1220_0163_Supporting Statement Part B_2022-2024_Feb10_2022

1220_0163_Supporting Statement Part B_2022-2024_Feb10_2022.docx

Consumer Price Index Housing Survey

OMB: 1220-0163

Consumer Price Index Housing Survey

OMB Number 1220-0163

OMB Expiration Date: May 31, 2022

SUPPORTING STATEMENT FOR

Consumer

Price Index Housing Survey

OMB Control No. 1220-0163

B. COLLECTION OF INFORMATION EMPLOYING STATISTICAL METHODS

Starting in January 2018 and continuing into 2022, the CPI Housing Survey sample used 75 geographic areas or Primary Sampling Units (PSUs) nationwide to be the boundaries from which rental housing units were selected based on 2010 Census data. Technical details of the sample design and estimation procedures of the Consumer Price Index are provided in the BLS Handbook of Methods, as well as "Redesigning the Consumer Price Index Area Sample" by Johnson, Shoemaker and Rhee, from the 2002 ASA Proceedings, and “The 2018 revision of the Consumer Price Index geographic sample” by Paben, Johnson, and Schilp from the October 2016 Monthly Labor Review. A copy of the CPI section of the BLS Handbook of Methods (Attachment VIII) and the October 2016 Monthly Labor Review (Attachment IX) are included.

Describe (including a numerical estimate) the potential respondent universe and any sampling or other respondent selection methods to be used. Data on the number of entities (e.g., establishments, State and local government units, households, or persons) in the universe covered by the collection and in the corresponding sample are to be provided in tabular form for the universe as a whole and for each of the strata in the proposed sample. Indicate expected response rates for the collection as a whole. If the collection had been conducted previously, include the actual response rate achieved during the last collection.

The universe for the CPI Housing Survey consists of all urban rental-housing units used as primary residences. The number of year-round rental-housing units in the universe is approximately 45 million units.* These units are estimated as follows:

Renters 42,036,000

Vacant 2,855,000

* Source: Table 11. Estimates of the Total Housing Inventory for the United States: 2020, Housing Vacancies and Homeownership (CPS/HVS), U. S. Census Bureau.

The Rent index measures changes in rents paid by tenants and received by landlords adjusted for changes in quality. The Owners’ Equivalent Rent index (OER) measures the change in the implicit rent for owner-occupied housing. The implicit rent is the amount the homeowner would pay to rent, or earn from renting his/her home in a competitive market. It is for the construction of these indexes that a sample is selected and information gathered. The current sample based on the 2010 Census uses approximately 8,600 segments with five units per segment, or, 43,000 rental units in 75 PSUs.

2. Describe the procedures for the collection of information including:

Statistical methodology for stratification and sample selection,

Estimation procedure,

Degree of accuracy needed for the purpose described in the justification,

Unusual problems requiring specialized sampling procedures, and

Any use of periodic (less frequent than annual) data collection cycles to reduce burden.

The collection instruments for computer-assisted data collection (CADC) are found in Attachment II.

2. a. Description of Sampling Methodology

A

multi-stage sampling process is used in the CPI. For Housing the

main steps are:

(1) the sampling of geographic areas

(segments);

(2) configuration and weighting of selected

segments;

(3) the purchase of coded addresses for selected

segments;

(4) the elimination of addresses with a very high

probability of being owners, addresses that can be identified as

commercial and post office boxes, and ineligible public housing

units;

(5)

the sampling of specific addresses in the segments;

(6) the

telephone/personal visit screening and initiation of eligible

addresses from which rent prices will be followed over time.

In housing, about 1/6 of the sample rotates each year, with rotation occurring each month.

2. b. Description of Estimation Methodology

The CPI-U and CPI-W are defined as fixed quantity price indexes, and are the ratio of the cost of purchasing a set of items of constant quality and constant quantity in two different time periods. The published CPI for the Rent and Owners’ Equivalent Rent (OER) strata uses a Laspeyres estimator.

The

Laspeyres index,

,

where t is the comparison period for which a new index will be

calculated and 0 the reference period, can be denoted by:

,

where t is the comparison period for which a new index will be

calculated and 0 the reference period, can be denoted by:

where:

is the price for the ith item in comparison period t,

is the price for the ith item in comparison period t,

is the price for the ith item in reference period 0,

is the price for the ith item in reference period 0,

is the quantity of the ith item consumed in the reference

period 0.

is the quantity of the ith item consumed in the reference

period 0.

