. Click the Next button to proceed to the following screen.

Figure 12 – Required Programmatic Data Sample Screen for NEUs

Non-UGLG

Note: This section is applicable only to Alaska, Connecticut, Massachusetts, Rhode Island, Vermont, U.S. Virgin Islands, and American Samoa.

On this screen, State and territory recipients will provide information pertaining to distributions made to units of general local government within counties that are not units of general local government (non-UGLG).

Specific, step-by-step instructions for filling out the Non-UGLG templates are in Section VI of this guide.

For any unit of general local government within a non-UGLG county that declined funding and requested a transfer to the State under Section 603(c)(4), the unit of general local government and its State or territory must complete, sign, and attach the Treasury form with a copy of the ACH or wire transfer as evidence of the transfer.

States and territories are required to provide updates on distributions as part of the Interim Report due on August 31, 2021, covering distributions from the date of award, to the extent such distributions have been made prior to that date.

Recipients are asked to provide updates on distributions to units of general local government within non-UGLG counties to Treasury every month thereafter until all distributions have been made. States should, unless otherwise instructed by Treasury, provide updates to Treasury where information or status has changed. Each report should cover all changes since the prior month’s report (e.g., submission by September 30, 2021, for the period covering August 1-31, 2021).

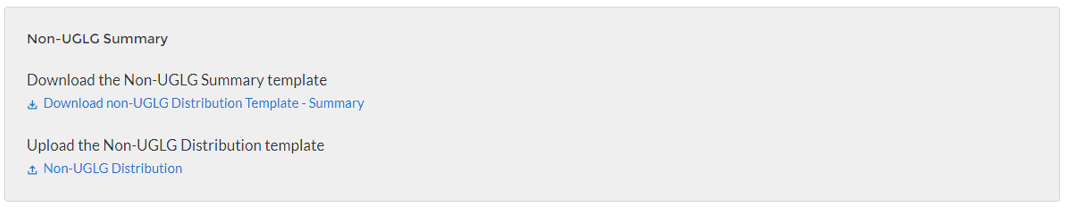

The following Non-UGLG Distribution templates are uploaded to this screen:

Non-UGLG Distribution Template

Non-UGLG Distribution: Transactions

Users will also be asked to provide a summary of the state’s Non-UGLG distribution process to date, to include substantive instructions or guidance that the state issued (e.g., key deadlines, guidance, etc.).

Download the non-UGLG Distribution Templates from Treasury’s Portal screen (see Figure 13).

Fill the downloaded templates with information specific to the Recipient and units of general local government within non-UGLG counties, as per Section VI of this guide.

Upload the non-UGLG Distribution Template and non-UGLG Distribution – Transactions template by using the respective Upload buttons on the screen. Each template must be uploaded separately as a .csv file.

Upload the PDF form for a unit of general local government within non-UGLG counties declining funding and requesting transfer to the State under Section 603(c)4. Units of general local government within non-UGLG counties that decline funding will be marked in column U of the non-UGLG distribution template.

After uploading the applicable templates and documentation, provide a written summary of the State’s non-UGLG distribution process to date. Include any substantive instructions or guidance provided to the non-UGLG (e.g., key deadlines, guidance).

Once all of the above information is entered, click Save. Click the Next button to proceed to the following screen.

