CMS - 10794 - Supporting Statement Final

CMS - 10794 - Supporting Statement Final.docx

Estimation of Improper Payments of the Advanced Payment of Premium Tax Credit (APTC) in State Exchanges under the Affordable Care Act (CMS-10794)

OMB: 0938-1416

Supporting Statement – Part A

Estimation of Improper Payments of the Advanced Payment of Premium Tax Credit (APTC) in State Exchanges under the Affordable Care Act

Supporting Statement for Paperwork Reduction Act Submissions

A. Background

45 CFR, part 155, subpart P State Exchange Improper Payment Measurement (SEIPM) program (see, CMS-9911-P) will set forth the requirements for the SEIPM program. SEIPM program is the process for determining estimated improper payments and other information required under the Payment Integrity Information Act of 2019 (PIIA), and implementing guidance, for advance payments of the premium tax credit (APTC), which includes a review of a state Exchange’s determinations regarding eligibility for and enrollment in a qualified health plan; the calculation of APTCs; redeterminations of eligibility determinations during a benefit year; and annual eligibility redeterminations. As part of the SEIPM program, CMS will require the state Exchanges to submit data and, to facilitate this, CMS is creating an SEIPM data request process. To facilitate that process, we are developing a SEIPM data request form that we will use to compile information from each state Exchange in an ongoing manner. (See attachment NPRM CMS-9911-P) Under paragraph (a) of § 155.1510 CMS will request a state Exchange to provide pre-sampling data to associate the units to be sampled with all policy identification numbers that received an APTC within the benefit year under review, and to associate specific types of inconsistencies with those units where applicable. Paragraph (b) indicates that the sampled unit data we are requesting from state Exchanges will provide CMS with information regarding various state Exchange functions, e.g., electronic verifications, manual reviews of data matching inconsistencies, special enrollment period verifications, eligibility determinations, redeterminations, enrollment reconciliation, and plan management. To ensure the necessary data are available for estimation, the U.S. Department of Health and Human Services’ (HHS) Centers for Medicare & Medicaid Services (CMS) proposes an integrated set of streamlined and standardized collection instruments and an associated process to ensure consistent, accurate data across all State Exchanges.

Annually, the state Exchange must provide eligibility and enrollment information for the purpose of drawing a sample, and eligibility and enrollment information for the purpose of conducting reviews and measuring the improper payments of the selected sample.

B. Justification

1 . Need and Legal Basis

This collection of information is needed to support the SEIPM program (CMS-9911-P, RIN 0938-AU65). The collection is necessary so that CMS can identify errors made by the state Exchanges in determining eligibility and enrollment that resulted in improper payments of APTCs. The APTC program has been identified as susceptible to significant improper payments and consequently CMS is required to administer an improper payment measurement program for each state Exchange.

As such, CMS requires data from the state Exchanges that will be used to directly support the process of measuring improper payment rates for state Exchanges. The SEIPM data request form is the mechanism through which that information will be collected. The information requested in the SEIPM data request form will be collected in two phases. The first phase consists of the pre-sampling data request. The second phase consists of the sampled unit data.

Specifically, the information being requested is necessary for identifying the sampling frame and then subsequently selecting a random sample. In addition, the data is necessary for determining whether each associated payment was paid properly and to ultimately calculate an improper payment rate. The sampled unit data submitted by a State Exchange is used by HHS to make an initial error findings decision for that State Exchange. A State Exchange can request redetermination of an error findings decision, and can also appeal the redetermination decision to CMS. After all redeterminations and appeals are completed, a final error findings decisions is issued to the State Exchange. These final error findings decisions are used in calculating an aggregated annual State Exchange improper payment rate across all State Exchanges, which is published in the Annual Financial Report. Based on a State Exchange’s error rate for a given benefit year, HHS, in its reasonable discretion, may require the State Exchange to develop and submit a corrective action plan to correct errors resulting in improper payments.

