Integrated Postsecondary Education Data System (IPEDS) 2022-23 through 2024-25

Integrated Postsecondary Education Data System (IPEDS) 2022-23 through 2024-25

Student Financial Aid Package 2022-23 through 2024-25_30

Integrated Postsecondary Education Data System (IPEDS) 2022-23 through 2024-25

OMB: 1850-0582

Integrated Postsecondary Education Data System (IPEDS) 2022-23 through 2024-25

Student Financial Aid (SFA)

OMB No. 1850-0582 v.30

Submitted by:

National Center for Education Statistics (NCES)

Institute of Education Sciences

U.S. Department of Education

February 2022

Student Financial Aid Package 2022-23 through 2024-25 Data Collections

Contents

Student Financial Aid Package 2022-23 through 2024-25 Data Collections 1

Academic & Program Reporters with Undergraduate Students 2

Questions with varied applicability 2

Years that change across the 3 years of clearance 2

Student Financial Aid Screens for Institutions Reporting on a Fall Cohort (Academic Reporters) 4

Student Financial Aid Screens for institutions with Graduate Students only 32

Student Financial Aid Instructions for Institutions With Graduate Students Only 64

Student Financial Aid FAQ for All Institutions 66

Changes for 2022-23

Throughout

the materials, additions are indicated in red,

deletions are indicated in red

strikethrough.

Questions with varied applicability

Some questions are not applicable to all institutions. Please see the table below for information. In the materials below, variability is indicated with [purple].

Academic Reporters form |

|

Part A., Part C Page 2., Part D, Part E. |

Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only

|

Part C. Page 1. |

Applicable to public institutions only |

Cost of Attendance, Net Price Calculation for Group 3, Net Price Calculation for Group 4 |

In-district, In-state, and Out-of-State breakdowns applicable to public institutions only |

Public Reporters Form |

|

Part A., Part C Page 2., Part D, Part E. |

Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only |

Years that change across the 3 years of clearance

Dates change for some elements depending on the collection year. Please see the table below for information. Dates currently included throughout the materials are for the 2022-23 data collection and are highlighted in green.

Academic Reporters form |

|

Parts A., B., C., D., E. |

Most recent Fall Collection Year 2022-23: Fall 2021 Collection Year 2023-24: Fall 2022 Collection Year 2024-25: Fall 2023 Prior Fall Collection Year 2022-23: Fall 2020 Collection Year 2023-24: Fall 2020 Collection Year 2024-25: Fall 2022 |

Part B., C (p. 2)., D., E. |

Academic year Collection Year 2022-23: 2021-22 Collection Year 2023-24: 2022-23 Collection Year 2024-25: 2023-24 |

Cost of attendance, Parts D., E., F., G. |

3 years of data Collection Year 2022-23: 2019-20, 2020-21, 2021-22 Collection Year 2023-24: 2020-21, 2021-22, 2022-23 Collection Year 2024-25: 2021-22, 2022-23, 2023-24 |

Program Reporters form |

|

Part A. |

Most recent reporting period for enrollment Collection Year 2022-23: July 1, 2021-June 30, 2022 Collection Year 2023-24: July 1, 2022-June 30, 2023 Collection Year 2024-25: July 1, 2023-June 30, 2024 Prior year reporting period Collection Year 2022-23: 2020-2021 Collection Year 2023-24: 2021-2022 Collection Year 2024-25: 2022-2023 |

Part B., C (p. 2)., D., E. |

Period for aid awarded Collection Year 2022-23: July 1, 2021-June 30, 2022 Collection Year 2023-24: July 1, 2022-June 30, 2023 Collection Year 2024-25: July 1, 2023-June 30, 2024 Academic year Collection Year 2022-23: 2021-22 Collection Year 2023-24: 2022-23 Collection Year 2024-25: 2023-24 |

Part C (p. 2) |

Period for aid awarded Collection Year 2022-23: July 1, 2021 through June 30, 2022 Collection Year 2023-24: July 1, 2022 through June 30, 2023 Collection Year 2024-25: July 1, 2023 through June 30, 2024 |

Cost of attendance, Parts D., E., F., G. |

3 years of data Collection Year 2022-23: 2019-20, 2020-21, 2021-22 Collection Year 2023-24: 2020-21, 2021-22, 2022-23 Collection Year 2024-25: 2021-22, 2022-23, 2023-24 |

All Forms |

|

Section II |

Post-9/11 GI Bill Benefits Collection Year 2022-23: July 1, 2021 - June 30, 2022 Collection Year 2023-24: July 1, 2022 - June 30, 2023 Collection Year 2024-25: July 1, 2023 - June 30, 2024 Department of Defense Tuition Assistance Program Collection Year 2022-23: October 1, 2021 - September 30, 2022 Collection Year 2023-24: October 1, 2022 - September 30, 2023 Collection Year 2024-25: October 1, 2023 - September 30, 2024 |

Student Financial Aid Screens for Institutions Reporting on a Fall Cohort (Academic Reporters)

Overview

IPEDS Student Financial Aid Component Overview – Academic Reporters

Welcome to the Student Financial Aid (SFA) component. The purpose of the SFA component is to collect information about financial aid provided to various groups of undergraduate students and military/veteran educational benefits for all students at your institution.

Data Reporting Reminders:

Report data to accurately reflect the time period corresponding with the IPEDS survey component, even if such reporting is seemingly inconsistent with prior-year reporting.

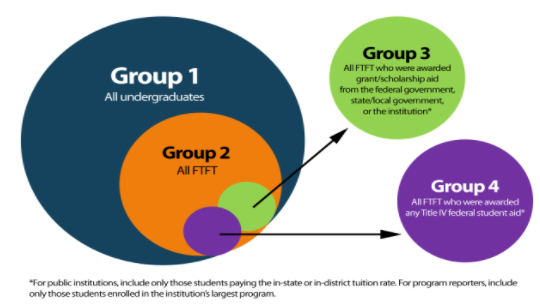

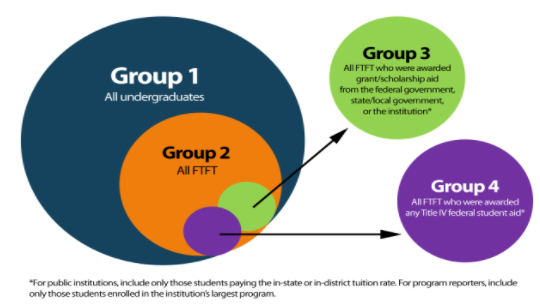

Undergraduate Student Groups

You will be asked to report information for different groups of students.

Group 1: All undergraduate students

Group 2: Of Group 1, full-time, first-time degree/certificate-seeking students (FTFT)

Group 3: Of Group 2, FTFT students who paid the lower of in-state/in-district tuition rate and were awarded any grant/scholarship aid from the federal government, state/local government, or the institution

Group 4: Of Group 2, FTFT students who paid the lower of in-state/in-district tuition rate and were awarded any Title IV federal student aid

COA Revisions

Revisions to Cost of Attendance (COA) used to calculate the net price of attendance can be made in this component.