Figure 13 – Required Programmatic Data Example, Non-UGLG

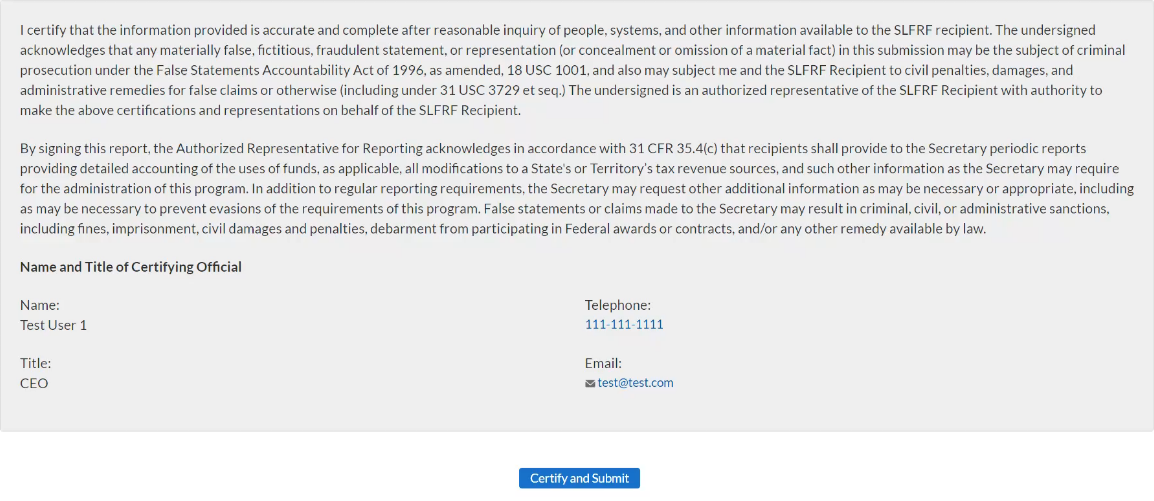

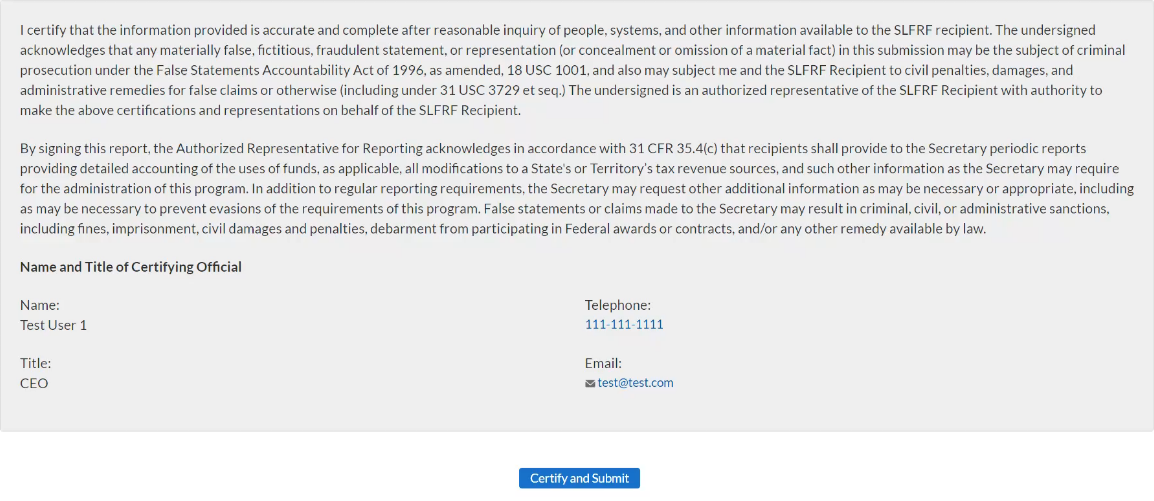

Official Certification

On this screen, the Authorized Representative for Reporting (ARR) will be asked to certify information pertaining to the Interim Report. By certifying this submission, the ARR is confirming that all reported information is accurate and approved for submission (see Figure 14).

Users who are not designated as an ARR will not be presented with the screen.

The ARR’s Name, Title, Telephone Number, and E-Mail Address will be presented on screen for review.

Allow the Certifying Official to review all prior screens and entries to verify accuracy of the inputted record.

Figure 14 – Official Certification

Once all of the information is validated, click the Certify and Submit button to complete the entry.

Non-entitlement Units of Local Government (NEUs), defined in section 603(g)(5) of the Social Security Act, as added by section 9901 of the American Rescue Plan Act of 2021, are local governments typically serving populations of less than 50,000. NEUs include cities, villages, towns, townships, or other types of local governments.

NEUs receive SLFRF payments through their State and territory governments. State and territory governments receive a specific allocation of these funds from Treasury for this purpose and are responsible for distributing these funds to the NEUs within their State. Award amounts are based on population.

Additional information on distributions to NEUs can be found here.

States and Territories are required to provide an update on distributions to eligible NEUs as part of the Interim Report due on August 31, 2021, covering NEU distributions from the date of award to July 31, 2021.

Recipients are asked to provide updates on distributions to individual NEUs to Treasury every month thereafter until all distributions have been made. States should, unless otherwise instructed by Treasury, provide updates to Treasury where information or status has changed. Each report should cover all changes since the prior month’s report (e.g., submission by September 30, 2021, for the period covering August 1-31, 2021).

Recipients are also required to provide updates to NEU distributions as part of the Project and Expenditure Report.

Templates will be available for download from the Treasury reporting portal. Each NEU template will need to be completed separately to allow for the proper uploading of information into the Treasury reporting portal. Additional instructions for uploading these templates into the portal will be provided in the forthcoming User Guide on use of the system.

The NEU distribution templates cover three areas:

NEU Distribution: Eligible NEUs

NEU Distribution: Ineligible Local Governments

NEU Distribution: Transactions

NEU Distribution: Eligible NEUs

In this section, the State or territory will populate the table for all eligible NEUs within the State and territory’s Jurisdiction, including eligible NEUs that are unresponsive or declined funding. The “Status” column will enable the recipient to indicate whether the NEU has acted on their funding.

For NEUs that are unresponsive or declined funding, States or territories do not have to provide information for all fields below. Optional fields are denoted by (*).

Download the NEU template from the Treasury reporting portal.

Populate the following information:

Column B: Provide the name of the State or Territory in which the NEU resides

Column D: Include the NEU Recipient Number assigned by the State to the NEU (e.g., AZ0013)

Column D: Include the NEU Name

Column E: Include the NEU's DUNS number

Column F: Include the NEU's Taxpayer Identification Number (TIN)

Columns G- M: Include the NEU's address (including city, State, zip code, and zip+4)

Column N: Include the NEU's primary email address. If there is no NEU primary email address, provide the point of contact's email address.

Column O: Include the NEU's primary point of contact's full name (first then last)

Column P: Include the NEU's primary point of contact's phone number (###-###-####)

Column Q: Include the NEU's primary point of contact's email address

Column R: Include the NEU's authorized representative name. If the primary point of contact is also the authorized representative, provide the name again.

Column S: Include the NEU's authorized representative email address. If the primary point of contact is also the authorized representative, provide the email again.

Column T: Indicate the NEU's status:

Action Taken (i.e., the NEU requested funding or declined funding & requested Sec. 603(c)(4) transfer to the State)

Action Not Taken (i.e., the NEU is nonresponsive / declined funding)

Column U: Provide the Total NEU Budget Reference submitted by the NEU as part of its request for funding or Sec. 603(c)(4) transfer to the State

Column V: Provide the revised Total NEU Budget Reference (e.g., if revisions were made based on updated Treasury guidance on the NEU’s interpretation of the 75 percent budget cap issued on June 30, 2021) *

Column W: Provide the Total Allocation Across 1st and 2nd Tranches before application of the 75 percent budget cap

Column X: Provide the Total Allocation Across 1st and 2nd Tranches (before application of 75 percent budget cap) (first revision, if applicable) *

Column Y: Provide the Total Allocation Across 1st and 2nd Tranches (before application of 75 percent cap) (second revision, if applicable) *

Column Z: Provide the Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap

Column AA: Provide the Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (first revision, if applicable) *

Column AB: Provide the Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (second revision, if applicable) *

Column AC: Include any additional notes required to explain the NEU distribution summary line items, as applicable *

Upload NEU template to the Treasury reporting portal. Additional instructions for uploading these templates into the portal will be provided in the forthcoming User Guide on use of the system.

NEU Distribution: Ineligible Local Governments

In this section, the State or territory will populate the local governments that were deemed ineligible to receive a NEU distribution. Optional fields denoted by (*).

As with the NEU Distribution Summary, the Interim Report should cover from award date to July 31, 2021. States or territories are asked to provide updates to Treasury every month thereafter. For these updates, States should only provide entries where information has changed.