The indexes for the Rent and OER strata are specifically calculated as follows:

Let

be the set of rental units interviewed in the Housing survey in

time t in a market basket with valid comparable rents in both

time t and t-6. Vacant units that were previously

renter occupied are also included in

be the set of rental units interviewed in the Housing survey in

time t in a market basket with valid comparable rents in both

time t and t-6. Vacant units that were previously

renter occupied are also included in

and

have current (t) and previous (t-6) month's rents

assigned using a vacancy imputation process. Non-interviewed units

that were previously renter occupied are also included in

and

have current (t) and previous (t-6) month's rents

assigned using a vacancy imputation process. Non-interviewed units

that were previously renter occupied are also included in

and

have current (t) and previous (t-6) month's rents

assigned using a non-interview imputation process. Let the rent for

rental unit i in time t be

and

have current (t) and previous (t-6) month's rents

assigned using a non-interview imputation process. Let the rent for

rental unit i in time t be

and

let

and

let

be a

factor that adjusts for the estimated small loss in quality due to

the aging it experienced between t-1 and t. The

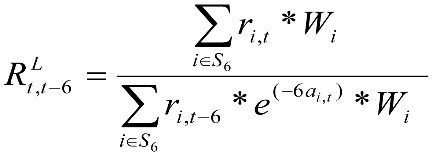

6-month estimate of rent change is calculated by:

be a

factor that adjusts for the estimated small loss in quality due to

the aging it experienced between t-1 and t. The

6-month estimate of rent change is calculated by:

where:

![]() is the inverse probability of selection adjusted for non-response for

renter unit i.

is the inverse probability of selection adjusted for non-response for

renter unit i.

Using

and

the index for the previous month,

and

the index for the previous month,

, the

BLS computes the current month's rent index,

, the

BLS computes the current month's rent index,

, as

follows:

, as

follows:

The final Rent and OER indexes for month t for each market basket are last month's index times the sixth root of the 6-month estimate of rent change.

The rents for renters are obtained directly. The basic weights for Rent and OER were computed with the initiation of the sample design. Recent research by Adams and Verbrugge (2021) reveals that OER should be weighted so that the type of structure (that is, single family versus multi-unit) is more closely aligned with five-year American Community Survey (ACS) data. To that end, BLS is currently pursuing the adjustment of unit-level weights so that it better represents owner-occupied inflation.

2. c. Degree of Accuracy Required

The statute mandating the CPI does not specify a required precision or accuracy for the index. However, the BLS does provide measures of the standard error for the All U.S. CPI (CPI-U) and for the Northeast, Midwest, South and West Regions CPI (CPI-U). The most recent standard error data can be viewed at https://www.bls.gov/cpi/tables/variance-estimates/home.htm. The BLS also requires that the precision of the CPI be maximized given the total cost. The allocation of the Rent sample was optimized given a fixed cost constraint with the stipulation that the variances of the Rent Index and the Owners' Equivalent Rent index be approximately equal.

For example, the estimate of the CPI-U median standard error for 12-month intervals from January 2020 through December 2020 was 0.15 for Rent of Primary Residence; and 0.15 for Owners’ Equivalent Rent of Residences.

2.d. Special Sampling Procedures

Data are collected from the first day to the last day of the reference month. For example, data for the January index are collected during January 1 through 31.

2.e. Use of Periodic Data Collection Cycles

The rental units in the CPI survey are divided into 6 subsamples, called panels. Each month one panel (one-sixth of the renter units) is collected. For example, panel 1 is collected each January and July, and panel 2 is collected each February and August. Collecting each panel twice a year reduces the burden on each respondent.

3. Describe methods to maximize response rates and to deal with issues of non-response. The accuracy and reliability of information collected must be shown to be adequate for intended uses. For collections based on sampling, a special justification must be provided for any collection that will not yield "reliable" data that can be generalized to the universe studied.

The Bureau of Labor Statistics has constantly engaged in research to improve the quality of the data collected and used in the CPI Housing indexes. The CPI collects data in a sample of 75 metropolitan areas called Primary Sampling Units. The majority of the current sample, 43,000 rental units, were selected based on 2010 Census data.

The survey design for the new sample of rented units has an important feature: Commercially available address lists are used in place of a labor-intensive manual listing process, resulting in significant cost savings. A vendor supplies these addresses for each newly-created segment. For each address the vendor provides codes indicating that address’s probability of being owner occupied. Since owners are out of scope for the Housing Survey, addresses that are most certainly owners are removed. Addresses that can be identified as commercial and post office boxes are also removed. Once commercial and owner occupied addresses are removed, SMD samples the remaining set of units to be sent out for initiation. These addresses are screened by the field using property tax records for varying municipalities to further remove owner-occupied housing from the CPI rental sample.

The BLS utilizes several techniques to ensure that adequate sample sizes and response rates are maintained for estimating the CPI. Initial sample sizes are larger than the desired sample sizes to cover non-responses, e.g., refusal, unable to locate, housing units that convert to owner occupied, non-contact, and also hard-to-reach, among other reasons. Response rates are tracked, and, once sample sufficiency is met, screening ceases within the area.