Consult the instructions and screens to make sure you are reporting the correct aid amounts for the correct groups of students.

College Affordability and Transparency Lists

Net price amounts calculated in SFA will be used to populate the U.S. Department of Education’s College Affordability and Transparency lists.

Interactive Edits and Error Messages

SFA contains interactive edits that will check for blank fields, invalid values, or values that fall outside expected ranges. Some error messages will require you to confirm or explain the values that you entered. Some error messages are fatal and will require you to contact the IPEDS Help Desk at (877) 225-2568 for resolution.

Context Boxes

You will find optional text boxes throughout SFA. Context boxes allow you to provide more information about the data you enter. Some of these context boxes may be made available to the public on College Navigator, so make sure that the information you enter can be understood easily by students, parents, and the general public.

Changes in reporting:

The following changes were implemented for the 2022-23 data collection period:

Degree/certificate-seeking and non-degree/certificate-seeking data items were added in Parts A and B to disaggregate financial aid award amounts reported in Part B by these student categories.

New FAQs were added to clarify concepts.

Minor wording changes were made for clarification.

Resources:

To download the survey materials for this component: Survey Materials

If you have questions about completing this survey, please contact the IPEDS Help Desk at 1-877-225-2568.

Section 1: Part A

Part A - Establish Your Groups [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Reporting Reminders:

Part A establishes the number of students in various groups. Note that the numbers on this screen will be carried forward to other parts of the Student Financial Aid component.

In the fields below, report the number of students in each of the following groups.

|

Fall 2021 |

YOUR PRIOR YEAR DATA |

||

Fall 2020 |

||||

01 |

Group 1 All undergraduate students |

|

|

|

|

01a |

Of those in Group 1, those who are degree/certificate-seeking |

|

|

|

01b |

Of those in Group 1, those who are non-degree/certificate-seeking (Line 01 – Line 01a) |

|

|

02 |

Group 2 Of those in Group 1, those who are full-time, first-time degree/certificate-seeking |

|

|

|

|

02a |

Of those in Group 2, those who were awarded any Federal Work Study, loans to students, or grant or scholarship aid from the federal government, state/local government, the institution, or other sources known to the institution |

|

|

|

02b |

Of those in Group 2, those who were awarded any loans to students or grant or scholarship aid from the federal government, state/local government, or the institution |

|

|

03 |

Group 3 Of those in Group 2, those paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the federal government, state/local government, or the institution |

|

|

|

04 |

Group 4 Of those in Group 2, those paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid |

|

|

|

Section 1: Part B

Reporting Reminders:

Group 1 students are ALL undergraduate students (including first-time students) enrolled in Fall 2021.

For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

All undergraduate students enrolled in Fall 2021 for the 2021-22 academic year as defined by the institution

Grant or scholarship aid from:

federal government

state/local government

the institution

other sources known to the institution

Loans to students from:

the federal government

In the fields below, report the number of Group 1 students and the total amount of aid awarded to these students for each type of aid.

|

Information from Part A |

Fall 2021 |

|

|

|

|

|

|||||||

|

Group 1: All undergraduate students (This number is carried forward from Part A, Line 01.) |

|

|

|

|

|

|

|||||||

|

Of those in Group 1, those who are degree/certificate-seeking (This number is carried forward from Part A, Line 01a.) |

|

|

|

|

|

|

|||||||

|

Of those in Group 1, those who are non-degree/certificate-seeking (This number is carried forward from Part A, Line 01b.) |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

Aid Type |

2021-22 |

|||||||||||||

All undergraduate students (Group 1) |

All degree/certificate-seeking undergraduates |

All non-degree/certificate-seeking undergraduates |

||||||||||||

Number of students awarded aid |

Percentage of students receiving aid |

Total amount of aid awarded |

Average amount of aid awarded (Col. 3/Col. 1) |

Number of students awarded aid |

Percentage of students receiving aid |

Total amount of aid awarded |

Average amount of aid awarded (Col. 7/Col. 5) |

Number of students awarded aid (Col. 1 – Col. 5) |

Percentage of students receiving aid |

Total amount of aid awarded (Col. 3 – Col. 7) |

Average amount of aid awarded |

|||

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

Col. 5 |

Col. 6 |

Col. 7 |

Col. 8 |

Col. 9 |

Col. 10 |

Col. 11 |

Col. 12 |

|||

01 |

Grant or scholarship aid from the federal government, state/local government, the institution, and other sources known to the institution (Do NOT include federal student loans) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02 Federal Pell Grants |

|

|

|

|

|

|

|

|

|

||||

03 |

Federal student loans |

|

|

|

|

|

|

|

|

|||||

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part C, Page 1

Part C, Page 1 - Enter Information about Group 2 [Applicable to public institutions only]

Reporting Reminders:

Group 2 students are all full-time, first-time degree/certificate-seeking undergraduate students enrolled in Fall 2021.

In the fields below, report the number of Group 2 students paying in-district, in-state, and out-of-state tuition rates. If your institution does not offer different rates, report all students as paying in-state tuition rates.

-

Information from Part A

Fall 2021

Group 2: Full-time, first-time degree/certificate-seeking undergraduates

(This number is carried forward from Part A, Line 02)

-

Group 2 students:

YOUR PRIOR YEAR DATA

Fall 2021

Fall 2020

Number of Group 2 students

Percentage of Group 2 students

Percentage of Group 2 students

01

01a

paying in-district tuition rates

01b

paying in-state tuition rates

01c

paying out-of-state tuition rates

01d

Unknown (calculated value)

This value is calculated using the following formula:

[A02-(C01a+C01b+C01c)]

Section 1: Part C, Page 2

Part C, Page 2 - Enter Information about Group 2 [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Reporting Reminders:

Part C includes financial aid information about Group 2. Group 2 students are all full-time, first-time degree/certificate-seeking undergraduate students enrolled in Fall 2021.

For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

Full-time, first-time degree/certificate-seeking undergraduate students enrolled in Fall 2021 for the 2021-22 academic year as defined by the institution

Grant or scholarship aid from:

federal government

state/local government

the institution

Loans to students from:

the federal government

other sources, including private or other loans

Do not include:

grant or scholarship aid from private or other sources

PLUS loans or loans made to anyone other than the student

Any time during academic year 2021-22

For program reporters, this is the aid year period from July 1, 2021 through June 30, 2022.

In the fields below, report the number of Group 2 students and the total amount of aid awarded to these students for each type of aid. Enter unduplicated student counts within a category (e.g., Federal Pell Grants). However, a student can appear in more than one aid category.