Column B: Provide the name of the State or Territory in which the local government resides

Column C: Include the Local Government Name

Column D: Include the Local Government's DUNS number, if known/available *

Column E: Select the rationale for ineligibility:

Ineligible MCD (i.e., any Minor Civil Divisions in a "weak-MCD" State that did not meet the facts-and-circumstances test as outlined in Treasury's guidance)

Other. If other, provide additional explanation in Column E

Column F: Provide an explanation for "Other" ineligibility rationale *

NEU Distribution: Transactions

In this section, the State or territory will populate the table for all NEU transactions. As with the Eligible NEUs and Ineligible Local Governments information, the Interim Report should cover from the award date to July 31, 2021. States or territories are asked to provide updates to Treasury every month thereafter. For these updates, States should only provide entries where information has changed.

Column B: Provide the name of the State or Territory in which the NEU resides

Column C: Provide the NEU Recipient Number assigned by the State or Territory to the NEU

Column D: Provide the NEU Name

Column E: Provide the NEU's DUNS number

Column F: Provide the transaction ID, assigned by the State or Territory

Column G: Indicate whether the transaction was a Payment or Transfer to State under Section 603(c)(4)

Column H: Provide a description of the transaction (e.g., initial payment under First Tranche, subsequent distribution under First Tranche)

Column I: Provide the transaction amount. Use negative numbers for downward revisions. For transfers to the State under Section 603(c)(4), include the amount intended for transfer to the State.

Column J: Provide the date of the transaction. For transfers to the State under Section 603(c)(4), provide the date that Treasury's transfer form agreement was signed by both parties, not the expected date of Treasury’s approval.

Note: This section is applicable only to Alaska, Connecticut, Massachusetts, Rhode Island, Vermont, U.S. Virgin Islands, and American Samoa.

Section 603(b)(3)(B)(ii) of the Social Security Act (the Act), as amended by the American Rescue Plan Act of 2021, provides that in the case of an amount to be paid to a county that is not a unit of general local government (non-UGLG), the amount shall instead be paid to the State in which such county is located, and such State shall distribute such amount to each unit of general local government within such county based on population.

Units of general local government within non-UGLG counties can include non-entitlement units of local government (NEUs) and metropolitan cities. As noted in the Guidance on Counties that are Not Units of General Local Government, NEUs and metropolitan cities located in non-UGLG counties that receive funds under Section 603(b)(3)(B)(ii) of the Act must have already accepted the award terms for payments made under Section 603(b)(2) (for NEUs) or section 603(b)(1) (for metropolitan cities).

State and territory governments will receive a specific allocation of these funds from Treasury and are responsible for calculating the allocations and distributing funds to units of general local government within non-UGLG counties in the State or territory.

States and territories are required to provide updates on distributions as part of the Interim Report due on August 31, 2021, covering distributions from the date of award, to the extent such distributions have been made prior to that date.

States and territories should provide updates to Treasury every month thereafter until all distributions have been made. States should, unless otherwise instructed by Treasury, provide updates to Treasury where information or status has changed. Each report should cover any changes since the prior month’s report.

Templates will be available for download from the Treasury reporting portal. Each non-UGLG template will need to be completed separately to allow for the proper uploading of information into Treasury’s portal.

The Non-UGLG Distribution templates cover two areas:

Non-UGLG Distribution Summary

Non-UGLG Distribution: Transactions

Non-UGLG Distribution Summary

In this template, the State or territory will populate the spreadsheet for units of general local government (UGLG) within non-UGLG counties that are eligible to receive a disbursement under Section 603(b)(3)(B)(ii) of the Social Security Act, as added by the American Rescue Plan Act of 2021. States' interim report should cover information since the beginning of the program, and States are asked to provide updates to Treasury every month thereafter. For these updates, States should only provide entries where information or status has changed. Each report should cover any changes since the prior month's report. Optional fields denoted by (*).

Column A: Provide the name of the Non-UGLG County

Column B: Provide the name of the UGLG Jurisdiction within the non-UGLG county

Column C: Provide the population of the Jurisdiction

Column D: Provide the amount of funds allocated to the Jurisdiction

Column E: Include the Jurisdiction Number assigned by the State to the Jurisdiction (e.g., AZ0013)

Column F: Include the Jurisdiction DUNS number

Column G: Include the Jurisdiction Taxpayer Identification Number (TIN)

Columns H-N: Include the Jurisdiction address (including city, State and zip code) *

Column O: Include the Jurisdiction primary email address. If there is no primary email address, provide the point of contact's email address.

Column P: Include the Jurisdiction primary point of contact's full name (first then last)

Column Q: Include the Jurisdiction primary point of contact's phone number (###-###-####)

Column R: Include the Jurisdiction primary point of contact's email address

Column S: Include the Jurisdiction authorized representative name. If the primary point of contact is also the authorized representative, provide the name again.

Column T: Include the Jurisdiction authorized representative email address. If the primary point of contact is also the authorized representative, provide the email again.

Column U: Did the Jurisdiction decline and transfer funding to the State? Indicate Y or N

Column V: Include any additional notes required to explain the Jurisdiction distribution summary line items, as applicable *

Non-UGLG Distribution: Transactions

In this template, the State or territory will populate the spreadsheet for all distributions to units of general local government within non-UGLG counties. As with the Summary, States' interim report should cover information since the beginning of the program, and States are asked to provide updates to Treasury every month thereafter. For these updates, States should only provide entries where information has changed.

Column A: Provide the name of the Non-UGLG County Name

Column B: Provide the name of the UGLG Jurisdiction within the non-UGLG county

Column C: Provide the Jurisdiction Number assigned by the State

Column D: Include the Jurisdiction DUNS number

Column E: Provide the transaction ID, assigned by the State

Column F: Indicate whether the transaction was a Payment or Transfer to State under Section 603(c)(4)

Column G: Provide a description of the transaction (Enter “First Tranche” or “Second Tranche”)

Column H: Provide the transaction amount. Use negative numbers for downward revisions. For transfers to the State under Section 603(c)(4), include the amount intended for transfer to the State.

Column I: Provide the date of the transaction. For transfers to the State under Section 603(c)(4), provide the date that Treasury's transfer form agreement was signed by both parties (not the expected date on which Treasury would grant the transfer).

On these screens, you will review and confirm key information on your organization and upload the Recovery Plan as a PDF as well as include a link to the public site the Recovery Plan is posted.