2. Information Users

CMS and its contractors will use the information collected from the state Exchanges to ensure a statistically sound sampling methodology, to complete reviews of eligibility and enrollment on all cases sampled, and to calculate an improper payment rate. Results will be communicated to the state Exchanges to aid in identifying the root causes of improper payments so that state Exchanges can develop and implement a plan for reduction of such payments. A summary of improper payments information must also be included in the Agency Financial Report (AFR) as required by the PIIA.

3. Use of Information Technology

CMS will provide the SEIPM data request form electronically to the State Exchanges. The form will be a spreadsheet that each State Exchange must complete. The State Exchanges will export data from their existing IT systems in the specified format, into the spreadsheet. The specific method for extraction will vary depending on each State Exchange’s source data. The State Exchanges currently participating in SEIPM engagement with CMS are able to submit all data electronically, and we expect this to be the case with all states. If any states have certain data are only available as hard copy, the State Exchange may need to convert paper documentation to an electronic format for transmission to CMS; however adjustment of format is expected to be an extremely rare occurrence.

4. Duplication of Efforts

This information collection does not duplicate any other effort and the information cannot be obtained from any other source. State Exchanges are responsible for processing new applications and annual renewals for health plans, and the pertinent data is either new or updated each year. CMS does not collect or have access to this data. Although the IRS may have some data, federal law at 26 IRC § 6103 prohibits the IRS from disclosing this data.

5. Small Businesses

The collection of information does not impact small businesses or other small entities.

6. Less Frequent Collection

State Exchanges are responsible for processing new applications and annual renewals for health plans, and the pertinent data is either new or updated each year. As such, CMS cannot meet the requirements of PIIA as implemented by the SEIPM program without collecting this information annually.

7. Special Circumstances

No special circumstances apply.

8. Federal Register/Outside Consultation

This collection of information is proposed in Patient Protection and Affordable Care Act; HHS Notice of Benefit and Payment Parameters for 2023, CMS-9911-P, RIN 0938-AU65.

CMS has worked directly with State Exchanges and other stakeholders in developing the SEIPM data request form and associated procedures. CMS piloted elements of the program with participating State Exchanges and held outreach sessions with them to gather feedback.

9. Payments/Gifts to Respondents

CMS will not provide any payment or gift to respondents associated with this reporting requirement.

10. Confidentiality

CMS contracts include a non-disclosure section that assures the information provided by respondents remains confidential.

11. Sensitive Questions

No questions of a sensitive nature are asked.

12. Burden Estimates (Hours & Wages)

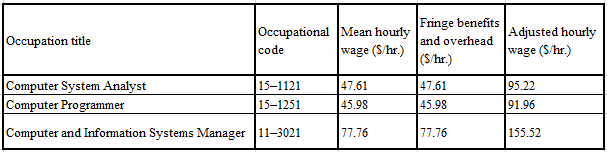

CMS used the May 2020 Bureau of Labor Statistics’ wage estimates available at (https://www.bls.gov/oes/current/oes_nat.htm) as the basis for standard mean hourly wages to calculate the burden costs. This mean hourly wage is adjusted by a factor of 100 percent to include fringe benefits. Table 1 shows the occupations used in this burden estimate.

TABLE 1—Adjusted Hourly Wages Used in Burden Estimates

|

There are currently 18 State Exchanges that would be subject to the proposed data collection. Table 2 shows the overall estimated annual burden for the data collection, totaling $1,339,523 for the 18 State Exchanges that are currently in operation. The adjusted hourly wage is taken from Table 1. The estimated burden takes into account the expected effort to complete each required section of the form, including pre-sampling, verification and eligibility, auto re-enrollment, periodic data matching, enrollment reconciliation, plan management, and manual review data. These are all interrelated components of the single data collection. We estimate completion of the pre-sampling data request would take 12 hours per respondent at an estimated $1,364 each. We estimate completion of the sampled unit data request would take 707 hours per respondent at an estimated cost of $73,054 per respondent. To compile our estimates, we referenced our experience in collecting data in our FFE pilot initiative. We identified specific personnel and the number of hours that would be involved in collecting the sampled unit data broken down by specific area (for example, eligibility verification, auto re-enrollment, periodic data matching, enrollment reconciliation, plan management, and manual reviews including document retrieval). We expect respondent costs will not substantially vary since the data being collected is largely in a digitized format and that each State Exchange will be providing information for approximately 100 sampled units. The total burden estimate across all 18 State Exchanges is $1,339,523.