-

Information from Part A

Fall 2021

Group 2: Full-time, first-time degree/certificate-seeking undergraduates

(This number is carried forward from Part A, Line 02)

Group 2a: (This number is carried forward from Part A, Line 02a)

Of those in Group 2, those who were awarded:

Federal Work Study

Loans to students

Grant or scholarship aid from the federal government, state/local government, or the institution

Other sources known to the institution

Group 2b (This number is carried forward from Part A, Line 02b)

Of those in Group 2, those who were awarded:

Loans to students

Grant or scholarship aid from the federal government, state/local government, or the institution

Group 3 (This number is carried forward from Part A, Line 03)

Of those in Group 2, those who paid the lower of in-state or in-district tuition rate and were awarded:

Grant or scholarship aid from the federal government, state/local government, or the institution

Aid Type |

|

YOUR PRIOR YEAR DATA |

||||||

Fall 2021 |

Fall 2020 |

|||||||

Number of Group 2 students who were awarded aid |

Percentage of Group 2 students who were awarded aid |

Total amount of aid awarded to Group 2 students |

Average amount of aid awarded to Group 2 students |

Average amount of aid awarded to Group 2 students |

||||

01 |

Grants or scholarships from the federal government, state/local government, or the institution |

|

|

|

|

|

||

02 |

Federal grants |

|

|

|

|

|

||

02a |

Federal Pell Grants |

|

|

|

|

|

||

02b |

Other federal grants |

|

|

|

|

|

||

03 |

State/local government grants or scholarships (includes fellowships/tuition waivers/exemptions) |

|

|

|

|

|

||

04 |

Institutional grants or scholarships (includes fellowships/tuition waivers/exemptions) |

|

|

|

|

|

||

05 |

Loans to students |

|

|

|

|

|

||

05a |

Federal loans |

|

|

|

|

|

||

05b |

Other loans (including private loans) |

|

|

|

|

|

||

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Comparison Chart

Comparison Chart

Reporting Reminders:

Based on the information reported on the previous screens for Group 1 (all undergraduates) and Group 2 (full-time, first-time degree/certificate-seeking undergraduates), this comparison chart seeks to help institutions check their reported data. Assuming that the information on Groups 1 and 2 is correct, then the calculated fields for ‘All Other Undergraduates’ should be the balance (Group 1 minus Group 2). If the balance does not check with your institution’s calculations, please correct your reported numbers for Groups 1 and 2 before moving forward with the completion of the SFA survey component.

Note:

Data for the 'All Other Undergraduates' will appear in the IPEDS Data Center for data users, but not in College Navigator.

|

Fall 2021 |

Academic Year 2021-22 |

Academic Year 2021-22 |

||

|

Number of students |

Federal Pell Grants |

Federal Student Loans |

||

01 |

Group 1 (all undergraduates) |

|

|

|

|

02 |

Number of students who were awarded aid |

|

|

|

|

03 |

Percentage who were awarded aid |

|

|

|

|

04 |

Total amount of aid awarded |

|

|

|

|

05 |

Average amount of aid awarded |

|

|

|

|

06 |

Group 2 (Full-time, first-time undergraduates) |

|

|

|

|

07 |

Number of students who were awarded aid |

|

|

|

|

08 |

Percentage who were awarded aid |

|

|

|

|

09 |

Total amount of aid awarded |

|

|

|

|

10 |

Average amount of aid awarded |

|

|

|

|

11 |

All other undergraduates (Line 01 - Line 06) |

|

|

|

|

12 |

Number of students who were awarded aid (Line 02 - Line 07) |

|

|

|

|

13 |

Percentage who were awarded aid (Line 12/Line 11) |

|

|

|

|

14 |

Total amount of aid awarded (Line 04 - Line 09) |

|

|

|

|

15 |

Average amount of aid awarded (Line 14/Line 12) |

|

|

|

|

Section 1: Cost of Attendance

Cost of attendance for full-time, first-time undergraduate students [In-district, In-state, and Out-of-State breakdowns applicable to public institutions only]

Reporting Reminders:

Please enter the amounts requested below. These data will be made available to the public on College Navigator. If your institution participates in any Title IV programs (Federal Pell Grant, Federal Direct Loan

Stafford, etc.), you must complete all information.Estimates of expenses for books and supplies, room and board, and other expenses are those from the Cost of Attendance report used by the financial aid office in determining financial need. Please talk to your financial aid office to get these numbers to ensure that you are reporting correctly.

These numbers are carried forward from Institutional Characteristics and should only be changed if an error was made in the reporting.

Charges for full academic year |

2019-20 |

2020-21 |

2021-22 |

Published tuition and required fees: |

|||

In-district |

|

|

|

Tuition |

|

|

|

Required fees |

|

|

|

Tuition + fees total |

|

|

|

In-state |

|

|

|

Tuition |

|

|

|

Required fees |

|

|

|

Tuition + fees total |

|

|

|

Out-of-state |

|

|

|

Tuition |

|

|

|

Required fees |

|

|

|

Tuition + fees total |

|

|

|

|

|

|

|

Books and supplies |

|

|

|

On-campus: |

|||

Room and board |

|

|

|

Other expenses |

|

|

|

Room and board and other Expenses |

|

|

|

Off-campus (not with family): |

|||

Room and board |

|

|

|

Other expenses |

|

|

|

Room and board and other Expenses |

|

|

|

Off-campus (with family): |

|||

Other expenses |

|

|

|

Section 1: Part D

Part D - Enter Information about Group 3 [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Reporting Reminders:

Group 3 students are all full-time, first-time degree/certificate-seeking undergraduate students enrolled in Fall 2021 paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution. The information you report in this part will be used in Part F to calculate average institutional net price.

For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

Full-time, first-time degree/certificate-seeking undergraduate students enrolled in Fall 2021 for the 2021-22 academic year as defined by the institution paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution

Do not include students who were awarded only grant or scholarship aid from private or other sources, or students who were awarded only non-grant aid

Grant or scholarship aid from:

federal government

state/local government

the institution

Loans to students from:

the federal government

other sources, including private or other loans

Do not include:

grant or scholarship aid from private or other sources

PLUS loans or loans made to anyone other than the student

Any time during academic year 2021-22

In the fields below, report the number of Group 3 students with each type of living arrangement and the total amount of grant or scholarship aid from the federal government, state/local government, or the institution awarded to these students.

Information from Part A: |

YOUR PRIOR YEAR DATA 2019-20 |

YOUR PRIOR YEAR DATA 2020-21 |

2021-22 |

||

Group 3 Full-time, first-time degree/certificate-seeking undergraduate students paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution (This number is carried forward from Part A, Line 03) |

|

|

|

||

01 |

Report the number of Group 3 students with the following living arrangements: |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

|

|

2019-20 |

2020-21 |

2021-22 |

|||

|

01a |

On-campus |

|

|

|

|

01b |

Off-campus (with family) |

|

|

|

|

01c |

Off-campus (not with family) |

|

|

|

|

01d |

Unknown (calculated) This value is calculated using the following formula: [A03-(D01a+D01b+D01c)] |

|

|

|

02 |

Report the total amount of grant or scholarship aid from the federal government, state/local government, or the institution awarded to Group 3 students |

|

|

|

|

03 |

Average grant or scholarship aid from the federal government, state/local government, or the institution awarded to Group 3 students (calculated value). This value is calculated using the following formula: [D02/A03] |

|

|

|

|

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part E

Part E – Enter Information about Group 4 [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Reporting Reminders:

Part E includes financial aid information about Group 4. undergraduate students enrolled in Fall 2021 paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid, including federal grants or federal student loans. The information you report in this part will be used in Part G to calculate average institutional net price by income level.