Recipients that must submit a Recovery Plan Performance Report include:

States

Territories

Metropolitan cities and counties with a population that exceeds 250,000 residents

Recipients that do not submit a Recovery Plan Performance Report include:

Metropolitan cities and counties with a population below 250,000 residents which received more than $5 million in SLFRF funding

Tribal Governments

Metropolitan cities and counties with a population below 250,000 residents which received less than $5 million in SLFRF funding

NEUs

The Recovery Plan provides information on the recipient’s projects and how they plan to ensure program outcomes are achieved in an effective, efficient, and equitable manner. It will include key performance indicators identified by the recipient and some mandatory indicators identified by Treasury.

The initial Recovery Plan will cover the period from the date of award to July 31, 2021 and must be submitted to Treasury by August 31, 2021. Thereafter, the Recovery Plan will cover a 12-month period and recipients will be required to submit the report to Treasury within 30 days after the end of the 12-month period (by July 31).

To simplify the reporting process, recipients will upload their Recovery Plan into the portal by August 31, 2021 in PDF format. To reduce burden and increase efficiency, recipients will not be required to enter their project inventory and other programmatic data directly into the portal until October 31, 2021 when they also submit their first Project and Expenditure Report submission.

The plan should be posted on a prominent public-facing website of your government – somewhere interested members of the public will be able to find it, such as your home page or general web pages related to your coronavirus response.

SLFRF Recovery Plan Performance Report Template

The SLFRF Recovery Plan Performance Report Template is meant as a suggested template for applicable SLFRF recipients to assist them in submitting their Recovery Plan. Recipients should consult the SLFRF Guidance on Recipient Compliance and Reporting Responsibilities (Reporting Guidance) for detailed guidance on the submission of this report.

Treasury encourages Recipients to tailor this report to best meet their needs in terms of format and content. Treasury recommends the use of infographics, tables, charts, pictures, case studies, and other explanatory elements in describing their programs.

The Recovery Plan Template is available at www.treasury.gov/SLFRPReporting .

Upon login, you will be directed to the recipient information page, which is intended to verify relevant information in the Treasury reporting portal.

Recipient Information

Review and confirm your Recipient Profile pre-populated from your SLFRF Application file (see Figure 15). If you have previously entered a DUNS (+4) number, it will appear here. If you have a Recipient DUNS (+4) number and the field is not populated, update, as necessary.

The screen will also display the names and contact information for individuals the Recipient has designated for key roles for the SLFRP program.

Figure 15 – Recipient Information

Please use the textbox (see Figure 16) to flag errors, notifying Treasury if any information is incorrect

Figure 16 – Recipient Profile Discrepancies Entry

Once all fields have been reviewed and verified, click the Next button to proceed to the following screen.

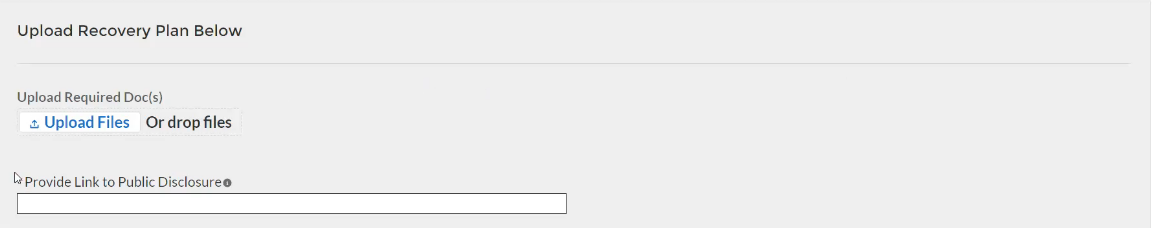

Performance Report

On this screen, Recipients will upload their Recovery Plan. Recipients with populations that exceed 250,000 residents are required to submit this performance report to Treasury.

Upon navigating to this screen (see Figure 17), download and complete the SLFRF Recovery Plan Template available on screen. When complete, convert the Word template to a PDF.

Upload the PDF of the Recovery Plan using the onscreen buttons.

After uploading the PDF, enter a link for public disclosure where this report will be available for public review.

Figure 17 – Recovery Plan Performance Report Screen

Once all of the above information is entered, click Save. Click the Next button to proceed to the following screen.

Official Certification

On this screen, the Authorized Representative for Reporting (ARR) will be asked to certify information pertaining to the Interim Report. By certifying this submission, the ARR is confirming that all reported information is accurate and approved for submission (see Figure 18).

Users who are not designated as an ARR will not be presented with the screen.

The ARR’s Name, Title, Telephone Number, and E-Mail Address will be presented on screen for review.

Allow the Certifying Official to review all prior screens and entries to verify accuracy of the inputted record.

Figure 18 – Official Certification

Once all of the above information is entered, click the Certify and Submit button to complete the entry.

Reporting Requirements and Process

If a recipient has received funding as of July 15, 2021 but has not incurred obligations or expenditures as of the end of the reporting period, what are the reporting requirements?

Interim Report: Recipients should submit a report showing no ($0) obligations or expenditures have yet been incurred.

Recovery Plan: Recipients should submit a Recovery Plan describing the planned approach to the use of funds and planned projects.

If a recipient has received funding as of July 15, 2021 but has not established projects as of the end of the reporting period, what are the reporting requirements?

No project level reporting is required in the Interim Report. Recipients should submit a Recovery Plan describing the planned approach to the use of funds and planned projects.

If a recipient has not received funding as of July 15, 2021, what are the reporting requirements?

Treasury recognizes that recipients will need sufficient time to gather the information and determine how allocate funds in accordance with the Interim Final Rule. As such, recipients that have not received funding as of July 15, 2021 must submit an Interim Report and Recovery Plan (if applicable) within 60 days of receiving funding.

Does the $5 million threshold apply to funds received or the total allocation?

The reporting threshold is based on the total allocation expected under the SLFRF program, not the funds received by the recipient as of the time of reporting. Recipient reporting tiers will be displayed in the reporting portal. If you believe there is an error with the reporting tier or application of the $5 million threshold, please email [email protected].

Should recipients submit a Recovery Plan if they are awaiting approval by legislative or other governance entities on the proposed projects, and such approval is not received as of the end of the reporting period?