TABLE 2—Proposed Annual Recordkeeping and Reporting Requirements

This data collection will impose a limited burden on the State Exchanges The burden is the result of the implementation of the SEIPM program for the State Exchanges to meet the requirements of the Payment Integrity Information Act of 2019. The burden will vary by state, depending on the specific characteristics of their systems of record, however, as stated above, we do not anticipate that the burden costs will vary substantially since the data being collected is largely in a digitized format. The burden is limited to extracting data already required to be maintained by the State Exchanges and providing same to CMS in specified formats.

13. Capital Costs

There are no capital costs for this data collection which uses existing systems and software.

14. Cost to Federal Government

Under the SEIPM program, CMS

employees will be necessary to perform oversight functions related to

the sampling and review. CMS’s oversight activities related to

this program are as follows: oversight of the statistical contractor,

oversight of the review contractor and other duties as assigned.

TABLE 3—Projected Costs to Federal Government

![]()

15. Changes to Burden

Not applicable

16. Publication/Tabulation Dates

Plan for tabulation and publication of SEIPM results

The SEIPM review cycle occurs over a repeating three-year period with each year designated as follows:

-

Year 1

Plan Year

Year 2

Measurement Year

Year 3

Reporting Year

Process Steps:

During the Plan Year of each SEIPM review cycle, State Exchanges transmit policy and payment data in their normal course of business as part of the monthly State-Based Marketplace Inbound (SBMI) process. These data are already available to CMS and do not require an additional data collection. These data will be used by CMS in preparing the SEIPM data request form.

At approximately midway through the Plan Year, CMS will provide to the State Exchanges instructions for assembly of the SEIPM data request form.

During the first quarter of the Measurement Year, the State Exchanges will be asked to assemble and submit the pre-sampling data. CMS and its contractors will use the data provided to select a sample and provide a list of sampled units to each State Exchange.

Upon receipt of the list of sampled units, State Exchanges will be asked to extract the required supporting detail information from their eligibility and enrollment system(s) and return the sampled unit data to the CMS review contractor for analysis and reporting. CMS will provide a report of error findings to the State Exchange, which may request redetermination of the error findings.

During the Reporting Year of the SEIPM review cycle, in accordance with the schedule for producing the Agency Financial Reports for HHS, CMS will post to the HHS Agency Financial Reports website an improper payment amount and rate for State Exchanges in aggregate. The first publication is expected to occur in 2025.

Project time schedule, information collection dates, reporting, and publication

The SEIPM program anticipates beginning operations in 2023 and continuing operations until the program is replaced or terminated.

The program anticipates collecting information from each State Exchange on an annual basis in two phases during the Measurement Year: pre-sampling data in the first quarter and sampled unit data in the second quarter. The timing of the information collection may change depending on various factors including external factors such as State Exchange IT systems, natural disasters, weather events, flu or virus outbreaks, etc.

-

SEIPM Program

2023

Plan Year

2024

Measurement Year

2025

Reporting Year

Operations

Begin in Spring 2023

Ongoing

Ongoing

Information Collection

Annually

Q1: Phase 1 Pre-sampling Data

Q2: Phase 2 Sampled Unit Data

AFR Submission Date

Annually

NLT October

AFR Publication Date

Annually

November

The cycle above will repeat with each subsequent year becoming the most current Plan Year.

17. Expiration Date

Expiration date: Three years from the approval date

OMB Control Number: TBD

18. Certification Statement

There are no exceptions to the certification statement identified in Item 19, "Certification for Paperwork Reduction Act Submissions," of OMB Form 83-I.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Peter Calhoun |

| File Modified | 0000-00-00 |

| File Created | 2022-01-22 |

© 2026 OMB.report | Privacy Policy