For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

Full-time, first-time degree/certificate-seeking undergraduate students enrolled Fall 2021 for the 2021-22 academic year as defined by the institution paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid

Grant or scholarship aid from:

federal government

state/local government

the institution

Do not include:

grant or scholarship aid from private or other sources

loan amounts

Federal Work Study amounts

Student who received HEERF grants only.

Any time during academic year 2021-22

In the fields below, report the number of Group 4 students with each type of living arrangement and the total amount of grant or scholarship aid from the federal government, state/local government, or the institution awarded to these students by income level.

Information from Part A: |

YOUR PRIOR YEAR DATA 2019-20 |

YOUR PRIOR YEAR DATA 2020-21 |

2021-22 |

||

Group 4 Full-time, first-time degree/certificate-seeking undergraduate students paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid (This number is carried forward from Part A, Line 04) |

|

|

|

||

01 |

Report the number of Group 4 students with the following living arrangements: |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

|

|

2019-20 |

2020-21 |

2021-22 |

|||

|

01a |

On-campus |

|

|

|

|

01b |

Off-campus (with family) |

|

|

|

|

01c |

Off-campus (not with family) |

|

|

|

|

01d |

Unknown (calculated) This value is calculated using the following formula: [A03-(E01a+E01b+E01c)] |

|

|

|

|

Number of students who were awarded any Title IV aid (Group 4) |

Of those in Column 1, the number who were awarded any grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

Of those in Column 1, the total amount of grant or scholarship aid awarded from the following sources: the federal government, state/local government, or the institution |

Average amount of federal, state/local, and institutional grant or scholarship aid awarded to Group 4 students |

||

2019-20 |

||||||

|

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

||

02 |

Income level |

|||||

|

02a |

$0-30,000 |

|

|

|

|

|

02b |

$30,001-48,000 |

|

|

|

|

|

02c |

$48,001-75,000 |

|

|

|

|

|

02d |

$75,001-110,000 |

|

|

|

|

|

02e |

$110,001 and more |

|

|

|

|

|

02f |

Total all income levels |

|

|

|

|

|

Number of students who were awarded any Title IV aid (Group 4) |

Of those in Column 1, the number who were awarded any grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

Of those in Column 1, the total amount of grant or scholarship aid awarded from the following sources: the federal government, state/local government, or the institution |

Average amount of federal, state/local, and institutional grant or scholarship aid awarded to Group 4 students |

||

2020-21 |

||||||

|

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

||

03 |

Income level |

|||||

|

03a |

$0-30,000 |

|

|

|

|

|

03b |

$30,001-48,000 |

|

|

|

|

|

03c |

$48,001-75,000 |

|

|

|

|

|

03d |

$75,001-110,000 |

|

|

|

|

|

03e |

$110,001 and more |

|

|

|

|

|

03f |

Total all income levels |

|

|

|

|

|

Number of students who were awarded any Title IV aid (Group 4) |

Of those in Column 1, the number who were awarded any grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

Of those in Column 1, the total amount of grant or scholarship aid awarded from the following sources: the federal government, state/local government, or the institution |

Average amount of federal, state/local, and institutional grant or scholarship aid awarded to Group 4 students |

||

2021-22 |

||||||

|

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

||

04 |

Income level |

|||||

|

04a |

$0-30,000 |

|

|

|

|

|

04b |

$30,001-48,000 |

|

|

|

|

|

04c |

$48,001-75,000 |

|

|

|

|

|

04d |

$75,001-110,000 |

|

|

|

|

|

04e |

$110,001 and more |

|

|

|

|

|

04f |

Total all income levels |

|

|

|

|

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part F

Part F – Net Price Calculation for Group 3 [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Note:

The following net price calculation is based on information that your institution reported in the Institutional Characteristics component and the Student Financial Aid component. For more information about the data your institution reported in the Institutional Characteristics component, please contact your institution’s IPEDS Keyholder.

Components of cost of attendance |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

2021-22 |

||

2019-20 |

2020-21 |

||||

01 |

Published tuition and required fees (lower of in-state or in-district tuition rate) |

|

|

|

|

02 |

Books and supplies |

|

|

|

|

03 |

Room and board and other expenses by living arrangement |

||||

|

03a |

On-campus |

|

|

|

|

03b |

Off-campus (with family) |

|

|

|

|

03c |

Off-campus (not with family) |

|

|

|

04 |

Number of Group 3 students by living arrangement |

||||

|

04a |

On-campus |

|

|

|

|

04b |

Off-campus (with family) |

|

|

|

|

04c |

Off-campus (not with family) |

|

|

|

|

04d |

Unknown |

|

|

|

05 |

Weighted average for room and board and other expenses by number of students for each living arrangement (excluding unknown values) See instructions for the formula for this calculation |

|

|

|

|

06 |

Total cost of attendance This value is calculated using the following formula: [F01+F02+F05] |

|

|

|

|

07 |

Average amount of grant or scholarship aid awarded to Group 3 students from the following sources: the federal government, state/local government, and the institution |

|

|

|

|

08 |

Average institutional net price for Group 3 students This value is calculated using the following formula: [F06-F07] |

|

|

|

|

As required by the Higher Education Act, as amended (2008), these amounts will be posted on the U.S. Department of Education’s College Navigator website and used in the U.S. Department of Education’s College Affordability and Transparency Lists. |

|||||

Section 1: Part G

Part G – Net Price Calculation for Group 4 [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Note:

The following net price calculation is based on information that your institution reported in the Institutional Characteristics component and the Student Financial Aid component. For more information about the data your institution reported in the Institutional Characteristics component, please contact your institution’s IPEDS Keyholder.