Recipients should submit a Recovery Plan that includes information about any projects that are approved or authorized for release by August 31, 2021. A recipient should then submit an updated Recovery Plan within 60 days after approval by the legislature or other governance entities.

How should a recipient report funds if funds were received as multiple entity types (e.g., a county and an NEU, or county and a city)?

When receiving funds as multiple entity types, a recipient’s reporting tier is determined by their total allocation across both recipient types and the highest tier for which they qualify. For example, if a recipient receives funding as an NEU and a county with population under $250,000 and their total allocation across both entity types is over $5M, the recipient should report as a county with population under 250,000 and over $5M in total SLFRF funding. A recipient’s reporting tier will be available for review in the reporting portal. If you believe there is an error in consolidating or not consolidating your governmental entities for the purposes of reporting, please email [email protected].

What reporting is required if no SLFRF funding was used for the activities covered by the Required Performance Indicators noted in Part 2 C.2. of the Reporting Guidance related to the Recovery Plan?

A recipient only needs to report on mandatory performance indicators if funds were used for that purpose / Expenditure Category.

Do jurisdictions need to have committed or dedicated funding received by the August 31, 2021 deadline for the initial Recovery Plan?

No. Funding does not need to be committed or dedicated by the time the initial Recovery Plan is submitted. The Recovery Plan should include planned uses of funds and projects to the extent known at the time the Recovery Plan is submitted. Updates can be provided in subsequent project and expenditure reports.

The guidance covering submission of the Recovery Plan indicates that in addition to submitting a PDF version of the Recovery Plan recipients must also upload a project inventory file and input other programmatic data. Is this no longer required?

Treasury has delayed the collection of this information in the Treasury reporting portal in order to streamline reporting and lessen the reporting burden for recipients. Recipients are still required to upload a PDF version of their Recovery Plan by August 31. Recipients are encouraged to use the suggested template posted in the www.treasury.gov/SLFRPReporting website when preparing the Recovery Plan template. Some data from the Recovery Plan will be required to be submitted with the first Project and Expenditure report by October 31, 2021. The User Guide for the Project and Expenditure Report will include additional information.

How should recipients report if the population threshold changes during the four-year reporting period?

The population threshold is determined by Treasury at award date and will not change during the four-year reporting period. A recipient’s reporting tier will be available for review in the reporting portal.

Can records be edited or updated after submission? How do I report changes?

Interim Report: No changes will be allowed after the initial submission. Any updates will be captured when the first Project and Expenditure Report is submitted.

Quarterly Project and Expenditure Reports: Updates should be provided in the next quarterly Project and Expenditure Report.

Annual Project and Expenditure Report: Recipients will have an opportunity to provide updates with next quarterly submission date, when the portal opens for quarterly submitters. Additional information will be included in the forthcoming User Guide for the Project and Expenditure Report.

Recovery Plan: Recipients will be allowed to submit updates of their Recovery Plan reflecting any significant changes. They should also provide concurrent updates to the publicly posted version.

How do recipients correct or edit pre-populated information or project information in Treasury’s Portal?

In the event that information presented in the Treasury reporting portal requires correction, recipients should email [email protected] and provide the necessary edits.

Is there any possibility of extension for the reporting deadlines for individual recipients?

Generally, No. The data submitted by recipients will be used internally for oversight purposes and to fulfill Treasury’s transparency and legal obligations. Late submissions undermine the efficiency and timeliness of these processes. Recipient submissions after the reporting deadline will be considered as late, and recipients will be asked to provide a date by which the delayed reporting will be submitted so that Treasury can plan for incorporating the data. Treasury’s own reporting will highlight those recipients whose reports were not received by the deadline. If there are any changes to the overall reporting deadlines, they will be communicated to the relevant impacted recipients.

Is there a penalty for not submitting timely reports?

A record of late reporting could lead to a finding of non-compliance, which could result in development of a corrective action plan, or other consequences.

Will the data recipients submit be made publicly available?

Yes, Treasury will make the data submitted by recipients publicly available. The content and timing of release is still under development. Treasury encourages recipients to make their data directly available through their own websites. States and territories are reminded that they need to post the Recovery Plan in their public website by the date the report is transmitted to Treasury.

What is meant by Date of Award?

The Date of Award is the day the recipient certifies the funding.

When are recipients subject to the quarterly reporting?

Recipients are required to provide quarterly reporting starting in the period funds were received and certified. Quarterly reporting is required for all quarters thereafter.

NEUs

When do NEUs have to complete their SAM.gov registration? When will NEUs gain access to Treasury’s portal for data entry and report submission?

NEUs that have not previously registered with SAM.gov may do so after receipt of the award, but before the submission of mandatory reporting. NEUs need to submit their first report by October 31, 2021.

What is the timeline to disburse funds when NEUs are non-responsive or require approval to receive funds? How should the state or territory consider this non-responsiveness or approval requirement within the reporting deadlines?

Section 603(b)(2)(C)(i) states that “[n]ot later than 30 days after a State receives a payment,” it “shall distribute” funds to each NEU in the state. Section 603(b)(2)(C)(ii) provides for a 30-day extension if a state certifies in writing an “excessive administrative burden,” and possible additional 30-day extensions at the discretion of the Secretary of the Treasury if the state provides a written plan to the Secretary specifying “when the State expects to make such distribution and the actions the State has taken and will take in order to make all such distributions before the end of the distribution period.”

As outlined above, the statute expects state governments to allocate and disburse payments to all eligible NEUs within 30 days of receiving their NEU payment from Treasury. The statute also directs Treasury to grant a 30-day extension if a state certifies an “excessive administrative burden” in writing. Accordingly, Treasury will grant a 30-day extension for all states that complete and submit an extension form, which can be requested by emailing [email protected] with the subject line “NEU Distribution - Extension Form.” Treasury encourages all states to expeditiously distribute funding to eligible NEUs.

At the end of the first 30-day extension (60 days after the date on which the state received an NEU payment), states that have not made all distributions of their NEU funding may request an additional 30-day extension, which may be granted at the discretion of the Secretary of the Treasury. These states will be asked to provide a written plan that specifies the expected timing of the remaining distributions and efforts that the state has and will undertake to make these distributions. As part of this state plan, Treasury will accept plans from states that detail “reasonable efforts” to contact non-responsive NEUs and propose issuing a subsequent distribution of unclaimed funds if the NEUs remain non-responsive.