Additionally, Economic Assistants who collect the data are trained to obtain complete address and telephone information for all possible eligible respondents--tenants, managers or authorized respondents--in order to complete the survey. Any potential respondent may be contacted by telephone or in person at any time during the index collection month time period. In 2020, 57.5% of attempted units reported rent; 30.6% of units did not respond; 3.9% of units were reported as vacant; 8.1% of units are not used in estimation*.

* Source: 2020 Response Rates for the Consumer Price Index, 2020, Bureau of Labor Statistics. https://www.bls.gov/cpi/tables/response-rates/home.htm.

In the CPI Housing survey, imputations are employed for two different cases: one is for non-responding units and the other is for vacant units. For non-responding units, a current price is imputed based on the movements of other units within the PSU. Units that are reported as vacant have rents imputed for them as well. Rents for newly vacant units, that have become vacant within the previous six months, are imputed using rent changes for responding units that have been occupied by the current tenant for six months or less. Rents for longer term vacant units are imputed using responding changes for units that have been occupied by the current tenant for longer than six months. For both cases, group-mean imputation is used.

4. Describe any tests of procedures or methods to be undertaken. Testing is encouraged as an effective means of refining collections of information to minimize burden and improve utility. Tests must be approved if they call for answers to identical questions from 10 or more respondents. A proposed test or set of test may be submitted for approval separately or in combination with the main collection of information.

In FY22 Q3, the CPI is planning to conduct a pilot program for completing Housing reinterviews via USPS-mailed letters. Housing reinterviews are conducted to evaluate the quality of the work performed by our data collection staff. The pilot is intended to enhance the response rate for our quality program which is currently conducted via telephone. The letters will be mailed to a small subset of respondents, and we anticipate sending up to 2,000 total letters during the pilot project. These letters will replace up to 2,000 telephone contacts normally made as part of our quality program.

The letters were developed with input from our Office of Survey Methods Research cognitive group. Attachments XIVa-XIVd. Housing Reinterview Letter Pilot represent the letter versions that will be used. The two primary differences in the letters are the format of the rent question (open ended or multiple choice) and the request for contact information (requested or not). The different versions are used to gauge impacts on response rates and the pilot will split the letters evenly across the four (4) versions.

5. Provide the name and telephone number of individuals consulted on statistical aspects of the design and the name of the agency unit, contractor(s), grantee(s), or other person(s) who will actually collect and/or analyze person(s) who will actually collect and/or analyze the information for the agency.

Robert A. Cage, Assistant Commissioner for Consumer Prices and Price Indexes (telephone 202-691-6950) is the CPI program manager and has overall responsibility for the CPI. Robert G. Poole, Division of Price Statistical Methods in the Office of Prices and Living Conditions of the BLS (telephone: 202-691-6910) have reviewed and approved the statistical methodology for the survey design. The Office of Field Operations of the BLS will collect all data. The data will be processed by the Division of Consumer Price Computer Systems of the Directorate of Survey Processing of the Office of Technology and Survey Processing of BLS. The Branch of Consumer Prices analyze the data.

OMB Supporting Statement Attachments:

Code of Laws—Title 29

Screen Shots—Collection Instrument for Housing

Housing Survey Brochure and fact sheet (English)

Housing Survey Brochure and fact sheet (Spanish)

Housing Introductory Letter (Sample)

Housing Screening Letter (potential renter)

Housing Screening Letter (seasonal rental)

Consumer Price Index

https://www.bls.gov/opub/hom/cpi/pdf/cpi.pdf

Steven P. Paben, William H. Johnson, John F. Schilp. “The 2018 revision of the Consumer Price Index geographic sample”. Monthly Labor Review, October 2016.

https://www.bls.gov/opub/mlr/2016/article/the-2018-revision-of-the-CPI-geographic-sample.htm

Housing Shuttle Form – Long Pricing

Housing Shuttle Form – Short Pricing

Modernizing Data Collection: APIs & Web Scraping

Modernizing Data Collection: Corporate Data

XIVa. CPI Housing Reinterview Pilot v1 – Contains the open-ended rent question but it does not include a request for additional contact information

XIVb. CPI Housing Reinterview Pilot v2 - Contains the open-ended rent question and a request for additional contact information at the end)

XIVc. CPI Housing Reinterview Pilot v3 – Contains a multiple choice rent question which includes the original collected rent but it does not include a request for additional contact information

XIVd. CPI Housing Reinterview Pilot v4 – Contains a multiple choice rent question which includes the original collected rent as well as a request for additional contact information at the end

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Nora Kincaid |

| File Modified | 0000-00-00 |

| File Created | 2022-03-17 |

© 2026 OMB.report | Privacy Policy