Components of cost of attendance |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

2021-22 |

|||

2019-20 |

2020-21 |

|||||

01 |

Published tuition and required fees (lower of in-state or in-district) |

|

|

|

||

02 |

Books and supplies |

|

|

|

||

03 |

Room and board and other expenses by living arrangement |

|||||

|

03a |

On-campus |

|

|

|

|

|

03b |

Off-campus (with family) |

|

|

|

|

|

03c |

Off-campus (not with family) |

|

|

|

|

04 |

Number of Group 4 students by living arrangement |

|||||

|

04a |

On-campus |

|

|

|

|

|

04b |

Off-campus (with family) |

|

|

|

|

|

04c |

Off-campus (not with family) |

|

|

|

|

|

04d |

Unknown |

|

|

|

|

05 |

Weighted average for room and board and other expenses by number of students for each living arrangement (excluding unknown values) See instructions for the formula for this calculation |

|

|

|

||

06 |

Total cost of attendance This value is calculated using the following formula: [G01+G02+G05] |

|

|

|

||

07 |

Average amount of grant or scholarship aid awarded to Group 4 students from the following sources: the federal government, state/local government, and the institution |

|

|

|

||

|

07a |

$0-30,000 |

|

|

|

|

|

07b |

$30,001-48,000 |

|

|

|

|

|

07c |

$48,001-75,000 |

|

|

|

|

|

07d |

$75,001-110,000 |

|

|

|

|

|

07e |

$110,001 and more |

|

|

|

|

|

07f |

Total all income levels |

|

|

|

|

08 |

Average institutional net price for Group 4 students This value is calculated using the following formula: [G06-G07] |

|||||

|

08a |

$0-30,000 |

|

|

|

|

|

08b |

$30,001-48,000 |

|

|

|

|

|

08c |

$48,001-75,000 |

|

|

|

|

|

08d |

$75,001-110,000 |

|

|

|

|

|

08e |

$110,001 and more |

|

|

|

|

|

08f |

Total all income levels |

|

|

|

|

As required by the Higher Education Act, as amended (2008), these amounts will be posted on the U.S. Department of Education’s College Navigator website. |

||||||

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 2: Military Servicemembers and Veteran's Benefits - Undergraduate and Graduate

Section 2: Military Servicemembers and Veteran's Benefits

Important Note:

Report for Post-9/11 GI Bill Benefits: July 1, 2021 - June 30, 2022

Report for Department of Defense Tuition Assistance Program: October 1, 2021 - September 30, 2022

Reporting Reminders:

Report the total number of student recipients and the total dollar amounts for each program.

Student recipients can also include eligible dependents.

Student recipients may be listed in both categories.

Consult with your campus certifying official, who may not be in the student financial aid office.

For Post-9/11 GI Bill Benefits, do not include the matching institutional aid provided through the Yellow Ribbon Program if your school participated.

Information reported to IPEDS is only what is known to the institution.

Enter zero (0) if your institution did not have beneficiaries for that student level or program. Please do not leave a cell blank.

Type of benefit/assistance |

Number of students receiving benefits/assistance |

Total dollar amount of benefits/assistance disbursed through the institution |

Average dollar amount of benefits/assistance disbursed through the institution |

YOUR PRIOR YEAR DATA |

Average dollar amount of benefits/assistance disbursed through the institution |

||||

Post-9/11 GI Bill Benefits |

||||

Undergraduate students |

|

|

|

|

Graduate students |

|

|

|

|

Total |

|

|

|

|

Department of Defense Tuition Assistance Program |

||||

Undergraduate students |

|

|

|

|

Graduate students |

|

|

|

|

Total |

|

|

|

|

Prepared by

Prepared by

Reporting Reminders:

The name of the preparer is being collected so that we can follow up with the appropriate person in the event that there are questions concerning the data.

The Keyholder will be copied on all email correspondence to other preparers.

The time it took to prepare this component is being collected so that we can continue to improve our estimate of the reporting burden associated with IPEDS.

Please include in your estimate the time it took for you to review instructions, query and search data sources, complete and review the component, and submit the data through the Data Collection System.

Thank you for your assistance.

This survey component was prepared by: |

||

Keyholder |

SFA Contact |

HR Contact |

Finance Contact |

Academic Library Contact |

Other |

|

||

|

||

How many staff from your institutions were involved in the data collection and reporting process of this survey component? |

|

How many hours did you and others from your institution only spend on each of the steps below when responding to this survey component? Exclude the hours spent collecting data for state and other reporting purposes. |

||||

Staff member |

Collecting Data Needed |

Revising Data to Match IPEDS Requirements |

Entering Data |

Revising and Locking Data |

Your office |

|

|

|

|

Other offices |

|

|

|

|

Student Financial Aid Screens for Institutions Reporting on a Full-year Cohort (Program Reporters)

Overview

IPEDS Student Financial Aid Component Overview - Program Reporters

Welcome to the Student Financial Aid (SFA) component. The purpose of the SFA component is to collect information about financial aid provided to various groups of undergraduate students and military/veteran educational benefits for all students at your institution.

Data Reporting Reminders:

Report data to accurately reflect the time period corresponding with the IPEDS survey component, even if such reporting is seemingly inconsistent with prior-year reporting.

Undergraduate Student Groups

You will be asked to report information for different groups of students.

Group 1: All undergraduate students

Group 2: Of Group 1, full-time, first-time degree/certificate-seeking students (FTFT)

Group 3: Of Group 2, students enrolled in the institution’s largest program and were awarded any grant/scholarship aid from the federal government, state/local government, or the institution. For public institutions, include only those who paid the lower of in-state or in-district tuition rate.

Group 4: Of Group 2, students enrolled in the institution’s largest program and were awarded any Title IV federal student aid. For public institutions, include only those who paid the lower of in-state or in-district tuition rate.

COA Revisions

Revisions to Cost of Attendance (COA) used to calculate the net price of attendance can be made in this component.

Consult the instructions and screens to make sure you are reporting the correct aid amounts for the correct groups of students.

College Affordability and Transparency Lists

Net price amounts calculated in SFA will be used to populate the U.S. Department of Education’s College Affordability and Transparency lists.

Interactive Edits and Error Messages

SFA contains interactive edits that will check for blank fields, invalid values, or values that fall outside expected ranges. Some error messages will require you to confirm or explain the values that you entered. Some error messages are fatal and will require you to contact the IPEDS Help Desk at (877) 225-2568 for resolution.

Context Boxes

You will find optional text boxes throughout SFA. Context boxes allow you to provide more information about the data you enter. Some of these context boxes may be made available to the public on College Navigator, so make sure that the information you enter can be understood easily by students, parents, and the general public.

Changes in reporting:

The following changes were implemented for the 2022-23 data collection period:

Degree/certificate-seeking and non-degree/certificate-seeking data items were added in Parts A and B to disaggregate financial aid award amounts reported in Part B by these student categories.

New FAQs were added to clarify concepts.

Minor wording changes were made for clarification.

Resources:

To download the survey materials for this component: Survey Materials

If you have questions about completing this survey, please contact the IPEDS Help Desk at 1-877-225-2568.

Section 1: Part A

Part A - Establish Your Groups [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Reporting Reminders:

Part A establishes the number of students in various groups. Note that the numbers on this screen will be carried forward to other parts of the Student Financial Aid component.