As outlined in the guidance, a state may only issue a subsequent distribution if it has made “reasonable efforts” to contact an NEU that remains unresponsive. States should not issue a subsequent distribution until at least 60 days after the state begins accepting and processing requests for funding from NEUs.

Who has oversight of the NEUs, the state/territory or Treasury?

NEUs are considered prime recipients of Treasury and states and territories are not responsible for monitoring NEUs for compliance with use of funds, beyond distributing and collecting signed copies of the award terms and conditions and assurances of compliance with Title VI of the Civil Rights Act of 1964. However, if a state transfers funds to an NEU under Section 602 of the Social Security Act, as added by the American Rescue Plan Act of 2021 (e.g., a transaction that is not a distribution of funds to the NEU as required by Section 603(b)(2)(C) of the Social Security Act) or otherwise establishes a subrecipient relationship with an NEU, the state will be obligated under the award terms to account for the uses of the funds and report on such uses.

Eligible Uses /Use of Funds /Expenditure Categories

In the event that something is funded/purchased using the Recovery Funds and reported, and then subsequently it is realized that the funding/purchase does not qualify for use of the Recovery Funds, can that report be amended and a correction be made?

Yes. Recipients can make corrections to reporting to adjust for ineligible uses, and must pay for that expense using non-SLFRF funding. See 1.11 above.

Should Expenditure Category 7.1 be used for all administrative costs for a project?

No. Administrative costs for a specific project should be reported under the appropriate expenditure category for that project. For example, administrative costs for a small business economic assistance program would be reported under EC 2.9- Small Business Economic Assistance (General). Only general SLFRF administrative costs which are not associated with a particular project and do not fall into another Expenditure Category should be reported under EC 7.1- Administrative Expenses. EC 7.1 may include both direct and indirect costs.

How should recipients report use of funds when the expense is not listed or does not fit one of the Expenditure Categories designations?

Recipients should align the project to the best fit of Expenditure Category and use the project description to further describe the project as needed.

Should expenditures be reported on an accrual or cash basis?

Expenditures may be reported on a cash or accrual basis, as long as the methodology is disclosed and consistently applied. Reporting must be consistent with the definition of expenditures pursuant to 2 CFR 200.1. Your organization should appropriately maintain accounting records for compiling and reporting accurate, compliant financial data, in accordance with appropriate accounting standards and principles.

Evidence-based interventions

Are there targets for the amount of funds that must be spent on evidence based interventions?

Treasury’s Reporting Guidance requires recipients to report in their Recovery Plan on “the dollar amount of the total project spending that is allocated towards evidence-based interventions for each project” in certain Expenditure Categories (see list of Expenditure Categories in the Reporting Guidance appendix for details). While Treasury encourages all SLFRF recipients to invest funds in evidence-based interventions whenever possible and to increase these amounts over time, there are no targets or requirement to spend a specific amount of money on evidence-based interventions. Recipients are exempt from this requirement in cases where a program evaluation is being conducted.

What expenses should be counted as evidence-based for the purposes of reporting?

As outlined in the Reporting Guidance, evidence-based refers to interventions with strong or moderate evidence for the purposes of SLFRF reporting. Appendix 2 of the Reporting Guidance contains additional information on the definition of strong and moderate evidence. In addition to spending funds on evidence-based interventions, Treasury also encourages all recipients to conduct evaluations to build evidence about new or innovative programs or services they are providing with SLFR funds. As a reminder, SLFR funds may be used by recipients to perform evaluations, build their internal evaluation capacity, or to contract with external organizations for evaluation related activities.

How should evidence be considered when disbursing funds through contracts or grants?

When sub-granting SLFR funds to third parties, recipients are encouraged to include provisions related to evidence in relevant project areas. Specifically, recipients may include provisions that ask third party recipients (or prospective recipients) of SLFR funds about the level of evidence for the programs or services that they are providing. This could consist of a requirement or preference in grant or contract solicitations that ask third party sub-grantees about whether their programs or services are evidence-based according to the definition in Appendix 2 of the Reporting Guidance. Requiring third party recipients to report on whether their programs or services are evidence-based will facilitate reporting for the Recovery Plan.

Appendix A – Bulk Upload Overview

The following segment provides overview on the bulk file upload process. There are three (3) unique bulk file upload templates as outlined below:

NEU Distribution – Eligible NEUs

NEU Distribution – Ineligible Local Government

NEU Distribution - Transactions

Template Description

Each of the three bulk file upload templates contain instructions on how to populate the respective fields within each file. When adding content to each template, please follow the “Help” text, which will provide what is and isn’t permitted for each cell. Each Module in the web application provides a link to download the template. All templates have the same structure as described below:

Row 1: Template Version

Row 2: Template Name

Row 3: Instructions: Brief description of the template constraints.

Row 4: Field IDs: Column identifiers

Row 5: Field Label: Brief description of each Field or Column

Row 6: Required or Optional: This field specifies if the field is optional or required. When the column is required, and a recipient does not provide the required data, the system will not accept any record or allow the file to be uploaded.

Row 7: Field Help Text: Provides a description of the column. There are 2 types of fields, 1). an open value either text or numbers and 2). A predefined list of pick list values:

Open Value: Any text or number. Text for NEU State name or a Number that represents amounts. Most text types are free formats, the only expectation is for Dates, each column that represents a date describes the accepted format. For any number field, it is not required to add “,” to represent thousands and it is not required to add “$” to represent currency. Only add decimal “.” when needed.

Pick List: A predefined list of values that is accepted by the system. When the column is a pick list, row 7 provides the list of options that the system accepts. End users should “copy and paste” the valid value for each record. If the respondent provides a value that is not in the predefined pick list, the system will not accept the file. Responses should not contain double quotes

Row 8: Data that Recipient submits. Row 8 is where recipients insert specific data to submit. The system accepts 1 or many rows.

The following is special guidance for each row or set of rows:

Do not change the content of rows 1 to 7.

Rows 4 to 7 provide metadata of each data element or column of the information that respondents will provide.