In the fields below, report the number of students in each of the following groups.

|

July 1, 2021 – June 30, 2022 |

YOUR PRIOR YEAR DATA |

||

2020-21 |

||||

01 |

Group 1 All undergraduate students |

|

|

|

|

01a |

Of those in Group 1, those who are degree/certificate-seeking |

|

|

|

01b |

Of those in Group 1, those who are non-degree/certificate-seeking (Line 01 – Line 01a) |

|

|

02 |

Group 2 Of those in Group 1, those who are full-time, first-time degree/certificate-seeking |

|

|

|

|

02a |

Of those in Group 2, those who were awarded any Federal Work Study, loans to students, or grant or scholarship aid from the federal government, state/local government, the institution, or other sources known to the institution |

|

|

|

02b |

Of those in Group 2, those who were awarded any loans to students or grant or scholarship aid from the federal government, state/local government, or the institution |

|

|

03 |

Group 3 Of those in Group 2, those enrolled in your institution’s largest program paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

|

|

|

04 |

Group 4 Of those in Group 2, those enrolled in your institution’s largest program paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid |

|

|

|

Section 1: Part B

Reporting Reminders:

Group 1 students are ALL undergraduate students (including first-time students) enrolled in academic year 2021-22.

Fall 2021.For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

All undergraduate students enrolled for academic year 2021-22 as defined by the institution

Grant or scholarship aid from:

federal government

state/local government

the institution

other sources known to the institution

Loans to students from:

the federal government

Any time during academic year 2021-22

(the aid year period from July 1, 2021 through June 30, 2022)

In the fields below, report the number of Group 1 students and the total amount of aid awarded to these students for each type of aid.

|

Information from Part A |

2021-22 |

|

|

|

|

|

|||||||

|

Group 1: All undergraduate students (This number is carried forward from Part A, Line 01.) |

|

|

|

|

|

|

|||||||

|

Of those in Group 1, those who are degree/certificate-seeking (This number is carried forward from Part A, Line 01a.) |

|

|

|

|

|

|

|||||||

|

Of those in Group 1, those who are non-degree/certificate-seeking (This number is carried forward from Part A, Line 01b.) |

|

|

|

|

|

|

|||||||

Aid Type |

2021-22 |

|||||||||||||

All undergraduate students (Group 1) |

All degree/certificate-seeking undergraduates |

All non-degree/certificate-seeking undergraduates |

||||||||||||

Number of students awarded aid |

Percentage of students receiving aid |

Total amount of aid awarded |

Average amount of aid awarded (Col. 3/Col. 1) |

Number of students awarded aid |

Percentage of students receiving aid |

Total amount of aid awarded |

Average amount of aid awarded (Col. 7/Col. 5) |

Number of students awarded aid (Col. 1 – Col. 5) |

Percentage of students receiving aid |

Total amount of aid awarded (Col. 3 – Col. 7) |

Average amount of aid awarded |

|||

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

Col. 5 |

Col. 6 |

Col. 7 |

Col. 8 |

Col. 9 |

Col. 10 |

Col. 11 |

Col. 12 |

|||

01 |

Grant or scholarship aid from the federal government, state/local government, the institution, and other sources known to the institution (Do NOT include federal student loans) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02 Federal Pell Grants |

|

|

|

|

|

|

|

|

|

||||

03 |

Federal student loans |

|

|

|

|

|

|

|

|

|||||

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part C, Page 2

Part C, Page 2 - Enter Information about Group 2 [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Reporting Reminders:

Part C includes financial aid information about Group 2. Group 2 students are all full-time, first-time degree/certificate-seeking undergraduate students enrolled in academic year 2021-22

Fall 2021.For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

Full-time, first-time degree/certificate-seeking undergraduate students enrolled during academic year 2021-22 as defined by the institution

Grant or scholarship aid from:

federal government

state/local government

the institution

Loans to students from:

the federal government

other sources, including private or other loans

Do not include:

grant or scholarship aid from private or other sources

PLUS loans or loans made to anyone other than the student

Any time during academic year 2021-22

In the fields below, report the number of Group 2 students and the total amount of aid awarded to these students for each type of aid. Enter unduplicated student counts within a category (e.g., Federal Pell Grants). However, a student can appear in more than one aid category.

-

Information from Part A

2021-22

Group 2: Full-time, first-time degree/certificate-seeking undergraduates

(This number is carried forward from Part A, Line 02)

Group 2a: (This number is carried forward from Part A, Line 02a)

Of those in Group 2, those who were awarded:

Federal Work Study

Loans to students

Grant or scholarship aid from the federal government, state/local government, or the institution

Other sources known to the institution

Group 2b (This number is carried forward from Part A, Line 02b)

Of those in Group 2, those who were awarded:

Loans to students

Grant or scholarship aid from the federal government, state/local government, or the institution

Group 3 (This number is carried forward from Part A, Line 03)

Of those in Group 2, those who paid the lower of in-state or in-district tuition rate and were awarded:

Grant or scholarship aid from the federal government, state/local government, or the institution

Aid Type |

|

YOUR PRIOR YEAR DATA |

||||||

2021-22 |

2020-21 |

|||||||

Number of Group 2 students who were awarded aid |

Percentage of Group 2 students who were awarded aid |

Total amount of aid awarded to Group 2 students |

Average amount of aid awarded to Group 2 students |

Average amount of aid awarded to Group 2 students |

||||

01 |

Grants or scholarships from the federal government, state/local government, or the institution |

|

|

|

|

|

||

02 |

Federal grants |

|

|

|

|

|

||

02a |

Federal Pell Grants |

|

|

|

|

|

||

02b |

Other federal grants |

|

|

|

|

|

||

03 |

State/local government grants or scholarships (includes fellowships/tuition waivers/exemptions) |

|

|

|

|

|

||

04 |

Institutional grants or scholarships (includes fellowships/tuition waivers/exemptions) |

|

|

|

|

|

||

05 |

Loans to students |

|

|

|

|

|

||

05a |

Federal loans |

|

|

|

|

|

||

05b |

Other loans (including private loans) |

|

|

|

|

|

||

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Comparison Chart

Comparison Chart

Reporting Reminders:

Based on the information reported on the previous screens for Group 1 (all undergraduates) and Group 2 (full-time, first-time degree/certificate-seeking undergraduates), this comparison chart seeks to help institutions check their reported data. Assuming that the information on Groups 1 and 2 is correct, then the calculated fields for ‘All Other Undergraduates’ should be the balance (Group 1 minus Group 2). If the balance does not check with your institution’s calculations, please correct your reported numbers for Groups 1 and 2 before moving forward with the completion of the SFA survey component.

Note:

Data for the 'All Other Undergraduates' will appear in the IPEDS Data Center for data users, but not in College Navigator.

|

Academic Year 2021-22 |

Academic Year 2021-22 |

Award Year 2021-22 |

||

|

Number of students |

Federal Pell Grants |

Federal Student Loans |

||

01 |

Group 1 (all undergraduates) |

|

|

|

|

02 |

Number of students who were awarded aid |

|

|

|

|

03 |

Percentage who were awarded aid |

|

|

|

|

04 |

Total amount of aid awarded |

|

|

|

|

05 |

Average amount of aid awarded |

|

|

|

|

06 |

Group 2 (Full-time, first-time undergraduates) |

|

|

|

|

07 |

Number of students who were awarded aid |

|

|

|

|

08 |

Percentage who were awarded aid |

|

|

|

|

09 |

Total amount of aid awarded |

|

|

|

|

10 |

Average amount of aid awarded |

|

|

|

|

11 |

All other undergraduates (Line 01 - Line 06) |

|

|

|

|

12 |

Number of students who were awarded aid (Line 02 - Line 07) |

|

|

|

|

13 |

Percentage who were awarded aid (Line 12/Line 11) |

|

|

|

|

14 |

Total amount of aid awarded (Line 04 - Line 09) |

|

|

|

|

15 |

Average amount of aid awarded (Line 14/Line 12) |

|

|

|

|

Section 1: Cost of Attendance [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Cost of attendance

Reporting Reminders:

These numbers are carried forward from Institutional Characteristics and should only be changed if an error was made in the reporting.

LARGEST PROGRAM BY ENROLLMENT: |

|||

CIP CODE OF LARGEST PROGRAM |

|

||

TITLE OF LARGEST PROGRAM |

|

||

Program is measured in: |

|

||

Total Length of PROGRAM |

|

||

Total length of PROGRAM in WEEKS, as completed by a student attending full-time |

|

||

Total length of ACADEMIC YEAR (as used to calculate your Federal Pell Grant budget) in WEEKS |

|

||

|

|

|

|

Published student charges for the entire program |

2019-20 |

2020-21 |

2021-22 |

Tuition and required fees for the entire program (public program reporters report the lower of in-state or in-district, if applicable) |

|

|

|

Books and supplies for the entire program |

|

|

|

The following numbers need to be reported for 4.33 weeks (1 month).

The correct numbers should be available from your financial aid office. Off-campus numbers should be based on costs for your area, not on national averages. |

|||

On-campus: |

|||

Room and board for 4.33 weeks (1 month) |

|

|

|

Other expenses for 4.33 weeks (1 month) |

|

|

|

Room and board and other Expenses for 4..33 weeks (1 month) |

|

|

|

Off-campus (not with family): |

|||

Room and board for 4.33 weeks (1 month) |

|

|

|

Other expenses for 433 weeks (1 month) |

|

|

|

Room and board and other Expenses for 4.33 weeks (1 month) |

|

|

|

Off-campus (with family): |

|||

Other expenses for 4.33 weeks (1 month) |

|

|

|

Section 1: Cost of Attendance (calculated)

Cost of attendance

Reporting Reminders:

These numbers are carried forward from Institutional Characteristics and should only be changed after consulting with the data provider if an error was made in the reporting.

CIP CODE OF LARGEST PROGRAM |

|

||

TITLE OF LARGEST PROGRAM |

|

||

Published student charges for the entire program |

2019-20 |

2020-21 |

2021-22 |

Tuition and required fees |

|

|

|

Books and supplies |

|

|

|

On-campus: |

|||

Room and board |

|

|

|

Other expenses |

|

|

|

Room and board and other Expenses |

|

|

|

Off-campus (not with family): |

|||

Room and board |

|

|

|

Other expenses |

|

|

|

Room and board and other Expenses |

|

|

|

Off-campus (with family): |

|||

Other expenses |

|

|

|

Section 1: Part D [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Part D - Enter Information about Group 3

Reporting Reminders:

Group 3 students are all full-time, first-time degree/certificate-seeking undergraduate students enrolled in your institution’s largest program any time during academic year 2021-22 paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution. The information you report in this part will be used in Part F to calculate average institutional net price.

For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

Full-time, first-time degree/certificate-seeking undergraduate students enrolled in your institution’s largest program during the 2021-22 academic year as defined by the institution paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution

Do not include students who were awarded only grant or scholarship aid from private or other sources, or students who were awarded only non-grant aid

Grant or scholarship aid from:

federal government

state/local government

the institution

Do not include:

grant or scholarship aid from private or other sources

Any time during academic year 2021-22 (the aid year period July 1, 2021, to June 30, 2022)

In the fields below, report the number of Group 3 students with each type of living arrangement and the total amount of grant or scholarship aid from the federal government, state/local government, or the institution awarded to these students.

Note:

In this part, you must report information for your institution’s largest program. Your largest program is the program with the

mostgreatest number of undergraduate students enrolled. You must provide three years’ worth of data for your largest program. If your institution’s largest program has changed or is not the same for all years listed, contact the IPEDS Help Desk.

Information from Part A: |

YOUR PRIOR YEAR DATA 2019-20 |

YOUR PRIOR YEAR DATA 2020-21 |

2021-22 |

||

Group 3 Full-time, first-time degree/certificate-seeking undergraduate students enrolled in your institution’s largest program paying the lower of in-state or in-district tuition rate who were awarded grant or scholarship aid from the following sources: the federal government, state/local government, or the institution (This number is carried forward from Part A, Line 03) |

|

|

|

||

01 |

Report the number of Group 3 students with the following living arrangements: |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

|

|

2019-20 |

2020-21 |

2021-22 |

|||

|

01a |

On-campus |

|

|

|

|

01b |

Off-campus (with family) |

|

|

|

|

01c |

Off-campus (not with family) |

|

|

|

|

01d |

Unknown (calculated) This value is calculated using the following formula: [A03-(D01a+D01b+D01c)] |

|

|

|

02 |

Report the total amount of grant or scholarship aid from the federal government, state/local government, or the institution awarded to Group 3 students |

|

|

|

|

03 |

Average grant or scholarship aid from the federal government, state/local government, or the institution awarded to Group 3 students (calculated value). This value is calculated using the following formula: [D02/A03] |

|

|

|

|

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part E [Instruction ‘paying the lower of in-state or in-district tuition rate’ applicable to public institutions only]

Part E – Enter Information about Group 4

Reporting Reminders:

Group 4 students are full-time, first-time degree/certificate-seeking undergraduate students enrolled in your institution’s largest program any time during academic year 2021-22 paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid. The information you report in this part will be used in Part G to calculate average institutional net price by income level.

For this part, report:

-

For These Students

The Following Type(s) of Aid

Awarded in This Period

Full-time, first-time degree/certificate-seeking undergraduate students enrolled in your institution’s largest program during academic year 2021-22 as defined by the institution paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid

Grant or scholarship aid from:

federal government

state/local government

the institution

Do not include:

grant or scholarship aid from private or other sources

loan amounts

Federal Work Study amounts

Any time during academic year 2021-22 (the aid year period July 1, 2021, to June 30, 2022)

In the fields below, report the number of Group 4 students with each type of living arrangement and the total amount of grant or scholarship aid from the federal government, state/local government, or the institution awarded to these students by income level.