Add your data starting in row 8 column B.

Bulk Upload Process

The upload process includes the following steps:

Download the template from the link provided in the web application section of the module.

Open the template in Microsoft Excel.

Save the template as a .CSV file and change the name of the file as needed.

Add your data starting with row 8 column B of the applicable template.

Add additional rows as needed.

Upload the new file to the portal. The system will provide a message if the upload was successful or unsuccessful.

Reuse the same file if the upload process fails, after correcting the issue. Reconcile the issues that the system indicated and repeat step 6 until all issues are corrected.

Bulk Upload Creation Steps

The collective bulk file upload process is contingent upon uploading the template files in the order below:

Load the NEU Distribution – Eligible NEUs

Load the NEU Distribution – Ineligible

Load the NEU Distribution – Transactions

Note: All data submitted via the bulk upload functionality must be submitted as a .CSV file.

CSV Guidance

Refer to the following link for descriptions of the CSV format.

https://en.wikipedia.org/wiki/Comma-separated_values

The date format is: MM/DD/YYYY. Example:

06/22/2021

All currency values are numeric. It is not required to add “,” for thousand or millions.

All currency values should not contain a “$” sign. The file will be rejected if a “$” is included in the data entry.

Upload Template Description

Each data element and/or column in the CSV files is described below:

Index No: Reference number for the data element. For internal use only.

Defined term: Column Short description.

Definition: Column long description or definition.

CSV Column Name: The column header name that must be used in the CSV file.

Required: Indicates if the column is required or not required.

List Value: The content of the column is from a list of predefined values. This is valid for some of the columns. The list is provided for all cases. Most of the cases is N/A which means that the type is ether String or Numeric.

Data type: Specify the data type of the column. The options are: Numeric, Text, Date, and Pick List.

Max Length: Indicates the maximum length in characters that is allowed for each column.

The downloadable template contains all information required to create the upload files to include required/optional fields, help text, and permissible data types. The following table highlights the data elements required for the NEU Distribution – Eligible NEUs.

Defined Term |

Definition |

Required |

List Values |

Data Type |

Max |

State or Territory |

Name of the state or territory performing the transfer to the NEU (e.g, California, Maine, Maryland) |

Required |

n/a |

String |

20 |

NEU Recipient Number |

A unique identification code for each NEU assigned by the State to the NEU as part of the request for funding (e.g., AZ1003) |

Required |

n/a |

Number |

10 |

NEU/Local Government Name |

Legal name of the NEU organization/local government. |

Required |

n/a |

String |

120 |

NEU/Local Government DUNS Number |

NEU/local government DUNS Number |

Required |

n/a |

Number |

9 |

NEU Taxpayer Identification Number (TIN) |

NEU Taxpayer Identification Number (TIN) |

Required |

n/a |

Number |

9 |

NEU Address 1 |

First line of the NEU organization's address. |

Required |

n/a |

String |

120 |

NEU Address 2 |

Second line of the NEU organization's address. |

Optional |

n/a |

String |

120 |

NEU Address 3 |

Third line of the NEU organization's address. |

Optional |

n/a |

String |

120 |

NEU City |

Name of city in which the NEU organization is located. |

Required |

n/a |

String |

120 |

NEU State |

United States Postal Service (USPS) two-letter abbreviation for the state or territory in which the NEU organization is located. |

Required |

n/a |

String |

2 |

NEU Zip Code |

United States ZIP code (five digits)

|

Required |

n/a |

Number |

5 |

NEU Zip +4 |

United States ZIP code (five digits) concatenated with the additional +4 digits associated with the NEU organization's address. |

Required |

n/a |

Number |

4 |

NEU Email Address |

Email address of the NEU organization. |

Required |

n/a |

String |

120 |

NEU Point of Contact (POC) Name |

Name of a Point of Contact at the NEU. |

Required |

n/a |

String |

120 |

NEU POC Phone Number |

Phone number of the primary Point of Contact for the NEU organization. |

Required |

n/a |

String |

10 |

NEU POC Email |

Email address of the primary Point of Contact for the NEU organization. |

Required |

n/a |

String |

120 |

Authorized Representative Name |

Name of an Authorized Representative of the NEU. If the primary point of contact is also the authorized representative, please provide the name again. |

Required |

n/a |

String |

120 |

Authorized Representative Email |

Email of an Authorized Representative of the NEU. If the primary point of contact is also the authorized representative, please provide the email again. |

Required |

n/a |

String |

120 |

Status |

Eligibility status of a given NEU. Indicate the NEU's status: 1) Action Taken (i.e., the NEU requested funding or declined funding & requested Sec. 603(c)(4) transfer to the state); or 2) Action Not Taken (i.e., the NEU is nonresponsive / declined funding) |

Required |

1) Action Taken (i.e., the

NEU requested funding or declined funding & requested Sec.

603(c)(4) transfer to the state); |

Pick List |

n/a |

Total NEU Budget Reference (original) |

Provide the Total NEU Budget Reference submitted by the NEU as part of its request for funding or Sec. 603(c)(4) transfer to the state |

Required |

n/a |

Dollar Numeric |

12, 2 |

Total NEU Budget Reference (revised, if applicable) |

Provide the revised Total NEU Budget Reference, if revisions were made based on updated NEU Guidance (i.e., updated Treasury guidance on interpretation of the 75 percent budget cap issued on June 30, 2021) |

optional |

n/a |

Dollar Numeric |

12, 2 |

Total Allocation Across 1st and 2nd Tranches (before application of 75 percent cap) |

Provide the Total Allocation Across 1st and 2nd Tranches before application of the 75 percent budget cap |

Required |

n/a |

Dollar Numeric |

12, 2 |

Total Allocation Across 1st

and 2nd Tranches (before application of 75 percent cap) |

Provide the Total Allocation Across 1st and 2nd Tranches (before application of 75 percent budget cap) (first revision, if applicable) |

optional |

n/a |

Dollar Numeric |

12, 2 |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap |

Required |

n/a |

Dollar Numeric |

12, 2 |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (first revision, if applicable) |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (first revision, if applicable) |

optional |

n/a |

Dollar Numeric |

12, 2 |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (second revision, if applicable) |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (second revision, if applicable) |

optional |

n/a |

Dollar Numeric |

12, 2 |

Additional Notes |

Include any additional notes required to explain the NEU distribution summary line items, as applicable |

Optional |

n/a |

String |

400 |

The downloadable template contains all information required to create the upload files to include required/optional fields, help text, and permissible data types. The templates provide all information required to create the upload files. The following table highlights the data elements required for the NEU Distribution - Ineligible.