Largest Program Information from the IPEDS Institutional Characteristics component |

2021-22 |

||

|

CIP Code |

|

|

|

Title |

|

|

Information from Part A: |

YOUR PRIOR YEAR DATA 2019-20 |

YOUR PRIOR YEAR DATA 2020-21 |

2021-22 |

||

Group 4 Full-time, first-time degree/certificate-seeking undergraduate students enrolled in your institution’s largest program paying the lower of in-state or in-district tuition rate who were awarded any Title IV federal student aid (This number is carried forward from Part A, Line 04) |

|

|

|

||

01 |

Report the number of Group 4 students with the following living arrangements: |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

|

|

2019-20 |

2020-21 |

2021-22 |

|||

|

01a |

On-campus |

|

|

|

|

01b |

Off-campus (with family) |

|

|

|

|

01c |

Off-campus (not with family) |

|

|

|

|

01d |

Unknown (calculated) This value is calculated using the following formula: [A03-(E01a+E01b+E01c)] |

|

|

|

|

Number of students who were awarded any Title IV aid (Group 4) |

Of those in Column 1, the number who were awarded any grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

Of those in Column 1, the total amount of grant or scholarship aid awarded from the following sources: the federal government, state/local government, or the institution |

Average amount of federal, state/local, and institutional grant or scholarship aid awarded to Group 4 students |

||

2019-20 |

||||||

|

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

||

02 |

Income level |

|||||

|

02a |

$0-30,000 |

|

|

|

|

|

02b |

$30,001-48,000 |

|

|

|

|

|

02c |

$48,001-75,000 |

|

|

|

|

|

02d |

$75,001-110,000 |

|

|

|

|

|

02e |

$110,001 and more |

|

|

|

|

|

02f |

Total all income levels |

|

|

|

|

|

Number of students who were awarded any Title IV aid (Group 4) |

Of those in Column 1, the number who were awarded any grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

Of those in Column 1, the total amount of grant or scholarship aid awarded from the following sources: the federal government, state/local government, or the institution |

Average amount of federal, state/local, and institutional grant or scholarship aid awarded to Group 4 students |

||

2020-21 |

||||||

|

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

||

03 |

Income level |

|||||

|

03a |

$0-30,000 |

|

|

|

|

|

03b |

$30,001-48,000 |

|

|

|

|

|

03c |

$48,001-75,000 |

|

|

|

|

|

03d |

$75,001-110,000 |

|

|

|

|

|

03e |

$110,001 and more |

|

|

|

|

|

03f |

Total all income levels |

|

|

|

|

|

Number of students who were awarded any Title IV aid (Group 4) |

Of those in Column 1, the number who were awarded any grant or scholarship aid from the following sources: the federal government, state/local government, or the institution |

Of those in Column 1, the total amount of grant or scholarship aid awarded from the following sources: the federal government, state/local government, or the institution |

Average amount of federal, state/local, and institutional grant or scholarship aid awarded to Group 4 students |

||

2021-22 |

||||||

|

Col. 1 |

Col. 2 |

Col. 3 |

Col. 4 |

||

04 |

Income level |

|||||

|

04a |

$0-30,000 |

|

|

|

|

|

04b |

$30,001-48,000 |

|

|

|

|

|

04c |

$48,001-75,000 |

|

|

|

|

|

04d |

$75,001-110,000 |

|

|

|

|

|

04e |

$110,001 and more |

|

|

|

|

|

04f |

Total all income levels |

|

|

|

|

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part F

Part F – Net Price Calculation for Group 3 [lower of in-state or in-district applicable to public institutions only]

Note:

The following net price calculation is based on information that your institution reported in the Institutional Characteristics component and the Student Financial Aid component. For more information about the data your institution reported in the Institutional Characteristics component, please contact your institution’s IPEDS Keyholder.

Largest Program Information from the IPEDS Institutional Characteristics component |

2021-22 |

||

|

CIP Code |

|

|

|

Title |

|

|

Components of cost of attendance

Please note: Net price calculations use ACADEMIC YEAR costs, not full program costs |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

2021-22 |

||

2019-20 |

2020-21 |

||||

01 |

Published tuition and required fees (lower of in-state or in-district) |

|

|

|

|

02 |

Books and supplies |

|

|

|

|

03 |

Room and board and other expenses by living arrangement |

||||

|

03a |

On-campus |

|

|

|

|

03b |

Off-campus (with family) |

|

|

|

|

03c |

Off-campus (not with family) |

|

|

|

04 |

Number of Group 3 students by living arrangement |

||||

|

04a |

On-campus |

|

|

|

|

04b |

Off-campus (with family) |

|

|

|

|

04c |

Off-campus (not with family) |

|

|

|

|

04d |

Unknown |

|

|

|

05 |

Weighted average for room and board and other expenses by number of students for each living arrangement (excluding unknown values) See instructions for the formula for this calculation |

|

|

|

|

06 |

Total cost of attendance This value is calculated using the following formula: [F01+F02+F05] |

|

|

|

|

07 |

Average amount of grant or scholarship aid awarded to Group 3 students from the following sources: the federal government, state/local government, and the institution |

|

|

|

|

08 |

Average institutional net price for Group 3 students This value is calculated using the following formula: [F06-F07] |

|

|

|

|

As required by the Higher Education Act, as amended (2008), these amounts will be posted on the U.S. Department of Education’s College Navigator website and used in the U.S. Department of Education’s College Affordability and Transparency Lists. |

|||||

You may use the box below to provide additional context for the data you have reported above. Context notes will be posted on the College Navigator website. Therefore, you should write all context notes using proper grammar (e.g., complete sentences with punctuation) and common language that can be easily understood by students and parents (e.g., spell out acronyms).

![]()

Section 1: Part G

Part G – Net Price Calculation for Group 4 [lower of in-state or in-district applicable to public institutions only]

Note:

The following net price calculation is based on information that your institution reported in the Institutional Characteristics component and the Student Financial Aid component. For more information about the data your institution reported in the Institutional Characteristics component, please contact your institution’s IPEDS Keyholder.

Largest Program Information from the IPEDS Institutional Characteristics component |

2021-22 |

||

|

CIP Code |

|

|

|

Title |

|

|

Components of cost of attendance

Please note: Net price calculations use ACADEMIC YEAR costs, not full program costs |

YOUR PRIOR YEAR DATA |

YOUR PRIOR YEAR DATA |

2021-22 |

|||

2019-20 |

2020-21 |

|||||

01 |

Published tuition and required fees (lower of in-state or in-district) |

|

|

|

||

02 |

Books and supplies |

|

|

|

||

03 |

Room and board and other expenses by living arrangement |

|||||

|

03a |

On-campus |

|

|

|

|

|

03b |

Off-campus (with family) |

|

|

|

|

|

03c |

Off-campus (not with family) |

|

|

|

|

04 |

Number of Group 4 students by living arrangement |

|||||

|

04a |

On-campus |

|

|

|

|