Defined Term |

Definition |

Required |

List Values |

Data Type |

Max |

State or Territory |

Name of the state or territory performing the transfer to the NEU (e.g, California, Maine, Maryland) |

Required |

n/a |

String |

20 |

NEU/Local Government Name |

Legal name of the NEU organization/local government. |

Required |

n/a |

String |

120 |

NEU/Local Government DUNS Number |

NEU/local government DUNS Number |

Optional |

n/a |

Number |

9 |

Reason for Ineligibility |

Select the rationale for ineligibility: 1) Ineligible MCD (i.e., any Minor Civil Divisions in a "weak-MCD" State that did not meet the facts-and-circumstances test as outlined in Treasury's guidance); or 2) Other. If other, please provide additional explanation in Column E |

Required |

1) Ineligible MCD (i.e.,

any Minor Civil Divisions in a "weak-MCD" State that

did not meet the facts-and-circumstances test as outlined in

Treasury's guidance); |

Pick List |

n/a |

Notes |

Provide an explanation for “Other” ineligibility rationale |

Option |

n/a |

String |

400 |

TEMPLATE 3: NEU Distribution - Transactions

The downloadable template contains all information required to create the upload files to include required/optional fields, help text, and permissible data types. The following table highlights the data elements required for NEU Distribution - Transactions.

Defined Term |

Definition |

Required |

List Values |

Data Type |

Max |

State or Territory |

Name of the state or territory performing the transfer to the NEU (e.g, California, Maine, Maryland) |

Required |

n/a |

String |

20 |

NEU Recipient Number |

A unique identification code for each NEU assigned by the State to the NEU as part of the request for funding (e.g., AZ1003) |

Required |

n/a |

Number |

10 |

NEU/Local Government Name |

Legal name of the NEU organization/local government. |

Required |

n/a |

String |

120 |

NEU/Local Government DUNS Number |

NEU/local government DUNS Number |

Required |

n/a |

Number |

9 |

Transaction ID (assigned by State or Territory) |

Provide the transaction ID, assigned by the State or Territory |

Required |

n/a |

String |

25 |

Transaction Type |

Transaction type (payment or Transfer to State under Section 603(c)(4)) |

Required |

|- Payment; |

Pick List |

n/a |

Transaction Description |

Transaction description of the transaction (e.g., initial payment under First Tranche, subsequent distribution under First Tranche) |

Required |

n/a |

String |

25 |

Transaction Amount |

Transaction amount. Use negative numbers for downward revisions. For transfers to the state under Section 603(c)(4), include the amount of the intended transfer. |

Required |

n/a |

Dollar Numeric |

12,2 |

Date |

Provide the date of the transaction. For transfers to the state under Section 603(c)(4), provide the date that Treasury's transfer form agreement was signed by both parties, not the expected date of Treasury approval. |

Required |

n/a |

Date Numeric (MM/DD/YYYY) |

10 |

Appendix B – Key Terminology

The following table contains key terminology current on the date of release for this user guide. It may be updated as needed.

Term |

Definition |

Actual General Revenue (as of 12 months ended December 31, 2020) |

Actual general revenue as of the twelve months ended December 31, 2020 for the reporting relevant jurisdiction |

Allocation amount |

Provide the amount of funds allocated to the Jurisdiction |

Base Year Revenue |

Base year general revenue (e.g., revenue in the last full fiscal year prior to the public health emergency) |

CFDA No./Assistance Listing No. |

The five-digit number assigned in the awarding document to a Federal Award. |

Congressional District |

A territorial division within a state from which members of the U.S. House of Representatives are elected. This information will automatically populate based on the Recipient organization's zip code +4. |

Cumulative Obligations to Date |

For purposes of reporting in the SLFRF portal, an obligation is an order placed for property and services, contracts and subawards made, and similar transactions that require payment. |

Cumulative Expenditures to Date |

For purposes of reporting in the SLFRF portal, an expenditure is the amount that has been incurred as a liability of the entity (the service has been rendered or the good has been delivered to the entity). |

Dollar value of evidence-based interventions |

The dollar value of the total project spending that is allocated for evidence-based interventions for each project in the following expenditure category groups: Public Health (EC1); Negative Economic Impacts (EC2); and Services to Disproportionately Impacted Communities (EC3) |

Estimated Revenue Loss Due to Covid-19 Public Health Emergency |

Estimated revenue loss due to the Covid-19 public health emergency as of December 31, 2020 |

FAIN |

The Federal Award Identification Number (FAIN) is the unique identifying number assigned to all financial assistance awards or grants. |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (first revision, if applicable) |

Final Allocation Across 1st and 2nd Tranches after application of the 75 percent budget cap (first revision, if applicable) |

Fiscal Year End Date |

Fiscal year end date for the State, U.S. Territory, Metropolitan city, County, or Tribe |

Funding Amount $ |

Amount funded for this project |

Growth Adjustment Used |

Equal to the greater of 4.1 percent (or 0.041) and the recipient’s average annual revenue growth over the three full fiscal years prior to the COVID–19 public health emergency. |

How revenue replacement funds were allocated to government services |

An explanation of how revenue replacement funds were allocated to government services |

Indicate that Fiscal Recovery Funds were not used to make a deposit in a pension fund |

Indicate that Fiscal Recovery Funds were not used to make a deposit in a pension fund (Yes or No) |

Initial Allocation Across 1st and 2nd Tranches (before application of 75 percent cap) |

Provide the Total Allocation Across 1st and 2nd Tranches before application of the 75 percent budget cap |

Jurisdiction Name |

Jurisdiction Recipient Name |

Jurisdiction Recipient Number |

Include the Jurisdiction Recipient Number assigned by the State to the Jurisdiction (e.g., AZ0013) |

Non-entitlement units of local government (NEUs) |